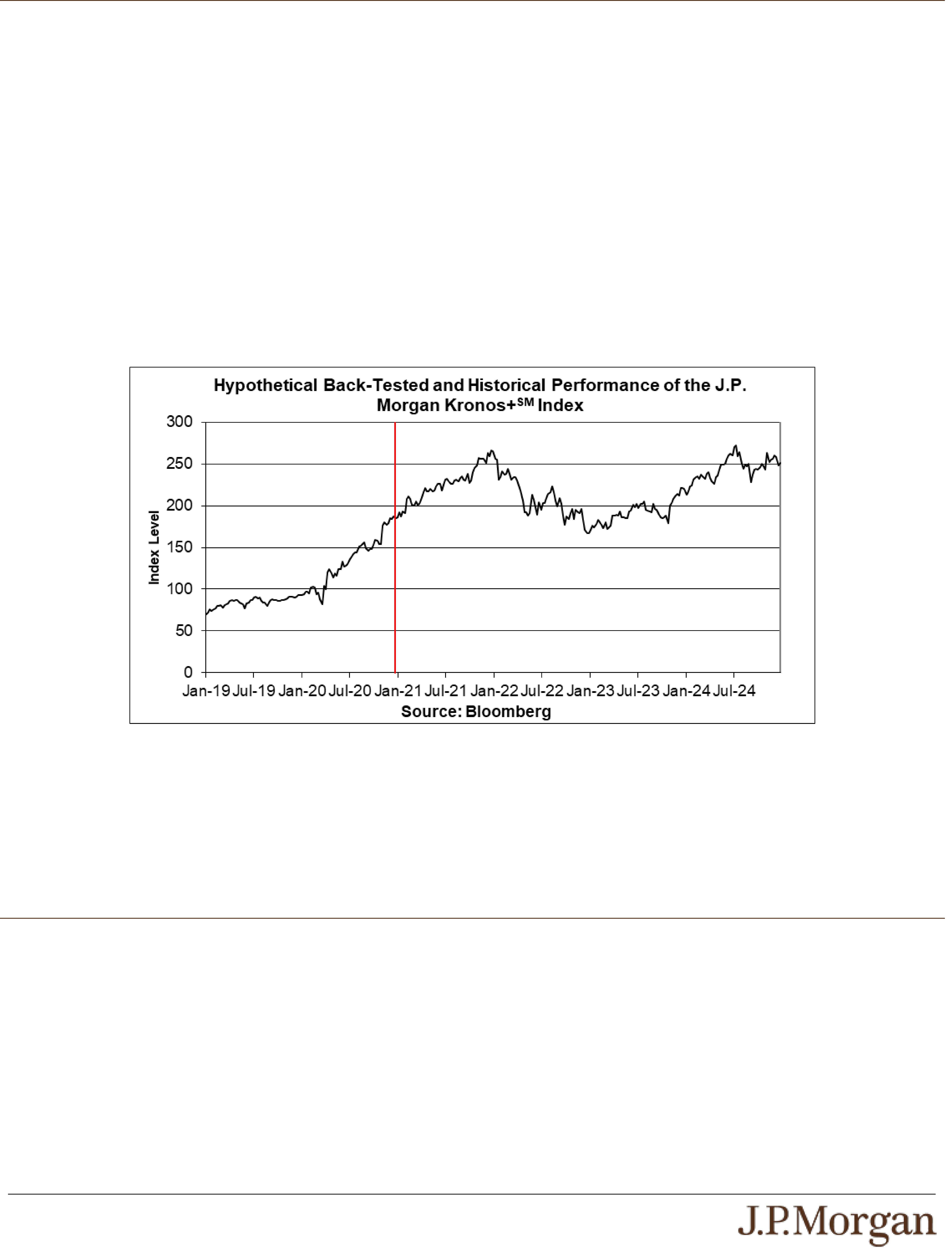

it has been decreasing and has tended to decrease if it has been increasing. There can be no assurance that this mean reverting effect

will be observed regularly or at all in the future or that any instances of mean reversion observed in the future will exceed any instances

of momentum in the future.

It has been theorized that this effect might be due in part to month-end rebalancing flows from investors targeting fixed portfolio weights

of equities securities included in the Constituent. An investor seeking to apply fixed portfolio weights may determine to sell assets that

have increased in value (which may cause the value of those assets to decline) and buy assets that have decreased in value (which

may cause the value of those assets to increase) in order to return those assets to their target fixed portfolio weights. However, other

unidentified factors might contribute to or be primarily responsible for this effect, and there can be no assurance that any factor will

continue to exist or continue to cause this effect.

Index construction. The Index generally provides a fully-invested (i.e., 100%) exposure to the Constituent (subject to the Index

Deduction), but that exposure may be increased to a leveraged long 200% exposure (with an accompanying notional financing cost) or

decreased to 0% (with a notional cash return), in which case the Index will be uninvested, during portions of each month in order to

implement the Index’s strategies described below, in each case, subject to modification in the event of a market disruption:

● Turn-of-the-month strategy: For the first four days of each calendar month on which the New York Stock Exchange is

scheduled to open for trading for its regular trading session (each, an “Index Business Day”), the Index will provide a

leveraged exposure to the Constituent (with an accompanying notional financing cost). The Index will also seek to apply the

turn-of-the-month strategy for the last two Index Business Days of each calendar month, but the exposure to the Constituent

during that period is also subject to the month-end mean reversion strategy as described below.

● Options expiry momentum strategy: If the closing level of the Constituent on the fifth Index Business Day immediately

preceding the Saturday following the third Friday of each calendar month (the third Friday of each calendar month is typically

the scheduled monthly expiry of U.S. equity and equity index option contracts, including on the Constituent) is greater than the

closing level of the Constituent on the Index Business Day immediately following the third Friday of the prior calendar month,

the Index will provide a leveraged exposure to the Constituent (with an accompanying notional financing cost) for the four

Index Business Days ending on the Index Business Day after the third Friday of the current calendar month. If the closing

level of the Constituent on the fifth Index Business Day immediately preceding the Saturday following the third Friday of each

calendar month is less than the closing level of the Constituent on the Index Business Day immediately following the third

Friday of the prior calendar month, the Index will be uninvested (with a notional cash return) for the four Index Business Days

ending on the Index Business Day after the third Friday of the current calendar month.

● Month-end mean reversion strategy: If the closing level of the Constituent on the seventh Index Business Day immediately

preceding the last Index Business Day of the calendar month is greater than the closing level of the Constituent on the last

Index Business Day of the immediately preceding calendar month, the Index will be uninvested (with a notional cash return) for

the four Index Business Days immediately preceding the final two Index Business Days of the month and, due to the turn-of-

the-month strategy, the Index will be fully invested in the Constituent for the final two Index Business Days of the month. If the

closing level of the Constituent on the seventh Index Business Day immediately preceding the last Index Business Day of the

calendar month is less than the closing level of the Constituent on the last Index Business Day of the immediately preceding

calendar month, the Index will provide a leveraged exposure to the Constituent (with an accompanying notional financing cost)

for the final six Index Business Days of the month. The exposure to the Constituent is capped at 200%, so it will not exceed

200% even during the period when the turn-of-the-month strategy and the month-end mean reversion strategy overlap.

Calculating the level of the Index. On any given day, the closing level of the Index (the “Index Level”) reflects (a) (i) the price

performance of the Constituent (i.e., dividends, if any, are not reflected), (ii) a notional cash return, or (iii) 200% of the price

performance of the Constituent (i.e., dividends, if any, are not reflected) less a notional financing cost with respect to the leveraged

portion of the exposure, in each case less (b) the Index Deduction of 0.95% per annum. The Index Level was set equal to 0.05 on July

7, 1954, the base date of the Index.

The notional cash return is intended to approximate interest that could be earned when the Index provides no exposure to the

Constituent, and the notional financing cost is intended to approximate the cost of using borrowed funds for the leveraged portion. The

notional cash return and the notional financing cost are each currently calculated by reference to the Effective Federal Funds Rate.

The Effective Federal Funds Rate is a measure of the interest rate at which depository institutions lend balances at the Federal

Reserve to other depository institutions overnight, calculated as the volume-weighted median of overnight federal funds transactions

reported by U.S. banks and U.S. branches and agencies of non-U.S. banks, and is quoted on the basis of an assumed year of 360

days. Assuming a positive Effective Federal Funds Rate, the notional cash return will have a positive effect on the performance of the

Index when the exposure to the Constituent is 0%, and the notional financing cost will have a negative effect on the performance of the

Index when the exposure to the Constituent is 200%.