PS-8 | Structured Investments

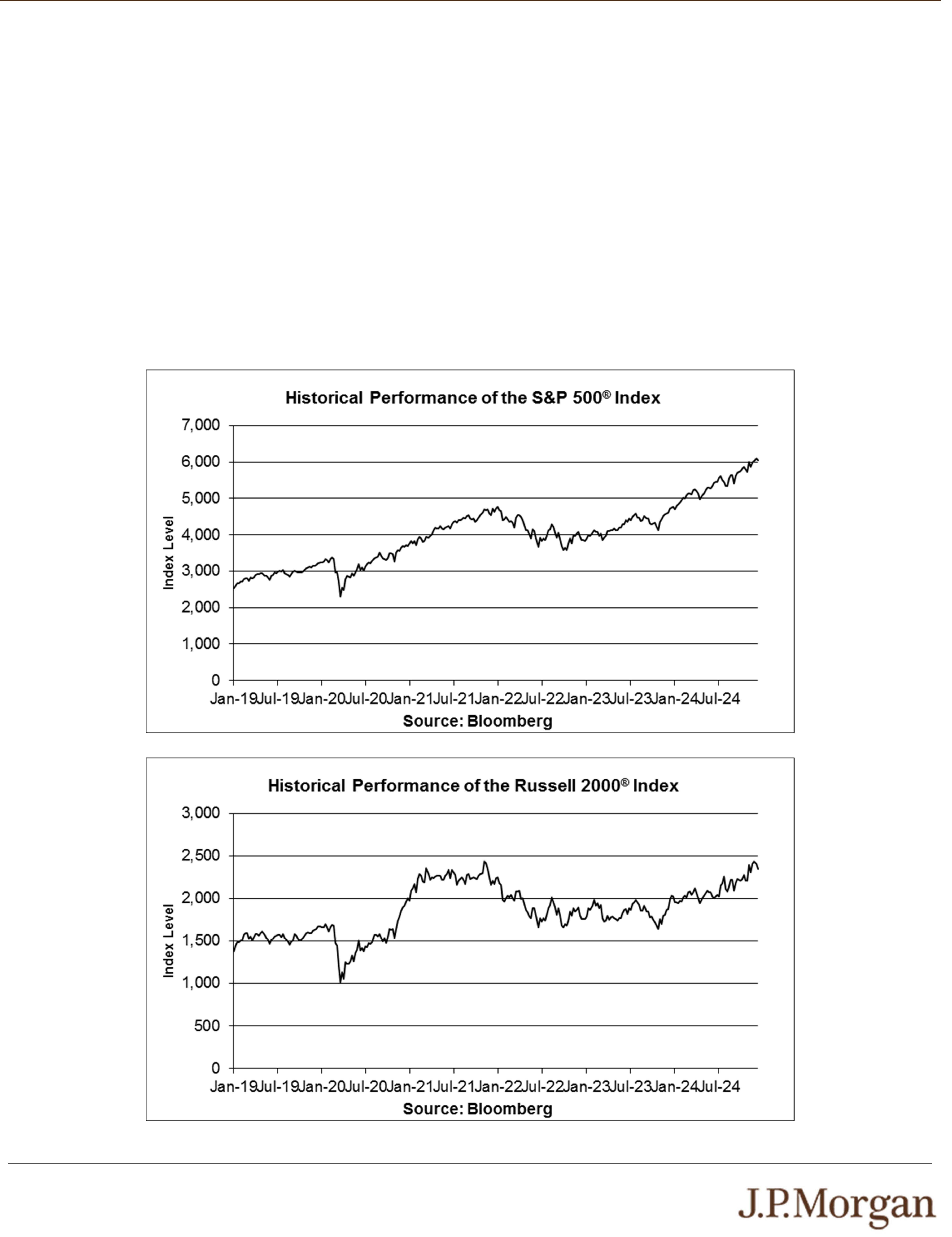

Yield Notes Linked to the Lesser Performing of the S&P 500

®

Index and the

Russell 2000

®

Index

Tax Treatment

You should review carefully the section entitled “Material U.S. Federal Income Tax Consequences” in the accompanying product

supplement no. 4-I. Based on the advice of Davis Polk & Wardwell LLP, our special tax counsel, and on current market conditions, in

determining our reporting responsibilities we intend to treat the notes for U.S. federal income tax purposes as units each consisting of:

(x) a cash-settled Put Option written by you that in circumstances where the payment due at maturity is less than $1,000 (excluding

accrued but unpaid interest), requires you to pay us an amount equal to that difference and (y) a Deposit of $1,000 per $1,000 principal

amount note to secure your potential obligation under the Put Option, as more fully described in “Material U.S. Federal Income Tax

Consequences — Tax Consequences to U.S. Holders — Notes Treated as Units Each Comprising a Put Option and a Deposit” in the

accompanying product supplement, and in particular in the subsection thereof entitled “— Notes with a Term of More than One Year.”

By purchasing the notes, you agree (in the absence of an administrative determination or judicial ruling to the contrary) to follow this

treatment and the allocation described in the following paragraph. However, there are other reasonable treatments that the IRS or a

court may adopt, in which case the timing and character of any income or loss on the notes could be materially and adversely affected.

In addition, in 2007 Treasury and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid

forward contracts” and similar instruments. The notice focuses on a number of issues, the most relevant of which for investors in the

notes are the character of income or loss (including whether the Put Premium might be currently included as ordinary income) and the

degree, if any, to which income realized by non-U.S. investors should be subject to withholding tax. While it is not clear whether the

notes would be viewed as similar to the typical prepaid forward contract described in the notice, it is possible that any Treasury

regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect.

We will determine the portion of each Interest Payment on the notes that we will allocate to interest on the Deposit and to Put Premium,

respectively, and will provide that allocation in the pricing supplement for the notes. If the notes had priced on December 20, 2024 we

would have allocated approximately 74.62% of each Interest Payment to interest on the Deposit and the remainder to Put Premium.

The actual allocation that we will determine for the notes may differ from this hypothetical allocation, and will depend upon a variety of

factors, including actual market conditions and our borrowing costs for debt instruments of comparable maturities on the Pricing Date.

Assuming that the treatment of the notes as units each comprising a Put Option and a Deposit is respected, amounts treated as interest

on the Deposit will be taxed as ordinary income, while the Put Premium will not be taken into account prior to sale or settlement.

Section 871(m) of the Code and Treasury regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding

tax (unless an income tax treaty applies) on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain

financial instruments linked to U.S. equities or indices that include U.S. equities. Section 871(m) provides certain exceptions to this

withholding regime, including for instruments linked to certain broad-based indices that meet requirements set forth in the applicable

Treasury regulations. Additionally, a recent IRS notice excludes from the scope of Section 871(m) instruments issued prior to January

1, 2027 that do not have a delta of one with respect to underlying securities that could pay U.S.-source dividends for U.S. federal

income tax purposes (each an “Underlying Security”). Based on certain determinations made by us, we expect that Section 871(m) will

not apply to the notes with regard to Non-U.S. Holders. Our determination is not binding on the IRS, and the IRS may disagree with

this determination. Section 871(m) is complex and its application may depend on your particular circumstances, including whether you

enter into other transactions with respect to an Underlying Security. If necessary, further information regarding the potential application

of Section 871(m) will be provided in the pricing supplement for the notes. You should consult your tax adviser regarding the potential

application of Section 871(m) to the notes.

The discussions above and in the accompanying product supplement do not address the consequences to taxpayers subject to special

tax accounting rules under Section 451(b) of the Code. You should consult your tax adviser regarding all aspects of the U.S. federal

income tax consequences of an investment in the notes, including possible alternative treatments and the issues presented by the 2007

notice. Purchasers who are not initial purchasers of notes at the issue price should also consult their tax advisers with respect to the

tax consequences of an investment in the notes, including possible alternative treatments, as well as the allocation of the purchase

price of the notes between the Deposit and the Put Option.

The Estimated Value of the Notes

The estimated value of the notes set forth on the cover of this pricing supplement is equal to the sum of the values of the following

hypothetical components: (1) a fixed-income debt component with the same maturity as the notes, valued using the internal funding

rate described below, and (2) the derivative or derivatives underlying the economic terms of the notes. The estimated value of the

notes does not represent a minimum price at which JPMS would be willing to buy your notes in any secondary market (if any exists) at

any time. The internal funding rate used in the determination of the estimated value of the notes may differ from the market-implied

funding rate for vanilla fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference