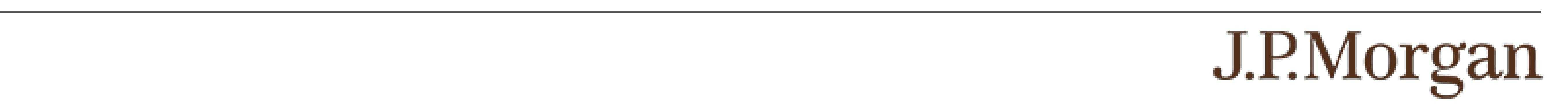

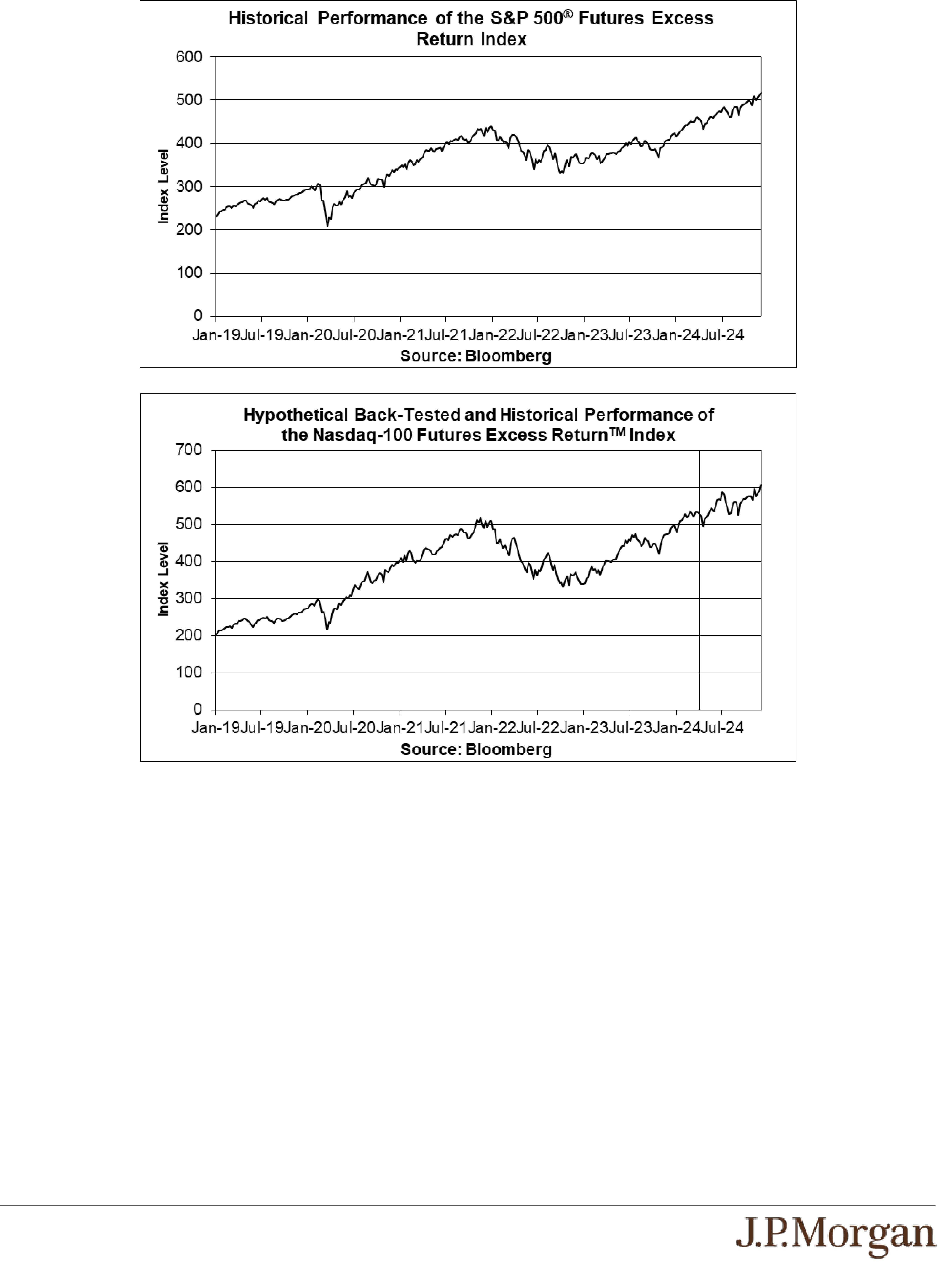

Risks Relating to the Indices

• JPMORGAN CHASE & CO. IS CURRENTLY ONE OF THE COMPANIES THAT MAKE UP THE S&P 500® INDEX AND THE

DOW JONES INDUSTRIAL AVERAGE®, THE INDICES UNDERLYING THE APPLICABLE UNDERLYING FUTURES

CONTRACTS OF THE S&P 500® FUTURES EXCESS RETURN INDEX AND THE DOW JONES INDUSTRIAL AVERAGE®

FUTURES EXCESS RETURN INDEX. RESPECTIVELY,

but JPMorgan Chase & Co. will not have any obligation to consider your interests in taking any corporate action that might affect

the level of the S&P 500® Futures Excess Return Index or the Dow Jones Industrial Average® Futures Excess Return Index.

