has elected to receive the management fee in shares of the Company’s common stock, resulting in a non-cash expense. During the years ended December 31, 2022, 2021 and 2020 the Company incurred management fees of $837.7 million, $445.3 million and $224.8 million, respectively.

During the years ended December 31, 2022, 2021 and 2020, the Company issued 51.3 million, 30.1 million and 18.5 million unregistered Class I shares, respectively, to the Adviser as payment for management fees. The Company also had a payable of $71.6 million and $56.6 million related to the management fees as of December 31, 2022 and December 31, 2021, respectively. During January 2023, the Adviser was issued 4.8 million unregistered Class I shares as payment for the management fees accrued as of December 31, 2022. The shares issued to the Adviser for payment of the management fee were issued at the applicable NAV per share at the end of each month for which the fee was earned. The Adviser did not submit any repurchase requests for shares previously issued as payment for management fees during the year ended December 31, 2022. During the year ended December 31, 2021, the Adviser submitted 25.2 million Class I shares for repurchase by the Company, for a total repurchase amount of $321.4 million.

Accrued affiliate service provider expenses and incentive compensation awards

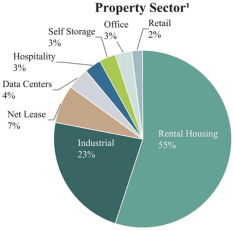

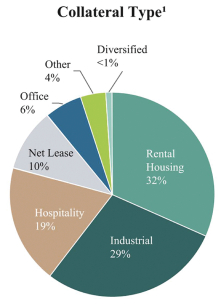

The Company has engaged Link, a portfolio company owned by Blackstone-advised investment vehicles, to provide, as applicable, operational services (including, without limitation, property management, leasing, and construction and project management), management services, loan management services, corporate support services (including, without limitation, accounting, information technology, legal, tax and human resources) and transaction support services for the Company’s industrial properties.

The Company has engaged LivCor, a portfolio company owned by Blackstone-advised investment vehicles, to provide, as applicable, operational services (including, without limitation, construction and project management), management services, loan management services, corporate support services (including, without limitation, accounting, information technology, legal, tax and human resources) and transaction support services for the Company’s multifamily properties.

The Company has engaged Revantage, portfolio companies owned by Blackstone-advised investment vehicles, to provide, as applicable, corporate support services (including, without limitation, accounting, legal, tax, treasury, valuation services, information technology and data management).

The Company has engaged BRE, a portfolio company controlled (but not owned) by Blackstone-advised investment vehicles, to provide, as applicable, operational services (including, without limitation, construction and project management), management services, loan management services, corporate support services (including, without limitation, accounting, legal and tax) and transaction support services for the Company’s hospitality properties.

The Company has engaged ShopCore, a portfolio company owned by Blackstone-advised investment vehicles, to provide, as applicable, operational services (including, without limitation, property management, construction and project management and leasing), management services, loan management services, corporate support services (including, without limitation, accounting, information technology, legal, tax and human resources) and transaction support services for the Company’s retail properties.

The Company has engaged Beam Living, a portfolio company owned by Blackstone-advised investment vehicles, to provide, as applicable, operational services (including, without limitation, construction and project management), management services, loan management services, corporate support services (including, without limitation, accounting, information technology, legal, tax and human resources) and transaction support services for certain of the Company’s multifamily properties in New York City.

233