- USFD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B7 Filing

US Foods Holding (USFD) 424B7Prospectus with selling stockholder info

Filed: 29 Nov 17, 12:00am

Filed Pursuant to Rule 424(b)(7)

Registration Number 333-220445

The information in this preliminary prospectus supplement is not complete and may be changed. Neither this prospectus supplement nor the accompanying prospectus is an offer to sell these securities, and neither is soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion Dated November 29, 2017

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated September 13, 2017)

39,955,545 Shares

US FOODS HOLDING CORP.

Common Stock

The selling stockholders named in this prospectus supplement are offering 39,955,545 shares of common stock of US Foods Holding Corp. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “USFD.” On November 28, 2017, the closing sales price of our common stock as reported on the NYSE was $27.63 per share.

Subject to the completion of the offering, we intend to concurrently repurchase from the underwriter 10,000,000 of the aggregate 39,955,545 shares of our common stock that are the subject of the offering. The price per share to be paid by us will equal the price at which the underwriter will purchase the shares from the selling stockholders in the offering. The offering is not conditioned upon the completion of the share repurchase.

Investing in our common stock involves risk. Before buying shares of our common stock, you should read the discussion of material risks described in the section titled “Risk Factors” beginning onpage S-22 of this prospectus supplement, on page 4 of the accompanying prospectus and beginning on page 10 of our Annual Report onForm 10-K for the fiscal year ended December 31, 2016, as well as the other information included or incorporated or deemed incorporated by reference herein.

None of the Securities and Exchange Commission, any state securities commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter has agreed to purchase the shares of our common stock from the selling stockholders at a price of $ per share, which will result in proceeds to the selling stockholders, before expenses, of $ . The underwriter may offer the shares of our common stock that are not subject to the share repurchase from time to time in one or more transactions on the NYSE, in theover-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. See “Underwriting.”

Delivery of the shares of common stock against payment is expected to be made on or about , 2017.

Morgan Stanley

Prospectus supplement dated , 2017

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-ii | ||||

| S-iii | ||||

| S-iii | ||||

| S-1 | ||||

| S-15 | ||||

| S-17 | ||||

| S-22 | ||||

| S-28 | ||||

| S-30 | ||||

| S-30 | ||||

| S-30 | ||||

| S-31 | ||||

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TONON-U.S. HOLDERS OF OUR COMMON STOCK | S-36 | |||

| S-39 | ||||

| S-42 | ||||

| S-44 | ||||

| S-48 | ||||

| S-48 | ||||

| S-48 | ||||

| S-50 | ||||

| Prospectus | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 10 | ||||

| 11 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document contains two parts. The first part is this prospectus supplement, which describes the terms of the offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated or deemed incorporated by reference herein and therein. The second part is the accompanying prospectus, which contains a description of our common stock and gives more general information, some of which may not apply to the offering. If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on this prospectus supplement. Before purchasing any shares of our common stock, you should read carefully both this prospectus supplement and the accompanying prospectus, together with the documents incorporated or deemed incorporated by reference herein and therein (as described below under the heading “Incorporation by Reference”), any related free writing prospectus and the additional information described below under the heading “Where You Can Find More Information.”

This prospectus supplement and the accompanying prospectus are part of an effective registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement, portions of which we have omitted as permitted by the rules and regulations of the SEC. Statements contained in this prospectus supplement and the accompanying prospectus as to the contents of any contract or other document are not necessarily complete. You should refer to the copy of each contract or document filed as an exhibit to, or incorporated by reference in, the registration statement for a complete description. See “Incorporation by Reference.” The registration statement and the exhibits can be obtained from the SEC as indicated under the heading “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus, any related free writing prospectus and the other information to which we refer you. Neither we, the selling stockholders nor the underwriter has authorized anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus or in any related free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and any related free writing prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference herein or therein is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus supplement in that jurisdiction. Persons who come into possession of this prospectus supplement in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to the offering and the distribution of this prospectus supplement applicable to that jurisdiction. See “Underwriting.”

Market data, industry statistics, and forecasts included or incorporated by reference in this prospectus supplement or the accompanying prospectus, other than those provided by third party experts, are based on the good faith estimates of management, which in turn are based upon management’s reviews of independent industry publications, reports by market research firms, and other independent and publicly available sources.

S-ii

Unless we indicate otherwise, market data and industry statistics included or incorporated by reference in this prospectus supplement or the accompanying prospectus are for the fiscal year ended December 31, 2016. All references to our market share refer to our net sales as compared to aggregate revenues for the U.S. foodservice distribution industry.

Although we are not aware of any misstatements regarding the industry data that we include or incorporate by reference in this prospectus supplement or the accompanying prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and “Forward-Looking Statements” in this prospectus supplement, “Risk Factors” and “Forward-Looking Statements” in the accompanying prospectus and “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report onForm 10-K for the fiscal year ended December 31, 2016 and our Quarterly Report onForm 10-Q for the fiscal quarter ended September 30, 2017, which are incorporated by reference in this prospectus supplement and the accompanying prospectus.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus supplement and the accompanying prospectus include or incorporate by reference some of our trademarks, trade names, and service marks, including US Foods, Keeping Kitchens Cooking, Cattleman’s Selection, Clean Force, Cross Valley Farms, Chef’s Line, Chef’Store, del Pasado, Devonshire, Food Fanatics, Glenview Farms, Harbor Banks, Harvest Value, Hilltop Hearth, Metro Deli, Molly’s Kitchen, Monarch, Monogram, Optimax Pacific Jade, Patuxent Farms, Rykoff Sexton, Rituals, Roseli, Stock Yards, Superior, Thirster and Valu+Plus. Each one of these trademarks, trade names or service marks is either (i) our registered trademark, (ii) a trademark for which we have a pending application, (iii) a trade name or service mark for which we claim common law rights or (iv) a registered trademark or application for registration which we have been authorized by a third party to use.

Solely for convenience, the trademarks, service marks and trade names included or incorporated by reference in this prospectus supplement and the accompanying prospectus are without the® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus supplement and the accompanying prospectus include or incorporate by reference additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names included or incorporated by reference in this prospectus supplement and the accompanying prospectus are, to our knowledge, the property of their respective owners.

As used in this prospectus supplement, unless otherwise noted or the context otherwise requires, references to: (i) the “Company,” “US Foods,” “we,” “our,” or “us” refer to US Foods Holding Corp. and its consolidated subsidiaries; (ii) “CD&R” refer to Clayton, Dubilier & Rice, LLC and its affiliates; (iii) “KKR” refer to Kohlberg Kravis Roberts & Co. L.P. and its affiliates; (iv) the “Sponsors” refer to investment funds associated with CD&R and KKR; (v) the “underwriter” refer to the firm listed on the cover page of this prospectus supplement; (vi) the “Acquisition Agreement” refer to the agreement we entered into in December 2013 to merge with Sysco Corporation, which was subsequently terminated in June 2015; (vii) the “Acquisition” refer to the aforementioned proposed merger with Sysco Corporation; and (ix) “IPO” refer to the initial public offering of our common stock, which was completed on June 1, 2016.

S-iii

References to “fiscal 2017” are to the52-week period ending December 30, 2017, references to “fiscal 2016” are to the52-week period ended December 31, 2016, references to “fiscal 2015” are to the53-week period ended January 2, 2016, references to “fiscal 2014” are to the52-week period ended December 27, 2014, references to “fiscal 2013” are to the52-week period ended December 28, 2013, and references to “fiscal 2012” are to the52-week period ended December 29, 2012. Unless otherwise indicated or the context otherwise requires, financial data included or incorporated by reference in this prospectus supplement reflects the consolidated business and operations of US Foods Holding Corp. and its consolidated subsidiaries.

