- QNCX Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Quince Therapeutics (QNCX) DEF 14ADefinitive proxy

Filed: 30 Apr 21, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

CORTEXYME, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: | |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

(4) | Proposed maximum aggregate value of transaction: | |||

| ||||

(5) | Total fee paid: | |||

| ||||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| ||||

(2) | Form, Schedule or Registration Statement No.: | |||

| ||||

(3) | Filing Party: | |||

| ||||

(4) | Date Filed: | |||

| ||||

269 East Grand Ave.

South San Francisco, California

To Our Stockholders:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders, or the Annual Meeting, of Cortexyme, Inc. on Wednesday, June 16, 2021 at 11:00 a.m. Pacific Time. Due to the ongoing public health impact of the coronavirus (COVID-19) pandemic and to support the health and well-being of our stockholders, business partners, employees and board of directors, the Annual Meeting will be a completely virtual meeting, conducted via live webcast on the internet at https://web.lumiagm.com/294872708. There will be no physical location for the Annual Meeting. You will be able to attend and participate in the Annual Meeting online, submit questions during the meeting and vote your shares electronically. In addition, although the live webcast is available only to stockholders at the time of the meeting, following completion of the Annual Meeting, a webcast replay will be posted to the Investor Relations section of our website at https://ir.cortexyme.com.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement. The Annual Meeting materials include the notice, the proxy statement, our annual report and the proxy card, each of which is available at https://www.astproxyportal.com/ast/22818.

Please use this opportunity to take part in our affairs by voting on the business to come before the Annual Meeting. You will receive a Notice of Internet Availability of Proxy Materials, or the Notice, which we expect to mail on or about April 29, 2021, unless you have previously requested to receive our proxy materials in paper form. Only stockholders of record at the close of business on April 20, 2021 may vote at the Annual Meeting and any postponements or adjournments of the meeting. All stockholders are cordially invited to participate in the Annual Meeting and any postponements or adjournments of the meeting. However, to ensure your representation at the Annual Meeting, please vote as soon as possible by using the internet or telephone, as instructed in the Notice. Alternatively, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail. Returning the paper proxy card or voting electronically does NOT deprive you of your right to participate in the virtual meeting and to vote your shares for the matters acted upon at the meeting.

Your vote is important. Whether or not you expect to attend and participate in the Annual Meeting, please submit your proxy electronically via the internet or by telephone by following the instructions in the Notice or if you asked to receive the proxy materials in paper form, please complete, sign and date the proxy card and return it in the postage paid envelope provided.

Sincerely,

Casey C. Lynch

President, Chief Executive Officer and Chairperson of the Board of Directors

April 29, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 16, 2021: THE PROXY STATEMENT, PROXY CARD AND ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020 ARE AVAILABLE FREE OF CHARGE AT HTTPS://WWW.ASTPROXYPORTAL.COM/AST/22818.

CORTEXYME, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Time and Date: | June 16, 2021 at 11:00 a.m. Pacific Time. | |||

Place: | The Annual Meeting will be held on Wednesday, June 16, 2021 at 11:00 a.m. Pacific Time via live webcast on the internet at https://web.lumiagm.com/294872708. | |||

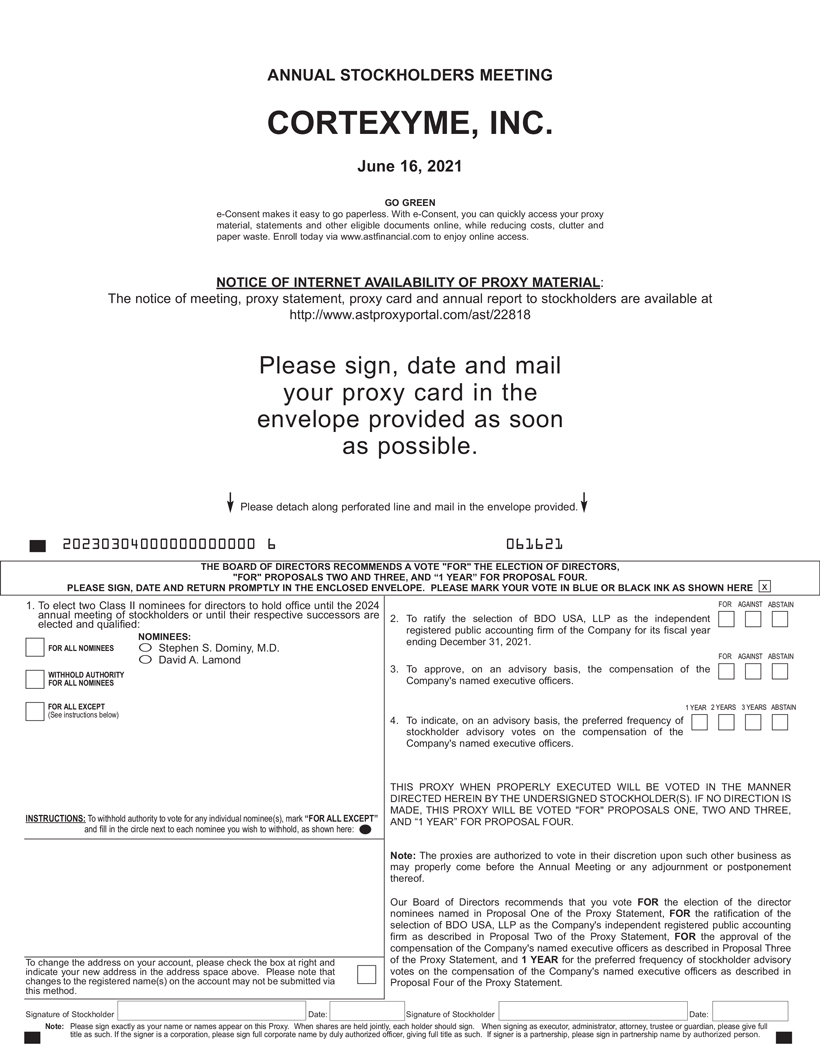

Items of Business: | 1. | Elect the two Class II nominees for directors listed in the accompanying Proxy Statement, each to serve a three-year term expiring at the 2024 annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. | ||

2. | Ratify the selection of BDO USA, LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021. | |||

3. | Approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Proxy Statement accompanying this Notice. | |||

4. | Indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers. | |||

5. | Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | |||

Record Date: | Only stockholders of record at the close of business on April 20, 2021 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. | |||

Proxy Voting: | Each share of common stock that you own represents one vote. | |||

For questions regarding your stock ownership, you may contact us through our Investor Relations section of our website at https://ir.cortexyme.com or, if you are a registered holder, contact our transfer agent, American Stock Transfer & Trust Company, LLC, through its website at www.astfinancial.com or by phone at (800) 937-5449. | ||||

By Order of the Board of Directors,

Casey C. Lynch

President, Chief Executive Officer and

Chairperson of the Board of Directors

April 29, 2021

i

CORTEXYME, INC.

