Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 1 29 October 2021 ASX RELEASE Company Announcements Platform Third Quarter 2021 Market Update Sezzle Inc. (ASX:SZL) (Sezzle or Company) // Installment payment platform, Sezzle, is pleased to provide the market an update on key financial trends for the third quarter ended 30 September 2021 (3Q21). • Underlying Merchant Sales (UMS) for 3Q rose 101.9% YoY to US$460.7M (A$633.5M1, +12.0% QoQ). • 3Q21 Total Income grew 78.9% YoY to US$28.5M. • Merchant connectivity in the quarter was strong as evidenced by: o Active2 Merchants increasing 112.5% YoY to 44,400 (+10.2% QoQ); o BigCommerce designating Sezzle as its preferred BNPL partner; o Sezzle achieving G2’s highest-rated placement in the G2 Grid® Report in the Installment Payments category; and o the Company launching Sezzle Capital for merchants through its partnership with Wayflyer. • Consumer adoption of Sezzle’s product offering continued to take positive strides: o Active2 Consumers reached 3.2 million at quarter end (+77.9% YoY, +10.7% QoQ). o The top 10% of Sezzle users (as measured by UMS) remained highly engaged, transacting 49x on average over the trailing twelve-month period ended 30 September 2021. o Repeat usage continued to improve, as it increased for the 33rd consecutive month to 92.3%. o In-store represented more than 5.0% of UMS in the quarter, reflecting the long-term Omnichannel opportunity. 1 A$ to US$ exchange rate of $0.7271 as of 30 September 2021. 2 Active defined as having transacted in the last twelve months.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 2 • The Company significantly lowered its provision for uncollectible accounts receivable, as it declined over 100bps in 3Q21 to 2.3% of UMS from 3.4% of UMS in 2Q21. • After quarter end, Sezzle reached an agreement with Alliance Data Systems Corporation. Similar to the Company’s arrangement with Ally Bank, Alliance Data’s Bread will offer long-term loans through Sezzle’s merchant network. “’We are excited to report 3Q21 results that reflect new highs, while concurrently making substantial progress in our receivable loss rates,” stated Sezzle’s Executive Chairman and CEO Charlie Youakim. “We are also enthusiastic about the recent agreement with Alliance Data’s Bread, which brings another well-known partner to our long-term lending product.” Key Accomplishments During the Quarter: • Underlying Merchant Sales (UMS) and Total Income. UMS continued to set new records, as the Company reached US$460.7 million UMS during the quarter. Total income increased 78.9% YoY to US$28.5 million for 3Q21 and as a percentage of UMS decreased 56ps compared to 2Q21, as large enterprise merchants became a larger percentage of the Company’s transactions. In addition to Target, significant wins for the first 9 months of 2021 include Lamps Plus, Barstool Sports, The Hut Group, Wakefern Food, BELLAMI Hair, California Pet Pharmacy, Market America, TSC Apparel, and Rogers Sporting Goods. “We have always been able to attract SMB clients, but we are really pleased with the momentum in our large enterprise efforts,” said Veronica Katz, Chief Revenue Officer. “At the end of 3Q20, we didn’t have any IR200 merchants that were using our core Sezzle product. Now we have five that are live, and we are encouraged by our pipeline of discussions.” Sezzle is excited for the upcoming holiday season and the increase in consumer and merchant engagement it brings. The Company will promote several campaigns in 4Q21, that will help consumers shop the best deals, drive traffic and consumer engagement for our merchant partners, and give back to those in need.

