Issuer: JPMorgan Chase Financial Company LLC, a direct,

wholly owned finance subsidiary of JPMorgan Chase & Co.

Guarantor: JPMorgan Chase & Co.

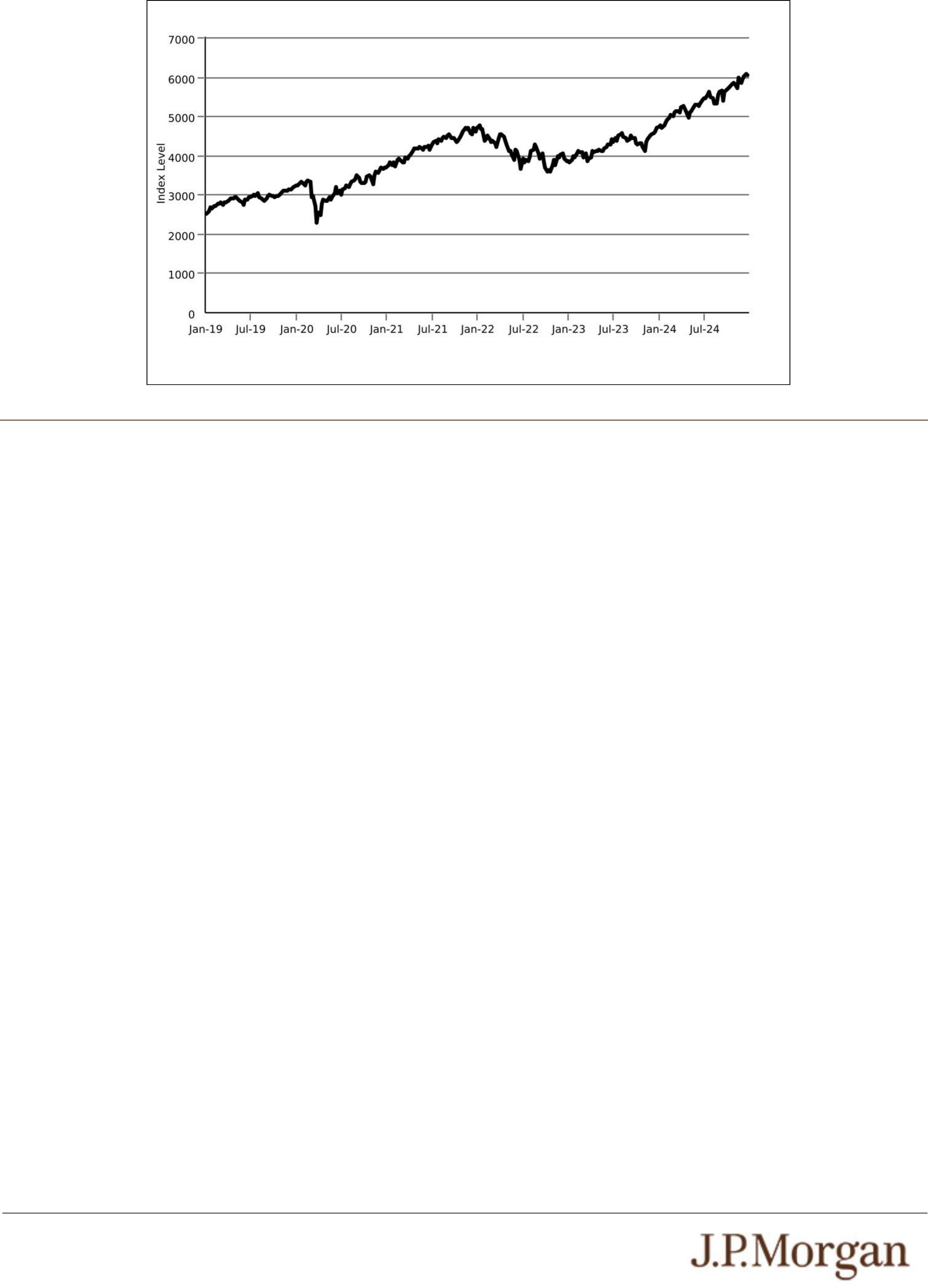

Indices: The Nasdaq-100® Technology Sector IndexSM

(Bloomberg ticker: NDXT), the Russell 2000® Index (Bloomberg

ticker: RTY) and the S&P 500® Index (Bloomberg ticker: SPX)

(each an “Index” and collectively, the “Indices”)

Contingent Interest Payments:

If the notes have not been previously redeemed early and the

closing level of each Index on any Review Date is greater than

or equal to its Interest Barrier, you will receive on the applicable

Interest Payment Date for each $1,000 principal amount note a

Contingent Interest Payment equal to $6.9167 (equivalent to a

Contingent Interest Rate of 8.30% per annum, payable at a rate

of 0.69167% per month).

If the closing level of any Index on any Review Date is less than

its Interest Barrier, no Contingent Interest Payment will be made

with respect to that Review Date.

Contingent Interest Rate: 8.30% per annum, payable at a rate

of 0.69167% per month

Interest Barrier: With respect to each Index, 70.00% of its

Initial Value, which is 7,642.439 for the Nasdaq-100®

Technology Sector IndexSM, 1,633.8567 for the Russell 2000®

Index and 4,235.427 for the S&P 500® Index

Trigger Value: With respect to each Index, 60.00% of its Initial

Value, which is 6,550.662 for the Nasdaq-100® Technology

Sector IndexSM, 1,400.4486 for the Russell 2000® Index and

3,630.366 for the S&P 500® Index

Pricing Date: December 17, 2024

Original Issue Date (Settlement Date): On or about December

20, 2024

Review Dates*: January 17, 2025, February 18, 2025, March

17, 2025, April 17, 2025, May 19, 2025, June 17, 2025, July 17,

2025, August 18, 2025, September 17, 2025, October 17, 2025,

November 17, 2025, December 17, 2025, January 20, 2026,

February 17, 2026, March 17, 2026, April 17, 2026, May 18,

2026, June 17, 2026, July 17, 2026, August 17, 2026,

September 17, 2026, October 19, 2026 and November 17, 2026

(the “final Review Date”)

Interest Payment Dates*: January 23, 2025, February 21,

2025, March 20, 2025, April 23, 2025, May 22, 2025, June 23,

2025, July 22, 2025, August 21, 2025, September 22, 2025,

October 22, 2025, November 20, 2025, December 22, 2025,

January 23, 2026, February 20, 2026, March 20, 2026, April 22,

2026, May 21, 2026, June 23, 2026, July 22, 2026, August 20,

2026, September 22, 2026, October 22, 2026 and the Maturity

Date

Maturity Date*: November 20, 2026

*Subject to postponement in the event of a market disruption event and

as described under “General Terms of Notes — Postponement of a

Determination Date — Notes Linked to Multiple Underlyings” and

“General Terms of Notes — Postponement of a Payment Date” in the

accompanying product supplement

Early Redemption:

We, at our election, may redeem the notes early, in whole but

not in part, on any of the Interest Payment Dates (other than the

first, second and final Interest Payment Dates) at a price, for

each $1,000 principal amount note, equal to (a) $1,000 plus (b)

the Contingent Interest Payment, if any, applicable to the

immediately preceding Review Date. If we intend to redeem

your notes early, we will deliver notice to The Depository Trust

Company, or DTC, at least three business days before the

applicable Interest Payment Date on which the notes are

redeemed early.

Payment at Maturity:

If the notes have not been redeemed early and the Final Value

of each Index is greater than or equal to its Trigger Value, you

will receive a cash payment at maturity, for each $1,000

principal amount note, equal to (a) $1,000 plus (b) the

Contingent Interest Payment, if any, applicable to the final

Review Date.

If the notes have not been redeemed early and the Final Value

of any Index is less than its Trigger Value, your payment at

maturity per $1,000 principal amount note will be calculated as

follows:

$1,000 + ($1,000 × Least Performing Index Return)

If the notes have not been redeemed early and the Final Value

of any Index is less than its Trigger Value, you will lose more

than 40.00% of your principal amount at maturity and could lose

all of your principal amount at maturity.

Least Performing Index: The Index with the Least Performing

Index Return

Least Performing Index Return: The lowest of the Index

Returns of the Indices

Index Return:

With respect to each Index,

(Final Value – Initial Value)

Initial Value

Initial Value: With respect to each Index, the closing level of

that Index on the Pricing Date, which was 10,917.77 for the

Nasdaq-100® Technology Sector IndexSM, 2,334.081 for the

Russell 2000® Index and 6,050.61 for the S&P 500® Index

Final Value: With respect to each Index, the closing level of

that Index on the final Review Date