UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 000-55931

Blackstone Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| | | | |

| Maryland | | 81-0696966 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| 345 Park Avenue | | |

| New York | , | NY | | 10154 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 583-5000

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | Accelerated filer | | ☐ |

| | | | |

| Non-accelerated filer | | ☒ | Smaller reporting company | | ☐ |

| | | | | | |

| Emerging growth company | | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 12, 2021, the issuer had the following shares outstanding: 1,185,308,733 shares of Class S common stock, 1,877,094,046 shares of Class I common stock, 56,203,721 shares of Class T common stock, and 273,758,489 shares of Class D common stock.

TABLE OF CONTENTS

| | | | | | | | |

| PART I. | | |

| | |

| ITEM 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ITEM 2. | | |

| | | |

| ITEM 3. | | |

| | | |

| ITEM 4. | | |

| | | |

| PART II. | | |

| | | |

| ITEM 1. | | |

| | | |

| ITEM 1A. | | |

| | | |

| ITEM 2. | | |

| | | |

| ITEM 3. | | |

| | | |

| ITEM 4. | | |

| | | |

| ITEM 5. | | |

| | | |

| ITEM 6. | | |

| | | |

| | |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | |

| | September 30, 2021 | | December 31, 2020 |

| Assets | | | |

| Investments in real estate, net | $ | 43,596,089 | | | $ | 32,457,713 | |

Investments in unconsolidated entities (includes $558,399 and $0 at fair value as of September 30, 2021 and December 31, 2020, respectively) | 4,252,882 | | | 816,220 | |

| Investments in real estate debt | 6,902,995 | | | 4,566,306 | |

| Cash and cash equivalents | 1,560,719 | | | 333,388 | |

| Restricted cash | 2,070,369 | | | 711,135 | |

| Other assets | 5,065,548 | | | 1,799,253 | |

| Total assets | $ | 63,448,602 | | | $ | 40,684,015 | |

| | | |

| Liabilities and Equity | | | |

| Mortgage notes, term loans, and secured revolving credit facilities, net | $ | 24,966,176 | | | $ | 19,976,161 | |

| Secured financings of investments in real estate debt | 2,767,399 | | | 2,140,993 | |

| Unsecured revolving credit facilities | — | | | — |

| Due to affiliates | 1,979,927 | | | 887,660 | |

| Other liabilities | 3,258,061 | | | 1,465,194 | |

| Total liabilities | 32,971,563 | | | 24,470,008 | |

| | | |

| Commitments and contingencies | — | | | — | |

| Redeemable non-controlling interests | 80,838 | | | 30,056 | |

| | | |

| Equity | | | |

| | | |

| Common stock — Class S shares, $0.01 par value per share, 3,000,000 shares authorized; 1,081,497 and 702,853 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 10,815 | | | 7,029 | |

| Common stock — Class I shares, $0.01 par value per share, 6,000,000 shares authorized; 1,686,440 and 927,080 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 16,863 | | | 9,270 | |

| Common stock — Class T shares, $0.01 par value per share, 500,000 shares authorized; 53,946 and 45,943 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 539 | | | 459 | |

| Common stock — Class D shares, $0.01 par value per share, 500,000 shares authorized; 243,538 and 124,141 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 2,435 | | | 1,241 | |

| Additional paid-in capital | 34,020,582 | | | 19,059,045 | |

| Accumulated other comprehensive loss | (8,643) | | | — | |

| Accumulated deficit and cumulative distributions | (4,804,187) | | | (3,224,318) | |

| Total stockholders' equity | 29,238,404 | | | 15,852,726 | |

| Non-controlling interests attributable to third party joint ventures | 748,195 | | | 143,253 | |

| Non-controlling interests attributable to BREIT OP unitholders | 409,602 | | | 187,972 | |

| Total equity | 30,396,201 | | | 16,183,951 | |

| Total liabilities and equity | $ | 63,448,602 | | | $ | 40,684,015 | |

See accompanying notes to condensed consolidated financial statements.

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Revenues | | | | | | | |

| Rental revenue | $ | 808,098 | | | $ | 562,053 | | | $ | 2,141,823 | | | $ | 1,647,865 | |

| Hospitality revenue | 127,507 | | | 56,038 | | | 288,310 | | | 205,291 | |

| Other revenue | 43,704 | | | 17,280 | | | 92,814 | | | 49,844 | |

| Total revenues | 979,309 | | | 635,371 | | | 2,522,947 | | | 1,903,000 | |

| | | | | | | |

| Expenses | | | | | | | |

| Rental property operating | 314,017 | | | 193,306 | | | 799,707 | | | 548,729 | |

| Hospitality operating | 92,280 | | | 60,339 | | | 223,053 | | | 204,168 | |

| General and administrative | 7,106 | | | 5,430 | | | 21,855 | | | 19,025 | |

| Management fee | 122,866 | | | 57,619 | | | 288,144 | | | 160,544 | |

| Performance participation allocation | 449,822 | | | — | | | 892,410 | | | — | |

| Impairment of investments in real estate | — | | | 6,217 | | | — | | | 12,343 | |

| Depreciation and amortization | 482,045 | | | 332,599 | | | 1,282,053 | | | 1,008,756 | |

| Total expenses | 1,468,136 | | | 655,510 | | | 3,507,222 | | | 1,953,565 | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Income from unconsolidated entities | 78,445 | | | 25,073 | | | 183,155 | | | 63,678 | |

| Income (loss) from investments in real estate debt | 83,052 | | | 206,046 | | | 438,986 | | | (317,212) | |

| Net (loss) gain on dispositions of real estate | (9,586) | | | 100,070 | | | 13,216 | | | 100,441 | |

| Interest income | 41 | | | 122 | | | 136 | | | 2,102 | |

| Interest expense | (204,538) | | | (174,193) | | | (567,685) | | | (539,276) | |

| Loss on extinguishment of debt | (3,372) | | | (5,258) | | | (9,545) | | | (6,495) | |

| Other income (expense) | 177,631 | | | (9,252) | | | 411,160 | | | (29,022) | |

| Total other income (expense) | 121,673 | | | 142,608 | | | 469,423 | | | $ | (725,784) | |

| Net (loss) income | $ | (367,154) | | | $ | 122,469 | | | $ | (514,852) | | | $ | (776,349) | |

| Net loss attributable to non-controlling interests in third party joint ventures | $ | 5,472 | | | $ | 593 | | | $ | 5,149 | | | $ | 1,796 | |

| Net loss (income) attributable to non-controlling interests in BREIT OP | 4,393 | | | (1,790) | | | 6,129 | | | $ | 10,177 | |

| Net (loss) income attributable to BREIT stockholders | $ | (357,289) | | | $ | 121,272 | | | $ | (503,574) | | | $ | (764,376) | |

| Net (loss) income per share of common stock — basic and diluted | $ | (0.12) | | | $ | 0.07 | | | $ | (0.21) | | | $ | (0.49) | |

| Weighted-average shares of common stock outstanding, basic and diluted | 2,873,453 | | | 1,651,693 | | | 2,379,158 | | | 1,545,984 | |

See accompanying notes to condensed consolidated financial statements.

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Net (loss) income | $ | (367,154) | | | $ | 122,469 | | | $ | (514,852) | | | $ | (776,349) | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation losses, net | (8,643) | | | — | | | (8,643) | | | — | |

| Comprehensive (loss) income | (375,797) | | | 122,469 | | | (523,495) | | | (776,349) | |

| Comprehensive loss attributable to non-controlling interests in third party joint ventures | 5,472 | | | 593 | | | 5,149 | | | 1,796 | |

| Comprehensive loss (income) attributable to non-controlling interests in BREIT OP | 4,393 | | | (1,790) | | | 6,129 | | | 10,177 | |

| Comprehensive (loss) income attributable to BREIT stockholders | $ | (365,932) | | | $ | 121,272 | | | $ | (512,217) | | | $ | (764,376) | |

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Changes in Equity (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | Accumulated

Other Comprehensive Loss | | Accumulated

Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at June 30, 2021 | $ | 9,218 | | | $ | 13,262 | | | $ | 502 | | | $ | 1,815 | | | $ | 26,842,197 | | | $ | — | | | $ | (4,008,476) | | | $ | 22,858,518 | | | $ | 153,817 | | | $ | 250,150 | | | $ | 23,262,485 | |

| Common stock issued | 1,561 | | | 3,639 | | | 37 | | | 612 | | | 7,446,347 | | | — | | | — | | | 7,452,196 | | | — | | | — | | | 7,452,196 | |

| Offering costs | — | | | — | | | — | | | — | | | (249,159) | | | — | | | — | | | (249,159) | | | — | | | — | | | (249,159) | |

| Distribution reinvestment | 65 | | | 83 | | | 3 | | | 13 | | | 211,879 | | | — | | | — | | | 212,043 | | | — | | | — | | | 212,043 | |

| Common stock/units repurchased | (29) | | | (123) | | | (3) | | | (5) | | | (205,990) | | | — | | | — | | | (206,150) | | | — | | | — | | | (206,150) | |

| Amortization of compensation awards | — | | | 2 | | | — | | | — | | | 151 | | | — | | | — | | | 153 | | | — | | | 1,177 | | | 1,330 | |

| Net loss ($382 allocated to redeemable non‑controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | (357,289) | | | (357,289) | | | (5,092) | | | (4,391) | | | (366,772) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | (8,643) | | | — | | | (8,643) | | | — | | | — | | | (8,643) | |

| Distributions declared on common stock ($0.1637 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | (438,422) | | | (438,422) | | | — | | | — | | | (438,422) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 603,165 | | | 167,946 | | | 771,111 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,695) | | | (5,280) | | | (8,975) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | (24,843) | | | — | | | — | | | (24,843) | | | — | | | — | | | (24,843) | |

| Balance at September 30, 2021 | $ | 10,815 | | | $ | 16,863 | | | $ | 539 | | | $ | 2,435 | | | $ | 34,020,582 | | | $ | (8,643) | | | $ | (4,804,187) | | | $ | 29,238,404 | | | $ | 748,195 | | | $ | 409,602 | | | $ | 30,396,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | Accumulated

