The way forward. A N N U A L G E N E R A L M E E T I N G 1 J U N E 2 0 2 2 This presentation has been authorized and approved by the Sezzle Board

DISCLAIMER This presentation (the “Presentation”) contains summary information about the activities of Sezzle as at the date of this Presentation. The information in this Presentation is of a general nature and does not purport to be complete and the information in the Presentation remains subject to change without notice. Also, the information in the Presentation should not be relied upon as advice to investors, potential investors or current shareholders. This Presentation has been prepared without taking into account the objectives, financial situation or needs of any particular investor, prospective investor or current shareholder. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and seek appropriate advice, including financial, legal and taxation advice appropriate to their jurisdiction. The Presentation also includes information regarding our market and industry that is derived from publicly available third-party sources that have not been independently verified by Sezzle. This Presentation is not a disclosure document under Australian law. Accordingly, this Presentation should not be relied upon as advice to current shareholders, investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular shareholder or investor. This Presentation contains certain “forward-looking statements” within the meaning of the US federal securities laws including, but not limited to, statements regarding our anticipated new products, our ability to gain future market share, our timeline and intentions to expand into Canada, our strategy, our future operations, our financial position, our estimated revenues and losses, our projected costs, our prospects, and the plans and objectives of management. These forward-looking statements are generally identified by the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” or similar expressions. These forward- looking statements are subject to a number of risks and uncertainties, including those set out in this Presentation, but not limited to: (i) our ability to complete the merger and other transactions contemplated by the Agreement and Plan of Merger (the “Zip Merger Agreement”) dated February 28, 2022, by and among Sezzle, Zip Co Limited (“Parent”) and Zip’s wholly owned subsidiary Miyagi Merger Sub, Inc. (the “Proposed Transaction”), including due to the failure to satisfy the conditions for the completion of the merger; (ii) risks related to disruption of management’s attention from business operations due to the Proposed Transaction; (iii) the effect of the Proposed Transaction on our results of operations and business generally; including our ability to retain and hire key personnel and maintain our relationships with customers and partners; (iv) the risk that the Proposed Transaction will not be completed in a timely manner, increasing the expected costs of the Proposed Transaction; (v) the occurrence of any event, change or circumstance that could give rise to the termination of the Zip Merger Agreement; (vi) impact of the “buy-now, pay-later” (“BNPL”) industry becoming subject to increased regulatory scrutiny; (vii) impact of operating in a highly competitive industry; (viii) impact of macro-economic conditions on consumer spending; (ix) our ability to increase our merchant network, our base of consumers and Underlying Merchant Sales (“UMS”); (x) our ability to effectively manage growth, sustain our growth rate and maintain our market share; (xi) our ability to meet additional capital requirements; (xii) impact of exposure to consumer bad debts and insolvency of merchants; (xiii) impact of the integration, support and prominent presentation of our platform by our merchants; (xiv) impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; (xv) impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to our operations; (xvi) impact of the loss of key partners and merchant relationships; (xvii) impact of exchange rate fluctuations in the international markets in which we operate; (xviii) our ability to protect our intellectual property rights; (xix) our ability to retain employees and recruit additional employees; (xx) impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and the international markets in which we operate; (xxi) our ability to achieve our public benefit purpose and maintain our B Corporation certification; and (xxii) the other factors identified in the “Risk Factors” section of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2022. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Nevertheless, and despite the fact that management’s expectations and estimates are based on assumptions management believes to be reasonable and data management believes to be reliable, our actual results, performance or achievements are subject to future risks and uncertainties, any of which could materially affect our actual performance. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements to reflect events or circumstances after the date of this Presentation. This Presentation has been prepared in good faith, but no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, correctness, reliability or adequacy of any statements, estimates, opinions or other information, or the reasonableness of any assumption or other statement, contained in the Presentation (any of which may change without notice). All financial figures are expressed in U.S. dollars unless otherwise stated. In addition to financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this Presentation includes certain financial information, including Underlying Merchant Sales (“UMS”), Active Consumers and Active Merchants, which has been provided as supplemental measures of operating performance that are key metrics used by management to assess Sezzle’s growth and operating performance. In particular, UMS is a key operating metric in assessing the volume of transactions that take place on the Sezzle Platform, which is an indicator of the success of Sezzle’s merchants and the strength of the Sezzle Platform. Sezzle also use these operating metrics in order to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other peer companies using similar measures. UMS, Active Consumers and Active Merchants do not represent revenue earned by Sezzle, are not components of Sezzle’s income or included within Sezzle’s financial results prepared in accordance with GAAP. The UMS, Active Consumers and Active Merchants financial measures used by Sezzle may differ from the non-U.S. GAAP financial measures used by other companies. For definitions of UMS, Active Consumers and Active Merchants, see slides 21 and 22. SE ZZLE INC AGM P RE SE NTATION 20 22 | 2

How to vote • When the poll is open, select the vote icon at the top of the screen • To vote, select your preferred option • You will see a vote confirmation • To change or cancel your vote, select “click here to change your vote” at any time until the poll is closed Items of Business 2A Re-elect Mr Sam Sample as a Director FOR AGAINST ABSTAIN 2B Re-elect Ms Jane Citizen as a Director SE ZZLE INC AGM P RE SE NTATION 20 22 | 3

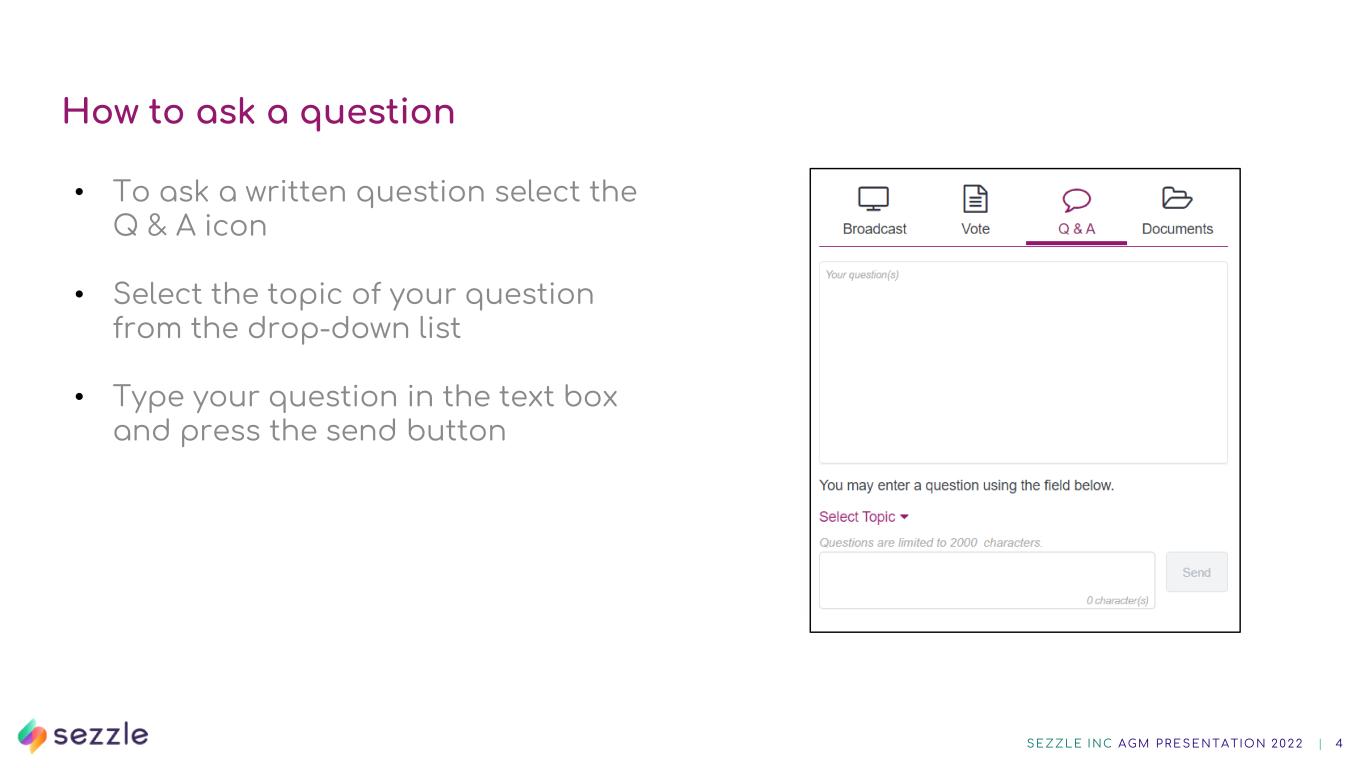

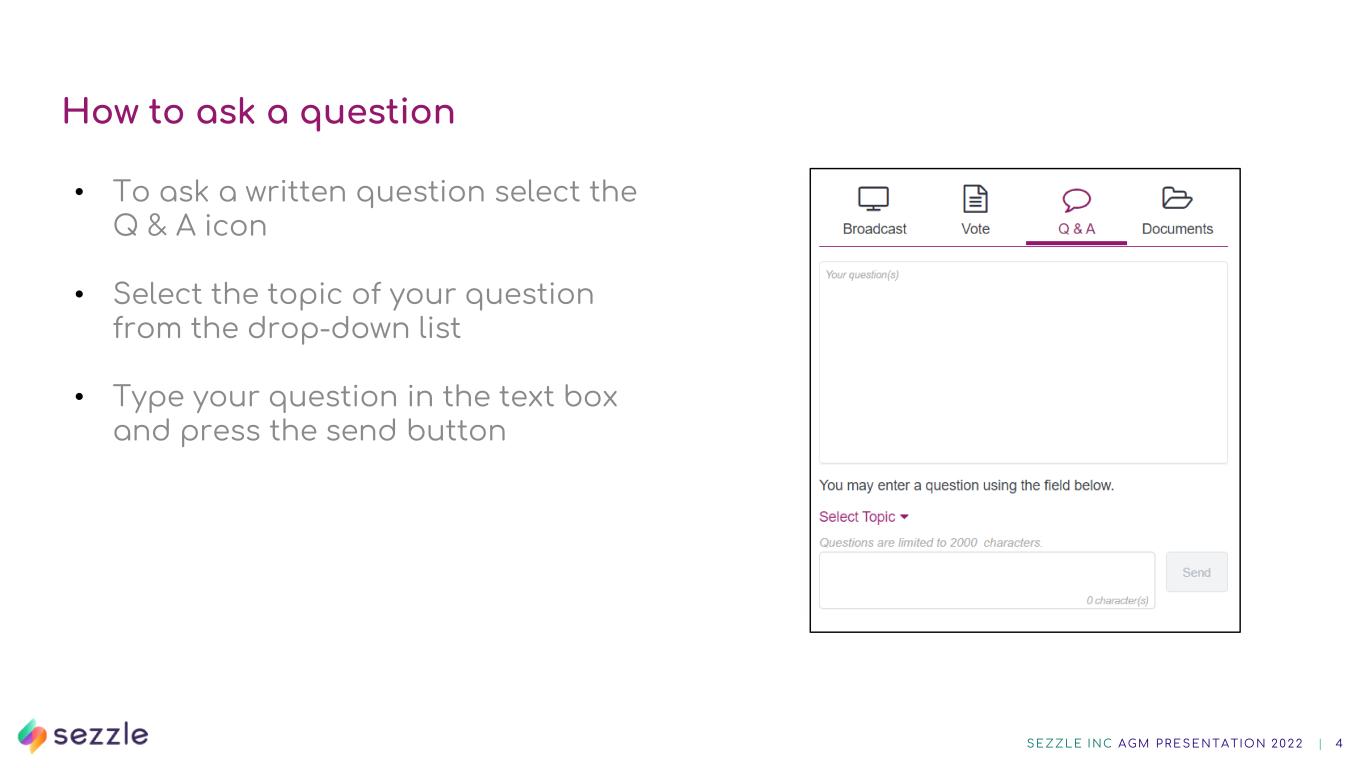

How to ask a question • To ask a written question select the Q & A icon • Select the topic of your question from the drop-down list • Type your question in the text box and press the send button SE ZZLE INC AGM P RE SE NTATION 20 22 | 4

Agenda 1 . COMPANY MISSION 4. VOTING AND RESOLUTIONS 2. VISION AND ECOSYSTEM SE ZZLE INC AGM P RE SE NTATION 20 22 | 5 3. FINANCIAL PERFORMANCE

OUR MISSION Financially empowering the next generation. OUR MANTRA The way forward. We see change as an opportunity to shape the future. SE ZZLE INC AGM P RE SE NTATION 20 22 | 6

