UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2019

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 000-55931

Blackstone Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in its charter)

| |

Maryland | 81-0696966 |

(State or other jurisdiction of incorporation or organization) 345 Park Avenue New York, NY (Address of principal executive offices) | (I.R.S. Employer Identification No.) 10154 (Zip Code) |

Registrant’s telephone number, including area code: (212) 583-5000

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☒ | | Smaller reporting company | | ☐ |

| | | | | | |

Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 14, 2019, the issuer had the following shares outstanding: 421,961,887 shares of Class S common stock, 35,233,903 shares of Class T common stock, 63,674,039 shares of Class D common stock, and 286,858,436 shares of Class I common stock.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. | FINANCIAL STATEMENTS |

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| | June 30, 2019 | | | December 31, 2018 | |

Assets | | | | | | | | |

Investments in real estate, net | | $ | 14,266,583 | | | $ | 10,259,687 | |

Investments in real estate-related securities and loans | | | 3,460,922 | | | | 2,259,913 | |

Cash and cash equivalents | | | 150,062 | | | | 68,089 | |

Restricted cash | | | 477,768 | | | | 238,524 | |

Other assets | | | 506,752 | | | | 410,945 | |

Total assets | | $ | 18,862,087 | | | $ | 13,237,158 | |

| | | | | | | | |

Liabilities and Equity | | | | | | | | |

Mortgage notes, term loans, and secured revolving credit facilities, net | | $ | 8,379,181 | | | $ | 6,833,269 | |

Repurchase agreements | | | 2,447,134 | | | | 1,713,723 | |

Unsecured revolving credit facilities | | | 240,000 | | | | — | |

Due to affiliates | | | 430,011 | | | | 301,581 | |

Accounts payable, accrued expenses, and other liabilities | | | 979,203 | | | | 464,398 | |

Total liabilities | | | 12,475,529 | | | | 9,312,971 | |

| | | | | | | | |

Commitments and contingencies | | | — | | | | — | |

Redeemable non-controlling interest | | | 10,183 | | | | 9,233 | |

| | | | | | | | |

Equity | | | | | | | | |

Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; no shares issued and outstanding as of June 30, 2019 and December 31, 2018 | | | — | | | | — | |

Common stock — Class S shares, $0.01 par value per share, 500,000,000 shares authorized; 381,155,980 and 276,989,019 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | | 3,812 | | | | 2,770 | |

Common stock — Class T shares, $0.01 par value per share, 500,000,000 shares authorized; 31,903,877 and 23,313,429 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | | 319 | | | | 233 | |

Common stock — Class D shares, $0.01 par value per share, 500,000,000 shares authorized; 52,916,501 and 30,375,353 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | | 529 | | | | 304 | |

Common stock — Class I shares, $0.01 par value per share, 500,000,000 shares authorized; 228,556,040 and 108,261,331 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | | 2,286 | | | | 1,083 | |

Additional paid-in capital | | | 6,969,300 | | | | 4,327,444 | |

Accumulated deficit and cumulative distributions | | | (845,511 | ) | | | (587,548 | ) |

Total stockholders' equity | | | 6,130,735 | | | | 3,744,286 | |

Non-controlling interests attributable to third party joint ventures | | | 113,725 | | | | 75,592 | |

Non-controlling interests attributable to BREIT OP unitholders | | | 131,915 | | | | 95,076 | |

Total equity | | | 6,376,375 | | | | 3,914,954 | |

Total liabilities and equity | | $ | 18,862,087 | | | $ | 13,237,158 | |

See accompanying notes to condensed consolidated financial statements.

1

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended June 30, | | | Six Months Ended June 30, | |

| 2019 | | | 2018 | | | 2019 | | | 2018 | |

Revenues | | | | | | | | | | | | | | | |

Rental revenue | $ | 247,672 | | | $ | 125,814 | | | $ | 459,869 | | | $ | 213,375 | |

Hotel revenue | | 94,351 | | | | 21,196 | | | | 169,617 | | | | 39,017 | |

Other revenue | | 12,285 | | | | 5,216 | | | | 21,913 | | | | 9,518 | |

Total revenues | | 354,308 | | | | 152,226 | | | | 651,399 | | | | 261,910 | |

Expenses | | | | | | | | | | | | | | | |

Rental property operating | | 101,211 | | | | 51,452 | | | | 189,022 | | | | 90,070 | |

Hotel operating | | 63,197 | | | | 13,522 | | | | 114,517 | | | | 25,136 | |

General and administrative | | 4,878 | | | | 2,901 | | | | 8,059 | | | | 4,946 | |

Management fee | | 22,487 | | | | 9,281 | | | | 39,664 | | | | 16,250 | |

Performance participation allocation | | 29,898 | | | | 9,476 | | | | 50,061 | | | | 17,349 | |

Depreciation and amortization | | 161,854 | | | | 84,826 | | | | 301,333 | | | | 158,950 | |

Total expenses | | 383,525 | | | | 171,458 | | | | 702,656 | | | | 312,701 | |

Other income (expense) | | | | | | | | | | | | | | | |

Income from real estate-related securities and loans | | 51,784 | | | | 17,397 | | | | 113,467 | | | | 30,632 | |

Gain on disposition of real estate | | 29,686 | | | | — | | | | 29,686 | | | | — | |

Interest income | | 303 | | | | 121 | | | | 497 | | | | 198 | |

Interest expense | | (103,279 | ) | | | (49,841 | ) | | | (194,866 | ) | | | (81,232 | ) |

Other income (expense) | | (2,061 | ) | | | (389 | ) | | | (407 | ) | | | (389 | ) |

Total other income (expense) | | (23,567 | ) | | | (32,712 | ) | | | (51,623 | ) | | | (50,791 | ) |

Net loss | $ | (52,784 | ) | | $ | (51,944 | ) | | $ | (102,880 | ) | | $ | (101,582 | ) |

Net loss attributable to non-controlling interests in third party joint ventures | $ | 970 | | | $ | 1,217 | | | $ | 3,006 | | | $ | 2,930 | |

Net loss attributable to non-controlling interests in BREIT OP | | 1,110 | | | | 245 | | | | 2,324 | | | | 622 | |

Net loss attributable to BREIT stockholders | $ | (50,704 | ) | | $ | (50,482 | ) | | $ | (97,550 | ) | | $ | (98,030 | ) |

Net loss per share of common stock — basic and diluted | $ | (0.08 | ) | | $ | (0.19 | ) | | $ | (0.17 | ) | | $ | (0.41 | ) |

Weighted-average shares of common stock outstanding, basic and diluted | | 631,744,799 | | | | 272,727,892 | | | | 560,647,423 | | | | 239,600,008 | |

See accompanying notes to condensed consolidated financial statements.

2

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Changes in Equity (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Non- | | | Non- | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | controlling | | | controlling | | | | | |

| | Par Value | | | | | | | Accumulated | | | | | | | Interests | | | Interests | | | | | |

| | Common | | | Common | | | Common | | | Common | | | Additional | | | Deficit and | | | Total | | | Attributable | | | Attributable | | | | | |

| | Stock | | | Stock | | | Stock | | | Stock | | | Paid-in | | | Cumulative | | | Stockholders' | | | to Third Party | | | to BREIT OP | | | Total | |

| | Class S | | | Class T | | | Class D | | | Class I | | | Capital | | | Distributions | | | Equity | | | Joint Ventures | | | Unitholders | | | Equity | |

Balance at December 31, 2018 | | $ | 2,770 | | | $ | 233 | | | $ | 304 | | | $ | 1,083 | | | $ | 4,327,444 | | | $ | (587,548 | ) | | $ | 3,744,286 | | | $ | 75,592 | | | $ | 95,076 | | | $ | 3,914,954 | |

Common stock issued | | | 414 | | | | 38 | | | | 75 | | | | 245 | | | | 843,347 | | | | — | | | | 844,119 | | | | — | | | | — | | | | 844,119 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (50,847 | ) | | | — | | | | (50,847 | ) | | | — | | | | — | | | | (50,847 | ) |

Distribution reinvestment | | | 24 | | | | 2 | | | | 2 | | | | 11 | | | | 41,995 | | | | — | | | | 42,034 | | | | — | | | | — | | | | 42,034 | |

Common stock repurchased | | | (18 | ) | | | (6 | ) | | | — | | | | (18 | ) | | | (45,468 | ) | | | — | | | | (45,510 | ) | | | — | | | | — | | | | (45,510 | ) |

Amortization of compensation awards | | | — | | | | — | | | | — | | | | 1 | | | | 99 | | | | — | | | | 100 | | | | — | | | | 500 | | | | 600 | |

Net loss ($277 allocated to redeemable non-controlling interest) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (46,846 | ) | | | (46,846 | ) | | | (2,036 | ) | | | (937 | ) | | | (49,819 | ) |

Distributions declared on common stock ($0.1582 gross per share) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (69,542 | ) | | | (69,542 | ) | | | — | | | | — | | | | (69,542 | ) |

Contributions from non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4,894 | | | | 4,714 | | | | 9,608 | |

