CARDLYTICS Q3 2022 Earnings Presentation November 1, 2022

Disclaimer This presentation includes forward-looking statements. All statements contained in this presentation other than statements of historical facts, including statements regarding expectations about future financial performance or results of Cardlytics, Inc. (“Cardlytics,” “we,” “us,” or “our) including the potential benefits of our acquisitions of Dosh, Bridg and Entertainment, becoming cash flow positive by the second half of 2023, earnings guidance for the fourth quarter of 2022, Bridg's future gross margin, the anticipated impact of our strategic initiatives to create shareholder value and growth in MAUs and ARPU are forward looking statements. The words “anticipate,” believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements. The future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: risks related to the uncertain impacts that COVID-19 may have on our business, financial condition, results of operations; unfavorable conditions in the global economy and the industries that we serve; our quarterly operating results have fluctuated and may continue to vary from period to period; our ability sustain our revenue and billings growth; risks related the integration of Dosh, Bridg and Entertainment with our company; potential payments under the Merger Agreement with Bridg; risks related to our substantial dependence on our Cardlytics platform product; risks related to our substantial dependence on JPMorgan Chase Bank, National Association (“Chase”), Bank of America, National Association (“Bank of America”), Wells Fargo Bank, National Association (“Wells Fargo”) and a limited number of other financial institution (“FI”) partners; risks related to our ability to maintain relationships with Chase, Bank of America and Wells Fargo; the amount and timing of budgets by marketers, which are affected by budget cycles, economic conditions and other factors, including the impact of the COVID-19 pandemic; our ability to generate sufficient revenue to offset contractual commitments to FIs; our ability to attract new partners, which include FI partners and merchant data partners, and maintain relationships with bank processors and digital banking providers; our ability to maintain relationships with marketers; our ability to adapt to changing market conditions, including our ability to adapt to changes in consumer habits, negotiate fee arrangements with new and existing partners and retailers, and develop and launch new services and features; and other risks detailed in the “Risk Factors” section of our Form 10-Q filed with the Securities and Exchange Commission on November 1, 2022. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements or events and circumstances reflected in the forward-looking statements will occur. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations, except as required by law. In addition to U.S. GAAP financial information, this presentation includes billings, adjusted contribution, adjusted Partner Share and other third-party costs, adjusted EBITDA, adjusted EBITDA margin, non-GAAP net loss and non-GAAP net loss) per share, each of which is a non-GAAP financial measure. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. Reconciliations of billings, adjusted contribution, adjusted Partner Share and other third-party costs, adjusted EBITDA, adjusted EBITDA margin, non-GAAP net loss and non-GAAP net loss per share to the most directly comparable GAAP measures are included in the appendix to this presentation. Please see appendix for definitions.

Company overview

© 2021 Cardlytics 4 We power a native ad platform in our partners’ digital channels.

