loan management services, construction management services, property management services, leasing services, transaction support services (which may consist of assembling relevant information with respect to investment acquisitions and dispositions, conducting financial and market analyses, coordinating closing and post-closing procedures for acquisitions, dispositions and other transactions, coordinating of design and development works, coordinating with brokers, lawyers, accountants and other advisors, assisting with due diligence, site visits and other services), transaction consulting services and other similar operational matters. Such service providers, include, without limitation, the following companies, which we have engaged and expect to continue engaging with respect to properties in the sectors noted to provide some or all of the services described above:

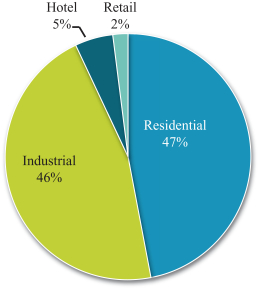

LivCor.We have engaged LivCor, LLC, a portfolio company owned by a Blackstone-advised fund for certain of our multi-family properties.

Equity Office Management/Equity Office Properties. We have engaged Equity Office Management, L.L.C. (“EOM”), a portfolio company owned by Blackstone-advised funds for certain of our office and industrial properties.

ShopCore. We have engaged ShopCore, LLC, a portfolio company owned by a Blackstone-advised fund for certain of our retail properties.

Gateway. We have engaged Gateway Industrial Properties L.L.C. (“Gateway”), a portfolio company owned by a Blackstone-advised fund, to provide the services that EOM had previously provided to our industrial properties.

BRE Hotels and Resorts. We have engaged BRE Hotels and Resorts, a portfolio company controlled (but not owned) by a Blackstone-advised fund for certain of our hotel properties.

Revantage. We have engaged Revantage Corporate Services, LLC (“Revantage”), a portfolio company owned by a Blackstone-advised fund, to provide corporate support services, including tax, treasury, accounting, legal, risk management, information technology and human resources. Revantage will consolidate such functions under one operating platform. Such functions are currently performed by each engaging portfolio entity, and in certain circumstances third parties. In connection with such consolidation, certain employees of one or more portfolio entities that currently perform such functions are expected to be reassigned to Revantage.

COE. We expect to engage the Blackstone Center of Excellence, located in Gurgaon, India (the “COE”), a center of resources administered by ThoughtFocus Technologies LLC, an independent firm in which Blackstone holds a minority position and participates as a member of the board, for certain of our properties.

Group Purchasing and Other Arrangements with Other Blackstone Vehicles. We have entered and may in the future enter into arrangements with Other Blackstone Vehicles whereby we procure property and/or other types of insurance as a group (i.e., among us, certain Other Blackstone Vehicles and/or their respective properties) from an insurance provider where the insurance provider may charge lower premiums to the group than it would on an individual basis. In such event, the obligation to pay the premiums on such group policies may be allocated among us and any such Other Blackstone Vehicles according to the relative values of the respective properties that are insured by such policies or other factors that Blackstone may reasonably determine. Additionally, we and such Other Blackstone Vehicles may jointly contribute to a pool of funds that may be used to pay any losses subject to the deductibles on any such group insurance policies, which contributions may similarly be allocated among us and any such Other Blackstone Vehicles according to the relative values of the respective properties that are insured by such policies or other factors that Blackstone may reasonably determine.

For more information regarding our relationships with these entities, see “Selected Information Regarding our Operations—Related Party Transactions” on page 171 of this prospectus, as well as “Transactions with Related Persons and Certain Control Persons—Our Relationship with Our Adviser and Blackstone—Affiliate Service Agreements” in our definitive Proxy Statement on Schedule 14A, Note 11 to our consolidated financial

89