UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

KNOWBE4, INC.

_____________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required. |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Fee computed on table in exhibit required by Item25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

KnowBe4, Inc.

33 N. Garden Avenue, Suite 1200

Clearwater, FL 33755

April 5, 2022

Dear Fellow Stockholders:

We are pleased to invite you to attend the 2022 annual meeting of stockholders (the “Annual Meeting”) of KnowBe4, Inc. (“KnowBe4” or the “Company”) to be held on Monday, May 16, 2022 at 10:00 a.m. (Eastern Time). The Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/KNBE2022, where you will be able to listen to the meeting live, submit questions and vote online.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement contain details of the business to be conducted at the Annual Meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our board of directors, we would like to express our appreciation for your continued support of and interest in KnowBe4.

| | | | | | | | |

| | | Sincerely, |

| | | |

| | Chief Executive Officer and Chairperson

of the Board of Directors |

KnowBe4, Inc.

33 N. Garden Avenue, Suite 1200

Clearwater, FL 33755

___________________________________________________

Notice of Annual Meeting of Stockholders

___________________________________________________

| | | | | |

| Time and Date | 10:00 a.m. (Eastern Time), Monday, May 16, 2022 |

| |

| |

| Place | The Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/KNBE2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. |

| |

| |

| Items of Business | •To elect Stephen Shanley as a Class I director, to serve office until our 2025 annual meeting of stockholders or until his successor is elected and qualified. •To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. •To transact other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

| |

| |

| Record Date | Tuesday, March 22, 2022 (the “Record Date”). Only stockholders of record as of the Record Date are entitled to notice of and to vote at the Annual Meeting. |

| |

| |

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our statement and our annual report, is first being sent or given on or about Tuesday, April 5, 2022 to all stockholders entitled to vote at the Annual Meeting. The proxy material and our annual report can be accessed as of Tuesday, April 5, 2022 by visiting http://www.proxyvote.com, as well as on our investor relations webpage at https://investors.knowbe4.com/. |

| |

| |

| Voting | Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. |

| |

| |

| By order of the Board of Directors, |

| /s/ Sjoerd Sjouwerman |

| Sjoerd Sjouwerman |

| Chief Executive Officer and Chairperson of the Board of Directors |

| Clearwater, Florida |

| April 5, 2022 |

______________________________________________________________________________________________________________

Proxy Statement for 2022 Annual Meeting of Stockholders

_______________________________________________________________________________________________________________

Table of Contents

KnowBe4, Inc.

Proxy Statement

2022 Annual Meeting of Stockholders

To be held at 10:00 a.m. (Eastern Time), on Monday, May 16, 2022

GENERAL INFORMATION

This proxy statement is being furnished by KnowBe4, Inc. in connection with the solicitation of proxies by our board of directors for use at the 2022 Annual Meeting of Stockholders of KnowBe4, Inc. (the “Annual Meeting”) to be held on Monday, May 16, 2022, at 10:00 a.m. (Eastern Time), solely via live webcast on the Internet at www.virtualshareholdermeeting.com/KNBE2022, and for any postponements, adjournments or continuations thereof. In this proxy statement, the terms “KnowBe4,” “the company,” “we,” “us” and “our” refer to KnowBe4, Inc. and our subsidiaries.

On or about April 5, 2022, we expect to mail a Notice of Internet Availability of Proxy Materials (the “Notice”), containing instructions on how to access this proxy statement for the Annual Meeting and our Annual Report on Form 10-K for the year ended December 31, 2021, to our stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement, and references to our website address in this proxy statement are inactive textual references only.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

What proposals will be voted on at the Annual Meeting?

The following proposals will be voted on at the Annual Meeting:

•the election of Stephen Shanley as a Class I director to serve until our 2025 annual meeting of stockholders or until his successor is elected and qualified; and

•the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the Annual Meeting.

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

•“FOR” the election of Stephen Shanley as a Class I director; and

•“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

Who is entitled to vote at the Annual Meeting?

Holders of our Class A and Class B common stock as of the close of business on March 22, 2022 (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, there were 72,905,795 shares of our Class A common stock outstanding and 101,903,213 shares of our Class B common stock outstanding. Our Class A common

stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each matter properly brought before the Annual Meeting, and each share of Class B common stock is entitled to ten votes on each matter properly brought before the Annual Meeting. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our common stock.

Is there a list of registered stockholders entitled to vote at the Annual Meeting?

A list of registered stockholders entitled to vote at the Annual Meeting will be made available for examination by any stockholder for any purpose germane to the meeting for a period of at least ten days prior to the Annual Meeting between the hours of 9:00 a.m. and 4:30 p.m., Eastern Time, at our principal executive offices located at 33 N. Garden Avenue, Suite 1200, Clearwater, FL 33755 by contacting our general counsel. The list of registered stockholders entitled to vote at the Annual Meeting will also be available online during the Annual Meeting at www.virtualshareholdermeeting.com/KNBE2022, for those stockholders attending the Annual Meeting.

How many votes are needed for approval of each proposal?

•Proposal No. 1: The director nominee receiving the highest number of votes cast by the shares present virtually or represented by proxy at the Annual Meeting and entitled to vote on the election of directors will be elected to the board of directors. You may vote FOR or WITHHOLD with respect to the nominee for Class I director. Abstentions and broker non-votes will have no effect on the outcome of the vote. As a result, any shares not voted FOR the nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non‑vote, will have no effect on the outcome of the election. Thus, if you hold your shares in street name and you do not instruct your broker, bank or other nominee how to vote in the election of the director, no votes will be cast on your behalf, but your proxy will be counted for the purpose of establishing a quorum.

•Proposal No. 2: The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal.

What is the quorum requirement for the Annual Meeting?

A quorum is the minimum number of shares required to be present or represented at the Annual Meeting for the meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of the voting power of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the Annual Meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another time or place.

How do I vote and what are the voting deadlines?