PROXY STATEMENT FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, JUNE 16, 2021

APRIL 29, 2021

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of our board of directors of Cortexyme, Inc. (“Cortexyme”) for use at Cortexyme’s 2021 Annual Meeting of Stockholders (the “Annual Meeting” or “meeting”) to be held on Wednesday, June 16, 2021 at 11:00 a.m. Pacific Time via live webcast on the internet at https://web.lumiagm.com/294872708. References in the Proxy Statement to “we,” “us,” “our,” “the Company” or “Cortexyme” refer to Cortexyme, Inc.

INTERNET AVAILABILITY OF PROXY MATERIALS

We will mail, on or about April 29, 2021, the Notice of Internet Availability of Proxy Materials, or the Notice, to our stockholders of record and beneficial owners at the close of business on April 20, 2021. On the date of mailing of the Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge.

The Notice will identify the website where the proxy materials will be made available; the date, the time and location of the Annual Meeting; the matters to be acted upon at the meeting and our board of directors’ recommendations with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request a paper or e-mail copy of the Proxy Statement; our Annual Report on Form 10-K for the year ended December 31, 2020, or our Annual Report, and a form of proxy relating to the Annual Meeting; information on how to access the form of proxy; and information on how to participate in the meeting and vote in person online.

QUESTIONS AND ANSWERS ABOUT THE MEETING

| Q: | What is the purpose of the meeting? |

| A: | At the meeting, stockholders will act upon the proposals described in this Proxy Statement. In addition, following the formal portion of the meeting, management will be available to respond to questions from stockholders. |

| Q: | What proposals are scheduled to be voted on at the meeting? |

| A: | Stockholders will be asked to vote on the following proposals at the meeting: |

| 1. | to elect Stephen S. Dominy, M.D. and David A. Lamond as Class II directors to serve for a term of three years or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal; |

| 2. | to ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; |

| 3. | to approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the Proxy Statement accompanying this Notice; and |

| 4. | to indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers. |

1

| Q: | Could matters other than Proposals One through Four be decided at the meeting? |

| A: | Our amended and restated bylaws require that we receive advance notice of any proposal to be brought before the meeting by stockholders of Cortexyme, and we have not received notice of any such proposals. If any other matter were to come before the meeting, the proxy holders appointed by our board of directors will have the discretion to vote on those matters for you. |

| Q: | How does the board of directors recommend I vote on these proposals? |

| A: | Our board of directors recommends that you vote your shares: |

| • | “FOR ALL” nominees to the board of directors (Proposal One); |

| • | “FOR” the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal Two); |

| • | “FOR”, on an advisory basis, the compensation of our named executive officers, as disclosed in the Proxy Statement (Proposal Three); and |

| • | “Every year”, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers (Proposal Four). |

| Q: | Who may vote at the Annual Meeting? |

| A: | Stockholders of record as of the close of business on April 20, 2021, or the Record Date, are entitled to receive notice of, to attend and participate, and to vote at the Annual Meeting. At the close of business on the Record Date, there were 29,588,481 shares of our common stock outstanding and entitled to vote. |

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the stockholder of record with respect to those shares, and the Notice or these proxy materials were sent directly to you by Cortexyme.

Beneficial Owner of Shares Held in Street Name: Shares Registered in the Name of a Broker or Nominee

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the Notice or these proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting. Beneficial owners must obtain a valid proxy from the organization that holds their shares and present it to American Stock Transfer & Trust Company, LLC at least two (2) weeks in advance of the Annual Meeting.

| Q: | How do I vote? |

| A. | You may vote by mail or follow any alternative voting procedure (such as telephone or internet voting) described on your proxy card. To use an alternative voting procedure, follow the instructions on each Notice and/or proxy card that you receive. The procedures for voting are as follows: |

2

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may:

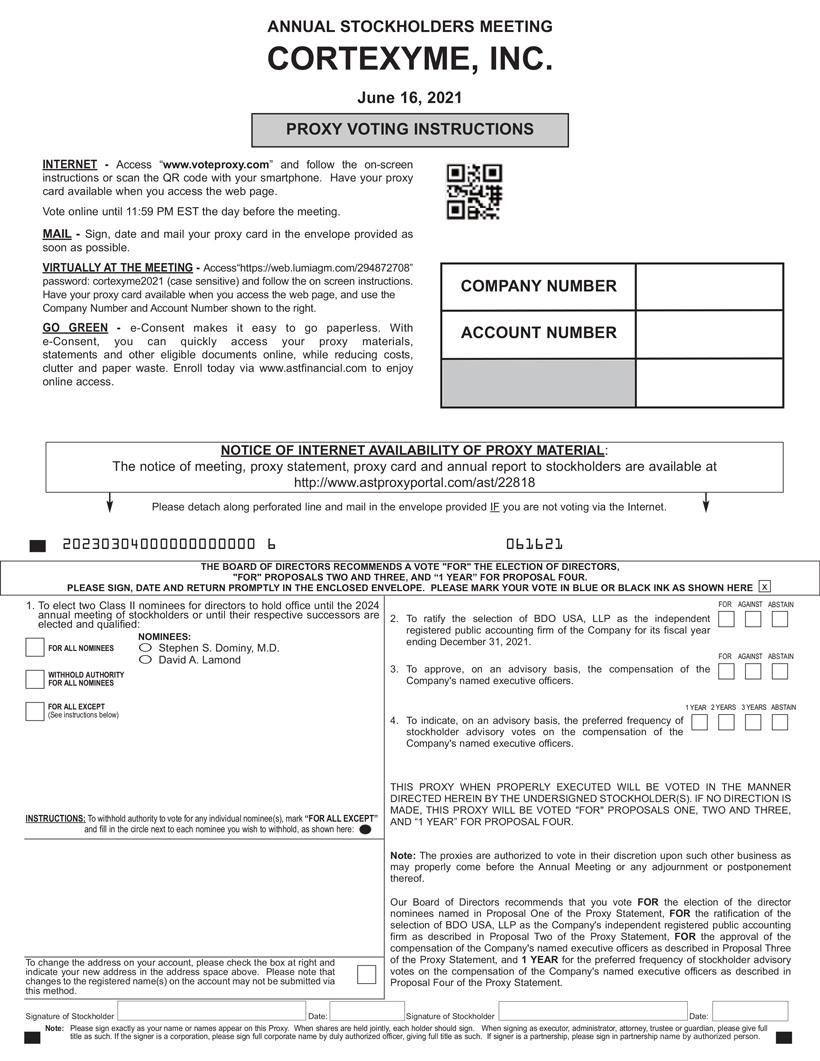

| • | vote by telephone or through the internet – in order to do so, please follow the instructions shown on your Notice or proxy card; |

| • | vote by mail – if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided; or |

| • | vote in person – you may virtually attend and participate in the Annual Meeting online at https://web.lumiagm.com/294872708 and vote your shares electronically before the polls close during the Annual Meeting. The password for the meeting is cortexyme2021. |

Votes submitted by telephone or through the internet must be received by 11:59 p.m. Eastern Time, on June 15, 2021. Submitting your proxy, whether by telephone, through the internet or by mail if you request or received a paper proxy card, will not affect your right to vote in person should you decide to attend and participate in the meeting virtually.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction card provided by your brokerage firm, bank, or other nominee as directed by your nominee. To electronically vote in person at the meeting online, you must obtain a legal proxy from your nominee. Follow the instructions from your nominee included with our proxy materials or contact your nominee to request a proxy form.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

| Q: | How do I vote by internet or telephone? |

| A. | If you wish to vote by internet or telephone, you may do so by following the voting instructions included on your Notice or proxy card. Please have each Notice or proxy card you received in hand when you vote over the internet or by telephone as you will need information specified therein to submit your vote. The giving of such a telephonic or internet proxy will not affect your right to vote in person (as detailed above) should you decide to attend the meeting virtually. |

The telephone and internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

| Q: | What shares can I vote? |

| A: | Each share of Cortexyme common stock issued and outstanding as of the close of business on April 20, 2021 is entitled to vote on all items being voted on at the meeting. You may vote all shares owned by you as of April 20, 2021, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. |

| Q: | How many votes am I entitled to per share? |

| A: | Each holder of shares of common stock is entitled to one vote for each share of common stock held as of April 20, 2021. |

| Q: | What is the quorum requirement for the meeting? |

| A: | The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present in person online or represented by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are |

3

counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy. |

| Q: | How are abstentions and broker non-votes treated? |

| A: | Abstentions (i.e. shares present at the Annual Meeting and marked “abstain”) are deemed to be shares presented or represented by proxy and entitled to vote, and are counted for purposes of determining whether a quorum is present. Abstentions have no effect on Proposal One and Proposal Four and will have the same effect as “Against” votes on Proposal Two and Proposal Three. |

A broker non-vote occurs when the beneficial owner of shares fails to provide the broker, bank or other nominee that holds the shares with specific instructions on how to vote on any “non-routine” matters under NYSE rules brought to a vote at the stockholders meeting. In this situation, the broker, bank or other nominee will not vote on the “non-routine” matter. Broker non-votes are counted for purposes of determining whether a quorum is present have no effect on the outcome of the matters voted upon.

Note that if you are a beneficial holder, brokers and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is the proposal for the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal Two). A broker or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. “Non-routine” matters include all proposals other than Proposal Two, including the election of directors. Accordingly, we encourage you to provide voting instructions to your broker or other nominee whether or not you plan to attend the meeting.

| Q: | What is the vote required for each proposal? |

| A: | The votes required to approve each proposal are as follows: |

| • | Proposal One: Each director must be elected by shall be elected by a plurality of the votes of the shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote on the election of directors, meaning that the two individuals nominated for election to our board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. |

| • | Proposal Two: Approval will be obtained if the number of votes “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal, based on the shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote on the matter. |

| • | Proposal Three: Approval on an advisory basis will be obtained if the number of votes “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal, based on the shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote on the matter. |

| • | Proposal Four: Approval on an advisory basis will be obtained for the frequency receiving the votes of the holders of a majority of shares present in person, by remote communication or represented by proxy and entitled to vote on the matter. |

| Q: | If I submit a proxy, how will it be voted? |

| A: | When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote or revoke my proxy?” |

4

| Q: | What should I do if I get more than one proxy or voting instruction card? |

| A: | Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials or one Notice for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to our Annual Meeting to ensure that all of your shares are voted and counted. |

| Q: | Can I change my vote or revoke my proxy? |

| A: | You may change your vote or revoke your proxy at any time prior to the taking of the vote or the polls closing at the Annual Meeting. |

If you are the stockholder of record, you may change your vote by:

| • | granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method); |

| • | providing a written notice of revocation to Cortexyme’s Secretary at Cortexyme, Inc., 269 East Grand Avenue, South San Francisco, CA 94080, prior to your shares being voted; or |

| • | participating in the Annual Meeting and voting electronically online at https://web.lumiagm.com/294872708. The password for the meeting is cortexyme2021. Participation alone at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically vote during the meeting online at https://web.lumiagm.com/294872708. |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

| Q: | How can I attend the Annual Meeting in person? |

| A: | There is no physical location for the Annual Meeting. You are invited to attend the Annual Meeting by participating online if you are a stockholder of record or a street name stockholder as of April 20, 2021, the Record Date. See, “How can I participate in the Annual Meeting?” below for more details. Please be aware that participating in the Annual Meeting will not, by itself, revoke a proxy. See, “Can I change my vote or revoke my proxy?” above for more details. |

| Q. | How can I participate in the Annual Meeting? |

| A: | The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend and participate in the Annual Meeting online and submit your questions during the Annual Meeting by visiting https://web.lumiagm.com/294872708. You will also be able to vote your shares electronically at the Annual Meeting. To participate and vote in the Annual Meeting, go to https://web.lumiagm.com/294872708 and follow the on screen instructions. Please have each Notice or proxy card you received in hand as you will need information specified therein. |

The meeting webcast will begin promptly at 11:00 a.m., Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:30 a.m., Pacific Time, and you should allow ample time for the check-in procedures. We plan to have a webcast replay which will be posted to the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations.

5

| Q: | Can I submit questions prior to the meeting? |

| A: | No, you can only submit questions during the meeting. |

| Q: | What if during the check-in time or during the meeting I have technical difficulties or trouble accessing the virtual meeting website? |

| A: | If you encounter any technical difficulties accessing the virtual meeting during the check-in or meeting time, please log into https://go.lumiglobal.com/faq. |

| Q: | Why is the Annual Meeting being held only online? |

| A: | We have been closely monitoring developments with the COVID-19 pandemic and the related recommendations, protocols and restrictions issued by public health authorities and federal, state, and local governments. In light of these ongoing concerns and in order to support the health and well-being of our stockholders, business partners, employees and board of directors, we will be conducting the Annual Meeting solely online. |

| Q. | How can I get electronic access to the proxy materials? |

| A: | The Notice will provide you with instructions regarding how to: |

| • | view our proxy materials for the meeting through the internet; and |

| • | instruct us to send our future proxy materials to you electronically by email. |

If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

| Q: | Is there a list of stockholders entitled to vote at the Annual Meeting? |

| A: | The names of stockholders of record entitled to vote will be available for inspection by stockholders of record for ten (10) days prior to the meeting and during the Annual Meeting. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to our Secretary at ir@cortexyme.com to arrange for electronic access to the stockholder list. |

| Q: | Who will tabulate the votes? |

| A: | A representative of American Stock Transfer & Trust Company, LLC will serve as the Inspector of Elections and will tabulate the votes at the Annual Meeting. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. |

| Q: | I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

| A: | The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.” |

6

Brokers with account holders who are Cortexyme stockholders may be householding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or Cortexyme that you no longer wish to participate in householding.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Cortexyme, Inc., 269 East Grand Avenue, South San Francisco, CA 94080 or (3) contact our Investor Relations department by email at ir@cortexyme.com or by telephone at (415) 910-5717. Stockholders who currently receive multiple copies of the proxy statement or annual report at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

| Q: | What if I have questions about my Cortexyme shares or need to change my mailing address? |

| A: | You may contact our transfer agent, American Stock Transfer & Trust Company, LLC, by telephone at (800) 937-5449, through its website at www.astfinancial.com or by U.S. mail at 6201 15th Avenue, Brooklyn, NY 11219, if you have questions about your Cortexyme shares or need to change your mailing address. |

| Q: | Who is soliciting my proxy and paying for the expense of solicitation? |

| A: | The proxy for the Annual Meeting is being solicited on behalf of our board of directors. We will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we may reimburse these individuals for their reasonable out-of-pocket expenses. We do not expect to, but have the option to, retain a proxy solicitor. If you choose to access the proxy materials or vote via the internet or by phone, you are responsible for any internet access or phone charges you may incur. |

| Q: | What are the requirements to propose actions to be included in our proxy materials for next year’s annual meeting of stockholders, or our 2022 Annual Meeting, or for consideration at our 2022 Annual Meeting? |

| A: | Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2022 Annual Meeting: |

Our amended and restated bylaws provide that stockholders may present proposals for inclusion in our proxy statement by submitting their proposals in writing to the attention of our Secretary at our principal executive office. Our current principal executive office is located at 269 East Grand Avenue, South San Francisco, CA 9408. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and related SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. In order to be included in the proxy statement for our 2022 Annual Meeting, stockholder proposals must be received by our Secretary no later than December 30, 2021 and must otherwise comply with the requirements of Rule 14a-8 of the Exchange Act.

Requirements for Stockholder Proposals to be presented at our 2022 Annual Meeting: |

Our amended and restated bylaws provide that stockholders may present proposals to be considered at an annual meeting by providing timely notice to our Secretary at our principal executive office. To be timely for our 2022 Annual Meeting, our Secretary must receive the written notice at our principal executive office:

| • | not earlier than the close of business on February 18, 2022, and |

7

| • | not later than the close of business on March 20, 2022. |

If we hold our 2022 annual meeting of stockholders more than 30 days before or more than 60 days after June 16, 2022 (the one-year anniversary date of the Annual Meeting), then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received by our Secretary at our principal executive office:

| • | not earlier than the close of business on the 120th day prior to such annual meeting, and |

| • | not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which public announcement of the date of such annual meeting is first made. |

A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting the information required by our amended and restated bylaws. If a stockholder who has notified Cortexyme of such stockholder’s intention to present a proposal at an annual meeting does not appear to present such stockholder’s proposal at such meeting, Cortexyme does not need to present the proposal for vote at such meeting.

8

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

We have a strong commitment to good corporate governance practices. These practices provide an important framework within which our board of directors, its committees and our management can pursue our strategic objectives in order to promote the interests of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions and other policies for the governance of our company. Our Corporate Governance Guidelines are available without charge on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website. Our Corporate Governance Guidelines are subject to modification from time to time by our board of directors pursuant to the recommendations of our nominating and corporate governance committee.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our board of directors shall be free to choose its Chairperson in any way that it considers in the best interests of our company, and that our nominating and corporate governance committee periodically considers the leadership structure of our board of directors and makes such recommendations to our board of directors with respect thereto as appropriate. In addition, our Corporate Governance Guidelines provide that, when the positions of Chairperson and Chief Executive Officer are held by the same person, our board of directors will designate a Lead Independent Director. We established a Lead Independent Director role with broad authority and responsibility, as described further below. The independent members of the board of directors also meet in executive session without management, which provides the board of directors with the benefit of having the perspective of independent directors. The Lead Independent Director presides over these executive sessions.

