Selected Risk Considerations

An investment in the notes involves significant risks. These risks are explained in more detail in the “Risk Factors” sections of the

accompanying prospectus supplement and product supplement and in Annex A to the accompanying prospectus addendum.

Risks Relating to the Notes Generally

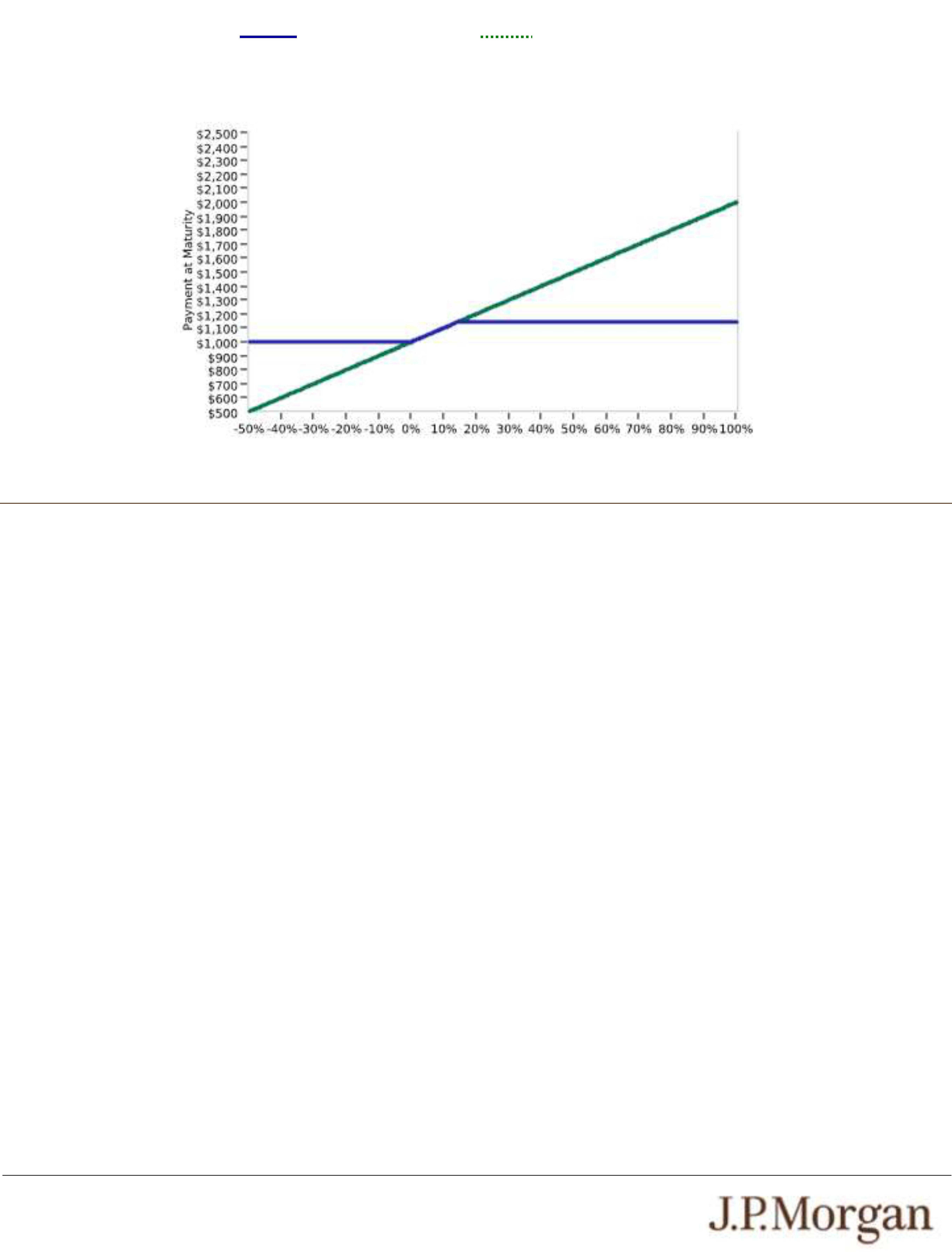

● THE NOTES MAY NOT PAY MORE THAN THE PRINCIPAL AMOUNT AT MATURITY —

If the Final Value is less than or equal to the Initial Value, you will receive only the principal amount of your notes at maturity, and

you will not be compensated for any loss in value due to inflation and other factors relating to the value of money over time.

● YOUR MAXIMUM GAIN ON THE NOTES IS LIMITED BY THE MAXIMUM AMOUNT,

regardless of any appreciation of the Index, which may be significant.

● CREDIT RISKS OF JPMORGAN FINANCIAL AND JPMORGAN CHASE & CO. —

Investors are dependent on our and JPMorgan Chase & Co.’s ability to pay all amounts due on the notes. Any actual or potential

change in our or JPMorgan Chase & Co.’s creditworthiness or credit spreads, as determined by the market for taking that credit

risk, is likely to adversely affect the value of the notes. If we and JPMorgan Chase & Co. were to default on our payment

obligations, you may not receive any amounts owed to you under the notes and you could lose your entire investment.

● AS A FINANCE SUBSIDIARY, JPMORGAN FINANCIAL HAS NO INDEPENDENT OPERATIONS AND HAS LIMITED ASSETS

—

As a finance subsidiary of JPMorgan Chase & Co., we have no independent operations beyond the issuance and administration of

our securities and the collection of intercompany obligations. Aside from the initial capital contribution from JPMorgan Chase &

Co., substantially all of our assets relate to obligations of JPMorgan Chase & Co. to make payments under loans made by us to

JPMorgan Chase & Co. or under other intercompany agreements. As a result, we are dependent upon payments from JPMorgan

Chase & Co. to meet our obligations under the notes. We are not a key operating subsidiary of JPMorgan Chase & Co. and in a

bankruptcy or resolution of JPMorgan Chase & Co. we are not expected to have sufficient resources to meet our obligations in

respect of the notes as they come due. If JPMorgan Chase & Co. does not make payments to us and we are unable to make

payments on the notes, you may have to seek payment under the related guarantee by JPMorgan Chase & Co., and that

guarantee will rank pari passu with all other unsecured and unsubordinated obligations of JPMorgan Chase & Co. For more

information, see the accompanying prospectus addendum.

● THE NOTES DO NOT PAY INTEREST.

● YOU WILL NOT RECEIVE DIVIDENDS ON THE SECURITIES INCLUDED IN THE INDEX OR HAVE ANY RIGHTS WITH

RESPECT TO THOSE SECURITIES.

● LACK OF LIQUIDITY —

The notes will not be listed on any securities exchange. Accordingly, the price at which you may be able to trade your notes is likely

to depend on the price, if any, at which JPMS is willing to buy the notes. You may not be able to sell your notes. The notes are not

designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity.

Risks Relating to Conflicts of Interest

● POTENTIAL CONFLICTS —

We and our affiliates play a variety of roles in connection with the notes. In performing these duties, our and JPMorgan Chase &

Co.’s economic interests are potentially adverse to your interests as an investor in the notes. It is possible that hedging or trading

activities of ours or our affiliates in connection with the notes could result in substantial returns for us or our affiliates while the

value of the notes declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product

supplement.

Risks Relating to the Estimated Value and Secondary Market Prices of the Notes

● THE ESTIMATED VALUE OF THE NOTES IS LOWER THAN THE ORIGINAL ISSUE PRICE (PRICE TO PUBLIC) OF THE

NOTES —

The estimated value of the notes is only an estimate determined by reference to several factors. The original issue price of the

notes exceeds the estimated value of the notes because costs associated with selling, structuring and hedging the notes are

included in the original issue price of the notes. These costs include the selling commissions, the projected profits, if any, that our

affiliates expect to realize for assuming risks inherent in hedging our obligations under the notes and the estimated cost of hedging

our obligations under the notes. See “The Estimated Value of the Notes” in this pricing supplement.

● THE ESTIMATED VALUE OF THE NOTES DOES NOT REPRESENT FUTURE VALUES OF THE NOTES AND MAY DIFFER

FROM OTHERS’ ESTIMATES —

See “The Estimated Value of the Notes” in this pricing supplement.

● THE ESTIMATED VALUE OF THE NOTES IS DERIVED BY REFERENCE TO AN INTERNAL FUNDING RATE —

The internal funding rate used in the determination of the estimated value of the notes may differ from the market-implied funding

rate for vanilla fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference may

be based on, among other things, our and our affiliates’ view of the funding value of the notes as well as the higher issuance,

operational and ongoing liability management costs of the notes in comparison to those costs for the conventional fixed income

instruments of JPMorgan Chase & Co. This internal funding rate is based on certain market inputs and assumptions, which may

prove to be incorrect, and is intended to approximate the prevailing market replacement funding rate for the notes. The use of an

internal funding rate and any potential changes to that rate may have an adverse effect on the terms of the notes and any

secondary market prices of the notes. See “The Estimated Value of the Notes” in this pricing supplement.