Other Comprehensive Loss | | Accumulated

Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at June 30, 2020 | $ | 6,322 | | | $ | 8,200 | | | $ | 440 | | | $ | 1,032 | | | $ | 16,952,056 | | | $ | — | | | $ | (2,749,989) | | | $ | 14,218,061 | | | $ | 159,459 | | | $ | 191,993 | | | $ | 14,569,513 | |

| Common stock issued | 312 | | | 565 | | | 15 | | | 68 | | | 1,021,753 | | | — | | | — | | | 1,022,713 | | | — | | | — | | | 1,022,713 | |

| Offering costs | — | | | — | | | — | | | — | | | (35,098) | | | — | | | — | | | (35,098) | | | — | | | — | | | (35,098) | |

| Distribution reinvestment | 54 | | | 52 | | | 3 | | | 9 | | | 128,911 | | | — | | | — | | | 129,029 | | | — | | | — | | | 129,029 | |

| Common stock/units repurchased | (68) | | | (225) | | | (8) | | | (13) | | | (332,425) | | | — | | | — | | | (332,739) | | | — | | | (152) | | | (332,891) | |

| Amortization of compensation awards | — | | | 1 | | | — | | | — | | | 99 | | | — | | | — | | | 100 | | | — | | | (31) | | | 69 | |

Net income (loss) ($263 loss allocated to redeemable non‑controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | 121,272 | | | 121,272 | | | (328) | | | 1,788 | | | 122,732 | |

| Distributions declared on common stock ($0.1586 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | (245,039) | | | (245,039) | | | — | | | — | | | (245,039) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 223 | | | 1,270 | | | 1,493 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | (1,946) | | | — | | | — | | | (1,946) | | | (16,652) | | | (3,466) | | | (22,064) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | (6,429) | | | — | | | — | | | (6,429) | | | — | | | — | | | (6,429) | |

| Balance at September 30, 2020 | $ | 6,620 | | | $ | 8,593 | | | $ | 450 | | | $ | 1,096 | | | $ | 17,726,921 | | | $ | — | | | $ | (2,873,756) | | | $ | 14,869,924 | | | $ | 142,702 | | | $ | 191,402 | | | $ | 15,204,028 | |

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Changes in Equity (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Par Value | | | | Accumulated

Other Comprehensive Loss | | Accumulated

Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at December 31, 2020 | $ | 7,029 | | | $ | 9,270 | | | $ | 459 | | | $ | 1,241 | | | $ | 19,059,045 | | | $ | — | | | $ | (3,224,318) | | | $ | 15,852,726 | | | $ | 143,253 | | | $ | 187,972 | | | $ | 16,183,951 | |

| Common stock issued | 3,741 | | | 8,010 | | | 81 | | | 1,178 | | | 15,957,649 | | | — | | | — | | | 15,970,659 | | | — | | | — | | | 15,970,659 | |

| Offering costs | — | | | — | | | — | | | — | | | (540,776) | | | — | | | — | | | (540,776) | | | — | | | — | | | (540,776) | |

| Distribution reinvestment | 183 | | | 208 | | | 10 | | | 34 | | | 535,004 | | | — | | | — | | | 535,439 | | | — | | | — | | | 535,439 | |

| Common stock/units repurchased | (138) | | | (629) | | | (11) | | | (18) | | | (956,242) | | | — | | | — | | | (957,038) | | | (129) | | | (1,450) | | | (958,617) | |

| Amortization of compensation awards | — | | | 4 | | | — | | | — | | | 395 | | | — | | | — | | | 399 | | | — | | | 3,046 | | | 3,445 | |

| Net loss ($920 allocated to redeemable non‑controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | (503,574) | | | (503,574) | | | (4,233) | | | (6,125) | | | (513,932) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | (8,643) | | | — | | | (8,643) | | | — | | | — | | | (8,643) | |

| Distributions declared on common stock ($0.4852 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | (1,076,295) | | | (1,076,295) | | | — | | | — | | | (1,076,295) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 619,991 | | | 240,412 | | | 860,403 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,687) | | | (14,253) | | | (24,940) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | (34,493) | | | — | | | — | | | (34,493) | | | — | | | — | | | (34,493) | |

| Balance at September 30, 2021 | $ | 10,815 | | | $ | 16,863 | | | $ | 539 | | | $ | 2,435 | | | $ | 34,020,582 | | | $ | (8,643) | | | $ | (4,804,187) | | | $ | 29,238,404 | | | $ | 748,195 | | | $ | 409,602 | | | $ | 30,396,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Par Value | | | | Accumulated

Other Comprehensive Loss | | Accumulated Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at December 31, 2019 | $ | 5,308 | | | $ | 4,743 | | | $ | 398 | | | $ | 847 | | | $ | 11,716,721 | | | — | | | $ | (1,422,885) | | | $ | 10,305,132 | | | $ | 157,795 | | | $ | 151,721 | | | $ | 10,614,648 | |

| Common stock issued | 1,555 | | | 4,278 | | | 75 | | | 282 | | | 6,968,348 | | | — | | | — | | | 6,974,538 | | | — | | | — | | | 6,974,538 | |

| Offering costs | — | | | — | | | — | | | — | | | (161,478) | | | — | | | — | | | (161,478) | | | — | | | — | | | (161,478) | |

| Distribution reinvestment | 153 | | | 140 | | | 9 | | | 24 | | | 356,869 | | | — | | | — | | | 357,195 | | | — | | | — | | | 357,195 | |

| Common stock/units repurchased | (396) | | | (571) | | | (32) | | | (57) | | | (1,145,159) | | | — | | | — | | | (1,146,215) | | | — | | | (1,907) | | | (1,148,122) | |

| Amortization of compensation awards | — | | | 3 | | | — | | | — | | | 297 | | | — | | | — | | | 300 | | | — | | | 969 | | | 1,269 | |

| Net loss ($1,273 allocated to redeemable non-controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | (764,376) | | | (764,376) | | | (536) | | | (10,164) | | | (775,076) | |

| Distributions declared on common stock ($0.4755 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | (686,495) | | | (686,495) | | | — | | | — | | | (686,495) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 11,394 | | | 61,163 | | | 72,557 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | (1,946) | | | — | | | — | | | (1,946) | | | (25,951) | | | (10,380) | | | (38,277) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | (6,731) | | | — | | | — | | | (6,731) | | | — | | | — | | | (6,731) | |

| Balance at September 30, 2020 | $ | 6,620 | | | $ | 8,593 | | | $ | 450 | | | $ | 1,096 | | | $ | 17,726,921 | | | $ | — | | | $ | (2,873,756) | | | $ | 14,869,924 | | | $ | 142,702 | | | $ | 191,402 | | | $ | 15,204,028 | |

See accompanying notes to condensed consolidated financial statements.

Blackstone Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (514,852) | | | $ | (776,349) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Management fee | 288,144 | | | 160,544 | |

| Performance participation allocation | 892,410 | | | — | |

| Impairment of investments in real estate | — | | | 12,343 | |

| Depreciation and amortization | 1,282,053 | | | 1,008,756 | |

| Net gain on dispositions of real estate | (13,216) | | | (100,441) | |

| Loss on extinguishment of debt | 9,545 | | | 6,495 | |

| Unrealized (gain) loss on changes in fair value of financial instruments | (668,503) | | | 484,332 | |

| Income from unconsolidated entities | (183,155) | | | (63,678) | |

| Distributions from unconsolidated entities | 84,315 | | | 57,856 | |

| Other items | (21,409) | | | (23,996) | |

| Change in assets and liabilities: | | | |

| (Increase) / decrease in other assets | (166,966) | | | (69,800) | |

| Increase / (decrease) in due to affiliates | (1,109) | | | (1,222) | |

| Increase / (decrease) in other liabilities | 203,156 | | | 34,611 | |

| Net cash provided by operating activities | 1,190,413 | | | 729,451 | |

| Cash flows from investing activities: | | | |

| Acquisitions of real estate | (9,932,224) | | | (3,246,297) | |

| Capital improvements to real estate | (348,139) | | | (230,749) | |

| Proceeds from disposition of real estate | 194,575 | | | 385,269 | |

| Pre-acquisition costs and deposits | (593,566) | | | (58,274) | |

| Investment in unconsolidated entities | (3,336,486) | | | (808,312) | |

| Purchase of investments in real estate debt | (3,058,345) | | | (1,177,967) | |

| Proceeds from sale/repayment of investments in real estate debt | 1,170,285 | | | 363,175 | |

| Purchase of real estate-related equity securities | (1,738,385) | | | (703,695) | |

