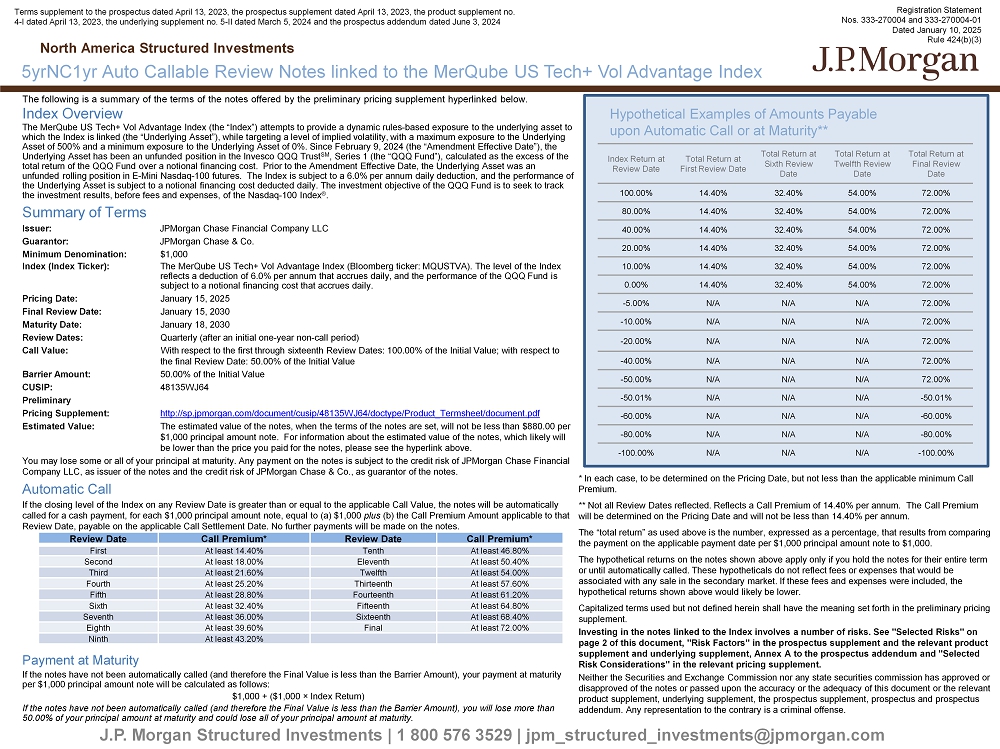

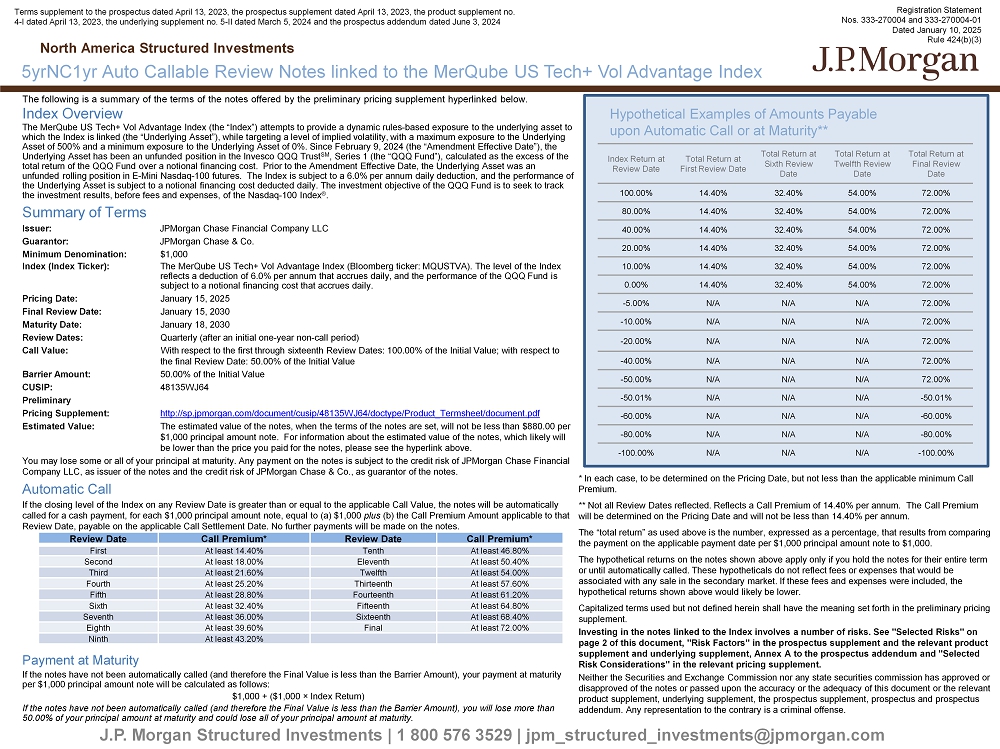

The following is a summary of the terms of the notes offered by the preliminary pricing supplement hyperlinked below. Index Overview The MerQube US Tech+ Vol Advantage Index (the “Index”) attempts to provide a dynamic rules - based exposure to the underlying asset to which the Index is linked (the “Underlying Asset”), while targeting a level of implied volatility, with a maximum exposure to th e Underlying Asset of 500% and a minimum exposure to the Underlying Asset of 0%. Since February 9, 2024 (the “Amendment Effective Date”), the Underlying Asset has been an unfunded position in the Invesco QQQ Trust SM , Series 1 (the “QQQ Fund”), calculated as the excess of the total return of the QQQ Fund over a notional financing cost. Prior to the Amendment Effective Date, the Underlying Asset was an unfunded rolling position in E - Mini Nasdaq - 100 futures. The Index is subject to a 6.0% per annum daily deduction, and the perfo rmance of the Underlying Asset is subject to a notional financing cost deducted daily. The investment objective of the QQQ Fund is to s eek to track the investment results, before fees and expenses, of the Nasdaq - 100 Index ® . Summary of Terms Issuer: JPMorgan Chase Financial Company LLC Guarantor: JPMorgan Chase & Co. Minimum Denomination: $1,000 Index (Index Ticker): The MerQube US Tech+ Vol Advantage Index (Bloomberg ticker: MQUSTVA). The level of the Index reflects a deduction of 6.0% per annum that accrues daily, and the performance of the QQQ Fund is subject to a notional financing cost that accrues daily. Pricing Date: January 15, 2025 Final Review Date: January 15, 2030 Maturity Date: January 18, 2030 Review Dates: Quarterly (after an initial one - year non - call period) Call Value: With respect to the first through sixteenth Review Dates: 100.00% of the Initial Value; with respect to the final Review Date: 50.00% of the Initial Value Barrier Amount: 50.00% of the Initial Value CUSIP: 48135WJ64 Preliminary Pricing Supplement: http://sp.jpmorgan.com/document/cusip/48135WJ64/doctype/Product_Termsheet/document.pdf Estimated Value: The estimated value of the notes, when the terms of the notes are set, will not be less than $880.00 per $1,000 principal amount note. For information about the estimated value of the notes, which likely will be lower than the price you paid for the notes, please see the hyperlink above. You may lose some or all of your principal at maturity. Any payment on the notes is subject to the credit risk of JPMorgan Ch ase Financial Company LLC, as issuer of the notes and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. Automatic Call If the closing level of the Index on any Review Date is greater than or equal to the applicable Call Value, the notes will be au tomatically called for a cash payment, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Call Premium Amount applicable to that Review Date, payable on the applicable Call Settlement Date. No further payments will be made on the notes. Payment at Maturity If the notes have not been automatically called (and therefore the Final Value is less than the Barrier Amount), your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 î Index Return) If the notes have not been automatically called (and therefore the Final Value is less than the Barrier Amount), you will los e m ore than 50.00% of your principal amount at maturity and could lose all of your principal amount at maturity. J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_investments@jpmorgan.com 5yrNC1yr Auto Callable Review Notes linked to the MerQube US Tech+ Vol Advantage Index North America Structured Investments Total Return at Final Review Date Total Return at Twelfth Review Date Total Return at Sixth Review Date Total Return at First Review Date Index Return at Review Date 72.00% 54.00% 32.40% 14.40% 100.00% 72.00% 54.00% 32.40% 14.40% 80.00% 72.00% 54.00% 32.40% 14.40% 40.00% 72.00% 54.00% 32.40% 14.40% 20.00% 72.00% 54.00% 32.40% 14.40% 10.00% 72.00% 54.00% 32.40% 14.40% 0.00% 72.00% N/A N/A N/A - 5.00% 72.00% N/A N/A N/A - 10.00% 72.00% N/A N/A N/A - 20.00% 72.00% N/A N/A N/A - 40.00% 72.00% N/A N/A N/A - 50.00% - 50.01% N/A N/A N/A - 50.01% - 60.00% N/A N/A N/A - 60.00% - 80.00% N/A N/A N/A - 80.00% - 100.00% N/A N/A N/A - 100.00% * In each case, to be determined on the Pricing Date, but not less than the applicable minimum Call Premium. ** Not all Review Dates reflected. Reflects a Call Premium of 14.40% per annum. The Call Premium will be determined on the Pricing Date and will not be less than 14.40% per annum. The “total return” as used above is the number, expressed as a percentage, that results from comparing the payment on the applicable payment date per $1,000 principal amount note to $1,000. The hypothetical returns on the notes shown above apply only if you hold the notes for their entire term or until automatically called. These hypotheticals do not reflect fees or expenses that would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical returns shown above would likely be lower. Capitalized terms used but not defined herein shall have the meaning set forth in the preliminary pricing supplement. Investing in the notes linked to the Index involves a number of risks. See "Selected Risks" on page 2 of this document, "Risk Factors" in the prospectus supplement and the relevant product supplement and underlying supplement, Annex A to the prospectus addendum and "Selected Risk Considerations" in the relevant pricing supplement. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this document or the relevant product supplement, underlying supplement, the prospectus supplement, prospectus and prospectus addendum. Any representation to the contrary is a criminal offense. Terms supplement to the prospectus dated April 13, 2023, the prospectus supplement dated April 13, 2023, the product suppleme nt no. 4 - I dated April 13, 2023, the underlying supplement no. 5 - II dated March 5, 2024 and the prospectus addendum dated June 3, 2024 Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 Dated January 10, 2025 Rule 424(b)(3) Call Premium* Review Date Call Premium* Review Date At least 46.80% Tenth At least 14.40 % First At least 50.40% Eleventh At least 18.00 % Second At least 54.00% Twelfth At least 21.60% Third At least 57.60% Thirteenth At least 25.20% Fourth At least 61.20% Fourteenth At least 28.80% Fifth At least 64.80% Fifteenth At least 32.40% Sixth At least 68.40% Sixteenth At least 36.00% Seventh At least 72.00% Final At least 39.60% Eighth At least 43.20% Ninth Hypothetical Examples of Amounts Payable upon Automatic Call or at Maturity**

J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_investments@jpmorgan.com Selected Risks Risks Relating to the Notes Generally • Your investment in the notes may result in a loss. The notes do not guarantee any return of principal. • The level of the Index will include a 6.0% per annum daily deduction. • Any payment on the notes is subject to the credit risks of JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co. Therefore the value of the notes prior to maturity will be subject to changes in the market’s view of the creditworthiness of JPMorgan Chase Financial Company LLC or JPMorgan Chase & Co. • As a finance subsidiary, JPMorgan Chase Financial Company LLC has no independent operations and has limited assets. • The appreciation potential of the notes is limited to any Call Premium Amount paid on the notes. • The benefit provided by the Barrier Amount may terminate on the final Review Date. • The automatic call feature may force a potential early exit. • No interest payments, dividend payments or voting rights. • Lack of liquidity: J.P. Morgan Securities LLC (who we refer to as “JPMS”) intends to offer to purchase the notes in the secondary market but is not required to do so. The price, if any, at which JPMS will be willing to purchase notes from you in the secondary market, if at all, may result in a significant loss of your principal. • The tax consequences of the notes may be uncertain. You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the notes. Risks Relating to Conflicts of Interest • Potential conflicts: We and our affiliates play a variety of roles in connection with the issuance of notes, including acting as calculation agent and hedging our obligations under the notes, and making the assumptions used to determine the pricing of the notes and the estimated value of the notes when the terms of the notes are set. It is possible that such hedging or other trading activities of J.P. Morgan or its affiliates could result in substantial returns for J.P. Morgan and its affiliates while the value of the notes declines. • Our affiliate, JPMS, worked with MerQube in developing the guidelines and policies governing the composition and calculation of the Index. Selected Risks (continued) Risks Relating to the Estimated Value and Secondary Market Prices of the Notes • The estimated value of the notes will be lower than the original issue price (price to public) of the notes. • The estimated value of the notes does not represent future values and may differ from others’ estimates. • The estimated value of the notes is determined by reference to an internal funding rate. • The value of the notes, which may be reflected in customer account statements, may be higher than the then current estimated value of the notes for a limited time period. Risks Relating to the Index • The Index Sponsor may adjust the Index in a way that affects its level, and the Index Sponsor has no obligation to consider your interests. • The Index may not be successful or outperform any alternative strategy that might be employed in respect of the Underlying Asset. • The Index may not approximate its target volatility. • The Index is subject to risks associated with the use of significant leverage. • The Index may be significantly uninvested. • An investment in the notes will be subject to risks associated with non - U.S. securities. • The QQQ Fund is subject to management risk. • The performance and market value of the QQQ Fund, particularly during periods of market volatility, may not correlate with the performance of the QQQ Fund’s underlying index as well as the net asset value per share. • Hypothetical back - tested data relating to the Index do not represent actual historical data and are subject to inherent limitations, and the historical and hypothetical back - tested performance of the Index are not indications of its future performance. • The Index was established on June 22, 2021 and may perform in unanticipated ways. Additional Information Any information relating to performance contained in these materials is illustrative and no assurance is given that any indic ati ve returns, performance or results, whether historical or hypothetical, will be achieved. These terms are subject to change, and J.P. Morgan undertakes no duty to update this information. This document shall be amended, s upe rseded and replaced in its entirety by a subsequent preliminary pricing supplement and/or pricing supplement, and the documents referred to therein. In the event any inconsistency between the information pres ent ed herein and any such preliminary pricing supplement and/or pricing supplement, such preliminary pricing supplement and/or pricing supplement shall govern. Past performance, and especially hypothetical back - tested performance, is not indicative of future results. Actual performance m ay vary significantly from past performance or any hypothetical back - tested performance. This type of information has inherent limitations and you should carefully consider these limitations before placing reliance on such information. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion o f U .S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with JPMorgan Cha se & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax - related penalties. Investment suitability must be determined individually for each investor, and the financial instruments described herein may not be suitable for all investors. This information is not intended to provide and should not be relied upon as providing accounting, legal, regulatory or tax advice. Investors should consult with their own advisers as to the se matters. This material is not a product of J.P. Morgan Research Departments. North America Structured Investments 5yrNC1yr Auto Callable Review Notes linked to the MerQube US Tech+ Vol Advantage Index The risks identified above are not exhaustive. Please see “Risk Factors” in the prospectus supplement and the applicable prod uct supplement and underlying supplement, Annex A to the prospectus addendum and “Selected Risk Considerations” in the applicable preliminary pricing supplement for additional information.