Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos. 333-270004 and 333-270004-01

Pricing Supplement to the Prospectus and Prospectus Supplement, each dated April 13, 2023, the Underlying Supplement No. 1-I

dated April 13, 2023, the Product Supplement No. 4-I dated April 13, 2023 and the Prospectus Addendum dated June 3, 2024

JPMorgan Chase Financial Company LLC

Medium-Term Notes, Series A

$3,144,000

Capped Buffered Enhanced Participation Equity Notes due 2025

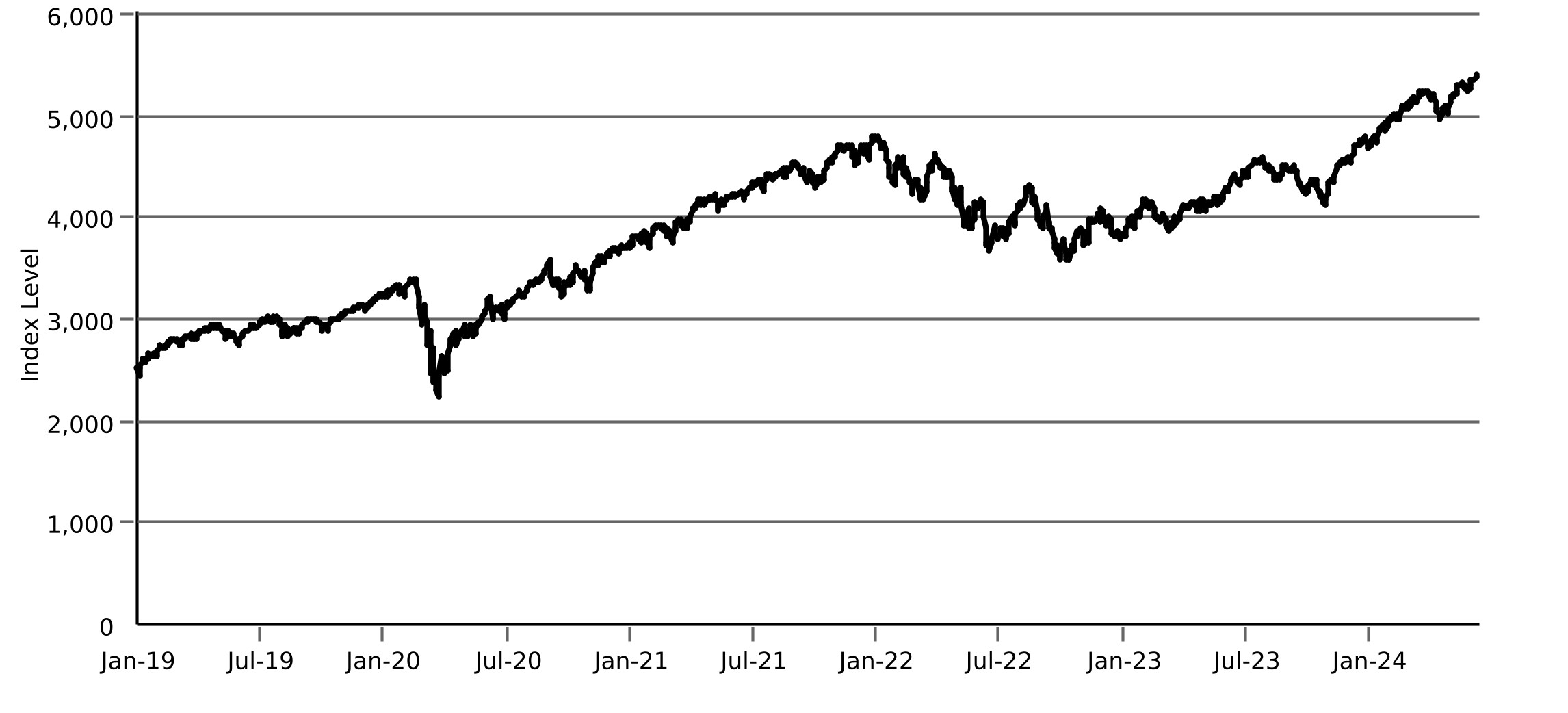

(Linked to the S&P 500® Index)

Fully and Unconditionally Guaranteed by JPMorgan Chase & Co.

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date (December 16, 2025, subject to adjustment) is based on the performance of the S&P 500® Index (which we refer to as the underlier) as measured from and including the trade date (June 12, 2024) to and including the determination date (December 12, 2025, subject to adjustment). If the final underlier level on the determination date is greater than the initial underlier level, the return on your notes will be positive, subject to the maximum settlement amount of $1,148.00 for each $1,000 principal amount note. If the final underlier level declines by up to 10.00% from the initial underlier level, you will receive the principal amount of your notes. If the final underlier level declines by more than 10.00% from the initial underlier level, the return on your notes will be negative. You could lose your entire investment in the notes. Any payment on the notes is subject to the credit risk of JPMorgan Chase Financial Company LLC (“JPMorgan Financial”), as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes.

To determine your payment at maturity, we will calculate the underlier return, which is the percentage increase or decrease in the final underlier level from the initial underlier level. On the stated maturity date, for each $1,000 principal amount note, you will receive an amount in cash equal to:

●if the underlier return is positive (the final underlier level is greater than the initial underlier level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 2.00 times (c) the underlier return, subject to the maximum settlement amount;

●if the underlier return is zero or negative but not below -10.00% (the final underlier level is equal to or less than the initial underlier level but not by more than 10.00%), $1,000; or

●if the underlier return is negative and is below -10.00% (the final underlier level is less than the initial underlier level by more than 10.00%), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) approximately 1.1111 times (c) the sum of the underlier return plus 10.00%. You will receive less than $1,000.

Your investment in the notes involves certain risks, including, among other things, our credit risk. See “Risk Factors” on page S-2 of the accompanying prospectus supplement, Annex A to the accompanying prospectus addendum, “Risk Factors” on page PS-11 of the accompanying product supplement and “Selected Risk Factors” on page PS-12 of this pricing supplement.

The foregoing is only a brief summary of the terms of your notes. You should read the additional disclosure provided herein so that you may better understand the terms and risks of your investment.

The estimated value of the notes, when the terms of the notes were set, was $977.70 per $1,000 principal amount note. See “Summary Information — The Estimated Value of the Notes” on page PS-7 of this pricing supplement for additional information about the estimated value of the notes and “Summary Information — Secondary Market Prices of the Notes” on page PS-8 of this pricing supplement for information about secondary market prices of the notes.

Original issue date (settlement date): June 20, 2024

Original issue price: 100.00% of the principal amount

Underwriting commission/discount: 1.51% of the principal amount*

Net proceeds to the issuer: 98.49% of the principal amount

See “Summary Information — Supplemental Use of Proceeds” on page PS-8 of this pricing supplement for information about the components of the original issue price of the notes.

*J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the selling commissions of 1.51% of the principal amount it receives from us to an unaffiliated dealer. See “Plan of Distribution (Conflicts of Interest)” on page PS-86 of the accompanying product supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement, the accompanying product supplement, the accompanying underlying supplement, the accompanying prospectus supplement, the accompanying prospectus or the accompanying prospectus addendum. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

Pricing Supplement dated June 12, 2024