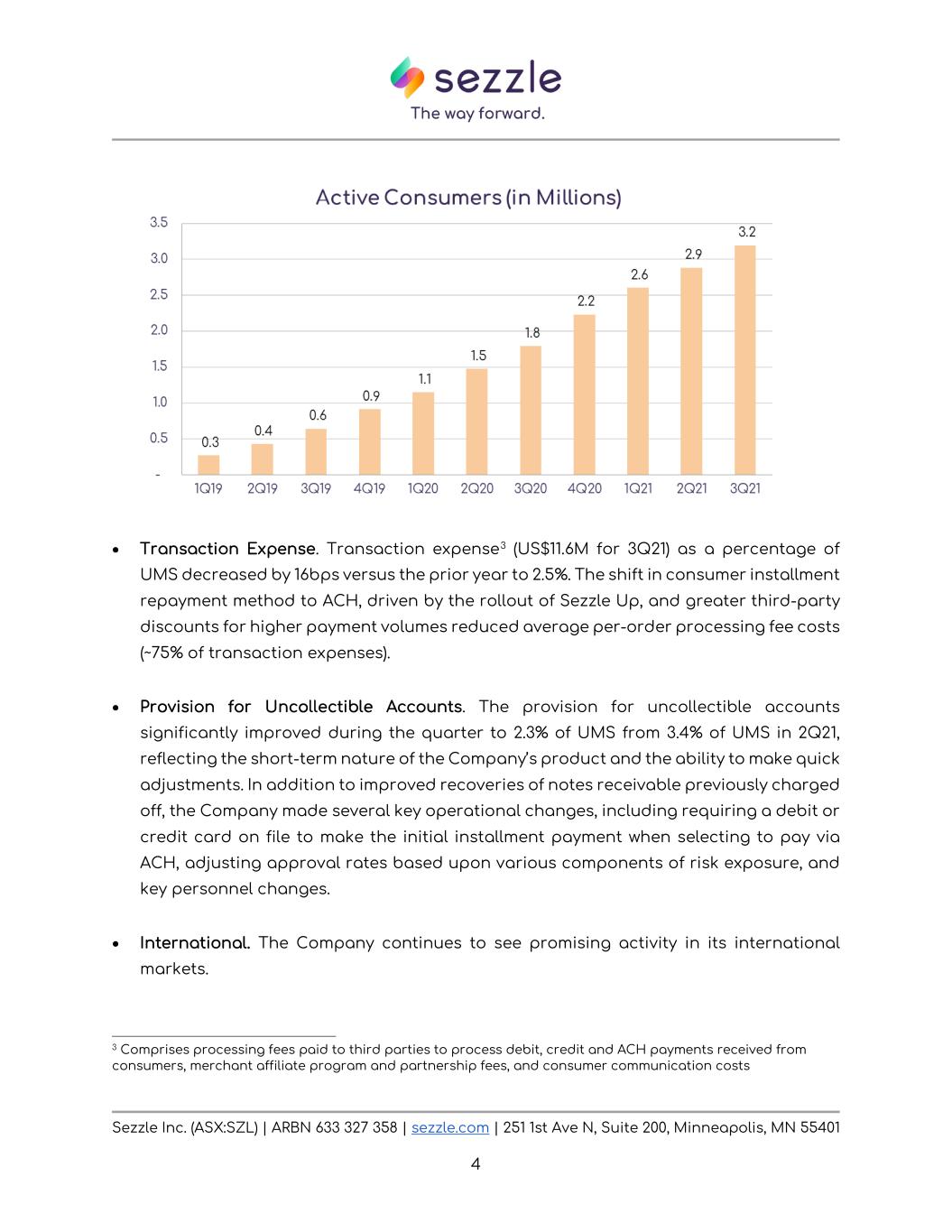

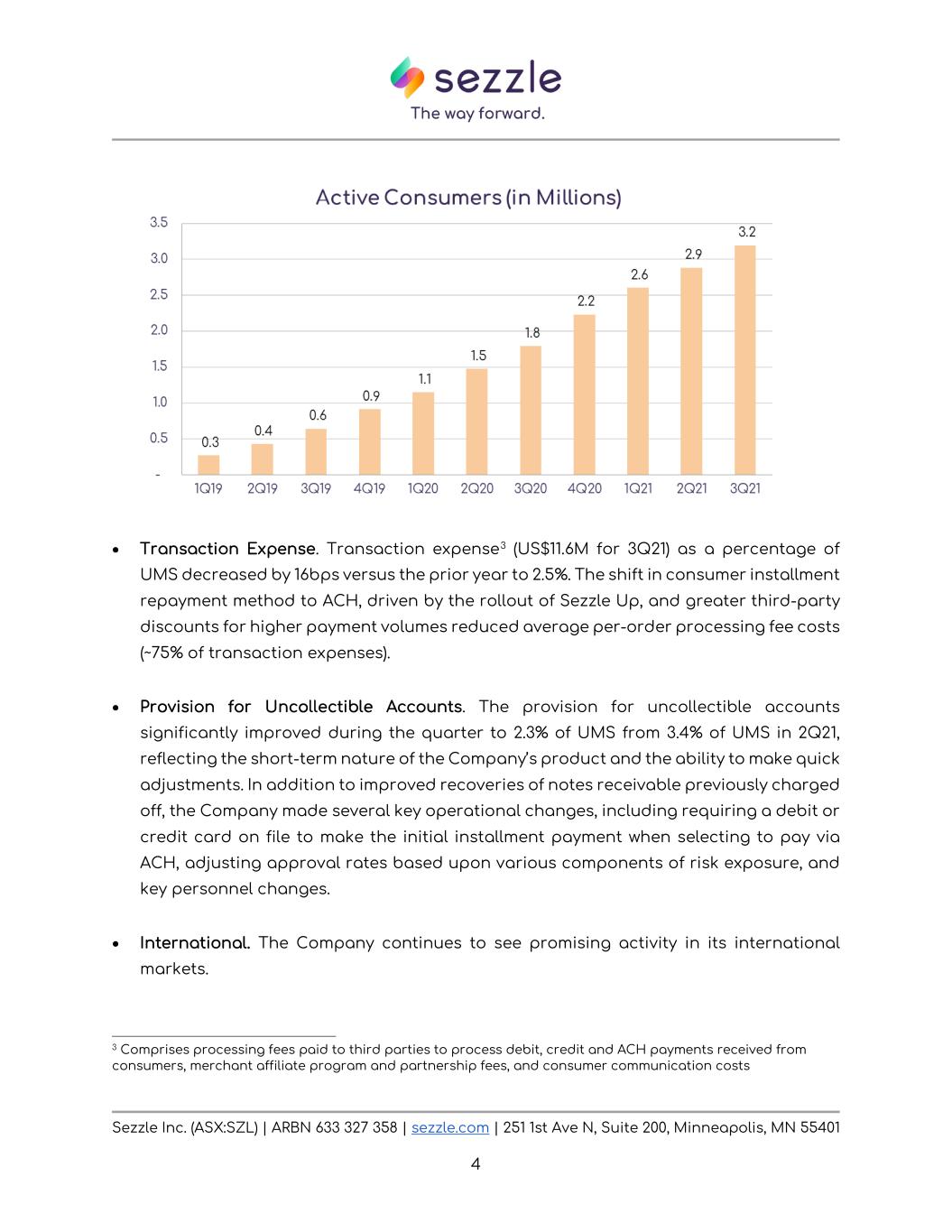

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 3 • Merchant Connectivity. o Active Merchants. Active Merchants increased 112.5% YoY in 3Q21 (over 4,100 additions in the quarter), resulting in over 44,000 merchants on the Sezzle platform. o BigCommerce Partnership. In August, Sezzle announced it was designated as BigCommerce’s preferred Buy Now, Pay Later partner. “There are a number of BNPL providers in the market right now, but Sezzle’s commitment to giving consumers a responsible way to slowly build credit without taking on large amounts of debt was a key differentiator in deciding to make them a preferred BNPL partner,” stated Mark Rosales, vice president of Payments at BigCommerce. o G2 Recognition. Sezzle was recognized as the number one installment payment solution by G2, a leading business solutions review platform for merchants and businesses to compare, rate, and select software and services. The award is based on high levels of customer satisfaction and recommendation ratings from verified Sezzle merchants. More specifically, Sezzle achieved the highest-rated placement in the G2 Grid® Report in the Installment Payments category. o Sezzle Capital. On 20 July 2021, the Company announced the launch of its Sezzle Capital program via a partnership with Wayflyer, a leading revenue-based financing and growth platform. The program enables same day funding of working capital for up to US$10 million for qualified merchants. Qualified Sezzle Capital merchants can apply in minutes, get loan offers in hours, and receive funds in days; without any credit risk or additional capital requirements to Sezzle. • Active Consumers. Active Consumers rose 77.9% YoY and improved 10.7% QoQ, as Active Consumers reached 3.2 million. In addition, the continued increase in consumer engagement drove Active Consumer repeat usage to 92.3%. Sezzle’s Active Consumer base remains a key growth driver for both the Company and its partners.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 4 • Transaction Expense. Transaction expense3 (US$11.6M for 3Q21) as a percentage of UMS decreased by 16bps versus the prior year to 2.5%. The shift in consumer installment repayment method to ACH, driven by the rollout of Sezzle Up, and greater third-party discounts for higher payment volumes reduced average per-order processing fee costs (~75% of transaction expenses). • Provision for Uncollectible Accounts. The provision for uncollectible accounts significantly improved during the quarter to 2.3% of UMS from 3.4% of UMS in 2Q21, reflecting the short-term nature of the Company’s product and the ability to make quick adjustments. In addition to improved recoveries of notes receivable previously charged off, the Company made several key operational changes, including requiring a debit or credit card on file to make the initial installment payment when selecting to pay via ACH, adjusting approval rates based upon various components of risk exposure, and key personnel changes. • International. The Company continues to see promising activity in its international markets. 3 Comprises processing fees paid to third parties to process debit, credit and ACH payments received from consumers, merchant affiliate program and partnership fees, and consumer communication costs

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 5 o Canada. Sezzle Canada reached a key milestone of 3,000 Active Merchants in the region’s second year of operations, representing a 220.3% YoY increase. Recent key additions included retailers Bentley, Fairweather, JD Sports, and Umbra. UMS is now at a run-rate pace in excess of US$100.0 million annually. Consumer adoption also remains strong in the region, reaching nearly 190,000 Active Consumers (232.2% YoY increase). The achievements exhibit Sezzle’s rapid adoption in the early stages of buy now, pay later in the Canadian market. o Europe. Sezzle Europe is in the very early stages, as it launched at the end of 2020, and therefore KPIs (e.g., UMS, Active Consumers, Active Merchants) are currently immaterial to the overall Company. Sezzle Europe has positively positioned Sezzle with larger enterprises and cross-border opportunities between North America and Europe. For example, in 3Q21 the Company signed The Hut Group, a vertically integrated, digital-first consumer brands group consisting of over 1,000 owned and third-party brands. o India. Similar to Sezzle Europe, Sezzle India’s KPIs are still immaterial to the overall Company; however, the growth rates point to a favorable acceptance of Sezzle’s product offering. Active Merchants are up 37% QoQ, Active Consumers rose 56% QoQ, and UMS increased 38% QoQ. Recent Events Strategic Partnership with Alliance Data Systems (Bread). After quarter end on 26 October 2021, Sezzle announced a strategic partnership with Alliance Data Systems Corporation (NYSE: ADS), a global provider of data-driven marketing, loyalty, and payment solutions. Specifically, Alliance Data’s Bread business will offer its pay-over-time installment loan through Sezzle’s merchant network. Through an integrated partnership, Sezzle will leverage Bread’s three to 48-month product, with interest rates as low as 0% for qualifying customers, allowing Sezzle to reach more consumers buying big-ticket items. Similar to Sezzle’s current long-term product offering through Ally Bank (NYSE: ALLY), Bread will originate and maintain the loans on its books. The companies expect to have Bread available for Sezzle merchants in early 2022.

