The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos. 333-270004 and 333-270004-01

Subject to Completion. Dated February 3, 2025. †

Pricing Supplement to the Prospectus and Prospectus Supplement, each dated April 13, 2023, the Underlying Supplement No. 1-I dated April 13, 2023, the Product Supplement No. 4-I dated April 13, 2023 and the Prospectus Addendum dated June 3, 2024

JPMorgan Chase Financial Company LLC

Medium-Term Notes, Series A

$

Digital Equity Notes due 2026

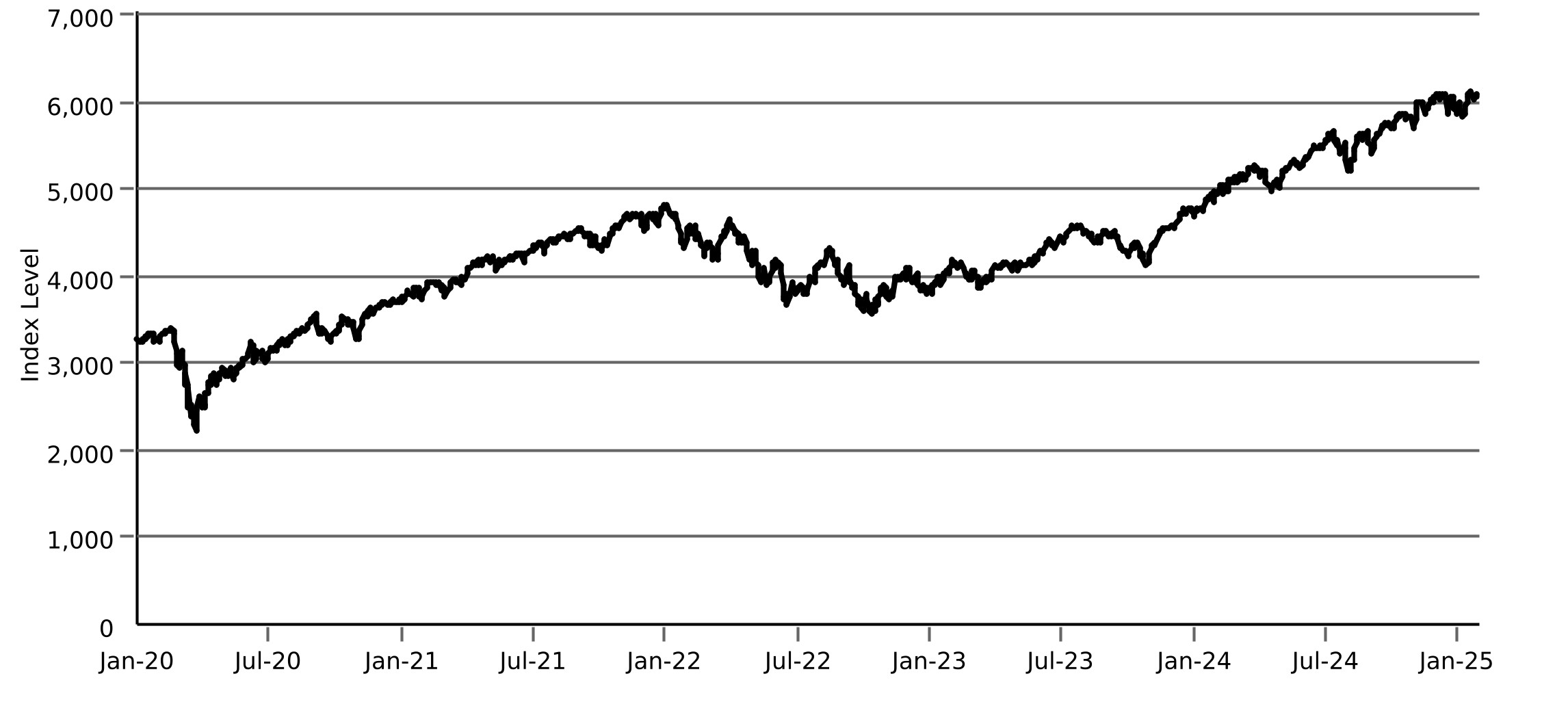

(Linked to the S&P 500® Index)

Fully and Unconditionally Guaranteed by JPMorgan Chase & Co.

The notes will not bear interest. The amount that you will be paid on your notes on the stated maturity date (August 19, 2026, subject to adjustment) is based on the performance of the S&P 500® Index (which we refer to as the underlier) as measured from and including the trade date (on or about February 10, 2025) to and including the determination date (August 17, 2026, subject to adjustment). If the final underlier level on the determination date is greater than or equal to 87.50% of the initial underlier level (set on the trade date), you will receive the threshold settlement amount (expected to be between $1,109.70 and $1,129.00 for each $1,000 principal amount note). If the final underlier level declines by more than 12.50% from the initial underlier level, the return on your notes will be negative. You could lose your entire investment in the notes. Any payment on the notes is subject to the credit risk of JPMorgan Chase Financial Company LLC (“JPMorgan Financial”), as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes.

To determine your payment at maturity, we will calculate the underlier return, which is the percentage increase or decrease in the final underlier level from the initial underlier level. On the stated maturity date, for each $1,000 principal amount note, you will receive an amount in cash equal to:

●if the underlier return is greater than or equal to -12.50% (the final underlier level is greater than or equal to 87.50% of the initial underlier level), the threshold settlement amount; or

●if the underlier return is below -12.50% (the final underlier level is less than the initial underlier level by more than 12.50%), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) approximately 1.1429 times (c) the sum of the underlier return plus 12.50%. You will receive less than $1,000.

Your investment in the notes involves certain risks, including, among other things, our credit risk. See “Risk Factors” on page S-2 of the accompanying prospectus supplement, Annex A to the accompanying prospectus addendum, “Risk Factors” on page PS-11 of the accompanying product supplement and “Selected Risk Factors” on page PS-12 of this pricing supplement.

The foregoing is only a brief summary of the terms of your notes. You should read the additional disclosure provided herein so that you may better understand the terms and risks of your investment.

The estimated value of the notes, when the terms of the notes are set, will be provided in the final pricing supplement and is expected to be between $980.00 and $990.00 per $1,000 principal amount note. See “Summary Information — The Estimated Value of the Notes” on page PS-7 of this pricing supplement for additional information about the estimated value of the notes and “Summary Information — Secondary Market Prices of the Notes” on page PS-7 of this pricing supplement for information about secondary market prices of the notes.

Original issue date (settlement date): on or about February 18, 2025

Original issue price: 100.00% of the principal amount

Underwriting commission/discount: 0.00% of the principal amount

Net proceeds to the issuer: 100.00% of the principal amount

See “Summary Information — Supplemental Use of Proceeds” on page PS-8 of this pricing supplement for information about the components of the original issue price of the notes.

J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will not receive selling commissions for these notes and will sell the notes to an unaffiliated dealer at 100.00% of the principal amount. See “Plan of Distribution (Conflicts of Interest)” on page PS-86 of the accompanying product supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement, the accompanying product supplement, the accompanying underlying supplement, the accompanying prospectus supplement, the accompanying prospectus or the accompanying prospectus addendum. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

†This amended and restated pricing supplement amends and restates the pricing supplement related hereto dated

January 29, 2025 to product supplement no. 4-I in its entirety (the original pricing supplement is available on the SEC

website at http://www.sec.gov/Archives/edgar/data/1665650/000183988225005296/jpm_424b2-02826.htm.

Pricing Supplement dated February , 2025