Index supplement to the prospectus, the prospectus supplement and the product supplement no. 4 - I each dated April 13, 2023, and the underlying supplement no. 5 - II dated March 5, 2024 Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 Dated August 1, 2024 Rule 424(b)(3) MerQube US Large Cap Vol Advantage Index ® August 2024 Investing in the notes involves a number of risks. See “Selected risks associated with the Index” beginning on page 11 of this document, “Risk Factors” in the relevant product supplement and underlying supplement and “Selected Risk Considerations” in the relevant pricing supplement. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this document or the accompanying pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

IMPORTANT INFORMATION The information contained in this document is for discussion purposes only. Any information relating to performance contained in these materials is illustrative and no assurance is given that any indicative returns, performance or results, whether historical or hypothetical, will be achieved. All information herein is subject to change without notice, however, J.P. Morgan undertakes no duty to update this information. In the event of any inconsistency between the information presented herein and any offering document, the offering document shall govern. USE OF HYPOTHETICAL BACKTESTED RETURNS Any backtested historical performance and weighting information included herein is hypothetical. The Index may not have traded in the manner shown in the hypothetical backtest included herein, and no representation is being made that the Index will achieve similar performance. There are frequently significant differences between hypothetical backtested performance and actual subsequent performance. The results obtained from backtesting information should not be considered indicative of the actual results that might be obtained from an investment in notes referencing the Index. J.P. Morgan provides no assurance or guarantee that notes linked to the Index will operate or would have operated in the past in a manner consistent with these materials. The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations. Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate. Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations presented in this document. HISTORICAL AND BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS. Set forth within this document are some hypothetical backtested performance metrics for products that contain an automatic call feature. These performance metrics were calculated by aggregating the performance of a series of hypothetical products with the same term to maturity, product payout profile, automatic call features and underlier(s) as the selected product. The results generated by the product backtesting feature are not indicative of future returns for the selected product. The backtested product performance metrics do not reflect fees or expenses associated with an actual product purchased from JPMorgan. Investment suitability must be determined individually for each investor, and investments linked to the Index may not be suitable for all investors. This material is not a product of J.P. Morgan Research Departments. Copyright © 2024 JPMorgan Chase & Co. All rights reserved. For additional regulatory disclosures, please consult: www.jpmorgan.com/disclosures . Information contained on this website is not incorporated by reference in, and should not be considered part of, this document. 1

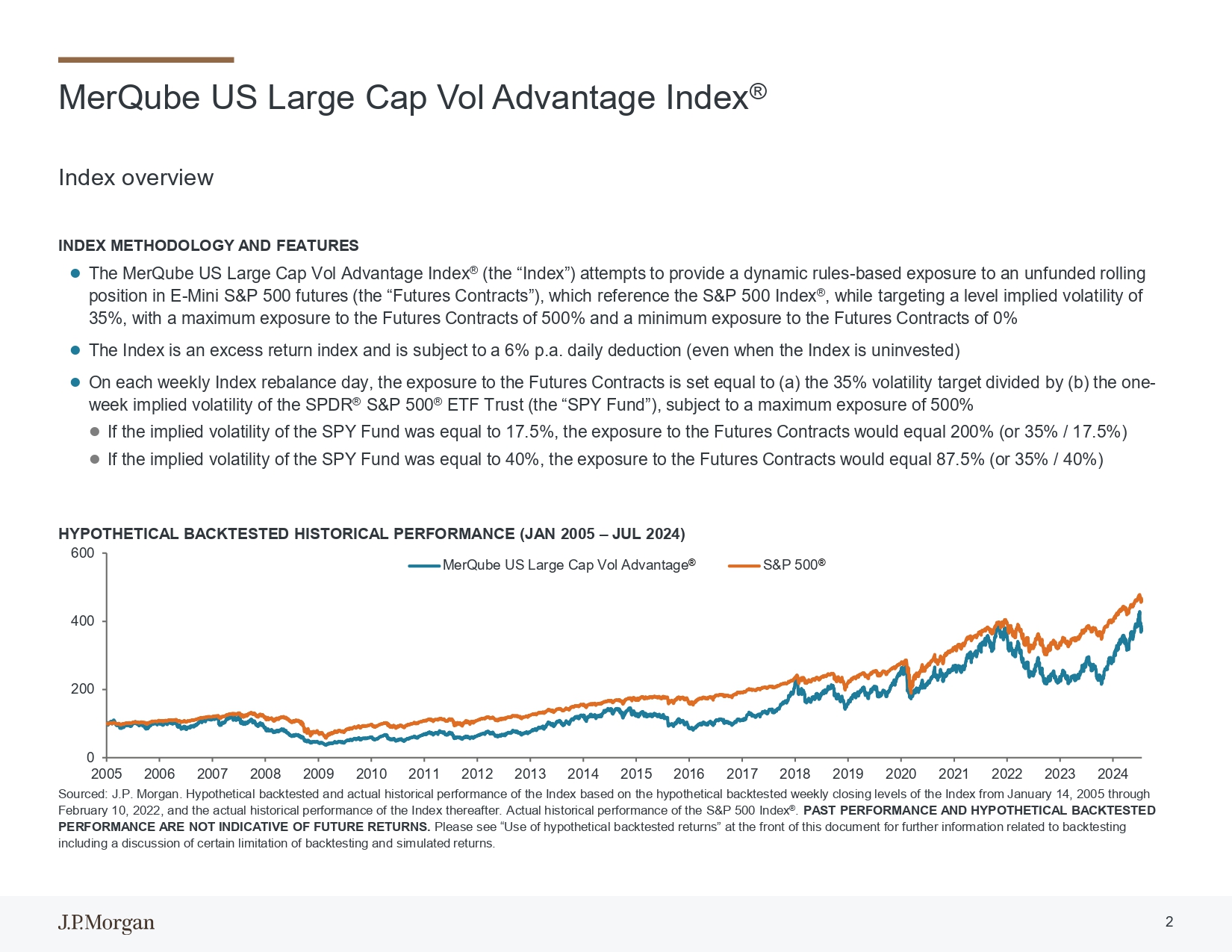

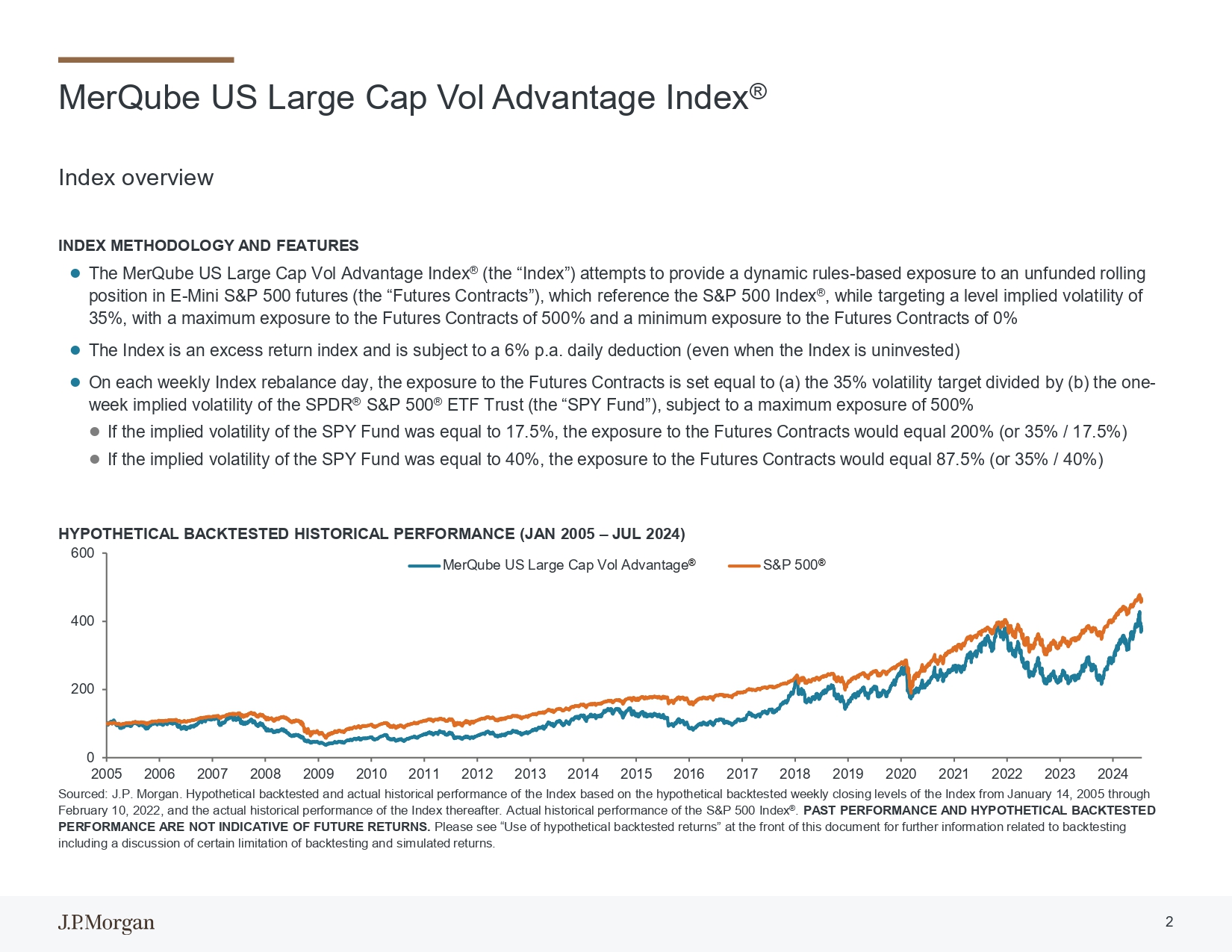

200 2 400 HYPOTHETICAL BACKTESTED HISTORICAL PERFORMANCE (JAN 2005 – JUL 2024) 600 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Sourced: J.P. Morgan. Hypothetical backtested and actual historical performance of the Index based on the hypothetical backtested weekly closing levels of the Index from January 14, 2005 through February 10, 2022, and the actual historical performance of the Index thereafter. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns. MerQube US Large Cap Vol Advantage Index ® Index overview INDEX METHODOLOGY AND FEATURES The MerQube US Large Cap Vol Advantage Index ® (the “Index”) attempts to provide a dynamic rules - based exposure to an unfunded rolling position in E - Mini S&P 500 futures (the “Futures Contracts”), which reference the S&P 500 Index ® , while targeting a level implied volatility of 35 % , with a maximum exposure to the Futures Contracts of 500 % and a minimum exposure to the Futures Contracts of 0 % The Index is an excess return index and is subject to a 6% p.a. daily deduction (even when the Index is uninvested) On each weekly Index rebalance day, the exposure to the Futures Contracts is set equal to (a) the 35% volatility target divided by (b) the one - week implied volatility of the SPDR ® S&P 500 ® ETF Trust (the “SPY Fund”), subject to a maximum exposure of 500% If the implied volatility of the SPY Fund was equal to 17.5%, the exposure to the Futures Contracts would equal 200% (or 35% / 17.5%) If the implied volatility of the SPY Fund was equal to 40%, the exposure to the Futures Contracts would equal 87.5% (or 35% / 40%) S&P 500 ® MerQube US Large Cap Vol Advantage ®

