united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23128

Centerstone Investors Trust

(Exact name of registrant as specified in charter)

135 5th Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

Philip Santopadre, Gemini Fund Services, LLC

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-503-5789

Date of fiscal year end: 3/31

Date of reporting period:3/31/19

Item 1. Reports to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.centerstoneinv.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker -dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers, if any, are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Centerstone Funds. This and other important information about the Funds are contained in the prospectus, which can be obtained by calling 877.314.9006. The prospectus should be read carefully before investing.

The Centerstone Funds are distributed by Northern Lights Distributors, LLC, Member FINRA/ SIPC. Centerstone Investors, LLC is not affiliated with Northern Lights Distributors, LLC.

| |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

TABLE OF CONTENTS

| 3 | CENTERSTONE’S DISTINCT INVESTMENT APPROACH |

| | |

| 4 | CENTERSTONE’S OPERATING PRINCIPLES |

| | |

| 5 | CENTERSTONE’S GUIDELINES TO INTELLIGENT INVESTING |

| | |

| 6 | SHAREHOLDER LETTER |

| | |

| | CENTERSTONE INVESTORS FUND |

| | |

| 10 | Centerstone Investors Fund Overview |

| | |

| 12 | Portfolio of Investments |

| | |

| | CENTERSTONE INTERNATIONAL FUND |

| | |

| 18 | Centerstone International Fund Overview |

| | |

| 20 | Portfolio of Investments |

| | |

| 25 | STATEMENTS OF ASSETS AND LIABILITIES |

| | |

| 27 | STATEMENTS OF OPERATIONS |

| | |

| 28 | STATEMENTS OF CHANGES IN NET ASSETS |

| | |

| | FINANCIAL HIGHLIGHTS |

| | |

| 30 | Centerstone Investors Fund |

| | |

| 32 | Centerstone International Fund |

| | |

| 34 | NOTES TO FINANCIAL STATEMENTS |

| | |

| 54 | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| | |

| 56 | FUNDS’ EXPENSES |

| | |

| 58 | SUPPLEMENTAL INFORMATION |

| | |

| 65 | PRIVACY NOTICE |

| | |

| 67 | TRUSTEES & OFFICERS |

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 1 |

| | |

| 2 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

CENTERSTONE’S DISTINCT INVESTMENT APPROACH

(Unaudited)

Successful investing requires a strong dose of common sense. As a result, we approach security analysis from a different perspective. We are business analysts, not “equity” analysts. Business analysis is a more holistic approach which includes the entirety of a firm’s capital structure and allows us, in our opinion, to more accurately gauge the prospects for impairment in business value.

|

| |

| “Successful investing requires a strong dose of common sense. As a result, we approach security analysis from a different perspective. We are business analysts, not ‘equity’ analysts.” |

| |

|

As the name of the firm states, we areinvestors, which implies a long-term time horizon. Since most peers operate on an annual cycle, they attempt to maximize short-term gains. Being privately owned with an employee ownership culture allows us, in our opinion, to more effectively align our interests with our investors.

We define risk simply as the chance for permanent loss of capital. Our distinct investment approach seeks to minimize losses at a portfolio level by trying to have adequate diversification of risks. We will default to cash and high quality bonds in the absence of qualifying investments. It is our belief that our risk management techniques on a security-level and portfolio-level attempt to address the risk most commonly defined by shareholders: volatility.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 3 |

CENTERSTONE’S OPERATING PRINCIPLES

(Unaudited)

TIME HORIZON

| ♦ | Long-term investment horizon |

| ♦ | Emphasis on long-term earnings power, rather than current earnings |

MARGIN OF SAFETY AND INTRINSIC VALUE

| ♦ | Invest in a security after we have determined that the market price is lower than its intrinsic value, the difference being our margin of safety |

| ♦ | Margin of safety affords us a cushion to potentially avoid paying more than its intrinsic value |

SEEK TO MANAGE RISK THROUGH BOTTOM-UP RESEARCH

| ♦ | In our opinion, it is important to avoid highly leveraged businesses, specifically because they are more exposed to an impairment of value during periods of industry or economic distress |

| ♦ | Focus our efforts on understanding the likelihood of a change in the earnings power of a business due to changing competitive dynamics, technological challenges and regulations, among other factors |

| ♦ | In most cases, we will avoid shareholder-unfriendly businesses as it relates to management’s capital allocation decisions |

GENERAL MARKET RISK WITHIN A BOTTOM-UP APPROACH

| ♦ | In environments with an insufficient margin of safety, fully invested portfolio mandates can become too exposed to the risk of loss by owning potentially overvalued securities, while a more flexible policy may help to reduce that risk by holding a reserve in cash and high quality debt instruments |

| | |

| 4 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

(Unaudited)

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 5 |

Abhay Deshpande, CFA

chief investment officer | | DEAR FELLOW CENTERSTONE SHAREHOLDERS,

It is often said that life is like a rollercoaster—it does not only consist of highs. The same holds true for the markets. For the fiscal year ended March 31, 2019 the markets corrected themselves from their highs followed by swings back up. This pattern has now become the new normal, and as a result, Main Street is treating the markets with caution. |

It seems that Main Street is living with the memories of the last economic crisis in mind and is worried that the next recession will replicate the damage of the last one. My opinion has been that there are few reasons to worry over a global recession because there are few common cause variables that affect all economies across the world. The most likely path is that global growth settles back into the slow-growth “muddle through” pattern that it has been in since the end of the last era. This rollercoaster pattern that the market has become accustomed to has provided entry points for us, as we tune out the noise and focus on the fundamentals.

COUNTER-CYCLICAL INVESTING

As mentioned, we took advantage of the steep down swings throughout the fiscal year by adding several new positions. This is the most active I remember being since the summer of 2011. Clearly, the volatility has been irksome but it has allowed us to deploy more of our reserves* and become more meaningfully invested. This counter-cyclical behavior is normal for us and is a function of the intrinsic value-based approach that we practice. In other words, provided that intrinsic values have not been impaired, we will typically be more aggressive as stock prices decline. By contrast, when discounts narrow, our reserves* will usually trend upward.

In the most recent months, we have been favoring some more cyclical names which, although leaders in their respective industries, often do have volatile end markets and therefore volatile results over time. However, we have chosen those that we believe will either maintain or grow their market shares, have

| | |

| 6 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| SHAREHOLDER LETTER |

| March31, 2019 |

decent balance sheets and management teams that are working in your favor. The result of this is that since the Funds have less ballast, they will likely find themselves more exposed to market volatility. This dynamic is part of our absolute value-oriented approach in that our reserves* will tend to move counter to the size of the opportunity set.

INTERNATIONAL INVESTING

I have been making the case for international investing, on and off, for almost 30 years and have watched as market leadership has shifted from US to non-US equities many times over my career. For instance, the US for most of its history was the world’s leader when it came to corporate governance, shareholder protection, property rights and of course innovation. The developed non-US economies have mostly caught up and now much of the developing Asian market economies are closing the gap. It is becoming harder to justify valuation gaps based on historic reasons, which conflicts with our calculations that show a historically wide gap between US and non-US valuations (favoring US stocks).

Regardless though, in hindsight, the diversified approach I have taken helped to offset, for example, the rather tepid US stock market recovery after the bursting of the technology bubble in 2000, as non-US stocks greatly outperformed US stocks right until the financial crisis. It is just one example but there have been enough others to suggest that it is always good to be diversified across asset classes and geographies despite what popular opinion might suggest or what trailing numbers say.

THREE YEAR ANNIVERSARY

As our young Funds approach their 3-year birthdays this May, let me again take this opportunity, on behalf of all of us at Centerstone Investors, to thank you for your support in these early days. It is because of you that our Fund flows have been steady and we have been able to grow through this tumultuous period. I am sure the year will have many surprises but we are optimistic that Centerstone Funds will continue to rise to the challenge.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 7 |

DISCUSSION OF FUND PERFORMANCE

CENTERSTONE INVESTORS FUND

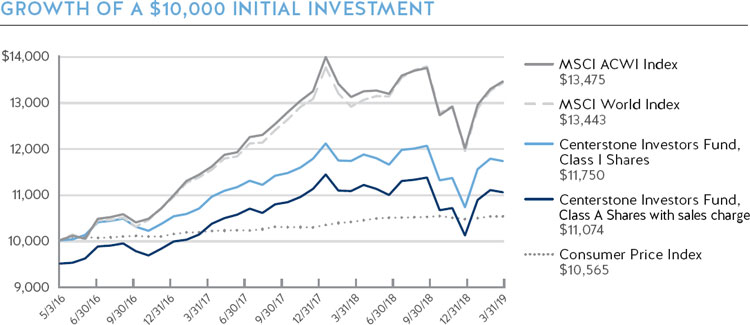

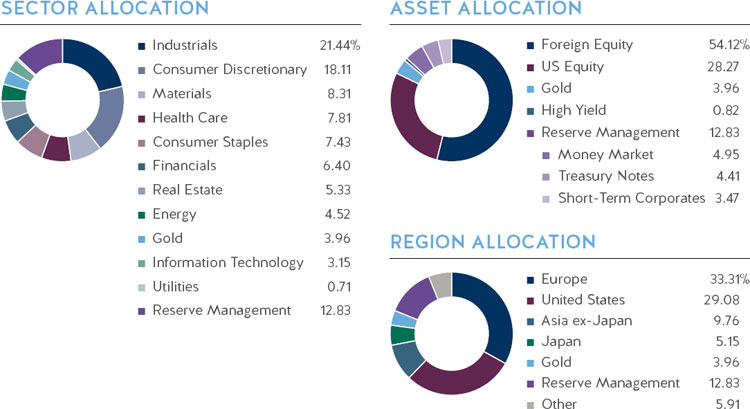

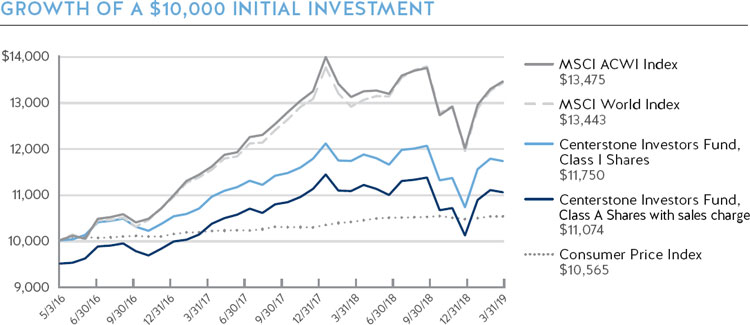

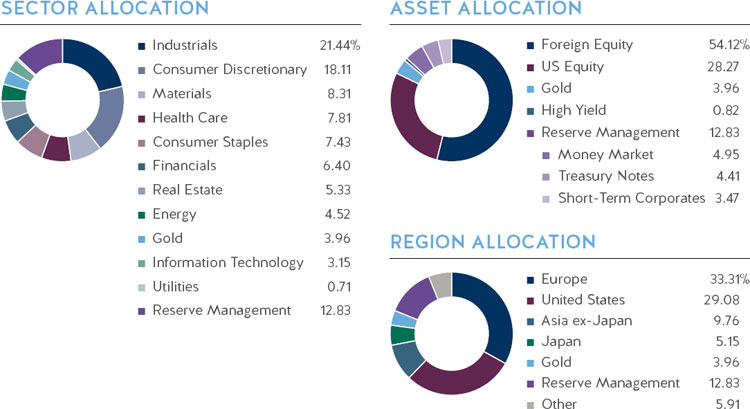

For the fiscal year ended March 31, 2019, the Centerstone Investors Fund Class I shares (CENTX) returned -0.02%, Class A shares (CETAX) returned -0.25% and Class A shares with a sales charge (CETAX) returned -5.27% compared with 2.60% for the MSCI ACWI Index and 4.01% for the MSCI World Index, respectively. The Fund’s reserves* made up 16.52% of the portfolio on average for the fiscal year and 12.83% of the portfolio as of March 31, 2019.

During the fiscal year, the Centerstone Investors Fund’s five largest contributors to performance were Versum Materials (United States, US Equity, Information Technology), O’Reilly Automotive (United States, US Equity, Consumer Discretionary), Dentsply Sirona (United States, US Equity, Health Care), Now (United States, US Equity, Industrials) and Indocement (Indonesia, Foreign Equity, Materials), collectively adding 2.62% to performance. The five largest detractors were Mekonomen (Sweden, Foreign Equity, Consumer Discretionary), Valeo (France, Foreign Equity, Consumer Discretionary), Perrigo (Ireland, Foreign Equity, Health Care), Tapestry (United States, US Equity, Consumer Discretionary) and Ichiyoshi Securities (Japan, Foreign Equity, Financials), collectively subtracting 3.11% from performance.

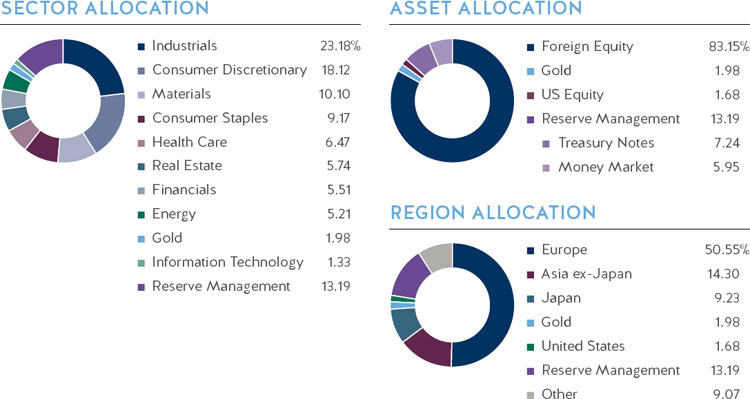

CENTERSTONE INTERNATIONAL FUND

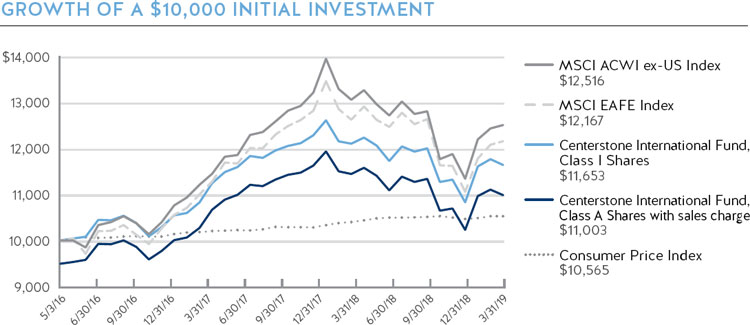

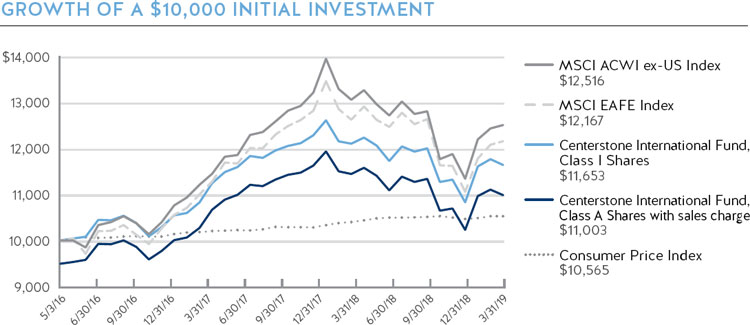

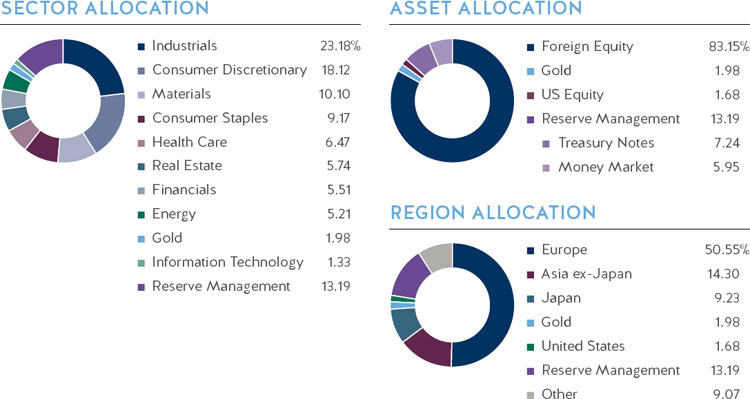

For the fiscal year ended March 31, 2019, the Centerstone International Fund Class I shares (CINTX) returned -3.78%, Class A shares (CSIAX) returned -4.05% and Class A shares with a sales charge (CSIAX) returned -8.83% compared with -4.22% for the MSCI ACWI Ex-US Index and -3.71% for the MSCI EAFE Index, respectively. The Fund’s reserves* made up 14.13% of the portfolio on average for the fiscal year and 13.19% of the portfolio as of March 31, 2019.

During the fiscal year, the Centerstone International Fund’s five largest contributors to performance were Indocement (Indonesia, Foreign Equity, Materials), TransCanada (Canada, Foreign Equity, Energy), Kerry Logistics (Hong Kong, Foreign Equity, Industrials), ICA Gruppen (Sweden, Foreign Equity, Consumer Staples) and Roche (Switzerland, Foreign Equity, Health

| | |

| 8 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| SHAREHOLDER LETTER |

| March31, 2019 |

Care), collectively adding 2.26% to performance. The five largest detractors were Mekonomen (Sweden, Foreign Equity, Consumer Discretionary), Valeo (France, Foreign Equity, Consumer Discretionary), Ichiyoshi Securities (Japan, Foreign Equity, Financials), Nagaileben (Japan, Foreign Equity, Health Care) and Hornbach (Germany, Foreign Equity, Consumer Discretionary), collectively subtracting 3.89% from performance.

We appreciate our partnership and we look forward to celebrating many more anniversaries.

Sincerely,

Abhay Deshpande, CFA

CHIEF INVESTMENT OFFICER

| * | Reserve positions are cash & cash equivalents, treasury securities and short-term high quality bonds |

The commentary represents the opinion of Centerstone Investors as of March 2019, and is subject to change based on market and other conditions. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. Any statistics contained here have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

The MSCI ACWI ex-US Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets, excluding the US. The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the market performance of developed markets, excluding the US & Canada.

All indices provide total returns in US dollars with net dividends reinvested.

Investors are not able to invest directly in the indices referenced and unmanaged index returns do not reflect any fees, expenses or sales charges. The referenced indices are shown for general market comparisons.

5339-NLD-4/15/2019

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 9 |

| CENTERSTONE INVESTORS

FUND OVERVIEW

(Unaudited) |

|  |  |

| | | |

| Seeks to generate long-term growth of capital by investing across the globe | Global investments across industries, market capitalizations and capital structure | Invest in global equities and fixed income, with a bottom-up value approach. Weightings will vary depending on opportunities |

| | | | | | Since |

| PERFORMANCE | 1 Month | 3 Month | 1 Year | 2 Year | Inception* |

| Class I (CENTX) | –0.45% | 9.50% | –0.02% | 4.78% | 5.70% |

| Class A (CETAX) | –0.45 | 9.43 | –0.25 | 4.51 | 5.42 |

| Class A (CETAX) with Sales Charge† | –5.43 | 3.92 | –5.27 | 1.86 | 3.57 |

| Class C (CENNX) | –0.54 | 9.21 | –1.00 | 3.76 | 4.81 |

| MSCI ACWI Index | 1.26 | 12.18 | 2.60 | 8.55 | 10.79 |

| MSCI World Index | 1.31 | 12.48 | 4.01 | 8.70 | 10.70 |

| * | Inception date is May 3, 2016 |

| † | Class A Maximum Sales Charge is 5.00% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 877.314.9006. Investors are not able to invest directly in the indices referenced in the illustration above and unmanaged index returns do not reflect any fees, expenses or sales charges. Definitions for the indices can be found on page 11.

| TOP 10 HOLDINGS§ | % of Portfolio | | | % of Portfolio |

| Gold & Gold-Related (US) | 3.96% | | Henry Schein (US) | 1.78% |

| Coast Capital Mercury Fund LP (GBR)^ | 2.48 | | Merlin Entertainments (GBR) | 1.77 |

| TransCanada (CAN) | 1.91 | | Mohawk Industries (US) | 1.69 |

| Vopak (NLD) | 1.80 | | Air Liquide (FRA) | 1.67 |

| Kerry Logistics (HKG) | 1.79 | | Versum Materials (US) | 1.63 |

| | | | TOTAL | 20.47% |

| § | Holdings in cash, cash equivalents and short term instruments have been excluded. |

The security holdings are presented to illustrate examples of the securities that the Fund has bought and the diversity of areas in which the Fund may invest, and may not be representative of the Fund’s current or future investments. Portfolio holdings are subject to change and should not be considered investment advice.

| ^ | FirstGroup PLC (a security traded on the London Stock Exchange) is the only underlying holding of Coast Capital Mercury Fund LP. |

| | |

| 10 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| | CLASS I | | CLASS A | | CLASS C |

| | CENTX | ♦ | CETAX | ♦ | CENNX |

| | (Unaudited) |

Fund inception date is May 3, 2016.

Returns for Class A shares include a maximum sales charge of 5.00%.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index is not available for direct investment.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The index is not available for direct investment. All indices provide total returns in US dollars with net dividends reinvested.

The Consumer Price Index (CPI) represents the change in price of goods and services purchased for consumption by households.

All indices provide total returns in US dollars with net dividends reinvested.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 11 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 74.23% | | | | |

| BRAZIL — 0.91% | | | | |

| | 1,495,611 | | | Cielo SA | | $ | 3,617,413 | |

| | | | | | | | | |

| CANADA — 2.66% | | | | |

| | 166,812 | | | TransCanada Corp. | | | 7,492,091 | |

| | 83,692 | | | Metro, Inc. | | | 3,081,263 | |

| | | | | | | | 10,573,354 | |

| CHILE — 1.20% | | | | |

| | 130,374 | | | Cia Cervecerias Unidas SA | | | 3,840,818 | |

| | 102,546,552 | | | Vina San Pedro Tarapaca SA | | | 919,220 | |

| | | | | | | | 4,760,038 | |

| DENMARK — 1.97% | | | | |

| | 161,237 | | | ISS A/S | | | 4,910,747 | |

| | 295,388 | | | Matas A/S | | | 2,922,143 | |

| | | | | | | | 7,832,890 | |

| FINLAND — 0.76% | | | | |

| | 136,088 | | | Tikkurila Oyj | | | 2,235,848 | |

| | 47,185 | | | Wartsila OYJ Abp | | | 763,109 | |

| | | | | | | | 2,998,957 | |

| FRANCE — 6.15% | | | | |

| | 52,039 | | | Air Liquide SA | | | 6,622,559 | |

| | 57,679 | | | Schneider Electric SE | | | 4,527,144 | |

| | 153,064 | | | Cie Plastic Omnium SA | | | 4,077,779 | |

| | 33,080 | | | Sodexo SA | | | 3,642,749 | |

| | 28,962 | | | Danone SA | | | 2,230,102 | |

| | 17,666 | | | Eiffage SA | | | 1,698,195 | |

| | 4,402 | | | LVMH Moet Hennessy Louis Vuitton SE | | | 1,621,405 | |

| | | | | | | | 24,419,933 | |

| GERMANY — 5.55% | | | | |

| | 119,249 | | | Brenntag AG | | | 6,130,975 | |

| | 48,082 | | | Bayerische Motoren Werke AG | | | 3,712,606 | |

| | 158,054 | | | Hamburger Hafen und Logistik AG | | | 3,611,203 | |

| | 44,048 | | | Fraport AG Frankfurt Airport Services Worldwide | | | 3,379,136 | |

| | 57,806 | | | Hornbach Holding AG & Co. KGaA | | | 2,898,522 | |

| | 11,392 | | | Continental AG | | | 1,718,585 | |

| | 31,679 | | | Hornbach Baumarkt AG | | | 566,178 | |

| | | | | | | | 22,017,205 | |

See Accompanying Notes to Financial Statements.

| | |

| 12 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 74.23% (continued) | | | | |

| HONG KONG — 3.02% | | | | |

| | 3,905,926 | | | Kerry Logistics Network Ltd. | | $ | 7,072,058 | |

| | 403,000 | | | Hongkong Land Holdings Ltd. | | | 2,868,414 | |

| | 381,900 | | | Hysan Development Co. Ltd. | | | 2,047,058 | |

| | | | | | | | 11,987,530 | |

| INDONESIA — 0.83% | | | | |

| | 2,134,262 | | | Indocement Tunggal Prakarsa Tbk PT | | | 3,290,068 | |

| | | | | | | | | |

| IRELAND — 1.51% | | | | |

| | 124,581 | | | Perrigo Co. PLC | | | 5,999,821 | |

| | | | | | | | | |

| ISRAEL — 0.59% | | | | |

| | 448,400 | | | Israel Chemicals Ltd. | | | 2,342,871 | |

| | | | | | | | | |

| JAPAN — 5.13% | | | | |

| | 284,275 | | | Mitsubishi Estate Co. Ltd. | | | 5,158,148 | |

| | 165,051 | | | Nagaileben Co. Ltd.* | | | 3,585,921 | |

| | 490,553 | | | Ichiyoshi Securities Co. Ltd.* | | | 3,445,231 | |

| | 14,896 | | | FANUC Corp. | | | 2,547,420 | |

| | 73,334 | | | Aica Kogyo Co. Ltd.* | | | 2,451,521 | |

| | 90,205 | | | Sekisui Jushi Corp.* | | | 1,591,054 | |

| | 9,752 | | | Shimano, Inc. | | | 1,587,791 | |

| | | | | | | | 20,367,086 | |

| MALAYSIA — 0.99% | | | | |

| | 2,420,000 | | | Genting Bhd. | | | 3,941,177 | |

| | | | | | | | | |

| MEXICO — 0.51% | | | | |

| | 178,482 | | | Fresnillo PLC | | | 2,022,719 | |

| | | | | | | | | |

| NETHERLANDS — 1.80% | | | | |

| | 148,793 | | | Koninklijke Vopak NV | | | 7,126,757 | |

| | | | | | | | | |

| SINGAPORE — 0.73% | | | | |

| | 355,369 | | | Oversea-Chinese Banking Corp. Ltd. | | | 2,905,347 | |

| | | | | | | | | |

| SPAIN — 1.39% | | | | |

| | 2,495,743 | | | Prosegur Cash SA | | | 5,513,477 | |

| | | | | | | | | |

| SWEDEN — 3.88% | | | | |

| | 164,836 | | | Loomis AB | | | 5,684,301 | |

| | 126,442 | | | ICA Gruppen AB | | | 5,076,347 | |

| | 664,479 | | | Mekonomen AB* | | | 4,642,897 | |

| | | | | | | | 15,403,545 | |

| SWITZERLAND — 4.96% | | | | |

| | 51,173 | | | Novartis AG | | | 4,918,725 | |

| | 14,999 | | | Roche Holding AG | | | 4,133,048 | |

| | 56,284 | | | Cie Financiere Richemont SA | | | 4,106,105 | |

| | 43,050 | | | Nestle SA | | | 4,104,835 | |

| | 8,401 | | | Swatch Group AG | | | 2,406,061 | |

| | | | | | | | 19,668,774 | |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 13 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 74.23% (continued) | | | | |

| THAILAND — 4.14% | | | | |

| | 690,160 | | | Siam City Cement PCL | | $ | 4,895,918 | |

| | 6,402,100 | | | Thai Beverage PCL | | | 3,995,307 | |

| | 6,318,000 | | | Krung Thai Bank PCL | | | 3,826,298 | |

| | 484,400 | | | Bangkok Bank PCL | | | 3,300,847 | |

| | 65,350 | | | Bangkok Bank PCL (NVDR) | | | 426,783 | |

| | | | | | | | 16,445,153 | |

| UNITED KINGDOM — 1.76% | | | | |

| | 1,563,763 | | | Merlin Entertainments PLC | | | 7,000,155 | |

| | | | | | | | | |

| UNITED STATES — 23.79% | | | | |

| | 117,609 | | | Henry Schein, Inc.* | | | 7,069,477 | |

| | 53,009 | | | Mohawk Industries, Inc.* | | | 6,687,085 | |

| | 128,000 | | | Versum Materials, Inc. | | | 6,439,680 | |

| | 89,716 | | | Colgate-Palmolive Co. | | | 6,149,135 | |

| | 37,900 | | | Carlisle Cos., Inc. | | | 4,647,298 | |

| | 165,856 | | | Mosaic Co. | | | 4,529,527 | |

| | 136,226 | | | Tapestry, Inc. | | | 4,425,983 | |

| | 11,208 | | | O’Reilly Automotive, Inc.* | | | 4,352,066 | |

| | 52,240 | | | Scotts Miracle-Gro Co. | | | 4,105,019 | |

| | 49,918 | | | Target Corp. | | | 4,006,419 | |

| | 400,000 | | | General Electric Co. | | | 3,996,000 | |

| | 80,400 | | | Dentsply Sirona, Inc. | | | 3,987,036 | |

| | 29,455 | | | United Technologies Corp. | | | 3,796,455 | |

| | 269,794 | | | NOW, Inc.* | | | 3,766,324 | |

| | 56,000 | | | State Street Corp. | | | 3,685,360 | |

| | 51,700 | | | Emerson Electric Co. | | | 3,539,899 | |

| | 46,826 | | | Sonoco Products Co. | | | 2,881,204 | |

| | 13,629 | | | 3M Co. | | | 2,831,834 | |

| | 53,106 | | | TJX Cos., Inc. | | | 2,825,770 | |

| | 8,592 | | | Grainger, Inc. | | | 2,585,591 | |

| | 35,558 | | | CarMax, Inc.* | | | 2,481,948 | |

| | 9,750 | | | FleetCor Technologies, Inc.* | | | 2,404,253 | |

| | 10,536 | | | McDonald’s Corp. | | | 2,000,786 | |

| | 38,117 | | | Covetrus, Inc.* | | | 1,214,027 | |

| | | | | | | | 94,408,176 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost — $288,852,560) | | | 294,642,446 | |

See Accompanying Notes to Financial Statements.

| | |

| 14 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Principal | | | Security | | Coupon | | Maturity | | Value | |

| BONDS & NOTES — 4.26% | | | | | | | | |

| SWITZERLAND — 0.18% | | | | | | | | |

| | | | | | | | | | | | |

| $ | 700,000 | | | UBS Group Funding Switzerland AG, Quarterly US LIBOR +1.7800 — 144A** | | 4.57% | | 4/14/2021 | | $ | 717,239 | |

| UNITED STATES — 4.08% | | | | | | | | |

| | 5,050,000 | | | PHI, Inc. + | | 5.25% | | 3/15/2019 | | | 3,232,000 | |

| | 2,083,000 | | | American Electric Power Co., Inc. | | 2.15% | | 11/13/2020 | | | 2,063,468 | |

| | 2,000,000 | | | Apple, Inc., Quarterly US LIBOR +0.5000** | | 3.20% | | 2/9/2022 | | | 2,016,937 | |

| | 1,700,000 | | | Goldman Sachs Group, Inc., Quarterly US LIBOR +1.6000** | | 4.23% | | 11/29/2023 | | | 1,738,369 | |

| | 1,500,000 | | | CVS Health Corp., Quarterly US LIBOR +0.6300** | | 3.23% | | 3/9/2020 | | | 1,503,413 | |

| | 1,500,000 | | | JM Smucker Co. | | 2.50% | | 3/15/2020 | | | 1,495,829 | |

| | 1,500,000 | | | Ford Motor Credit Co. LLC | | 2.68% | | 1/9/2020 | | | 1,493,601 | |

| | 1,146,000 | | | Wells Fargo & Co., Quarterly US LIBOR +1.3400** | | 3.96% | | 3/4/2021 | | | 1,165,626 | |

| | 1,000,000 | | | United Technologies Corp. | | 1.90% | | 5/4/2020 | | | 992,126 | |

| | 500,000 | | | Wells Fargo & Co., Quarterly US LIBOR +0.6800** | | 3.43% | | 1/30/2020 | | | 502,376 | |

| | | | | | | | | | | | 16,203,745 | |

| TOTAL BONDS & NOTES (Cost — $18,286,152) | | | | | | | 16,920,984 | |

| Shares | | | Security | | Value | |

| EXCHANGE TRADED FUND — COMMODITY — 3.95% | | | | |

| | 128,609 | | | SPDR Gold Shares* | | | 15,691,584 | |

| TOTAL EXCHANGE TRADED FUND — COMMODITY (Cost — $15,427,724) | | | | |

| Principal | | | Security | | Coupon | | Maturity | | Value | |

| PREFERRED STOCK — 2.66% | | | | | | | | |

| | 185,458 | | | Bank of America Corp., Quarterly US LIBOR +0.5000%** | | 4.00% | | 5/13/2019 | | | 3,894,618 | |

| | 196,003 | | | Goldman Sachs Group, Inc., Quarterly US LIBOR +0.7500%** | | 4.00% | | 5/13/2019 | | | 3,845,579 | |

| | 83,489 | | | Pacific Gas & Electric Co. | | 5.50% | | Perpetual | | | 1,715,699 | |

| | 59,349 | | | Pacific Gas & Electric Co. | | 5.00% | | Perpetual | | | 1,091,428 | |

| | | | | | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost — $11,816,174) | | | | | | | 10,547,324 | |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 15 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| PRIVATE INVESTMENT FUND — 2.47% | | | | |

| | 8,389,676 | | | Coast Capital Mercury Fund LP*#^^ | | $ | 9,807,531 | |

| | | | | | | | | |

| TOTAL PRIVATE INVESTMENT FUND (Cost — $11,100,000) | | | | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS — 2.76% | | | | |

| | 65,590 | | | Ventas, Inc. | | | 4,185,298 | |

| | 24,729 | | | Unibail-Rodamco SE | | | 4,053,889 | |

| | 204,068 | | | Monmouth Real Estate Investment Corp. | | | 2,689,616 | |

| | | | | | | | | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost — $11,976,110) | | | 10,928,803 | |

| Principal | | | Security | | Coupon | | Maturity | | Value | |

| US GOVERNMENT & AGENCY OBLIGATIONS — 4.39% | | | | | | |

| US TREASURY NOTES/BONDS — 4.39% | | | | | | | | |

| $ | 6,700,000 | | | United States Treasury Note | | 1.38% | | 7/31/2019 | | | 6,675,398 | |

| | 5,000,000 | | | United States Treasury Note | | 2.63% | | 2/15/2029 | | | 5,091,797 | |

| | 3,000,000 | | | United States Treasury Note | | 1.25% | | 8/31/2019 | | | 2,984,531 | |

| | 2,700,000 | | | United States Treasury Note | | 1.38% | | 9/30/2019 | | | 2,685,340 | |

| | | | | | | | | | | | | |

| TOTAL US GOVERNMENT & AGENCY OBLIGATIONS (Cost $17,408,724) | | | | | 17,437,066 | |

| Shares | | | Security | | Value | |

| SHORT-TERM INVESTMENTS — 4.93% | | | | |

| MONEY MARKET FUND — 4.93% | | | | |

| | 19,562,165 | | | State Street Institutional Treasury Plus Money Market Fund,

Trust Class, 2.32%^ | | | 19,562,165 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost — $19,562,165) | | | 19,562,165 | |

| | | | | |

| TOTAL INVESTMENTS — 99.65% (Cost — $394,429,609) | | $ | 395,537,903 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.35% | | | 1,375,070 | |

| NET ASSETS — 100.00% | | $ | 396,912,973 | |

LP: Limited Partnership

PCL: Public Company Limited

PLC: Public Limited Company

NVDR: Non-Voting Depositary Receipt

| * | Non-income producing security |

144A Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. The aggregate value of such securities is $717,239 or 0.18% of net assets.

See Accompanying Notes to Financial Statements.

| | |

| 16 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| # | Security fair valued as of March 31, 2019, in accordance the with the procedures approved by the Board of Trustees. Total value of all such securities as March 31, 2019, amounted to $9,807,531, which represents approximately 2.47% of the net assets of the Fund. FirstGroup PLC (a security traded on the London Stock Exchange) is the only underlying holding of Coast Capital Mercury Fund LP. |

| ^ | Interest rate reflects seven-day effective yield on March 31, 2019. |

| ^^ | Withdrawals are not permitted within 12 months of their contribution date and subject to an early redemption fee of 3% on redemptions made within 12 months to 24 months of their contribution date. |

As of March 31, 2019 the following Forward Foreign Currency Contracts were open:

FORWARD FOREIGN CURRENCY CONTRACTS

| | | | | | | Local | | | | | | | | | |

| | | | | | | Currency | | | | | US $ | | | | |

| | | | | | | Amount | | | | | Value at | | | Unrealized | |

| Foreign | | Settlement | | | | Purchased/ | | US $ | | | March 31, | | | Appreciation/ | |

| Currency | | Date | | Counterparty | | Sold | | Equivalent | | | 2019 | | | (Depreciation)* | |

| To Buy: | | �� | | | | | | | | | | | | | | | | |

| Canadian Dollar | | 4/18/2019 | | State Street Bank | | 2,300,000 | | $ | 1,717,003 | | | $ | 1,721,807 | | | $ | 4,804 | |

| Euro | | 4/2/2019 | | State Street Bank | | 202,508 | | | 227,299 | | | | 227,163 | | | | (136 | ) |

| | | | | | | | | $ | 1,944,302 | | | $ | 1,948,970 | | | $ | 4,668 | |

| | | | | | | | | | | | | | | | | | | |

| To Sell: | | | | | | | | | | | | | | | | | | |

| British Pound | | 4/1/2019 | | State Street Bank | | 407,837 | | $ | 533,386 | | | $ | 531,188 | | | $ | 2,198 | |

| Canadian Dollar | | 4/18/2019 | | State Street Bank | | 2,300,000 | | | 1,772,656 | | | | 1,721,807 | | | | 50,849 | |

| Canadian Dollar | | 6/11/2019 | | State Street Bank | | 2,800,000 | | | 2,088,002 | | | | 2,098,977 | | | | (10,975 | ) |

| Danish Krone | | 6/11/2019 | | State Street Bank | | 10,600,000 | | | 1,605,783 | | | | 1,603,036 | | | | 2,747 | |

| Euro | | 4/1/2019 | | State Street Bank | | 199,826 | | | 224,467 | | | | 224,155 | | | | 312 | |

| Euro | | 9/11/2019 | | State Street Bank | | 12,500,000 | | | 14,250,788 | | | | 14,215,271 | | | | 35,517 | |

| Singapore Dollar | | 9/11/2019 | | State Street Bank | | 2,700,000 | | | 1,992,209 | | | | 1,998,423 | | | | (6,214 | ) |

| Swedish Krona | | 6/11/2019 | | State Street Bank | | 28,000,000 | | | 2,985,920 | | | | 3,027,792 | | | | (41,872 | ) |

| Swiss Franc | | 9/11/2019 | | State Street Bank | | 4,000,000 | | | 4,033,616 | | | | 4,079,482 | | | | (45,866 | ) |

| | | | | | | | | $ | 29,486,827 | | | $ | 29,500,131 | | | $ | (13,304 | ) |

| * | The amount represents fair value derivative instruments subject to foreign currency risk exposure as of March 31, 2019. |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 17 |

| CENTERSTONE INTERNATIONAL

FUND OVERVIEW

(Unaudited) |

|  |  |

| Seeks to generate long-term growth of capital by investing across international markets, including developed and emerging | Non-US investments across industries, market capitalizations and capital structure | Invest majority of assets in foreign equities with flexibility to invest in fixed income, with a bottom-up value approach |

| | | | | | Since |

| PERFORMANCE | 1 Month | 3 Month | 1 Year | 2 Year | Inception* |

| Class I (CINTX) | –1.08% | 7.55% | –3.78% | 3.72% | 5.40% |

| Class A (CSIAX) | –1.08 | 7.45 | –4.05 | 3.45 | 5.19 |

| Class A (CSIAX) with Sales Charge† | –6.00 | 2.05 | –8.83 | 0.81 | 3.34 |

| Class C (CSINX) | –1.18 | 7.32 | –4.83 | 2.64 | 4.55 |

| MSCI ACWI ex-US Index | 0.60 | 10.31 | –4.22 | 5.65 | 8.02 |

| MSCI EAFE Index | 0.63 | 9.98 | –3.71 | 5.14 | 6.97 |

| * | Inception date is May 3, 2016 |

| † | Class A Maximum Sales Charge is 5.00% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 877.314.9006. Investors are not able to invest directly in the indices referenced in the illustration above and unmanaged index returns do not reflect any fees, expenses or sales charges. Definitions for the indices can be found on page 19.

| TOP 10 HOLDINGS§ | % of Portfolio | | | % of Portfolio |

| Air Liquide (FRA) | 2.90% | | Merlin Entertainments (GBR) | 2.31% |

| TransCanada (CAN) | 2.87 | | Brenntag (DEU) | 2.31 |

| Coast Capital Mercury Fund LP (GBR)^ | 2.62 | | Loomis (SWE) | 2.30 |

| Kerry Logistics (HKG) | 2.41 | | ISS (DNK) | 2.25 |

| Vopak (NLD) | 2.33 | | Prosegur Cash (ESP) | 2.08 |

| | | | TOTAL | 24.39% |

| § | Holdings in cash, cash equivalents and short term instruments have been excluded. |

The security holdings are presented to illustrate examples of the securities that the Fund has bought and the diversity of areas in which the Fund may invest, and may not be representative of the Fund’s current or future investments. Portfolio holdings are subject to change and should not be considered investment advice.

| ^ | FirstGroup PLC (a security traded on the London Stock Exchange) is the only underlying holding of Coast Capital Mercury Fund LP. |

| | |

| 18 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| | CLASS I | | CLASS A | | CLASS C |

| | CINTX | ♦ | CSIAX | ♦ | CSINX |

| | (Unaudited) |

Fund inception date is May 3, 2016.

Returns for Class A shares include a maximum sales charge of 5.00%.

The MSCI ACWI ex-US Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets, excluding the US. The index is not available for direct investment.

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the market performance of developed markets, excluding the US & Canada. The index is not available for direct investment.

The Consumer Price Index (CPI) represents the change in price of goods and services purchased for consumption by households.

All indices provide total returns in US dollars with net dividends reinvested.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 19 |

| CENTERSTONE INTERNATIONAL FUND |

| PORTFOLIO OF INVESTMENTS |

| March 31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 80.12% | | | | |

| BRAZIL — 1.32% | | | | |

| | 1,081,365 | | | Cielo SA | | $ | 2,615,482 | |

| CANADA — 4.00% | | | | |

| | 125,658 | | | TransCanada Corp. | | | 5,643,726 | |

| | 62,676 | | | Metro, Inc. | | | 2,307,524 | |

| | | | | | | | 7,951,250 | |

| CHILE — 1.92% | | | | |

| | 103,883 | | | Cia Cervecerias Unidas SA | | | 3,060,393 | |

| | 84,677,397 | | | Vina San Pedro Tarapaca SA | | | 759,042 | |

| | | | | | | | 3,819,435 | |

| DENMARK — 3.61% | | | | |

| | 146,242 | | | ISS A/S | | | 4,454,049 | |

| | 274,642 | | | Matas A/S | | | 2,716,912 | |

| | | | | | | | 7,170,961 | |

| FINLAND — 1.17% | | | | |

| | 106,155 | | | Tikkurila Oyj | | | 1,744,066 | |

| | 35,483 | | | Wartsila OYJ Abp | | | 573,856 | |

| | | | | | | | 2,317,922 | |

| FRANCE — 10.69% | | | | |

| | 44,999 | | | Air Liquide SA | | | 5,726,638 | |

| | 47,669 | | | Schneider Electric SE | | | 3,741,473 | |

| | 114,369 | | | Cie Plastic Omnium SA | | | 3,046,905 | |

| | 26,728 | | | Sodexo SA | | | 2,943,2 7 1 | |

| | 23,159 | | | Eiffage SA | | | 2,226,225 | |

| | 25,882 | | | Danone SA | | | 1,992,939 | |

| | 4,147 | | | LVMH Moet Hennessy Louis Vuitton SE | | | 1,527,480 | |

| | | | | | | | 21,204,931 | |

| GERMANY — 8.93% | | | | |

| | 88,734 | | | Brenntag AG | | | 4,562,100 | |

| | 45,620 | | | Bayerische Motoren Werke AG | | | 3,522,505 | |

| | 129,082 | | | Hamburger Hafen und Logistik AG | | | 2,949,253 | |

| | 32,678 | | | Fraport AG Frankfurt Airport Services Worldwide | | | 2,506,888 | |

| | 45,915 | | | Hornbach Holding AG & Co. KGaA | | | 2,302,281 | |

| | 9,665 | | | Continental AG | | | 1,458,052 | |

| | 22,938 | | | Hornbach Baumarkt AG | | | 409,956 | |

| | | | | | | | 17,711,035 | |

See Accompanying Notes to Financial Statements.

| | |

| 20 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INTERNATIONAL FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 80.12% (continued) | | | | |

| HONG KONG — 4.45% | | | | |

| | 2,635,377 | | | Kerry Logistics Network Ltd. | | $ | 4,771,606 | |

| | 303,350 | | | Hongkong Land Holdings Ltd. | | | 2,159,140 | |

| | 353,900 | | | Hysan Development Co. Ltd. | | | 1,896,973 | |

| | | | | | | | 8,827,719 | |

| INDONESIA — 1.10% | | | | |

| | 1,418,313 | | | Indocement Tunggal Prakarsa Tbk PT | | | 2,186,398 | |

| IRELAND — 1.58% | | | | |

| | 64,999 | | | Perrigo Co. PLC | | | 3,130,352 | |

| ISRAEL — 0.94% | | | | |

| | 356,127 | | | Israel Chemicals Ltd. | | | 1,860,748 | |

| JAPAN — 9.18% | | | | |

| | 214,525 | | | Mitsubishi Estate Co. Ltd. | | | 3,892,540 | |

| | 160,024 | | | Nagaileben Co. Ltd.* | | | 3,476,704 | |

| | 438,847 | | | Ichiyoshi Securities Co. Ltd.* | | | 3,082,092 | |

| | 71,181 | | | Aica Kogyo Co. Ltd.* | | | 2,379,547 | |

| | 11,514 | | | FANUC Corp. | | | 1,969,051 | |

| | 104,945 | | | Sekisui Jushi Corp.* | | | 1,851,041 | |

| | 9,638 | | | Shimano, Inc. | | | 1,569,230 | |

| | | | | | | | 18,220,205 | |

| MALAYSIA — 1.43% | | | | |

| | 1,738,000 | | | Genting Bhd. | | | 2,830,481 | |

| MEXICO — 0.82% | | | | |

| | 144,240 | | | Fresnillo PLC | | | 1,634,658 | |

| NETHERLANDS — 2.32% | | | | |

| | 96,257 | | | Koninklijke Vopak NV | | | 4,610,433 | |

| SINGAPORE — 1.14% | | | | |

| | 277,901 | | | Oversea-Chinese Banking Corp. Ltd. | | | 2,272,001 | |

| SPAIN — 2.07% | | | | |

| | 1,856,578 | | | Prosegur Cash SA | | | 4,101,464 | |

| SWEDEN — 6.11% | | | | |

| | 131,349 | | | Loomis AB | | | 4,529,516 | |

| | 95,298 | | | ICA Gruppen AB | | | 3,825,989 | |

| | 539,882 | | | Mekonomen AB* | | | 3,772,304 | |

| | | | | | | | 12,127,809 | |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 21 |

| CENTERSTONE INTERNATIONAL FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Shares | | | Security | | Value | |

| COMMON STOCK — 80.12% (continued) | | | | |

| SWITZERLAND — 7.26% | | | | |

| | 32,952 | | | Novartis AG | | $ | 3,167,331 | |

| | 32,332 | | | Nestle SA | | | 3,082,870 | |

| | 10,963 | | | Roche Holding AG | | | 3,020,908 | |

| | 40,695 | | | Cie Financiere Richemont SA | | | 2,968,836 | |

| | 7,539 | | | Swatch Group AG | | | 2,159,183 | |

| | | | | | | | 14,399,128 | |

| THAILAND — 6.10% | | | | |

| | 490,204 | | | Siam City Cement PCL | | | 3,477,452 | |

| | 4,946,200 | | | Thai Beverage PCL | | | 3,086,735 | |

| | 4,746,000 | | | Krung Thai Bank PCL | | | 2,874,265 | |

| | 390,300 | | | Bangkok Bank PCL | | | 2,659,622 | |

| | | | | | | | 12,098,074 | |

| UNITED KINGDOM — 2.30% | | | | |

| | 1,020,552 | | | Merlin Entertainments PLC | | | 4,568,481 | |

| UNITED STATES — 1.68% | | | | |

| | 121,878 | | | Mosaic, Co. | | | 3,328,488 | |

| TOTAL COMMON STOCK (Cost — $163,210,057) | | | 158,987,455 | |

| | | | | | | | | |

| EXCHANGE TRADED FUND — COMMODITY — 1.97% | | | | |

| | 32,052 | | | SPDR Gold Shares* | | | 3,910,665 | |

| TOTAL COMMODITY (Cost — $3,985,620) | | | | |

| | | | | |

| PRIVATE INVESTMENT FUND — 2.61% | | | | |

| | 4,435,630 | | | Coast Capital Mercury Fund LP*#^^ | | | 5,185,252 | |

| TOTAL PRIVATE INVESTMENT FUND (Cost — $5,900,000) | | | | |

| | | | | |

| REAL ESTATE INVESTMENT TRUSTS — 1.69% | | | | |

| | 20,441 | | | Unibail-Rodamco SE | | | 3,350,946 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost — $4,590,311) | | | | |

See Accompanying Notes to Financial Statements.

| | |

| 22 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INTERNATIONAL FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

| Principal | | | Security | | Coupon | | Maturity | | Value | |

| US GOVERNMENT & AGENCY OBLIGATIONS — 7.20% | | | | | | |

| US TREASURY NOTES/BONDS — 7.20% | | | | | | |

| $ | 5,000,000 | | | United States Treasury Note | | 1.38% | | 7/31/2019 | | $ | 4,981,641 | |

| | 4,500,000 | | | United States Treasury Note | | 1.25% | | 8/31/2019 | | | 4,476,797 | |

| | 2,500,000 | | | United States Treasury Note | | 2.63% | | 2/15/2029 | | | 2,545,898 | |

| | 2,300,000 | | | United States Treasury Note | | 1.38% | | 9/30/2019 | | | 2,287,512 | |

| TOTAL US GOVERNMENT & AGENCY OBLIGATIONS (Cost $14,302,936) | | | 14,291,848 | |

| | | | | | | | | | | | | |

| Shares | | | Security | | | | | | Value | |

| SHORT-TERM INVESTMENTS — 5.92% | | | | | | |

| MONEY MARKET FUND — 5.92% | | | | | | |

| | 11,742,239 | | | State Street Institutional Treasury Plus Money Market Fund, | | | | | | |

| | | | | Trust Class, 2.32%^ | | | | | | | 11,742,239 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost — $11,742,239) | | | | | 11,742,239 | |

| TOTAL INVESTMENTS — 99.51% (Cost — $203,731,163) | | | | $ | 197,468,405 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.49% | | | | | 962,160 | |

| NET ASSETS — 100.00% | | | | | | $ | 198,430,565 | |

LP: Limited Partnership

PCL: Public Company Limited

PLC: Public Limited Company

| * | Non-income producing security |

| # | Security fair valued as of March 31, 2019, in accordance with the procedures approved by the Board of Trustees. Total value of all such securities as March 31, 2019, amounted to $5,185,252, which represents approximately 2.61% of the net assets of the Fund. FirstGroup PLC (a security traded on the London Stock Exchange) is the only underlying holding of Coast Capital Mercury Fund LP. |

| ^ | Interest rate reflects seven-day effective yield on March 31, 2019. |

| ^^ | Withdrawals are not permitted within 12 months of their contribution date and subject to an early redemption fee of 3% on redemptions made within 12 months to 24 months of their contribution date. |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 23 |

| CENTERSTONE INTERNATIONAL FUND |

| PORTFOLIO OF INVESTMENTS |

| March31, 2019 |

As of March 31, 2019 the following Forward Foreign Currency Contracts were open:

FORWARD FOREIGN CURRENCY CONTRACTS

| | | | | | | Local | | | | | | | | | | |

| | | | | | | Currency | | | | | | US $ | | | | |

| | | | | | | Amount | | | | | | Value at | | | Unrealized | |

| Foreign | | Settlement | | | | Purchased/ | | | US $ | | | March 31, | | | Appreciation/ | |

| Currency | | Date | | Counterparty | | Sold | | | Equivalent | | | 2019 | | | (Depreciation)* | |

| | | | | | | | | | | | | | | | | |

| To Buy: | | | | | | | | | | | | | | | | | | | | |

| Canadian Dollar | | 4/18/2019 | | State Street Bank | | | 2,000,000 | | | $ | 1,502,936 | | | $ | 1,497,223 | | | $ | (5,713 | ) |

| Euro | | 4/2/2019 | | State Street Bank | | | 151,054 | | | | 169,546 | | | | 169,445 | | | | (101 | ) |

| | | | | | | | | | | $ | 1,672,482 | | | $ | 1,666,668 | | | $ | (5,814 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| To Sell: | | | | | | | | | | | | | | | | | | | | |

| British Pound | | 4/1/2019 | | State Street Bank | | | 326,364 | | | $ | 426,832 | | | $ | 425,073 | | | $ | 1,759 | |

| Canadian Dollar | | 4/18/2019 | | State Street Bank | | | 2,000,000 | | | | 1,541,440 | | | | 1,497,224 | | | | 44,216 | |

| Canadian Dollar | | 6/11/2019 | | State Street Bank | | | 2,200,000 | | | | 1,640,573 | | | | 1,649,196 | | | | (8,623 | ) |

| Danish Krone | | 6/11/2019 | | State Street Bank | | | 9,700,000 | | | | 1,469,443 | | | | 1,466,929 | | | | 2,514 | |

| Euro | | 4/1/2019 | | State Street Bank | | | 174,519 | | | | 196,039 | | | | 195,767 | | | | 272 | |

| Euro | | 9/11/2019 | | State Street Bank | | | 10,000,000 | | | | 11,400,630 | | | | 11,372,216 | | | | 28,414 | |

| Singapore Dollar | | 9/11/2019 | | State Street Bank | | | 2,000,000 | | | | 1,475,710 | | | | 1,480,313 | | | | (4,603 | ) |

| Swedish Krona | | 6/11/2019 | | State Street Bank | | | 22,000,000 | | | | 2,346,080 | | | | 2,378,980 | | | | (32,900 | ) |

| Swiss Franc | | 9/11/2019 | | State Street Bank | | | 3,000,000 | | | | 3,025,212 | | | | 3,059,611 | | | | (34,399 | ) |

| | | | | | | | | | | $ | 23,521,959 | | | $ | 23,525,309 | | | $ | (3,350 | ) |

| * | The amount represents fair value derivative instruments subject to foreign currency risk exposure as of March 31, 2019. |

See Accompanying Notes to Financial Statements.

| | |

| 24 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| March31, 2019 |

| | | Centerstone | | | Centerstone | |

| | | Investors | | | International | |

| | | Fund | | | Fund | |

| Assets: | | | | | | | | |

| Investments in securities, at cost | | $ | 394,429,609 | | | $ | 203,731,163 | |

| Investments in securities, at value | | $ | 395,537,903 | | | $ | 197,468,405 | |

| Foreign currency, at value (Cost $32 and $110, respectively) | | | 28 | | | | 1 1 1 | |

| Interest and dividends receivable | | | 755,237 | | | | 460,086 | |

| Foreign tax reclaim receivable | | | 368,614 | | | | 293,823 | |

| Receivable for securities sold | | | 804,876 | | | | 659,478 | |

| Receivable for fund shares sold | | | 684,261 | | | | 124,409 | |

| Unrealized appreciation on open forward foreign currency contracts | | | 96,427 | | | | 77,175 | |

| Prepaid expenses and other assets | | | 26,865 | | | | 26,71 1 | |

| Total Assets | | | 398,274,211 | | | | 199,110,198 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for securities purchased | | | 708,538 | | | | 336,707 | |

| Payable for fund shares redeemed | | | 156,400 | | | | 68,288 | |

| Unrealized depreciation on open forward foreign currency contracts | | | 105,063 | | | | 86,339 | |

| Payable to advisor | | | 265,539 | | | | 106,236 | |

| Payable for shareholder servicing fees | | | 33,512 | | | | 21,717 | |

| Payable for distribution fees | | | 19,938 | | | | 12,628 | |

| Payable for custody fees | | | 18,987 | | | | 16,187 | |

| Accrued expenses and other liabilities | | | 53,261 | | | | 31,531 | |

| Total Liabilities | | | 1,361,238 | | | | 679,633 | |

| | | | | | | | | |

| Net Assets | | $ | 396,912,973 | | | $ | 198,430,565 | |

| | | | | | | | | |

| Net Assets consist of: | | | | | | | | |

| Paid in capital (par value $0.001 per share) | | $ | 395,368,661 | | | $ | 205,015,843 | |

| Accumulated earnings (losses) | | | 1,544,312 | | | | (6,585,278 | ) |

| Net Assets | | $ | 396,912,973 | | | $ | 198,430,565 | |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 25 |

| CENTERSTONE INVESTORS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| March31, 2019 |

| | | Centerstone | | | Centerstone | |

| | | Investors | | | International | |

| | | Fund | | | Fund | |

| Net Asset Value Per Share | | | | | | | | |

| Class I Shares: | | | | | | | | |

| Net Assets | | $ | 349,733,628 | | | $ | 168,337,130 | |

| Shares of beneficial interest outstanding | | | | | | | | |

| (no par value; unlimited shares authorized) | | | 31,283,230 | | | | 15,350,023 | |

| Net asset value, offering and redemption price per share* | | $ | 11.18 | | | $ | 10.97 | |

| | | | | | | | | |

| Class A Shares:** | | | | | | | | |

| Net Assets | | $ | 31,491,790 | | | $ | 20,618,561 | |

| Shares of beneficial interest outstanding | | | | | | | | |

| (no par value; unlimited shares authorized) | | | 2,827,608 | | | | 1,881,247 | |

| Net asset value, and redemption price per share* | | $ | 11.14 | | | $ | 10.96 | |

| Offering price per share | | | | | | | | |

| (NAV per share plus maximum sales charge of 5%) | | $ | 11.73 | | | $ | 11.54 | |

| | | | | | | | | |

| Class C Shares: | | | | | | | | |

| Net Assets | | $ | 15,687,555 | | | $ | 9,474,874 | |

| Shares of beneficial interest outstanding | | | | | | | | |

| (no par value; unlimited shares authorized) | | | 1,422,435 | | | | 873,169 | |

| Net asset value, offering and redemption price per share* | | $ | 11.03 | | | $ | 10.85 | |

| Redemption proceeds per share (NAV per share less maximum contigent deferred sales charge)^ | | $ | 10.92 | | | $ | 10.74 | |

| * | Each Fund will deduct a 2.00% redemption fee on the redemption amount if you sell your shares less than 30 days after purchase. |

| ** | A maximum contingent deferred sales charge (“CDSC”) of 1.00% may apply to certain redemptions of Class A shares made within the first 18 months of their purchase when an initial sales charge was not paid on the purchase. |

| ^ | If you redeem Class C shares within 12 months after purchase, you will be charged a CDSC of up to 1.00%. The charge will apply to the lesser of the original cost of the Class C shares being redeemed or the proceeds of your redemption. |

See Accompanying Notes to Financial Statements.

| | |

| 26 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS |

| STATEMENTS OF OPERATIONS |

| Year ended March 31, 2019 |

| | | Centerstone | | | Centerstone | |

| | | Investors | | | International | |

| | | Fund | | | Fund | |

| Investment Income: | | | | | | | | |

| Interest income | | $ | 1,295,958 | | | $ | 400,121 | |

| Dividend income | | | 7,950,918 | | | | 4,833,306 | |

| Less: Foreign withholding taxes | | | (703,222 | ) | | | (583,713 | ) |

| Total Investment Income | | | 8,543,654 | | | | 4,649,714 | |

| | | | | | | | | |

| Operating Expenses: | | | | | | | | |

| Investment advisory fees | | | 3,237,433 | | | | 1,650,132 | |

| Distribution fees — Class A Shares | | | 83,734 | | | | 58,827 | |

| Distribution fees — Class C Shares | | | 128,958 | | | | 74,446 | |

| Shareholder servicing fees | | | 348,280 | | | | 238,388 | |

| Administration fees | | | 161,016 | | | | 93,187 | |

| Trustees’ fees | | | 112,161 | | | | 81,662 | |

| Custodian fees | | | 109,615 | | | | 100,126 | |

| Legal fees | | | 65,572 | | | | 46,850 | |

| Registration & filing fees | | | 59,999 | | | | 59,999 | |

| Chief Compliance Officer fees | | | 41,415 | | | | 27,380 | |

| Others expenses | | | 112,314 | | | | 70,076 | |

| Total Operating Expenses | | | 4,460,497 | | | | 2,501,073 | |

| Less: Fees waived by the advisor | | | (287,829 | ) | | | (349,834 | ) |

| Net Operating Expenses | | | 4,172,668 | | | | 2,151,239 | |

| Net Investment Income | | | 4,370,986 | | | | 2,498,475 | |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency: | | | | | | | | |

| Net realized gain from: | | | | | | | | |

| Investments | | | 4,381,918 | | | | 1,114,585 | |

| Forward foreign currency contracts | | | 1,246,592 | | | | 1,119,264 | |

| | | | 5,628,510 | | | | 2,233,849 | |

| Net change in unrealized appreciation (depreciation) from: | | | | | | | | |

| Investments | | | (10,792,061 | ) | | | (12,293,866 | ) |

| Foreign currency translations | | | (17,924 | ) | | | (17,434 | ) |

| Forward foreign currency contracts | | | 87,574 | | | | 84,939 | |

| | | | (10,722,411 | ) | | | (12,226,361 | ) |

| | | | | | | | | |

| Net Realized and Unrealized Loss | | | (5,093,901 | ) | | | (9,992,512 | ) |

| | | | | | | | | |

| Net Decrease in Net Assets Resulting From Operations | | $ | (722,915 | ) | | $ | (7,494,037 | ) |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 27 |

| CENTERSTONE INVESTORS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Centerstone | | | Centerstone | |

| | | Investors Fund | | | International Fund | |

| | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 4,370,986 | | | $ | 1,639,525 | | | $ | 2,498,475 | | | $ | 718,575 | |

| Net realized gain (loss) from investments and forward foreign currency contracts | | | 5,628,510 | | | | 3,576,182 | | | | 2,233,849 | | | | 2,860,841 | |

| Net change in unrealized appreciation/(depreciation) on investments foreign currency translations and forward foreign currency contacts | | | (10,722,411 | ) | | | 9,228,922 | | | | (12,226,361 | ) | | | 3,787,613 | |

| | | | | | | | | | | | | | | | | |

| Net Increase/(Decrease) in Net Assets Resulting From Operations | | | (722,915 | ) | | | 14,444,629 | | | | (7,494,037 | ) | | | 7,367,029 | |

| | | | | | | | | | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | | | | | | | | | |

| Net Investment Income: | | | | | | | | | | | | | | | | |

| Class I | | | — | | | | (955,240 | ) | | | — | | | | (260,620 | ) |

| Class A | | | — | | | | (63,381 | ) | | | — | | | | (12,021 | ) |

| Class C | | | — | | | | (3,689 | ) | | | — | | | | — | |

| Net Realized Gains: | | | | | | | | | | | | | | | | |

| Class I | | | — | | | | (1,352,968 | ) | | | — | | | | (1,482,989 | ) |

| Class A | | | — | | | | (128,262 | ) | | | — | | | | (201,144 | ) |

| Class C | | | — | | | | (39,914 | ) | | | — | | | | (59,922 | ) |

| Total Distributions Paid* | | | | | | | | | | | | | | | | |

| Class I | | | (10,231,138 | ) | | | — | | | | (5,354,962 | ) | | | — | |

| Class A | | | (1,049,112 | ) | | | — | | | | (687,739 | ) | | | — | |

| Class C | | | (381,496 | ) | | | — | | | | (181,125 | ) | | | — | |

| | | | | | | | | | | | | | | | | |

| Total Distributions to Shareholders | | | (11,661,746 | ) | | | (2,543,454 | ) | | | (6,223,826 | ) | | | (2,016,696 | ) |

| | | | | | | | | | | | | | | | | |

| * | Distributions from net investment income and net realized capital gains are combined for the year ended March 31, 2019. See “Recent Accounting Pronouncements and Reporting Updates” in the Notes to Financial Statements for more information. The dividends and distributions to shareholders for the year ended March 31, 2018 have not been reclassified to conform to the current year’s presentation. |

See Accompanying Notes to Financial Statements.

| | |

| 28 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| CENTERSTONE INVESTORS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Centerstone | | | Centerstone | |

| | | Investors Fund | | | International Fund | |

| | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| Fund Share Transactions of Beneficial Interest: | | | | | | | | | | | | | | | | |

| Net proceeds from shares sold | | | | | | | | | | | | | | | | |

| Class I | | $ | 167,665,618 | | | $ | 177,705,651 | | | $ | 111,529,235 | | | $ | 101,883,963 | |

| Class A | | | 26,567,854 | | | | 28,089,225 | | | | 22,793,901 | | | | 17,770,109 | |

| Class C | | | 11,135,640 | | | | 7,473,001 | | | | 7,790,312 | | | | 4,685,357 | |

| Reinvestment of distributions | | | | | | | | | | | | | | | | |

| Class I | | | 8,802,053 | | | | 2,063,884 | | | | 4,742,589 | | | | 1,463,175 | |

| Class A | | | 1,045,243 | | | | 190,928 | | | | 675,457 | | | | 205,503 | |

| Class C | | | 368,478 | | | | 42,398 | | | | 170,425 | | | | 58,393 | |

| Redemption fee proceeds | | | | | | | | | | | | | | | | |

| Class I | | | 11,484 | | | | 2,765 | | | | 19,841 | | | | 2,601 | |

| Class A | | | 1,230 | | | | 255 | | | | 3,133 | | | | 357 | |

| Class C | | | 485 | | | | 74 | | | | 913 | | | | 88 | |

| Cost of shares redeemed | | | | | | | | | | | | | | | | |

| Class I | | | (81,063,288 | ) | | | (16,756,170 | ) | | | (71,902,930 | ) | | | (13,149,876 | ) |

| Class A | | | (23,197,896 | ) | | | (9,426,539 | ) | | | (23,780,762 | ) | | | (2,254,413 | ) |

| Class C | | | (3,516,557 | ) | | | (142,630 | ) | | | (3,778,800 | ) | | | (243,509 | ) |

| | | | | | | | | | | | | | | | | |

| Net Increase in Net Assets From Share Transactions of Beneficial Interest | | | 107,820,344 | | | | 189,242,842 | | | | 48,263,314 | | | | 110,421,748 | |

| | | | | | | | | | | | | | | | | |

| Total Increase in Net Assets | | | 95,435,683 | | | | 201,144,017 | | | | 34,545,451 | | | | 115,772,081 | |

| | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of Year | | | 301,477,290 | | | | 100,333,273 | | | | 163,885,114 | | | | 48,113,033 | |

| End of Year** | | $ | 396,912,973 | | | $ | 301,477,290 | | | $ | 198,430,565 | | | $ | 163,885,114 | |

| ** | Includes distributions in excess of net investment gain of $30,237 and $12,969 as of March 31, 2018 for the Centerstone Investors Fund and Centerstone International Fund, respectively. |

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 29 |

CENTERSTONE INVESTORS FUND

FINANCIAL HIGHLIGHTS

The table sets forth financial data for one share of beneficial interest outstanding in each period:

| | | | | | Income from | | | Less | | | | |

| | | | | | investment operations: | | | distributions: | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | | |

| | | | | | | | | | | | income | | | | | | | | | | | | | |

| | | | | | | | | Net | | | (loss) | | | | | | | | | | | | Paid in | |

| | | Net | | | Net | | | realized | | | from | | | From | | | | | | | | | capital | |

| | | asset | | | invest- | | | and | | | invest- | | | net | | | From | | | | | | from | |

| | | value, | | | ment | | | unreal- | | | ment | | | invest- | | | net | | | Total | | | redemp- | |

| | | beginning | | | income | | | ized gain | | | opera- | | | ment | | | realized | | | distribu- | | | tion | |

| | | of period | | | (loss)** | | | (loss) | | | tions | | | income | | | gains | | | tions | | | fees(1) | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.55 | | | | 0.14 | | | | (0.16 | ) | | | (0.02 | ) | | | (0.12 | ) | | | (0.23 | ) | | | (0.35 | ) | | | 0.00 | |

| Year Ended March 31, 2018 | | $ | 10.64 | | | | 0.10 | | | | 0.94 | | | | 1.04 | | | | (0.05 | ) | | | (0.08 | ) | | | (0.13 | ) | | | 0.00 | |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.07 | | | | 0.63 | | | | 0.70 | | | | (0.05 | ) | | | (0.01 | ) | | | (0.06 | ) | | | 0.00 | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.51 | | | | 0.12 | | | | (0.16 | ) | | | (0.04 | ) | | | (0.10 | ) | | | (0.23 | ) | | | (0.33 | ) | | | 0.00 | |

| Year Ended March 31, 2018 | | $ | 10.62 | | | | 0.07 | | | | 0.94 | | | | 1.01 | | | | (0.04 | ) | | | (0.08 | ) | | | (0.12 | ) | | | 0.00 | |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.04 | | | | 0.64 | | | | 0.68 | | | | (0.05 | ) | | | (0.01 | ) | | | (0.06 | ) | | | 0.00 | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.43 | | | | 0.02 | | | | (0.15 | ) | | | (0.13 | ) | | | (0.04 | ) | | | (0.23 | ) | | | (0.27 | ) | | | 0.00 | |

| Year Ended March 31, 2018 | | $ | 10.59 | | | | (0.03 | ) | | | 0.96 | | | | 0.93 | | | | (0.01 | ) | | | (0.08 | ) | | | (0.09 | ) | | | 0.00 | |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.01 | | | | 0.64 | | | | 0.65 | | | | (0.05 | ) | | | (0.01 | ) | | | (0.06 | ) | | | 0.00 | |

| * | The Fund’s inception date is May 3, 2016. |

| ** | The net investment income per share data was determined using the average shares outstanding throughout the period. |

| (1) | Amount is less than $0.005 per share. |

| ‡ | Assumes reinvestment of all dividends and distributions, if any. Total return does not reflect any sales charges, if any, or the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

| ^ | Annualized for periods less than one year. |

See Accompanying Notes to Financial Statements.

| | |

| 30 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| | | | | | | Ratios/ | | | | | | Ratios of net | | | | |

| | | | | | | Supple- | | | | | | investment income | | | | |

| | | | | | | mental | | | Ratios of expenses | | | (loss) to average | | | | |

| | | | | | | Data: | | | to average net assets | | | net assets | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net | | | | | | Net | | | | | | | | | | | | | | | | |

| asset | | | | | | assets, | | | | | | | | | | | | | | | | |

| value, | | | | | | end of | | | Before | | | After | | | Before | | | After | | | Portfolio | |

| end of | | | Total | | | period | | | fee | | | fee | | | fee | | | fee | | | turnover | |

| period | | | return‡ | | | (in 000s) | | | waivers | | | waivers | | | waivers | | | waivers | | | rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 11.18 | | | | (0.02 | )% | | $ | 349,734 | | | | 1.18 | % | | | 1.10 | % | | | 1.20 | % | | | 1.28 | % | | | 33.65 | % |

| $ | 11.55 | | | | 9.82 | % | | $ | 264,705 | | | | 1.34 | % | | | 1.10 | % | | | 0.65 | % | | | 0.88 | % | | | 20.55 | % |

| $ | 10.64 | | | | 7.02 | %(2) | | $ | 90,803 | | | | 2.42 | % ^ | | | 1.10 | % ^ | | | (0.57 | )% ^ | | | 0.75 | % ^ | | | 33.34 | %(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 11.14 | | | | (0.25 | )% | | $ | 31,492 | | | | 1.43 | % | | | 1.35 | % | | | 0.94 | % | | | 1.02 | % | | | 33.65 | % |

| $ | 11.51 | | | | 9.49 | % | | $ | 28,609 | | | | 1.59 | % | | | 1.35 | % | | | 0.41 | % | | | 0.65 | % | | | 20.55 | % |

| $ | 10.62 | | | | 6.77 | %(2) | | $ | 8,910 | | | | 2.55 | % ^ | | | 1.35 | % ^ | | | (0.77 | )% ^ | | | 0.44 | % ^ | | | 33.34 | %(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 11.03 | | | | (1.00 | )% | | $ | 15,688 | | | | 2.18 | % | | | 2.10 | % | | | 0.09 | % | | | 0.18 | % | | | 33.65 | % |

| $ | 11.43 | | | | 8.74 | % | | $ | 8,164 | | | | 2.34 | % | | | 2.10 | % | | | (0.57 | )% | | | (0.30 | )% | | | 20.55 | % |

| $ | 10.59 | | | | 6.50 | %(2) | | $ | 621 | | | | 3.86 | % ^ | | | 2.10 | % ^ | | | (1.68 | )% ^ | | | 0.08 | % ^ | | | 33.34 | %(2) |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 31 |

CENTERSTONE INTERNATIONAL FUND

FINANCIAL HIGHLIGHTS

The table sets forth financial data for one share of beneficial interest outstanding in each period:

| | | | | | Income from | | | Less | | | | |

| | | | | | investment operations: | | | distributions: | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | | |

| | | | | | | | | | | | income | | | | | | | | | | | | | |

| | | | | | | | | Net | | | (loss) | | | | | | | | | | | | | |

| | | Net | | | Net | | | realized | | | from | | | From | | | | | | | | | Paid in | |

| | | asset | | | invest- | | | and | | | invest- | | | net | | | From | | | | | | capital | |

| | | value, | | | ment | | | unreal- | | | ment | | | invest- | | | net | | | Total | | | from | |

| | | beginning | | | income | | | ized gain | | | opera- | | | ment | | | realized | | | distribu- | | | redemp- | |

| | | of period | | | (loss)** | | | (loss) | | | tions | | | income | | | gains | | | tions | | | tion fees | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.82 | | | | 0.16 | | | | (0.62 | ) | | | (0.46 | ) | | | (0.15 | ) | | | (0.24 | ) | | | (0.39 | ) | | | 0.00 | (1) |

| Year Ended March 31, 2018 | | $ | 10.75 | | | | 0.09 | | | | 1.18 | | | | 1.27 | | | | (0.03 | ) | | | (0.17 | ) | | | (0.20 | ) | | | 0.00 | (1) |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.03 | | | | 0.79 | | | | 0.82 | | | | (0.06 | ) | | | (0.01 | ) | | | (0.07 | ) | | | 0.00 | (1) |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.81 | | | | 0.15 | | | | (0.64 | ) | | | (0.49 | ) | | | (0.12 | ) | | | (0.24 | ) | | | (0.36 | ) | | | 0.00 | (1) |

| Year Ended March 31, 2018 | | $ | 10.75 | | | | 0.06 | | | | 1.18 | | | | 1.24 | | | | (0.01 | ) | | | (0.17 | ) | | | (0.18 | ) | | | 0.00 | (1) |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.06 | | | | 0.75 | | | | 0.81 | | | | (0.06 | ) | | | (0.01 | ) | | | (0.07 | ) | | | 0.01 | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended March 31, 2019 | | $ | 11.71 | | | | 0.05 | | | | (0.62 | ) | | | (0.57 | ) | | | (0.05 | ) | | | (0.24 | ) | | | (0.29 | ) | | | 0.00 | (1) |

| Year Ended March 31, 2018 | | $ | 10.73 | | | | (0.04 | ) | | | 1.19 | | | | 1.15 | | | | — | | | | (0.17 | ) | | | (0.17 | ) | | | 0.00 | (1) |

| Period Ended March 31, 2017* | | $ | 10.00 | | | | 0.00 | (1) | | | 0.79 | | | | 0.79 | | | | (0.05 | ) | | | (0.01 | ) | | | (0.06 | ) | | | 0.01 | |

| * | The Fund’s inception date is May 3, 2016. |

| ** | The net investment income per share data was determined using the average shares outstanding throughout the period. |

| (1) | Amount is less than $0.005 per share. |

| ‡ | Assumes reinvestment of all dividends and distributions, if any. Total return does not reflect any sales charges, if any, or the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

| ^ | Annualized for periods less than one year. |

See Accompanying Notes to Financial Statements.

| | |

| 32 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

| | | | | | | Ratios/ | | | | | | | | | Ratios of net | | | | |

| | | | | | | Supple- | | | | | | | | | investment income | | | | |

| | | | | | | mental | | | Ratios of expenses | | | (loss) to average | | | | |

| | | | | | | Data: | | | to average net assets | | | net assets | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net | | | | | | Net | | | | | | | | | | | | | | | | |

| asset | | | | | | assets, | | | | | | | | | | | | | | | | |

| value, | | | | | | end of | | | Before | | | After | | | Before | | | After | | | Portfolio | |

| end of | | | Total | | | period | | | fee | | | fee | | | fee | | | fee | | | turnover | |

| period | | | return‡ | | | (in 000s) | | | waivers | | | waivers | | | waivers | | | waivers | | | rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 10.97 | | | | (3.78 | )% | | $ | 168,337 | | | | 1.29 | % | | | 1.10 | % | | | 1.22 | % | | | 1.41 | % | | | 34.01 | % |

| $ | 11.82 | | | | 11.90 | % | | $ | 135,303 | | | | 1.50 | % | | | 1.10 | % | | | 0.33 | % | | | 0.73 | % | | | 20.86 | % |

| $ | 10.75 | | | | 8.32 | %(2) | | $ | 40,395 | | | | 2.91 | % ^ | | | 1.10 | % ^ | | | (1.46 | )% ^ | | | 0.35 | % ^ | | | 19.46 | %(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 10.96 | | | | (4.05 | )% | | $ | 20,619 | | | | 1.54 | % | | | 1.35 | % | | | 1.13 | % | | | 1.33 | % | | | 34.01 | % |

| $ | 11.81 | | | | 11.53 | % | | $ | 22,772 | | | | 1.75 | % | | | 1.35 | % | | | 0.13 | % | | | 0.54 | % | | | 20.86 | % |

| $ | 10.75 | | | | 8.27 | %(2) | | $ | 6,510 | | | | 3.17 | % ^ | | | 1.35 | % ^ | | | (1.18 | )% ^ | | | 0.65 | % ^ | | | 19.46 | %(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 10.85 | | | | (4.83 | )% | | $ | 9,475 | | | | 2.29 | % | | | 2.10 | % | | | 0.22 | % | | | 0.41 | % | | | 34.01 | % |

| $ | 11.71 | | | | 10.70 | % | | $ | 5,810 | | | | 2.50 | % | | | 2.10 | % | | | (0.74 | )% | | | (0.34 | )% | | | 20.86 | % |

| $ | 10.73 | | | | 8.02 | %(2) | | $ | 1,208 | | | | 3.90 | % ^ | | | 2.10 | % ^ | | | (1.78 | )% ^ | | | 0.02 | % ^ | | | 19.46 | %(2) |

See Accompanying Notes to Financial Statements.

| | |

| Centerstone Investors ♦ Annual Report ♦ March 31, 2019 | 33 |

CENTERSTONE INVESTORS

NOTES TO FINANCIAL STATEMENTS

March31, 2019

The Centerstone Investors Fund and the Centerstone International Fund (each a “Fund” and collectively the “Funds”) are each a series of Centerstone Investors Trust, (the “Trust”) a Delaware statutory trust. The Trust is an open-ended management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust is governed by its Board of Trustees (the “Board” or “Trustees”). Each Fund is a diversified series of the Trust. The Centerstone Investors Fund seeks long-term growth of capital by investing in a range of securities and asset classes from markets around the world, including the US market. The Centerstone International Fund seeks long-term growth of capital by investing in a range of securities and asset classes primarily from foreign(non-US) markets. Centerstone Investors, LLC (the “Advisor”), manages the Funds. The Funds’ inception date was May 3, 2016.

All classes of shares for each of the Funds have identical rights to earnings, assets and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only individual classes.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies” including FASB Accounting Standard Update ASU 2013-08.

The following is a summary of significant accounting policies followed by the Funds in preparation of their financial statements.

| | |

| 34 | Centerstone Investors ♦ Annual Report ♦ March 31, 2019 |

CENTERSTONE INVESTORS

NOTES TO FINANCIAL STATEMENTS

March31, 2019