A N N U A L R E P O R T F O R T H E Y E A R E N D E D D E C E M B E R 3 1 , 2 0 2 1 The way forward.

1 | O U R M I S S I O N Financially empowering the next generation. 01 sezzle

P E R F O R M A N C E H I G H L I G H T S E X E C U T I V E C H A I R M A N A N D C E O ’ S L E T T E R D I R E C T O R S ’ R E P O R T O P E R AT I N G & F I N A N C I A L R E V I E W K E Y R I S K S & B U S I N E S S C H A L L E N G E S C O N S O L I D AT E D F I N A N C I A L S TAT E M E N T S D I R E C T O R S ’ D E C L A R AT I O N A D D I T I O N A L A S X I N F O R M AT I O N C O R P O R AT E D I R E C T O R Y C O N T E N T S 02|SEZZLE INC ANNUAL REPORT 2021

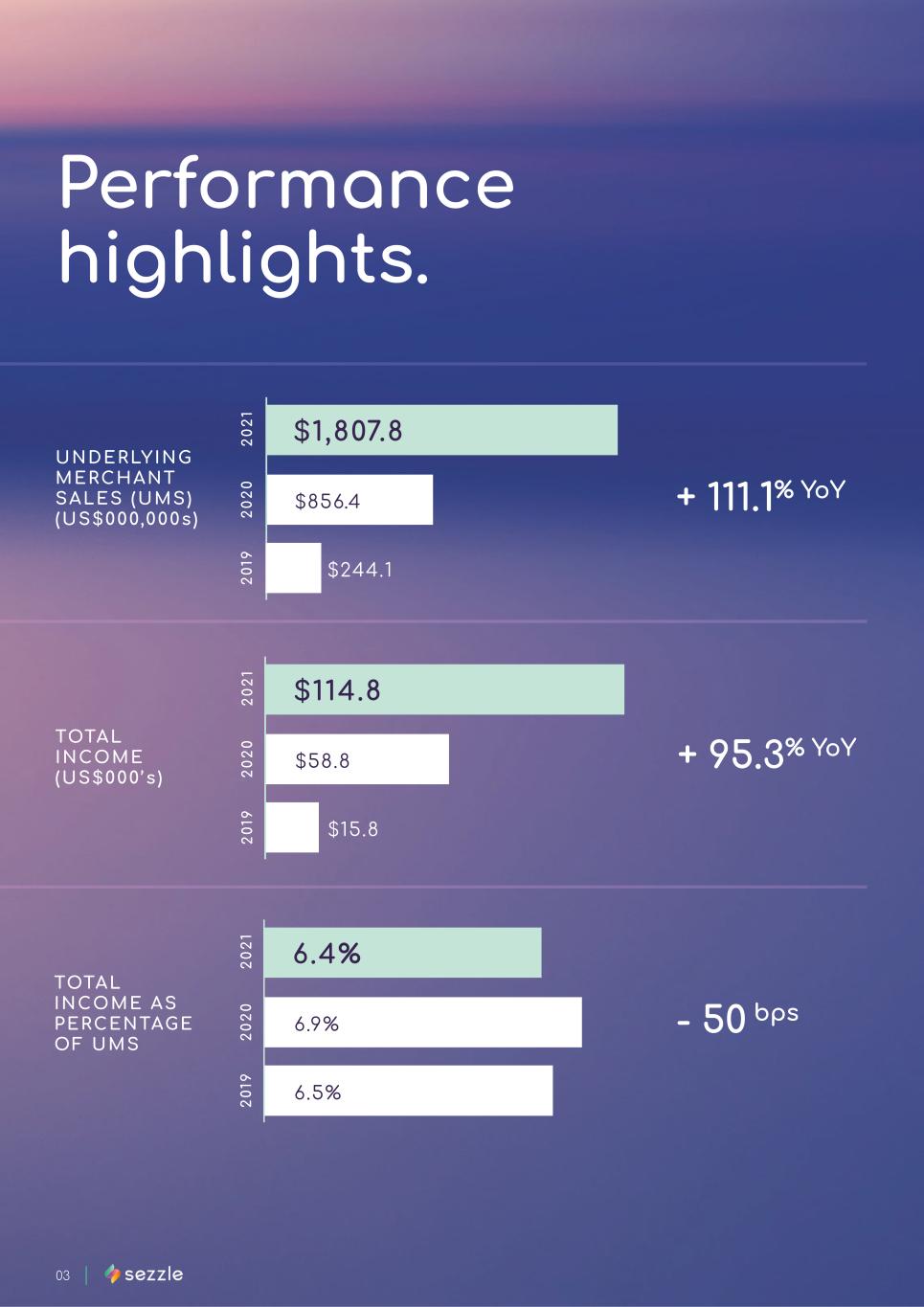

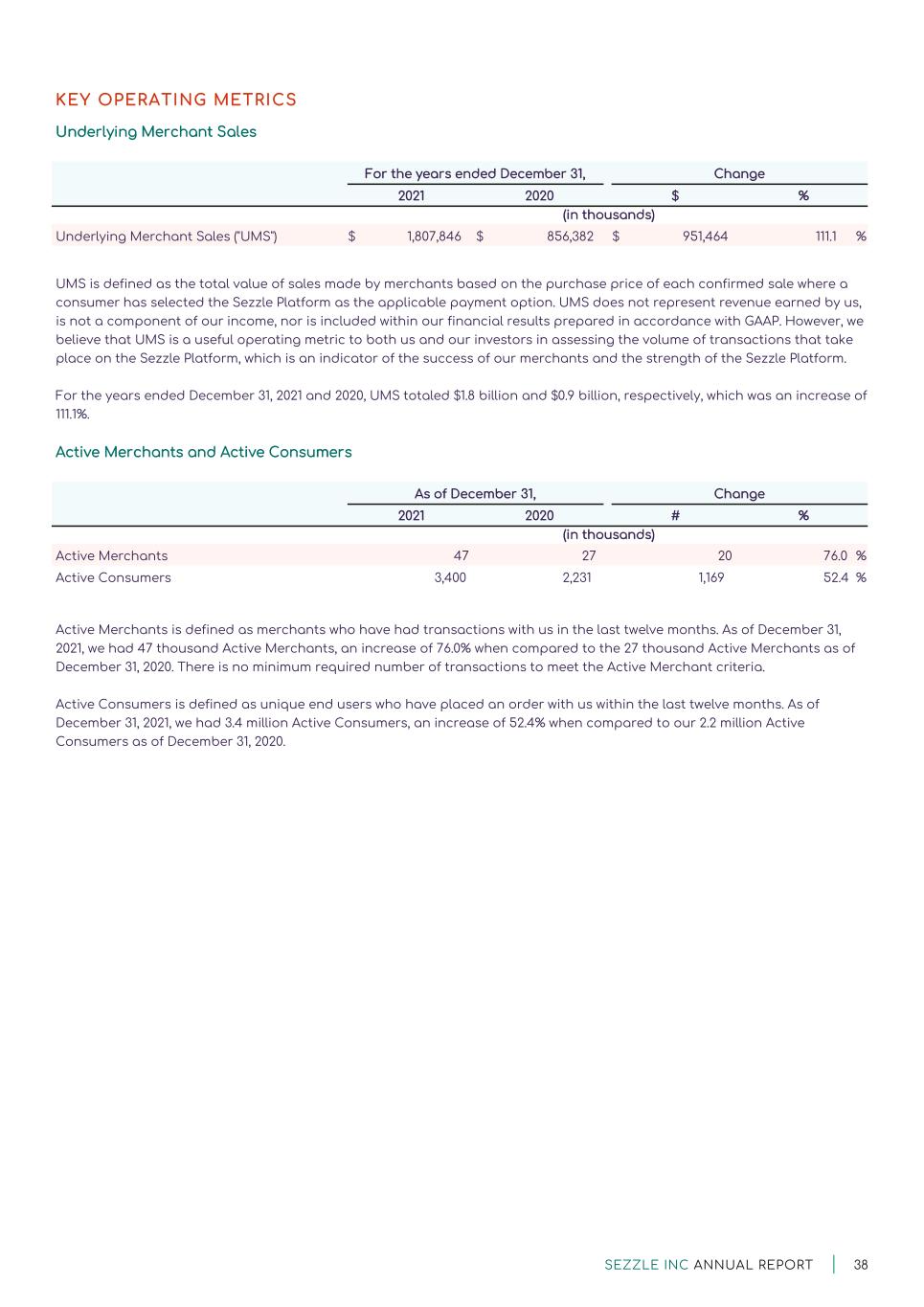

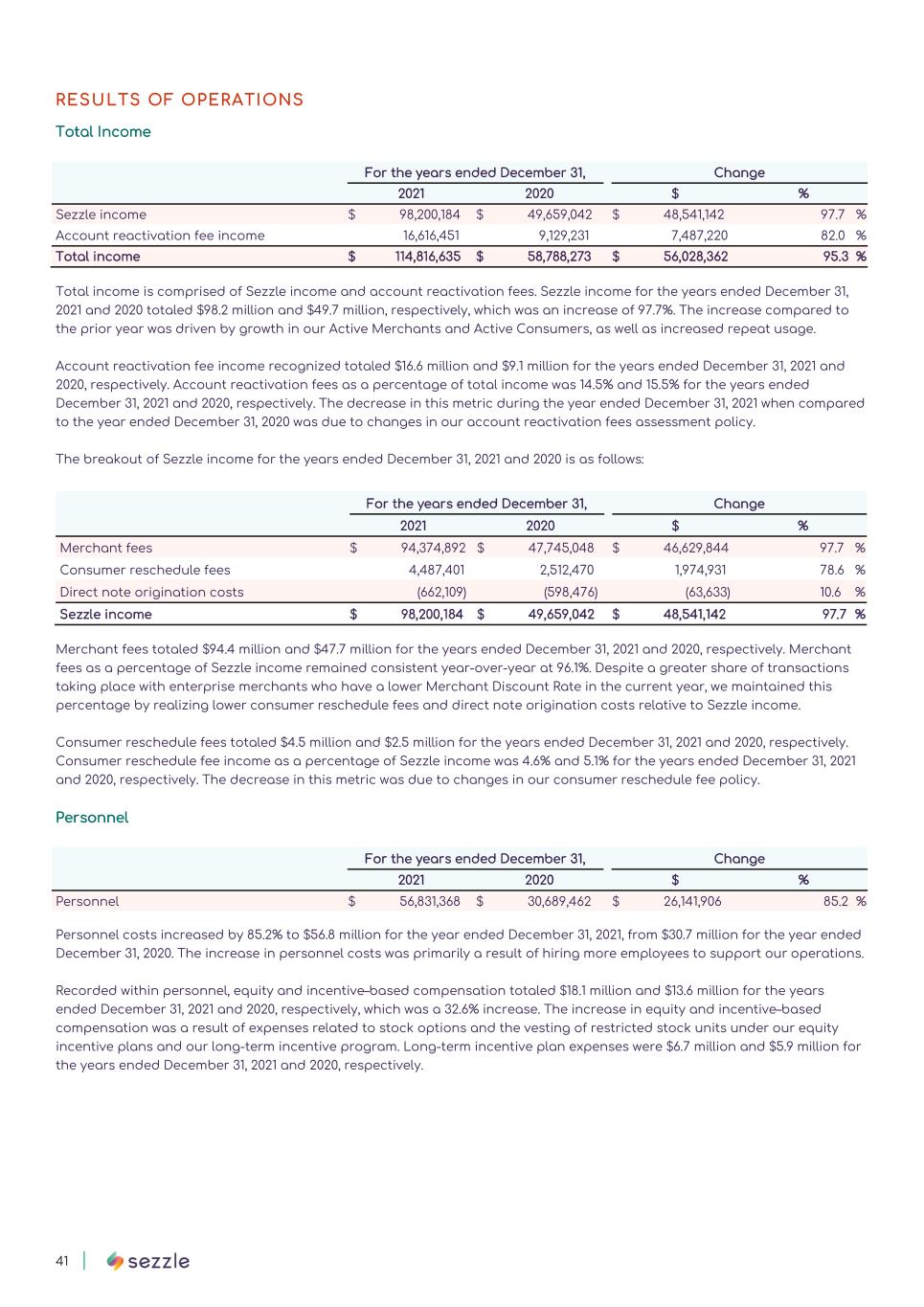

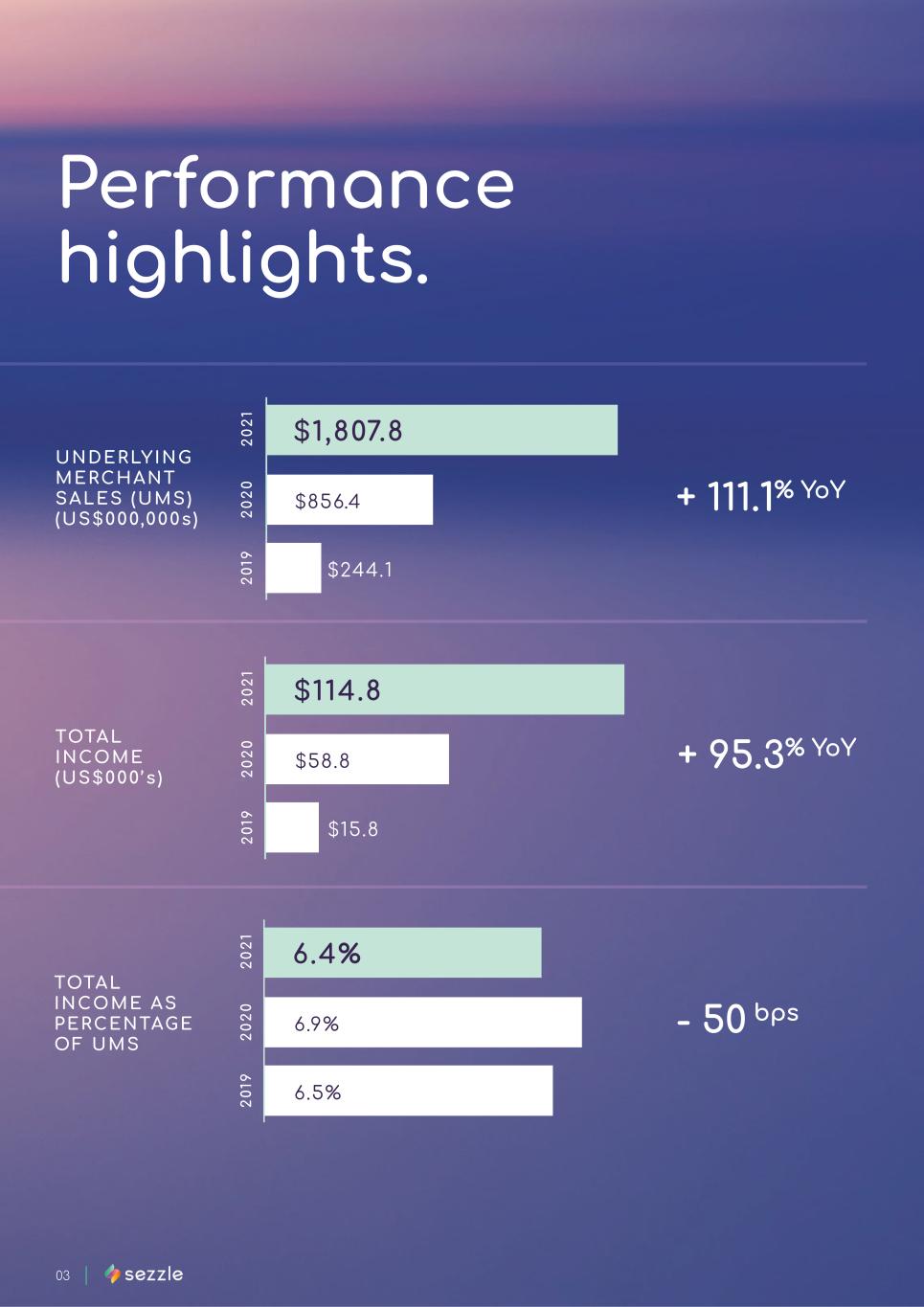

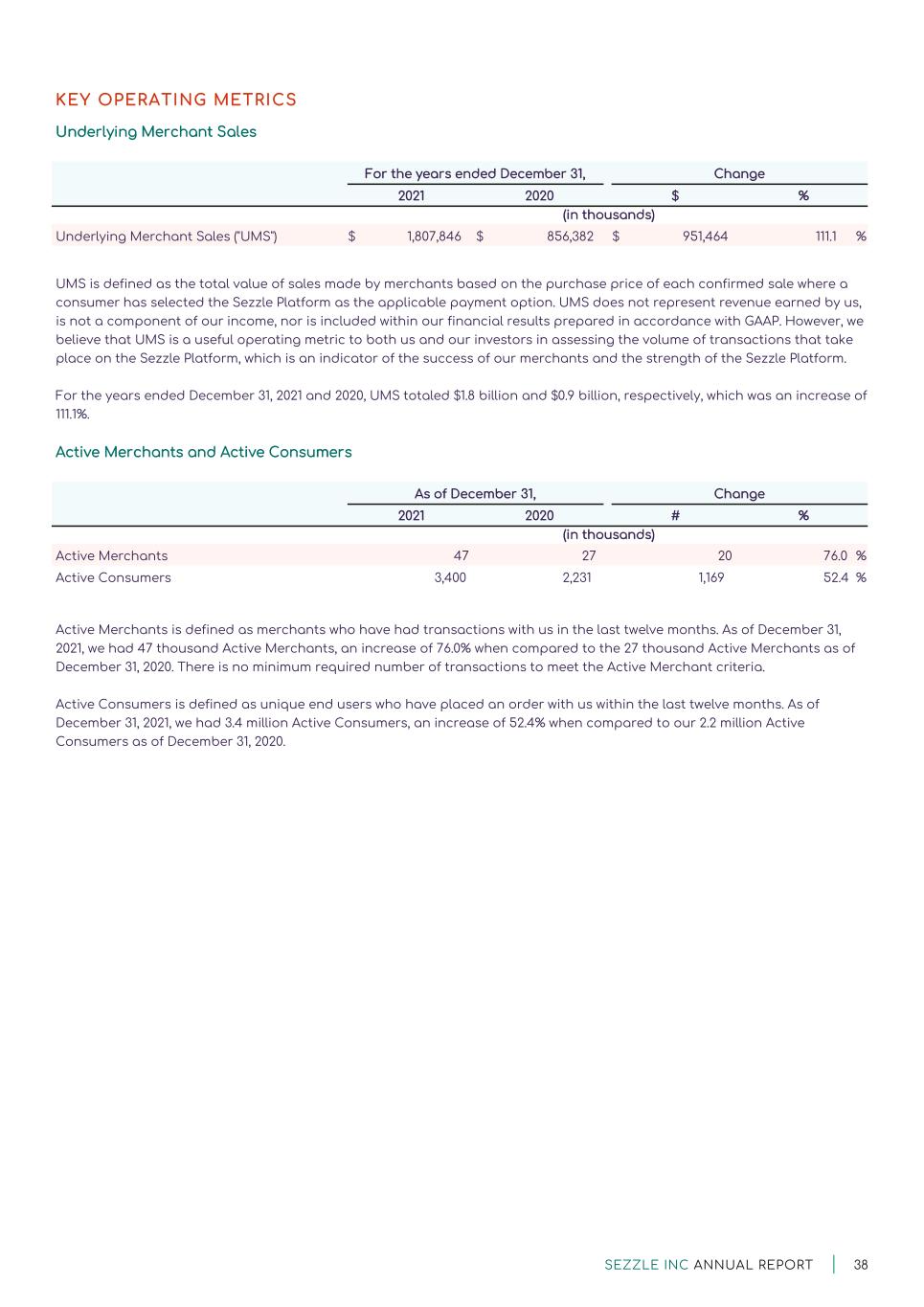

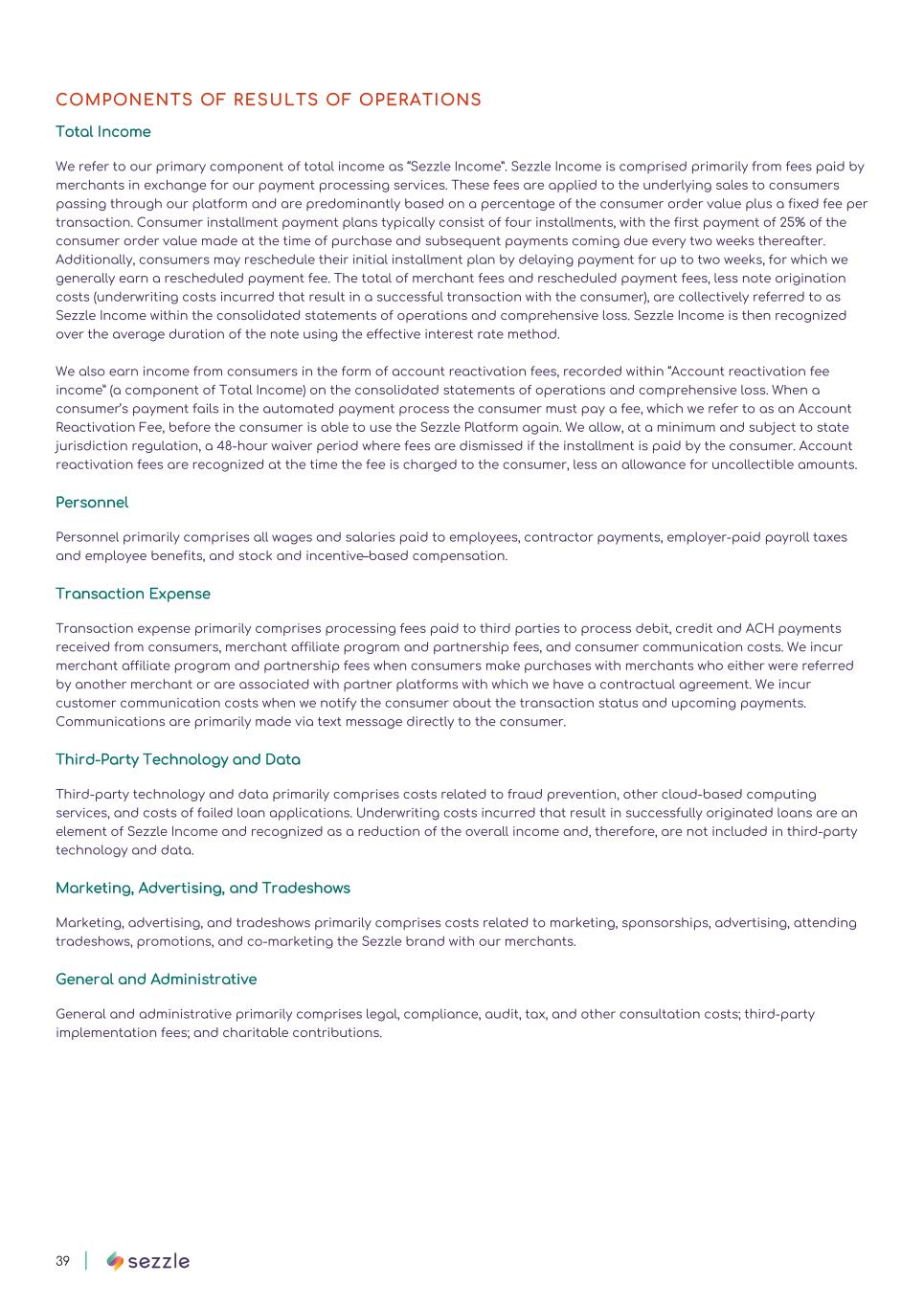

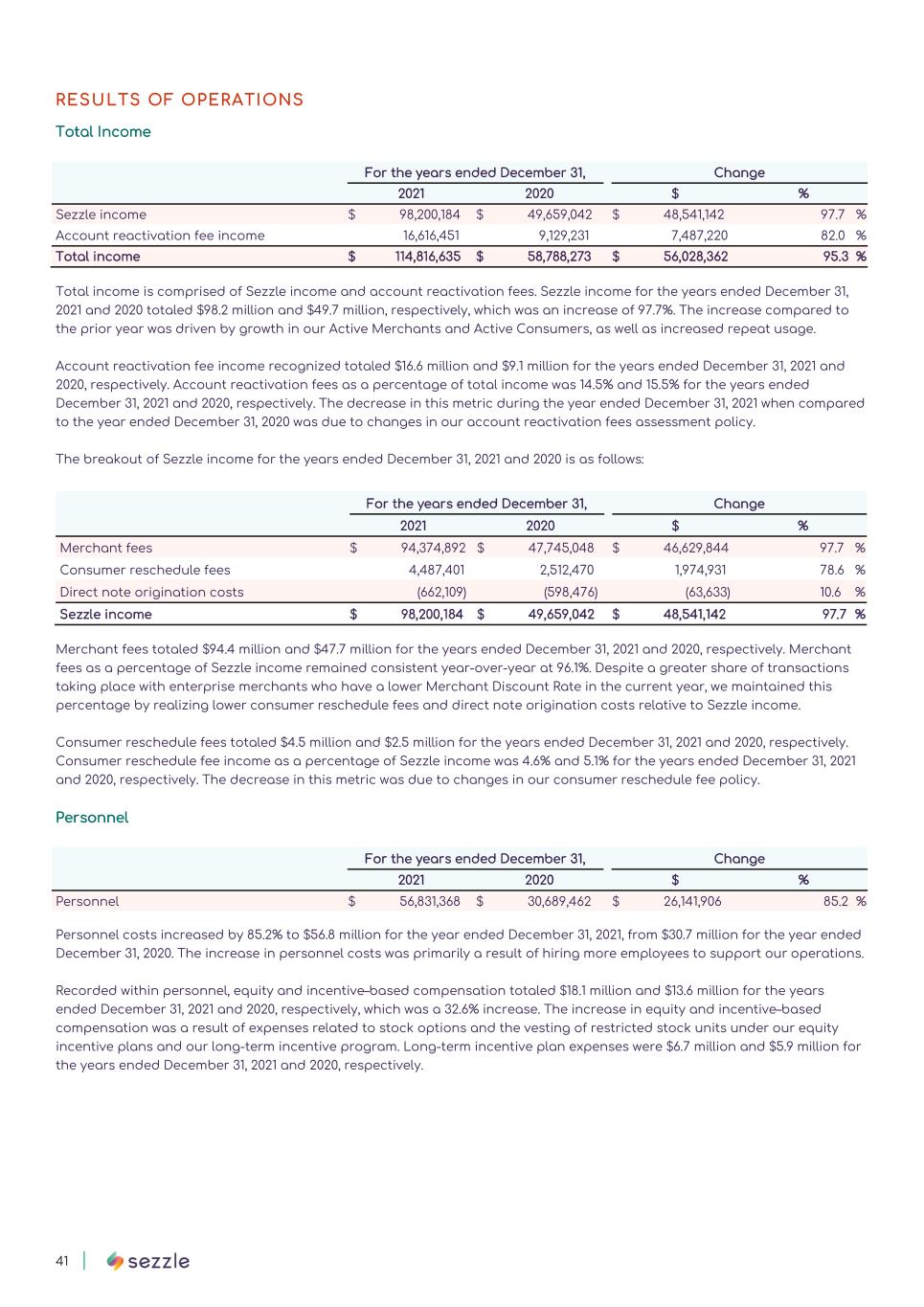

Performance highlights. + 95.3% YoYTOTAL INCOME (US$000 ’s ) 03 | + 111. % YoY UNDERLYING MERCHANT SALES (UMS) (US$000,000s) $1,807.8 $8520 20 20 21 $244.120 19 $114.8 $58.820 20 20 21 $15.820 19 - 50 bps TOTAL INCOME AS PERCENTAGE OF UMS 6.4% 6.9%20 20 20 21 20 19 6.5%

P E R F O R M A N C E H I G H L I G H T S 04SEZZLE INC ANNUAL REPORT 2021 | + 76.0% YoYACTIVE MERCHANTS 46,982 20 20 20 21 20 19 + 5 % YoYACTIVE CONSUMERS 3,400,425 20 20 20 21 20 19 + 308 bps REPEAT USAGE (% OF ACTIVE CONSUMERS) 92.8% 20 20 20 21 20 19

Executive Chairman & CEO Letter 05 | sezzle

06| E X E C U T I V E C H A I R M A N A N D C E O ’ S L E T T E R SEZZLE INC ANNUAL REPORT 2021

07 | group of innovative leaders across the world intent on advancing important environmental, social, and economic causes. We partnered with Trees for the Future and made a commitment to plant a tree for every new user in 2021. • • • As a purpose-driven company, our team went beyond finance by supporting empowerment across many facets of consumers’ lives, creating a better world for the next generation through ethical initiatives: B Corp certification, Carbon Neutral verification, tree planting, and credit building. sezzle

8SEZZLE INC ANNUAL REPORT 2020 | E X E C U T I V E C H A I R M A N A N D C E O ’ S L E T T E R • • 0 1 [ ( : ', sezzle , 1111 p --•• $300.00 get your limit boost ➔ AVAILABLE TO SPEND $200.00 $500.00 C • • use your cord ➔ Cl9 Exclusive in-opp only ~ EXPRESS ~ rack 1, sezzle The Home Depot &P,HS NQfQ111romRo,;k ACCOUN T NUMBER 5412 7512 3412 3456 Security Code Val id lhru 123 10/22

S U S TA I N A B I L I T Y G O V E R N A N C E R E G U L AT O R Y E N G A G E M E N T 09 | sezzle

R E M U N E R AT I O N T H E R O A D A H E A D E X E C U T I V E C H A I R M A N A N D C E O ’ S L E T T E R 10SEZZLE INC ANNUAL REPORT 2021 |

Directors’ Report 11 | sezzle

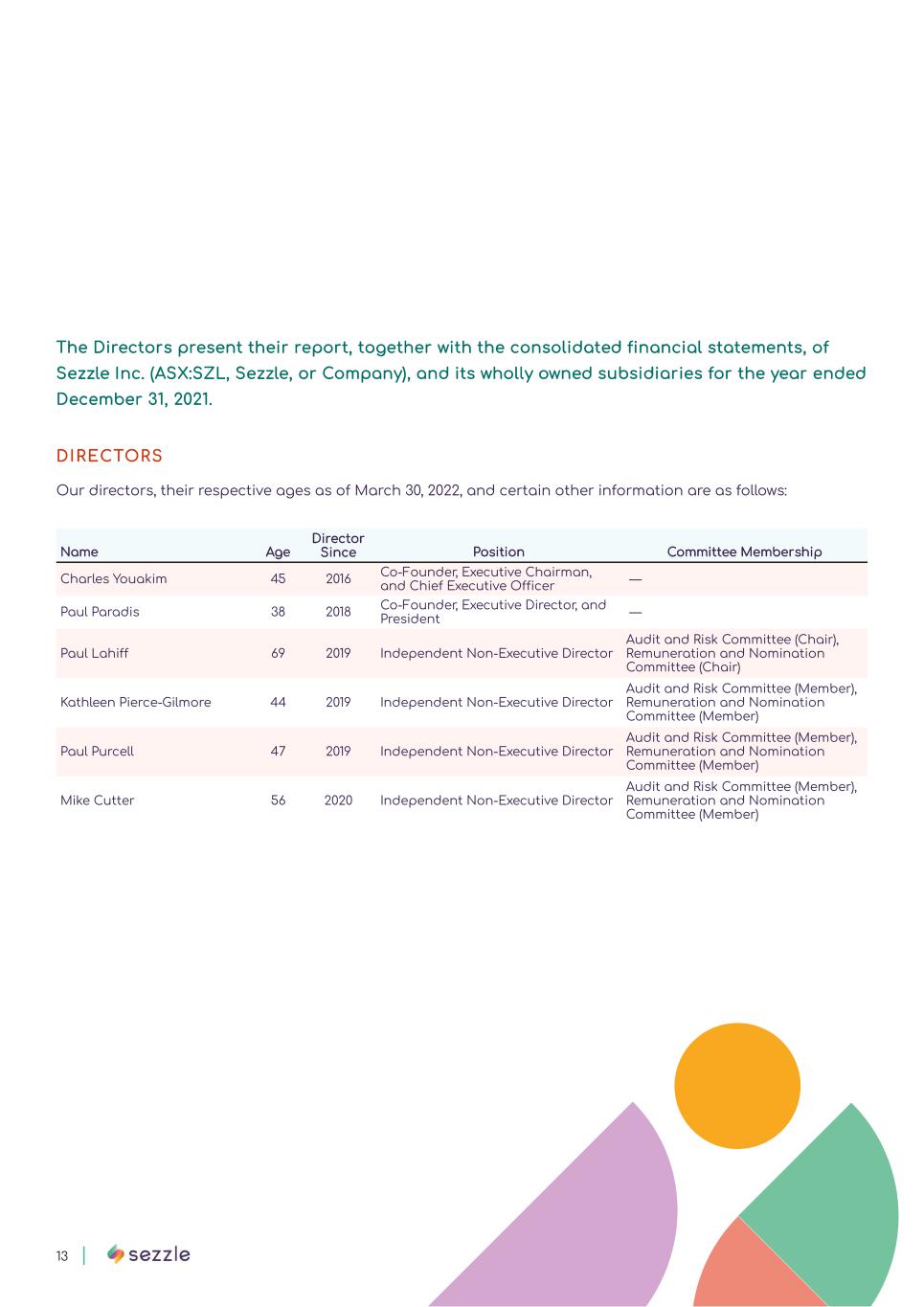

012| D I R E C T O R S R E P O R T SEZZLE INC ANNUAL REPORT 2021

sezzle

sezzle

sezzle

sezzle

sezzle

• • • • • • • • • • • • • • •

sezzle

• • • • • • •

sezzle

sezzle

• • • • • • • • sezzle

| Operating & Financial Review sezzle

14SEZZLE INC ANNUAL REPORT 2021 | 0 O P E R AT I N G & F I N A N C I A L R E V I E W

sezzle

SEZZLE INC ANNUAL REPORT | 34 PROPOSED MERGER WITH WHOLLY-OWNED SUBSIDIARY OF ZIP On February 28, 2022, we entered into the Zip Merger Agreement, pursuant to which, upon the terms and subject to the conditions thereof, Merger Sub will be merged with and into Sezzle Inc., with Sezzle Inc. surviving the merger as a wholly- owned subsidiary of Zip. Subject to the terms and conditions of the Zip Merger Agreement, each share of our common stock (including each share of our common stock in respect of which a Company CDI (as defined in the Zip Merger Agreement) has been issued) issued and outstanding immediately prior to the Effective Time (other than shares of our common stock that are held by us (or any of our subsidiaries), Zip (or any of its subsidiaries) or Merger Sub) shall be cancelled and converted into the right to receive, at the election of our stockholders (subject to the immediately following sentence), (a) a number of Zip ordinary shares equal to 0.98 (the “Exchange Ratio”) or (b) a number of Zip American depositary receipts (“Zip ADRs”) representing a number of Zip ordinary shares equal to the Exchange Ratio. Any person who is an Australian Stockholder (as defined in the Zip Merger Agreement) will only be entitled to consideration in the form of Zip ordinary shares. The Zip Merger Agreement includes customary representations, warranties and covenants by us, Zip and Merger Sub. Subject to the terms of the Zip Merger Agreement and certain exceptions, we and Zip have agreed to operate our respective businesses in the ordinary course consistent with past practice and use commercially reasonable efforts to maintain their respective business organizations and advantageous business relationships until the closing of the transaction. Concurrently with the execution and delivery of the Zip Merger Agreement, certain significant stockholders of both us (Charles Youakim and Paul Paradis) and Zip (Larry Diamond and Peter Gray) entered into support agreements pursuant to which, among other things, they agreed to vote all of their stock or ordinary shares of common stock, as applicable in favor of the transaction. Subject to the terms and conditions of the Zip Merger Agreement, unvested and outstanding options and RSUs will be converted into Zip options and performance rights with similar terms and conditions as existing options and RSUs, provided, that each company option that is subject to a Company total shareholder return performance-based vesting condition (“Company TSR”) shall, immediately prior to the Effective Time, become earned, if at all, by using the Closing Date (as defined in the Zip Merger Agreement) as the end of the applicable performance period for purposes of measuring performance based vesting with the resulting option, if any, subject to service-based vesting through the end of the original performance period , and vested options and RSUs will be cancelled and converted into the right to receive merger consideration. The consummation of the transaction is subject to certain closing conditions, including, but not limited to (i) the declaration by the SEC of the effectiveness of the registration statements on Form F-4 and Form F-6 (and the absence of any stop order or proceedings suspending such effectiveness), (ii) the Zip ADRs being authorized for listing on a United States Exchange (as defined in the Zip Merger Agreement) and the Zip Ordinary Shares issuable pursuant to the Zip Merger Agreement being authorized for listing on the ASX, (iii) the Australian Prospectus (to the extent required by applicable Law (as defined in the Zip Merger Agreement)) being lodged with the Australian Securities and Investments Commission (the “ASIC”) and the exposure period prescribed by section 727(3) of the Corporations Act will have elapsed (if applicable) and no stop order is issued by ASIC in relation to the Australian Prospectus and remains in effect (or waivers from the requirement to lodge the Australian Prospectus have been received from ASIC), (iv) receipt of required waivers from the ASX and the ASIC, (v) the expiration or termination of any applicable waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976, (vi) no governmental order or law prohibiting the consummation of the Contemplated Transactions or making the consummation of the Contemplated Transactions illegal and (vii) the required Australian approvals having been obtained and the condition described in the preceding clause (v) being satisfied without the imposition of a Burdensome Condition (as defined in the Zip Merger Agreement). If the Zip Merger Agreement is terminated under certain circumstances, the Company may be required to pay Zip a termination fee of A$7,800,000 or Zip may be required to pay the Company a termination fee of A$31,400,000.