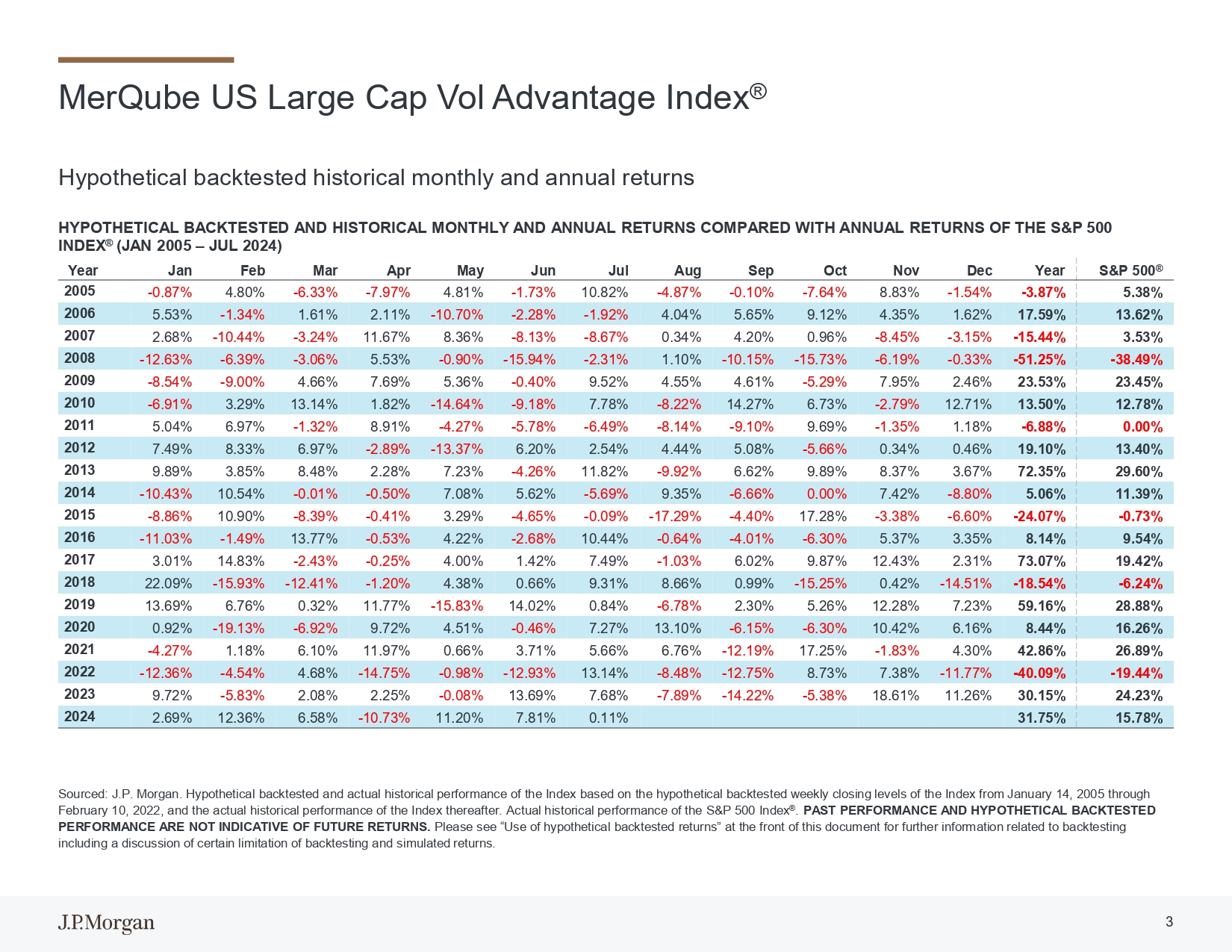

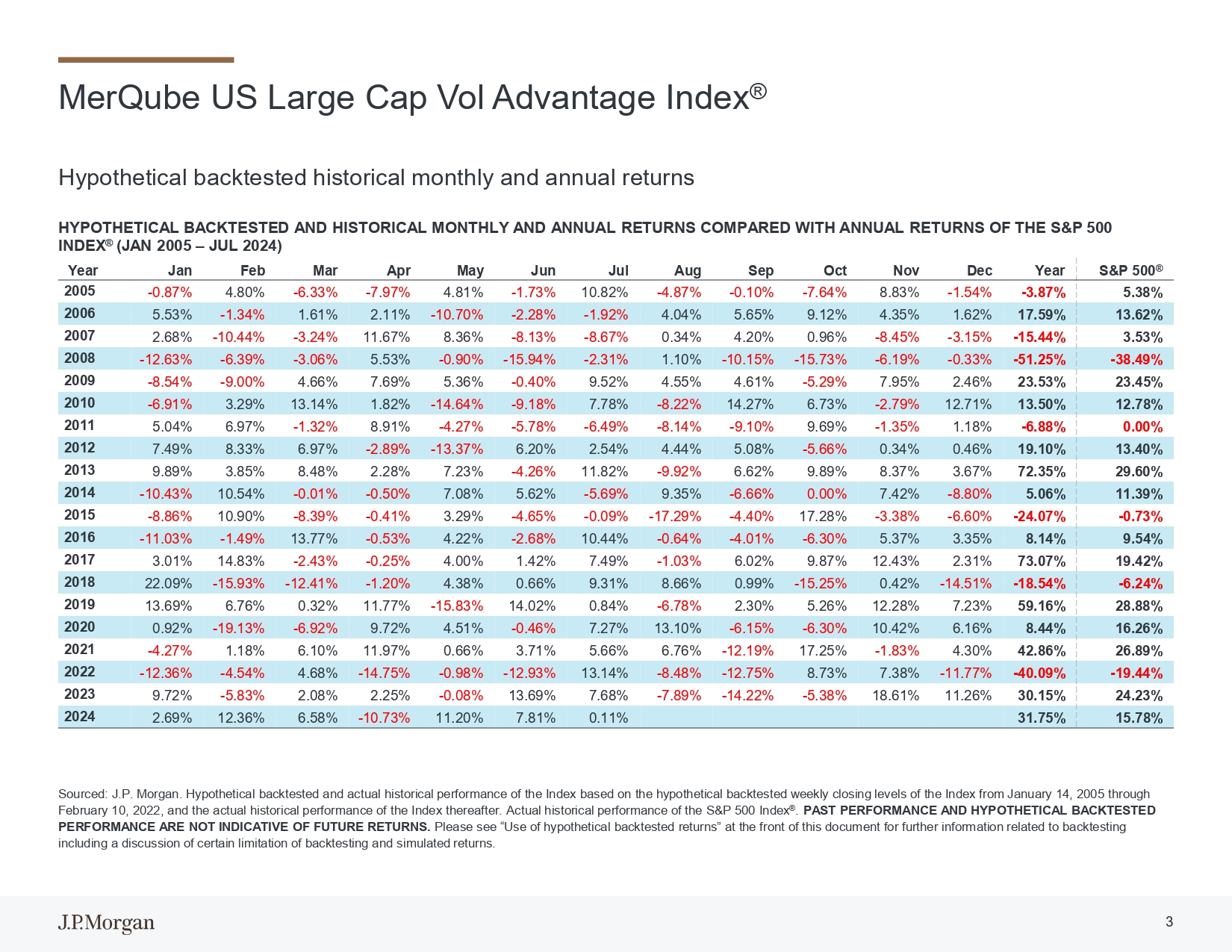

Hypothetical backtested historical monthly and annual returns 3 HYPOTHETICAL BACKTESTED AND HISTORICAL MONTHLY AND ANNUAL RETURNS COMPARED WITH ANNUAL RETURNS OF THE S&P 500 INDEX ® (JAN 2005 – JUL 2024) Sourced: J.P. Morgan. Hypothetical backtested and actual historical performance of the Index based on the hypothetical backtested weekly closing levels of the Index from January 14, 2005 through February 10, 2022, and the actual historical performance of the Index thereafter. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns. MerQube US Large Cap Vol Advantage Index ® S&P 500 ® Year Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Year 5.38% - 3.87% - 1.54% 8.83% - 7.64% - 0.10% - 4.87% 10.82% - 1.73% 4.81% - 7.97% - 6.33% 4.80% - 0.87% 2005 13.62% 17.59% 1.62% 4.35% 9.12% 5.65% 4.04% - 1.92% - 2.28% - 10.70% 2.11% 1.61% - 1.34% 5.53% 2006 3.53% - 15.44% - 3.15% - 8.45% 0.96% 4.20% 0.34% - 8.67% - 8.13% 8.36% 11.67% - 3.24% - 10.44% 2.68% 2007 - 38.49% - 51.25% - 0.33% - 6.19% - 15.73% - 10.15% 1.10% - 2.31% - 15.94% - 0.90% 5.53% - 3.06% - 6.39% - 12.63% 2008 23.45% 23.53% 2.46% 7.95% - 5.29% 4.61% 4.55% 9.52% - 0.40% 5.36% 7.69% 4.66% - 9.00% - 8.54% 2009 12.78% 13.50% 12.71% - 2.79% 6.73% 14.27% - 8.22% 7.78% - 9.18% - 14.64% 1.82% 13.14% 3.29% - 6.91% 2010 0.00% - 6.88% 1.18% - 1.35% 9.69% - 9.10% - 8.14% - 6.49% - 5.78% - 4.27% 8.91% - 1.32% 6.97% 5.04% 2011 13.40% 19.10% 0.46% 0.34% - 5.66% 5.08% 4.44% 2.54% 6.20% - 13.37% - 2.89% 6.97% 8.33% 7.49% 2012 29.60% 72.35% 3.67% 8.37% 9.89% 6.62% - 9.92% 11.82% - 4.26% 7.23% 2.28% 8.48% 3.85% 9.89% 2013 11.39% 5.06% - 8.80% 7.42% 0.00% - 6.66% 9.35% - 5.69% 5.62% 7.08% - 0.50% - 0.01% 10.54% - 10.43% 2014 - 0.73% - 24.07% - 6.60% - 3.38% 17.28% - 4.40% - 17.29% - 0.09% - 4.65% 3.29% - 0.41% - 8.39% 10.90% - 8.86% 2015 9.54% 8.14% 3.35% 5.37% - 6.30% - 4.01% - 0.64% 10.44% - 2.68% 4.22% - 0.53% 13.77% - 1.49% - 11.03% 2016 19.42% 73.07% 2.31% 12.43% 9.87% 6.02% - 1.03% 7.49% 1.42% 4.00% - 0.25% - 2.43% 14.83% 3.01% 2017 - 6.24% - 18.54% - 14.51% 0.42% - 15.25% 0.99% 8.66% 9.31% 0.66% 4.38% - 1.20% - 12.41% - 15.93% 22.09% 2018 28.88% 59.16% 7.23% 12.28% 5.26% 2.30% - 6.78% 0.84% 14.02% - 15.83% 11.77% 0.32% 6.76% 13.69% 2019 16.26% 8.44% 6.16% 10.42% - 6.30% - 6.15% 13.10% 7.27% - 0.46% 4.51% 9.72% - 6.92% - 19.13% 0.92% 2020 26.89% 42.86% 4.30% - 1.83% 17.25% - 12.19% 6.76% 5.66% 3.71% 0.66% 11.97% 6.10% 1.18% - 4.27% 2021 - 19.44% - 40.09% - 11.77% 7.38% 8.73% - 12.75% - 8.48% 13.14% - 12.93% - 0.98% - 14.75% 4.68% - 4.54% - 12.36% 2022 24.23% 30.15% 11.26% 18.61% - 5.38% - 14.22% - 7.89% 7.68% 13.69% - 0.08% 2.25% 2.08% - 5.83% 9.72% 2023 15.78% 31.75% 0.11% 7.81% 11.20% - 10.73% 6.58% 12.36% 2.69% 2024

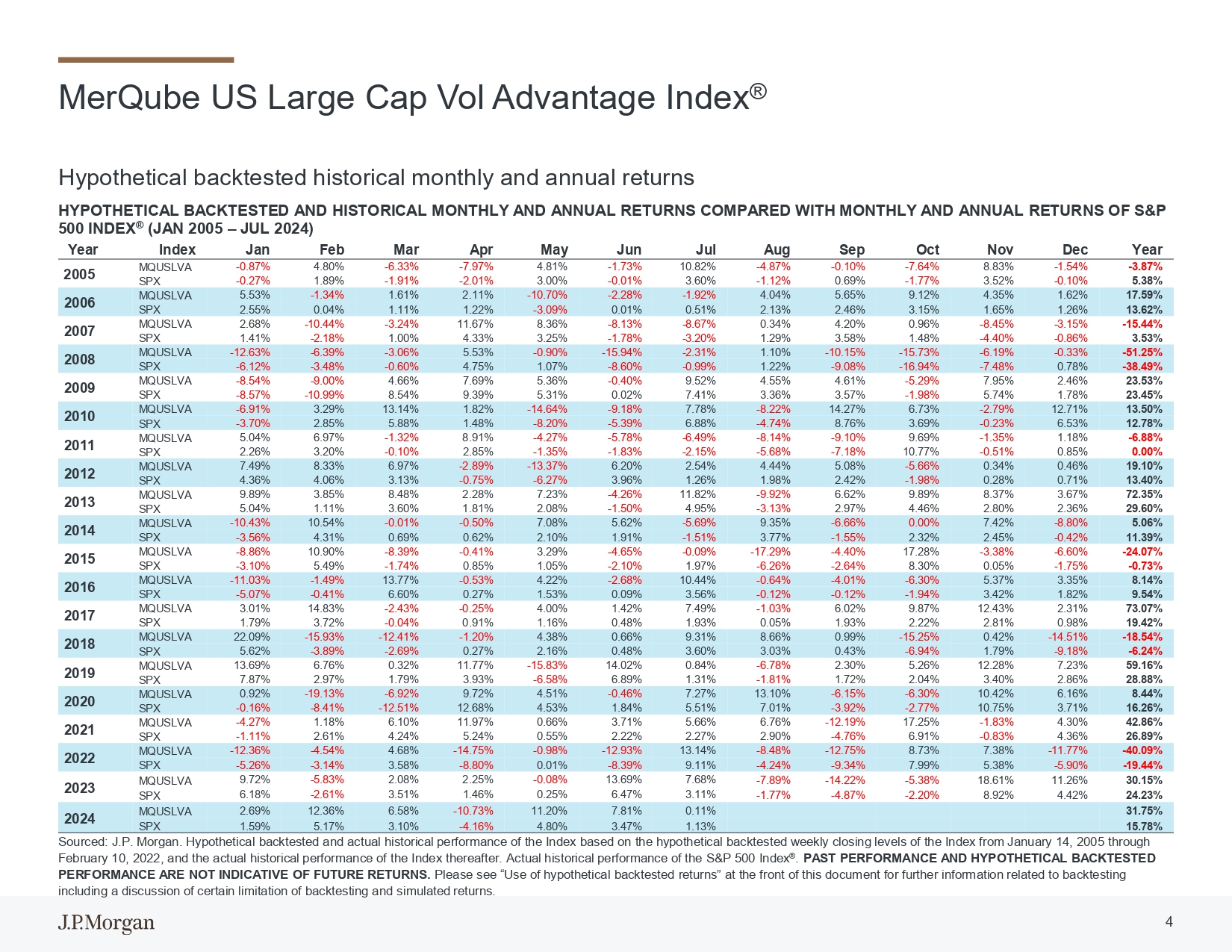

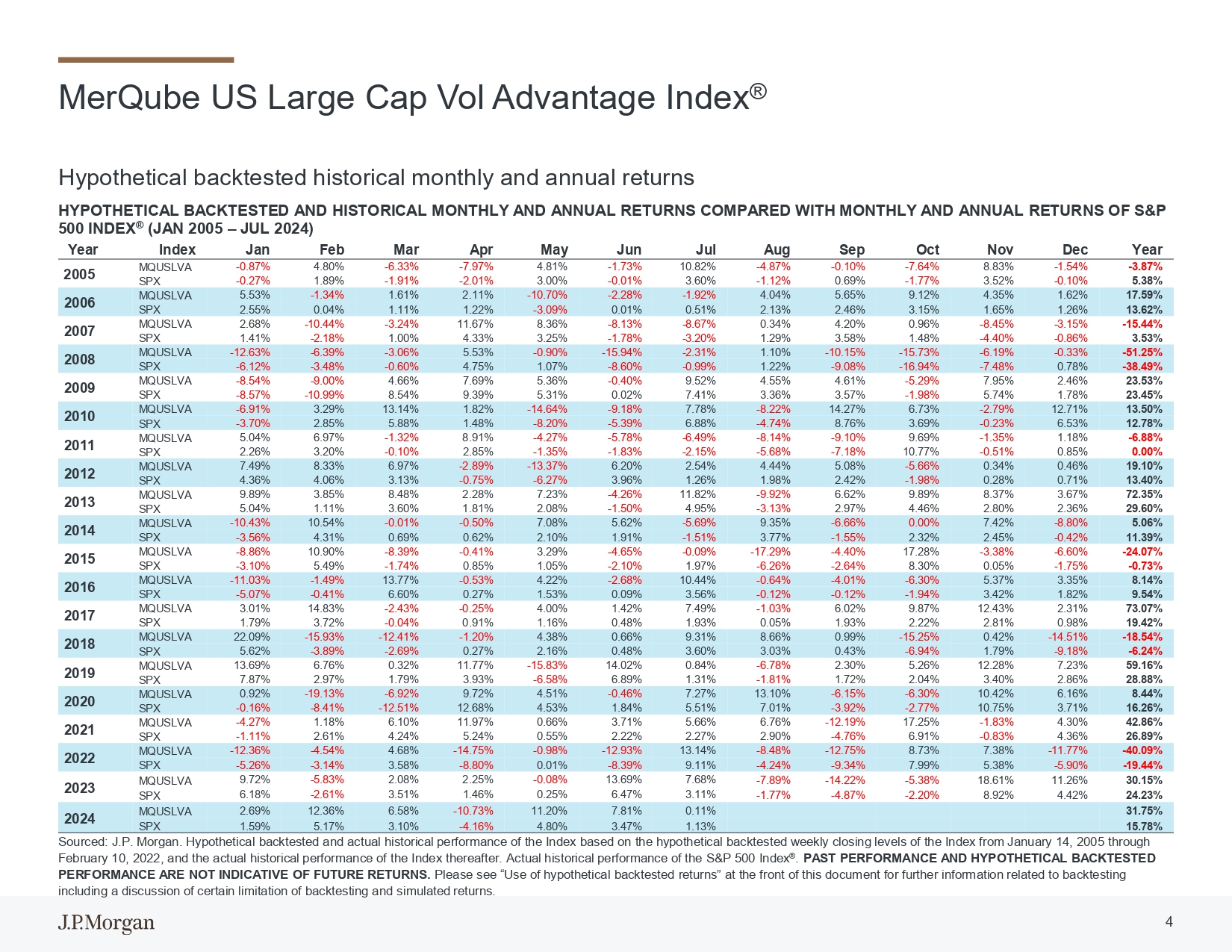

Hypothetical backtested historical monthly and annual returns HYPOTHETICAL BACKTESTED AND HISTORICAL MONTHLY AND ANNUAL RETURNS COMPARED WITH MONTHLY AND ANNUAL RETURNS OF S&P 500 INDEX ® (JAN 2005 – JUL 2024) 4 Sourced: J.P. Morgan. Hypothetical backtested and actual historical performance of the Index based on the hypothetical backtested weekly closing levels of the Index from January 14, 2005 through February 10, 2022, and the actual historical performance of the Index thereafter. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns. MerQube US Large Cap Vol Advantage Index ® Year Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Index Year - 3.87% - 1.54% 8.83% - 7.64% - 0.10% - 4.87% 10.82% - 1.73% 4.81% - 7.97% - 6.33% 4.80% - 0.87% MQUSLVA 2005 5.38% - 0.10% 3.52% - 1.77% 0.69% - 1.12% 3.60% - 0.01% 3.00% - 2.01% - 1.91% 1.89% - 0.27% SPX 17.59% 1.62% 4.35% 9.12% 5.65% 4.04% - 1.92% - 2.28% - 10.70% 2.11% 1.61% - 1.34% 5.53% MQUSLVA 2006 13.62% 1.26% 1.65% 3.15% 2.46% 2.13% 0.51% 0.01% - 3.09% 1.22% 1.11% 0.04% 2.55% SPX - 15.44% - 3.15% - 8.45% 0.96% 4.20% 0.34% - 8.67% - 8.13% 8.36% 11.67% - 3.24% - 10.44% 2.68% MQUSLVA 2007 3.53% - 0.86% - 4.40% 1.48% 3.58% 1.29% - 3.20% - 1.78% 3.25% 4.33% 1.00% - 2.18% 1.41% SPX - 51.25% - 0.33% - 6.19% - 15.73% - 10.15% 1.10% - 2.31% - 15.94% - 0.90% 5.53% - 3.06% - 6.39% - 12.63% MQUSLVA 2008 - 38.49% 0.78% - 7.48% - 16.94% - 9.08% 1.22% - 0.99% - 8.60% 1.07% 4.75% - 0.60% - 3.48% - 6.12% SPX 23.53% 2.46% 7.95% - 5.29% 4.61% 4.55% 9.52% - 0.40% 5.36% 7.69% 4.66% - 9.00% - 8.54% MQUSLVA 2009 23.45% 1.78% 5.74% - 1.98% 3.57% 3.36% 7.41% 0.02% 5.31% 9.39% 8.54% - 10.99% - 8.57% SPX 13.50% 12.71% - 2.79% 6.73% 14.27% - 8.22% 7.78% - 9.18% - 14.64% 1.82% 13.14% 3.29% - 6.91% MQUSLVA 2010 12.78% 6.53% - 0.23% 3.69% 8.76% - 4.74% 6.88% - 5.39% - 8.20% 1.48% 5.88% 2.85% - 3.70% SPX - 6.88% 1.18% - 1.35% 9.69% - 9.10% - 8.14% - 6.49% - 5.78% - 4.27% 8.91% - 1.32% 6.97% 5.04% MQUSLVA 2011 0.00% 0.85% - 0.51% 10.77% - 7.18% - 5.68% - 2.15% - 1.83% - 1.35% 2.85% - 0.10% 3.20% 2.26% SPX 19.10% 0.46% 0.34% - 5.66% 5.08% 4.44% 2.54% 6.20% - 13.37% - 2.89% 6.97% 8.33% 7.49% MQUSLVA 2012 13.40% 0.71% 0.28% - 1.98% 2.42% 1.98% 1.26% 3.96% - 6.27% - 0.75% 3.13% 4.06% 4.36% SPX 72.35% 3.67% 8.37% 9.89% 6.62% - 9.92% 11.82% - 4.26% 7.23% 2.28% 8.48% 3.85% 9.89% MQUSLVA 2013 29.60% 2.36% 2.80% 4.46% 2.97% - 3.13% 4.95% - 1.50% 2.08% 1.81% 3.60% 1.11% 5.04% SPX 5.06% - 8.80% 7.42% 0.00% - 6.66% 9.35% - 5.69% 5.62% 7.08% - 0.50% - 0.01% 10.54% - 10.43% MQUSLVA 2014 11.39% - 0.42% 2.45% 2.32% - 1.55% 3.77% - 1.51% 1.91% 2.10% 0.62% 0.69% 4.31% - 3.56% SPX - 24.07% - 6.60% - 3.38% 17.28% - 4.40% - 17.29% - 0.09% - 4.65% 3.29% - 0.41% - 8.39% 10.90% - 8.86% MQUSLVA 2015 - 0.73% - 1.75% 0.05% 8.30% - 2.64% - 6.26% 1.97% - 2.10% 1.05% 0.85% - 1.74% 5.49% - 3.10% SPX 8.14% 3.35% 5.37% - 6.30% - 4.01% - 0.64% 10.44% - 2.68% 4.22% - 0.53% 13.77% - 1.49% - 11.03% MQUSLVA 2016 9.54% 1.82% 3.42% - 1.94% - 0.12% - 0.12% 3.56% 0.09% 1.53% 0.27% 6.60% - 0.41% - 5.07% SPX 73.07% 2.31% 12.43% 9.87% 6.02% - 1.03% 7.49% 1.42% 4.00% - 0.25% - 2.43% 14.83% 3.01% MQUSLVA 2017 19.42% 0.98% 2.81% 2.22% 1.93% 0.05% 1.93% 0.48% 1.16% 0.91% - 0.04% 3.72% 1.79% SPX - 18.54% - 14.51% 0.42% - 15.25% 0.99% 8.66% 9.31% 0.66% 4.38% - 1.20% - 12.41% - 15.93% 22.09% MQUSLVA 2018 - 6.24% - 9.18% 1.79% - 6.94% 0.43% 3.03% 3.60% 0.48% 2.16% 0.27% - 2.69% - 3.89% 5.62% SPX 59.16% 7.23% 12.28% 5.26% 2.30% - 6.78% 0.84% 14.02% - 15.83% 11.77% 0.32% 6.76% 13.69% MQUSLVA 2019 28.88% 2.86% 3.40% 2.04% 1.72% - 1.81% 1.31% 6.89% - 6.58% 3.93% 1.79% 2.97% 7.87% SPX 8.44% 6.16% 10.42% - 6.30% - 6.15% 13.10% 7.27% - 0.46% 4.51% 9.72% - 6.92% - 19.13% 0.92% MQUSLVA 2020 16.26% 3.71% 10.75% - 2.77% - 3.92% 7.01% 5.51% 1.84% 4.53% 12.68% - 12.51% - 8.41% - 0.16% SPX 42.86% 4.30% - 1.83% 17.25% - 12.19% 6.76% 5.66% 3.71% 0.66% 11.97% 6.10% 1.18% - 4.27% MQUSLVA 2021 26.89% 4.36% - 0.83% 6.91% - 4.76% 2.90% 2.27% 2.22% 0.55% 5.24% 4.24% 2.61% - 1.11% SPX - 40.09% - 11.77% 7.38% 8.73% - 12.75% - 8.48% 13.14% - 12.93% - 0.98% - 14.75% 4.68% - 4.54% - 12.36% MQUSLVA 2022 - 19.44% - 5.90% 5.38% 7.99% - 9.34% - 4.24% 9.11% - 8.39% 0.01% - 8.80% 3.58% - 3.14% - 5.26% SPX 30.15% 11.26% 18.61% - 5.38% - 14.22% - 7.89% 7.68% 13.69% - 0.08% 2.25% 2.08% - 5.83% 9.72% MQUSLVA 2023 24.23% 4.42% 8.92% - 2.20% - 4.87% - 1.77% 3.11% 6.47% 0.25% 1.46% 3.51% - 2.61% 6.18% SPX 31.75% 0.11% 7.81% 11.20% - 10.73% 6.58% 12.36% 2.69% MQUSLVA 2024 15.78% 1.13% 3.47% 4.80% - 4.16% 3.10% 5.17% 1.59% SPX

