- SEZL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Sezzle (SEZL) 425Business combination disclosure

Filed: 28 Feb 22, 7:00am

28 FEBRUARY 2022 Zip and Sezzle: Stronger Together Filed by Sezzle Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 under the Securities Exchange Act of 1934 Subject Company: Sezzle Inc. Commission File No.: 000 - 56267 Date: February 28, 2022

Larry Diamond Co - Founder & Global CEO Today’s presenters ● Co - founded Zip Co in 2013 ● Has overseen Zip’s growth from a technology start - up to a company with c. 10 million customers globally ● 12+ years experience in retail, IT, and investment banking at Pacific Brands, Macquarie Capital and Deutsche Bank ● Co - founded Zip Co in 2013 ● 25+ years experience in the retail finance industry – specifically consumer and merchant credit risk, compliance and operations management ● Peter is the Responsible Manager of Zip’s Australian Credit License having managed credit for c. 10 million customers ● Co - founded Sezzle in 2016 ● Charlie is a serial entrepreneur with over 12 years of experience in fintech startups, taking them from inception to large - scale success ● Prior to Sezzle, Charlie founded Passport Parking, a leading transportation software and payments company Peter Gray Co - Founder & Global COO Charlie Youakim Co - Founder, Chairman & CEO 1

Compelling strategic and financial rationale Notes: 1. Please refer to page 16 for more details on the composition of the potential synergies, including the material assumptions. Investors are also referred to the ‘Key risks’ in Appendix B of this Presentation (including, without limitation, the risks in section 1.6 (Integration risk and realisation of synergies) and section 1.7 (Future earnings risk)) and the Disclaimers in this Presentation, in particular to the paragraph titled ‘Cautionary Statement Regarding Forward - Looking Statements’, in relation to the risks and uncertainties associated with the targeted potential synergies and other forward looking statements in connection with the Proposed Transaction. The prospective financial information included in this Presentation, including the references to the potential impact on EBTDA and the potential synergies, is predictive in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Brings together highly complementary enterprise and SMB merchant networks with a strengthened set of capabilities to win together, across a diverse set of verticals Provides meaningful customer benefits unlocking BNPL anywhere for Sezzle customers and provides Zip customers access to Sezzle’s US merchant network, accelerating Zip’s growth trajectory Significantly enhances Zip’s scale and product offering, with the capabilities to accelerate in the US Enables potential material cost synergies to be achieved and opportunities for improved unit economics, supporting Zip’s path to profitability 1 Integration path to deliver near - term financial benefits including accretion and balance sheet support to deliver sustainable growth and support potential synergies realisation; potential to create significant value for both Zip and Sezzle shareholders Meaningful customer benefits Complementary merchant networks Tran s f o r ma t io n al combination Synergies and path to profitability Accretion and balance sheet strength A B C D E 2

Tran s a c t ion overview ● Zip and Sezzle have entered into a definitive merger agreement under which Zip has agreed to acquire Sezzle in an all - scrip transaction (the “ Proposed Transaction ”) ● The Proposed Transaction has been unanimously recommended by the Sezzle and Zip Boards of Directors and the mergers and acquisitions committee of Sezzle’s Board of Directors, and each of Sezzle’s co - founders, Charlie Youakim and Paul Paradis (accounting for 48% of Sezzle’s outstanding shares of common capital stock), and Zip’s co - founders Larry Diamond and Peter Gray (accounting for 12% of Zip’s issued ordinary shares), have agreed to vote, subject to certain exceptions, in favour of the Proposed Transaction 1 Transaction con s id e r a t ion ● Sezzle stockholders will be entitled to receive 0.98 Zip shares for every share of Sezzle common stock owned 2 – The total consideration for the Sezzle shares under Zip’s proposal represents an implied value of Sezzle of approximately A$491m 3 – It values Sezzle at a 22.0% premium based on current spot prices A$1.78 (Sezzle) and A$2.21 (Zip) as of 25 February 2022, and 31.7% premium based on 30 day VWAPs ● Upon closing of the Proposed Transaction, Sezzle stockholders will be entitled to receive up to a maximum of 222.3m Zip ordinary shares or American Depository Receipts (“ ADRs ”) of Zip, representing a maximum of 22% of the issued shares of Zip immediately following the closing of the Proposed Transaction (on a fully diluted basis) 4 Fin a nci al i mpac t 5 , 6 ● Proposed Transaction expected to be accretive to revenue per share and accretive to EBTDA per share in FY24F, including the full impact of potential synergies ● Potential to realise material cost synergies and opportunities for revenue and margin uplift with EBTDA benefits of up to c. A$130m EBTDA in FY24 (of which A$60 - 80m EBTDA are cost synergies) – Expected to be EBTDA and cash flow positive during FY24, including the full impact of potential synergies ● Balance sheet strength supporting sustainable growth following A$148.7m fully underwritten placement and up to A$50m non - underwritten share purchase plan 7 with more capital runway to execute on potential synergies – Improved capital recycling driven by an increase in volume coming from Pay in 4 to c. 60% Transaction overview: key terms Notes: market data sourced from IRESS as of 25 February 2022. 1. Each of Charlie Youakim, Paul Paradis, Larry Diamond and Peter Gray have made their respective voting commitments via their respective shareholding entities. 2. As part of the Proposed Transaction, Zip is also establishing an American Depository Receipts program (with such securities required to be listed on a US exchange as a condition to the closing of the Proposed Transaction) (the Zip ADRs) and Sezzle stockholders outside of Australia may elect under and subject to the terms of the definitive merger agreement to receive 0.98 Zip ADRs for every share of Sezzle common stock owned in lieu of receiving Zip shares. To the extent that eligible Sezzle stockholders do not elect to receive Zip ADRs by a prescribed date before closing of the Proposed Transaction, they will only be entitled to receive Zip shares. 3. Implied value calculated on a fully diluted basis and based on the closing price of Zip shares of A$2.21 as of 25 February 2022. This excludes the impact of any permitted equity financing that may be undertaken by Sezzle before closing of the Proposed Transaction in accordance with the merger agreement (which is capped at a maximum amount of 24.7m Sezzle shares at a minimum price of A$1.53). 4. Estimated ownership percentage calculated on a fully diluted basis and assumes the inclusion of 78.3m shares issued under the Placement and excludes the impact of any permitted equity financing that may be undertaken by Sezzle before closing of the Proposed Transaction in accordance with the merger agreement (which is capped at a maximum amount of 24.7m Sezzle shares at a minimum price of A$1.53). 5. Please refer to page 16 for more details on the composition of the potential synergies, including the material assumptions. Investors are also referred to the ‘Key risks’ in Appendix B of this Presentation (including, without limitation, the risks in section 1.6 (Integration risk and realisation of synergies) and section 1.7 (Future earnings risk)) and the Disclaimers in this Presentation, in particular to the paragraph titled ‘Cautionary Statement Regarding Forward - Looking Statements’, in relation to the risks and uncertainties associated with the targeted potential s yn er g i e s a nd o t h e r fo rw ard l oo k i ng s t a t e m e nts i n con n e c t i on wi t h t he P r o p o s e d T ra n s a c t i o n. T he p r o s p e c t i v e fi nanc i a l i n f o r ma t i o n i nc l u d e d i n t hi s s l i d e , i nc l u d i ng t he r e f e r e nc e s t o t he p o t e nti a l i m p a c t on EB T D A a nd t he p o t e nti a l s yn er g i e s , i s p r e d i c t i ve 3 in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. 6. EBTDA is a financial measure not prepared in accordance with International Financial Reporting Standards (“IFRS”) and Generally Accepted Accounting Principles (“GAAP”). 7. Zip reserves the right to increase or decrease the size of the SPP and/or scale back applications under the SPP as its discretion.

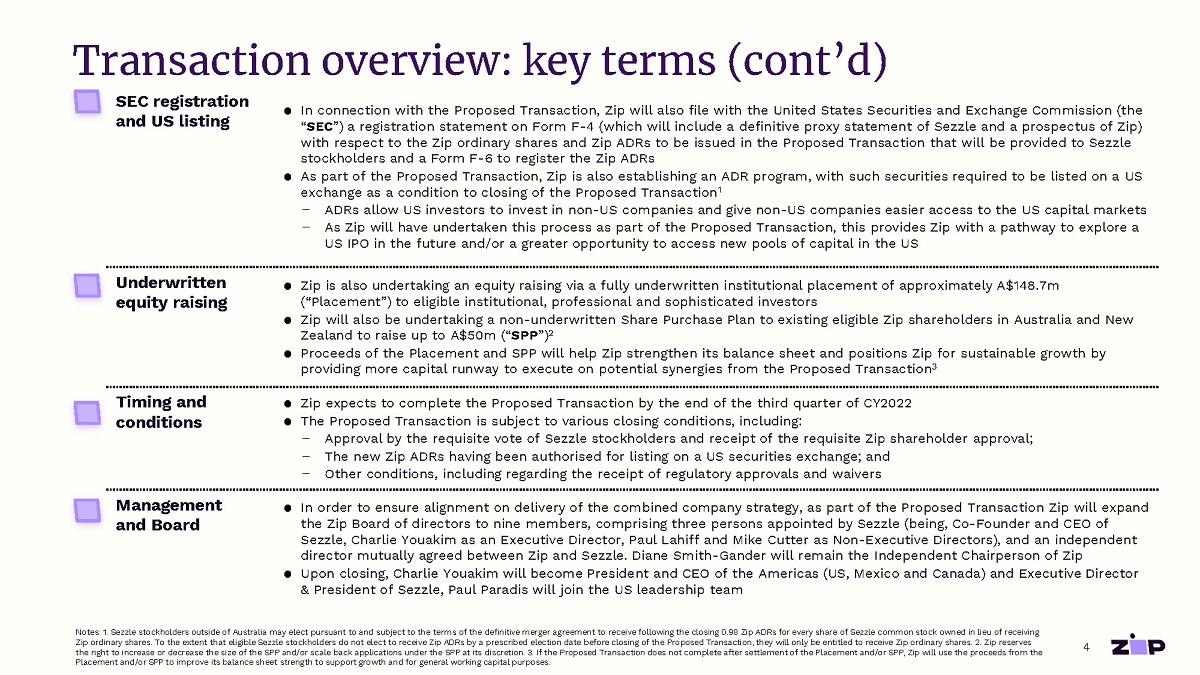

SEC registration and US listing ● In connection with the Proposed Transaction, Zip will also file with the United States Securities and Exchange Commission (the “ SEC ”) a registration statement on Form F - 4 (which will include a definitive proxy statement of Sezzle and a prospectus of Zip) with respect to the Zip ordinary shares and Zip ADRs to be issued in the Proposed Transaction that will be provided to Sezzle stockholders and a Form F - 6 to register the Zip ADRs ● As part of the Proposed Transaction, Zip is also establishing an ADR program, with such securities required to be listed on a US exchange as a condition to closing of the Proposed Transaction 1 – ADRs allow US investors to invest in non - US companies and give non - US companies easier access to the US capital markets – As Zip will have undertaken this process as part of the Proposed Transaction, this provides Zip with a pathway to explore a US IPO in the future and/or a greater opportunity to access new pools of capital in the US U n der w r it t en equity raising ● Zip is also undertaking an equity raising via a fully underwritten institutional placement of approximately A$148.7m (“Placement”) to eligible institutional, professional and sophisticated investors ● Zip will also be undertaking a non - underwritten Share Purchase Plan to existing eligible Zip shareholders in Australia and New Zealand to raise up to A$50m (“ SPP ”) 2 ● Proceeds of the Placement and SPP will help Zip strengthen its balance sheet and positions Zip for sustainable growth by providing more capital runway to execute on potential synergies from the Proposed Transaction 3 Timing and conditions ● Zip expects to complete the Proposed Transaction by the end of the third quarter of CY2022 ● The Proposed Transaction is subject to various closing conditions, including: – Approval by the requisite vote of Sezzle stockholders and receipt of the requisite Zip shareholder approval; – The new Zip ADRs having been authorised for listing on a US securities exchange; and – Other conditions, including regarding the receipt of regulatory approvals and waivers M a n a g eme n t and Board ● In order to ensure alignment on delivery of the combined company strategy, as part of the Proposed Transaction Zip will expand the Zip Board of directors to nine members, comprising three persons appointed by Sezzle (being, Co - Founder and CEO of Sezzle, Charlie Youakim as an Executive Director, Paul Lahiff and Mike Cutter as Non - Executive Directors), and an independent director mutually agreed between Zip and Sezzle. Diane Smith - Gander will remain the Independent Chairperson of Zip ● Upon closing, Charlie Youakim will become President and CEO of the Americas (US, Mexico and Canada) and Executive Director & President of Sezzle, Paul Paradis will join the US leadership team 4 Transaction overview: key terms (cont’d) Notes: 1. Sezzle stockholders outside of Australia may elect pursuant to and subject to the terms of the definitive merger agreement to receive following the closing 0.98 Zip ADRs for every share of Sezzle common stock owned in lieu of receiving Zip ordinary shares. To the extent that eligible Sezzle stockholders do not elect to receive Zip ADRs by a prescribed election date before closing of the Proposed Transaction, they will only be entitled to receive Zip ordinary shares. 2. Zip reserves the right to increase or decrease the size of the SPP and/or scale back applications under the SPP at its discretion. 3. If the Proposed Transaction does not complete after settlement of the Placement and/or SPP, Zip will use the proceeds from the Placement and/or SPP to improve its balance sheet strength to support growth and for general working capital purposes.

● US based Buy Now, Pay Later platform facilitating fast, secure and easy digital payments ● Provides short term (<2 month) interest - free pay in 4 installment products (paid over 6 weeks) ● Long term installment capability off balance sheet ● Credit building offering through Sezzle Up ● Over 3.4m active customers and over 47k active merchants ● US$1.8bn TTV in the 12 months to December 2021 ● Proprietary technology developed for application layer, fraud detection and real - time credit underwriting engine ● Large key businesses in US and Canada ● Founded by Charlie Youakim (Exec. Chairman & CEO), Paul Paradis (Exec. Director & President) and Killian Brackey (CTO) Merchants & retailers Other institutions (credit agencies, card networks, banks) Payment related E - Commerce platforms Sezzle: A US BNPL platform with strength in SMB 5 Key highlights Omni - channel solutions

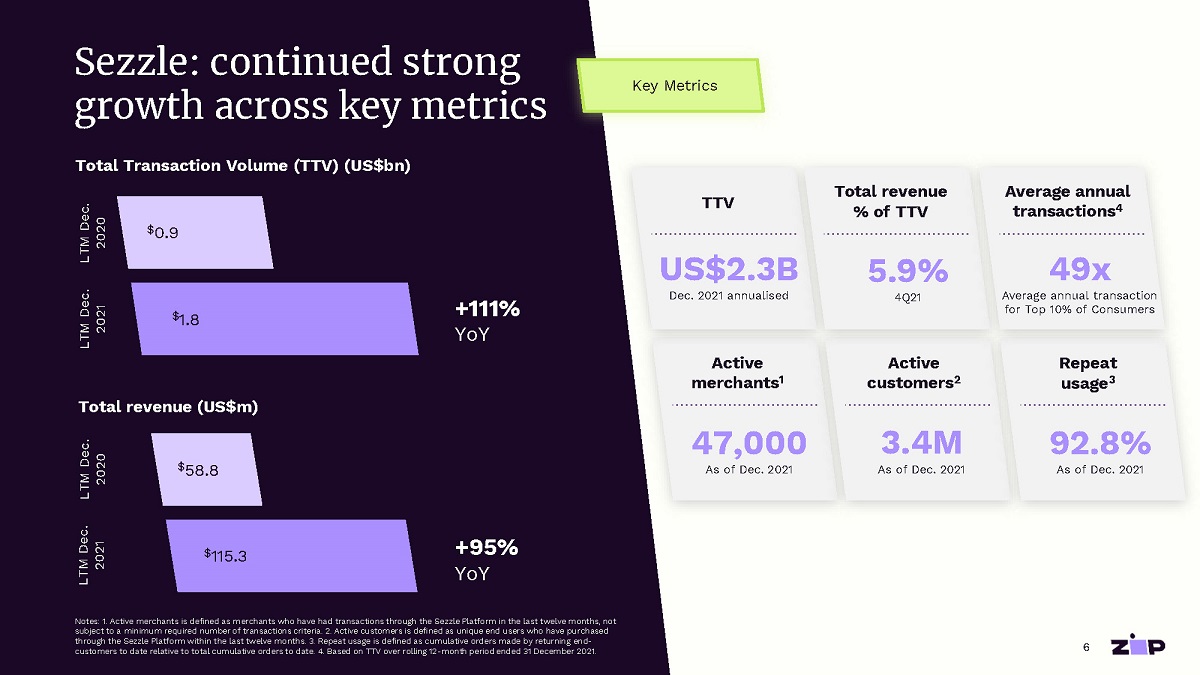

TTV Active merc h a n t s 1 Total revenue % of TTV Active cu s t o mer s 2 Average annual transactions 4 Re p eat usage 3 49x Average annual transaction for Top 10% of Consumers 47 ,000 As of Dec. 2021 9 2 .8 % As of Dec. 2021 3.4M As of Dec. 2021 5 . 9 % 4Q21 Notes: 1. Active merchants is defined as merchants who have had transactions through the Sezzle Platform in the last twelve months, not subject to a minimum required number of transactions criteria. 2. Active customers is defined as unique end users who have purchased through the Sezzle Platform within the last twelve months. 3. Repeat usage is defined as cumulative orders made by returning end - customers to date relative to total cumulative orders to date. 4. Based on TTV over rolling 12 - month period ended 31 December 2021. Total Transaction Volume (TTV) (US$bn) Total revenue (US$m) LTM Dec. 2020 $ 0.9 +1 1 1 % YoY LTM Dec. 2021 $ 1.8 LTM Dec. 2020 LTM Dec. 2021 U S $2.3B Dec. 2021 annualised $ 58.8 $ 115.3 +95% YoY Sezzle: continued strong growth across key metrics 6 Key Metrics

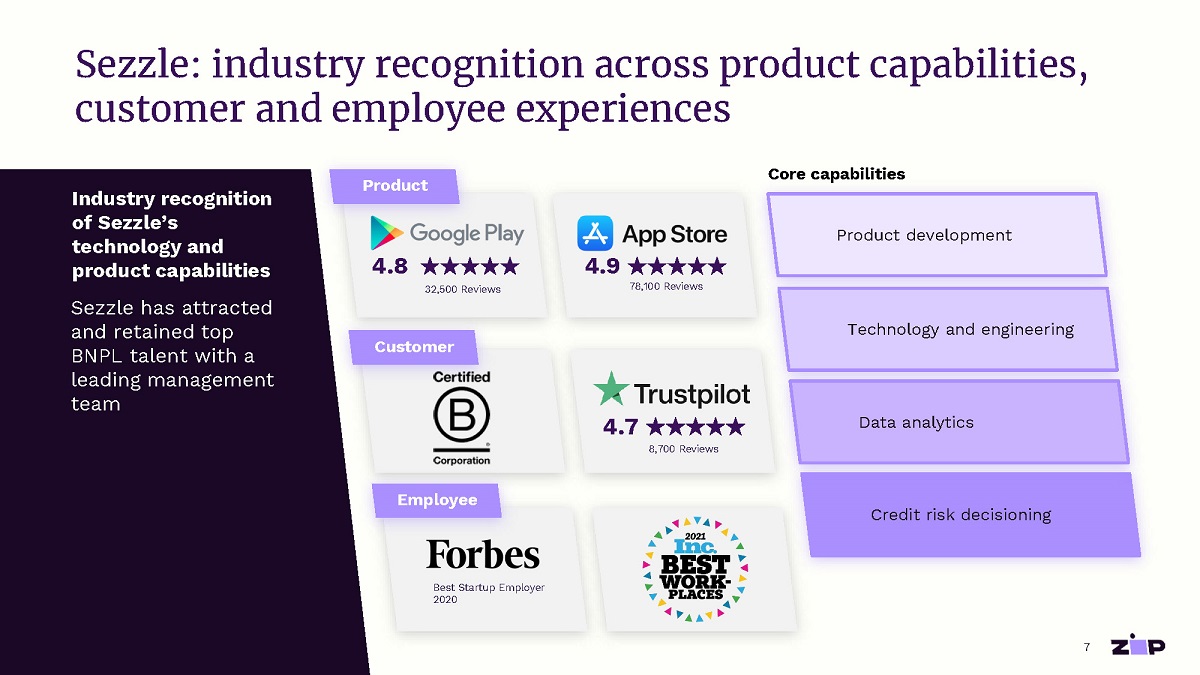

4 .9 78,100 Reviews Best Startup Employer 2020 Core capabilities Sezzle: industry recognition across product capabilities, customer and employee experiences Industry recognition of Sezzle’s technology and product capabilities Sezzle has attracted and retained top BNPL talent with a leading management team 7 4 .8 32,500 Reviews Credit risk decisioning Technology and engineering Data analytics Product development P r odu ct C u s t o mer E m p l oy ee 4 .7 8,700 Reviews

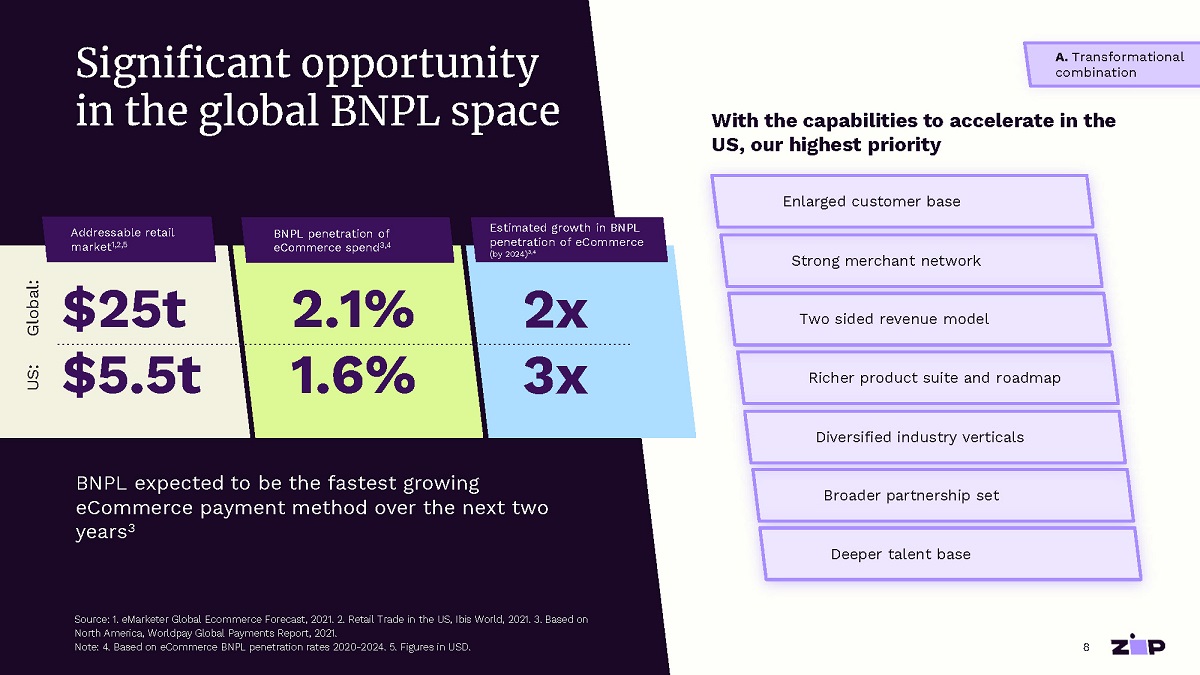

BNPL expected to be the fastest growing eCommerce payment method over the next two years 3 Significant opportunity in the global BNPL space $25t $ 5 .5t 2. 1 % 2x 1.6 % 3x Source: 1. eMarketer Global Ecommerce Forecast, 2021. 2. Retail Trade in the US, Ibis World, 2021. 3. Based on North America, Worldpay Global Payments Report, 2021. Note: 4. Based on eCommerce BNPL penetration rates 2020 - 2024. 5. Figures in USD. With the capabilities to accelerate in the US, our highest priority Richer product suite and roadmap Strong merchant network Two sided revenue model Enlarged customer base Broader partnership set Deeper talent base Diversified industry verticals 8 A. Transformational combination G l obal: US: Addressable retail market 1,2,5 BNPL penetration of eCommerce spend 3,4 Estimated growth in BNPL penetration of eCommerce (by 2024) 3,4

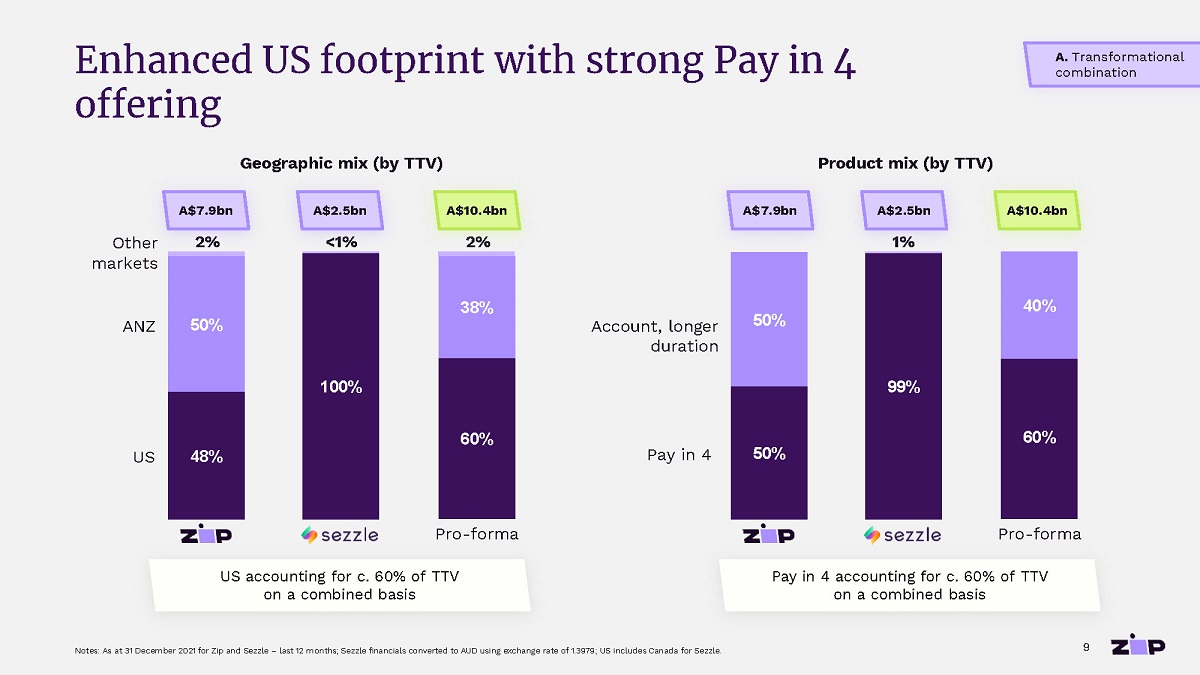

Enhanced US footprint with strong Pay in 4 offering Notes: As at 31 December 2021 for Zip and Sezzle – last 12 months; Sezzle financials converted to AUD using exchange rate of 1.3979; US includes Canada for Sezzle. Geographic mix (by TTV) Product mix (by TTV) 9 A. Transformational combination 50% 48% 100% 38% 60% Pro - forma US AN Z Other market s 2% 99% 60% Pro - forma Pay in 4 Account, longer d u rat ion US accounting for c. 60% of TTV on a combined basis Pay in 4 accounting for c. 60% of TTV on a combined basis A$7 . 9 bn A $2 . 5bn <1% A $10. 4 bn 2% A$7 . 9 bn A $2 . 5bn 1% A $10. 4 bn 40% 50% 50%

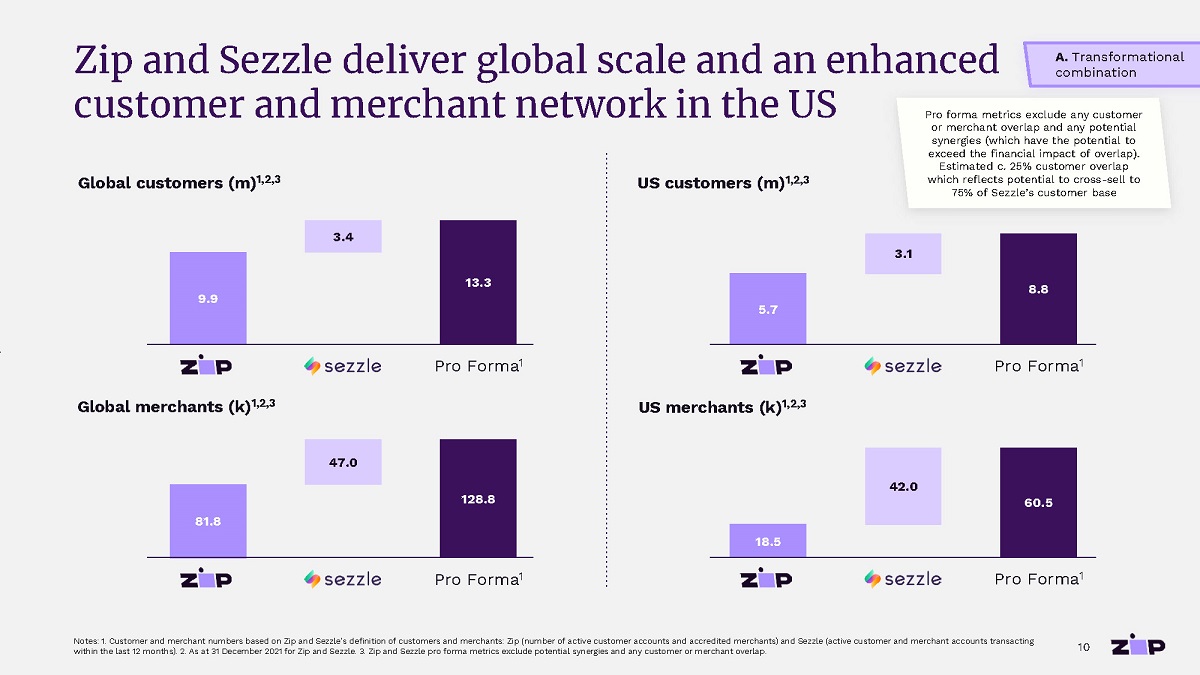

Zip and Sezzle deliver global scale and an enhanced customer and merchant network in the US Notes: 1. Customer and merchant numbers based on Zip and Sezzle’s definition of customers and merchants: Zip (number of active customer accounts and accredited merchants) and Sezzle (active customer and merchant accounts transacting within the last 12 months). 2. As at 31 December 2021 for Zip and Sezzle. 3. Zip and Sezzle pro forma metrics exclude potential synergies and any customer or merchant overlap. Global customers (m) 1,2,3 US customers (m) 1,2,3 Global merchants (k) 1,2,3 US merchants (k) 1,2,3 Pro forma metrics exclude any customer or merchant overlap and any potential synergies (which have the potential to exceed the financial impact of overlap). Estimated c. 25% customer overlap which reflects potential to cross - sell to 75% of Sezzle’s customer base 10 A. Transformational combination 9 . 9 3.4 13 . 3 Pro Forma 1 5.7 3.1 8. 8 Pro Forma 1 81.8 47.0 128.8 Pro Forma 1 18.5 42.0 60.5 Pro Forma 1

M e r c h a n t network 1 18.5k 42.0k Products Short duration Short duration, long duration, credit builder Channels App (open loop), check - out, in - store Ch e c k - o u t , in - store Merchant focus Enterprise SMB, enterprise 3 E n g a g e m e n t (Top 10%) 44x 4 49x 5 Providing Zip and Sezzle customers access to each other’s product suite to drive deeper engagement Select Products Pro Forma Short Duration ط ط ط Long Duration ظ ط (off - balance sheet) ط (off - balance sheet) SMB ظ ط ط Enterprise ط ط 3 ط Rewards ط ط ط Bank Partnership ط 2 ظ ط Credit Builder ظ ط ط Physical Card ط ظ ط Notes: 1. As at 31 December 2021. 2. Partnership with WebBank announced November 2021. 3. Sezzle’s primary focus is SMB merchants, with a select focus on enterprise merchants. 4. Based on active app customers in the 12 months to December 2021. 5. Based on TTV over rolling 12 - month period ended 31 December 2021. Combined proposition for US customers Complementary US product suite B. Meaningful customer benefits 11

Deepening our commitment to customers through a shared product vision Short term BNPL Long term BNPL (off - balance sheet) Savings Account Credit Builder PFM Zip Business Merchant interest Zip Business Finance S u b s c ripti o n s Debit spend (Pay Now) Cross - border Express Checkout WALLET VISION ● Spend and Earn ● Budget and Learn ● Banking ● Save and Invest Customer solutions Merchant solutions MERCHANT VISION ● Payments ● Demand Generation ● Analytics & Insights ● Growth Solutions B i l l s Rewards C r y pto Physical cards Virtual card integration Remember Me Single global integration Notes: Mix of current and future product roadmap. Incremental Sezzle solutions 12 Merchant interest program B. Meaningful customer benefits

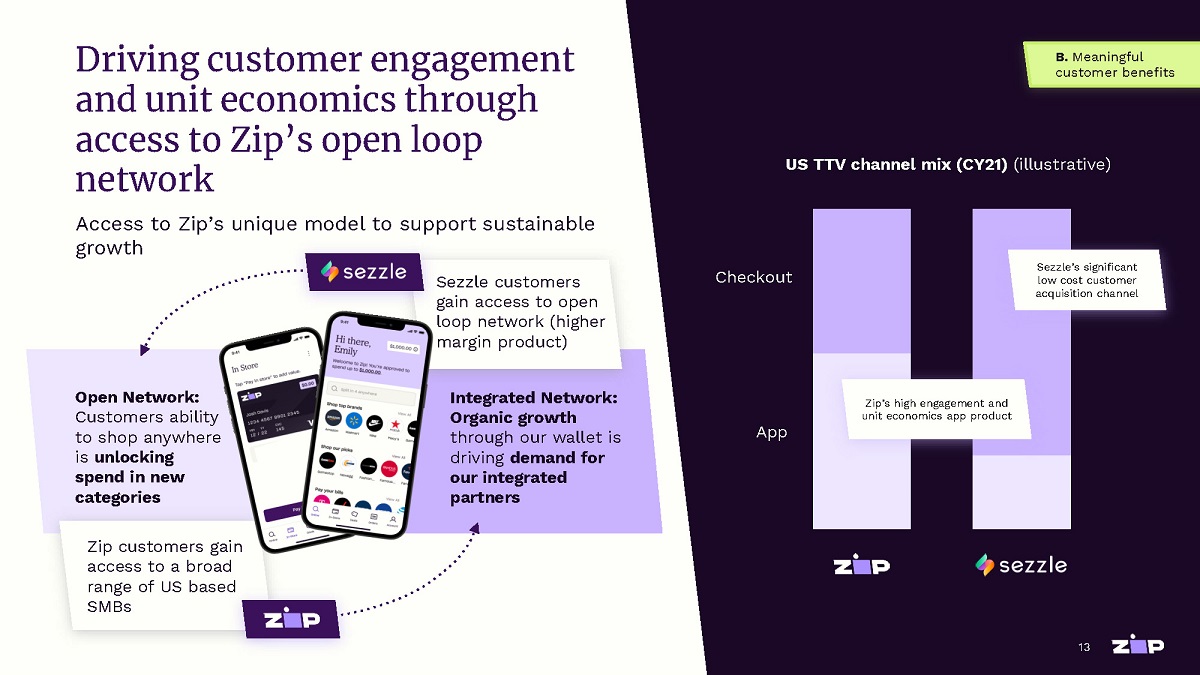

C h e c kout App US TTV channel mix (CY21) (illustrative) Integrated Network: Organic growth through our wallet is driving demand for our integrated p a rt n ers Open Network: Customers ability to shop anywhere is unlocking spend in new ca te g o r ies Zip customers gain access to a broad range of US based SMBs Access to Zip’s unique model to support sustainable growth Sezzle customers gain access to open loop network (higher margin product) Driving customer engagement and unit economics through access to Zip’s open loop network B. Meaningful customer benefits 13 h engageme Zip’s hig unit econ nt and omics app product s significant st customer S ezz l e’ low co acquis ition channel

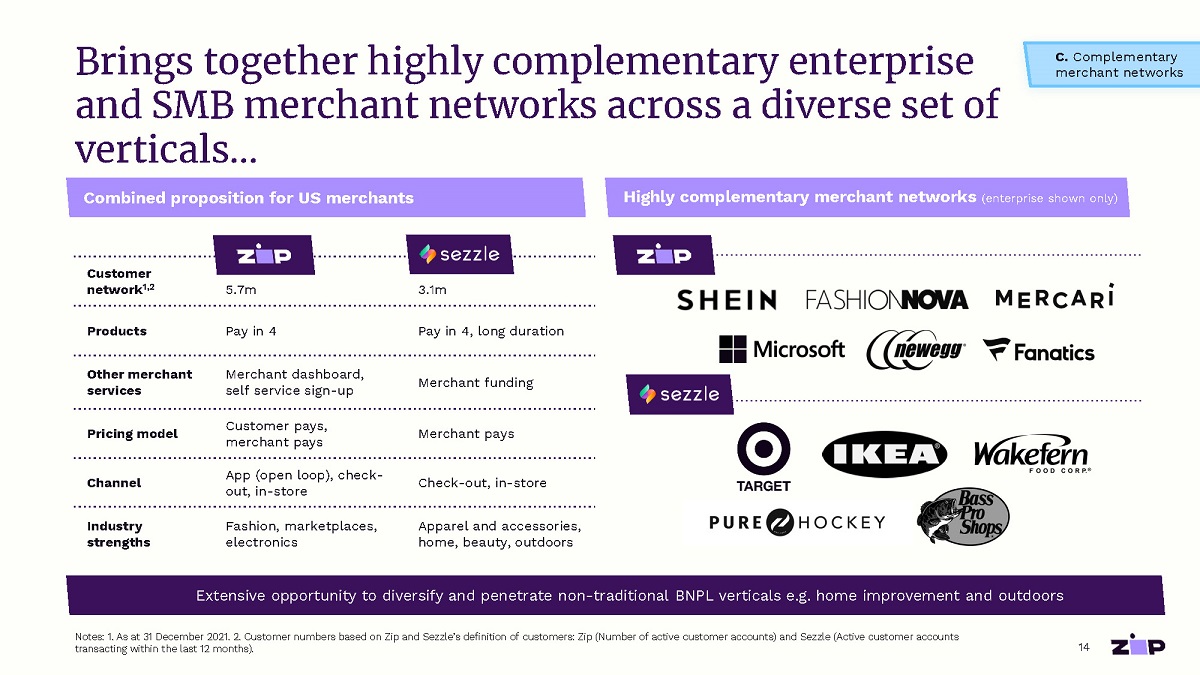

Brings together highly complementary enterprise and SMB merchant networks across a diverse set of verticals… Customer ne tw or k 1,2 5.7m 3.1m Products Pay in 4 Pay in 4, long duration Other merchant services Merchant dashboard, self service sign - up Merchant funding Pricing model Customer pays, merchant pays Merchant pays Channel App (open loop), check - out, in - store Check - out, in - store Industry strengths Fashion, marketplaces, electronics Apparel and accessories, home, beauty, outdoors Combined proposition for US merchants Highly complementary merchant networks (enterprise shown only) Notes: 1. As at 31 December 2021. 2. Customer numbers based on Zip and Sezzle’s definition of customers: Zip (Number of active customer accounts) and Sezzle (Active customer accounts transacting within the last 12 months). Extensive opportunity to diversify and penetrate non - traditional BNPL verticals e.g. home improvement and outdoors 14 C. Complementary merchant networks

Diversified product suite, with c. 60% of TTV from capital efficient Pay in 4 c. 129k merchants globally across a diverse mix of verticals 1 Healthy (c. 6 - 7%) revenue margins across both businesses >A$18 billion installments underwritten 2 on a combined basis Proof points c. 13m customers globally¹ …strengthening the combined company’s capabilities to win together Products Short and long duration installments in the US delivered through a single checkout experience Network Flexibility A high margin, open loop app combined with a strong merchant network enabling Zip and Sezzle customers to BNPL everywhere Revenue Model A two sided revenue model that optimises economics to support merchants across any vertical Risk Management Combined data and credit assets to drive improved decisioning for merchants and reduce costs Global Scale A truly global payments technology company with strong presence in the US and access to emerging markets 15 C. Complementary merchant networks Notes: 1. Zip and Sezzle pro forma metrics exclude potential synergies and any customer or merchant overlap. Customer and merchant numbers based on Zip and Sezzle’s definition of customers and merchants: Zip (Number of active customer accounts and accredited merchants) and Sezzle (Active customer and merchant accounts transacting within the last 12 months). 2. Represents all time TTV for Zip and Sezzle as at 31 December 2021.

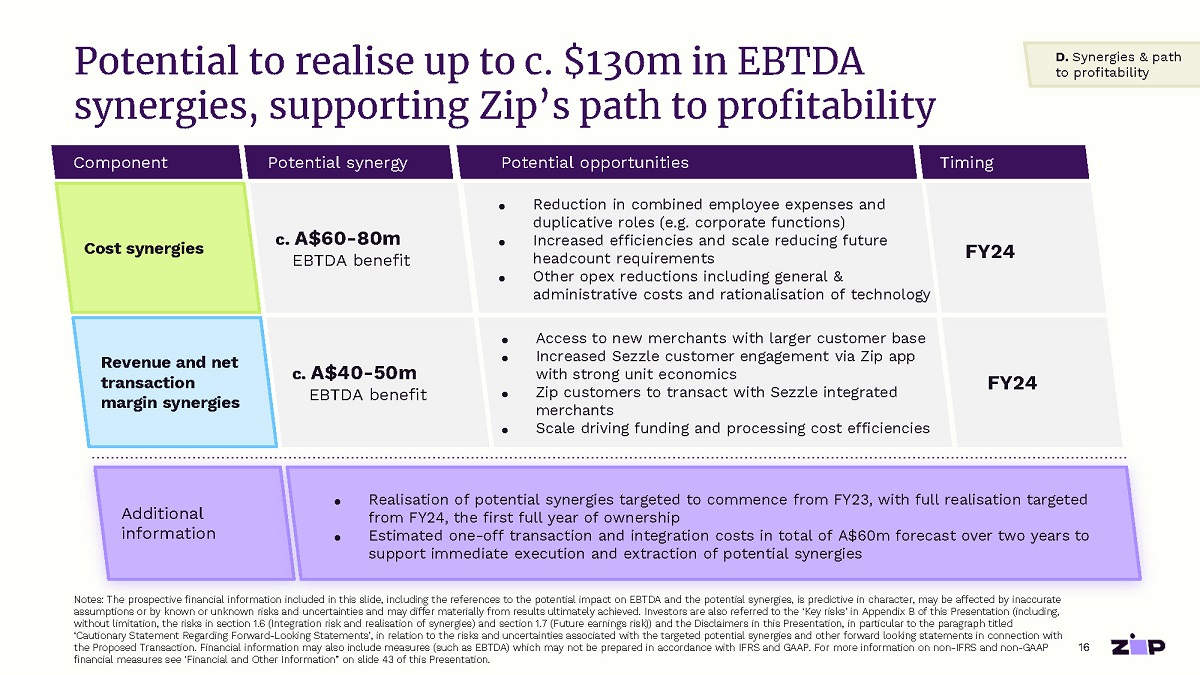

Potential to realise up to c. $130m in EBTDA synergies, supporting Zip’s path to profitability Notes: The prospective financial information included in this slide, including the references to the potential impact on EBTDA and the potential synergies, is predictive in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Investors are also referred to the ‘Key risks’ in Appendix B of this Presentation (including, without limitation, the risks in section 1.6 (Integration risk and realisation of synergies) and section 1.7 (Future earnings risk)) and the Disclaimers in this Presentation, in particular to the paragraph titled ‘Cautionary Statement Regarding Forward - Looking Statements’, in relation to the risks and uncertainties associated with the targeted potential synergies and other forward looking statements in connection with the Proposed Transaction. Financial information may also include measures (such as EBTDA) which may not be prepared in accordance with IFRS and GAAP. For more information on non - IFRS and non - GAAP financial measures see 'Financial and Other Information” on slide 43 of this Presentation. Revenue and net transaction margin synergies Cost synergies Additional i n f ormatio n Ti m i ng Component Potential synergy Potential opportunities c. A$40 - 50m EBTDA benefit c. A$60 - 80m EBTDA benefit Ƚ Ƚ ● Reduction in combined employee expenses and duplicative roles (e.g. corporate functions) Increased efficiencies and scale reducing future headcount requirements Other opex reductions including general & administrative costs and rationalisation of technology Ƚ Ƚ ● Access to new merchants with larger customer base ● Increased Sezzle customer engagement via Zip app with strong unit economics Zip customers to transact with Sezzle integrated merchants Scale driving funding and processing cost efficiencies FY2 4 FY2 4 ● Realisation of potential synergies targeted to commence from FY23, with full realisation targeted from FY24, the first full year of ownership ● Estimated one - off transaction and integration costs in total of A$60m forecast over two years to support immediate execution and extraction of potential synergies D. Synergies & path to profitability 16

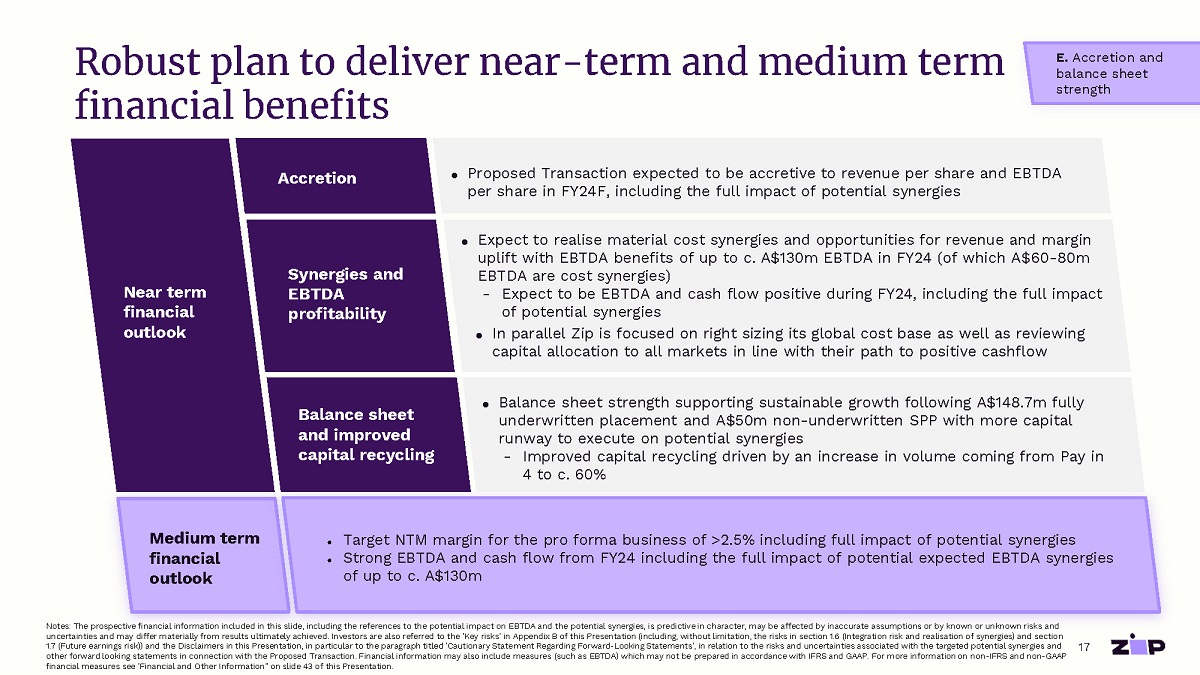

Notes: The prospective financial information included in this slide, including the references to the potential impact on EBTDA and the potential synergies, is predictive in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Investors are also referred to the ‘Key risks’ in Appendix B of this Presentation (including, without limitation, the risks in section 1.6 (Integration risk and realisation of synergies) and section 1.7 (Future earnings risk)) and the Disclaimers in this Presentation, in particular to the paragraph titled ‘Cautionary Statement Regarding Forward - Looking Statements’, in relation to the risks and uncertainties associated with the targeted potential synergies and other forward looking statements in connection with the Proposed Transaction. Financial information may also include measures (such as EBTDA) which may not be prepared in accordance with IFRS and GAAP. For more information on non - IFRS and non - GAAP financial measures see 'Financial and Other Information” on slide 43 of this Presentation. Robust plan to deliver near - term and medium term financial benefits E. Accretion and balance sheet strength Near term financial outlook Medium term financial outlook A c cretion Synergies and EBTDA profitability Balance sheet and improved capital recycling ● Proposed Transaction expected to be accretive to revenue per share and EBTDA per share in FY24F, including the full impact of potential synergies ● Balance sheet strength supporting sustainable growth following A$148.7m fully underwritten placement and A$50m non - underwritten SPP with more capital runway to execute on potential synergies - Improved capital recycling driven by an increase in volume coming from Pay in 4 to c. 60% ● Expect to realise material cost synergies and opportunities for revenue and margin uplift with EBTDA benefits of up to c . A $ 130 m EBTDA in FY 24 (of which A $ 60 - 80 m EBTDA are cost synergies) - Expect to be EBTDA and cash flow positive during FY 24 , including the full impact of potential synergies ● In parallel Zip is focused on right sizing its global cost base as well as reviewing capital allocation to all markets in line with their path to positive cashflow ● Target NTM margin for the pro forma business of >2.5% including full impact of potential synergies ● Strong EBTDA and cash flow from FY24 including the full impact of potential expected EBTDA synergies of up to c. A$130m 17

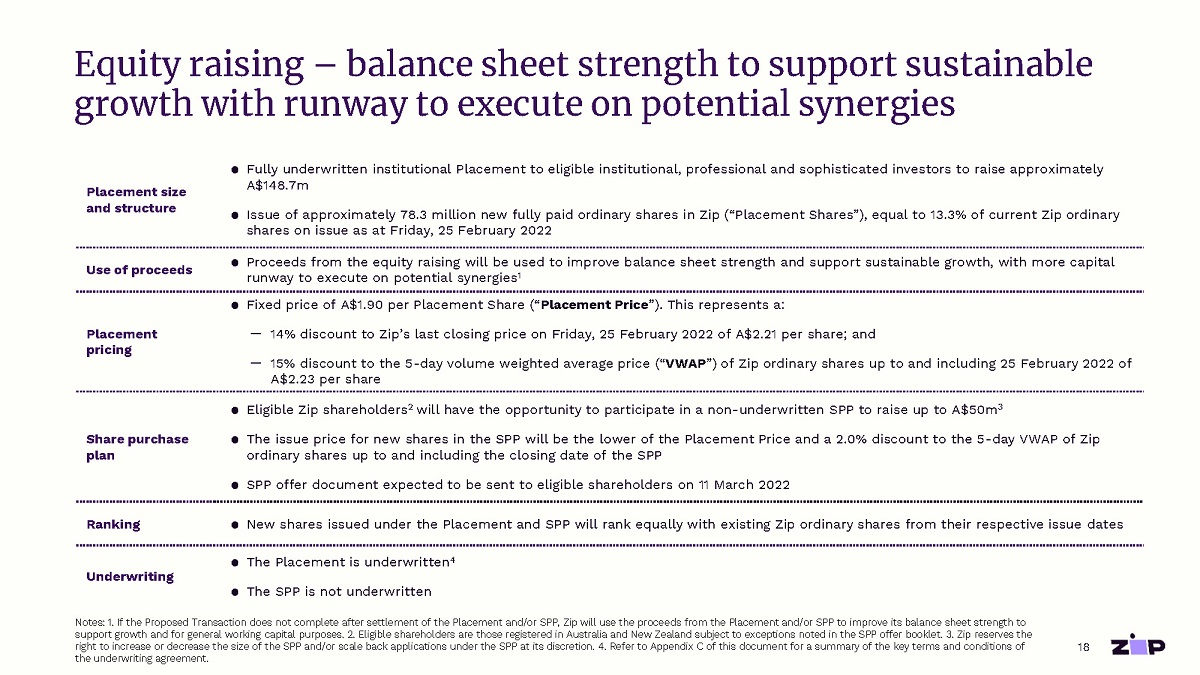

18 Placement size and structure ● Fully underwritten institutional Placement to eligible institutional, professional and sophisticated investors to raise approximately A$148.7m ● Issue of approximately 78.3 million new fully paid ordinary shares in Zip (“Placement Shares”), equal to 13.3% of current Zip ordinary shares on issue as at Friday, 25 February 2022 Use of proceeds ● Proceeds from the equity raising will be used to improve balance sheet strength and support sustainable growth, with more capital runway to execute on potential synergies 1 Placeme n t pricing ● Fixed price of A$1.90 per Placement Share (“ Placement Price ”). This represents a: − 14% discount to Zip’s last closing price on Friday, 25 February 2022 of A$2.21 per share; and − 15% discount to the 5 - day volume weighted average price (“ VWAP ”) of Zip ordinary shares up to and including 25 February 2022 of A$2.23 per share Share purchase plan ● Eligible Zip shareholders 2 will have the opportunity to participate in a non - underwritten SPP to raise up to A$50m 3 ● The issue price for new shares in the SPP will be the lower of the Placement Price and a 2.0% discount to the 5 - day VWAP of Zip ordinary shares up to and including the closing date of the SPP ● SPP offer document expected to be sent to eligible shareholders on 11 March 2022 Ranking ● New shares issued under the Placement and SPP will rank equally with existing Zip ordinary shares from their respective issue dates Underwriting ● The Placement is underwritten 4 ● The SPP is not underwritten Equity raising – balance sheet strength to support sustainable growth with runway to execute on potential synergies Notes: 1. If the Proposed Transaction does not complete after settlement of the Placement and/or SPP, Zip will use the proceeds from the Placement and/or SPP to improve its balance sheet strength to support growth and for general working capital purposes. 2. Eligible shareholders are those registered in Australia and New Zealand subject to exceptions noted in the SPP offer booklet. 3. Zip reserves the right to increase or decrease the size of the SPP and/or scale back applications under the SPP at its discretion. 4. Refer to Appendix C of this document for a summary of the key terms and conditions of the underwriting agreement.

19 Notes: The above timetable is indicative only and subject to variation. Zip reserves the right to alter the timetable at its absolute discretion and without notice, subject to ASX Listing Rules and the Corporation Act 2001 (Cth) and other applicable law. All dates and times are Australian Eastern Daylight Time unless otherwise stated. Key information for the Placement and the SPP Placement timetable SPP timetable Event Date Announcement of completion of the Placement Tuesday, 1 March 2022 Settlement of Placement Shares issued under the Placement Thursday, 3 March 2022 Allotment and commencement of trading of Placement Shares issued under the Placement Friday, 4 March 2022 E v e n t D a te Record date for SPP 7:00 pm (AEDT), Friday, 25 February 2022 SPP offer opens and dispatch SPP documents to shareholders Friday, 11 March 2022 SPP offer closes 5:00 pm (AEDT), Friday, 1 April 2022 SPP results announced Wednesday, 6 April 2022 Settlement and allotment of the SPP Shares issued under the SPP Friday, 8 April 2022 Expected quotation on the ASX and normal trading of the SPP Shares issued under the SPP Monday, 11 April 2022 Dispatch of allotment confirmations / holding statements for the SPP Shares issued under the SPP Monday, 11 April 2022

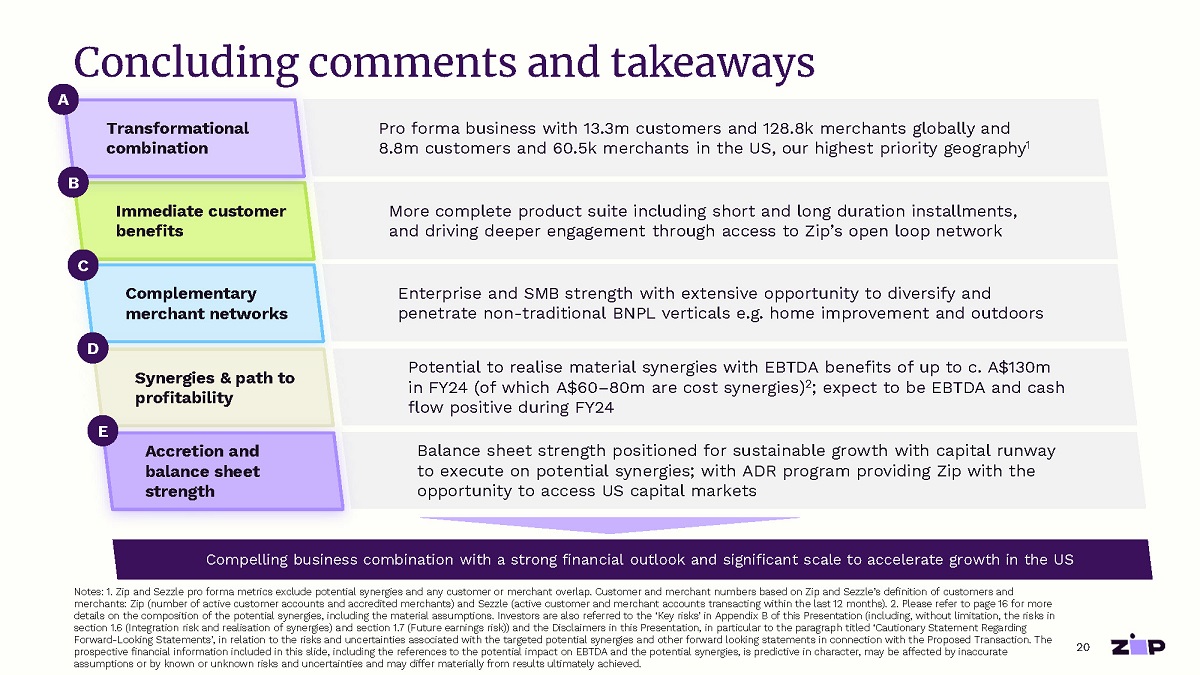

Concluding comments and takeaways Notes: 1. Zip and Sezzle pro forma metrics exclude potential synergies and any customer or merchant overlap. Customer and merchant numbers based on Zip and Sezzle’s definition of customers and merchants: Zip (number of active customer accounts and accredited merchants) and Sezzle (active customer and merchant accounts transacting within the last 12 months). 2. Please refer to page 16 for more details on the composition of the potential synergies, including the material assumptions. Investors are also referred to the ‘Key risks’ in Appendix B of this Presentation (including, without limitation, the risks in section 1.6 (Integration risk and realisation of synergies) and section 1.7 (Future earnings risk)) and the Disclaimers in this Presentation, in particular to the paragraph titled ‘Cautionary Statement Regarding Forward - Looking Statements’, in relation to the risks and uncertainties associated with the targeted potential synergies and other forward looking statements in connection with the Proposed Transaction. The prospective financial information included in this slide, including the references to the potential impact on EBTDA and the potential synergies, is predictive in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Enterprise and SMB strength with extensive opportunity to diversify and penetrate non - traditional BNPL verticals e.g. home improvement and outdoors More complete product suite including short and long duration installments, and driving deeper engagement through access to Zip’s open loop network Pro forma business with 13.3m customers and 128.8k merchants globally and 8.8m customers and 60.5k merchants in the US, our highest priority geography 1 Potential to realise material synergies with EBTDA benefits of up to c. A$130m in FY24 (of which A$60 – 80m are cost synergies) 2 ; expect to be EBTDA and cash flow positive during FY24 Balance sheet strength positioned for sustainable growth with capital runway to execute on potential synergies; with ADR program providing Zip with the opportunity to access US capital markets Immediate customer benefits Complementary merchant networks Tran s f o r ma t io n al combination Synergies & path to profitability Accretion and balance sheet strength A B C D E Compelling business combination with a strong financial outlook and significant scale to accelerate growth in the US 20

Appendix A: Supporting Information

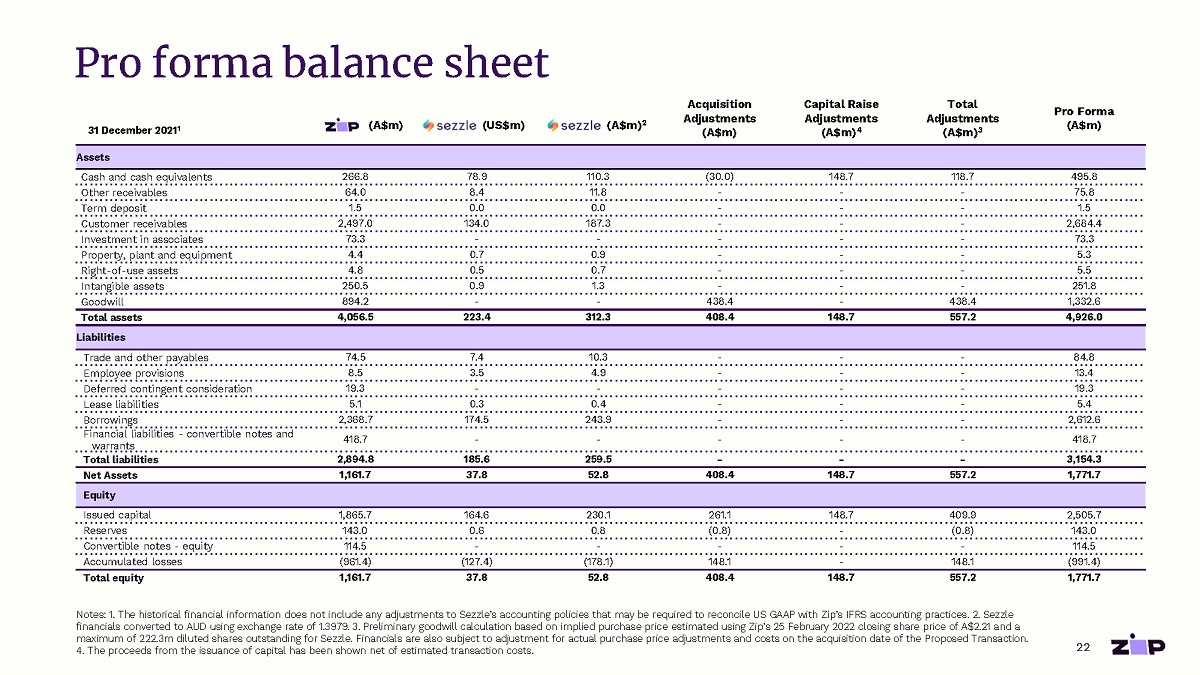

31 December 2021 1 (A$m) (US$m) (A$m) 2 Acquisition Ad jus t men t s (A$m) Capital Raise Ad jus t men t s (A$m) 4 Total Ad jus t men t s (A$m) 3 Pro Forma (A$m) Assets Cash and cash equivalents 266.8 78.9 110.3 (30.0) 148.7 118.7 495.8 Other receivables 64.0 8.4 11.8 - - - 75.8 Term deposit 1.5 0.0 0.0 - - - 1.5 Customer receivables 2,497.0 134.0 187.3 - - - 2,684.4 Investment in associates 73.3 - - - - - 73.3 Property, plant and equipment 4.4 0.7 0.9 - - - 5.3 Right - of - use assets 4.8 0.5 0.7 - - - 5.5 Intangible assets 250.5 0.9 1.3 - - - 251.8 Goodwill 894.2 - - 438.4 - 438.4 1,332.6 Total assets 4,056.5 223.4 312.3 408.4 148.7 557.2 4,926.0 Liabilities Trade and other payables 74.5 7.4 10.3 - - - 84.8 Employee provisions 8.5 3.5 4.9 - - - 13.4 Deferred contingent consideration 19.3 - - - - - 19.3 Lease liabilities 5.1 0.3 0.4 - - - 5.4 Borrowings 2,368.7 174.5 243.9 - - - 2,612.6 Financial liabilities - convertible notes and warrants 418.7 - - - - - 418.7 Total liabilities 2,894.8 185.6 259.5 - - - 3,154.3 Net Assets 1,161.7 37.8 52.8 408.4 148.7 557.2 1,771.7 Equity Issued capital 1,865.7 164.6 230.1 261.1 148.7 409.9 2,505.7 Reserves 143.0 0.6 0.8 (0.8) - (0.8) 143.0 Convertible notes - equity 114.5 - - - - - 114.5 Accumulated losses (961.4) (127.4) (178.1) 148.1 - 148.1 (991.4) Total equity 1,161.7 37.8 52.8 408.4 148.7 557.2 1,771.7 Pro forma balance sheet Notes: 1. The historical financial information does not include any adjustments to Sezzle’s accounting policies that may be required to reconcile US GAAP with Zip’s IFRS accounting practices. 2. Sezzle financials converted to AUD using exchange rate of 1.3979. 3. Preliminary goodwill calculation based on implied purchase price estimated using Zip’s 25 February 2022 closing share price of A$2.21 and a maximum of 222.3m diluted shares outstanding for Sezzle. Financials are also subject to adjustment for actual purchase price adjustments and costs on the acquisition date of the Proposed Transaction. 4. The proceeds from the issuance of capital has been shown net of estimated transaction costs. 22

Appendix B: Key Risks

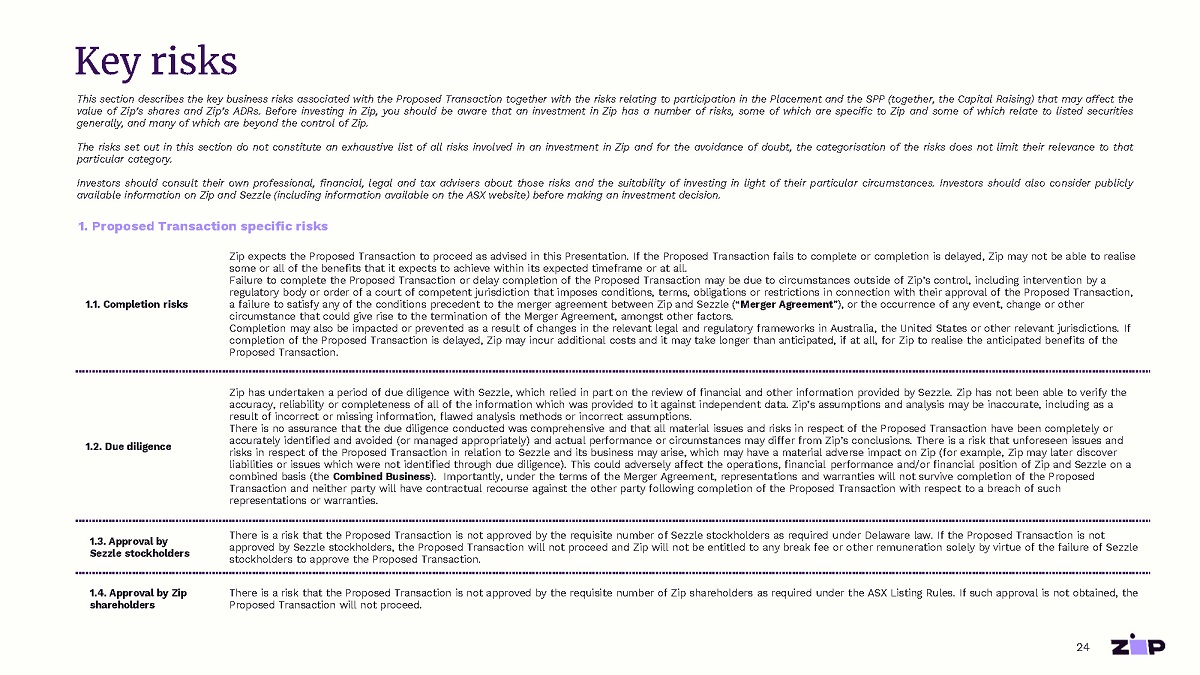

1.1. Completion risks Zip expects the Proposed Transaction to proceed as advised in this Presentation. If the Proposed Transaction fails to complete or completion is delayed, Zip may not be able to realise some or all of the benefits that it expects to achieve within its expected timeframe or at all. Failure to complete the Proposed Transaction or delay completion of the Proposed Transaction may be due to circumstances outside of Zip’s control, including intervention by a regulatory body or order of a court of competent jurisdiction that imposes conditions, terms, obligations or restrictions in connection with their approval of the Proposed Transaction, a failure to satisfy any of the conditions precedent to the merger agreement between Zip and Sezzle (“ Merger Agreement ”), or the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, amongst other factors. Completion may also be impacted or prevented as a result of changes in the relevant legal and regulatory frameworks in Australia, the United States or other relevant jurisdictions. If completion of the Proposed Transaction is delayed, Zip may incur additional costs and it may take longer than anticipated, if at all, for Zip to realise the anticipated benefits of the Proposed Transaction. 1.2. Due diligence Zip has undertaken a period of due diligence with Sezzle, which relied in part on the review of financial and other information provided by Sezzle. Zip has not been able to verify the accuracy, reliability or completeness of all of the information which was provided to it against independent data. Zip’s assumptions and analysis may be inaccurate, including as a result of incorrect or missing information, flawed analysis methods or incorrect assumptions. There is no assurance that the due diligence conducted was comprehensive and that all material issues and risks in respect of the Proposed Transaction have been completely or accurately identified and avoided (or managed appropriately) and actual performance or circumstances may differ from Zip’s conclusions. There is a risk that unforeseen issues and risks in respect of the Proposed Transaction in relation to Sezzle and its business may arise, which may have a material adverse impact on Zip (for example, Zip may later discover liabilities or issues which were not identified through due diligence). This could adversely affect the operations, financial performance and/or financial position of Zip and Sezzle on a combined basis (the Combined Business ). Importantly, under the terms of the Merger Agreement, representations and warranties will not survive completion of the Proposed Transaction and neither party will have contractual recourse against the other party following completion of the Proposed Transaction with respect to a breach of such representations or warranties. 1.3. Approval by Sezzle stockholders There is a risk that the Proposed Transaction is not approved by the requisite number of Sezzle stockholders as required under Delaware law. If the Proposed Transaction is not approved by Sezzle stockholders, the Proposed Transaction will not proceed and Zip will not be entitled to any break fee or other remuneration solely by virtue of the failure of Sezzle stockholders to approve the Proposed Transaction. 1.4. Approval by Zip shareholders There is a risk that the Proposed Transaction is not approved by the requisite number of Zip shareholders as required under the ASX Listing Rules. If such approval is not obtained, the Proposed Transaction will not proceed. Key risks 24 This section describes the key business risks associated with the Proposed Transaction together with the risks relating to participation in the Placement and the SPP (together, the Capital Raising) that may affect the value of Zip’s shares and Zip’s ADRs . Before investing in Zip, you should be aware that an investment in Zip has a number of risks, some of which are specific to Zip and some of which relate to listed securities generally, and many of which are beyond the control of Zip . The risks set out in this section do not constitute an exhaustive list of all risks involved in an investment in Zip and for the avoidance of doubt, the categorisation of the risks does not limit their relevance to that particular category . Investors should consult their own professional, financial, legal and tax advisers about those risks and the suitability of investing in light of their particular circumstances . Investors should also consider publicly available information on Zip and Sezzle (including information available on the ASX website) before making an investment decision . 1. Proposed Transaction specific risks

1.5. Market value of the consideration The price at which Zip’s shares will be quoted on the ASX and Zip’s American Depository Receipts (“ ADRs ") will be quoted on a U.S. exchange may experience price and volume fluctuations that are due to a number of factors outside Zip’s control and which are not explained by the fundamental operations and activities of Zip. General factors that may affect the market price of Zip’s shares and ADRs include (i) future announcements concerning Zip’s business or Zip’s competitors’ businesses; (ii) economic conditions in both Australia and the US; (iii) investor sentiment, local and international share market conditions; (iv) changes in interest rates and the rate of inflation and central bank policies; (v) he global security situation and the possibility of terrorist disturbances; (vi) pandemics and endemics, including COVID - 19; (vii) changes to government regulation, policy or legislation, in particular taxation laws; (viii) changes in accounting standards, policies, guidance, interpretations or principles; (ix) changes which may occur to the taxation of companies as a result of changes in Australian and foreign taxation laws; (x) adverse resolution of new or pending litigation or other claims against the Combined Business; (xi) announcement of new technologies; (xii) geopolitical instability, including international hostilities and acts of terrorism; (xiii) demand for and supply of Zip’s shares and ADRs; (xiv) analyst reports; (xv) changes to the system of dividend imputation in Australia; (xvi) changes in exchange rates and (xvii) variations in commodity prices. These factors may cause Zip’s shares and ADRs to trade at prices above or below the price at which the securities were initially issued. There is no guarantee of the market price of Zip’s shares and Zip’s ADRs issued as consideration under the Proposed Transaction. Future market prices may either be above or below current or historical market prices. 1.6. Integration risk and realisation of synergies The success of the Proposed Transaction will depend, in part, on Zip’s ability to successfully combine the businesses of Zip and Sezzle, which currently operate as independent companies, including realising the targeted synergies, cost savings and operational efficiencies from the combination. There is a risk that the Combined Business’s success and the operations, financial performance and/or financial position of the Combined Business could be adversely affected if the Sezzle business is not integrated effectively with Zip’s business. There are inherent risks in the integration of Sezzle. Without limiting the possible issues or challenges that could be faced in the integration of Sezzle, there may be issues with the integration of operating and management systems (such as IT, information, or accounting systems),challenges maintaining employee morale and attracting and motivating and retaining management personnel and other key employees, the possibility of faulty assumptions underlying expectations regarding the integration process, consolidating corporate and administrative infrastructures and eliminating duplicative operations and challenges that divert management attention or do not deliver the expected benefits of the Proposed Transaction. Many of these factors will be outside of the Combined Business’s control and these issues may cause unexpected delays, liabilities and costs to the Combined Business. Additionally, there are inherent risks in connection with the targeted potential synergies. For example, there is a risk that the targeted synergies of the Proposed Transaction may be less than estimated or potential synergies are not achieved or take longer to achieve. If the integration of Zip and Sezzle takes longer than expected there may be delays in achieving the targeted potential synergies. In addition, Zip’s initial estimate of the cost of integration may differ from the actual cost of integration. Zip may not be able to realise the targeted cost synergies and/or Zip may not be able to win new customers and merchants (including as required to offset any customer loss as a result of the Proposed Transaction). Further, given the costs associated with implementing the targeted synergies, Zip’s ability to realise the benefits is dependent, in part, on Zip having sufficient capital and other resources to complete the integration in the manner and time period contemplated. The potential achievement of any revenue synergies is also partly dependent upon influencing customer behaviour and therefore may be difficult to achieve. The estimated synergies from the Proposed Transaction are predicative in character, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. These risks may have a material impact on the operations, financial performance and/or financial position of the Combined Business and the future price of Zip’s shares and Zip’s ADRs. 1.7. Future earnings risk It is possible that Zip’s financial and business analysis of Sezzle and the Combined Business, and the assumptions made by Zip, draw conclusions and forecasts that are inaccurate, or which will not be realised in due course. To the extent that the actual results achieved by Sezzle and consequently the Combined Business are different than those anticipated, there is a risk that the operations, financial performance and/or financial position of Sezzle, and consequently of the Combined Business, may differ (potentially in a materially adverse way) from the performance and forecasts as described in this Presentation. There is also no guarantee that any prospective future earnings of Zip will be realised after completion of the Proposed Transaction. Depending on the success of the Proposed Transaction, integration of the Sezzle business may have an adverse impact on existing arrangements with merchants and customers as well as the ability to onboard new customers and merchants which may have an adverse impact on future earnings and Combined Business’s ability to realise the same margins in the current economic climate. The prospective financial information of the Combined Business (including in relation to revenue, total transaction value ( TTV ), net transaction margin ( NTM ), expenditure, cash flow, EBTDA) is presented for illustrative purposes only and is not necessarily indicative of what the Combined Business’s actual financial position or results of operations will be and such financial information may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Investors should also note that Presentation contains pro forma historical financial information, which is provided for illustrative purposes only and is not represented as being indicative of Zip’s (or anyone else’s) views on the Combined Business’s future financial condition and/or performance. Key risks (cont’d) 25 1. Proposed Transaction specific risks

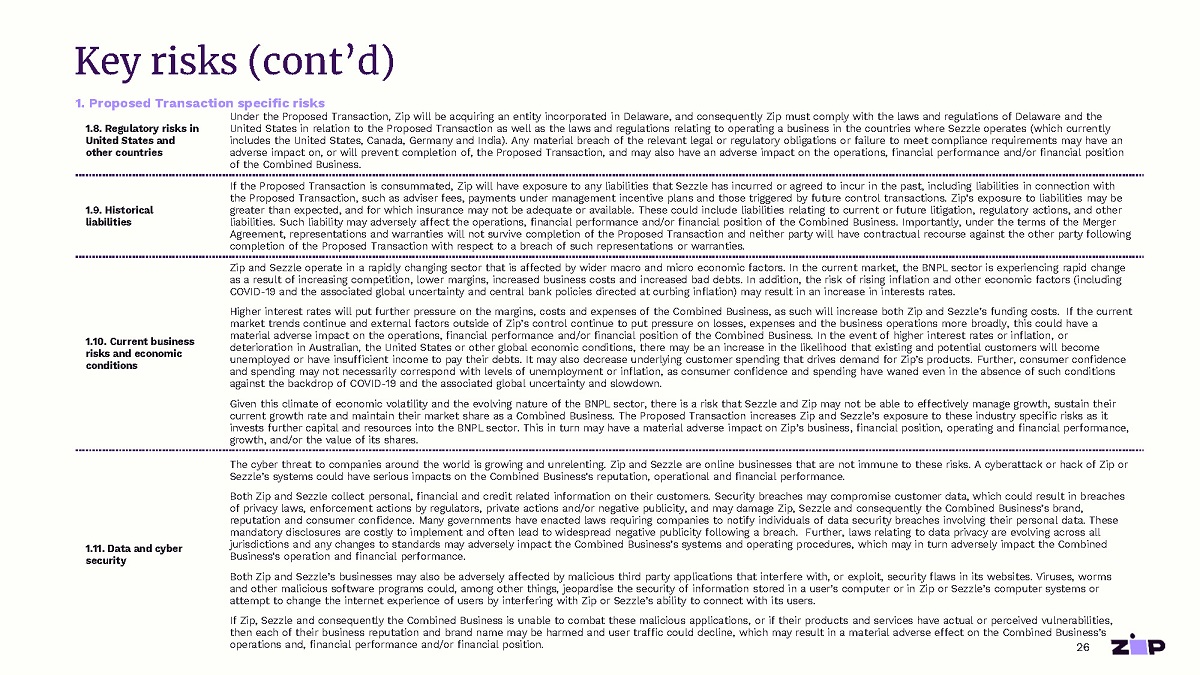

Key risks (cont’d) 1.8. Regulatory risks in United States and other countries Under the Proposed Transaction, Zip will be acquiring an entity incorporated in Delaware, and consequently Zip must comply with the laws and regulations of Delaware and the United States in relation to the Proposed Transaction as well as the laws and regulations relating to operating a business in the countries where Sezzle operates (which currently includes the United States, Canada, Germany and India). Any material breach of the relevant legal or regulatory obligations or failure to meet compliance requirements may have an adverse impact on, or will prevent completion of, the Proposed Transaction, and may also have an adverse impact on the operations, financial performance and/or financial position of the Combined Business. 1.9. Historical liabilities If the Proposed Transaction is consummated, Zip will have exposure to any liabilities that Sezzle has incurred or agreed to incur in the past, including liabilities in connection with the Proposed Transaction, such as adviser fees, payments under management incentive plans and those triggered by future control transactions. Zip's exposure to liabilities may be greater than expected, and for which insurance may not be adequate or available. These could include liabilities relating to current or future litigation, regulatory actions, and other liabilities. Such liability may adversely affect the operations, financial performance and/or financial position of the Combined Business. Importantly, under the terms of the Merger Agreement, representations and warranties will not survive completion of the Proposed Transaction and neither party will have contractual recourse against the other party following completion of the Proposed Transaction with respect to a breach of such representations or warranties. 1.10. Current business risks and economic conditions Zip and Sezzle operate in a rapidly changing sector that is affected by wider macro and micro economic factors. In the current market, the BNPL sector is experiencing rapid change as a result of increasing competition, lower margins, increased business costs and increased bad debts. In addition, the risk of rising inflation and other economic factors (including COVID - 19 and the associated global uncertainty and central bank policies directed at curbing inflation) may result in an increase in interests rates. Higher interest rates will put further pressure on the margins, costs and expenses of the Combined Business, as such will increase both Zip and Sezzle’s funding costs. If the current market trends continue and external factors outside of Zip’s control continue to put pressure on losses, expenses and the business operations more broadly, this could have a material adverse impact on the operations, financial performance and/or financial position of the Combined Business. In the event of higher interest rates or inflation, or deterioration in Australian, the United States or other global economic conditions, there may be an increase in the likelihood that existing and potential customers will become unemployed or have insufficient income to pay their debts. It may also decrease underlying customer spending that drives demand for Zip’s products. Further, consumer confidence and spending may not necessarily correspond with levels of unemployment or inflation, as consumer confidence and spending have waned even in the absence of such conditions against the backdrop of COVID - 19 and the associated global uncertainty and slowdown. Given this climate of economic volatility and the evolving nature of the BNPL sector, there is a risk that Sezzle and Zip may not be able to effectively manage growth, sustain their current growth rate and maintain their market share as a Combined Business. The Proposed Transaction increases Zip and Sezzle’s exposure to these industry specific risks as it invests further capital and resources into the BNPL sector. This in turn may have a material adverse impact on Zip’s business, financial position, operating and financial performance, growth, and/or the value of its shares. 1.11. Data and cyber security The cyber threat to companies around the world is growing and unrelenting. Zip and Sezzle are online businesses that are not immune to these risks. A cyberattack or hack of Zip or Sezzle’s systems could have serious impacts on the Combined Business's reputation, operational and financial performance. Both Zip and Sezzle collect personal, financial and credit related information on their customers. Security breaches may compromise customer data, which could result in breaches of privacy laws, enforcement actions by regulators, private actions and/or negative publicity, and may damage Zip, Sezzle and consequently the Combined Business’s brand, reputation and consumer confidence. Many governments have enacted laws requiring companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures are costly to implement and often lead to widespread negative publicity following a breach. Further, laws relating to data privacy are evolving across all jurisdictions and any changes to standards may adversely impact the Combined Business’s systems and operating procedures, which may in turn adversely impact the Combined Business's operation and financial performance. Both Zip and Sezzle’s businesses may also be adversely affected by malicious third party applications that interfere with, or exploit, security flaws in its websites. Viruses, worms and other malicious software programs could, among other things, jeopardise the security of information stored in a user’s computer or in Zip or Sezzle’s computer systems or attempt to change the internet experience of users by interfering with Zip or Sezzle’s ability to connect with its users. If Zip, Sezzle and consequently the Combined Business is unable to combat these malicious applications, or if their products and services have actual or perceived vulnerabilities, then each of their business reputation and brand name may be harmed and user traffic could decline, which may result in a material adverse effect on the Combined Business’s operations and, financial performance and/or financial position. 26 1. Proposed Transaction specific risks

1.12. Section 7874 of the Code As described more fully below, under current law, Zip is not expected to be treated as a U.S. corporation for U.S. federal income tax purposes as a result of the Proposed Transaction. A corporation is generally considered a tax resident in the jurisdiction of its organisation or incorporation for U.S. federal income tax purposes. Because Zip will be an Australia incorporated entity, it would generally be classified as a non - U.S. corporation (and, therefore, a non - U.S. tax resident) under the applicable rules. However, Section 7874 of the United States Internal Revenue Code of 1986, as amended (the Code) provides an exception under which a non - U.S. incorporated entity may, in certain circumstances, be treated as a U.S. corporation for U.S. federal income tax purposes. The percentage (by vote and value) of Zip ordinary shares considered held for purposes of Section 7874 of the Code by former shareholders of an acquired U.S. corporation (e.g., Sezzle) immediately after the Proposed Transaction by reason of holding stock of an acquired U.S. corporation (e.g., Sezzle common stock) is referred to as the “Section 7874 percentage.” Under Section 7874 of the Code, if the Section 7874 percentage is 80% or more, and certain other circumstances exist, Zip will be treated as a U.S. corporation for U.S. federal income tax purposes. If Zip were to be treated as a U.S. corporation for U.S. federal income tax purposes, it would be subject to U.S. corporate income tax on its worldwide income, and the income of its non - U.S. subsidiaries would generally be subject to U.S. tax when deemed recognised under the U.S. tax rules for controlled foreign subsidiaries, including as a result of such subsidiaries having any investments in certain U.S. property such as stock or debt obligations of U.S. affiliates. In such case, Zip would be subject to substantially greater U.S. tax liability than currently contemplated. Additionally, any transactions undertaken by Zip or Sezzle to integrate their combined operations might give rise to U.S. taxable gain. Moreover, in such case, a non - U.S. shareholder of Zip would be subject to U.S. withholding tax on the gross amount of any dividends paid by Zip to such shareholder (subject to an exemption or reduced rate available under an applicable tax treaty). The determination of the Section 7874 percentage is subject to various adjustments under the Code and the U.S. Treasury Regulations promulgated thereunder. These U.S. Treasury Regulations, among other things, disregard, for purposes of determining the Section 7874 percentage, certain non - ordinary course distributions made by Zip during the 36 months preceding the Proposed Transaction, including ordinary course dividends and share repurchases. In addition, for purposes of Section 7874 of the Code, multiple acquisitions of U.S. corporations by a non - U.S. corporation, if treated as part of a plan or series of related transactions, may be treated as a single acquisition. If multiple acquisitions of U.S. corporations are treated as a single acquisition, all shareholders of the acquired U.S. corporations would be aggregated for purposes of determining the Section 7874 percentage. As a result, even if the Section 7874 percentage was less than 80% in the Proposed Transaction, the United States Internal Revenue Service (the IRS) may assert that the Proposed Transaction should be integrated with one or more of such transactions and treated as a single transaction. Each of Zip and Sezzle believes that the Proposed Transaction is a separate transaction from any such prior transactions and should not be integrated with one or more of such transactions. However, there can be no assurance that the IRS will agree with that position and, in the event that the IRS were to prevail with an assertion that the Proposed Transaction should be integrated with more than one such prior transaction, Zip could be treated as a U.S. corporation for U.S. federal tax purposes. Further, if the Section 7874 percentage were determined to be at least 60% (but less than 80%), and certain other circumstances exist, Section 7874 of the Code would cause Zip to be treated as a “surrogate foreign corporation,” which could erode some of the synergies expected from the Proposed Transaction during the 10 - year period following the closing of the Proposed Transaction. Zip could be prohibited from using its foreign tax credits, net operating losses or other attributes to offset the income or gain recognized by reason of the transfer of property to a foreign related person or any income received or accrued by reason of a license of any property by Zip to a foreign related person. Additionally, these rules may limit Zip’s ability to integrate certain non - U.S. operations or access cash earned by certain non - U.S. subsidiaries, in each case without incurring substantial U.S. tax liabilities. Based on the rules for determining share ownership under Section 7874 of the Code, the U.S. Treasury Regulations promulgated thereunder, and certain factual assumptions, after the Proposed Transaction, the Section 7874 percentage is expected to be less than 60%. Therefore, under current law, Zip is not expected to be treated as a U.S. corporation or as a surrogate foreign corporation for U.S. federal income tax purposes as a result of the Proposed Transaction. However, as noted above, determining the Section 7874 percentage is complex and is subject to factual and legal uncertainties. Thus, there can be no assurance that the IRS will agree with the position that Zip should not be treated as a U.S. corporation or a surrogate foreign corporation. Zip may terminate the merger agreement if it has not received an opinion from a nationally recognized tax advisor reasonably satisfactory to Zip as of the closing date concluding that Zip should not be treated as a surrogate foreign corporation for United States federal income tax purposes under Section 7874(a)(2)(B) of the Code or as a domestic corporation for United States federal income tax purposes by reason of Section 7874(b) of the Code as a result of the Proposed Transactions. Key risks (cont’d) 27 1. Proposed Transaction specific risks

