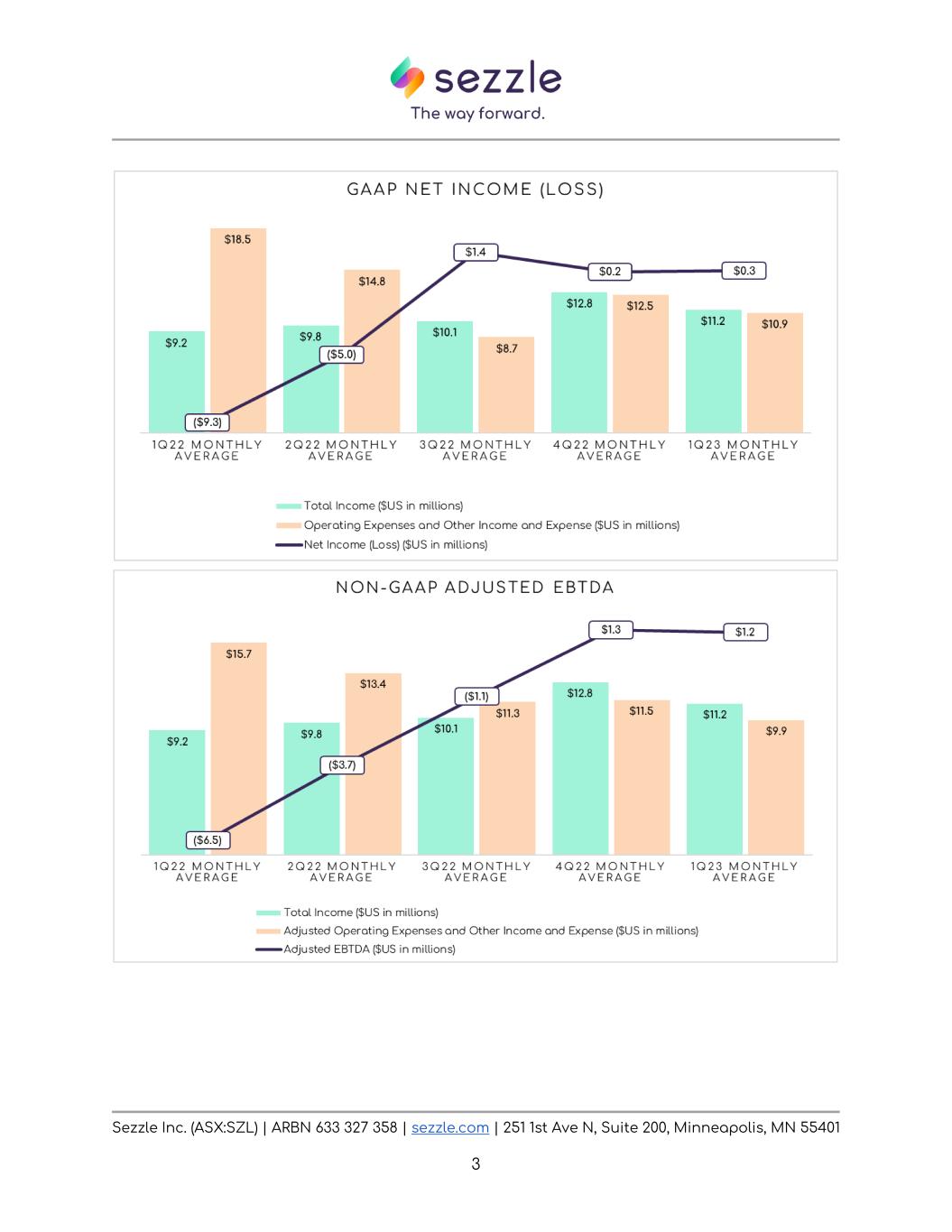

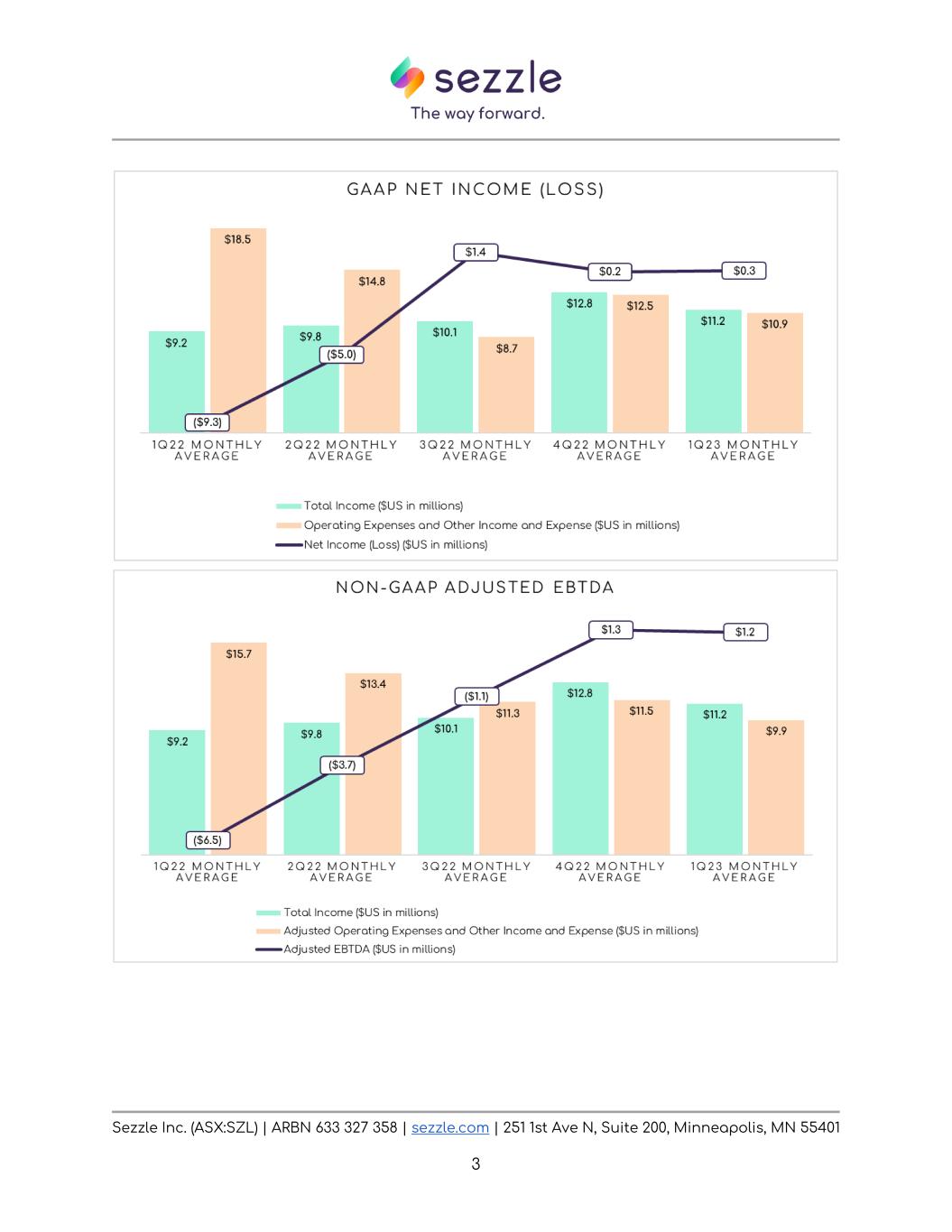

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 1 20 March 2023 ASX RELEASE Company Announcements Platform February Business Update A Month of Profitability with Total Income Up 29.1% YoY Sezzle Inc. (ASX:SZL) (Sezzle or Company) // Purpose-driven installment payment platform, Sezzle, is pleased to provide the market with an update on key financial metrics for the month ended 28 February 2023.1 • Total Income for February increased 29.1% YoY to US$10.7M (A$15.8M2). Total Income as a percentage of Underlying Merchant Sales (UMS) remained strong at 9.0% (a 320bps YoY improvement) with average daily UMS up 12.0% in February 2023 compared to January 2023. • Sezzle achieved profitability in February, posting positive Net Income (a GAAP measure), Adjusted EBTDA3 (a non-GAAP measure), and Adjusted EBITDA3 (a non-GAAP measure). • February’s Net Income of US$0.8M improved US$9.8M YoY and US$0.9M MoM due to the outperformance of the Provision for Uncollectible Accounts. • Similarly, February’s Adjusted EBTDA and Adjusted EBITDA increased to a positive US$1.4M and US$2.6M, respectively. Relative to January, Adjusted EBTDA and Adjusted EBITDA increased by 40.2% and 27.8%, respectively. • Sezzle Premium has over 138,000 active subscribers (17 March 2023). • As of 28 February 2023, capital and liquidity were healthy with US$68.0M of cash on hand (US$1.3M restricted) and US$53.3M drawn on its US$100M credit facility. • On 13 March 2023, the Company disclosed (Statement on Silicon Valley Bank filed on the ASX) that less than 2% (US$1.2M) of the Company’s funds (i.e., cash and cash equivalents) were held at Silicon Valley Bank (SVB). The funds that were held at SVB have since been moved to other institutions that are insured by the Federal Deposit Insurance Corporation with no loss to the Company. 1 Results are unaudited preliminary financial results. 2 A$ to US$ exchange rate of $0.6749 as of 28 February 2023. 3 Adjusted EBTDA and Adjusted EBITDA are non-GAAP financial measures. For a reconciliation of GAAP Net Income (Loss) to Adjusted EBTDA and Adjusted EBITDA, see Appendix for reconciliation.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 2 • On 14 March 2023, Sezzle announced its intent (see Proposed Direct Listing on Nasdaq Global Market filed on ASX 14 March 2023) to list its shares of common stock for trading on the Nasdaq Global Market, expanding the universe of potential investors to the United States. The Company does not plan to seek funding from market participants as part of the listing and will continue to trade on the Australian Securities Exchange. • Management does not foresee any near-term capital needs due to the Company’s strong liquidity position and operational performance reflected in positive Net Income and Adjusted EBTDA. “Although it has only been two months, we are on schedule to deliver profitability in 2023. Year-to-date we have delivered Net Income of US$0.6M, Adjusted EBTDA of US$2.4M, and Adjusted EBITDA of US$4.6M,” stated Charlie Youakim, Sezzle’s Chairman and CEO. “As mentioned in our 4Q22 update, we have yet to see the impact of the next round of initiatives, which we estimate will bring at least another US$10.0M in revenue and cost benefits. Yes, we are excited about the future.”

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 3

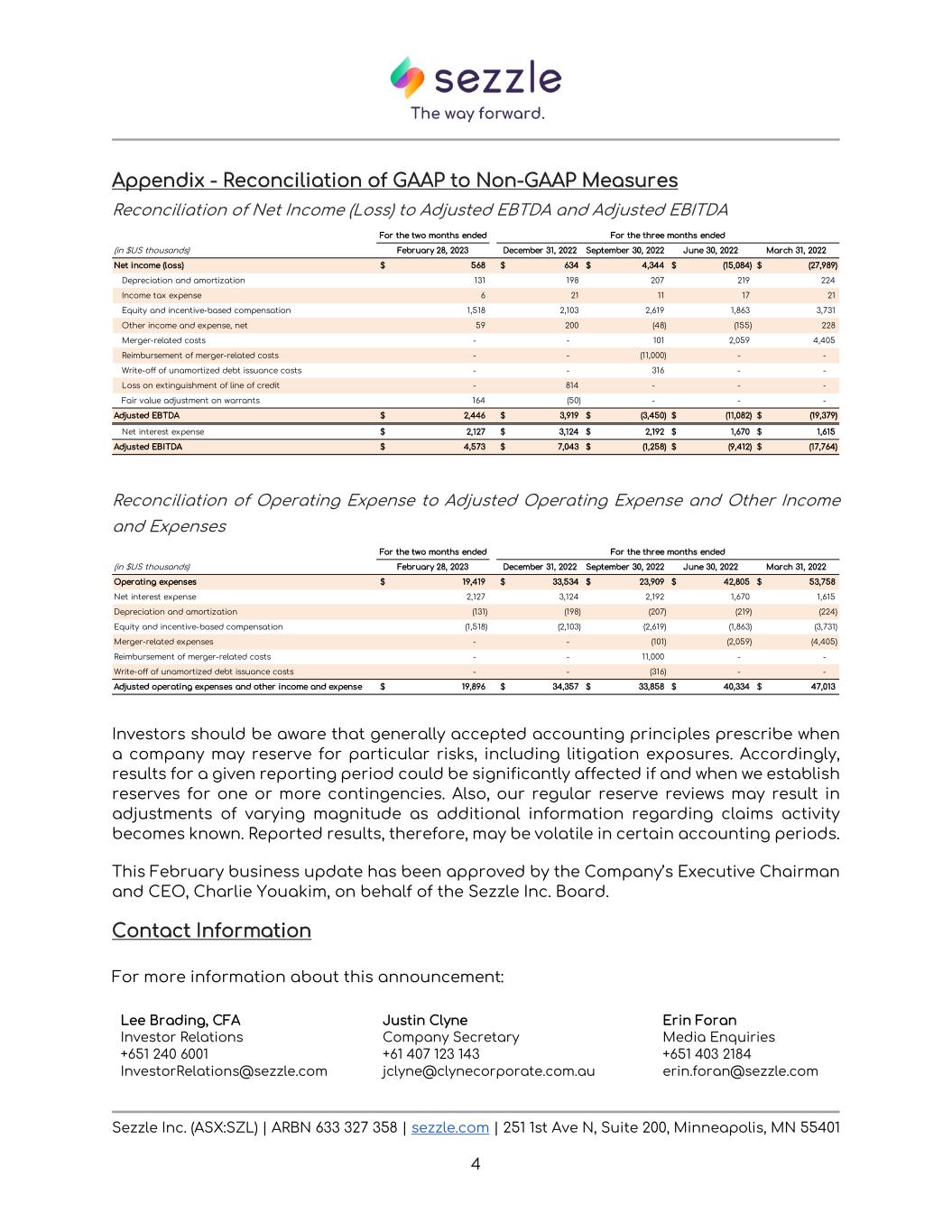

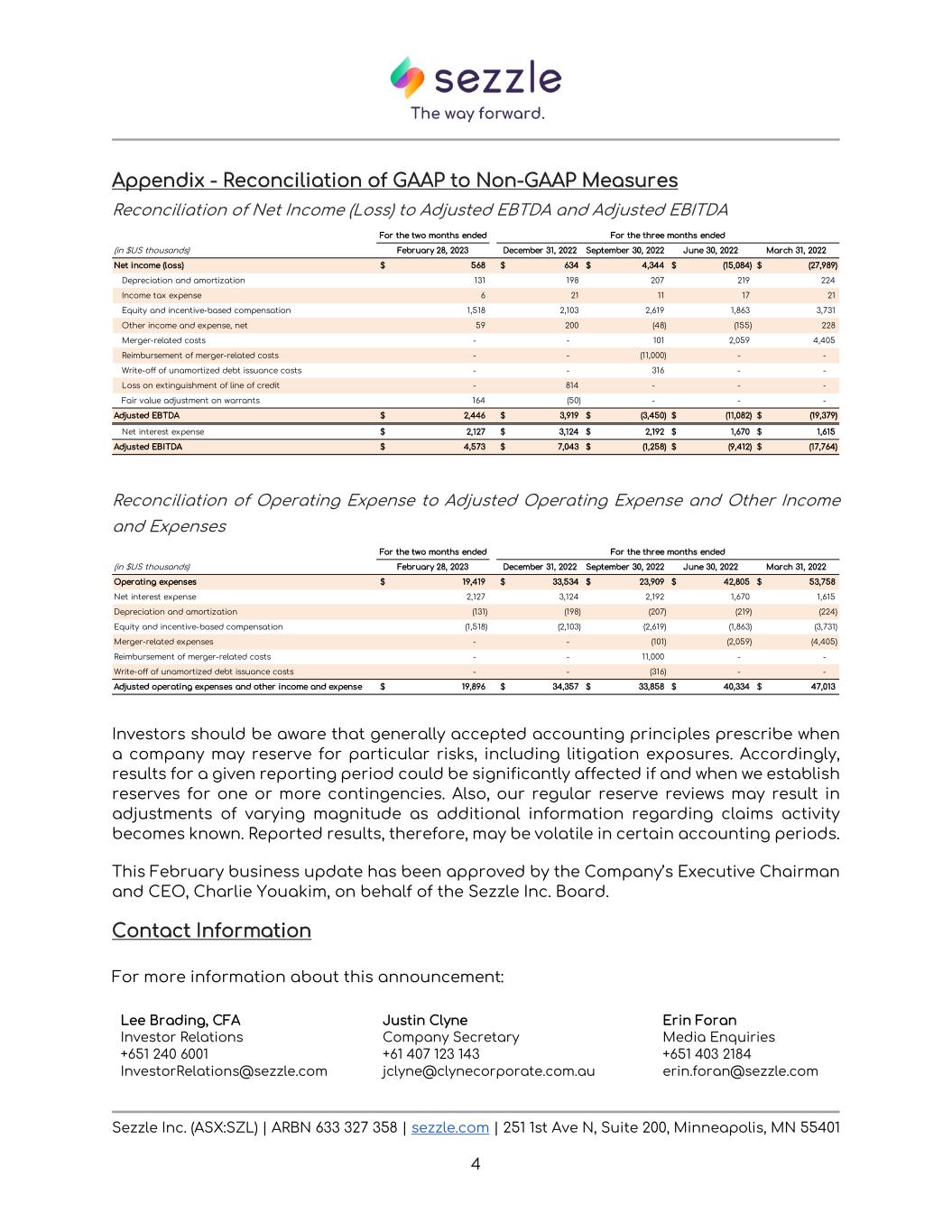

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 4 Appendix - Reconciliation of GAAP to Non-GAAP Measures Reconciliation of Net Income (Loss) to Adjusted EBTDA and Adjusted EBITDA Reconciliation of Operating Expense to Adjusted Operating Expense and Other Income and Expenses Investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when we establish reserves for one or more contingencies. Also, our regular reserve reviews may result in adjustments of varying magnitude as additional information regarding claims activity becomes known. Reported results, therefore, may be volatile in certain accounting periods. This February business update has been approved by the Company’s Executive Chairman and CEO, Charlie Youakim, on behalf of the Sezzle Inc. Board. Contact Information For more information about this announcement: For the two months ended For the three months ended (in $US thousands) February 28, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Net income (loss) 568$ 634$ 4,344$ (15,084)$ (27,989)$ Depreciation and amortization 131 198 207 219 224 Income tax expense 6 21 11 17 21 Equity and incentive-based compensation 1,518 2,103 2,619 1,863 3,731 Other income and expense, net 59 200 (48) (155) 228 Merger-related costs - - 101 2,059 4,405 Reimbursement of merger-related costs - - (11,000) - - Write-off of unamortized debt issuance costs - - 316 - - Loss on extinguishment of line of credit - 814 - - - Fair value adjustment on warrants 164 (50) - - - Adjusted EBTDA 2,446$ 3,919$ (3,450)$ (11,082)$ (19,379)$ Net interest expense 2,127$ 3,124$ 2,192$ 1,670$ 1,615$ Adjusted EBITDA 4,573$ 7,043$ (1,258)$ (9,412)$ (17,764)$ For the two months ended For the three months ended (in $US thousands) February 28, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Operating expenses 19,419$ 33,534$ 23,909$ 42,805$ 53,758$ Net interest expense 2,127 3,124 2,192 1,670 1,615 Depreciation and amortization (131) (198) (207) (219) (224) Equity and incentive-based compensation (1,518) (2,103) (2,619) (1,863) (3,731) Merger-related expenses - - (101) (2,059) (4,405) Reimbursement of merger-related costs - - 11,000 - - Write-off of unamortized debt issuance costs - - (316) - - Adjusted operating expenses and other income and expense 19,896$ 34,357$ 33,858$ 40,334$ 47,013$ Lee Brading, CFA Investor Relations +651 240 6001 InvestorRelations@sezzle.com Justin Clyne Company Secretary +61 407 123 143 jclyne@clynecorporate.com.au Erin Foran Media Enquiries +651 403 2184 erin.foran@sezzle.com

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 5 About Sezzle Inc. Sezzle is a fintech company on a mission to financially empower the next generation. Sezzle’s payment platform increases the purchasing power for millions of consumers by offering interest-free installment plans at online stores and select in-store locations. Sezzle’s transparent, inclusive, and seamless payment option allows consumers to take control over their spending, be more responsible, and gain access to financial freedom. For more information visit sezzle.com. Forward Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements include our expectations, whether stated or implied, regarding our planned rights offering, financing plans and other future events. Forward-looking statements generally can be identified by the use of words such as "anticipate," "expect," "plan," "could," "may," "will," "believe," "estimate," "forecast," "goal," "project," and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others: impact of the “buy-now, pay-later” (“BNPL”) industry becoming subject to increased regulatory scrutiny; impact of operating in a highly competitive industry; a change in our intention to become listed on the Nasdaq Global Market; impact of a reverse stock split on the value of our common stock; impact of macro- economic conditions on consumer spending; our ability to increase our merchant network, our base of consumers and underlying merchant sales (UMS); our ability to effectively manage growth, sustain our growth rate and maintain our market share; our ability to meet additional capital requirements; impact of exposure to consumer bad debts and insolvency of merchants; impact of the integration, support and prominent presentation of our platform by our merchants; impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to our operations; impact of the loss of key partners and merchant relationships; impact of exchange rate fluctuations in the international markets in which we operate; our ability to protect our intellectual property rights; our ability to retain employees and recruit additional employees; impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and Canada; and our ability to achieve our public benefit purpose and maintain our B Corporation certification. The Company cautions investors not to place considerable

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 6 reliance on the forward-looking statements contained in this press release. You are encouraged to read the Company's filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company's business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. Current Trading Restrictions Sezzle’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. The CDIs have not been registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are currently ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future, unless the re-sale of the CDIs is registered under the Securities Act or another exemption is available. To enforce the above transfer restrictions, all CDIs issued currently bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act. Non-GAAP Financial Measures To supplement our operating results prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we present the following non-GAAP financial measures: Adjusted earnings before taxes, depreciation, and amortization (“Adjusted EBTDA”); and adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”). Definitions of these non-GAAP financial measures and summaries of the reasons why management believes that the presentation of these non- GAAP financial measures provide useful information to the company and investors are as follows: • Adjusted EBTDA is defined as GAAP net income (loss), adjusted for certain non-cash and non-recurring charges including depreciation, amortization, equity and incentive–based compensation, and merger-related costs as detailed in the reconciliation table of adjusted EBTDA to GAAP net income (loss) below. We believe that this financial measure is a useful measure for period-to-period comparison of our business by removing the effect of certain non-cash and non-recurring charges that may not directly correlate to the underlying performance of our business. • Adjusted EBITDA is defined as GAAP net income (loss), adjusted for certain non-cash and non-recurring charges including depreciation, amortization, equity and incentive–based compensation, and merger-related costs, as well as net interest expense as detailed in the reconciliation table of GAAP net income (loss) to adjusted

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 7 EBITDA. We believe that this financial measure is a useful measure for period-to- period comparison of our business by removing the effect of certain non-cash and non-recurring charges, as well as funding costs, that may not directly correlate to the underlying performance of our business. • Adjusted operating expense and other income and expenses is defined as GAAP operating expenses plus net interest expense; and less depreciation and amortization, equity and incentive-based compensation, and other non-recurring or non-cash charges as detailed in the reconciliation table of adjusted operating expense and other income and expenses to GAAP operating expense above. We believe that adjusted operating expense and other income and expenses is a useful financial measure to both management and investors for evaluating our operating performance without the impact of certain non-cash and non-recurring charges that do not necessarily correlate to the underlying performance of our business. Additionally, we have included these non-GAAP measures because they are key measures used by our management to evaluate our operating performance, guide future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of resources. Therefore, we believe these measures provide useful information to investors and other users of this press release to understand and evaluate our operating results in the same manner as our management and board of directors. However, non-GAAP financial measures have limitations, should be considered supplemental in nature, and are not meant as a substitute for the related financial information prepared in accordance with U.S. GAAP. These limitations include the following: • Adjusted EBTDA and adjusted EBITDA exclude certain recurring, non-cash charges such as depreciation, amortization, and equity and incentive–based compensation, which have been, and will continue to be for the foreseeable future, recurring GAAP expenses. Further, these non-GAAP financial measures exclude certain significant cash inflows and outflows, such as merger-related costs (which are comprised of legal fees in connection with our terminated proposed merger with Zip Co Limited) and reimbursements for such merger-related costs, which have a significant impact on our working capital and cash. ------------------------------------------------------------------ • Adjusted EBITDA excludes net interest expense, which has a significant impact on our GAAP net income, working capital, and cash. • Long-lived assets being depreciated or amortized may need to be replaced in the future, and these non-GAAP financial measures do not reflect the capital expenditures needed for such replacements, or for any new capital expenditures or commitments. • These non-GAAP financial measures do not reflect income taxes that may represent a reduction in cash available to us. • Non-GAAP measures do not reflect changes in, or cash requirements for, our working capital needs. -------------------------------------------------------------------------------- • Other companies, including companies in our industry, may calculate the non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 8 Because of these limitations, you should not consider these non-GAAP financial measures in isolation or as substitutes for analysis of our financial results as reported under GAAP, and these non-GAAP financial measures should be considered alongside other financial performance measures, including net income (loss) and other financial results presented in accordance with GAAP. We encourage you to review the related GAAP financial measures and the reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business.