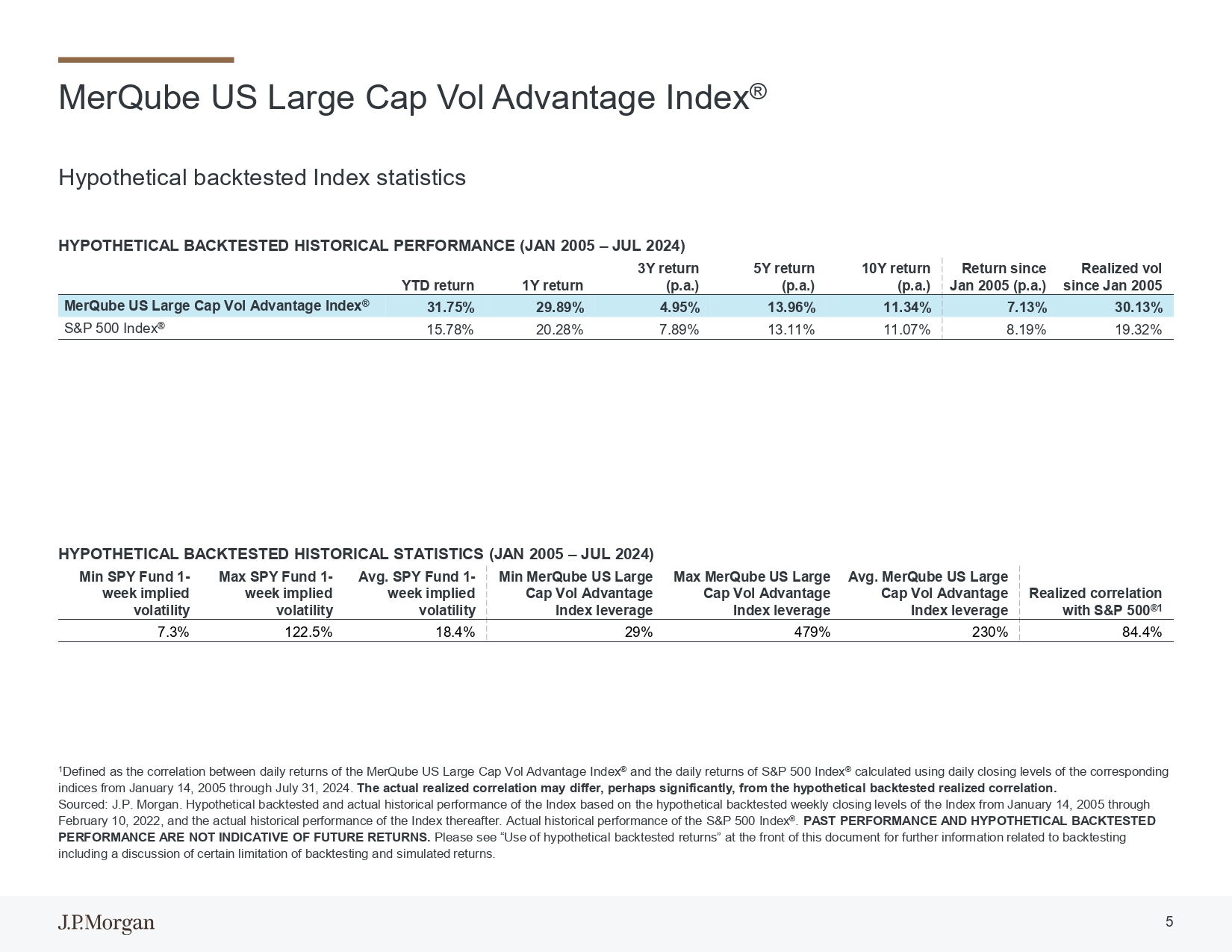

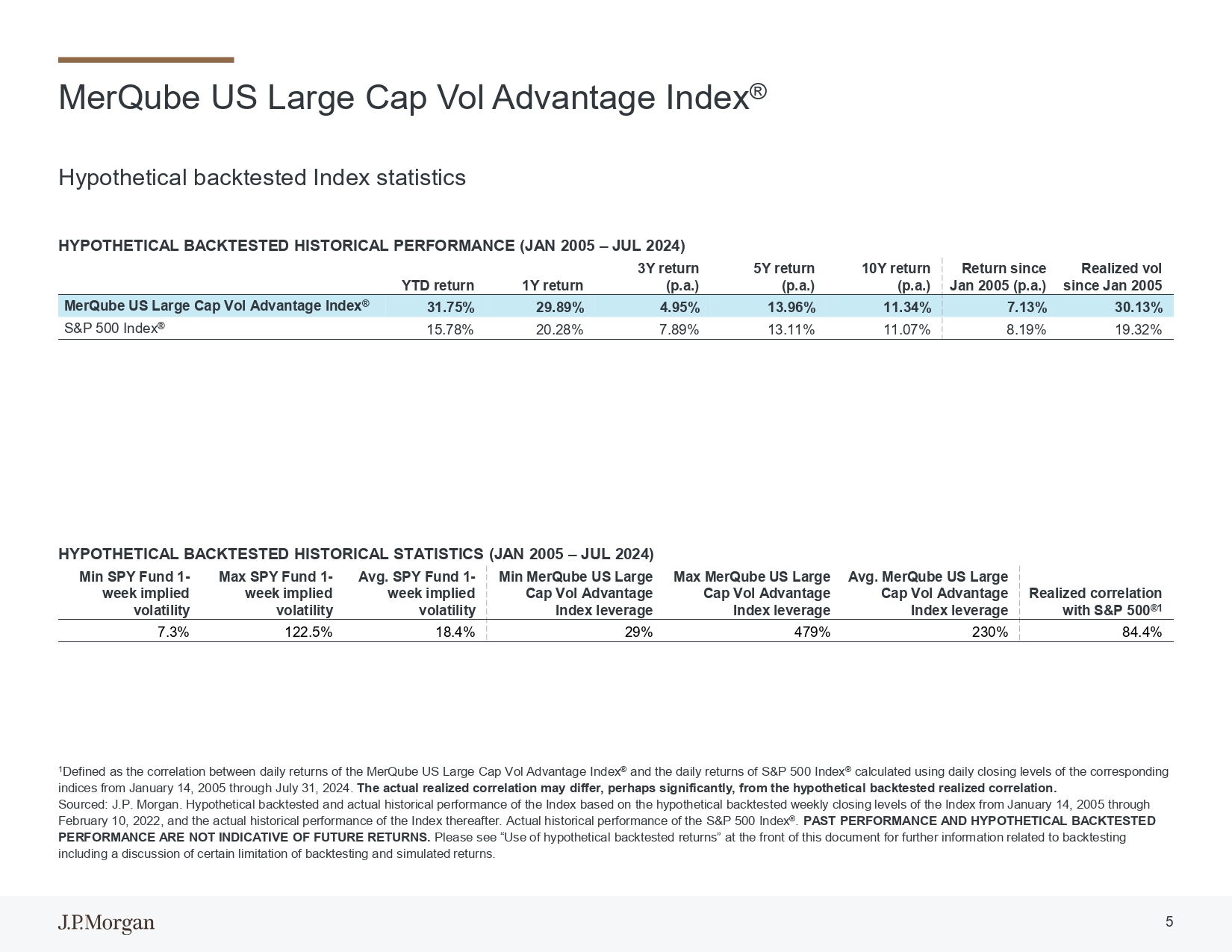

MerQube US Large Cap Vol Advantage Index ® 5 Hypothetical backtested Index statistics 1 Defined as the correlation between daily returns of the MerQube US Large Cap Vol Advantage Index ® and the daily returns of S&P 500 Index ® calculated using daily closing levels of the corresponding indices from January 14, 2005 through July 31, 2024. The actual realized correlation may differ, perhaps significantly, from the hypothetical backtested realized correlation. Sourced: J.P. Morgan. Hypothetical backtested and actual historical performance of the Index based on the hypothetical backtested weekly closing levels of the Index from January 14, 2005 through February 10, 2022, and the actual historical performance of the Index thereafter. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns. Realized vol since Jan 2005 Return since Jan 2005 (p.a.) 10Y return (p.a.) 5Y return (p.a.) 3Y return (p.a.) 1Y return YTD return 30.13% 7.13% 11.34% 13.96% 4.95% 29.89% 31.75% MerQube US Large Cap Vol Advantage Index ® 19.32% 8.19% 11.07% 13.11% 7.89% 20.28% 15.78% S&P 500 Index ® Realized correlation with S&P 500 ®1 Avg. MerQube US Large Cap Vol Advantage Index leverage Max MerQube US Large Cap Vol Advantage Index leverage Min MerQube US Large Cap Vol Advantage Index leverage Avg. SPY Fund 1 - week implied volatility Max SPY Fund 1 - week implied volatility Min SPY Fund 1 - week implied volatility 84.4% 230% 479% 29% 18.4% 122.5% 7.3% HYPOTHETICAL BACKTESTED HISTORICAL STATISTICS (JAN 2005 – JUL 2024) HYPOTHETICAL BACKTESTED HISTORICAL PERFORMANCE (JAN 2005 – JUL 2024)

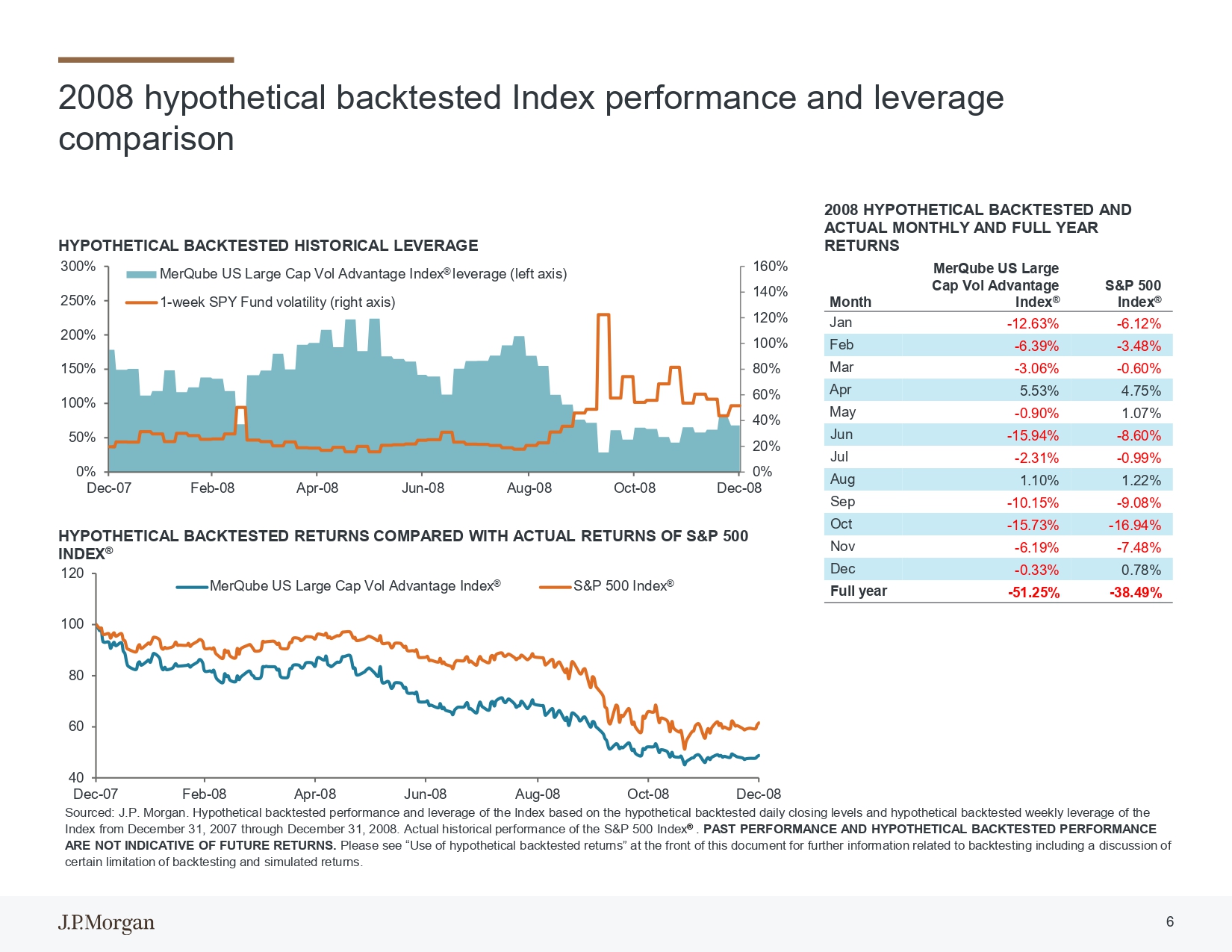

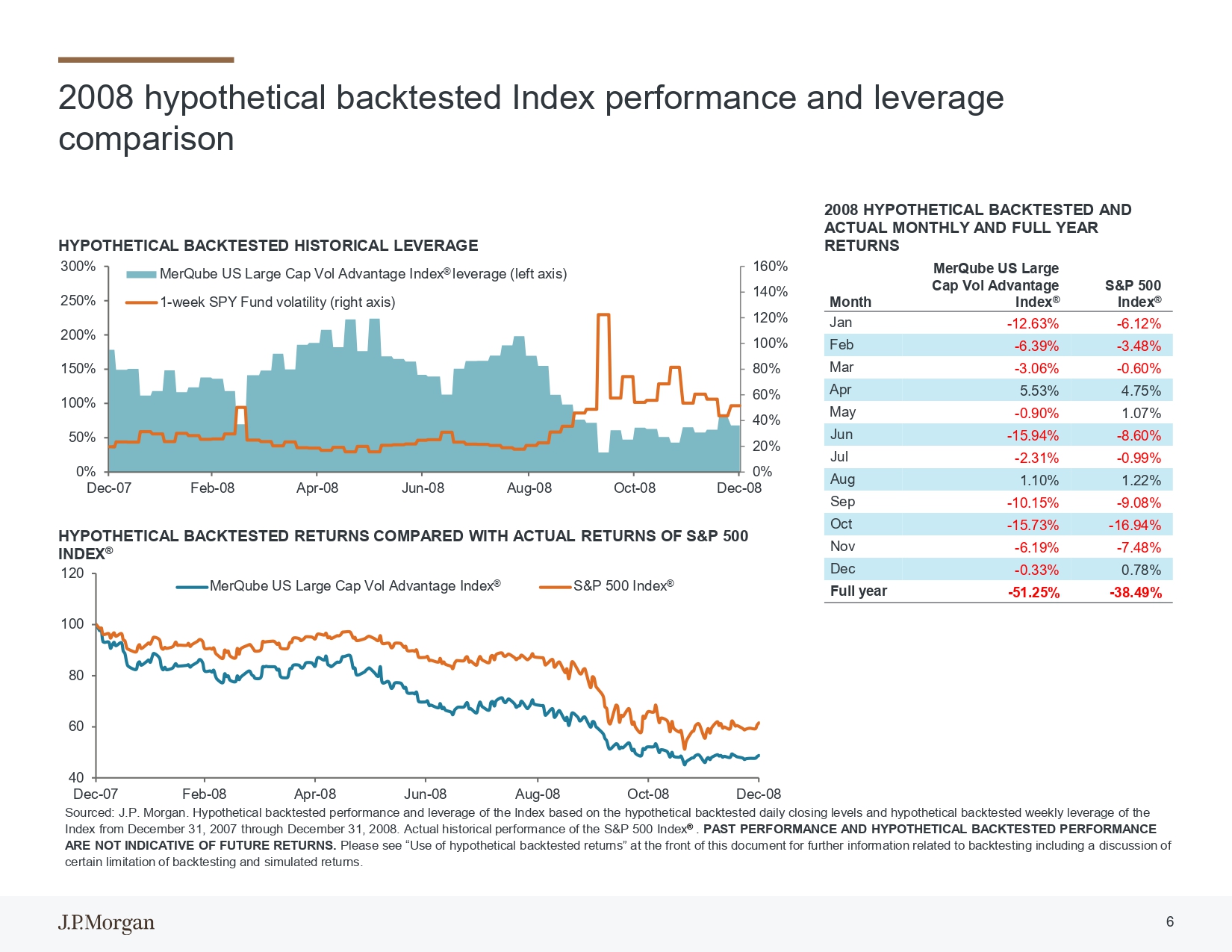

160% 140% 120% 100% 80% 60% 40% 20% 0% 6 0% 50% 100% 150% 200% 250% 300% Dec - 07 Feb - 08 Apr - 08 Jun - 08 Aug - 08 Oct - 08 Dec - 08 MerQube US Large Cap Vol Advantage Index ® leverage (left axis) 1 - week SPY Fund volatility (right axis) 2008 hypothetical backtested Index performance and leverage comparison HYPOTHETICAL BACKTESTED HISTORICAL LEVERAGE 2008 HYPOTHETICAL BACKTESTED AND ACTUAL MONTHLY AND FULL YEAR RETURNS S&P 500 Index ® MerQube US Large Cap Vol Advantage Index ® Month - 6.12% - 12.63% Jan - 3.48% - 6.39% Feb - 0.60% - 3.06% Mar 4.75% 5.53% Apr 1.07% - 0.90% May - 8.60% - 15.94% Jun - 0.99% - 2.31% Jul 1.22% 1.10% Aug - 9.08% - 10.15% Sep - 16.94% - 15.73% Oct - 7.48% - 6.19% Nov 0.78% - 0.33% Dec - 38.49% - 51.25% Full year HYPOTHETICAL BACKTESTED RETURNS COMPARED WITH ACTUAL RETURNS OF S&P 500 INDEX ® 120 MerQube US Large Cap Vol Advantage Index ® S&P 500 Index ® 100 80 60 40 Dec - 07 Feb - 08 Apr - 08 Jun - 08 Aug - 08 Oct - 08 Dec - 08 Sourced: J.P. Morgan. Hypothetical backtested performance and leverage of the Index based on the hypothetical backtested daily closing levels and hypothetical backtested weekly leverage of the Index from December 31, 2007 through December 31, 2008. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns.

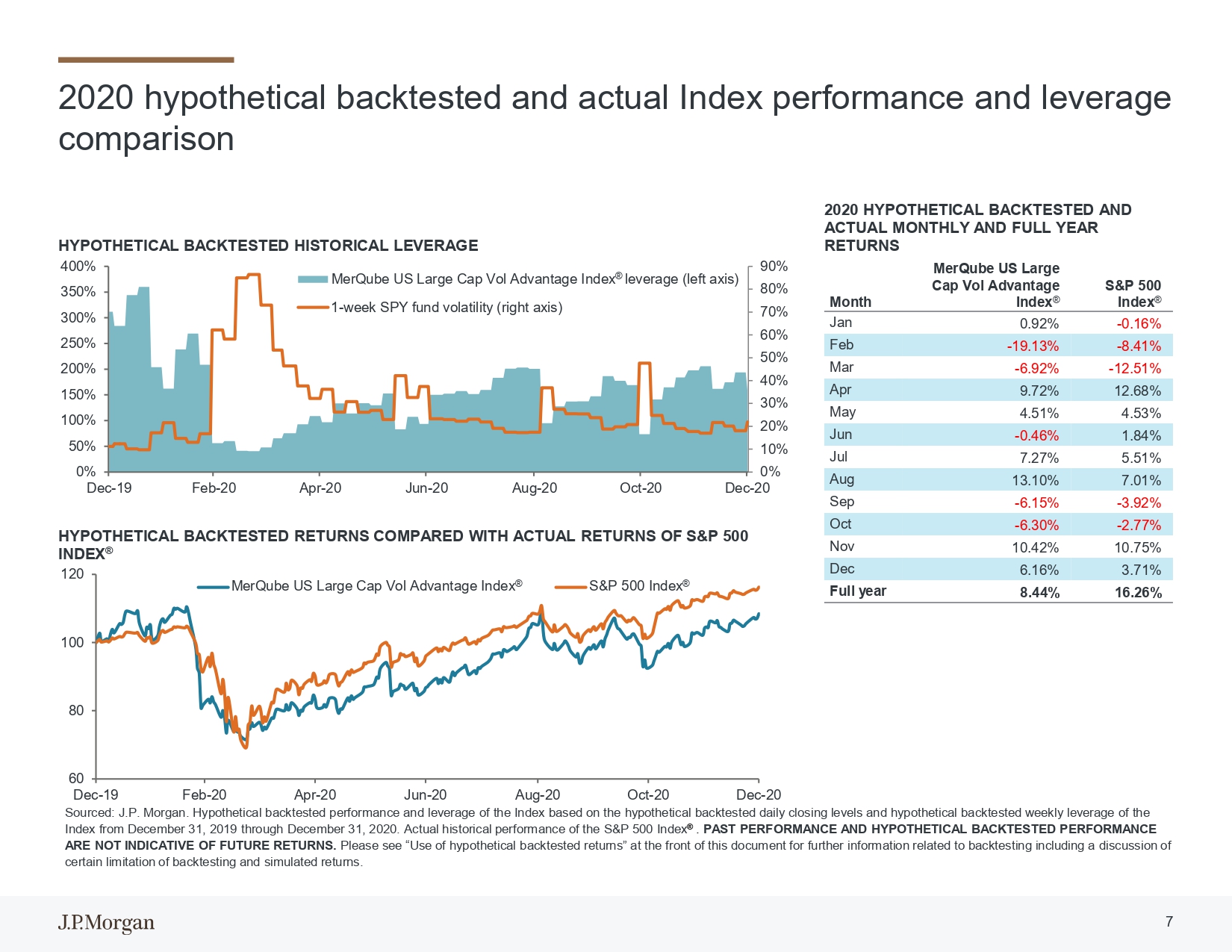

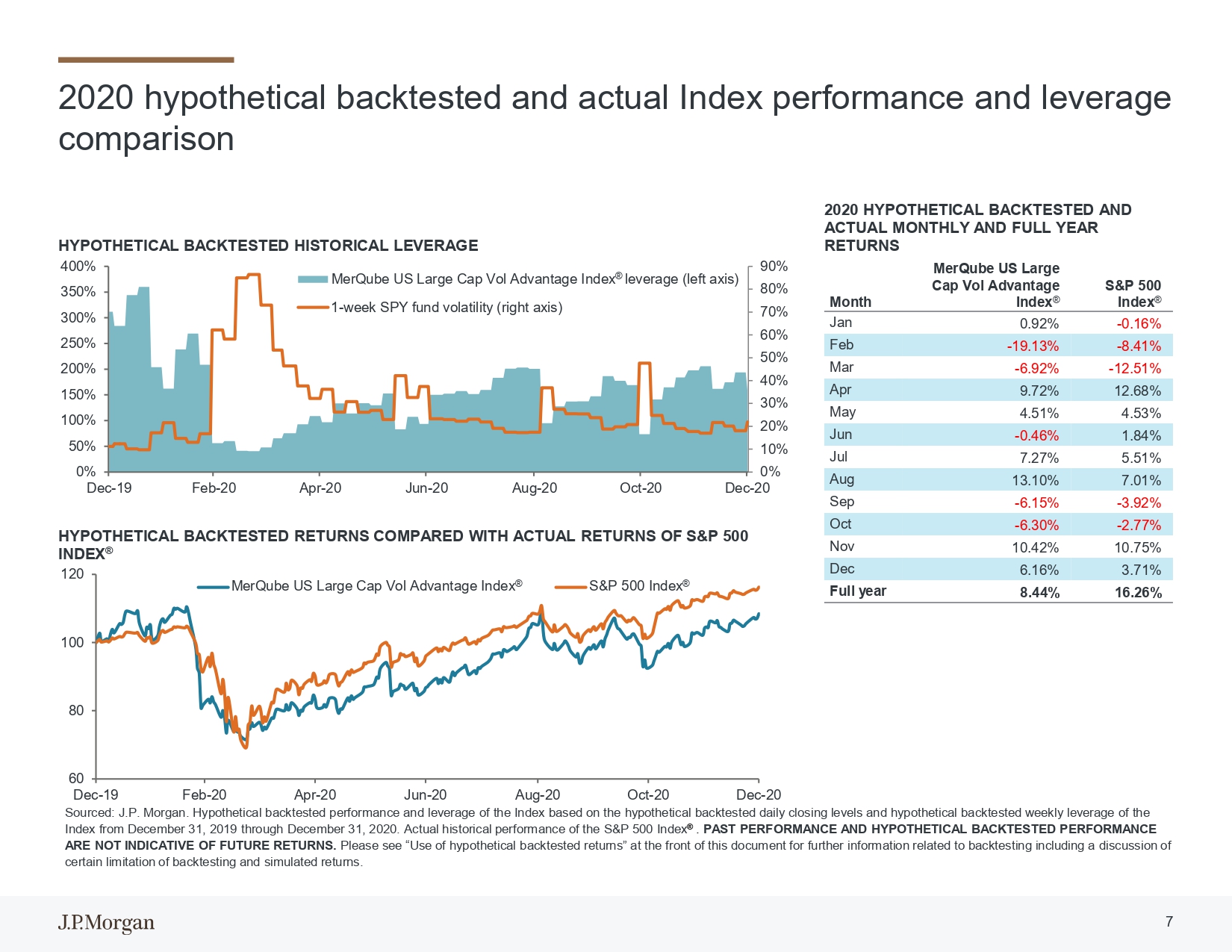

90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 400% 350% 300% 250% 200% 150% 100% 50% 0% Dec - 19 Feb - 20 Apr - 20 Jun - 20 Aug - 20 Oct - 20 Dec - 20 MerQube US Large Cap Vol Advantage Index ® leverage (left axis) 1 - week SPY fund volatility (right axis) 60 Dec - 19 Feb - 20 Apr - 20 Jun - 20 Aug - 20 Oct - 20 Dec - 20 Sourced: J.P. Morgan. Hypothetical backtested performance and leverage of the Index based on the hypothetical backtested daily closing levels and hypothetical backtested weekly leverage of the Index from December 31, 2019 through December 31, 2020. Actual historical performance of the S&P 500 Index ® . PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. Please see “Use of hypothetical backtested returns” at the front of this document for further information related to backtesting including a discussion of certain limitation of backtesting and simulated returns. 7 80 HYPOTHETICAL BACKTESTED RETURNS COMPARED WITH ACTUAL RETURNS OF S&P 500 INDEX ® 120 MerQube US Large Cap Vol Advantage Index ® S&P 500 Index ® 100 2020 hypothetical backtested and actual Index performance and leverage comparison S&P 500 Index ® MerQube US Large Cap Vol Advantage Index ® Month - 0.16% 0.92% Jan - 8.41% - 19.13% Feb - 12.51% - 6.92% Mar 12.68% 9.72% Apr 4.53% 4.51% May 1.84% - 0.46% Jun 5.51% 7.27% Jul 7.01% 13.10% Aug - 3.92% - 6.15% Sep - 2.77% - 6.30% Oct 10.75% 10.42% Nov 3.71% 6.16% Dec 16.26% 8.44% Full year HYPOTHETICAL BACKTESTED HISTORICAL LEVERAGE 2020 HYPOTHETICAL BACKTESTED AND ACTUAL MONTHLY AND FULL YEAR RETURNS

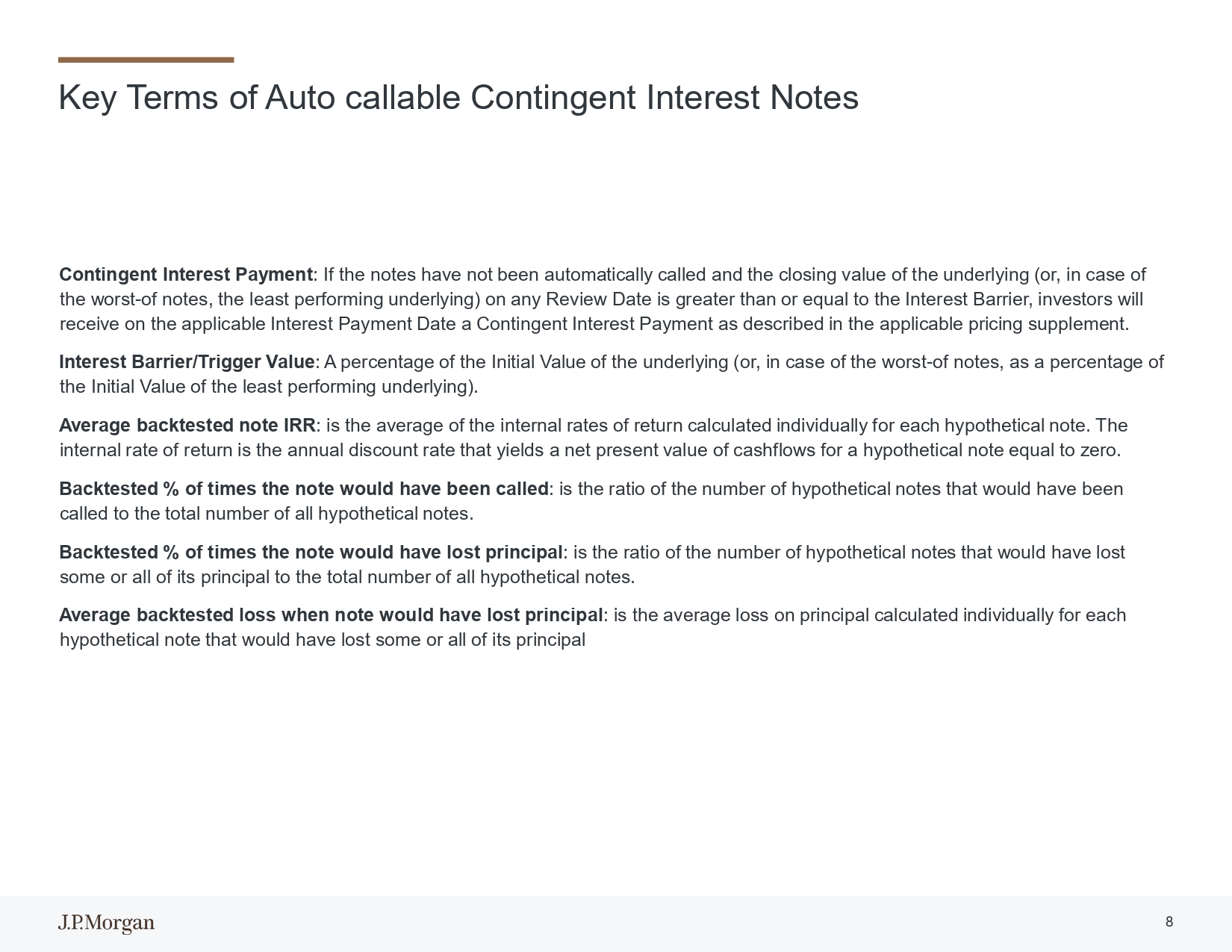

Key Terms of Auto callable Contingent Interest Notes 8 Contingent Interest Payment : If the notes have not been automatically called and the closing value of the underlying (or, in case of the worst - of notes, the least performing underlying) on any Review Date is greater than or equal to the Interest Barrier, investors will receive on the applicable Interest Payment Date a Contingent Interest Payment as described in the applicable pricing supplement . Interest Barrier/Trigger Value : A percentage of the Initial Value of the underlying (or, in case of the worst - of notes, as a percentage of the Initial Value of the least performing underlying). Average backtested note IRR : is the average of the internal rates of return calculated individually for each hypothetical note. The internal rate of return is the annual discount rate that yields a net present value of cashflows for a hypothetical note equal to zero. Backtested % of times the note would have been called : is the ratio of the number of hypothetical notes that would have been called to the total number of all hypothetical notes. Backtested % of times the note would have lost principal : is the ratio of the number of hypothetical notes that would have lost some or all of its principal to the total number of all hypothetical notes. Average backtested loss when note would have lost principal : is the average loss on principal calculated individually for each hypothetical note that would have lost some or all of its principal

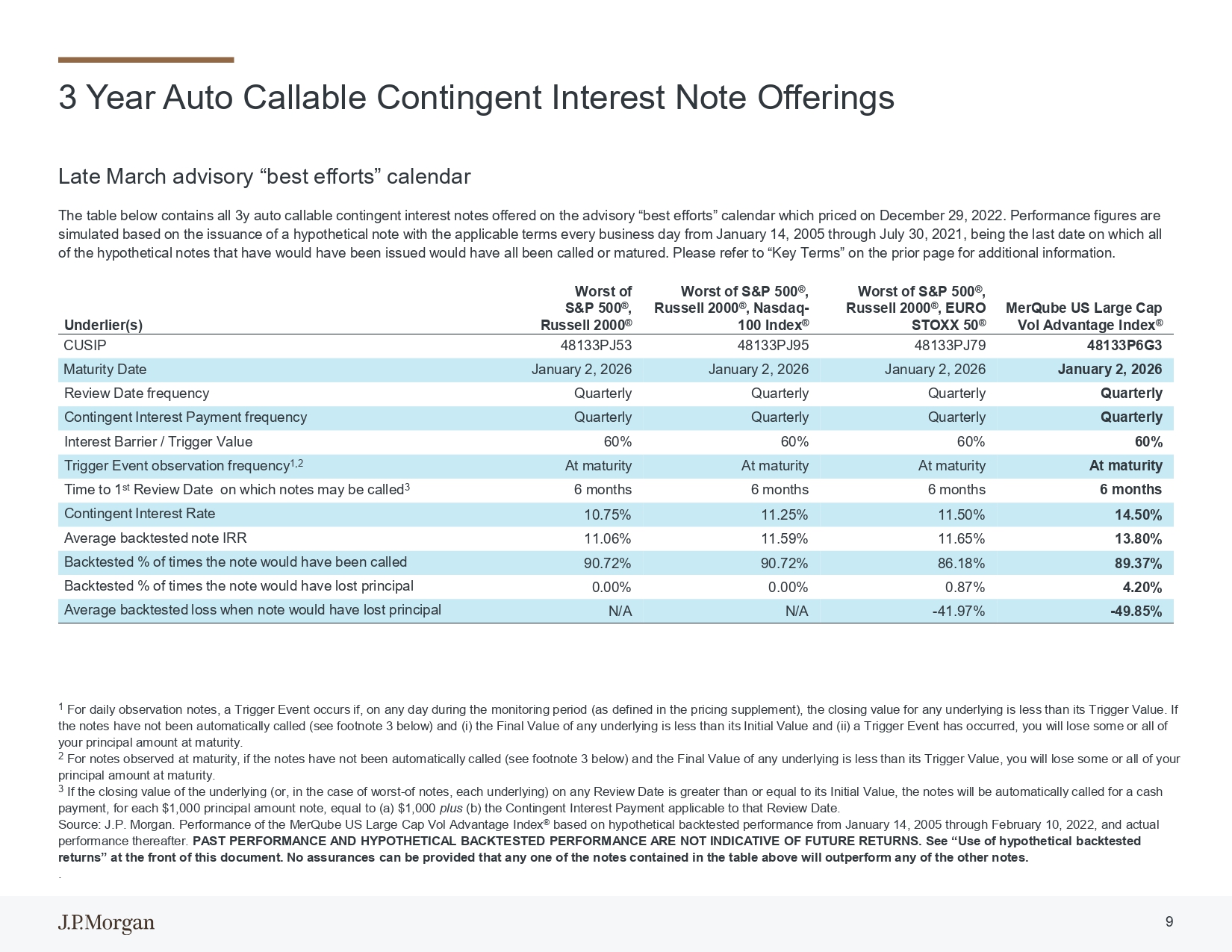

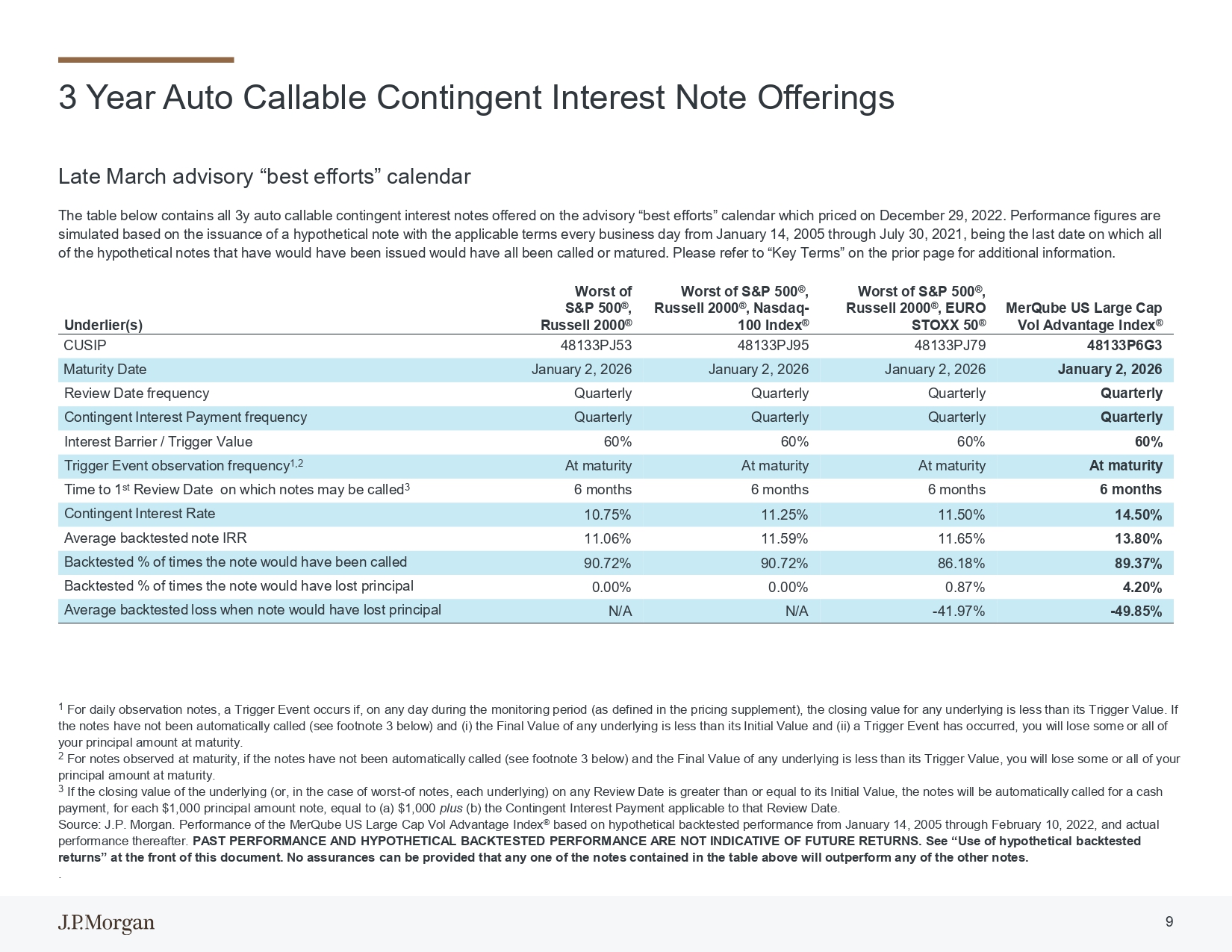

3 Year Auto Callable Contingent Interest Note Offerings 9 Late March advisory “best efforts” calendar The table below contains all 3 y auto callable contingent interest notes offered on the advisory “best efforts” calendar which priced on December 29 , 2022 . Performance figures are simulated based on the issuance of a hypothetical note with the applicable terms every business day from January 14 , 2005 through July 30 , 2021 , being the last date on which all of the hypothetical notes that have would have been issued would have all been called or matured . Please refer to “Key Terms” on the prior page for additional information . 1 For daily observation notes, a Trigger Event occurs if, on any day during the monitoring period (as defined in the pricing supplement), the closing value for any underlying is less than its Trigger Value. If the notes have not been automatically called (see footnote 3 below) and (i) the Final Value of any underlying is less than its Initial Value and (ii) a Trigger Event has occurred, you will lose some or all of your principal amount at maturity. 2 For notes observed at maturity, if the notes have not been automatically called (see footnote 3 below) and the Final Value of any underlying is less than its Trigger Value, you will lose some or all of your principal amount at maturity. 3 If the closing value of the underlying (or, in the case of worst - of notes, each underlying) on any Review Date is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to that Review Date. Source: J.P. Morgan. Performance of the MerQube US Large Cap Vol Advantage Index ® based on hypothetical backtested performance from January 14, 2005 through February 10, 2022, and actual performance thereafter. PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. See “Use of hypothetical backtested returns” at the front of this document. No assurances can be provided that any one of the notes contained in the table above will outperform any of the other notes. . MerQube US Large Cap Vol Advantage Index ® Worst of S&P 500 ® , Russell 2000 ® , EURO STOXX 50 ® Worst of S&P 500 ® , Russell 2000 ® , Nasdaq - 100 Index ® Worst of S&P 500 ® , Russell 2000 ® Underlier(s) 48133P6G3 48133PJ79 48133PJ95 48133PJ53 CUSIP January 2, 2026 January 2, 2026 January 2, 2026 January 2, 2026 Maturity Date Quarterly Quarterly Quarterly Quarterly Review Date frequency Quarterly Quarterly Quarterly Quarterly Contingent Interest Payment frequency 60% 60% 60% 60% Interest Barrier / Trigger Value At maturity At maturity At maturity At maturity Trigger Event observation frequency 1,2 6 months 6 months 6 months 6 months Time to 1 st Review Date on which notes may be called 3 14.50% 11.50% 11.25% 10.75% Contingent Interest Rate 13.80% 11.65% 11.59% 11.06% Average backtested note IRR 89.37% 86.18% 90.72% 90.72% Backtested % of times the note would have been called 4.20% 0.87% 0.00% 0.00% Backtested % of times the note would have lost principal - 49.85% - 41.97% N/A N/A Average backtested loss when note would have lost principal

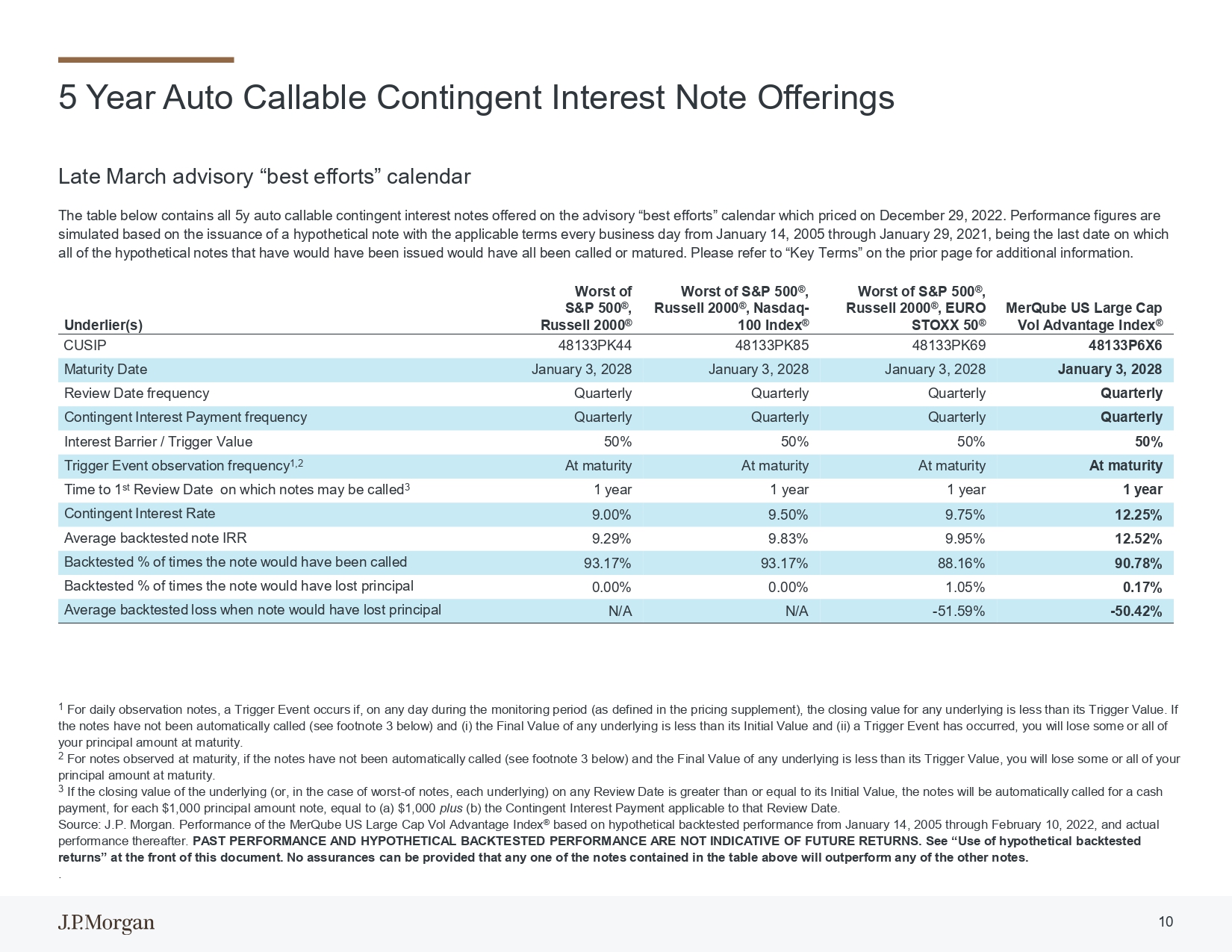

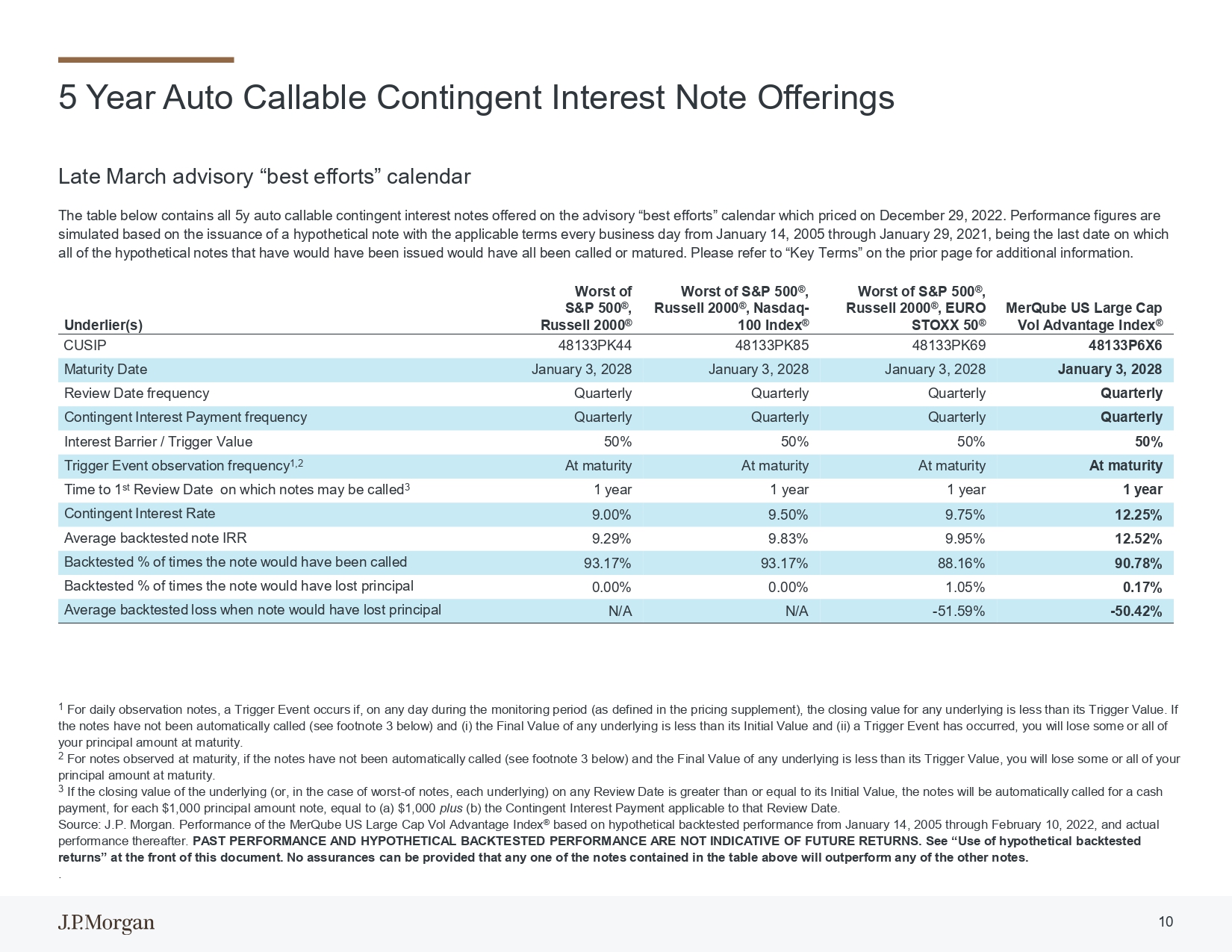

5 Year Auto Callable Contingent Interest Note Offerings 10 Late March advisory “best efforts” calendar The table below contains all 5y auto callable contingent interest notes offered on the advisory “best efforts” calendar which priced on December 29, 2022. Performance figures are simulated based on the issuance of a hypothetical note with the applicable terms every business day from January 14, 2005 through January 29, 2021, being the last date on which all of the hypothetical notes that have would have been issued would have all been called or matured. Please refer to “Key Terms” on the prior page for additional information. 1 For daily observation notes, a Trigger Event occurs if, on any day during the monitoring period (as defined in the pricing supplement), the closing value for any underlying is less than its Trigger Value. If the notes have not been automatically called (see footnote 3 below) and (i) the Final Value of any underlying is less than its Initial Value and (ii) a Trigger Event has occurred, you will lose some or all of your principal amount at maturity. 2 For notes observed at maturity, if the notes have not been automatically called (see footnote 3 below) and the Final Value of any underlying is less than its Trigger Value, you will lose some or all of your principal amount at maturity. 3 If the closing value of the underlying (or, in the case of worst - of notes, each underlying) on any Review Date is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to that Review Date. Source: J.P. Morgan. Performance of the MerQube US Large Cap Vol Advantage Index ® based on hypothetical backtested performance from January 14, 2005 through February 10, 2022, and actual performance thereafter. PAST PERFORMANCE AND HYPOTHETICAL BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RETURNS. See “Use of hypothetical backtested returns” at the front of this document. No assurances can be provided that any one of the notes contained in the table above will outperform any of the other notes. . MerQube US Large Cap Vol Advantage Index ® Worst of S&P 500 ® , Russell 2000 ® , EURO STOXX 50 ® Worst of S&P 500 ® , Russell 2000 ® , Nasdaq - 100 Index ® Worst of S&P 500 ® , Russell 2000 ® Underlier(s) 48133P6X6 48133PK69 48133PK85 48133PK44 CUSIP January 3, 2028 January 3, 2028 January 3, 2028 January 3, 2028 Maturity Date Quarterly Quarterly Quarterly Quarterly Review Date frequency Quarterly Quarterly Quarterly Quarterly Contingent Interest Payment frequency 50% 50% 50% 50% Interest Barrier / Trigger Value At maturity At maturity At maturity At maturity Trigger Event observation frequency 1,2 1 year 1 year 1 year 1 year Time to 1 st Review Date on which notes may be called 3 12.25% 9.75% 9.50% 9.00% Contingent Interest Rate 12.52% 9.95% 9.83% 9.29% Average backtested note IRR 90.78% 88.16% 93.17% 93.17% Backtested % of times the note would have been called 0.17% 1.05% 0.00% 0.00% Backtested % of times the note would have lost principal - 50.42% - 51.59% N/A N/A Average backtested loss when note would have lost principal