Distributions to non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,277 | ) | | | (1,536 | ) | | | (2,813 | ) |

Allocation to redeemable non-controlling interest | | | — | | | | — | | | | — | | | | — | | | | (1,080 | ) | | | — | | | | (1,080 | ) | | | — | | | | — | | | | (1,080 | ) |

Balance at March 31, 2019 | | $ | 3,190 | | | $ | 267 | | | $ | 381 | | | $ | 1,322 | | | $ | 5,115,490 | | | $ | (703,936 | ) | | $ | 4,416,714 | | | $ | 77,173 | | | $ | 97,817 | | | $ | 4,591,704 | |

Common stock issued | | | 610 | | | | 51 | | | | 146 | | | | 986 | | | | 1,965,318 | | | | — | | | | 1,967,111 | | | | — | | | | — | | | | 1,967,111 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (103,027 | ) | | | — | | | | (103,027 | ) | | | — | | | | — | | | | (103,027 | ) |

Distribution reinvestment | | | 28 | | | | 2 | | | | 3 | | | | 14 | | | | 51,813 | | | | — | | | | 51,860 | | | | — | | | | — | | | | 51,860 | |

Common stock repurchased | | | (16 | ) | | | (1 | ) | | | (1 | ) | | | (37 | ) | | | (60,032 | ) | | | — | | | | (60,087 | ) | | | — | | | | (70 | ) | | | (60,157 | ) |

Amortization of compensation awards | | | — | | | | — | | | | — | | | | 1 | | | | 99 | | | | — | | | | 100 | | | | — | | | | 500 | | | | 600 | |

Net loss ($74 allocated to redeemable non-controlling interest) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (50,704 | ) | | | (50,704 | ) | | | (970 | ) | | | (1,036 | ) | | | (52,710 | ) |

Distributions declared on common stock ($0.1588 gross per share) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (90,871 | ) | | | (90,871 | ) | | | — | | | | — | | | | (90,871 | ) |

Contributions from non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 41,049 | | | | 36,749 | | | | 77,798 | |

Distributions to non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3,527 | ) | | | (2,045 | ) | | | (5,572 | ) |

Allocation to redeemable non-controlling interest | | | — | | | | — | | | | — | | | | — | | | | (361 | ) | | | — | | | | (361 | ) | | | — | | | | — | | | | (361 | ) |

Balance at June 30, 2019 | | $ | 3,812 | | | $ | 319 | | | $ | 529 | | | $ | 2,286 | | | $ | 6,969,300 | | | $ | (845,511 | ) | | $ | 6,130,735 | | | $ | 113,725 | | | $ | 131,915 | | | $ | 6,376,375 | |

See accompanying notes to condensed consolidated financial statements.

3

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Changes in Equity (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Non- | | | Non- | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | controlling | | | controlling | | | | | |

| | Par Value | | | | | | | Accumulated | | | | | | | Interests | | | Interests | | | | | |

| | Common | | | Common | | | Common | | | Common | | | Additional | | | Deficit and | | | Total | | | Attributable | | | Attributable | | | | | |

| | Stock | | | Stock | | | Stock | | | Stock | | | Paid-in | | | Cumulative | | | Stockholders' | | | to Third Party | | | to BREIT OP | | | Total | |

| | Class S | | | Class T | | | Class D | | | Class I | | | Capital | | | Distributions | | | Equity | | | Joint Ventures | | | Unitholders | | | Equity | |

Balance at December 31, 2017 | | $ | 1,301 | | | $ | 56 | | | $ | 40 | | | $ | 307 | | | $ | 1,616,720 | | | $ | (132,633 | ) | | $ | 1,485,791 | | | $ | 23,848 | | | $ | — | | | $ | 1,509,639 | |

Common stock issued | | | 325 | | | | 42 | | | | 28 | | | | 163 | | | | 593,143 | | | | — | | | | 593,701 | | | | — | | | | — | | | | 593,701 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (37,361 | ) | | | — | | | | (37,361 | ) | | | — | | | | — | | | | (37,361 | ) |

Distribution reinvestment | | | 11 | | | | — | | | | — | | | | 4 | | | | 16,482 | | | | — | | | | 16,497 | | | | — | | | | — | | | | 16,497 | |

Common stock repurchased | | | (1 | ) | | | — | | | | — | | | | (1 | ) | | | (2,294 | ) | | | — | | | | (2,296 | ) | | | — | | | | — | | | | (2,296 | ) |

Amortization of restricted stock grant | | | — | | | | — | | | | — | | | | — | | | | 25 | | | | — | | | | 25 | | | | — | | | | — | | | | 25 | |

Net loss ($347 allocated to redeemable non-controlling interest) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (47,548 | ) | | | (47,548 | ) | | | (1,716 | ) | | | — | | | | (49,264 | ) |

Distributions declared on common stock ($0.1552 gross per share) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (28,384 | ) | | | (28,384 | ) | | | — | | | | — | | | | (28,384 | ) |

Contributions from non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6,940 | | | | — | | | | 6,940 | |

Distributions to non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (581 | ) | | | — | | | | (581 | ) |

Allocation to redeemable non-controlling interest | | | — | | | | — | | | | — | | | | — | | | | (883 | ) | | | — | | | | (883 | ) | | | — | | | | — | | | | (883 | ) |

Balance at March 31, 2018 | | $ | 1,636 | | | $ | 98 | | | $ | 68 | | | $ | 473 | | | $ | 2,185,832 | | | $ | (208,565 | ) | | $ | 1,979,542 | | | $ | 28,491 | | | $ | — | | | $ | 2,008,033 | |

Common stock issued | | | 343 | | | | 50 | | | | 100 | | | | 190 | | | | 732,275 | | | | — | | | | 732,958 | | | | — | | | | — | | | | 732,958 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (46,491 | ) | | | — | | | | (46,491 | ) | | | — | | | | — | | | | (46,491 | ) |

Distribution reinvestment | | | 14 | | | | 1 | | | | — | | | | 5 | | | | 21,984 | | | | — | | | | 22,004 | | | | — | | | | — | | | | 22,004 | |

Common stock repurchased | | | (7 | ) | | | — | | | | — | | | | (1 | ) | | | (8,810 | ) | | | — | | | | (8,818 | ) | | | — | | | | — | | | | (8,818 | ) |

Amortization of restricted stock grant | | | — | | | | — | | | | — | | | | — | | | | 25 | | | | — | | | | 25 | | | | — | | | | — | | | | 25 | |

Net loss ($275 allocated to redeemable non-controlling interest) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (50,482 | ) | | | (50,482 | ) | | | (1,214 | ) | | | — | | | | (51,696 | ) |

Distributions declared on common stock ($0.1566 gross per share) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (38,043 | ) | | | (38,043 | ) | | | — | | | | — | | | | (38,043 | ) |

Contributions from non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4,334 | | | | — | | | | 4,334 | |

Distributions to non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (646 | ) | | | — | | | | (646 | ) |

Allocation to redeemable non-controlling interest | | | — | | | | — | | | | — | | | | — | | | | (573 | ) | | | — | | | | (573 | ) | | | — | | | | — | | | | (573 | ) |

Balance at June 30, 2018 | | $ | 1,986 | | | $ | 149 | | | $ | 168 | | | $ | 667 | | | $ | 2,884,242 | | | $ | (297,090 | ) | | $ | 2,590,122 | | | $ | 30,965 | | | $ | — | | | $ | 2,621,087 | |

See accompanying notes to condensed consolidated financial statements.

4

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | Six Months Ended June 30, | |

| | 2019 | | | 2018 | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (102,880 | ) | | $ | (101,582 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Management fee | | | 39,664 | | | | 16,250 | |

Performance participation allocation | | | 50,061 | | | | 17,349 | |

Depreciation and amortization | | | 301,333 | | | | 158,950 | |

Gain on disposition of real estate | | | (29,686 | ) | | | — | |

Unrealized gain on changes in fair value of financial instruments | | | (45,492 | ) | | | (3,848 | ) |

Other items | | | 3,677 | | | | (519 | ) |

Change in assets and liabilities: | | | | | | | | |

(Increase) / decrease in other assets | | | (37,401 | ) | | | (24,186 | ) |

Increase / (decrease) in due to affiliates | | | (709 | ) | | | (257 | ) |

Increase / (decrease) in accounts payable, accrued expenses, and other liabilities | | | 14,902 | | | | 42,168 | |

Net cash provided by operating activities | | | 193,469 | | | | 104,325 | |

Cash flows from investing activities: | | | | | | | | |

Acquisitions of real estate | | | (3,763,487 | ) | | | (3,372,075 | ) |

Capital improvements to real estate | | | (67,091 | ) | | | (28,843 | ) |

Proceeds from disposition of real estate | | | 44,293 | | | | — | |

Pre-acquisition costs | | | (3,407 | ) | | | (615 | ) |

Purchase of real estate-related securities and loans | | | (1,296,050 | ) | | | (676,394 | ) |

Proceeds from settlement of real estate-related securities and loans | | | 276,205 | | | | 115,619 | |

Net cash used in investing activities | | | (4,809,537 | ) | | | (3,962,308 | ) |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of common stock | | | 2,596,552 | | | | 1,204,297 | |

Offering costs paid | | | (33,045 | ) | | | (19,208 | ) |

Subscriptions received in advance | | | 402,493 | | | | 137,896 | |

Repurchase of common stock | | | (53,638 | ) | | | (6,881 | ) |

Repurchase of management fee shares | | | (49,871 | ) | | | — | |

Redemption of redeemable non-controlling interest | | | (25,407 | ) | | | (8,400 | ) |

Redemption of affiliate service provider incentive compensation awards | | | (70 | ) | | | — | |

Borrowings from mortgage notes, term loans, and secured revolving credit facilities | | | 4,111,058 | | | | 3,141,053 | |

Repayments from mortgage notes, term loans, and secured revolving credit facilities | | | (2,942,083 | ) | | | (894,600 | ) |

Borrowings under repurchase agreements | | | 927,475 | | | | 508,949 | |

Settlement of repurchase agreements | | | (194,064 | ) | | | (89,557 | ) |

Borrowings from affiliate line of credit | | | 1,466,000 | | | | 575,000 | |

Repayments on affiliate line of credit | | | (1,466,000 | ) | | | (580,250 | ) |

Borrowings from unsecured credit facilities | | | 240,000 | | | | — | |

Payment of deferred financing costs | | | (22,839 | ) | | | (19,847 | ) |

Contributions from non-controlling interests | | | 43,443 | | | | 11,274 | |

Distributions to non-controlling interests | | | (8,778 | ) | | | (1,652 | ) |

Distributions | | | (53,941 | ) | | | (21,776 | ) |

Net cash provided by financing activities | | | 4,937,285 | | | | 3,936,298 | |

Net change in cash and cash equivalents and restricted cash | | | 321,217 | | | | 78,315 | |

Cash and cash equivalents and restricted cash, beginning of period | | | 306,613 | | | | 157,729 | |

Cash and cash equivalents and restricted cash, end of period | | $ | 627,830 | | | $ | 236,044 | |

Reconciliation of cash and cash equivalents and restricted cash to the condensed consolidated balance sheets: | | | | | | | | |

Cash and cash equivalents | | $ | 150,062 | | | $ | 56,456 | |

Restricted cash | | | 477,768 | | | | 179,588 | |

Total cash and cash equivalents and restricted cash | | $ | 627,830 | | | $ | 236,044 | |

5

Non-cash investing and financing activities: | | | | | | | | |

Assumption of mortgage notes in conjunction with acquisitions of real estate | | $ | 385,450 | | | $ | 151,220 | |

Assumption of other liabilities in conjunction with acquisitions of real estate | | $ | 25,847 | | | $ | 36,625 | |

Issuance of BREIT OP units as consideration for acquisitions of real estate | | $ | 36,749 | | | $ | — | |

Recognition of financing lease liability | | $ | 56,008 | | | $ | — | |

Accrued pre-acquisition costs | | $ | 1,217 | | | $ | 403 | |

Contributions from non-controlling interests | | $ | 2,520 | | | $ | — | |

Accrued capital expenditures and acquisition related costs | | $ | 3,406 | | | $ | 8,163 | |

Accrued distributions | | $ | 12,783 | | | $ | 6,194 | |

Accrued stockholder servicing fee due to affiliate | | $ | 121,421 | | | $ | 65,254 | |

Redeemable non-controlling interest issued as settlement of performance participation allocation | | $ | 37,484 | | | $ | 16,974 | |

Exchange of redeemable non-controlling interest for Class I shares | | $ | 11,620 | | | $ | — | |

Allocation to redeemable non-controlling interest | | $ | 1,441 | | | $ | 1,456 | |

Distribution reinvestment | | $ | 93,894 | | | $ | 38,503 | |

Accrued common stock repurchases | | $ | 2,088 | | | $ | 4,233 | |

Issuance of BREIT OP units as settlement of affiliate incentive compensation awards | | $ | 4,714 | | | $ | — | |

Payable for real estate-related securities | | $ | 129,317 | | | $ | 170,028 | |

See accompanying notes to condensed consolidated financial statements.

6

Blackstone Real Estate Income Trust, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Business Purpose

Blackstone Real Estate Income Trust, Inc. (“BREIT” or the “Company”) invests primarily in stabilized income-oriented commercial real estate in the United States and, to a lesser extent, in real estate-related securities and loans. The Company is the sole general partner of BREIT Operating Partnership, L.P., a Delaware limited partnership (“BREIT OP”). BREIT Special Limited Partner L.P. (the “Special Limited Partner”), a wholly-owned subsidiary of The Blackstone Group Inc. (together with its affiliates, “Blackstone”), owns a special limited partner interest in BREIT OP. Substantially all of the Company’s business is conducted through BREIT OP. The Company and BREIT OP are externally managed by BX REIT Advisors L.L.C. (the “Adviser”). The Adviser is part of the real estate group of Blackstone, a leading global investment manager, which serves as our sponsor. The Company was formed on November 16, 2015 as a Maryland corporation and qualifies as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

The Company had registered with the Securities and Exchange Commission (the “SEC”) an offering of up to $5.0 billion in shares of common stock (the “Initial Offering”) and accepted gross offering proceeds of $4.9 billion during the period January 1, 2017 to January 1, 2019. The Company subsequently registered with the SEC a follow-on offering of up to $12.0 billion in shares of common stock, consisting of up to $10.0 billion in shares in its primary offering and up to $2.0 billion in shares pursuant to its distribution reinvestment plan (the “Current Offering” and with the Initial Offering, the “Offering”). The Company intends to sell any combination of four classes of shares of its common stock, with a dollar value up to the maximum aggregate amount of the Current Offering. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. As of June 30, 2019, the Company had received net proceeds of $6.8 billion from selling shares in the Offering. The Company intends to continue selling shares on a monthly basis.

As of June 30, 2019, the Company owned 652 properties and had 163 positions in real estate-related securities and loans. The Company currently operates in five reportable segments: Multifamily, Industrial, Hotel, and Retail Properties, and Real Estate-Related Securities and Loans. Multifamily includes various forms of rental housing including apartments, student housing and manufactured housing. Financial results by segment are reported in Note 13 — Segment Reporting.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The condensed consolidated financial statements, including the condensed notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC.

Certain amounts in the Company’s prior period condensed consolidated financial statements have been reclassified to conform to the current period presentation. The Company has chosen to aggregate certain financial statement line items in the Company’s condensed consolidated statements of operations and condensed consolidated statements of cash flows. Such reclassifications had no effect on total revenues or net loss on the condensed consolidated statements of operations or previously reported totals or subtotals in the Condensed Consolidated Statements of Cash Flows.

The accompanying condensed consolidated financial statements include the accounts of the Company, the Company’s subsidiaries and joint ventures in which the Company has a controlling interest. For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities and operations of the joint ventures is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage. All intercompany balances and transactions have been eliminated in consolidation.

7

The Company consolidates partially owned entities in which it has a controlling financial interest. In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. BREIT OP and each of the Company’s joint ventures are considered to be a VIE. The Company consolidates these entities because it has the ability to direct the most significant activities of the entities such as purchases, dispositions, financings, budgets, and overall operating plans.

As of June 30, 2019, the total assets and liabilities of the Company’s consolidated VIEs, excluding BREIT OP, were $4.4 billion and $2.8 billion, respectively, compared to $2.8 billion and $1.9 billion as of December 31, 2018. Such amounts are included on the Company’s Condensed Consolidated Balance Sheets.

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

Fair Value Option

The Company elected the fair value option (“FVO”) for its investments in term loans. Unrealized gains and losses on the value of financial instruments for which the FVO has been elected are recorded as a component of net income or loss. The Company records any unrealized gains or losses on its investments in term loans as a component of Income from Real Estate-Related Securities and Loans on the Condensed Consolidated Statements of Operations.

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). Additionally, there is a hierarchal framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment and the state of the marketplace, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

As of June 30, 2019 and December 31, 2018, the Company’s $3.5 billion and $2.3 billion, respectively, of investments in real estate-related securities and loans were classified as Level 2.

Valuation

The Company’s investments in real estate-related securities and loans are reported at fair value. As of June 30, 2019, the Company’s investments in real estate-related securities and loans consisted of commercial mortgage-backed securities (“CMBS”), which are mortgage-related fixed income securities, corporate bonds, and term loans of real estate-related companies. The Company generally determines the fair value of its real estate-related securities and loans by utilizing third-party pricing service providers and broker-dealer quotations on the basis of last available bid price.

8

In determining the fair value of a particular investment, pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models for securities such as real estate-related securities and loans generally consider the attributes applicable to a particular class of the security (e.g., credit rating, seniority), current market data, and estimated cash flows for each class and incorporate deal collateral performance such as prepayment speeds and default rates, as available.

As of June 30, 2019, the fair value of the Company’s mortgage notes, term loans, secured and unsecured revolving credit facilities, repurchase agreements, and affiliate line of credit was approximately $51.1 million above carrying value. Fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using the appropriate discount rate. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3.

Stock-Based Compensation

The Company’s stock-based compensation consists of incentive compensation awards issued to certain employees of affiliate portfolio company service providers. Such awards vest over the life of the awards and stock-based compensation expense is recognized for these awards in net income on a straight-line basis over the applicable vesting period of the award, based on the value of the awards at grant. Refer to Note 11 for additional information.

Recent Accounting Pronouncements

On January 1, 2019, the Company adopted Accounting Standards Update 2016-02 (“ASU 2016-02”), “Leases,” and all related amendments (codified in Accounting Standards Codification Topic 842 (“Topic 842”)). Certain of the Company’s investments in real estate are subject to ground leases, for which lease liabilities and corresponding right-of-use (“ROU”) assets were recognized as a result of adoption. The Company calculated the amount of the lease liabilities and ROU assets by taking the present value of the remaining lease payments, and adjusted the ROU assets for any existing straight-line ground rent liabilities and acquired ground lease intangibles. The Company’s estimated incremental borrowing rate of a loan with a similar term as the corresponding ground leases was used as the discount rate, which was determined to be approximately 7.0%. Considerable judgment and assumptions were required to estimate the Company’s incremental borrowing rate which was determined by considering the Company’s credit quality, ground lease duration, and debt yields observed in the market.

Three of the Company’s existing ground leases were classified as operating leases, and upon adoption the Company recognized operating lease liabilities and corresponding ROU assets of $31.3 million. The Company’s existing below-market ground lease intangible asset of $4.5 million, above-market ground lease intangible liability of $4.6 million, and straight-line ground rent liability of $1.2 million were reclassified as of January 1, 2019 to be presented net of the operating ROU assets. In addition, the Company’s existing prepaid ground lease intangible asset of $15.7 million was reclassified as of January 1, 2019 to be presented along with the operating ROU assets.

On March 29, 2019, the Company made an acquisition which was subject to ground leases. The present value of the future lease payments under such leases exceeded the fair value of the underlying asset, as such, the Company recorded financing lease liabilities and corresponding ROU assets of $56.0 million.

The lease liabilities are included as a component of Accounts Payable, Accrued Expenses, and Other Liabilities and the related ROU assets are recorded as a component of Investments in Real Estate, Net on the Company’s Condensed Consolidated Balance Sheet. Refer to Note 3, Note 9 and Note 12 for additional information.

In transition, the Company elected the package of practical expedients to not reassess (i) whether existing arrangements are or contain a lease, (ii) the classification of an operating or financing lease in a period prior to adoption, and (iii) any initial direct costs for existing leases. Additionally, the Company elected to not use hindsight and carried forward its lease term assumptions when adopting Topic 842 and did not recognize lease liabilities and lease assets for leases with a term of 12 months or less. The Company applied ASU 2016-02 as of the effective date of January 1, 2019, and there was no impact to retained earnings as a result of the Company’s adoption.

9

The adoption of ASU 2016-02 for leases in which the Company is lessor did not have a material impact on the Company’s condensed consolidated financial statements. The Company elected to not separate non-lease components from lease components and presented lease related revenues as a single line item, net of bad debt expense on the Company’s Condensed Consolidated Statement of Operations. Prior to the adoption of ASU 2016-02, the Company separated lease related revenue between “rental revenue” and “tenant reimbursement income” and bad debt expense as a component of “rental property operating” expense. As a result of adoption, the Company reclassified the prior period balances of “tenant reimbursement income” to “rental revenue” to conform to the current period presentation. The Company did not reclassify the prior period balance of bad debt expense on its condensed consolidated statement of operations. The operating lease income presented in “rental revenue” for the three and six months ended June 30, 2018 includes $15.6 million and $24.6 million, respectively, previously classified as “tenant reimbursement income,” which was determined under the standard in effect prior to the Company’s adoption of ASU 2016-02. Refer to Note 12 for additional information.

3. Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | June 30, 2019 | | | December 31, 2018 | |

Building and building improvements | | $ | 11,711,288 | | | $ | 8,389,864 | |

Land and land improvements | | | 2,680,720 | | | | 1,961,977 | |

Furniture, fixtures and equipment | | | 248,560 | | | | 182,418 | |

Right of use asset - operating leases(1) | | | 47,386 | | | | — | |

Right of use asset - financing leases(1) | | | 56,008 | | | | — | |

Total | | | 14,743,962 | | | | 10,534,259 | |

Accumulated depreciation and amortization | | | (477,379 | ) | | | (274,572 | ) |

Investments in real estate, net | | $ | 14,266,583 | | | $ | 10,259,687 | |

(1) | Refer to Note 12 for additional details on the Company’s leases. |

During the six months ended June 30, 2019, the Company acquired interests in 27 real estate investments, which were comprised of 104 industrial, 51 multifamily, 22 hotel and one retail property.

10

The following table provides further details of the properties acquired during the six months ended June 30, 2019 ($ in thousands):

| | | | | | | | | | | | | | | |

Investment | | Ownership Interest(1) | | | Number of Properties | | | Location | | Segment | | Acquisition Date | | Purchase Price(2) | |

4500 Westport Drive | | 100% | | | | 1 | | | Harrisburg, PA | | Industrial | | Jan. 2019 | | $ | 11,975 | |

Roman Multifamily Portfolio | | 100% | | | | 14 | | | Various(3) | | Multifamily | | Feb. 2019 | | | 857,540 | |

Gilbert Heritage Apartments | | 90% | | | | 1 | | | Phoenix, AZ | | Multifamily | | Feb. 2019 | | | 60,984 | |

Courtyard Kona | | 100% | | | | 1 | | | Kailua-Kona, HI | | Hotel | | March 2019 | | | 105,587 | |

Elevation Plaza Del Rio | | 90% | | | | 1 | | | Phoenix, AZ | | Multifamily | | April 2019 | | | 70,550 | |

Raider Mulifamily Portfolio | | 100% | | | | 3 | | | Las Vegas, NV | | Multifamily | | April & June 2019 | | | 259,371 | |

Courtney at Universal Multifamily | | 100% | | | | 1 | | | Orlando, FL | | Multifamily | | April 2019 | | | 77,952 | |

Citymark Multifamily 2-Pack | | 95% | | | | 2 | | | Various(4) | | Multifamily | | April 2019 | | | 97,922 | |

Tri-Cities Multifamily 2-Pack | | 95% | | | | 2 | | | Richland & Kennewick, WA | | Multifamily | | April 2019 | | | 61,616 | |

Angler MH Portfolio | | 99% | | | | 5 | | | Phoenix, AZ | | Multifamily | | April 2019 | | | 61,975 | |

Florida MH 4-Pack | | 99% | | | | 1 | | | Tarpon Springs, FL | | Multifamily | | April 2019 | | | 10,053 | |

Bridge II Multifamily Portfolio | | 100% | | | | 5 | | | Various(5) | | Multifamily | | April & June 2019 | | | 350,923 | |

Morgan Savannah | | 100% | | | | 1 | | | Savannah, GA | | Industrial | | April 2019 | | | 26,254 | |

Minneapolis Industrial Portfolio | | 100% | | | | 34 | | | Minneapolis, MN | | Industrial | | April 2019 | | | 250,678 | |

Miami Doral 2-Pack | | 100% | | | | 2 | | | Miami, FL | | Multifamily | | May 2019 | | | 209,404 | |

Davis Multifamily 2-Pack | | 100% | | | | 2 | | | Various(6) | | Multifamily | | May 2019 | | | 89,687 | |

Slate Savannah | | 90% | | | | 1 | | | Savannah, GA | | Multifamily | | May 2019 | | | 44,267 | |

Amara at MetroWest | | 95% | | | | 1 | | | Orlando, FL | | Multifamily | | May 2019 | | | 73,933 | |

Colorado 3-Pack | | 100% | | | | 3 | | | Denver & Fort Collins, CO | | Multifamily | | May 2019 | | | 207,137 | |

Atlanta Industrial Portfolio | | 100% | | | | 61 | | | Atlanta, GA | | Industrial | | May 2019 | | | 203,745 | |

Edge Las Vegas | | 95% | | | | 1 | | | Las Vegas, NV | | Multifamily | | June 2019 | | | 61,337 | |

ACG IV Multifamily | | 95% | | | | 2 | | | Various(7) | | Multifamily | | June 2019 | | | 124,971 | |

Perimeter Multifamily 3-Pack | | 100% | | | | 3 | | | Atlanta, GA | | Multifamily | | June 2019 | | | 160,941 | |

Anson at the Lakes | | 100% | | | | 1 | | | Charlotte, NC | | Multifamily | | June 2019 | | | 107,287 | |

D.C. Powered Shell Warehouse Portfolio | | 90% | | | | 7 | | | Ashburn & Manassas, VA | | Industrial | | June 2019 | | | 266,322 | |

El Paseo Simi Valley | | 100% | | | | 1 | | | Simi Valley, CA | | Retail | | June 2019 | | | 39,115 | |

Raven Select Service Portfolio | | 100% | | | | 21 | | | Various(8) | | Hotel | | June 2019 | | | 305,470 | |

| | | | | | | 178 | | | | | | | | | $ | 4,196,996 | |

(1) | Certain of the investments made by the Company provide the seller or the other partner a profits interest based on certain internal rate of return hurdles being achieved. Such investments are consolidated by the Company and any profits interest due to the other partner is reported within non-controlling interests. |

(2) | Purchase price is inclusive of acquisition related costs. |

(3) | The Roman Multifamily Portfolio is primarily concentrated in Riverside, CA (18% of units), Denver, CO (13%), Tampa, FL (10%), Orlando, FL (9%), Charlotte, NC (9%), Portland, OR (8%), and Dallas, TX (8%). |

(4) | The Citymark Multifamily 2-Pack is located in Las Vegas, NV (61% of units) and Lithia Springs, GA (39%). |

(5) | The Bridge II Multifamily Portfolio is located in Phoenix, AZ (25% of units), Lakeland, FL (23%), Charlotte, NC (18%), Corona Hills, CA (17%), and Moreno Valley, CA (17%). |

(6) | The Davis Multifamily 2-Pack is located in Jacksonville, FL (56% of units) and Raleigh, NC (44%). |

(7) | ACG IV Multifamily is located in Puyallup, WA (74% of units) and Woodland, CA (26%). |

(8) | The Raven Select Service Portfolio is primarily concentrated in Fort Lauderdale/West Palm, FL (24% of keys), Austin/San Antonio, TX (14%), Salt Lake City, UT (10%), Boulder, CO (10%), Durham, NC (7%), Minneapolis, MN (7%), and Chicago, IL (6%). |

11

The following table summarizes the purchase price allocation for the properties acquired during the six months ended June 30, 2019 ($ in thousands):

| | Roman Multifamily Portfolio | | | All Other | | | Total | |

Building and building improvements | | $ | 714,941 | | | $ | 2,551,444 | | | $ | 3,266,385 | |

Land and land improvements | | | 110,206 | | | | 607,259 | | | | 717,465 | |

Furniture, fixtures and equipment | | | 8,538 | | | | 46,530 | | | | 55,068 | |

In-place lease intangibles | | | 23,855 | | | | 140,942 | | | | 164,797 | |

Above-market lease intangibles | | | — | | | | 3,596 | | | | 3,596 | |

Below-market lease intangibles | | | — | | | | (15,657 | ) | | | (15,657 | ) |

Other | | | — | | | | 5,342 | | | | 5,342 | |

Total purchase price | | | 857,540 | | | | 3,339,456 | | | | 4,196,996 | |

Assumed mortgage notes(1) | | | 237,981 | | | | 147,469 | | | | 385,450 | |

Net purchase price | | $ | 619,559 | | | $ | 3,191,987 | | | $ | 3,811,546 | |

(1) | Refer to Note 6 for additional details on the Company’s mortgage notes. |

The weighted-average amortization periods for the acquired in-place lease intangibles, above-market lease intangibles, and below-market lease intangibles of the properties acquired during the six months ended June 30, 2019 were three, six, and six years, respectively.

Dispositions

On June 6, 2019, the Company sold the parking garage attached to the Hyatt Place San Jose Downtown property to a third party. The sale included a four story, 261 space, parking structure and land parcel. The sale did not include the attached Hyatt Place San Jose Downtown hotel or the additional land parcels under the hotel. Net proceeds from the sale were $44.3 million, which resulted in a realized gain of $29.7 million recorded as Gain on Disposition of Real Estate on the Company’s Condensed Consolidated Statements of Operations.

Jupiter12 Industrial Portfolio

On June 2, 2019, the Company entered into an agreement to acquire a 64 million square foot income-oriented, high-quality, 95% leased industrial portfolio (the “Jupiter Portfolio”) in well-located, in-fill locations for $5.3 billion, excluding closing costs. The Jupiter Portfolio consists of 316 industrial properties with 51% of aggregate square footage located in Dallas/Fort Worth, Chicago, Central Pennsylvania, Atlanta and Central Florida. The Jupiter Portfolio is leased to 745 tenants including e-commerce and logistics companies such as Amazon, FedEx and DHL, as well as Starbucks, Wayfair and Whirlpool. The Company expects the closing of the acquisition to occur in October 2019.

12

4. Intangibles

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities consisted of the following ($ in thousands):

| | June 30, 2019 | | | December 31, 2018 | |

Intangible assets: | | | | | | | | |

In-place lease intangibles | | $ | 505,668 | | | $ | 354,261 | |

Above-market lease intangibles | | | 25,202 | | | | 21,626 | |

Prepaid ground lease intangibles | | | — | | | | 16,114 | |

Below-market ground lease intangibles | | | — | | | | 5,415 | |

Other | | | 6,719 | | | | 5,676 | |

Total intangible assets | | | 537,589 | | | | 403,092 | |

Accumulated amortization: | | | | | | | | |

In-place lease amortization | | | (189,995 | ) | | | (104,745 | ) |

Above-market lease amortization | | | (7,409 | ) | | | (4,903 | ) |

Prepaid ground lease amortization | | | — | | | | (378 | ) |

Below-market ground lease amortization | | | — | | | | (162 | ) |

Other | | | (348 | ) | | | (246 | ) |

Total accumulated amortization | | | (197,752 | ) | | | (110,434 | ) |

Intangible assets, net | | $ | 339,837 | | | $ | 292,658 | |

Intangible liabilities: | | | | | | | | |

Below-market lease intangibles | | $ | 77,224 | | | $ | 62,199 | |

Above-market ground lease intangibles | | | — | | | | 4,657 | |

Total intangible liabilities | | | 77,224 | | | | 66,856 | |

Accumulated amortization: | | | | | | | | |

Below-market lease amortization | | | (17,110 | ) | | | (11,132 | ) |

Above-market ground lease amortization | | | — | | | | (15 | ) |

Total accumulated amortization | | | (17,110 | ) | | | (11,147 | ) |

Intangible liabilities, net | | $ | 60,114 | | | $ | 55,709 | |

The estimated future amortization on the Company’s intangibles for each of the next five years and thereafter as of June 30, 2019 is as follows ($ in thousands)

| | In-place Lease Intangibles | | | Above-market Lease Intangibles | | | Below-market Lease Intangibles | |

2019 (remaining) | | $ | 107,624 | | | $ | 2,732 | | | $ | (7,560 | ) |

2020 | | | 62,850 | | | | 4,711 | | | | (12,712 | ) |

2021 | | | 47,215 | | | | 4,015 | | | | (10,032 | ) |

2022 | | | 32,999 | | | | 2,786 | | | | (7,993 | ) |

2023 | | | 21,478 | | | | 1,459 | | | | (6,349 | ) |

2024 | | | 13,698 | | | | 871 | | | | (4,462 | ) |

Thereafter | | | 29,809 | | | | 1,219 | | | | (11,006 | ) |

| | $ | 315,673 | | | $ | 17,793 | | | $ | (60,114 | ) |

13

5. Investments in Real Estate-Related Securities and Loans

The following tables detail the Company’s investments in real estate-related securities and loans ($ in thousands):

| | | | | | | | June 30, 2019 | |

Number of Positions | | | Credit Rating(1) | | Collateral(2) | | Weighted Average Coupon(3) | | Weighted Average Maturity Date(4) | Face Amount/ Notional(5) | | Cost Basis | | Fair Value | |

CMBS - Floating: | | | | | | | | | | | | | | | | |

| 42 | | | BB | | Hospitality, Industrial, Multifamily, Office, Retail, Diversified | | L+2.79% | | 10/29/2024 | $ | 1,131,473 | | $ | 1,132,757 | | $ | 1,136,303 | |

| 33 | | | BBB | | Hospitality, Multifamily, Office, Retail, Diversified | | L+2.30% | | 10/20/2024 | | 816,234 | | | 817,997 | | | 819,883 | |

| 21 | | | B | | Hospitality, Multifamily, Office | | L+3.45% | | 10/27/2024 | | 461,587 | | | 460,488 | | | 462,143 | |

| 5 | | | A | | Hospitality, Industrial, Retail, Diversified | | L+2.01% | | 1/25/2025 | | 200,293 | | | 200,643 | | | 201,479 | |

| 13 | | | Other | | Multifamily | | L+2.48% | | 6/27/2026 | | 112,045 | | | 112,586 | | | 112,698 | |

| 114 | | | | | | | | | | | | | | | 2,724,471 | | | 2,732,506 | |

CMBS - Fixed: | | | | | | | | | | | | | | | | | | | |

| 8 | | | BBB | | Multifamily, Diversified | | 4.3% | | 4/30/2028 | | 67,662 | | | 64,999 | | | 68,560 | |

| 6 | | | BB | | Hospitality, Multifamily, Office, Diversified | | 4.0% | | 1/17/2026 | | 75,850 | | | 73,048 | | | 75,458 | |

| 4 | | | B | | Hospitality, Multifamily, Diversified | | 4.3% | | 4/4/2026 | | 82,493 | | | 81,534 | | | 81,402 | |

| 6 | | | Other | | Multifamily, Diversified | | 4.5% | | 10/7/2026 | | 56,298 | | | 54,008 | | | 55,476 | |

| 24 | | | | | | | | | | | | | | | 273,589 | | | 280,896 | |

CMBS - Zero Coupon: | | | | | | | | | | | | | | | | |

| 1 | | | BB | | Multifamily | | N/A | | 4/21/2025 | | 27,273 | | | 19,964 | | | 20,368 | |

| 3 | | | Other | | Multifamily | | N/A | | 4/11/2027 | | 208,817 | | | 102,232 | | | 110,684 | |

| 4 | | | | | | | | | | | | | | | 122,196 | | | 131,052 | |

CMBS - Interest Only: | | | | | | | | | | | | | | | | |

| 2 | | | AAA | | Multifamily | | 0.1% | | 5/21/2026 | | 1,800,924 | | | 10,367 | | | 10,367 | |

| 1 | | | BBB | | Multifamily | | 0.1% | | 1/5/2028 | | 225,803 | | | 1,534 | | | 1,534 | |

| 1 | | | A | | Multifamily | | 0.1% | | 5/2/2025 | | 194,399 | | | 978 | | | 978 | |

| 1 | | | Other | | Multifamily | | 4.5% | | 1/7/2029 | | 42,024 | | | 12,340 | | | 12,340 | |

| 5 | | | | | | | | | | | | | | | 25,219 | | | 25,219 | |

Corporate Bonds: | | | | | | | | | | | | | | | | |

| 7 | | | BB | | Hospitality, Multifamily, Diversified | | 5.9% | | 6/30/2026 | | 146,586 | | | 145,860 | | | 152,028 | |

| 2 | | | B | | Hospitality, Multifamily | | 5.9% | | 10/9/2025 | | 15,609 | | | 15,585 | | | 15,931 | |

| 9 | | | | | | | | | | | | | | | 161,445 | | | 167,959 | |

Term Loans: | | | | | | | | | | | | | | | | |

| 4 | | | B | | Hospitality, Diversified | | L+3.79% | | 1/11/2025 | | 43,810 | | | 43,418 | | | 43,226 | |

| 2 | | | BB | | Hospitality, Diversified | | L+2.74% | | 5/2/2026 | | 55,471 | | | 55,211 | | | 55,096 | |

| 1 | | | Other | | Diversified | | L+1.70% | | 2/6/2022 | | 25,608 | | | 25,000 | | | 24,968 | |

| 7 | | | | | | | | | | | | | | | 123,629 | | | 123,290 | |

| 163 | | | | | | | | | | | | | | $ | 3,430,549 | | $ | 3,460,922 | |

14

| | | | | | | | December 31, 2018 | |

Number of Positions | | | Credit Rating(1) | | Collateral(2) | | Weighted Average Coupon(3) | | | Weighted Average Maturity Date(4) | | Face Amount/ Notional(5) | | | Cost Basis | | | Fair Value | |

CMBS: | | | | | | | | | | | | | | | | | | | | | | | |

| 38 | | | BB | Hospitality, Industrial, Multifamily, Office, Retail | L+2.83% | | | 9/4/2024 | | $ | 941,240 | | | $ | 939,742 | | | $ | 930,411 | |

| 26 | | | BBB | | Hospitality, Industrial, Multifamily, Office | | L+2.15% | | | 11/18/2024 | | | 578,771 | | | | 576,601 | | | | 571,171 | |

| 21 | | | B | | Hospitality, Multifamily, Office | | L+3.56% | | | 9/19/2024 | | | 496,383 | | | | 495,095 | | | | 490,019 | |

| 3 | | | A | | Hospitality, Industrial, Retail | | L+1.81% | | | 3/10/2023 | | | 89,165 | | | | 89,184 | | | | 88,358 | |

| 7 | | | Other | | Multifamily | | L+1.99% | | | 6/13/2026 | | | 35,442 | | | | 34,876 | | | | 34,951 | |

| 95 | | | | | | | | | | | | | | | | | | 2,135,498 | | | | 2,114,910 | |

CMBS - Interest Only: | | | | | | | | | | | | | | | | | | | | |

| 2 | | | AAA | | Multifamily | | 0.1% | | | 3/12/2027 | | | 1,802,581 | | | | 9,959 | | | | 9,957 | |

| 1 | | | BBB | | Multifamily | | 0.1% | | | 5/25/2028 | | | 225,802 | | | | 1,414 | | | | 1,415 | |

| 1 | | | A | | Multifamily | | 0.1% | | | 7/25/2025 | | | 194,399 | | | | 1,001 | | | | 1,001 | |

| 4 | | | | | | | | | | | | | | | | | | 12,374 | | | | 12,373 | |

CMBS - Zero Coupon: | | | | | | | | | | | | | | | | | | | | |

| 2 | | | Other | | Multifamily | | N/A | | | 3/2/2027 | | | 166,793 | | | | 80,892 | | | | 81,875 | |

Corporate Bond: | | | | | | | | | | | | | | | | | | | | |

| 1 | | | BB | | Hospitality | | 6.5% | | | 9/15/2026 | | | 52,652 | | | | 52,652 | | | | 50,755 | |

| 102 | | | | | | | | | | | | | | | | | $ | 2,281,416 | | | $ | 2,259,913 | |

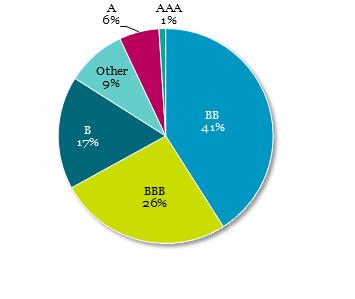

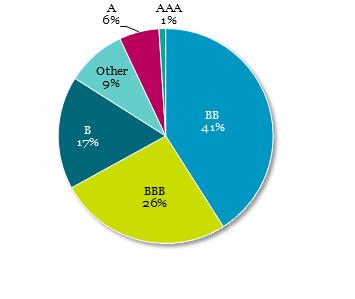

(1) | AAA represents credit ratings of AAA and AAA-, A represents credit ratings of A+, A, and A-, BBB represents credit ratings of BBB+, BBB, and BBB-, BB represents credit ratings of BB+, BB, and BB-, and B represents credit ratings of B+, B, and B-. Other consists of investments that, as of June 30, 2019 and December 31, 2018, were either not ratable or have not been submitted to rating agencies. |

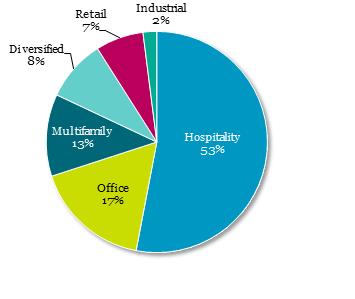

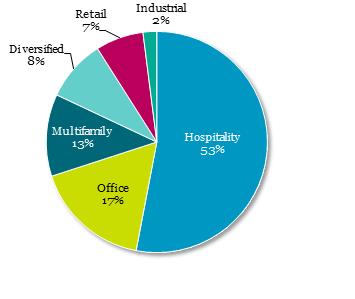

(2) | Multifamily real estate-related securities and loans are collateralized by various forms of rental housing including single-family homes and apartments. |

(3) | The term “L” refers to the one-month U.S. dollar-denominated London Interbank Offer Rate (“LIBOR”). As of June 30, 2019 and December 31, 2018, one-month LIBOR was equal to 2.4% and 2.5%, respectively. |

(4) | Weighted average maturity date is based on the fully extended maturity date of the instrument or, in the case of CMBS, the underlying collateral. |

(5) | Represents notional amount for interest only positions. |

The Company’s investments in real estate-related securities and loans included CMBS collateralized by properties owned by Blackstone-advised investment vehicles and CMBS collateralized by loans originated or acquired by Blackstone-advised investment vehicles. The following table details the Company’s affiliate CMBS positions ($ in thousands):

| | Fair Value | | Interest Income | | |

| | June 30, | | December 31, | | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| | 2019 | | 2018 | | 2019 | | | 2018 | | 2019 | | 2018 | |

CMBS collateralized by properties | | $ | 1,057,625 | | $ | 919,392 | | $ | 12,290 | | | $ | 8,771 | | $ | 24,370 | | $ | 15,795 | |

CMBS collateralized by a loan | | | 164,770 | | | 163,404 | | | 2,090 | | | | 762 | | | 4,187 | | | 1,448 | |

Total | | $ | 1,222,395 | | $ | 1,082,796 | | $ | 14,380 | | | $ | 9,533 | | $ | 28,557 | | $ | 17,243 | |

For additional information regarding the Company’s investments in affiliated CMBS, see Note 5 to the consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. The terms and conditions of such affiliated CMBS held as of June 30, 2019 are consistent with the terms described in such Note.

The Company’s investments in real estate-related securities and loans also included $98.5 million of CMBS collateralized by pools of commercial real estate debt, all or a portion of which included certain of the Company’s mortgage notes. The Company recognized $1.7 million and $3.3 million of interest income related to such CMBS during the three and six months ended June 30, 2019, respectively. No such investments were owned during the six months ended June 30, 2018.

During the three and six months ended June 30, 2019, the Company recorded a net unrealized gain of $20.8 million and $51.8 million, respectively. During the three and six months ended June 30, 2018, the Company recorded a net unrealized gain of $2.1 million and $3.8 million, respectively. Such unrealized gains were recorded as a component of Income from Real Estate-Related Securities and Loans on the Company’s Condensed Consolidated Statements of Operations.

During the three and six months ended June 30, 2019, the Company sold two CMBS positions for approximately its cost basis. The Company did not sell any positions during the corresponding periods of the prior year.

15

6. Mortgage Notes, Term Loans, and Secured Revolving Credit Facilities

The following table is a summary of the Company’s mortgage notes, term loans, and secured revolving credit facilities ($ in thousands):

| | | | | | | | | | | | Principal Balance Outstanding(3) | |

Indebtedness | | Weighted Average Interest Rate(1) | | | Weighted Average Maturity Date(2)(3) | | Maximum Facility Size | | | June 30, 2019 | | | December 31, 2018 | |

Fixed rate | | | | | | | | | | | | | | | | | | |

Fixed rate mortgages | | 4.00% | | | 12/6/2025 | | N/A | | | $ | 6,176,501 | | | $ | 4,782,326 | |

Mezzanine loan | | 5.85% | | | 4/5/2025 | | N/A | | | | 200,000 | | | | 200,000 | |

Total fixed rate loans | | 4.06% | | | 11/28/2025 | | | | | | | 6,376,501 | | | | 4,982,326 | |

Variable rate | | | | | | | | | | | | | | | | | | |

Floating rate mortgages | | L+1.71% | | | 5/9/2026 | | N/A | | | | 667,916 | | | | 675,116 | |

Variable rate term loans | | L+1.66% | | | 3/19/2023 | | N/A | | | | 732,325 | | | | 603,500 | |

Variable rate secured revolving credit facilities | | L+1.65% | | | 4/19/2023 | | $ | 1,032,325 | | | | 662,825 | | | | 624,200 | |

Total variable rate loans | | L+1.67% | | | 4/3/2024 | | | | | | | 2,063,066 | | | | 1,902,816 | |

Total loans secured by the Company's properties | | 4.06% | | | 7/3/2025 | | | | | | | 8,439,567 | | | | 6,885,142 | |

Deferred financing costs, net | | | | | | | | | | | | | (61,922 | ) | | | (53,546 | ) |

Premium on assumed debt, net | | | | | | | | | | | | | 1,536 | | | | 1,673 | |

Mortgage notes, term loans, and secured revolving credit facilities, net | | | | | | | | | $ | 8,379,181 | | | $ | 6,833,269 | |

(1) | The term “L” refers to the one-month LIBOR. As of June 30, 2019, one-month LIBOR was equal to 2.4%. |

(2) | For loans where the Company, at its sole discretion, has extension options, the maximum maturity date has been assumed. |

(3) | The majority of the Company’s mortgages contain yield or spread maintenance provisions. |

The following table presents the future principal payments due under the Company’s mortgage notes, term loans, and secured revolving credit facilities as of June 30, 2019 ($ in thousands):

Year | | Amount | |

2019 (remaining) | | $ | 16,751 | |

2020 | | | 98,938 | |

2021 | | | 48,458 | |

2022 | | | 881,656 | |

2023 | | | 610,819 | |

2024 | | | 1,594,210 | |

Thereafter | | | 5,188,735 | |

Total | | $ | 8,439,567 | |

7. Repurchase Agreements

The Company has entered into master repurchase agreements with Citigroup Global Markets Inc. (the “Citi MRA”), Royal Bank of Canada (the “RBC MRA”), Bank of America Merrill Lynch (the “BAML MRA”), Morgan Stanley Bank, N.A. (the “MS MRA”), MUFG Securities EMEA PLC (the “MUFG MRA”), HSBC Bank USA, National Association (the “HSBC MRA”), and Barclays Bank PLC (the “Barclays MRA”) to provide the Company with additional financing capacity secured by certain of the Company’s investments in real estate-related securities. The terms of the Citi MRA, RBC MRA, BAML MRA, MS MRA, MUFG MRA, and HSBC MRA provide the lenders the ability to determine the size and terms of the financing provided based upon the particular collateral pledged by the Company from time-to-time. The Barclays MRA has a maximum facility size of $750.0 million and repurchase agreements under the Barclays MRA have longer dated maturity compared to the Company’s other master repurchase agreements. Additionally, the Barclays MRA contains specific spread and advance rate provisions based on the rating of the underlying CMBS. The Company is in compliance with all financial covenants of the Barclays MRA.

16

The following tables are a summary of the Company’s repurchase agreements ($ in thousands):

| | June 30, 2019 |

Facility | | Weighted Average Maturity Date(1) | | Security Interests | | Collateral Assets(2) | | | Outstanding Balance | | | Prepayment Provisions |

RBC MRA | | 10/3/2019 | | CMBS | | $ | 1,241,029 | | | $ | 984,284 | | | None |

Barclays MRA | | 9/29/2021 | | CMBS(3) | | | 987,429 | | | | 750,000 | | | None |

MS MRA | | 7/15/2019 | | CMBS | | | 482,566 | | | | 404,834 | | | None |

Citi MRA | | 7/21/2019 | | CMBS | | | 296,331 | | | | 244,180 | | | None |

MUFG MRA | | 4/30/2020 | | CMBS | | | 84,447 | | | | 63,836 | | | None |

| | | | | | $ | 3,091,802 | | | $ | 2,447,134 | | | |

| | December 31, 2018 |

Facility | | Weighted Average Maturity Date(1) | | Security Interests | | Collateral Assets(2) | | | Outstanding Balance | | | Prepayment Provisions |

Barclays MRA | | 9/29/2021 | | CMBS(3) | | $ | 989,059 | | | $ | 750,000 | | | None |

RBC MRA | | 6/18/2019 | | CMBS | | | 794,917 | | | | 650,018 | | | None |

Citi MRA | | 1/13/2019 | | CMBS | | | 193,372 | | | | 154,736 | | | None |

MS MRA | | 1/15/2019 | | CMBS | | | 173,050 | | | | 146,569 | | | None |

MUFG MRA | | 4/30/2020 | | CMBS | | | 15,266 | | | | 12,400 | | | None |

| | | | | | $ | 2,165,664 | | | $ | 1,713,723 | | | |

(1) | Subsequent to quarter end, the Company rolled its repurchase agreement contracts expiring in July 2019 into new contracts. |

(2) | Represents the fair value of the Company’s investments in real estate-related securities that serve as collateral. |

(3) | As of June 30, 2019 and December 31, 2018, the security interests pledged under the Barclays MRA include one corporate bond. |

The weighted average interest rate of the Company’s repurchase agreements was 3.61% (L+1.22%) as of June 30, 2019. The term “L” refers to the one-month, three-month or 12-month U.S. dollar-denominated LIBOR.

8. Unsecured Revolving Credit Facilities

On February 21, 2019, the Company entered into a $350.0 million unsecured line of credit with a third party. The line of credit expires on February 22, 2022 and may be extended for up to one year. Interest under the line of credit is determined based on one-month U.S. dollar-denominated LIBOR plus 2.50%. During the second quarter of 2019, the Company increased the capacity of the unsecured line of credit to $685.0 million. As of June 30, 2019, there was $240.0 million outstanding on such line.

The Company also maintains a $250 million unsecured line of credit with an affiliate of Blackstone of which there was no outstanding balance as of June 30, 2019. For additional information regarding the affiliate line of credit, see Note 8 to the consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

9. Other Assets and Other Liabilities

The following table summarizes the components of other assets ($ in thousands):

| | June 30, 2019 | | | December 31, 2018 | |

Real estate intangibles, net | | $ | 339,837 | | | $ | 292,658 | |

Receivables | | | 60,470 | | | | 45,799 | |

Prepaid expenses | | | 20,024 | | | | 10,746 | |

Pre-acquisition costs | | | 17,552 | | | | 15,361 | |

Straight-line rent receivable | | | 16,395 | | | | 10,337 | |

Deferred financing costs, net | | | 13,112 | | | | 5,822 | |

Deferred leasing costs, net | | | 12,050 | | | | 7,621 | |

Other | | | 27,312 | | | | 22,601 | |

Total | | $ | 506,752 | | | $ | 410,945 | |

17

The following table summarizes the components of accounts payable, accrued expenses, and other liabilities ($ in thousands):

| | June 30, 2019 | | | December 31, 2018 | |

Subscriptions received in advance | | $ | 402,493 | | | $ | 166,542 | |

Payable for real estate-related securities and loans | | | 129,317 | | | | — | |

Accounts payable and accrued expenses | | | 80,304 | | | | 53,247 | |

Real estate taxes payable | | | 64,299 | | | | 56,555 | |

Intangible liabilities, net | | | 60,114 | | | | 55,709 | |

Right of use lease liability - financing leases | | | 56,270 | | | | 4,300 | |

Distribution payable | | | 34,143 | | | | 21,360 | |

Right of use lease liability - operating leases | | | 31,714 | | | | — | |

Tenant security deposits | | | 31,120 | | | | 23,493 | |

Accrued interest expense | | | 28,852 | | | | 24,432 | |

Prepaid rental income | | | 23,396 | | | | 29,112 | |

Other | | | 37,181 | | | | 29,648 | |

Total | | $ | 979,203 | | | $ | 464,398 | |

10. Equity and Redeemable Non-controlling Interest

Common Stock

The following table details the movement in the Company’s outstanding shares of common stock (in thousands):

| | Six Months Ended June 30, 2019 | |

| | Class S | | | Class T | | | Class D | | | Class I | | | Total | |

December 31, 2018 | | | 276,989 | | | | 23,313 | | | | 30,375 | | | | 108,261 | | | | 438,938 | |

Common stock issued | | | 102,407 | | | | 8,864 | | | | 22,112 | | | | 123,319 | | | | 256,702 | |

Distribution reinvestment | | | 5,157 | | | | 388 | | | | 574 | | | | 2,484 | | | | 8,603 | |

Common stock repurchased | | | (3,397 | ) | | | (661 | ) | | | (144 | ) | | | (5,508 | ) | | | (9,710 | ) |

June 30, 2019 | | | 381,156 | | | | 31,904 | | | | 52,917 | | | | 228,556 | | | | 694,533 | |

Share Repurchase Plan

For the six months ended June 30, 2019, the Company repurchased 9,710,021 shares of common stock and 6,454 BREIT OP units representing a total of $105.7 million. The Company had no unfulfilled repurchase requests during the six months ended June 30, 2019.

Distributions

The Company generally intends to distribute substantially all of its taxable income, which does not necessarily equal net income as calculated in accordance with GAAP, to its stockholders each year to comply with the REIT provisions of the Internal Revenue Code.

Each class of common stock receives the same gross distribution per share. The net distribution varies for each class based on the applicable stockholder servicing fee, which is deducted from the monthly distribution per share and paid directly to the applicable distributor.

The following table details the aggregate distributions declared for each applicable class of common stock for the six months ended June 30, 2019:

| | Class S | | | Class T | | | Class D | | | Class I | |

Aggregate gross distributions declared per share of common stock | | $ | 0.3170 | | | $ | 0.3170 | | | $ | 0.3170 | | | $ | 0.3170 | |

Stockholder servicing fee per share of common stock | | | (0.0464 | ) | | | (0.0455 | ) | | | (0.0135 | ) | | | — | |

Net distributions declared per share of common stock | | $ | 0.2706 | | | $ | 0.2715 | | | $ | 0.3035 | | | $ | 0.3170 | |

18

Redeemable Non-controlling Interest

In connection with its performance participation interest, the Special Limited Partner holds Class I units in BREIT OP. See Note 11 for further details of the Special Limited Partner’s performance participation interest. Because the Special Limited Partner has the ability to redeem its Class I units for Class I shares in the Company or cash, at the election of the Special Limited Partner, the Company has classified these Class I units as Redeemable Non-controlling Interest in mezzanine equity on the Company’s Condensed Consolidated Balance Sheets. The Redeemable Non-controlling Interest is recorded at the greater of the carrying amount, adjusted for their share of the allocation of income or loss and dividends, or the redemption value, which is equivalent to fair value, of such units at the end of each measurement period. As the redemption value was greater than the adjusted carrying value at June 30, 2019, the Company recorded an allocation adjustment of $1.4 million between Additional Paid-in Capital and Redeemable Non-controlling Interest.

The following table summarizes the redeemable non-controlling interest activity for the six months ended June 30, 2019 ($ in thousands):

December 31, 2018 | | $ | 9,233 | |

Settlement of 2018 performance participation allocation | | | 37,484 | |

Conversion to Class I shares | | | (11,620 | ) |

Repurchases | | | (25,407 | ) |

GAAP income allocation | | | (351 | ) |

Distributions | | | (597 | ) |

Fair value allocation | | | 1,441 | |

June 30, 2019 | | $ | 10,183 | |

11. Related Party Transactions

Management Fee

The Adviser is entitled to an annual management fee equal to 1.25% of the Company’s NAV, payable monthly, as compensation for the services it provides to the Company. The management fee can be paid, at the Adviser’s election, in cash, shares of common stock, or BREIT OP units. The Adviser has elected to receive the management fee in shares of the Company’s common stock to date. During the three and six months ended June 30, 2019, the Company incurred management fees of $22.5 million and $39.7 million, respectively. During the three and six months ended June 30, 2018, the Company incurred management fees of $9.3 million and $16.3 million, respectively.

During the six months ended June 30, 2019 and 2018, the Company issued 2,870,390 and 1,206,253, respectively, unregistered Class I shares to the Adviser as payment for management fees. The Company also had a payable of $8.3 million and $5.1 million related to the management fees as of June 30, 2019 and December 31, 2018, respectively, which is included in Due to Affiliates on the Company’s Condensed Consolidated Balance Sheets. During July 2019, the Adviser was issued 746,844 unregistered Class I shares as payment for the $8.3 million management fees accrued as of June 30, 2019. The shares issued to the Adviser for payment of the management fee were issued at the applicable NAV per share at the end of each month for which the fee was earned. During the six months ended June 30, 2019, the Adviser submitted 4,574,431 Class I shares for repurchase resulting in a total repurchase of $49.9 million. The Adviser did not submit any shares for repurchase during the six months ended June 30, 2018.

Performance Participation Allocation

The Special Limited Partner holds a performance participation interest in BREIT OP that entitles it to receive an allocation of BREIT OP’s total return to its capital account. During the three and six months ended June 30, 2019, the Company recognized $29.9 million and $50.1 million, respectively, of Performance Participation Allocation expense in the Company’s Condensed Consolidated Statements of Operations as the performance hurdle was achieved as of June 30, 2019. During the three and six months ended June 30, 2018, the Company recognized $9.5 million and $17.3 million, respectively, of Performance Participation Allocation expense as the performance hurdle was achieved as of June 30, 2018.

19

In January 2019, the Company issued approximately 3.5 million Class I units in BREIT OP to the Special Limited Partner as payment for the 2018 performance participation allocation. Such Class I units were issued at the NAV per unit as of December 31, 2018. Subsequent to the Class I units being issued, 0.4 million of such units were redeemed for $4.3 million and 1.1 million of such units were exchanged for unregistered Class I shares in the Company. Additionally, during the three months ended June 30, 2019, the Special Limited Partner redeemed approximately 1.9 million Class I units in BREIT OP for $21.1 million. The remaining Class I units held by the Special Limited Partner are included in Redeemable Non-Controlling Interest on the Company’s Condensed Consolidated Balance Sheets.

Due to Affiliates

The following table details the components of due to affiliates ($ in thousands):

| | June 30, 2019 | | December 31, 2018 | |

Accrued stockholder servicing fee(1) | | $ | 359,917 | | $ | 238,496 | |

Performance participation allocation | | | 50,061 | | | 37,484 | |

Accrued management fee | | | 8,272 | | | 5,124 | |

Advanced organization and offering costs | | | 7,159 | | | 8,181 | |

Accrued affiliate service provider expenses | | | 3,214 | | | 3,115 | |

Accrued affiliate incentive compensation awards | | | — | | | 4,714 | |

Other | | | 1,388 | | | 4,467 | |

Total | | $ | 430,011 | | $ | 301,581 | |

(1) | The Company accrues the full amount of the future stockholder servicing fees payable to the Dealer Manager for Class S, Class T, and Class D shares up to the 8.75% of gross proceeds limit at the time such shares are sold. The Dealer Manager has entered into agreements with the selected dealers distributing the Company’s shares in the Offering, which provide, among other things, for the re-allowance of the full amount of the selling commissions and dealer manager fee and all or a portion of the stockholder servicing fees received by the Dealer Manager to such selected dealers. |

Accrued affiliate service provider expenses and incentive compensation awards

In March 2019, the Company engaged Link Industrial Properties LLC (“Link”), a portfolio company owned by a Blackstone-advised fund, to provide operational services (including property management, leasing, and construction management), corporate support services (including accounting, legal, and tax), and transaction support services for the Company’s industrial assets. Prior to such time, Gateway Industrial Properties L.L.C. serviced the Company’s industrial assets. For further detail on other affiliate relationships, see Note 11 to the consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

The following tables detail the amounts incurred for affiliate service providers during the three and six months ended June 30, 2019 and 2018 ($ in thousands).

| | Affiliate Service | | | Affiliate Service Provider | | | Capitalized Transaction | |

| | Provider Expenses | | | Incentive Compensation Awards | | | Support Services | |

| | Three Months Ended June 30, | | | Three Months Ended June 30, | | | Three Months Ended June 30, | |

| | 2019 | | | 2018 | | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

LivCor, L.L.C. | | $ | 4,398 | | | $ | 2,048 | | | $ | 13 | | | $ | — | | | $ | 563 | | | $ | 101 | |