UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23137

SIERRA TOTAL RETURN FUND

(exact name of registrant as specified in charter)

280 Park Ave, 6th Floor East

New York, NY 10017

(Address of principal executive offices) (Zip code)

Seth Taube

Chief Executive Officer

280 Park Ave, 6th Floor East

New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 759-0777

Date of fiscal year end: June 30

Date of reporting period: July 1, 2017 – December 31, 2017

Item 1. Reports to Stockholders.

| Sierra Total Return Fund | Shareholder Letter |

| | December 31, 2017 (Unaudited) |

Dear Shareholders:

We are pleased to provide Sierra Total Return Fund’s (the “Fund”) semi-annual report for the period ended December 31, 2017. The Fund began investing on June 1, 2017, and seeks a total return for shareholders through a combination of current income and long-term capital appreciation. As of December 31, 2017, the Fund had 47 investments across 17 industries. Investments in floating rate securities (including securities backed by floating rate investments) totaled 84% of the Fund’s portfolio. The Fund has yet to deploy any leverage, though it expects to in the upcoming quarters.

The Fund intends to create a diversified portfolio of credit investments through a disciplined and balanced allocation among four distinct strategies. Our goal is to create a granular portfolio of investments focused on secured floating rate investments in U.S. middle market companies. We believe this portfolio strategy has the ability to generate superior risk-adjusted returns over the long-term.

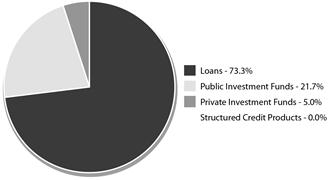

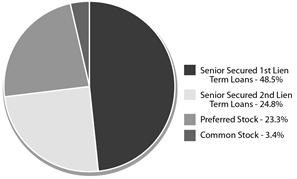

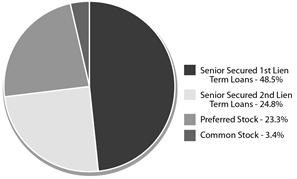

As of December 31, 2017, the following presents our portfolio by our core strategies and asset types, as a percentage of total investments:

| STRATEGY DIVERSIFICATION | | ASSET TYPE DIVERSIFICATION |

| | | |

| |  |

The U.S. and global economy remained strong throughout 2017. We expect that the U.S. and global economy will remain healthy in the near term. To the extent the strength continues, we expect it will be constructive for the Fund’s investments in the fixed-income oriented funds.

We are excited about the future and look forward to your continued interest in Sierra Total Return Fund.

| Sincerely, | |

| | |

| Seth Taube | |

| CEO and Chairman of the Board of Trustees | |

| Sierra Total Return Fund | |

Past performance is not indicative of future results. Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Diversification does not ensure a profit or protect against loss in a declining market. Investing involves risk. Principal loss is possible. The Fund offers the following share classes: Class A – SRNAX, Class L – SRNLX, Class T – SRNTX, Class I – SRNIX. For more information on the differences in share classes, refer to the applicable prospectus, which can be found at: www.sierratotalreturnfund.com.

FUND RISK DISCLOSURE

There currently is no secondary market for the Fund’s shares and the Fund expects that no secondary market will develop. To provide liquidity to shareholders, the Fund intends to make quarterly offers to repurchase its shares at net asset value. There can be no assurance, however, that the Fund will be able to provide this intended level of liquidity. Investments in lesser-known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. The sales of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s NAV.

| | |

| Semi-Annual Report | December 31, 2017 | 1 |

| Sierra Total Return Fund | Shareholder Letter |

| | December 31, 2017 (Unaudited) |

Shares of the Fund will not be listed on any securities exchange, which makes them inherently illiquid. Regardless of how the Fund performs, an investor may not be able to sell or otherwise liquidate his or her shares whenever such investor would prefer and will be unable to reduce his or her exposure or any market downturn. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance.

Investing in the Fund involves risks, including, but not limited to, the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of its investment adviser to effectively allocate the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. The Fund is newly organized and has a limited operating history.

Investors should be aware that traded and non-traded BDCs, senior loans, real estate investments and REITs, structured products and CLOs are all significantly different investments each with its own risks, rewards and limitations. Investors should understand these differences (which may include investment objectives, costs and expenses, liquidity, market risk, safety, fluctuation of principal or return, insurance, tax features, interest rate risk and consequences, etc.) before making an investment.

SC Distributors is the exclusive wholesale marketing agent for Sierra Total Return Fund. ALPS Distributors, Inc. is the distributor of Sierra Total Return Fund. SC Distributors and ALPS Distributors, Inc. are not affiliated. ALPS Distributor, Inc., 1290 Broadway, Suite 1100, Denver, CO 80203, member FINRA.

The Fund will concentrate its investments in debt and equity fixed income and its portfolio will be significantly impacted by the performance of the debt/credit markets. The value of companies engaged in the debt/credit industry is affected by: (i) changes in general economic and market conditions; (ii) changes in the value of debt investments; (iii) risks related to local economic conditions and increased competition and (iv) changes in interest rates and leverage.

| | |

| 2 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Manager Commentary |

| | December 31, 2017 (Unaudited) |

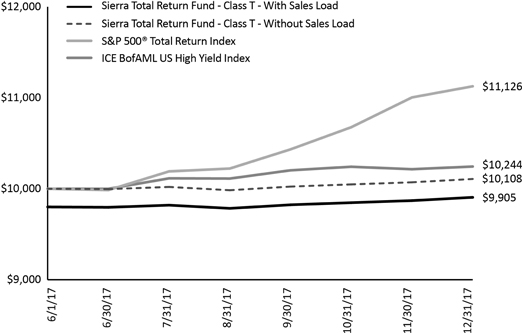

Performance (for the period ended December 31, 2017)

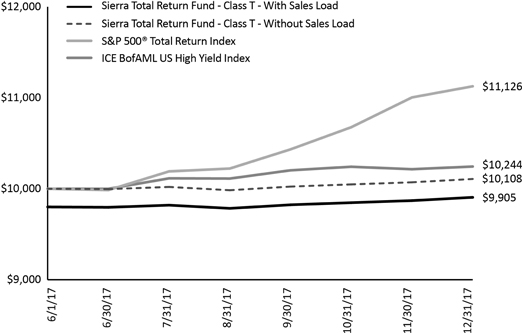

| | | 1 Month | | Quarter | | 6 Month | | Since Inception | | Inception |

| Sierra Total Return Fund - Class T – Without Sales Load | | 0.36% | | 0.83% | | 1.12% | | 1.08% | | 6/1/17 |

| Sierra Total Return Fund - Class T – With Sales Load | | -1.66% | | -1.18% | | -0.91% | | -0.95% | | 6/1/17 |

| S&P 500® Total Return Index | | 1.11% | | 6.64% | | 11.42% | | 11.26% | | 6/1/17 |

| ICE BofAML US High Yield Index | | 0.29% | | 0.41% | | 2.45% | | 2.44% | | 6/1/17 |

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. Class T shares are subject to a maximum sales load of 2.00% of the amount invested in Class T shares. For performance information current to the most recent month-end, please call toll-free 1-888-292-3178.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly into an index.

ICE BofAML US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Index constituents are market capitalization weighted. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly into an index.

Pursuant to the Expense Support Agreement, STRF Advisors LLC (the “Adviser”) has agreed to reimburse the Fund for expenses the Fund incurs for the purpose of limiting the Fund’s payment of certain operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, incentive fees, shareholder services expenses, annual dealer manager fees, distribution fees and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) in any fiscal year to 2.66% per annum of the Fund’s average daily gross assets attributable to Class T shares (the “Operational Expense Limit”). The Fund’s Expense Support and Reimbursement Agreement with the Adviser will remain in effect at least until July 25, 2018. Following this term, the Adviser may elect, in its sole discretion, to offer to continue the Expense Support Agreement for successive quarterly periods. Any such continuance must be approved by a majority of the Fund’s board of trustees (the “Board”), including a majority of the trustees that are not “interested persons” of the Fund, as such term is defined under the Investment Company Act of 1940, as amended. The Board may terminate the Expense Support Agreement at any time, and there can be no assurance that the Adviser will renew the Expense Support Agreement after the period noted above. The Adviser will be eligible to recoup expense support payments it previously made, both during the term of the Expense Support Agreement and upon its termination by the Board, within the three years following the period in which the expenses occurred and the Adviser will recoup an amount from the Fund to the extent the amount recouped does not cause the Fund’s average daily gross assets with respect to Class T shares in the period of recoupment to exceed the lesser of the Operational Expense Limit in effect at the time the Expense Support Payment was made in that period or the Operational Expense Limit in effect at such time STRF Advisors seeks recoupment. Without the waiver the expenses would be 150.10% for Class T shares. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a distribution in the future; or, if any such distribution is paid, the amount or rate of the distribution.

| | |

| Semi-Annual Report | December 31, 2017 | 3 |

| Sierra Total Return Fund | Manager Commentary |

| | December 31, 2017 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings* | Percent of

Net Assets |

| Vail Holdco Corp. | 4.71% |

| Lighthouse Network, LLC | 4.67% |

| Alpine SG, LLC | 2.36% |

| Deliver Buyer, Inc. | 2.36% |

| Resolute Investment Managers, Inc. | 2.36% |

| RMS Holding Company, LLC | 2.36% |

| Sierra Acquisition, Inc. | 2.36% |

| CPI Holdings, Inc. | 2.34% |

| Golden West Packaging Group, LLC | 2.34% |

| Wink Holdco, Inc. | 2.34% |

| Top Ten Holdings | 28.20% |

| Asset Type Allocation | Percent of

Net Assets |

| Senior Secured First Lien Term Loans | 48.80% |

| Senior Secured Second Lien Term Loans | 23.45% |

| Preferred Stocks | 21.97% |

| Common Stocks | 3.11% |

| Warrants | 0.10% |

| Cash, Cash Equivalents, & Other Net Assets | 2.57% |

| Total Net Assets | 100.00% |

* Excludes money market investments.

| | |

| 4 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Schedule of Investments |

| | December 31, 2017 (Unaudited) |

| Description | | Shares | | | Fair Value | |

| COMMON STOCKS - 3.11% |

| BANKING, FINANCE, INSURANCE & REAL ESTATE - 3.11% | | | | | | | | |

| Ares Capital Corp. | | | 1,100 | | | $ | 17,292 | |

| FS Investment Corp. | | | 1,000 | | | | 7,350 | |

| New Mountain Finance Corp. | | | 1,000 | | | | 13,550 | |

| NorthStar Realty Europe Corp. | | | 1,000 | | | | 13,430 | |

| PennantPark Investment Corp. | | | 2,100 | | | | 14,511 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $70,905) | | | | | | $ | 66,133 | |

| | | | | | | | | |

| PREFERRED STOCKS - 21.96% | | | | | | | | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE - 17.35% | | | | | | | | |

| Apollo Commercial Real Estate Finance, Inc., Series C, 8.000% | | | 900 | | | $ | 23,229 | |

| Arbor Realty Trust, Inc., Series C, 8.500% | | | 2,000 | | | | 52,367 | |

| ARMOUR Residential REIT, Inc., Series B, 7.875% | | | 2,000 | | | | 50,040 | |

| Chimera Investment Corp., Series B, 8.000% | | | 1,000 | | | | 25,800 | |

| Invesco Mortgage Capital, Inc., Series B, 7.750%(a) | | | 1,000 | | | | 25,760 | |

| New York Mortgage Trust, Inc., Series D, 8.000%(a) | | | 3,000 | | | | 74,070 | |

| New York Mortgage Trust, Inc., Series C, 7.875% | | | 689 | | | | 16,879 | |

| PennyMac Mortgage Investment Trust, Series B, 8.000%(a) | | | 2,000 | | | | 50,360 | |

| Resource Capital Corp., 8.250% | | | 2,000 | | | | 49,980 | |

| WHOLESALE - 4.61% | | | | | | | | |

| Vail Holdco Corp.(b) | | | 50,000 | | | | 50,000 | |

| Vail Holdco Corp., 12.500%(b) | | | 50,000 | | | | 47,815 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCKS (Cost $464,184) | | | | | | $ | 466,300 | |

| Description | | Interest Rate* | | Maturity | | Par Amount | | | Fair Value | |

| SENIOR SECURED FIRST LIEN TERM LOANS - 45.87% | | | | | | | | | |

| AUTOMOTIVE - 2.22% | | | | | | | | | | | | |

| Rough Country, LLC(a)(b) | | 1M-L+4.50%, 1.00%, Floor | | 05/25/2023 | | $ | 47,311 | | | $ | 47,112 | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE - 2.34% | | | | | | | | | | | | |

| Lighthouse Network, LLC(a)(b) | | 1M-L+4.50%, 1.00%, Floor | | 11/29/2024 | | | 50,000 | | | | 49,750 | |

| CONSTRUCTION & BUILDING - 1.83% | | | | | | | | | | | | |

| SFP Holding, Inc.(a)(b)(c) | | 3M-L+6.25%, 1.00%, Floor | | 09/01/2022 | | | 38,889 | | | | 38,889 | |

| CONSUMER GOODS: DURABLE - 2.35% | | | | | | | | | | | | |

| KNB Holdings Corporation(a)(b) | | 3M-L+5.50%, 1.00%, Floor | | 04/26/2024 | | | 49,688 | | | | 49,812 | |

| CONTAINERS, PACKAGING & GLASS - 4.21% | | | | | | | | | | | | |

| Brooks & Whittle Holding Corp.(a)(b)(c) | | 3M-L+6.25%, 1.00%, Floor | | 10/17/2023 | | | 40,557 | | | | 40,557 | |

| Interflex Acquisition Company, LLC(a)(b) | | 1M-L+8.00%, 1.00%, Floor | | 08/18/2022 | | | 48,750 | | | | 48,750 | |

| FOREST PRODUCTS & PAPER - 2.34% | | | | | | | | | | | | |

| Golden West Packaging Group, LLC(a)(b) | | 1M-L+5.25%, 1.00%, Floor | | 06/20/2023 | | | 49,750 | | | | 49,750 | |

| HEALTHCARE & PHARMACEUTICALS - 3.40% | | | | | | | | | | | | |

| Central States Dermatology Services, LLC(a)(b)(c) | | 3M-L+6.50%, 1.00%, Floor | | 04/20/2022 | | | 43,129 | | | | 43,129 | |

| Smile Doctors LLC(a)(b)(c) | | 3M-L+5.75%, 1.00%, Floor | | 10/06/2022 | | | 29,027 | | | | 29,027 | |

| HIGH TECH INDUSTRIES - 2.35% | | | | | | | | | | | | |

| Alpine SG, LLC(a)(b) | | 3M-L+6.50%, 1.00%, Floor | | 11/16/2022 | | | 50,000 | | | | 50,000 | |

| MEDIA: ADVERTISING, PRINTING & PUBLISHING - 6.96% | | | | | | | | | | | | |

| Imagine! Print Solutions, LLC(a)(b) | | 3M-L+4.75%, 1.00%, Floor | | 06/21/2022 | | | 99,250 | | | | 98,257 | |

| New Media Holdings II, LLC(a)(b) | | 1M-L+6.25%, 1.00%, Floor | | 07/14/2022 | | | 49,623 | | | | 49,623 | |

| MEDIA: DIVERSIFIED & PRODUCTION - 2.34% | | | | | | | | | | | | |

| The Octave Music Group, Inc.(a)(b) | | 1M-L+4.75%, 1.00%, Floor | | 05/28/2021 | | | 49,618 | | | | 49,618 | |

| SERVICES: BUSINESS - 4.70% | | | | | | | | | | | | |

| Deliver Buyer, Inc.(a)(b) | | 3M-L+5.00%, 1.00%, Floor | | 05/01/2024 | | | 49,875 | | | | 49,875 | |

| RMS Holding Company, LLC(a)(b) | | 3M-L+6.00%, 1.00%, Floor | | 11/16/2022 | | | 49,875 | | | | 49,875 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2017 | 5 |

| Sierra Total Return Fund | Schedule of Investments |

| | December 31, 2017 (Unaudited) |

| Description | | Interest Rate* | | Maturity | | | Par Amount | | | | Fair Value | |

| SERVICES: CONSUMER - 6.31% | | | | | | | | | | | | |

| Barry's Bootcamp Holdings, LLC(a)(b)(c) | | 3M-L+6.50%, 1.00%, Floor | | 07/14/2022 | | $ | 85,714 | | | $ | 85,714 | |

| LifeMiles, Ltd.(a)(b) | | 3M-L+5.50%, 1.00%, Floor | | 08/18/2022 | | | 48,750 | | | | 48,263 | |

| TRANSPORTATION: CARGO - 4.52% | | | | | | | | | | | | |

| United Road Services, Inc.(a)(b) | | 1M-L+5.25%, 1.00%, Floor | | 09/01/2024 | | | 49,625 | | | | 49,377 | |

| YRC Worldwide Inc.(a)(b) | | 1M-L+8.50%, 1.00%, Floor | | 07/26/2022 | | | 46,874 | | | | 46,621 | |

| | | | | | | | | | | | | |

| TOTAL SENIOR SECURED FIRST LIEN TERM LOANS (Cost $974,256) | | | | | | | | | | $ | 973,999 | |

| | | | | | | | | | | | | |

| SENIOR SECURED SECOND LIEN TERM LOANS - 23.39% | | | | | | | | | | | | |

| AEROSPACE & DEFENSE - 2.34% | | | | | | | | | | | | |

| CPI Holdings, Inc.(a)(b) | | 1M-L+7.25%, 1.00%, Floor | | 07/28/2025 | | | 50,000 | | | | 49,750 | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE - 9.43% | | | | | | | | | | | | |

| Asurion, LLC(a)(b) | | 1M-L+6.00%, 1.00%, Floor | | 08/04/2025 | | | 50,000 | | | | 51,000 | |

| Lighthouse Network, LLC(a)(b) | | 1M-L+8.50%, 1.00%, Floor | | 11/28/2025 | | | 50,000 | | | | 49,500 | |

| Resolute Investment Managers, Inc.(a)(b) | | 3M-L+7.50%, 1.00% Floor | | 04/30/2023 | | | 50,000 | | | | 50,000 | |

| Wink Holdco, Inc.(a)(b) | | 3M-L+6.75%, 1.00%, Floor | | 12/01/2025 | | | 50,000 | | | | 49,750 | |

| BEVERAGE & FOOD - 2.36% | | | | | | | | | | | | |

| RESIC Enterprises, LLC(a)(b) | | 1M-L+8.75%, 1.00%, Floor | | 11/10/2025 | | | 50,000 | | | | 50,000 | |

| CAPITAL EQUIPMENT - 2.29% | | | | | | | | | | | | |

| Engineered Machinery Holdings, Inc.(a)(b)(c) | | 3M-L+7.25%, 1.00%, Floor | | 07/18/2025 | | | 49,349 | | | | 48,649 | |

| HEALTHCARE & PHARMACEUTICALS - 2.33% | | | | | | | | | | | | |

| Midwest Physician Administrative Services, LLC(a)(b) | | 3M-L+7.00%, 0.75%, Floor | | 08/15/2025 | | | 50,000 | | | | 49,500 | |

| MEDIA: ADVERTISING, PRINTING & PUBLISHING - 2.32% | | | | | | | | | | | | |

| Imagine! Print Solutions, LLC(a)(b) | | 3M-L+8.75%, 1.00%, Floor | | 06/21/2023 | | | 50,000 | | | | 49,250 | |

| SERVICES: CONSUMER - 2.32% | | | | | | | | | | | | |

| MH Sub I, LLC(a)(b) | | 3M-L+7.50%, 1.00%, Floor | | 09/15/2025 | | | 50,000 | | | | 49,185 | |

| | | | | | | | | | | | | |

| TOTAL SENIOR SECURED SECOND LIEN TERM LOANS (Cost $496,262) | | | | | | | | | | $ | 496,584 | |

| | | | | | | | | | | | | |

| WARRANT - 0.10% | | | | | | | | | | | | |

| WHOLESALE - 0.10% | | | | | | | | | | | | |

| Vail Holdco Corp.(b) | | | | | | | 35 | | | | 2,150 | |

| | | | | | | | | | | | | |

| TOTAL WARRANT (Cost $2,150) | | | | | | | | | | $ | 2,150 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 94.43% (Cost $2,007,757) | | | | | | | | | | | 2,005,166 | |

| US BANK MONEY MARKET CORP. TRUST - 7.63% | | 0.20% | | | | $ | 161,928 | | | | 161,928 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (2.06)% | | | | | | | | | | | (43,658 | ) |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 2,123,436 | |

| (a) | Floating or variable rate security. The reference rate is described below. The Interest Rate in effect as of December 31, 2017 is based on the reference rate plus the displayed spread as of the security's last reset date. |

| (b) | Fair Value estimated using Fair Valuation Policies and Procedures adopted by the Board. The security is valued using significant unobservable inputs, which are categorized as Level 3 assets under the definition of ASC 820 fair value hierarchy. The aggregate fair value of these securities is $1,570,548 which represents 73.96% of net assets. |

| (c) | The investment has an unfunded commitment as of December 31, 2017. For further details, see Note 8. Fair value includes an analysis of the unfunded commitment. |

| See Notes to Financial Statements. | |

| 6 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Schedule of Investments |

| | December 31, 2017 (Unaudited) |

| * Investment Abbreviations: |

| L - London Interbank Offered Rate |

| |

| Libor Rates: |

| 1M-L - 1 Month LIBOR as of December 31, 2017 was 1.56% |

| 2M-L - 2 Month LIBOR as of December 31, 2017 was 1.62% |

| 3M-L - 3 Month LIBOR as of December 31, 2017 was 1.69% |

| 6M-L - 6 Month LIBOR as of December 31, 2017 was 1.84% |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2017 | 7 |

| Sierra Total Return Fund | Statement of Assets and Liabilities |

| | December 31, 2017 (Unaudited) |

| ASSETS: | | | |

| Investments, at fair value (Cost $2,007,757) | | $ | 2,005,166 | |

| Cash and cash equivalents | | | 163,973 | |

| Receivable for investment securities sold | | | 50,562 | |

| Dividend receivable | | | 3,922 | |

| Interest receivable | | | 5,485 | |

| Receivable due from adviser | | | 1,032,079 | |

| Offering costs | | | 549,626 | |

| Prepaid expenses and other assets | | | 56,000 | |

| Total Assets | | | 3,866,813 | |

| | | | | |

| LIABILITIES: | | | | |

| Distributions fees payable | | | 3,971 | |

| Shareholder fees payable | | | 1,324 | |

| Management fees payable | | | 11,953 | |

| Due to Adviser | | | 1,188,076 | |

| Accrued fund accounting and administration fees payable | | | 251,262 | |

| Accrued trustees' fees payable | | | 7,886 | |

| Other payables and accrued expenses | | | 278,905 | |

| Total Liabilities | | | 1,743,377 | |

| Net Assets | | $ | 2,123,436 | |

| | | | | |

| COMPOSITION OF NET ASSETS: |

| Paid-in capital | | $ | 2,121,403 | |

| Accumulated net investment loss | | | (6,058 | ) |

| Accumulated net realized gain | | | 10,682 | |

| Net unrealized depreciation | | | (2,591 | ) |

| Net Assets | | $ | 2,123,436 | |

| | | | | |

| Commitments (Note 8) | | | | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Class T Shares | | | | |

| Net Assets | | $ | 2,123,436 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common share authorized) (Note 8) | | | 85,105 | |

| Net Asset Value and redemption price per share | | $ | 24.95 | |

| Maximum Offering Price per Share (Including Maximum Sales Load of 2.00%) | | $ | 25.46 | |

| | | | | |

| See Notes to Financial Statements. | |

| 8 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Statement of Operations |

| | For the Six Months Ended December 31, 2017 (Unaudited) |

| INVESTMENT INCOME: | | | | |

| Dividends (net of foreign withholding tax $28) | | $ | 22,108 | |

| Interest (net of foreign withholding tax $589) | | | 53,603 | |

| Facility and other fees | | | 877 | |

| Total Investment Income | | | 76,588 | |

| | | | | |

| EXPENSES: | | | | |

| Management fees | | | 25,305 | |

| Fund accounting and administration fees | | | 373,138 | |

| Distribution fees | | | 7,940 | |

| Shareholder servicing fees | | | 2,647 | |

| Offering costs | | | 662,811 | |

| Insurance expenses | | | 61,539 | |

| Legal and audit fees | | | 229,007 | |

| Custodian fees | | | 15,511 | |

| Trustees' fees and expenses | | | 18,253 | |

| Printing expenses | | | 11,613 | |

| Transfer agent fees | | | 38,502 | |

| Other expenses | | | 143,048 | |

| Total expenses before expenses support reimbursement (Note 3) | | | 1,589,314 | |

| Net expenses support reimbursement (Note 3) | | | (1,533,724 | ) |

| Net expenses | | | 55,590 | |

| Net Investment Income | | | 20,998 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: |

| Net realized gain on investments | | | 10,385 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (3,493 | ) |

| Net Realized and Unrealized Gain on Investments | | | 6,892 | |

| | | | | |

| Net Increase in Net Assets | | $ | 27,890 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2017 | 9 |

| Sierra Total Return Fund | Statement of Changes in Net Assets |

| | | For the Six

Months Ended

December 31, 2017

(Unaudited) | | | For the Period

June 1, 2017

(Commencement of

Operations) to

June 30, 2017 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income/(loss) | | $ | 20,998 | | | $ | (5,650 | ) |

| Net realized gain on investments | | | 10,385 | | | | – | |

| Net realized gain distributions from real estate investment trusts | | | – | | | | 166 | |

| Net realized gain distributions from other investment companies | | | – | | | | 128 | |

| Change in unrealized appreciation/(depreciation) | | | (3,493 | ) | | | 902 | |

| Net Increase/(Decrease) in Net Assets from Operations | | | 27,890 | | | | (4,454 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: |

| From net investment income | | | (27,527 | ) | | | – | |

| Net Decrease in Net Assets from Distributions to Shareholders | | | (27,527 | ) | | | – | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class T Shares | | | | | | | | |

| Proceeds from sale of shares of beneficial interest | | | – | | | | 2,000,000 | |

| Shares issued in reinvestment of distributions | | | 27,527 | | | | – | |

| Net Increase from Capital Share Transactions | | | 27,527 | | | | 2,000,000 | |

| Net Increase in Net Assets | | | 27,890 | | | | 1,995,546 | |

| | | | | | | | | |

| NET ASSETS: |

| Beginning of period | | | 2,095,546 | | | | 100,000 | |

| End of period(a) | | $ | 2,123,436 | | | $ | 2,095,546 | |

| (a) Including accumulated net investment income/(loss) of: | | $ | (6,058 | ) | | $ | 471 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class T Shares | | | | | | | | |

| Beginning shares | | | 84,000 | | | | 4,000 | |

| Issued | | | – | | | | 80,000 | |

| Distributions reinvested | | | 1,105 | | | | – | |

| Net increase in capital shares | | | 1,105 | | | | 80,000 | |

| Ending shares | | | 85,105 | | | | 84,000 | |

| See Notes to Financial Statements. | |

| 10 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Statement of Cash Flows |

| For the Six Months Ended December 31, 2017 (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net increase in net assets from operations | | $ | 27,890 | |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by operating activities: | | | | |

| Purchases of investment securities | | | (3,002,703 | ) |

| Proceeds from disposition of investment securities | | | 1,646,792 | |

| Net realized (gain)/loss: | | | | |

| Investments | | | (10,385 | ) |

| Net change in unrealized (appreciation)/depreciation: | | | | |

| Investments | | | 3,493 | |

| (Increase) decrease in assets: | | | | |

| Receivable due from adviser | | | (1,032,079 | ) |

| Dividend receivable | | | (203 | ) |

| Interest receivable | | | (5,346 | ) |

| Offering costs | | | 660,168 | |

| Prepaid expenses and other assets | | | (55,624 | ) |

| Increase (decrease) in liabilities: | | | | |

| Shareholder fees payable | | | 907 | |

| Management fees payable | | | 7,269 | |

| Due to adviser | | | 172,694 | |

| Distribution fees payable | | | 2,721 | |

| Accrued fund accounting and administration fees payable | | | 195,465 | |

| Accrued trustees' fees payable | | | 7,886 | |

| Accrued chief compliance officer fee payable | | | (6,444 | ) |

| Other payables and accrued expenses | | | 42,379 | |

| Net cash used in operating activities | | | (1,345,120 | ) |

| | | | | |

| | | | | |

| NET DECREASE IN CASH FOR THE PERIOD | | | (1,345,120 | ) |

| | | | | |

| CASH, BEGINNING OF PERIOD | | $ | 1,509,093 | |

| CASH, END OF PERIOD | | $ | 163,973 | |

| | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 27,527 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2017 | 11 |

| Sierra Total Return Fund | Financial Highlights |

| | For a share outstanding throughout the periods presented |

| | | For the Six

Months Ended

December 31, 2017

(Unaudited) | | | For the Period

June 1, 2017

(Commencement of

Operations) to

June 30, 2017 | |

| OPERATING PERFORMANCE: |

| Net asset value - beginning of period | | $ | 24.95 | | | $ | 25.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

| Net investment income/(loss)(a) | | | 0.25 | | | | (0.07 | ) |

| Net realized and unrealized gain on investments | | | 0.08 | | | | 0.02 | |

| Total Income/(Loss) from Investment Operations | | | 0.33 | | | | (0.05 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: |

| From net investment income | | | (0.33 | ) | | | – | |

| Total Distributions to Shareholders | | | (0.33 | ) | | | – | |

| | | | | | | | | |

| Net asset value - end of period | | $ | 24.95 | | | $ | 24.95 | |

| | | | | | | | | |

| Total Investment Return - Net Asset Value(b) | | | 1.32 | %(c) | | | (0.20 | %)(c) |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: |

| Net assets end of period | | $ | 2,123,436 | | | $ | 2,095,546 | |

| Ratio of expenses to average net assets excluding reimbursement | | | 5.25 | %(d) | | | 5.98 | %(d) |

| Ratio of expenses to average net assets including reimbursement | | | 150.10 | %(d) | | | 96.26 | %(d) |

| Ratio of net investment income/(loss) to average net assets | | | 1.98 | %(d) | | | (3.39 | %)(d) |

| Portfolio turnover rate | | | 91 | %(c) | | | 0 | %(c) |

| (a) | Calculated using daily average shares outstanding. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude applicable sales charges. |

| (c) | Not Annualized. |

| (d) | Expenses and net investment loss amounts used to calculate the ratios above include amounts allocated to investors of Class T Shares. An individual investor's results may vary based on a variety of factors including differing fee arrangements and the timing of capital transactions. These ratios to average net assets have been annualized except certain non-recurring expenses, such as organization/offering costs which have not been annualized. |

| See Notes to Financial Statements. | |

| 12 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

1. ORGANIZATION

Sierra Total Return Fund (the ‘‘Fund’’) is a Delaware statutory trust registered under the Investment Act of 1940, as amended (“1940 Act”), as a continuously offered, non-diversified, closed-end management investment company that operates as an interval fund. In order to operate as an interval fund, the Fund has adopted a fundamental policy to make repurchase offers for no less than 5.00% and no more than 25% of its outstanding shares at the net asset value (‘‘NAV’’) during each calendar quarter of each year.

The Fund currently has Class T shares outstanding. Class T Shares are offered at NAV plus a maximum sales load of 2.00% of the amount invested in Class T shares. Class T shares are subject to (i) a monthly shareholder services fee that will accrue at an annual rate of up to 0.25% of the average daily net assets of the Fund attributable to Class T shares; (ii) a distribution fee that will accrue at an annual rate equal to 0.75% of the average daily net assets of the Fund attributable to Class T shares; and (iii) an early withdrawal charge equal to 1.00% of the original purchase price of Class T shares repurchased by the Fund, through a quarterly repurchase offer request, during the 365 days following such shareholder’s initial purchase. Class T shares are subject to a total sales charge cap, which consists of the upfront sales load, early withdrawal charges and the ongoing distribution fee of 6.25% under FINRA Rule 2341.

The Fund’s investment adviser is STRF Advisors LLC (the “Adviser”). The Adviser is registered with the U.S. Securities and Exchange Commission (“SEC”) as a registered investment adviser under the Investment Advisers Act of 1940, as amended. The Adviser’s registration became effective on May 12, 2016.

The investment objective of the Fund is to seek a total return through a combination of current income and long-term capital appreciation by investing in a portfolio of debt securities and equities. The Fund expects to pursue its investment objectives by investing its assets in the debt and equities of fixed-income and fixed-income related securities, including real estate securities. The Fund may invest without limitation in fixed-income and fixed-income related securities of any industry, sector, or minimum market cap. In addition, the Fund may invest across domestic and

foreign markets.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946 - Financial Services, Investment Companies. The accompanying financial statements have been prepared on the accrual basis of accounting in conformity with GAAP. All financial information is presented in U.S. Dollars, the functional currency of the Fund.

Organizational and Offering Costs

All costs incurred by the Fund in connection with its organization were expensed as incurred. The Adviser paid these organizational expenses on behalf of the Fund and the Fund has recorded a corresponding payable to the Adviser for the reimbursement of these expenses. Organization costs consist of costs incurred to establish the Fund and enable it legally to do business. Examples of these costs are incorporation fees, legal fees, and audit fees relating to the initial registration statement and the seed audit. Expenses that have been advanced by the Adviser are subject to recoupment under the Expense Support Agreement as described in Note 3.

Offering costs incurred by the Fund were treated as deferred charges until operations commenced on June 1, 2017 and thereafter were amortized over a twelve month period using the straight line method. Examples of these costs are legal fees pertaining to the Fund’s shares offered for sale, costs of printing prospectuses and SEC and state notice fees. As of December 31, 2017, the Fund has $549,626 of deferred offering expenses on the Statement of Assets and Liabilities which will be amortized over the next five months. The Fund has expensed $662,811, which is included in the Statement of Operations for the period ended December 31, 2017.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions related to the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the period. Actual results could differ from those estimates.

| | |

| Semi-Annual Report | December 31, 2017 | 13 |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

Cash and Cash Equivalents

The Fund considers cash equivalents to be highly liquid investments or investments with original maturities of three months or less. Cash and cash equivalents include deposits in a money market demand deposit account. The Fund deposits its cash in a financial institution that, at times, may be in excess of the Federal Deposit Insurance Corporation insurance limits. There are no restrictions on cash. As of December 31, 2017, the Fund had a balance of $163,973 in cash and cash equivalents, of which $161,928 included money market demand deposit accounts.

Recent Accounting Pronouncements and Regulatory Developments

In November 2016, the FASB issued Accounting Standards Update “Restricted Cash” which will require entities to include the total of cash, cash equivalents, restricted cash, and restricted cash equivalents in the beginning and ending cash balances in the Statement of Cash Flows. The guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those years. At this time, management is evaluating the impact, if any, of this guidance on the Fund’s presentation in the Statement of Cash Flows.

In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which clarified the implementation guidance on principal versus agent considerations. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarified the implementation guidance regarding performance obligations and licensing arrangements. The new standard will become effective for the Fund on January 1, 2018, with early application permitted to the effective date of January 1, 2017. The Fund is evaluating the effect that the above referenced guidance will have on its consolidated financial statements and related disclosures. The Fund has not yet selected a transition method nor has it determined the effect of the standard on its ongoing financial reporting. The guidance does not apply to revenue associated with financial instruments, including loans and notes that are accounted for under other U.S. GAAP. As a result, the Fund does not expect the new revenue recognition guidance to have a material impact on the elements of its consolidated statements of operations, most closely associated with financial instruments, including realized gains, fees, interest and dividend income. The Fund plans to adopt the revenue recognition guidance effective July 1, 2018. The Fund’s implementation efforts include the identification of revenue within the scope of the guidance, as well as the evaluation of revenue contracts and related accounting policies. While the Fund has not yet identified any material changes in the timing of revenue recognition, the Fund’s review is ongoing, and it continues to evaluate the presentation of certain contract costs.

In March 2017, the Financial Accounting Standards Board issued Accounting Standards Update “Premium Amortization on Purchased Callable Debt Securities” that amends the amortization period for a callable debt security held at a premium from the maturity date to the earliest call date. The guidance is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. At this time, management is evaluating the implications of these changes on the funds.

Loan Participations and Assignments

The Fund may invest in loan participations and assignments. The Fund considers loan participations and assignments to be investments in debt securities. Loan participations typically will result in the Fund having a contractual relationship only with the lender, not with the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Under a loan participation, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement relating to the loan, nor any rights of set-off against the borrower, and the Fund may not benefit directly from any collateral supporting the loan in which it has purchased the participation. As a result, the Fund will assume the credit risk of both the borrower and the lender that is selling the participation. In the event of the insolvency of the lender selling a participation, the Fund may be treated as a general creditor of the lender and may not benefit from any set-off between the lender and the borrower. When the Fund purchases assignments of loans from lenders, the Fund will acquire direct rights against the borrower on the loan, except that under certain circumstances such rights may be more limited than those held by the assigning lender.

Fair Value Measurements

The Fund applies fair value accounting to all of its financial instruments in accordance with the 1940 Act and ASC Topic 820 - Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework used to measure fair value and requires disclosures for fair value measurements. In accordance with ASC 820, the Fund has categorized its financial instruments carried at fair value, based on the priority of the valuation technique, into a three-level fair value hierarchy. Fair value is a market-based measure considered from the perspective of the market participant who holds the financial instrument rather than an entity specific measure. Therefore, when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that management believes market participants would use in pricing the financial instrument at the measurement date.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 — Valuations based on quoted prices in active markets for identical assets or liabilities at the measurement date.

| | |

| 14 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

Level 2 — Valuations based on inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable at the measurement date. This category includes quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in non-active markets including actionable bids from third parties for privately held assets or liabilities, and observable inputs other than quoted prices such as yield curves and forward currency rates that are entered directly into valuation models to determine the value of derivatives or other assets or liabilities.

Level 3 — Valuations based on inputs that are unobservable and where there is little, if any, market activity at the measurement date. The inputs for the determination of fair value may require significant management judgment or estimation and are based upon management’s assessment of the assumptions that market participants would use in pricing the assets or liabilities. These investments include debt and equity investments in private companies or assets valued using the Market or Income Approach and may involve pricing models whose inputs require significant judgment or estimation because of the absence of any meaningful current market data for identical or similar investments. The inputs in these valuations may include, but are not limited to, capitalization and discount rates, beta and Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") multiples. The information may also include pricing information or broker quotes which include a disclaimer that the broker would not be held to such a price in an actual transaction. The non-binding nature of consensus pricing and/or quotes accompanied by disclaimer would result in classification as Level 3 information, assuming no additional corroborating evidence.

Investments for which market quotations are readily available are valued at such market quotations, which are generally obtained from an independent pricing service or multiple broker-dealers or market makers. The Fund weighs the use of third-party broker quotations, if any, in determining fair value based on management's understanding of the level of actual transactions used by the broker to develop the quote and whether the quote was an indicative price or binding offer. However, debt investments with remaining maturities within 60 days that are not credit impaired are valued at cost plus accreted discount, or minus amortized premium, which approximates fair value. Investments for which market quotations are not readily available are valued at fair value as determined by the Fund’s board of trustees based upon input from management and third party valuation firms. Because these investments are illiquid and because there may not be any directly comparable companies whose financial instruments have observable market values, these loans are valued using a fundamental valuation methodology, consistent with traditional asset pricing standards, that is objective and consistently applied across all loans and through time.

Investments in investment companies are generally determined utilizing the NAV supplied by, or on behalf of, management of each investment company, which is net of management and incentive fees or allocations charged by the investment company and is in accordance with the "practical expedient", as defined by ASC 820. NAVs received by, or on behalf of, management of each investment company are based on the fair value of the investment company's underlying investments in accordance with policies established by management of each investment company, as described in each of their financial statements and offering memorandum.

The methodologies utilized by the Fund in estimating the fair value of its investments categorized as Level 3 generally fall into the following two categories:

| · | The “Market Approach” uses prices and other relevant information generated by market transactions involving identical or comparable assets, liabilities, or a group of assets and liabilities, such as a business. |

| · | The “Income Approach” converts future amounts (for example, cash flows or income and expenses) to a single current (that is, discounted) amount. When the Income Approach is used, the fair value measurement reflects current market expectations about those future amounts. |

The Fund uses third-party valuation firms to assist the board of trustees (the “Board”) in the valuation of its portfolio investments. The valuation reports generated by the third-party valuation firms consider the evaluation of financing and sale transactions with third parties, expected cash flows and market based information, including comparable transactions, performance multiples, and movement in yields of debt instruments, among other factors. Based on market data obtained from the third-party valuation firms, the Fund uses a combined market yield analysis and an enterprise model of valuation. In applying the market yield analysis, the value of the Fund’s loans is determined based upon inputs such as the coupon rate, current market yield, interest rate spreads of similar securities, the stated value of the loan, and the length to maturity. In applying the enterprise model, the Fund uses a waterfall analysis which takes into account the specific capital structure of the borrower and the related seniority of the instruments within the borrower’s capital structure into consideration. To estimate the enterprise value of the portfolio company, the Fund weighs some or all of the traditional market valuation methods and factors based on the individual circumstances of the portfolio company in order to estimate the enterprise value. The methodologies for performing investments may be based on, among other things: valuations of comparable public companies, recent sales of private and public comparable companies, discounting the forecasted cash flows of the portfolio company, third party valuations of the portfolio company, considering offers from third parties to buy the Fund, estimating the value to potential strategic buyers and considering the value of recent investments in the equity securities of the portfolio company. For non-performing investments, the Fund may estimate the liquidation or collateral value of the portfolio company’s assets and liabilities using an expected recovery model. The Fund may estimate the fair value of warrants based on a model such as the Black-Scholes model or simulation models or a combination thereof.

| Semi-Annual Report | December 31, 2017 | 15 |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

The methodologies and information that the Fund utilizes when applying the Market Approach for performing investments include, among other things:

| · | valuations of comparable public companies (“Guideline Comparable Approach”); |

| · | recent sales of private and public comparable companies (“Guideline Comparable Approach”); |

| · | recent acquisition prices of the Fund, debt securities or equity securities (“Acquisition Price Approach”); |

| · | external valuations of the portfolio company, offers from third parties to buy the Fund (“Estimated Sales Proceeds Approach”); |

| · | subsequent sales made by the Fund of its investments (“Expected Sales Proceeds Approach”); and |

| · | estimating the value to potential buyers. |

The methodologies and information that the Fund utilizes when applying the Income Approach for performing investments include:

| · | discounting the forecasted cash flows of the portfolio company or securities (“Discounted Cash Flow” or “DCF” Approach); and |

| · | Black-Scholes model or simulation models or a combination thereof (“Income Approach – Option Model”) with respect to the valuation

of warrants. |

The Fund undertakes a multi-step valuation process each quarter when valuing investments for which market quotations are not readily available, as described below:

| · | the Fund’s quarterly valuation process begins with each portfolio investment being initially valued by the valuation professionals; |

| · | conclusions are then documented and discussed with senior management; and |

| · | an independent valuation firm engaged by the Fund’s board of trustees prepares an independent valuation report for approximately one-third of the portfolio investments each quarter on a rotating quarterly basis on non-fiscal year-end quarters, such that each of these investments will be valued by an independent valuation firm at least twice per annum when combined with the fiscal year-end review of all the investments by independent valuation firms. |

In addition, all of the Fund’s investments are subject to the following valuation process:

| · | management reviews preliminary valuations and conducts its own independent assessment; |

| · | the audit committee of the Fund’s board of trustees reviews the preliminary valuations of senior management and independent valuation firms; and |

| · | the Fund’s board of trustees discusses valuations and determines the fair value of each investment in the Fund’s portfolio in good faith based on the input of the Adviser, the respective independent valuation firms and the audit committee. |

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may differ significantly from the values that would have been used had a readily available market value existed for such investments, and the differences could be material.

The following is a summary of the inputs used in valuing the Fund’s investments as of December 31, 2017:

| | | Valuation Inputs | | | | |

| Investments in Securities at Fair Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 66,133 | | | $ | – | | | $ | – | | | $ | 66,133 | |

| Preferred Stocks | | | 368,485 | | | | – | | | | 97,815 | | | | 466,300 | |

| Senior Secured First Lien Term Loans | | | – | | | | – | | | | 973,999 | | | | 973,999 | |

| Senior Secured Second Lien Term Loans | | | – | | | | – | | | | 496,584 | | | | 496,584 | |

| Warrant | | | – | | | | – | | | | 2,150 | | | | 2,150 | |

| Total | | $ | 434,618 | | | $ | – | | | $ | 1,570,548 | | | $ | 2,005,166 | |

|

There were no transfers between Levels 1, 2 and 3 during the period ended December 31, 2017. It is the Fund’s policy to recognize transfers between levels at the end of the reporting period.

| | |

| 16 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

The following is a reconciliation of assets in which Level 3 inputs were used in determining value:

| Asset Type | | Balance

as of

June 30,

2017 | | | Accured

Discount/

premium | | | Return

of

Capital | | | Realized

Gain/(Loss) | | | Change in

Unrealized

Appreciation/

Deperciation | | | Purchases | | | Sales

Proceeds | | | Transfer

into

Level 3 | | | Transfer

Out of

Level 3 | | | Balance

as of

December

31, 2017 | | | Net change

in unrealized

appreciation/

(depreciation)

included in the

Statements

of Operations

attributable

to Level 3

investments

held at

December 31,

2017 | |

| Preferred Stock | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | (35 | ) | | $ | 97,850 | | | $ | – | | | $ | – | | | $ | – | | | $ | 97,815 | | | $ | (35 | ) |

| Senior Secured First Lien Term Loans | | | 697,000 | | | | 126 | | | | – | | | | 4,820 | | | | 183 | | | | 683,187 | | | | (411,317 | ) | | | – | | | | – | | | | 973,999 | | | | 181 | |

| Senior Secured Second Lien Term Loans | | | 49,250 | | | | 102 | | | | – | | | | – | | | | 324 | | | | 446,908 | | | | – | | | | – | | | | – | | | | 496,584 | | | | 324 | |

| Warrant | | | – | | | | – | | | | – | | | | – | | | | – | | | | 2,150 | | | | – | | | | – | | | | – | | | | 2,150 | | | | – | |

| | | $ | 746,250 | | | $ | 228 | | | $ | – | | | $ | 4,820 | | | $ | 472 | | | $ | 1,230,095 | | | $ | (411,317 | ) | | $ | – | | | $ | – | | | $ | 1,570,548 | | | $ | 470 | |

Significant unobservable valuation inputs for material Level 3 investments as of December 31, 2017 are as follows:

| | | Fair Value

at 12/31/2017 | | | Valuation Technique | | Unobservable Input | | Range

(Weighted Average) |

| Senior Secured First Lien Term Loans | | $ | 341,043 | | | Income Approach (DCF) | | Market yield | | 6.48% - 10.82% (7.76%) |

| Senior Secured First Lien Term Loans | | | 632,956 | | | Recent Arms-Length Transaction | | Recent Arms-Length Transaction | | N/A |

| Senior Secured Second Lien Term Loans | | | 149,435 | | | Income Approach (DCF) | | Market yield | | 7.86% - 11.16% (9.67%) |

| Senior Secured Second Lien Term Loans | | | 347,149 | | | Recent Arms-Length Transaction | | Recent Arms-Length Transaction | | N/A |

| Equity | | | 99,965 | | | Recent Arms-Length Transaction | | Recent Arms-Length Transaction | | N/A |

| Total | | $ | 1,570,548 | | | | | | | |

A change to the unobservable input may result in a significant change to the value of the investment as follows:

| Unobservable Input | Impact to Value if Input Increases | Impact to Value if Input Decreases |

| Recent Arms length transactions | N/A | N/A |

Security Transactions and Investment Income

Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes

The Fund has elected, and intends to qualify annually, to be treated as a registered investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). In order to maintain RIC tax treatment, among other things, the Fund is required to meet certain source of income and asset diversification requirements and timely distribute to its shareholders at least 90% of the sum of its investment company taxable income ("ICTI"), as defined by the Code, and net tax-exempt interest income (which is the excess of the Fund’s gross tax-exempt interest

| | |

| Semi-Annual Report | December 31, 2017 | 17 |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

income over certain disallowed deductions) for each taxable year in order to be eligible for tax treatment under Subchapter M of the Code. Depending on the level of ICTI earned in a tax year, the Fund may choose to carry forward ICTI in excess of current year dividend distributions into the next tax year. Any such carryover ICTI must be distributed before the end of that next tax year through a dividend declared prior to filing the final tax return related to the year which generated such ICTI. The Fund intends to qualify as a RIC, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis.

The Fund accounts for income taxes in conformity with ASC Topic 740 - Income Taxes (“ASC 740”). ASC 740 provides guidelines for how uncertain tax positions should be recognized, measured, presented and disclosed in financial statements. ASC 740 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” to be sustained by the applicable tax authority. Tax positions deemed to meet the “more-likely-than-not” threshold would be recorded as a tax benefit or expense. For the period ended December 31, 2017, there were no interest or penalties due to uncertain income tax positions.

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Code applicable to RICs.

As of December 31, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders

Distributions from investment income, if any, are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP. The Fund did not pay any distributions during the period ending December 31, 2017.

Fair Value of Other Financial Instruments

The carrying amounts of certain of the Fund’s financial instruments, including cash and cash equivalents and accounts payable and accrued expenses, approximate fair value due to their short-term nature.

Indemnification

The Fund expects to indemnify its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund in a manner consistent with the 1940 Act. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund has had no material claims or payments pursuant to such agreements. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

3. Management FEES AND OTHER RELATED PARTY TRANSACTIONS

Management Fee

The Fund’s management fee is calculated and payable monthly in arrears at the annual rate of 1.50% of the Fund’s average daily total assets during such period. No management fees were incurred until the Fund commenced operations. For the period ended December 31, 2017, the Fund incurred $25,305 of management fees.

Incentive Fee

The Fund’s incentive fee is calculated and payable quarterly in arrears in an amount equal to 15% of the Fund’s ‘‘pre-incentive fee net investment income’’ for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s ‘‘adjusted capital,’’ equal to 1.50% per quarter, subject to a ‘‘catch-up’’ feature, which allows the Adviser to recover foregone incentive fees that were previously limited by the hurdle rate. Any incentive fees will be accrued and tracked on a daily basis. For this purpose, ‘‘pre-incentive fee net investment income’’ means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with paid-in-kind interest and zero coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. ‘‘Adjusted capital’’ means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund’s fundamental policy to make repurchase offers. No incentive fees were paid during the period ended December 31, 2017.

| | |

| 18 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

Expense Support Agreement

The Fund entered into an Expense Support and Reimbursement Agreement, (the “Expense Support Agreement”), with the Adviser.

The Adviser has agreed to reimburse the Fund for expenses the Fund incurs for the purpose of limiting the Fund’s payment of certain operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, incentive fees, shareholder services expenses, annual dealer manager fees, distribution fees and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) in any fiscal year to 2.66% per annum of the Fund’s average daily gross assets attributable to each of Class A, Class T, Class I, Class S, and Class L shares (the ‘‘Operational Expense Limit’’). The Adviser will be eligible to recoup expense support payments it previously made, both during the term of the Expense Support Agreement and upon its termination by the Board, within the three years following the period in which the expenses occurred, and the Adviser will recoup an amount from the Fund to the extent the amount recouped does not cause the Fund’s average daily gross assets with respect to the respective Class A, Class T, Class I, Class S, and Class L shares in the period of recoupment to exceed the lesser of the Operational Expense Limit in effect at the time the Expense Support Payment was made in that period or the Operational Expense Limit in effect at such time the Adviser seeks recoupment. The initial term of the Expense Support Agreement was for twelve months, beginning as of the effective date of the Fund’s registration statement, November 9, 2016. The Adviser and the Fund have agreed to extend the term of the Expense Support Agreement through July 25, 2018. The Board of Trustees may terminate the Expense Support Agreement at any time, and there can be no assurance that the Adviser will renew the Expense Support Agreement after July 25, 2018.

As of December 31, 2017, the following amounts were available for recoupment by the Adviser based upon their potential expiration dates:

| Period Ended | | Amount of Expense

Payment Obligations | | | Amount Repaid

to STRF Advisors | | | Eligible to be

Repaid Through |

| June 30, 2017 | | $ | (556,460 | ) | | | – | | | June 30, 2020 |

| December 31, 2017 | | $ | (1,533,724 | ) | | | – | | | December 31, 2021 |

Administration

The Fund entered into an administration agreement (“Administration Agreement”) with Medley Capital LLC, (“Medley”), an affiliate of the Adviser, whereby Medley provides administrative services necessary to conduct the Fund’s day-to-day operations. Such services will include providing office facilities and equipment, clerical, bookkeeping, accounting and recordkeeping services, legal services, and all such other services as deemed necessary by the Fund. The Fund will reimburse Medley for any such costs and expenses which have been paid by Medley on behalf of the Fund on the terms and conditions set forth in the Administration Agreement. The Fund incurred $1,032,079 of administrative expenses from Medley for the period ended December 31, 2017, $251,262 of which was payable as of December 31, 2017.

Sub-Administration

Medley entered into a sub-administration agreement with ALPS Fund Services, Inc. (“ALPS”) to serve as sub-administrator and fund accounting agent for the Fund. ALPS will provide certain administrative and bookkeeping services to Medley for the benefit of the Fund.

Distributor and Transfer Agent

ALPS Distributor, Inc., (the “Distributor”) an affiliate of ALPS, serves as the Fund’s principal underwriter within the meaning of the 1940 Act, and acts as the distributor of the Fund’s shares on a best efforts basis, subject to various conditions. The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. During the period ended December 31, 2017, no fees were retained by

the Distributor.

The Board has adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Servicing Plan, the Fund’s Class T shares are subject to a shareholder services fee at an annual rate of 0.25% of the average daily net assets attributable to Class T shares. For the period ended December 31, 2017, the Fund incurred shareholder services fees of $2,647. Class T shares are subject to distribution fee that accrues at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class T shares and is payable on a quarterly basis. For the period ended December 31, 2017, the Fund accrued $7,940 in distribution fees.

DST Systems, Inc. ("DST"), the parent company of ALPS, serves as the transfer agent to the Fund. Under the Transfer Agency Agreement, DST is responsible for maintaining all shareholder records of the Fund.

| | |

| Semi-Annual Report | December 31, 2017 | 19 |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

Trustees

Each trustee who is not an “interested person” of the Fund or the Adviser as defined in Section 2(a)(19) of the 1940 Act (the “Independent Trustees”) receives an annual fee of $2,500. Independent Trustees also receive $2,000 ($500 for each telephonic board or committee meeting) plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each in-person board or committee meeting. None of the interested trustees receive compensation from the Fund. The Fund incurred $18,253 of trustees fees for the period ended December 31, 2017.

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended December 31, 2017 amounted to $2,355,315 and $1,697,679, respectively.

5. TAX BASIS INFORMATIOn

The character of distributions made during the period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by the Fund. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of the date of the Semi-Annual Report for the period ended December 31, 2017. There were no distributions paid during the fiscal period ended June 30, 2017.

The following information is computed on a tax basis for each item as of December 31, 2017:

| Cost of investments for income tax purposes (excluding money market investments) | | $ | 2,007,757 | |

| Gross appreciation (excess of value over tax cost) | | $ | 5,045 | |

| Gross depreciation (excess of tax cost over value) | | | (7,636 | ) |

| Net unrealized depreciation | | $ | (2,591 | ) |

The difference between book basis and tax basis distributable earnings and unrealized appreciation/(depreciation) is primarily attributable to the tax treatment of organizational costs and certain other investments.

6. REPURCHASE OFFERS

Once each quarter, pursuant to Rule 23c-3 under the 1940 Act, the Fund intends to offer to repurchase at NAV no less than 5% and no more than 25% of its outstanding shares as of the close of regular business hours on the New York Stock Exchange pursuant to a fundamental policy. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all the shares in a shareholder's account are tendered. If shareholders tender for repurchase more than the repurchase offer amount for a given repurchase offer, the Fund will repurchase the shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. During the period ended December 31, 2017, the Fund made one repurchase offer of the outstanding 4,255 Class T shares. No shareholders tendered their Class T shares during the period ended December 31, 2017.

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2017, the Adviser is the beneficial owner of more than 25% of the voting securities and controls the Fund. Control Investments are defined by the 1940 Act as investments in companies in which the Company owns more than 25% of the voting securities or maintains greater than 50% of the board representation.

| | |

| 20 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

| | December 31, 2017 (Unaudited) |

8. COMMITMENTS

As of December 31, 2017, the Fund had $63,265 of unfunded commitments under loan and financing agreements. This amount is primarily composed of commitments for senior secured term loans and revolvers. The unrealized gain or loss associated with unfunded commitments is recorded in the financial statements and reflected as an adjustment to the valuation of the related security in the Schedule of Investments. The par amounts of the unfunded commitments are not recognized by the Fund until the commitment is funded.

| Barry’s Bootcamp Holdings, LLC | | $ | 14,286 | |

| Brook & Whittle Holding Corp. | | | 9,443 | |

| Central States Dermatology Services, LLC | | | 6,663 | |

| Engineered Machinery Holdings | | | 851 | |

| SFP Holding, Inc. | | | 11,111 | |

| Smile Doctors, LLC | | | 20,911 | |

| Total Commitments | | $ | 63,265 | |

9. SUBSEQUENT EVENTS

Subsequent to December 31, 2017, the Fund executed a margin agreement and has begun deploying leverage.

| | |

| Semi-Annual Report | December 31, 2017 | 21 |

| Sierra Total Return Fund | Additional Information |

| | December 31, 2017 (Unaudited) |

1. PROXY VOTING POLICIES AND VOTING RECORD

The Board has adopted the Adviser’s Proxy Voting Policies and Procedures (“Policies”) on behalf of the Fund, which delegate the responsibility for voting proxies to the Adviser, subject to the Board’s continuing oversight. A description of, or a copy of, the Policies is available without charge, upon request, by calling the Fund toll-free at 1-888-292-3178, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2017 is available without charge upon request by calling toll-free 1-888-292-3178, or on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files a complete listing of portfolio holdings for the Fund with the SEC as of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request by calling 1-888-292-3178. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

3. Approval of the Investment Management Agreement

The Board determined at a meeting held on August 18, 2016 to approve the Investment Management Agreement. In its consideration of the approval of the Investment Management Agreement, the Board considered information it had received relating to, among other things:

| • | the nature, quality and extent of the advisory and other services to be provided to the Fund by the Adviser; |

| • | the investment performance of individuals affiliated with the Fund and the Adviser; |

| • | comparative data with respect to advisory fees or similar expenses paid by other non-traded closed-end funds with similar investment objectives; |

| • | the Fund’s projected operating expenses and expense ratio compared to non-traded closed-end funds with similar investment objectives; |

| • | any existing and potential sources of indirect income to the Adviser from its relationships with the Fund and the profitability of

those relationships; |

| • | information about the services to be performed and the personnel performing such services under the Investment Management Agreement; |

| • | the organizational capability and financial condition of the Adviser and its affiliates; |

| • | the Adviser’s practices regarding the selection and compensation of brokers that may execute portfolio transactions for the Fund and the brokers’ provision of brokerage and research services to the Adviser; and |

| • | the possibility of obtaining similar services from other third-party service providers or through an internally managed structure. |

Based on the information reviewed and related discussions, the Board concluded that fees payable to the Adviser pursuant to the Investment Management Agreement were reasonable in relation to the services to be provided. The Board did not assign relative weights to the above factors or the other factors considered by it. In addition, the Board did not reach any specific conclusion on each factor considered, but conducted an overall analysis of these factors.

| | |

| 22 | www.sierratotalreturnfund.com |

This Page Intentionally Left Blank

Must be accompanied or preceded by a Prospectus.

ALPS Distributors, Inc. is the Distributor for the Sierra Total Return Fund.

Item 2. Code of Ethics.

Not applicable to this report.

Item 3. Audit Committee Financial Expert.

Not applicable to this report

Item 4. Principal Accountant Fees and Services.