As filed with the Securities and Exchange Commission on May 9, 2016

Registration No. 333-209379

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3 TO FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NUTRITIONAL HIGH INTERNATIONAL INC.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

| Canada | | 5122 | | N/A |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

77 King Street West, Suite 2905 P. O. Box 121

Toronto Ontario M5K 1H1

(416) 840-3798

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

David Posner

Chief Executive Officer

77 King Street West, Suite 2905 P. O. Box 121

Toronto Ontario M5K 1H1

(647) 958-6727

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Gregg E. Jaclin, Esq. |

| Szaferman Lakind Blumstein & Blader, P.C. |

| 101 Grovers Mill Road, Suite 200 |

| Lawrenceville, New Jersey |

| Phone: (609) 275-0400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ☐

CALCULATION OF REGISTRATION FEE

| Title of Securities Being Registered | | Amount Being Registered (1) | | | Proposed Maximum

Aggregate Offering Price | | | Amount of

Registration Fee (2) | |

| | | | | | | | | | |

| Common Stock ($0.0001 par value) | | | 29,178,000 | | | $ | 945,367.20 | | | $ | 95.20 | |

| | (1) | Represents the number of shares being registered for resale by the selling stockholder pursuant to an equity purchase agreement ("Purchase Agreement") that we entered into with Kodiak Capital Group, LLC ("Kodiak Capital"), The purchase price of the shares that may be sold to Kodiak Capital under the Purchase Agreement will be equal to a 25% discount to the closing bid price for the Company's common stock as reported by Bloomberg Finance, L.P., of the 5th trading day immediately following the date in which the Put Shares (as defined in the Purchase Agreement) have been deposited into the Kodiak Capital's brokerage account, but at a price that is equal to no less than CDN $0.05 ("Floor Price"). If the Company delivers a put notice and the purchase price is below the Floor Price, Kodiak Capital may elect to purchase all, or any portion of the put shares for CDN $0.05. According to the amendment to the Equity Purchase Agreement between the Company and Kodiak Capital, the Company, at its sole discretion, may waive the Floor Price. If the Company decides to waive the Floor Price, the Investor is under obligation to purchase the Put Shares pursuant to the Put Notice. |

| | (2) | Calculated pursuant to Rule 457(c) based on the closing price of our Common Stock as reported on the OTC on January 29, 2016 which was $0.0324 per share. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We have filed a registration statement with the Securities and Exchange Commission relating to this preliminary prospectus. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED: May 9, 2016 |

Up to 29,178,000 Shares of Common Stock

NUTRITIONAL HIGH INTERNATIONAL INC.

________________________________________

This prospectus relates to the resale from time to time, of up to 29,178,000 shares of the common stock of Nutritional High International Inc. (hereafter, "we" "us" "our", "SPLIF" or the "Company") by Kodiak Capital Group, LLC ("Kodiak Capital"), a Delaware limited liability company. We are not selling any shares of common stock in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the selling stockholders. We will, however, receive proceeds from the sale of securities pursuant to our exercise of the put right under the Purchase Agreement. Any participating broker-dealers and, if the selling stockholder is an affiliate of any such broker-dealers, may be deemed to be "underwriters" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholder has informed us that it is not a broker-dealer, is not an affiliate of a broker dealer, and does not have any agreement or understanding, directly or indirectly, with any person to distribute our common stock.

The shares being registered herein are comprised of 29,178,000 common shares in the capital of the Company ("Common Stock" or "Common Shares") that are issuable pursuant to the Purchase Agreement that we entered into with Kodiak Capital on December 23, 2015. The purchase price of the shares that may be sold to Kodiak Capital under the Purchase Agreement will be equal to the greater of (i) 25% discount to the closing bid price for the Company's common stock as reported by Bloomberg Finance, L.P., of the 5th trading day immediately following the date in which the Put Shares (as defined in the Purchase Agreement) have been deposited into the Kodiak Capital's brokerage account, or (ii) CDN $0.05. If the Company delivers a put notice and the purchase price is below the Floor Price, Kodiak Capital may elect to purchase all, or any portion of the put shares for CDN $0.05. According to the amendment to the Purchase Agreement between the Company and Kodiak Capital, the Company, at its sole discretion, may waive the Floor Price. If the Company decides to waive the Floor Price, the Investor is under obligation to purchase the Put Shares pursuant to the Put Notice. Kodiak Capital is an "underwriter" within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act. The total amount of shares of common stock which may be sold pursuant to this Prospectus would constitute approximately 17.1% of our issued and outstanding common stock as of May 9, 2016, assuming that the selling stockholder will sell all of the shares offered for sale.

The selling stockholder may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. Kodiak Capital is paying all of the registration expenses incurred in connection with the registration of the shares except for accounting fees and expenses and we will not pay any of the selling commissions, brokerage fees and related expenses.

The Company's Common Shares are currently listed on the OTCQB. Our common stock is quoted on the OTCQB under the symbol "SPLIF". The Shares registered hereunder are being offered for sale by the Selling Security Holder at prices established on the OTCQB during the term of this offering. On May 6, 2016, the closing price as reported on the OTCQB was $0.0308 per share. The Company's Common Shares are also listed on the Canadian Securities Exchange (the "CSE") under the trading symbol EAT". On May 6, 2016, the closing price as reported on the CSE was CDN $0.03 per share.

The Company qualifies as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

An investment in our common stock is subject to many risks and an investment in our shares will also involve a high degree of risk. The shares issuable from the Purchase Agreement will dilute the ownership interest and voting power of existing stockholders. See "Risk Factors" on page 11 to read about factors you should consider before purchasing shares of our common stock.

_______________________________________

NEITHER THE SECURITIES AND EXCHANGE COMMISSION ("SEC") NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 9, 2016

TABLE OF CONTENTS

PROSPECTUS SUMMARY | 5 |

SUMMARY CONSOLIDATED FINANCIAL DATA | 10 |

RISK FACTORS | 11 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 18 |

USE OF PROCEEDS | 19 |

DETERMINATION OF OFFERING PRICE | 19 |

DILUTION | 20 |

SELLING STOCKHOLDERS | 21 |

PLAN OF DISTRIBUTION | 22 |

MARKET PRICE OF COMMON STOCK AND OTHER STOCKHOLDER MATTERS | 24 |

EXCHANGE RATE INFORMATION | 26 |

SELECTED CONSOLIDATED FINANCIAL DATA | 27 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 28 |

OUR CORPORATE HISTORY AND BACKGROUND | 36 |

DESCRIPTION OF BUSINESS | 38 |

MANAGEMENT | 55 |

EXECUTIVE COMPENSATION | 60 |

PRINCIPAL STOCKHOLDERS | 66 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 67 |

DESCRIPTION OF SECURITIES | 68 |

TAXATION | 71 |

ENFORCEABILITY OF CIVIL LIABILITIES | 77 |

EXPENSES RELATED TO THIS OFFERING | 78 |

LEGAL MATTERS | 78 |

EXPERTS | 78 |

WHERE YOU CAN FIND MORE INFORMATION | 78 |

FINANCIAL STATEMENTS | 79 |

PART II INFORMATION NOT REQUIRED IN THE PROSPECTUS | 141 |

SIGNATURES | 145 |

EXHIBIT INDEX | 146 |

You should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the Securities and Exchange Commission ("SEC") and incorporated by reference herein, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements, before making an investment decision. Certain statements in this summary are forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements." All references to "we," "us," "our," "SPLIF" and the "Company" mean Nutritional High International Inc.

All dollar amounts in this prospectus are expressed in Canadian dollars unless otherwise indicated. The Company's accounts are maintained in Canadian dollars and the Company's financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. All reference to "U.S. dollars", "USD", or to "US$" are to United States dollars.

Overview

The Company mainly conducts its business in the medical marijuana, retail marijuana and hemp infused products sectors in the United States, where such activity is permitted and regulated by applicable laws, through entities that hold a valid license, which we refer to as licensed operators, to produce and distribute such products in accordance with applicable regulations. The Company also pursues similar opportunities in Canada; however, it does not expect to invest significant resources in Canada due to regulatory uncertainty.

Marijuana, for the purposes of this prospectus, is referred to herein as all parts of the plant of the genus cannabis, the seeds thereof, the resin extracted from any part of the plant, and every compound, manufacture, salt, derivative, mixture, or preparation of the plant, its seeds, or its resin, but does not include industrial hemp, nor does it include fiber produced from stalks, oil, or cake made from the seeds of the plant, sterilized seed of the plant which is incapable of germination, or the weight of any other ingredient combined with marijuana to prepare topical or oral administrations, food, drink, or other product.

Traditionally, the female marijuana or cannabis plant was consumed by smoking. The flower of the plant is dried and smoked either through a pipe, a cigarette or a filtration device/apparatus such as a water pipe or a vaporizer.

Leafs, nodes and stems are not typically utilized for consuming cannabis through smoking, but are used in production of other products such as oil extracts, referring to hereinafter as marijuana concentrate, which are produced by extracting cannabinoids from marijuana by a method including, but not limited to use of solvent, water, ice, dry ice or propylene glycol, glycerin, butter, olive oil or other typical cooking fats. The marijuana concentrate is then used to manufacture a products, referring to hereinafter as marijuana-infused products, for medical or recreational adult use in jurisdictions where permitted by the applicable regulatory authorities that are intended for use or consumption other than by smoking.

Regulations differ significantly amongst the U.S. states. Some U.S. states only cultivation, processing and distribution of marijuana for medical purposes only, which we refer as medical marijuana, and may also include marijuana-infused products, which we refer as medical marijuana-infused products. Some U.S. states may also permit cultivation, processing and distribution of marijuana for recreational purposes, which we refer as retail marijuana or recreational marijuana, and may also include marijuana-infused products, which we refer as retail marijuana-infused products.

Most U.S. states that have legalized medical marijuana or retail marijuana impose a range of requirements on the business operators, including obtaining a license from state governmental authorities. Some states (such as Colorado) require licensed operators (or their shareholders) to be residents of that U.S. State, which we refer as residency requirement. Other states (such as Illinois, Nevada, Maryland and Arizona) do not impose a residency requirement. The State of Oregon permits out-state ownership, however, such ownership is subject to a number of restrictions.

For the marijuana related products, the Company's strategy in the states with residency requirements is focused on providing products or services to the industry rather than directly owning production or retail operations. The Company is currently actively pursuing the opportunities in the State of Colorado and Illinois. The State of Colorado permits the sale, possession, use, production, distribution and personal cultivation of marijuana, however, that the Colorado Supreme Court has held that even workers who use marijuana for medical reasons may be discharged for violation of federal law. On the other hand, the State of Illinois currently allows only the medical use of marijuana under very controlled circumstances.

In addition, pursuant to federal regulations, hemp-infused products (also refer to as hemp stalk oil-infused products) are excluded from the definition of "marihuana", as long as the product does not contain active levels of tetrahydrocannabinol ("THC"), the psychoactive compound of the cannabis plant. It is generally accepted that products with less than 0.3% THC do not contain active levels of THC. Changes in related state and federal regulation could have a material positive or negative impact on the Company's operations.

The Company has two distinct objectives as a part of the separate business units:

| | Ø | Marijuana-Infused Products Segment. The Company is focused on developing, acquiring and designing marijuana-infused products and marijuana concentrate products and brands for use by licensed operators entering into royalty or raw materials and packaging agreements with the Company in jurisdictions where permitted; and |

| | Ø | Hemp-Infused Products Segment. The Company is focused on developing, acquiring, manufacturing and distributing products infused with non-psychoactive constituent of the industrial hemp plant (less than 0.3% THC or otherwise as permitted by applicable law), which may be distributed in all 50 states. The Company is pursuing a retail distribution strategy through networks of retail dispensaries where THC products are sold, head shops, vitamin stores and independent grocers via direct sales and distributors and is considering online sales, and multi-level marketing. |

The two segments we described above are operating segments only and that for financial reporting purposes we combine them and report our results as one segment. The Company will establish operations only in U.S. states which have implemented adequate licensing frameworks and are in compliance with the Cole Memo as hereinafter described below.

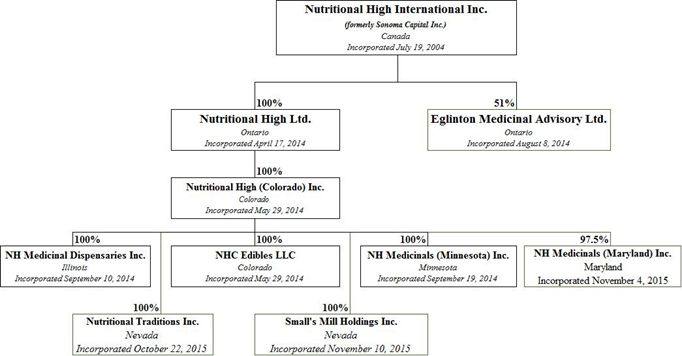

We are a holding company and we conduct our business through our operating subsidiaries as follows:

NHC Edibles LLC ("NHC") and Nutritional High (Colorado) Inc. ("NHCI") carry out the Company's operations in the Marijuana–Infused Products Segment. NHC's activities in the State of Colorado includes but not limited to acquiring and leasing real estate to licensed operators and entering into raw materials and packaging agreements and financing agreements with licensed operators who are focused in the retail market and subject to residency requirements, that do not require it to obtain a licence.

NH Medicinal Dispensaries Inc ("NHMDI") and Small's Mill Holdings Inc. ("SMHI") carry out the Company's operations in the Marijuana Sector in the State of Illinois. NHMDI has submitted an application for a dispensary license with the State of Illinois and has received an authorization to register a medical marijuana dispensary. SMHI has taken possession of the Lawrenceville Property under the Lawrenceville PSA.

Nutritional Traditions Inc. carries out the Company's operations in the Hemp-Infused Product Segment. See "Our Corporate History and Background – Our Subsidiaries"

Marijuana-Infused Products Segment

In its Marijuana-Infused Products Segment, the Company is focused on developing, acquiring and designing marijuana-infused products and marijuana concentrate products and brands for use by licensed operators who enter into raw materials and packaging agreements or royalty agreements with the Company in respect to the Company's brands, recipes and know-how ("NH Licensed Operators") or sell packaging to licensed operators with the Company's branding, as permitted by the applicable regulation. The Marijuana-Infused Products Segment is solely focused on the U.S. states where marijuana-infused products are permitted by law and regulation. We have no current agreements with licensed operators other than the agreement with an Illinois cannabis cultivation and extraction facility to develop a framework under which the extraction facility will manufacture and distribute our oils and edibles in Illinois. The agreement provides for a right to negotiate an agreement to negotiate the framework in good faith, but provides for no financial terms in this regard. As such, the Company considers the agreement not material to its operations at this time. We currently have no commercial products.

The Company's business model in its Marijuana-Infused Products Segment differs depending on the residency requirements of the applicable jurisdiction. Most U.S. states that have legalized marijuana for medical or recreational use require the businesses or individuals to hold a valid license under applicable regulation in the respective U.S. state issued by the applicable state authorities. In some U.S. states, for a licensed operator to be eligible to be granted a license, the owners of the licensed operator must be residents of such U.S. state. As such, listed companies or other widely held enterprises are ineligible to obtain a license in those U.S. states where a licensed operator must be a state resident. In such U.S. states, the Company will work with a licensed operator to provide them with financing, licensing of its products, recipes and brands, know how, consulting services and may purchase the facilities where such license operators operate or intend to operate. In U.S. states where there are no residency requirements and where the Company may acquire licensing on its own, the Company may apply to become a license operator. The Company will not operate in jurisdictions which have not legalized marijuana, and does not intend on operating in jurisdictions which have legalized marijuana but have not developed and imposed a licensing regime for licensed operators.

In certain jurisdictions, and more specifically in the states with the residency requirements, the Company may conduct business in the value chain segments, which do not require a license from the requisite regulatory authorities. Such ancillary value chain segments do not directly handle, process, manufacture, cultivate or distribute cannabis products, and may include: unsecured lending, providing real estate to licensed operators, equipment leasing and providing non-cannabis raw materials (such as packaging, food ingredients, etc.) The focus of this strategy is to provide the services to licensed operators that are focused on extraction and processing of cannabis to enable them to attain a stronger competitive advantage in the market, while proving an acceptable economic return to the Company.

In certain circumstances the Company may pursue other value chain segments, such as operating a dispensary, in the states where the regulatory environment is unsuitable to earn an economic rate of return in the extraction/processing segment, given the Company's assessment. This aim of this strategy is to secure a foothold in such markets, through obtaining a license to operate a business that is not directly related to extraction/processing and then partner with another licensed operator who is able to operate in the extraction/processing space. The Company has employed this type of strategy in the State of Illinois, where it is working to obtain a dispensary license, but has also partnered with another licensed operator to be in a position to sell its products in Illinois.

Hemp-Infused Products Segment

In its Hemp-Infused Products Segment, the Company is focused on developing, acquiring, manufacturing and distributing products infused with non-psychoactive constituent of the industrial hemp plant (less than 0.3% THC or as otherwise permitted by applicable law), which may be distributed in all 50 U.S. states. The Company is pursuing a retail distribution strategy through networks of retail dispensaries where THC products are sold, head shops, vitamin stores and independent grocers via direct sales and distributors and is considering online sales, and multi-level marketing. Having access to the Company's expertise in manufacturing products from cannabis, these hemp-infused products are expected to have a competitive edge in the market. The products are being sold under the "Nutritional Traditions" brand name and initially available to California retail customers. Distribution will be expanded outside of California beginning in 2016.

U.S. Federal Law and Cole Memo Compliance

The use, possession, sale, cultivation and transportation of cannabis remains illegal under U.S. federal law. The concepts of "medical marijuana" and "retail marijuana" do not exist under U.S. federal law. The Federal Controlled Substances Act classifies "marihuana" as a Schedule I drug. Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of safety for the use of the drug under medical supervision. As such, marijuana-related practices or activities, including without limitation, the manufacture, importation, possession, use or distribution of marijuana are illegal under U.S. federal law. Strict compliance with state laws with respect to marijuana will neither absolve the Company of liability under U.S. federal law, nor will it provide a defense to any federal proceeding which may be brought against the Company.

In a memorandum dated August 29, 2013, addressed to "All United States Attorneys" from James M. Cole, Deputy Attorney General (the "Cole Memo"), the U.S. Department of Justice acknowledged that certain U.S. states had enacted laws relating to the use of marijuana and outlined the U.S. federal government's enforcement priorities with respect to marijuana notwithstanding the fact that certain U.S. states have legalized or decriminalized the use, sale and manufacture of marijuana:

| | · | Preventing the distribution of marijuana to minors; |

| | · | Preventing revenue from the sale of marijuana from going to criminal enterprises, gangs, and cartels; |

| | · | Preventing the diversion of marijuana from U.S. states where it is legal under state law in some form to other U.S. states; |

| | · | Preventing U.S. State-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity; |

| | · | Preventing violence and the use of firearms in the cultivation and distribution of marijuana; |

| | · | Preventing drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use; |

| | · | Preventing the growing of marijuana on public lands and the attendant public safety and environmental dangers posed by marijuana production on public lands; and |

| | · | Preventing marijuana possession or use on U.S. federal property. |

There is no guarantee that the current presidential administration will not change its stated policy regarding the low-priority enforcement of U.S. federal laws that conflict with state laws. Additionally, any new U.S. federal government administration that follows could change this policy and decide to enforce the U.S. federal laws vigorously.

The Company's operations are compliant with the Cole Memo.

Recent Developments

Key Management Changes

On April 28, 2016 the Company announced key management changes.

| · | Jim (Vernon) Frazier has replaced Gary Margolin as Chief Operating Officer of the Company; and |

| · | Given Mr. Frazier's extensive operational capabilities and past product development experience in the food and confectionary industry, the Company has elected to not renew its consulting agreement with Anne Marie Youhana as VP Product Development and Quality Control. |

The Company's board has approved for issuance of 2,500,000 stock options to Mr. Frazier. Each Stock Option is exercisable into Common Shares at a price of $0.07 per Common Share for a period of five years from the date of issuance, vesting every 6 months over a three year period.

Closing of US$800,000 Pueblo Property Refinancing

On April 19th, 2016, the Company has completed a US$800,000 refinancing of its Pueblo, Colorado, property (the "Refinancing") with a Florida-based institutional investor ("Lender").

Under the terms of the Refinancing, the Lender has provided an initial advance of US$600,000 earmarked to fund the completion of certain construction and improvements at the Pueblo facility to enable Palo Verde LLC (the Company's licensed tenant) to commence the production of cannabis extracts and cannabis derivative products. A portion of the proceeds was used to pay out the previous first mortgagee on the facility in the amount of CN$127,000. Upon completion of the build-out of the marijuana oil extraction facility, the Lender will disburse a subsequent advance of US$200,000 to be used to complete the build out of the commercial kitchen to enable Palo Verde to commence production of marijuana-infused edibles.

In connection with the Refinancing, the Company has also granted the Lender 3,333,334 share purchase warrants exercisable into Common Shares at an exercise price of $0.06 per Share, which shall expire 18 months after issuance. The Company and the Lender have entered into a Registration Rights Agreement, which provides the Lender with piggyback registration rights for the warrants issued to the Lender, if the Company proposed to register a public offering solely of its Common Shares. The Lender has acknowledged that the Company has this pending registration statement at the time of issuance, and agreed that this registration statement will be exempted from granting the Lender piggyback registration rights.

Illinois Joint-Venture, Oils and Edibles Relationship and Conditional Approval for Registration of the Dispensary

The Company has significant developments in Illinois, which include:

| · | Entered into joint-venture agreement ("JV Agreement") with ILDISP LLC, which has ties to the Illinois medical marijuana industry, to build and assist in operating the Company's planned dispensary in Lawrenceville, Illinois; |

| · | Been granted conditional approval ("Conditional Approval") by the Illinois Department of Financial and Professional Regulation ("IDFPR") to establish the Lawrenceville Dispensary; |

| · | Commenced renovations at the Lawrenceville Dispensary property; and |

| · | Entered into an agreement with an Illinois cannabis cultivation and extraction facility to develop a framework under which the extraction facility will manufacture and distribute Nutritional High's oils and edibles in Illinois. |

Under the terms of the JV Agreement ILDISP LLC will fund up to USD $300,000 of the expenses and working capital required to complete and launch the Lawrenceville Dispensary. In addition, subject to regulatory approval (as discussed below), ILDISP LLC will provide the Company with a guarantee for half the Seller Take-Back Mortgage. If ILDISP LLC makes its full contribution, in exchange for its contribution, ILDISP LLC shall receive a 50% interest in NHMD, the Company's wholly owned subsidiary which holds the Conditional Approval for the Lawrenceville Dispensary, and a 50% interest in SMHI, the Company's wholly owned subsidiary which holds the Company's interest in the Dispensary real estate property located in Lawrenceville, IL. The joint venture might require a need for additional capital infusions in excess of $300,000, which would require the Company to make additional contributions, failing to do which may result in reduction of the Company's interest in NHMDI and SMHI. In addition, ILDISP's failure to contribute may create an greater need for the Company to contribute additional capital, which may not be available to the Company on favorable terms or at all.

ILDISP LLC has already made initial advances to fund the Lawrenceville Dispensary renovations and property mortgage payments. The joint venture is subject to the approval of the IDFPR. Furthermore, it is contemplated that ILDISP LLC will contribute to the management of the Lawrenceville Dispensary and its relationships in the surrounding community will help accelerate the growth and development of the Dispensary. Upon securing IDFRP approval, it is expected that a shareholders agreement, in a form and substance acceptable to the Company and ILDISP LLC, will be entered into. While the form of shareholders agreement will not be finalized until IDFRP approval has been secured, the shareholders agreement will contain customary provisions such as governance of the rights and responsibilities of the shareholders, respective share ownership and dilution mechanism if additional capital is required, corporate governance protection and various other checks and balances as between the shareholders. The Board of Directors of both NHMD and SMHI shall be composed of an equal number of directors appointed by both ILDISP and Nutritional High, once the requisite approvals are obtained.

In addition, NHMD has been advised by the IDFPR that it has been awarded Conditional Approval to register the Lawrenceville Dispensary under the Compassionate Use of Medical Cannabis Pilot Program Act (Illinois) ("CUMCPPA"). The Conditional Approval sets out the requirements that NHMD must fulfill prior to IDFPR approving the registration of the dispensary, which includes completing the renovations and passing the final inspection to the satisfaction of IDFPR. Upon meeting IDFRP's conditions, it is expected that NHMD will be granted a final license to operate the Lawrenceville Dispensary.

The Company also has entered into an agreement with an Illinois cannabis cultivation and extraction facility

to develop a framework under which the extraction facility will manufacture and distribute Nutritional High's oils and edibles in Illinois. The cultivation and extraction facility is licensed with Illinois Department of Agriculture and was amongst the first of the companies to commence commercial cultivation and processing of cannabis products under the CUMCPPA. The Company will develop its business framework with the extraction facility over the next 18 months and will provide updates as this business initiative develops. The agreement provides for a right to negotiate an agreement to negotiate the framework in good faith, but provides for no financial terms in this regard. As such, the Company considers the agreement not material to its operations at this time.

Lawrenceville Dispensary Application and Lawrenceville Property Acquisition

The Company has taken possession of the real estate property in Lawrenceville, Illinois ("Lawrenceville Property") on November 25, 2015, under a purchase and sale agreement between NHMDI and the vendor of the Lawrenceville Property ("Lawrenceville PSA"). The final acquisition price for the Lawrenceville property was USD $350,000. The Company has also negotiated a seller take-back mortgage ("Seller Take-Back Mortgage"), which will have a 15 year amortization period, bearing an interest at the rate of 6% and be due in two years from the date of issuance as a balloon payment. Upon payment of the Seller Take-Back Mortgage, title to the Lawrenceville Property will automatically transfer SMHI (as hereinafter defined).

Private Placement

On December 2, 2015, the Company completed a non-brokered private placement of 4,200,000 units at $0.05 per unit for gross proceeds of $210,000. Each unit consisted of one common share and one half of one share purchase warrant, with each warrant exercisable into one common share at a price of $0.07 per share for a period of 18 months from the date of issuance.

Hemp Product Launch

The Company has rolled out of the first three products in its Hemp-Infused Products Segment. Initial products are being made available to consumers in California include capsules, push caps for water bottles, and a push cap formulation for post-exercise recovery called "Rapid Recovery". In addition, the Company intends to commenced sales of these products in Colorado in 2016, targeting sales to marijuana dispensaries in Colorado, further developing sales channels for the Company's marijuana oil and edible brands.

Equity Purchase Agreement with Kodiak Capital

On December 23, 2015, we entered into the Purchase Agreement with Kodiak Capital. Pursuant to the terms of the Purchase Agreement, Kodiak Capital committed to purchase up to $1,000,000 of our common stock over a period until the earlier of (i) the date on which Kodiak Capital shall have purchased put shares pursuant to the Purchase Agreement for an aggregate purchase price of $1,000,000, or (ii) December 31, 2016. The purchase price of the shares that may be sold to Kodiak Capital under the Purchase Agreement will be equal to the greater of (i) 25% discount to the closing bid price for the Company's common stock as reported by Bloomberg Finance, L.P., of the 5th trading day immediately following the date in which the Put Shares (as defined in the Purchase Agreement) have been deposited into the Kodiak Capital's brokerage account, or (ii) CDN $0.05 ("Floor Price"). If the Company delivers a put notice and the purchase price is below the Floor Price, Kodiak Capital may elect to purchase all, or any portion of the put shares for CDN $0.05. According to the amendment to the Equity Purchase Agreement between the Company and Kodiak Capital dated May 5, 2016, the Company, at its sole discretion, may waive the Floor Price. If the Company decides to waive the Floor Price, the Investor is under obligation to purchase the Put Shares pursuant to the Put Notice.

We do not have the right to commence any sales to Kodiak Capital under the Purchase Agreement until the SEC has declared effective the registration statement of which this prospectus forms a part. Thereafter, we may, from time to time and at our sole discretion, direct Kodiak Capital to purchase shares of our common stock, but we would be unable to sell shares to them if such purchase would result in their respective beneficial ownership equaling more than 9.99% of the outstanding common stock. Except as described in this prospectus, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Kodiak Capital. We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. Kodiak Capital is not permitted to engage in any short shales of our common stock during the period covered by the Purchase Agreement.

In connection with the Purchase Agreement, we also entered into the Registration Rights Agreement, pursuant to which we are obligated to file a registration statement with the SEC by January 30, 2016. Kodiak Capital agreed to extend the filing deadline to February 10, 2016.

At an assumed purchase price of CDN $0.05 (equal to the greater of (i) 75% of the closing price of our common stock of CDN $0.03 on May 6, 2016, or (ii) CDN $0.05), we will be able to receive $1,000,000 in gross proceeds, assuming the sale of the entire 29,178,000 shares being registered hereunder pursuant to the Purchase Agreement, assuming the USD:CDN exchange rate of $1.4598. However, we may be required to register more shares in order to receive the full amount of the investment amount if the Company decides to waive the Floor Price, and/or if the USD:CDN exchange rate increases at the drawdown.

Risk Factors

We face certain risks, challenges and uncertainties that may materially affect our business, financial condition, results of operations and prospects. The primary ones include:

| • | Funding from our Purchase Agreement with Kodiak Capital may be limited or be insufficient to fund our operations or to implement our strategy; |

| | |

| • | The Company has limited operating history and encounters risks and uncertainties which might significantly harm the Company's business if those where not addressed properly. In addition, there is substantial doubt upon the Company's ability to continue as a going concern. At January 31, 2016 the Company had working capital (deficiency) of $(327,988) (July 31, 2015 - $116,439), had not yet achieved profitable operations, has accumulated losses of $3,393,225 (July 31, 2015 - $2,740,442) and expects to incur further losses in the development of its business; |

| | |

| • | Our business is dependent on laws pertaining to the marijuana industry; |

| | |

| • | Marijuana-related practices or activities are illegal under U.S. federal laws. Strict enforcement of federal law regarding marijuana would likely result in our inability to proceed with our business plan; |

| | |

| • | We face an inherent risk of exposure to product liability claims, regulatory action and litigation if its products are alleged to have caused significant loss or injury; |

| | |

| • | The Company may need to raise significant additional funds in order to support its growth, however, the Company cannot be sure that this additional financing, if needed, will be available on acceptable terms, or at all; |

| | |

| • | The success of the Company is dependent on the performance of its senior management. The loss of the services of these persons would have a material adverse effect on the Company's business and its prospects; |

| | |

| • | Exchange rate fluctuations may adversely affect the Company's financial position and results; |

| | |

| • | You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited because we are incorporated under Canadian law, a substantial portion of our assets are in Canada and most of our directors and executive officers reside outside the United States; |

| | |

| • | If the selling shareholder sells a large number of shares all at once or in blocks, the market price of our shares would most likely decline; |

| | |

| • | The sale of our common stock to Kodiak Capital may cause dilution, and the sale of the shares of common stock acquired by Kodiak Capital, or the perception that such sales may occur, could cause the price of our common stock to fall; |

| | |

| • | Kodiak Capital will pay less than the then-prevailing market price for our common stock; |

| | |

| • | The Company's put right may convert into a greater number of shares than we have assumed in this prospectus; |

| | |

| • | The market price of our common stock may fluctuate significantly; |

| | |

| • | We are an "emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors; |

| | |

| • | Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock; and |

| | |

| • | Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them. |

You should consider the risks discussed in the "Risk Factors" section and elsewhere in this prospectus before investing in our common stock.

Emerging Growth Company

We are an "emerging growth company" as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the "Securities Act"), as modified by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Our principal executive offices are located at 77 King Street West, Suite 2905 P. O. Box 121, Toronto Ontario M5K 1H1 and our telephone number is (416) 840-3798. Our website address is www.nutritionalhigh.com. The information contained therein or connected thereto shall not be deemed to be incorporated into this preliminary prospectus or the registration statement of which it forms a part. The information on our website is not part of this preliminary prospectus.

The Offering

| Common stock offered for resale: | | 29,178,000 shares of common stock |

| | | |

| Common Stock outstanding after this offering: | | 171,120,514 shares of common stock(1) |

| | | |

| Use of proceeds: | | We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of shares to Kodiak Capital pursuant to the Purchase Agreement. We intend to use the net proceeds received from any such sales of shares to Kodiak Capital under the Purchase Agreement for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company. |

| | | |

| Risk factors: | | There are significant risks involved in investing in the Company. For a discussion of risk factors you should consider before buying our common stock, see "Risk Factors" beginning on page 11. |

| | | |

| Ticker symbol: | | OTCQB: "SPLIF" CSE: "EAT" |

| | | |

| Underwriter: | | Kodiak Capital Group, LLC is considered an underwriter of the Company. An underwriter must make public disclosure similar to disclosure made by an issuer in the event of purchases and sales of securities. |

| | (1) | The number of shares of our common stock outstanding after this offering is based on 141,942,514 shares of common stock outstanding as of May 9, 2016 and excludes shares of common stock issuable upon exercise of warrants and conversion of convertible notes prior to this offering. |

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary financial information set forth below has been derived from the financial statements of the Company for periods presented and should be read in conjunction with the financial statements and the notes thereto included elsewhere in this prospectus and in the information set forth in the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations."

| | | Six months

ended | | | For the Year Ended | | From Incorporation (April 17, 2014) to | |

| | | January 31,

2016 (Unaudited) | | | July 31, 2015 | | July 31, 2014 | |

| Statements of Net Loss and Comprehensive Loss: | | | | | | | | |

| Total revenue | | $ | Nil | | | Nil | | Nil | |

| Total expenses | | | (832,188 | ) | | | (2,179,122 | ) | | | (681,155 | ) |

| Other income (expenses) | | | 179,558 | | | | 110,762 | | Nil | |

| Net loss and comprehensive loss | | | (661,552 | ) | | | (2,083,645 | ) | | | (681,155 | ) |

| Basic and diluted loss per common share | | | (0.005 | ) | | | (0.2 | ) | | | (0.01 | ) |

| Current Assets | | | 233,802 | | | | 388,713 | | | | 673,525 | |

| Total Assets | | | 2,608,669 | | | | 1,972,588 | | | | 695,477 | |

| Total Liabilities | | | 1,199,035 | | | | 1,142,249 | | | | 220,150 | |

| Shareholders' Equity | | $ | 1,409,634 | | | | 830,339 | | | | 475,327 | |

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

Funding from our Purchase Agreement with Kodiak Capital may be limited or be insufficient to fund our operations or to implement our strategy.

Under our Purchase Agreement with Kodiak Capital, upon effectiveness of the registration statement of which this prospectus is a part, and subject to other conditions, we may direct Kodiak Capital to purchase up to $1,000,000 of our shares of common stock until the earlier of (i) the date on which Kodiak Capital shall have purchased put shares pursuant to the Purchase Agreement for an aggregate purchase price of $1,000,000, or (ii) December 31, 2016. The purchase price of the shares that may be sold to Kodiak Capital under the Purchase Agreement will be equal to the greater of (i) 25% discount to the closing bid price for the Company's common stock as reported by Bloomberg Finance, L.P., of the 5th trading day immediately following the date in which the Put Shares (as defined in the Purchase Agreement) have been deposited into the Kodiak Capital's brokerage account, or (ii) CDN $0.05. If the Company delivers a put notice and the purchase price is below the Floor Price, Kodiak Capital may elect to purchase all, or any portion of the put shares for CDN $0.05. The Company, at its sole discretion, may waive the Floor Price. If the Company decides to waive the Floor Price, the Investor is under obligation to purchase the Put Shares pursuant to the Put Notice.

There can be no assurance that we will be able to receive all or any of the purchase price from Kodiak Capital because the Purchase Agreement contains certain limitations, restrictions, requirements, conditions and other provisions that could limit our ability to cause Kodiak Capital to buy common stock from us. For instance, there is a floor price of CDN $0.05 pursuant to the Purchase Agreement. If the Company delivers a put notice and the purchase price is below CDN $0.05, Kodiak Capital may elect to purchase all, or any portion of the put shares for CDN $0.05. The Company, at its sole discretion, may waive the Floor Price. If the Company decides to waive the Floor Price, the Investor is under obligation to purchase the Put Shares pursuant to the Put Notice. If the Company decides not to waive the floor price, there is no assurance that Kodiak Capital is willing to pay CDN $0.05 for the put shares and as such we may not be able to receive all or any of the purchase price. Also, the Company is prohibited from issuing a drawdown notice if the amount requested in such drawdown notice would cause the Company to sell or Kodiak Capital to purchase an aggregate number of shares of the Company's common stock which would result in beneficial ownership by Kodiak Capital of more than 9.99% of the Company's common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder).

The extent to which we rely on Kodiak Capital as a source of funding will depend on a number of factors, including the amount of working capital needed, the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources. If obtaining sufficient funding from Kodiak Capital were to prove unavailable or prohibitively dilutive, we would need to secure another source of funding. Even if we sell all $1,000,000 of common stock under the Purchase Agreement with Kodiak Capital, we will still need additional capital to fully implement our current business, operating plans and development plans.

The Company has limited operating history and encounters risks and uncertainties which might significantly harm the Company's business if those where not addressed properly. In addition, there is substantial doubt upon the Company's ability to continue as a going concern.

The Company has a very limited history of operations, is in the early stage of development and must be considered a start-up. As such, the Company is subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders' investment and the likelihood of success must be considered in light of its early stage of operations. The Company has no history of earnings. Because the Company has a limited operating history in emerging area of business, you should consider and evaluate its operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. These risks may include:

| | · | risks that it may not have sufficient capital to achieve its growth strategy; |

| | · | risks that it may not develop its product and service offerings in a manner that enables it to be profitable and meet its customers' requirements; |

| | · | risks that its growth strategy may not be successful; |

| | · | risks that fluctuations in its operating results will be significant relative to its revenues; and |

| | · | risks relating to an evolving regulatory regime. |

The Company's future growth will depend substantially on its ability to address these and the other risks described in this section. If it does not successfully address these risks, its business may be significantly harmed.

In addition, at January 31, 2016 the Company had working capital (deficiency) of $(327,988) (July 31, 2015 - $116,439), had not yet achieved profitable operations, has accumulated losses of $3,393,225 (July 31, 2015 - $2,740,442) and expects to incur further losses in the development of its business, all of which describes the material uncertainties that cast significant doubt upon the Company's ability to continue as a going concern. The Company will require additional financing in order to conduct its planned business operations, meet its ongoing levels of corporate overhead and discharge its liabilities and commitments as they come due. There can be no assurance that we will have adequate capital resources to fund planned operations or that any additional funds will be available to us when needed or at all, or, if available, will be available on favorable terms or in amounts required by us. If we are unable to obtain adequate capital resources to fund operations, we may be required to delay, scale back or eliminate some or all of our operations, which may have a material adverse effect on our business, results of operations and ability to operate as a going concern.

The Company relies on securing agreements with NH Licensed Operators in the targeted jurisdictions that have been able to obtain a License with the appropriate regulatory authorities. Failure of a NH Licensed Operators to comply with the requirements of their License or any failure to maintain their License would have a material adverse impact on the business, financial condition and operating results of the Company.

The regulatory framework in most U.S. states restricts the Company from obtaining a License to grow, store, process and sell marijuana products. As such, the Company relies on securing agreements with NH Licensed Operators in the targeted jurisdictions that have been able to obtain a License with the appropriate regulatory authorities. Failure of a NH Licensed Operators to comply with the requirements of their License or any failure to maintain their License would have a material adverse impact on the business, financial condition and operating results of the Company. Should the regulatory authorities not grant a License or grant a License on different terms unfavorable to the NH Licensed Operators, and should the Company be unable to secure alternative NH Licensed Operators, the business, financial condition and results of the operation of the Company would be materially adversely affected.

If the federal government changes its approach to the enforcement of laws relating to marijuana, the Company would need to seek to replace those tenants with non-marijuana tenants, who would likely pay lower rents. It is likely that the Company would realize an economic loss on its capital acquisitions and improvements made to its capital assets specific to the marijuana industry, and the Company would likely lose all or substantially all of its investments in the markets affected by such regulatory changes.

The Company will advance significant funds to Palo Verde in a form of unsecured loans, which the Company may not be able to collect if Palo Verde fails to achieve commercial production

Palo Verde is a development stage entity with limited capacity to raise funds. There is no assurance that any or all of the amounts loaned will be recovered by the Company. If Palo Verde is unable to commence commercial production in a profitable fashion or secure an alternative source of funds, the full amount of the loan might be written off.

Our business is dependent on laws pertaining to the marijuana industry.

Our business operation is dependent on state laws pertaining to the marijuana industry. Continued development of the marijuana industry is dependent upon continued legislative authorization of marijuana at the state level. Any number of factors could slow or halt progress in this area. Further, progress, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Any one of these factors could slow or halt use of marijuana, which would negatively impact our proposed business.

As of December 20, 2015, 23 states, the District of Columbia and Guam allow their residents to use medical marijuana. Voters in the states of Colorado and Washington approved and implemented regulations to legalize cannabis for adult use. The state laws are in conflict with the Federal Controlled Substances Act, which makes marijuana use and possession illegal on a national level. The Obama administration has made numerous statements indicating that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to stringently enforce the federal laws. Any such change in the federal government's enforcement of current federal laws could cause significant financial damage to the Company and its stockholders, including the potential exposure to criminal liability.

Laws and regulations affecting our industry are constantly changing.

The constant evolution of laws and regulations affecting the marijuana industry could detrimentally affect our operations. Local, state and federal medical marijuana laws and regulations are broad in scope and subject to changing interpretations. These changes may require us to incur substantial costs associated with legal and compliance fees and ultimately require us to alter our business plan. Furthermore, violations of these laws, or alleged violations, could disrupt our business and result in a material adverse effect on our operations. In addition, we cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible that regulations may be enacted in the future that will be directly applicable to our business.

Marijuana-related practices or activities are illegal under U.S. federal laws. Strict enforcement of federal law regarding marijuana would likely result in our inability to proceed with our business plan.

The concepts of "medical marijuana" and "retail marijuana" do not exist under U.S. federal law. The Federal Controlled Substances Act classifies "marihuana" as a Schedule I drug. Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of safety for the use of the drug under medical supervision. As such, marijuana-related practices or activities, including without limitation, the manufacture, importation, possession, use or distribution of marijuana are illegal under U.S. federal law. Strict compliance with state laws with respect to marijuana will neither absolve the Company of liability under U.S. federal law, nor will it provide a defense to any federal proceeding which may be brought against the Company.

There are regulation that may hinder the Company's ability to establish and maintain bank accounts due to the marijuana business.

The U.S. federal prohibitions on the sale of marijuana may result in NH Licensed Operators, the Company and its subsidiaries being restricted from accessing the U.S. banking system and they may be unable to deposit funds in federally insured and licensed banking institutions. Banking restrictions could be imposed due to the Company and banking institutions could refuse to accept payments from NH Licensed Operators. At times NH Licensed Operators, and in some cases the Company or its subsidiaries, may not have deposit services and are at risk that any bank accounts they have could be closed at any time. Such risks increase costs to the Company and to the NH Licensed Operators. Additionally, similar risks are associated with large amounts of cash at these businesses. These businesses require heavy security with respect to holding and transport of cash, whether or not they have bank accounts.

In the event financial service providers do not accept accounts or transactions related to the marijuana industry, it is possible that the Company or NH Licensed Operators may seek alternative payment solutions, including but not limited to crypto currencies such as Bitcoin. There are risks inherent in crypto currencies, most notably its volatility and security issues. If the industry was to move towards alternative payment solutions and accept payments in crypto currency the Company would have to adopt policies and protocols to manage its volatility and exchange rate risk exposures. The Company's inability to manage such risks may adversely affect the Company's operations and financial performance.

We face an inherent risk of exposure to product liability claims, regulatory action and litigation if its products are alleged to have caused significant loss or injury.

As a licensing company (in the case of the Company) and a manufacturer and distributor of products (in the case of the licensed operators) designed to be ingested by humans, the licensed operators and the Company face an inherent risk of exposure to product liability claims, regulatory action and litigation if its products are alleged to have caused significant loss or injury. In addition, the manufacture and sale of marijuana-infused products based on the Company's recipes and brands involve the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Previously unknown adverse reactions resulting from human consumption of the Company's and the licensed operator's products alone or in combination with other medications or substances could occur.

We may incur unexpected expenses relating to the recall and any legal proceedings that might arise in connection with the recall.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labeling disclosure. If any of the products developed by the Company and sold by NH Licensed Operators are recalled due to an alleged product defect or for any other reason, the Company could be required to incur the unexpected expense relating to the recall and any legal proceedings that might arise in connection with the recall. In addition, a product recall may require significant management attention and could harm the image of the brand and Company.

Our insurance does not cover all potential liabilities and such uninsurable risks may cause a material adverse effect on the financial condition of the Company.

The medical and retail marijuana business is subject to several risks that could result in damage to or destruction of properties or facilities or cause personal injury or death, environmental damage, delays in production and monetary losses and possible legal liability. It is not always possible to fully insure against such risks, and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company. While the Company and its subsidiaries (as the case may be) carries insurance covering its real estate properties, it is possible that it may not obtain insurance to cover all potential liabilities that may arise as a result any of the above noted risks may cause a material adverse effect on the financial condition of the Company.

The Company may need to raise significant additional funds in order to support its growth, however, the Company cannot be sure that this additional financing, if needed, will be available on acceptable terms, or at all.

The Company may need to raise significant additional funds in order to support its growth, develop new or enhanced services and products, respond to competitive pressures, acquire or invest in complementary or competitive businesses or technologies, or take advantage of unanticipated opportunities. If its financial resources are insufficient, it will require additional financing in order to meet its plans for expansion. The Company cannot be sure that this additional financing, if needed, will be available on acceptable terms, or at all.

Furthermore, any debt financing, if available, may involve restrictive covenants, which may limit its operating flexibility with respect to business matters. If additional funds are raised through the issuance of equity securities, the percentage ownership of existing shareholders will be reduced, such shareholders may experience additional dilution in net book value, and such equity securities may have rights, preferences or privileges senior to those of its existing shareholders.

Access to public and private capital and financing continues to be negatively impacted by many factors as a result of the global financial crisis and global recession. Such factors may impact the Company's ability to obtain debt and equity financing in the future on favorable terms or obtain any financing at all. Additionally, global economic conditions may cause a long term decrease in asset values. If such global volatility, market turmoil and the global recession continue, the Company's operations and financial condition could be adversely impacted.

The Company is subject to risks generally associated with ownership of real estate.

The Company is subject to risks generally associated with ownership of real estate, including: (a) changes in general economic or local conditions; (b) changes in supply of, or demand for, similar or competing properties in the area; (c) bankruptcies, financial difficulties or defaults by tenants or other parties (including licensed operators and NH Licensed Operators); (d) increases in operating costs, such as taxes and insurance; (e) the inability to achieve full stabilized occupancy at rental rates adequate to produce targeted returns; (f) periods of high interest rates and tight money supply; (g) excess supply of rental properties in the market area; (h) liability for uninsured losses resulting from natural disasters or other perils; (i) liability for environmental hazards; and (j) changes in tax, real estate, environmental, zoning or other laws or regulations. There is no assurance that the Company's investments will yield an economic profit.

Weakness in regional and national economies could materially and adversely impact the licensed operators and NH Licensed Operators leasing the real estate properties that the Company's may acquire in the future. If the licensed operators or NH Licensed Operators suffer a business disruption or the Company's ability to collect the rents from those parties may be limited, and the recourse available to the Company can be limited. As such, this may hinder the Company's ability to service its financial obligations, and in some cases may lead to complete loss of the Company's assets if its lenders were to foreclose.

The Company may not be able to deduct certain costs from its revenue for U.S. federal taxation purposes.

U.S. federal prohibitions on the sale of marijuana may result in the Company not being able to deduct certain costs from its revenue for U.S. federal taxation purposes if the U.S. Internal Revenue Service determines that revenue sources of the Company are generated from activities which are not permitted under U.S. federal law.

We may face threats from illegal drug dealers and cartels which could negatively impact the Company, its employees and its business operations.

Currently, there are many drug dealers and cartels that cultivate, buy, sell and trade marijuana in the United States, Canada and worldwide. Many of these dealers and cartels are violent and dangerous, well financed and well organized. It is possible that these dealers and cartels could feel threatened by legalized marijuana businesses such as those with whom the Company does business and could take action against or threaten the Company, its principals, employees and/or agents and this could negatively impact the Company and its business.

The success of the Company is dependent on the performance of its senior management. The loss of the services of these persons would have a material adverse effect on the Company's business and its prospects.

The success of the Company is currently dependent on the performance of its senior management. The loss of the services of these persons would have a material adverse effect on the Company's business and prospects in the short term. There is no assurance the Company can maintain the services of its officers or other qualified personnel required to operate its business. Failure to do so could have a material adverse effect on the Company and its prospects.

The Company is in early development stage and facing many factors that may prevent realization of growth targets.

The Company is currently in the early development stage. There is a risk that the additional resources will be needed and milestones will not be achieved on time, on budget, or at all, as they can be adversely affected by a variety of factors, including some that are discussed elsewhere in these risk factors and the following as it relates to the Company and its licensed operators or NH Licensed Operators, as the case may be:

| | · | delays in obtaining, or conditions imposed by, regulatory approvals; |

| | · | facility design errors; |

| | · | environmental pollution; |

| | · | non-performance by third party contractors; |

| | · | increases in materials or labour costs; |

| | · | construction performance falling below expected levels of output or efficiency; |

| | · | breakdown, aging or failure of equipment or processes; |

| | · | contractor or operator errors; |

| | · | labour disputes, disruptions or declines in productivity; |

| | · | inability to attract sufficient numbers of qualified workers; |

| | · | disruption in the supply of energy and utilities; and |

| | · | major incidents and/or catastrophic events such as fires, explosions, earthquakes or storms. |

The Company faces increasing competition in the medicinal and recreational marijuana industry.

The marijuana industry is highly competitive. The Company will compete with numerous other businesses in the medicinal and recreational industry, many of which possess greater financial and marketing resources and other resources than the Company. The marijuana business is often affected by changes in consumer tastes and discretionary spending patterns, national and regional economic conditions, demographic trends, consumer confidence in the economy, traffic patterns, local competitive factors, cost and availability of raw material and labour, and governmental regulations. Any change in these factors could materially and adversely affect the Company's operations.

The Company expects to face additional competition from new entrants. If the number of legal users of marijuana in its target jurisdiction increases, the demand for products will increase and the Company expects that competition will become more intense, as current and future competitors begin to offer an increasing number of diversified products.

The products provided by the Company to NH Licensed Operators may become subject to regulation governing food and related products.

Should the Federal government legalize marijuana for medical or recreational use nation-wide, it is possible that the U.S. Food and Drug Administration ("FDA") would seek to regulate the products under the Food, Drug and Cosmetics Act of 1938. The FDA may issue rules and regulations including certified good manufacturing practices related to the growth, cultivation, harvesting and processing of medical marijuana and marijuana-infused products. Clinical trials may be needed to verify efficacy and safety of the medical marijuana. It is also possible that the FDA would require that facilities where medical marijuana is cultivated be registered with the applicable government agencies and comply with certain federal regulations. In the event any of these regulations are imposed, The Company cannot foresee the impact on its operations and economics. If the Company or the NH Licensed Operators are unable to comply with the regulations and or registration as prescribed by the FDA or another federal agency, the Company or the NH Licensed Operators may be unable to continue to operate in its current form or at all.

The Company's operations are subject to environmental and safety laws and regulations concerning. Violation of such laws and regulations would have a material adverse effect to the Company's business.

The Company's operations are subject to environmental and safety laws and regulations concerning, among other things, emissions and discharges to water, air and land, the handling and disposal of hazardous and non-hazardous materials and wastes, and employee health and safety. The Company will incur ongoing costs and obligations related to compliance with environmental and employee health and safety matters. Failure to comply with environmental and safety laws and regulations may result in additional costs for corrective measures, penalties or in restrictions on our manufacturing operations. In addition, changes in environmental, employee health and safety or other laws, more vigorous enforcement thereof or other unanticipated events could require extensive changes to the Company's operations or give rise to material liabilities, which could have a material adverse effect on the business, results of operations and financial condition of the Company.

The Company is relying largely on its own market research to forecast sales.