● RISKS ASSOCIATED WITH THE UTILITIES SECTOR WITH RESPECT TO THE FUND —

All or substantially all of the equity securities held by the Fund are issued by companies whose primary line of business is directly

associated with the utilities sector. As a result, the value of the notes may be subject to greater volatility and be more adversely

affected by a single economic, political or regulatory occurrence affecting this sector than a different investment linked to securities

of a more broadly diversified group of issuers. Utility companies are affected by supply and demand, operating costs, government

regulation, environmental factors, liabilities for environmental damage and general civil liabilities and rate caps or rate changes.

Although rate changes of a regulated utility usually fluctuate in approximate correlation with financing costs, due to political and

regulatory factors, rate changes ordinarily occur only following a delay after the changes in financing costs. This factor will tend to

favorably affect a regulated utility company’s earnings and dividends in times of decreasing costs, but conversely, will tend to

adversely affect earnings and dividends when costs are rising. The value of regulated utility equity securities may tend to have an

inverse relationship to the movement of interest rates. Certain utility companies have experienced full or partial deregulation in

recent years. These utility companies are frequently more similar to industrial companies in that they are subject to greater

competition and have been permitted by regulators to diversify outside of their original geographic regions and their traditional lines

of business. These opportunities may permit certain utility companies to earn more than their traditional regulated rates of return.

Some companies, however, may be forced to defend their core business and may be less profitable. In addition, natural disasters,

terrorist attacks, government intervention or other factors may render a utility company’s equipment unusable or obsolete and

negatively impact profitability. Among the risks that may affect utility companies are the following: risks of increases in fuel and

other operating costs; the high cost of borrowing to finance capital construction during inflationary periods; restrictions on

operations and increased costs and delays associated with compliance with environmental and nuclear safety regulations; and the

difficulties involved in obtaining natural gas for resale or fuel for generating electricity at reasonable prices. Other risks include

those related to the construction and operation of nuclear power plants, the effects of energy conservation and the effects of

regulatory changes. These factors could affect the utilities sector and could affect the value of the equity securities held by the

Fund and the price of the Fund during the term of the notes, which may adversely affect the value of your notes.

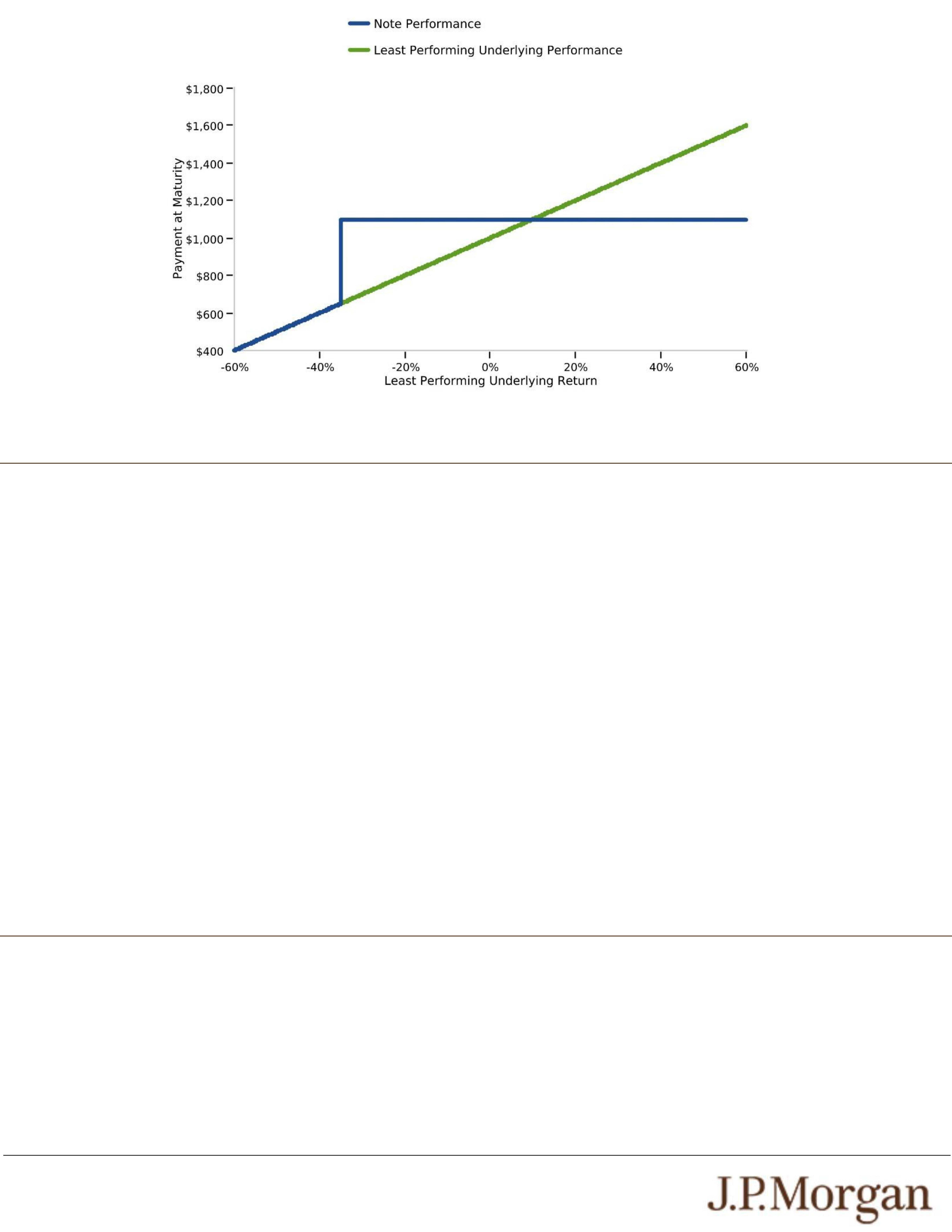

● YOU ARE EXPOSED TO THE RISK OF DECLINE IN THE VALUE OF EACH UNDERLYING —

Payments on the notes are not linked to a basket composed of the Underlyings and are contingent upon the performance of each

individual Underlying. Poor performance by any of the Underlyings over the term of the notes may negatively affect your payment

at maturity and will not be offset or mitigated by positive performance by any other Underlying.

● YOUR PAYMENT AT MATURITY WILL BE DETERMINED BY THE LEAST PERFORMING UNDERLYING.

● THE BENEFIT PROVIDED BY THE BARRIER AMOUNT MAY TERMINATE ON THE OBSERVATION DATE —

If the Final Value of any Underlying is less than its Barrier Amount, the benefit provided by the Barrier Amount will terminate and

you will be fully exposed to any depreciation of the Least Performing Underlying.

● THE NOTES DO NOT PAY INTEREST.

● YOU WILL NOT RECEIVE DIVIDENDS ON THE FUND OR THE SECURITIES INCLUDED IN OR HELD BY ANY UNDERLYING

OR HAVE ANY RIGHTS WITH RESPECT TO THE FUND OR THOSE SECURITIES.

● THE ANTI-DILUTION PROTECTION FOR THE FUND IS LIMITED —

The calculation agent will make adjustments to the Share Adjustment Factor for certain events affecting the shares of the Fund.

However, the calculation agent will not make an adjustment in response to all events that could affect the shares of the Fund. If an

event occurs that does not require the calculation agent to make an adjustment, the value of the notes may be materially and

adversely affected.

● THE RISK OF THE CLOSING VALUE OF AN UNDERLYING FALLING BELOW ITS BARRIER AMOUNT IS GREATER IF THE

VALUE OF THAT UNDERLYING IS VOLATILE.

● LACK OF LIQUIDITY —

The notes will not be listed on any securities exchange. Accordingly, the price at which you may be able to trade your notes is likely

to depend on the price, if any, at which JPMS is willing to buy the notes. You may not be able to sell your notes. The notes are not

designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity.

● THE ESTIMATED VALUE OF THE NOTES IS LOWER THAN THE ORIGINAL ISSUE PRICE (PRICE TO PUBLIC) OF THE

NOTES —

The estimated value of the notes is only an estimate determined by reference to several factors. The original issue price of the

notes exceeds the estimated value of the notes because costs associated with selling, structuring and hedging the notes are

included in the original issue price of the notes. These costs include the selling commissions, the projected profits, if any, that our

affiliates expect to realize for assuming risks inherent in hedging our obligations under the notes and the estimated cost of hedging

our obligations under the notes. See “The Estimated Value of the Notes” in this pricing supplement.

● THE ESTIMATED VALUE OF THE NOTES DOES NOT REPRESENT FUTURE VALUES OF THE NOTES AND MAY DIFFER

FROM OTHERS’ ESTIMATES —

See “The Estimated Value of the Notes” in this pricing supplement.

● THE ESTIMATED VALUE OF THE NOTES IS DERIVED BY REFERENCE TO AN INTERNAL FUNDING RATE —

The internal funding rate used in the determination of the estimated value of the notes may differ from the market-implied funding

rate for vanilla fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference may

be based on, among other things, our and our affiliates’ view of the funding value of the notes as well as the higher issuance,

operational and ongoing liability management costs of the notes in comparison to those costs for the conventional fixed income

instruments of JPMorgan Chase & Co. This internal funding rate is based on certain market inputs and assumptions, which may

prove to be incorrect, and is intended to approximate the prevailing market replacement funding rate for the notes. The use of an

internal funding rate and any potential changes to that rate may have an adverse effect on the terms of the notes and any

secondary market prices of the notes. See “The Estimated Value of the Notes” in this pricing supplement.