Casey C. Lynch is the Chairperson of our board of directors and our President and Chief Executive Officer. This allows the board of directors to benefit from Ms. Lynch’s in-depth knowledge of our business and industry, and her ability to effectively identify strategic priorities and formulate and implement strategic initiatives. As President and Chief Executive Officer, Ms. Lynch is also intimately involved in our day-to-day operations and is thus in a position to elevate the most critical business issues for consideration by the board of directors. Our independent directors bring experience, oversight and expertise from outside of our company, while Ms. Lynch brings company-specific experience and expertise. Our board of directors believes that Ms. Lynch’s combined role enables strong leadership, creates clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders. Accordingly, our board of directors has determined that the combined role of Chairperson and Chief Executive Officer with a strong Lead Independent Director provides balance and is the best leadership structure for us at the current time and is in the best interests of our Company and our stockholders.

Lead Independent Director

Our board of directors appointed Una Ryan, OBE, Ph.D. to serve as our Lead Independent Director. The responsibilities of the Lead Independent Director include:

| • | presiding at executive sessions of independent directors; |

| • | serving as a liaison between the Chairperson and the independent directors; |

| • | consulting with the Chairperson regarding the information sent to our board of directors in connection with its meetings; |

| • | having the authority to call meetings of our board of directors and meetings of the independent directors; |

9

| • | being available under appropriate circumstances for consultation and direct communication with stockholders; |

| • | encouraging and facilitating direct dialogue between all directors (particularly those with dissenting views) and management; and |

| • | performing such other functions and responsibilities as requested by our board of directors from time to time. |

Our Board of Directors’ Role in Risk Oversight

One of the key functions of our board of directors is informed oversight of our risk management process. Although our board of directors does not have a standing risk management committee, it administers this oversight function directly through the board of directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. Areas of focus include economic, operational, financial (accounting, credit, investment, liquidity and tax), competitive, legal, regulatory, cybersecurity, privacy, compliance and reputational risks, and continued risk exposures related to COVID-19. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board of directors and to our personnel who are responsible for risk assessment and information about the identification, assessment and management of critical risks, and our management’s risk mitigation strategies.

Our audit committee is responsible for reviewing and discussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies with respect to risk assessment and risk management. The audit committee also monitors compliance with legal and regulatory requirements and assists our board of directors in fulfilling its oversight responsibilities with respect to risk management. Our nominating and corporate governance committee assesses risks related to our corporate governance practices, the independence of our board of directors and monitors the effectiveness of our governance guidelines. Our compensation committee assesses and monitors whether our compensation policies and programs have the potential to encourage excessive risk-taking.

We believe this division of responsibilities is an effective approach for addressing the risks we currently face and that our board leadership structure supports this approach.

Independence of Directors

The Nasdaq listing rules generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in such member’s capacity as a member of the audit committee, the board of directors or any other board committee (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors conducts an annual review of the independence of our directors. Our board of directors has determined that none of the non-management members of our board of directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of the members of our board of directors, other than Ms. Lynch and Dr. Dominy, is “independent” as that term is defined under the rules of Nasdaq. Our board of directors has also determined that all members of our audit committee, compensation committee and nominating and corporate governance committee are independent and satisfy the relevant SEC and Nasdaq independence requirements for such committees.

10

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for each committee are available on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website. Members serve on these committees until (i) they resign from their respective committee, (ii) they no longer serve as a director or (iii) as otherwise determined by our board of directors.

Audit Committee

Our audit committee is currently composed of Christopher J. Senner, who is the chair of our audit committee, Kevin Young, CBE and Una Ryan, OBE, Ph.D. Mr. Young, who is not standing for re-election, will come off our audit committee effective as of the Annual Meeting. The composition of our audit committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations; provided, however, that our board of directors will need to select a replacement for Mr. Young in order to remain in compliance with Nasdaq Listing Rule 5605(c)(2)(A), which requires the audit committee to be comprised of a minimum of three independent directors. If we have not selected a replacement by the Annual Meeting, we are entitled to a cure period to regain compliance with Nasdaq Listing Rule 5605(c)(2)(A), which cure period will expire upon the one year anniversary of the Annual Meeting. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Mr. Senner is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K of the Securities Act of 1933, as amended, or the Securities Act. This designation does not impose any duties, obligations or liabilities that are greater than those generally imposed on members of our audit committee and our board of directors.

Our audit committee, among other things:

| • | selects a firm to serve as the independent registered public accounting firm to audit our financial statements; |

| • | helps to ensure the independence of the independent registered public accounting firm; |

| • | discusses the scope and results of the audit with the independent registered public accounting firm, and reviews, with management and the independent accountants, our interim and year end operating results; |

| • | develops procedures for employees to anonymously submit concerns about questionable accounting or audit matters; |

| • | considers the adequacy of our internal accounting controls and audit procedures; |

| • | reviews and discusses with management and, as appropriate, the independent auditor, our guidelines and policies with respect to risk assessment and risk management, including our major financial risk exposures and the steps taken by management to monitor and control these exposures and the adequacy and effectiveness of our information security policies and practices and the internal controls regarding information security, including those concerning data privacy, cybersecurity and backup of information systems; |

| • | reviews and approves any proposed transaction between our company and any related party; and |

| • | approves the fees and other compensation to be paid to our independent registered public accounting firm, and preapproves all audit and non-audit related services provided by our independent registered public accounting firm. |

Our audit committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website.

11

The information contained in the following report of our audit committee is not considered to be “soliciting material,” “filed” or incorporated by reference in any past or future filing by us under the Exchange Act or the Securities Act unless and only to the extent that we specifically incorporate it by reference.

Our audit committee has reviewed and discussed with our management and BDO USA, LLP, our audited financial statements for the fiscal year ended December 31, 2020. Our audit committee has also discussed with BDO USA, LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

Our audit committee has received and reviewed the written disclosures and the letter from BDO USA, LLP required by applicable requirements of the PCAOB regarding the independent accountant’s communications with our audit committee concerning independence, and has discussed with BDO USA, LLP its independence from us.

Based on the review and discussions referred to above, our audit committee recommended to our board of directors that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the SEC.

Submitted by the Audit Committee

Christopher J. Senner, Chair

Una Ryan, OBE, Ph.D.

Kevin Young, CBE

Compensation Committee

Our compensation committee is currently composed of David A. Lamond, who is the chair of our compensation committee, Kevin Young, CBE and Margaret A. McLoughlin, Ph.D. Mr. Young, who is not standing for re-election, will come off our compensation committee effective as of the Annual Meeting. The composition of our compensation committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Each member of this committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our compensation committee, among other things:

| • | reviews and determines the compensation of our executive officers and recommends to our board of directors the compensation for our directors; |

| • | administers our stock and equity incentive plans; |

| • | reviews and makes recommendations to our board of directors with respect to incentive compensation and equity plans; and |

| • | establishes and reviews general policies relating to compensation and benefits of our employees. |

The compensation committee may delegate its authority to a subcommittee of the compensation committee (consisting either of a subset of members of the committee or, after giving due consideration to whether the eligibility criteria described within the compensation committee charter with respect to committee members and whether such other board members satisfy such criteria, any members of the board of directors) except for its exclusive authority to determine the amount and form of compensation paid to the Chief Executive Officer.

Our compensation committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website.

12

Compensation Committee Processes and Procedures

Typically, the compensation committee meets at least four times annually and with greater frequency if necessary. The agenda for each meeting is developed by the chair of the compensation committee. The compensation committee meets regularly in executive session. In addition, members of management and other employees as well as outside advisors or consultants are regularly invited by the compensation committee to make presentations, to provide financial or other background information or advice or to otherwise participate in compensation committee meetings. However, the compensation committee meets regularly without such members present, and in all cases members of management are not present during the portion of meetings at which their compensation or performance is discussed or determined. Under the charter of the compensation committee, the compensation committee has the authority to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the compensation committee considers necessary or appropriate in the performance of its duties, including compensation consultants to assist in its evaluation of executive and director compensation. Under the charter, before selecting a compensation consultant, legal counsel or other adviser, the compensation committee must consider all factors related to the independence of such advisors, including those specified by the Nasdaq listing rules.

The compensation committee has retained Compensia, Inc. (“Compensia”) as its independent compensation consultant. The compensation committee requested that Compensia assist in reviewing our compensation programs and to ensure that our compensation programs remain competitive in attracting and retaining talented executives.

In addition, as part of its engagement, our compensation committee requested that Compensia develop a group of peer companies to use as a reference in making compensation decisions, evaluating current pay practices and considering different compensation programs and best practices. Although our board of directors and compensation committee consider the advice and recommendations of Compensia as it relates to our executive compensation program, the board of directors and compensation committee ultimately make their own decisions about these matters.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee during 2020 included David A. Lamond, Margaret A. McLoughlin, Ph.D. and Kevin Young, CBE. Mr. Young, who is not standing for re-election, will come off our compensation committee effective as of the Annual Meeting. None of the members of our compensation committee in 2020 was at any time during 2020 or at any other time one of our officers or employees, and none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During 2020, none of our executive officers served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is currently composed of David A. Lamond, who is the chair of our nominating and corporate governance committee, Kevin Young, CBE, Margaret A. McLoughlin, Ph.D. and Una Ryan, OBE, Ph.D. Mr. Young, who is not standing for re-election, will come off our nominating and corporate governance committee effective as of the Annual Meeting. The composition of our nominating and corporate governance committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Our nominating and corporate governance committee, among other things:

| • | identifies, evaluates and recommends nominees to our board of directors and committees of our board of directors; |

| • | conducts searches for appropriate directors; |

| • | evaluates the performance of our board of directors and of individual directors; |

| • | considers and makes recommendations to the board of directors regarding the composition of the board and its committees; |

13

| • | reviews developments in corporate governance practices; |

| • | evaluates the adequacy of our corporate governance practices and reporting; and |

| • | makes recommendations to our board of directors concerning corporate governance matters. |

Our nominating and corporate governance committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website.

Board and Committee Meetings and Attendance

Our board of directors and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. During 2020: (i) our board of directors met nine (9) times; (ii) our audit committee met four (4) times; (iii) our compensation committee met seven (7) times; and (iv) our nominating and corporate governance committee met four (4) times.

During 2020, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. All of the directors who were members of our Board at the time of the 2020 Annual Meeting attended the 2020 Annual Meeting.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson or Lead Independent Director) may do so by letters addressed to the attention of our Chief Financial Officer.

All communications are reviewed by the Chief Financial Officer and provided to the members of our board of directors as appropriate. Unsolicited items, sales materials, abusive, threatening or otherwise inappropriate materials and other routine items and items unrelated to the duties and responsibilities of our board of directors will not be provided to directors.

The address for these communications is:

Cortexyme, Inc.

269 East Grand Avenue

South San Francisco, CA 94080

Attn: Chief Financial Officer

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the members of our board of directors, officers and employees. Our Code of Business Conduct and Ethics is posted on the Investor Relations section of our website, which is located at https://ir.cortexyme.com/investor-relations, by clicking on “Governance Documents” in the “Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website at the location specified above.

14

Hedging and Pledging Policy

Under the terms of our insider trading policy, no employees, contractors, consultants and members of our board of directors (and their respective family members and any affiliated entities, such as venture capital funds) may engage in hedging or monetization transactions involving our securities, such as prepaid variable forward contracts, equity swaps, collars or exchange funds. In addition, such persons may not hold our securities in a margin account or pledge our securities as collateral for a loan unless the pledge has been approved by our compliance officer.

15

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of our nominating and corporate governance committee in accordance with its charter, our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the criteria approved by our board of directors regarding director candidate qualifications. In recommending candidates for nomination, our nominating and corporate governance committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates.

Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth below under “Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2022 Annual Meeting” and “Requirements for Stockholder Proposals to be presented at our 2022 Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced and highly qualified board of directors, our nominating and corporate governance committee is responsible for developing and recommending to our board of directors the desired qualifications, expertise and characteristics of members of our board of directors, including any specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on our board of directors and any specific qualities or skills that the committee believes are necessary for one or more of the members of our board of directors to possess.

Because the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our board of directors from time to time, our board of directors has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and Nasdaq listing requirements and the provisions of our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the charters of the committees of our board of directors. When considering nominees, our nominating and corporate governance committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, diversity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry and ability to devote adequate time and effort to responsibilities of our board of directors in the context of its existing composition. Our board of directors does not have a formal policy with respect to diversity and inclusion; however, it affirms the value placed on diversity within our company. Through the nomination process, our nominating and corporate governance committee seeks to promote board membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds and other characteristics that are expected to contribute to our board of directors’ overall effectiveness. Further, our board of directors is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. The brief biographical description of each director set forth in “Proposal One: Election of Directors” below includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

16

PROPOSAL ONE: ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors and is divided into three classes, with staggered three-year terms, pursuant to our amended and restated certificate of incorporation and our amended and restated bylaws. There are two directors in Class II whose term of office expires in 2021, Kevin Young and David Lamond. One of these directors, Mr. Lamond, will stand for election at the Annual Meeting, while Mr. Young is not standing for re-election. At the recommendation of our nominating and corporate governance committee, our board of directors nominated each of Stephen Dominy and David Lamond for election at the Annual Meeting as a Class II director for a three-year term expiring at our 2024 Annual Meeting of Stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

Shares represented by proxies will be voted “FOR” the election of each of the two nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected. Proxies may not be voted for more than two directors. Stockholders may not cumulate votes for the election of directors.

Nominees to Our Board of Directors

The nominees and their ages, occupations and lengths of service on our board of directors as of April 20, 2021 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| Name | Age | Position | Director Since | |||||

Stephen S. Dominy, M.D. | 65 | Chief Scientific Officer, Director and Director Nominee | December 2015 | |||||

David A. Lamond(1)(2) | 46 | Director and Director Nominee | December 2015 | |||||

| (1) | Member of our compensation committee |

| (2) | Member of our nominating and corporate governance committee |

Stephen S. Dominy, M.D., has served as a member of our board of directors since December 2015 and as our Chief Scientific Officer since April 2016. Prior to co-founding Cortexyme, Dr. Dominy served as a Division Director at San Francisco General Hospital and as Associate Professor of Psychiatry at the University of California, San Francisco School of Medicine from 2006 to 2016. Dr. Dominy holds a B.S. in Pharmacy from The Ohio State University College of Pharmacy and an M.D. from the Wright State University Boonshoft School of Medicine. We believe that Dr. Dominy is qualified to be nominated as a director because of his educational background, as well as his extensive research and technical experience that provides an important perspective on operations and development.

David A. Lamond has served on our board of directors since December 2015. Mr. Lamond has served as the president of En Pointe LLC, an investment firm, since 2016. He served as the President, Chief Executive Officer and Chief Investment Officer of Lamond Capital Partners LLC from 2011 to 2016. He also serves on the board of directors of Applied Molecular Transport, a biotechnology company, EG 427, a biotechnology company, Lucira Health Inc, a molecular diagnostics company, Inquis Medical, a medical device company and Windfall Data, an analytics company. He previously served on the board of Arrinex, a medical device company until its acquisition by Stryker Corporation in February 2019. Mr. Lamond holds a B.A. in History from Duke University and a J.D. from Duke Law School. We believe that Mr. Lamond is qualified to be nominated as a director because his extensive experience in important ecosystem partners and his service on a number of boards provides an important perspective on operations, finance and corporate governance matters.

Continuing Directors

The directors who are serving for terms that end following the Annual Meeting and their ages, occupations and lengths of service on our board of directors as of April 20, 2021 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

17

| Name | Age | Position | Director Since | |||||

Class III Directors: | ||||||||

Casey C. Lynch | 47 | President, Chief Executive Officer and Chairperson of the Board | July 2014 | |||||

Christopher J. Senner (1) | 53 | Director | March 2019 | |||||

Class I Directors: | ||||||||

Margaret A. McLoughlin Ph.D.(2)(3) | 58 | Director | December 2015 | |||||

Una Ryan, OBE, Ph.D.(1)(3) | 79 | Director | January 2019 | |||||

| (1) | Member of our audit committee |

| (2) | Member of our compensation committee |

| (3) | Member of our nominating and corporate governance committee |

Casey C. Lynch has served as our President and Chief Executive Officer and a member of our board of directors since July 2014, and as Chairman of our board of directors since November 2018. Ms. Lynch also serves on the board of directors of Longboard Pharmaceuticals, Inc., a biopharmaceutical company. Prior to co-founding Cortexyme, Ms. Lynch co-founded various companies and organizations in the biotechnology industry including Aspira Biosystems, Inc. and NeuroInsights, LLC. She served as Aspira’s co-founder, President and Chief Executive Officer from 1999 to 2004 and she co-founded NeuroInsights, LLC and served as its Managing Director from 2004 to 2015. Ms. Lynch also co-founded Neurotechnology Industry Organization and served as a board member from March 2005 to September 2018. Ms. Lynch holds a B.S. in Neuroscience from the University of California, Los Angeles, an M.S. in Neuroscience from the University of California, San Francisco and obtained a certificate in Management Development for Entrepreneurs Program from the University of California, Los Angeles. We believe that Ms. Lynch is qualified to serve as a director because of her operational and historical expertise gained from serving as our President and Chief Executive Officer, and her extensive professional and educational experience in the biotechnology industry.

Christopher J. Senner has served on our board of directors since March 2019. Mr. Senner has served as Executive Vice President and Chief Financial Officer for Exelixis, Inc. since 2015. Prior to joining Exelixis, Inc., Mr. Senner served as Vice President, Corporate Finance for Gilead Sciences, Inc., a biopharmaceutical company, from 2010 to 2015, where he was accountable for controllership, tax, treasury and corporate and operational financial planning. Mr. Senner previously spent 18 years at Wyeth, a pharmaceutical company acquired by Pfizer Inc. in 2009, in a variety of financial roles with increasing responsibility, most notably as Chief Financial Officer of Wyeth’s United States pharmaceuticals business and the BioPharma business unit. Mr. Senner holds an undergraduate degree in Finance from Bentley College. We believe that Mr. Senner’s extensive executive and professional experience in the biotechnology industry qualify him to serve as a director.

Margaret A. McLoughlin, Ph.D., has served on our board of directors since December 2015. From January 2014 to April 2019, Dr. McLoughlin served as an Executive Director in World Wide Business Development, at Pfizer Inc. focusing on venture investments, and from June 2018 to April 2019, she was a Partner in Pfizer Ventures, a venture capital arm of Pfizer Inc. focused on companies working in areas aligned with the future directions of Pfizer Inc. Dr. McLoughlin served as a director on the board of directors of 4D Molecular Therapeutics, System1 Biosciences and Adapsyn Biosciences. Dr. McLoughlin joined Pfizer Inc. in 2001 and prior to focusing on venture investments, had roles of increasing responsibility within Worldwide Business Development where she led transactions with multiple biotech companies, academic institutions and other large pharma companies. Prior to working at Pfizer Inc., Dr. McLoughlin served as a Director in Yale’s Office of Cooperative Research for two years. Dr. McLoughlin served in various positions at Mallinckrodt Medical from 1992 to 1999, holding positions in Discovery Research, followed by Technology Planning. Dr. McLoughlin holds a B.S. in Chemistry from the University of California, Irvine and a Ph.D. in Chemistry from the University of California, Santa Barbara. We believe that Dr. McLoughlin is qualified to serve as a director because of her extensive experience in the biotechnology industry and her service on a number of boards, which provides an important perspective on operations and corporate governance matters, as well as her education in biotechnology.

18

Una Ryan, OBE, Ph.D., has served on our board of directors since January 2019. Dr. Ryan has served as a Managing Director at Golden Seeds LLC since 2012, a Partner at Astia Angel since 2012, and a Limited Partner at Breakout Ventures since 2016. She was Chairman of The Bay Area BioEconomy Initiative from 2012 to 2015. Dr. Ryan served as the President and Chief Executive Officer at Waltham Technologies, Inc. from 2008 to 2010. She served as the Chief Executive Officer, President and Chief Operating Officer of AVANT Immunotherapeutics Inc. from 1998 to 2008 (which then became known as Celldex, Inc). She also served as the President and Chief Executive Officer of Diagnostics for All, or DFA, from 2009 to 2012 and as Director of Health Sciences at Monsanto Corporation from 1989 to 1993. Dr. Ryan serves on the board of directors of the following private companies: RenovoRx and Elemental Machines. She also serves on the board of directors of the following non-profit entities: Cambridge in America, the University of Bristol Foundation and the San Francisco Art Institute. Dr. Ryan previously served as a director on the board of directors for AVANT Immunotherapeutics, Inc, Nativis, Inc., AMRIGlobal, Inc, BayBio, MassBio, BIO, or Biotechnology Innovation Organization, New England Healthcare Institute, Board of Associates of the Whitehead Institute and Strategy & Policy Council of the MIT Center for Biomedical Innovation. Dr. Ryan holds a B.S. in Zoology, Microbiology, Chemistry from Bristol University and a Ph.D. in Cellular and Molecular Biology from Cambridge University. Dr. Ryan was awarded the Order of the British Empire for services to biotechnology. We believe that Dr. Ryan is qualified to serve as a director because of her extensive experience in the biotechnology industry and her service on a number of boards of companies, which provides an important perspective on operations and corporate governance matters.

There are no family relationships among our directors and executive officers.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL” NOMINEES FOR THE ELECTION OF THE TWO CLASS II DIRECTORS SET FORTH IN THIS PROPOSAL ONE.

19

PROPOSAL TWO: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has selected BDO USA, LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2021 and recommends that our stockholders vote for the ratification of such selection. The ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 requires the affirmative vote of a majority of the number of votes cast “FOR” and “AGAINST” the proposal. Abstentions (and broker non-votes, if any) will be counted toward the tabulation of votes cast on the proposal and will have the same effect as votes against this proposal. In the event that BDO USA, LLP is not ratified by our stockholders, the audit committee will review its future selection of BDO USA, LLP as our independent registered public accounting firm.

BDO USA, LLP audited our financial statements for the fiscal years ended December 31, 2020 and December 31, 2019. Representatives of BDO USA, LLP are expected to be present at the Annual Meeting and they will be given an opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our audit committee annually. In addition to performing the audit of our financial statements, BDO USA, LLP provided various other services during the fiscal years ended December 31, 2020 and December 31, 2019. Our audit committee has determined that BDO USA, LLP’s provision of these services, which are described below, does not impair BDO USA, LLP’s independence from us. During the years ended December 31, 2020 and December 31, 2019, fees for services provided by BDO USA, LLP were as follows:

| Year Ended December 31, | ||||||||

| 2020 | 2019 | |||||||

Audit fees(1) | $ | 622,021 | $ | 817,990 | ||||

Tax fees(2) | $ | 17,375 | $ | 78,776 | ||||

Total fees | $ | 639,396 | $ | 896,766 | ||||

| (1) | Consists of fees rendered in connection with the audit of our financial statements, including audited financial statements presented in our Annual Report on Form 10-K, review of the interim financial statements included in our quarterly reports and services normally provided in connection with regulatory filings. Included in 2019 Audit fees is approximately $0.5 million of fees billed in connection with our initial public offering, which closed in 2019. |

| (2) | Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance, as well as technical tax advice related to federal and state income tax matters. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm, the scope of services provided by our independent registered public accounting firm and the fees for the services to be performed. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by our independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL TWO.

20

PROPOSAL THREE: ADVISORY VOTE ON THE COMPENSATION OF

THE NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and Section 14A of the Exchange Act, the Company’s stockholders are entitled to vote to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement in accordance with SEC rules. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement.

The compensation of our named executive officers subject to the vote is disclosed in “Compensation Discussion and Analysis,” and the compensation tables and the related narrative disclosure contained in this Proxy Statement. As discussed in the “Compensation Discussion and Analysis” section of this Proxy Statement, the Board believes that our executive compensation program effectively aligns executive pay with our performance and our stockholders’ interests and results in the attraction and retention of highly talented executives. The Board encourages our stockholders to read the disclosures set forth in the “Compensation Discussion and Analysis” section of this Proxy Statement to review the correlation between compensation and performance, as well as compensation actions taken in 2020.

Accordingly, the Board recommends that our stockholders vote FOR the following resolution: