Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 1 1 May 2023 ASX RELEASE Company Announcements Platform March Business Update Top-line Growth and Lower Loss Rates lead to 3rd Straight Profitable Quarter Sezzle Inc. (ASX:SZL) (Sezzle or Company) // Purpose-driven installment payment platform, Sezzle, is pleased to provide the market with an update on key financial metrics for the quarter and month ended 31 March 2023.1 “Driven by the outperformance of our credit losses, we are running ahead of our plan for profitability in 2023, and this, before our next group of initiatives take effect,” stated Charlie Youakim, Sezzle’s Executive Chairman and CEO. “We believe the next round of initiatives will result in at least US$10.0M in revenue and cost benefits, and we expect to begin seeing these benefits in the second half of 2023.” 1Q23 Highlights • Total Income for 1Q23 increased 25.5% YoY to US$34.7M (A$51.9M2). Total Income as a percentage of Underlying Merchant Sales (UMS) for the quarter was 9.4% (a 324bps YoY improvement). • Sezzle achieved profitability in 1Q23, recording US$1.7M in Net Income compared to a Net Loss of US$28.0M in 1Q22. o For the third straight quarter, the Company posted positive Net Income (a GAAP measure), and for the second straight quarter positive Adjusted EBTDA3 (a non- GAAP measure) and Adjusted EBITDA3 (a non-GAAP measure). 1 Results are unaudited preliminary financial results. 2 A$ to US$ exchange rate of $0.6686 as of 31 March 2023. 3 Adjusted EBTDA and Adjusted EBITDA are non-GAAP financial measures. For a reconciliation of GAAP Net Income (Loss) to Adjusted EBTDA and Adjusted EBITDA, see Appendix for reconciliation.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 2 March Highlights • Total Income for March rose 29.8% YoY to US$12.3M (A$18.4M1). For March, total Income as a percentage of UMS was 9.1% (a 335bps YoY improvement). • Sezzle achieved profitability in March, posting positive Net Income (a GAAP measure) of US$1.2M, due to the outperformance of the Provision for Credit Losses. Other Notable Items • As of 31 March 2023, capital and liquidity were healthy with US$60.6M of cash on hand (US$1.5M restricted) and US$59.8M drawn on its US$100M credit facility. • As of 31 March 2023, notes receivable (net) and merchant accounts payable amounted to US$84.8M and US$65.3M, respectively. The Merchant Interest Program represented US$51.3M of the Merchant Accounts Payable balance. • Average daily UMS is down approximately 4.1% in April (through 28 April) compared to March 2023. • Sezzle Premium has over 149,000 active subscribers (28 April 2023). • The ASX Settlement has accepted the Company’s application to remove the Foreign Ownership Restricted United States (FORUS) person prohibited tag from the Company’s CHESS Depository Interests (CDIs), effective today. The removal is expected to take effect on or about May 8, 2023 (Australian time). • The Company plans to report first quarter results and hold a conference call for investors on 16 May 2023 (Australian time). 1 A$ to US$ exchange rate of $0.6686 as of 31 March 2023.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 3 1 1 Amount includes US$11.0 benefit from reimbursement of merger-related costs in 3Q22. Please see Appendix reconciliation tables and Company’s filings with the SEC and ASX for further details. 1

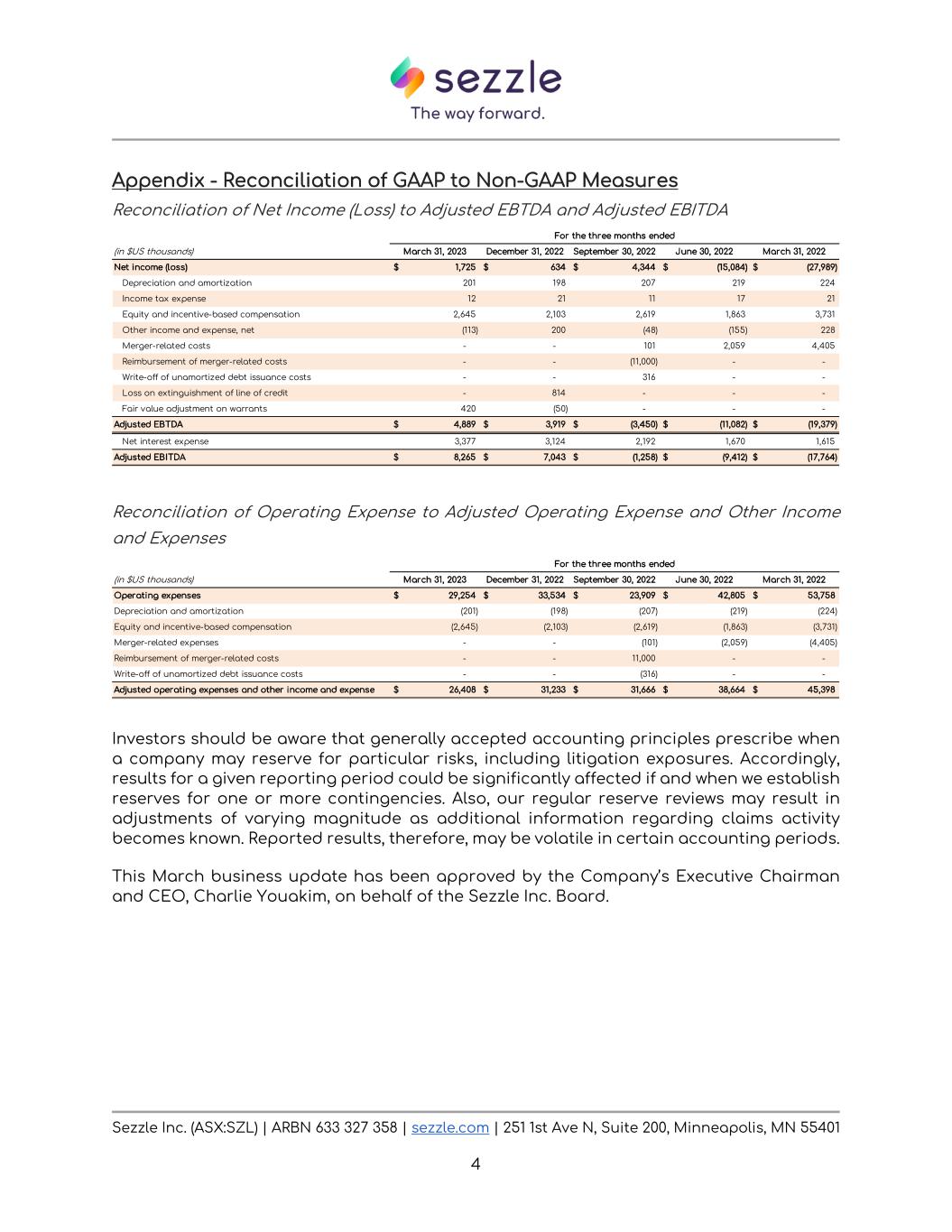

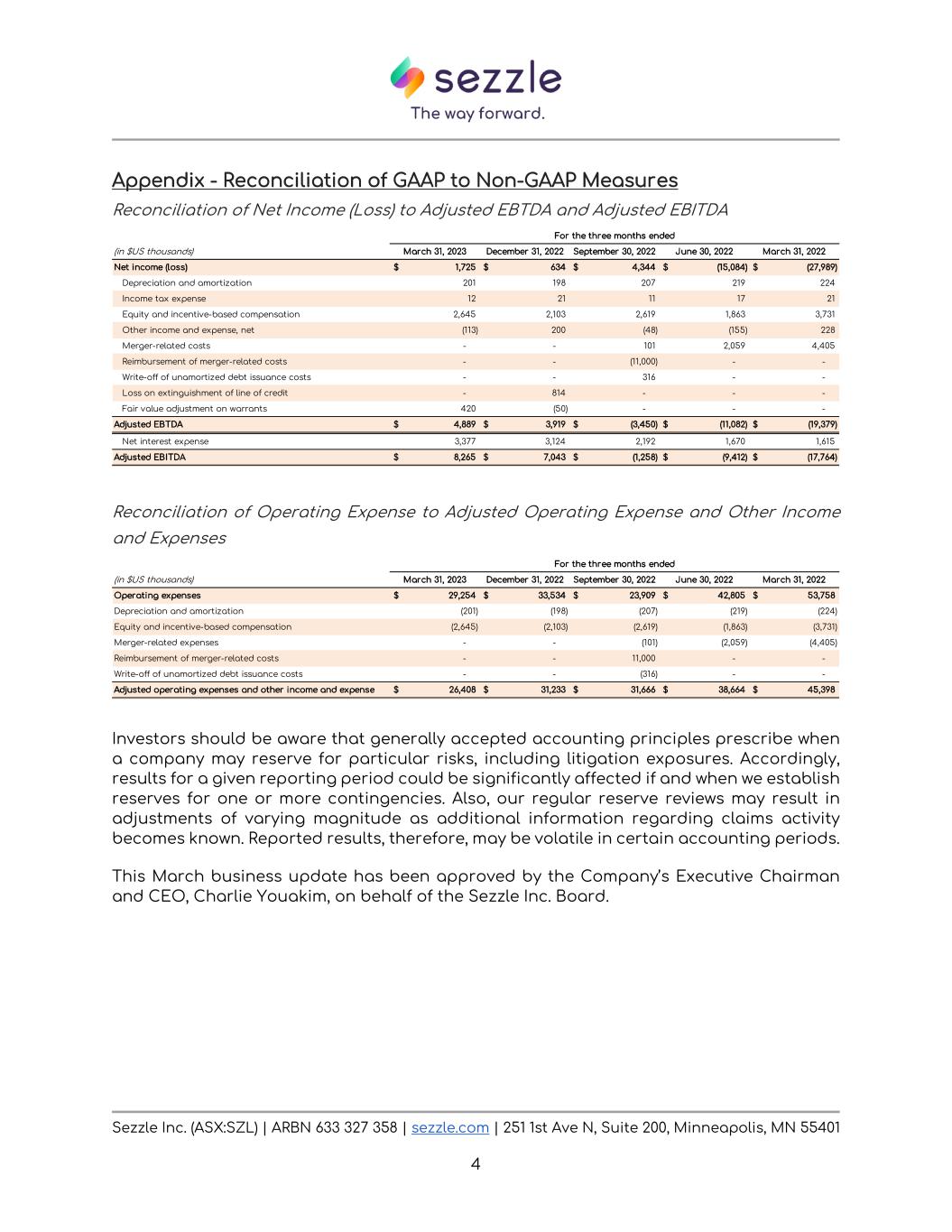

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 4 Appendix - Reconciliation of GAAP to Non-GAAP Measures Reconciliation of Net Income (Loss) to Adjusted EBTDA and Adjusted EBITDA Reconciliation of Operating Expense to Adjusted Operating Expense and Other Income and Expenses Investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when we establish reserves for one or more contingencies. Also, our regular reserve reviews may result in adjustments of varying magnitude as additional information regarding claims activity becomes known. Reported results, therefore, may be volatile in certain accounting periods. This March business update has been approved by the Company’s Executive Chairman and CEO, Charlie Youakim, on behalf of the Sezzle Inc. Board. For the three months ended (in $US thousands) March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Net income (loss) 1,725$ 634$ 4,344$ (15,084)$ (27,989)$ Depreciation and amortization 201 198 207 219 224 Income tax expense 12 21 11 17 21 Equity and incentive-based compensation 2,645 2,103 2,619 1,863 3,731 Other income and expense, net (113) 200 (48) (155) 228 Merger-related costs - - 101 2,059 4,405 Reimbursement of merger-related costs - - (11,000) - - Write-off of unamortized debt issuance costs - - 316 - - Loss on extinguishment of line of credit - 814 - - - Fair value adjustment on warrants 420 (50) - - - Adjusted EBTDA 4,889$ 3,919$ (3,450)$ (11,082)$ (19,379)$ Net interest expense 3,377 3,124 2,192 1,670 1,615 Adjusted EBITDA 8,265$ 7,043$ (1,258)$ (9,412)$ (17,764)$ For the three months ended (in $US thousands) March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Operating expenses 29,254$ 33,534$ 23,909$ 42,805$ 53,758$ Depreciation and amortization (201) (198) (207) (219) (224) Equity and incentive-based compensation (2,645) (2,103) (2,619) (1,863) (3,731) Merger-related expenses - - (101) (2,059) (4,405) Reimbursement of merger-related costs - - 11,000 - - Write-off of unamortized debt issuance costs - - (316) - - Adjusted operating expenses and other income and expense 26,408$ 31,233$ 31,666$ 38,664$ 45,398$

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 5 Contact Information For more information about this announcement: About Sezzle Inc. Sezzle is a fintech company on a mission to financially empower the next generation. Sezzle’s payment platform increases the purchasing power for millions of consumers by offering interest-free installment plans at online stores and select in-store locations. Sezzle’s transparent, inclusive, and seamless payment option allows consumers to take control over their spending, be more responsible, and gain access to financial freedom. For more information visit sezzle.com. Forward Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements include our expectations, whether stated or implied, regarding our financing plans and other future events. Forward-looking statements generally can be identified by the use of words such as "anticipate," "expect," "plan," "could," "may," "will," "believe," "estimate," "forecast," "goal," "project," and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others: impact of the “buy-now, pay-later” (“BNPL”) industry becoming subject to increased regulatory scrutiny; impact of operating in a highly competitive industry; a change in our intention to become listed on the Nasdaq Global Market; impact of a reverse stock split on the value of our common stock; impact of macro- economic conditions on consumer spending; our ability to increase our merchant network, our base of consumers and underlying merchant sales (UMS); our ability to effectively manage growth, sustain our growth rate and maintain our market share; our ability to meet additional capital requirements; impact of exposure to consumer bad debts and insolvency of merchants; impact of the integration, support and prominent presentation of our platform by our merchants; impact of any data security breaches, cyberattacks, Lee Brading, CFA Investor Relations +651 240 6001 InvestorRelations@sezzle.com Justin Clyne Company Secretary +61 407 123 143 jclyne@clynecorporate.com.au Erin Foran Media Enquiries +651 403 2184 erin.foran@sezzle.com

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 6 employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to our operations; impact of the loss of key partners and merchant relationships; impact of exchange rate fluctuations in the international markets in which we operate; our ability to protect our intellectual property rights; our ability to retain employees and recruit additional employees; impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and Canada; and our ability to achieve our public benefit purpose and maintain our B Corporation certification. The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read the Company's filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company's business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. Non-GAAP Financial Measures To supplement our operating results prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we present the following non-GAAP financial measures: Adjusted earnings before taxes, depreciation, and amortization (“Adjusted EBTDA”); and adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”). Definitions of these non-GAAP financial measures and summaries of the reasons why management believes that the presentation of these non- GAAP financial measures provide useful information to the company and investors are as follows: • Adjusted EBTDA is defined as GAAP net income (loss), adjusted for certain non-cash and non-recurring charges including depreciation, amortization, equity and incentive–based compensation, and merger-related costs as detailed in the reconciliation table of adjusted EBTDA to GAAP net income (loss) below. We believe that this financial measure is a useful measure for period-to-period comparison of our business by removing the effect of certain non-cash and non-recurring charges that may not directly correlate to the underlying performance of our business. • Adjusted EBITDA is defined as GAAP net income (loss), adjusted for certain non-cash and non-recurring charges including depreciation, amortization, equity and incentive–based compensation, and merger-related costs, as well as net interest expense as detailed in the reconciliation table of GAAP net income (loss) to adjusted EBITDA. We believe that this financial measure is a useful measure for period-to- period comparison of our business by removing the effect of certain non-cash and non-recurring charges, as well as funding costs, that may not directly correlate to the underlying performance of our business. • Adjusted operating expense and other income and expenses is defined as GAAP operating expenses plus net interest expense; and less depreciation and

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 7 amortization, equity and incentive-based compensation, and other non-recurring or non-cash charges as detailed in the reconciliation table of adjusted operating expense and other income and expenses to GAAP operating expense above. We believe that adjusted operating expense and other income and expenses is a useful financial measure to both management and investors for evaluating our operating performance without the impact of certain non-cash and non-recurring charges that do not necessarily correlate to the underlying performance of our business. Additionally, we have included these non-GAAP measures because they are key measures used by our management to evaluate our operating performance, guide future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of resources. Therefore, we believe these measures provide useful information to investors and other users of this press release to understand and evaluate our operating results in the same manner as our management and board of directors. However, non-GAAP financial measures have limitations, should be considered supplemental in nature, and are not meant as a substitute for the related financial information prepared in accordance with U.S. GAAP. These limitations include the following: • Adjusted EBTDA and adjusted EBITDA exclude certain recurring, non-cash charges such as depreciation, amortization, and equity and incentive–based compensation, which have been, and will continue to be for the foreseeable future, recurring GAAP expenses. Further, these non-GAAP financial measures exclude certain significant cash inflows and outflows, such as merger-related costs (which are comprised of legal fees in connection with our terminated proposed merger with Zip Co Limited) and reimbursements for such merger-related costs, which have a significant impact on our working capital and cash. ------------------------------------------------------------------ • Adjusted EBITDA excludes net interest expense, which has a significant impact on our GAAP net income, working capital, and cash. • Long-lived assets being depreciated or amortized may need to be replaced in the future, and these non-GAAP financial measures do not reflect the capital expenditures needed for such replacements, or for any new capital expenditures or commitments. • These non-GAAP financial measures do not reflect income taxes that may represent a reduction in cash available to us. • Non-GAAP measures do not reflect changes in, or cash requirements for, our working capital needs. -------------------------------------------------------------------------------- • Other companies, including companies in our industry, may calculate the non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. Because of these limitations, you should not consider these non-GAAP financial measures in isolation or as substitutes for analysis of our financial results as reported under GAAP, and these non-GAAP financial measures should be considered alongside other financial performance measures, including net income (loss) and other financial results presented in accordance with GAAP. We encourage you to review the related GAAP financial measures and the reconciliations of these non-GAAP financial measures to their most directly

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 8 comparable GAAP financial measures and not rely on any single financial measure to evaluate our business.