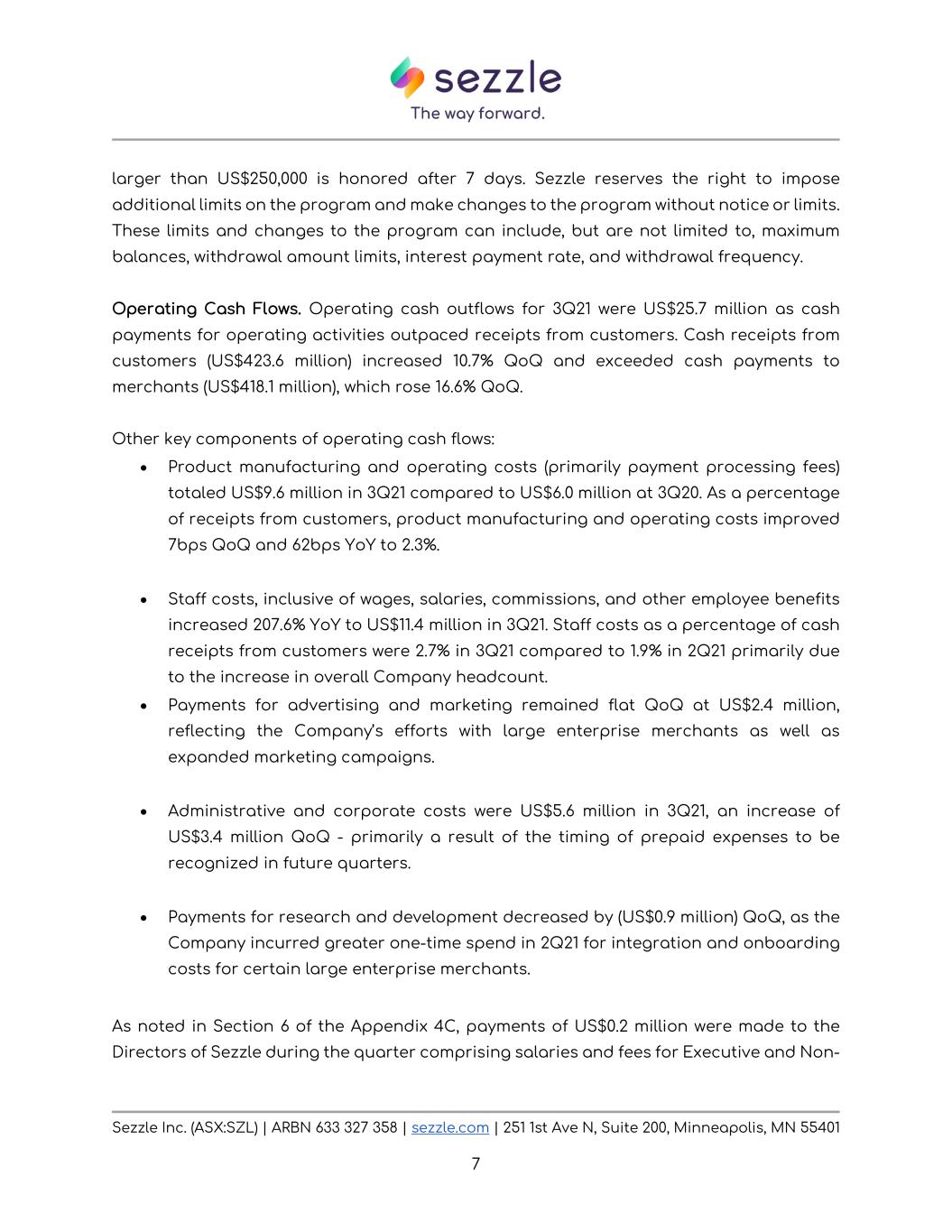

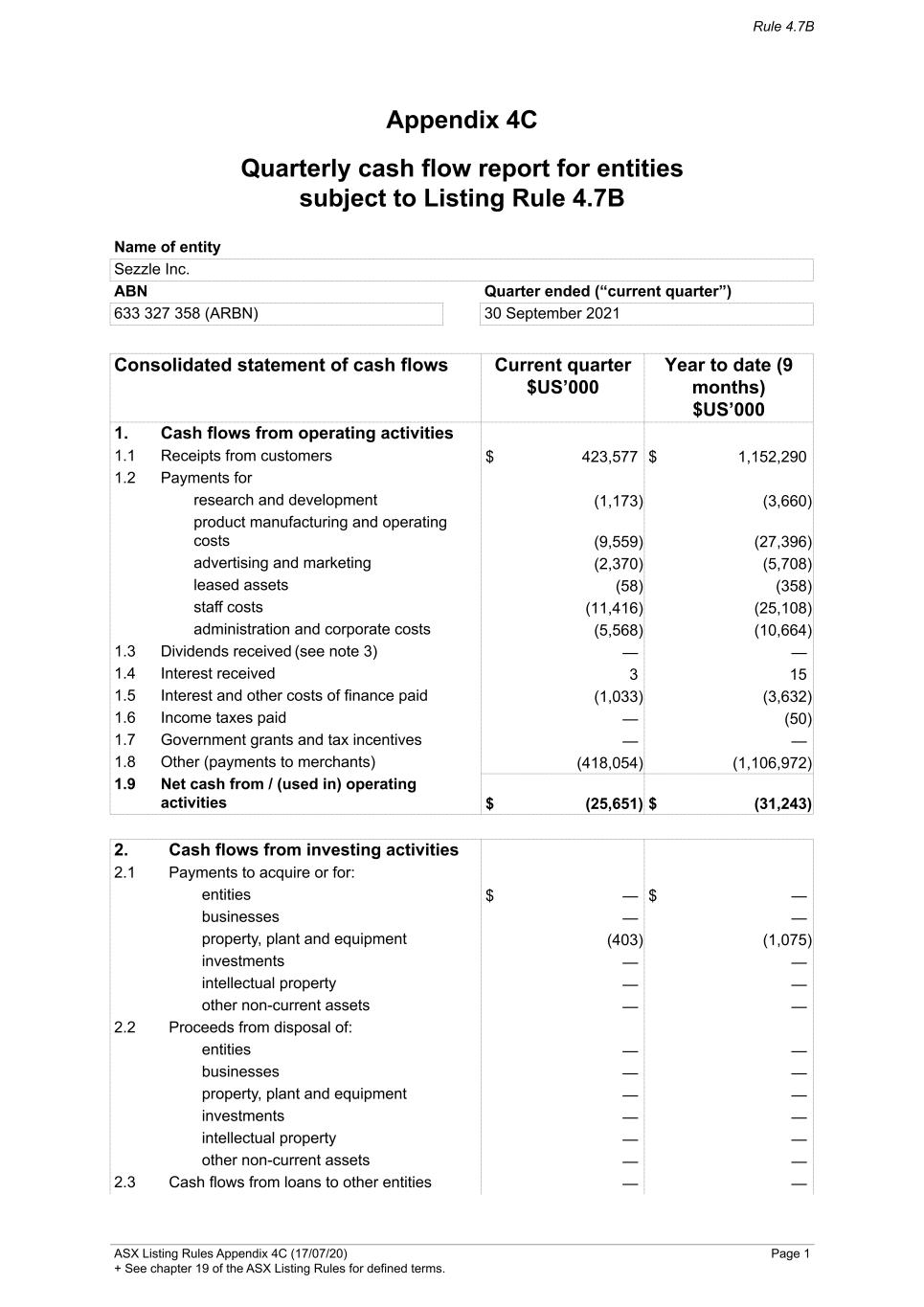

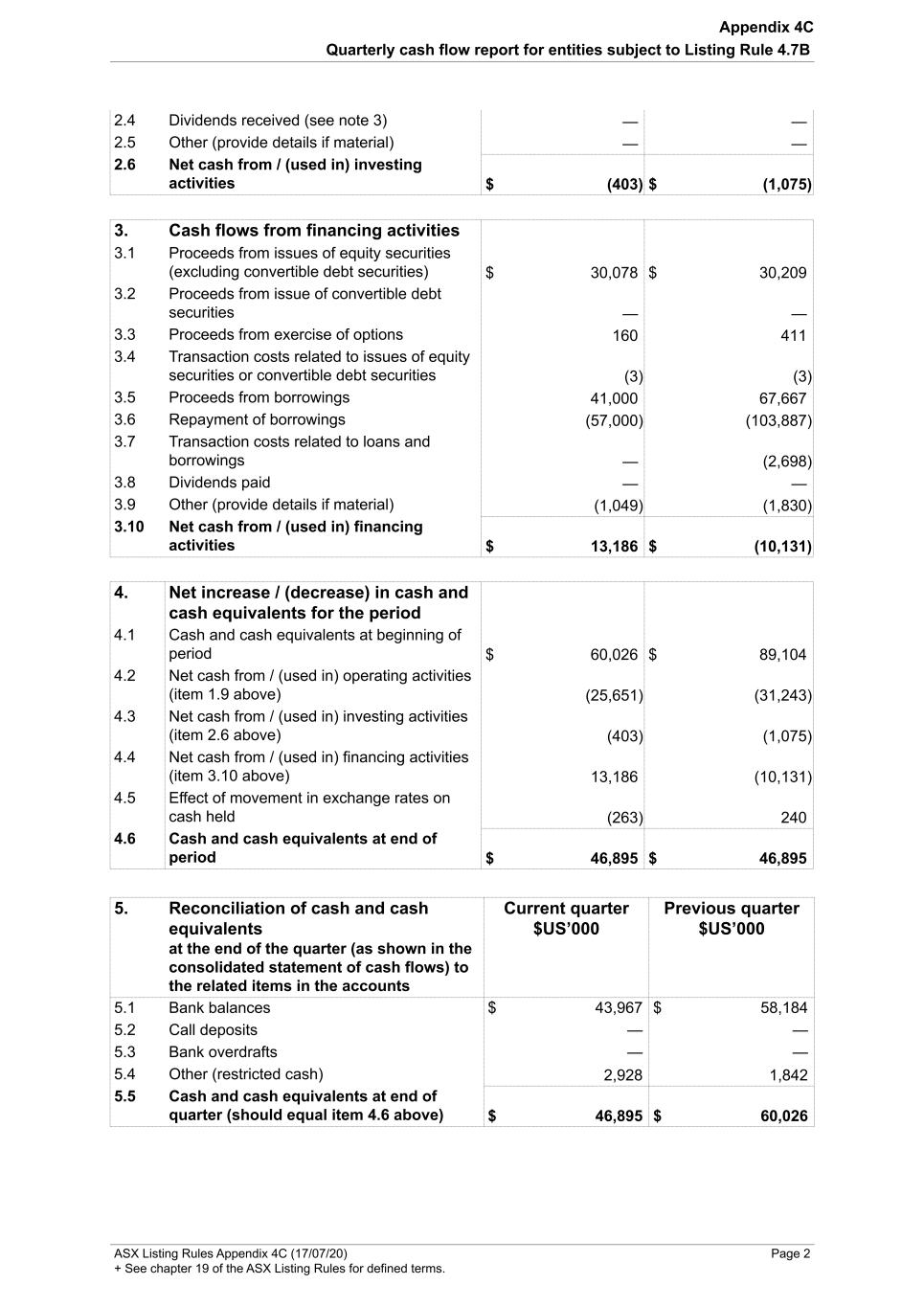

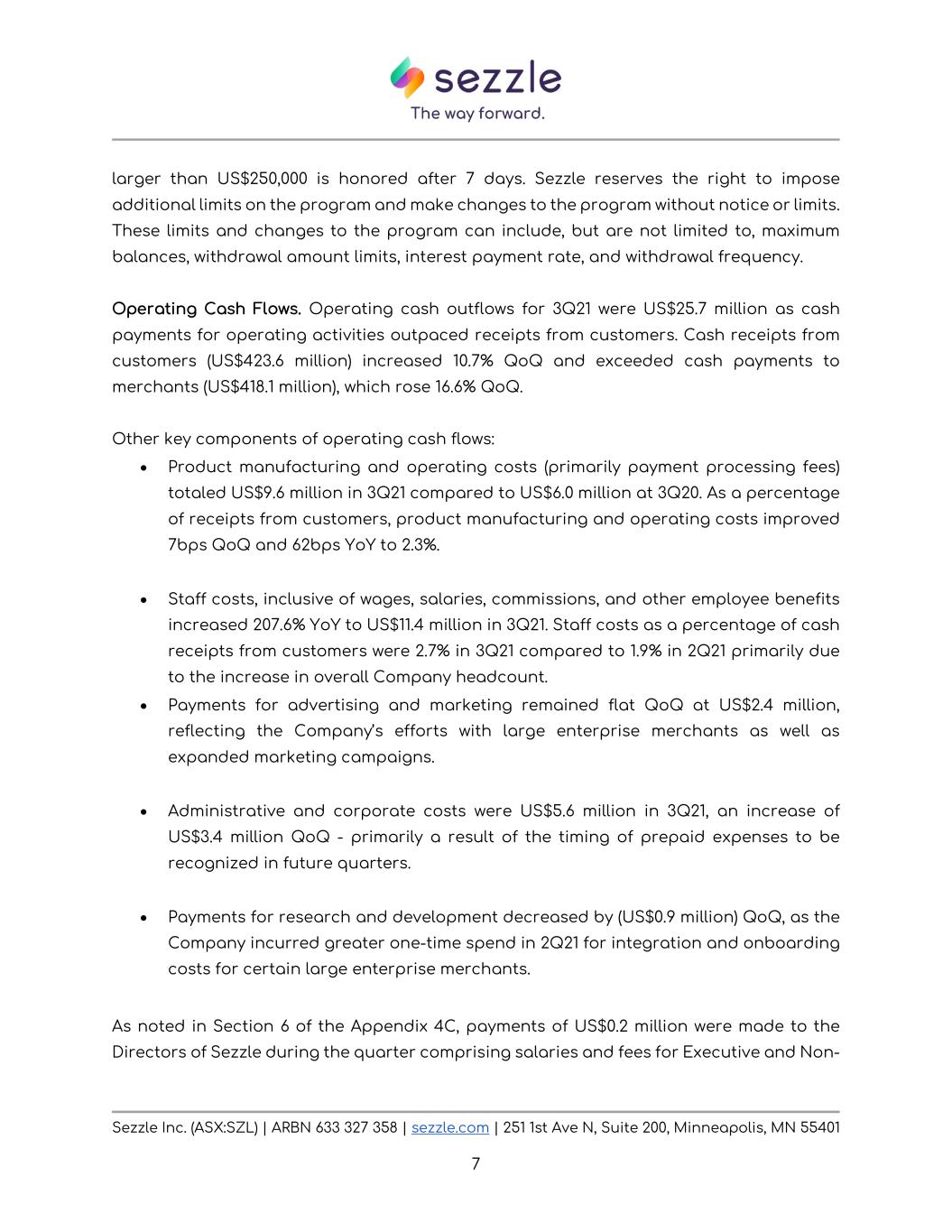

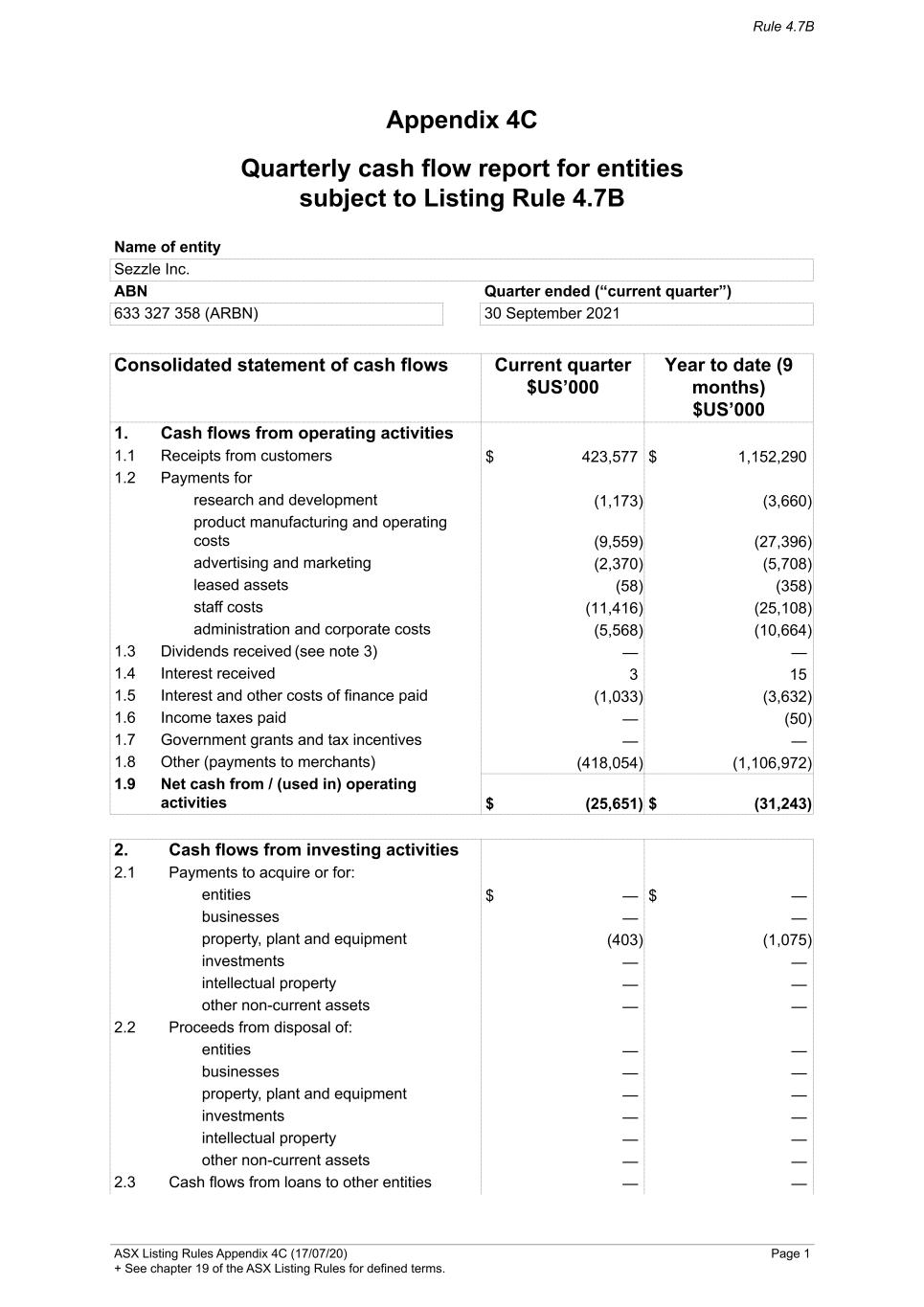

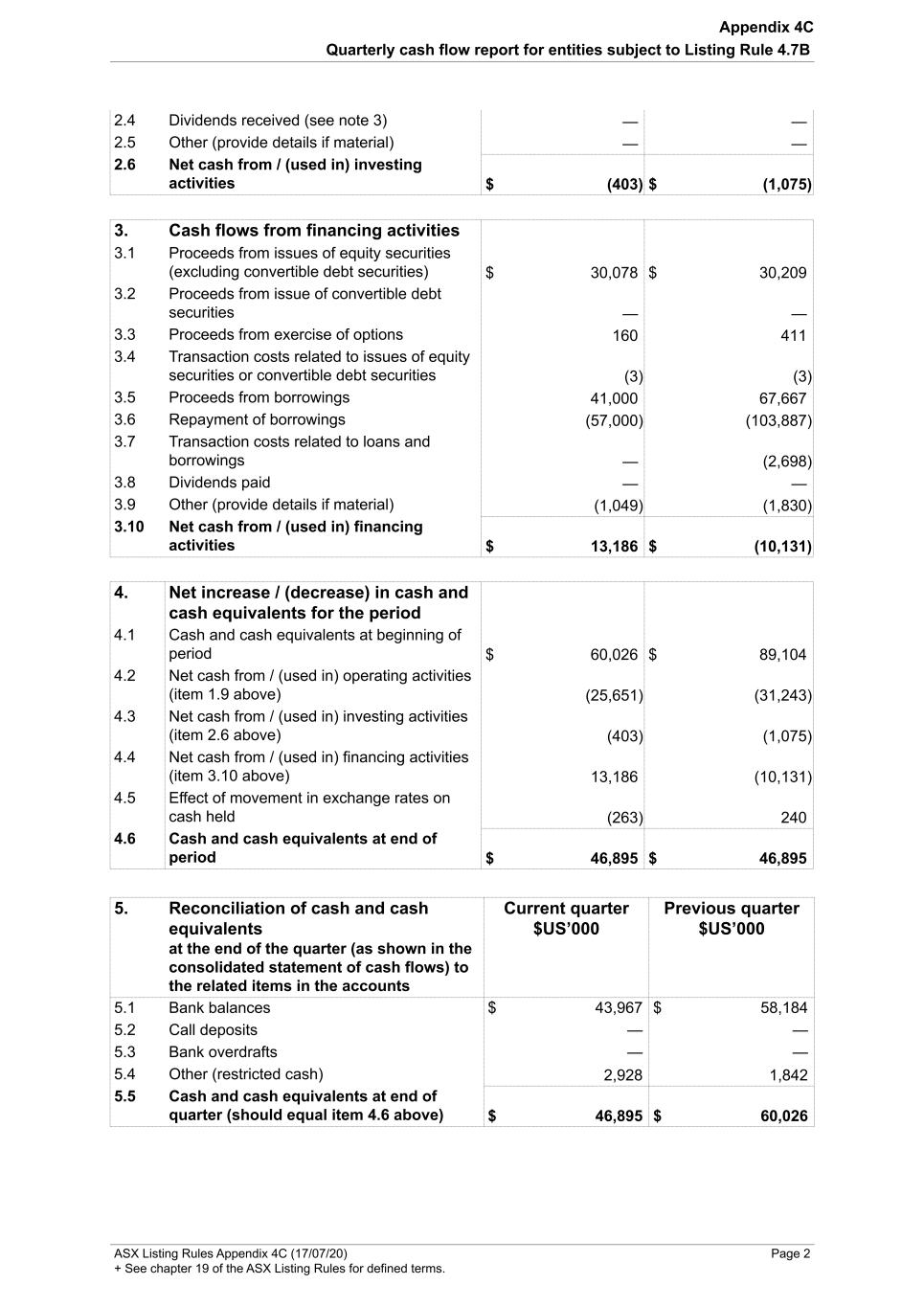

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 6 Quarterly Cash Flows As of 30 September 2021, the Company had total cash on hand of US$46.9 million, consisting of US$44.0 million of cash and cash equivalents and US$2.9 million of restricted cash. Total cash on hand declined by US$13.1 million during the third quarter, driven by uses in operating and investing activities of US$26.1 million, offset by net cash inflows from financing activities of US$13.2 million. The QoQ increase in uses of cash for operating activities was primarily driven by the timing of payment receipts from customers compared to payments issued to merchants. Additionally, the mix of merchants also effects the timing of payments and receipts. For example, large enterprise merchants tend not to participate in the Company’s merchant interest program. Led by a US$30.0 million investment from Discover during the quarter, financing activities were a US$13.2 million source of cash. The investment from Discover was partially offset by a US$16.0 million net pay down on the line of credit, leaving US$5.0 million drawn on the facility as of 30 September 2021. At quarter end, the Company had US$87.8 million of