●THE TAX DISCLOSURE IS SUBJECT TO CONFIRMATION —

The information set forth under “Tax Treatment” in this pricing supplement remains subject to confirmation by our special tax counsel

following the pricing of the notes. If that information cannot be confirmed by our tax counsel, you may be asked to accept revisions to

that information in connection with your purchase. Under these circumstances, if you decline to accept revisions to that information,

your purchase of the notes will be canceled.

●THE ESTIMATED VALUE OF THE NOTES WILL BE LOWER THAN THE ORIGINAL ISSUE PRICE (PRICE TO PUBLIC) OF THE

NOTES —

The estimated value of the notes is only an estimate determined by reference to several factors. The original issue price of the notes

will exceed the estimated value of the notes because costs associated with selling, structuring and hedging the notes are included in

the original issue price of the notes. These costs include the selling commissions, the projected profits, if any, that our affiliates expect

to realize for assuming risks inherent in hedging our obligations under the notes and the estimated cost of hedging our obligations

under the notes. See “The Estimated Value of the Notes” in this pricing supplement.

●THE ESTIMATED VALUE OF THE NOTES DOES NOT REPRESENT FUTURE VALUES OF THE NOTES AND MAY DIFFER FROM

OTHERS’ ESTIMATES —

See “The Estimated Value of the Notes” in this pricing supplement.

●THE ESTIMATED VALUE OF THE NOTES IS DERIVED BY REFERENCE TO AN INTERNAL FUNDING RATE —

The internal funding rate used in the determination of the estimated value of the notes may differ from the market-implied funding rate

for vanilla fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference may be

based on, among other things, our and our affiliates’ view of the funding value of the notes as well as the higher issuance, operational

and ongoing liability management costs of the notes in comparison to those costs for the conventional fixed income instruments of

JPMorgan Chase & Co. This internal funding rate is based on certain market inputs and assumptions, which may prove to be incorrect,

and is intended to approximate the prevailing market replacement funding rate for the notes. The use of an internal funding rate and

any potential changes to that rate may have an adverse effect on the terms of the notes and any secondary market prices of the notes.

See “The Estimated Value of the Notes” in this pricing supplement.

●THE VALUE OF THE NOTES AS PUBLISHED BY JPMS (AND WHICH MAY BE REFLECTED ON CUSTOMER ACCOUNT

STATEMENTS) MAY BE HIGHER THAN THE THEN-CURRENT ESTIMATED VALUE OF THE NOTES FOR A LIMITED TIME

PERIOD —

We generally expect that some of the costs included in the original issue price of the notes will be partially paid back to you in

connection with any repurchases of your notes by JPMS in an amount that will decline to zero over an initial predetermined period.

See “Secondary Market Prices of the Notes” in this pricing supplement for additional information relating to this initial period.

Accordingly, the estimated value of your notes during this initial period may be lower than the value of the notes as published by JPMS

(and which may be shown on your customer account statements).

●SECONDARY MARKET PRICES OF THE NOTES WILL LIKELY BE LOWER THAN THE ORIGINAL ISSUE PRICE OF THE NOTES

—

Any secondary market prices of the notes will likely be lower than the original issue price of the notes because, among other things,

secondary market prices take into account our internal secondary market funding rates for structured debt issuances and, also,

because secondary market prices may exclude selling commissions, projected hedging profits, if any, and estimated hedging costs

that are included in the original issue price of the notes. As a result, the price, if any, at which JPMS will be willing to buy the notes from

you in secondary market transactions, if at all, is likely to be lower than the original issue price. Any sale by you prior to the Maturity

Date could result in a substantial loss to you.

●SECONDARY MARKET PRICES OF THE NOTES WILL BE IMPACTED BY MANY ECONOMIC AND MARKET FACTORS —

The secondary market price of the notes during their term will be impacted by a number of economic and market factors, which may

either offset or magnify each other, aside from the selling commissions, projected hedging profits, if any, estimated hedging costs and

the levels of the Indices. Additionally, independent pricing vendors and/or third party broker-dealers may publish a price for the notes,

which may also be reflected on customer account statements. This price may be different (higher or lower) than the price of the notes,

if any, at which JPMS may be willing to purchase your notes in the secondary market. See “Risk Factors — Risks Relating to the

Estimated Value and Secondary Market Prices of the Notes — Secondary market prices of the notes will be impacted by many

economic and market factors” in the accompanying product supplement.

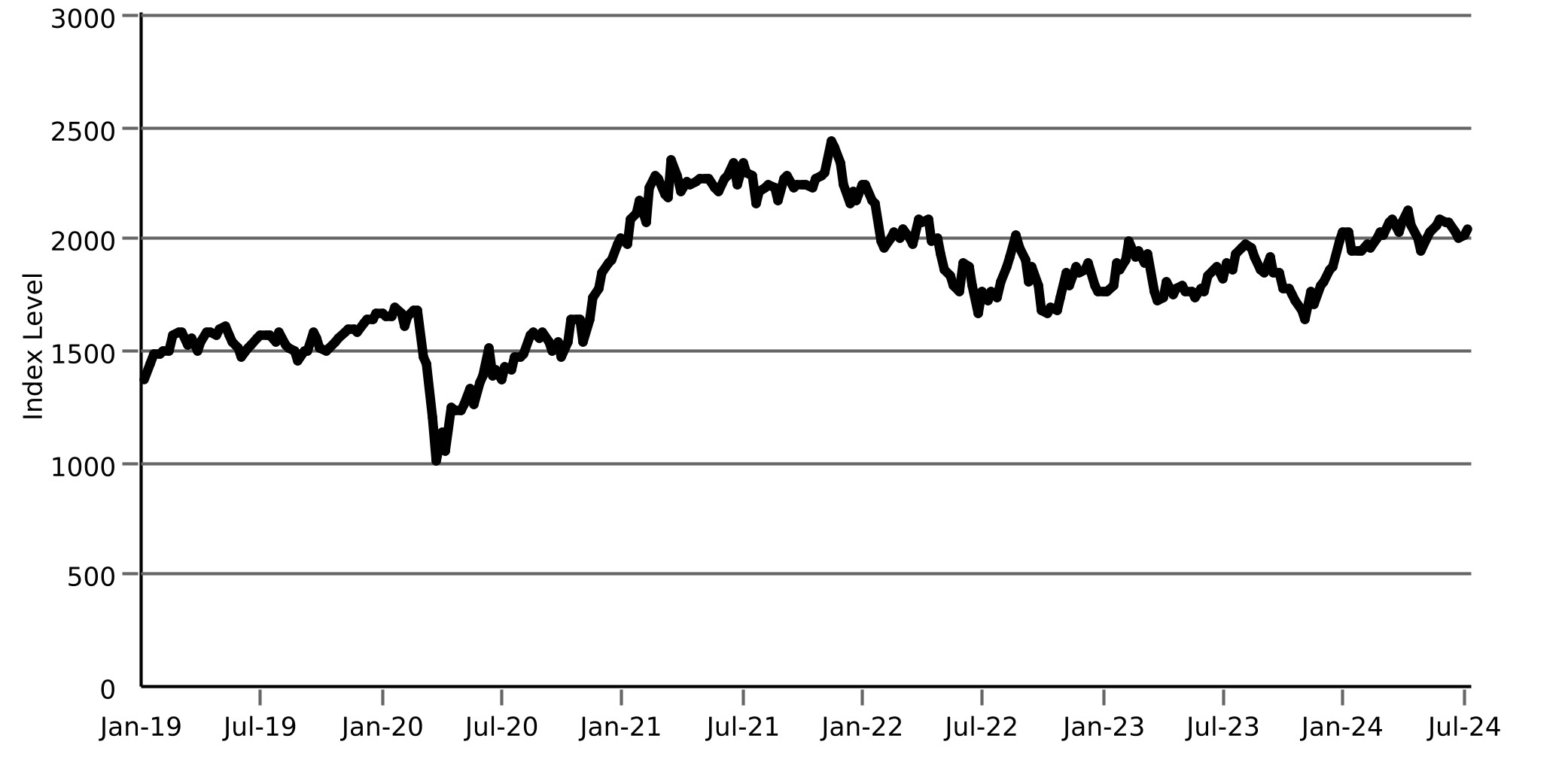

The Russell 2000® Index consists of the middle 2,000 companies included in the Russell 3000ETM Index and, as a result of the index

calculation methodology, consists of the smallest 2,000 companies included in the Russell 3000® Index. The Russell 2000® Index is

designed to track the performance of the small capitalization segment of the U.S. equity market. For additional information about the

Russell 2000® Index, see “Equity Index Descriptions — The Russell Indices” in the accompanying underlying supplement.

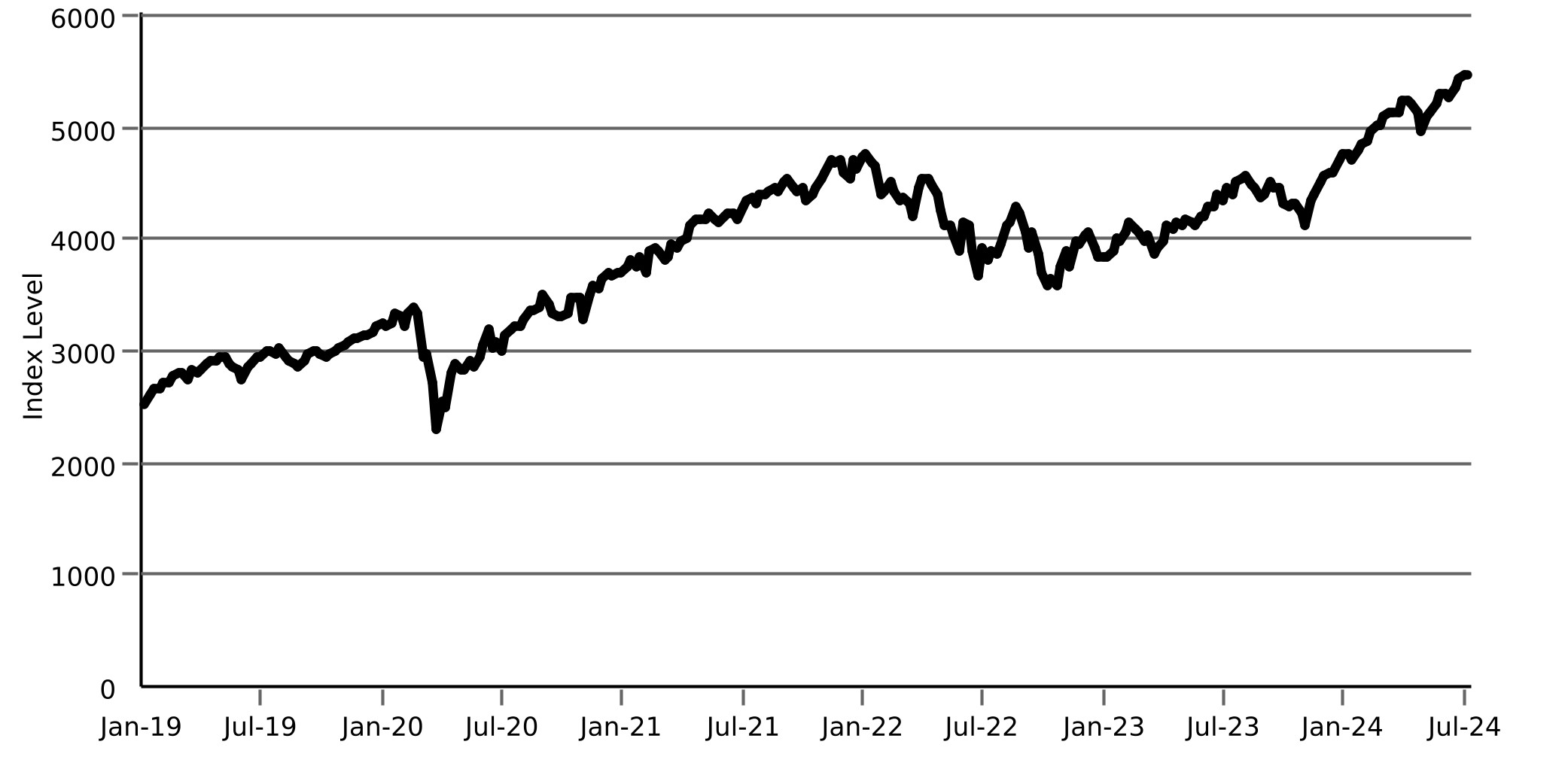

The S&P 500® Index consists of stocks of 500 companies selected to provide a performance benchmark for the U.S. equity markets. For

additional information about the S&P 500® Index, see “Equity Index Descriptions — The S&P U.S. Indices” in the accompanying underlying

supplement.