Exhibit 99.1 Quince Therapeutics to Acquire EryDel July 24, 2023

Forward-looking statements Statements in this presentation contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, may be forward-looking statements. Forward-looking statements contained in this news release may be identified by the use of words such as “believe,” “may,” “should,” “expect,” “anticipate,” “plan,” “believe,” “estimated,” “potential,” “intend,” “will,” “can,” “seek,” or other similar words. Examples of forward-looking statements include, among others, statements relating to Quince’s acquisition of EryDel; the timing of the closing of the transaction; the expected benefits of the transaction, including the continued current and future clinical development and potential expansion of EryDel assets, related platform, and related timing and costs; the strategic development path for EryDex; planned FDA and EMA submissions and clinical trials and timeline, prospects, and milestone expectations; the timing and success of the clinical trials and related data, including plans and the ability to initiate, fund, conduct and/or complete current and additional studies; the potential therapeutic benefits, safety, and efficacy of EryDex; statements about its ability to obtain, and the timing relating to, further development of EryDex, regulatory submissions and interactions with regulators; therapeutic and commercial potential; the integration of EryDel’s business, operations, and employees into Quince; Quince’s future development plans and related timing; its cash position and projected cash runway; the company’s focus, objectives, plans, and strategies; and the ability to execute on any strategic transactions. Forward-looking statements are based on Quince’s current expectations and are subject to inherent uncertainties, risks, and assumptions that are difficult to predict and could cause actual results to differ materially from what the company expects. Further, certain forward- looking statements are based on assumptions as to future events that may not prove to be accurate. Factors that could cause actual results to differ include, but are not limited to, the risks and uncertainties described in the section titled “Risk Factors” in the company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on May 15, 2023, and other reports as filed with the SEC. Forward-looking statements contained in this news release are made as of this date, and Quince undertakes no duty to update such information except as required under applicable law. 2

Transformative acquisition with value-creating clinical milestones Phase 3 lead asset EryDex targets Ataxia-Telangiectasia (A-T) with no currently approved treatments and estimated $1+ billion peak sales opportunity EryDex designed for controlled, slow release of dexamethasone over several weeks without long-term toxicity typically associated with chronic steroid administration Plan to enroll first patient in global Phase 3 trial of EryDex in second quarter of 2024 with NDA submission targeted by end of 2025, assuming positive study results Well-capitalized into 2026 with ability to fully fund EryDex expected through Phase 3 trial and to NDA submission, assuming positive study results 3 3 3

EryDel significant achievements Headquarters • Bresso, Italy 20+ years of work on autologous intracellular drug encapsulation (AIDE) technology platform Manufacturing $100+ million invested since founding out of University of Urbino, Italy • Medolla, Italy EryDex designated as orphan drug for A-T treatment from FDA and EMA Leadership • Luca Benatti: CEO Special protocol assessment (SPA) in place with FDA for single Phase 3 clinical trial of EryDex – sufficient for NDA submission, assuming positive study results • Guenter Janhofer: CMO • Giovanni Mambrini: COO EryDex efficacy and safety profile demonstrated in prior Phase 3 clinical • Thomas Sabia: CCO trial of A-T patients Employees Open label extension (OLE) and compassionate use data demonstrates up to 10+ years of chronic steroid administration without typical safety issues • 21 4 4

EryDel acquisition transaction details Overview Stock-for-stock upfront exchange of Quince stock and potential downstream milestone cash payments of up to $485 million Unanimously approved by both companies’ Board of Directors • Up to $5 million in development milestones • $25 million at NDA acceptance • $60 million in approval milestones EryDel stockholders to own maximum of approximately 16.7% of combined company – subject to downward adjustment • $395 million in market and sales milestones • No royalties paid to EryDel stockholders Governance & Leadership Structure Approvals & Closing David Lamond remains Chairperson EryDel to operate as wholly owned subsidiary Subject to certain regulatory approvals and of Quince Board of Directors of Quince with ongoing presence in Italy other closing conditions Retain EryDel team and keep organization intact Dirk Thye remains Quince Chief Executive Officer Expected to close in third quarter 2023 and Director Assumption of $13 million (€10 million principal) EIB loan with scheduled payments beginning in Quince Board of Directors expanded with the second half of 2026 addition of EryDel representative Luca Benatti 5

Autologous intracellular drug encapsulation (AIDE) technology Unique drug/device combination enables automated process for autologous intracellular drug encapsulation Platform capable of expansion to other drugs or biologics, including enzyme replacement therapy 6

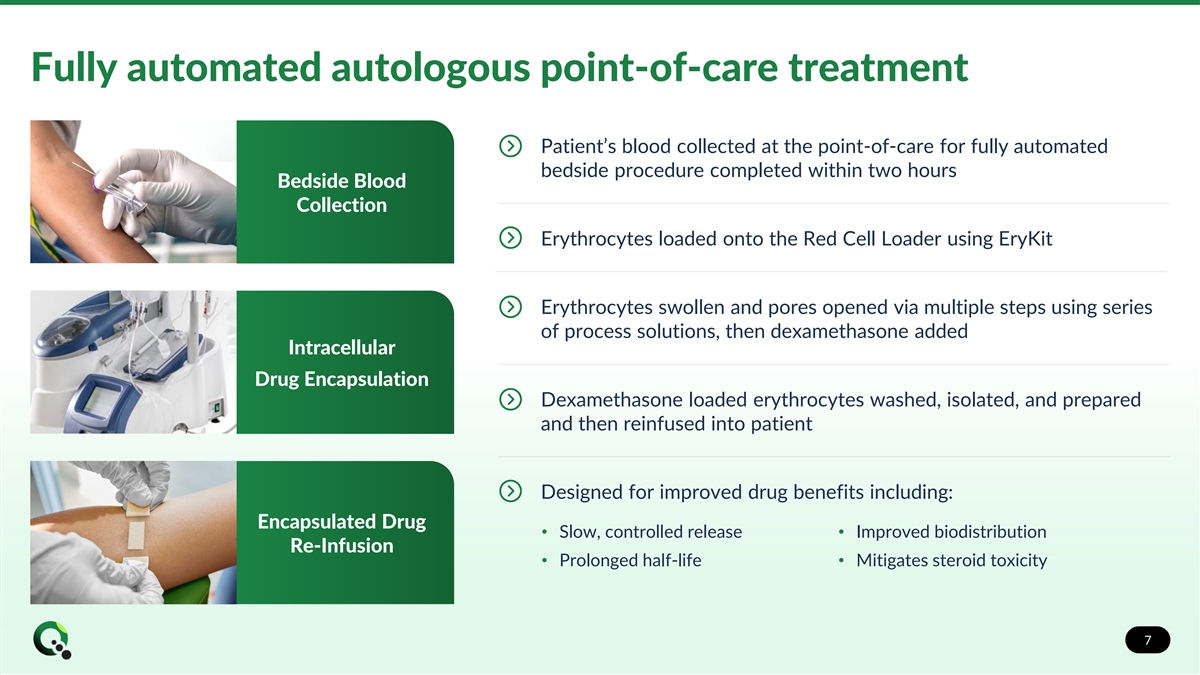

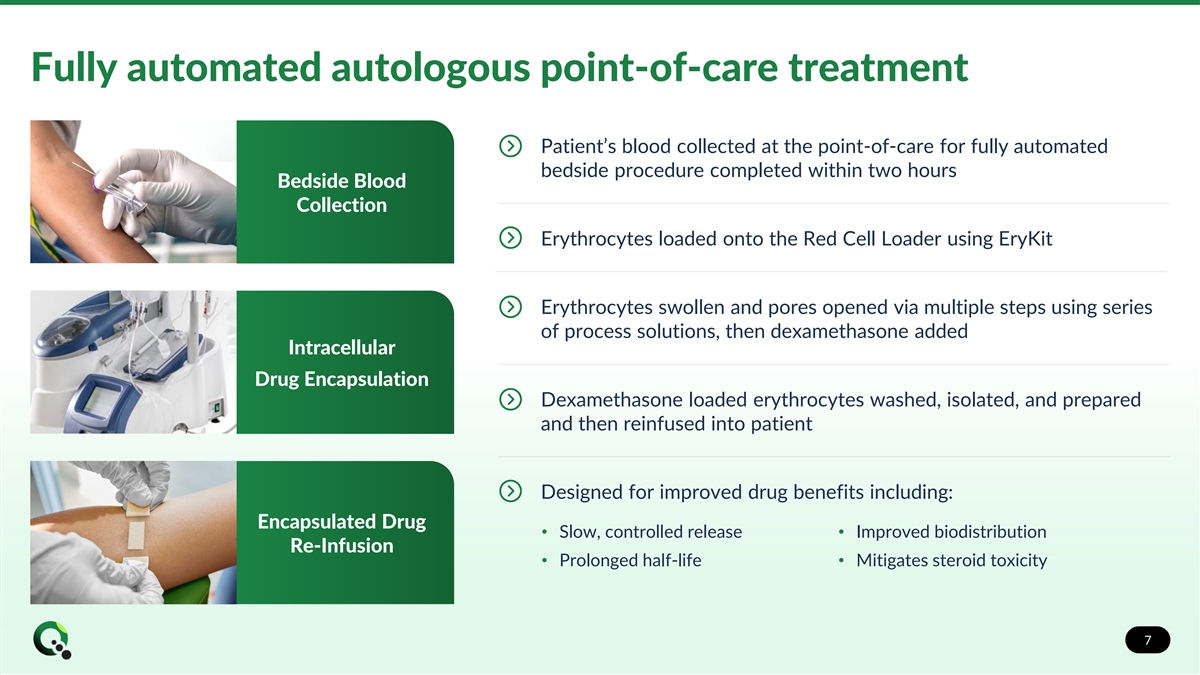

Fully automated autologous point-of-care treatment Patient’s blood collected at the point-of-care for fully automated bedside procedure completed within two hours Bedside Blood Collection Erythrocytes loaded onto the Red Cell Loader using EryKit Erythrocytes swollen and pores opened via multiple steps using series of process solutions, then dexamethasone added Intracellular Drug Encapsulation Dexamethasone loaded erythrocytes washed, isolated, and prepared and then reinfused into patient Designed for improved drug benefits including: Encapsulated Drug • Slow, controlled release• Improved biodistribution Re-Infusion • Prolonged half-life• Mitigates steroid toxicity 7

No currently approved treatments for A-T patients A-T is an inherited neurodegenerative and immunodeficiency disorder caused by mutations in ATM gene Approximately 10,000 A-T patients in U.S., U.K., and EU4 countries Neurological symptoms worsen until patients are wheelchair-bound, usually by adolescence Median lifespan of approximately 25 years, with mortality due to infections and malignancy Currently no approved treatments for A-T and no known effective approaches to delay progression of disease 8

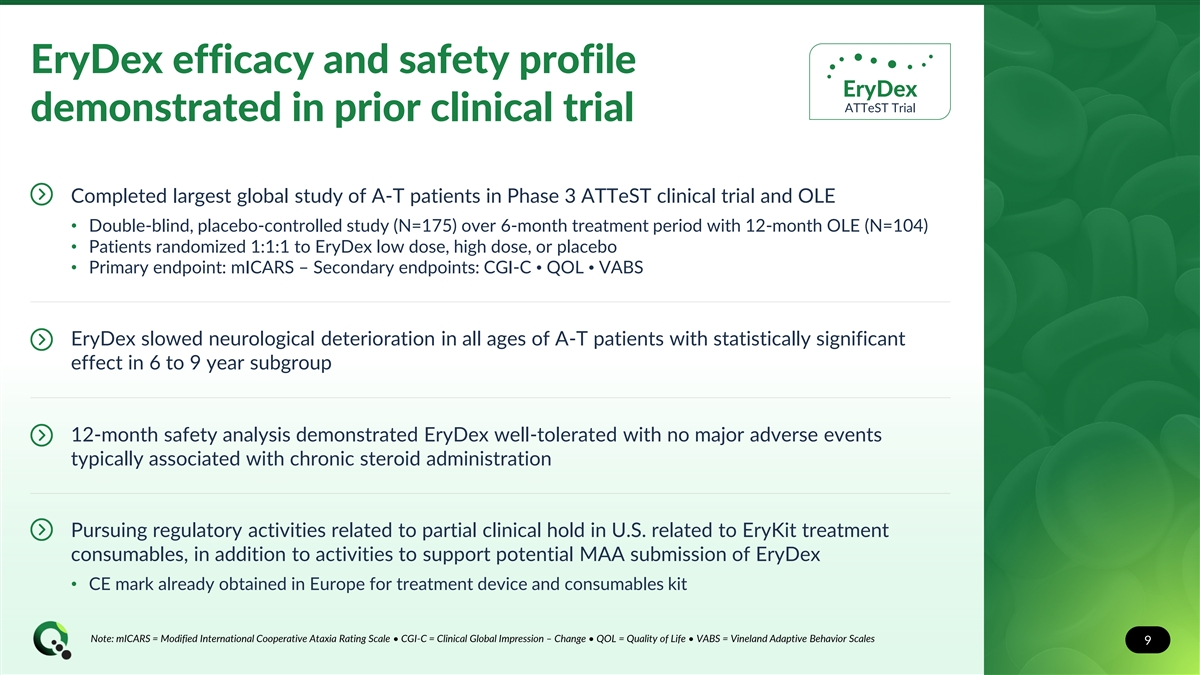

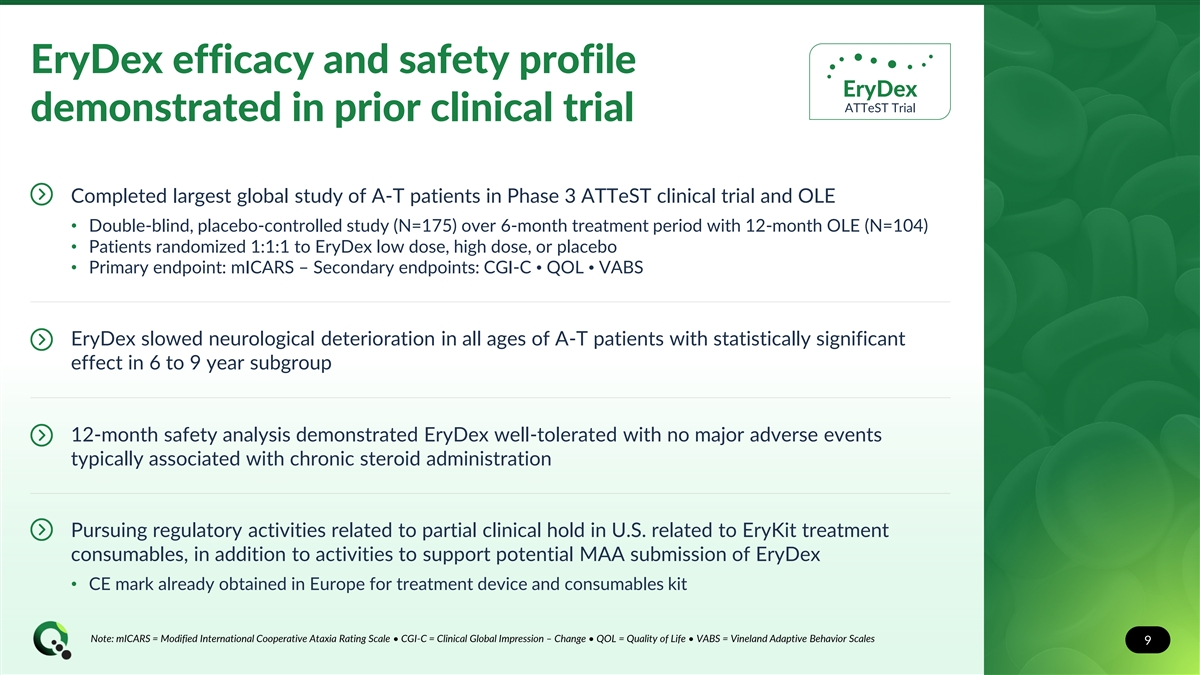

EryDex efficacy and safety profile EryDex ATTeST Trial demonstrated in prior clinical trial Completed largest global study of A-T patients in Phase 3 ATTeST clinical trial and OLE • Double-blind, placebo-controlled study (N=175) over 6-month treatment period with 12-month OLE (N=104) • Patients randomized 1:1:1 to EryDex low dose, high dose, or placebo • Primary endpoint: mICARS – Secondary endpoints: CGI-C • QOL • VABS EryDex slowed neurological deterioration in all ages of A-T patients with statistically significant effect in 6 to 9 year subgroup 12-month safety analysis demonstrated EryDex well-tolerated with no major adverse events typically associated with chronic steroid administration Pursuing regulatory activities related to partial clinical hold in U.S. related to EryKit treatment consumables, in addition to activities to support potential MAA submission of EryDex • CE mark already obtained in Europe for treatment device and consumables kit 9 Note: mICARS = Modified International Cooperative Ataxia Rating Scale • CGI-C = Clinical Global Impression – Change • QOL = Quality of Life • VABS = Vineland Adaptive Behavior Scales 9 9

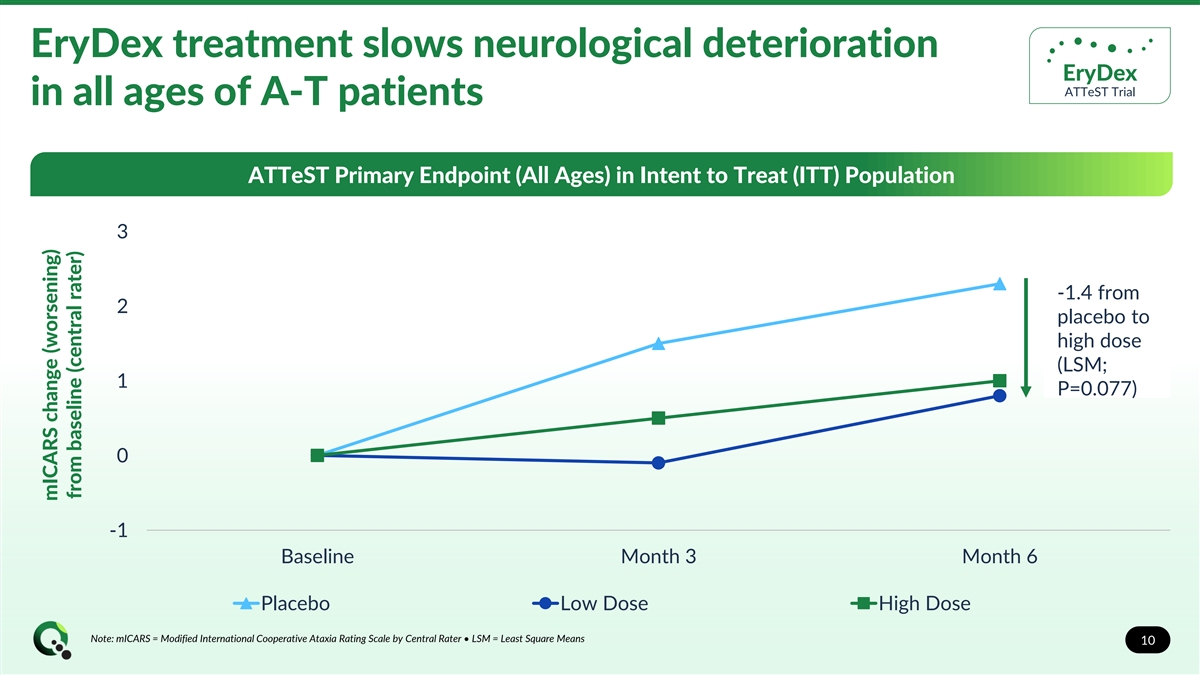

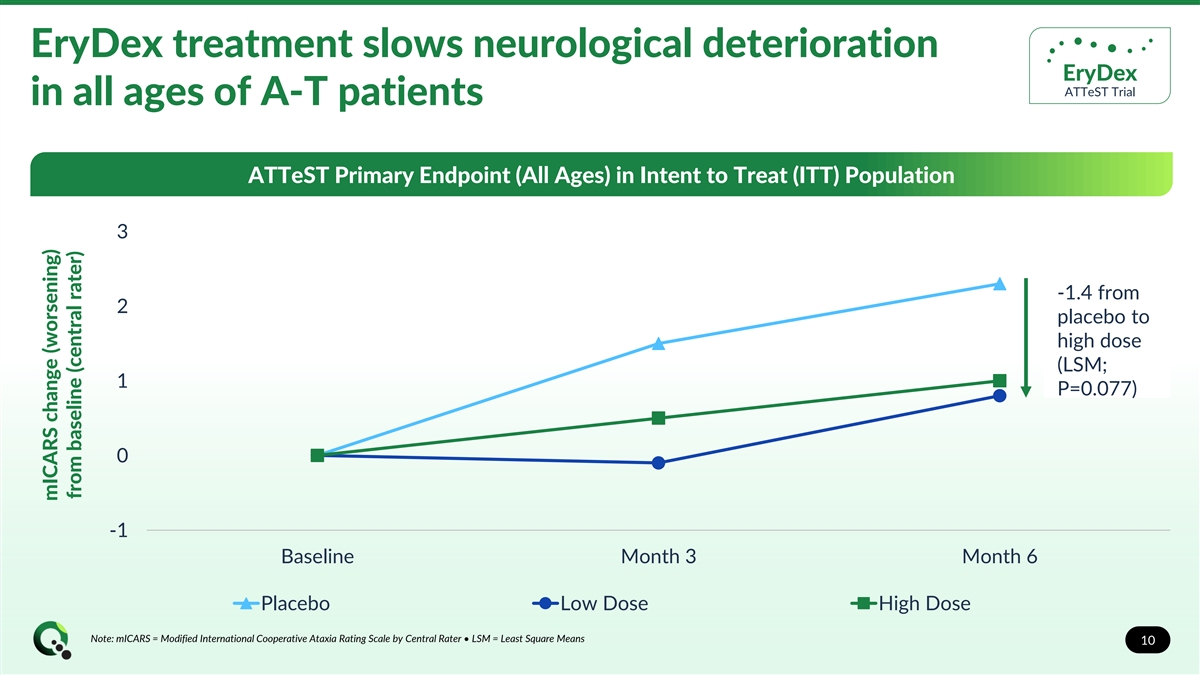

EryDex treatment slows neurological deterioration EryDex ATTeST Trial in all ages of A-T patients ATTeST Primary Endpoint (All Ages) in Intent to Treat (ITT) Population 3 -1.4 from 2 placebo to high dose (LSM; 1 P=0.077) 0 -1 Baseline Month 3 Month 6 Placebo Low Dose High Dose Note: mICARS = Modified International Cooperative Ataxia Rating Scale by Central Rater • LSM = Least Square Means 10 mICARS change (worsening) from baseline (central rater)