| Proceeds from sale of real estate-related equity securities | — | | | 102,932 | |

| Net cash used in investing activities | (17,642,285) | | | (5,373,918) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common stock | 15,183,976 | | | 6,014,033 | |

| Offering costs paid | (118,997) | | | (71,135) | |

| Subscriptions received in advance | 1,720,934 | | | 217,461 | |

| Repurchase of common stock | (843,042) | | | (996,873) | |

| Repurchase of management fee shares | (172,230) | | | (112,664) | |

| Borrowings under mortgage notes, term loans, and secured revolving credit facilities | 7,614,710 | | | 6,207,729 | |

| Repayments of mortgage notes, term loans, and secured revolving credit facilities | (4,966,542) | | | (5,849,236) | |

| Borrowings under secured financings of investments in real estate debt | 916,684 | | | 1,898,018 | |

| Repayments of secured financings of investments in real estate debt | (275,980) | | | (2,616,391) | |

| Borrowings under affiliate unsecured revolving credit facility | 950,000 | | | 175,000 | |

| Repayments of affiliate unsecured revolving credit facility | (950,000) | | | (175,000) | |

| Borrowings under unsecured revolving credit facilities | 160,000 | | | 130,000 | |

| Repayments of unsecured revolving credit facilities | (160,000) | | | (130,000) | |

| Payment of deferred financing costs | (51,696) | | | (41,721) | |

| Redemption of redeemable non-controlling interest | (111,949) | | | (83,625) | |

| Redemption of affiliate service provider incentive compensation awards | (1,083) | | | (1,755) | |

| Contributions from non-controlling interests | 637,158 | | | 22,503 | |

| Distributions to and redemptions of non-controlling interests | (19,876) | | | (41,202) | |

| Distributions | (474,565) | | | (301,788) | |

| Net cash provided by financing activities | 19,037,502 | | | 4,243,354 | |

| Net change in cash and cash equivalents and restricted cash | 2,585,630 | | | (401,113) | |

| Cash and cash equivalents and restricted cash, beginning of period | 1,044,523 | | | 1,109,702 | |

| Effects of currency translation on cash, cash equivalents and restricted cash | 935 | | | — | |

| Cash and cash equivalents and restricted cash, end of period | $ | 3,631,088 | | | $ | 708,589 | |

| | | |

| Reconciliation of cash and cash equivalents and restricted cash to the condensed consolidated balance sheets: | | | |

| Cash and cash equivalents | $ | 1,560,719 | | | $ | 240,022 | |

| Restricted cash | 2,070,369 | | | 468,567 | |

| Total cash and cash equivalents and restricted cash | $ | 3,631,088 | | | $ | 708,589 | |

| | | | | | | | | | | |

| Non-cash investing and financing activities: | | | |

| Assumption of mortgage notes in conjunction with acquisitions of real estate | $ | 2,353,084 | | | $ | 224,123 | |

| Assumption of other liabilities in conjunction with acquisitions of real estate | $ | 51,824 | | | $ | 257 | |

| Issuance of BREIT OP units as consideration for acquisitions of real estate | $ | 165,746 | | | $ | — | |

| Assumption of other liabilities in conjunction with acquisitions of investments in unconsolidated entities | $ | 9,435 | | | $ | — | |

| Recognition of financing lease liability | $ | 16,855 | | | $ | — | |

| Accrued pre-acquisition costs | $ | 8,797 | | | $ | 1,203 | |

| Accrued capital expenditures and acquisition related costs | $ | 18,276 | | | $ | 7,168 | |

| Accrued distributions | $ | 67,264 | | | $ | 27,754 | |

| Accrued stockholder servicing fee due to affiliate | $ | 423,471 | | | $ | 94,245 | |

| Redeemable non-controlling interest issued as settlement of performance participation allocation | $ | 192,648 | | | $ | 141,396 | |

| Exchange of redeemable non-controlling interest for Class I shares | $ | 12,246 | | | $ | 9,228 | |

| Exchange of redeemable non-controlling interest for Class I or Class B units | $ | 68,453 | | | $ | 48,543 | |

| Allocation to redeemable non-controlling interest | $ | 34,493 | | | $ | 6,731 | |

| Distribution reinvestment | $ | 535,439 | | | $ | 357,195 | |

| Accrued common stock repurchases | $ | 75,308 | | | $ | 71,047 | |

| Accrued common stock repurchases due to affiliate | $ | — | | | $ | 18,937 | |

| Payable for unsettled investments in real estate debt | $ | 236,686 | | | $ | 1,065 | |

| Receivable for unsettled investments in real estate debt | $ | 5,233 | | | $ | — | |

See accompanying notes to condensed consolidated financial statements.

Blackstone Real Estate Income Trust, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Business Purpose

