Draft D5.1, Company Confidential

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________

FORM 10-Q

________________________________________________________________________

| | | | | |

| (Mark One) | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarter ended: June 30, 2020 | |

| or | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ____________to ____________ | |

Commission File Number 001-38598

________________________________________________________________________

BLOOM ENERGY CORPORATION

(Exact name of Registrant as specified in its charter)

________________________________________________________________________

| | | | | |

| Delaware | 77-0565408 |

| (Sate or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

| 4353 North First Street, San Jose, California | 95134 |

| (Address of principal executive offices) | (Zip Code) |

| |

| (408) 543-1500 | |

| (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Securities Exchange Act | | |

Title of Each Class(1) | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock $0.0001 par value | BE | New York Stock Exchange |

(1) Our Class B Common Stock is not registered but is convertible into shares of Class A Common Stock at the election of the holder. | | |

________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

The number of shares of the registrant’s common stock outstanding as of July 30, 2020 was as follows:

Class A Common Stock $0.0001 par value 103,162,077 shares

Class B Common Stock $0.0001 par value 29,391,554 shares

Draft D5.1, Company Confidential

Bloom Energy Corporation

Quarterly Report on Form 10-Q for the Three and Six Months Ended June 30, 2020

Table of Contents

| | | | | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

| Item 1 - Financial Statements (Unaudited) | |

| Condensed Consolidated Balance Sheets | |

| Condensed Consolidated Statements of Operations | |

| Condensed Consolidated Statements of Comprehensive Loss | |

| Condensed Consolidated Statements of Redeemable Noncontrolling Interest, Total Stockholders' Deficit and Noncontrolling Interest | |

| Condensed Consolidated Statements of Cash Flows | |

| Notes to Condensed Consolidated Financial Statements | |

| Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3 - Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4 - Controls and Procedures | |

| |

| PART II - OTHER INFORMATION | |

| Item 1 - Legal Proceedings | |

| Item 1A - Risk Factors | |

| Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3 - Defaults Upon Senior Securities | |

| Item 4 - Mine Safety Disclosures | |

| Item 5 - Other Information | |

| Item 6 - Exhibits | |

| |

| Signatures | |

Unless the context otherwise requires, the terms "we," "us," "our," "Bloom Energy," and the "Company" each refer to Bloom Energy Corporation and all of its subsidiaries.

Explanatory Note

As previously disclosed, we restated the relevant unaudited interim condensed consolidated financial statements as of and for the quarterly periods ended September 30, 2019, June 30, 2019, and March 31, 2019. The quarterly restatements are or will be effective with the filing of our 2020 Quarterly Reports on Form 10-Q. See Note 2, Restatement of Previously Issued Condensed Consolidated Financial Statements, in Item 1, Financial Statements, for additional information related to the restatement of our condensed consolidated financial statements as of and for the three and six months ended June 30, 2019.

Part I

ITEM 1 - FINANCIAL STATEMENTS

Bloom Energy Corporation

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

| | | | | | | | | | | | | | |

| | | | |

| | June 30,

2020 | | December 31, 2019 |

| Assets | | | | |

| Current assets: | | | | |

Cash and cash equivalents1 | | $ | 144,072 | | | $ | 202,823 | |

Restricted cash1 | | 40,393 | | | 30,804 | |

| | | | |

Accounts receivable1 | | 49,614 | | | 37,828 | |

| Inventories | | 112,479 | | | 109,606 | |

| Deferred cost of revenue | | 68,233 | | | 58,470 | |

Customer financing receivable1 | | 5,254 | | | 5,108 | |

Prepaid expenses and other current assets1 | | 20,747 | | | 28,068 | |

| Total current assets | | 440,792 | | | 472,707 | |

Property, plant and equipment, net1 | | 601,566 | | | 607,059 | |

Customer financing receivable, non-current1 | | 48,111 | | | 50,747 | |

Restricted cash, non-current1 | | 139,664 | | | 143,761 | |

| Deferred cost of revenue, non-current | | 6,421 | | | 6,665 | |

Other long-term assets1 | | 40,989 | | | 41,652 | |

| Total assets | | $ | 1,277,543 | | | $ | 1,322,591 | |

| Liabilities, Redeemable Noncontrolling Interest, Stockholders’ Deficit and Noncontrolling Interest | | | | |

| Current liabilities: | | | | |

Accounts payable1 | | $ | 64,896 | | | $ | 55,579 | |

| Accrued warranty | | 10,175 | | | 10,333 | |

Accrued expenses and other current liabilities1 | | 88,052 | | | 70,284 | |

Deferred revenue and customer deposits1 | | 102,944 | | | 89,192 | |

| | | | |

| Financing obligations | | 11,603 | | | 10,993 | |

| Current portion of recourse debt | | 14,697 | | | 304,627 | |

Current portion of non-recourse debt1 | | 11,367 | | | 8,273 | |

| Current portion of recourse debt from related parties | | — | | | 20,801 | |

Current portion of non-recourse debt from related parties1 | | — | | | 3,882 | |

| Total current liabilities | | 303,734 | | | 573,964 | |

| | | | |

Derivative liabilities1 | | 22,281 | | | 17,551 | |

Deferred revenue and customer deposits, net of current portion1 | | 114,684 | | | 125,529 | |

| | | | |

| Financing obligations, non-current | | 440,444 | | | 446,165 | |

| Long-term portion of recourse debt | | 347,664 | | | 75,962 | |

Long-term portion of non-recourse debt1 | | 218,316 | | | 192,180 | |

| Long-term portion of recourse debt from related parties | | 53,675 | | | — | |

Long-term portion of non-recourse debt from related parties1 | | — | | | 31,087 | |

Other long-term liabilities1 | | 27,276 | | | 28,013 | |

| Total liabilities | | 1,528,074 | | | 1,490,451 | |

| | | | |

| Commitments and contingencies (Note 14) | | | | |

| Redeemable noncontrolling interest | | 118 | | | 443 | |

| Stockholders’ deficit: | | | | |

| Preferred stock | | — | | | — | |

| Common stock | | 13 | | | 12 | |

| Additional paid-in capital | | 2,747,890 | | | 2,686,759 | |

| Accumulated other comprehensive income (loss) | | (9) | | | 19 | |

| Accumulated deficit | | (3,064,845) | | | (2,946,384) | |

| Total stockholders’ deficit | | (316,951) | | | (259,594) | |

| Noncontrolling interest | | 66,302 | | | 91,291 | |

| Total liabilities, redeemable noncontrolling interest, stockholders' deficit and noncontrolling interest | | $ | 1,277,543 | | | $ | 1,322,591 | |

1We have variable interest entities which represent a portion of the consolidated balances recorded within these financial statement line items in the condensed consolidated balance sheets (see Note 13, Power Purchase Agreement Programs).

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | | | |

| | | 2020 | | 2019 | | 2020 | | 2019 | | |

| | | | | As Restated | | | | As Restated | | |

| Revenue: | | | | | | | | | | |

| Product | | $ | 116,197 | | | $ | 144,081 | | | $ | 215,756 | | | $ | 235,007 | | | |

| Installation | | 29,839 | | | 13,076 | | | 46,457 | | | 25,295 | | | |

| Service | | 26,208 | | | 23,026 | | | 51,355 | | | 46,493 | | | |

| Electricity | | 15,612 | | | 20,143 | | | 30,987 | | | 40,532 | | | |

| Total revenue | | 187,856 | | | 200,326 | | | 344,555 | | | 347,327 | | | |

| Cost of revenue: | | | | | | | | | | |

| Product | | 83,127 | | | 113,228 | | | 155,616 | | | 202,000 | | | |

| Installation | | 38,287 | | | 17,685 | | | 59,066 | | | 33,445 | | | |

| Service | | 28,652 | | | 18,763 | | | 59,622 | | | 46,684 | | | |

| Electricity | | 11,541 | | | 22,300 | | | 24,071 | | | 35,284 | | | |

| Total cost of revenue | | 161,607 | | | 171,976 | | | 298,375 | | | 317,413 | | | |

| Gross profit | | 26,249 | | | 28,350 | | | 46,180 | | | 29,914 | | | |

| Operating expenses: | | | | | | | | | | |

| Research and development | | 19,377 | | | 29,772 | | | 42,656 | | | 58,631 | | | |

| Sales and marketing | | 11,427 | | | 18,194 | | | 25,376 | | | 38,567 | | | |

| General and administrative | | 24,945 | | | 43,662 | | | 54,043 | | | 82,736 | | | |

| Total operating expenses | | 55,749 | | | 91,628 | | | 122,075 | | | 179,934 | | | |

| Loss from operations | | (29,500) | | | (63,278) | | | (75,895) | | | (150,020) | | | |

| Interest income | | 332 | | | 1,700 | | | 1,151 | | | 3,585 | | | |

| Interest expense | | (14,374) | | | (22,722) | | | (35,128) | | | (44,522) | | | |

| Interest expense to related parties | | (794) | | | (1,606) | | | (2,160) | | | (3,218) | | | |

| Other income (expense), net | | (3,913) | | | (222) | | | (3,921) | | | 43 | | | |

| Loss on extinguishment of debt | | — | | | — | | | (14,098) | | | — | | | |

| Gain (loss) on revaluation of embedded derivatives | | 412 | | | (540) | | | 696 | | | (1,080) | | | |

| Loss before income taxes | | (47,837) | | | (86,668) | | | (129,355) | | | (195,212) | | | |

| Income tax provision | | 141 | | | 258 | | | 265 | | | 466 | | | |

| Net loss | | (47,978) | | | (86,926) | | | (129,620) | | | (195,678) | | | |

| Less: net loss attributable to noncontrolling interests and redeemable noncontrolling interests | | (5,466) | | | (5,015) | | | (11,159) | | | (8,847) | | | |

| Net loss attributable to Class A and Class B common stockholders | | $ | (42,512) | | | $ | (81,911) | | | (118,461) | | | (186,831) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net loss per share available to Class A and Class B common stockholders, basic and diluted | | $ | (0.34) | | | $ | (0.72) | | | $ | (0.95) | | | $ | (1.66) | | | |

| Weighted average shares used to compute net loss per share attributable to Class A and Class B common stockholders, basic and diluted | | 125,928 | | | 113,622 | | | 124,823 | | | 112,737 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Comprehensive Loss

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | | | | |

| | | 2020 | | 2019 | | 2020 | | 2019 | | | |

| | | | | As Restated | | | | As Restated | | | |

| Net loss | | $ | (47,978) | | | $ | (86,926) | | | $ | (129,620) | | | $ | (195,678) | | | | |

| Other comprehensive income (loss), net of taxes: | | | | | | | | | | | |

| Unrealized gain (loss) on available-for-sale securities | | (23) | | | 9 | | | (23) | | | 26 | | | | |

| Change in derivative instruments designated and qualifying in cash flow hedges | | (503) | | | (3,502) | | | (8,717) | | | (5,693) | | | | |

| Other comprehensive loss, net of taxes | | (526) | | | (3,493) | | | (8,740) | | | (5,667) | | | | |

| Comprehensive loss | | (48,504) | | | (90,419) | | | (138,360) | | | (201,345) | | | | |

| Less: comprehensive loss attributable to noncontrolling interests and redeemable noncontrolling interests | | (5,968) | | | (8,355) | | | (19,870) | | | (14,235) | | | | |

| Comprehensive loss attributable to Class A and Class B stockholders | | $ | (42,536) | | | $ | (82,064) | | | $ | (118,490) | | | $ | (187,110) | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Redeemable Noncontrolling Interest, Total Stockholders' Deficit and Noncontrolling Interest

(in thousands, except Shares) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2020 | | | | | | | | | | | | | | | |

| | Redeemable

Noncontrolling

Interest | | | Class A and Class B

Common Stock¹ | | | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total Stockholders' Deficit | | Noncontrolling

Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at March 31, 2020 | | $ | 67 | | | | 125,150,690 | | | $ | 12 | | | $ | 2,689,208 | | | $ | 14 | | | $ | (3,022,333) | | | $ | (333,099) | | | $ | 73,867 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Conversion of notes | | — | | | | 4,718,128 | | | 1 | | | 41,129 | | | — | | | — | | | 41,130 | | | — | |

| | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | — | | | | 309,547 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

| Exercise of stock options | | — | | | | 59,924 | | | — | | | 341 | | | — | | | — | | | 341 | | | — | |

| Stock-based compensation expense | | — | | | | — | | | — | | | 17,212 | | | — | | | — | | | 17,212 | | | — | |

| Unrealized loss on available for sale securities | | — | | | | — | | | — | | | — | | | (23) | | | — | | | (23) | | | — | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (503) | |

| Distributions to noncontrolling interests | | (16) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,530) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | 67 | | | | — | | | — | | | — | | | — | | | (42,512) | | | (42,512) | | | (5,532) | |

| Balances at June 30, 2020 | | $ | 118 | | | | 130,238,289 | | | $ | 13 | | | $ | 2,747,890 | | | $ | (9) | | | $ | (3,064,845) | | | $ | (316,951) | | | $ | 66,302 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended June 30, 2019 | | | | | | | | | | | | | | | |

| | | | | Redeemable Noncontrolling Interest | | | Class A and Class B

Common Stock | | | | Additional Paid-In Capital | | Accumulated Other Comprehensive Gain (Loss) | | Accumulated

Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | | | | Shares | | Amount | | | | | | | | | | |

| Balances at March 31, 2019 (as Restated) | | | | | $ | 58,802 | | | | 113,214,063 | | | $ | 11 | | | $ | 2,552,011 | | | $ | 5 | | | $ | (2,746,890) | | | $ | (194,863) | | | $ | 114,664 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | | | | — | | | | 543,636 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | | | — | | | | 191,644 | | | — | | | 828 | | | — | | | — | | | 828 | | | — | |

| Stock-based compensation expense | | | | | — | | | | — | | | — | | | 51,195 | | | — | | | — | | | 51,195 | | | — | |

| Unrealized gain on available for sale securities | | | | | — | | | | — | | | — | | | — | | | 9 | | | — | | | 9 | | | — | |

| Change in effective portion of interest rate swap agreement | | | | | — | | | | — | | | — | | | — | | | (162) | | | — | | | (162) | | | (3,340) | |

| Distributions to noncontrolling interests | | | | | (3,255) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,595) | |

| Mandatory redemption of noncontrolling interests | | | | | (55,684) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Net income (loss) (as restated) | | | | | 642 | | | | — | | | — | | | — | | | — | | | (81,911) | | | (81,911) | | | (5,657) | |

| Balances at June 30, 2019 (as Restated) | | | | | $ | 505 | | | | 113,949,343 | | | $ | 11 | | | $ | 2,604,034 | | | $ | (148) | | | $ | (2,828,801) | | | $ | (224,904) | | | $ | 104,072 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2020 | | | | | | | | | | | | | | | |

| | Redeemable Noncontrolling Interest | | | Class A and Class B

Common Stock¹ | | | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at December 31, 2019 | | $ | 443 | | | | 121,036,289 | | | $ | 12 | | | $ | 2,686,759 | | | $ | 19 | | | $ | (2,946,384) | | | $ | (259,594) | | | $ | 91,291 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Conversion of notes | | — | | | | 4,718,128 | | | 1 | | | 41,129 | | | — | | | — | | | 41,130 | | | — | |

| Adjustment of embedded derivative for debt modification | | — | | | | — | | | — | | | (24,071) | | | — | | | — | | | (24,071) | | | — | |

| Issuance of restricted stock awards | | — | | | | 3,320,153 | | | — | | | — | | | — | | | — | | | — | | | — | |

| ESPP purchase | | — | | | | 992,846 | | | — | | | 4,177 | | | — | | | — | | | 4,177 | | | — | |

| Exercise of stock options | | — | | | | 170,873 | | | — | | | 1,008 | | | — | | | — | | | 1,008 | | | — | |

| Stock-based compensation expense | | — | | | | — | | | — | | | 38,888 | | | — | | | — | | | 38,888 | | | — | |

| Unrealized loss on available for sale securities | | — | | | | — | | | — | | | — | | | (23) | | | — | | | (23) | | | — | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | (5) | | | — | | | (5) | | | (8,712) | |

| Distributions to noncontrolling interests | | (17) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,427) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | | (308) | | | | — | | | — | | | — | | | — | | | (118,461) | | | (118,461) | | | (10,850) | |

| Balances at June 30, 2020 | | $ | 118 | | | | 130,238,289 | | | $ | 13 | | | $ | 2,747,890 | | | $ | (9) | | | $ | (3,064,845) | | | $ | (316,951) | | | $ | 66,302 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2019 | | | | | | | | | | | | | | | |

| | Redeemable Noncontrolling Interest | | | Class A and Class B

Common Stock¹ | | | | Additional Paid-In Capital | | Accumulated Other Comprehensive Gain (Loss) | | Accumulated Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at December 31, 2018 (as Restated) | | $ | 57,261 | | | | 109,421,183 | | | $ | 11 | | | $ | 2,481,352 | | | $ | 131 | | | $ | (2,624,104) | | | $ | (142,610) | | | $ | 125,110 | |

| Cumulative effect upon adoption of new accounting standard (Note 3) | | — | | | | — | | | — | | | — | | | — | | | (17,996) | | | (17,996) | | | — | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | — | | | | 3,504,098 | | | — | | | — | | | — | | | — | | | — | | | — | |

| ESPP purchase | | — | | | | 696,036 | | | — | | | 6,916 | | | — | | | — | | | 6,916 | | | — | |

| Exercise of stock options | | — | | | | 328,026 | | | — | | | 1,405 | | | — | | | — | | | 1,405 | | | — | |

| Stock-based compensation expense | | — | | | | — | | | — | | | 114,361 | | | — | | | — | | | 114,361 | | | — | |

| Unrealized gain on available-for-sale securities | | — | | | | — | | | — | | | — | | | 26 | | | — | | | 26 | | | — | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | (305) | | | — | | | (305) | | | (5,388) | |

| Distributions to noncontrolling interests | | (3,537) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (4,208) | |

| Mandatory redemption of noncontrolling interests | | (55,684) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Cumulative effect of hedge accounting | | — | | | | — | | | — | | | — | | | — | | | 130 | | | 130 | | | (130) | |

| Net income (loss) (as restated) | | 2,465 | | | | — | | | — | | | — | | | — | | | (186,831) | | | (186,831) | | | (11,312) | |

| Balances at June 30, 2019 (as Restated) | | $ | 505 | | | | 113,949,343 | | | $ | 11 | | | $ | 2,604,034 | | | $ | (148) | | | $ | (2,828,801) | | | $ | (224,904) | | | $ | 104,072 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, | | | | |

| | | 2020 | | 2019 | | |

| | | | | As Restated | | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (129,620) | | | $ | (195,678) | | | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | |

| Depreciation and amortization | | 25,852 | | | 37,034 | | | |

| Write-off of property, plant and equipment, net | | — | | | 2,704 | | | |

| Impairment of equity method investment | | 4,236 | | | — | | | |

| Write-off of PPA II and PPA IIIb decommissioned assets | | — | | | 25,613 | | | |

| Debt make-whole expense | | — | | | 5,934 | | | |

| | | | | | |

| Revaluation of derivative contracts | | (72) | | | 1,636 | | | |

| Stock-based compensation | | 41,650 | | | 119,186 | | | |

| Loss on long-term REC purchase contract | | 2 | | | 60 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Loss on extinguishment of debt | | 14,098 | | | — | | | |

| Amortization of debt issuance and premium cost, net | | (470) | | | 11,255 | | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable | | (11,787) | | | 49,741 | | | |

| Inventories | | (3,532) | | | 22,197 | | | |

| Deferred cost of revenue | | (9,995) | | | (38,793) | | | |

| Customer financing receivable and other | | 2,490 | | | 2,713 | | | |

| Prepaid expenses and other current assets | | 7,314 | | | 10,227 | | | |

| Other long-term assets | | (3,574) | | | (272) | | | |

| Accounts payable | | 8,831 | | | (5,461) | | | |

| Accrued warranty | | (159) | | | (6,696) | | | |

| Accrued expenses and other current liabilities | | 13,665 | | | 5,581 | | | |

| | | | | | |

| Deferred revenue and customer deposits | | 2,907 | | | 51,913 | | | |

| Other long-term liabilities | | (2,071) | | | 4,722 | | | |

| Net cash provided by (used in) operating activities | | (40,235) | | | 103,616 | | | |

| Cash flows from investing activities: | | | | | | |

| Purchase of property, plant and equipment | | (19,560) | | | (23,619) | | | |

| Payments for acquisition of intangible assets | | — | | | (970) | | | |

| | | | | | |

| Proceeds from maturity of marketable securities | | — | | | 104,500 | | | |

| Net cash provided by (used in) investing activities | | (19,560) | | | 79,911 | | | |

| Cash flows from financing activities: | | | | | | |

| Proceeds from issuance of debt | | 70,000 | | | — | | | |

| Proceeds from issuance of debt to related parties | | 30,000 | | | — | | | |

| Repayment of debt | | (82,248) | | | (83,997) | | | |

| Repayment of debt to related parties | | (2,105) | | | (1,220) | | | |

| Debt make-whole payment | | — | | | (5,934) | | | |

| Debt issuance costs | | (3,371) | | | — | | | |

| Proceeds from financing obligations | | — | | | 20,333 | | | |

| Repayment of financing obligations | | (5,111) | | | (4,006) | | | |

| | | | | | |

| Payments to noncontrolling and redeemable noncontrolling interests | | — | | | (18,690) | | | |

| Distributions to noncontrolling and redeemable noncontrolling interests | | (5,815) | | | (7,753) | | | |

| Proceeds from issuance of common stock | | 5,186 | | | 8,321 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net cash provided by (used in) financing activities | | 6,536 | | | (92,946) | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | (53,259) | | | 90,581 | | | |

| Cash, cash equivalents, and restricted cash: | | | | | | |

| Beginning of period | | 377,388 | | | 280,485 | | | |

| End of period | | $ | 324,129 | | | $ | 371,066 | | | |

| | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Cash paid during the period for interest | | $ | 34,487 | | | $ | 35,702 | | | |

| Cash paid during the period for taxes | | 224 | | | 497 | | | |

| Non-cash investing and financing activities: | | | | | | |

| | | | | | |

| Liabilities recorded for property, plant and equipment | | $ | 494 | | | $ | 4,662 | | | |

| Liabilities recorded for noncontrolling and redeemable noncontrolling interest | | — | | | 36,994 | | | |

| Equity investment in PPA II assets | | — | | | 27,809 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Accrued distributions to Equity Investors | | 2 | | | 566 | | | |

| Accrued interest for notes | | — | | | 888 | | | |

| Accrued debt issuance costs | | 1,220 | | | — | | | |

| Conversion of notes | | 41,130 | | | — | | | |

| Adjustment of embedded derivative related to debt extinguishment | | 24,071 | | | — | | | |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Notes to Condensed Consolidated Financial Statements

1. Nature of Business, Liquidity, Basis of Presentation and Summary of Significant Accounting Policies

Nature of Business

We design, manufacture, sell and, in certain cases, install solid-oxide fuel cell systems ("Energy Servers") for on-site power generation. Our Energy Servers utilize an innovative fuel cell technology and provide efficient energy generation with reduced operating costs and lower greenhouse gas emissions as compared to conventional fossil fuel generation. By generating power where it is consumed, our energy producing systems offer increased electrical reliability and improved energy security while providing a path to energy independence. We were originally incorporated in Delaware under the name of Ion America Corporation on January 18, 2001 and on September 16, 2006, we changed our name to Bloom Energy Corporation.

Liquidity

We have generally incurred operating losses and negative cash flows from operations since our inception. On March 31, 2020, we extended the maturity of our current debt to reduce our required debt payments in the next 12 months. After the following debt extensions were completed, the current portion of our total recourse and non-recourse debt was $26.1 million as of June 30, 2020. Notable elements of our debt extension are as follows:

•On March 31, 2020, we entered into an Amendment Support Agreement with the beneficial owners of our outstanding 6% Convertible Notes due December 1, 2020 pursuant to the maturity date of the outstanding 6% Convertible Notes was extended to December 1, 2021, the interest rate increased from 6% to 10%, and the strike price on the conversion feature was reduced from $11.25 to $8.00 per share. The Amendment Support Agreement required that we repay at least $70.0 million of these 10% Convertible Notes on or before September 1, 2020, which we satisfied through a cash payment of $70.0 million on May 1, 2020. The amended terms are reflected in the Amended and Restated Indenture between Bloom and US Bank National Association dated April 20, 2020.

•In conjunction with entering into the Amendment Support Agreement on March 31, 2020, we also entered into a 10% Convertible Note Purchase Agreement with Foris Ventures, LLC, a new Noteholder, and New Enterprise Associates 10, Limited Partnership, an existing Noteholder, and we issued an additional $30.0 million aggregate principal amount of 10% Convertible Notes. The Amended and Restated Indenture was also amended to reflect a new principal amount of $290.0 million to accommodate the additional $30.0 million in new 10% Convertible Notes.

•On March 31, 2020, we entered into an Amended and Restated Subordinated Secured Convertible Note Modification Agreement (the “Constellation Note Modification Agreement”) with Constellation NewEnergy, Inc. (“Constellation”), pursuant to which Constellation agreed to extend the maturity date to December 31, 2021, increase the interest rate from 5% to 10% and reduce the strike price on the conversion feature from $38.64 to $8.00 per share.

•On May 1, 2020, we entered into a note purchase agreement pursuant to which certain investors purchased $70.0 million of 10.25% Senior Secured Notes due 2027 in a private placement. The proceeds from this note were used to extinguish the $70.0 million of 10% Convertible Notes on May 1, 2020.

•On June 18, 2020, Constellation exercised their voluntary conversion feature and exchanged their entire Constellation Note at the conversion price of $8.00 per share into 4.7 million shares of Class A common stock. At the time of this exchange the unamortized premium of $3.4 million was recorded as an adjustment to additional paid-in capital.

The impact of COVID-19 on our ability to execute our business strategy and on our financial position and results of operations is uncertain. Our future cash flow requirements may vary materially from those currently planned and will depend on many factors, including our rate of revenue growth, the timing and extent of spending on research and development efforts and other business initiatives, the rate of growth in the volume of system builds, the expansion of sales and marketing activities, market acceptance of our product, our ability to secure financing for customer use, the timing of installations, and overall economic conditions including the impact of COVID-19 on our ongoing and future operations. However, in the opinion of management, the combination of our existing cash and cash equivalents and operating cash flows is expected to be sufficient to meet our operational and capital cash flow requirements and other cash flow needs for the next 12 months from the date of issuance of this Quarterly Report on Form 10-Q, but we may access capital markets opportunistically to continue to improve our capital structure and to address outstanding debt principal repayments that are due in December 2021 if market conditions are favorable.

For additional information, see Note 7, Outstanding Loans and Security Agreements and Note 17, Subsequent Events.

Basis of Presentation

We have prepared the unaudited condensed consolidated financial statements included herein pursuant to the rules and regulations of the U.S. Securities and Exchange Commission ("SEC"), and as permitted by those rules, the condensed consolidated financial statements do not include all disclosures required by generally accepted accounting principles as applied in the United States (“U.S. GAAP”). However, we believe that the disclosures herein are adequate to ensure the information presented is not misleading. The condensed consolidated balance sheets as of June 30, 2020 and December 31, 2019 (the latter has been derived from the audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019), and the condensed consolidated statements of operations, of comprehensive loss, of redeemable noncontrolling interest, total stockholders' deficit and noncontrolling interest, and of cash flows for the periods ended June 30, 2020 and 2019, and related notes, should be read in conjunction with the audited financial statements and the notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 31, 2020.

We believe that all necessary adjustments, which consisted only of normal recurring items, have been included in the accompanying financial statements to fairly state the results of the interim periods. The results of operations for the interim periods presented are not necessarily indicative of the operating results to be expected for any subsequent interim period or for our fiscal year ending December 31, 2020.

Principles of Consolidation

These condensed consolidated financial statements reflect our accounts and operations and those of our subsidiaries in which we have a controlling financial interest. We use a qualitative approach in assessing the consolidation requirement for each of our variable interest entities ("VIE"), which we refer to as our power purchase agreement entities ("PPA Entities"). This approach focuses on determining whether we haves the power to direct those activities of the PPA Entities that most significantly affect their economic performance and whether we have the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the PPA Entities. For all periods presented, we have determined that we are the primary beneficiary in all of our operational PPA Entities, other than with respect to the PPA II and PPA IIIb Entities, as discussed in Note 13, Power Purchase Agreement Programs. We evaluate our relationships with the PPA Entities on an ongoing basis to ensure that we continue to be the primary beneficiary. All intercompany transactions and balances have been eliminated in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and the accompanying notes. The most significant estimates include the determination of the stand-alone selling price, including material rights estimates, inventory valuation, specifically excess and obsolescence provisions for obsolete or unsellable inventory and, in relation to property, plant and equipment (specifically Energy Servers), assumptions relating to economic useful lives and impairment assessments.

Other accounting estimates include variable consideration relating to product performance guaranties, assumptions to compute the fair value of lease and non-lease components and related financing obligations such as incremental borrowing rates, estimated output, efficiency and residual value of the Energy Servers, warranty, product performance guaranties and extended maintenance, derivative valuations, estimates for recapture of U.S. Treasury grants and similar grants, estimates relating to contractual indemnities provisions, estimates for income taxes and deferred tax asset valuation allowances, and stock-based compensation costs. The full extent to which the COVID-19 pandemic will directly or indirectly impact our business, results of operations and financial condition, including sales, expenses, our allowance for doubtful accounts, stock-based compensation, the carrying value of our long-lived assets, inventory, financial assets, and valuation allowances for tax assets, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain it or treat it, as well as the economic impact on local, regional, national and international customers, suppliers and markets. We have made estimates of the impact of COVID-19 within our financial statements and there may be changes to those estimates in future periods as new information becomes available. Actual results could differ materially from these estimates under different assumptions and conditions.

Concentration of Risk

Geographic Risk - The majority of our revenue and long-lived assets are attributable to operations in the United States for all periods presented. Additionally, we sell our Energy Servers in Japan, China, India, and the Republic of Korea (collectively, the "Asia Pacific region"). In the three and six months ended June 30, 2020, total revenue in the Asia Pacific

region was 30% and 33%, respectively, of our total revenue. In the three and six months ended June 30, 2019, total revenue in the Asia Pacific region was 21% and 26%, respectively, of our total revenue.

Credit Risk - At June 30, 2020, one customer, Kaiser Foundation Hospitals, accounted for approximately 26% of accounts receivable. At December 31, 2019, two customers, Costco Wholesale Corporation and The Kraft Group LLC, accounted for approximately 19% and 17% of accounts receivable, respectively. At June 30, 2020 and December 31, 2019, we did not maintain any allowances for doubtful accounts as we deemed all of our receivables fully collectible. To date, we have neither provided an allowance for uncollectible accounts nor experienced any credit loss.

Customer Risk - In the quarter ended June 30, 2020, revenue from three customers, Duke Energy, SK Engineering & Construction Co., Ltd. ("SK E&C") and NextEra Energy, accounted for approximately 32%, 29%, and 12%, respectively, of our total revenue. In the six months ended June 30, 2020, revenue from two customers, SK E&C and Duke Energy, accounted for approximately 32% and 32%, respectively, of our total revenue. In the quarter ended June 30, 2019, revenue from two customers, The Southern Company and SK E&C accounted for approximately 56% and 21%, respectively, of our total revenue. In the six months ended June 30, 2019, revenue from two customers, The Southern Company and SK E&C accounted for approximately 44% and 26%, respectively, of our total revenue. Duke Energy and The Southern Company wholly own a Third-Party PPA which purchases Energy Servers from us, however, such purchases and resulting revenue are made on behalf of various customers of these two Third-Party PPAs.

Summary of Significant Accounting Policies

The significant accounting policies used in preparation of these condensed consolidated financial statements for the periods ended June 30, 2020 are consistent with those discussed in Note 1 to the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2019, except as described below.

Recent Accounting Pronouncements

Other than the adoption of the accounting guidance mentioned below, there have been no other significant changes in our reported financial position or results of operations and cash flows resulting from the adoption of new accounting pronouncements.

Accounting Guidance Implemented in 2020

Fair Value Measurement - In August 2018, the Financial Accounting Standards Board ("FASB") issued ASU 2018-13, Fair Value Measurement Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement ("ASU 2018-13"). ASU 2018-13 has eliminated, amended and added disclosure requirements for fair value measurements. Entities will no longer be required to disclose the amount of, and reasons for, transfers between Level 1 and Level 2 of the fair value hierarchy, the policy of timing of transfers between levels of the fair value hierarchy and the valuation processes for Level 3 fair value measurements. Companies will be required to disclose the range and weighted average used to develop significant unobservable inputs for Level 3 fair value measurements. ASU 2018-13 was effective for annual and interim periods beginning after December 15, 2019. Early adoption was permitted. We adopted ASU 2018-13 as of January 1, 2020 and the adoption did not have a material effect on our financial statements and related disclosures.

Stock Compensation - In June 2018, the FASB issued ASU 2018-07, Compensation - Stock Compensation: Improvements to Nonemployee Share-Based Payment Accounting ("ASU 2018-07") which aligns the accounting for share-based payment awards issued to employees and nonemployees. Measurement of equity-classified nonemployee awards will now be valued on the grant date and will no longer be remeasured through the performance completion date. ASU 2018-07 also changes the accounting for nonemployee awards with performance conditions to recognize compensation cost when achievement of the performance condition is probable, rather than upon achievement of the performance condition, as well as eliminating the requirement to reassess the equity or liability classification for nonemployee awards upon vesting, except for certain award types. ASU 2018-07 was effective for us for interim and annual reporting periods beginning after December 15, 2019. Early adoption was permitted. We adopted ASU 2018-07 using a modified retrospective approach in January 2020 and the adoption of ASU 2018-07 did not have a material effect on our financial statements and related disclosures.

Accounting Guidance Not Yet Adopted

Leases - In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), as amended (“ASC 842”), which provides new authoritative guidance on lease accounting. Among its provisions, the standard changes the definition of a lease, requires lessees to recognize right-of-use assets and lease liabilities on the balance sheet for operating leases and also requires additional qualitative and quantitative disclosures about lease arrangements. All leases in scope will be classified as either operating or financing. Operating and financing leases will require the recognition of an asset and liability to be measured at the

present value of the lease payments. ASC 842 also makes a distinction between operating and financing leases for purposes of reporting expenses on the income statement. We are the lessee under various agreements for facilities and equipment that are currently accounted for as operating leases and expect to continue to enter into new such leases. Additionally, we expect to continue to enter into Managed Services related financing leases in the future and are the lessor of Energy Servers that are subject to power purchase arrangements with customers under our PPA and Managed Services programs that are currently accounted for as leases.

We are currently evaluating the impact of the adoption of this update on our financial statements. We will be assessing the impacts of whether new power purchase arrangements with customers meet the new definition of a lease and recognizing right of use assets and lease liabilities for arrangements currently accounted for as operating leases where we are the lessee. We anticipate that we will no longer be an emerging growth company beginning on December 31, 2020, after which we will not be able to take advantage of the reduced disclosure requirements applicable to emerging growth companies. As a result, we expect to adopt this guidance on a modified retrospective basis on December 31, 2020 and to reflect the adoption as of January 1, 2020 in our annual results for the period ended December 31, 2020.

Financial Instruments - In June 2016, the FASB issued ASU 2016-13, Financial Instruments- Credit Losses (Topic 326) as amended, ("Topic 326"), including in February 2020, the FASB issued ASU 2020-02, which provides guidance regarding methodologies, documentation, and internal controls related to expected credit losses. The pronouncement eliminates the incurred credit loss impairment methodology and replaces it with an expected credit loss concept based on historical experience, current conditions, and reasonable and supportable forecasts. Early adoption is permitted. Topic 326 requires a modified retrospective approach by recording a cumulative-effect adjustment to retained earnings as of the beginning of the period of adoption. We anticipate that we will no longer be an emerging growth company beginning on December 31, 2020, after which we will not be able to take advantage of the reduced disclosure requirements applicable to emerging growth companies. As a result, we expect to adopt this guidance on a modified retrospective basis on December 31, 2020 and reflect the adoption as of January 1, 2020 in our annual results for the period ended December 31, 2020. We are currently evaluating the impact of the adoption of this update on our financial statements.

Income taxes - In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes (Topic 740) ("ASU 2019-12"), wherein the accounting for income taxes is simplified by eliminating certain exceptions and implementing additional requirements which result in a more consistent application of ASC 740 Income Taxes. ASU 2019-12 is effective as for public business entities, for fiscal years beginning after December 15, 2020, and interim periods within those fiscal years. We anticipate that we will no longer be an emerging growth company beginning on December 31, 2020, after which we will not be able to take advantage of the reduced disclosure requirements applicable to emerging growth companies. We expect to adopt this guidance on a prospective basis on January 1, 2021. We are evaluating the effect on our financial statements and related disclosures.

Cessation of LIBOR - In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting ("ASU 2020-04") which provides optional expedients and exceptions for applying GAAP to contract modifications and hedging relationships, subject to meeting certain criteria, that reference London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued. The amendments in ASU 2020-04 are effective for all entities as of March 12, 2020 through December 31, 2022. An entity may elect to apply the amendments for contract modifications as of any date from the beginning of an interim period that includes or is subsequent to March 12, 2020, or prospectively from a date within an interim period that includes or is subsequent to March 12, 2020, up to the date that the financial statements are available to be issued. We are currently evaluating the impact of the adoption of this update on our financial statements.

We do not expect any other new accounting standards to have a material impact on our financial position, results of operations or cash flows when they become effective.

2. Restatement of Previously Issued Condensed Consolidated Financial Statements

We have restated herein our condensed consolidated financial statements as of and for the three and six months ended June 30, 2019. We have also restated related amounts within the accompanying footnotes to the condensed consolidated financial statements.

Restatement Background

As previously disclosed in our Annual Report on Form 10-K as filed on March 31, 2020, on February 11, 2020, our management, in consultation with the Audit Committee of our Board of Directors, determined that our previously issued consolidated financial statements as of and for the year ended December 31, 2018, as well as financial statements as of and for

the three month period ended March 31, 2019, the three and six month periods ended June 30, 2019 and 2018 and the three and nine month periods ended September 30, 2019 and 2018 should no longer be relied upon due to misstatements related to our Managed Services Agreements and similar arrangements and we would restate such financial statements to make the necessary accounting corrections. The revenue for the Managed Services Agreements and similar transactions will now be recognized over the duration of the contract instead of upfront. The restatement also includes corrections for additional identified immaterial misstatements in certain of the impacted periods.

The misstatements impacting as of and for the three and six months ended June 30, 2019 are described in greater detail below.

Description of Misstatements

Under our Managed Services program, we sell our equipment to a bank financing party under a sale-leaseback transaction, which pays us for the Energy Server and takes title to the Energy Server. We then enter into a service contract with an end customer, who pays the bank a fixed, monthly fee for its use of the Energy Server and pays us for our maintenance and operation of the Energy Server.

The majority of these Managed Services Agreements and similar transactions were originally recorded as sales, subject to an operating lease, in which revenues and associated costs were recognized at the time of installation and acceptance of the Energy Server at the customer site.

In December 2019, in the course of reviewing a Managed Services transaction that closed on November 27, 2019, an issue was identified related to the accounting for our Managed Services transactions. The issue primarily related to whether the terms of our Managed Services Agreements and similar arrangements, including the events of default provisions, satisfied the requirements for sales under the revenue accounting standards. Subsequently, it was determined that the previous accounting for the Managed Services Agreements and similar transactions was misstated, as the Managed Services Agreements and similar transactions should have been accounted for as financing transactions under lease accounting standards.

The impact of the correction of the misstatement is to recognize amounts received from the bank financing party as a financing obligation, and the Energy Server is recorded within property, plant and equipment, net, on our consolidated balance sheets. We recognize revenue for the electricity generated by the systems, based on payments received by the bank from the customer, and the corresponding financing obligations to the bank is also amortized as these payments are received by the bank from the customer, with interest thereon being calculated on an effective interest rate basis. Depreciation expense is also recognized over the estimated useful life of the Energy Server.

In addition, it was determined that stock-based compensation costs relating to manufacturing employees that were previously expensed as incurred incorrectly, should have been capitalized as a component of Energy Server manufacturing costs to inventory, deferred cost of revenues, construction-in-progress and property, plant and equipment in accordance with SEC Staff Accounting Bulletin Topic 14. These costs will now be expensed on consumption of the related inventory and over the economic useful life of the property, plant and equipment, as applicable.

Also, as part of a review of historical revenue agreements as a result of the above errors, it was noted that we failed to identify embedded derivatives in certain revenue agreements for an escalator price protection (“EPP”) feature given to our customers. As a result, we have recorded a derivative liability, with an offset to product revenue, to account for the fair value of this feature at inception and will record the liability at its then fair value at each period end with any changes in fair value recognized in gain (loss) on revaluation of embedded derivatives.

In addition to the impact of the restatement described above, in preparation of the condensed consolidated financial statements for the three months ended March 31, 2020, errors in our condensed consolidated statements of comprehensive loss were discovered. For the three and six month periods ended June 30, 2019, the presentation of this statement and other errors identified in this statement have been corrected, which resulted in an additional $5.0 million and $8.8 million increase to comprehensive loss, and an increase of $5.0 million and $8.8 million in comprehensive loss attributable to noncontrolling interest and redeemable noncontrolling interests, respectively. The condensed consolidated statements of comprehensive loss for the three and nine months ended September 30, 2019 will also be corrected when those periods are next reported. In the consolidated statements of comprehensive loss for the years ended December 31, 2019 and 2018, comprehensive loss as previously reported is understated by $5.8 million and overstated by $1.8 million, respectively. In addition, the reconciliation of comprehensive loss to comprehensive loss attributable to Class A and Class B stockholders was erroneously omitted. As it relates to the impact of the errors to the consolidated statements of comprehensive loss for the years ended December 31, 2019 and 2018, management evaluated the impact of the errors to the previously issued financial statements and concluded the impacts were not material. Accordingly, these items are and will be corrected when those periods are next reported.

Finally, there were certain other immaterial misstatements identified or which had been previously identified that are also being corrected in connection with the restatement of previously issued financial statements.

Description of Restatement Reconciliation Tables

In the following tables, we have presented a reconciliation of our condensed consolidated balance sheet and statements of operations and cash flows from our prior periods as previously reported to the restated amounts as of and for the three and six months ended June 30, 2019. In addition to the errors to the condensed consolidated statement of comprehensive loss discussed above, that Statement has been restated for the restatement impact to net loss. The condensed consolidated statement of redeemable noncontrolling interest, total stockholders' deficit and noncontrolling interest for the three and six months ended June 30, 2019 has also been restated for the restatement impact to net loss. See the condensed consolidated statements of operations reconciliation table below for additional information on the restatement impact to net loss.

Bloom Energy Corporation

Condensed Consolidated Balance Sheet

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2019 | | | | | | | | |

| | | As Previously Reported | | Restatement Impacts | | Restatement Reference | | ASC 606 Adoption Impacts | | As Restated And Recast |

| | | | | | | | | | | |

| Assets | | | | | | | | | | |

| Current assets: | | | | | | | | | | |

| Cash and cash equivalents | | $ | 308,009 | | | $ | — | | | | | $ | — | | | $ | 308,009 | |

| Restricted cash | | 23,706 | | | — | | | | | — | | | 23,706 | |

| | | | | | | | | | |

| Accounts receivable | | 38,296 | | | 4,172 | | | 1 | | (2,430) | | | 40,038 | |

| Inventories | | 104,934 | | | 1,955 | | | 2 | | — | | | 106,889 | |

| Deferred cost of revenue | | 86,434 | | | (6,127) | | | 3 | | — | | | 80,307 | |

| Customer financing receivable | | 5,817 | | | — | | | | | — | | | 5,817 | |

| Prepaid expenses and other current assets | | 25,088 | | | 1,252 | | | 4 | | 143 | | | 26,483 | |

| Total current assets | | 592,284 | | | 1,252 | | | | | (2,287) | | | 591,249 | |

| Property, plant and equipment, net | | 406,610 | | | 234,649 | | | 5 | | — | | | 641,259 | |

| Customer financing receivable, non-current | | 64,146 | | | — | | | | | — | | | 64,146 | |

| Restricted cash, non-current | | 39,351 | | | — | | | | | — | | | 39,351 | |

| Deferred cost of revenue, non-current | | 59,213 | | | (55,367) | | | 3 | | — | | | 3,846 | |

| Other long-term assets | | 60,975 | | | 9,118 | | | 6 | | 2,743 | | | 72,836 | |

| Total assets | | $ | 1,222,579 | | | $ | 189,652 | | | | | $ | 456 | | | $ | 1,412,687 | |

| Liabilities, Redeemable Noncontrolling Interest, Stockholders’ Deficit and Noncontrolling Interests | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable | | $ | 61,427 | | | $ | — | | | | | $ | — | | | $ | 61,427 | |

| Accrued warranty | | 12,393 | | | (1,154) | | | 7 | | (999) | | | 10,240 | |

| Accrued expenses and other current liabilities | | 109,722 | | | (4,329) | | | 8 | | — | | | 105,393 | |

| | | | | | | | | | |

| Financing obligations | | — | | | 10,027 | | | 9 | | — | | | 10,027 | |

| Deferred revenue and customer deposits | | 129,321 | | | (13,847) | | | 10 | | 3,264 | | | 118,738 | |

| Current portion of recourse debt | | 15,681 | | | — | | | | | — | | | 15,681 | |

| Current portion of non-recourse debt | | 7,654 | | | — | | | | | — | | | 7,654 | |

| | | | | | | | | | |

| Current portion of non-recourse debt from related parties | | 2,889 | | | —�� | | | | | — | | | 2,889 | |

| Total current liabilities | | 339,087 | | | (9,303) | | | | | 2,265 | | | 332,049 | |

| | | | | | | | | | |

| Derivative liabilities | | 13,079 | | | 5,096 | | | 11 | | — | | | 18,175 | |

| Deferred revenue and customer deposits, net of current portion | | 181,221 | | | (95,840) | | | 10 | | 25,369 | | | 110,750 | |

| | | | | | | | | | |

| Financing obligations, non-current | | — | | | 400,078 | | | 9 | | — | | | 400,078 | |

| Long-term portion of recourse debt | | 362,424 | | | — | | | | | — | | | 362,424 | |

| Long-term portion of non-recourse debt | | 219,182 | | | — | | | | | — | | | 219,182 | |

| Long-term portion of recourse debt from related parties | | 27,734 | | | — | | | | | — | | | 27,734 | |

| Long-term portion of non-recourse debt from related parties | | 32,643 | | | — | | | | | — | | | 32,643 | |

| Other long-term liabilities | | 58,417 | | | (28,438) | | | 8 | | — | | | 29,979 | |

| Total liabilities | | 1,233,787 | | | 271,593 | | | | | 27,634 | | | 1,533,014 | |

| | | | | | | | | | |

| Redeemable noncontrolling interest | | 505 | | | — | | | | | — | | | 505 | |

| | | | | | | | | | |

| Stockholders’ deficit: | | | | | | | | | | |

| Preferred stock | | — | | | — | | | | | — | | | — | |

| Common stock | | 11 | | | — | | | | | — | | | 11 | |

| Additional paid-in capital | | 2,603,279 | | | 755 | | | 12 | | — | | | 2,604,034 | |

| Accumulated other comprehensive loss | | (148) | | | — | | | | | — | | | (148) | |

| Accumulated deficit | | (2,718,927) | | | (82,696) | | | | | (27,178) | | | (2,828,801) | |

| Total stockholders’ deficit | | (115,785) | | | (81,941) | | | | | (27,178) | | | (224,904) | |

| Noncontrolling interest | | 104,072 | | | — | | | | | — | | | 104,072 | |

| Total liabilities, redeemable noncontrolling interest, stockholders' deficit and noncontrolling interest | | $ | 1,222,579 | | | $ | 189,652 | | | | | $ | 456 | | | $ | 1,412,687 | |

1 Accounts receivable — The correction of these misstatements resulted from the change of accounting for Managed Services Agreements, for which the amount recorded to accounts receivable represents amounts invoiced for capacity billings to end customers which have not yet been collected by the financing entity as of the period end.

2 Inventories — The correction of these misstatements resulted from the change of accounting for inventory, including net capitalization of stock-based compensation cost of $2.0 million.

3 Deferred cost of revenue, current and non-current — The correction of these misstatements resulted from reclassifying deferred cost of revenue to property, plant and equipment, net, for the leased Energy Servers under the Managed Services Agreements and similar sale-leaseback arrangements of $7.4 million (short-term) and $55.4 million (long-term), net capitalization of stock-based compensation costs of $3.7 million into current deferred cost of revenue, and the correction of certain other immaterial misstatements identified to relieve installation deferred cost of revenue of $2.5 million.

4 Prepaid expenses and other current assets — The correction of these misstatements resulted from the change of accounting for Managed Services Agreements and similar arrangements, whereby prepaid property tax and insurance payments are now classified within prepaid expenses, rather than offset against deferred revenue.

5 Property, plant and equipment, net — The correction of these misstatements resulted from the change of accounting for Managed Services transactions and similar arrangements, whereby product and install cost of revenue are now recorded as property, plant and equipment, net in the cases where the risks of ownership have not completely transferred to the financing party of $230.9 million. This includes a net capitalization of stock-based compensation cost for these assets of $3.7 million.

6 Other long-term assets — The correction of these misstatements resulted from the change of accounting for Managed Services Agreements and similar arrangements, whereby the timing difference of capacity billings to end customers and the payments received from the financing entity is recorded within long term receivables and prepaid property tax and insurance payments are now classified within other long-term assets, rather than offset against long-term deferred revenue.

7 Accrued warranty — The correction of these misstatements resulted from the change of accounting for accrued warranty, which is now recorded on an as-incurred basis for our Managed Services Agreements and similar arrangements, reducing accrued warranty by $0.2 million and the change of accounting for the grid pricing escalation guarantees we provided in some of our sales arrangements, which are now recorded as derivative liabilities, reducing accrued warranty by $0.9 million.

8 Accrued expense and other current liabilities and other long-term liabilities — The correction of these misstatements resulted from the change of accounting for Managed Services Agreements, for which historical accrued liabilities recorded at inception of the agreements, as well as subsequent reductions of those liabilities, were reversed.

9 Financing obligations, current and non-current — The correction of these misstatements resulted from the change of accounting for Managed Services Agreements and similar arrangements, whereby instead of recognizing the upfront proceeds received from the bank as revenue, the proceeds received are classified as financing obligations.

10Deferred revenue and customer deposits, current and non-current — The correction of these misstatements resulted from the change of accounting for the recognition of product and installation revenue from upfront or ratable recognition to recognition of the capacity payments received from the end customer as power is generated by the Energy Servers as electricity revenue.

11 Derivative liabilities — The correction of these misstatements resulted from the change of accounting for embedded derivatives related to grid pricing escalation guarantees we provided in some of our sales arrangements. These are now recorded as derivative liabilities and were previously treated as an accrued liability.

12 Additional paid-in capital — Relates to the correction of an unadjusted misstatement in the valuation of our 6% Notes derivative, resulting in a credit to additional paid-in capital and additional expense of $0.8 million recorded within other expense, net.

.

Bloom Energy Corporation

Condensed Consolidated Statement of Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Three Months Ended

June 30, 2019 | | | | | | | | | | | | |

| | | | | | | As Previously Reported | | Restatement Impacts | | Restatement Reference | | ASC 606 Adoption Impacts | | As Restated And Recast | | | | |

| | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | |

| Product | | | | | | $ | 179,899 | | | $ | (22,757) | | | a | | $ | (13,061) | | | $ | 144,081 | | | | | |

| Installation | | | | | | 17,285 | | | (5,900) | | | a | | 1,691 | | | 13,076 | | | | | |

| Service | | | | | | 23,659 | | | (586) | | | a | | (47) | | | 23,026 | | | | | |

| Electricity | | | | | | 12,939 | | | 7,204 | | | a | | — | | | 20,143 | | | | | |

| Total revenue | | | | | | 233,782 | | | (22,039) | | | | | (11,417) | | | 200,326 | | | | | |

| Cost of revenue: | | | | | | | | | | | | | | | | | | |

| Product | | | | | | 131,952 | | | (19,005) | | | c, d | | 281 | | | 113,228 | | | | | |

| Installation | | | | | | 22,116 | | | (4,431) | | | c | | — | | | 17,685 | | | | | |

| Service | | | | | | 19,599 | | | 920 | | | b, d | | (1,756) | | | 18,763 | | | | | |

| Electricity | | | | | | 18,442 | | | 3,858 | | | c | | — | | | 22,300 | | | | | |

| Total cost of revenue | | | | | | 192,109 | | | (18,658) | | | | | (1,475) | | | 171,976 | | | | | |

| Gross profit | | | | | | 41,673 | | | (3,381) | | | | | (9,942) | | | 28,350 | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | |

| Research and development | | | | | | 29,772 | | | — | | | | | — | | | 29,772 | | | | | |

| Sales and marketing | | | | | | 18,359 | | | 17 | | | e | | (182) | | | 18,194 | | | | | |

| General and administrative | | | | | | 43,662 | | | — | | | | | — | | | 43,662 | | | | | |

| Total operating expenses | | | | | | 91,793 | | | 17 | | | | | (182) | | | 91,628 | | | | | |

| Loss from operations | | | | | | (50,120) | | | (3,398) | | | | | (9,760) | | | (63,278) | | | | | |

| Interest income | | | | | | 1,700 | | | — | | | | | — | | | 1,700 | | | | | |

| Interest expense | | | | | | (16,725) | | | (5,997) | | | f | | — | | | (22,722) | | | | | |

| Interest expense to related parties | | | | | | (1,606) | | | — | | | | | — | | | (1,606) | | | | | |

| Other expense, net | | | | | | (222) | | | — | | | | | — | | | (222) | | | | | |

| Loss on revaluation of warrant liabilities and embedded derivatives | | | | | | — | | | (540) | | | g | | — | | | (540) | | | | | |

| Loss before income taxes | | | | | | (66,973) | | | (9,935) | | | | | (9,760) | | | (86,668) | | | | | |

| Income tax provision | | | | | | 258 | | | — | | | | | — | | | 258 | | | | | |

| Net loss | | | | | | (67,231) | | | (9,935) | | | | | (9,760) | | | (86,926) | | | | | |

| Less: net loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | | | | (5,015) | | | — | | | | | — | | | (5,015) | | | | | |

| Net loss attributable to Class A and Class B common stockholders | | | | | | $ | (62,216) | | | $ | (9,935) | | | | | $ | (9,760) | | | $ | (81,911) | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

a Revenue impacted by Managed Services restatements — The correction of these misstatements resulted from the change from upfront recognition of product and installation revenue to recognition of the capacity payments received from the end customer as power is generated by the Energy Servers as electricity revenue over the term of our Managed Services Agreements and similar sale-leaseback arrangements, which also impacted our service revenue allocation.

b Service cost of revenue impacted by grid pricing escalation guarantees — The correction of these misstatements resulted in a change in the accounting for our grid escalation guarantees that resulted in a decrease in service cost of revenue of $0.1 million.

c Cost of revenue impacted by Managed Services restatements — The correction of these misstatements resulted from the change from upfront recognition of product and installation cost of revenue to recognition of the depreciation expense on the capitalized Energy Servers over their useful life of 21 years for our Managed Services Agreements and similar sale-leaseback transactions, resulting in a decrease in product cost of revenue of $18.1 million and installation cost of revenue of $5.2 million, offset by an increase in electricity cost of revenue of $3.8 million, together with the correction of certain other immaterial misstatements identified to record installation cost of revenue of $0.8 million.

d Cost of revenue impacted by stock-based compensation allocation — The correction of these misstatements resulted from the capitalization of stock-based compensation costs, with a net benefit to product cost of revenue of $0.9 million, and an increase in service cost of revenue of $1.0 million due to the expensing of stock-based compensation related to field replacement units.

e Sales and marketing and general and administrative expenses — The correction of these misstatements primarily resulted from the change of accounting for sales commission expense on an as earned basis, to accounting for the expense over the term of our Managed Services Agreements and similar sale-leaseback arrangements.

f Interest expense — The correction of these misstatements resulted from the change of accounting for sales that should have been accounted for as financing transactions, in which the upfront consideration received from the financing party is accounted for as a financing obligation and interest expense is recognized over the term of the Managed Services Agreement using the effective interest method.

g Gain (loss) on revaluation of warrant liabilities and embedded derivatives — The correction of these misstatements resulted from the change of accounting for the grid pricing escalation guarantees we provided in some of our sales arrangements which is now recorded as a derivative liability that needs to be fair valued each period end. The fair value increased in the period, resulting in a loss of $0.5 million.

Bloom Energy Corporation

Condensed Consolidated Statement of Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Six Months Ended

June 30, 2019 | | | | | | | | | | | | |

| | | | | | As Previously Reported | | Restatement Impacts | | Restatement Reference | | ASC 606 Adoption Impacts | | As Restated And Recast | | | | |

| | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | |

| Product | | | | | | $ | 321,633 | | | $ | (70,928) | | | a | | $ | (15,698) | | | $ | 235,007 | | | | | |

| Installation | | | | | | 39,543 | | | (17,095) | | | a | | 2,847 | | | 25,295 | | | | | |

| Service | | | | | | 46,949 | | | (1,160) | | | a | | 704 | | | 46,493 | | | | | |

| Electricity | | | | | | 26,364 | | | 14,168 | | | a | | — | | | 40,532 | | | | | |

| Total revenue | | | | | | 434,489 | | | (75,015) | | | | | (12,147) | | | 347,327 | | | | | |

| Cost of revenue: | | | | | | | | | | | | | | | | | | |

| Product | | | | | | 255,952 | | | (53,985) | | | c, d | | 33 | | | 202,000 | | | | | |

| Installation | | | | | | 46,282 | | | (12,837) | | | c | | — | | | 33,445 | | | | | |

| Service | | | | | | 47,156 | | | 2,251 | | | b, d | | (2,723) | | | 46,684 | | | | | |

| Electricity | | | | | | 27,671 | | | 7,613 | | | c | | — | | | 35,284 | | | | | |

| Total cost of revenue | | | | | | 377,061 | | | (56,958) | | | | | (2,690) | | | 317,413 | | | | | |

| Gross profit | | | | | | 57,428 | | | (18,057) | | | | | (9,457) | | | 29,914 | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | |

| Research and development | | | | | | 58,631 | | | — | | | | | — | | | 58,631 | | | | | |

| Sales and marketing | | | | | | 38,822 | | | 19 | | | e | | (274) | | | 38,567 | | | | | |

| General and administrative | | | | | | 82,736 | | | — | | | | | — | | | 82,736 | | | | | |

| Total operating expenses | | | | | | 180,189 | | | 19 | | | | | (274) | | | 179,934 | | | | | |

| Loss from operations | | | | | | (122,761) | | | (18,076) | | | | | (9,183) | | | (150,020) | | | | | |

| Interest income | | | | | | 3,585 | | | — | | | | | — | | | 3,585 | | | | | |

| Interest expense | | | | | | (32,687) | | | (11,835) | | | f | | — | | | (44,522) | | | | | |

| Interest expense to related parties | | | | | | (3,218) | | | — | | | | | — | | | (3,218) | | | | | |

| Other expense, net | | | | | | 43 | | | — | | | | | — | | | 43 | | | | | |

| Loss on revaluation of warrant liabilities and embedded derivatives | | | | | | — | | | (1,080) | | | g | | — | | | (1,080) | | | | | |

| Loss before income taxes | | | | | | (155,038) | | | (30,991) | | | | | (9,183) | | | (195,212) | | | | | |

| Income tax provision | | | | | | 466 | | | — | | | | | — | | | 466 | | | | | |

| Net loss | | | | | | (155,504) | | | (30,991) | | | | | (9,183) | | | (195,678) | | | | | |

| Less: net loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | | | | (8,847) | | | — | | | | | — | | | (8,847) | | | | | |

| Net loss attributable to Class A and Class B common stockholders | | | | | | $ | (146,657) | | | $ | (30,991) | | | | | $ | (9,183) | | | $ | (186,831) | | | | | |

a Revenue impacted by Managed Services restatements — The correction of these misstatements resulted from the change from upfront recognition of product and installation revenue to recognition of the capacity payments received from the end customer as power is generated by the Energy Servers as electricity revenue over the term of our Managed Services Agreements and similar sale-leaseback arrangements, which also impacted our service revenue allocation.

b Service cost of revenue impacted by grid pricing escalation guarantees — The correction of these misstatements resulted in a change in the accounting for our grid escalation guarantees that resulted in a decrease in service cost of revenue of 0.2 million.

c Cost of revenue impacted by Managed Services restatements — The correction of these misstatements resulted from the change from upfront recognition of product and installation cost of revenue to recognition of the depreciation expense on the capitalized Energy Servers over their useful life of 21 years for our Managed Services Agreements and similar sale-leaseback transactions, resulting in a decrease in product cost of revenue of $55.6 million and installation cost of revenue of $14.4 million, offset by an increase in electricity cost of revenue of $7.5 million, together with the correction of certain other immaterial misstatements identified to record installation cost of revenue of $1.6 million.

d Cost of revenue impacted by stock-based compensation allocation — The correction of these misstatements resulted from the capitalization of stock-based compensation costs, with a net benefit to product cost of revenue of $1.6 million, and an increase in service cost of revenue of $2.4 million due to the expensing of stock-based compensation related to field replacement units.

e Sales and marketing and general and administrative expenses — The correction of these misstatements primarily resulted from the change of accounting for sales commission expense on an as earned basis, to accounting for the expense over the term of our Managed Services Agreements and similar sale-leaseback arrangements.

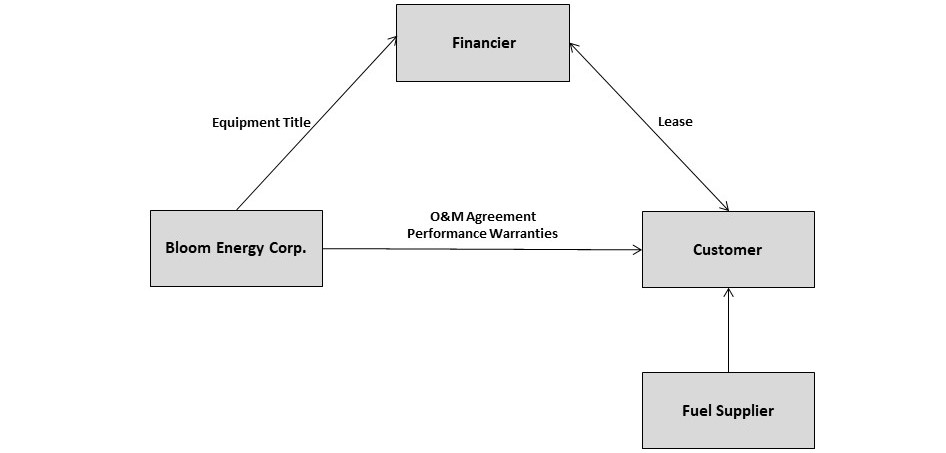

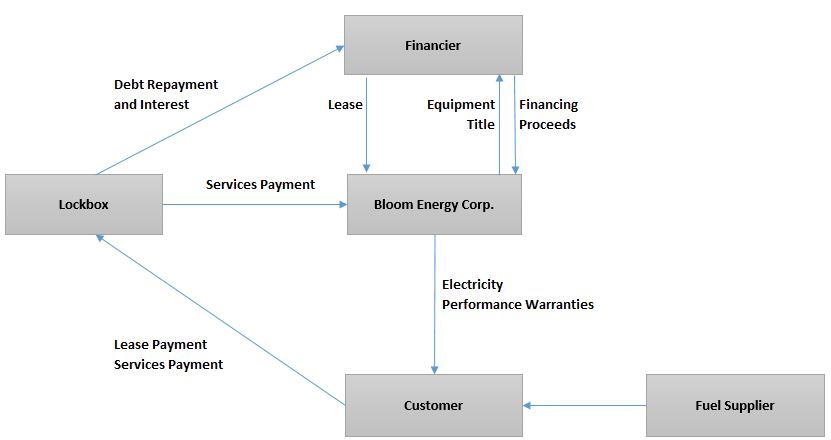

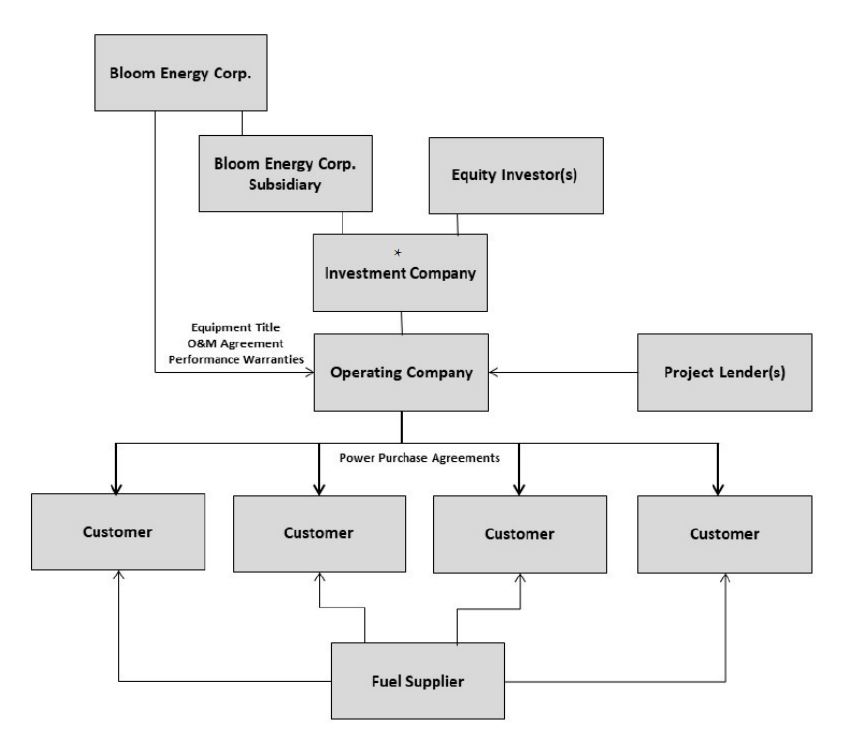

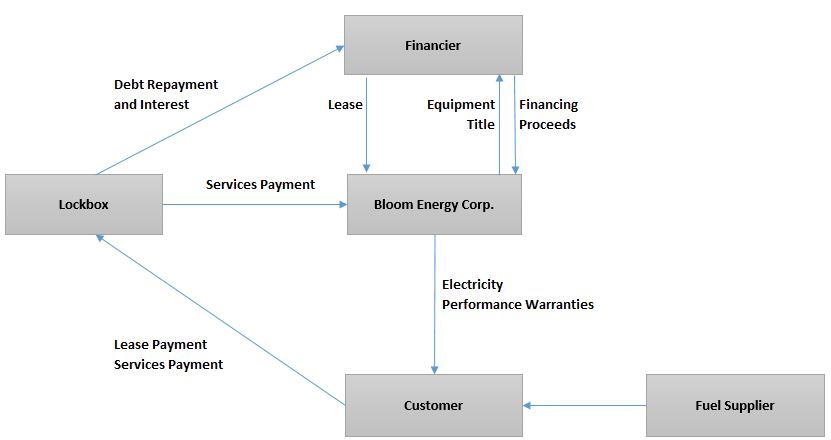

f Interest expense — The correction of these misstatements resulted from the change of accounting for sales that should have been accounted for as financing transactions, in which the upfront consideration received from the financing party is accounted for as a financing obligation and interest expense is recognized over the term of the Managed Services Agreement using the effective interest method.