● THE APPRECIATION POTENTIAL OF THE NOTES IS LIMITED TO THE SUM OF ANY CONTINGENT INTEREST PAYMENTS

THAT MAY BE PAID OVER THE TERM OF THE NOTES,

regardless of any appreciation of any Fund, which may be significant. You will not participate in any appreciation of any Fund.

● POTENTIAL CONFLICTS —

We and our affiliates play a variety of roles in connection with the notes. In performing these duties, our and JPMorgan Chase &

Co.’s economic interests are potentially adverse to your interests as an investor in the notes. It is possible that hedging or trading

activities of ours or our affiliates in connection with the notes could result in substantial returns for us or our affiliates while the

value of the notes declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product

supplement.

● JPMORGAN CHASE & CO. IS CURRENTLY ONE OF THE COMPANIES THAT MAKE UP THE SPDR® S&P 500® ETF TRUST

AND ITS UNDERLYING INDEX,

but JPMorgan Chase & Co. will not have any obligation to consider your interests in taking any corporate action that might affect

the price of one share of the SPDR® S&P 500® ETF Trust or the level of its Underlying Index (as defined under “The Funds”

below).

● THERE ARE RISKS ASSOCIATED WITH THE FUNDS —

The Funds are subject to management risk, which is the risk that the investment strategies of the applicable Fund’s investment

adviser, the implementation of which is subject to a number of constraints, may not produce the intended results. These constraints

could adversely affect the market prices of the shares of the Funds and, consequently, the value of the notes.

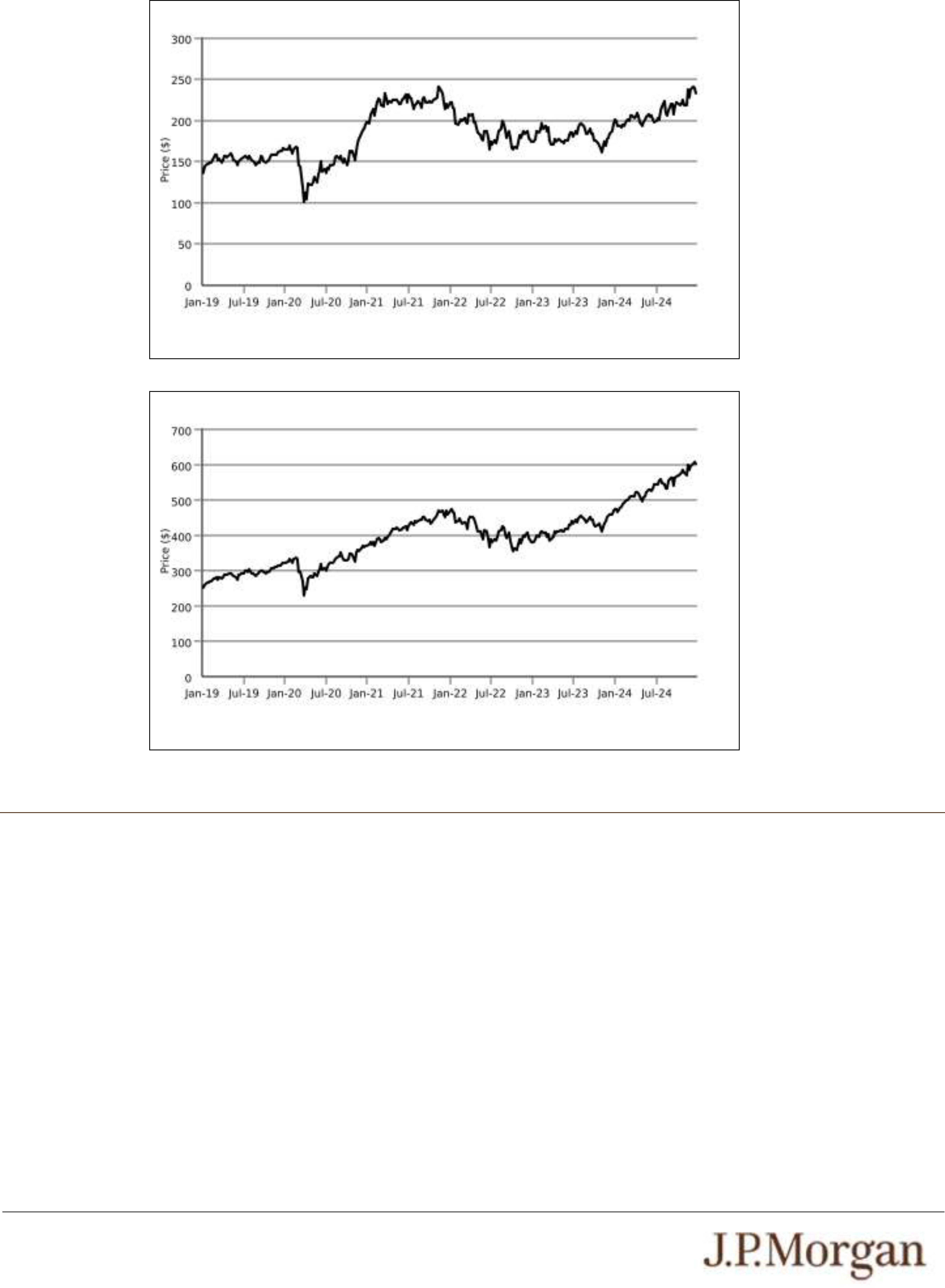

● THE PERFORMANCE AND MARKET VALUE OF EACH FUND, PARTICULARLY DURING PERIODS OF MARKET

VOLATILITY, MAY NOT CORRELATE WITH THE PERFORMANCE OF THAT FUND’S UNDERLYING INDEX AS WELL AS

THE NET ASSET VALUE PER SHARE —

Each Fund does not fully replicate its Underlying Index (as defined under “The Funds” below) and may hold securities different

from those included in its Underlying Index. In addition, the performance of each Fund will reflect additional transaction costs and

fees that are not included in the calculation of its Underlying Index. All of these factors may lead to a lack of correlation between

the performance of each Fund and its Underlying Index. In addition, corporate actions with respect to the equity securities

underlying each Fund (such as mergers and spin-offs) may impact the variance between the performances of that Fund and its

Underlying Index. Finally, because the shares of each Fund are traded on a securities exchange and are subject to market supply

and investor demand, the market value of one share of each Fund may differ from the net asset value per share of that Fund.

During periods of market volatility, securities underlying each Fund may be unavailable in the secondary market, market

participants may be unable to calculate accurately the net asset value per share of that Fund and the liquidity of that Fund may be

adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of

each Fund. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing

to buy and sell shares of a Fund. As a result, under these circumstances, the market value of shares of a Fund may vary

substantially from the net asset value per share of that Fund. For all of the foregoing reasons, the performance of each Fund may

not correlate with the performance of its Underlying Index as well as the net asset value per share of that Fund, which could

materially and adversely affect the value of the notes in the secondary market and/or reduce any payment on the notes.

● AN INVESTMENT IN THE NOTES IS SUBJECT TO RISKS ASSOCIATED WITH SMALL CAPITALIZATION STOCKS WITH

RESPECT TO THE iSHARES® RUSSELL 2000 ETF —

Small capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative

to larger companies. Small capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend

payment could be a factor that limits downward stock price pressure under adverse market conditions.

● NON-U.S. SECURITIES RISK WITH RESPECT TO THE INVESCO QQQ TRUSTSM, SERIES 1 —

The non-U.S. equity securities held by the Invesco QQQ TrustSM, Series 1 have been issued by non-U.S. companies. Investments

in securities linked to the value of such non-U.S. equity securities involve risks associated with the home countries and/or the

securities markets in the home countries of the issuers of those non-U.S. equity securities. Also, with respect to equity securities

that are not listed in the U.S., there is generally less publicly available information about companies in some of these jurisdictions

than there is about U.S. companies that are subject to the reporting requirements of the SEC.

● YOU ARE EXPOSED TO THE RISK OF DECLINE IN THE PRICE OF ONE SHARE OF EACH FUND—

Payments on the notes are not linked to a basket composed of the Funds and are contingent upon the performance of each

individual Fund. Poor performance by any of the Funds over the term of the notes may result in the notes not being automatically

called on an Autocall Review Date, may negatively affect whether you will receive a Contingent Interest Payment on any Interest

Payment Date and your payment at maturity and will not be offset or mitigated by positive performance by any other Fund.

● YOUR PAYMENT AT MATURITY WILL BE DETERMINED BY THE LEAST PERFORMING FUND.

● THE BENEFIT PROVIDED BY THE TRIGGER VALUE MAY TERMINATE ON THE FINAL REVIEW DATE—

If the Final Value of one share of any Fund is less than its Trigger Value and the notes have not been automatically called, the

benefit provided by the Trigger Value will terminate and you will be fully exposed to any depreciation of the Least Performing Fund.

● THE AUTOMATIC CALL FEATURE MAY FORCE A POTENTIAL EARLY EXIT —

If your notes are automatically called, the term of the notes may be reduced to as short as approximately six months and you will

not receive any Contingent Interest Payments after the applicable Call Settlement Date. There is no guarantee that you would be

able to reinvest the proceeds from an investment in the notes at a comparable return and/or with a comparable interest rate for a

similar level of risk. Even in cases where the notes are called before maturity, you are not entitled to any fees and commissions

described on the front cover of this pricing supplement.