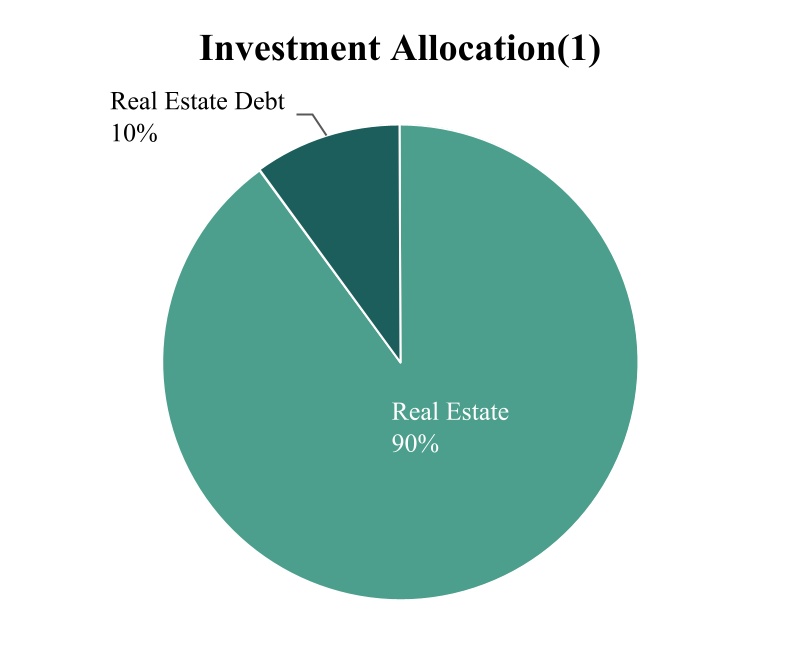

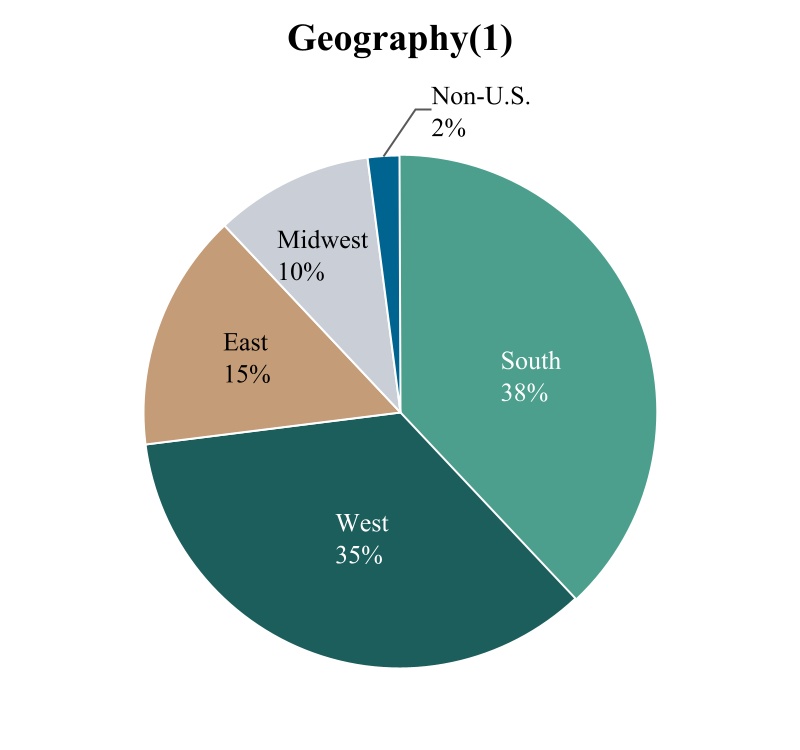

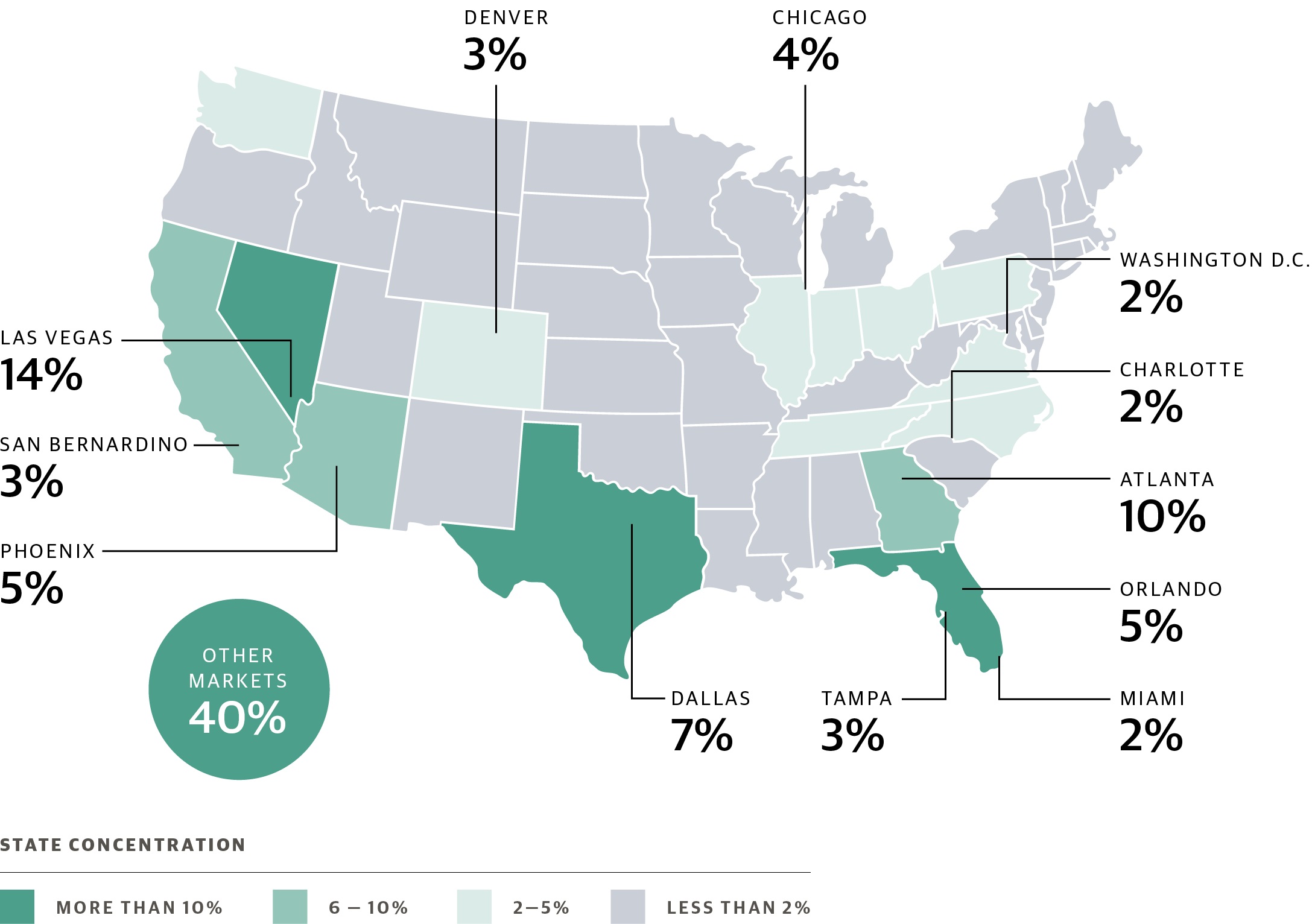

Blackstone Real Estate Income Trust, Inc. (“BREIT” or the “Company”) invests primarily in stabilized income-oriented commercial real estate in the United States and, to a lesser extent, in real estate debt. The Company is the sole general partner and majority limited partner of BREIT Operating Partnership, L.P., a Delaware limited partnership (“BREIT OP”). BREIT Special Limited Partner L.P. (the “Special Limited Partner”), a wholly-owned subsidiary of Blackstone Inc. (together with its affiliates, “Blackstone”), owns a special limited partner interest in BREIT OP. Substantially all of the Company’s business is conducted through BREIT OP. The Company and BREIT OP are externally managed by BX REIT Advisors L.L.C. (the “Adviser”). The Adviser is part of the real estate group of Blackstone, a leading global investment manager. The Company was formed on November 16, 2015 as a Maryland corporation and qualifies as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

The Company had previously registered with the Securities and Exchange Commission (the “SEC”) 2 offerings for up to an aggregate of $17.0 billion in shares of common stock (the “Previous Offerings”), and accepted gross offering proceeds of $16.3 billion during the period from January 1, 2017 to February 1, 2021. The Company subsequently registered a follow-on offering with the SEC of up to $24.0 billion in shares of common stock, consisting of up to $20.0 billion in shares in its primary offering and up to $4.0 billion in shares pursuant to its distribution reinvestment plan, which the Company began using to offer shares of its common stock in February 2021 (the “Current Offering” and with the Previous Offerings, the “Offering”). As of September 30, 2021, the Company had received aggregate net proceeds of $37.4 billion from selling shares of the Company’s common stock through both the Offering and in unregistered sales. The Company intends to sell any combination of 4 classes of shares of its common stock, with a dollar value up to the maximum aggregate amount of the Current Offering. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. The Company intends to continue selling shares on a monthly basis.

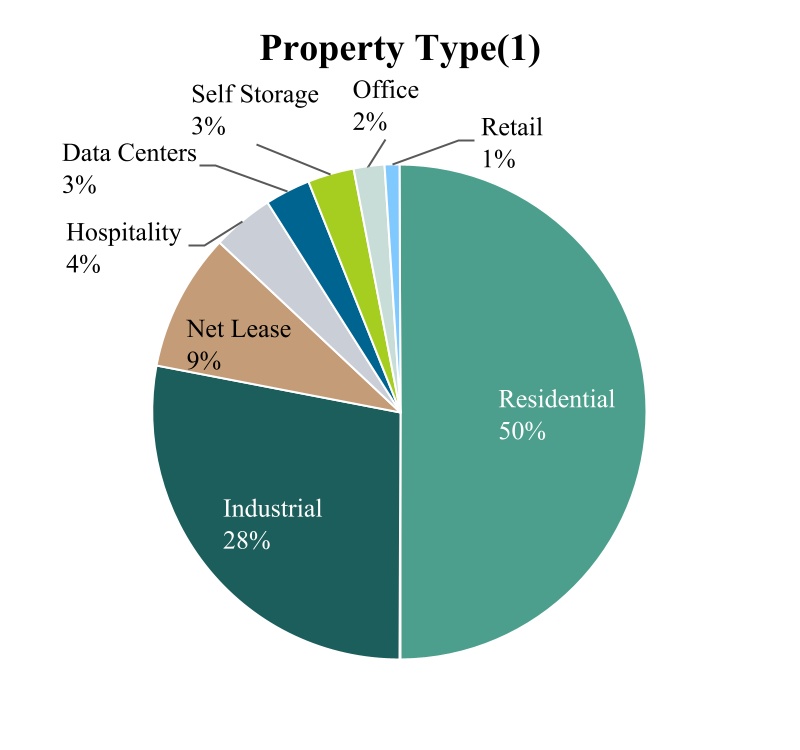

As of September 30, 2021, the Company owned 1,599 properties and 20,940 single family rental homes. The Company currently operates in 9 reportable segments: Residential, Industrial, Net Lease, Data Centers, Hospitality, Self Storage, Retail, and Office properties, and Investments in Real Estate Debt. Residential includes multifamily and other types of rental housing such as manufactured housing, student housing and single family rental housing, as well as senior living. Net Lease includes the real estate assets of The Bellagio Las Vegas (the “Bellagio”) and the unconsolidated interest in the MGM Grand and Mandalay Bay joint venture. Any additional unconsolidated interests are included in the respective property segment as further described in Note 4 – Investments in Unconsolidated Entities. Financial results by segment are reported in Note 15 — Segment Reporting.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The condensed consolidated financial statements, including the condensed notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing the Company's condensed consolidated financial statements are reasonable and prudent. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC.

The accompanying condensed consolidated financial statements include the accounts of the Company, the Company’s subsidiaries, and joint ventures in which the Company has a controlling interest. All intercompany balances and transactions have been eliminated in consolidation.

Principles of Consolidation

The Company consolidates all entities in which it has a controlling financial interest through majority ownership or voting rights and variable interest entities whereby the Company is the primary beneficiary. In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. Entities that do not qualify as VIEs are generally

considered voting interest entities (“VOEs”) and are evaluated for consolidation under the voting interest model. VOEs are consolidated when the Company controls the entity through a majority voting interest or other means. When the requirements for consolidation are not met and the Company has significant influence over the operations of the entity, the investment is accounted for under the equity method of accounting. Equity method investments for which the Company has not elected a fair value option are initially recorded at cost and subsequently adjusted for the Company’s pro-rata share of net income, contributions and distributions. When the Company elects the fair value option (“FVO”), the Company records its share of net asset value of the Entity and any related unrealized gains and losses.

BREIT OP and each of the Company’s joint ventures are considered to be either a VIE or VOE. The Company consolidates these entities, excluding certain equity method investments, because it has the ability to direct the most significant activities of the entities such as purchases, dispositions, financings, budgets, and overall operating plans.

For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities, and operations of each joint venture is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage. Certain of the joint ventures formed by the Company provide the other partner a profits interest based on certain internal rate of return hurdles being achieved. Any profits interest due to the other partner is reported within non-controlling interests.

As of September 30, 2021, the total assets and liabilities of the Company’s consolidated VIEs, excluding BREIT OP, were $14.9 billion and $8.5 billion, respectively, compared to $11.5 billion and $8.0 billion as of December 31, 2020. Such amounts are included on the Company’s Condensed Consolidated Balance Sheets.

