PS-1 | Structured Investments

Step-Up Auto Callable Notes Linked to the S&P

®

Global 100 PR 5% Daily

Risk Control 0.5% Deduction Index (USD) ER

Key Terms

Issuer: JPMorgan Chase Financial Company LLC, a direct,

wholly owned finance subsidiary of JPMorgan Chase & Co.

Guarantor: JPMorgan Chase & Co.

Index: The S&P

®

Global 100 PR 5% Daily Risk Control 0.5%

Deduction Index (USD) ER (Bloomberg ticker: SPGLR5TE).

The level of the Index reflects a 0.50% per annum deduction

and a notional financing cost, in each case, deducted daily.

Call Premium Amount: The Call Premium Amount with

respect to each Review Date is set forth below:

• first Review Date: 12.00% × $1,000

• second Review Date: 24.00% × $1,000

• third Review Date: 36.00% × $1,000

• fourth Review Date: 48.00% × $1,000

• fifth Review Date: 60.00% × $1,000

• sixth Review Date: 72.00% × $1,000

Call Value: The Call Value for each Review Date is set forth

below:

• first Review Date: 101.00% of the Initial Value

• second Review Date: 102.00% of the Initial Value

• third Review Date: 103.00% of the Initial Value

• fourth Review Date: 104.00% of the Initial Value

• fifth Review Date: 105.00% of the Initial Value

• sixth Review Date: 106.00% of the Initial Value

Participation Rate: 100.00%

Pricing Date: December 19, 2024

Original Issue Date (Settlement Date): On or about

December 24, 2024

Review Dates*: December 23, 2025, December 21, 2026,

December 20, 2027, December 19, 2028, December 19, 2029,

December 19, 2030 and December 19, 2031 (final Review

Date)

Call Settlement Dates*: December 26, 2025, December 24,

2026, December 23, 2027, December 22, 2028, December 24,

2029 and December 24, 2030

Maturity Date*: December 24, 2031

* Subject to postponement in the event of a market disruption

event and as described under “General Terms of Notes —

Postponement of a Determination Date — Notes Linked to a Single

Underlying — Notes Linked to a Single Underlying (Other Than a

Commodity Index)” and “General Terms of Notes — Postponement

of a Payment Date” in the accompanying product supplement

Automatic Call

†

:

If the closing level of the Index on any Review Date (other than

the final Review Date) is greater than or equal to the Call Value

for that Review Date, the notes will be automatically called for

a cash payment, for each $1,000 principal amount note, equal

to (a) $1,000 plus (b) the Call Premium Amount applicable to

that Review Date, payable on the applicable Call Settlement

Date. No further payments will be made on the notes.

If the notes are automatically called, you will not benefit from

the feature that provides you with a positive return at maturity

equal to the Index Return times the Participation Rate if the

Final Value is greater than the Initial Value. Because this

feature does not apply to the payment upon an automatic call,

the payment upon an automatic call may be significantly less

than the payment at maturity for the same level of appreciation

in the Index.

Payment at Maturity

†

:

If the notes have not been automatically called, at maturity, you

will receive a cash payment, for each $1,000 principal amount

note, of $1,000 plus the Additional Amount, which may be

zero.

If the notes have not been automatically called, you are entitled

to repayment of principal in full at maturity, subject to the credit

risks of JPMorgan Financial and JPMorgan Chase & Co.

Additional Amount

†

: If the notes have not been automatically

called, the Additional Amount payable at maturity per $1,000

principal amount note will equal:

$1,000 × Index Return × Participation Rate,

provided that the Additional Amount will not be less than zero.

Index Return:

(Final Value – Initial Value)

Initial Value

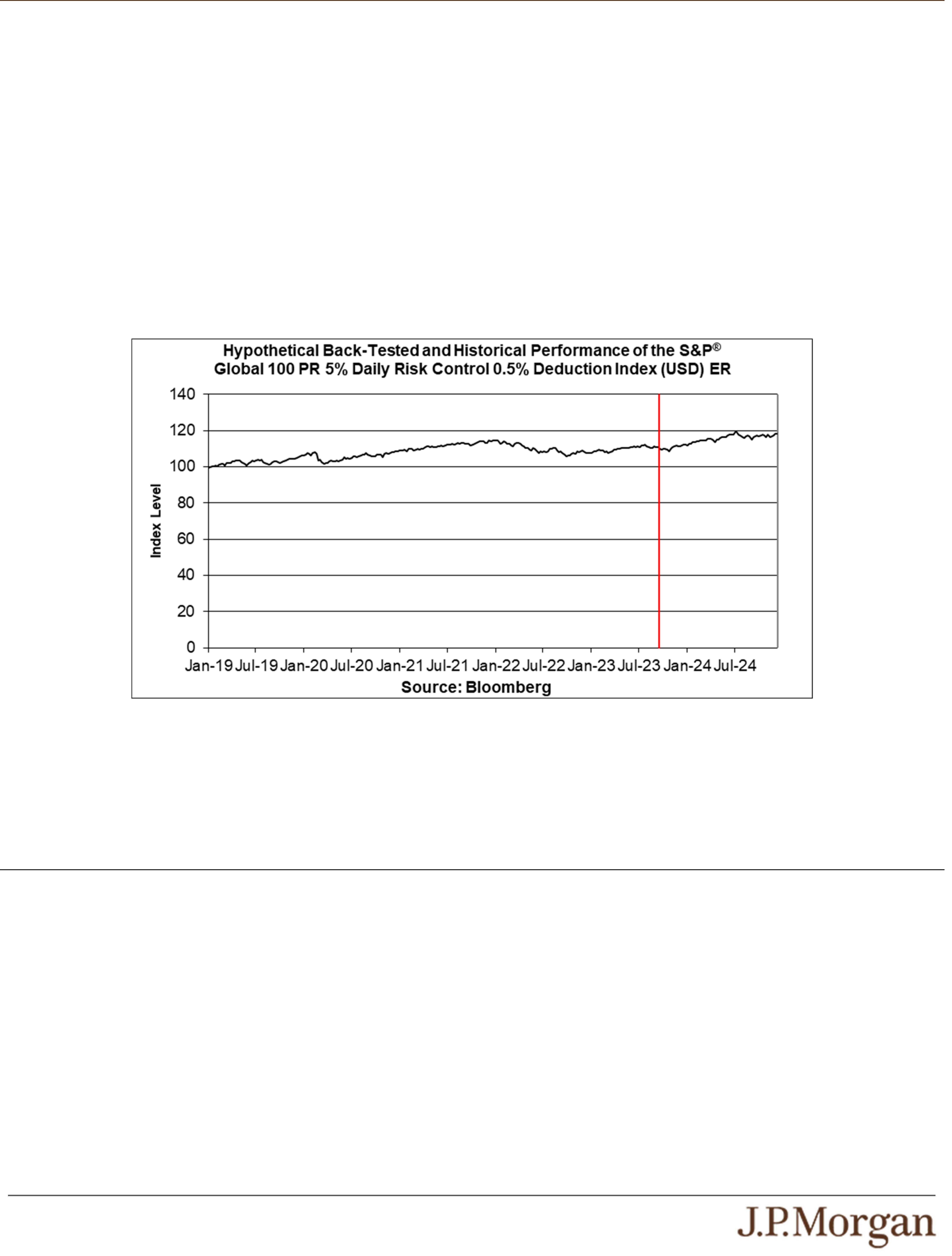

Initial Value: The closing level of the Index on the Pricing

Date, which was 117.16

Final Value: The closing level of the Index on the final Review

Date

† Subject to the impact of a change-in-law event as described under

“General Terms of Notes — Consequences of a Change-in-Law Event”

in the accompanying product supplement. In the event of a change-in-

law event, we have the right, but not the obligation, to cause the

calculation agent to determine on the change-in-law date, as defined in

the accompanying product supplement, the payment at maturity.

Under these circumstances, the notes will no longer be subject to

automatic call and the payment at maturity will be determined prior to,

and without regard to the closing level of the Index on, the final Review

Date.