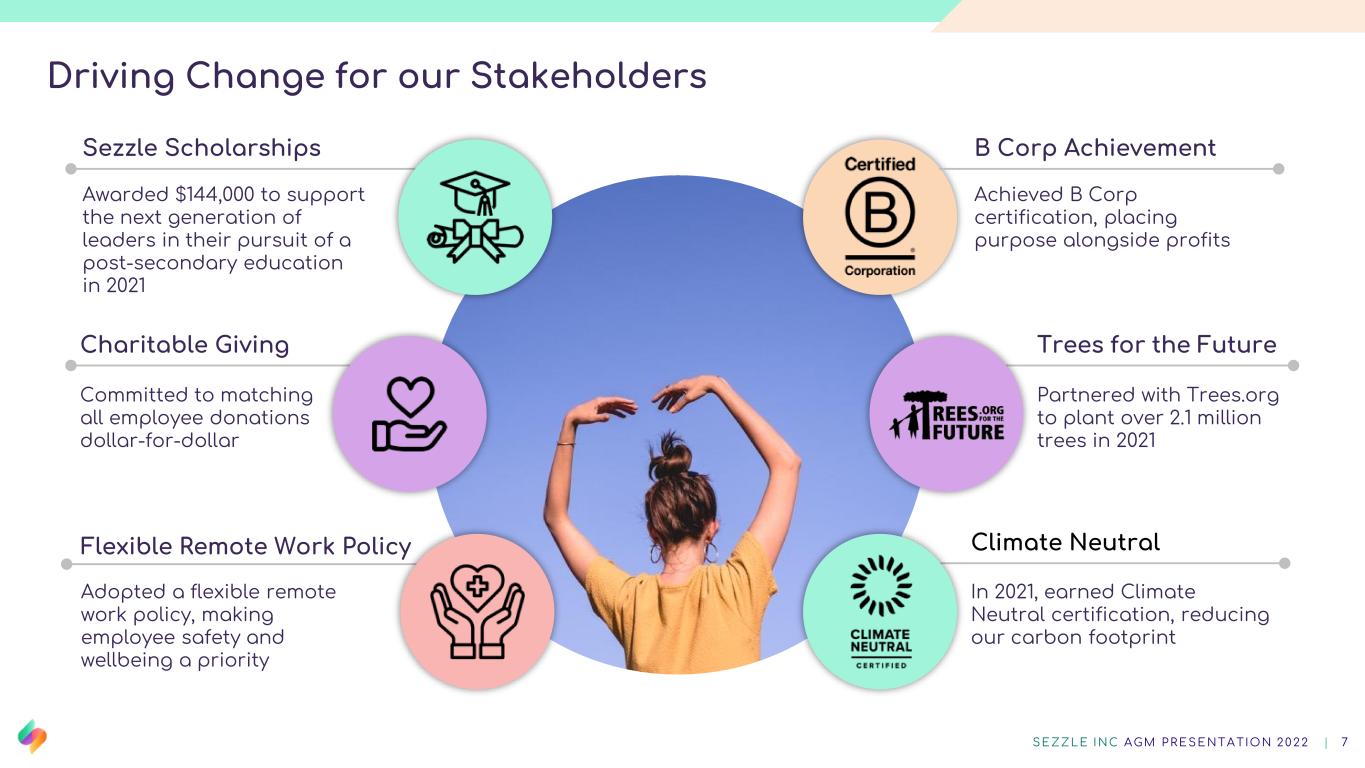

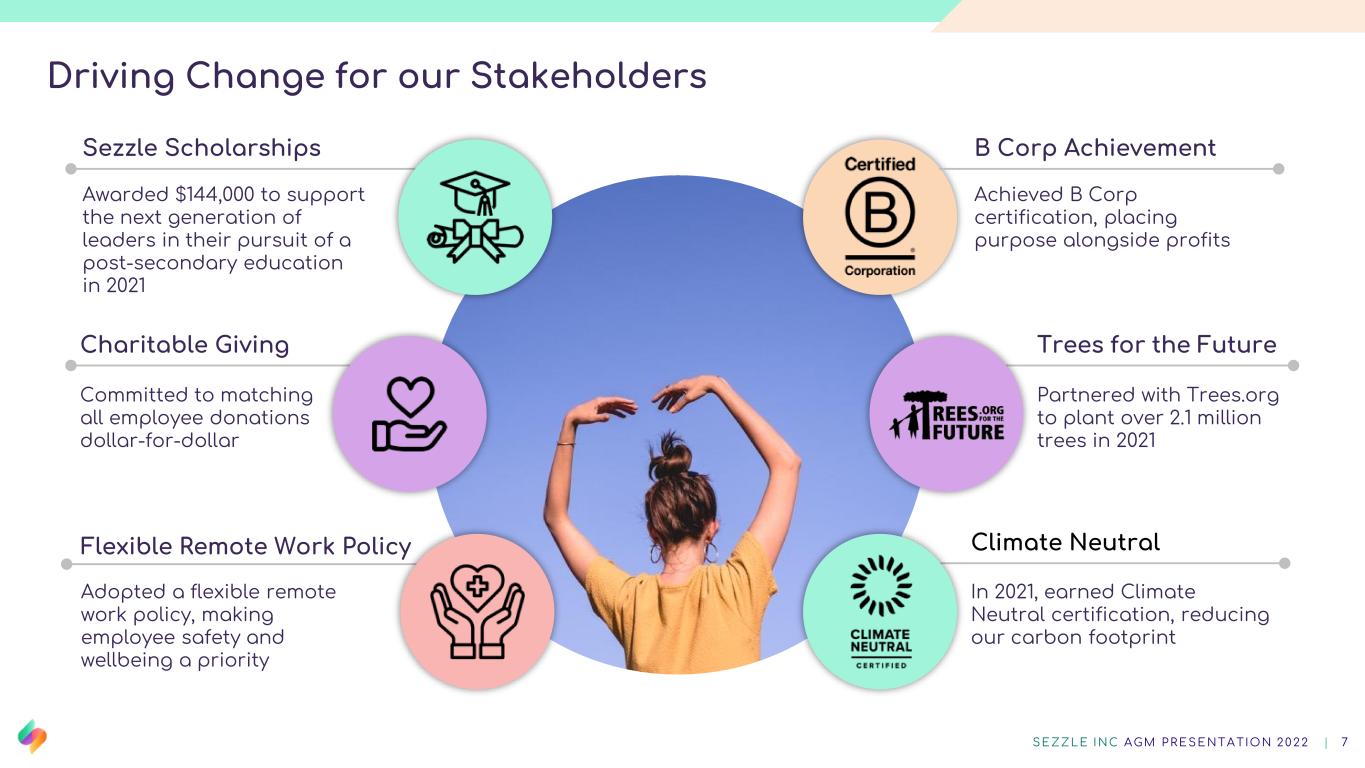

Driving Change for our Stakeholders Charitable Giving Committed to matching all employee donations dollar-for-dollar Flexible Remote Work Policy Adopted a flexible remote work policy, making employee safety and wellbeing a priority Climate Neutral In 2021, earned Climate Neutral certification, reducing our carbon footprint Trees for the Future Partnered with Trees.org to plant over 2.1 million trees in 2021 B Corp Achievement Achieved B Corp certification, placing purpose alongside profits Sezzle Scholarships Awarded $144,000 to support the next generation of leaders in their pursuit of a post-secondary education in 2021 SE ZZLE INC AGM P RE SE NTATION 20 22 | 7

Top 10 Payment and Card Solution Providers Best BNPL App for Students Top Installment Platform Top 10 Financial Services Brands Receiving Recognition for our Efforts SE ZZLE INC AGM P RE SE NTATION 20 22 | 8 The Midwest’s Best Enterprise Software Companies Best BNPL App for Flexible Payment Plan

Vision and Ecosystem VISION SE ZZLE INC AGM P RE SE NTATION 20 22 | 9

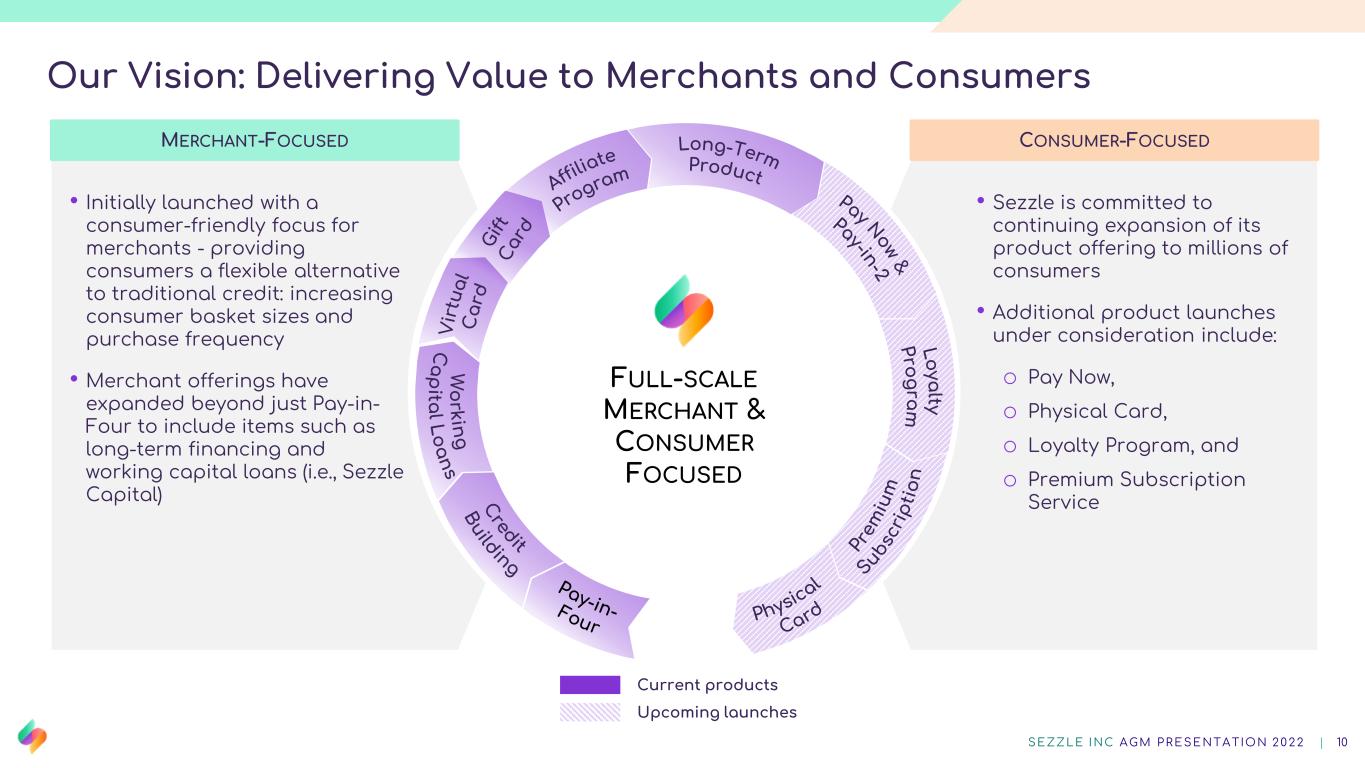

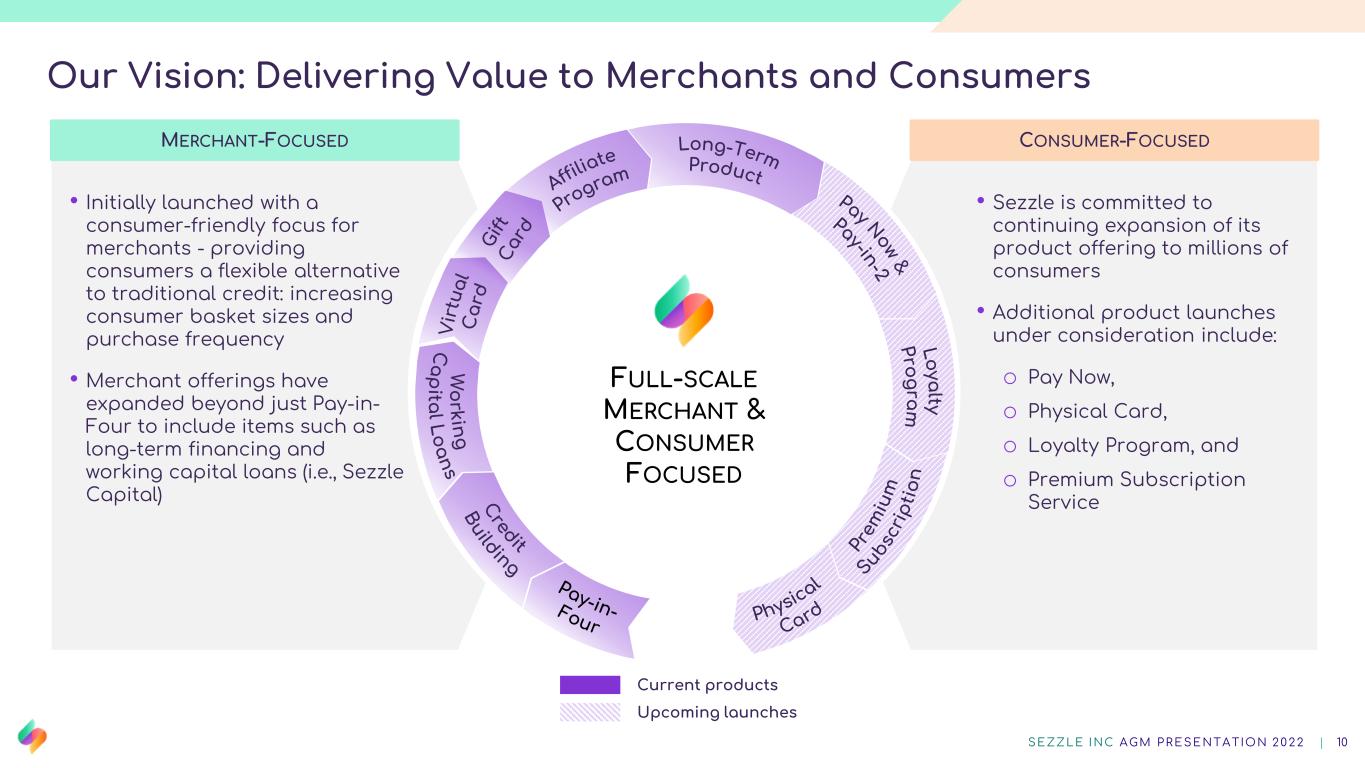

CONSUMER-FOCUSEDMERCHANT-FOCUSED • Initially launched with a consumer-friendly focus for merchants - providing consumers a flexible alternative to traditional credit: increasing consumer basket sizes and purchase frequency • Merchant offerings have expanded beyond just Pay-in- Four to include items such as long-term financing and working capital loans (i.e., Sezzle Capital) SE ZZLE INC AGM P RE SE NTATION 20 22 | 10 Our Vision: Delivering Value to Merchants and Consumers • Sezzle is committed to continuing expansion of its product offering to millions of consumers • Additional product launches under consideration include: o Pay Now, o Physical Card, o Loyalty Program, and o Premium Subscription Service Upcoming launches Current products FULL-SCALE MERCHANT & CONSUMER FOCUSED

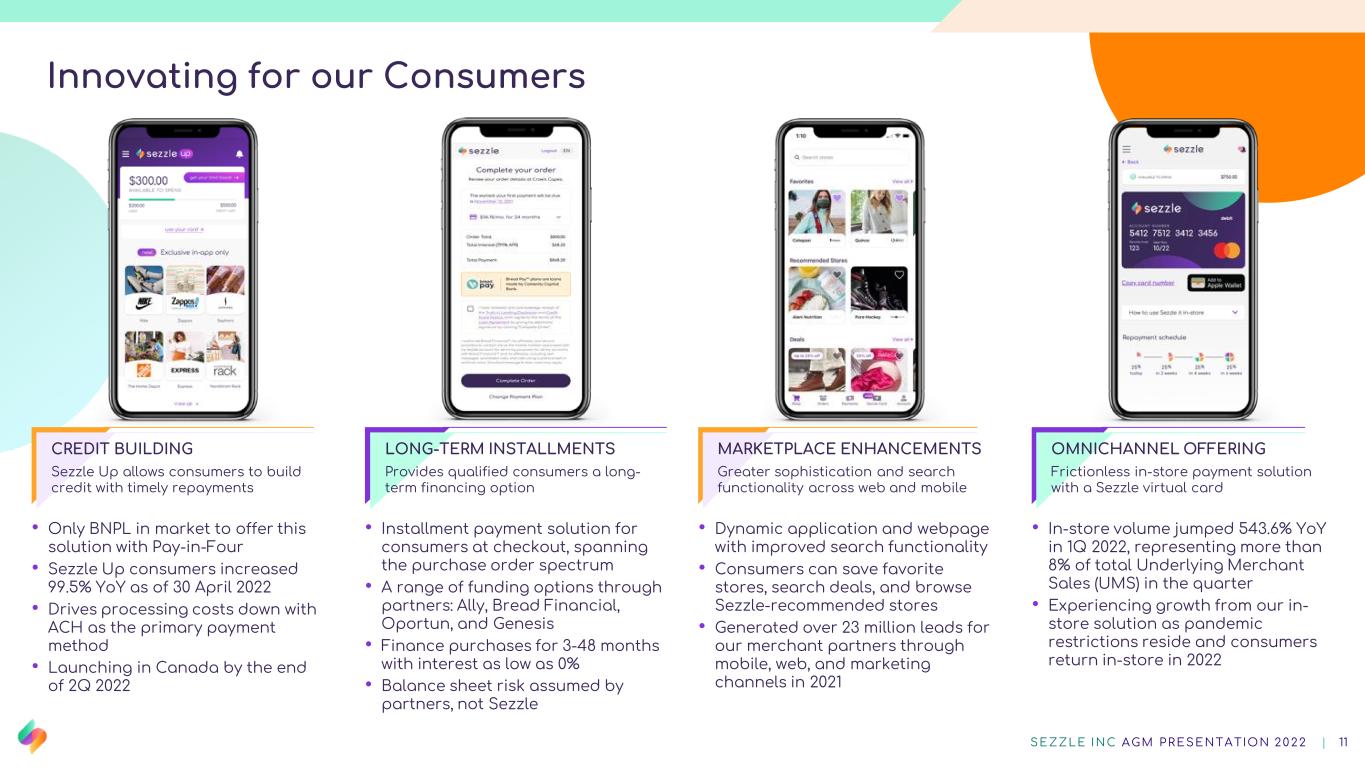

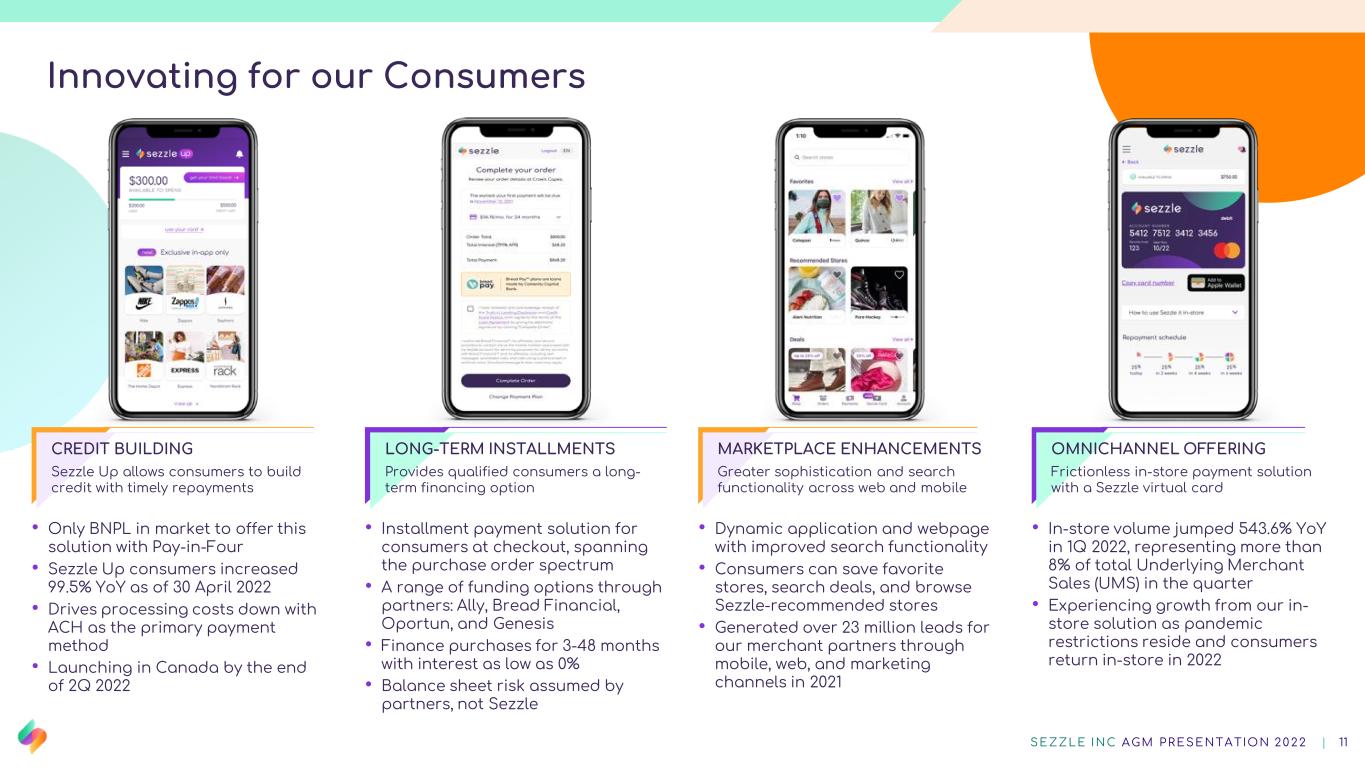

CREDIT BUILDING Sezzle Up allows consumers to build credit with timely repayments LONG-TERM INSTALLMENTS Provides qualified consumers a long- term financing option OMNICHANNEL OFFERING Frictionless in-store payment solution with a Sezzle virtual card Innovating for our Consumers • Only BNPL in market to offer this solution with Pay-in-Four • Sezzle Up consumers increased 99.5% YoY as of 30 April 2022 • Drives processing costs down with ACH as the primary payment method • Launching in Canada by the end of 2Q 2022 • Installment payment solution for consumers at checkout, spanning the purchase order spectrum • A range of funding options through partners: Ally, Bread Financial, Oportun, and Genesis • Finance purchases for 3-48 months with interest as low as 0% • Balance sheet risk assumed by partners, not Sezzle • Dynamic application and webpage with improved search functionality • Consumers can save favorite stores, search deals, and browse Sezzle-recommended stores • Generated over 23 million leads for our merchant partners through mobile, web, and marketing channels in 2021 • In-store volume jumped 543.6% YoY in 1Q 2022, representing more than 8% of total Underlying Merchant Sales (UMS) in the quarter • Experiencing growth from our in- store solution as pandemic restrictions reside and consumers return in-store in 2022 MARKETPLACE ENHANCEMENTS Greater sophistication and search functionality across web and mobile SE ZZLE INC AGM P RE SE NTATION 20 22 | 11

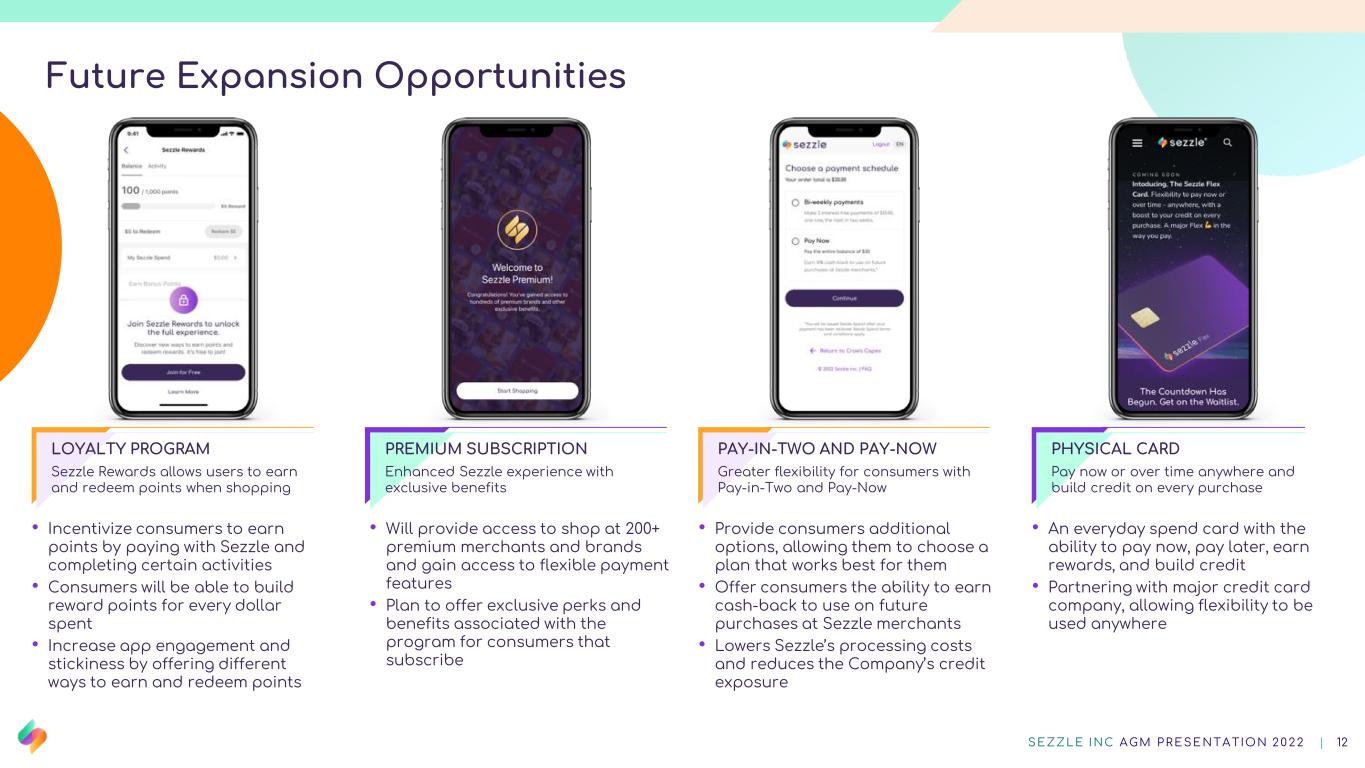

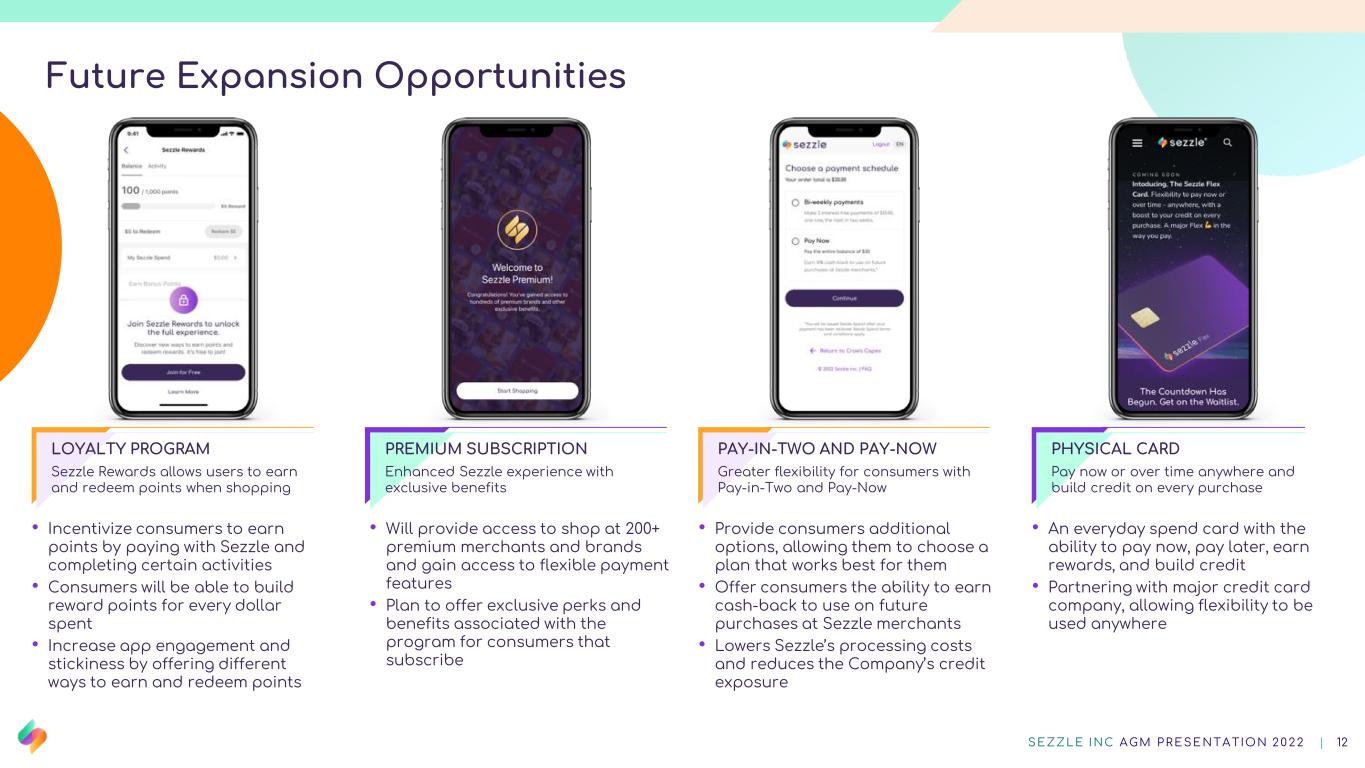

LOYALTY PROGRAM Sezzle Rewards allows users to earn and redeem points when shopping PREMIUM SUBSCRIPTION Enhanced Sezzle experience with exclusive benefits PHYSICAL CARD Pay now or over time anywhere and build credit on every purchase • Incentivize consumers to earn points by paying with Sezzle and completing certain activities • Consumers will be able to build reward points for every dollar spent • Increase app engagement and stickiness by offering different ways to earn and redeem points • Will provide access to shop at 200+ premium merchants and brands and gain access to flexible payment features • Plan to offer exclusive perks and benefits associated with the program for consumers that subscribe Future Expansion Opportunities • Provide consumers additional options, allowing them to choose a plan that works best for them • Offer consumers the ability to earn cash-back to use on future purchases at Sezzle merchants • Lowers Sezzle’s processing costs and reduces the Company’s credit exposure • An everyday spend card with the ability to pay now, pay later, earn rewards, and build credit • Partnering with major credit card company, allowing flexibility to be used anywhere PAY-IN-TWO AND PAY-NOW Greater flexibility for consumers with Pay-in-Two and Pay-Now SE ZZLE INC AGM P RE SE NTATION 20 22 | 12

$1.8 $150.6 $472.8 Sezzle UMS Global BNPL U.S. Rest of World $623.4 Market Opportunity (Figures in $US Trillion) SIGNIFICANT MARKET OPPORTUNITY BEYOND BNPL Source: 2022 The Global Payments Report by FIS BNPL: LOW MARKET PENETRATION (Figures in $US Billion) $10.8$0.6 $11.4 $12.3 $16.1 $8.5 $2.9 $40.9 Buy Now, Pay Later Debit Card Credit Card Mobile Wallet Cash Other Payment Products Global Commerce U.S. Rest of World $51.7 • In 2021, BNPL represented only 1% of the point-of-sale payment system in North America and is expected to double to 2% by 2025 • ~4% of 2021 e-commerce in North America was BNPL, with penetration expected to reach 9% in 2025 SE ZZLE INC AGM P RE SE NTATION 20 22 | 13 • Future product expansions will significantly increase Sezzle’s total addressable market • With 3.5 million Active Consumers as of 31 March 2022, Sezzle has a significant opportunity to attain a larger share of consumer wallets

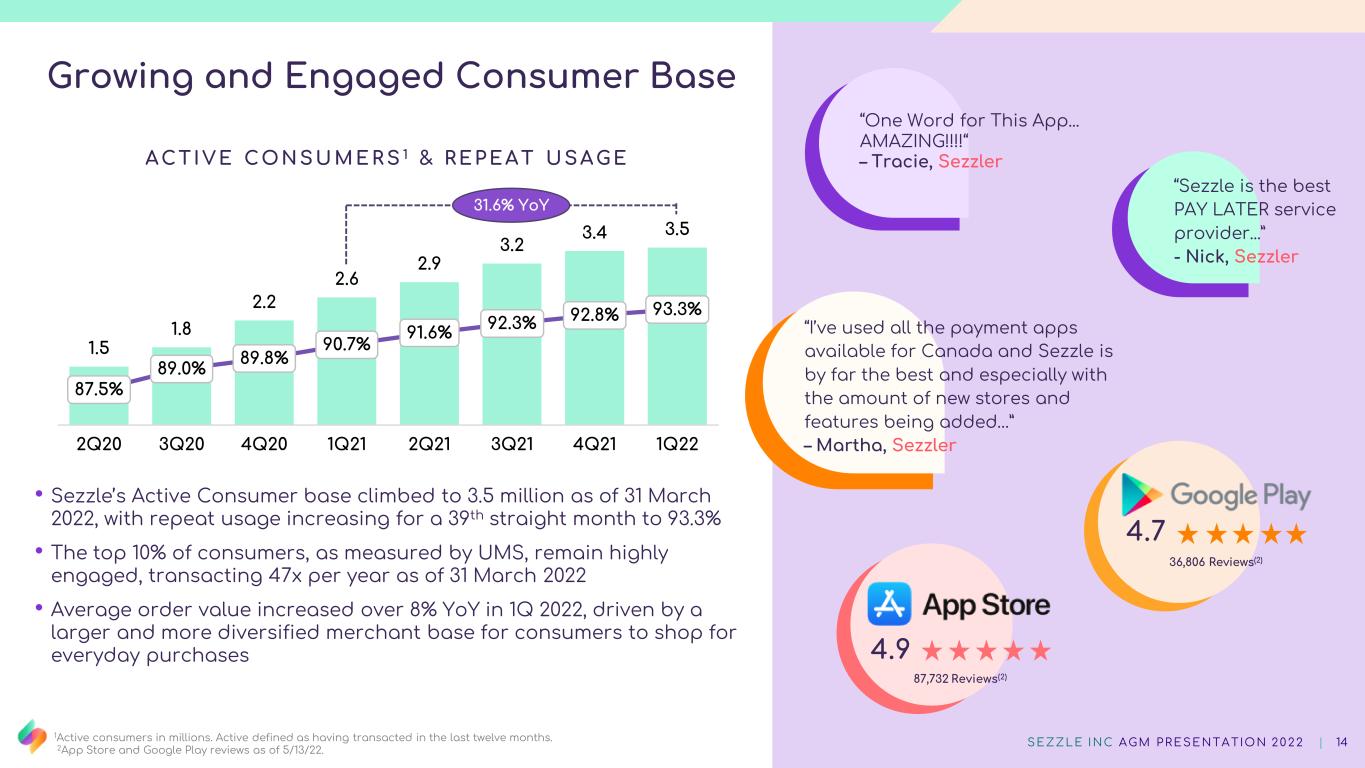

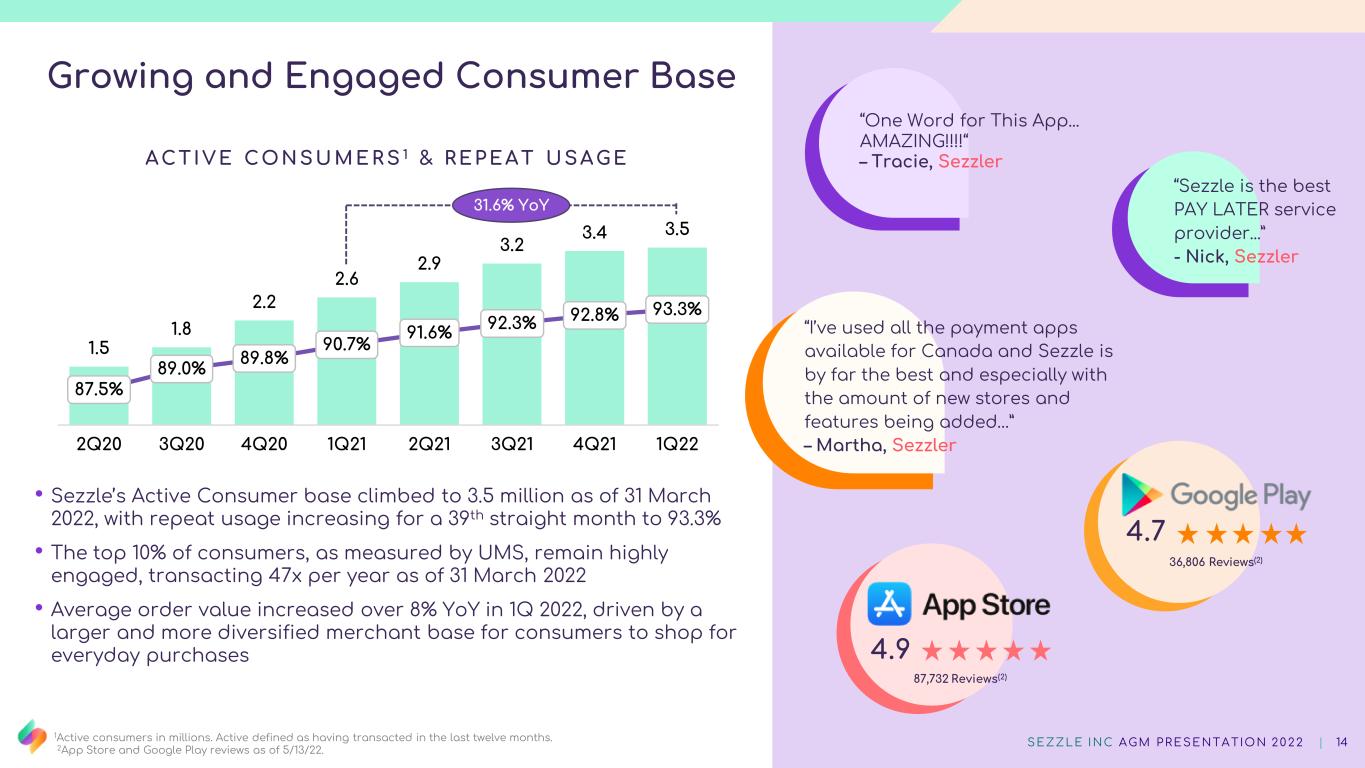

“One Word for This App... AMAZING!!!!“ – Tracie, Sezzler “I’ve used all the payment apps available for Canada and Sezzle is by far the best and especially with the amount of new stores and features being added…” – Martha, Sezzler “Sezzle is the best PAY LATER service provider...” - Nick, Sezzler 4.7 36,806 Reviews(2) 1.5 1.8 2.2 2.6 2.9 3.2 3.4 3.5 87.5% 89.0% 89.8% 90.7% 91.6% 92.3% 92.8% 93.3% 85.0% 87.0% 89.0% 91.0% 93.0% 95.0% 97.0% 99.0% 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 ACTIVE CONSU M E R S 1 & REPEAT USAGE 4.9 87,732 Reviews(2) Growing and Engaged Consumer Base 31.6% YoY • Sezzle’s Active Consumer base climbed to 3.5 million as of 31 March 2022, with repeat usage increasing for a 39th straight month to 93.3% • The top 10% of consumers, as measured by UMS, remain highly engaged, transacting 47x per year as of 31 March 2022 • Average order value increased over 8% YoY in 1Q 2022, driven by a larger and more diversified merchant base for consumers to shop for everyday purchases 1Active consumers in millions. Active defined as having transacted in the last twelve months. 2App Store and Google Play reviews as of 5/13/22. SE ZZLE INC AGM P RE SE NTATION 20 22 | 14

SMB & MIDDLE MARKET 20,000+ New Active Merchant Partners added in 2021 ENTERPRISE Partnering with Top Tier Brands of All Sizes SE ZZLE INC AGM P RE SE NTATION 20 22 | 15

Highly Focused on Core Verticals while Pioneering Elsewhere In addition, we continue to test non-traditional BNPL verticals Top Performing Verticals in 2021 YoY Growth (%) Clothing & Accessories 63.1% Beauty & Wellness 64.6% General Merchandise 1,833.4% Sports & Hobbies 107.5% • In 2021, Sezzle continued to grow and expand into new product verticals by partnering with a wide range of merchants • Top performing categories in 2021 include Clothing & Accessories, Beauty & Wellness, General Merchandise, and Sports & Hobbies, which grew 63.1%, 64.6%, 1,833.4%, and 107.5%, respectively, compared to the previous year T R A V E L B U S I N E S S S E R V I C E S M E D I C A L C A R E F O O D A N D B E V E D U C A T I O N S E R V I C E S H A R D W A R E T O O L S SE ZZLE INC AGM P RE SE NTATION 20 22 | 16

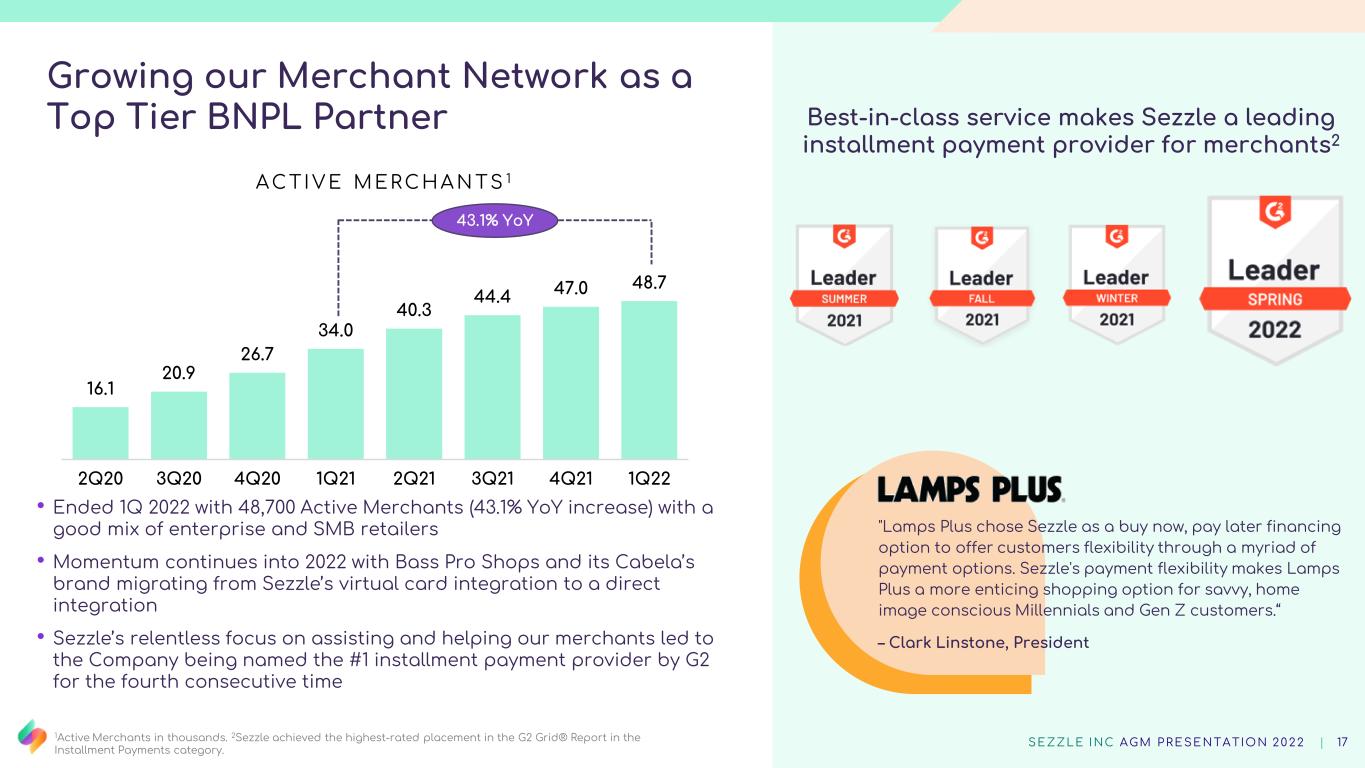

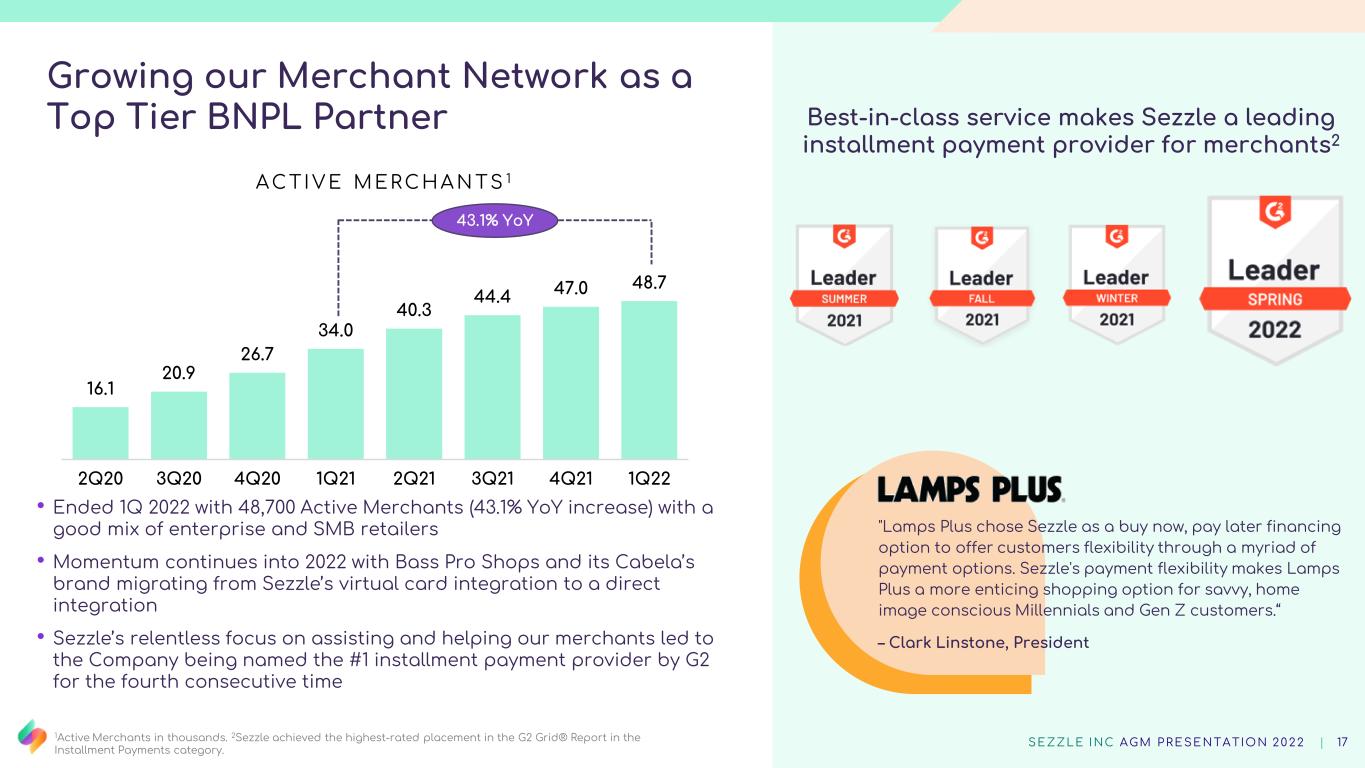

Growing our Merchant Network as a Top Tier BNPL Partner 16.1 20.9 26.7 34.0 40.3 44.4 47.0 48.7 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 AC TIV E MERC HA N TS 1 Best-in-class service makes Sezzle a leading installment payment provider for merchants2 "Lamps Plus chose Sezzle as a buy now, pay later financing option to offer customers flexibility through a myriad of payment options. Sezzle's payment flexibility makes Lamps Plus a more enticing shopping option for savvy, home image conscious Millennials and Gen Z customers.“ – Clark Linstone, President 43.1% YoY • Ended 1Q 2022 with 48,700 Active Merchants (43.1% YoY increase) with a good mix of enterprise and SMB retailers • Momentum continues into 2022 with Bass Pro Shops and its Cabela’s brand migrating from Sezzle’s virtual card integration to a direct integration • Sezzle’s relentless focus on assisting and helping our merchants led to the Company being named the #1 installment payment provider by G2 for the fourth consecutive time 1Active Merchants in thousands. 2Sezzle achieved the highest-rated placement in the G2 Grid® Report in the Installment Payments category. SE ZZLE INC AGM P RE SE NTATION 20 22 | 17

Growing Alongside Strategic Partners Merchant Support • In July 2021, the Company launched Sezzle Capital in partnership with Wayflyer • Sezzle Capital enables qualified merchants to receive same-day funding of working capital up to US$10 million, without credit risk or additional capital requirements to Sezzle • Since the launch of the program, Sezzle Capital has deployed millions of dollars to support our merchant partners’ and their capital needs • To further support merchant partners in all sizes, including the smallest SMBs, the Company is partnering with Liberis (expected to launch 3Q 2022) Merchant Acquisition • Sezzle works with a number of leading eCommerce platforms such as BigCommerce, Bolt, Shopify, Wix, CommentSold, and WooCommerce. BigCommerce and Bolt were the most recent additions • In August 2021, BigCommerce selected Sezzle as their preferred buy now, pay later partner, allowing merchants to enable the Sezzle payment option at their checkout page with a single click Consumer Products • Starting in May 2021 (with Ally), Sezzle launched a long-term financing solution to help consumers seamlessly finance purchases up to $40,000 at interest rates as low as 0% • Recently partnered with Bread Financial to provide consumers with a range of competitive financing options for higher- priced purchases. Genesis and Oportun are expected to launch on our long-term platform by year end • These partnerships broaden Sezzle’s consumer financing options and enable merchants to offer shoppers more flexibility (across prime and sub-prime consumers) SE ZZLE INC AGM P RE SE NTATION 20 22 | 18

Financials FINANCIALS SE ZZLE INC AGM P RE SE NTATION 20 22 | 19

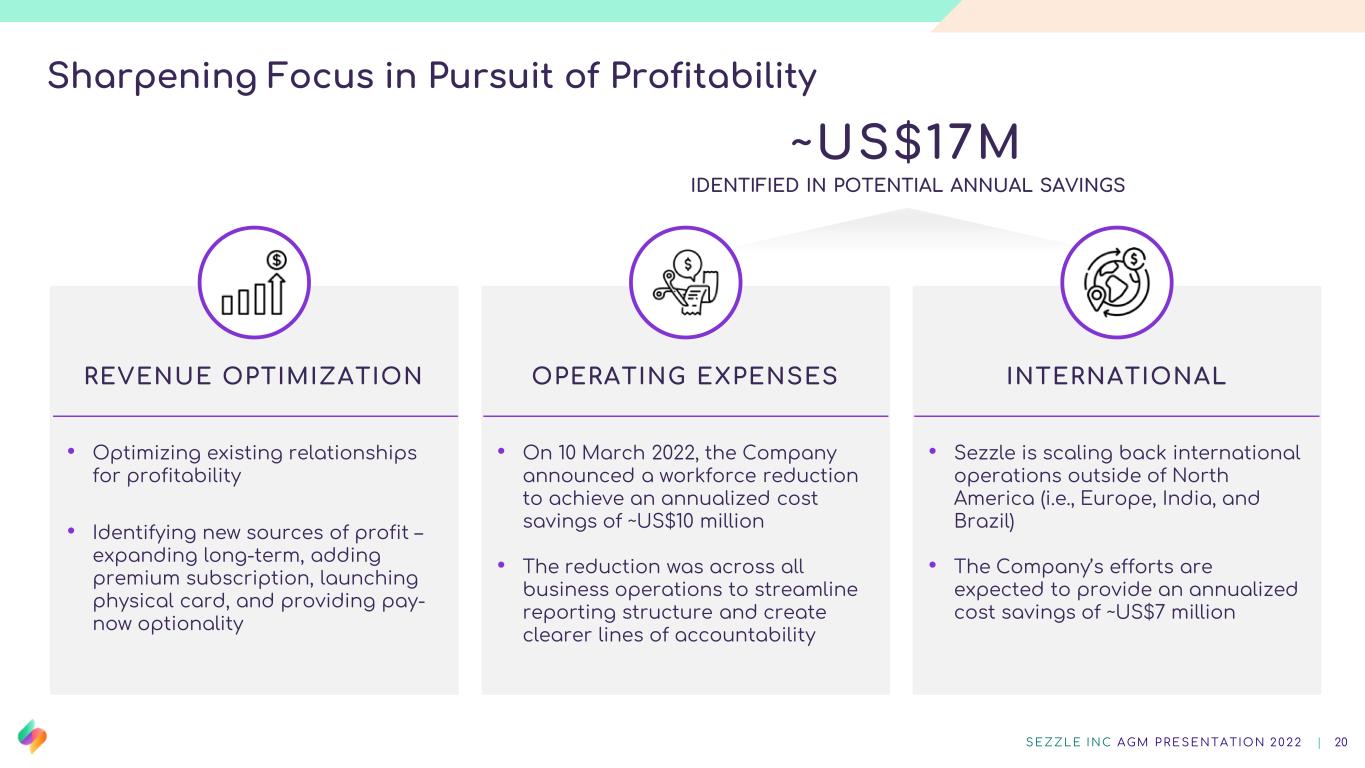

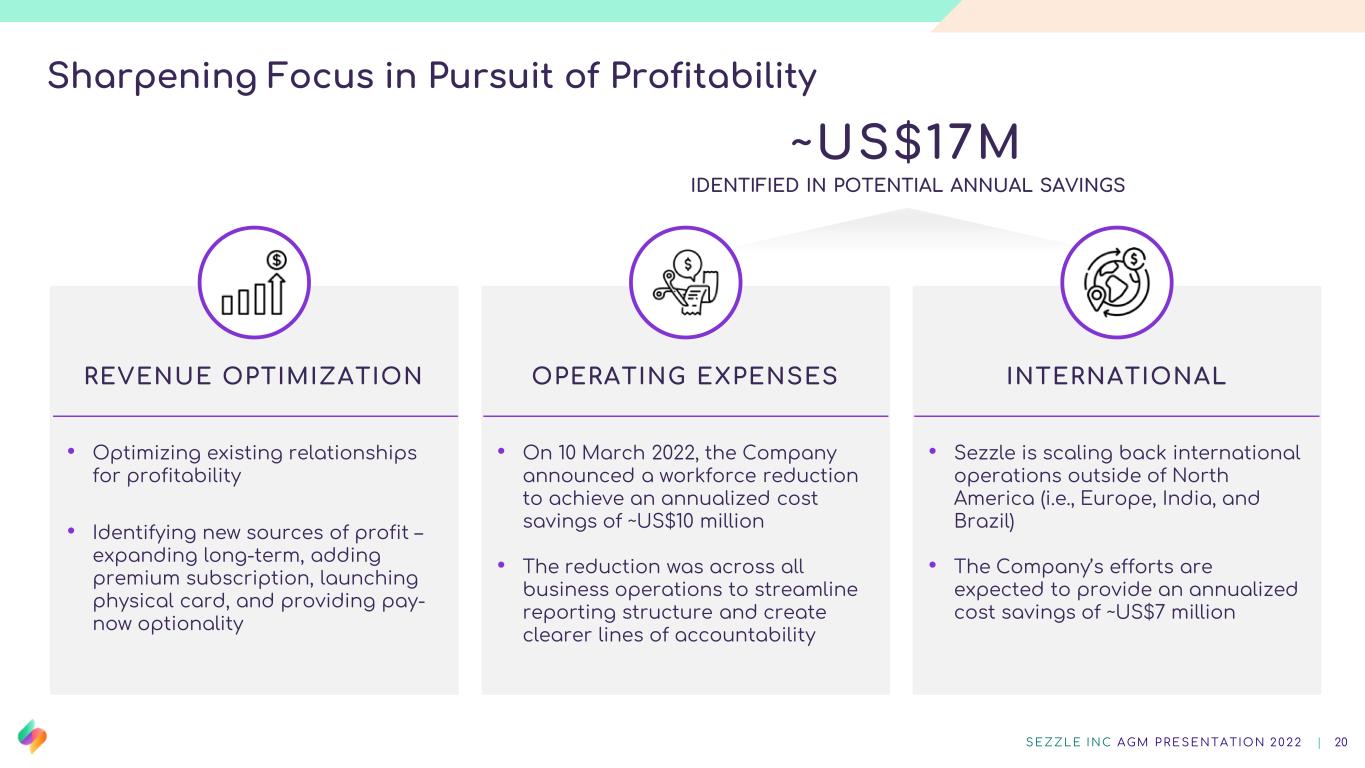

Sharpening Focus in Pursuit of Profitability REVENUE OPTIMIZATION OPERATING EXPENSES INTERNATIONAL • Optimizing existing relationships for profitability • Identifying new sources of profit – expanding long-term, adding premium subscription, launching physical card, and providing pay- now optionality • On 10 March 2022, the Company announced a workforce reduction to achieve an annualized cost savings of ~US$10 million • The reduction was across all business operations to streamline reporting structure and create clearer lines of accountability • Sezzle is scaling back international operations outside of North America (i.e., Europe, India, and Brazil) • The Company’s efforts are expected to provide an annualized cost savings of ~US$7 million SE ZZLE INC AGM P RE SE NTATION 20 22 | 20 ~US$17M IDENTIFIED IN POTENTIAL ANNUAL SAVINGS