Certain of the Company’s joint ventures are accounted for under the equity method of accounting as the requirements for consolidation are not met. As of September 30, 2021, the Company did not consolidate 6 of its joint ventures and accounted for these under the equity method of accounting. The Company has elected the FVO for 2 of its equity method investments while the remaining 4 are presented at historical cost. Refer to Note 4 for additional details on the Company’s investments in unconsolidated entities.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. As of September 30, 2021, the novel coronavirus (“COVID-19”) pandemic is ongoing. During 2020, the COVID-19 pandemic created disruption in global supply chains, increased rates of unemployment and adversely impacted many industries. In 2021, the global economy has, with certain setbacks, begun reopening and wider distribution of vaccines and easing of travel restrictions appear to be encouraging greater economic activity. Nonetheless, the recovery could remain uneven, particularly given uncertainty with respect to the distribution and acceptance of the vaccines and their effectiveness with respect to new variants of the virus, and the resolution of supply chain issues and other longer lasting impacts of the pandemic. As a result, the Company is still unable to predict when normal economic activity and business operations will fully resume. The Company believes the estimates and assumptions underlying its condensed consolidated financial statements are reasonable and supportable based on the information available as of September 30, 2021. However, uncertainty over the ultimate impact COVID-19 will have on the global economy generally, and the Company’s business in particular, makes any estimates and assumptions as of September 30, 2021 inherently less certain than they would be absent the current and potential impacts of COVID-19. Actual results may ultimately differ from those estimates.

Foreign Currency

In the normal course of business, the Company makes investments in real estate outside the United States ("U.S.") through subsidiaries that have a non-U.S. dollar functional currency. Non-U.S. dollar denominated assets and liabilities of these foreign subsidiaries are translated to U.S. dollars at the prevailing exchange rate at the reporting date and income, expenses, gains, and losses are translated at the average exchange rate over the applicable period. Cumulative translation adjustments arising from the translation of non-U.S. dollar denominated assets and liabilities are recorded in Other Comprehensive Income (Loss).

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). The Company uses a hierarchical framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment, and the state of the marketplace, including the existence and transparency of transactions between market participants.

Investments with readily available actively quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

Valuation of assets and liabilities measured at fair value

The Company’s investments in real estate debt are reported at fair value. As of September 30, 2021 and December 31, 2020, the Company’s investments in real estate debt, directly or indirectly, consisted of commercial mortgage-backed securities (“CMBS”) and residential mortgage-backed securities (“RMBS”), which are securities backed by one or more mortgage loans secured by real estate assets, as well as corporate bonds, term loans, mezzanine loans, and other investments in debt issued by real estate-related companies or secured by real estate assets. The Company generally determines the fair value of its investments in real estate debt by utilizing third-party pricing service providers whenever available.

In determining the fair value of a particular investment, pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models for securities such as real estate debt generally consider the attributes applicable to a particular class of the security (e.g., credit rating, seniority), current market data, and estimated cash flows for each security, and incorporate specific collateral performance, as applicable.

Certain of the Company’s investments in real estate debt, such as mezzanine loans and other investments, are unlikely to have readily available market quotations. In such cases, the Company will generally determine the initial value based on the acquisition price of such investment if acquired by the Company or the par value of such investment if originated by the Company. Following the initial measurement, the Company will determine fair value by utilizing or reviewing certain of the following (i) market yield data, (ii) discounted cash flow modeling, (iii) collateral asset performance, (iv) local or macro real estate performance, (v) capital market conditions, (vi) debt yield or loan-to-value ratios, and (vii) borrower financial condition and performance. During September 2021, the Company made an investment in an unconsolidated joint venture that holds investments in real estate debt, which is reflected at its initial investment as of September 30, 2021 (Level 2 inputs). The Company believes the transaction price provides the most observable indication of fair value as of September 30, 2021 given the timing of the investment and lack of significant changes in market conditions. Refer to Note 5 for additional details on the Company’s investments in real estate debt.

The Company’s investments in equity securities of public and private real estate-related companies are reported at fair value. In determining the fair value of public equity securities, the Company utilizes the closing price of such securities in the principal market in which the security trades (Level 1 inputs). The Company’s investment in a preferred equity security is reflected at its fair value as of September 30, 2021 (Level 2 inputs). In determining the fair value, the Company utilizes inputs such as stock volatility, discount rate, and risk-free interest rate. The Company's investment in a private real estate company is reflected at its fair value as of September 30, 2021 (Level 3 inputs). To determine the fair value, the Company utilizes inputs such as the multiples of comparable companies and select financial statement metrics. As of September 30, 2021 and December 31, 2020, the Company’s $2.7 billion and $0.6 billion of equity securities, respectively, were recorded as a component of Other Assets on the Company’s Condensed Consolidated Balance Sheets.

The resulting unrealized gains and losses from public and private real estate-related companies are recorded as a component of Other Income (Expense) on the Company’s Condensed Consolidated Statements of Operations. During the three and nine months ended September 30, 2021, the Company recognized $154.8 million and $379.6 million of unrealized gains, respectively, on its investments in equity securities. During the three and nine months ended September 30, 2020, the Company recognized $15.4 million of unrealized losses and $40.6 million of unrealized losses, respectively, on its investments in equity securities.

The Company has elected the FVO for 2 of its equity method investments and therefore, reports these investments at fair value. As such, the resulting unrealized gains and losses are recorded as a component of Income From Unconsolidated Entities on the Company’s Condensed Consolidated Statements of Operations. The Company separately values the assets and liabilities of the equity method investments. To determine the fair value of the assets of the equity method investments, the Company utilizes a discounted cash flow methodology, taking into consideration various factors including discount rate and exit capitalization rate. The Company determines the fair value of the indebtedness of the equity method investment by modeling the cash flows required by the debt agreements and discounting them back to the present value using an estimated market yield. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. After the fair value of the assets and liabilities are determined, the Company applies its ownership interest to the net asset value and reflects this amount as its equity method investment at fair value. The inputs used in determining the Company’s equity method investments carried at fair value are considered Level 3.

The Company’s derivative financial instruments are reported at fair value. As of September 30, 2021 and December 31, 2020, the Company’s derivative financial instruments consisted of foreign currency and interest rate contracts. The fair values of the Company’s foreign currency and interest rate contracts were estimated using advice from a third-party derivative specialist, based on contractual cash flows and observable inputs comprising yield curves, foreign currency rates and credit spreads (Level 2 inputs).

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2021 | | December 31, 2020 |

| Level I | | Level 2 | | Level 3 | | Total | | Level I | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | |

| Investments in real estate debt | $ | — | | | $ | 5,890,697 | | | $ | 1,012,298 | | | $ | 6,902,995 | | | $ | — | | | $ | 4,445,414 | | | $ | 120,892 | | | $ | 4,566,306 | |

| Equity securities | 2,088,122 | | | 387,600 | | | 224,408 | | | 2,700,130 | | | 327,935 | | | 271,250 | | | — | | | 599,185 | |

| Investments in unconsolidated entities | — | | | — | | | 558,399 | | | 558,399 | | | — | | | — | | | — | | | — | |

| Derivatives | — | | | 53,478 | | | — | | | 53,478 | | | — | | | — | | | — | | | — | |

| Total | $ | 2,088,122 | | | $ | 6,331,775 | | | $ | 1,795,105 | | | $ | 10,215,002 | | | $ | 327,935 | | | $ | 4,716,664 | | | $ | 120,892 | | | $ | 5,165,491 | |

| | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | |

| Derivatives | $ | — | | | $ | 22,860 | | | $ | — | | | $ | 22,860 | | | $ | — | | | $ | 55,536 | | | $ | — | | | $ | 55,536 | |

| Total | $ | — | | | $ | 22,860 | | | $ | — | | | $ | 22,860 | | | $ | — | | | $ | 55,536 | | | $ | — | | | $ | 55,536 | |

The following table details the Company’s assets measured at fair value on a recurring basis using Level 3 inputs ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Investments in

Real Estate Debt | | Investments in

Unconsolidated Entities | | Equity Securities | | Total |

| Balance as of December 31, 2020 | $ | 120,892 | | | $ | — | | | $ | — | | | $ | 120,892 | |

| Purchases | 894,696 | | | 439,347 | | | 205,980 | | | 1,540,023 | |

| Distributions received | — | | | (14,130) | | | — | | | (14,130) | |

| Included in net income | | | | | | | |

| Unrealized gain included in income from unconsolidated entities | — | | | 133,182 | | | — | | | 133,182 | |

| Discount accretion included in income (loss) from investments in real estate debt | 1,588 | | | — | | | — | | | 1,588 | |

| Unrealized loss included in income (loss) from investments in real estate debt | (4,878) | | | — | | | — | | | (4,878) | |

| Unrealized gain included in other income (expense) | — | | | — | | | 18,428 | | | 18,428 | |

| Balance as of September 30, 2021 | $ | 1,012,298 | | | $ | 558,399 | | | $ | 224,408 | | | $ | 1,795,105 | |

The following tables contain the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2021 |

| | Fair Value | | Valuation Technique | | Unobservable Inputs | | Weighted Average | | Impact to Valuation from an Increase in Input |

| Investments in real estate debt | $ | 1,012,298 | | | Discounted cash flow | | Yield | | 8.0% | | Decrease |

| Investments in unconsolidated entities | $ | 558,399 | | | Discounted cash flow | | Discount Rate | | 5.9% | | Decrease |

| | | | | | Exit Capitalization Rate | | 4.8% | | Decrease |

| | | | | | Weighted Average Cost of Capital | | 10.6% | | Decrease |

| Equity securities | $ | 224,408 | | | Market comparable | | Enterprise Value/

Forward EBITDA Multiple | | 21.1x | | Increase |

| | | | | | | | | |

| | December 31, 2020 |

| | Fair Value | | Valuation Technique | | Unobservable Input | | Rate | | Impact to Valuation from an Increase in Input |

| Investments in real estate debt | $ | 120,892 | | | Discounted cash flow | | Yield | | 10.3% | | Decrease |

Valuation of liabilities not measured at fair value

As of September 30, 2021, the fair value of the Company’s mortgage notes, term loans, and secured revolving credit facilities, secured financings on investments in real estate debt, and unsecured revolving credit facilities was $130.2 million above carrying value. As of December 31, 2020, the fair value of the Company’s mortgage notes, term loans, and secured revolving credit facilities, secured financings on investments in real estate debt, and unsecured revolving credit facilities was $48.6 million above carrying value. Fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using an estimated market yield. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3.