sezzle

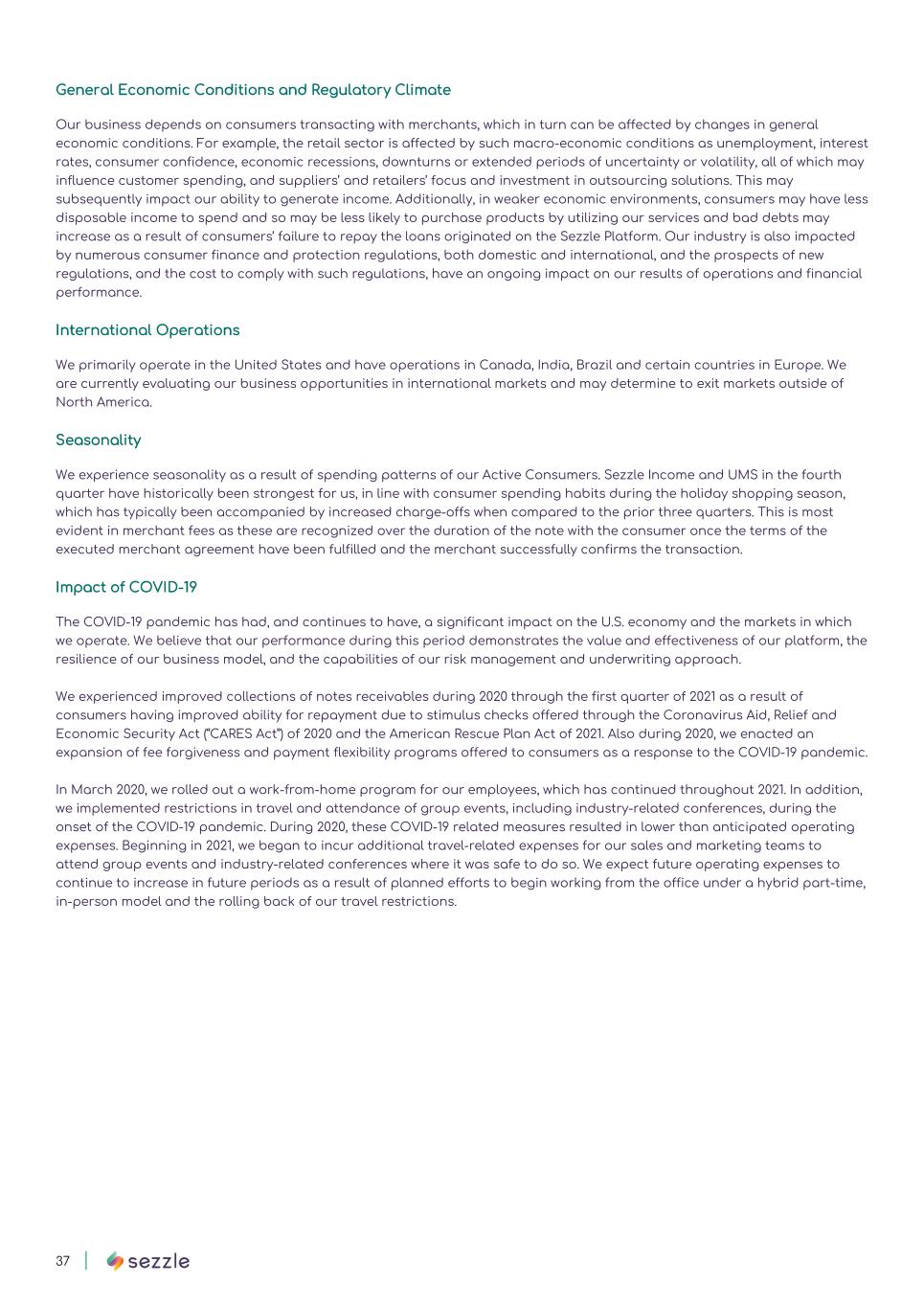

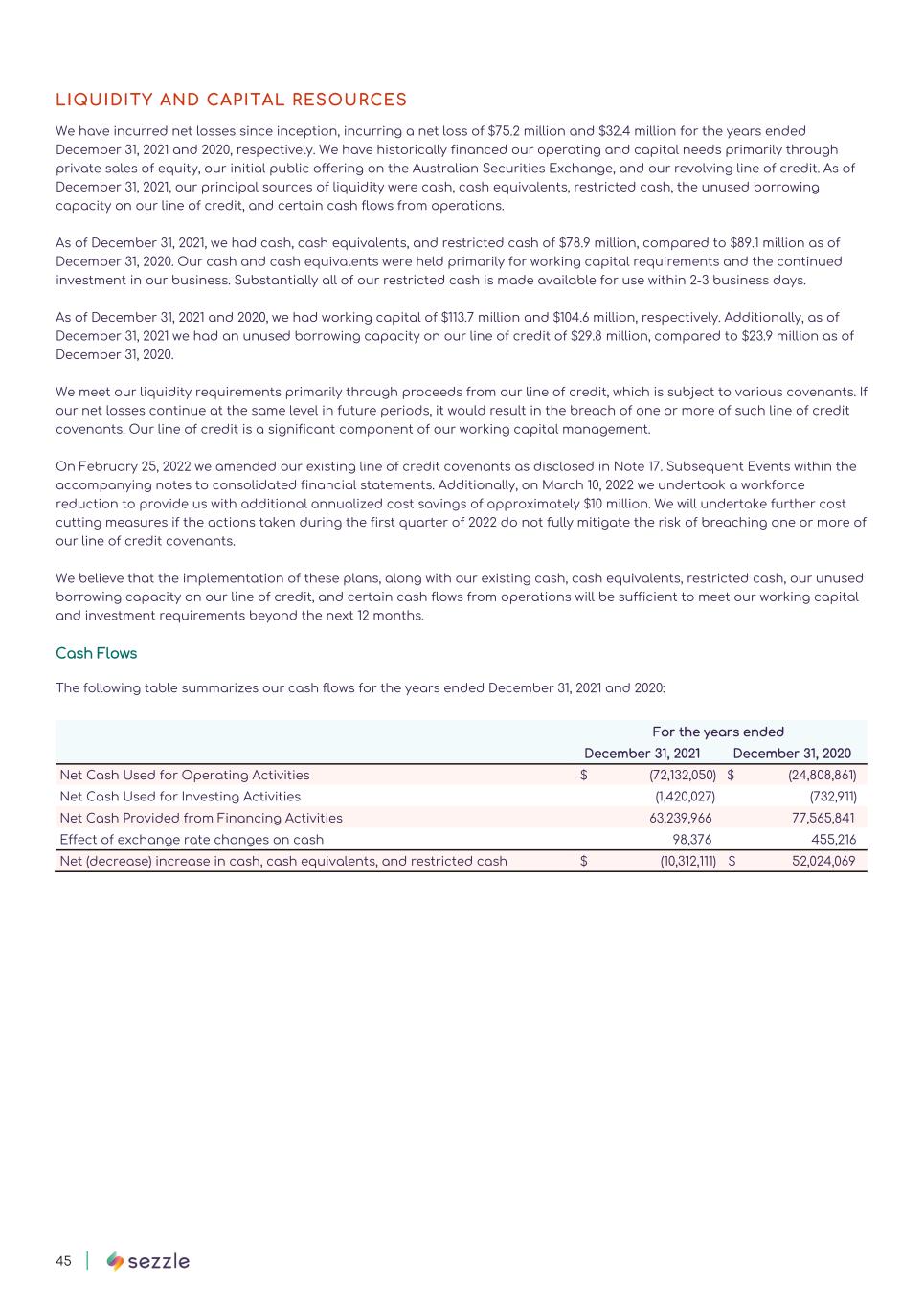

37 | General Economic Conditions and Regulatory Climate Our business depends on consumers transacting with merchants, which in turn can be affected by changes in general economic conditions. For example, the retail sector is affected by such macro-economic conditions as unemployment, interest rates, consumer confidence, economic recessions, downturns or extended periods of uncertainty or volatility, all of which may influence customer spending, and suppliers’ and retailers’ focus and investment in outsourcing solutions. This may subsequently impact our ability to generate income. Additionally, in weaker economic environments, consumers may have less disposable income to spend and so may be less likely to purchase products by utilizing our services and bad debts may increase as a result of consumers’ failure to repay the loans originated on the Sezzle Platform. Our industry is also impacted by numerous consumer finance and protection regulations, both domestic and international, and the prospects of new regulations, and the cost to comply with such regulations, have an ongoing impact on our results of operations and financial performance. International Operations We primarily operate in the United States and have operations in Canada, India, Brazil and certain countries in Europe. We are currently evaluating our business opportunities in international markets and may determine to exit markets outside of North America. Seasonality We experience seasonality as a result of spending patterns of our Active Consumers. Sezzle Income and UMS in the fourth quarter have historically been strongest for us, in line with consumer spending habits during the holiday shopping season, which has typically been accompanied by increased charge-offs when compared to the prior three quarters. This is most evident in merchant fees as these are recognized over the duration of the note with the consumer once the terms of the executed merchant agreement have been fulfilled and the merchant successfully confirms the transaction. Impact of COVID-19 The COVID-19 pandemic has had, and continues to have, a significant impact on the U.S. economy and the markets in which we operate. We believe that our performance during this period demonstrates the value and effectiveness of our platform, the resilience of our business model, and the capabilities of our risk management and underwriting approach. We experienced improved collections of notes receivables during 2020 through the first quarter of 2021 as a result of consumers having improved ability for repayment due to stimulus checks offered through the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) of 2020 and the American Rescue Plan Act of 2021. Also during 2020, we enacted an expansion of fee forgiveness and payment flexibility programs offered to consumers as a response to the COVID-19 pandemic. In March 2020, we rolled out a work-from-home program for our employees, which has continued throughout 2021. In addition, we implemented restrictions in travel and attendance of group events, including industry-related conferences, during the onset of the COVID-19 pandemic. During 2020, these COVID-19 related measures resulted in lower than anticipated operating expenses. Beginning in 2021, we began to incur additional travel-related expenses for our sales and marketing teams to attend group events and industry-related conferences where it was safe to do so. We expect future operating expenses to continue to increase in future periods as a result of planned efforts to begin working from the office under a hybrid part-time, in-person model and the rolling back of our travel restrictions. sezzle

sezzle

sezzle

sezzle

sezzle

| Key Risks & Business Challenges | sezzle

16SEZZLE INC ANNUAL REPORT 2021 | 0 K E Y R I S K S & B U S I N E S S C H A L L E N G E S

sezzle

• • • • • • • • • • • • • • • • • • • • • •

sezzle

SEZZLE INC ANNUAL REPORT | 52 The preparations for integration between us and Zip have placed, and we expect will continue to place, a significant burden on many of our key employees and on our internal resources. If, despite our efforts, key employees depart because of these uncertainties and burdens, or because they do not wish to remain with the combined company, our business and results of operations may be adversely affected. In addition, whether or not the merger is consummated, while it is pending we will continue to incur costs, fees, expenses and charges related to the proposed merger, which may materially and adversely affect our financial condition and results of operations. In addition, the Zip Merger Agreement generally requires us to operate our business in the ordinary course of business consistent with past practice pending consummation of the merger and also restricts us from taking certain actions without the consent of Zip. Such restrictions will be in place until either the merger is consummated or the Zip Merger Agreement is terminated. A breach of these covenants could result in termination of the Zip Merger Agreement. For these and other reasons, the pendency of the merger could adversely affect our business and results of operations. In the event that the proposed merger with a wholly-owned subsidiary of Zip is not consummated, the trading price of shares of our common stock and our future business and results of operations may be negatively affected. The conditions to the consummation of the proposed merger may not be satisfied as noted above. If the merger is not consummated, we generally would remain liable for significant transaction costs, and the focus of our management would have been diverted from seeking other potential strategic opportunities, in each case without realizing any benefits of the proposed merger. For these and other reasons, not consummating the merger could adversely affect our business and results of operations. Furthermore, if we do not consummate the merger, the price of shares of our common stock may decline (potentially significantly) from the current market price. Certain costs associated with the merger have already been incurred or may be payable even if the merger is not consummated. Further, a failed transaction may result in negative publicity and a negative impression of us in the investment community. Finally, any disruptions to our business resulting from the announcement and pendency of the merger, including any adverse changes in our relationships with our customers, partners, vendors and merchants or recruiting and retention efforts, could continue or accelerate in the event of a failed merger. The Zip Merger Agreement contains provisions that could make it difficult for a third party to acquire us prior to the completion of the proposed merger. The Zip Merger Agreement contains restrictions on our ability to obtain a third-party proposal for an acquisition of us. These provisions include our agreement not to solicit or engage in discussions with third parties regarding, enter into any agreement with respect to, or provide any confidential information in respect of, any Acquisition Proposal (as defined in the Zip Merger Agreement) or an IPO (as defined in the Merger Agreement), as well as restrictions on our ability to respond to such proposals, subject to certain expectations with respect to the fiduciary duties of our board of directors, among other conditions set forth in the Zip Merger Agreement. The Zip Merger Agreement also provides that under specified circumstances, including if the Merger Agreement is terminated by Zip because our board of directors changes its recommendation for approval of the merger, we may be required to pay to Zip a termination fee of A$7,800,000. These provisions might discourage an otherwise-interested third-party from considering or proposing an acquisition of us, even if it were prepared to pay consideration with a higher per share cash or market value than the market value proposed to be received or realized in the transaction. These provisions also might result in a potential third party acquirer proposing to pay a lower price to our shareholder than it might otherwise have proposed to pay due to the added expense of the A$7,800,000 termination fee than may become payable in certain circumstances. If the agreement is terminated and we determine to seek another business combination, we may not be able to negotiate a transaction with another party on terms comparable to, or better than, the terms of the transaction with Zip. Shareholder litigation could prevent or delay the closing of the proposed acquisition by Zip or otherwise negatively impact our business, operating results and financial condition. We may incur costs in connection with the defense or settlement of any future shareholder litigation in connection with the proposed transaction with Zip. Future shareholder litigation may adversely affect our ability to complete the proposed transaction with Zip. We could incur significant costs in connection with any such litigation lawsuits, including costs associated with the indemnification of obligations to our directors. Furthermore, one of the conditions to the closing of the transaction is the absence of any governmental order or law preventing the transaction or making the consummation of the transaction illegal. Consequently, if a plaintiff were to secure injunctive or other relief prohibiting, delaying or otherwise adversely affecting our ability to complete the proposed transaction, then such injunctive or other relief may prevent the proposed transaction from becoming effective within the expected time frame or at all.

sezzle

sezzle

• • • • • • • • • • • • • sezzle

SEZZLE INC ANNUAL REPORT | 58 In addition, international operations may continue to expose us to numerous regulatory risks. We are subject to regulations relating to our corporate conduct and the conduct of our business, including securities laws, consumer protection laws, trade regulations, advertising regulations, privacy and cybersecurity laws, wage and hour regulations, anti-money laundering (“AML”) laws and anti-corruption legislation. Certain jurisdictions have taken aggressive stances with respect to such matters and have implemented new initiatives and reforms, including more stringent regulations, disclosure and compliance requirements. Any violations of these regulations and requirements would likely have a material and adverse impact on our business and results of operations. We may require additional capital. We may require additional funding to support the provision of installments plans to consumers and working capital. There can be no assurance that such goals can be met without further financing and whether such financing, if necessary, can be obtained on favorable terms or at all. If we require additional capital to grow our business, we may rely on a combination of funding options including equity and our existing and new revolving credit facilities. An inability to raise capital through the issuance of equity securities or secure funding through new credit facilities, or any increase in the cost of such funding, may adversely impact our ability to grow our business. Failure by us to meet financial covenants under the credit agreement governing our existing revolving credit facility, or the occurrence of other specified events, may lead to an event of default. If an event of default were to occur, we may be required to make repayments under the credit facility in advance of the relevant maturity dates and/or termination of the credit facility, which would likely have an adverse impact on our business, results of operations and financial condition. Our existing revolving credit facility is secured by our consumer notes receivable we choose to pledge and is subject to covenants. Fifty percent of the total available funding facility ($125,000,000) is committed while the remaining fifty percent is available to us for expanding our funding capacity. Thus, a significant portion of our funding capacity is in part dependent on our accounts receivable, which can be volatile and, at times, at levels low enough to result in our inability to draw down on this part of the credit facility. Any material decrease in our accounts receivable could negatively impact our liquidity, which would have an adverse effect on our business, results of operations, and financial condition. In addition, it is possible that our transaction volume will outpace our ability to finance transactions if we do not have sufficient borrowing capacity under our credit facility, which in turn could result in a material adverse effect on our results of operations and financial condition. We may not realize any or all of our estimated costs savings or benefits from our recently announced workforce reduction plan. On March 10, 2022, we announced a reduction of our workforce that, when considered with normal attrition during the beginning of 2022, impacted approximately 20% of our North American workforce. We may not realize all or any of the anticipated costs savings and benefits from the workforce reduction. In addition, any cost savings that we realize may be offset by reductions in revenues or through increases in other expenses. If we are unable to achieve the expected efficiency and cost savings from the workforce reduction, or if we need to consider further reductions in workforce, our business and results of operations may be adversely affected. R ISKS RELATED TO OUR FINANCING PROGRAM Consumers may not view or treat their BNPL product loans as having the same significance as other obligations, and the loans facilitated through our platform are not secured, guaranteed, or insured and involve a high degree of financial risk. Consumers may not view the BNPL product loans facilitated through our platform as having the same significance as a loan or other credit obligation arising under more traditional circumstances. If a consumer neglects his or her payment obligations on a BNPL product loan facilitated through our platform or chooses not to repay his or her loan entirely, it will have an adverse effect on our business, results of operations, financial condition, prospects, and cash flows. Personal loans facilitated through our platform are not secured by any collateral, not guaranteed or insured by any third- party, and not backed by any governmental authority in any way. Therefore, we are limited in our ability to collect on these loans if a consumer is unwilling or unable to repay them. A consumer’s ability to repay their loans can be negatively impacted by increases in their payment obligations to other lenders under mortgage, credit card, and other debt obligations resulting from increases in base lending rates or structured increases in payment obligations. If a consumer defaults on a loan, we may be unsuccessful in our efforts to collect the amount of the loan. We may also be required to pay credit card processing costs for transactions that we fail to collect loans on from our consumers. Our originating bank partners could decide to originate fewer BNPL product loans through our platform. An increase in defaults precipitated by these risks and uncertainties could have a material adverse effect on our business, results of operations, financial condition, and prospects.

sezzle

SEZZLE INC ANNUAL REPORT | 60 If we fail to comply with the applicable requirements of Visa or other payment processors, those payment processors could seek to fine us, suspend us or terminate our registrations, which could have a material adverse effect on our business, results of operations, financial condition, and prospects. We partially rely on card issuers or payment processors, and must pay a fee for this service. From time to time, payment processors such as Visa may increase the interchange fees that they charge for each transaction using one of their cards. The payment processors routinely update and modify their requirements. Changes in the requirements, including changes to risk management and collateral requirements, may impact our ongoing cost of doing business and we may not, in every circumstance, be able to pass through such costs to our merchants or associated participants. Furthermore, if we do not comply with the payment processors’ requirements (e.g., their rules, bylaws, and charter documentation), the payment processors could seek to fine us, suspend us or terminate our registrations that allow us to process transactions on their networks. Some payment processors may also choose not to support BNPL solutions and the credit cards they issue therefore cannot be linked to pay for purchases made through BNPL entities, including Sezzle. The termination of our registration due to failure to comply with the applicable requirements of Visa or other payment processors, or any changes in the payment processors’ rules that would impair our registration, could require us to stop providing payment services to Visa or other payment processors, which could have a material adverse effect on our business, results of operations, financial condition, and prospects. We are also subject to the Payment Card Industry Data Security Standard (“PCI DSS”) with respect to the acceptance of payment cards. PCI DSS sets forth security standards relating to the processing of cardholder data and the systems that process such data, and a failure to adhere to these standards can result in fines, limitations on our ability to process payment cards, and impact to our relationship with our merchant partners and their own ability to comply with PCI DSS. R ISKS RELATED TO OUR TECHNOLOGY AND THE SEZZLE PLATFORM Our results depend on integration, support, and prominent presentation of our platform by our merchants. We use and rely on integration with third-party systems and platforms, particularly websites and other systems of our merchants. The success of our services, and our ability to attract additional consumers and merchants, depends on the ability of our technology and systems to integrate into, and operate with, these various third-party systems and platforms. In addition, as these systems and platform are regularly updated, it is possible that when such updates occur it could cause our services to operate inefficiently. This will likely require us to change the way we operate our systems and platform, which may take time and expense to remedy. We also depend on our merchants, which generally accept most major credit cards and other forms of payment, to present our platform as a payment option, such as by prominently featuring our platform on their websites or in their stores and not just as an option at website checkout. We do not have any recourse against merchants when they do not prominently present our platform as a payment option. The failure by our merchants to effectively integrate, support, and present our platform would likely have a material adverse effect on our business, results of operations and financial condition. Unanticipated surges or increases in transaction volumes may adversely impact our financial performance. Continued increases in transaction volumes may require us to expand and adapt our network infrastructure to avoid interruptions to our systems and technology. Any unanticipated surges or increases in transaction volumes may cause interruptions to our systems and technology, reduce the number of completed transactions, increase expenses, and reduce the level of customer service, and these factors could adversely impact our reputation and, thus, diminish consumer confidence in our systems, which may result in a material adverse effect on our business, results of operations and financial condition.

sezzle

sezzle

sezzle

sezzle

sezzle

SEZZLE INC ANNUAL REPORT | 70 Compliance with these laws and regulations is costly, time-consuming, and limits our operational flexibility. There is also a risk that if we fail to comply with these laws, regulations, and any related industry compliance standards, such failure may result in significantly increased compliance costs, cessation of certain business activities or the ability to conduct business, litigation, regulatory inquiries or investigations, and significant reputational damage. We are subject to various U.S. federal and state and, in Canada, provincial and territorial consumer protection laws. We must comply with various regulatory regimes, including those applicable to the protection of consumers in connection with credit transactions. The laws to which we are or may be subject include U.S. federal and state, Canadian provincial and territorial laws and regulations that impose requirements related to financial services, such as loan and consumer contract disclosures and terms, data privacy, credit discrimination, credit reporting, money; and transmission, recordkeeping, debt servicing and collection, and unfair or deceptive business practices. In addition, in the United States the laws and regulations to which we are subject include: • TILA and Regulation Z promulgated thereunder, which require certain disclosures to consumers regarding the terms and conditions of their loans and credit transactions, and impose additional requirements for any credit that is accessible by a credit card; • Section 5 of the Federal Trade Commission Act (“FTCA”), which prohibits UDAP in or affecting commerce, and Section 1031 of the Dodd-Frank Act, which prohibits UDAAP in connection with any consumer financial product or service; • The Equal Credit Opportunity Act (“ECOA”) and Regulation B promulgated thereunder, which prohibit creditors from discriminating against credit applicants on the basis of race, color, sex, age, religion, national origin, marital status, the fact that all or part of the applicant’s income derives from any public assistance program, or the fact that the applicant has in good faith exercised any right under the Federal Consumer Credit Protection Act or any applicable state law; • the FCRA, which promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies; • the Fair Debt Collection Practices Act, which provides guidelines and limitations concerning the conduct of third- party debt collectors in connection with the collection of consumer debts; • the Telephone Consumer Protection Act, which regulates the use of telephone and texting to communicate with customers; • the CAN-SPAM Act, which regulates the transmittal of commercial email messages; • the Federal Trade Commission’s Holder in Due Course Rule, and equivalent state laws, which make any holder of a consumer credit contract include the required notice and become subject to all claims and defenses that a borrower could assert against the seller of goods or services; • the CFPB’s Small Dollar Lending Rule, which requires disclosures related to payments and imposes other requirements for certain consumer loans; • the Electronic Fund Transfer Act and Regulation E promulgated thereunder, which provide disclosure requirements, guidelines, and restrictions on the electronic transfer of funds from consumers’ bank accounts; • the Electronic Signatures in Global and National Commerce Act and similar state laws, particularly the Uniform Electronic Transactions Act, which authorize the creation of legally binding and enforceable agreements utilizing electronic records and signatures, including applicable Canadian provincial and territorial e-commerce laws; • the Military Lending Act and similar state laws, which provide disclosure requirements, substantive conduct obligations, and prohibitions on certain behavior relating to loans made to covered borrowers, which include both servicemembers and their dependents; • the Servicemembers Civil Relief Act, which allows active duty military members to suspend or postpone certain civil obligations so that the military member can devote his or her full attention to military duties; • new requirements pursuant to the CARES Act, including requirements relating to collection and credit reporting, though many of the implementing regulations under the CARES Act have not yet been issued; • the Gramm-Leach-Bliley Act (the “GLBA”), which includes limitations on use and disclosure of nonpublic personal information about a consumer by a financial institution; and • state privacy and data security laws including, but not limited to, the California Consumer Privacy Act (“CCPA”), as amended by the California Privacy Rights Act (“CPRA”), the Virginia Consumer Data Protection Act (“CDPA”) which include limitations and requirements surrounding the use, disclosure, and other processing of certain personal information, the Colorado Privacy Act (“CoPA”) and the Utah Consumer Privacy Act (“UCPA”).

• • • • • • • sezzle

sezzle

sezzle

SEZZLE INC ANNUAL REPORT | 76 We will incur significant costs and are subject to additional regulations and requirements as a public company in both Australia and the United States, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes-Oxley Act and the listing standards of ASX. In addition, key members of our management team have limited experience managing a public company. As a U.S. public company, we will incur significant legal, accounting and other expenses that are not incurred by companies listed solely on the ASX, including costs associated with U.S. public company reporting requirements. Compliance with these requirements will place a strain on our management, systems and resources. The Exchange Act requires us to file annual, quarterly and current reports with respect to our business and financial condition within specified time periods and to prepare a proxy statement with respect to our annual meeting of stockholders. We also have incurred and will continue to incur costs associated with the Sarbanes-Oxley Act and rules implemented by the SEC and the ASX. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures, and internal controls over financial reporting. The ASX requires that we comply with various corporate governance requirements. The expenses generally incurred by U.S. public companies for reporting and corporate governance purposes have been increasing. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly, although we are currently unable to estimate these costs with any degree of certainty. These laws and regulations also could make it more difficult or costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. These laws and regulations could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, on our board committees or as our executive officers. Advocacy efforts by stockholders and third parties may also prompt even more changes in governance and reporting requirements. Furthermore, if we are unable to satisfy our obligations as a listed company, we could be subject to delisting of our common stock on the ASX, as well as fines, sanctions and other regulatory action and civil litigation. Many members of our management team have limited experience managing a publicly traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage our transition to being a public company in the United States, being subject to significant regulatory oversight and reporting obligations under the federal securities laws and the continuous scrutiny of securities analysts and investors, as well as the interaction of such oversight and reporting obligations with those applicable under ASX listing and regulatory requirements. These new obligations and constituents may require us to employ additional specialized staff and seek advice from third party service provides. They will also require significant attention from our senior management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business, results of operations and financial condition. If we discover a material weakness in our internal control over financial reporting that we are unable to remedy or otherwise fail to maintain effective internal control over financial reporting or disclosure controls and procedures, our ability to report our financial results on a timely and accurate basis may be adversely affected. We are required to comply with the SEC’s rules implementing Sections 302 and 404 of the Sarbanes-Oxley Act, which require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of internal controls over financial reporting. As an emerging growth company, our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) until the later of (i) the year following our first annual report required to be filed with the SEC or (ii) the date we are no longer an emerging growth company. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. To comply with the requirements of being a U.S. public company, we have undertaken various actions, and will need to take additional actions, such as implementing numerous internal controls and procedures and hiring additional accounting or internal audit staff or consultants. Testing and maintaining internal control can divert our management’s attention from other matters that are important to the operation of our business. Additionally, when evaluating our internal control over financial reporting, we may identify material weaknesses that we may not be able to remediate in time to meet the applicable deadline imposed upon us for compliance with the requirements of Section 404.

• • • • • • sezzle

sezzle

| Consolidated Financial Statements | sezzle

18SEZZLE INC ANNUAL REPORT 2021 | 0 C O N S O L I D AT E D F I N A N C I A L S TAT E M E N T S

<t bakertilly REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the shareholders and the board of directors of Sezzle Inc. and Subsidiaries: Opinion on the Financial Statements We have audited the accompanying consolidated balance sheets of Sezzle Inc. and Subsidiaries (the "Company") as of December 31 , 2021 and 2020, the related consolidated statements of operations and comprehensive loss, stockholders' equity and cash flows for the years ended December 31 , 2021 and 2020, and the related notes (collectively referred to as the "financial statements"). In our opinion, the consolidated financial statements present fairly, in all material respects. the financial position of the Company as of December 31 , 2021 and 2020, and the results of its operations and its cash flows for the years ended December 31, 2021 and 2020, in conformity with accounting principles generally accepted in the United States of America. Basis for Opinion These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting . Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion. ~1~u~uP We have served as the Company's auditor since 2019. Minneapolis, Minnesota March 30, 2022 Baker Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd. , the members of which are separate and independent legal entities. sezzle

sezzle

sezzle

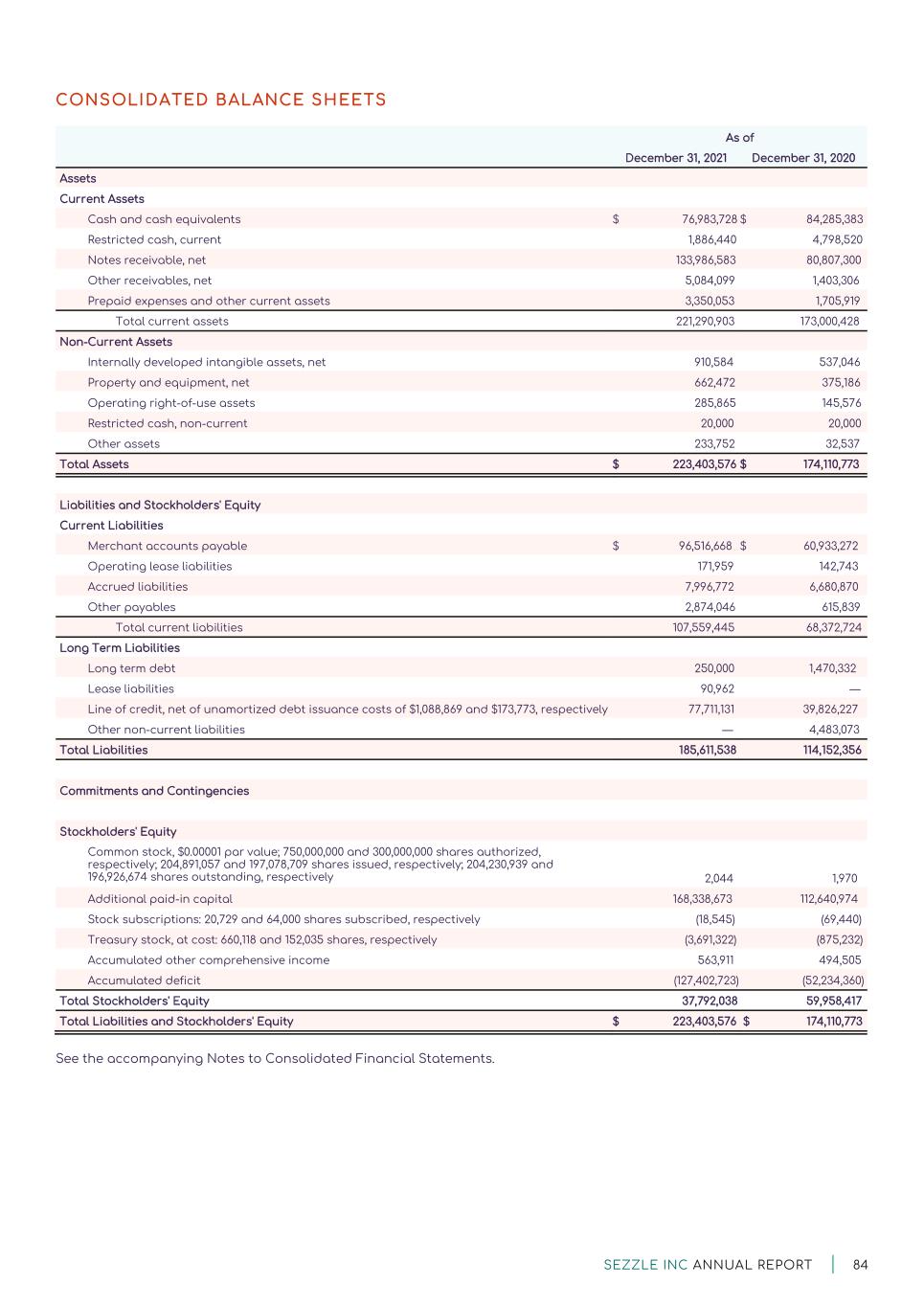

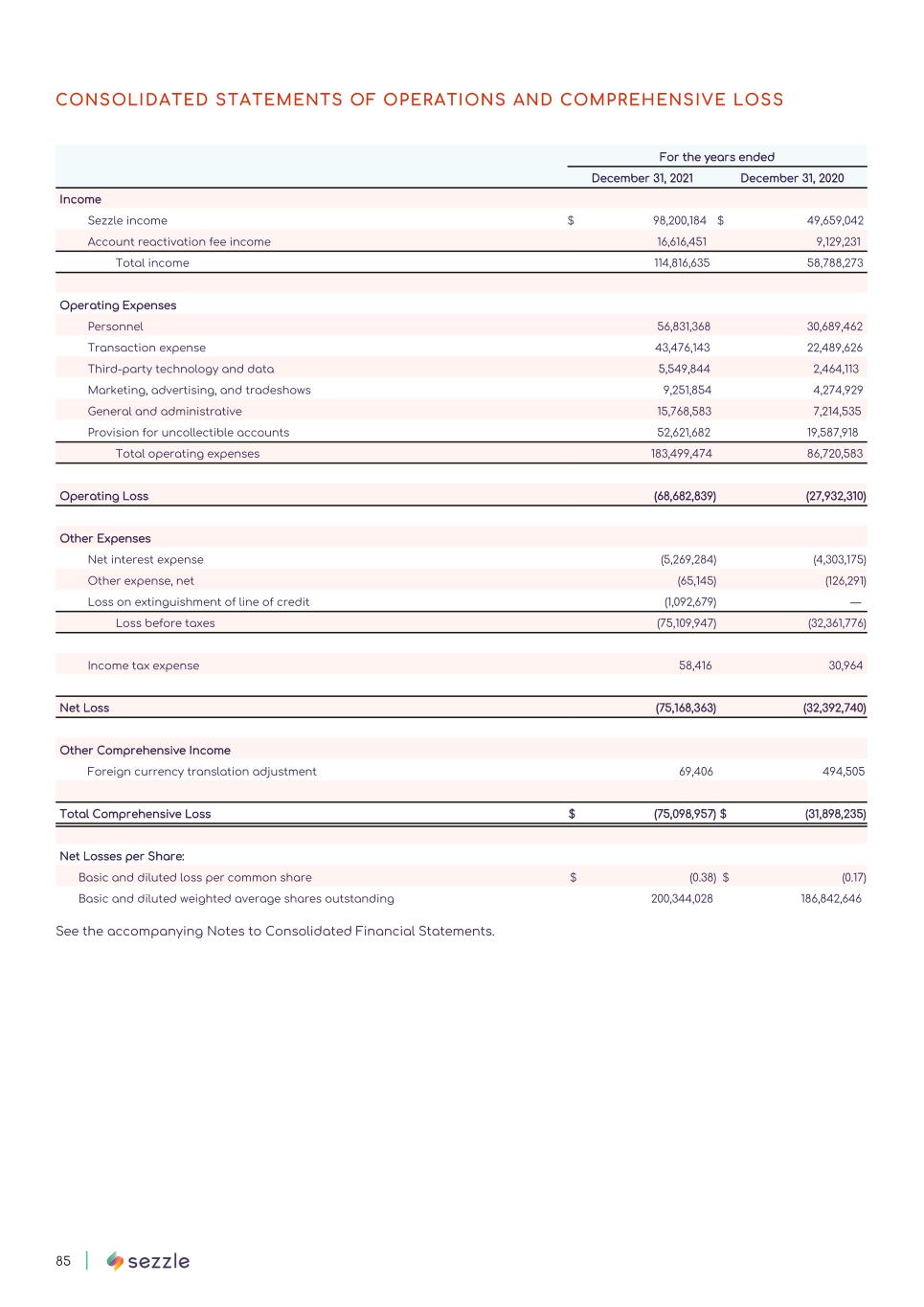

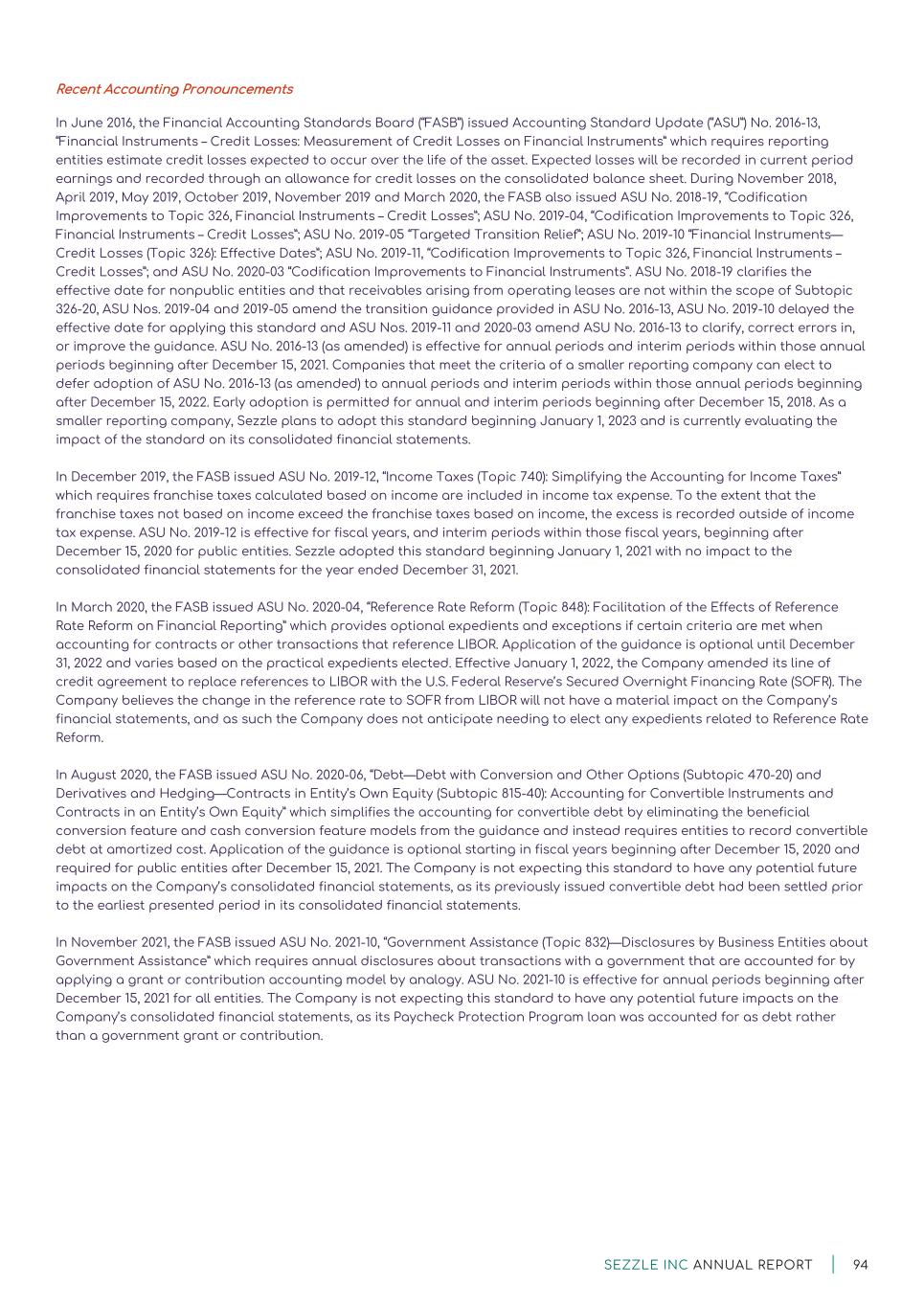

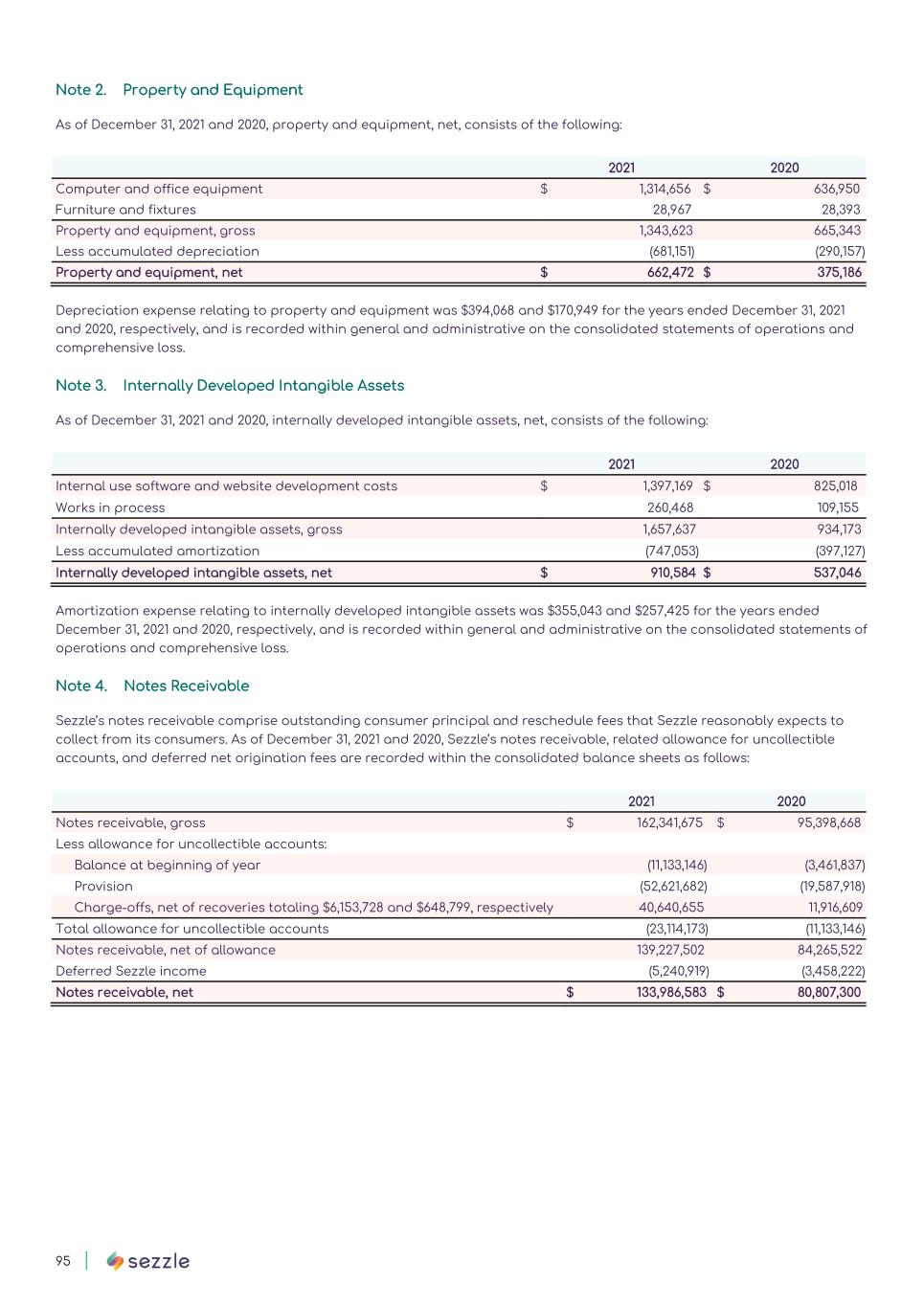

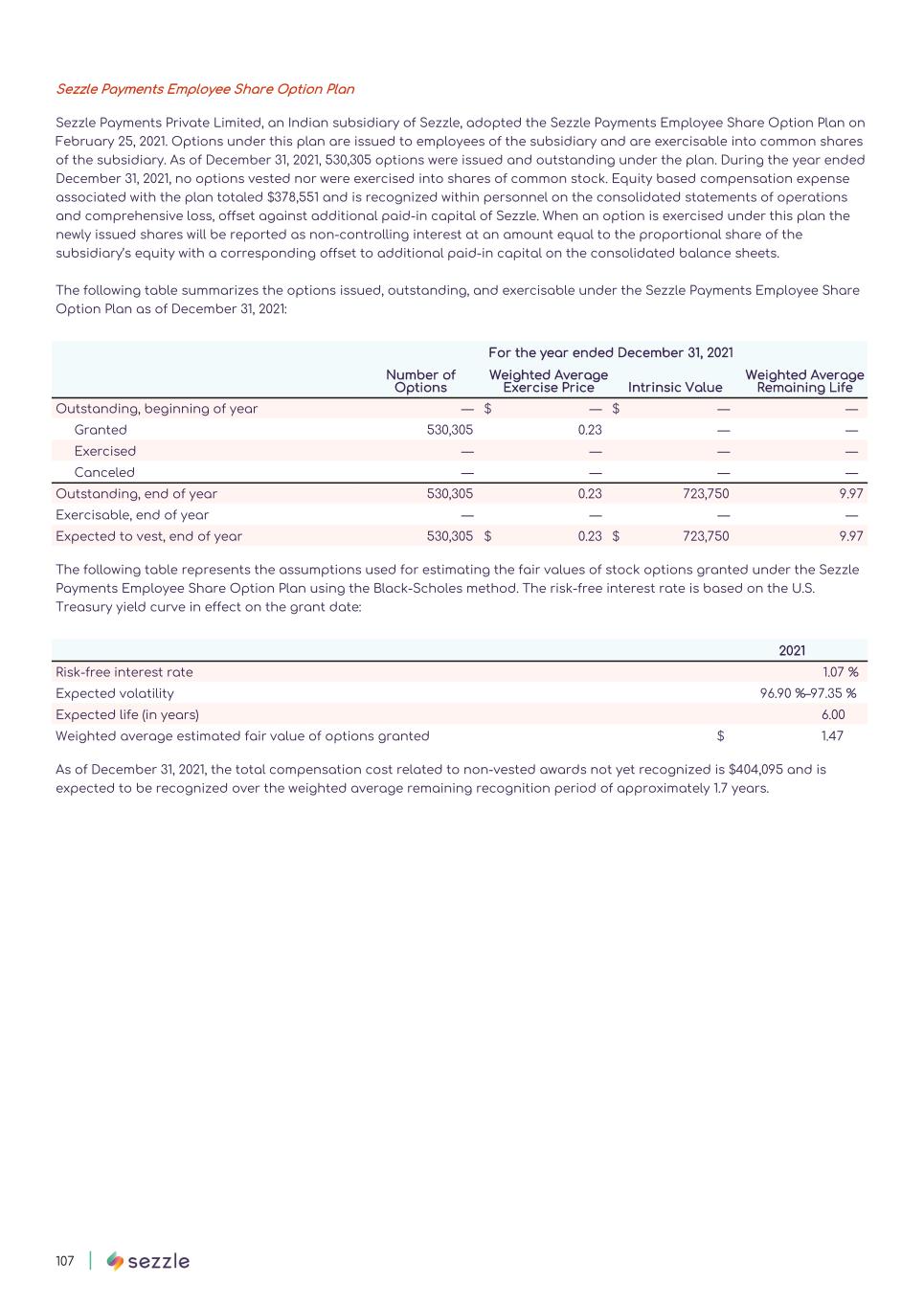

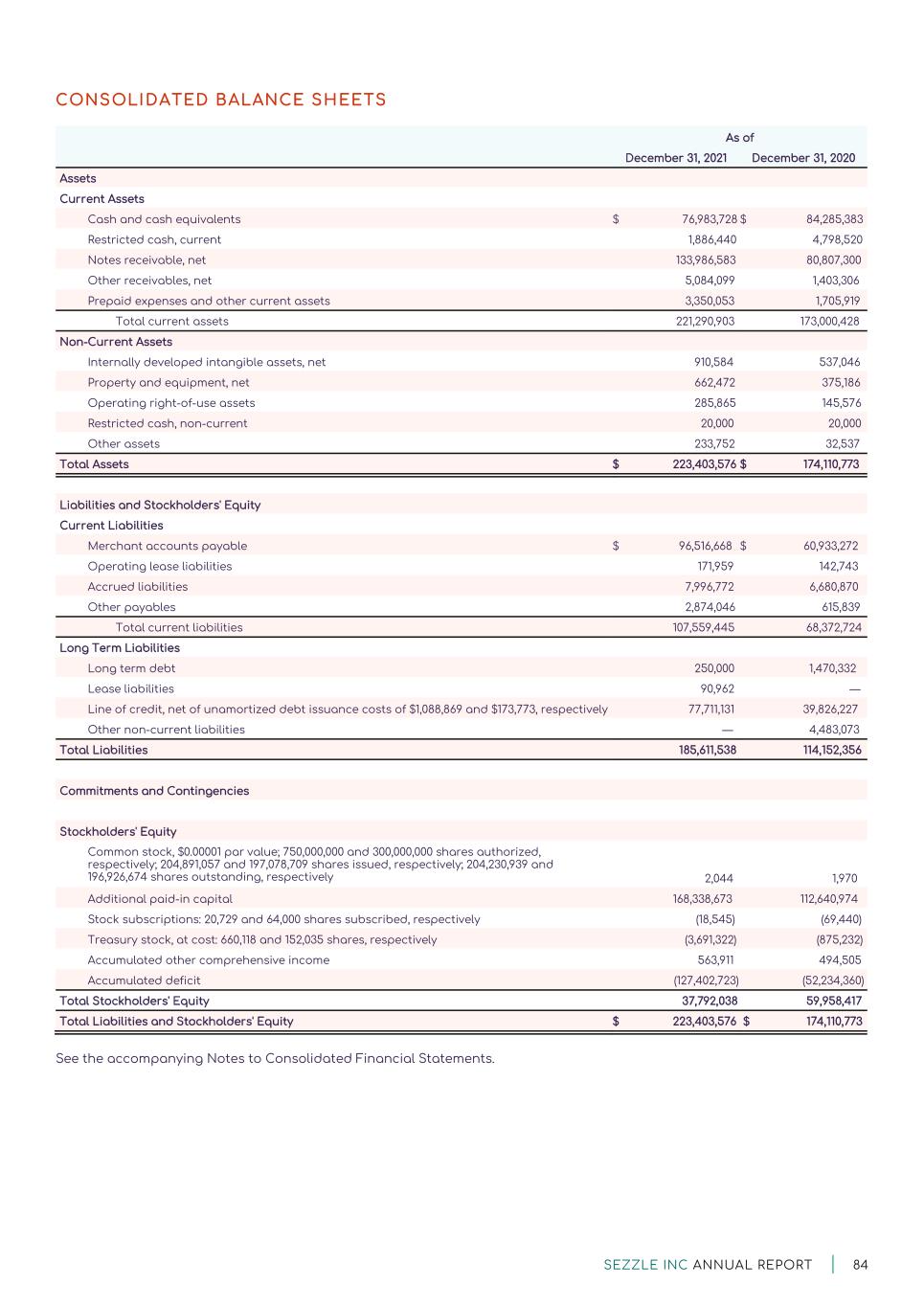

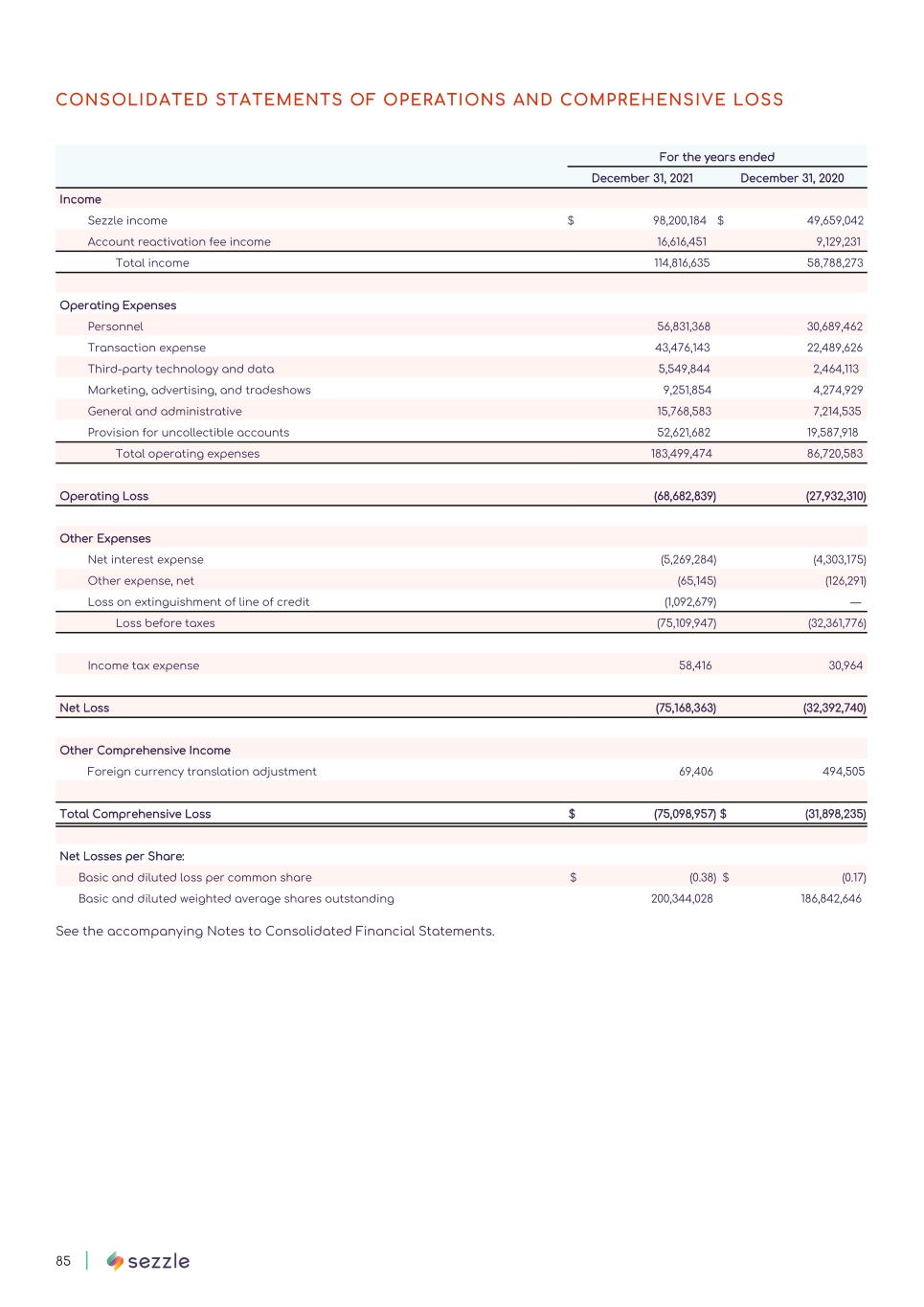

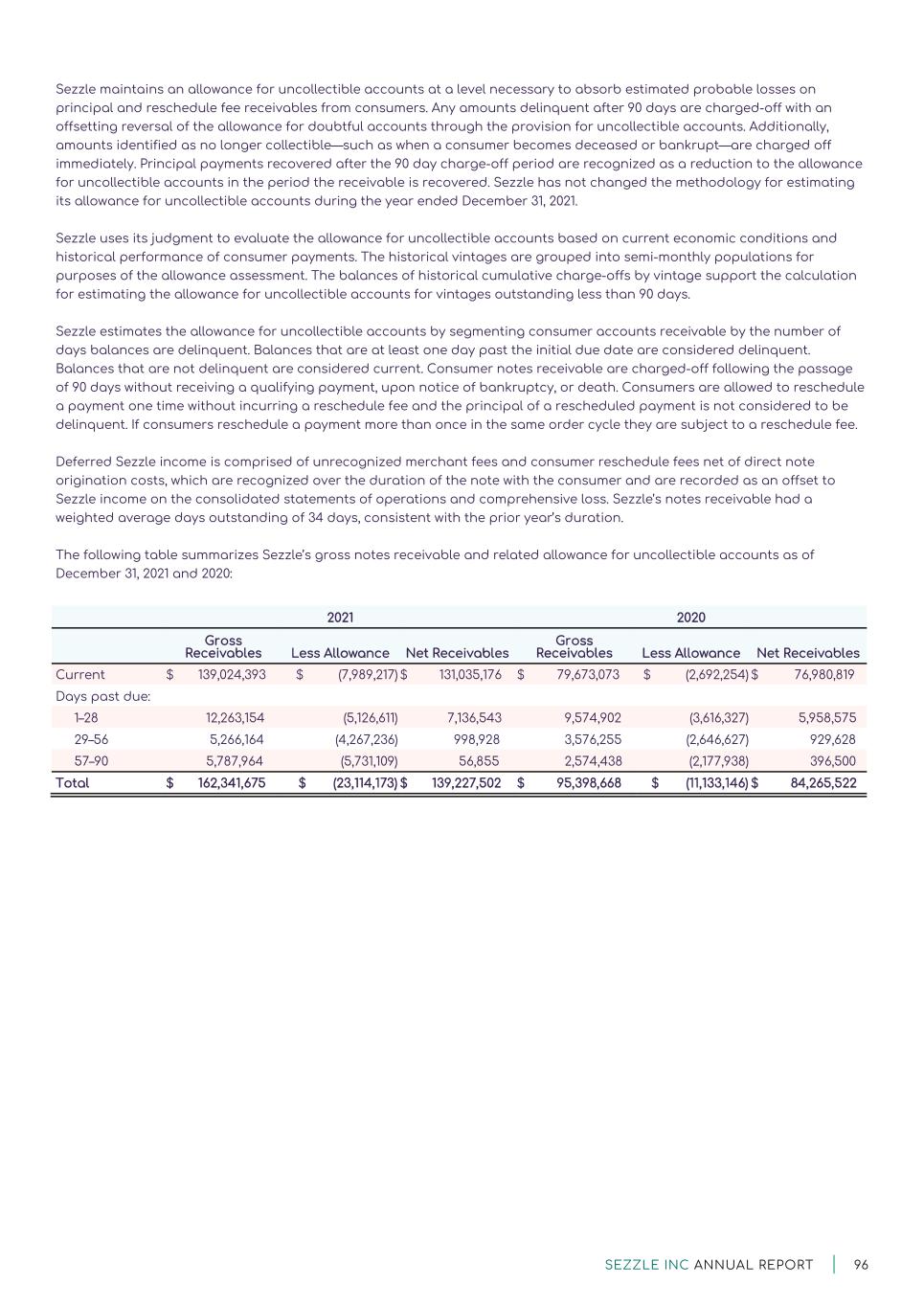

SEZZLE INC ANNUAL REPORT | 88 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Note 1. Principal Business Activity and Significant Accounting Policies Principal Business Activity Sezzle Inc. (the “Company” or “Sezzle”) is a technology-enabled payments company based in the United States with operations in the United States, Canada, India, Europe, and startup operations in Brazil. The Company is a Delaware Public Benefit Corporation formed on January 4, 2016. The Company offers its payment solution at online stores and a select number of brick-and-mortar retail locations, connecting consumers with merchants via a proprietary payments solution that instantly extends credit at point-of-sale, allowing consumers to purchase and receive the items that they need now while paying over time in interest-free installments. Merchants turn to Sezzle to increase sales by tapping into Sezzle’s existing user base, increase conversion rates, increase spend per transaction, increase purchase frequency, and reduce return rates, all without bearing any credit risk. Sezzle is a high-growth, networked platform that benefits from a symbiotic and mutually beneficial relationship between merchants and consumers. The Company’s core product allows consumers to make online purchases and split the payment for the purchase over four equal, interest-free payments over six weeks. The consumer makes the first payment at the time of checkout and makes the subsequent payments every two weeks thereafter. For the Company’s core direct integration solution, the purchase price, less merchant fees, is paid to merchants by Sezzle in advance of collecting the purchase price installments from the consumer. For the Sezzle Virtual Card solution, the full purchase price is paid to merchants at the time of sale, and Sezzle separately invoices the merchant for merchant fees due to the Company. The Company is headquartered in Minneapolis, Minnesota. Basis of Presentation and Principles of Consolidation The consolidated financial statements are prepared and presented under accounting principles generally accepted in the United States of America (U.S. GAAP). All amounts are reported in U.S. dollars, unless otherwise noted. The Company consolidates the accounts of subsidiaries for which it has a controlling financial interest. The accompanying consolidated financial statements include all the accounts and activity of Sezzle Inc. and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Liquidity and Financial Condition The Company meets its liquidity requirements primarily through proceeds from its line of credit, of which it is subject to various covenants. During the year ended December 31, 2021, the Company incurred net losses from its operations, which if continued at the same level in future periods would result in the breach of one or more of such line of credit covenants. The Company's line of credit is a significant component of its working capital management. On February 25, 2022 the Company amended its existing line of credit covenants as disclosed in the subsequent event footnote of the consolidated financial statements. Additionally, on March 10, 2022 the Company undertook a workforce reduction to provide the Company with additional annualized cost savings of approximately $10 million. The Company will undertake further cost cutting measures if the actions taken during the first quarter of 2022 do not fully mitigate the risk of breaching one or more of its line of credit covenants. Management believes that the implementation of these plans will allow the Company to continue as a going concern through at least March 31, 2023. There are no assurances that the Company’s implementation of these efforts will be successful, or that the degree of success will be sufficient to meet its current operating costs and requirements under its line of credit covenants. If the Company is unable to increase its profitability and liquidity, it may not be able to fund its ongoing operations. The accompanying consolidated financial statements assume that the Company will continue as a going concern and have been prepared on the basis of the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The accompanying consolidated financial statements do not include any adjustments to the recoverability and classifications of recorded assets and liabilities as a result of uncertainties.

sezzle

sezzle

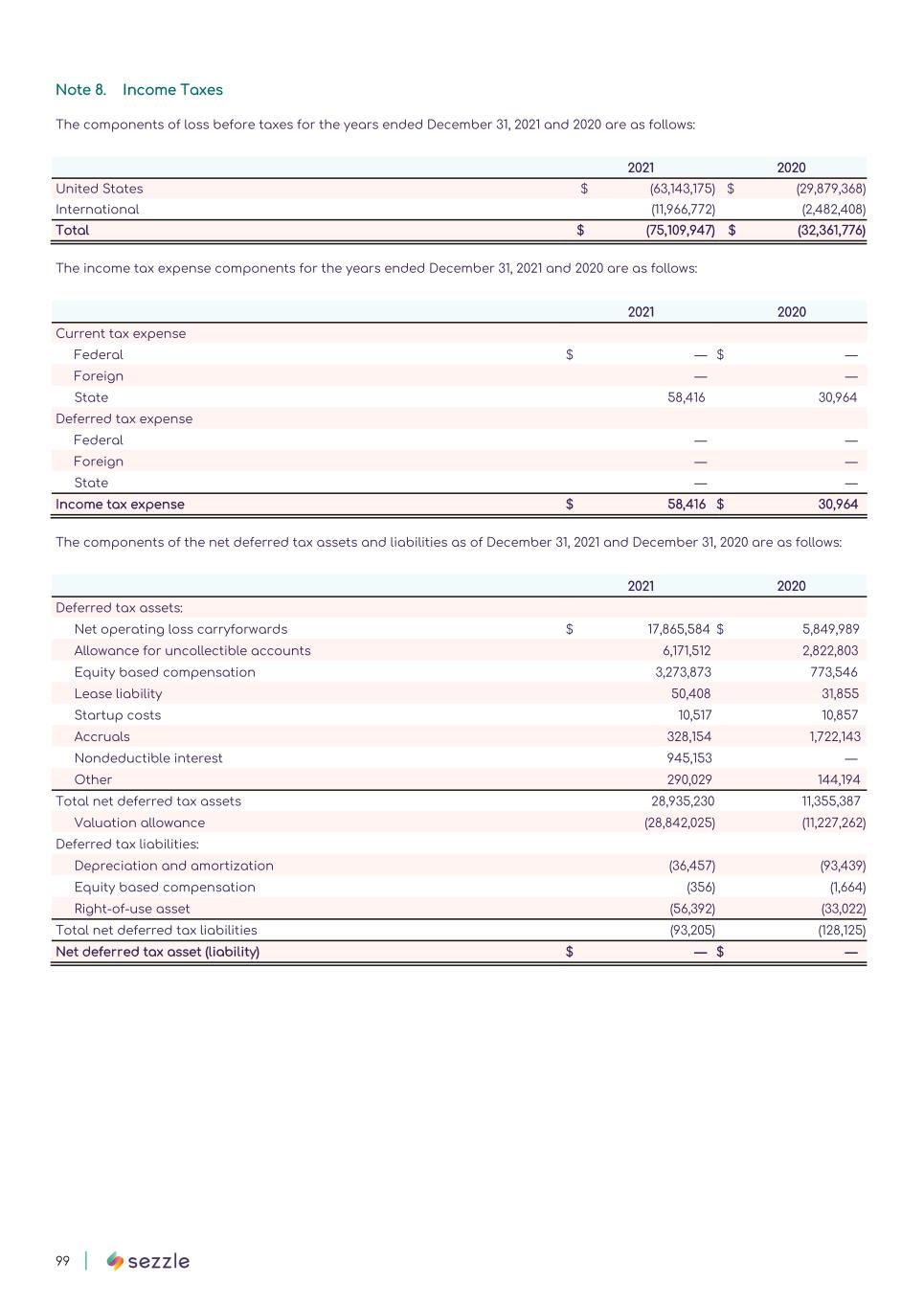

SEZZLE INC ANNUAL REPORT | 92 Income Taxes Income taxes are provided for the tax effects of transactions reported in the consolidated financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of receivables, property and equipment, equity based compensation, and accrued liabilities for financial and income tax reporting. The deferred tax assets and liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. A full valuation allowance is recorded against the Company's deferred tax assets. The Company evaluates its tax positions that have been taken or are expected to be taken on income tax returns to determine if an accrual is necessary for uncertain tax positions. To date the Company has not recorded any liabilities for uncertain tax positions. Refer to Note 8 for further information. Advertising Costs Advertising costs are expensed as incurred and consist of traditional marketing, digital marketing, sponsorships, and promotional product expenses. Such costs were $8,569,276 and $3,883,936 for the years ended December 31, 2021 and 2020, respectively. Equity Based Compensation The Company maintains stock compensation plans that offer incentives in the form of non-statutory stock options and restricted stock to employees, directors, and advisors of the Company. Equity based compensation expense reflects the fair value of awards measured at the grant date and recognized over the relevant vesting period. The Company estimates the fair value of stock options without a market condition on the measurement date using the Black-Scholes option valuation model. The fair value of stock options and restricted stock units with a market condition is estimated, at the date of grant, using the Monte Carlo Simulation model. The Black-Scholes and Monte Carlo Simulation models incorporate assumptions about stock price volatility, the expected life of the options, risk-free interest rate, and dividend yield. For valuing the Company’s stock option grants, significant judgment is required for determining the expected volatility of the Company’s common stock and is based on the historical volatility of both its common stock and its defined peer group. The fair value of restricted stock awards and restricted stock units is based on the fair market value of the Company’s common stock on the date of grant. The expense associated with equity based compensation is recognized over the requisite service period using the straight-line method. The Company issues new shares of common stock upon the exercise of stock options and vesting of restricted stock units. Refer to Note 13 and Note 15 for further information around the Company’s equity based compensation plans. Estimates The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements. The Company’s estimates and judgments are based on historical experience and various other assumptions that it believes are reasonable under the circumstances. The amount of assets and liabilities reported on the Company’s consolidated balance sheets and the amounts of income and expenses reported for each of the periods presented are affected by estimates and assumptions, which are used for, but not limited to, determining the allowance for uncollectible accounts recorded against outstanding receivables, the useful life of property and equipment and internally developed intangible assets, determining impairment of property and equipment and internally developed intangible assets, valuation of equity based compensation, leases, and income taxes.

sezzle

sezzle

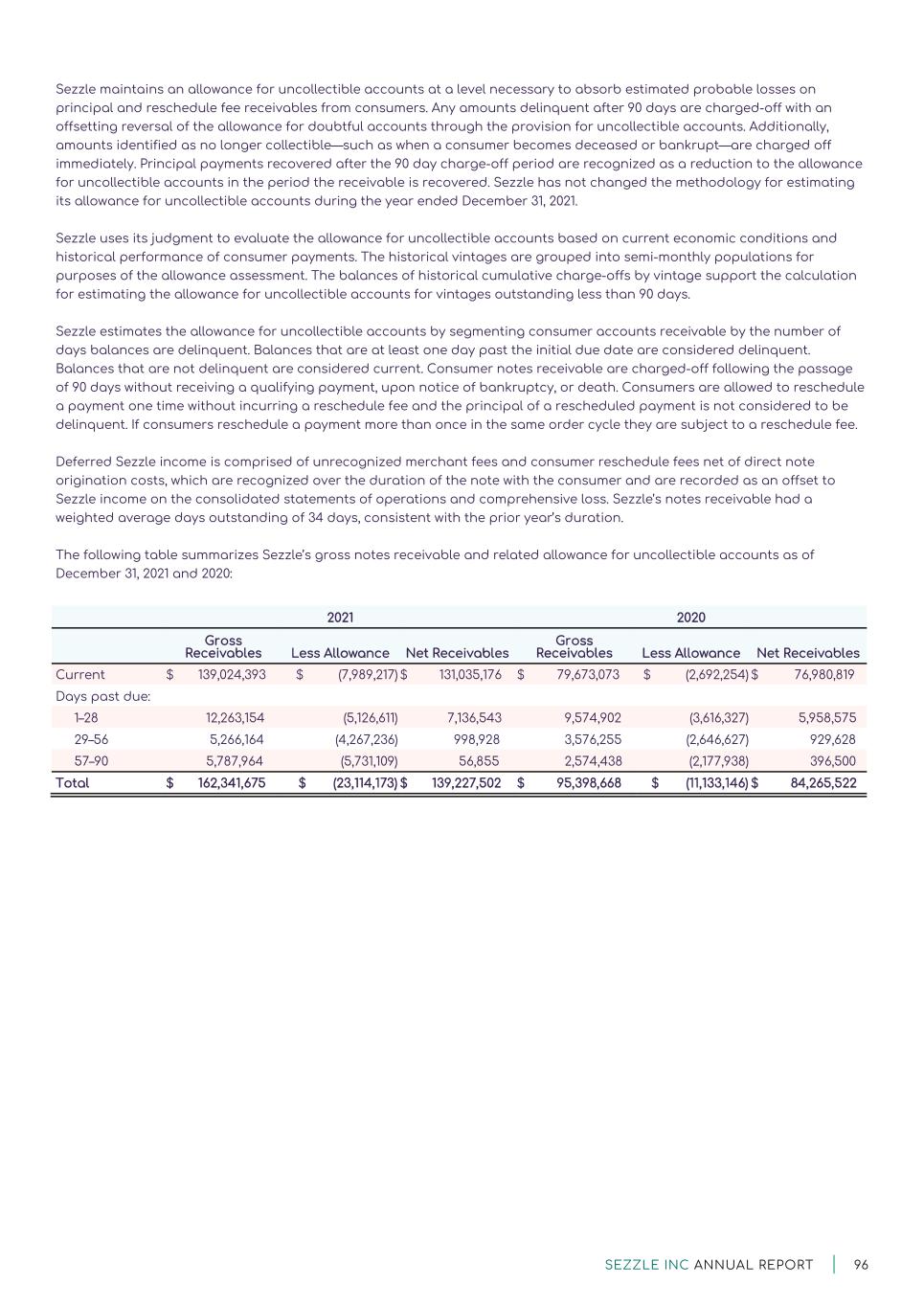

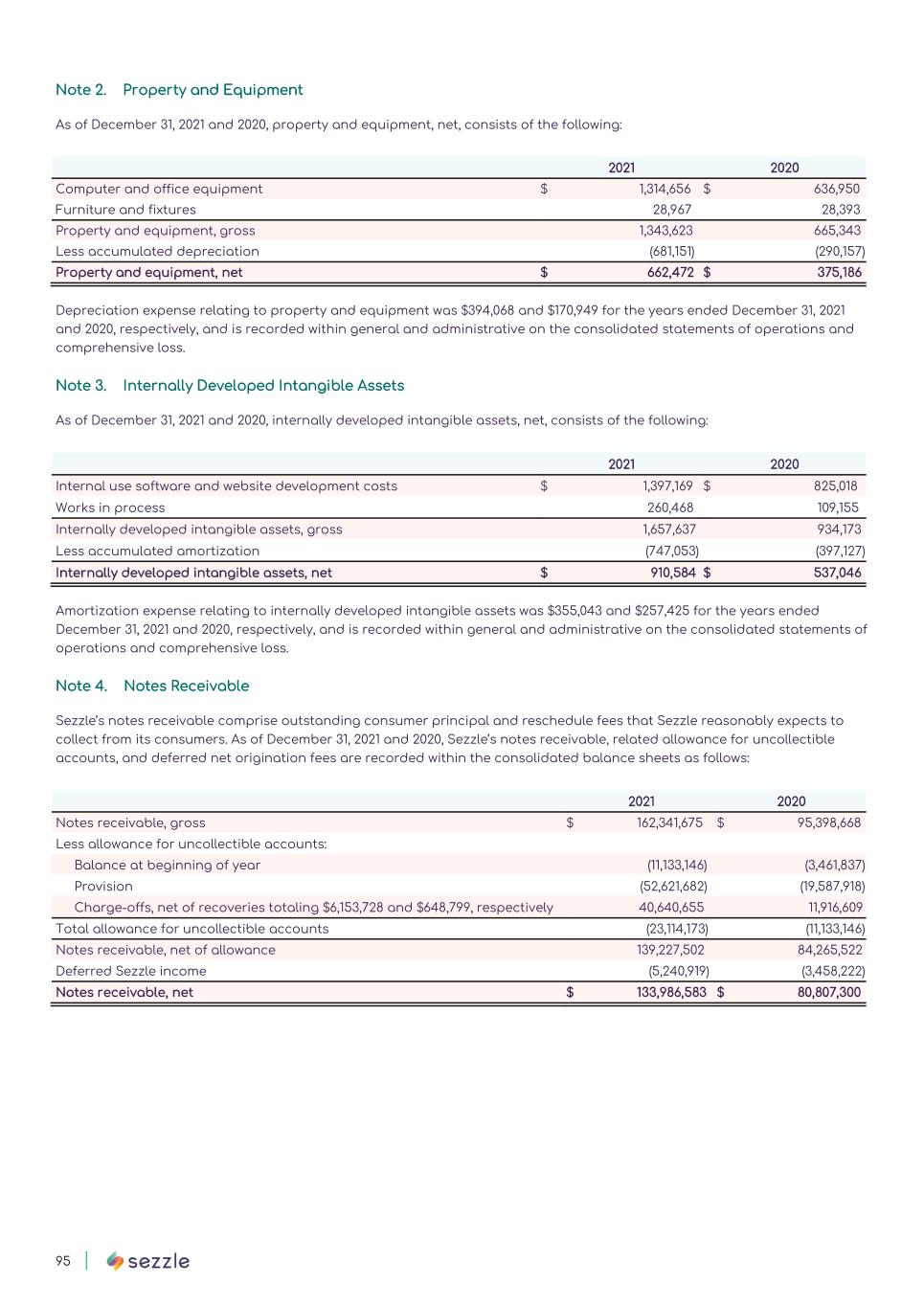

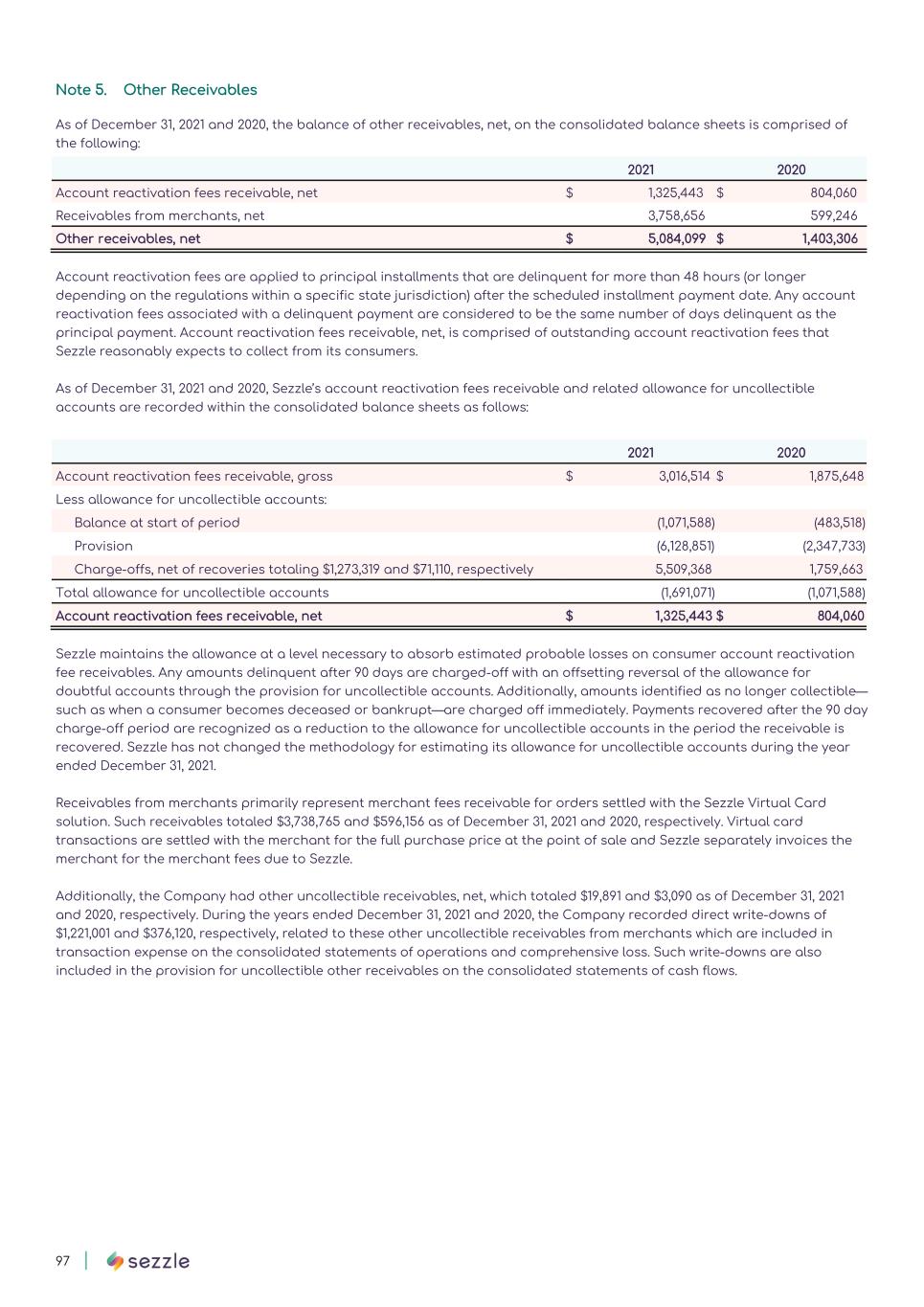

SEZZLE INC ANNUAL REPORT | 96 Sezzle maintains an allowance for uncollectible accounts at a level necessary to absorb estimated probable losses on principal and reschedule fee receivables from consumers. Any amounts delinquent after 90 days are charged-off with an offsetting reversal of the allowance for doubtful accounts through the provision for uncollectible accounts. Additionally, amounts identified as no longer collectible—such as when a consumer becomes deceased or bankrupt—are charged off immediately. Principal payments recovered after the 90 day charge-off period are recognized as a reduction to the allowance for uncollectible accounts in the period the receivable is recovered. Sezzle has not changed the methodology for estimating its allowance for uncollectible accounts during the year ended December 31, 2021. Sezzle uses its judgment to evaluate the allowance for uncollectible accounts based on current economic conditions and historical performance of consumer payments. The historical vintages are grouped into semi-monthly populations for purposes of the allowance assessment. The balances of historical cumulative charge-offs by vintage support the calculation for estimating the allowance for uncollectible accounts for vintages outstanding less than 90 days. Sezzle estimates the allowance for uncollectible accounts by segmenting consumer accounts receivable by the number of days balances are delinquent. Balances that are at least one day past the initial due date are considered delinquent. Balances that are not delinquent are considered current. Consumer notes receivable are charged-off following the passage of 90 days without receiving a qualifying payment, upon notice of bankruptcy, or death. Consumers are allowed to reschedule a payment one time without incurring a reschedule fee and the principal of a rescheduled payment is not considered to be delinquent. If consumers reschedule a payment more than once in the same order cycle they are subject to a reschedule fee. Deferred Sezzle income is comprised of unrecognized merchant fees and consumer reschedule fees net of direct note origination costs, which are recognized over the duration of the note with the consumer and are recorded as an offset to Sezzle income on the consolidated statements of operations and comprehensive loss. Sezzle’s notes receivable had a weighted average days outstanding of 34 days, consistent with the prior year’s duration. The following table summarizes Sezzle’s gross notes receivable and related allowance for uncollectible accounts as of December 31, 2021 and 2020: 2021 2020 Gross Receivables Less Allowance Net Receivables Gross Receivables Less Allowance Net Receivables Current $ 139,024,393 $ (7,989,217) $ 131,035,176 $ 79,673,073 $ (2,692,254) $ 76,980,819 Days past due: 1–28 12,263,154 (5,126,611) 7,136,543 9,574,902 (3,616,327) 5,958,575 29–56 5,266,164 (4,267,236) 998,928 3,576,255 (2,646,627) 929,628 57–90 5,787,964 (5,731,109) 56,855 2,574,438 (2,177,938) 396,500 Total $ 162,341,675 $ (23,114,173) $ 139,227,502 $ 95,398,668 $ (11,133,146) $ 84,265,522

sezzle

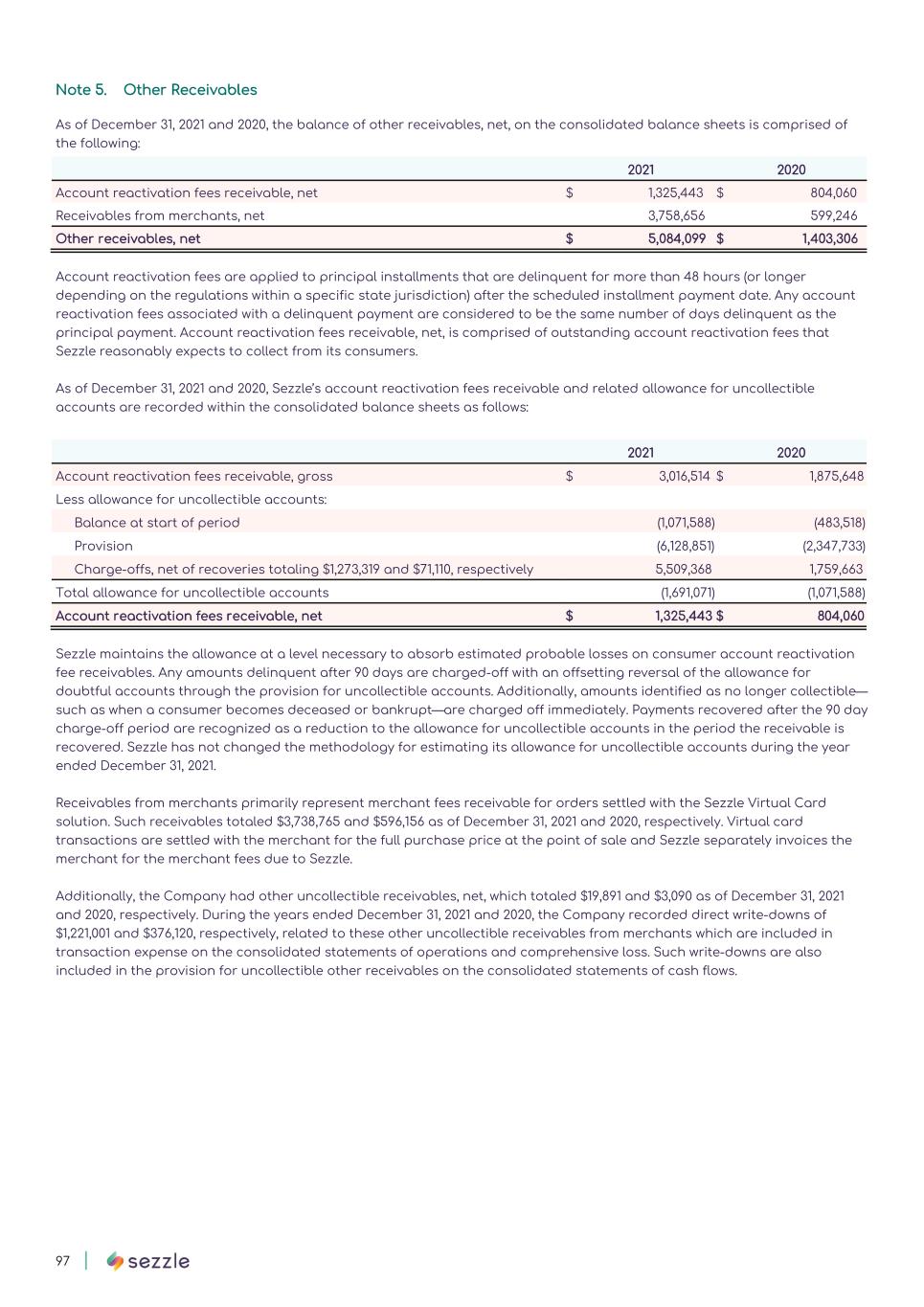

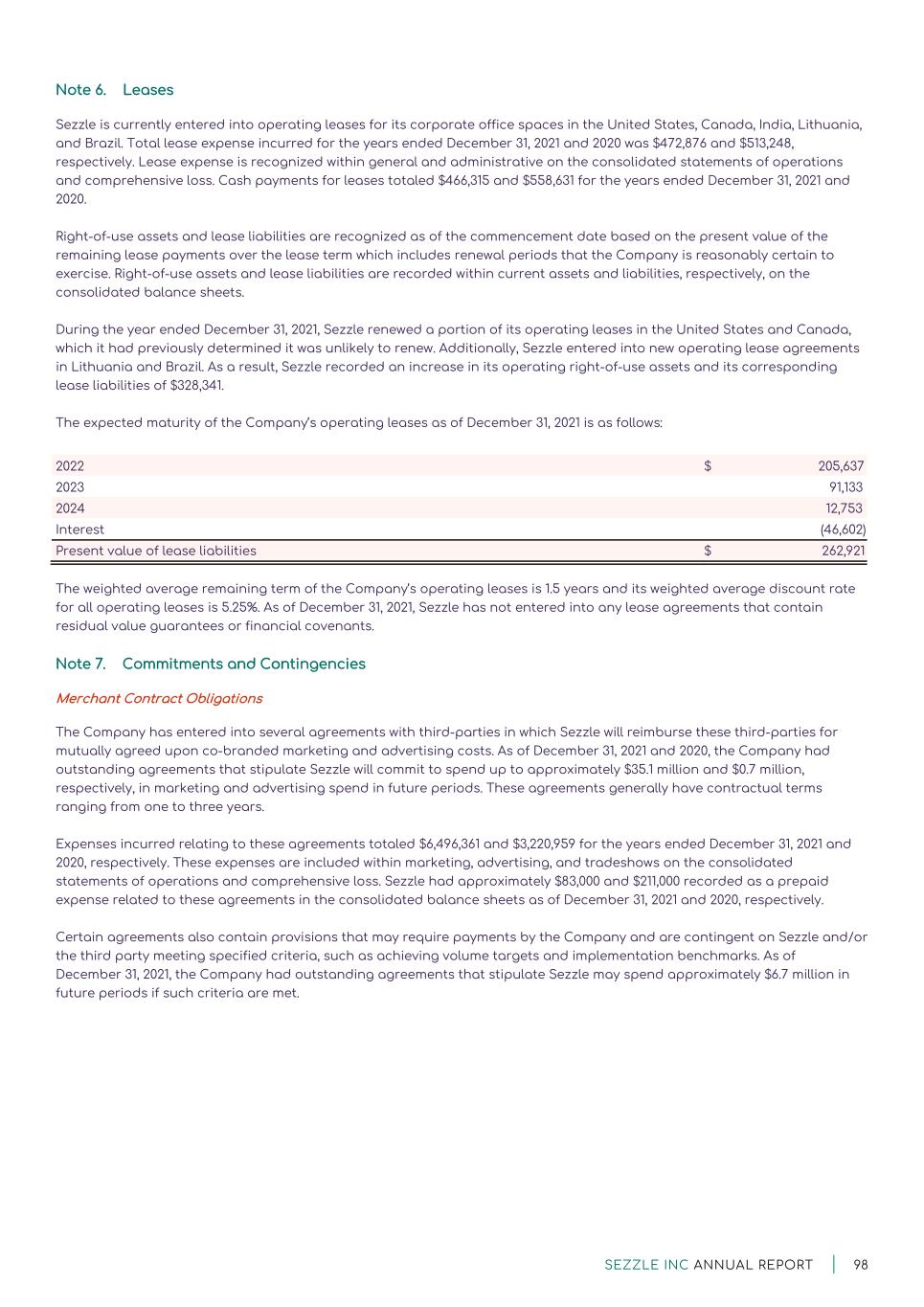

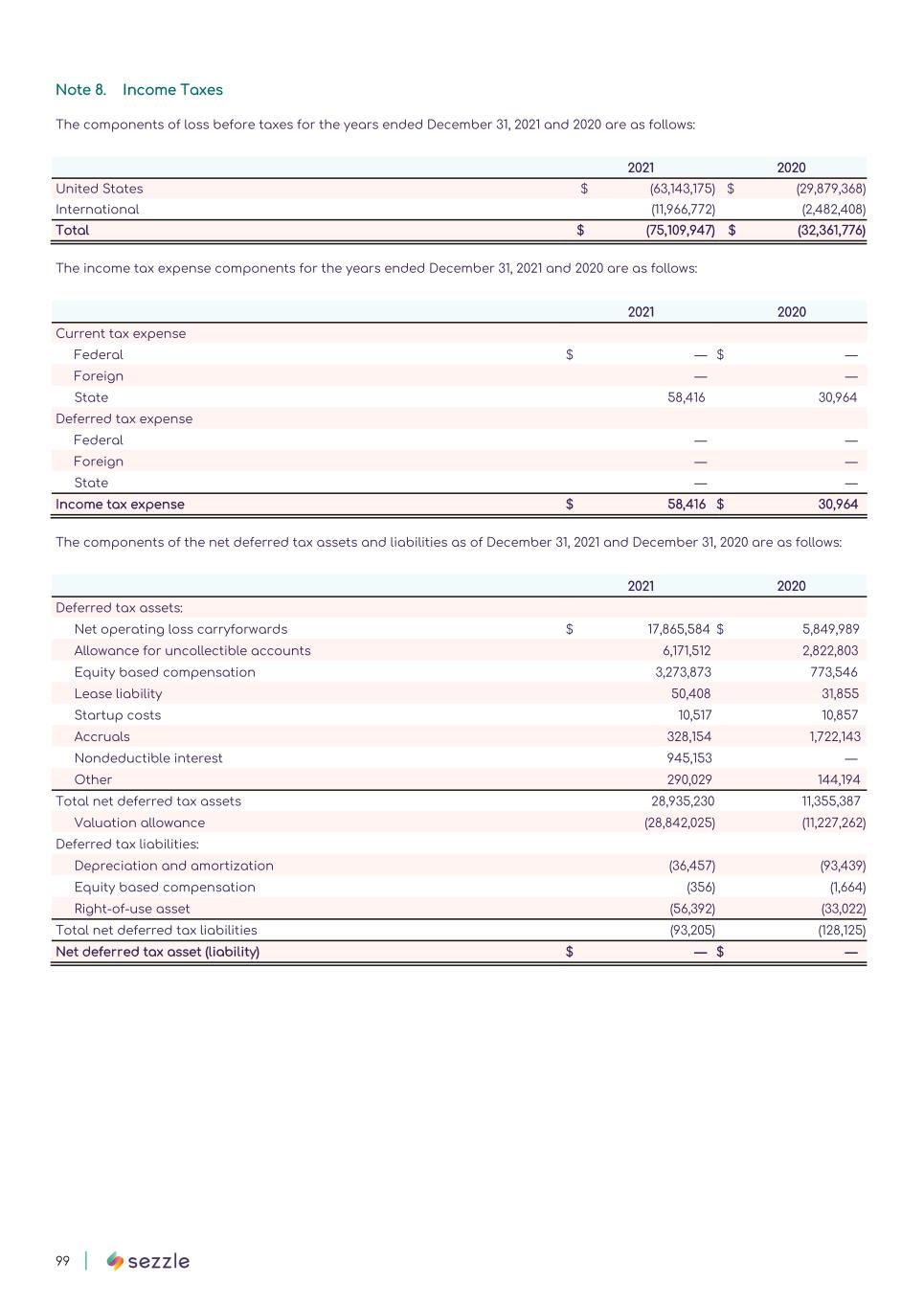

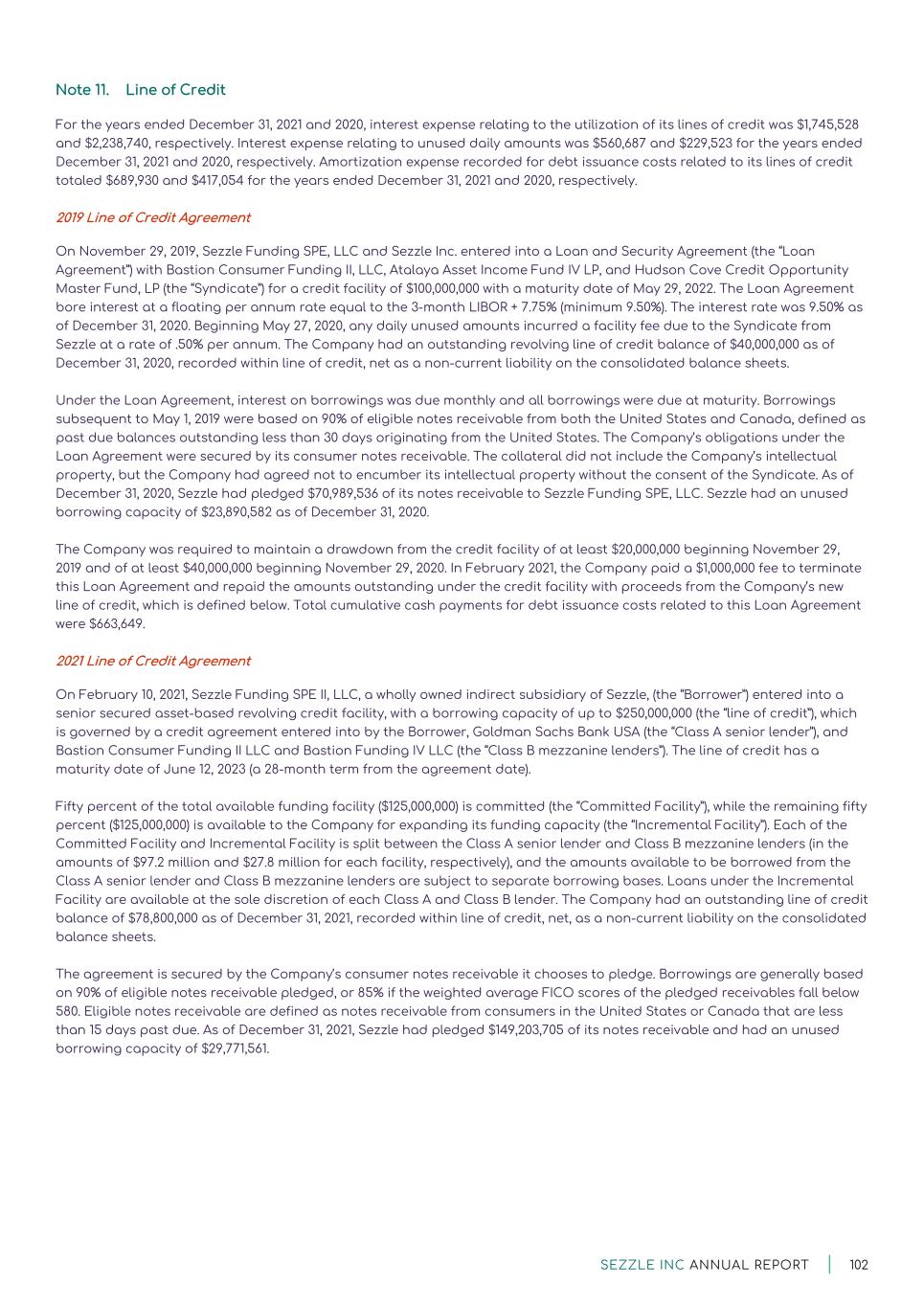

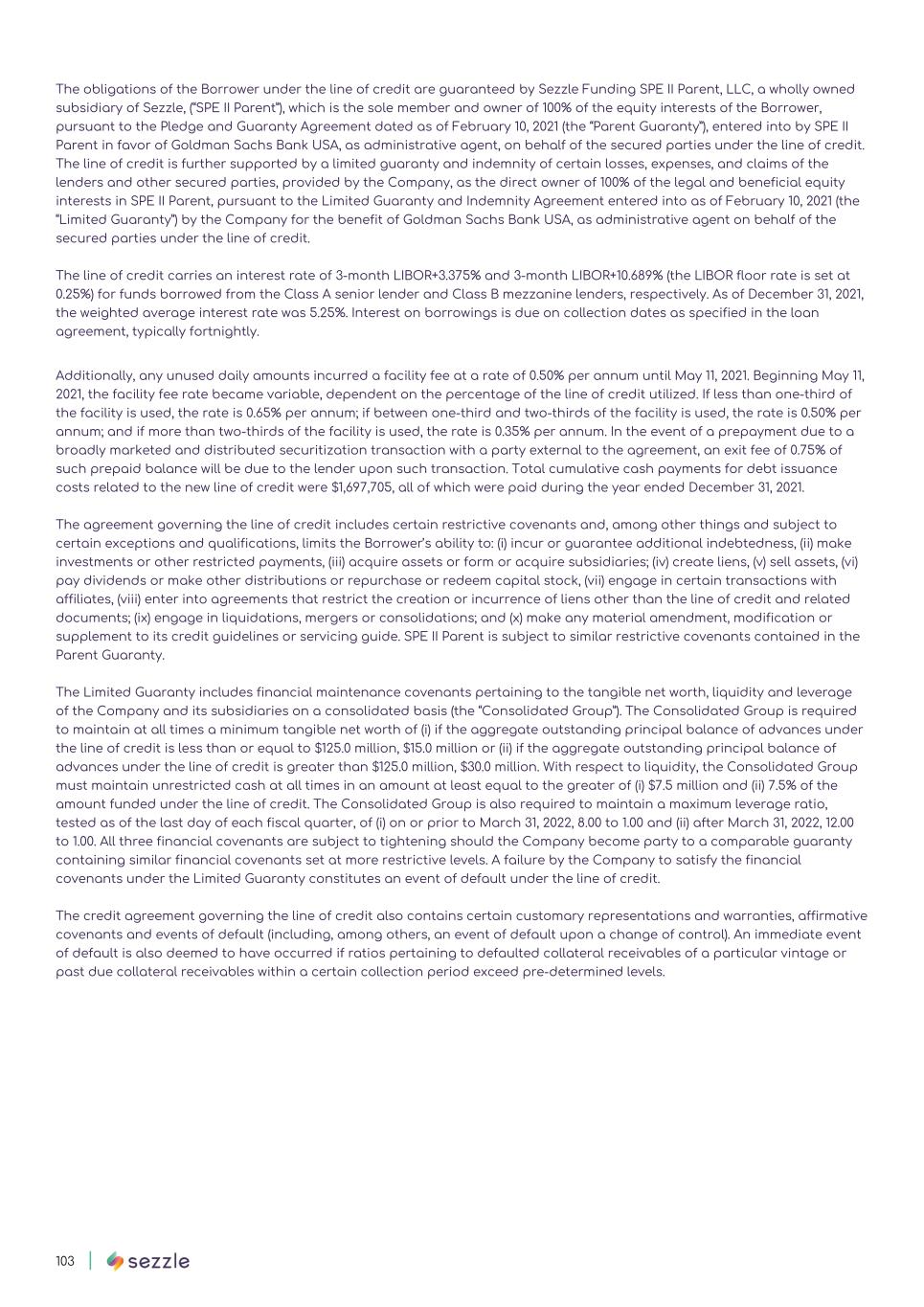

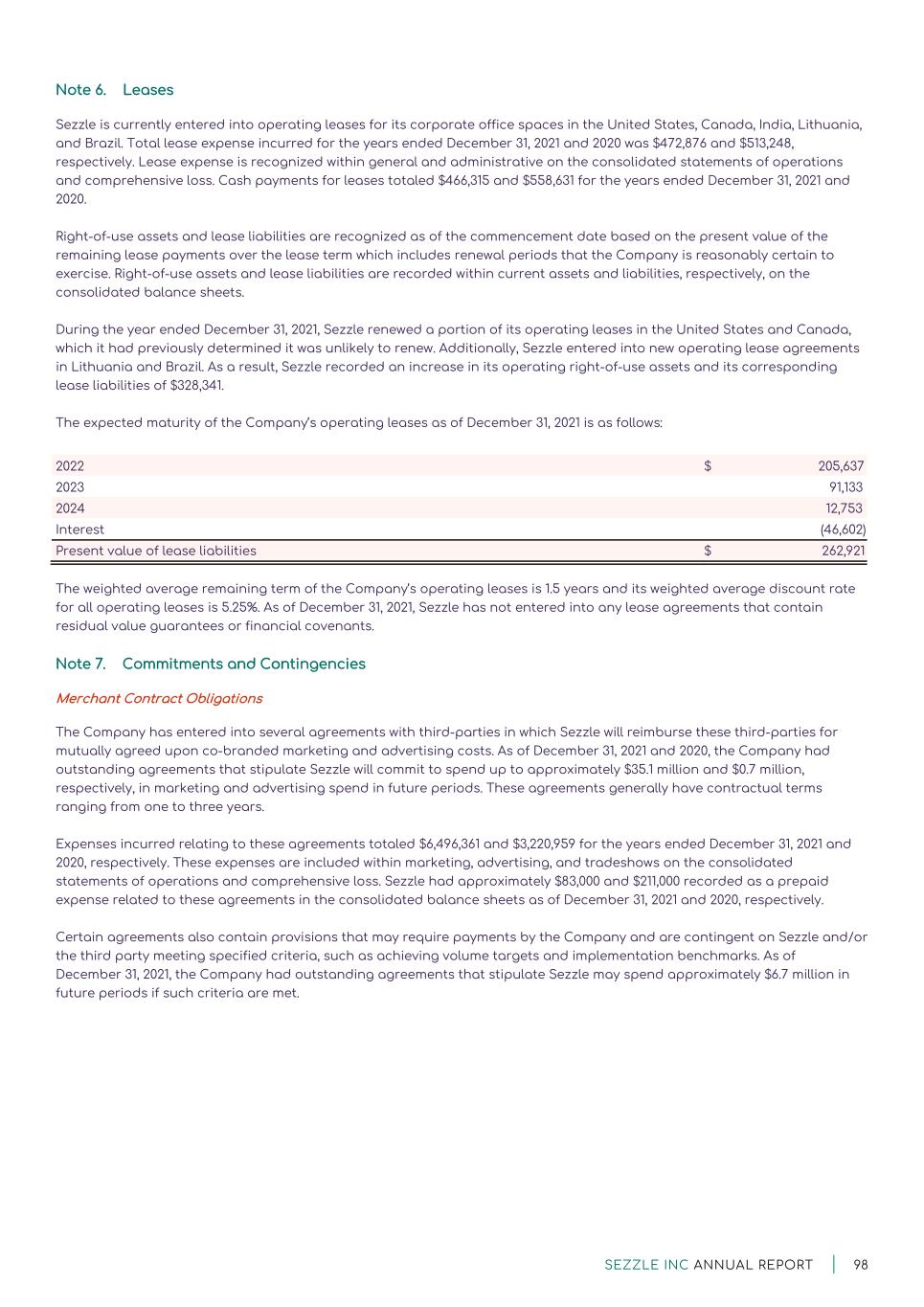

SEZZLE INC ANNUAL REPORT | 98 Note 6. Leases Sezzle is currently entered into operating leases for its corporate office spaces in the United States, Canada, India, Lithuania, and Brazil. Total lease expense incurred for the years ended December 31, 2021 and 2020 was $472,876 and $513,248, respectively. Lease expense is recognized within general and administrative on the consolidated statements of operations and comprehensive loss. Cash payments for leases totaled $466,315 and $558,631 for the years ended December 31, 2021 and 2020. Right-of-use assets and lease liabilities are recognized as of the commencement date based on the present value of the remaining lease payments over the lease term which includes renewal periods that the Company is reasonably certain to exercise. Right-of-use assets and lease liabilities are recorded within current assets and liabilities, respectively, on the consolidated balance sheets. During the year ended December 31, 2021, Sezzle renewed a portion of its operating leases in the United States and Canada, which it had previously determined it was unlikely to renew. Additionally, Sezzle entered into new operating lease agreements in Lithuania and Brazil. As a result, Sezzle recorded an increase in its operating right-of-use assets and its corresponding lease liabilities of $328,341. The expected maturity of the Company’s operating leases as of December 31, 2021 is as follows: 2022 $ 205,637 2023 91,133 2024 12,753 Interest (46,602) Present value of lease liabilities $ 262,921 The weighted average remaining term of the Company’s operating leases is 1.5 years and its weighted average discount rate for all operating leases is 5.25%. As of December 31, 2021, Sezzle has not entered into any lease agreements that contain residual value guarantees or financial covenants. Note 7. Commitments and Contingencies Merchant Contract Obligations The Company has entered into several agreements with third-parties in which Sezzle will reimburse these third-parties for mutually agreed upon co-branded marketing and advertising costs. As of December 31, 2021 and 2020, the Company had outstanding agreements that stipulate Sezzle will commit to spend up to approximately $35.1 million and $0.7 million, respectively, in marketing and advertising spend in future periods. These agreements generally have contractual terms ranging from one to three years. Expenses incurred relating to these agreements totaled $6,496,361 and $3,220,959 for the years ended December 31, 2021 and 2020, respectively. These expenses are included within marketing, advertising, and tradeshows on the consolidated statements of operations and comprehensive loss. Sezzle had approximately $83,000 and $211,000 recorded as a prepaid expense related to these agreements in the consolidated balance sheets as of December 31, 2021 and 2020, respectively. Certain agreements also contain provisions that may require payments by the Company and are contingent on Sezzle and/or the third party meeting specified criteria, such as achieving volume targets and implementation benchmarks. As of December 31, 2021, the Company had outstanding agreements that stipulate Sezzle may spend approximately $6.7 million in future periods if such criteria are met.

sezzle

sezzle

sezzle

sezzle

sezzle

sezzle

1 | Directors’ Declaration For the year ended December 31, 2021 The Directors declare that in the Directors’ opinion: 31 March 2022 sezzle