Financial Scorecard SE ZZLE INC AGM P RE SE NTATION 20 22 | 21 UNDERLYING MERCHANT SALES 1 (UMS) (US$ in MILLION’S) TOTAL INCOME ($ in MILLION’S) +111.1% YoY TOTAL INCOME AS PERCENTAGE OF UMS -50 Bps $15.8 $58.8 $114.8 2019 2020 2021 +95.3% YoY 6.5% 6.9% 6.4% 2019 2020 2021 +20.1% YoY -80.7 Bps +6.2% YoY 1UMS is defined as the total value of sales made by merchants based on the purchase price of each confirmed sale where a consumer has selected the Sezzle Platform as the applicable payment option. UMS does not represent revenue earned by Sezzle, is not a component of Sezzle’s income, nor is it included within Sezzle’s financial results prepared in accordance with U.S. GAAP. For more information on Sezzle’s use of UMS please refer to the disclaimer on slide 1. UNDERLYING MERCHANT SALES 1 (UMS) (US$ in MILLION’S) TOTAL INCOME ($ in MILLION’S) TOTAL INCOME AS PERCENTAGE OF UMS 2021 1Q22 $119.4 $375.1 $450.5 1Q20 1Q21 1Q22 $8.2 $26.0 $27.6 1Q20 1Q21 1Q22 6.8% 6.9% 6.1% 1Q20 1Q21 1Q22 $244.1 $856.4 $1,807.8 2019 2020 2021

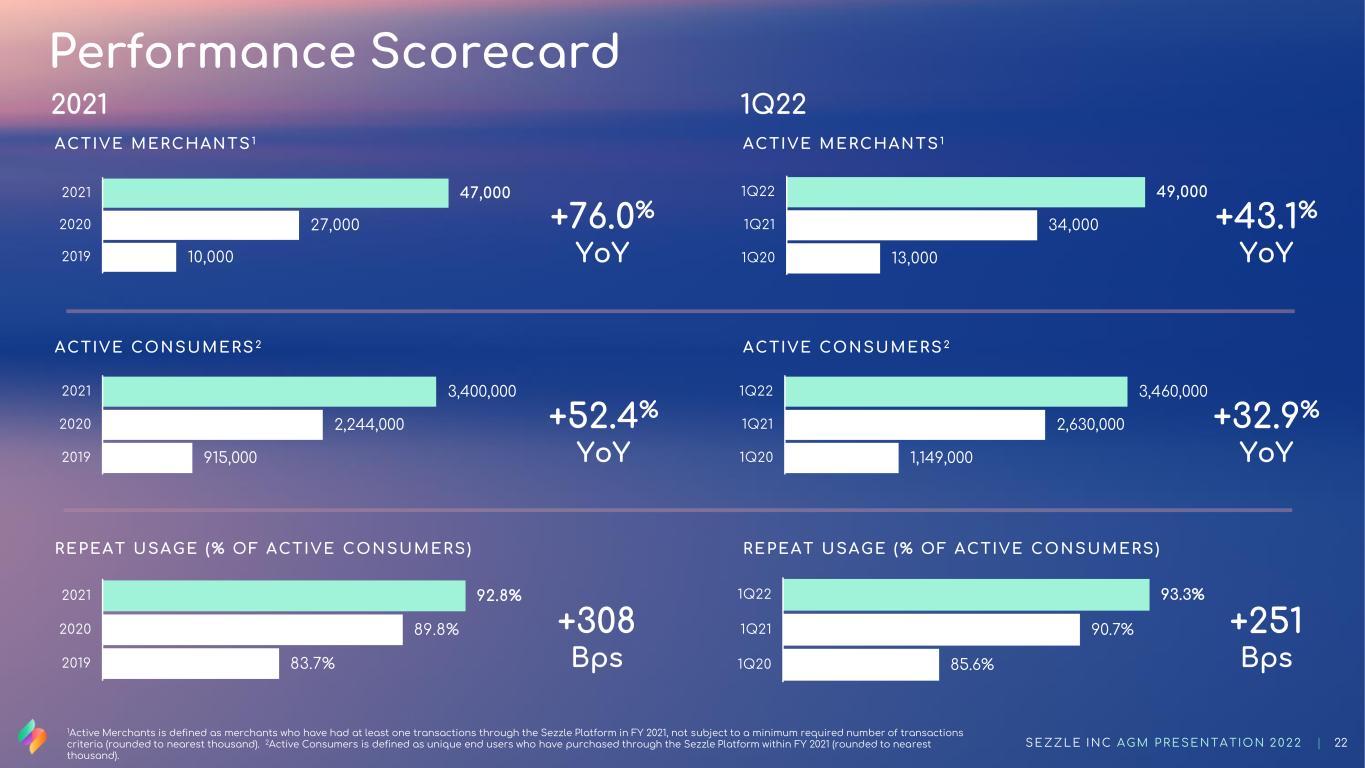

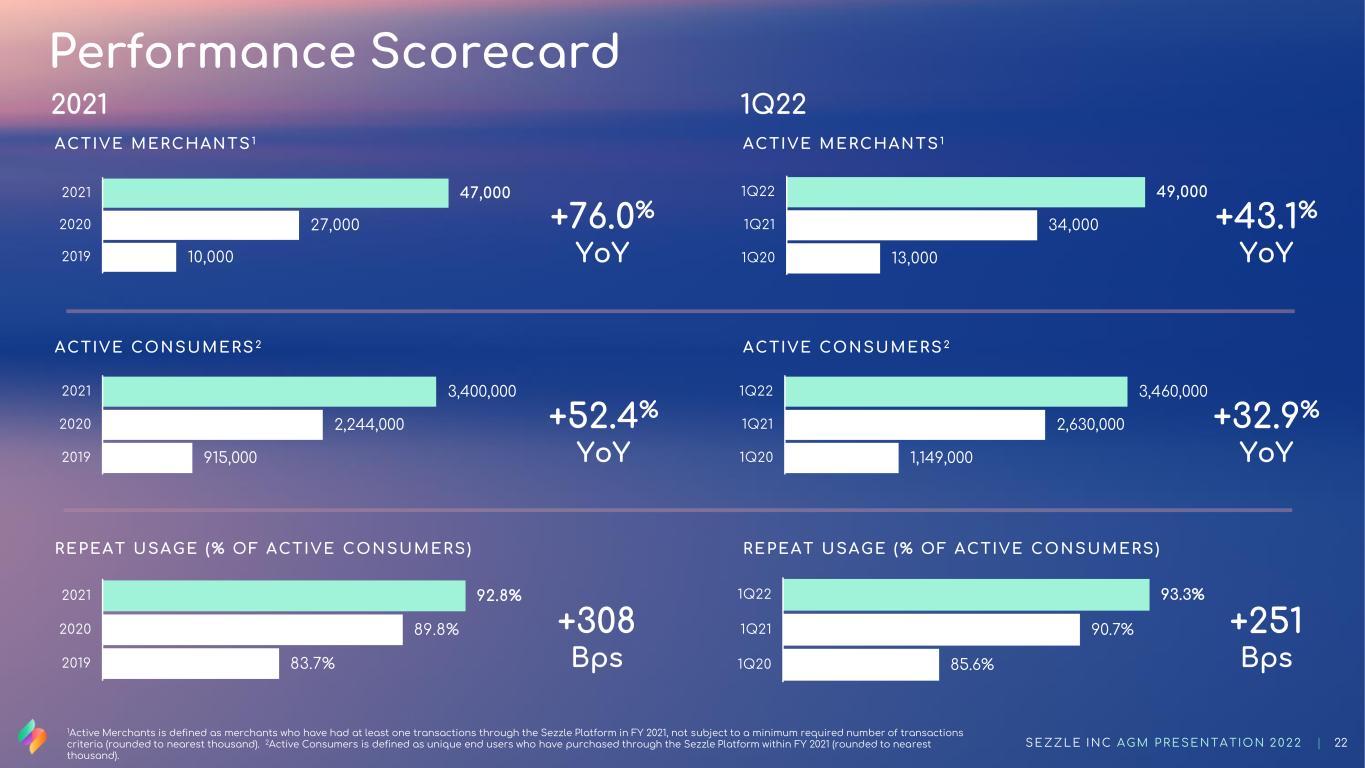

SE ZZLE INC AGM P RE SE NTATION 20 22 | 22 REPEAT USAGE (% OF ACTIVE CONSUMERS) ACTIVE MERCHANTS 1 ACTIVE CONSUMERS 2 +43.1% YoY +251 Bps +32.9% YoY 1Active Merchants is defined as merchants who have had at least one transactions through the Sezzle Platform in FY 2021, not subject to a minimum required number of transactions criteria (rounded to nearest thousand). 2Active Consumers is defined as unique end users who have purchased through the Sezzle Platform within FY 2021 (rounded to nearest thousand). 2021 Performance Scorecard 10,000 27,000 47,000 2019 2020 2021 83.7% 89.8% 92.8% 2019 2020 2021 +76.0% YoY +308 Bps +52.4% YoY 13,000 34,000 49,000 1Q20 1Q21 1Q22 REPEAT USAGE (% OF ACTIVE CONSUMERS) ACTIVE MERCHANTS 1 ACTIVE CONSUMERS 2 1Q22 85.6% 90.7% 93.3% 1Q20 1Q21 1Q22 915,000 2,244,000 3,400,000 2019 2020 2021 1,149,000 2,630,000 3,460,000 1Q20 1Q21 1Q22

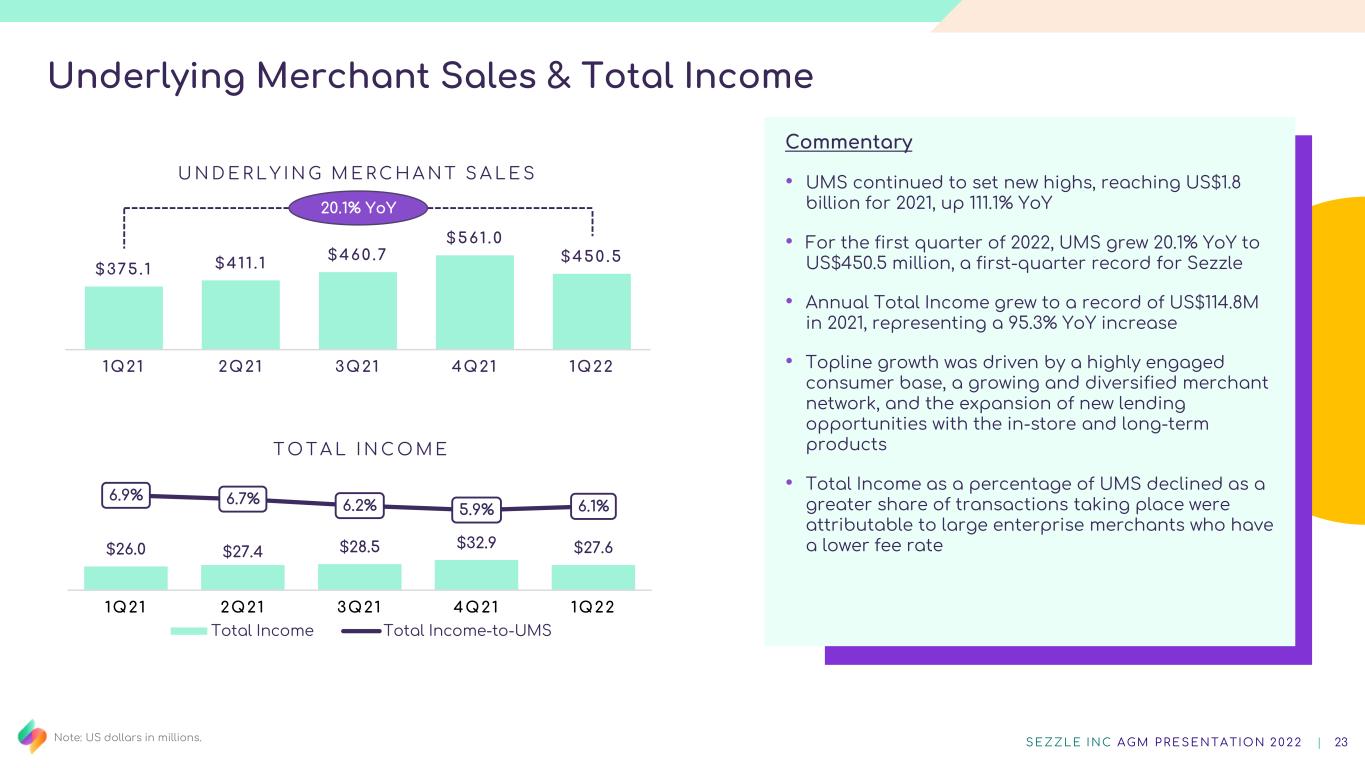

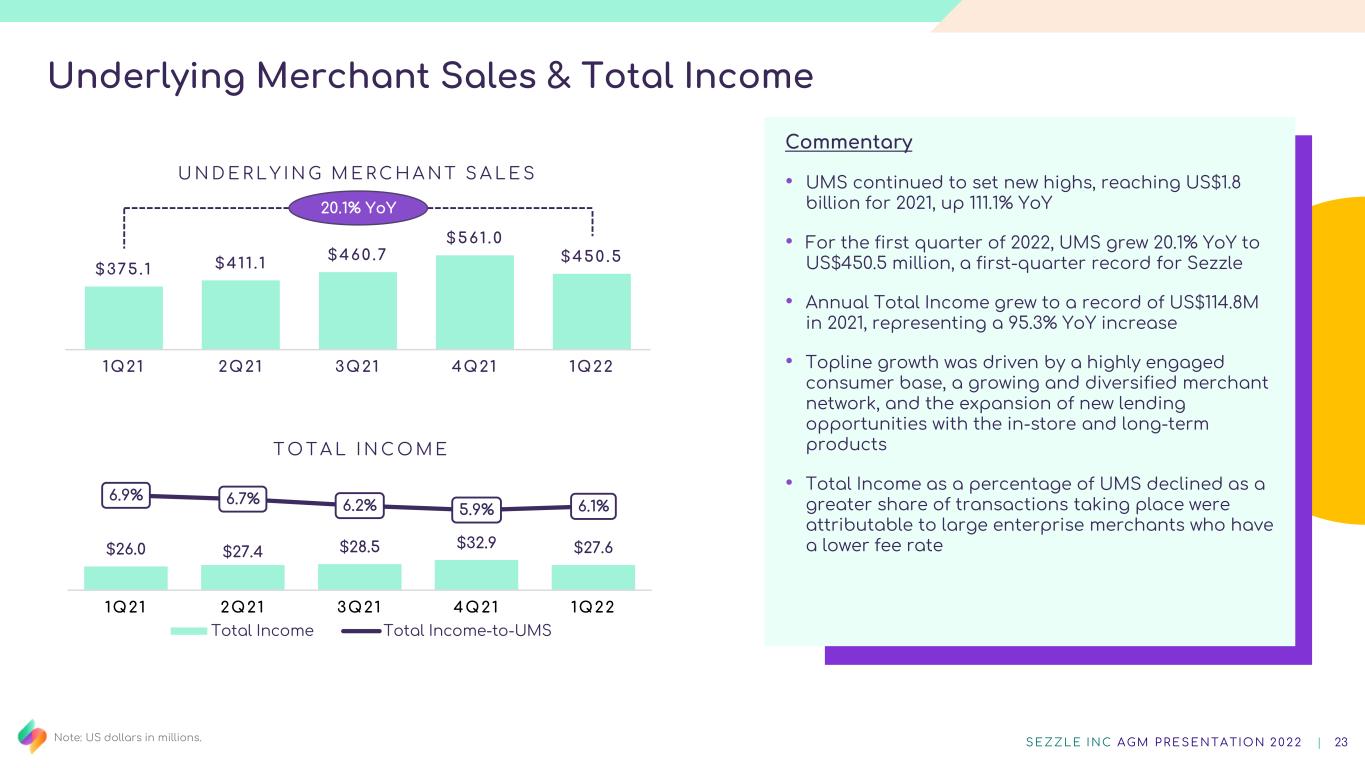

$375.1 $411 . 1 $460.7 $561 .0 $450.5 1Q21 2Q21 3Q21 4Q21 1Q22 U N D E R L Y I N G M E R C H A N T S A L E S Underlying Merchant Sales & Total Income SE ZZLE INC AGM P RE SE NTATION 20 22 | 23 Commentary • UMS continued to set new highs, reaching US$1.8 billion for 2021, up 111.1% YoY • For the first quarter of 2022, UMS grew 20.1% YoY to US$450.5 million, a first-quarter record for Sezzle • Annual Total Income grew to a record of US$114.8M in 2021, representing a 95.3% YoY increase • Topline growth was driven by a highly engaged consumer base, a growing and diversified merchant network, and the expansion of new lending opportunities with the in-store and long-term products • Total Income as a percentage of UMS declined as a greater share of transactions taking place were attributable to large enterprise merchants who have a lower fee rate 20.1% YoY Note: US dollars in millions. $26.0 $27.4 $28.5 $32.9 $27.6 6.9% 6.7% 6.2% 5.9% 6.1% 0.0%$0.0 $30.0 $60.0 $90.0 $120.0 1Q21 2Q21 3Q21 4Q21 1Q22 T O T A L I N C O M E Total Income Total Income-to-UMS

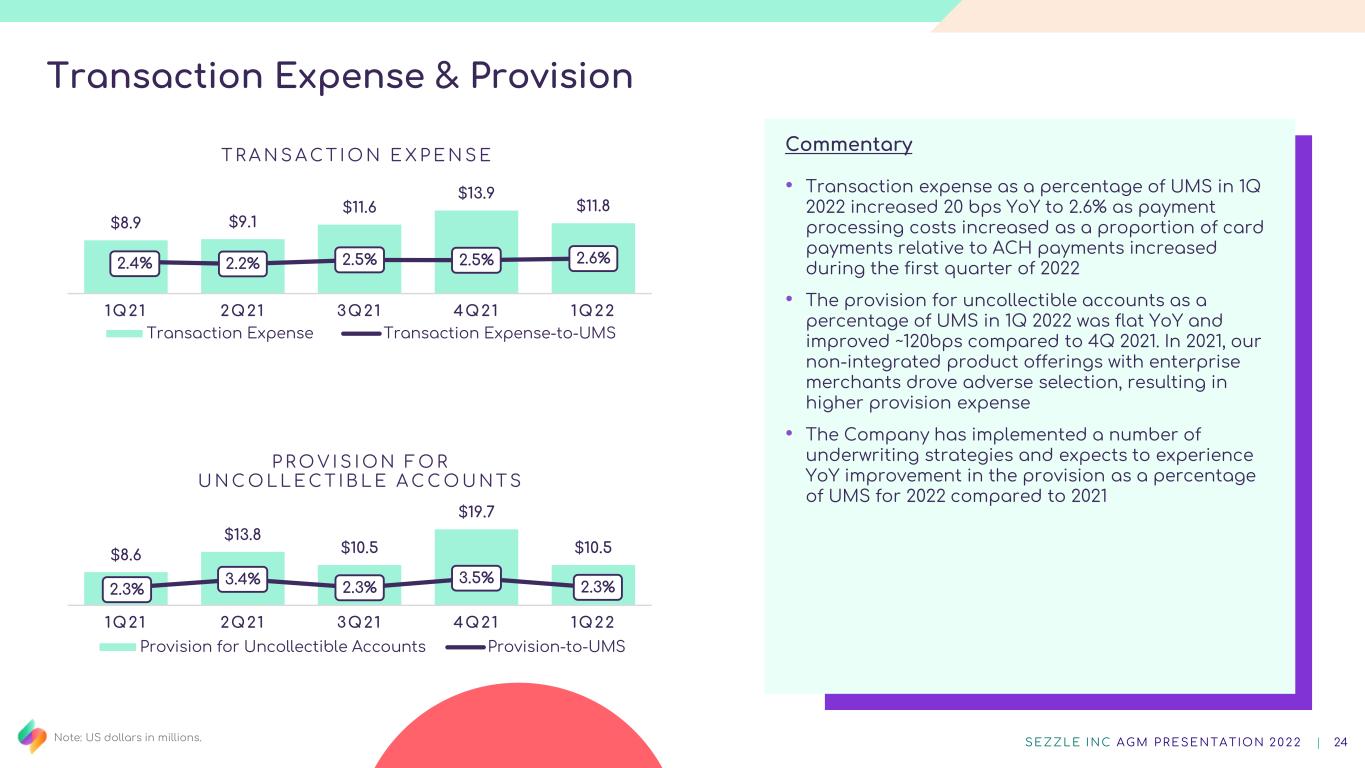

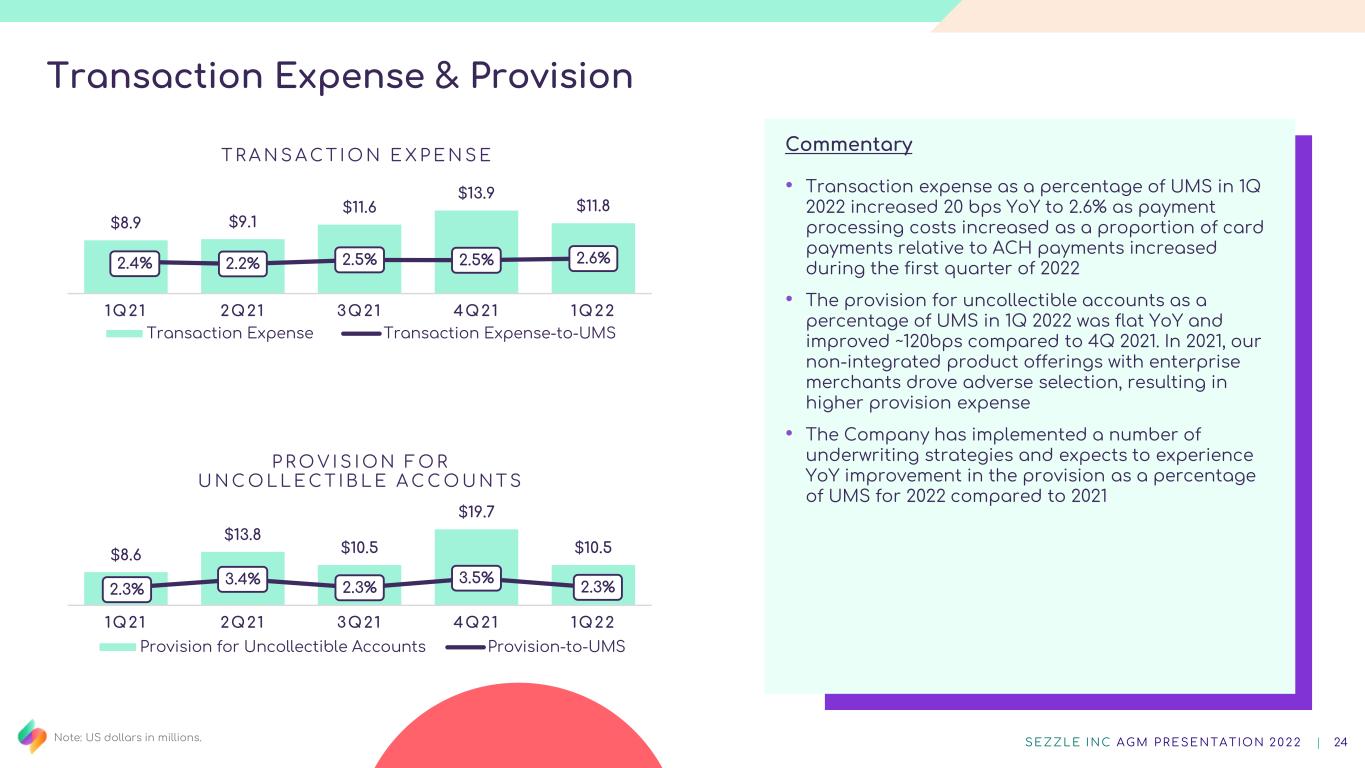

Transaction Expense & Provision Commentary • Transaction expense as a percentage of UMS in 1Q 2022 increased 20 bps YoY to 2.6% as payment processing costs increased as a proportion of card payments relative to ACH payments increased during the first quarter of 2022 • The provision for uncollectible accounts as a percentage of UMS in 1Q 2022 was flat YoY and improved ~120bps compared to 4Q 2021. In 2021, our non-integrated product offerings with enterprise merchants drove adverse selection, resulting in higher provision expense • The Company has implemented a number of underwriting strategies and expects to experience YoY improvement in the provision as a percentage of UMS for 2022 compared to 2021 Note: US dollars in millions. SE ZZLE INC AGM P RE SE NTATION 20 22 | 24 $8.9 $9.1 $11.6 $13.9 $11.8 2.4% 2.2% 2.5% 2.5% 2.6% 0.0%$0.0 1Q21 2Q21 3Q21 4Q21 1Q22 T R A N S A C T I O N E X P E N S E Transaction Expense Transaction Expense-to-UMS $8.6 $13.8 $10.5 $19.7 $10.5 2.3% 3.4% 2.3% 3.5% 2.3% 0.0%0.0 1Q21 2Q21 3Q21 4Q21 1Q22 P R O V I S I O N F O R U N C O L L E C T I B L E A C C O U N T S Provision for Uncollectible Accounts Provision-to-UMS

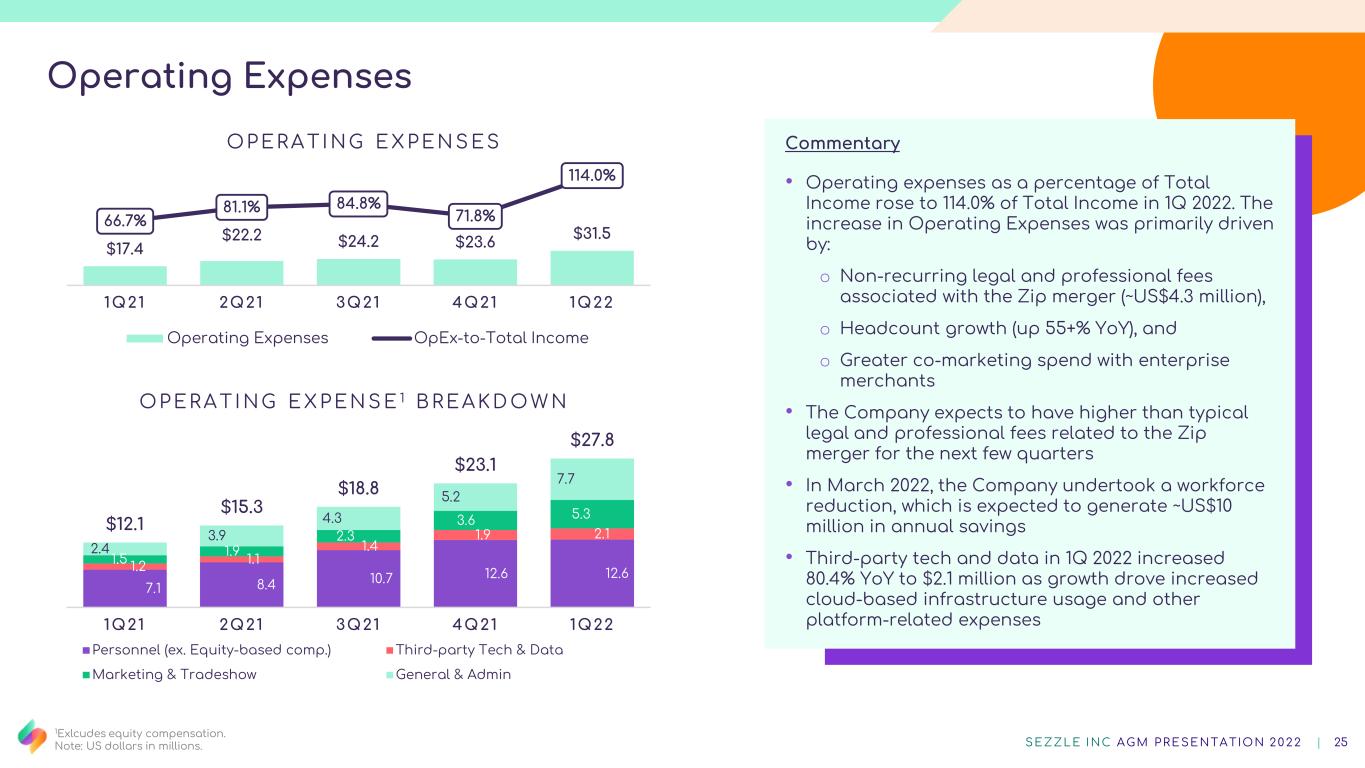

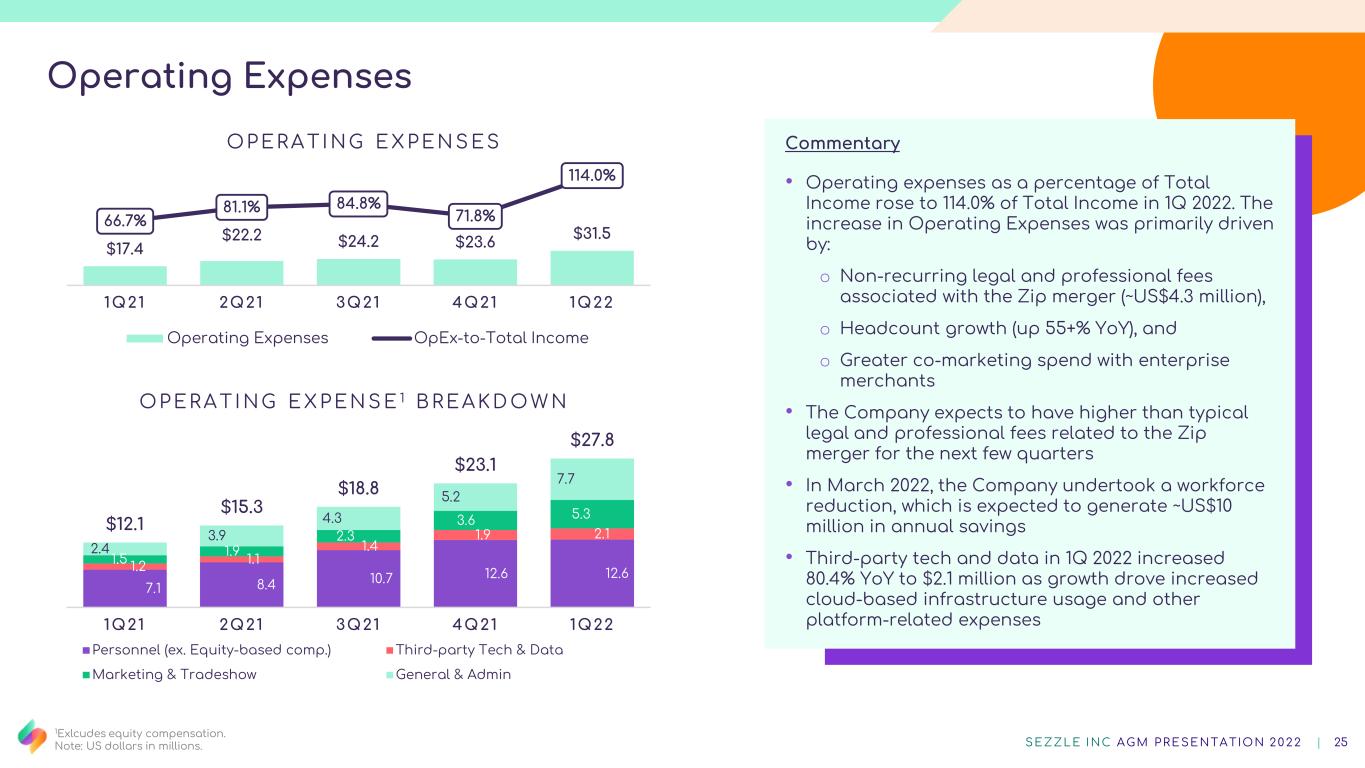

Operating Expenses Commentary • Operating expenses as a percentage of Total Income rose to 114.0% of Total Income in 1Q 2022. The increase in Operating Expenses was primarily driven by: o Non-recurring legal and professional fees associated with the Zip merger (~US$4.3 million), o Headcount growth (up 55+% YoY), and o Greater co-marketing spend with enterprise merchants • The Company expects to have higher than typical legal and professional fees related to the Zip merger for the next few quarters • In March 2022, the Company undertook a workforce reduction, which is expected to generate ~US$10 million in annual savings • Third-party tech and data in 1Q 2022 increased 80.4% YoY to $2.1 million as growth drove increased cloud-based infrastructure usage and other platform-related expenses 1Exlcudes equity compensation. Note: US dollars in millions. SE ZZLE INC AGM P RE SE NTATION 20 22 | 25 $17.4 $22.2 $24.2 $23.6 $31.5 66.7% 81.1% 84.8% 71.8% 114.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 0.0 1Q21 2Q21 3Q21 4Q21 1Q22 OPERA T I NG EX PEN S ES Operating Expenses OpEx-to-Total Income 7.1 8.4 10.7 12.6 12.61.2 1.1 1.4 1.9 2.1 1.5 1.9 2.3 3.6 5.3 2.4 3.9 4.3 5.2 7.7 $12.1 $15.3 $18.8 $23.1 $27.8 0.0 1Q21 2Q21 3Q21 4Q21 1Q22 OPERA T I NG EX PEN S E 1 B REAKD O W N Personnel (ex. Equity-based comp.) Third-party Tech & Data Marketing & Tradeshow General & Admin

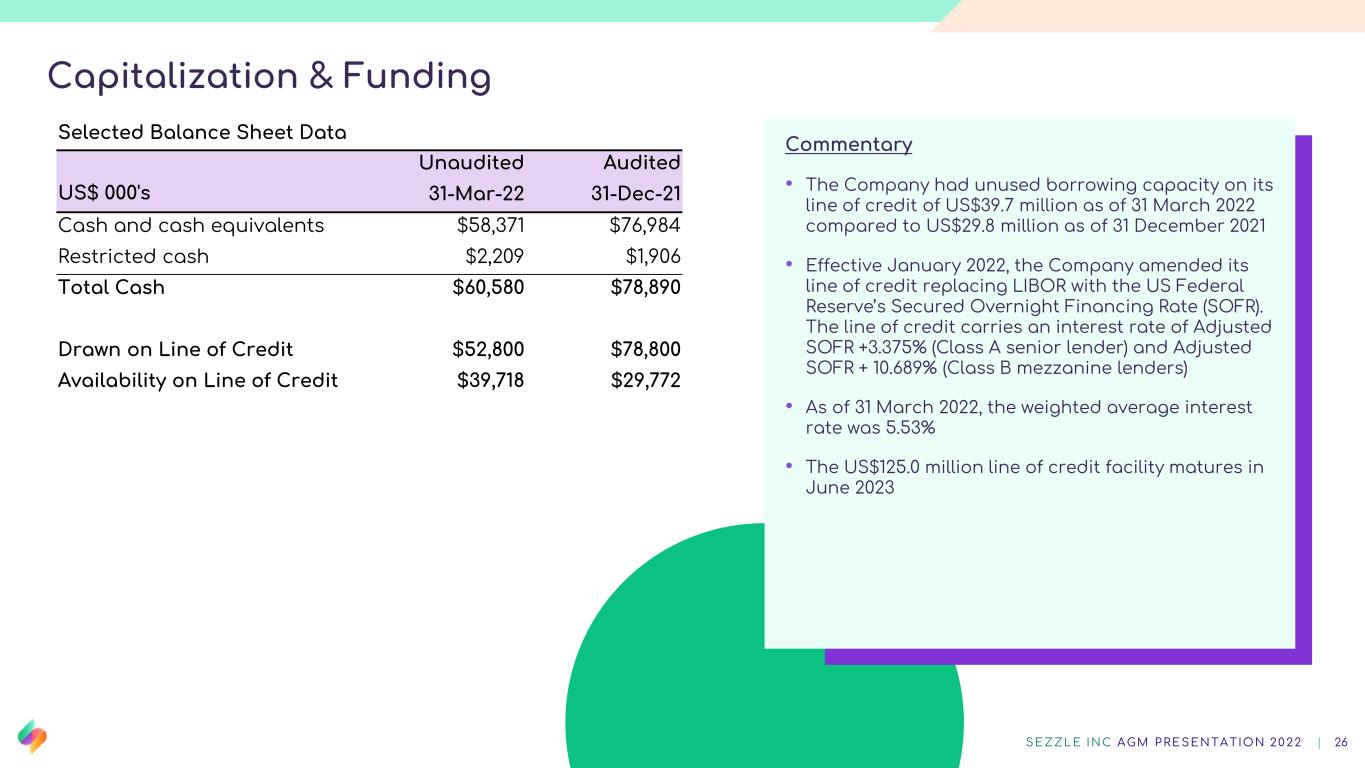

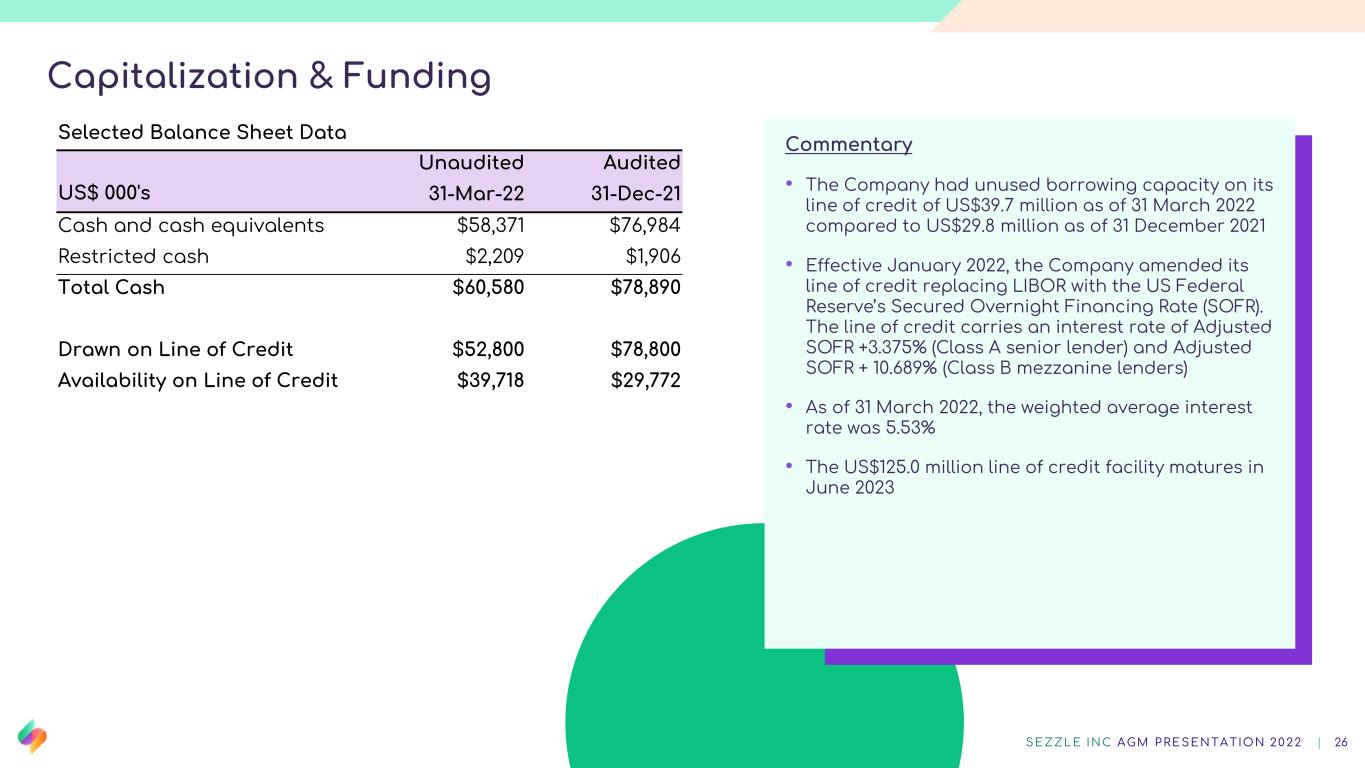

Capitalization & Funding Commentary • The Company had unused borrowing capacity on its line of credit of US$39.7 million as of 31 March 2022 compared to US$29.8 million as of 31 December 2021 • Effective January 2022, the Company amended its line of credit replacing LIBOR with the US Federal Reserve’s Secured Overnight Financing Rate (SOFR). The line of credit carries an interest rate of Adjusted SOFR +3.375% (Class A senior lender) and Adjusted SOFR + 10.689% (Class B mezzanine lenders) • As of 31 March 2022, the weighted average interest rate was 5.53% • The US$125.0 million line of credit facility matures in June 2023 Selected Balance Sheet Data Unaudited Audited US$ 000's 31-Mar-22 31-Dec-21 Cash and cash equivalents $58,371 $76,984 Restricted cash $2,209 $1,906 Total Cash $60,580 $78,890 Drawn on Line of Credit $52,800 $78,800 Availability on Line of Credit $39,718 $29,772 SE ZZLE INC AGM P RE SE NTATION 20 22 | 26

Zip Update SE ZZLE INC AGM P RE SE NTATION 20 22 | 27 • The merger with ZIP remains on track to close and will deliver significant scale and synergies upon completion, directly supporting our objective to accelerate growth and build a profitable business at scale • The waiting period for review by the Federal Trade Commission under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976 expired as announced to the Australian Securities Exchange Ltd (ASX) on 22 April 2022 • The transaction remains subject to the satisfaction of other customary closing conditions, such as Zip and Sezzle shareholder approval

Voting and Resolution VOTING AND RESOLUTION SE ZZLE INC AGM P RE SE NTATION 20 22 | 28

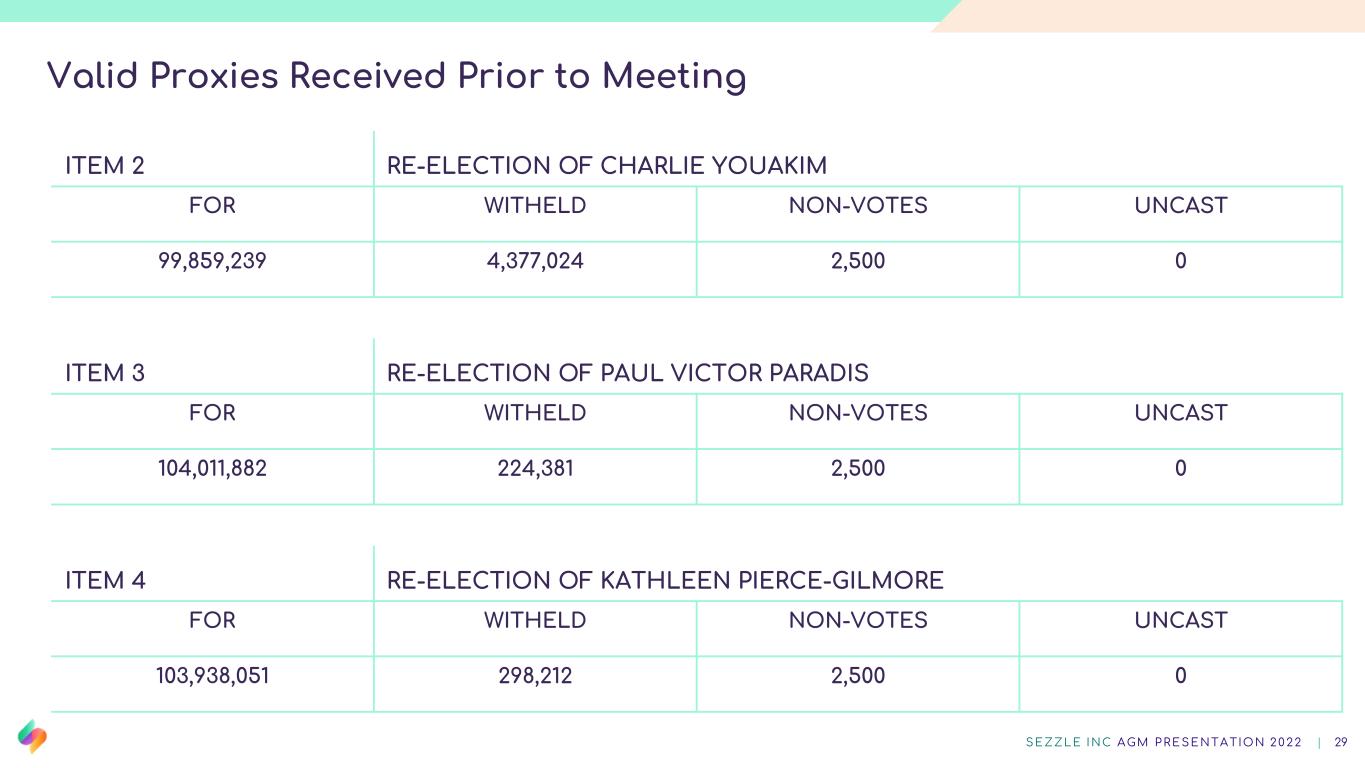

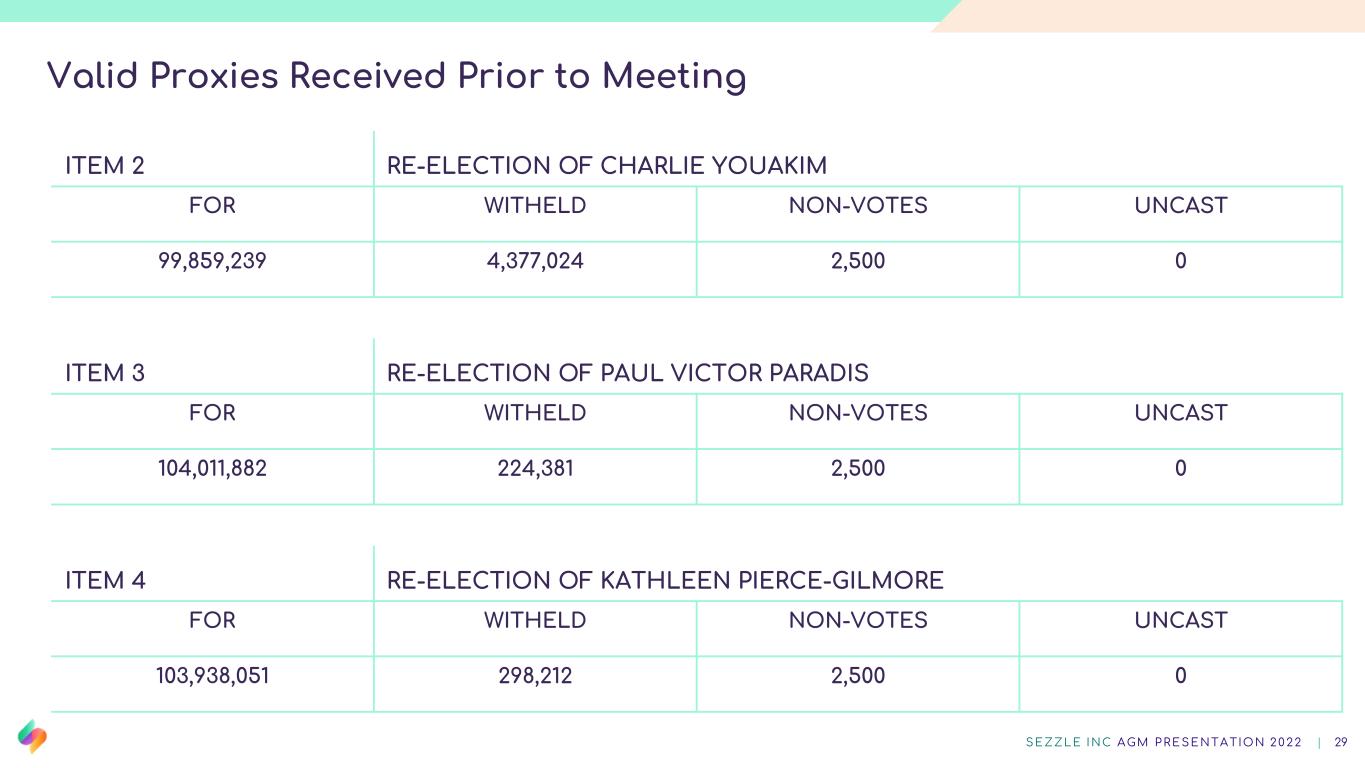

SE ZZLE INC AGM P RE SE NTATION 20 22 | 29 Valid Proxies Received Prior to Meeting ITEM 2 RE-ELECTION OF CHARLIE YOUAKIM FOR WITHELD NON-VOTES UNCAST 99,859,239 4,377,024 2,500 0 ITEM 3 RE-ELECTION OF PAUL VICTOR PARADIS FOR WITHELD NON-VOTES UNCAST 104,011,882 224,381 2,500 0 ITEM 4 RE-ELECTION OF KATHLEEN PIERCE-GILMORE FOR WITHELD NON-VOTES UNCAST 103,938,051 298,212 2,500 0

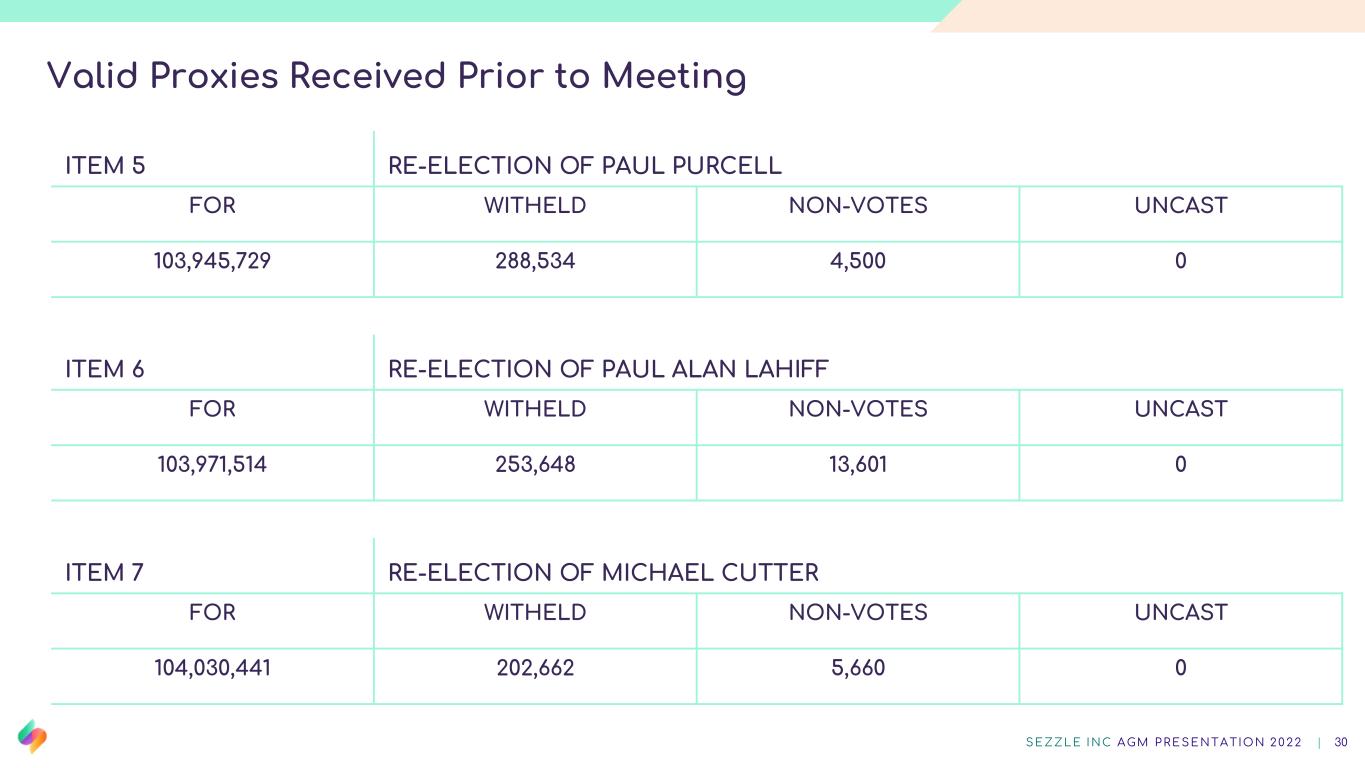

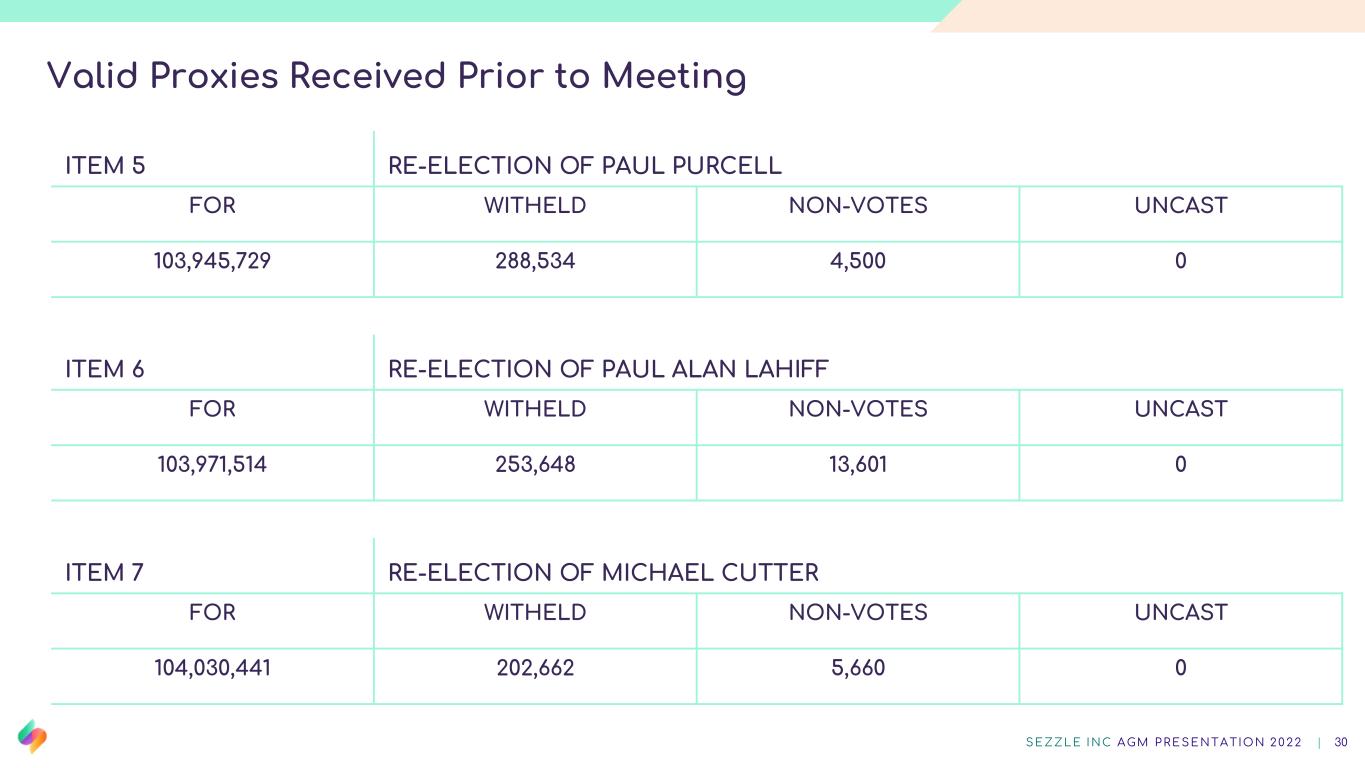

Valid Proxies Received Prior to Meeting ITEM 5 RE-ELECTION OF PAUL PURCELL FOR WITHELD NON-VOTES UNCAST 103,945,729 288,534 4,500 0 ITEM 6 RE-ELECTION OF PAUL ALAN LAHIFF FOR WITHELD NON-VOTES UNCAST 103,971,514 253,648 13,601 0 ITEM 7 RE-ELECTION OF MICHAEL CUTTER FOR WITHELD NON-VOTES UNCAST 104,030,441 202,662 5,660 0 SE ZZLE INC AGM P RE SE NTATION 20 22 | 30

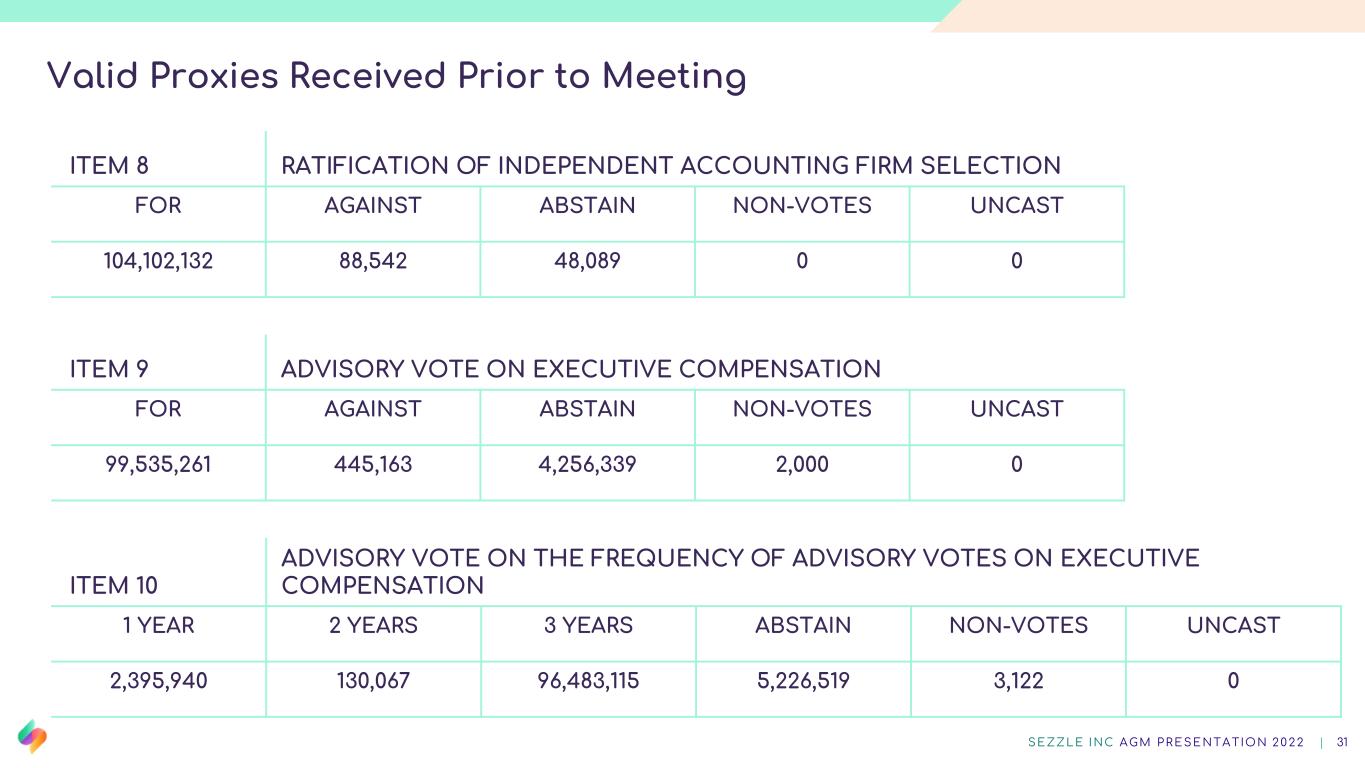

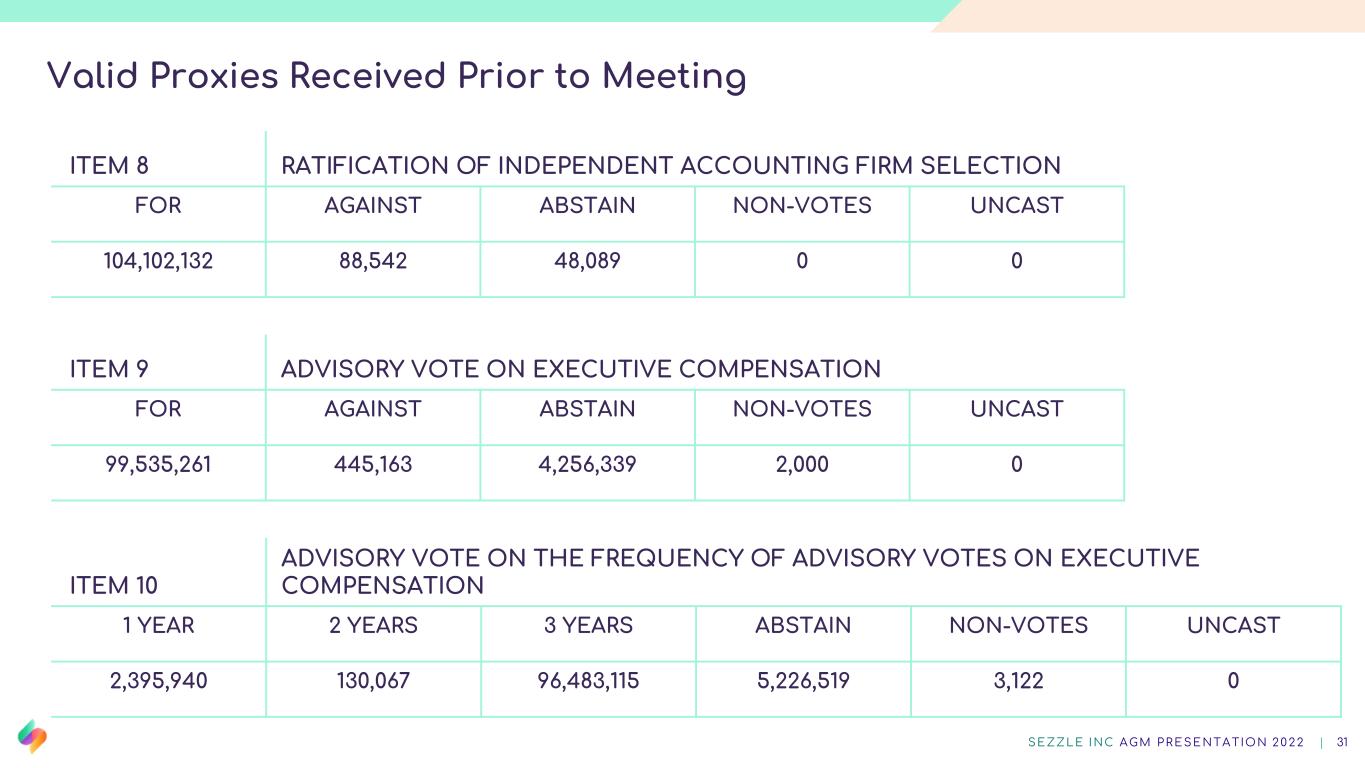

Valid Proxies Received Prior to Meeting ITEM 8 RATIFICATION OF INDEPENDENT ACCOUNTING FIRM SELECTION FOR AGAINST ABSTAIN NON-VOTES UNCAST 104,102,132 88,542 48,089 0 0 ITEM 9 ADVISORY VOTE ON EXECUTIVE COMPENSATION FOR AGAINST ABSTAIN NON-VOTES UNCAST 99,535,261 445,163 4,256,339 2,000 0 ITEM 10 ADVISORY VOTE ON THE FREQUENCY OF ADVISORY VOTES ON EXECUTIVE COMPENSATION 1 YEAR 2 YEARS 3 YEARS ABSTAIN NON-VOTES UNCAST 2,395,940 130,067 96,483,115 5,226,519 3,122 0 SE ZZLE INC AGM P RE SE NTATION 20 22 | 31

Thank you SE ZZLE INC AGM P RE SE NTATION 20 22 | 32

DISCLAIMER Additional Information and Where to Find It This Presentation is being made in respect of the proposed merger transaction involving the Sezzle and Zip Co Limited (“Parent”). In connection with the proposed acquisition by Parent of Sezzle (the “Proposed Transaction”), Parent will file with: (a) the SEC a registration statement on Form F-4, (b) to the extent required by the Australian Securities & Investments Commission (the “ASIC”), a prospectus in Australia with the ASIC in relation to the offer of ordinary shares of Parent, and (c) with the Australian Securities Exchange Ltd (the “ASX”), the Notice of Parent Extraordinary General Meeting in connection with the Parent stockholder approval. The registration statement will include a document that serves as a prospectus of Parent and a proxy statement of the Company (the “proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC, ASIC and the ASX. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AUSTRALIAN PROSPECTUS (IF ANY), NOTICE OF PARENT EXTRAORDINARY GENERAL MEETING, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE THEY DO AND THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus and Australian prospectus (if any) will be mailed to the Company’s security holders when it becomes available. Investors and security holders will be able to obtain the registration statement, the proxy statement/prospectus, the Australian prospectus (if any) and all other relevant documents filed or that will be filed free of charge from the SEC’s website at www.sec.gov or at the ASX’s website at www2.asx.com/au. The documents filed by the Parent or the Company with the SEC and the ASX may also be obtained free of charge at the Parent’s or Company’s website at https://investors.sezzle.com/ and https://zip.com/investors. Participants in the Solicitation Parent, the Company and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the Company’s security holders with respect to the Proposed Transaction. Information about Parent’s directors and executive officers is available in Parent’s Annual Report to Stockholders for the fiscal year ended June 30, 2021 filed with the ASX on September 28, 2021. Information concerning the ownership of the Company’s securities by the Company’s directors and executive officers is included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 30, 2022. Other information regarding persons who may, under the rules of the SEC, be deemed the participants in the proxy solicitation of the Company’s stockholders in connection with the Proposed Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction (if and when they become available). Security holders, potential investors and other readers should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Parent or the Company as indicated above. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or pursuant to another available exemption. SE ZZLE INC AGM P RE SE NTATION 20 22 | 33