• EACH INDEX IS SUBJECT TO SIGNIFICANT RISKS ASSOCIATED WITH THE APPLICABLE UNDERLYING FUTURES

CONTRACTS —

Each Index tracks the excess return of the applicable Underlying Futures Contracts (as defined under “The Indices” below). The

price of an Underlying Futures Contract depends not only on the level of the underlying index referenced by the Underlying Futures

Contract, but also on a range of other factors, including but not limited to the performance and volatility of the U.S. stock market,

corporate earnings reports, geopolitical events, governmental and regulatory policies and the policies of the exchange on which the

applicable Underlying Futures Contracts trade. In addition, the futures markets are subject to temporary distortions or other

disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government

regulation and intervention. These factors and others can cause the prices of the applicable Underlying Futures Contracts to be

volatile and could adversely affect the level of the Indices and any payments on, and the value of, your notes.

• SUSPENSION OR DISRUPTIONS OF MARKET TRADING IN THE APPLICABLE UNDERLYING FUTURES CONTRACTS MAY

ADVERSELY AFFECT THE VALUE OF YOUR NOTES —

Futures markets are subject to temporary distortions or other disruptions due to various factors, including lack of liquidity, the

participation of speculators, and government regulation and intervention. In addition, futures exchanges generally have regulations

that limit the amount of the applicable Underlying Futures Contract price fluctuations that may occur in a single day. These limits

are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a

result of those limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may

be made at a price beyond the limit, or trading may be limited for a set period of time. Limit prices have the effect of precluding

trading in a particular contract or forcing the liquidation of contracts at potentially disadvantageous times or prices. These

circumstances could delay the calculation of the level of each Index and could adversely affect the level of each Index and any

payments on, and the value of, your notes.

• THE PERFORMANCE OF EACH INDEX WILL DIFFER FROM THE PERFORMANCE OF THE INDEX UNDERLYING ITS

UNDERLYING FUTURES CONTRACTS —

A variety of factors can lead to a disparity between the performance of a futures contract on an equity index and the performance

of that equity index, including the expected dividend yields of the equity securities included in that equity index, an implicit financing

cost associated with futures contracts and policies of the exchange on which the futures contracts are traded, such as margin

requirements. Thus, a decline in expected dividends yields or an increase in margin requirements may adversely affect the

performance of each Index. In addition, the implicit financing cost will negatively affect the performance of each Index, with a

greater negative effect when market interest rates are higher. During periods of high market interest rates, each Index is likely to

underperform the equity index underlying its Underlying Futures Contracts, perhaps significantly.

• NEGATIVE ROLL RETURNS ASSOCIATED WITH THE APPLICABLE UNDERLYING FUTURES CONTRACTS MAY

ADVERSELY AFFECT THE LEVEL OF THE INDEX AND THE VALUE OF THE NOTES —

Each Index tracks the excess return of the applicable Underlying Futures Contracts. Unlike common equity securities, futures

contracts, by their terms, have stated expirations. As the exchange-traded Underlying Futures Contracts approach expiration, they

are replaced by contracts of the same series that have a later expiration. For example, an Underlying Futures Contract notionally

purchased and held in June may specify a September expiration date. As time passes, the contract expiring in September is

replaced by a contract for delivery in December. This is accomplished by notionally selling the September contract and notionally

purchasing the December contract. This process is referred to as “rolling.” Excluding other considerations, if prices are higher in

the distant delivery months than in the nearer delivery months, the notional purchase of the December contract would take place at

a price that is higher than the price of the September contract, thereby creating a negative “roll return.” Negative roll returns

adversely affect the returns of the applicable Underlying Futures Contracts and, therefore, the level of each Index and any

payments on, and the value of, the notes. Because of the potential effects of negative roll returns, it is possible for the level of

each Index to decrease significantly over time, even when the levels of the underlying index referenced by the applicable

Underlying Futures Contracts are stable or increasing. Relatively higher interest rates can result in more negative roll yields.

Accordingly, during periods of relatively higher interest rates, the likelihood that a roll return related to an Index will be negative, as