S-iv

This summary highlights information included or incorporated by reference in this prospectus supplement or the accompanying prospectus and does not contain all of the information you should consider before investing in shares of our common stock. You should read this entire prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein carefully, including any free writing prospectus prepared by us or on our behalf, including the sections entitled “Risk Factors” included and incorporated by reference in this prospectus supplement and the accompanying prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the related notes in our Annual Report onForm 10-K for the fiscal year ended December 31, 2016 and our Quarterly Report onForm 10-Q for the fiscal quarter ended September 30, 2017, which are incorporated by reference herein, before you decide to invest in shares of our common stock.

Our Company

US Foods is among America’s great food companies and one of only two foodservice distributors with a national footprint in the United States. We are the second largest foodservice distributor in the United States with a 2016 market share of approximately 8%. The U.S. foodservice distribution industry is large, fragmented, and growing, with total industry sales of approximately $285 billion in 2016 according to Technomic (August 2017).

Our mission is to beFirst In Food.We strive to inspire and empower chefs and foodservice operators to bring great food experiences to consumers. This mission is supported by our strategy ofGreat Food. Made Easy.This strategy centers on providing a broad and innovative offering of high-quality products to our customers, as well as a comprehensive suite of industry-leadinge-commerce, technology, and business solutions.

We have significant scale and an efficient operating model. We supply approximately 250,000 customer locations nationwide. These customer locations include independently owned single and multi-unit restaurants, regional restaurant concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail locations. We provide approximately 350,000 fresh, frozen, and dry food stock-keeping units, or SKUs, as well asnon-food items, sourced from approximately 5,000 suppliers. Our more than 4,000 sales associates manage customer relationships at local, regional, and national levels. They are supported by sophisticated marketing and category management capabilities, as well as a sales support team that includes world-class chefs and restaurant operations consultants. Our extensive network of over 60 distribution centers and fleet of approximately 6,000 trucks allow us to operate efficiently and provide high levels of customer service.

Built through organic growth and acquisitions, we trace our roots back over 150 years to a number of heritage companies with rich legacies in food innovation and customer service. In 2007, US Foodservice was acquired by CD&R and KKR from Royal Ahold N.V. Between fiscal 2007 and fiscal 2011, we made a number offar-reaching structural changes to our operating model. These changes included standardizing and centralizing certain business processes and moving to a common technology infrastructure. Despite the challenging market, net sales expanded at a 0.8% compounded annual growth rate, or “CAGR,” during these four years. In November 2011, we rebranded from “US Foodservice” to “US Foods” to reflect our new strategy for industry leadership centered on providing a superior and innovative food offering and making it easy for customers to do business with us. This new strategy helped our sales increase at a 4.7% CAGR between fiscal 2011 and fiscal 2013.

In December 2013, we entered into the Acquisition Agreement with Sysco Corporation. After failing to obtain regulatory approvals, the Acquisition Agreement was terminated on June 26, 2015. Since then, we have refocused on executing our strategy of bringing innovative products to market, expanding our portfolio of business solutions for customers, and driving advancements in technology. For the fiscal year ended

S-1

December 31, 2016, we generated $22.9 billion in net sales, $210 million in net income, and $972 million in Adjusted EBITDA.

Our principal executive offices are located at 9399 W. Higgins Road, Suite 500, Rosemont, IL 60018. The telephone number at our principal executive office is(847) 720-8000. Our website address ishttp://www.usfoods.com.Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our securities in the offering.

Our Industry

The U.S. foodservice distribution industry is large, fragmented, and resilient, with a long history of growth. The industry continues to benefit from increases in consumer spending on food-away-from-home, which has risen steadily for decades and accounted for approximately 50% of total food expenditures in 2016 and $751 billion in consumer spending, according to Technomic (August 2017).

The U.S. foodservice distribution industry is expected to grow at a real CAGR of 1.7% from 2017 to 2022, adding $30 billion to total annual foodservice distribution industry sales, according to Technomic (August 2017). Foodservice demand in the United States is highly resilient, with negative real annual growth only occurring in five years out of the past 44, according to Technomic (August 2017).

The U.S. foodservice distribution industry has a large number of companies competing in the space, including local, regional, and national distributors. Foodservice distributors typically fall into three categories, representing differences in customer focus, product offering, and supply chain:

| • | Broadline distributors who offer a “broad line” of products and services. |

| • | System distributors who carry specific products for large chains. |

| • | Specialized distributors focused on specific product categories or customer types (e.g., meat or produce). |

A number of adjacent competitors also serve the industry, includingcash-and-carry retailers, commercial wholesale outlets and warehouse clubs, commercial website outlets, and grocery stores. There is a high degree of customer overlap, particularly across the broadline, specialized, andcash-and-carry categories, as many customers purchase from multiple distributors. The U.S. foodservice distribution industry is comprised of different customer types of varying sizes, growth profiles, and product and service requirements. Industry sales data reflected below for 2016 is based on information from Technomic (August 2017).

| • | Independent restaurants/small chains and regional chains.U.S. foodservice distribution sales to independent restaurants and small chains were estimated at $70 billion in 2016, with a projected real CAGR of 1.5% over the next five years. Regional chains were estimated to represent $16 billion in foodservice distribution in 2016 and are projected to grow at a 1.8% real CAGR over the next five years. These restaurants typically differentiate themselves on their overall dining experience and a quality, diverse menu offering. They value business solutions that help attract diners, improve the effectiveness of their menu, and increase their operating efficiency. We believe there are significant opportunities to provide additional solutions to these customers that would be otherwise difficult for them to access, given their more limited size and resources. |

| • | Healthcare customers.Healthcare customers were estimated to comprise $14 billion in foodservice distribution sales in 2016 and are projected to grow at a 3.5% real CAGR over the next five years. |

S-2

These customers generally fall into acute care (e.g., hospital systems) or senior living categories. Healthcare customers have complex foodservice needs given their scale, need for menu diversity, and logistics considerations. Food is not as central to their overall business model but is a key contributor to patient satisfaction. As a result, some healthcare customers use third-party contract management companies to operate their foodservice facilities. Many use group purchasing organizations, or GPOs, as intermediaries in order to gain procurement scale. In our experience, most healthcare customers value foodservice partners with national scale, a broad product offering, and strong transactional and logistical capabilities. |

| • | Hospitality customers.This customer type was estimated to represent $19 billion in foodservice distribution sales in 2016 and is projected to grow at a 2.0% real CAGR over the next five years. Hospitality customers are a diverse group, ranging from large hotel chains and conference centers to local banquet halls, country clubs, casinos, and entertainment and sports complexes. Food is key to guest satisfaction for these customers, and they value solutions related to menu planning and efficiency improvements in their kitchens and restaurants. With complex foodservice needs, hospitality customers want a streamlined purchasing process and expect high order fulfillment levels. They also use GPOs as intermediaries to gain procurement scale. |

| • | National restaurant chains.The top 100 national restaurant chains generated an estimated $78 billion in foodservice distribution industry purchases in 2016 and are projected to grow at a 1.7% real CAGR over the next five years. This group tends to internally source most activities except distribution, often relying on system distributors for freight and logistics. |

We believe we can profitably grow our business by focusing on customers that benefit from the broad array of value-added solutions we provide, which makes these customers more effective and efficient. In our experience, these customers purchase a more attractive and profitable mix of items, and tend to show greater loyalty.

Customer Types in Foodservice Distribution

Source for expected growth and market size in the above text and chart: Technomic (August 2017). US Foods utilizes Technomic definitions of “Restaurant” and “Bars” as proxies for specific customer types: “Small

S-3

Chains & Independents” as Independent Restaurants,“101-500 Chains” as Regional Concepts and “Top 100 Chains” as National Restaurant Chains. The Company’s “All Other” category is the “Military, Corrections, Refreshment Services and All Other” Technomic definition.

Several important dynamics are affecting the industry. We believe we have the scale, foresight, and agility required to capitalize on these trends and will benefit from higher growth, greater customer retention, and improved profitability.

Evolving consumer tastes and preferences.Consumers demand healthy, diverse, and authentic food alternatives with fewer artificial ingredients. They also value locally harvested and sustainably manufactured products. Changes in consumer preferences create opportunities for new and innovative products, which in turn are expected to create growth, margin expansion, and better customer retention opportunities. Those distributors with a broad innovative product line, an efficient supply chain network, and a strong food safety program will be in position to meet these changing demands.

Generational shifts with millennials and baby boomers.Given their purchasing power, millennials and baby boomers will continue to significantly impact the food-away-from-home market. Millennials are now the largest demographic group in the United States and play a key role in driving growth in the broader U.S. food industry as their disposable incomes continue to increase. Baby boomers also continue to shape the industry by remaining in the workplace longer, prolonging their food-away-from-home expenditures.

Growing importance ofe-commerce.We have seen significant growth ine-commerce and believe this trend will accelerate, as millennials become key influencers and decision-makers within the foodservice industry, particularly at the customer level.E-commerce solutions deepen the relationship between distributors and customers, increase customer retention, and drive adoption of new products. They also create new insights and services that can make both parties more efficient. As a result, distributors investing in these capabilities will have a competitive edge.

Our Business Strategy

While we serve all customer types, our strategy focuses on independent restaurants, small chains and regional chains, and healthcare and hospitality customers. These customers generated approximately 66%, 66%, and 65% of our net sales in fiscal 2016, fiscal 2015, and fiscal 2014, respectively. Their expected growth, mix of product and category purchases, adoption of value-added solutions, and other factors make them attractive to us.

S-4

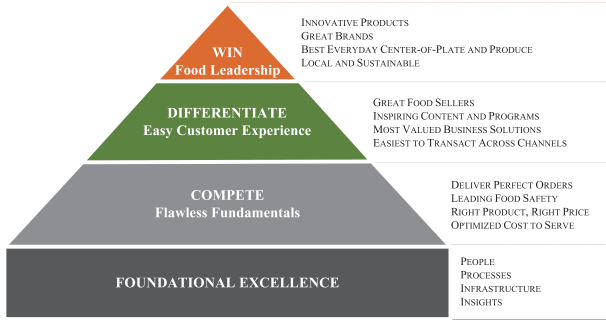

We offer innovative products and services that help chefs and operators succeed. Our digital platform makes it easier for customers to do business with us. We execute on these elements of our strategy while delivering on the fundamental requirements that are important to all of our customers. The strategy is supported by a series of capabilities and initiatives depicted in the following pyramid.

Great Food. Made Easy.

Strategic Priorities and Supporting Initiatives

| • | “Great Food.”Food leadership means meeting the needs of a diverse and growing customer base and providing a broad product portfolio. This offering includes items from leading manufacturers’ brands and our private brands. Our unique product innovation capabilities keep us at the forefront of emerging food trends. We work with suppliers to bring new items to market that reflect consumer preferences such as sustainable products.Great Food is especially important to our core independent and regional restaurant customers who value food quality, menu diversity, and insights into emerging trends in consumer preferences. |

| • | “Made Easy.”To improve the customer experience, we provide the broadest and most relevante-commerce and business support tools in the U.S. foodservice distribution industry. We combine this with a consultative selling approach to create data-driven customer insights that focus our efforts on the most impactful areas from a customer’s perspective. Our digital platform allows customers to easily place orders, track shipments, view product information, and verify orders at delivery. Our knowledge of consumer trends and innovative food offerings, coupled with a deep understanding of our customers’ operations, allows us to bring them opportunities for growth and efficiency. We continue to expand our capabilities with analytical tools that yield additional insights from our transactional and operational data. |

| • | Flawless Fundamentals.We strive to do everything right with our customers every day: from ordering to delivery to billing. Our customers value product quality, food safety, product price, and variety, as well as dependable and accurate transactions and delivery. We outperform most of our competitors in many of these areas, as evidenced by the result of customer surveys. We are always looking for ways to improve this experience, to further strengthen our customer relationships and widen the performance gap between us and our competitors. |

S-5

| • | Foundational Excellence.We focus on people, processes, infrastructure, and insights from analytics. This begins with a commitment to our approximately 25,000 employees: developing their talents and maintaining a strong and vibrant culture. We have significant scale in our operating network, coupled with leading supply chain management capabilities and standardized business processes. This includes a common technology infrastructure supporting transactional, operating, and financial activities. The result is a streamlined organizational model that supports local leadership with centralized capabilities. |

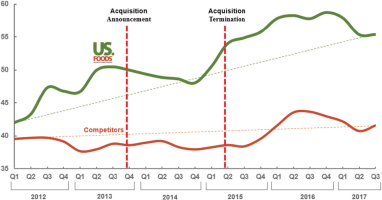

Research using the Net Promoter Score methodology (“NPS”)1 indicates that our strategy resonates with customers. We have higher NPS scores than our primary competitors.

Net Promoter Score Trends vs. Competitors

Rolling6-Month Average

Source: Datassential

| 1 | The NPS methodology is calculated using responses to a single question, on a0-10 scale: How likely is it that you would recommend US Foods to a friend or colleague? |

Respondents are grouped as follows:

Promoters (score9-10) are loyal enthusiasts who will keep buying and referring others, fueling growth.

Passives(score7-8) are satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

Detractors(score0-6) are unhappy customers who can damage the brand and impede growth through negativeword-of-mouth.

The NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters. The NPS can range from a low of-100 (if every customer is a Detractor) to a high of 100 (if every customer is a Promoter).

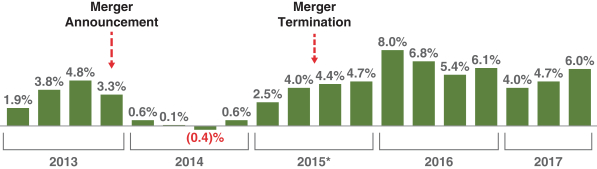

We believe our strategy has enabled us to grow with target customers. We have seen momentum returning to the business after the termination of the Acquisition Agreement, and have been achieving year-over-year quarterly growth rates with our independent restaurant customers at above market growth, which is consistent with the levels we experienced prior to the announcement of the Acquisition Agreement.

S-6

INDEPENDENT RESTAURANT CASE VOLUME GROWTH

YOY Change

| * | Q4 2015 and Q4 2016 results normalized for the 53rd week. Source: Company results and calculations. |

What Makes Us Different

We are one of two national players in a large, resilient, and fragmented industry. We believe the following factors differentiate us from competitors in the eyes of customers:

Innovative products.We believe we provide one of the most innovative food offerings in the industry supported by a team of food scientists, chefs, and packing engineers. They search the world for new and forward-thinking food concepts and work collaboratively with leading suppliers andco-packers to develop products based on these insights. Since 2011, we have launched over 450 new products, which generated approximately $1.5 billion in incremental cumulative net sales. We launched or rebranded over 150 sustainable products in fiscal 2016. We also are in the process of removing artificial ingredients from our premium private brands by substituting all natural alternatives for what we call the “US Foods Unpronounceables List.”

We launch products nationally under proprietary marketing campaigns calledThe Scoop.Each Scoop features 20 to 30 new US Foods products. The campaign, occurring several times a year, is coordinated with local sales teams across the country. Their efforts are supported by a variety of marketing tools including print and digital promotions, food shows, customer tasting events, and social media. We use proprietary analytic tools to identify high-potential target customers and direct our selling efforts accordingly. In fiscal 2016, 64% of our customers purchased Scoop items compared to 58% in fiscal 2015. Additionally, Scoop customers have 8% higher case volumes and up to 6% higher retention rates thannon-Scoop customers, resulting in higher sales and profits.

Broad product offering, including a leading private brand program.Our wide product assortment features approximately 350,000 fresh, frozen, and dry food SKUs andnon-food items that are sourced from approximately 5,000 suppliers. We believe we have industry-leading category management capabilities that allow us to capitalize on our procurement scale, while also enabling local customization. Our leading private brand program includes an extensive and growing assortment of over 15,000 products across 20 plus brands. These represented 33% of net sales for fiscal 2016 and 32% of net sales for fiscal 2015. Since fiscal 2013, our private brand offering has grown by more than 2,500 products. Although many competitors use private brands primarily as a lower price point option, we believe our broad spectrum of “good, better, best” tiers based on price and quality gives us an advantage. Our private brand products typically have higher gross margins compared to similar manufacturer-branded offerings. They are generally priced below comparable manufacturer brands, where available, which we believe drives preference and loyalty with customers.

S-7

Leading digital platform.We believe we were the first in our industry to offere-commerce and mobile technology solutions to customers. These solutions allow customers to more easily place orders, track shipments, analyze food costs, analyze trends based upon transactional history over time, manage inventory, make payments, and quickly view product information. Such solutions also enable our sales associates to spend more quality time with customers. Our sales associates can then focus on consultative selling and presenting value-adding services rather than entering orders. In our surveys and benchmarking studies, customers continue to rate our functionality and ease of use as better than competitors. Furthermore, customer adoption ofe-commerce continues to grow.

Independent RestaurantE-commerce Penetration

Source: Company data.

In fiscal 2016, $16 billion in net sales was generated throughe-commerce, representing 68% of our total net sales compared to 52% in fiscal 2011. In addition, as of the week ended September 30, 2017, 54% of our total net sales to independent restaurants was generated throughe-commerce. This has grown significantly since 2011. Our mobile application has been downloaded almost 300,000 times since its 2013 launch. Our digital platform functions range fromday-to-day transactions to product research to recommendations and promotions. We believe our sales frome-commerce orders are the highest in the industry, and they rank in the top 10 for allbusiness-to-business companies, according to 2017 B2BE-Commerce 300. Our digital platform is one of the primary ways we make it easy for our customers to do business with us, and it also provides extensive capabilities to help them run their own business. We continue to expand our suite of value-added service offerings, including business analytics, menu engineering, design and printing tools to assist our customers with managing inventory costs and driving traffic.

E-commerce has significant benefits for customers and drives incremental growth and profit for us. For example, our independent restaurant customers who usee-commerce to place orders have over 5% higher retention rates, over 5% higher purchase volumes, and an approximately 600 basis points higher NPS than those that do not. Manye-commerce customers are engaged in social media, providing additional channels for us to build strong and enduring relationships with them.

Superior team-based selling approach.Our sales per associate have significantly increased over the last several years, which we believe reflects our efficient team-based approach to customers, as well as use of proprietary tools that help our sales force better understand their customers.

| • | Robust front-line selling capabilities driving local “touch” with customers.We have more than 4,000 sales associates engaged in a team-based selling approach. These teams are supported on the street by chefs, restaurant operations consultants and product specialists, and customer service representatives. |

S-8

Together, this team provides cohesive support including menu planning, recipe ideas, product selection, and pricing strategies. Unlike many competitors, where sales associates view themselves as independent sales representatives managing their own book of business, our sales associates represent the entire US Foods brand. This gives them a local touch while tapping the expertise of our entire organization for each customer. We believe this concerted effort results in our receiving a higher share of our customers’ purchases and better customer retention. |

| • | Data-driven insights and predictive analytics to guide the selling team.Proprietary analytical capabilities enable us to apply predictive analytics to customer data, providing the insights that inform and optimizeday-to-day activities, such as pricing, sales planning, and cross-selling offers. Our sales associates use these tools to deepen customer relationships and explore new opportunities for mutual growth. For example, sales associates receive an alert if a customer is at risk of deviating from historical purchasing patterns, allowing the sales associate to quickly address the situation. We also leverage this capability to provide market insights to our suppliers that facilitate joint growth programs. Predictive analytics also increase the effectiveness of our “My Kitchen” marketing campaigns, which occur several times a year. My Kitchen provides tailored offers and product recommendations that are likely to be important to a particular customer and that are presented in a unique format. These promotions are relevant to customers and drive a greater share of purchases, new product adoption, and profitable growth for us. |

| • | Resource solutions that help customers operate more profitably.Our team of Restaurant Operations Consultants (ROCs) has grown exponentially since the inception of the program in 2011 and is currently comprised of approximately 70 experienced and highly skilled former restaurant owners and operators that are available to assist our customers in all aspects of their business, from menu enhancement ideas to implementation of labor saving practices in the kitchen. The restaurant industry is extremely competitive, with many new restaurants closing their doors within the first year. We believe that we can help our customers beat these odds and become successful through implementing tools and systems that the most successful restaurateurs use. ROCs are trained to help customers better manage the prime costs that lead to profitability and to drive more traffic into the store. This creates a true business partnership and enhances customer loyalty. |

| • | Grass roots, value-added marketing through “Food Fanatics.”Launched in 2012, the “Food Fanatics” marketing program combines local events with national media. Our team of 51in-house culinary experts, located in major markets around the country are the “Food Fanatics Chefs.” They are imbedded in local markets and provide advice to customers and sales associates. We host “Food Fanatics Live” events nationwide. Customers, vendors, and sales associates gather together to discuss food and technology trends of interest to customers in that local market. In fiscal 2016, we held 21 “Food Fanatics Live” shows in 21 cities with approximately 1,700 attendees at each show. Local efforts are supported by our award-winning “Food Fanatics” magazine, which is distributed to existing and potential customers. This magazine, which is free and primarily funded through advertising, includes third-party content on food trends, food people, and ideas to increase profitability for our customers. |

Functionalized operating model and business culture.We operate as one business with standardized business processes, a shared systems infrastructure, and an organizational model that optimizes national scale with local execution. Activities are centralized where scale matters, and our field structure focuses on local customer facing activities. For example, product innovation, research and development efforts, brand marketing,e-commerce initiatives, national vendor negotiations, and other aspects of our supply chain are managed centrally. We also employ a shared services model whereby transactional business processes are centralized to support the business in a highly efficient manner. We have also migrated to a common information technology platform. However, activities that are closer to the customer, such as pricing to local customers, certain product

S-9

replenishment, and local business development efforts are managed locally with support from regional leaders and our corporate office organized by function. Our functionalized model balances the advantages of scale and flexibility. The result is a more responsive and lower-cost operating model, which improves ourtime-to-market. This model also has enabled us to achieve greater consistency in our offering and execution, which is important to regional and national customers. In 2016, we moved to a multi-site approach to management, consolidating local back-office support functions from over 60 distribution centers into 26 area hubs with broader geographic scope. As part of this change, we also streamlined our regional leadership structure. For instance, at the end of 2016, the 26 area hubs reported to five regions instead of the eight regions we had in place in our prior organizational structure. In addition to generating expected cost savings, we believe this will enable better network and route optimization and more efficient integration of acquisitions.

One of only two national broadline players in a highly fragmented industry with resilient growth.We are the second-largest distributor, as measured by sales, in the approximately $285 billion U.S. foodservice distribution industry, making us about three times the size of the average regional competitor. The industry is very fragmented with an estimated 78% of sales from local and regional distributors without a national distribution footprint.

Our nationwide reach means we can serve large regional or multi-regional customers who want a more seamless experience across the geographies they serve. This scale also provides several advantages over regional or local distributors. We achieve volume savings from purchases on everything fromcost-of-goods to fleet and fuel. We achieve greater efficiencies of scale for our basic centralized administrative support functions, such as accounting, payroll, and tax, resulting in a lower unit cost for the services. We also have greater flexibility to invest in initiatives requiring significant capital and talent, such as product development,e-commerce, marketing, and other areas that support ourGreat Food. Made Easy strategy.

An experienced and invested management team.Our executive leadership team and regional presidents have over 160 years of expertise in the foodservice industry, which we believe has been an important factor in our past successes. These executives also bring deep experience from related industries, including retail, manufacturing, and other types of distribution. Our management and field leadership team, including regional and area presidents, has invested personal funds in our equity. Substantially all of management’s incentive compensation is tied to achieving growth and profitability targets.

Our Growth Strategy

Our growth strategy gives us an opportunity to outpace the projected growth of the U.S. foodservice distribution industry. We intend to do so by increasing revenue from our target customers, continuing to drive greater cost savings and efficiencies and making opportunistic acquisitions as described below:

Grow our revenue and gross profit with our target customers.We are taking the following actions to expand our net sales and profitability:

| • | Increase our share with new and existing customers.Our target customers are independent and regional restaurants, hospitality, and healthcare customers. Our strategy is to provide them with the most compelling combination of products, services, and analytical tools coupled with the ease of online transactions. Our internal studies show customers increasingly prefer our innovation, product offering, and digital platform and value added services. We have also seen significantly lower rates of customer churn for those using our innovative products and online platforms. |

| • | Grow our share incenter-of-plate and produce.Center-of-plate proteins and produce categories account for a significant portion of total industry sales. These categories are often provided by a number of specialty distributors with deep category knowledge but without scale. Our objective is to be |

S-10

a customer’s “first choice” in these categories in order to drive additional revenue and gross profit from current customers, as they shift business from specialty distributors to US Foods. To date, we have seen higher growth in markets where we are using this strategy. We are also strengthening our offering by expanding ourStock Yards manufacturing footprint.Stock Yards provides high-quality meat and seafood, custom cut and packaged to a customer’s specifications. In addition, acquisition opportunities offer the potential to accelerate this growth. |

| • | Expand our private brand program.Our private brands offer a differentiated positioning and product selection, better price points, and higher gross margins than manufacturer-branded products. We intend to continue leveraging our scale to further reduce the cost of goods for our private brand offerings and enhance incentives for our sales force to drive private brand growth. These efforts should increase profitability and customer loyalty. |

Continue to reduce our operating expenses.We are increasing our productivity in the following ways:

| • | Optimize our network and increase distribution productivity.We expect to drive productivity savings through a combination of continuous improvement, network consolidations and better alignment of compensation and productivity. For example, as part of a program to improve the effectiveness and efficiency of our distribution network, in 2016 we closed our Baltimore, Maryland distribution center. Over the last several years, we also opened two highly efficient distribution centers to serve growing markets. In addition, we are implementing formal continuous improvement processes across our distribution network. These processes are focused on a number of initiatives, including optimizing our delivery routes to reduce the number of miles driven, improving the slotting of products in our warehouses to reduce selection time, enhancing our freight lane management for inbound product, aligning employee incentives with productivity goals and improving the loading of trucks to reduce driver delivery time. |

| • | Increase the efficiency of our sales organization.We increased our net sales dollars per sales associate by over 30% between fiscal 2012 and fiscal 2016, from $4.0 million to $5.4 million. We expect our sales associates to become even more productive as they continue using our digital platform tools and team-based selling approach. |

| • | Use a lower-cost standard organization model and common systems infrastructure.We are targeting cost savings by further streamlining our overhead and shared services. We have moved from individual support centers at each distribution facility to a multi-site model where several facilities are served by a hub in order to streamline our infrastructure. We are consolidating our spending across indirect spend categories to capture additional savings from leveraging our scale through aggregating purchasing, modifying internal practices, and improving vendor compliance. In the third quarter of fiscal 2016, we launched a new effort to drive further efficiencies in corporate and administrative costs and to extend the scope of our shared services, taking a more holistic view ofend-to-end processes such asorder-to-cash andprocure-to-pay. In addition, we are continuing our efforts to centralize replenishment, which we expect to complete in early 2018. As a result, we expect to benefit from better sourcing, which will reducecost-of-goods and result in more optimal logistics and more efficient and effective management of inventory, while maintaining our high service levels. |

Pursue opportunistic acquisitions for accelerated growth.Our company has a strong record of identifying, completing, and integrating accretive acquisitions. Our preferred targets include broadline distributors with local strength and strong independent restaurant sales as well as specialty distributors with distinct capabilities across ethnic,center-of-plate, and produce categories. Because the U.S. foodservice distribution industry is fragmented, we believe there are plenty of attractive acquisition opportunities that will allow us to grow with our target customer groups and generate an attractive return on investment from the revenue and cost synergies we hope to capture from integrating the acquired businesses into our operations.

S-11

From December 2015 through fiscal 2016 we completed five acquisitions, including three broadline foodservice distributors and two specialty distributors to enhance our capability in produce and seafood. In fiscal 2017 on ayear-to-date basis, we have completed a total of five acquisitions, including three broadline foodservice distributors and two specialty acquisitions.

In February 2017, we acquired All American Foods (“All American”), a broadline distributor with annual sales of approximately $60 million. In June 2017, we acquired F. Christiana, a broadline distributor with annual sales of approximately $100 million. In July 2017, we acquired three broadline locations with aggregate annual sales of approximately $130 million, all owned and operated by TOBA, Inc. These broadline acquisitions further our strategy to expand our market share with independent restaurants.

In March 2017, we acquired SRA Foods, with annual sales of approximately $80 million. SRA Foods is a meat processor and distributor in Birmingham, Alabama. In April 2017, we acquired FirstClass Foods-Trojan, Inc. (“FirstClass Foods”), a meat processor and distributor, with annual sales of approximately $55 million. These specialty acquisitions enhance ourcenter-of-the plate capabilities, which are a key focus of our growth strategy.

Risks Related to Our Business and Our Industry

Investing in our common stock involves substantial risks, and our ability to successfully operate our business and execute our growth strategy is subject to numerous risks, including those that are generally associated with operating in the foodservice distribution industry. Some of the more significant challenges and risks include the following:

| • | ours is alow-margin business, and our profitability is directly affected by cost deflation or inflation, commodity volatility, and other factors; |

| • | competition in our industry is intense, and we may not be able to compete successfully; |

| • | we rely on third-party suppliers, and our business may be affected by interruption of supplies or increases in product costs; |

| • | we have substantial debt, which could adversely affect our financial health and our ability to raise additional capital or obtain financing in the future, react to changes in our business, and make payments on our debt, and the agreements and instruments governing our debt contain restrictions and limitations that impact our ability to incur additional debt and operate our business; |

| • | our ability to generate the significant amount of cash needed to pay interest and principal on our debt facilities and our ability to refinance all or a portion of our indebtedness or obtain additional financing depends on many factors beyond our control; |

| • | a change in our relationships with GPOs could negatively affect our relationships with customers, which could reduce our profitability; |

| • | our relationships with key long-term customers and GPOs may be materially diminished or terminated; |

| • | if we fail to increase or maintain our sales to independent restaurant customers, our profitability may suffer; |

| • | we may fail to consummate and effectively integrate the businesses we acquire; |

| • | we may be unable to achieve some or all of the benefits that we expect from our cost saving initiatives; |

| • | most of our customers are not obligated to continue purchasing products from us; |

S-12

| • | extreme weather conditions and natural disasters may interrupt our business, or our customers’ businesses, which could have a material adverse effect on our business, financial condition, or results of operations; |

| • | changes in industry pricing practices could negatively affect our profitability; |

| • | if our competitors implement a lower cost structure, they may be able to offer reduced prices to customers, and we may be unable to adjust our cost structure to compete profitably; |

| • | changes in consumer eating habits, or changes in macroeconomic conditions, including other factors affecting consumer confidence, could materially and adversely affect our business, financial condition, or results of operations; |

| • | any negative media exposure or other event that harms our reputation could hurt our business; and |

| • | other factors set forth or referred to under “Risk Factors” in this prospectus. |

Before you participate in the offering, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors,” as well as the information incorporated by reference in this prospectus from our filings with the SEC, including matters set forth under the heading “Risk Factors” in our Annual Report onForm 10-K for the fiscal year ended December 31, 2016.

Our Sponsors

CD&R

Founded in 1978, CD&R employs a distinctive approach to private equity investing, combining investment professionals and operating executives to pursue a strategy predicated on building stronger, more profitable businesses. Since inception, CD&R has managed the investment of $24 billion in 75 businesses with an aggregate transaction value of approximately $100 billion. CD&R has disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses. Investment funds associated with CD&R currently beneficially own approximately 8.9% of our common stock and intend to sell approximately 20 million shares of our common stock in the offering (including 5 million shares that we intend to repurchase from the underwriter). Immediately following the completion of the offering, CD&R will cease to own any shares of our common stock and, among other things, will no longer be entitled to designate any nominees to our Board of Directors (and, as a result, it is expected that the two directors who had been designated for nomination by CD&R will resign). See “Selling Stockholders—Transactions with the Selling Stockholders—Amended and Restated Stockholders Agreement.”

KKR

Founded in 1976 and led by Henry Kravis and George Roberts, KKR is a leading investment firm with $153.3 billion in assets under management as of September 30, 2017. With offices around the world, KKR manages assets through a variety of investment funds and accounts covering multiple asset classes. KKR seeks to create value by bringing operational expertise to its portfolio companies and through active oversight and monitoring of its investments. KKR complements its investment expertise and strengthens interactions with investors through its client relationships and capital markets platforms. KKR & Co. L.P. is publicly traded on the NYSE (NYSE: KKR). Investment funds associated with KKR currently beneficially own approximately 8.9% of our common stock and intend to sell approximately 20 million shares of our common stock in the offering (including 5 million shares that we intend to repurchase from the underwriter). Immediately following the completion of the offering, KKR will cease to own any shares of our common stock and, among other things, will no longer be entitled to designate any nominees to our Board of Directors (and, as a result, it is expected that the one director who had been designated for nomination by KKR will resign). See “Selling Stockholders—Transactions with the Selling Stockholders—Amended and Restated Stockholders Agreement.”

S-13

Share Repurchase

Subject to the completion of the offering, we intend to concurrently repurchase from the underwriter 10,000,000 of the aggregate 39,955,545 shares of our common stock that are the subject of the offering. The price per share to be paid by us will equal the price at which the underwriter will purchase the shares from the selling stockholders in the offering. We refer to this transaction as the “share repurchase.” At an assumed purchase price of $27.63 per share, the closing sales price of our common stock as reported on the NYSE on November 28, 2017, the aggregate share repurchase price would be approximately $276.3 million. The closing of the share repurchase is conditioned on the closing of the offering and therefore there can be no assurance that the share repurchase will be completed. The offering is not conditioned upon the completion of the share repurchase.

The terms and conditions of the share repurchase were reviewed and approved by a special committee of our Board of Directors comprised solely of independent directors. We intend to fund the share repurchase primarily with borrowings under our secured asset based revolving credit facility (the “ABL credit agreement”), our accounts receivable financing program, and from cash on hand. The funding of the share repurchase will increase the amount of debt on our balance sheet. Any shares of our common stock that we repurchase in the share repurchase will be retired.

The description of, and the other information in this prospectus supplement regarding, the share repurchase are included in this prospectus supplement for informational purposes only. Nothing in this prospectus supplement should be construed as an offer to sell, or the solicitation of an offer to buy, any of our common stock subject to the share repurchase.

S-14

The following summary of the offering contains basic information about the offering and our common stock and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of our common stock, please refer to the section of the accompanying prospectus entitled “Description of Capital Stock.”

Common stock offered by the selling stockholders | 39,955,545 shares. |

Concurrent share repurchase | Subject to the completion of the offering, we intend to concurrently repurchase from the underwriter 10,000,000 of the aggregate 39,955,545 shares of our common stock that are the subject of the offering. The price per share to be paid by us will equal the price at which the underwriter will purchase the shares from the selling stockholders in the offering. The offering is not conditioned upon the completion of the share repurchase. The terms and conditions of the share repurchase were reviewed and approved by a special committee of our Board of Directors comprised solely of independent directors. |

Common stock outstanding | 224,693,304 shares (or 214,693,304 shares after giving effect to the retirement of the shares in the concurrent share repurchase). |

Use of proceeds | We will not receive any proceeds from the sale of shares being sold in the offering. The selling stockholders will receive all of the net proceeds and bear all commissions and discounts, if any, from the sale of our common stock pursuant to this prospectus supplement. See “Use of Proceeds” and “Selling Stockholders.” |

Dividend policy | We have no current plans to pay dividends on our common stock. Any decision to declare and pay dividends in the future will be made at the sole discretion of our Board of Directors and will depend on, among other things, general and economic conditions, our financial condition, and results of operations, our available cash and current and anticipated cash needs, capital requirements, contractual, legal, tax, and regulatory restrictions, implications on the payment of dividends by us to our stockholders or by our subsidiaries to us, and such other factors as our Board of Directors may deem relevant. |

Risk factors | See “Risk Factors” beginning onpage S-22 of this prospectus supplement, on page 4 of the accompanying prospectus and beginning on page 10 of our Annual Report onForm 10-K for the fiscal year ended December 31, 2016 (which is incorporated by reference herein) for a discussion of risks you should carefully consider before deciding to invest in our common stock. |

Listing | Our common stock is listed on the NYSE under the symbol “USFD.” |

The number of shares of our common stock to be outstanding immediately after the completion of the offering is based on 224,693,304 shares of common stock outstanding as of November 24, 2017, or 214,693,304 shares of common stock after giving effect to the retirement of 10,000,000 shares in the concurrent share

S-15

repurchase, but does not give effect to (a) options relating to 5,359,451 shares of common stock, with a weighted average exercise price of $18.90 per share, outstanding under our 2007 Stock Incentive Plan for Key Employees of USF Holdings Corp., as amended (the “2007 Stock Incentive Plan”), and our US Foods Holding Corp. 2016 Omnibus Incentive Plan (the “2016 Plan”), (b) 1,389,844 shares of common stock that are issuable pursuant to unvested restricted stock units outstanding under the 2007 Stock Incentive Plan and the 2016 Plan, (c) 3,917,129 shares of common stock that are reserved for future issuance under the 2016 Plan, and (d) 580,524 shares of common stock available for issuance under the US Foods Holding Corp. Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”).

S-16

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The summary historical consolidated financial data set forth below should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report onForm 10-K for the fiscal year ended December 31, 2016 and our Quarterly Report onForm 10-Q for the fiscal quarter ended September 30, 2017 and our audited and unaudited consolidated financial statements and related notes thereto incorporated by reference in this prospectus supplement.

We operate on a52-53 week fiscal year, with all periods ending on Saturday. When a53-week fiscal year occurs, we report the additional week in the fiscal fourth quarter. Fiscal 2016 ended on December 31, 2016 and was comprised of 52 weeks. Fiscal 2015 ended on January 2, 2016 and was comprised of 53 weeks. Fiscal 2014, 2013, and 2012 included 52 weeks and ended on December 27, 2014, December 28, 2013, and December 29, 2012, respectively. The summary historical consolidated statements of operations data for fiscal 2016, 2015, and 2014, and the related summary balance sheet data as of fiscal 2016 and 2015 year end, have been derived from our audited consolidated financial statements and related notes incorporated by reference in this prospectus supplement. The summary historical consolidated statement of operations data for fiscal 2013 and 2012 and the summary balance sheet data as of fiscal 2014, 2013 and 2012 year end have been derived from our audited consolidated financial statements not included or incorporated by reference in this prospectus supplement. The summary historical interim financial data as of September 30, 2017 and for the39-weeks ended September 30, 2017 and October 1, 2016 have been derived from our unaudited consolidated interim financial statements incorporated by reference in this prospectus supplement, which have been prepared on a basis consistent with our annual audited consolidated financial statements. In the opinion of management, such unaudited financial data reflects all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for these periods. The interim results are not necessarily indicative of the results for the full year or any future period.

The following tables set forth our summary historical consolidated financial data for the periods and as of the dates indicated.

| 39-Weeks Ended | Fiscal Year | |||||||||||||||||||||||||||

| September 30, 2017 | October 1, 2016 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

| (unaudited) | (In millions, except for per share data)* | |||||||||||||||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||||||||||||||

Net sales | $ | 18,151 | $ | 17,241 | $ | 22,919 | $ | 23,127 | $ | 23,020 | $ | 22,297 | $ | 21,665 | ||||||||||||||

Cost of goods sold | 15,007 | 14,215 | 18,866 | 19,114 | 19,222 | 18,474 | 17,972 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Gross profit | 3,144 | 3,026 | 4,053 | 4,013 | 3,798 | 3,823 | 3,693 | |||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||

Distribution, selling and administrative costs | 2,749 | 2,689 | 3,586 | 3,650 | 3,546 | 3,494 | 3,350 | |||||||||||||||||||||

Restructuring and tangible asset impairment charges | 3 | 39 | 53 | 173 | — | 8 | 9 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 2,752 | 2,728 | 3,639 | 3,823 | 3,546 | 3,502 | 3,359 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income | 392 | 298 | 414 | 190 | 252 | 321 | 334 | |||||||||||||||||||||

Acquisition termination fees—net | — | — | — | 288 | — | — | — | |||||||||||||||||||||

Interest expense—net | 126 | 190 | 229 | 285 | 289 | 306 | 312 | |||||||||||||||||||||

Loss on extinguishment of debt | — | 54 | 54 | — | — | 42 | 31 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income (loss) before income taxes | 266 | 55 | 131 | 193 | (37 | ) | (27 | ) | (9 | ) | ||||||||||||||||||

Income tax provision (benefit) | 78 | (78 | ) | (79 | ) | 25 | 36 | 30 | 42 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | $ | 188 | $ | 133 | $ | 210 | $ | 168 | $ | (73 | ) | $ | (57 | ) | $ | (51 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) per share: | ||||||||||||||||||||||||||||

Basic | $ | 0.84 | $ | 0.69 | $ | 1.05 | $ | 0.99 | $ | (0.43 | ) | $ | (0.34 | ) | $ | (0.30 | ) | |||||||||||

Diluted (a) | $ | 0.83 | $ | 0.68 | $ | 1.03 | $ | 0.98 | $ | (0.43 | ) | $ | (0.34 | ) | $ | (0.30 | ) | |||||||||||

S-17

| 39-Weeks Ended | Fiscal Year | |||||||||||||||||||||||||||

| September 30, 2017 | October 1, 2016 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

| (unaudited) | (In millions, except for per share data)* | |||||||||||||||||||||||||||

Weighted-average number of shares used in per share amounts: | ||||||||||||||||||||||||||||

Basic | 222.6 | 193.3 | 200.1 | 169.6 | 169.5 | 169.6 | 169.6 | |||||||||||||||||||||

Diluted (a) | 226.3 | 196.8 | 204.0 | 171.1 | 169.5 | 169.6 | 169.6 | |||||||||||||||||||||

Other Data: | ||||||||||||||||||||||||||||

Cash flows—operating activities | $ | 506 | $ | 440 | $ | 556 | $ | 555 | $ | 402 | $ | 322 | $ | 316 | ||||||||||||||

Cash flows—investing activities | (321 | ) | (681 | ) | (762 | ) | (271 | ) | (118 | ) | (187 | ) | (380 | ) | ||||||||||||||

Cash flows—financing activities | (169 | ) | (126 | ) | (180 | ) | (110 | ) | (120 | ) | (197 | ) | 103 | |||||||||||||||

Capital expenditures | 163 | 105 | 164 | 187 | 147 | 191 | 293 | |||||||||||||||||||||

EBITDA (b) | 687 | 559 | 782 | 876 | 664 | 667 | 659 | |||||||||||||||||||||

Adjusted EBITDA (b) | 768 | 707 | 972 | 875 | 866 | 845 | 841 | |||||||||||||||||||||

Adjusted Net income (b) | 214 | 201 | 321 | 154 | 126 | 111 | 129 | |||||||||||||||||||||

Free cash flow (b) | 343 | 335 | 392 | 368 | 255 | 131 | 23 | |||||||||||||||||||||

| As of September 30, 2017 | As of Fiscal Year End | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

| (unaudited) | (In millions)* | |||||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||||||

Cash and cash equivalents | $ | 147 | $ | 131 | $ | 518 | $ | 344 | $ | 180 | $ | 242 | ||||||||||||

Total assets | 9,358 | 8,944 | 9,239 | 9,023 | 9,138 | 9,208 | ||||||||||||||||||

Total debt | 3,703 | 3,782 | 4,745 | 4,714 | 4,722 | 4,759 | ||||||||||||||||||

| (*) | Amounts may not add due to rounding. |

| (a) | When there is a loss for the applicable period, weighted average fully diluted shares outstanding was not used in the computation as the effect would be antidilutive. |

| (b) | EBITDA, Adjusted EBITDA, and Adjusted Net income arenon-GAAP measures used by management to measure operating performance. EBITDA is defined as Net income (loss), plus Interest expense—net, Income tax provision (benefit), and Depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted for 1) Sponsor fees; 2) Restructuring and tangible asset impairment charges; 3) Share-based compensation expense; 4) thenon-cash impact of LIFO reserve adjustments; 5) Loss on extinguishment of debt; 6) Pension settlements; 7) Business transformation costs; 8) Acquisition-related costs; 9) Acquisition termination fees—net; and 10) Other gains, losses, or charges as specified in our debt agreements. Adjusted Net income is defined as Net income (loss), excluding the items used to calculate Adjusted EBITDA listed above, and further adjusted for the tax effect of the exclusions and discrete tax items. EBITDA, Adjusted EBITDA, and Adjusted Net income are supplemental measures of our performance that are not required by—or presented in accordance with—GAAP. They are not measurements of our performance under GAAP and should not be considered as alternatives to Net income (loss) or any other performance measures derived in accordance with GAAP. |

Free cash flow is defined as Cash flows provided by operating activities less Capital expenditures. Free cash flow is used by management as a supplemental measure of our liquidity. We believe that Free cash flow is a useful financial metric to assess our ability to pursue business opportunities and investments. Free cash flow is not a measure of our liquidity under GAAP and should not be considered as an alternative to Cash flows provided by operating activities.

For additional information, see“—Non-GAAP Reconciliations” below.

S-18

Non-GAAP Reconciliations

We provide EBITDA, Adjusted EBITDA, and Adjusted Net income as supplemental measures to GAAP regarding our operational performance. Thesenon-GAAP financial measures exclude the impact of certain items and, therefore, have not been calculated in accordance with GAAP.

We believe EBITDA and Adjusted EBITDA provide meaningful supplemental information about our operating performance because they exclude amounts that we do not consider part of our core operating results when assessing our performance. Items excluded from Adjusted EBITDA include Restructuring and tangible asset impairment charges, Loss on extinguishment of debt, Sponsor fees, Share-based compensation expense, Pension settlements, thenon-cash impact of LIFO reserve adjustments, Business transformation costs (costs associated with the redesign of systems and processes), Acquisition-related costs, Acquisition termination fees—net, and other items as specified in our debt agreements.

We believe that Adjusted Net income is a useful measure of operating performance for both management and investors because it excludes items that are not reflective of our core operating performance and provides an additional view of our operating performance including depreciation, amortization, interest expense, and income taxes on a consistent basis from period to period. Adjusted Net income is Net income (loss) excluding such items as Restructuring and tangible asset impairment charges, Loss on extinguishment of debt, Sponsor fees, Share-based compensation expense, thenon-cash impact of LIFO reserve adjustments, Pension settlements, Business transformation costs (costs associated with redesign of systems and process), and other items, and is adjusted for the tax effect of the exclusions and discrete tax items. We believe that Adjusted Net income is used by investors, analysts and other interested parties to facilitate period-over-period comparisons and provides additional clarity as to how factors and trends impact our operating performance.

Management uses thesenon-GAAP financial measures (a) to evaluate our historical and prospective financial performance as well as our performance relative to our competitors as they assist in highlighting trends, (b) to set internal sales targets and spending budgets, (c) to measure operational profitability and the accuracy of forecasting, (d) to assess financial discipline over operational expenditures, and (e) as an important factor in determining variable compensation for management and employees. EBITDA and Adjusted EBITDA are also used for certain covenants and restricted activities under our debt agreements. We also believe these non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties to evaluate companies in our industry.

We use Free cash flow to review the liquidity of our operations. We measure Free cash flow as Cash flows provided by operating activities less Capital expenditures. We believe that Free cash flow is a useful financial metric to assess our ability to pursue business opportunities and investments. Free cash flow is not a measure of our liquidity under GAAP and should not be considered as an alternative to Cash flows provided by operating activities.

S-19

We caution readers that amounts presented in accordance with our definitions of EBITDA, Adjusted EBITDA, Adjusted Net income, and Free cash flow may not be the same as similar measures used by other companies. Not all companies and analysts calculate EBITDA, Adjusted EBITDA, Adjusted Net income or Free cash flow in the same manner. We compensate for these limitations by using thesenon-GAAP financial measures as supplements to GAAP financial measures and by presenting the reconciliations of thenon-GAAP financial measures to their most comparable GAAP financial measures.

| 39-Weeks Ended | Fiscal Year | |||||||||||||||||||||||||||

| September 30, 2017 | October 1, 2016 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

| (unaudited) | (In millions)* | |||||||||||||||||||||||||||

Net income (loss) | $ | 188 | $ | 133 | $ | 210 | $ | 168 | $ | (73 | ) | $ | (57 | ) | $ | (51 | ) | |||||||||||

Interest expense—net | 126 | 190 | 229 | 285 | 289 | 306 | 312 | |||||||||||||||||||||

Income tax provision (benefit) | 78 | (78 | ) | (79 | ) | 25 | 36 | 30 | 42 | |||||||||||||||||||

Depreciation and amortization expense | 295 | 314 | 421 | 399 | 412 | 388 | 356 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

EBITDA | 687 | 559 | 782 | 877 | 664 | 667 | 659 | |||||||||||||||||||||

Adjustments: | ||||||||||||||||||||||||||||

Sponsor fees (1) | — | 36 | 36 | 10 | 10 | 10 | 10 | |||||||||||||||||||||

Restructuring and tangible asset impairment charges (2) | 3 | 39 | 53 | 173 | — | 8 | 9 | |||||||||||||||||||||

Share-based compensation expense (3) | 15 | 14 | 18 | 16 | 12 | 8 | 4 | |||||||||||||||||||||

Net LIFO reserve change (4) | 14 | (25 | ) | (18 | ) | (74 | ) | 60 | 12 | 13 | ||||||||||||||||||

Loss on extinguishment of debt (5) | — | 54 | 54 | — | — | 42 | 31 | |||||||||||||||||||||

Pension settlements (6) | — | — | — | — | 2 | 2 | 18 | |||||||||||||||||||||

Business transformation costs (7) | 33 | 26 | 37 | 46 | 54 | 61 | 75 | |||||||||||||||||||||

Acquisition-related costs (8) | — | — | 1 | 85 | 38 | 4 | — | |||||||||||||||||||||

Acquisition termination fees—net (9) | — | — | — | (288 | ) | — | — | — | ||||||||||||||||||||

Other (10) | 16 | 5 | 10 | 31 | 26 | 31 | 22 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Adjusted EBITDA | 768 | 707 | 972 | 875 | 866 | 845 | 841 | |||||||||||||||||||||

Depreciation and amortization expense | (295 | ) | (314 | ) | (421 | ) | (399 | ) | (412 | ) | (388 | ) | (356 | ) | ||||||||||||||

Interest expense—net | (126 | ) | (190 | ) | (229 | ) | (285 | ) | (289 | ) | (306 | ) | (312 | ) | ||||||||||||||

Income tax provision, as adjusted (11) | (133 | ) | (2 | ) | (1 | ) | (37 | ) | (39 | ) | (40 | ) | (44 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Adjusted Net income | $ | 214 | $ | 201 | $ | 321 | $ | 154 | $ | 126 | $ | 111 | $ | 129 | ||||||||||||||

|