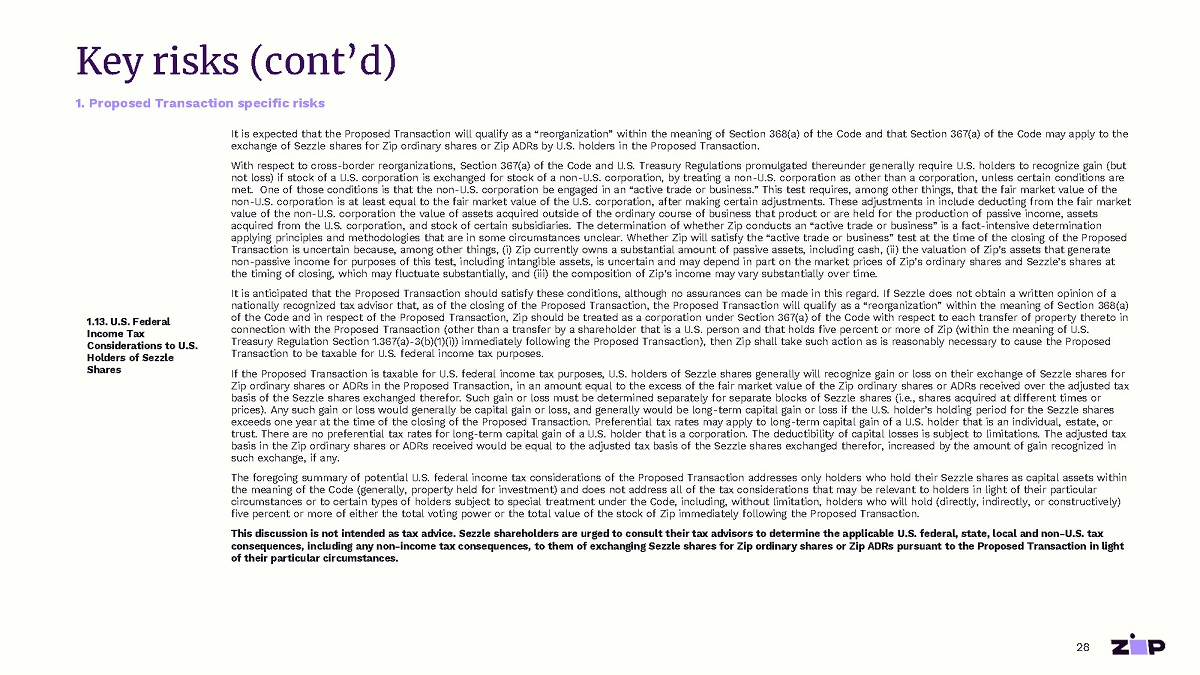

1.13. U.S. Federal Income Tax Considerations to U.S. Holders of Sezzle Shares It is expected that the Proposed Transaction will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and that Section 367(a) of the Code may apply to the exchange of Sezzle shares for Zip ordinary shares or Zip ADRs by U.S. holders in the Proposed Transaction. With respect to cross - border reorganizations, Section 367(a) of the Code and U.S. Treasury Regulations promulgated thereunder generally require U.S. holders to recognize gain (but not loss) if stock of a U.S. corporation is exchanged for stock of a non - U.S. corporation, by treating a non - U.S. corporation as other than a corporation, unless certain conditions are met. One of those conditions is that the non - U.S. corporation be engaged in an “active trade or business.” This test requires, among other things, that the fair market value of the non - U.S. corporation is at least equal to the fair market value of the U.S. corporation, after making certain adjustments. These adjustments in include deducting from the fair market value of the non - U.S. corporation the value of assets acquired outside of the ordinary course of business that product or are held for the production of passive income, assets acquired from the U.S. corporation, and stock of certain subsidiaries. The determination of whether Zip conducts an “active trade or business” is a fact - intensive determination applying principles and methodologies that are in some circumstances unclear. Whether Zip will satisfy the “active trade or business” test at the time of the closing of the Proposed Transaction is uncertain because, among other things, (i) Zip currently owns a substantial amount of passive assets, including cash, (ii) the valuation of Zip’s assets that generate non - passive income for purposes of this test, including intangible assets, is uncertain and may depend in part on the market prices of Zip’s ordinary shares and Sezzle’s shares at the timing of closing, which may fluctuate substantially, and (iii) the composition of Zip’s income may vary substantially over time. It is anticipated that the Proposed Transaction should satisfy these conditions, although no assurances can be made in this regard. If Sezzle does not obtain a written opinion of a nationally recognized tax advisor that, as of the closing of the Proposed Transaction, the Proposed Transaction will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and in respect of the Proposed Transaction, Zip should be treated as a corporation under Section 367(a) of the Code with respect to each transfer of property thereto in connection with the Proposed Transaction (other than a transfer by a shareholder that is a U.S. person and that holds five percent or more of Zip (within the meaning of U.S. Treasury Regulation Section 1.367(a) - 3(b)(1)(i)) immediately following the Proposed Transaction), then Zip shall take such action as is reasonably necessary to cause the Proposed Transaction to be taxable for U.S. federal income tax purposes. If the Proposed Transaction is taxable for U.S. federal income tax purposes, U.S. holders of Sezzle shares generally will recognize gain or loss on their exchange of Sezzle shares for Zip ordinary shares or ADRs in the Proposed Transaction, in an amount equal to the excess of the fair market value of the Zip ordinary shares or ADRs received over the adjusted tax basis of the Sezzle shares exchanged therefor. Such gain or loss must be determined separately for separate blocks of Sezzle shares (i.e., shares acquired at different times or prices). Any such gain or loss would generally be capital gain or loss, and generally would be long - term capital gain or loss if the U.S. holder’s holding period for the Sezzle shares exceeds one year at the time of the closing of the Proposed Transaction. Preferential tax rates may apply to long - term capital gain of a U.S. holder that is an individual, estate, or trust. There are no preferential tax rates for long - term capital gain of a U.S. holder that is a corporation. The deductibility of capital losses is subject to limitations. The adjusted tax basis in the Zip ordinary shares or ADRs received would be equal to the adjusted tax basis of the Sezzle shares exchanged therefor, increased by the amount of gain recognized in such exchange, if any. The foregoing summary of potential U.S. federal income tax considerations of the Proposed Transaction addresses only holders who hold their Sezzle shares as capital assets within the meaning of the Code (generally, property held for investment) and does not address all of the tax considerations that may be relevant to holders in light of their particular circumstances or to certain types of holders subject to special treatment under the Code, including, without limitation, holders who will hold (directly, indirectly, or constructively) five percent or more of either the total voting power or the total value of the stock of Zip immediately following the Proposed Transaction. This discussion is not intended as tax advice. Sezzle shareholders are urged to consult their tax advisors to determine the applicable U.S. federal, state, local and non - U.S. tax consequences, including any non - income tax consequences, to them of exchanging Sezzle shares for Zip ordinary shares or Zip ADRs pursuant to the Proposed Transaction in light of their particular circumstances. Key risks (cont’d) 28 1. Proposed Transaction specific risks

2.1. Legal and regulatory Post completion of the Proposed Transaction, Zip will operate in a number of new jurisdictions including India and Germany, in addition to its existing jurisdictions, each with differing legal and regulatory requirements. Zip will be subject to additional legal, regulatory, tax, licensing, and compliance requirements in respect of such new jurisdictions that may be materially different from the requirements in the jurisdictions in which Zip now operates, and a failure to comply with such local compliance obligations could result in a regulator commencing an investigation of Zip or taking enforceable actions, commencing proceedings, and/or seeking fines, undertakings, penalties, or licence revocation. After completion of the Proposed Transaction, the legal, regulatory, tax, licensing, and compliance requirements in new jurisdictions may impose stricter or more onerous requirements than those which Zip is currently familiar with and implementing them may disrupt its business or cause it to incur significantly more costs to comply with such laws. Zip will also have significantly increased presence and footprint in a number of jurisdictions in which it currently operates, including the United States and Canada. Zip will be subject to the relevant legal, regulatory, tax, licensing, and compliance requirements in respect of such jurisdictions, and a failure to comply with such local compliance obligations could result in a regulator investigating Zip or taking enforceable actions, commencing proceedings, and/or seeking fines, undertakings, penalties, or licence revocation. Additionally, there has been an increased supervisory, regulatory and enforcement focus on compliance with anti - money laundering and counter - terrorism financing laws ( AML/CTF laws ). Ineffective implementation, monitoring or remediation of the Combined Business’s policies, systems and controls in place designed to manage its obligations under AML/CTF laws could give rise to future compliance issues. Any such issues could lead to regulatory investigations, reviews, enforcement action, as well as potential litigation by third parties and adverse media coverage. Regulators across the globe have been showing a growing interest in the BNPL industry and there has been increased scrutiny of industry participants’ compliance with regulatory requirements. Consequently, there is a risk that new or modified laws or regulations or regulatory guidance will be introduced which may impose significant compliance costs, or even make it uneconomic for the Combined Business to continue to operate in its current markets. Any regulatory changes may adversely affect the Combined Business’s business and operations by negatively impacting its operations, financial performance and/or financial position. Additionally, the imposition of new compliance obligations that the Combined Business fails to comply with may result in administrative or enforcement action. In addition, existing laws or regulations may be subject to differing or new interpretations by regulators and others over time. Furthermore, changes in the various regulatory regimes in the future, including without limitation any potential requirement for BNPL entities to provide retrospective compensation for customers such as those being considered under investigations of the Consumer Financial Protection Bureau in the United States and Financial Conduct Authority in the United Kingdom, may also impact the Combined Business’s ability to effectively manage growth, sustain their current growth rate and maintain their market share as a Combined Business. Other legal or regulatory risks include changes in privacy, consumer or credit laws . Such risks could increase compliance costs and affect Zip’s reputation in the market . Zip may also be subject to disputes, claims or litigation including in relation to either Zip or Sezzle’s intellectual property, contractual and employment disputes, and Sezzle’s ability to achieve its public benefit purpose and maintain its B Corporation certification . 2.2 Competition With increasing awareness and consumer acceptance of BNPL products, a number of new entrants are joining the established players in the BNPL sector. Established players from offshore may also enter the market, who may attempt to take market share through discounting merchant service fees or financially incentivising local retailers. The significant numbers of existing players and new entrants into the BNPL sector, including and not limited to large financial institutions and other technology players such as including Shopify, PayPal, Block and Apple (among many others), may have a significant impact on the competitiveness of the Combined Business and may adversely impact the ability of the Combined Business to achieve growth and maintain its margins. With increased competition in the BNPL industry there is a risk that the Combined Business’s technology may be superseded by other technology or changes in business practices or that current or future competitors can develop technologies that would allow them to offer products at a cost or quality that gives them a significant advantage over the Combined Business’s products. Additionally, current and future competitors may have greater scale and resources, including access to capital, than the Combined Business. While the Combined Business may not be successful in offering services and systems that remain current with the continuing changes in technology, evolving industry standards and changing customer preference, whether in a timely manner or not, or expenses may be greater than expected. This may materially and adversely impact the Combined Business’s operations, financial performance and/or financial position. Key risks (cont’d) 29 2. Zip risks, including post completion

2.3. Loss of key contracts and relationships The continued success of the Combined Business relies on each of Sezzle and Zip retaining their key contracts including their third party merchant partners. There is no guarantee that the key contracts and partnerships will continue after the Proposed Transaction and if they do continue, that they will be successful. For example, there is a risk that specific merchants may seek to terminate their agreements with Sezzle as a result of a change of control or for convenience following completion of the Proposed Transaction. There is also a risk Sezzle and Zip will be unable to increase their merchant network, base of consumers and underlying merchant sales following completion of the Proposed Transaction. Any loss of key merchants or contracts as a result of the Proposed Transaction may result in a material adverse impact to the operations, financial performance and/or financial position of the Combined Business. 2.4. Additional requirements for capital and funding and existing funding facilities Access to capital and funding is a fundamental requirement for the success of Zip’s business. The Proposed Transaction may result in unforeseen requirements for additional capital to maintain the business of the Combined Business, including as required to achieve the targeted synergies. The Combined Business may not be able to secure financing on favourable terms, or at all, to meet its future capital needs, and therefore additional capital raisings that could dilute the capital of Zip or additional debt facilities may be required. Any existing and future debt financing may contain covenants that impact the operation of the Combined Business’s business and pursuit of business opportunities. Zip’s ability to conduct a capital raising in the future will depend on the market conditions at the time and any further volatility in the share market or a significant fall in the price of Zip’s shares and Zip’s ADRs increase the risk that Zip may not be able to raise sufficient capital (or at all). Zip and Sezzle each have various financing arrangements in place in Australia and overseas, including various warehouse facilities to support the funding of purchases by customers. The terms of these facilities and future instruments governing the Combined Business debt may contain covenants which impose significant operating and financial restrictions on the Combined Business. Such covenants could limit the Combined Business’s ability to finance its future operations and capital needs and the Combined Business’s ability to pursue business opportunities and activities that may be in its interest. Additionally, if repayments are not made under these warehouse facilities, or certain terms and conditions are not satisfied, it could result in an event of default or other adverse change under these facilities and Zip’s and Sezzle’s lenders may be entitled to various rights and remedies adverse to Zip and Sezzle, including increased interests payments, the right to impose restrictions on Zip and Sezzle’s ability to use the respective facility and/or to terminate their respective funding arrangements. Zip and/or Sezzle may breach the conditions of their financing arrangements either before on or after completion of the Proposed Transaction, which would require Zip and/or Sezzle to seek waivers from the relevant obligations. In these circumstances, Zip and/or Sezzle’s capacity to pay their merchants and other creditors may be diminished if they or the Combined Business is unable to obtain such waiver or secure additional funding on the same or other acceptable terms. If the Proposed Transaction completes, Zip will be exposed to Sezzle’s existing financing facilities with third party banks and may not be able to receive relevant waivers required under these facilities, which could result in an event of default (or other adverse change under these facilities) and have a material adverse effect on Zip. Additionally, there is no guarantee that the existing merchant funding facilities will remain viable in the future and there is a risk that Zip will be unable to exit or obtain future asset funding facilities after integration with the Sezzle business. This could result in damage to the Combined Business’s brand, growth, and ability to fund its business. Additionally, there are a variety of funding risks inherent in Zip’s and Sezzle’s financing sources which are particularly heightened in the current economic environment. A dispute, or a breakdown in the relationship, between Zip and/or Sezzle and their respective financiers, a failure to reach a suitable arrangement with a particular financier, or the failure of a financier to pay or otherwise satisfy its contractual obligations (including as a result of insolvency, financial stress or the impacts of COVID - 19), could have an adverse effect on the reputation and/or the financial performance of Zip, Sezzle and the Combined Business. The loss of financing or an adverse impact on Zip’s or Sezzle’s financing as a consequence of the Combined Business or other external factors could have a material impact on Zip’s business, operating and financial performance. For the avoidance of doubt, Zip may be exposed to the above risks before completion of the Proposed Transaction and irrespective of completion of the Proposed Transaction. 2.5. Loss of key management personnel The success and performance of the Combined Business relies on the effectiveness, talent and experience of key management personnel. The proposed management team that will remain after the Proposed Transaction are highly experienced and have significant knowledge, talent and experience in executing growth strategies in the BNPL industry. The loss of any key personnel including senior management such as the founders and early stage employees across Zip or Sezzle, could cause disruption to the conduct of the Combined Business’s business in the short term and may have a material adverse impact on the Combined Business’s operations, financial performance and/or financial position. It may be difficult to replace key personnel, or to do so in a timely manner or at comparable expense. Key risks (cont’d) 30 2. Zip risks, including post completion