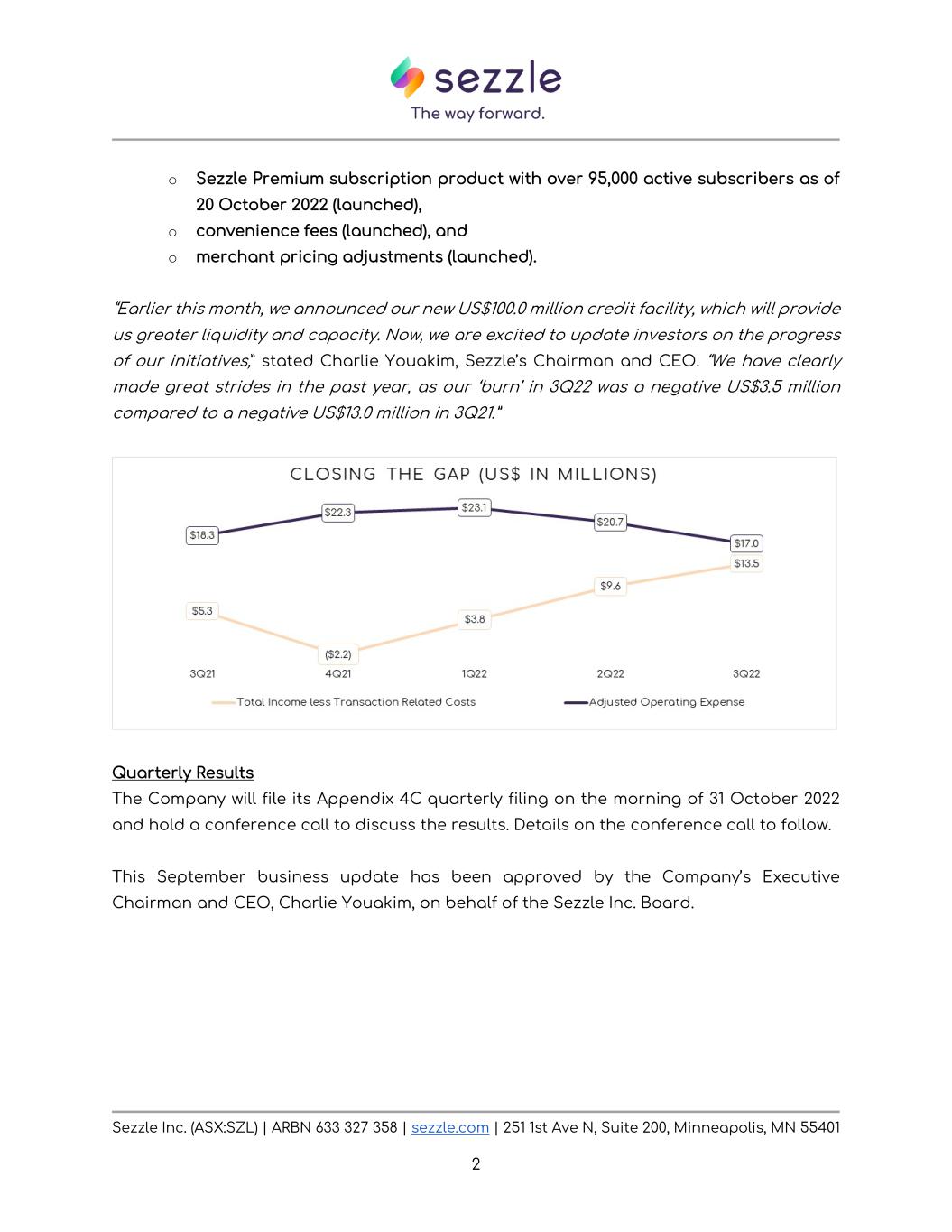

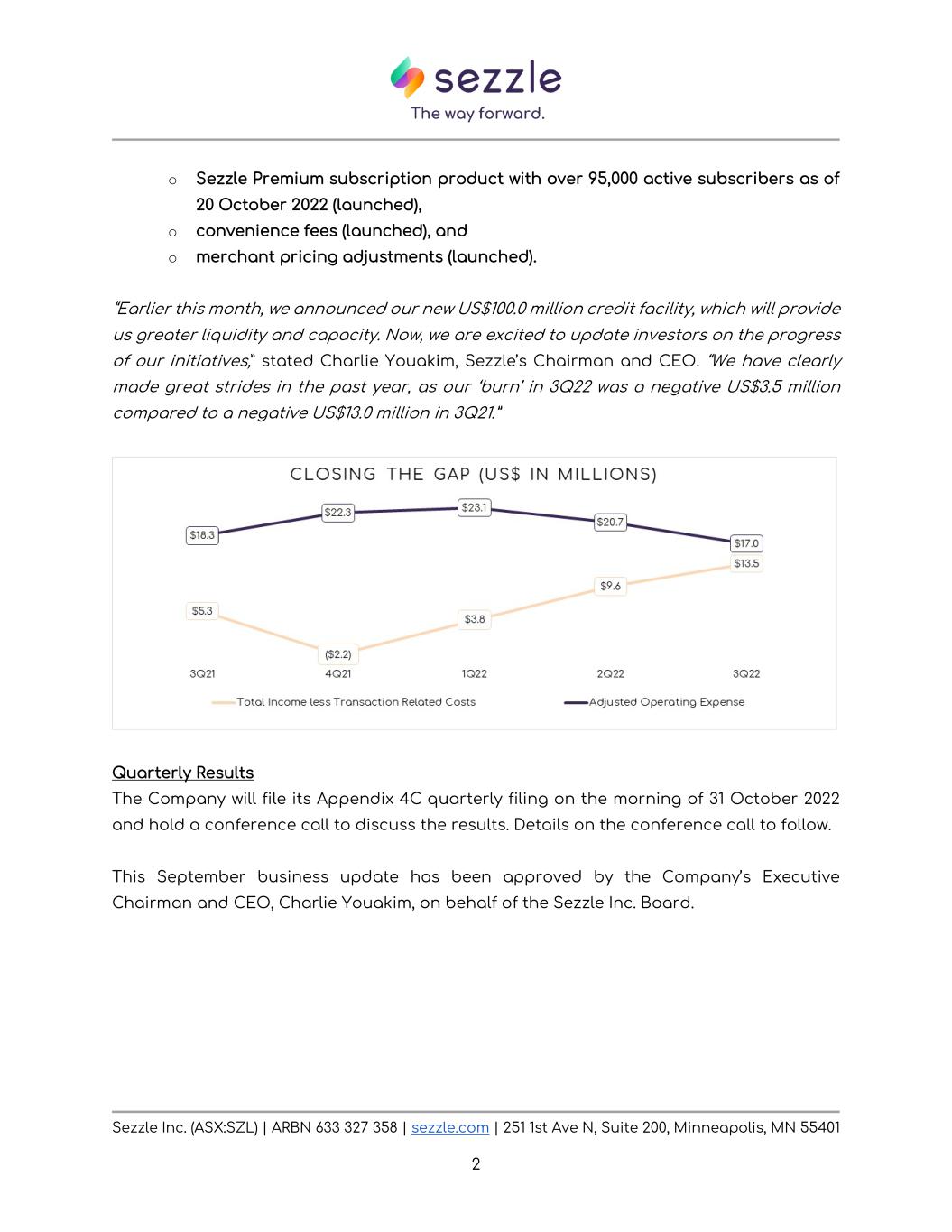

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 1 21 October 2022 ASX RELEASE Company Announcements Platform September Business Update Initiatives Making a Difference Sezzle Inc. (ASX:SZL) (Sezzle or Company) // Purpose-driven installment payment platform, Sezzle, is pleased to provide the market with an update on key financial metrics for the month and quarter ended 30 September 2022.1 • Underlying Merchant Sales (UMS) for 3Q22 rose 0.6% QoQ to US$421.5M (A$655.3M2), with Total Income increasing 4.0% QoQ to US$30.4M (A$47.3M2), representing a 23bps QoQ improvement as a percentage of UMS. • Revenue and cost initiatives as well as the continuous refinement of the Company’s underwriting strategies had a positive effect on the Company’s performance. The gap between Total Income less Transaction Related Costs3 and Adjusted Operating Expenses4 narrowed significantly from the peak level of a negative US$24.5M in 4Q21 (average monthly US$8.2M) to only a negative US$3.5M in 3Q22 (average monthly US$1.2M). • The Company has announced a number of key initiatives in 2022. These initiatives are expected to generate US$60.0M in annualized revenue and cost savings and are anticipated to be fully rolled out by 1Q23. Those initiatives include: o offboarded or renegotiated rates with merchants and network partners (completed, but continue to monitor going forward), o reduction in workforce (completed), o scaled back efforts in Europe and Brazil (in process), o ceased payment processing in India (completed), o reduced third-party spend (on going), 1 Results are unaudited. 2 A$ to US$ exchange rate of $0.6432 as of 30 September 2022. 3 Total Income less Transaction Related Costs is a non-GAAP financial measure equal to Total Income less the sum of Transaction Expense, Provision for Uncollectible Accounts, and Net Interest Expense. 4 Adjusted Operating Expense is a non-GAAP measure equal to the sum of Personnel (excluding equity-based compensation), third-party tech & data, marketing & tradeshows, adjusted general & administrative expense (excluding depreciation, amortization, impairments, and non-recurring expenses).

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 2 o Sezzle Premium subscription product with over 95,000 active subscribers as of 20 October 2022 (launched), o convenience fees (launched), and o merchant pricing adjustments (launched). “Earlier this month, we announced our new US$100.0 million credit facility, which will provide us greater liquidity and capacity. Now, we are excited to update investors on the progress of our initiatives,” stated Charlie Youakim, Sezzle’s Chairman and CEO. “We have clearly made great strides in the past year, as our ‘burn’ in 3Q22 was a negative US$3.5 million compared to a negative US$13.0 million in 3Q21.” Quarterly Results The Company will file its Appendix 4C quarterly filing on the morning of 31 October 2022 and hold a conference call to discuss the results. Details on the conference call to follow. This September business update has been approved by the Company’s Executive Chairman and CEO, Charlie Youakim, on behalf of the Sezzle Inc. Board.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 3 Contact Information For more information about this announcement: Lee Brading, CFA Investor Relations +651 240 6001 InvestorRelations@sezzle.com Justin Clyne Company Secretary +61 407 123 143 jclyne@clynecorporate.com.au Erin Foran Media Enquiries +651 403 2184 erin.foran@sezzle.com About Sezzle Inc. Sezzle is a fintech company on a mission to financially empower the next generation. Sezzle’s payment platform increases the purchasing power for millions of consumers by offering interest-free installment plans at online stores and select in-store locations. Sezzle’s transparent, inclusive, and seamless payment option allows consumers to take control over their spending, be more responsible, and gain access to financial freedom. For more information visit sezzle.com. Sezzle’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. Accordingly, the CDIs have not been, and will not be, registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future, unless the re-sale of the CDIs is registered under the Securities Act or another exemption is available. To enforce the above transfer restrictions, all CDIs issued bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act. Cautionary Note Regarding Forward-Looking Statements This report contains certain forward-looking statements within the meaning of the federal securities laws with respect to: statements regarding our anticipated new products, our ability to gain future market share, our timeline and intentions relating to operations in international markets, our strategy, our future operations, our financial position, our estimated revenues and losses, our projected costs, our prospects, and the plans and objectives of management. These forward-looking statements are generally identified by the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” or similar expressions. These forward-looking statements are subject to a number of risks and uncertainties, including those set out in this Presentation, but not limited to: (i) the potential impact of the termination of our merger agreement with Zip Co Limited, including any

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 4 impact on our stock price, business, financial condition and results of operations, and the potential negative impact to our business and employee relationships(ii) impact of the “buy-now, pay-later” (“BNPL”) industry becoming subject to increased regulatory scrutiny; (iii) impact of operating in a highly competitive industry; (iv) impact of macro-economic conditions on consumer spending; (v) our ability to increase our merchant network, our base of consumers and Underlying Merchant Sales (“UMS”); (vi) our ability to effectively manage growth, sustain our growth rate and maintain our market share; (vii) our ability to meet additional capital requirements; (vii) impact of exposure to consumer bad debts and insolvency of merchants; (ix) impact of the integration, support and prominent presentation of our platform by our merchants; (x) impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; (xi) impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to our operations; (xii) impact of the loss of key partners and merchant relationships; (xiii) impact of exchange rate fluctuations in the international markets in which we operate; (xiv) our ability to protect our intellectual property rights; (xv) our ability to retain employees and recruit additional employees; (xvi) impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and the international markets in which we operate; (xvii) our ability to achieve our public benefit purpose and maintain our B Corporation certification; and (xviii) the other factors identified in the “Risk Factors” section of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 30, 2022 and subsequent quarterly reports on Form 10-Q. The foregoing list of factors is not exhaustive. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Nevertheless, and despite the fact that management’s expectations and estimates are based on assumptions management believes to be reasonable and data management believes to be reliable, our actual results, performance or achievements are subject to future risks and uncertainties, any of which could materially affect our actual performance. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements to reflect events or circumstances after the date of this release. This release has been prepared in good faith, but no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, correctness, reliability or adequacy of any statements, estimates, opinions or other information, or the reasonableness of any assumption or other statement, contained in the presentation (any of which may change without notice). No Offer or Solicitation This report shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 5 means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or pursuant to another available exemption.