Stockholder of Record. If shares of our common stock are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant

your voting proxy directly to the individuals listed on the proxy card or to vote live at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

If you are a stockholder of record, you may vote in one of the following ways:

•by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59 pm, Eastern Time, on May 15, 2022 (have the Notice or proxy card in hand when you visit the website);

•by toll-free telephone at 1-800-690-6903, 24 hours a day, 7 days a week, until 11:59 pm, Eastern Time, on May 15, 2022 (have the Notice or proxy card in hand when you call);

•by completing, signing and mailing your proxy card (if you received printed proxy materials), which must be received prior to the Annual Meeting; or

•by attending the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/KNBE2022, where you may vote during the meeting (have the Notice or proxy card in hand when you visit the website).

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank, or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock live at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. We therefore recommend that you follow the voting instructions in the materials you receive. If you request a printed copy of our proxy materials by mail, your broker, bank, or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank, or other nominee as “street name stockholders.”

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the election of Stephen Shanley as a Class I director; and

•“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

In addition, if any other matters are properly brought before the Annual Meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non‑routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non‑routine matters, then those shares will be treated as broker non‑votes with respect to the non‑routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the Annual Meeting by:

•entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above);

•completing and returning a later‑dated proxy card, which must be received prior to the Annual Meeting;

•delivering a written notice of revocation to our general counsel at KnowBe4, Inc., 33 N. Garden Avenue, Suite 1200, Clearwater, FL 33755, Attention: General Counsel, which must be received prior to the Annual Meeting; or

•attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

What do I need to do to attend the Annual Meeting?

We will be hosting the Annual Meeting via live audio webcast only.

Stockholder of Record. If you were a stockholder of record as of the Record Date, then you may attend the Annual Meeting virtually, and will be able to submit your questions during the meeting and vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/KNBE2022. To attend and participate in the Annual Meeting, you will need the control number included on the Notice or proxy card. The Annual Meeting live audio webcast will begin promptly at 10:00 am, Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 am, Eastern Time, and you should allow ample time for the check-in procedures.

Street Name Stockholders. If you were a street name stockholder as of the Record Date and your voting instruction form or the Notice indicates that you may vote your shares through the proxyvote.com website, then you may access and participate in the Annual Meeting with the control number indicated on that voting instruction form or Notice. Otherwise, street name stockholders should contact their bank, broker or other nominee and obtain a legal proxy in order to be able to attend and participate in the Annual Meeting.

How can I get help if I have trouble checking in or listening to the Annual Meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Sjoerd Sjouwerman, our Chief Executive Officer and Chairperson of the board of directors, has been designated as proxy holder for the Annual Meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the Annual Meeting, then the proxy holder will use the proxy holder’s own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, then the proxy holder can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of election.

How can I contact KnowBe4’s transfer agent?

You may contact our transfer agent, Computershare Trust Company, N.A., by writing Computershare Trust Company, N.A., at P.O. Box 43001 Providence, RI, 02940-3001. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at https://www.computershare.com/us.

How are proxies solicited for the Annual Meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the Annual Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the Annual Meeting?

We will disclose voting results on a Current Report on Form 8‑K that we will file with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the meeting. If final voting results are not available to us in time to file a Form 8‑K, we will file a Form 8‑K to publish preliminary results and will provide the final results in an amendment to the Form 8‑K as soon as they become available.

Why did I receive a Notice instead of a full set of proxy materials?

In accordance with the rules of the SEC we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice instead of a paper copy of the proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice or more than one set of printed proxy materials?

If you receive more than one Notice or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one copy of the Notice or proxy statement and annual report. How may I obtain an additional copy of the Notice or proxy statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice and, if applicable, the proxy statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, the proxy statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to

request that we only send a single copy of next year’s notice of internet availability or proxy statement and annual report, as applicable, you may contact us as follows:

KnowBe4, Inc. Attention: Investor Relations

33 N. Garden Avenue, Suite 1200

Clearwater, FL 33755

Tel: (855) 566-9234

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board

Our board of directors currently consists of eight directors, six of whom are independent under the listing standards of The Nasdaq Global Select Market (“Nasdaq”). Our board of directors is divided into three classes, designated as Class I, Class II and Class III, each with a staggered three-year term. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

Upon the recommendation of our nominating and corporate governance committee, we are nominating Stephen Shanley for election as a Class I director at the Annual Meeting. If elected, Mr. Shanley will hold office for a three-year term until the annual meeting of stockholders to be held in 2025 and until his successor is elected and qualified or until his early resignation, removal or death. Joseph DiSabato, who is currently a Class I director, will not stand for re-election after his current term, which will expire at the Annual Meeting. Accordingly, the nominating and corporate governance committee did not nominate Mr. DiSabato for re-election as a director, and, immediately following the expiration of Mr. DiSabato's term at the Annual Meeting, the board of directors will consist of seven directors with one vacancy.

The following table sets forth the names, ages as of March 31, 2022, and certain other information for each of our directors and director nominees:

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Position(s) | Director Class | Director Since | Current Term Expires | Expiration of Term for Which Nominated |

| Nominee for Director | | | | | | |

Stephen Shanley(1)(2) | 35 | Director | I | 2019 | 2022 | 2025 |

| Resigning Director | | | | | | |

Joseph DiSabato(3) | 55 | Director | I | 2019 | 2022 | |

| Continuing Directors | | | | | | |

Jeremiah Daly(2)(4) | 40 | Director | II | 2016 | 2023 | — |

Kara Wilson(2)(4) | 52 | Director | II | 2020 | 2023 | — |

| Shrikrishna (“Krish”) Venkataraman | 45 | Director | II | 2022 | 2023 | — |

| Sjoerd (“Stu”) Sjouwerman | 65 | Chief Executive Officer & Chairperson | III | 2010 | 2024 | — |

Kevin Klausmeyer(1) | 63 | Director | III | 2020 | 2024 | — |

Gerhard Watzinger(1)(2)(4) | 61 | Director | III | 2019 | 2024 | — |

____________________________________

(1) Member of audit committee.

(2) Member of nominating and corporate governance committee.

(3) Mr. DiSabato will not stand for re-election, and his current term on our board of directors will expire at the Annual Meeting.

(4) Member of compensation committee.

Nominee for Director

| | | | | |

| Stephen Shanley has served as a member of our board of directors since March 2019. Since August 2014, Mr. Shanley has served as a Partner at Kohlberg Kravis Roberts & Co. Partners LLP and Kohlberg Kravis Roberts & Co. (International) Partners LLP (NYSE: KKR), a leading global investment firm. Mr. Shanley is the head of KKR’s Technology Growth Equity business in Europe. Mr. Shanley currently serves on the board of directors of Darktrace Limited, as well as on the board of directors of several privately-held technology companies including Feedzai - Consultadoria e Inovação Tecnológica, S.A., ReliaQuest, LLC, Zwift Inc., and OutSystems Holdings S.A. Prior to joining KKR, Mr. Shanley was an investor at Technology Crossover Ventures, a technology-focused growth equity firm. Prior to that, Mr. Shanley was with the TMT investment banking group of Needham & Company, LLC, and started his career in the transaction services group of KPMG US LLP. Mr. Shanley holds a B.S. and a B.Sc. from Santa Clara University.

We believe Mr. Shanley is qualified to serve on our board of directors because of his extensive business and investment experience, particularly in the technology industry. |

Resigning Director

| | | | | |

| Joseph DiSabato has served as a member of our board of directors since April 2019. Mr. DiSabato has notified us of his decision to retire from service on our board of directors following completion of his current term and will not stand for re-election at the Annual Meeting. Since 2000, Mr. DiSabato has served as is a managing director in Growth Equity within Goldman Sachs Asset Management and a member of Goldman Sachs' Asset Management Corporate and Growth Investment committees. Mr. DiSabato first joined Goldman Sachs in 1988, was named a managing director in 2000 and was named a partner in 2004. Mr. DiSabato serves on the board of directors of several privately-held companies, including Infusion Software, Inc., a an e-mail marketing and sales platform provider for small businesses, and Newfold Digital Inc., a web hosting and information technology services company (formerly publicly traded under the name Endurance International Group Holdings, Inc.). Mr. DiSabato holds a B.S. from the Massachusetts Institute of Technology and an M.B.A. from UCLA Anderson Graduate School of Management. |

Continuing Directors

| | | | | |

| Jeremiah Daly has served as a member of our board of directors since January 2016. Mr. Daly is a co-founder and General Partner of Elephant, a venture capital firm, where he has served since May 2015. Prior to co-founding Elephant, Mr. Daly was an investor at Accel, Highland Capital Partners and Summit Partners. Mr. Daly holds an A.B. in Government from Dartmouth College.

We believe Mr. Daly is qualified to serve on our board of directors because of his extensive experience working with the management teams of, and investing in, a number of privately and publicly held companies. |

| | | | | |

| Kara Wilson has served as a member of our board of directors since January 2020. Since October 2019, Ms. Wilson has served as a Senior Advisor to KKR & Co. Inc. From June 2017 to May 2019, Ms. Wilson served as Chief Marketing Officer at Rubrik, Inc., a cloud management company ("Rubrik"), where she was responsible for Rubrik's global marketing initiatives including corporate, product, and technical marketing, and global communication. Prior to Rubrik, Ms. Wilson served in various leadership roles at FireEye, Inc. (acquired by Symphony Technology Group in 2021 and now known as Trellix), including as Chief Marketing Officer from August 2013 to June 2017 and as Executive Vice President from October 2016 to June 2017. Prior to that, Ms. Wilson held marketing leadership roles at Okta, Inc., an identity and access management company, SAP SE, an enterprise software company, and Cisco Systems, Inc., a networking, cloud and cybersecurity solutions provider. In addition, Ms. Wilson has served on the board of directors of Paychex, Inc., a publicly traded provider of human resource, payroll and benefits services, since July 2017. Ms. Wilson also serves on the board of directors of several privately held companies, including Corel Corporation OneStream Software LLC, SkyHive Technologies Inc., ReliaQuest LLC, Outsystems Holdings S.A., and Accela, Inc. Ms. Wilson holds a B.A. in Political Economy from the University of California, Berkeley.

We believe Ms. Wilson is qualified to serve on our board of directors due to her over 25 years of experience driving go-to-market strategies for large, medium and hyper-growth startups, as well as her experience serving as a director and on the management team of publicly traded cybersecurity companies. |

| | | | | |

| Krish Venkataraman has served as a member of our board of directors since March 2022 and previously served as our Co-President and Chief Financial Officer from September 2018 to March 2022. From March 2016 to September 2018, Mr. Venkataraman served as Chief Financial Officer of Dealogic, a global fintech company, where he led the company through a successful and strategic sale. Prior to that, from March 2014 to February 2016, Mr. Venkataraman acted as Chief Financial Officer and Chief Operating Officer of Syncsort Incorporated, a global big data software company, where he also led a successful sale. Prior to Syncsort, Mr. Venkataraman held various management roles including as Chief Financial Officer for information technology for NYSE Euronext, where he helped in the sale process to Intercontinental Exchange; as Chief Administrative Officer for U.S. equities for Lehman Brothers Holdings Inc., and as a strategist for both the American Express Company and Deloitte Consulting. Mr. Venkataraman holds a B.S. from Carnegie Mellon University and an M.B.A. from Cornell University – Johnson School of Management.

We believe Mr. Venkataraman is qualified to serve on our board of directors due to the operational insight he brings as our former Chief Financial Officer and due to his executive leadership roles at other technology companies. |

| | | | | |

| Stu Sjouwerman founded our company in August 2010 and has served as our Chief Executive Officer and as a member of our board of directors since our inception. Mr. Sjouwerman is Editor-in-Chief of Cyberheist News, an electronic magazine tailored to deliver IT security news, technical updates and social engineering alerts. A serial entrepreneur and data security expert, Mr. Sjouwerman has more than 30 years of experience in the IT industry, is a five-time Inc. 500 award winner and the author of four books including “Cyberheist: The Biggest Financial Threat Facing American Businesses.” Mr. Sjouwerman attended Universiteit van Amsterdam where he studied Educational Sciences.

We believe Mr. Sjouwerman is qualified to serve on our board of directors due to the experience and operational insight he brings as our Chief Executive Officer and founder, and due to his extensive experience building and growing companies in the IT industry. |

| | | | | |

| Kevin Klausmeyer has served as a member of our board of directors since August 2020. In addition, since November 2019 and from June 2017 to November 2017, Mr. Klausmeyer has served on the board of directors of Jamf Holding Corp., a publicly traded provider of Apple enterprise management software. Mr. Klausmeyer also serves on the board of directors of several privately held technology companies, including Ivalua Inc., a provider of procurement software, and ComboCurve, Inc., a SaaS provider to the oil and gas industry. Mr. Klausmeyer began his career in public accounting with Arthur Andersen and subsequently held senior financial positions at several software companies, including BMC Software, Inc., a multinational information technology services and consulting company, and PentaSafe Security Technologies (acquired by NetIQ Corp), which was a security management and software technology company. Mr. Klausmeyer holds a B.B.A. in Accounting from the University of Texas at Austin.

We believe Mr. Klausmeyer is qualified to serve on our board of directors because of his experience on other public technology companies’ boards and his executive leadership roles at technology companies. |

| | | | | |

| Gerhard Watzinger has served as a member of our board of directors since October 2019. From April 2013 to September 2013, Mr. Watzinger served as Chief Executive Officer of IGATE Corporation, an IT services company. Prior to that, Mr. Watzinger served as Executive Vice President for Corporate Strategy and Mergers & Acquisitions of the McAfee business unit of Intel Corporation ("Intel"), a designer and manufacturer of advanced integrated digital technology platforms, from February 2011 (upon Intel's acquisition of McAfee, Inc. ("McAfee") to March 2012, and in a similar leadership role at McAfee, Inc. from November 2007 to February 2011. Mr. Watzinger joined McAfee in November 2007 upon McAfee's acquisition of SafeBoot Corporation, a data protection software company, where he served as Chief Executive Officer from February 2004 to November 2007. In addition, since April 2012, Mr. Watzinger has served as chairman of the board of directors of CrowdStrike Holdings, Inc., a publicly traded cybersecurity technology company, since September 2008, he has served on the board of directors of Mastech Digital, Inc., a publicly traded digital transformation information technology services company, and since December 2014, he has served on the board of directors of Absolute Software, a publicly traded persistent software company. Mr. Watzinger holds an advanced degree in Computer Science from the Munich University of Applied Sciences.

We believe Mr. Watzinger is qualified to serve on our board of directors due to his expertise within the IT industry, as well as his experience serving as a member of the board of directors of other publicly traded companies. |

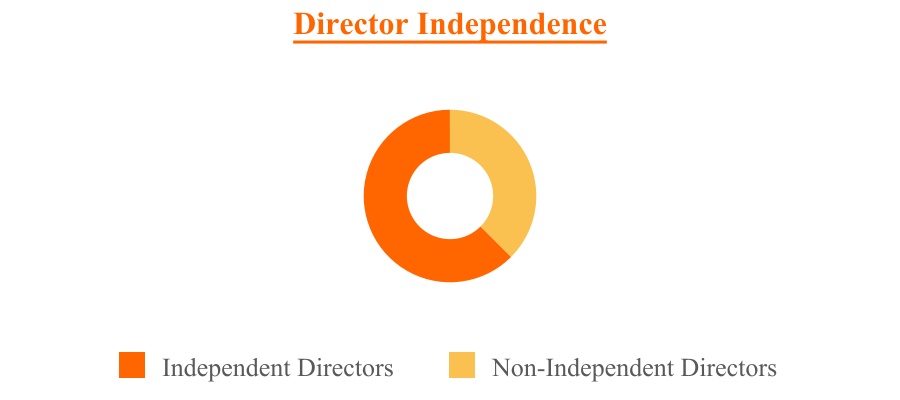

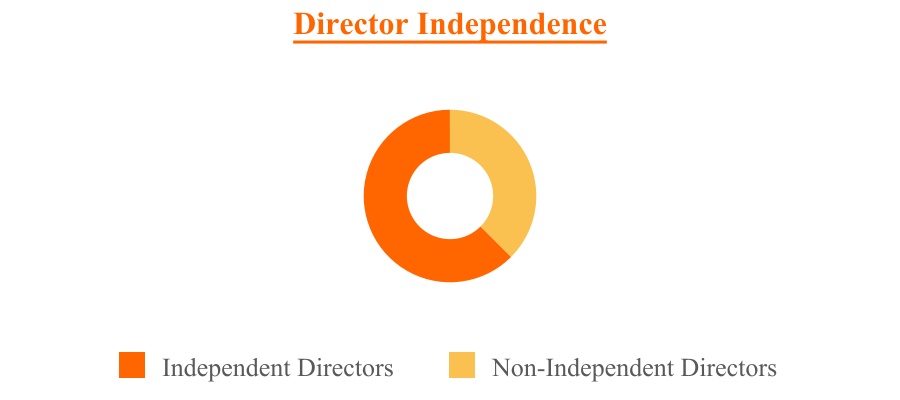

Director Independence

Our Class A common stock is listed on Nasdaq. As a company listed on Nasdaq, we are required under Nasdaq listing rules to maintain a board comprised of a majority of independent directors as determined affirmatively by our board of directors. Under Nasdaq listing rules, a director will only qualify as an independent director if, in the opinion of that listed company’s board of directors, the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, the Nasdaq listing rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Nasdaq listing rules applicable to audit committee members. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and Nasdaq listing rules applicable to compensation committee members.

Our board of directors has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Mr. Daly, Mr. Klausmeyer, Mr. Shanley, Mr. Watzinger and Ms. Wilson, representing five of our eight directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under the listing standards of Nasdaq. Mr. Sjouwerman and Mr. Venkataraman are not considered a independent directors because of their positions as our Chief Executive Officer and former Co-President and Chief Financial Officer, respectively.

In making these determinations, our board of directors considered the current and prior relationships that each non‑employee director has with our company and all other facts and circumstances that our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non‑employee director, and the transactions involving them described in the section titled “Related Person Transactions.”

Board Leadership Structure

Mr. Sjouwerman currently serves as both the chairperson of our board of directors and as our Chief Executive Officer. As our co-founder, Mr. Sjouwerman is best positioned to identify strategic priorities, lead critical discussion and execute our business plan.

Our board of directors does not have a policy regarding the separation of the roles of Chief Executive Officer and chairperson of the board of directors, as our board of directors believes it is in our best interest to make that determination based on our position and direction and the membership of the board of directors. Our board of directors has determined that having Mr. Sjouwerman serve as chairperson is in the best interest of our stockholders at this time because the detailed knowledge of our day-to-day operations and business that Mr. Sjouwerman

possesses greatly enhances the decision-making processes of our board of directors as a whole. We have a governance structure in place, including independent directors, designed to ensure the powers and duties of the dual role are handled responsibly. We do not have a lead independent director.

Role of Board in Risk Oversight Process

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our audit committee also monitors compliance with legal and regulatory requirements.

Board Committees

Our board of directors has established the following standing committees of the board:

| | | | | | | | | | | | | | |

Audit

Committee | | Compensation

Committee | | Nominating and Corporate Governance Committee |

The composition and responsibilities of each of the committees of our board of directors is described below.

Audit Committee

The current members of our audit committee are Messrs. Klausmeyer, Shanley and Watzinger. Mr. Klausmeyer is the chairperson of our audit committee. Our board of directors has determined that each member of our audit committee meets the requirements for independence of audit committee members under the rules and regulations of the SEC and the listing standards of Nasdaq, and also meets the financial literacy requirements of the listing standards of Nasdaq. Our board of directors has determined that Messrs. Klausmeyer and Watzinger are audit committee financial experts within the meaning of Item 407(d) of Regulation S‑K. Our audit committee is responsible for, among other things:

•appointing and overseeing an independent auditor, and approving audit and non-audit services;

•evaluating the independence and qualifications of the independent auditor at least annually;

•reviewing our annual audited financial statements and quarterly financial statements;

•reviewing the responsibilities, functions, qualifications and performance of our internal audit function, including internal audit’s charter, plans, budget, objectivity and the scope and results of internal audits;

•reviewing the results of the internal audit program, including significant issues in internal audit reports and responses by management;

•setting the Company's hiring policies for employees or former employees of our independent auditor;

•reviewing, approving and monitoring related party transactions involving directors or executive officers and reviewing and monitoring conflicts of interest situations involving such individuals where appropriate;

•periodically, meeting separately with (a) management, (b) our internal auditors (or other personnel responsible for the design and implementation of the internal audit function) and (c) our independent auditors (with and without management present), in each case to discuss any matters that the audit committee or the others believe should be discussed privately;

•addressing complaints received by us regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters;

•reviewing with our management and/or General Counsel, on at least an annual basis: (i) our legal, regulatory and ethical compliance programs and (ii) any legal matters that could have a significant impact on our financial statements, our compliance with laws and regulations and any material inquiries received from regulators or governmental agencies;

•reporting regularly to our board of directors about issues including, but not limited to, any issues that arise with respect to the quality or integrity of our financial statements, our compliance with legal or regulatory requirements, the performance and independence of the independent auditors and, when the internal audit function is established, the performance of the internal audit function;

•reviewing at least annually the adequacy of the audit committee’s charter and recommend any proposed changes to our board of directors for approval; and

•conducting and presenting to our board of directors an annual self-performance evaluation of the audit committee.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. A copy of the charter of our audit committee is available on our website at https://investors.knowbe4.com/index.php/corporate-governance/governance-documents. During 2021, our audit committee held eight meetings.

Compensation Committee

The current members of our compensation committee are Messrs. Watzinger and Daly and Ms. Wilson. Mr. Watzinger is the chairperson of our compensation committee. Our board of directors has determined that each member of our compensation committee meets the requirements for independence for compensation committee members under the rules and regulations of the SEC and the listing standards of Nasdaq. Each member of the compensation committee is also a non‑employee director, as defined pursuant to Rule 16b‑3 promulgated under the Exchange Act. Our compensation committee is responsible for, among other things:

•establishing, and periodically reviewing, a general compensation strategy for our organization, and overseeing the development and implementation of our compensation plans to ensure that these plans are consistent with this general compensation strategy;

•administering all of our equity-based plans and such other plans as shall be designated from time to time by our board of directors;

•reviewing, approving and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers;

•reviewing and recommending to our board of directors the form and amount of compensation (including perquisites and other benefits), and any additional compensation to be paid, for service on our board of directors and committees of our board of directors and for service as a chairperson of a committee at least annually;

•overseeing, in connection with our board of directors, engagement with stockholders and proxy advisory firms on executive compensation matters;

•retaining or obtaining the advice of compensation consultants, independent legal counsel and other advisers;

•conducting and presenting to our board of directors an annual self-performance evaluation of the compensation committee; and

•reviewing at least annually the adequacy of the compensation committee’s charter and recommending any proposed changes to our board of directors for approval.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. A copy of the charter of our compensation committee is available on our website at https://investors.knowbe4.com/index.php/corporate-governance/governance-documents. During 2021, our compensation committee held four meetings and acted by written/electronic consent seven times.

Nominating and Corporate Governance Committee

The current members of our nominating and corporate governance committee are Ms. Wilson and Messrs. Daly, Shanley and Watzinger. Ms. Wilson is the chairperson of our nominating and corporate governance committee. Our board of directors has determined that each member of our nominating and corporate governance committee meets the requirements for independence for nominating and corporate governance committee members under the listing standards of Nasdaq. Our nominating and corporate governance committee is responsible for, among other things:

•making recommendations to our board of directors regarding the structure of our board of directors, the composition of our board of directors, the criteria for membership and the process for filling vacancies on our board of directors;

•identifying individuals qualified to become members of our board of directors (taking into consideration, if applicable, the criteria for board of directors’ membership) and recommending to our board of directors’ nominees to fill vacancies and newly created directorships on our board of directors and the nominees to stand for election as directors;

•reviewing and recommending to our board of directors the corporate governance guidelines of our board of directors;

•conducting and presenting to our board of directors an annual self-performance evaluation of the nominating and governance committee;

•overseeing the evaluation of our board of directors and its committees and report such evaluation to our board of directors; and

•reviewing at least annually the adequacy of the nominating and governance committee’s charter and recommending any proposed changes to our board of directors for approval.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of Nasdaq. A copy of the charter of our nominating and corporate governance committee is available on our website at https://investors.knowbe4.com/index.php/corporate-governance/governance-documents. During 2021, our nominating and corporate governance committee did not meet.

Attendance at Board and Stockholder Meetings

During our fiscal year ended December 31, 2021, our board of directors held 11 meetings and acted by written/electronic consent six times. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period for which he or she has been a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at the annual meetings of stockholders, we encourage, but do not require, directors to attend. The Annual Meeting will be the first annual meeting of our stockholders.

Compensation Committee Interlocks and Insider Participation

During 2021, the members of our compensation committee were Messrs. Daly and Watzinger and Ms. Wilson. None of the members of our compensation committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Considerations in Evaluating Director Nominees

Our board of directors and nominating and corporate governance committee regularly review the composition of the board of directors and use a variety of methods for identifying and evaluating potential director nominees. In their evaluation of director candidates, including the current directors eligible for re-election, they will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors and other director qualifications. Some of the factors that are considered in

assessing director nominee qualifications include, without limitation, issues of character, professional ethics and integrity, judgment, business experience and diversity, and with respect to diversity, such factors as race, ethnicity, gender, differences in professional background, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board of directors.

Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that the board should be a diverse body, and our board of directors and nominating and corporate governance committee consider a broad range of perspectives, backgrounds and experiences.

If our nominating and corporate governance committee determines that an additional or replacement director is required, then the committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, board or management.

After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and our board of directors has the final authority in determining the selection of director candidates for nomination to our board of directors.

Board Diversity Matrix

In making determinations regarding nominations of directors, the board of directors and nominating and corporate governance committee may take into account the benefits of diverse viewpoints. The following chart provides summary information about the diversity of our directors as of April 5, 2022:

| | | | | | | | | | | |

| BOARD DIVERSITY |

| | | |

| 8 Total Directors |

| Gender Identity |

| Female | | Male |

| | | |

| Directors | 1 | | 7 |

| | | |

| Demographic Background | | | |

| | | |

| | | |

| Asian | — | | 1 |

| | | |

| | | |

| White | 1 | | 6 |

| | | |

| | | |

| | | |

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and corporate governance committee will consider recommendations and nominations for candidates to our board of directors from stockholders in the same manner as candidates recommended to the committee from other sources, so long as such recommendations and nominations comply with our amended and restated certificate of incorporation and amended and restated bylaws, all applicable company policies and all applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our bylaws and corporate governance guidelines and the director nominee criteria described above.

A stockholder that wants to recommend a candidate to our board of directors should direct the recommendation in writing by letter to our general counsel at KnowBe4, Inc., 33 N. Garden Avenue, Suite 1200, Clearwater, FL 33755, Attention: General Counsel. Such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us and evidence of the recommending stockholder’s ownership of our capital stock. Such recommendation must also include a statement

from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and the rules and regulations of the SEC and should be sent in writing to our general counsel at the address above. To be timely for our 2023 annual meeting of stockholders, nominations must be received by our general counsel observing the deadlines discussed below under “Other Matters—Stockholder Proposals or Director Nominations for 2023 Annual Meeting.”

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors, may do so by writing and sending the correspondence to our Nominating and Corporate Governance Committee with copies to the Chief Financial Officer and General Counsel by mail to our principal executive offices at KnowBe4, Inc., 33 N. Garden Avenue, Suite 1200, Clearwater, FL 33755. Our General Counsel, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board of directors to consider and (3) matters that are of a type that are improper or irrelevant to the functioning of our board of directors or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our General Counsel, in consultation with appropriate directors as necessary will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the board. These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our board of directors are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans and (5) holding our securities in a margin account.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted corporate governance guidelines. These guidelines address, among other items, the qualifications and responsibilities of our directors and director candidates, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. The full text of our corporate governance guidelines and code of business conduct and ethics are available on our website at https://investors.knowbe4.com/index.php/corporate-governance/governance-documents. We will post amendments to our code of business conduct and ethics or any waivers of our code of business conduct and ethics for directors and executive officers on the same website.

Director Compensation

In connection with our initial public offering (“IPO”), we adopted an outside director compensation policy for our non-employee directors (the “Director Compensation Policy”). Under our Director Compensation Policy, non-employee directors receive compensation in the form of cash and equity, as described below. We also reimburse our

non-employee directors for expenses incurred in connection with attending board and committee meetings as well as continuing director education.

Cash Compensation

Non-employee directors are entitled to receive the following cash compensation for their service under the Director Compensation Policy:

| | | | | |

| Position | Annual Cash Retainer |

| Base Director Fee | $ | 30,000 | |

| Additional Chairperson Fee | |

| Chair of the Board | $ | 20,000 | |

| Chair of the Audit Committee | $ | 20,000 | |

| Chair of the Compensation Committee | $ | 10,000 | |

| Chair of the Nominating and Corporate Governance Committee | $ | 7,500 | |

| Additional Committee Member Fee (excluding chairpersons) | |

| Audit Committee | $ | 10,000 | |

| Compensation Committee | $ | 5,000 | |

| Nominating and Corporate Governance Committee | $ | 4,000 | |

Each non-employee director who serves as the chairperson of a committee will receive only the annual cash fee as the chairperson of the committee and not the additional annual cash fee as a member of the committee. All cash payments to non-employee directors are paid quarterly in arrears on a pro-rated basis.

Equity Compensation

Initial Award

Under our Director Compensation Policy, each non-employee director upon first becoming a non-employee director after our IPO automatically receives an initial award of restricted stock units having a value of $360,000. The initial restricted stock unit award will vest annually over three years, subject to continued service through the vesting date. If a non-employee director first became a non-employee director at a time other than at an annual meeting, then the director will receive a pro-rata portion of the annual award described below, which will vest at the next following annual meeting of stockholders, subject to continued service through the vesting date.

Annual Award

Each non-employee director automatically receives an annual restricted stock unit award having a value of $180,000, effective on the date of each annual meeting of stockholders. The annual restricted stock unit award will vest on the earlier of one year following the grant date or the next annual meeting of stockholders, subject to continued service through the vesting date. All awards under the Outside Director Compensation Policy accelerate and vest upon a change in control.

Non-Employee Director Compensation for Fiscal 2021

The following table sets forth information regarding the total compensation awarded to, earned by or paid to our non‑employee directors for their service on our board of directors, for the fiscal year ended December 31, 2021. Directors who are also our employees receive no additional compensation for their service as directors. During 2021,

Mr. Sjouwerman was an employee and executive officer of the company and therefore did not receive compensation as a director. See “Executive Compensation” for additional information regarding Mr. Sjouwerman’s compensation.

| | | | | | | | | | | |

| Name | Fees Paid or Earned in Cash ($)(1) | All Other Compensation ($) | Total ($) |

Jeremiah Daly(2) | $ | — | | $ | — | | $ | — | |

Joseph DiSabato(2) | — | | — | | — | |

| Kevin Klausmeyer | 45,000 | | — | | 45,000 | |

Stephen Shanley(2) | — | | — | | — | |

| Gerhard Watzinger | 48,072 | | — | | 48,072 | |

| Kara Wilson | 39,375 | | — | | 39,375 | |

Kevin Mitnick(3) | — | | 207,770 | | 207,770 | |

____________________________________

(1) The amounts reported represent a partial year of the board and directors and committee chair cash compensation due to the timing of our IPO and the effective date of our Director Compensation Policy.

(2) Messrs. Daly, DiSabato and Shanley waived any compensation payable under our Director Compensation Policy.

(3) Kevin Mitnick resigned from our board of directors in March 2021, but the consulting agreement in place with Mr. Mitnick remains in effect as of the date of this proxy statement. The amount disclosed in the column titled "All Other Compensation" includes all payments to Mr. Mitnick for fiscal 2021 pursuant to a consulting agreement in place between Mr. Mitnick and KnowBe4, consisting of (i) $22,276 for car payments, (ii) $24,576 for healthcare and insurance premiums, (iii) $6,498 in computer equipment and (iv) $154,420 for consulting fees.

The following table lists all outstanding equity awards held by non‑employee directors as of December 31, 2021:

| | | | | | | | |

| Name | Grant Date | Number of Shares Underlying Outstanding Options |

| Kevin Klausmeyer | 8/3/2020 | 468,384 | |

| Gerhard Watzinger | 10/1/2019 | 696,760 | |

| Kara Wilson | 1/9/2020 | 696,760 | |

| | |

PROPOSAL NO. 1

ELECTION OF CLASS I DIRECTOR

Our board of directors currently consists of eight directors and is divided into three classes with staggered three‑year terms. At the Annual Meeting, one Class I director will be elected for a three‑year term, to serve until the 2025 annual meeting of stockholders and until his successor is elected and qualified or until his earlier resignation.

Nominee

If elected, Stephen Shanley will hold office for a three-year term until the annual meeting of stockholders to be held in 2025 and until his successor is elected and qualified or until his early resignation, removal or death. Joseph DiSabato, who is currently a Class I director, will not stand for re-election after his current term, which will expire at the Annual Meeting. Accordingly, the nominating and corporate governance committee did not nominate Mr. DiSabato for re-election as a director, and, immediately following the expiration of Mr. DiSabato's term at the Annual Meeting, the board of directors will consist of seven directors with one vacancy. For more information concerning the nominee, please see the section titled “Board of Directors and Corporate Governance.”

Mr. Shanley has agreed to serve as director if elected, and management has no reason to believe that he will be unavailable to serve. In the event a nominee is unable or declines to serve as a director at the time of the Annual Meeting, proxies will be voted for any nominee designated by the present board of directors to fill the vacancy.

Vote Required

The director nominee receiving the highest number of votes cast by the shares present virtually or by proxy and entitled to vote at the Annual Meeting on the election of directors will be elected to the board of directors. Votes that are withheld will be excluded entirely and will have no effect on the outcome of the election.

Board Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF MR. SHANLEY AS THE CLASS I DIRECTOR.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed KPMG LLP as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2022. KPMG LLP served as our independent registered public accounting firm for the fiscal year ended December 31, 2021.

At the Annual Meeting, we are asking our stockholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Our audit committee is submitting the appointment of KPMG LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Notwithstanding the appointment of KPMG LLP, and even if our stockholders ratify the appointment, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our audit committee believes that such a change would be in the best interests of our company and our stockholders. If our stockholders do not ratify the appointment of KPMG LLP, then our audit committee may reconsider the appointment. One or more representatives of KPMG LLP are expected to be present at the Annual Meeting, and they will have an opportunity to make a statement and are expected to be available to respond to appropriate questions from our stockholders.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to us by KPMG LLP for our fiscal years ended December 31, 2021 and 2020.

| | | | | | | | |

| 2021 | 2020 |

Audit Fees(1) | $ | 1,505,000 | | $ | 1,468,122 | |

| Audit-Related Fees | — | | — | |

Tax Fees(2) | 98,385 | | — | |

| All Other Fees | — | | — | |

| Total Fees | $ | 1,603,385 | | $ | 1,468,122 | |

____________________________________

(1) “Audit Fees” consist of fees billed for professional services rendered in connection with the audit of our consolidated financial statements, reviews of our quarterly consolidated financial statements and related accounting consultations and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years. This category also includes fees for services incurred in connection with our IPO and other public offerings.

(2) “Tax Fees” consist of fees billed for routine tax advice provided in connection with EU Directive 2018/822 and other tax and transfer pricing consulting services.

Auditor Independence

In 2021, there were no other professional services provided by KPMG LLP, other than those listed above, that would have required our audit committee to consider their compatibility with maintaining the independence of KPMG LLP.

Audit Committee Policy on Pre‑Approval of Audit and Permissible Non‑Audit Services of Independent Registered Public Accounting Firm

Our audit committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our audit committee is required to pre‑approve all audit and permitted non-audit and tax services provided by our independent registered public accounting firm in order to ensure that the provision of such services does not impair such accounting firm’s independence. All services provided by KPMG LLP for our fiscal year ended December 31, 2021 were approved by our audit committee and, following adoption of our pre-approval policy in April 2021, all services were pre-approved by our audit committee in accordance with the

policy. All services provided by KPMG LLP for our fiscal year ended December 31, 2020 were approved by our board of directors.

Vote Required

The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the same effect as a vote AGAINST this proposal.

Board Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR FISCAL YEAR ENDING DECEMBER 31, 2022.

REPORT OF THE AUDIT COMMITTEE

The audit committee is a committee of the board of directors comprised solely of independent directors as required by Nasdaq listing rules and the rules and regulations of the SEC. The audit committee operates under a written charter adopted by the board of directors. This written charter is reviewed annually for changes, as appropriate. With respect to KnowBe4’s financial reporting process, KnowBe4’s management is responsible for (1) establishing and maintaining internal controls and (2) preparing KnowBe4’s consolidated financial statements. KnowBe4’s independent registered public accounting firm, KPMG LLP, is responsible for performing an independent audit of KnowBe4’s consolidated financial statements. It is the responsibility of the audit committee to oversee these activities. It is not the responsibility of the audit committee to prepare KnowBe4’s financial statements. These are the fundamental responsibilities of management. In the performance of its oversight function, the audit committee has:

•reviewed and discussed the audited consolidated financial statements with management and KPMG LLP;

•discussed with KPMG LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board, or PCAOB, and the SEC; and

•received the written disclosures and the letter from KPMG LLP required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with KPMG LLP its independence.

Based on the review and discussions noted above, the audit committee recommended to the board of directors that the audited consolidated financial statements be included in KnowBe4’s Annual Report on Form 10‑K for the fiscal year ended December 31, 2021 for filing with the SEC.

Respectfully submitted by the members of the audit committee of the board of directors:

Kevin Klausmeyer (Chair)

Stephen Shanley

Gerhard Watzinger

This audit committee report shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A promulgated by the SEC or to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any prior or subsequent filing by KnowBe4 under the Securities Act of 1933, as amended, or the Securities Act, or the Exchange Act, except to the extent KnowBe4 specifically requests that the information be treated as “soliciting material” or specifically incorporates it by reference.

EXECUTIVE OFFICERS

The following table sets forth certain information about our executive officers as of March 31, 2022.

| | | | | | | | |

| Name | Age | Position |

| Sjoerd (“Stu”) Sjouwerman | 65 | Chief Executive Officer & Director |

| Robert (“Bob”) Reich | 62 | Chief Financial Officer |

| Lars Letonoff | 58 | Co-President & Chief Revenue Officer |

| | | | | |

| Stu Sjouwerman founded our company in August 2010 and has served as our Chief Executive Officer and as a member of our board of directors since our inception. Mr. Sjouwerman is Editor-in-Chief of Cyberheist News, an electronic magazine tailored to deliver IT security news, technical updates and social engineering alerts. A serial entrepreneur and data security expert, Mr. Sjouwerman has more than 30 years of experience in the IT industry, is a five-time Inc. 500 award winner and the author of four books including “Cyberheist: The Biggest Financial Threat Facing American Businesses.” Mr. Sjouwerman attended Universiteit van Amsterdam where he studied Educational Sciences. |

| | | | | |

| Bob Reich has served as our Chief Financial Officer since March 2022. Mr. Reich previously served as EVP and CFO of Catalina Marketing Corporation, a digital media solutions company, from April 2020 to March 2022. Prior to that, Mr. Reich served as EVP and CFO of Syniverse Holdings, Inc., a global software and services provider company, from March 2015 to April 2020. In these and other prior roles, Mr. Reich has been responsible for global financial operations, implementation of transformative growth strategies and financial structuring with a focus on long-term stability and growth. Mr. Reich is a certified public accountant and holds a B.A. from Carthage College. |

| | | | | |

| Lars Letonoff has served as our Co-President since January 2020 and as our Chief Revenue Officer since October 2015, and previously served as our VP of Sales from August 2011 to October 2015. Mr. Letonoff joined our company in August 2011, early in the organization’s initial start-up phase, and has developed our sales processes and sales team throughout our many phases of growth. He is responsible for all areas of global sales, including direct sales, channel sales, customer success, business development and strategic accounts. Mr. Letonoff holds a B.B.A. in Finance from University of South Florida – College of Business Administration and an M.B.A. from University of Tampa. |

EXECUTIVE COMPENSATION

Our named executive officers (“NEOs”), consisting of our principal executive officer and the two most highly compensated executive officers (other than our principal executive officer), as of December 31, 2021, were:

| | | | | |

| Name | Position |

| Sjoerd (“Stu”) Sjouwerman | Chief Executive Officer and Chairperson of the board of directors |

| Shrikrishna (“Krish”) Venkataraman | Former Co-President and Chief Financial Officer and current member of our board of directors(1) |

| Lars Letonoff | Co-President and Chief Revenue Officer |

____________________________________

(1) Mr. Venkataraman served as our Co-President and Chief Financial Officer until March 2022, at which time he ceased to be an executive officer and became a member of our board of directors.

Summary Compensation Table

The following table sets forth information regarding the compensation of our named executive officers for fiscal 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | |