From: Siadatpour, Payam

Sent: Tuesday, November 08, 2016 4:17 PM

To: Minore, Dominic

Cc: Sabour, Sara; Marzouk, Ben

Subject: Sierra Total Return Fund

Dominic,

As discussed, we hereby undertake to make the following changes in the final prospectus of Sierra Total Return Fund:

| 1. | On page 4, and in other pertinent sections of the Prospectus, revise the sentence that describes the incentive fee and hurdle rate to add the language in brackets: |

There is no accumulation of amounts on the hurdle rate from quarter to quarter, and accordingly there is no clawback of amounts previously paid [to the Adviser] if subsequent quarters are below the quarterly hurdle rate, and there is no delay of payment [to the Adviser] if prior quarters are below the quarterly hurdle rate.

| 2. | In the Plan of Distribution section delete the following sentence: “Nonetheless, the amount of such Additional Compensation will be included in the calculation of total underwriting compensation in accordance with FINRA rules.” Insert in its place the following sentence: “Nonetheless, the amount of such Additional Compensation will be included in the calculation of total underwriting compensation, which will not exceed the cap of 6.25% for Class T shares, in accordance with FINRA rules.” |

Please also note that we have attached hereto the form of subscription agreement. We are still revising the attached document and would like to file it as a prospectus supplement once it is final, rather than filing it with a pre-effective, exhibits only Form N-2. We will not effectuate any sales until such time that we file the attached as a prospectus supplement. Please let us know if that presents an issue.

Thanks,

Payam

Payam Siadatpour |Counsel

Sutherland Asbill & Brennan LLP

700 Sixth Street, NW, Suite 700 | Washington, DC 20001-3980

202.383.0278 direct | 202.637.3593 facsimile

payam.siadatpour@sutherland.com | www.sutherland.com

Biography |Download vCard

This e-mail message is intended only for the personal use of the recipient(s) named above. This message may be an attorney-client communication and as such privileged and confidential. If you are not an intended recipient, you may not review, copy, or distribute this message. If you have received this communication in error, please notify us immediately by e-mail and delete the original message.

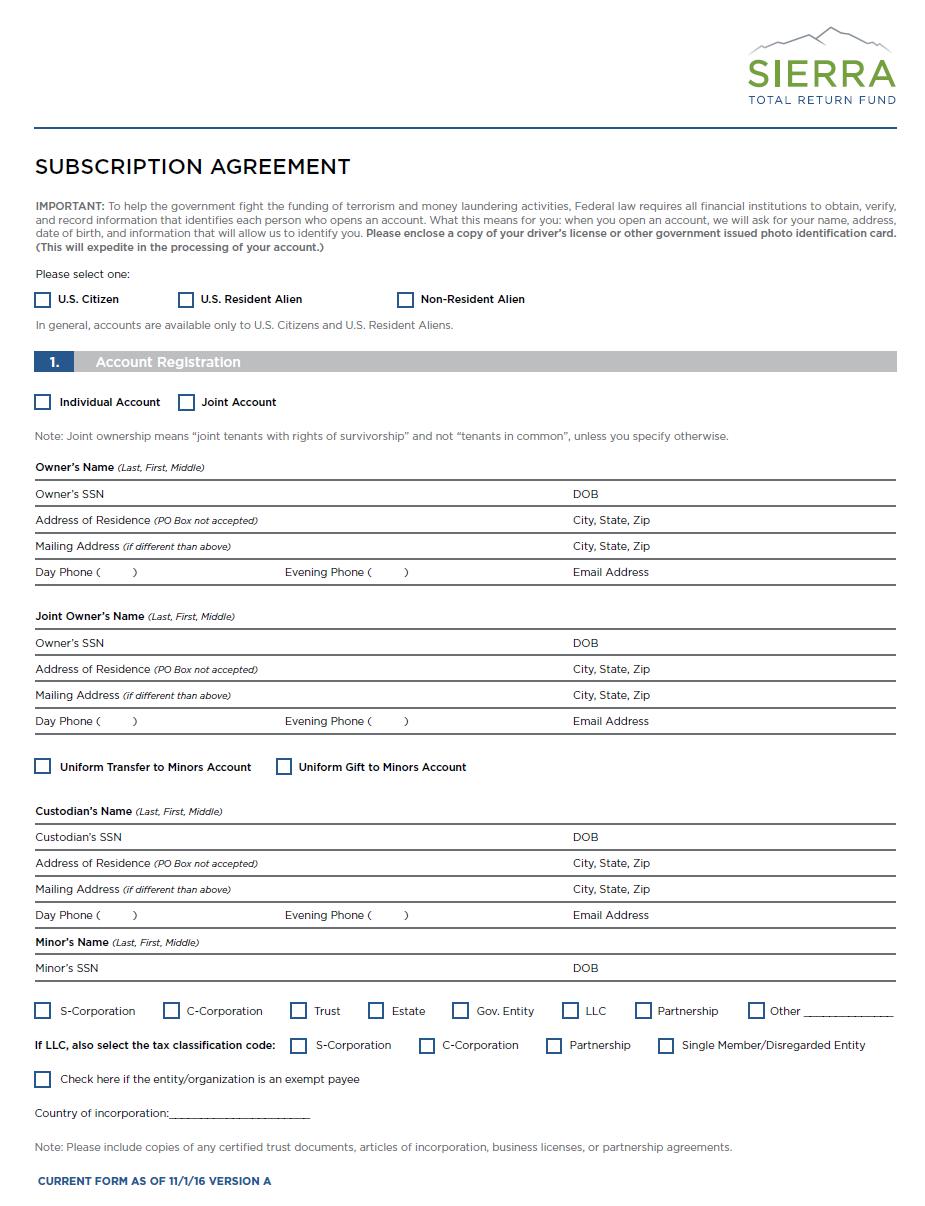

CURRENT FORM AS OF 11/1/16 VERSION A Note: Joint ownership means “joint tenants with rights of survivorship” and not “tenants in common”, unless you specify otherwise. SUBSCRIPTION AGREEMENT 1. Account Registration Individual Account Joint Account IMPORTANT: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: when you open an account, we will ask for your name, address, date of birth, and information that will allow us to identify you. Please enclose a copy of your driver’s license or other government issued photo identification card. (This will expedite in the processing of your account.) Please select one: U.S. Citizen U.S. Resident Alien Non-Resident Alien In general, accounts are available only to U.S. Citizens and U.S. Resident Aliens. Owner’s Name (Last, First, Middle) Owner’s SSN DOB Address of Residence (PO Box not accepted) City, State, Zip Mailing Address (if different than above) City, State, Zip Day Phone ( ) Evening Phone ( ) Email Address Joint Owner’s Name (Last, First, Middle) Owner’s SSN DOB Address of Residence (PO Box not accepted) City, State, Zip Mailing Address (if different than above) City, State, Zip Day Phone ( ) Evening Phone ( ) Email Address Uniform Transfer to Minors Account Uniform Gift to Minors Account Custodian’s Name (Last, First, Middle) Custodian’s SSN DOB Address of Residence (PO Box not accepted) City, State, Zip Mailing Address (if different than above) City, State, Zip Day Phone ( ) Evening Phone ( ) Email Address Minor’s Name (Last, First, Middle) Minor’s SSN DOB S-Corporation C-Corporation Trust Estate Gov. Entity LLC Partnership Other ______________ If LLC, also select the tax classification code: S-Corporation C-Corporation Partnership Single Member/Disregarded Entity Check here if the entity/organization is an exempt payee Country of incorporation:______________________ Note: Please include copies of any certified trust documents, articles of incorporation, business licenses, or partnership agreements.

Corporation/Entity Name Trust Date (MM/DD/YY) TIN (used for tax reporting purposes) Address of Residence (PO Box not accepted) City, State, Zip Mailing Address (if different than above) City, State, Zip Day Phone ( ) Evening Phone ( ) Email Address Name of Trustee/Person with control or authority over account SSN DOB Name of Co-Trustee/Person with control or authority over account SSN DOB Please consult with your Financial Advisor and check one of the following options pertaining to the class of shares you intend to purchase. The Prospectus contains additional information regarding these share classes, including the different fees which are payable with respect to each share class. Class T How would you like to make your initial fund purchase? Check - Make your personal check payable to Sierra Total Return Fund and enclose it with your application. We do not accept third party checks (see prospectus for acceptable method of payment). Electronically - Make a one-time withdrawal from the bank account listed in Section 5 for amount indicated below. Wire - Call our Shareholder Services Department at: 888.292.3178 for wiring instructions. Expected Trade Date (MM/DD/YY) Investment Minimum: $2,500 Sierra Total Return Fund $ or % Yes (Please complete below) No This option allows you to make automatic investments (must be the equivalent of at least $100 per month per fund) into your Sierra Total Return Fund account directly from your bank checking or savings account. Sierra Total Return Fund $ or % Enter Automatic Investment - Enter an investment amount and select a maximum of two investment days per month. How often would you like automatic investment? Monthly Quarterly Semi-Annually Annually On or about which date? (e.g., 1st, 8th, 15th, 22nd) If no date is specified, withdrawals will be made on or about the 5th of the following month, of receipt of your request. **Please note, the date of your first automatic investment should be at least 3 days after this request.** Please provide bank information in Section 5, if applicable

All dividends and capital gains will be reinvested unless otherwise indicated below. Dividend distribution: Cash Capital Gains distribution: Cash Check here if you would like cash distributions deposited directly to your bank account. Please provide bank information in 5, if applicable. Please provide bank information if you are establishing an automatic investment plan and/or are having cash distributions deposited into your account. Account type: Checking Savings Name on Bank Account Bank Name ABA Routing Number (First 9 digits at the bottom of the check or deposit slip) Bank Account Number (Second set of numbers at the bottom of check or deposit slip) Please attach a voided check or savings deposit slip from the specified bank account. I authorize Sierra Total Return Fund to initiate credit and debit entries to my account at the bank that I have indicated. I further agree that Sierra Total Return Fund will not be held accountable for any loss, liability, or expense for acting upon my instructions. It is understood that this authorization may be terminated by me at any time by written notification to Sierra Total Return Fund. The termination request will be effective as soon as Sierra Total Return Fund has had reasonable time to act upon it. As a shareholder, you will automatically have access to your accounts via our automated telephone and online computer services unless you specifically decline from them below. I DO NOT want any telephone privileges. I DO NOT want online privileges. E-Delivery options are available; please visit our website at www.sierratotalreturnfund.com. (Please have your account number) The cost basis of covered shares, generally shares acquired on or after January 1, 2012, is determined using the fund's default method, unless you elect a different method below. Please check one box. Average Cost (ACST) Default Cost Basis Method First In, First Out (FIFO) Last In, First Out (LIFO) Low Cost (LOFO) High Cost (HIFO) Loss Gain Utilization (LGUT) Specific Share Identification (SLID) Secondary Method* *If you elect Specific Share Identification, you may also elect a Secondary Method, other than Average Cost, that will apply when lots are not specified. If a Secondary Method is not elected, the default is FIFO. The method you elect will apply to covered shares for funds established under this account, including funds you may acquire at a later date, unless you instruct us otherwise. If available, cost basis for noncovered shares, generally shares acquired before January 1, 2012, is determined using the Average Cost method. Non- covered shares are redeemed prior to covered shares unless otherwise specified at the time of the redemption. To determine which cost basis method is appropriate for your tax situation, please consult a qualified tax professional.

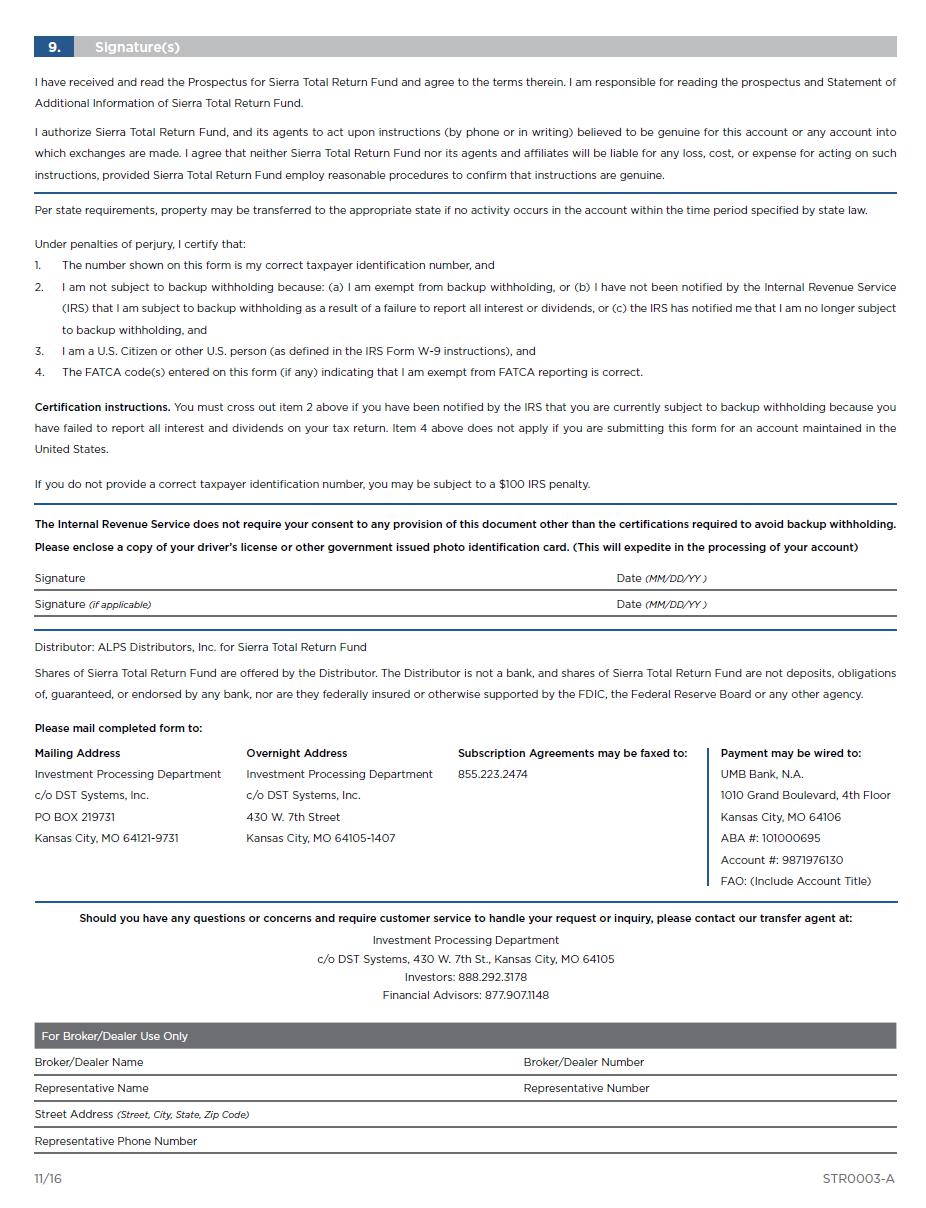

I have received and read the Prospectus for Sierra Total Return Fund and agree to the terms therein. I am responsible for reading the prospectus and Statement of Additional Information of Sierra Total Return Fund. I authorize Sierra Total Return Fund, and its agents to act upon instructions (by phone or in writing) believed to be genuine for this account or any account into which exchanges are made. I agree that neither Sierra Total Return Fund nor its agents and affiliates will be liable for any loss, cost, or expense for acting on such instructions, provided Sierra Total Return Fund employ reasonable procedures to confirm that instructions are genuine. Per state requirements, property may be transferred to the appropriate state if no activity occurs in the account within the time period specified by state law. Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number, and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. Citizen or other U.S. person (as defined in the IRS Form W-9 instructions), and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. Item 4 above does not apply if you are submitting this form for an account maintained in the United States. If you do not provide a correct taxpayer identification number, you may be subject to a $100 IRS penalty. The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Please enclose a copy of your driver's license or other government issued photo identification card. (This will expedite in the processing of your account) Signature Date (MM/DD/YY ) Signature (if applicable) Date (MM/DD/YY ) Distributor: ALPS Distributors, Inc. for Sierra Total Return Fund Shares of Sierra Total Return Fund are offered by the Distributor. The Distributor is not a bank, and shares of Sierra Total Return Fund are not deposits, obligations of, guaranteed, or endorsed by any bank, nor are they federally insured or otherwise supported by the FDIC, the Federal Reserve Board or any other agency. Please mail completed form to: Mailing Address Investment Processing Department c/o DST Systems, Inc. PO BOX 219731 Kansas City, MO 64121-9731 Overnight Address Investment Processing Department c/o DST Systems, Inc. 430 W. 7th Street Kansas City, MO 64105-1407 Subscription Agreements may be faxed to: 855.223.2474 Payment may be wired to: UMB Bank, N.A. 1010 Grand Boulevard, 4th Floor Kansas City, MO 64106 ABA #: 101000695 Account #: 9871976130 FAO: (Include Account Title) Should you have any questions or concerns and require customer service to handle your request or inquiry, please contact our transfer agent at: Investment Processing Department c/o DST Systems, 430 W. 7th St., Kansas City, MO 64105 Investors: 888.292.3178 Financial Advisors: 877.907.1148 Broker/Dealer Name Broker/Dealer Number Representative Name Representative Number Street Address (Street, City, State, Zip Code) Representative Phone Number