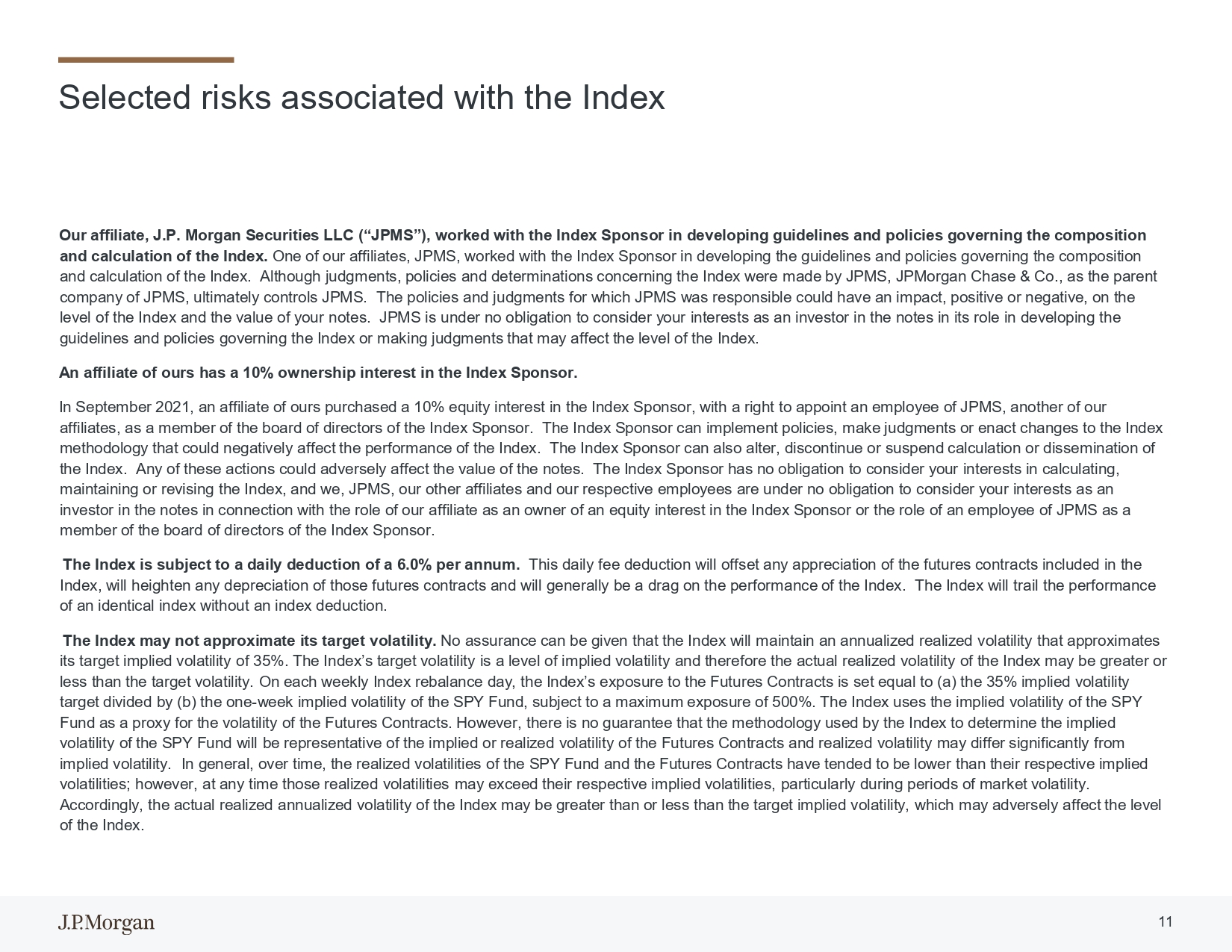

Selected risks associated with the Index 11 Our affiliate, J.P. Morgan Securities LLC (“JPMS”), worked with the Index Sponsor in developing guidelines and policies governing the composition and calculation of the Index. One of our affiliates, JPMS, worked with the Index Sponsor in developing the guidelines and policies governing the composition and calculation of the Index. Although judgments, policies and determinations concerning the Index were made by JPMS, JPMorgan Chase & Co., as the parent company of JPMS, ultimately controls JPMS. The policies and judgments for which JPMS was responsible could have an impact, positive or negative, on the level of the Index and the value of your notes. JPMS is under no obligation to consider your interests as an investor in the notes in its role in developing the guidelines and policies governing the Index or making judgments that may affect the level of the Index. An affiliate of ours has a 10% ownership interest in the Index Sponsor. In September 2021, an affiliate of ours purchased a 10% equity interest in the Index Sponsor, with a right to appoint an employee of JPMS, another of our affiliates, as a member of the board of directors of the Index Sponsor. The Index Sponsor can implement policies, make judgments or enact changes to the Index methodology that could negatively affect the performance of the Index. The Index Sponsor can also alter, discontinue or suspend calculation or dissemination of the Index. Any of these actions could adversely affect the value of the notes. The Index Sponsor has no obligation to consider your interests in calculating, maintaining or revising the Index, and we, JPMS, our other affiliates and our respective employees are under no obligation to consider your interests as an investor in the notes in connection with the role of our affiliate as an owner of an equity interest in the Index Sponsor or the role of an employee of JPMS as a member of the board of directors of the Index Sponsor. The Index is subject to a daily deduction of a 6.0% per annum. This daily fee deduction will offset any appreciation of the futures contracts included in the Index, will heighten any depreciation of those futures contracts and will generally be a drag on the performance of the Index. The Index will trail the performance of an identical index without an index deduction. The Index may not approximate its target volatility. No assurance can be given that the Index will maintain an annualized realized volatility that approximates its target implied volatility of 35%. The Index’s target volatility is a level of implied volatility and therefore the actual realized volatility of the Index may be greater or less than the target volatility. On each weekly Index rebalance day, the Index’s exposure to the Futures Contracts is set equal to (a) the 35% implied volatility target divided by (b) the one - week implied volatility of the SPY Fund, subject to a maximum exposure of 500%. The Index uses the implied volatility of the SPY Fund as a proxy for the volatility of the Futures Contracts. However, there is no guarantee that the methodology used by the Index to determine the implied volatility of the SPY Fund will be representative of the implied or realized volatility of the Futures Contracts and realized volatility may differ significantly from implied volatility. In general, over time, the realized volatilities of the SPY Fund and the Futures Contracts have tended to be lower than their respective implied volatilities; however, at any time those realized volatilities may exceed their respective implied volatilities, particularly during periods of market volatility. Accordingly, the actual realized annualized volatility of the Index may be greater than or less than the target implied volatility, which may adversely affect the level of the Index.

Select risks associated with the Index 12 The Index is subject to risks associated with the use of significant leverage. On a weekly Index rebalance day, the Index will employ leverage to increase the exposure of the Index to the Futures Contracts if the implied volatility of the SPY Fund is below 35%, subject to a maximum exposure of 500%. Under normal market conditions in the past, the SPY Fund has tended to exhibit an implied volatility below 35%. Accordingly, the Index has generally employed leverage in the past, except during periods of elevated volatility. When leverage is employed, any movements in the prices of the Futures Contracts will result in greater changes in the level of the Index than if leverage were not used. In particular, the use of leverage will magnify any negative performance of the Futures Contracts, which, in turn, would negatively affect the performance of the Index. Because the Index’s leverage is adjusted only on a weekly basis, in situations where a significant increase in volatility is accompanied by a significant decline in the value of the Futures Contracts, the level of the Index may decline significantly before the following Index rebalance day when the Index’s exposure to the Futures Contracts would be reduced. The Index may be significantly uninvested. The Index may be significantly uninvested on any given day, and will realize only a portion of any gains due to appreciation of the Futures Contracts on any such day. The index deduction is deducted daily at a rate of 6.0% per annum, even when the Index is not fully invested. The Index is an excess return index that does not reflect “total returns”. The Index is an excess return index that does not reflect total returns. The Index measures the returns accrued from investing in uncollateralized futures contracts ( i.e. , the sum of the price return and the roll return associated with an investment in the Futures Contracts). By contrast, a total return index, in addition to reflecting those returns, would also reflect interest that could be earned on funds committed to the trading of the Futures Contracts (i.e., the collateral return associated with an investment in the Futures Contracts). JPMorgan Chase & Co. is currently one of the companies that make up the S&P 500 Index , but JPMorgan Chase & Co. will not have any obligation to consider your interests in taking any corporate action that might affect the level of the S&P 500 Index.

Selected risks associated with the Index 13 Concentration risks associated with the Index may adversely affect the value of the index and your investment . The Index generally provides exposure to a single futures contract on the S&P 500 Index ® that trades on the Chicago Mercantile Exchange. You should be aware that other indices may be more diversified than the Indices in terms of both the number and variety of futures contracts. The Index is subject to significant risks associated with futures contracts, including volatility. The Index tracks the returns of futures contracts. The price of a futures contract depends not only on the price of the underlying asset referenced by the futures contract, but also on a range of other factors, including but not limited to changing supply and demand relationships, interest rates, governmental and regulatory policies and the policies of the exchanges on which the futures contracts trade. In addition, the futures markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. These factors and others can cause the prices of futures contracts to be volatile. Other key risks. The Index was established on February 11, 2022, has a limited operating history and may perform in unanticipated ways. The notes are not regulated by the Commodity Futures Trading Commission. Historical performance of the Index should not be taken as an indication of the future performance of the Index during the term of the notes. The risks identified above are not exhaustive. You should also carefully review the related “Risk Factors” section in the relevant product supplement and underlying supplement and the “Selected Risk Considerations” in the relevant pricing supplement.

Disclaimers 14 Neither MerQube, Inc. nor any of its affiliates (collectively, “MerQube”) is the issuer or producer of any investment linked to the Index referenced herein and MerQube has no duties, responsibilities, or obligations to investors in such investment. The Index is a product of MerQube and has been licensed for use by JPMS (“Licensee”) and its affiliates. Such index is calculated using, among other things, market data or other information (“Input Data”) from one or more sources (each a “Data Provider”). MerQube ® is a registered trademark of MerQube, Inc. These trademarks have been licensed for certain purposes by Licensee, including use by Licensee’s affiliate in its capacity as the issuer of investments linked to the Index. Such investments are not sponsored, endorsed, sold or promoted by MerQube, any Data Provider, or any other third party, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Input Data, Index or any associated data. The notes are not sponsored, endorsed, sold, or promoted by London Stock Exchange Group plc or its affiliates (collectively, “LSE”) or any successor thereto or index owner and neither LSE nor any party hereto makes any representation or warranty whatsoever, whether express or implied, to the owners of the notes or any member of the public regarding the advisability of investing in securities generally or in the notes particularly or the ability of the Russell Indices to track general stock market performance or a segment of the same. LSE’s publication of the Russell Indices in no way suggests or implies an opinion by LSE as to the advisability of investment in any or all of the securities upon which the Russell Indices are based. LSE’s only relationship to the Issuer, the Guarantor (if applicable) and their affiliates is the licensing of certain trademarks and trade names of LSE and of the Russell Indices, which are determined, composed and calculated by LSE without regard to the Issuer, the Guarantor (if applicable) and their affiliates or the notes. LSE is not responsible for and has not reviewed the notes or any associated literature or publications and LSE makes no representation or warranty express or implied as to their accuracy or completeness, or otherwise. LSE reserves the right, at any time and without notice, to alter, amend, terminate or in any way change the Russell Indices. LSE has no obligation or liability in connection with the administration, marketing or trading of the notes. “Russell 1000 ® Index,” is a trademark of LSE and have been licensed for use by JPMorgan Chase Bank, National Association and its affiliates. This transaction is not sponsored, endorsed, sold, or promoted by LSE and LSE makes no representation regarding the advisability of entering into this transaction.

Disclaimers 15 LSE DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE RUSSELL INDICES OR ANY DATA INCLUDED THEREIN AND LSE SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. LSE MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE ISSUER, THE GUARANTOR (IF APPLICABLE) AND/OR THEIR AFFILIATES, INVESTORS, OWNERS OF THE PRODUCT(S), OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE RUSSELL INDICES OR ANY DATA INCLUDED THEREIN. LSE MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE RUSSELL INDICES OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL LSE HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. JPMorgan Chase & Co. or its affiliate has entered into an agreement with S&P Dow Jones that provides it and certain of its affiliates or subsidiaries, including JPMorgan Financial, with a non - exclusive license and, for a fee, with the right to use the S&P 500 ® Index, which are owned and published by S&P Dow Jones, in connection with certain securities, including the notes. The notes are not sponsored, endorsed, sold or promoted by S&P Dow Jones or its third party licensors. Neither S&P Dow Jones nor its third party licensors makes any representation or warranty, express or implied, to the owners of the notes or any member of the public regarding the advisability of investing in securities generally or in the notes particularly or the ability of the S&P 500 ® Index to track general stock market performance. S&P Dow Jones’ and its third party licensors’ only relationship to the Issuer or the Guarantor (if applicable) is the licensing of certain trademarks and trade names of S&P Dow Jones and the third party licensors and of the S&P 500 ® Index which is determined, composed and calculated by S&P Dow Jones or its third party licensors without regard to the Issuer or the Guarantor (if applicable) or the notes. S&P Dow Jones and its third party licensors have no obligation to take the needs of the Issuer or the Guarantor (if applicable) or the owners of the notes into consideration in determining, composing or calculating the S&P 500 ® Index. Neither S&P Dow Jones nor its third party licensors is responsible for and has not participated in the determination of the prices and amount of the notes or the timing of the issuance or sale of the notes or in the determination or calculation of the equation by which the notes are to be converted into cash. S&P Dow Jones has no obligation or liability in connection with the administration, marketing or trading of the notes.

Disclaimers 16 NEITHER S&P DOW JONES, ITS AFFILIATES NOR THEIR THIRD PARTY LICENSORS GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE S&P 500 ® INDEX OR ANY DATA INCLUDED THEREIN OR ANY COMMUNICATIONS, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATIONS (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES, ITS AFFILIATES AND THEIR THIRD PARTY LICENSORS SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS OR DELAYS THEREIN. S&P DOW JONES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE MARKS, THE S&P 500 ® INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES, ITS AFFILIATES OR THEIR THIRD PARTY LICENSORS BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE OR CONSEQUENTIAL DAMAGES, INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE. “Standard & Poor’s,” “S&P,” and “S&P 500,” are trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by JPMorgan Chase & Co. and its affiliates, including JPMorgan Financial. JPMorgan Chase & Co. or its affiliate has entered into an agreement with STOXX Limited (“STOXX”) providing it and certain of its affiliates or subsidiaries, including JPMorgan Financial, with a non - exclusive license and, for a fee, with the right to use the EURO STOXX 50 ® Index, which is owned and published by STOXX Limited, in connection with certain securities, including the notes. STOXX and its licensors (the “Licensors”) have no relationship to the Issuer or the Guarantor (if applicable), other than the licensing of the EURO STOXX 50 ® Index and the related trademarks for use in connection with the notes.

Disclaimers 17 STOXX and its Licensors do not : sponsor, endorse, sell or promote the notes; recommend that any person invest in the notes or any other securities; have any responsibility or liability for or make any decisions about the timing, amount or pricing of the notes; have any responsibility or liability for the administration, management or marketing of the notes; or consider the needs of the notes or the holders of the notes in determining, composing or calculating the EURO STOXX 50 ® Index or have any obligation to do so. STOXX and its Licensors will not have any liability in connection with the notes. Specifically, STOXX and its Licensors do not make any warranty, express or implied and disclaim any and all warranty about: The results to be obtained by the notes, the holders of the notes or any other person in connection with the use of the EURO STOXX 50 ® Index and the data included in the EURO STOXX 50 ® Index; The accuracy or completeness of the EURO STOXX 50 ® Index and its data; or The merchantability and the fitness for a particular purpose or use of the EURO STOXX 50 ® Index and its data; STOXX and its Licensors will have no liability for any errors, omissions or interruptions in the EURO STOXX 50 ® Index or its data; and Under no circumstances will STOXX or its Licensors be liable for any lost profits or indirect, punitive, special or consequential damages or losses, even if STOXX or its Licensors knows that they might occur. The licensing agreement with STOXX is solely for the benefit of the parties to that agreement and not for the benefit of the holders of the notes or any other third parties