availability under its US$250.0 million facility, an increase of US$31.0 million compared to the amount available as of 30 June 2021. Merchant accounts payable were US$90.7 million as of 30 September 2021. Of this amount, US$78.6 million was included within the merchant interest program. Interest expense associated with the program for the quarter ended 30 September 2021 totaled US$0.6 million. Deferred payments in the merchant interest program are due on demand, up to US$250,000 during any seven-day period, at the request of the merchant. Any request Select Balance Sheet Data Unaudited Unaudited US$000's 30-Jun-2021 30-Sep-2021 Cash and cash equivalents $58,184 $43,967 Restricted cash $1,842 $2,928 Total cash $60,027 $46,895 Drawn on line of credit $21,000 $5,000 Availability on line of credit $56,763 $87,770

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 7 larger than US$250,000 is honored after 7 days. Sezzle reserves the right to impose additional limits on the program and make changes to the program without notice or limits. These limits and changes to the program can include, but are not limited to, maximum balances, withdrawal amount limits, interest payment rate, and withdrawal frequency. Operating Cash Flows. Operating cash outflows for 3Q21 were US$25.7 million as cash payments for operating activities outpaced receipts from customers. Cash receipts from customers (US$423.6 million) increased 10.7% QoQ and exceeded cash payments to merchants (US$418.1 million), which rose 16.6% QoQ. Other key components of operating cash flows: • Product manufacturing and operating costs (primarily payment processing fees) totaled US$9.6 million in 3Q21 compared to US$6.0 million at 3Q20. As a percentage of receipts from customers, product manufacturing and operating costs improved 7bps QoQ and 62bps YoY to 2.3%. • Staff costs, inclusive of wages, salaries, commissions, and other employee benefits increased 207.6% YoY to US$11.4 million in 3Q21. Staff costs as a percentage of cash receipts from customers were 2.7% in 3Q21 compared to 1.9% in 2Q21 primarily due to the increase in overall Company headcount. • Payments for advertising and marketing remained flat QoQ at US$2.4 million, reflecting the Company’s efforts with large enterprise merchants as well as expanded marketing campaigns. • Administrative and corporate costs were US$5.6 million in 3Q21, an increase of US$3.4 million QoQ - primarily a result of the timing of prepaid expenses to be recognized in future quarters. • Payments for research and development decreased by (US$0.9 million) QoQ, as the Company incurred greater one-time spend in 2Q21 for integration and onboarding costs for certain large enterprise merchants. As noted in Section 6 of the Appendix 4C, payments of US$0.2 million were made to the Directors of Sezzle during the quarter comprising salaries and fees for Executive and Non-

