An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

PART II – OFFERING CIRCULAR

POMM INC.

985 Citadel Drive Northeast,

Suite A,

Atlanta , Georgia 30324

20,051 Units at $498.8 per Unit, comprised of an aggregate of 802,065 Shares at

$12.47 per share for the amount of $10,001,750.5

Minimum purchase: one unit which is comprised of 40 Shares($498.80 per Unit)

POMM Inc. is a Nevada corporation (the “Company” or “POMM”) focused on providing battery extension, electronic storage and data protection for smartphone users. Pursuant to this Offering Circular, the Company is offering a minimum of 40 shares and a maximum of 802,065 shares of common stock (the “Offering”), on a “best efforts”basis. There is a one Unit Minimum amount required for this offering. It is anticipated that the initial closing may occur after the Offering Circular is declaredqualified by the Securities and Exchange Commission. Thereafter, the Company may hold additional “rolling closings” at such time and place, and on such date or dates, as the Company may determine at its own discretion. The offering may continue until the earlier of October30, 2016 (which date may be extended at our option) or the date when all shares have been sold. Prospective purchasers of the shares of common stock should carefully consider the risk factors referred to in this Offering Circular (“Offering Circular”) before making an investment in the Company (See “RISK FACTORS” on page 5).

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED UNDER AN EXEMPTION FROM REGISTRATION; HOWEVER, THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THESE SECURITIES ARE EXEMPT FROM REGISTRATION.

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 5 OF THIS OFFERING CIRCULAR THAT MANAGEMENT BELIEVES PRESENT THE MOST SUBSTANTIAL RISKS TO AN INVESTOR IN THIS OFFERING.

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED OR APPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE THESE AUTHORITIES HAVE PASSED NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| | | Number of Shares | | | Price to Public(1) | | | Underwriting Discounts and Commissions (2) | | | Proceeds to the Company | |

| Per share: | | | 1 | | | $ | 12.47 | | | | -0- | | | $ | 12.47 | |

| Total Minimum | | | 40 | | | $ | 498.80 | | | | -0- | | | $ | 498.80 | |

| Total Maximum | | | 802,065 | (3) | | $ | 10,001,750.5 | | | | -0- | | | $ | 7,637,635 | (3) |

| (1) | The Shares are offered in denominations of $12.47 and any even multiple thereof. The minimum subscription is $498.80. The price of the stock was arbitrarily determined by POMM Inc. |

| (2) | There is no underwriter for the securities offered by this Offering Circular. The Company intends to sell the securities itself in its capacity as issuer. |

| (3) | Ancillary fees, such as legal, marketing and accounting/auditor’s fees associated with the Offering will be approximately $500,000.00. In addition 149,488 shares out of the 802,065 are resale shares for an existing shareholder for an aggregate of $1,864,115. |

We are providing the disclosure in the format prescribed by Part II of Form 1-A.

The date of this Prospectus is March 14, 2016

Prepared By:

Sunny J. Barkats

JSBarkats,PLLC

18 East 41st Street, 14th Floor

New York, NY 10017

P: (646) 502-7001

F: (646) 607-5544

Info@JSBarkats.com

www.JSBarkats.com

IMPORTANT INVESTOR NOTICES

PROSPECTIVE INVESTORS SHOULD NOT CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR AS INVESTMENT, LEGAL, BUSINESS OR TAX ADVICE. EACH INVESTOR SHOULD CONTACT HIS OR HER OWN ADVISORS REGARDING THE APPROPRIATENESS OF THIS INVESTMENT AND THE TAX CONSEQUENCES THEREOF WHICH MAY DIFFER DEPENDING ON AN INVESTOR’S PARTICULAR FINANCIAL SITUATION. IN NO EVENT SHOULD THIS OFFERING CIRCULAR BE DEEMED TO BE CONSIDERED TAX ADVICE PROVIDED BY US.

The information contained in this Offering Circular is as of the date set forth on the cover page, and delivery of this Offering Circular at any time does not imply that the information contained herein is correct as of any date subsequent to the date set forth on the cover page.

The Company reserves the right to reject any offering for equity or to terminate, at any time, the solicitation or indications of interest in investing in the opportunity or the further participation in the investigation and proposal process by any party. Finally, the Company reserves the right to modify, at any time, any procedures related to such process without assigning any reason therefore.

We are not a reporting Company under the federal securities laws. We do not intend to furnish annual reports to our security holders containing financial statements that have been audited by independent public accountants.

No expert has been named in the Offering and it is anticipated that all experts shall be independent of the Company.

At the time of this filing, no marketing arrangements of any kind are known to the Company. Further, to the Company’s knowledge, no underwriter intends to confirm any sales of the Company’s securities to any accounts over which it exercises discretionary authority.

This a self-underwritten Offering.

Inquiries

For additional information regarding POMM please contact:

David Freidenberg: david@privatepomm.com; Tel: (917) 300 0651

Gila Fish: gila@privatepomm.com Tel:+972545606209

Contact our attorneys at JSBarkats,PLLC located at18 East 41st Street, 14th Fl.,New York, NY 10017or via email:info@jsbarkats.com

TABLE OF CONTENTS

OFFERING SUMMARY

POMM INC.

Prepared by:

Sunny J. Barkats

JSBarkats,PLLC

18 East 41st Street, 14th Floor

New York, NY 10017

www.JSBarkats.com

This Offering Summary highlights information contained in other parts of this Offering Circular and is not a complete detailed description of the terms of the investment. Because it is a summary, it does not contain all of the information that you should consider before investing in the Offering. For a more complete understanding of this Offering Circular, you should read this entire document carefully, including information concerning the Company, the securities being sold through this Offering, and the information set forth under the heading “Risk Factors” starting on page 5.

Our Company

POMM Inc. (“Company”) is a holding company owning 100% of OS New Horizon – Personal Computing Solutions Ltd., (the “Subsidiary”) and together they are developing and commercializing advanced biometry-based, user-enhanced authentication, and privacy management solutions. The Company`s principal office is located at 985 Citadel Drive Northeast, Suite A, Atlanta, GA30324, and from that office it supervises the manufacturing of its secure, biometric, privacy system under the “POMM” brand name and is offering its POMM platforms for smartphone users in the United States market and abroad. The Company`s business activities are being directed or supervised from its principal office in Atlanta, GA.

This Offering

| Offering: | | A maximum offering of 20,051 Units, as defined hereafter, at $498.80 per Unit, for an aggregate of 802,065 shares of common stock (the "Shares") at $12.47 per share for the amount of $10,001,750.5 (the "Maximum Offering"), and a minimum subscription of one Unit that is comprised of Forty (40) Shares (the "Unit") per subscriber is permitted, which amount may be increased or decreased at the discretion of the Company's Board of Directors at the time. Investors will receive one (1) POMM device for free for each $5,000 they invest in this Offering. In addition such device will be serviced as a part of Beta test group. The issuance and sale of the Shares is being made in reliance upon “Regulation A+” under title IV tier II of the “Jobs Act” as amended in March 2015 which is an exemption from registration provided for under Section 3(b) of the Securities Act, and in reliance on applicable registration, or exemptions from registration, provisions under certain state securities laws. |

| | | |

| The Company | | The Company is a Nevada corporation. The Company`s principal office is at 985 Citadel Drive Northeast, Suite A, Atlanta, GA30324. The Company`s telephone number is (917) 300-0651. |

Ownership of the Company: | | Immediately following the Offering, it is anticipated that the outstanding capitalization of the Company will consist of 2,249,808 shares of common stock if the Maximum Offering is sold (or more if the Company elects to accept over subscriptions); Assuming the sale of all of the Shares in the Maximum Offering, the purchasers in the Offering will beneficially own an aggregate of approximately 22.66%, (or 23.66% in case the existing shareholders exercise their rights to sell their shares) of the Company’s outstanding common stock following the Offering on a fully diluted basis. |

Board Composition: | | The Company’s current Board of Directors is composed of Gila Fish and David Friedenberg. |

| Closing: | | It is anticipated that the initial closing may occur after the Offering Circular is declaredqualifiedby the staff at the Securities and Exchange Commission (the “SEC”). Thereafter, the Company may hold additional “rolling closings” at such time and place, and on such date or dates, as the Company may determine at its own discretion (each such date being sometimes referred to herein as a “Closing Date”). |

| Use of Proceeds: | | The Company anticipates net proceeds of the Offering, after payment of estimated costs and expenses associated with the Offering, of approximately $7,637,635if the Maximum Offering is sold. The net proceeds will be applied as described under “Use of Proceeds.” The Company plans to use the proceeds of the Offering to market and manufacture its MiniPOMM and POMMPro and for general corporate and working capital purposes. |

| Subscription Documents: | | To subscribe for Units, any individual qualified in the state this Offering is provided for subscriber must complete, execute, and return to the Company the Subscription Agreement (Exhibit “A”) and the Investor Questionnaire (Exhibit “B”), which contain certain representations, covenants, warranties, and undertakings, all of which should be carefully considered by the subscriber before execution. A qualified subscriber should only send a wire transfer to the Company`s Account established for the Offering or certified check payable to “POMM Inc.”, in an amount equal to the purchase price for the Units subscribed, moreover once the Offering Circular is disclosed qualified by the SEC and pursuant to the filing of a Form 1-Z all commitment shall be signed but no wire needs to be transferred until a binding notice of closing is emailed to the investor. |

| Investor Suitability: | | No Shares will be offered or sold to any prospective subscriber who does not qualify within the terms of the Investor Questionnaire. The Company reserves the right, in its sole discretion, for any reason or for no reason, to reject any potential subscriber and/or to limit the amount of Units sold to any subscriber in this Offering. |

| Acceptance of Rejection of Subscriptions: | | Subscription Agreements are not binding on the Company until accepted by the Company. If we reject all or a portion of any subscription, we will return to the prospective subscriber all, or the appropriate portion, of the amount submitted with such prospective investor’s subscription, without interest or deduction. After all refunds have been made, the Company and its directors, officers, counsel and agents will have no further liability to subscribers. |

Termination of Offering: | | If the Offering is terminated or withdrawn, the Company will return to subscribers the subscription amounts held in the subaccount created for this Offering, without interest or deduction therefrom. |

| | | |

| Additional Info: | | Web site:www.pomm.com |

| | | |

| Subscribers Eligibility | | The person who is not an accredited investor under Rule 501(a) of Regulation D can purchase in this Offering no more than: (a) 10% of the greater of annual income or net worth (for natural persons); or (b) 10% of the greater of annual revenue or net assets at fiscal year end (for non-natural persons). |

| | | |

Risk Factors: | | Investing in our shares involves ahigh degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this Offering Circular. |

FORWARD-LOOKING STATEMENTS

The following discussion may contain forward-looking statements and information that is based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the discussion that follows and elsewhere in this document, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

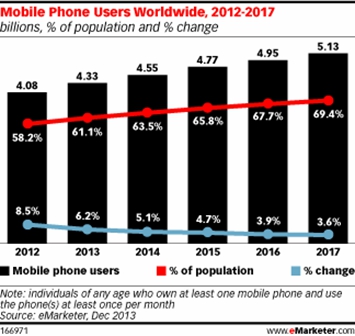

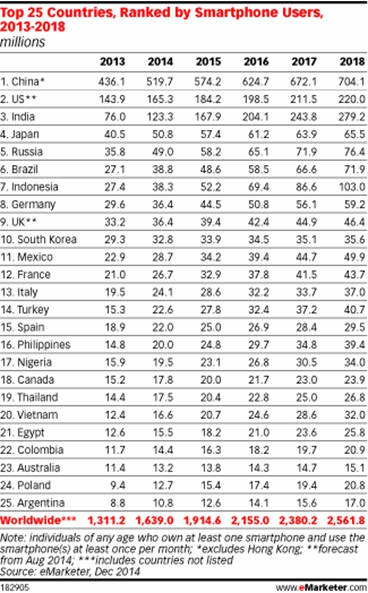

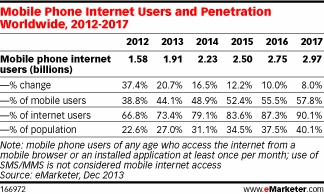

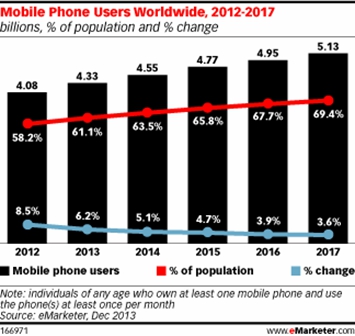

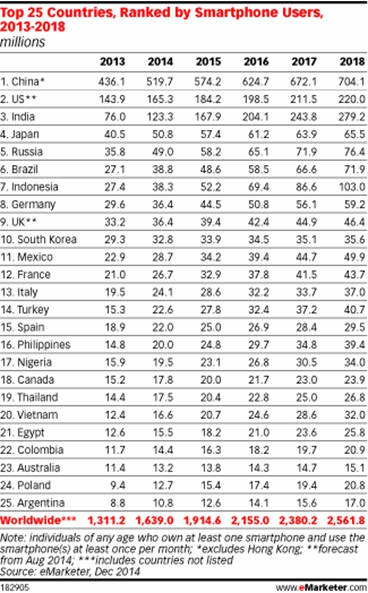

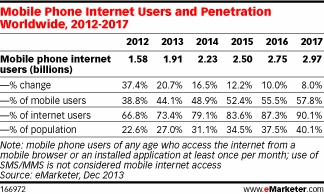

Our product is an add-on device suitable for smartphones. The estimation is that nowadays there are about 2.5 billion smartphone devices worldwide, based on Gartner. The growth rate is about 10% per year. So, at the end of 2018, the amount of devices should be more than 3 billion. We estimate that our product will be of interest to the high end early adaptors which are estimated to be 22% of the Smartphone users. Based on this statistics, we estimated a penetration rate of 0.055% in the first 3 years of the company activity which means about 370K POMM units sold till 2018.

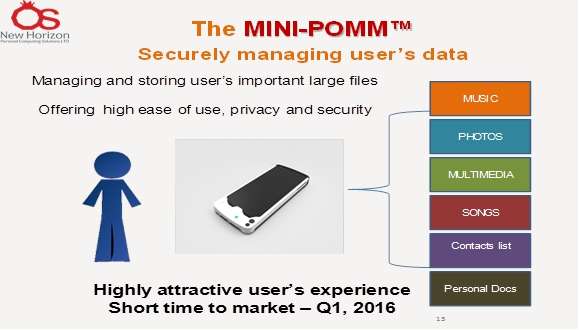

Lawyers and CPAs market size in USA and EU till 2018 is estimated to be 12M people. Since it will be quite complicated to educate the markets, we anticipate only 133K accumulated POMM units sold till 2018. According to all the above forecasts in all markets the accumulated POMM units will reach 500K POMM units sold till the end of 2018. The Company’s plan is to begin the sales in Q3 of 2016 with consumers’ based application for privacy such as secured gallery, secured document and secured notes and passwords. This will bring utterly new concept and products to the consumer market. We believe that we will have a lot of customers as the situation today is lack of privacy in the modern and digital world.

Based on all assumptions above the company forecast sales of approximately $55,000,000 in the year 2018 and operating profit of 20%.

RISK FACTORS

The investment opportunity offered in this document may not be suitable for all recipients of this document. Prior to investing, you should consult professional advisers who specialize in advising on investments of this nature.

This section “Risk Factors” contains what the Company believes to be the principal risk factors associated with an investment in the Company. In addition to the other information contained in this document, these risk factors should be considered carefully in evaluating whether to make an investment in the Company. If any of the following risks, which are not exhaustive, were to materialize, the Company’s business, financial condition, results or future operations could be materially adversely affected. Additional risks and uncertainties not presently known to the Company, or which the Company currently deem immaterial, may also have an adverse effect on the Company. Prospective investors should carefully consider the other information in this document. The risks listed below do not necessarily comprise all the risks associated with an investment in the Company and are not set out in any order of priority.

Risks Related to the Company’s Business

The Company is a Development STAGE company and we may be unable to keep pace with rapid industry, technological and market changes.

The markets in which we compete are characterized by rapid technological change, frequent new product introductions, evolving industry standards and changing needs of customers. Protection of personal information, access to customer data and other business and personal privacy concerns are major issues. We intend to spend a considerable amount of money on research and development and introduce new products from time to time. There can be no assurance that enhancements to existing products and solutions or new products and solutions will receive customer acceptance. As competition in the data protection industry increases, it may become increasingly difficult for us to maintain a technological advantage and to leverage that advantage toward increased revenues and profits. In addition, there can be no assurance that our vision of data protection on smartphones through our POMM platform will be accepted or validated in the marketplace.

Risks associated with the development and introduction of new products include delays in development and changes in data storage, networking virtualization, infrastructure management, information security and operating system technologies which could require us to modify existing products. Risks inherent in the transition to new products include:

| ● | the difficulty in forecasting customer preferences or demand accurately; |

| |

| ● | the inability to expand production capacity to meet demand for new products; |

| | |

| ● | the inability to successfully manage the interoperability and transition from older products; |

| |

| ● | the impact of customers’ demand for new products on the products being replaced, thereby causing a decline in sales of existing products and an excessive, obsolete supply of inventory; |

| | |

| ● | delays in initial shipments of new products; and |

| | |

| ● | delays in sales caused by the desire of customers to evaluate new products for extended periods of time. |

Further risks inherent in new product introductions include the uncertainty of price-performance relative to products of competitors and competitors’ responses to such new product introductions. Our failure to introduce new or enhanced products on a timely basis, keep pace with rapid industry, technological or market changes or effectively manage the transition to new products or new technologies could have a material adverse effect on our business, results of operations or financial condition.

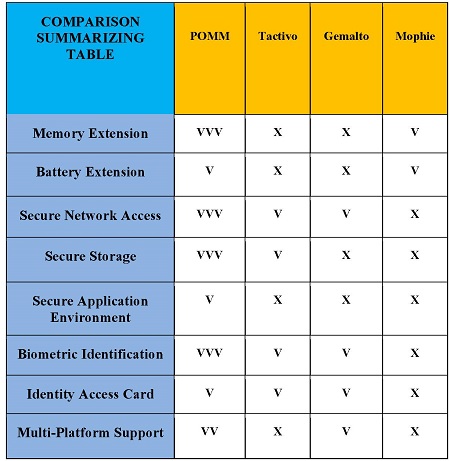

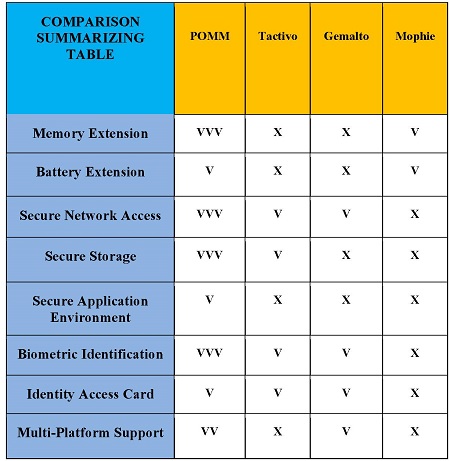

The Company operates in a competitive environment. Many of the Company’s current and potential competitors have longer operating histories, greater name recognition, more employees, and significantly greater financial, technical, marketing, public relations and distribution resources than the Company. The competitive environment may require the Company to make changes in the Company’s products, pricing, licensing, services or marketing to maintain and extend the Company’s current brand and technology franchise. Price concessions or the emergence of other pricing or distribution strategies of competitors may diminish the Company’s revenues, impact the Company’s margins, or lead to a reduction in the Company’s market share, any of which will harm the Company’s business.

If we cannot successfully execute on our strategy and continue to develop, manufacture and market solutions that respond promptly to the security and storage needs of our customers, our business and operating results may suffer.

The security and storage markets are characterized by constant change and innovation, and we expect them to continue to evolve rapidly. Moreover, many of our customers operate in markets characterized by rapidly changing technologies and business models, which require them to develop and manage increasingly complex enterprise networks, incorporating a variety of hardware, software applications, operating systems and networking protocols. Our historical success has been based on our ability to identify common customer needs and design solutions to address complex IT problems in email security and web security, and more recently in backup. Furthermore, our sales and marketing initiatives are primarily focused on higher-growth segments within the security and storage markets. To the extent we are not able to continue to identify IT challenges and execute our business model to timely and effectively design and market solutions to address these challenges, as well as to continue to expand our sales to higher-growth segments within the security and storage markets, our business, operating results and financial condition will be adversely affected.

Although the market expects rapid introduction of new solutions or enhancements to respond to new threats and address evolving customer needs, the development of these solutions is difficult, and the timetable for commercial release and availability is uncertain as there are periods of delay between releases and the availability of new solutions. We may experience delays in the development and availability of new solutions and fail to timely meet customer needs. If we fail to respond to the rapidly changing and rigorous needs of our customers by developing and making available on a timely basis new solutions or enhancements that can respond adequately to new security threats and address evolving customer needs, particularly in the higher-growth segments within the security and storage markets, our competitive position and business prospects will be harmed.

Additionally, the process of developing new technology is complex and uncertain, and if we fail to accurately predict customers’ changing needs and emerging technological trends or if we fail to achieve the benefits expected from our investments, our business could be harmed. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position and we must commit significant resources to developing new solutions before knowing whether our investments will result in solutions the market will accept. Our new solutions or solution enhancements could fail to attain sufficient market acceptance for many reasons, including:

| ● | delays in releasing our new solutions or enhancements to the market; |

| ● | failure to accurately predict market demand or customer demands; |

| ● | inability to protect against new types of attacks or techniques used by hackers; |

| ● | defects, errors or failures in their design or performance; |

| ● | negative publicity about their performance or effectiveness; |

| ● | introduction or anticipated introduction of competing solutions by our competitors; |

| ● | poor business conditions for our customers, causing them to delay IT purchases; |

| ● | the perceived value of our solutions or enhancements relative to their cost; |

| ● | easing of regulatory requirements around security or storage; and |

| ● | reluctance of customers to purchase solutions incorporating open source software. |

There can be no assurance that we will successfully identify new opportunities, develop and bring new solutions to market on a timely basis or achieve market acceptance of our solutions, or that solutions and technologies developed by others will not render our solutions or technologies obsolete or noncompetitive, all of which could adversely affect our business and operating results. If our new solutions or enhancements do not achieve adequate acceptance in the market, or if our new solutions do not result in increased sales, our competitive position will be impaired, our revenue will be diminished and the negative impact on our operating results may be particularly acute because of the upfront research, development, marketing, sales and other expenses we incurred in connection with the new solution or enhancement.

Significant developments in the security and storage of information in mobile computing and smartphones, particularly cloud storage and security and other alternative security and storage technologies, may materially adversely affect the demand for our products.

Developments or changes in the security and storage of information in mobile computing and smartphones, such as the emergence of hosted and more secure cloud storage, software as a service and mobile data access, are driving significant changes in storage in smartphone and computer architectures and solution requirements as well as presenting significant challenges in the security market, which may materially and adversely affect our business and prospects in ways we do not currently anticipate. The impact of these trends on overall long-term growth patterns is uncertain, especially in resource-constrained environments. The emergence of cloud computing and other alternative security and storage technologies, in which technology services are provided on a cloud server or other remote-access basis, may have a significant impact on the market for security and storage solutions on the POMM platform and may result in rapid changes in customer demands. This could be the case even if such advances do not deliver all of the benefits of our solutions. If alternative models gain traction, any failure by us to develop new or enhanced technologies or processes, or to react to changes or advances in existing technologies, could adversely affect our business and operating results.

We will introduce two standalone versions of pomm and will continue to introduce, new security and storage solutions but we may not gain broad market acceptance for our current products and our new solutions.

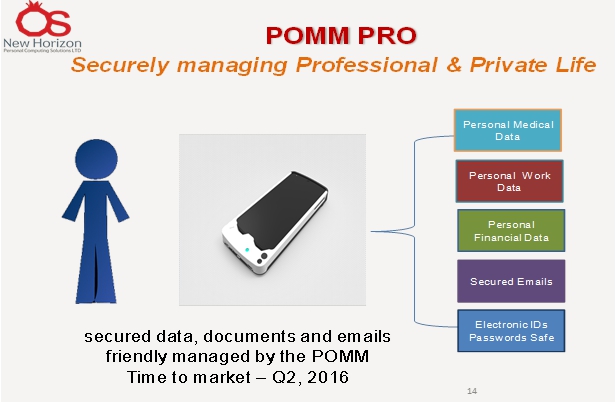

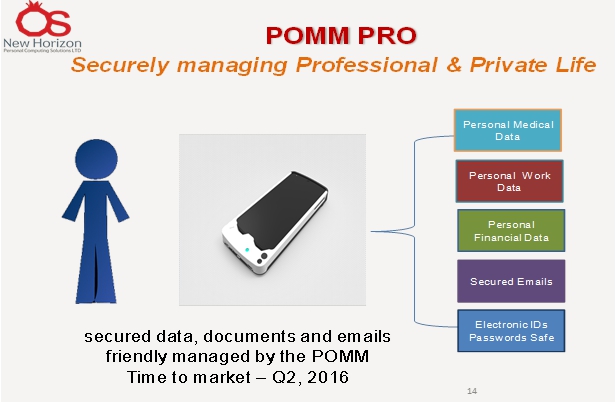

We will first launch MiniPOMM to general consumers and then later we will introduce POMM-Pro to professionals such as lawyers, accountants, brokers, managers and consultants. We will continue to release new security and storage solutions and enhanced versions of our two (2) existing POMM platforms, however, we cannot guarantee that we will be able to meet the markets’ demand in security and storage, to incorporate additional features, improve functionality or deliver other enhancements in order to meet our customers’ rapidly evolving smartphone privacy and storage needs. The return on our investments in MiniPOMM and POMM-Pro may be lower, or may develop more slowly, than we expect. Further, given their recent development and introduction, we cannot assure you that these solutions will gain broad market acceptance and that they will prove to be profitable in the longer term. Additionally, we intend to continue introducing new smartphone security and storage solutions to respond to the needs of our customers. If we fail to achieve high levels of market acceptance for these solutions or if market acceptance is delayed, or if the market segments we address with our new solutions do not grow as expected, we may fail to justify the amount of our investment in developing and bringing them to market, and our business, operating results and financial performance could be adversely affected.

We rely on third-party distributors and channel partners to sell our products. If our distributors and reseller channel partners fail to perform, our ability to sell our products will be limited, and, if we fail to optimize our distributor and reseller channel partner model going forward, our operating results will be harmed.

Substantially all of our sales orders are fulfilled by our channel partners, which include distributors and resellers. We also depend upon our channel partners to manage the customer sales process and to generate sales opportunities. To the extent our channel partners are unsuccessful in fulfilling our sales, managing the sales process or selling our solutions, or we are unable to enter into arrangements with, and retain a sufficient number of high-quality, motivated channel partners in each of the regions in which we sell our offerings, our ability to sell our POMM platforms and operating results will be harmed. In order to support our growth strategy, we continue to expand our channel partner network, both in the United States and internationally. If we are unable to successfully develop new channel partner relationships, or if we experience reseller shifts between distributors or any channel conflict occurs, it could negatively impact our ability to meet our revenue and profitability goals.

Our channel partners may be unsuccessful in marketing, selling and supporting our POMM platforms. They may also market, sell and support products that are competitive with ours, and may devote more resources to the marketing, sales and support of such products. We cannot assure you that we will retain these channel partners, that channel partners will sell our products effectively or that we will be able to secure additional or replacement channel partners. The loss of one or more of our significant channel partners or a decline in the number or size of orders from them could harm our operating results. In addition, our channel partner sales structure could subject us to lawsuits, potential liability, and reputational harm if, for example, any of our channel partners misrepresent the functionality of our solutions to customers or violate laws or our corporate policies.

We rely on A limited number of sources for some of our components. Insufficient supply and inventory may result in lost sales opportunities or delayed revenue, while excess inventory may harm our gross profit.

We intend to seek several experienced manufacturers in China to produce our hardware and our plastic molding for housing, as well as product integration and quality control. We intend to sign with two (2) subcontractors: one, to fulfill the production and testing of our POMM electronic circuit board and the other for producing the plastic molding for the housing. Since we will rely on a limited number of manufacturers and we are a start-up company, we may not receive the best market prices.

In addition, our inventory management systems and related supply chain visibility tools may be inadequate to enable us to forecast accurately and effectively manage the supply of our components. Additionally, we carry very little inventory of our POMM components, and we rely on our suppliers to deliver necessary POMM components in a timely manner. Insufficient supply levels may lead to shortages that result in delayed revenue or loss of sales opportunities altogether as potential customers turn to competitors’ products that could be more readily available. Additionally, any increases in the time required to manufacture our POMM components could adversely affect our business, brand, sales cycle and reputation. If we are unable to effectively manage our supply and inventory, our operating results could be adversely affected.

Since we anticipate depending on a limited number of sources for POMM components used in the manufacture of our POMM platforms, we are subject to the risk of shortages in supply of these components and the risk that component suppliers discontinue or modify components used in our POMM components. If these suppliers were to discontinue production of a necessary part or component, we would be required to expend resources and time in locating and integrating replacement parts or components from another vendor. Our reliance on a limited number of suppliers involves a number of additional risks, including risks related to:

| ● | supplier capacity constraints; |

| ● | failure of a key supplier to remain in business and adjust to market conditions; |

| ● | delays in, or the inability to execute on, a supplier roadmap for components and technologies; and |

In addition, for certain components, we are subject to potential price increases and limited availability as a result of market demand for these components. In the past, unexpected demand for computer and network products has caused worldwide shortages of certain electronic parts. If similar shortages occur in the future, our business could be adversely affected. We rely on purchase orders rather than long-term contracts with these suppliers, and as a result we might not be able to secure sufficient components, even if they were available, at reasonable prices or of acceptable quality to build POMM components in a timely manner and, therefore, might not be able to meet customer demands for our solutions, which would have a material and adverse effect on our business, operating results and financial condition.

Assertions by third parties of infringement or other violations by us of their intellectual property rights, or other lawsuits brought against us, could result in significant costs and substantially harm our business and operating results.

POMM Inc. and its subsidiary have substantial intellectual property assets. POMM Inc.'s subsidiary currently has four (4) patents, eight (5) similar international pending patents and 4 provisional patents. Patent and other intellectual property disputes are common in advanced biometry-based authentication and privacy management solutions. Some companies in the industry in which we compete, including some of our competitors, own large numbers of patents, copyrights, trademarks and trade secrets, which they may use to assert claims of infringement, misappropriation or other violations of intellectual property rights against us. There also is a market for intellectual property rights and a competitor, or other entity, could acquire intellectual property rights and assert similar claims based on the acquired intellectual property rights. They may also assert such claims against our customers or channel partners. As the number of patents and competitors in our market increase and overlaps occur, claims of infringement, misappropriation and other violations of intellectual property rights may increase. From time to time, we face allegations that we, our customers or our channel partners have infringed, misappropriated and violated intellectual property rights, including allegations made by our competitors or by non-practicing entities. Any claim of infringement, misappropriation or other violation of intellectual property rights by a third party, even those without merit, could cause us to incur substantial costs defending against the claim and could distract our management from our business.

In addition, future assertions of patent rights by third parties, and any resulting litigation, may involve non-practicing entities or other adverse patent owners who have no relevant revenue and against whom our own patents may therefore provide little or no deterrence or protection. We cannot assure you that we are not infringing or otherwise violating any third-party intellectual property rights.

An adverse outcome of a dispute may require us to, among other things, pay substantial damages including treble damages if we are found to have willfully infringed a third party’s patents or copyrights; cease making, using, selling, licensing, importing or otherwise commercializing POMM platform that are alleged to infringe or misappropriate the intellectual property rights of others; expend additional development resources to attempt to redesign our solutions or otherwise to develop non-infringing technology, which may not be successful; enter into potentially unfavorable royalty or license agreements in order to obtain the right to use necessary technologies or intellectual property rights or have royalty obligations imposed by a court; and indemnify our customers, partners and other third parties. Furthermore, we have agreed in certain instances to defend our channel partners against third-party claims asserting infringement of certain intellectual property rights, which may include patents, copyrights, trademarks or trade secrets, and to pay judgments entered on such claims. Any damages or royalty obligations we may become subject to, any prohibition against our commercializing our solutions and any third-party indemnity we may need to provide, as a result of an adverse outcome could harm our operating results.

If our security measures are breached or unauthorized access to customer data is otherwise obtained or our customers experience data losses, our brand, reputation and business could be harmed and we may incur significant liabilities.

Our customers rely on our biometry-based user-enhanced authentication and privacy management solutions to secure and store their data, which may include financial records, credit card information, business information, customer information, health information, other personally identifiable information or other sensitive personal information. A breach of our network security and systems or other events that cause the loss or public disclosure of, or access by third parties to, our customers’ stored files or data could have serious negative consequences for our business, including possible fines, penalties and damages, reduced demand for our solutions, an unwillingness of our customers to use our solutions, harm to our brand and reputation, and time-consuming and expensive litigation. The techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently, often are not recognized until launched against a target, and may originate from less regulated or remote areas around the world. As a result, we may be unable to proactively prevent these techniques, implement adequate preventative or reactionary measures, or enforce the laws and regulations that govern such activities. In addition, because of the large amount of data that we store for our customers, it is possible that hardware failures, human errors or errors in our systems could result in data loss or corruption, or cause the information that we collect to be incomplete or contain inaccuracies that our customers regard as significant. If our customers experience any data loss, or any data corruption or inaccuracies, whether caused by security breaches or otherwise, our brand, reputation and business could be harmed.

If an actual or perceived breach of network security occurs in our internal systems, our services may be perceived as not being secure and clients may curtail or stop using our solutions.

As a provider of network security solutions, we are a high profile target and our networks and solutions may have vulnerabilities that may be targeted by hackers and could be targeted by attacks specifically designed to disrupt our business and harm our reputation. We will not succeed unless the marketplace continues to be confident that we provide effective network and security protection. If an actual or perceived breach of network security occurs in our internal systems it could adversely affect the market perception of our solutions. We may not be able to correct any security flaws or vulnerabilities promptly, or at all. In addition, such a security breach could impair our ability to operate our business, including our ability to provide subscription and support services to our customers. If this happens, our business and operating results could be adversely affected.

Our business is subject to the risks of warranty claims and product liability claims, any of which may adversely affect our operating results and financial performance.

Our POMM platforms may contain undetected defects or errors, especially when we first introduce MiniPOMM or POMM-Pro or when new versions are released. Defects or errors could affect the performance of our POMM platforms and could delay the development or release of new products or new versions of solutions, adversely affect our reputation and our customers’ willingness to buy products from us and adversely affect market acceptance or perception of our offerings. Any such errors or delays in releasing new products and solutions or new versions or allegations of unsatisfactory performance could cause us to lose revenue or market share, cause us to incur substantial costs in redesigning our POMM platforms, cause us to lose significant customers, subject us to liability for damages and divert our resources from other tasks, any one of which could materially and adversely affect our business, operating results and financial condition. In addition, the occurrence of hardware or software errors which resulted in increased warranty or support claims could result in increased expenses or require us to maintain greater warranty reserves which would have an adverse effect on our business and financial performance.

Actual, possible or perceived defects or vulnerabilities in our products or services, the failure of our products or services to prevent a virus or security breach, or misuse of our products could harm our reputation and divert resources.

Because our POMM products and services are complex, they may contain defects or errors that are not detected until after their commercial release and deployment by our customers. Defects or vulnerabilities may impede or block network traffic or cause our products or services to be vulnerable to electronic break-ins or cause them to fail to help secure networks. We cannot ensure that our products will prevent all security threats. Because the techniques used by computer hackers to access or sabotage networks change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques. In addition, defects or errors in our POMM updates or our POMM hardware could result in a failure of our POMM products to effectively update end-customers’ vulnerability to attacks. Furthermore, our solutions may also fail to detect or prevent viruses, worms or similar threats due to a number of reasons such as the evolving nature of such threats and the continual emergence of new threats that we may fail to add to our POMM databases in time to protect our end-customers’ data.

An actual, possible or perceived security breach or infection of the database one of our end-customers, regardless of whether the breach is attributable to the failure of our products or services to prevent the security breach, could adversely affect the market’s perception of our security products and services and, in some instances, subject us to potential liability that is not contractually limited. We may not be able to correct any security flaws or vulnerabilities promptly, or at all. Our products may also be misused by end-customers or third parties who obtain access to our products. Any actual, possible, or perceived defects, errors or vulnerabilities in our products, or misuse of our products, could result in:

| ● | expenditure of significant financial and product development resources in efforts to analyze, correct, eliminate or work-around errors or defects or to address and eliminate vulnerabilities; |

| ● | loss of existing or potential end-customers or channel partners; |

| ● | delayed or lost revenue; |

| ● | delay or failure to attain market acceptance; |

| ● | negative publicity, which will harm our reputation; and |

| ● | litigation, regulatory inquiries or investigations that may be costly and harm our reputation and, in some instances, subject us to potential liability that is not contractually limited. |

RISKS RELATING TO EARLY STAGE DEVELOPMENT

Our POMM platform is in early stage development. Our core technology consists of two elements, a biometrically managed, highly secured, large-volume personal data storage device attached the customer’s smartphone and a Secured Trusted Gateway (STG) that enables POMM customers to communicate safely with service providers via the internet and cellular networks. Because our core technology is in the early stages of development, currently there are no standard-setting bodies or market-wide standards or specifications for secured data protection with similar hardware and software like the POMM platform. As a result, there are a number of competing technologies for data protection, including for identity, security, access and privacy applications, some of which could be given preference over our POMM platform. In addition, most of the information that is secured by the general public is over the Cloud since there is essentially unlimited storage space. There have been significant security breaches over the Cloud. If security and data protection becomes more secure over the Cloud it may affect the marketability and demand for our POMM platform and require us to make significant investment in our hardware and software to improve our POMM platform. We may also experience lower than anticipated prices due to intense competition or lower demand for our products if other data protection technologies develop that are cheaper or more secure than our products.

Managing inventory of our products and product components is complex. Insufficient inventory may result in lost sales opportunities or delayed revenue, while excess inventory may harm our gross margins.

Managing our inventory is complex. Our channel partners may increase orders during periods of product shortages, cancel orders or not place orders commensurate with our expectations if their inventory is too high, return products or take advantage of price protection (if any is available to the particular partner), or delay orders in anticipation of new products. They also may adjust their orders in response to the supply of our products and the products of our competitors that are available to them and in response to seasonal fluctuations in end-customer demand. Furthermore, if the time required to manufacture certain products or ship products increases for any reason, this could result in inventory shortfalls.

Our inventory management systems and related supply chain visibility tools may be inadequate to enable us to effectively manage inventory. Inventory management remains an area of focus as we balance the need to maintain inventory levels that are sufficient to ensure competitive lead times against the risk of inventory obsolescence because of rapidly changing technology and customer requirements. If we ultimately determine that we have excess inventory, we may have to reduce our prices and write-down inventory, which in turn could result in lower gross margins. Alternatively, insufficient inventory levels may lead to shortages that result in delayed revenue or loss of sales opportunities altogether as potential end-customers turn to competitors’ products that are readily available. If we are unable to effectively manage our inventory and that of our channel partners, our results of operations could be adversely affected.

Our dependence on the core management team and key personnel

Our future success depends in part on the loyalty of our existing core senior management team, which has managed our business for a substantial period of time and has significant experience in the industry, as well as on other key personnel, particularly in the areas of research and engineering, product development, marketing, production, supply chain management, financial management and human resources management, as well as privacy management solutions. If we lose the services of one or more of our core senior managers or key employees, or if one or more of them decide to join a competitor or otherwise compete directly or indirectly with POMM we may not be able to manage our business as efficiently as in the past, which could prevent us from growing as quickly or as profitably as we hope.

David Freidenberg and Gila Fish are key employees and may not be replaced. We do not have a key man insurance but intend to purchase one after the closing of this Offering.

Our operating results may be adversely affected as a result of unfavorable market, economic, social and political conditions.

An unstable global economic, social and political environment, including hostilities and conflicts in various regions outside the U.S., natural disasters, currency fluctuations, country specific operating regulations and potential fallout from the disclosures related to the U.S. Internet and communications surveillance may have a negative impact on demand for our services, our business and our foreign operations. More generally, the economic, social and political environment has impacted or may negatively impact, among other things:

| ● | our customers’ demand for our products and services; |

| ● | current and future demand for our products including decreases as a result of reduced spending on information technology and communications by our customers; |

| ● | price competition for our products and services; |

| ● | our ability to service our debt, to obtain financing or assume new debt obligations; and |

| ● | our ability to obtain payment for outstanding debts owed to us by our customers or other parties with whom we do business. |

In addition, to the extent that the economic, social and political environment impacts specific industry and geographic sectors in which many of our customers are concentrated, that may further negatively impact our business. If the market, economic, social and political conditions in the U.S. and globally do not improve, or if they deteriorate, we may experience material adverse impacts on our business, operating results, financial condition and cash flows as a consequence of the above factors or otherwise.

risks relating to our international activities

Given that we have a subsidiary based in Israel and we intend to do business internationally, we are subject to a number of political, regulatory and trade risks, including:

| ● | restrictions on the repatriation of capital, in particular regulations relating to transfer pricing and withholding taxes on payments made by subsidiaries and joint ventures; |

| ● | unexpected regulatory reforms; |

| ● | longer accounts receivable payment cycles and difficulties in collecting accounts receivable in certain countries; and |

| ● | limited legal protection of intellectual property rights in certain countries. |

We cannot guarantee that we will be able to manage these risks, many of which are outside our control, or that we will be able to ensure compliance with all applicable regulations without incurring additional costs. In addition, a significant portion of our manufacturing is based in China, and therefore, conducting business in such a country poses particular risks such as price fluctuation, limited supplies of resources, protection of intellectual property, political instability and other risks, which may not arise in other parts of the world.

WE ARE A START-uP EMERGING GROWth BUSINESS and HAVE LIMITED OPERATING HISTORY AND FACE MANY OF THE RISKS AND DIFFICULTIES FREQUENTLY ENCOUNTERED BY DEVELOPMENT STAGE COMPANY.

We have a limited operating history, and to date, our efforts have been focused primarily on the development and marketing of our business model. We have limited operating history for investors to evaluate the potential of our business development. We have not extensively built our customer base or our brand name. In addition, we also face many of the risks and difficulties inherent in gaining market share as a new company, including:

| ● | Increasing awareness of our brand name; |

| ● | Meeting customer demand and standards; |

| ● | Attaining customer loyalty; |

| ● | Developing and upgrading our product offerings; |

| ● | Implementing our advertising and marketing plan; |

| ● | Maintaining our current strategic relationships and developing new strategic relationships; |

| ● | Responding effectively to competitive pressures; and |

| ● | Attracting, retaining and motivating qualified personnel. |

Our future will depend on our continued ability to bring our products to the marketplace, which requires careful planning of providing a product that meets customer standards without incurring unnecessary cost and expense.

our financial projections contained in the OFFERING CIRCULAR are subject to a high degree of uncertainty.

Our financial projections contained in the Offering Circular were prepared by the company`s management. Our financial projects are based upon estimates of future events and circumstances that may or may not ultimately prove to be true or accurate. The underlying estimates and assumptions are subject to significant economic and competitive uncertainties and contingencies, many or all of which are beyond our control. We can make no representation or warranty as to the accuracy of these assumptions. Our financial projections have not been prepared or reviewed by independent auditors or accountants. There can be no assurance that our projections will or can be realized and actual results may differ materially from those set forth in our projections. Because of the above limitations on these projections, investors are cautioned against placing undue reliance on them.

The market studies described in the Memorandum were RANDOMLY CHOSEN OUT OF VARIOUS RESEaRCH sites and are not independent OR ALWAYS RELEVANT.

Our market studies were not prepared by or reviewed by an independent source. The results of these studies may not be representative or indicative of the actual consumer response to our products. There can be no assurance that the Company’s projections will or can be realized and actual results may differ materially from those set forth in our projections. Because of the above limitations, investors are cautioned against placing undue reliance on these market studies.

The implementation of our business strategy will require significant expenditure of capital and will require additional financing.

There is a minimum offering amount and the implementation of our business strategy will require significant expenditures of capital, and we will require additional financing in the near future. Additional funds may be sought through equity or debt financings. We cannot offer any assurances that commitments for such financings will be obtained on favorable terms, if at all. AS OF THE DATE OF THIS OFFERING CIRCULAR, WE HAVE LIMITED FUNDS. Equity financings could result in dilution to holders and debt financing could result in the imposition of significant financial and operational restrictions on us. Our inability to access adequate capital on acceptable terms could have a material adverse effect on our business, results of operations and financial condition.

OUR FUTURE GROWTH WILL REQUIRE THE RECRUITMMENT OF ADDITIONAL QUALIFIED EMPLOYEES AND THERE IS NO ASSURANCE THAT WE WILL BE ABLE TO FIND SUCH EMPLOYEES ON ACCEPTABLE TERMS.

In the event of our future growth, we may have to increase the depth and experience of our management team by adding new members. Our future success will depend to a large degree upon the active participation of our key officers and employees. We must hire a significant amount of employees to build out our infrastructure technology department for research and development and engineering. There is no assurance that we will be able to employ additional qualified persons on acceptable terms. Lack of qualified employees may adversely affect our business development.

we have arbitrarily determined the offering price for the Shares OF OUR COMMON STOCK.

We have arbitrarily determined the offering price for the shares of common stock. There is no present market for the shares of common stock. The offering price for such shares of common stock should not be considered an indication of the actual value of such shares of common stock and is not based on our net worth or prior earnings. We cannot assure you that such shares of common stock could be resold by you at the price you have paid or at any other price.

ESTABLISHING A NEW BRAND REQUIRES AN EFFECTIVE MARKETING AND PRODUCT PLACEMENT WHICH MAY TAKE A LONG PERIOD OF TIME.

Our principal business strategy is to develop our products as a respected brand within the industry in which they are sold. The marketing of consumer goods is highly dependent on creating favorable consumer perception. We intend to hire an advertising and public relations firm to represent us in the future. However, to date, we have not entered into any agreements to retain a firm to provide such services. Competitors have significantly greater advertising resources and experience and enjoy well-established brand names. There can be no assurance that our initial advertising and promotional activities will be successful in creating the desired consumer perception.

The occurrence of natural disasters or acts of violence or terrorism could adversely affect our operations and financial performance.

The occurrence of natural disasters or acts of violence or terrorism could result in physical damage to our properties, the temporary closure of stores or distribution centers, the temporary lack of an adequate work force, the temporary or long-term disruption in the supply of products (or a substantial increase in the cost of those products) from domestic or foreign suppliers, the temporary disruption in the delivery of goods to our distribution centers (or a substantial increase in the cost of those deliveries), the temporary reduction in the availability of products in our stores, and/or the temporary reduction in visits to stores by customers. If one or more natural disasters or acts of violence or terrorism were to impact our business, we could, among other things, incur significantly higher costs and longer lead times associated with distributing products. Furthermore, insurance costs associated with our business may rise significantly in the event of a large scale natural disaster or act of violence or terrorism.

We are a holding company with no operations of our own, and we depend on our subsidiaries for cash flow.

We are a holding company and do not have any material assets or operations other than ownership of equity interests of our subsidiaries. Our operations are conducted almost entirely through our subsidiaries, and our ability to generate cash to meet our obligations or to pay dividends is highly dependent on the earnings of, and receipt of funds from, our subsidiaries through dividends or intercompany loans. The ability of our subsidiaries to generate sufficient cash flow from operations to allow us and them to make scheduled payments on our obligations will depend on their future financial performance, which will be affected by a range of economic, competitive and business factors, many of which are outside of our control. We cannot assure you that the cash flow and earnings of our operating subsidiaries will be adequate for our subsidiaries to service their debt obligations. If our subsidiaries do not generate sufficient cash flow from operations to satisfy corporate obligations, we may have to: undertake alternative financing plans (such as refinancing), restructure debt, sell assets, reduce or delay capital investments, or seek to raise additional capital. We cannot assure you that any such alternative refinancing would be possible, that any assets could be sold, or, if sold, of the timing of the sales and the amount of proceeds realized from those sales, that additional financing could be obtained on acceptable terms, if at all, or that additional financing would be permitted under the terms of our various debt instruments then in effect. Furthermore, we and our subsidiaries may incur substantial additional indebtedness in the future that may severely restrict or prohibit our subsidiaries from making distributions, paying dividends or making loans to us.

Risks Related to Our Common Stock

YOU MAY EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 500,000,000 shares of common stock, par value $0.00001 per share. We are currently authorized to issue an aggregate of 10,000,000 shares of series A preferred stock, par value $0.00001 per share.

The company also has an active stock option plan (the “Plan”) to incentivize employees and the exercise of the preferred shares allocated under the Plan may also dilute our shareholders.

We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes. The future issuance of any such additional shares of our common stock or other securities may create downward pressure on the future trading price of our common stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes, including at a price (or exercise prices) below the price at which shares of our common stock are then quoted on a quotation system or stock exchange.JSBarkats and Sunny Barkats our securities counsel was issued as part of his engagement a 2.5% stake in the Company that shall not be diluted during the term of the Offering.

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT THE COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE, THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is no established public trading market for our common stock. Our shares are not and have not been listed or quoted on any exchange or quotation system. There is no public market for Regulation A+ shares and they can be no assurances that in the future a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate his or her investment.

WE DO NOT EXPECT TO PAY DIVIDENDS FOR SOME TIME, WHICH COULD RESULT IN NO RETURN ON YOUR INVESTMENT.

We have never declared or paid cash dividends on our common stock. We currently intend to retain our earnings, if any, to provide funds for the operation and expansion of our business and, therefore, do not anticipate declaring or paying cash dividends in the foreseeable future. Any payment of future dividends will be at the discretion of the Company’s board of directors and will depend upon, among other things, our earnings, financial condition, capital requirements, level of indebtedness, contractual restrictions with respect to the payment of dividends and other relevant factors of our operations.

DILUTION

If you invest in our shares, your interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our capital stock after this Offering. Our net tangible book value (deficit) as of September 30, 2015 was $1,110,000, or $0.92 per share of outstanding common stock. Without giving effect to any changes in the net tangible book value after September 30, 2015 other than the sale of 802,065 shares in this Offering at the initial public offering price of $12.47 per share, our pro forma net tangible book value as of September 30, 2015 would be $6,528,000 or $3.16 per share. Dilution in net tangible book value per share represents the difference between the amount per share paid by the purchasers of our shares in this Offering and the net tangible book value per share of our capital stock immediately afterwards. This represents an immediate increase of $4.08 per share of capital stock to existing shareholders and an immediate dilution of $9.31 per share of common stock to the new investors, or approximately 75% of the assumed initial public offering price of $12.47 per share. The following table illustrates this per share dilution:

| | | Maximum Offering | |

| Initial price to public | | $ | 12.47 | |

| Net tangible book value as of September 30, 2015 | | | (0.92 | ) |

| Increase in net tangible book value per share attributable to new Investors | | | 4.08 | |

| As adjusted net tangible book value per share after this Offering | | | 3.16 | |

| Dilution in net tangible book value per share to new investors | | $ | 9.31 | |

The following table summarizes the differences between the existing shareholders and the new investors with respect to the number of shares of common stock purchased, the total consideration paid, and the average price per share paid, on a maximum offering basis:

Maximum Offering:

| | | Shares Purchased | | | Total Consideration | | | Average Price Per | |

| | | Number | | | Percent | | | Amount | | | Percent | | | Share | |

| Founders | | | 149,488 | | | | 18.7 | % | | | 1,864,115 | | | | 18.7 | % | | $ | 12.47 | |

| New investors | | | 652,577 | | | | 81.3 | % | | | 8,137,635 | | | | 81.3 | % | | $ | 12.47 | |

| Total with reselling shareholders | | | 802,065 | | | | 100.0 | % | | | 10,001,750 | | | | 100.0 | % | | $ | 12.47 | |

| (1) | Shares offered by existing Shareholders will be up to 149,488 shares but in no case more than 30 percent of the shares sold. |

USE OF PROCEEDS

We estimate that, at a per share price of $12.47, the net proceeds from the sale of the 802,065 Shares in the Maximum Offering will be approximately $7,637,635, after deducting the estimated offering expenses of approximately $500,000 and $1,864,115 after the existing shareholders resold of 149,488 of their Shares pursuant to this Offering.

The net proceeds of this Offering will be used primarily to fund the manufacturing and marketing of our POMM products including the hiring of employees for our expansion to the US markets as well as for general corporate purposes.

Accordingly, we expect to use the net proceeds as follows:

| | | Maximum Offering | |

| | | Amount | | | Percentage | |

| Manufacturing costs | | $ | 2,760,230 | | | | 36 | % |

| Engineering design and development | | | 4,030,393 | | | | 53 | % |

| Advertising | | | 1,360,270 | | | | 18 | % |

| G&A | | | 749,592 | | | | 10 | % |

| Working capital (1) | | | (1,262,850 | ) | | | (17 | )% |

| | | | | | | | | |

| TOTAL | | $ | 7,637,635 | | | | 100.0 | % |

| (1) | A portion of working capital will be used for officers’ salaries. |

To the extent that we sell more than 802,065 Shares, the additional net proceeds will be used for working capital.

BUSINESS

Company Overview:

POMM Inc. (“POMM” or the “Company”) is the Nevada corporation and owns 100% of OS New Horizon, Ltd, – Personal Computing Solutions Ltd., (the “Subsidiary”), which is the R & D division, developing advanced biometry-based, user-enhanced authentication, and privacy management solutions, while the holding corporation POMM commercializes the products.

The Company`s business activities are directed or supervised by its office in Atlanta, GA, which makes financial, business and sales decisions.

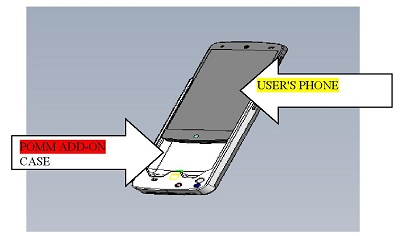

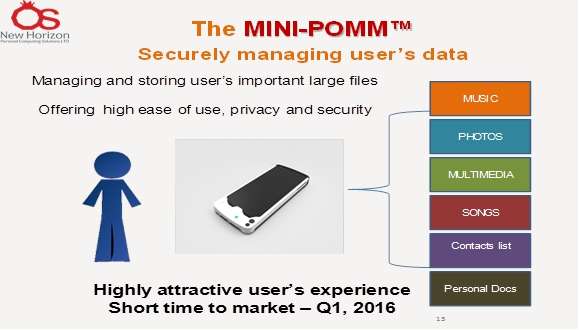

POMM and its Subsidiary’s main offering is their proprietary POMM™ (Privacy On My Mind) platform which is a unique, highly secured and isolated mobile private cloud, to be integrated with smartphones as a smartphone case and add-on. The POMM platform features a range of secured dedicated SW applications, developed and/or integrated by OS: large-volume data storage, video and music storage, galleries, chats, emails, passwords, contact lists etc. The Company believes that the owner of the POMM™ device will rest assured that his/her sensitive personal data is safe from hackers or other undesirable intruders, while he/she has immediate 24/7 access to this private information.

POMM System

The Company’s is focused on the secured privacy management and believe to be offeringa dual-product secured package concept, covered and protected by advanced multinational patents. (Attached here to as the "POMM PRO" and the "MINI POMM")

The POMM's core technology consists of two elements:

| | 1. | The POMM™ device – a biometrically managed, highly secured, large-volume personal data storage device, designed as a smartphone case and permanently attached to the user's smartphone. Using several advanced biometric sensors to perform owner authentication, the device also features a wellness status check – to prevent criminal coercion, and ensure that the accessing party is always the owner – alive and well and entering of his/her own free will. |

| 2. | The POMM system & environment – a Secured Trusted Gateway (STG) that enables POMM users to communicate safely with service providers via the internet and cellular networks. Authenticating identities at both ends, the secured POMM environment will allow the safe two-way exchange of private documents and transactions between the device owner and remote service providers – such as medical institutions, banks, investment houses and insurance companies. |

The current strategy focuses on standalone versions of the POMM™, MiniPOMM and POMMPro. The POMM environment is currently under development.

Our current R&D and engineering status is as follows:

| 1. | Electronic board: The developers of the POMM™ device have completed the full-scale integration of the selected CPU-based dedicated electronic board. The board's main components are 4 cores of advanced FreeScale iMX6 SOC CPUs - sampling and processing the outputs of the 6 integrated biometric sensors, managing peripherals and power, and controlling all data storage and IO functions. |

| 2. | Biometric sensors:Multiple biometricsensors have been incorporated into the POMM device, all resident on the electronic board. User authentication is enabled by: an imaging camera with active IR LED illumination for face recognition; an imaging camera with active IR LED illumination for palm pattern recognition; and recognition of the user's selected in-air 3D gesture. Other sensors monitor various physiological parameters - heartrate, blood oxygen saturation and body temperature – to ensure the user's aliveness, measure stress levels and prevent coercion. |

The full-scale design, integration and testing of the POMM™'s electronics were completed in the 1st half of 2015. All shown components reside on the electronic board and are encapsulated within its plastic double-wall environmentally sealed enclosure, designed as a smartphone case.

| 3. | Software:The POMM™'s S/W is based on the Linux advanced operating system, and consists of 4 main categories: |

| | | |

| | | Control(ready Q4 2015) - responsible for processing the APIs interacting with the smartphone's various dedicated secured applications. |

| | | |

| | | Data(ready Q4 2015) - responsible for storing and managing files and data objects in the POMM. The data management system includes: |

| a. | Secured data storage: the data received through the user's smartphone is transferred to the POMM's memory after preliminary encryption. This encryption is performed with highly secured encryption keys in a dedicated firmware-based encryption unit, stored inside the SOC processor's highly secured internal flash memory, and using a complex encryption algorithm. |

| b. | Secured data view: the encrypted data stored in the flash memory is transferred to the smartphone's memory through a secured view process, and displayed on the smartphone's screen after a preliminary decryption process. The transfer is performed by a secured decryption keys and a dedicated firmware-based data encryption unit stored inside the POMM processor's highly secured internal flash memory, and using a complex decryption algorithm. |

| c. | Filing: a file system and a SQL database enable storing, efficiently retrieving and managing all stored encrypted data objects. |

| | | Secure connection (ready Q4 2016) - responsible for secure communication with remote service providers. |

| | | |

| | | Biometry(ready Q4 2015) - responsible for biometric sensing and the entire procedure of user identification and authentication. The POMM supports VPN connections both by IPSEC and SSL, as well as SSL-secured encrypted communication with remote services and data providers. |

The biometric modules perform:

| a. | Enrollment:an initial user registration stage, generating and storing a biometric template of the user's footprint for each of the multiple biometric techniques – face recognition, palm view and 3D gesture – for future comparison. |

| b. | Authentication: Authenticating the user's identity by comparing the biometric template - created during the one-time enrolment process and stored in the Management Base module - with the biometric sample acquired by the sensors every time anyone tries to access the device. |

POMM Electronic Smartphone

Case

Background

In today's world, individuals are required to keep and manage substantial amounts of data of many different types: sensitive multimedia clips, photos, passwords, contact information, confidential medical and financial documents and much more. In all too many cases, however, and despite unending technological efforts, online data depositories are intruded upon, hacked and invaded, with very private information exposed to the public view.

Notable security breaches reported by the media have recently been the following: 1) publication of personal customer information taken from the Ashley Madison website in July 2015,12) publication of nude photos and lurid videos taken from celebrity cell phones from the iCloud system in August 2014 such as Jennifer Lawrence, Jude Law, Kate Upton (known as the “Fappening”),23) discovery of susceptible software facilitating hacking on over one billion Android phones3and 4) Sony Pictures suffering a large amount of theft of confidential data in October 2015.4

Many people entrust the Cloud with their personal information which may seem that such people have simply given up on privacy. However, recent studies indicate that this is not true for sensitive and private data as people all over the globe tend to be more conservative regarding sensitive information. Specifically, 50% of all Americans and 75% of all Europeans say they are unwilling to keep their health records in the Cloud, and about 58% of the Europeans say they would like an alternative solution.5The outcome of such market analyses, based on non-supported academic and government-needs studies initially compelled the Subsidiary to develop the POMM™.

1http://www.wired.com/2015/08/happened-hackers-posted-stolen-ashley-madison-data/

2http://www.cnn.com/2014/09/02/showbiz/hacked-nude-photos-five-things/

3http://www.npr.org/sections/alltechconsidered/2015/07/27/426613020/major-flaw-in-android-phones-would-let-hackers-in-with-just-a-text

4https://www.washingtonpost.com/news/the-switch/wp/2014/12/18/the-sony-pictures-hack-explained/

5SPECIAL EUROBAROMETER 359 Attitudes on Data Protection and Electronic

The Industry