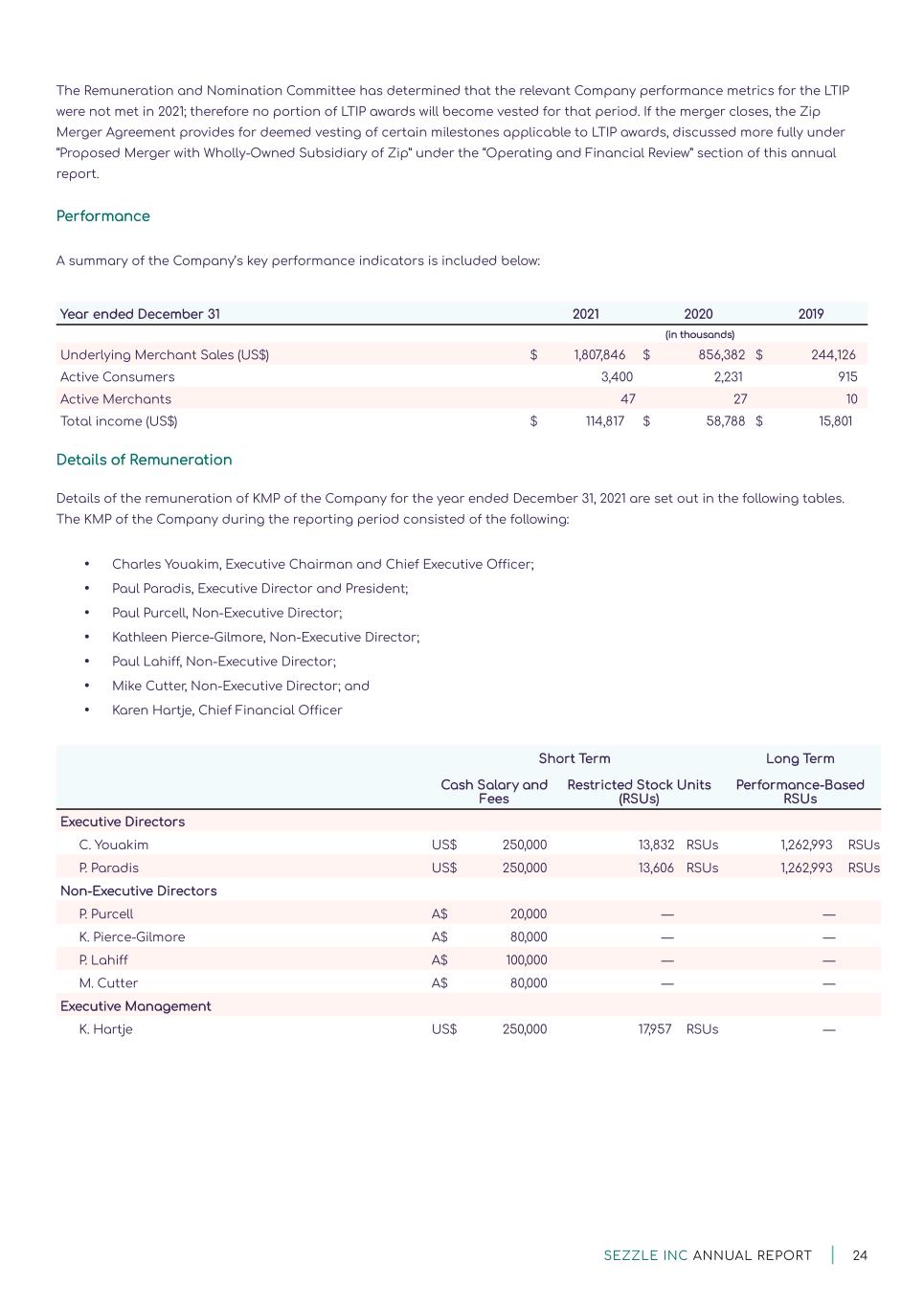

20SEZZLE INC ANNUAL REPORT 2021 | Corporate Governance: Substantial Shareholders: (Corporations Act) Number of Holders of Each Class of Equity Securities: Additional ASX Information Record Holder (if different) Name of substantial Holder within the meaning of section 671B of the Corporations Act Number of CDI’s in which the substantial holder holds a relevant interest % of total CDI’s on issue CHESS Depositary Interests (quoted on ASX) Unlisted Options (not quoted on ASX) Restricted Stock Units (not quoted on ASX) Common Stock (not quoted on ASX) 14,065 213 134 211 Numbers of HoldersCategory

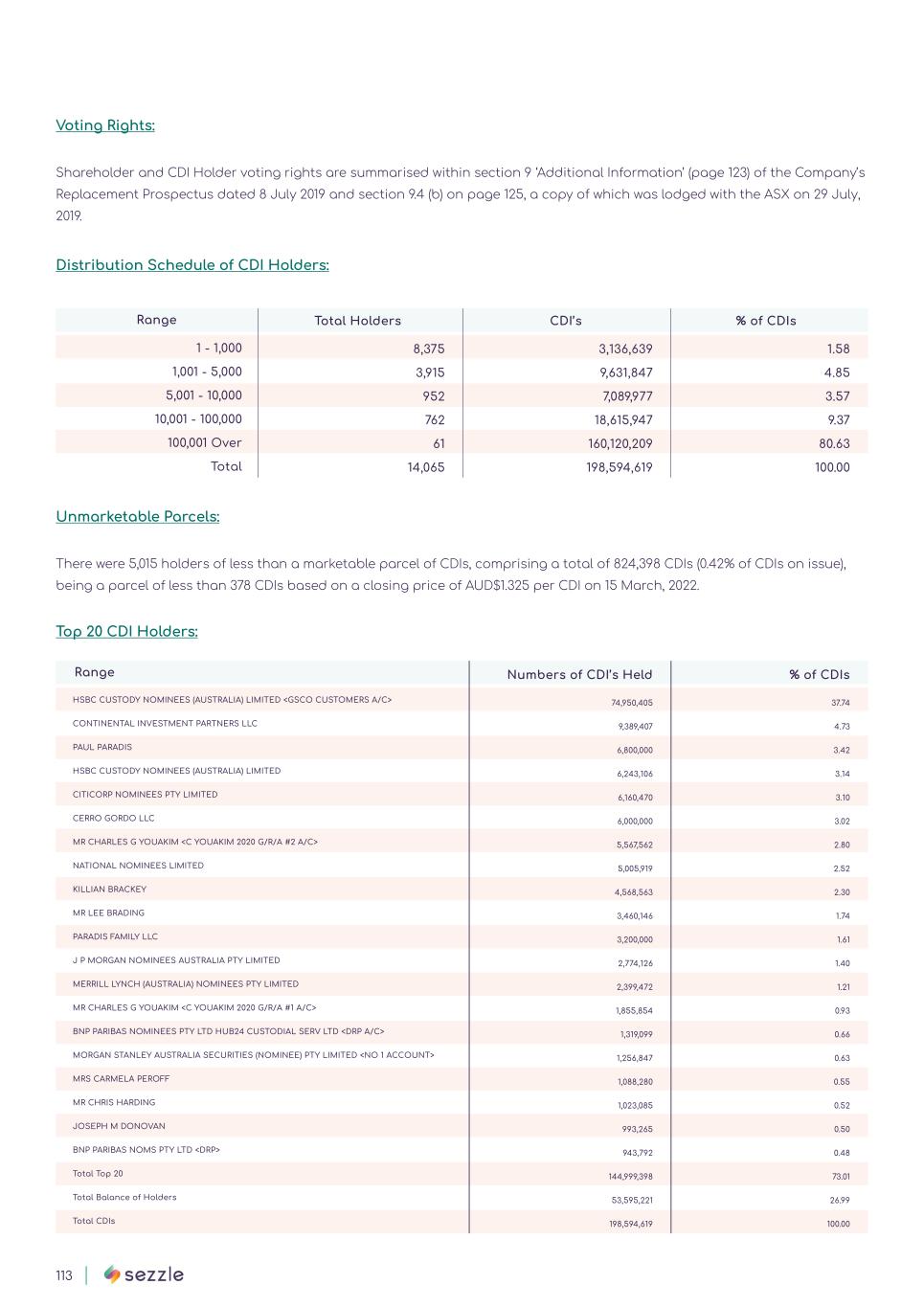

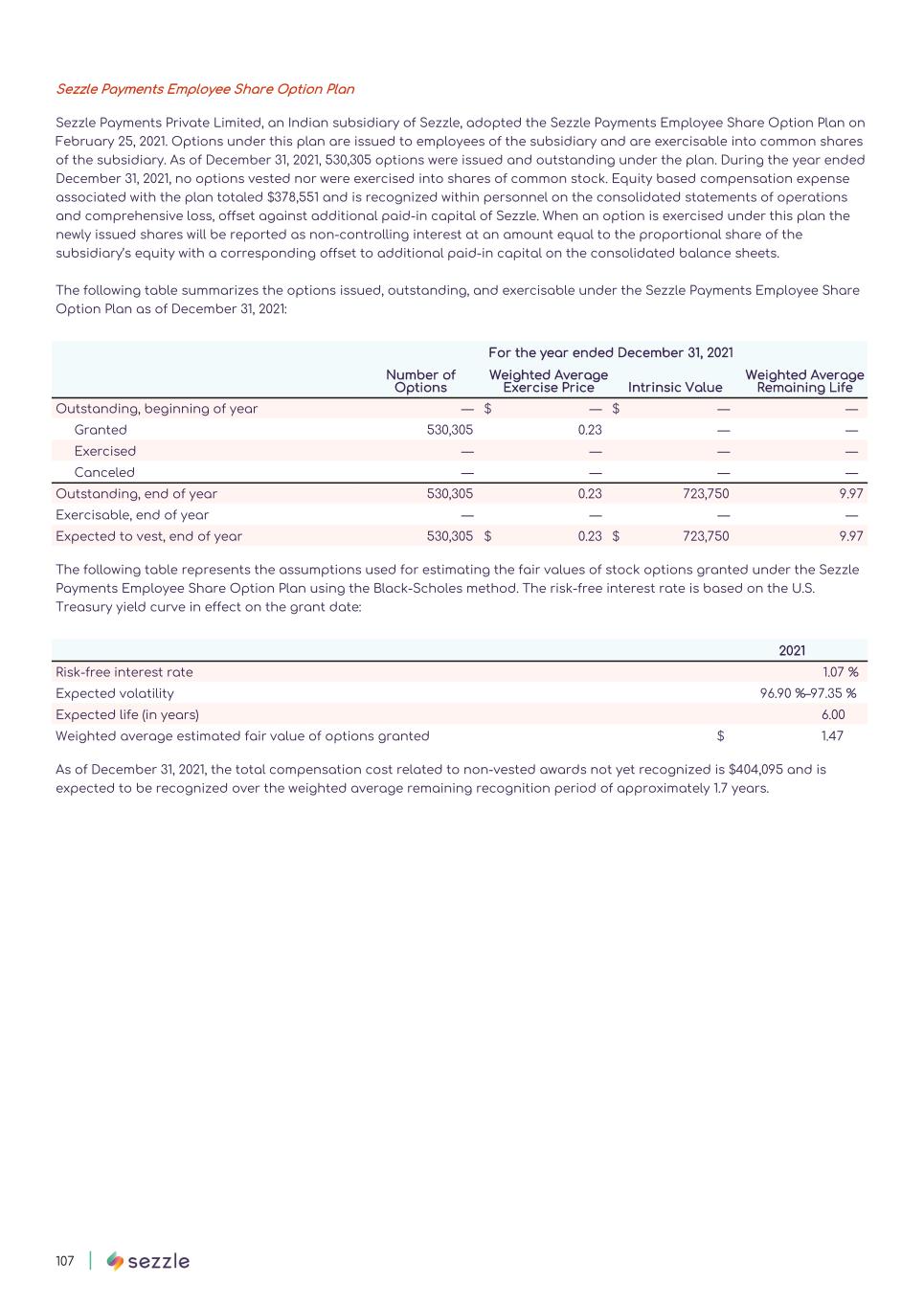

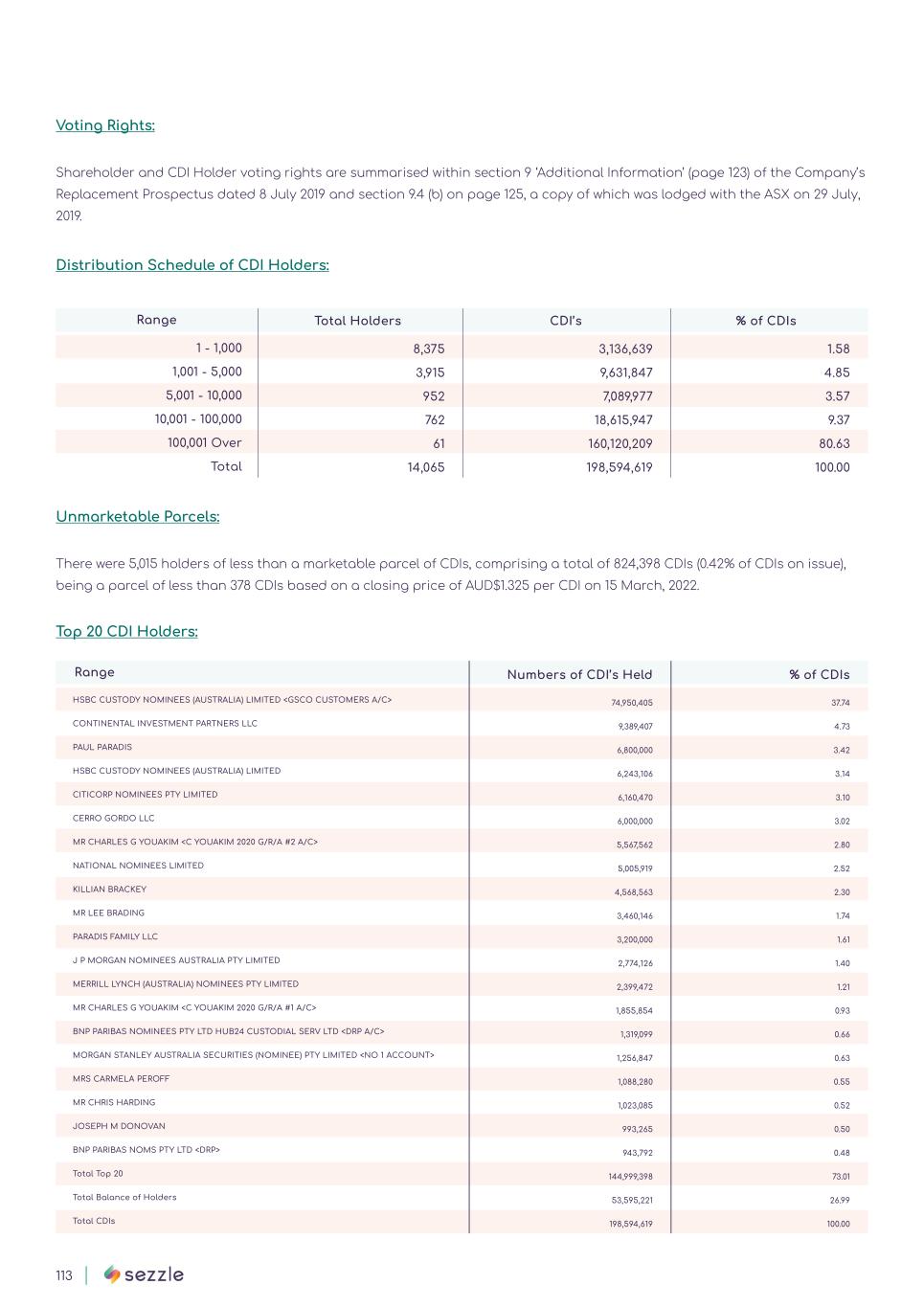

| Voting Rights: Distribution Schedule of CDI Holders: Unmarketable Parcels: Top 20 CDI Holders: Range 1 - 1,000 1,001 - 5,000 5,001 - 10,000 10,001 - 100,000 100,001 Over Total Total Holders 8,375 3,915 952 762 61 14,065 CDI’s 3,136,639 9,631,847 7,089,977 18,615,947 160,120,209 198,594,619 % of CDIs 1.58 4.85 3.57 9.37 80.63 100.00 Range Numbers of CDI’s Held % of CDIs HSBC CUSTODY NOMINEES (AUSTRALIA) LIMITED <GSCO CUSTOMERS A/C> CONTINENTAL INVESTMENT PARTNERS LLC PAUL PARADIS HSBC CUSTODY NOMINEES (AUSTRALIA) LIMITED CITICORP NOMINEES PTY LIMITED CERRO GORDO LLC MR CHARLES G YOUAKIM <C YOUAKIM 2020 G/R/A #2 A/C> NATIONAL NOMINEES LIMITED KILLIAN BRACKEY MR LEE BRADING PARADIS FAMILY LLC J P MORGAN NOMINEES AUSTRALIA PTY LIMITED MERRILL LYNCH (AUSTRALIA) NOMINEES PTY LIMITED MR CHARLES G YOUAKIM <C YOUAKIM 2020 G/R/A #1 A/C> BNP PARIBAS NOMINEES PTY LTD HUB24 CUSTODIAL SERV LTD <DRP A/C> MORGAN STANLEY AUSTRALIA SECURITIES (NOMINEE) PTY LIMITED <NO 1 ACCOUNT> MRS CARMELA PEROFF MR CHRIS HARDING JOSEPH M DONOVAN BNP PARIBAS NOMS PTY LTD <DRP> Total Top 20 Total Balance of Holders Total CDIs 74,950,405 9,389,407 6,800,000 6,243,106 6,160,470 6,000,000 5,567,562 5,005,919 4,568,563 3,460,146 3,200,000 2,774,126 2,399,472 1,855,854 1,319,099 1,256,847 1,088,280 1,023,085 993,265 943,792 144,999,398 53,595,221 198,594,619 37.74 4.73 3.42 3.14 3.10 3.02 2.80 2.52 2.30 1.74 1.61 1.40 1.21 0.93 0.66 0.63 0.55 0.52 0.50 0.48 73.01 26.99 100.00 sezzle

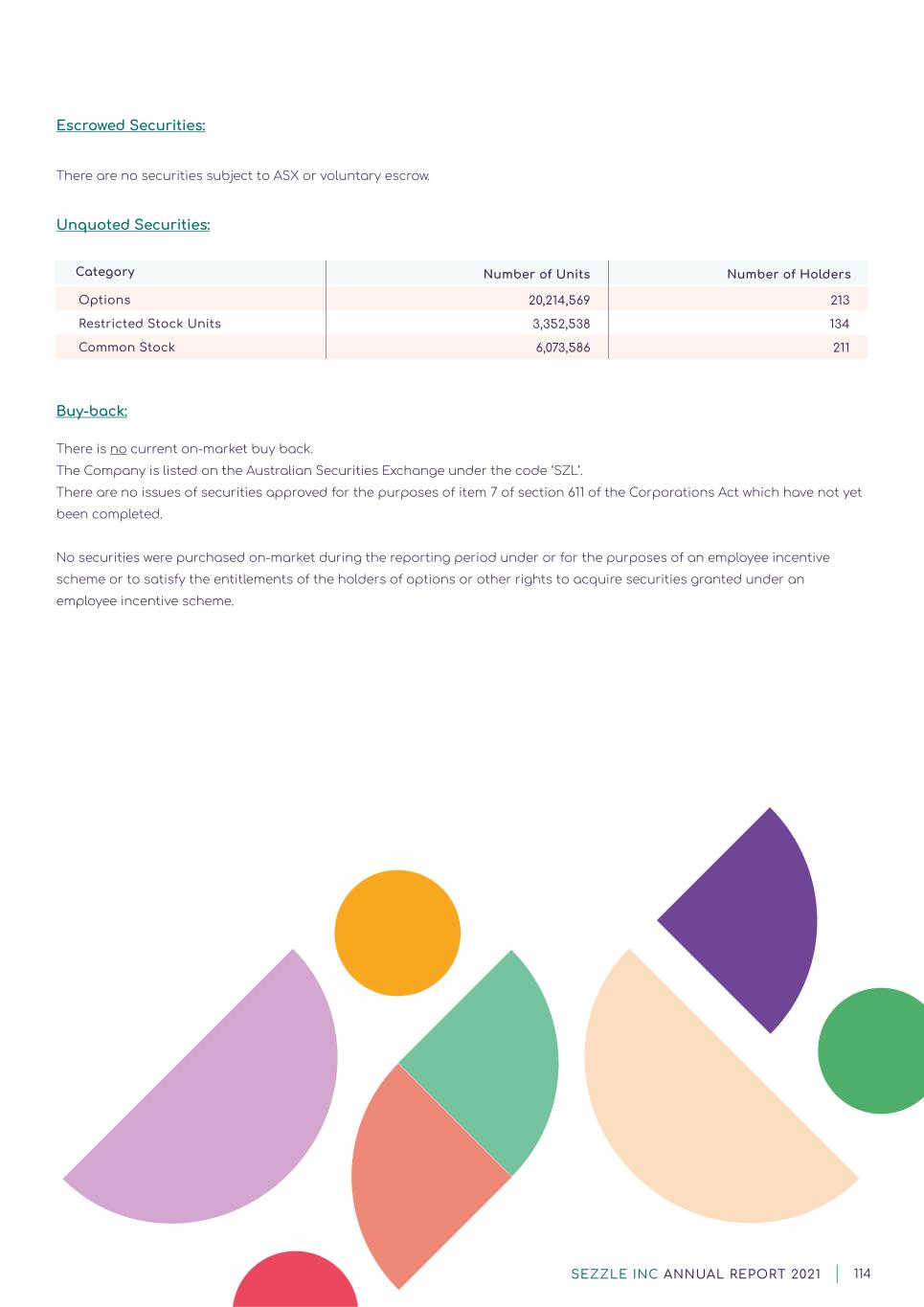

22SEZZLE INC ANNUAL REPORT 2021 | Escrowed Securities: Unquoted Securities: Buy-back: There is no Category Options Restricted Stock Units Common Stock Number of Units 20,214,569 3,352,538 6,073,586 Number of Holders 213 134 211

| A U D I T O R S S H A R E R E G I S T R Y COMPUTER SHARE INVESTOR SERVICES PTY LIMITED S O L I C I T O R S SQUIRE PATTON BOGGS E M A I L W E B S I T E A S X C O D E D I R E C T O R S Charlie Youakim Paul Paradis Paul Purcell Kathleen Pierce-Gilmore Mike Cutter C O M P A N Y S E C R E TA R Y Justin Clyne R E G I S T E R E D O F F I C E A N D P R I N C I P A L P L A C E O F B U S I N E S S UNITED STATES AUSTRALIA Corporate Directory sezzle

24SEZZLE INC ANNUAL REPORT 2021 | The way forward.