Derivative Financial Instruments

As of September 30, 2021 and December 31, 2020, all of the Company’s derivative instruments were non-designated hedges. The Company presents changes in the fair value of its non-designated hedges as a component of Income (loss) from Investments in Real Estate Debt or Other Income (Expense) on the Company’s Condensed Consolidated Statements of Operations depending on the nature of the derivative instrument.

The Company has elected to not offset derivative assets and liabilities or financial assets in its Condensed Consolidated Balance Sheets, including cash, that may be received or paid as part of collateral arrangements, even when an enforceable master netting agreement is in place that provide the Company, in the event of counterparty default, the right to liquidate collateral and the right to offset a counterparty’s rights and obligations. Derivative financial instruments are recorded as a component of either Other Assets or Other Liabilities on the Company’s Condensed Consolidated Balance Sheets at fair value.

Stock-Based Compensation

The Company’s stock-based compensation consists of incentive compensation awards issued to certain employees of affiliate portfolio company service providers and certain employees of Simply Self Storage, a wholly owned subsidiary of BREIT. Such awards vest over the life of the awards and stock-based compensation expense is recognized for these awards on a straight-line basis over the applicable vesting period of each award, based on the value of the awards on their grant date, as adjusted for forfeitures. Refer to Note 9 for additional information on the awards issued to certain employees of the affiliate portfolio companies.

On January 1, 2021, the Company issued awards to certain employees of Simply Self Storage which had a grant date fair value of $3.6 million. The Simply Self Storage awards are subject to certain performance conditions and a four-year service period. As such, if the Company determines it is probable that the performance conditions will be met, the value of the award will be amortized over the four-year service period, as adjusted for forfeitures. As of September 30, 2021, the Company determined it was probable that the performance conditions will be met. During the three and nine months ended September 30, 2021, the Company recorded $0.2 million and $0.6 million, respectively, of compensation expense related to such awards, which was included as a component of Rental Property Operating Expense in the Company’s Condensed Consolidated Statements of Operations. As of September 30, 2021, the total

unrecognized compensation cost relating to the Simply Self Storage awards was $2.6 million and is expected to be recognized over a period of 3.3 years from September 30, 2021.

Recent Accounting Pronouncements

In April 2020, the Financial Accounting Standards Board (“FASB”) staff issued a question and answer document (the “Lease Modification Q&A”) focused on the application of lease accounting guidance to lease concessions provided as a result of the COVID-19 pandemic. In accordance with the Lease Modification Q&A, the Company has made a policy election to not account for concessions as a lease modification if the total cash flows after the lease concessions are substantially the same, or less than, the cash flows in the original lease. However, if in the future, a concession is granted that modifies the terms and significantly alters the cash flows of the original lease, the Company will account for the changes as a lease modification. The Company has granted concessions as a result of the COVID-19 pandemic to certain tenants to defer rental payments until a later date. The Company continued to recognize rental revenue for such tenants during the nine months ended September 30, 2021, while also considering any necessary bad debt reserves.

In March 2020, the FASB issued Accounting Standards Update (“ASU”) 2020-04 “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” ASU 2020-04 provides optional expedients and exceptions to GAAP requirements for modifications on debt instruments, leases, derivatives, and other contracts, related to the expected market transition from LIBOR, and certain other floating rate benchmark indices (collectively, “IBORs”) to alternative reference rates. ASU 2020-04 generally considers contract modifications related to reference rate reform to be an event that does not require contract remeasurement at the modification date nor a reassessment of a previous accounting determination. In January 2021, the FASB issued ASU 2021-01 “Reference Rate Reform (Topic 848): Scope,” or ASU 2021-01. ASU 2021-01 clarifies that the practical expedients in ASU 2020-04 apply to derivatives impacted by changes in the interest rate used for margining, discounting, or contract price alignment. The guidance in ASU 2020-04 is optional and may be elected over time, through December 31, 2022, as reference rate reform activities occur. Once ASU 2020-04 is elected, the guidance must be applied prospectively for all eligible contract modifications. The Company has not adopted any of the optional expedients or exceptions as of September 30, 2021, but will continue to evaluate the possible adoption of any such expedients or exceptions during the effective period as circumstances evolve.

3. Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | | | | | | | | | | |

| September 30, 2021 | | December 31, 2020 |

| Building and building improvements | $ | 35,984,871 | | | $ | 25,991,610 | |

| Land and land improvements | 9,510,255 | | | 7,626,381 | |

| Furniture, fixtures and equipment | 659,207 | | | 495,395 | |

Right of use asset - operating leases(1) | 114,535 | | | 114,535 | |

Right of use asset - financing leases(1) | 72,862 | | | 56,008 | |

| Total | 46,341,730 | | | 34,283,929 | |

| Accumulated depreciation and amortization | (2,745,641) | | | (1,826,216) | |

| Investments in real estate, net | $ | 43,596,089 | | | $ | 32,457,713 | |

(1)Refer to Note 14 for additional details on the Company’s leases.

Acquisitions

During the nine months ended September 30, 2021, the Company acquired interests in 32 real estate investments for $12.5 billion, which comprised 67 residential properties, 37 industrial properties, 2 data center properties, 2 self storage properties, 1 retail property, and 1 office property.

The following table details the properties acquired during the nine months ended September 30, 2021 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segments | | Number of Transactions | | Number of Properties | | Sq. Ft. (in thousands)/Units | | Purchase Price(1) |

Residential properties(2) | | 21 | | 67 | | 25,329 units | | $ | 11,345,228 | |

| Industrial properties | | 6 | | 37 | | 5,114 sq. ft. | | 614,156 | |

| Data center properties | | 1 | | 2 | | 430 sq. ft. | | 180,057 | |

| Self storage properties | | 2 | | 2 | | 131 sq. ft. | | 19,938 | |

| Retail properties | | 1 | | 1 | | 296 sq. ft. | | 80,312 | |

| Office properties | | 1 | | 1 | | 361 sq. ft. | | 251,171 | |

| | 32 | | 110 | | | | $ | 12,490,862 | |

(1)Purchase price is inclusive of acquisition-related costs.

(2)Purchase price includes the 11,525 wholly-owned single family homes related to the acquisition of Home Partners of America ("HPA"), which are not included in the number of properties. Refer to Note 4 for details on the unconsolidated homes acquired in the HPA transaction.

The following table details the purchase price allocation for the properties acquired during the nine months ended September 30, 2021 ($ in thousands):

| | | | | |

| | Amount |

| Building and building improvements | $ | 9,806,490 | |

| Land and land improvements | 1,972,873 | |

| Furniture, fixtures and equipment | 163,743 | |

| In-place lease intangibles | 266,156 | |

| Above-market lease intangibles | 909 | |

| Below-market lease intangibles | (13,543) | |

| Brokerage firm relationship intangibles | 50,000 | |

| Trade name intangibles | 40,000 | |

| Management contract intangibles | 39,000 | |

| Other | 165,234 | |

| Total purchase price | 12,490,862 | |

Assumed debt(1) | 2,353,084 | |

| Net purchase price | $ | 10,137,778 | |

(1)Refer to Note 6 for additional details on the Company’s debt, which includes mortgage notes, term loans, and secured revolving credit facilities.

The weighted-average amortization periods for the acquired in-place lease intangibles, above-market lease intangibles, and below-market lease intangibles of the properties acquired during the nine months ended September 30, 2021 were three, five, and thirteen years, respectively.

Dispositions

The following table details the dispositions during the three and nine months ended September 30, 2021 and 2020 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, 2021 | | Nine Months Ended

September 30, 2021 | |

| Segments | | Number of Properties | | Net Proceeds | | Net Loss | | Number of Properties | | Net Proceeds | | Net Gain | | | | | |

Residential properties(1) | | 4 | | $ | 99,598 | | | $ | (9,586) | | | 9 | | $ | 194,575 | | | $ | 13,216 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 4 | | $ | 99,598 | | | $ | (9,586) | | | 9 | | $ | 194,575 | | | $ | 13,216 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, 2020 | | Nine Months Ended

September 30, 2020 | | | | | |

| Segments | | Number of Properties | | Net Proceeds | | Net Gain | | Number of Properties | | Net Proceeds | | Net Gain | | | | | |

| | | | | | | | | | | | | | | | | |

| Residential properties | | 6 | | $ | 246,244 | | | $ | 64,885 | | | 6 | | $ | 246,244 | | | $ | 64,885 | | | | | | |

| Hotel properties | | 1 | | 134,537 | | | 35,185 | | | 1 | | 134,537 | | | 35,185 | | | | | | |

| Industrial properties | | — | | — | | | — | | | 1 | | 4,488 | | | 371 | | | | | | |

| | 7 | | $ | 380,781 | | | $ | 100,070 | | | 8 | | $ | 385,269 | | | $ | 100,441 | | | | | | |

(1)Net proceeds and net gain/(loss) include 111 single family rental homes sold during the three and nine months ended September 30, 2021.

Properties Held for Sale

As of September 30, 2021, 1 industrial property was classified as held for sale. There were no properties classified as held for sale as of December 31, 2020. The held for sale assets and liabilities are components of Other Assets and Other Liabilities, respectively, on the Condensed Consolidated Balance Sheets.

The following table details the assets and liabilities of the Company’s properties classified as held for sale ($ in thousands):

| | | | | |

| Assets: | September 30, 2021 |

| Investments in real estate, net | $ | 21,670 | |

| Other assets | 681 | |

| Total assets | $ | 22,351 | |

| |

| Liabilities: | |

| Other liabilities | $ | 302 | |

| Total liabilities | $ | 302 | |

Impairment

The Company reviews its real estate investments for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value. If the GAAP depreciated cost basis of a real estate investment exceeds the expected undiscounted future cash flows of such real estate investment, the investment is considered impaired and the GAAP depreciated cost basis is reduced to the estimated fair value of the investment. During the three and nine months ended September 30, 2021, the Company did not recognize any impairments. During the three and nine months ended September 30, 2020, the Company recognized a $6.2 million impairment charge on one of its hotel properties and an aggregate $12.3 million impairment charge on 2 of its hotel properties, respectively. The impairment charge was a result of updates to the undiscounted cash flow assumptions for such asset to reflect a decrease in occupancy and future cash flows as a result of the COVID-19 pandemic.

4. Investments in Unconsolidated Entities

The Company holds investments in joint ventures that it accounts for under the equity method of accounting, as the Company’s ownership interest in each joint venture does not meet the requirements for consolidation. The joint ventures include 9,526 single family rental properties, 80 industrial properties, 48 data center properties, and 2 net lease properties. Refer to Note 2 for additional details.

The following table details the Company’s equity investment in unconsolidated entities as of September 30, 2021 and December 31, 2020 ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment in Joint Venture | | Segment | | Ownership

Interest | | September 30, 2021 | | December 31, 2020 |

QTS Data Centers(1) | | Data Centers | | 50.1% | | $ | 2,012,362 | | | $ | — | |

MGM Grand & Mandalay Bay(2) | | Net Lease | | 49.9% | | 821,422 | | | 816,220 | |

Home Partners of America JVs(3) | | Residential | | 12.2% - 27.8% | | 593,738 | | | — | |

Alaska Logistics Portfolio(4) | | Industrial | | 26.7% | | 266,961 | | | — | |

| Total unconsolidated entities at historical cost | | | | | | 3,694,483 | | | 816,220 | |

| WC Infill Industrial Portfolio | | Industrial | | 85.0% | | 329,457 | | | — | |

| Vault Industrial Portfolio | | Industrial | | 46.0% | | 228,942 | | | — | |

| Total unconsolidated entities at fair value | | | | | | 558,399 | | | — | |

| Total | | | | | | $ | 4,252,882 | | | $ | 816,220 | |

(1)The Company along with certain Blackstone-managed investment vehicles formed a joint venture ("QTS Data Centers") and acquired all outstanding shares of common stock of QTS Realty Trust ("QTS"). The Company's interest in QTS Data Centers is through a consolidated joint venture, whereby the non-controlling interest is a Blackstone-managed investment vehicle. As of September 30, 2021, the Company's investment includes $577.5 million attributable to such other Blackstone-managed investment vehicles.

(2)Includes $9.3 million and $9.4 million of BREIT outside basis attributable to the MGM Grand & Mandalay Bay joint venture as of September 30, 2021 and December 31, 2020, respectively.

(3)Includes $315.4 million of BREIT outside basis attributable to the Home Partners of America JVs as of September 30, 2021.

(4)The Company along with certain Blackstone-managed investment vehicles formed a joint venture ("Alaska Logistics Portfolio") and acquired a portfolio of logistics properties.

The following table details the Company’s income from unconsolidated entities for the three and nine months ended September 30, 2021 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2021 |

| Investment in Joint Venture | | Ownership

Interest | | Total

Revenue of Unconsolidated Joint Ventures | | Net Income (Loss) of Unconsolidated Joint Ventures | | BREIT's

Share | | Amortization of Outside Basis | | BREIT Income

(Loss) from Unconsolidated Entities |

QTS Data Centers(1) | | 50.1% | | $ | 53,073 | | | $ | (33,972) | | | $ | (17,020) | | | $ | — | | | $ | (17,020) | |

| MGM Grand & Mandalay Bay | | 49.9% | | 98,681 | | | 50,001 | | | 24,951 | | | (37) | | | 24,914 | |

| Home Partners of America JVs | | 12.2% - 27.8% | | 56,865 | | | (4,634) | | | (1,110) | | | (7,505) | | | (8,615) | |

| Alaska Industrial Portfolio | | 26.7% | | 20,755 | | | 796 | | | 212 | | | — | | | 212 | |

WC Infill Industrial Portfolio(2) | | 85.0% | | — | | | — | | | — | | | — | | | 43,911 | |

Vault Industrial Portfolio(2) | | 46.0% | | — | | | — | | | — | | | — | | | 35,043 | |

| Total | | | | | | | | | | | | $ | 78,445 | |

| | | | | | | | | | | | |

| | Nine Months Ended September 30, 2021 |

| Investment in Joint Venture | | Ownership

Interest | | Total

Revenue of Unconsolidated Joint Ventures | | Net Income (Loss) of Unconsolidated Joint Ventures | | BREIT's

Share | | Amortization of Outside Basis | | BREIT Income (Loss) from Unconsolidated Entities |

QTS Data Centers(1) | | 50.1% | | $ | 53,073 | | | $ | (33,972) | | | $ | (17,020) | | | $ | — | | | $ | (17,020) | |

| MGM Grand & Mandalay Bay | | 49.9% | | 296,044 | | | 151,314 | | | 75,506 | | | (110) | | | 75,396 | |

| Home Partners of America JVs | | 12.2% - 27.8% | | 56,865 | | | (4,634) | | | (1,110) | | | (7,505) | | | (8,615) | |

| Alaska Industrial Portfolio | | 26.7% | | 20,755 | | | 796 | | | 212 | | | — | | | 212 | |

WC Infill Industrial Portfolio(2) | | 85.0% | | — | | | — | | | — | | | — | | | 75,247 | |

Vault Industrial Portfolio(2) | | 46.0% | | — | | | — | | | — | | | — | | | 57,935 | |

| Total | | | | | | | | | | | | $ | 183,155 | |

(1)BREIT Income (Loss) from Unconsolidated Entities includes $4.9 million of loss attributable to a Blackstone-managed investment vehicle for the three and nine months ended September 30, 2021. The Company reflects this amount within net loss attributable to non-controlling interests.

(2)The Company elected the fair value option for these investments. Therefore, the income from unconsolidated entities represents the change in estimated fair value of the Company’s investment in such entities.

The following table details the Company’s income from unconsolidated entities for the three and nine months ended September 30, 2020 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2020 |

| Investment in Joint Venture | | Ownership

Interest | | Total

Revenue | | Net Income of Unconsolidated Joint Ventures | | BREIT's

Share | | Amortization of Outside Basis | | BREIT

Income from Unconsolidated Entities |

| MGM Grand & Mandalay Bay | | 49.9% | | $ | 98,682 | | | $ | 50,320 | | | $ | 25,110 | | | $ | (37) | | | $ | 25,073 | |

| | | | | | | | | | | | |

| | Nine Months Ended September 30, 2020 |

| Investment in Joint Venture | | Ownership

Interest | | Total

Revenue | | Net Income of Unconsolidated Joint Ventures | | BREIT's

Share | | Amortization of Outside Basis | | BREIT

Income from Unconsolidated Entities |

| MGM Grand & Mandalay Bay | | 49.9% | | $ | 247,800 | | | $ | 127,799 | | | $ | 63,772 | | | $ | (94) | | | $ | 63,678 | |

=

5. Investments in Real Estate Debt

The following tables detail the Company’s investments in real estate debt ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2021 |

| Type of Security/Loan | | Weighted Average Coupon(1) | | Weighted Average Maturity Date(2) | | Face

Amount | | Cost

Basis | | Fair

Value |

CMBS(3) | | L+2.7% | | 6/2/2026 | | $ | 5,031,213 | | | $ | 4,939,962 | | | $ | 4,957,915 | |

| Corporate bonds | | 4.8% | | 12/26/2027 | | 166,242 | | | 166,242 | | | 168,594 | |

| RMBS | | 3.8% | | 2/13/2051 | | 103,008 | | | 102,959 | | | 103,078 | |

| Total real estate securities | | 3.6% | | 12/15/2026 | | 5,300,463 | | | 5,209,163 | | | 5,229,587 | |

| Commercial real estate loans | | L+3.9% | | 2/12/2025 | | 1,480,951 | | | 1,463,893 | | | 1,467,521 | |

Other investments(4) | | 3.7% | | 7/25/2029 | | 235,956 | | | 205,887 | | | 205,887 | |

| Total investments in real estate debt | | L+2.7% | | 8/23/2026 | | $ | 7,017,370 | | | $ | 6,878,943 | | | $ | 6,902,995 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2020 |

| Type of Security/Loan | | Weighted Average Coupon(1) | | Weighted Average Maturity Date(2) | | Face

Amount | | Cost

Basis | | Fair

Value |

CMBS(3) | | L+2.0% | | 1/17/2026 | | $ | 4,093,201 | | | $ | 3,949,824 | | | $ | 3,753,428 | |

| Corporate bonds | | 5.0% | | 5/3/2027 | | 179,398 | | | 178,219 | | | 183,203 | |

| RMBS | | 4.5% | | 10/24/2049 | | 22,429 | | | 22,602 | | | 22,510 | |

| Total real estate securities | | 3.2% | | 3/29/2026 | | 4,295,028 | | | 4,150,645 | | | 3,959,141 | |

| Commercial real estate loans | | L+3.8% | | 8/8/2022 | | 623,574 | | | 572,869 | | | 607,165 | |

| Total investments in real estate debt | | L+2.2% | | 10/3/2025 | | $ | 4,918,602 | | | $ | 4,723,514 | | | $ | 4,566,306 | |

(1)The term “L” refers to the relevant floating benchmark rates, which include USD LIBOR, GBP LIBOR, EURIBOR, SOFR and SONIA, as applicable to each security and loan. Fixed rate CMBS and Commercial real estate loans are reflected as a spread over the relevant floating benchmark rates, as of September 30, 2021 and December 31, 2020, respectively, for purposes of the weighted-averages. Weighted Average Coupon for CMBS does not include zero coupon securities. As of September 30, 2021, we have interest rate swaps outstanding with a notional value of $1.1 billion that effectively converts a portion of our fixed rate investments in real estate debt to floating rates.

(2)Weighted average maturity date is based on the fully extended maturity date of the instrument or, in the case of CMBS and RMBS, the underlying collateral.

(3)Face amount excludes interest-only securities with a notional amount of $3.4 billion and $2.3 billion as of September 30, 2021 and December 31, 2020, respectively. In addition, CMBS includes zero coupon securities of $208.8 million and $236.1 million as of September 30, 2021 and December 31, 2020, respectively.

(4)Includes an interest in an unconsolidated joint venture that holds investments in real estate debt securities.

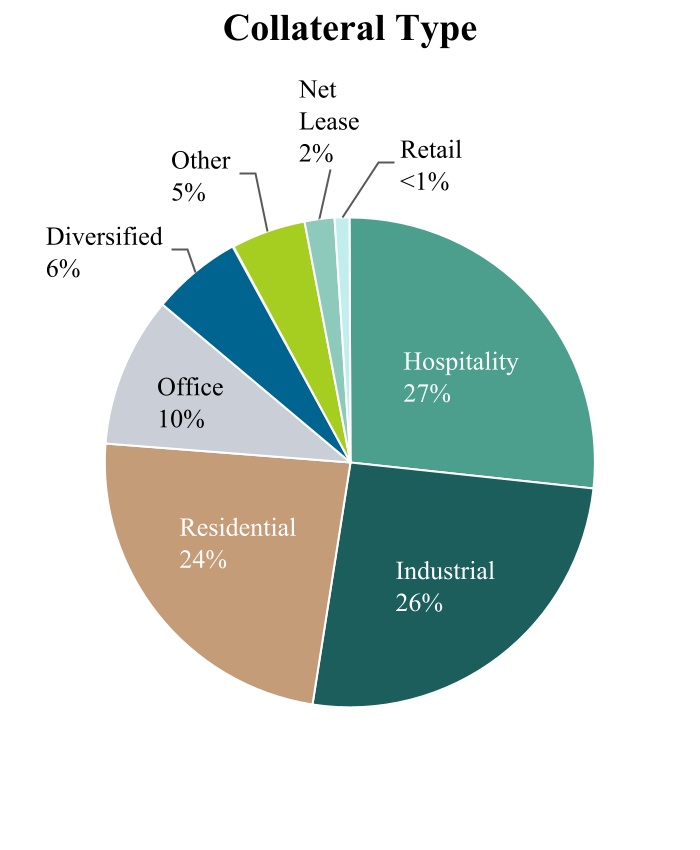

The following table details the collateral type of the properties securing the Company’s investments in real estate debt ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | September 30, 2021 | | | | December 31, 2020 |

Collateral(1) | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value |

| Hospitality | | | | $ | 1,940,260 | | | $ | 1,927,752 | | | 27% | | | | $ | 2,046,529 | | | $ | 1,904,256 | | | 42% |

| Industrial | | | | 1,786,310 | | | 1,778,578 | | | 26% | | | | 612,884 | | | 610,504 | | | 13% |

| Residential | | | | 1,582,301 | | | 1,627,865 | | | 24% | | | | 748,086 | | | 797,840 | | | 17% |

| Office | | | | 673,590 | | | 657,776 | | | 10% | | | | 720,665 | | | 681,596 | | | 15% |

| Diversified | | | | 428,523 | | | 432,214 | | | 6% | | | | 234,527 | | | 225,077 | | | 5% |

| Other | | | | 343,588 | | | 342,279 | | | 5% | | | | 238,202 | | | 213,654 | | | 5% |

| Net Lease | | | | 106,996 | | | 119,705 | | | 2% | | | | 105,246 | | | 117,219 | | | 3% |

| Retail | | | | 17,375 | | | 16,826 | | | –% | | | | 17,375 | | | 16,160 | | | —% |

| Total | | | | $ | 6,878,943 | | | $ | 6,902,995 | | | 100% | | | | $ | 4,723,514 | | | $ | 4,566,306 | | | 100% |

(1)Residential investments in real estate debt are collateralized by various forms of rental housing including apartments and single-family homes.

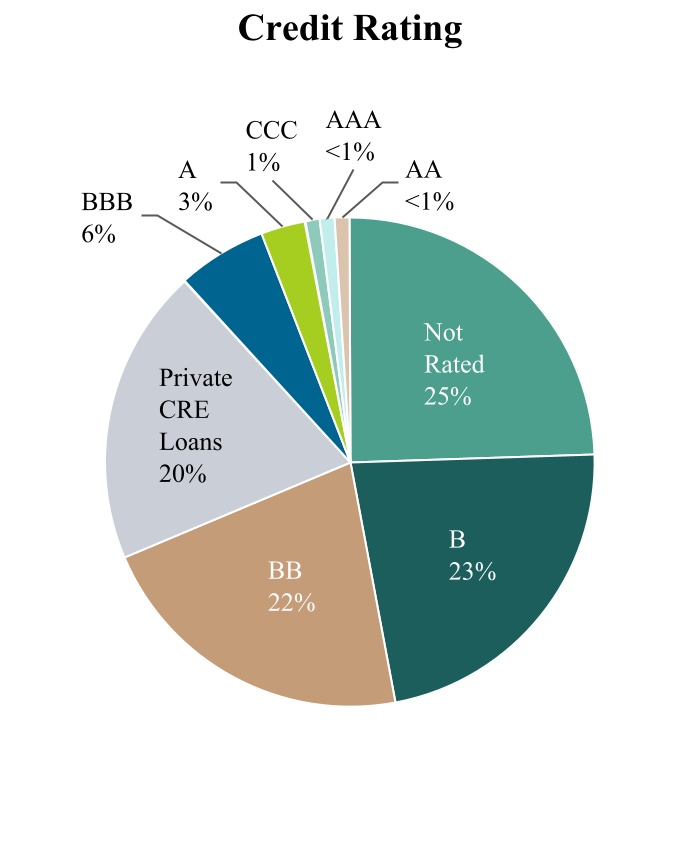

The following table details the credit rating of the Company’s investments in real estate debt ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2021 | | | | December 31, 2020 |

| Credit Rating | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value |

| AAA | | $ | 25,780 | | | $ | 25,743 | | | —% | | | | $ | 10,044 | | | $ | 10,047 | | | —% |

| AA | | 668 | | | 667 | | | —% | | | | 776 | | | 779 | | | —% |

| A | | 225,232 | | | 237,088 | | | 3% | | | | 262,097 | | | 267,023 | | | 6% |

| BBB | | 409,843 | | | 410,103 | | | 6% | | | | 797,918 | | | 753,393 | | | 17% |

| BB | | 1,483,674 | | | 1,493,393 | | | 22% | | | | 1,435,891 | | | 1,381,221 | | | 30% |

| B | | 1,571,261 | | | 1,557,244 | | | 23% | | | | 1,186,975 | | | 1,114,977 | | | 24% |

| CCC | | 35,209 | | | 36,325 | | | 1% | | | | 32,402 | | | 34,839 | | | 1% |

| Private Commercial Real Estate Loans | | 1,383,802 | | | 1,386,566 | | | 20% | | | | 522,306 | | | 555,291 | | | 12% |

| Not Rated | | 1,743,474 | | | 1,755,866 | | | 25% | | | | 475,105 | | | 448,736 | | | 10% |

| Total | | $ | 6,878,943 | | | $ | 6,902,995 | | | 100% | | | | $ | 4,723,514 | | | $ | 4,566,306 | | | 100% |