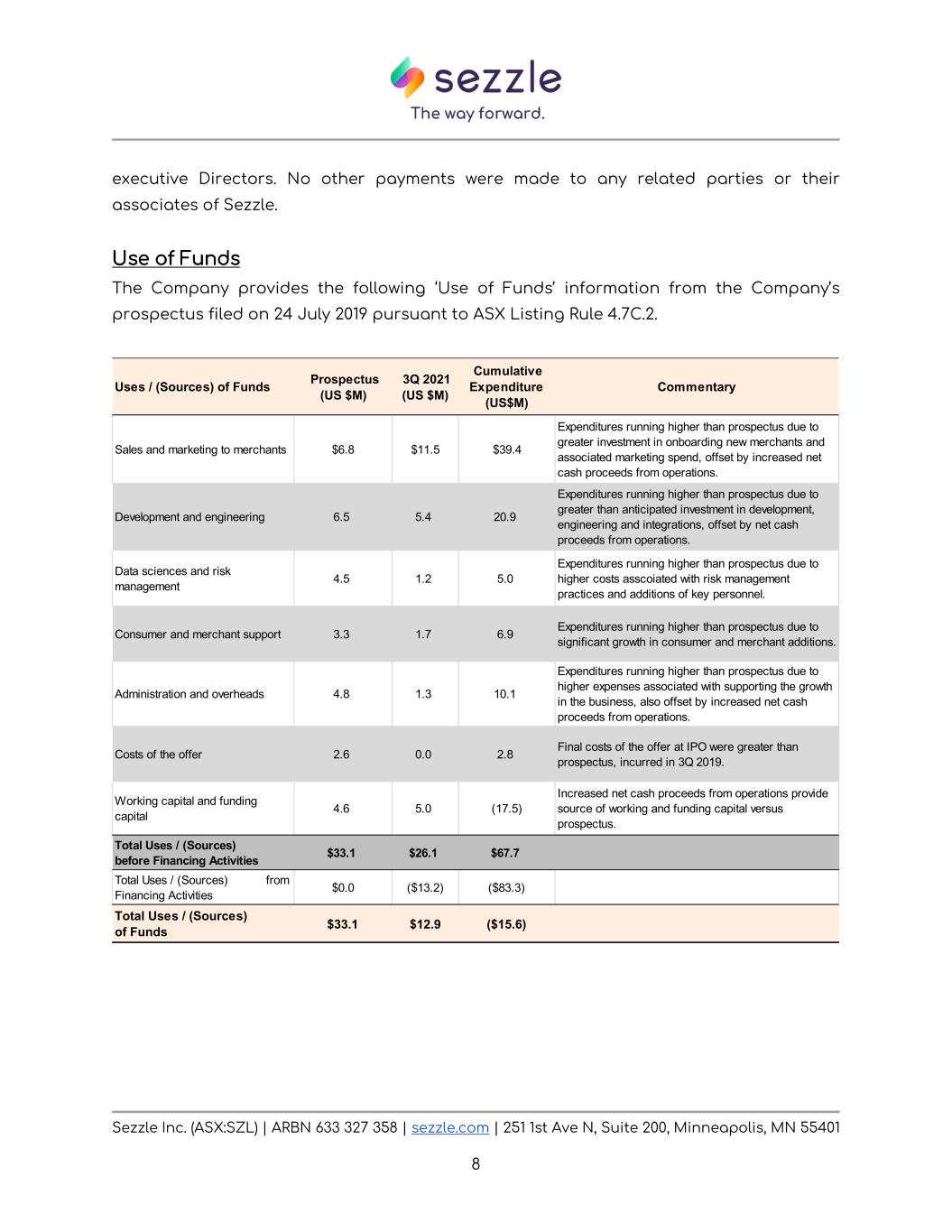

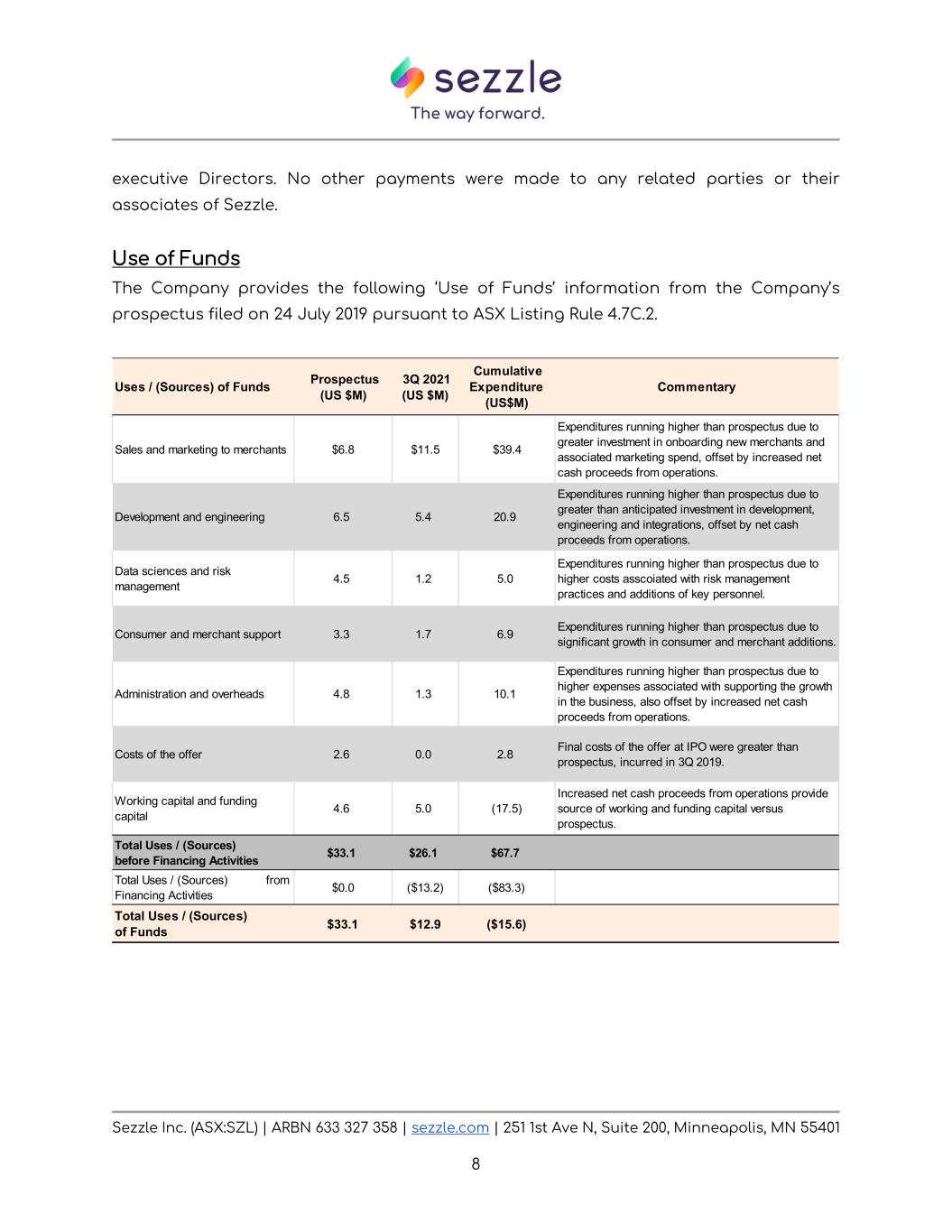

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 8 executive Directors. No other payments were made to any related parties or their associates of Sezzle. Use of Funds The Company provides the following ‘Use of Funds’ information from the Company’s prospectus filed on 24 July 2019 pursuant to ASX Listing Rule 4.7C.2. Uses / (Sources) of Funds Prospectus (US $M) 3Q 2021 (US $M) Cumulative Expenditure (US$M) Commentary Sales and marketing to merchants $6.8 $11.5 $39.4 Expenditures running higher than prospectus due to greater investment in onboarding new merchants and associated marketing spend, offset by increased net cash proceeds from operations. Development and engineering 6.5 5.4 20.9 Expenditures running higher than prospectus due to greater than anticipated investment in development, engineering and integrations, offset by net cash proceeds from operations. Data sciences and risk management 4.5 1.2 5.0 Expenditures running higher than prospectus due to higher costs asscoiated with risk management practices and additions of key personnel. Consumer and merchant support 3.3 1.7 6.9 Expenditures running higher than prospectus due to significant growth in consumer and merchant additions. Administration and overheads 4.8 1.3 10.1 Expenditures running higher than prospectus due to higher expenses associated with supporting the growth in the business, also offset by increased net cash proceeds from operations. Costs of the offer 2.6 0.0 2.8 Final costs of the offer at IPO were greater than prospectus, incurred in 3Q 2019. Working capital and funding capital 4.6 5.0 (17.5) Increased net cash proceeds from operations provide source of working and funding capital versus prospectus. Total Uses / (Sources) before Financing Activities $33.1 $26.1 $67.7 Total Uses / (Sources) from Financing Activities $0.0 ($13.2) ($83.3) Total Uses / (Sources) of Funds $33.1 $12.9 ($15.6)

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 9 U.S. Filings In accordance with the provisions of the U.S. Securities Act, Sezzle has become a reporting company for U.S. SEC purposes. As such, the Company will be filing its quarterly Form 10-Q for the period ended 30 September 2021 by 15 November 2021 (U.S. time) with a copy of the Form 10-Q to be lodged on the ASX platform at a similar time by 16 November 2021 (Australian time). Quarterly Earnings Conference Call The management team will host a conference call to discuss the quarterly earnings with investors on October 28, 2021, at 6:00 pm (US CT), 7:00 pm (US ET) and 10:00 am October 29, 2021 (Sydney). Participants can register for the conference call by navigating to: https://s1.c-conf.com/diamondpass/10017631-53zz13.html Please note that registered participants will receive their dial in number upon registration. Investors are encouraged to submit any questions in advance of the call by emailing them to: Investorrelations@sezzle.com. This Quarterly Activities Report and accompanying Appendix 4C have been approved by the Company’s Executive Chairman and CEO, Charlie Youakim, on behalf of the Sezzle Inc. Board. About Sezzle Inc. Sezzle is a fintech company on a mission to financially empower the next generation. Sezzle’s payment platform increases the purchasing power for millions of consumers by offering interest-free installment plans at online stores and select in-store locations. Sezzle’s transparent, inclusive, and seamless payment option allows consumers to take control over their spending, be more responsible, and gain access to financial freedom. The increase in purchasing power for consumers leads to increased sales and basket sizes for the more than 44,000 Active Merchants that offer Sezzle. For more information visit sezzle.com.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 10 Sezzle’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. Accordingly, the CDIs have not been, and will not be, registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future, unless the re-sale of the CDIs is registered under the Securities Act or another exemption is available. To enforce the above transfer restrictions, all CDIs issued bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act.

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B Name of entity Sezzle Inc. ABN Quarter ended (“current quarter”) 633 327 358 (ARBN) 30 September 2021 Consolidated statement of cash flows Current quarter $US’000 Year to date (9 months) $US’000 1. Cash flows from operating activities $ 423,577 $ 1,152,290 1.1 Receipts from customers 1.2 Payments for (1,173) (3,660) research and development product manufacturing and operating costs (9,559) (27,396) advertising and marketing (2,370) (5,708) leased assets (58) (358) staff costs (11,416) (25,108) administration and corporate costs (5,568) (10,664) 1.3 Dividends received (see note 3) — — 1.4 Interest received 3 15 1.5 Interest and other costs of finance paid (1,033) (3,632) 1.6 Income taxes paid — (50) 1.7 Government grants and tax incentives — — 1.8 Other (payments to merchants) (418,054) (1,106,972) 1.9 Net cash from / (used in) operating activities $ (25,651) $ (31,243) 2. Cash flows from investing activities $ — $ — 2.1 Payments to acquire or for: entities businesses — — property, plant and equipment (403) (1,075) investments — — intellectual property — — other non-current assets — — 2.2 Proceeds from disposal of: — — entities businesses — — property, plant and equipment — — investments — — intellectual property — — other non-current assets — — 2.3 Cash flows from loans to other entities — — Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 1 + See chapter 19 of the ASX Listing Rules for defined terms.

2.4 Dividends received (see note 3) — — 2.5 Other (provide details if material) — — 2.6 Net cash from / (used in) investing activities $ (403) $ (1,075) 3. Cash flows from financing activities $ 30,078 $ 30,209 3.1 Proceeds from issues of equity securities (excluding convertible debt securities) 3.2 Proceeds from issue of convertible debt securities — — 3.3 Proceeds from exercise of options 160 411 3.4 Transaction costs related to issues of equity securities or convertible debt securities (3) (3) 3.5 Proceeds from borrowings 41,000 67,667 3.6 Repayment of borrowings (57,000) (103,887) 3.7 Transaction costs related to loans and borrowings — (2,698) 3.8 Dividends paid — — 3.9 Other (provide details if material) (1,049) (1,830) 3.10 Net cash from / (used in) financing activities $ 13,186 $ (10,131) 4. Net increase / (decrease) in cash and cash equivalents for the period $ 60,026 $ 89,104 4.1 Cash and cash equivalents at beginning of period 4.2 Net cash from / (used in) operating activities (item 1.9 above) (25,651) (31,243) 4.3 Net cash from / (used in) investing activities (item 2.6 above) (403) (1,075) 4.4 Net cash from / (used in) financing activities (item 3.10 above) 13,186 (10,131) 4.5 Effect of movement in exchange rates on cash held (263) 240 4.6 Cash and cash equivalents at end of period $ 46,895 $ 46,895 5. Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts Current quarter $US’000 Previous quarter $US’000 5.1 Bank balances $ 43,967 $ 58,184 5.2 Call deposits — — 5.3 Bank overdrafts — — 5.4 Other (restricted cash) 2,928 1,842 5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above) $ 46,895 $ 60,026 Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 2 + See chapter 19 of the ASX Listing Rules for defined terms.

6. Payments to related parties of the entity and their associates Current quarter $US'000 6.1 Aggregate amount of payments to related parties and their associates included in item 1 $ 176 6.2 Aggregate amount of payments to related parties and their associates included in item 2 — Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. 7. Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. Total facility amount at quarter end $US’000 Amount drawn at quarter end $US’000 7.1 Loan facilities $ 250,000 $ 5,000 7.2 Credit standby arrangements — — 7.3 Other (please specify) — — 7.4 Total financing facilities $ 250,000 $ 5,000 7.5 Unused financing facilities available at quarter end $ 87,770 7.6 Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. Loan facilities consist of a revolving line of credit with three members, Goldman Sachs Bank USA, Bastion Consumer Funding II LLC, and Bastion Funding IV LLC, for a credit facility of up to US$250 million, with a committed amount of US$125 million. Borrowings on the line of credit carry a weighted average interest rate of 5.25% as of 30 September 2021. The line of credit is secured by consumer receivables and offers an available borrowing base of US$92.8 million, of which US$5.0 million is drawn as of 30 September 2021. Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 3 + See chapter 19 of the ASX Listing Rules for defined terms.

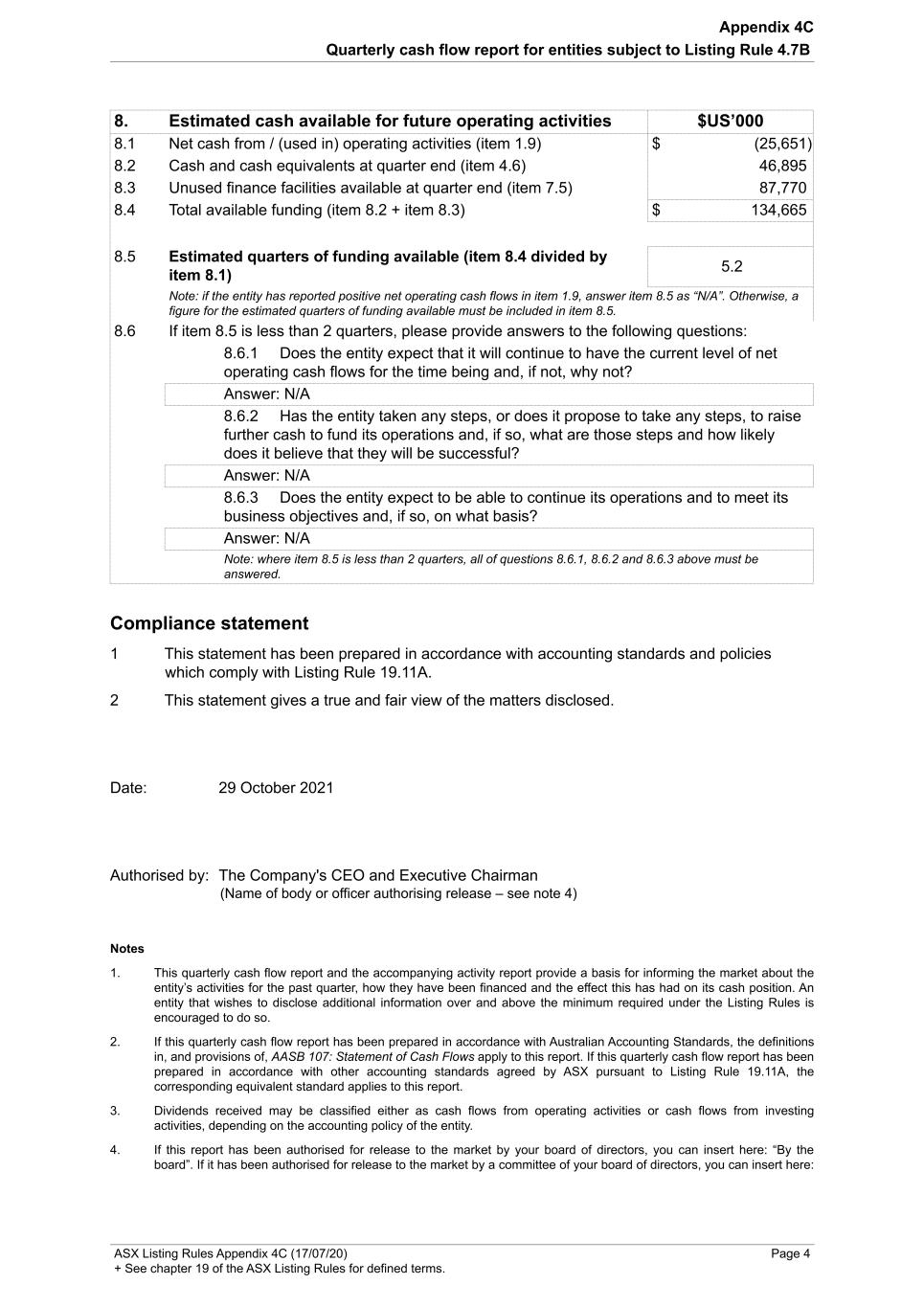

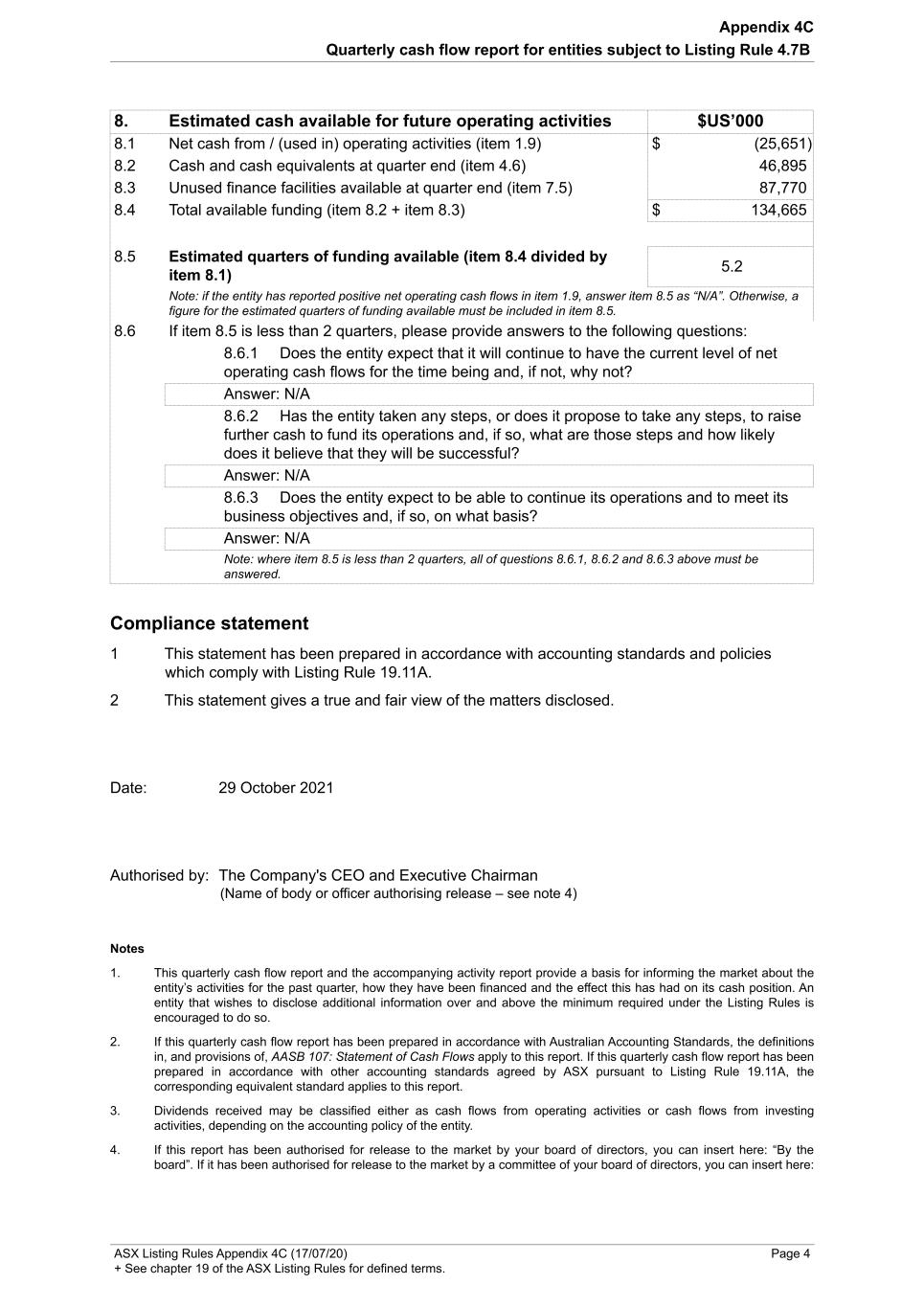

8. Estimated cash available for future operating activities $US’000 8.1 Net cash from / (used in) operating activities (item 1.9) $ (25,651) 8.2 Cash and cash equivalents at quarter end (item 4.6) 46,895 8.3 Unused finance facilities available at quarter end (item 7.5) 87,770 8.4 Total available funding (item 8.2 + item 8.3) $ 134,665 8.5 Estimated quarters of funding available (item 8.4 divided by item 8.1) 5.2 Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. 8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions: 8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? Answer: N/A 8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? Answer: N/A 8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? Answer: N/A Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. Compliance statement 1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. 2 This statement gives a true and fair view of the matters disclosed. Date: 29 October 2021 Authorised by: The Company's CEO and Executive Chairman (Name of body or officer authorising release – see note 4) Notes 1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. 2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report. 3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. 4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 4 + See chapter 19 of the ASX Listing Rules for defined terms.

“By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. 5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 5 + See chapter 19 of the ASX Listing Rules for defined terms.