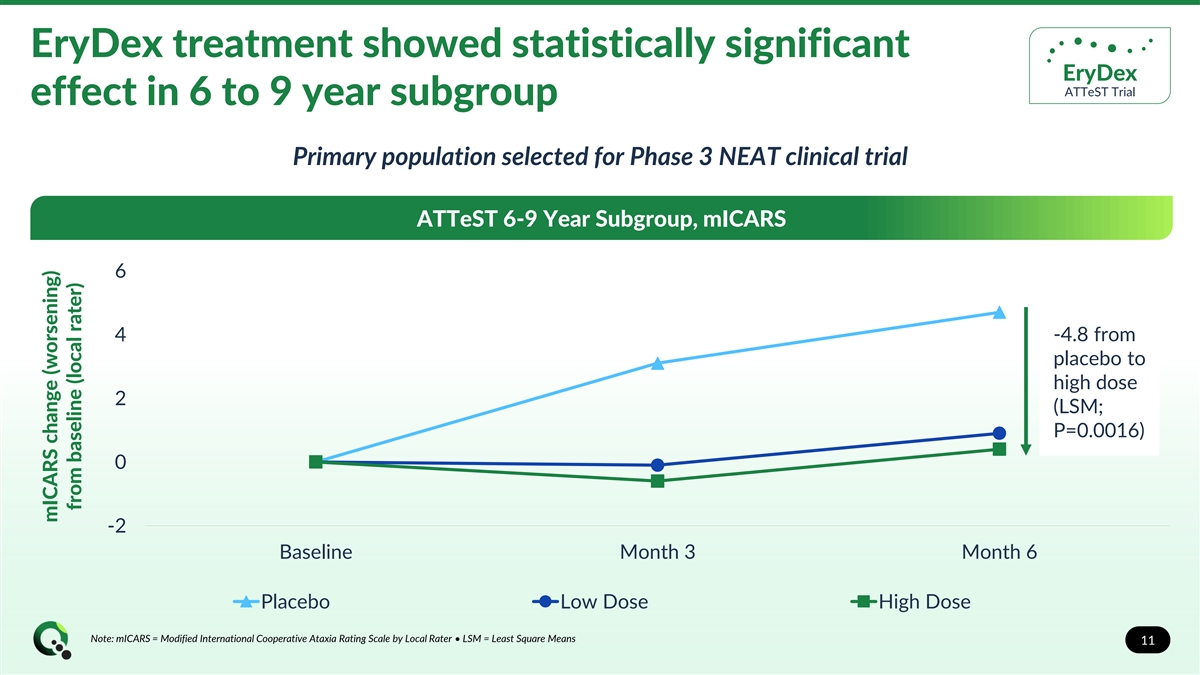

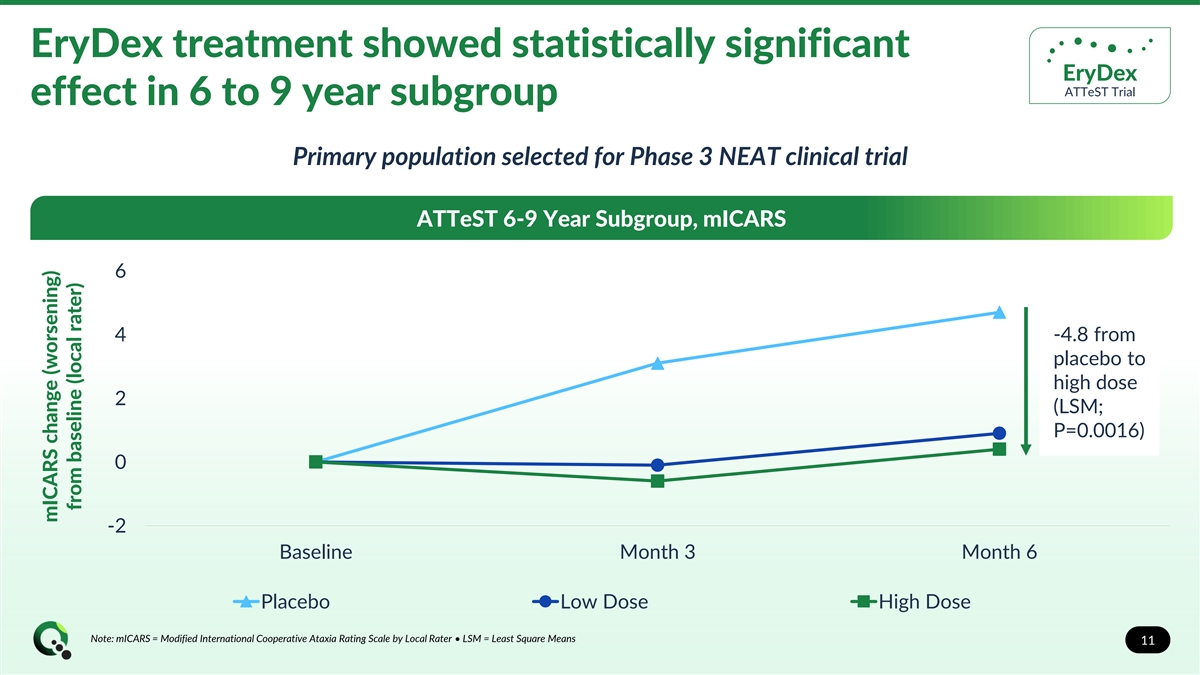

EryDex treatment showed statistically significant EryDex ATTeST Trial effect in 6 to 9 year subgroup Primary population selected for Phase 3 NEAT clinical trial ATTeST 6-9 Year Subgroup, mICARS 6 4 -4.8 from placebo to high dose 2 (LSM; P=0.0016) 0 -2 Baseline Month 3 Month 6 Placebo Low Dose High Dose Note: mICARS = Modified International Cooperative Ataxia Rating Scale by Local Rater • LSM = Least Square Means 11 mICARS change (worsening) from baseline (local rater)

EryDex consistent and statistically significant in EryDex ATTeST Trial 6 to 9 year subgroup across multiple endpoints ATTeST ICARS Values in ITT Population EMA Endpoint FDA Endpoint ICARS CR ICARS LR mICARS CR mICARS LR RmICARS CR RmICARS LR 0 -1 -2 P=0.028 -3 P=0.009 P=0.019 -4 Phase 3 NEAT Primary Endpoint -5 P=0.024 P=0.002 -6 P=0.020 -7 All Ages (n=58) 6-9 Years (n=33) Note: Values reflect Least Square Means (LSM) difference from placebo and the P value presented • ICARS = International Cooperative Ataxia Rating Scale – by Central Rater (CR) and Local Rater (LR) • mICARS = Modified 12 International Cooperative Ataxia Rating Scale – by Central Rater (CR) and Local Rater (LR) • RmICARS = Rescored Modified International Cooperative Ataxia Rating Scale – by Central Rater (CR) and Local Rater (LR) Improvement vs. Placebo

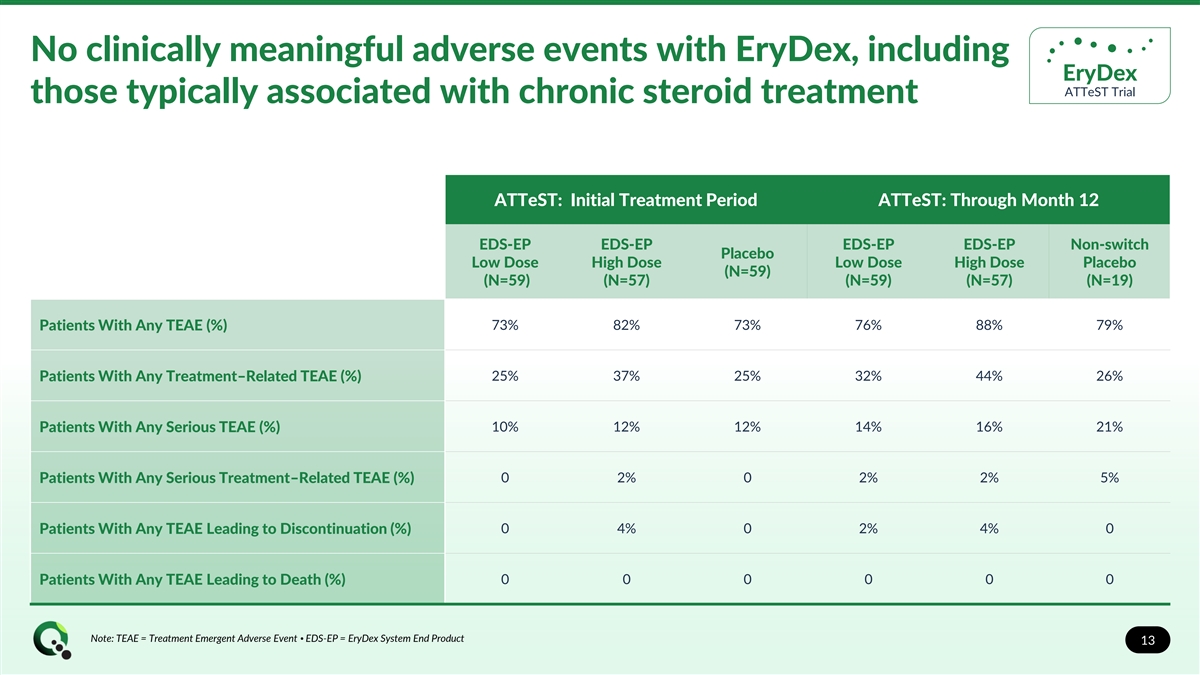

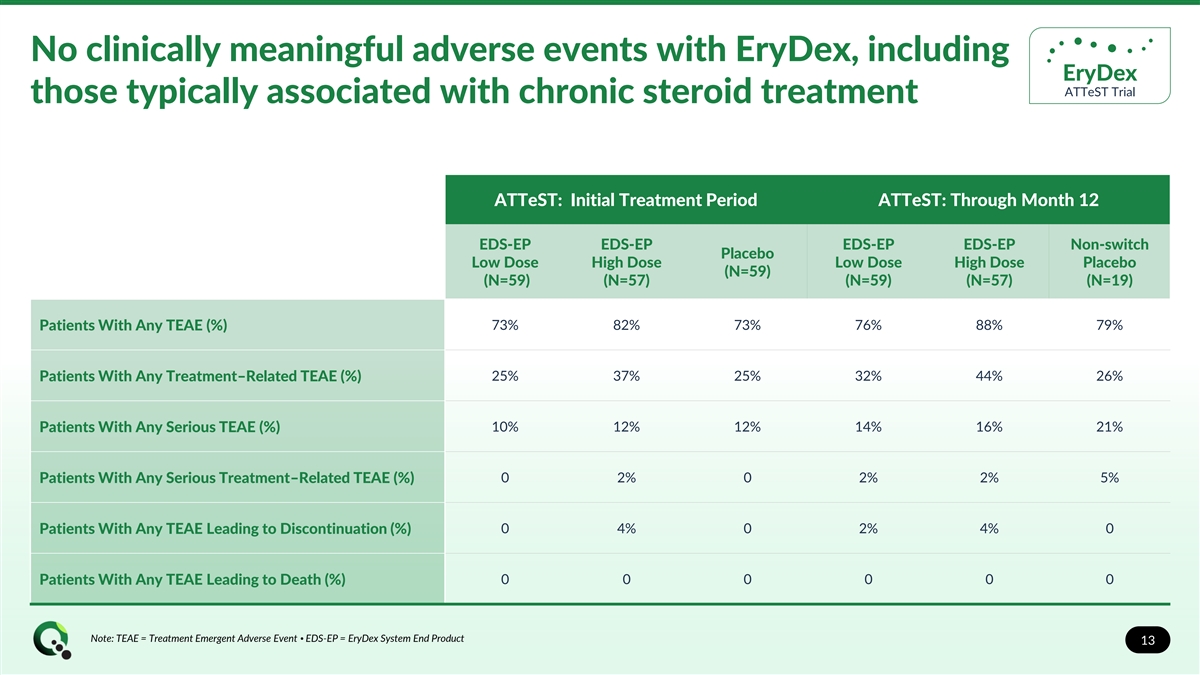

No clinically meaningful adverse events with EryDex, including EryDex ATTeST Trial those typically associated with chronic steroid treatment ATTeST: Initial Treatment Period ATTeST: Through Month 12 EDS-EP EDS-EP EDS-EP EDS-EP Non-switch Placebo Low Dose High Dose Low Dose High Dose Placebo (N=59) (N=59) (N=57) (N=59) (N=57) (N=19) 73% 82% 73% 76% 88% 79% Patients With Any TEAE (%) Patients With Any Treatment–Related TEAE (%) 25% 37% 25% 32% 44% 26% 10% 12% 12% 14% 16% 21% Patients With Any Serious TEAE (%) 0 2% 0 2% 2% 5% Patients With Any Serious Treatment–Related TEAE (%) Patients With Any TEAE Leading to Discontinuation (%) 0 4% 0 2% 4% 0 0 0 0 0 0 0 Patients With Any TEAE Leading to Death (%) Note: TEAE = Treatment Emergent Adverse Event • EDS-EP = EryDex System End Product 13

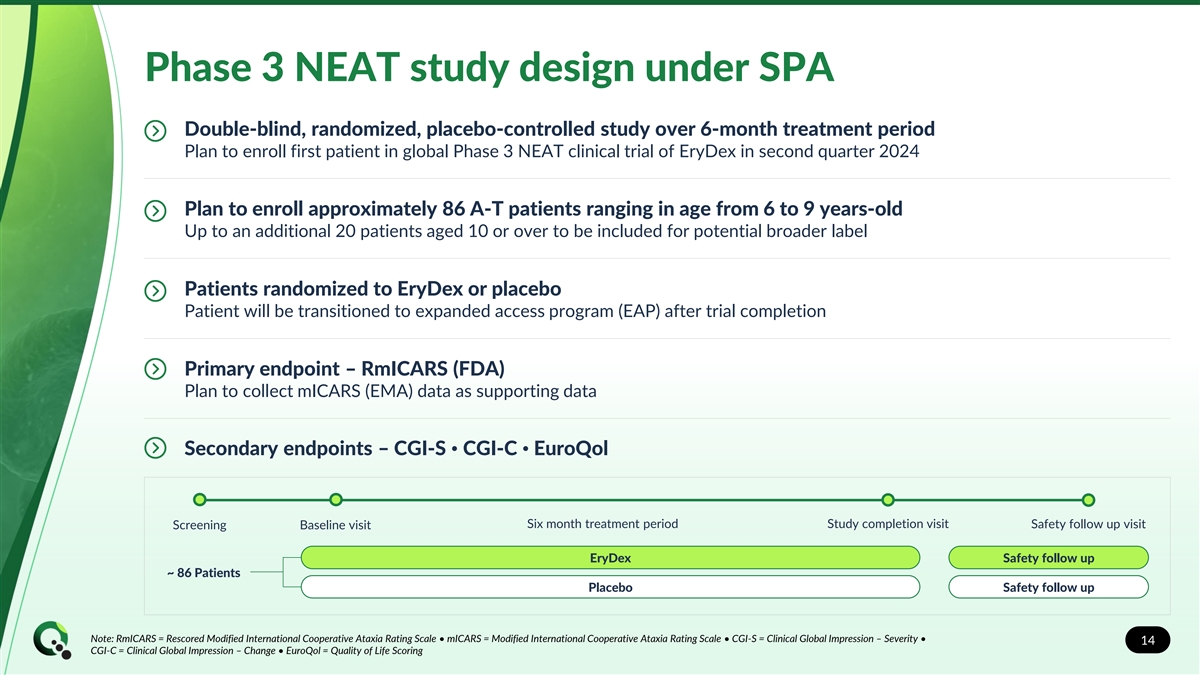

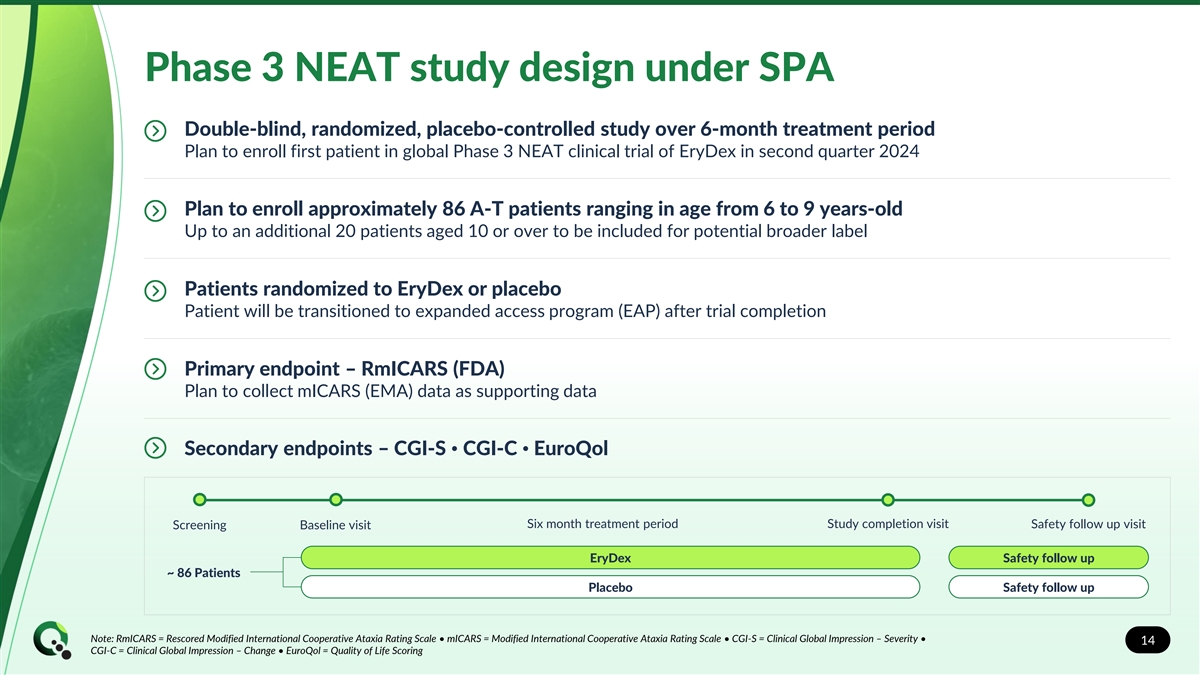

Phase 3 NEAT study design under SPA Double-blind, randomized, placebo-controlled study over 6-month treatment period Plan to enroll first patient in global Phase 3 NEAT clinical trial of EryDex in second quarter 2024 Plan to enroll approximately 86 A-T patients ranging in age from 6 to 9 years-old Up to an additional 20 patients aged 10 or over to be included for potential broader label Patients randomized to EryDex or placebo Patient will be transitioned to expanded access program (EAP) after trial completion Primary endpoint – RmICARS (FDA) Plan to collect mICARS (EMA) data as supporting data Secondary endpoints – CGI-S • CGI-C • EuroQol Six month treatment period Study completion visit Safety follow up visit Screening Baseline visit EryDex Safety follow up ~ 86 Patients Placebo Safety follow up Note: RmICARS = Rescored Modified International Cooperative Ataxia Rating Scale • mICARS = Modified International Cooperative Ataxia Rating Scale • CGI-S = Clinical Global Impression – Severity • 14 CGI-C = Clinical Global Impression – Change • EuroQol = Quality of Life Scoring

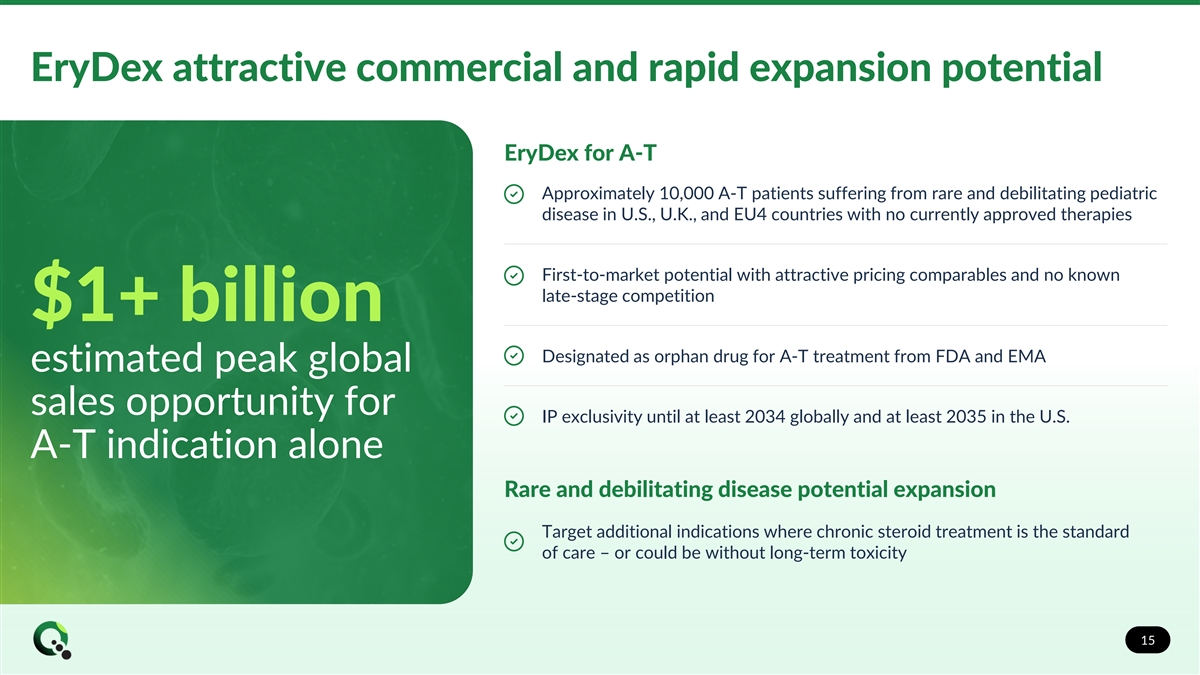

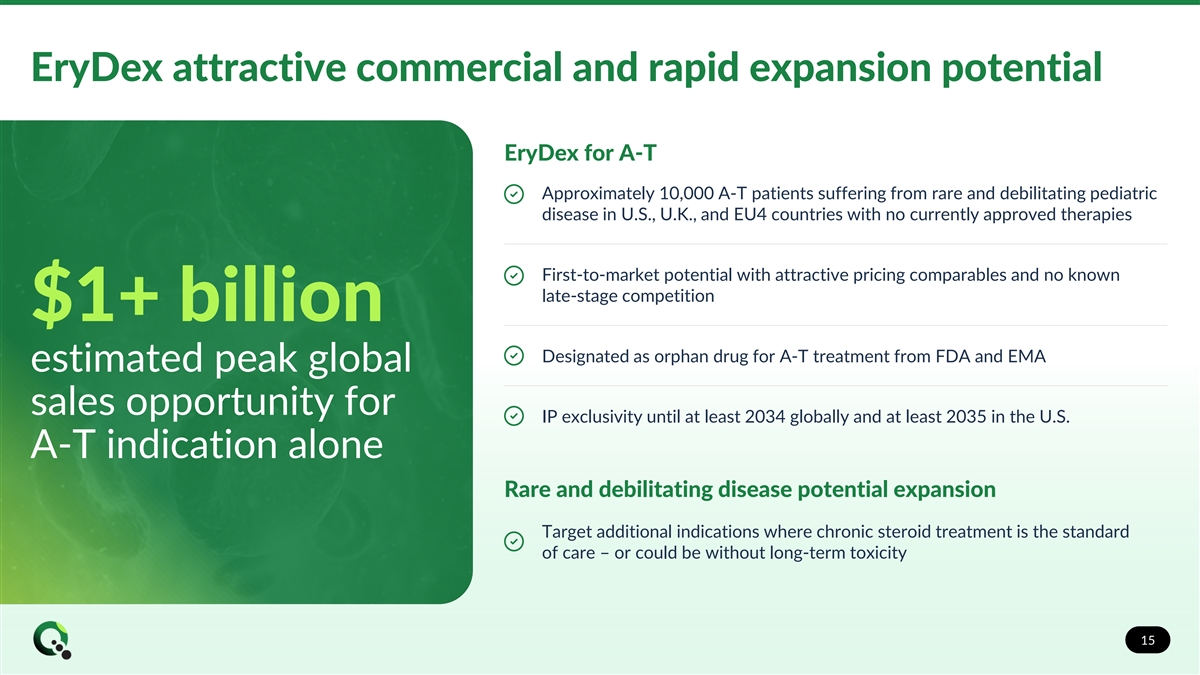

EryDex attractive commercial and rapid expansion potential EryDex for A-T Approximately 10,000 A-T patients suffering from rare and debilitating pediatric disease in U.S., U.K., and EU4 countries with no currently approved therapies First-to-market potential with attractive pricing comparables and no known late-stage competition $1+ billion Designated as orphan drug for A-T treatment from FDA and EMA estimated peak global sales opportunity for IP exclusivity until at least 2034 globally and at least 2035 in the U.S. A-T indication alone Rare and debilitating disease potential expansion Target additional indications where chronic steroid treatment is the standard of care – or could be without long-term toxicity 15

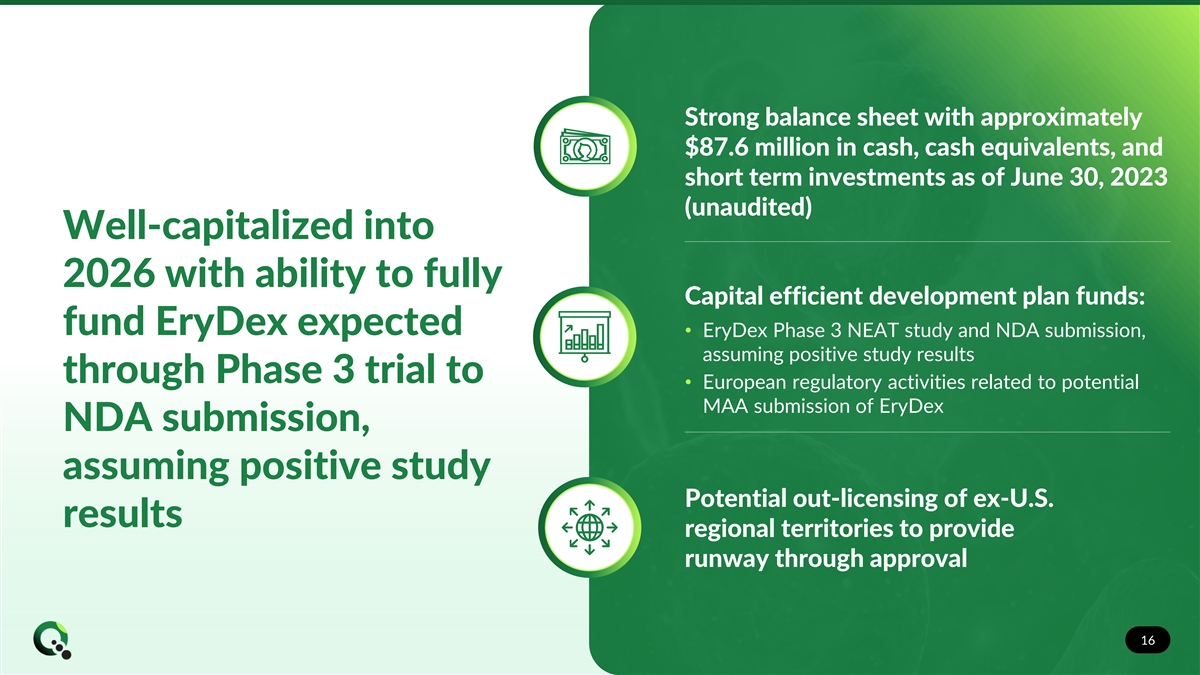

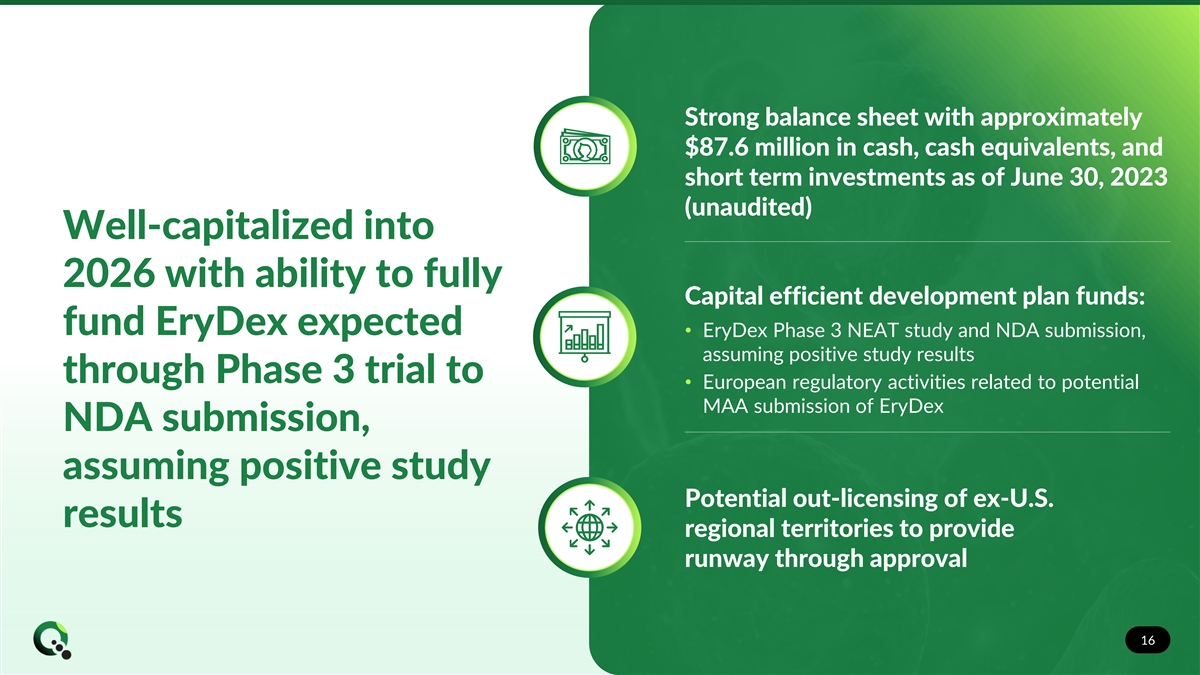

Strong balance sheet with approximately $87.6 million in cash, cash equivalents, and short term investments as of June 30, 2023 (unaudited) Well-capitalized into 2026 with ability to fully Capital efficient development plan funds: fund EryDex expected • EryDex Phase 3 NEAT study and NDA submission, assuming positive study results through Phase 3 trial to • European regulatory activities related to potential MAA submission of EryDex NDA submission, assuming positive study Potential out-licensing of ex-U.S. results regional territories to provide runway through approval 16 16

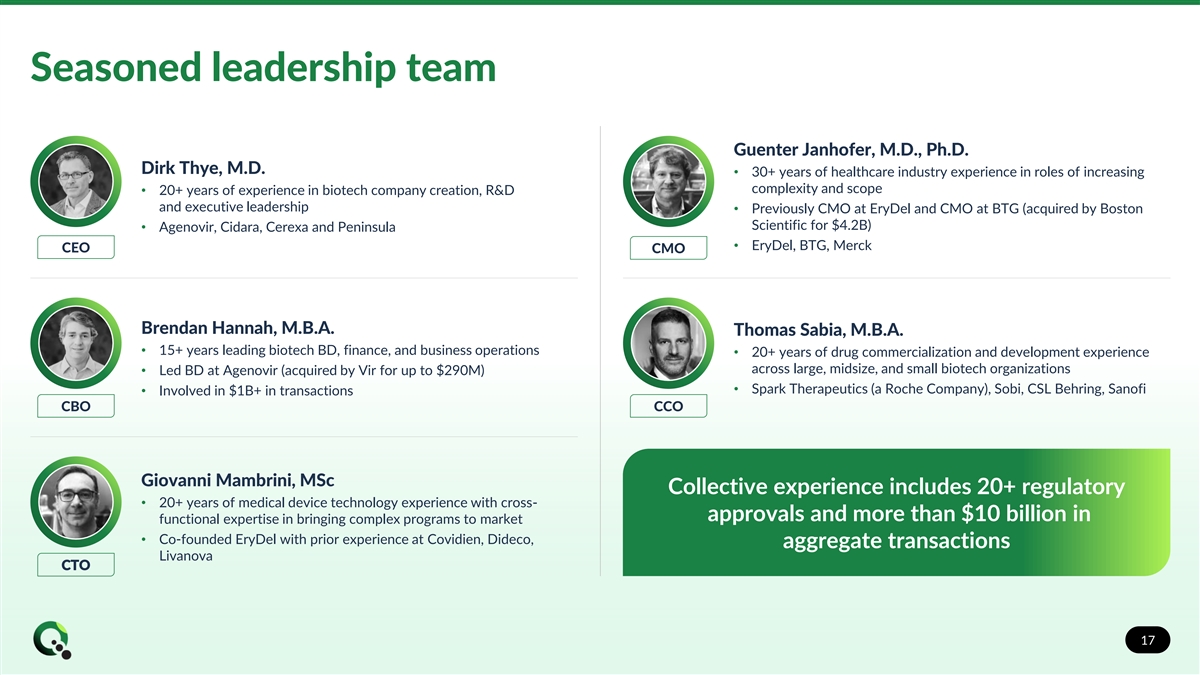

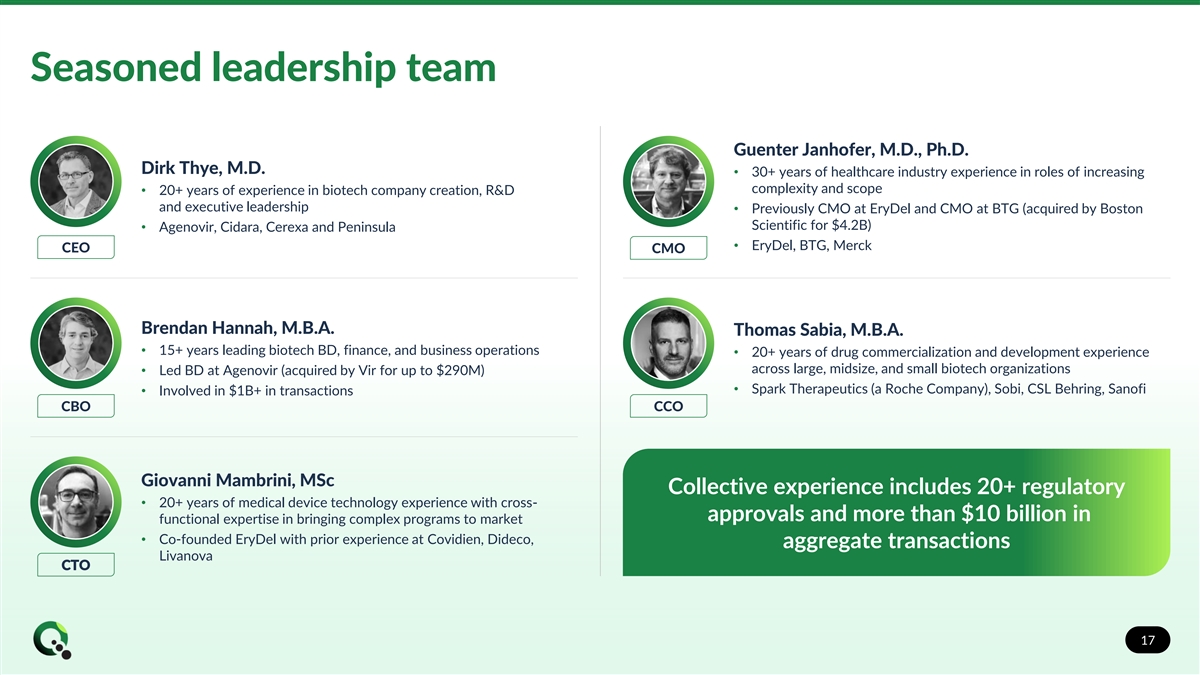

Seasoned leadership team Guenter Janhofer, M.D., Ph.D. Dirk Thye, M.D. • 30+ years of healthcare industry experience in roles of increasing complexity and scope • 20+ years of experience in biotech company creation, R&D and executive leadership • Previously CMO at EryDel and CMO at BTG (acquired by Boston Scientific for $4.2B) • Agenovir, Cidara, Cerexa and Peninsula • EryDel, BTG, Merck CEO CMO Brendan Hannah, M.B.A. Thomas Sabia, M.B.A. • 15+ years leading biotech BD, finance, and business operations • 20+ years of drug commercialization and development experience across large, midsize, and small biotech organizations • Led BD at Agenovir (acquired by Vir for up to $290M) • Spark Therapeutics (a Roche Company), Sobi, CSL Behring, Sanofi • Involved in $1B+ in transactions CBO CCO Giovanni Mambrini, MSc Collective experience includes 20+ regulatory • 20+ years of medical device technology experience with cross- approvals and more than $10 billion in functional expertise in bringing complex programs to market • Co-founded EryDel with prior experience at Covidien, Dideco, aggregate transactions Livanova CTO 17

Key clinical and corporate milestones Second half of 2023 2024 2025 Close acquisition of EryDel in third Enroll first patient in Phase 3 NEAT Phase 3 NEAT clinical trial topline results quarter 2023 clinical trial in second quarter 2024 Target EryDex NDA submission Target resolution of partial clinical hold Initiate pediatric study plan with FDA by end of 2025, assuming on improved EryKit treatment positive study results consumables in U.S. Determine additional indications for At least one Phase 2 study of EryDex EryDex and initiate R&D activities Initiate start up activities for Phase 3 follow on indication NEAT clinical trial Initiate R&D activities for at least one Potential out-licensing of ex-U.S. Pursue European regulatory activities additional program utilizing AIDE regional territories to provide runway related to potential MAA submission of technology platform through approval EryDex 18

Transformative acquisition with value-creating clinical milestones Phase 3 lead asset EryDex targets Ataxia-Telangiectasia (A-T) with no currently approved treatments and estimated $1+ billion peak sales opportunity EryDex designed for controlled, slow release of dexamethasone over several weeks without long-term toxicity typically associated with chronic steroid administration Plan to enroll first patient in global Phase 3 trial of EryDex in second quarter of 2024 with NDA submission targeted by end of 2025, assuming positive study results Well-capitalized into 2026 with ability to fully fund EryDex expected through Phase 3 trial and to NDA submission, assuming positive study results 19 19 19