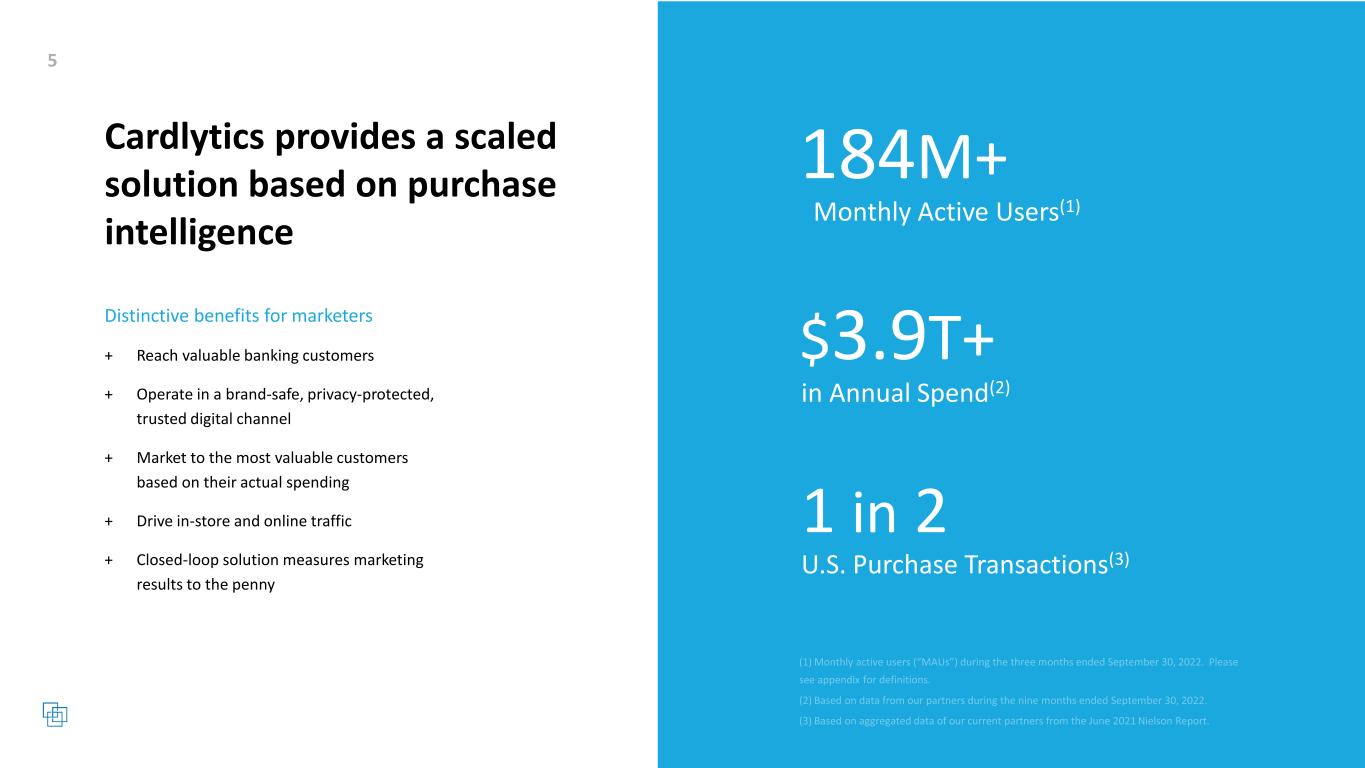

Cardlytics provides a scaled solution based on purchase intelligence 184M+ Monthly Active Users(1) $3.9T+ in Annual Spend(2) 1 in 2 U.S. Purchase Transactions(3) Distinctive benefits for marketers + Reach valuable banking customers + Operate in a brand-safe, privacy-protected, trusted digital channel + Market to the most valuable customers based on their actual spending + Drive in-store and online traffic + Closed-loop solution measures marketing results to the penny

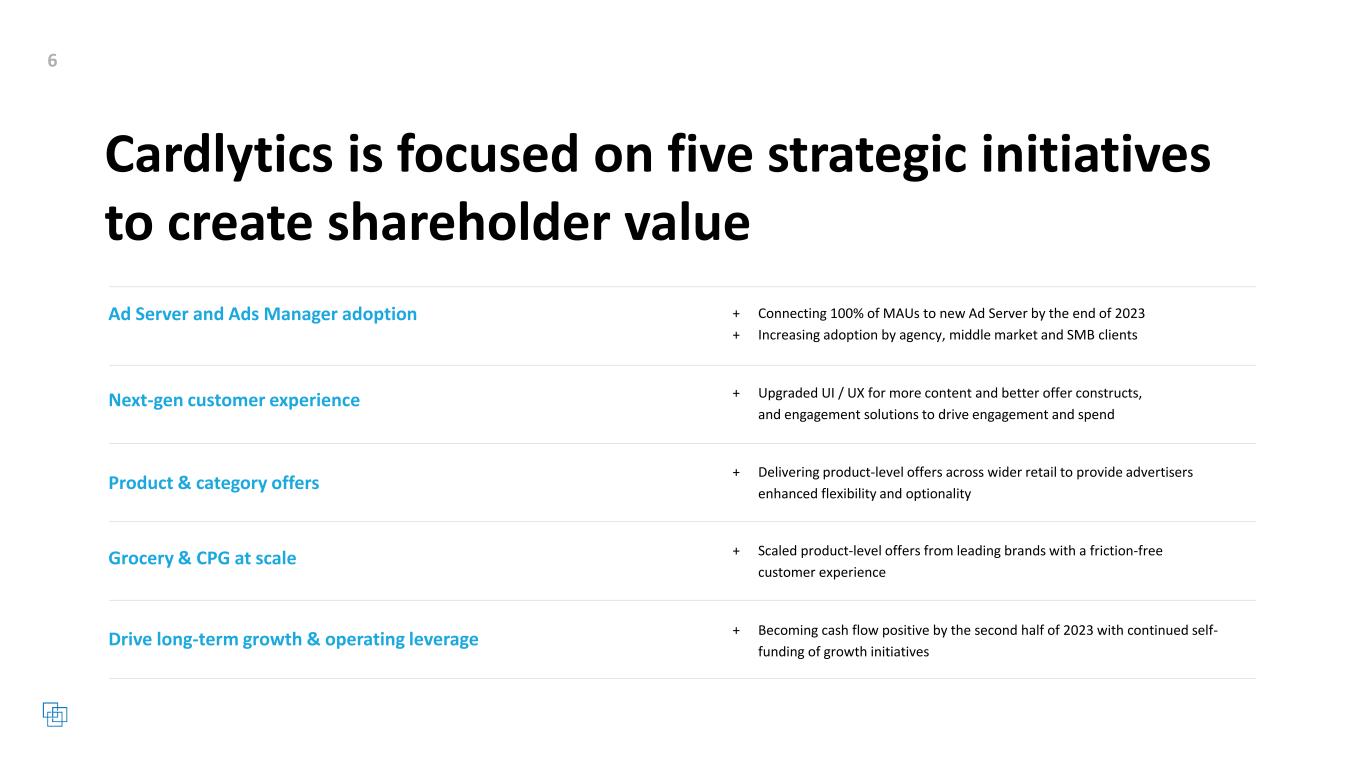

Cardlytics is focused on five strategic initiatives to create shareholder value + Connecting 100% of MAUs to new Ad Server by the end of 2023 + Increasing adoption by agency, middle market and SMB clients Drive long-term growth & operating leverage + Upgraded UI / UX for more content and better offer constructs, and engagement solutions to drive engagement and spend Ad Server and Ads Manager adoption + Delivering product-level offers across wider retail to provide advertisers enhanced flexibility and optionality Next-gen customer experience + Scaled product-level offers from leading brands with a friction-free customer experience Product & category offers + Becoming cash flow positive by the second half of 2023 with continued self- funding of growth initiatives Grocery & CPG at scale

Financial information & operating metrics

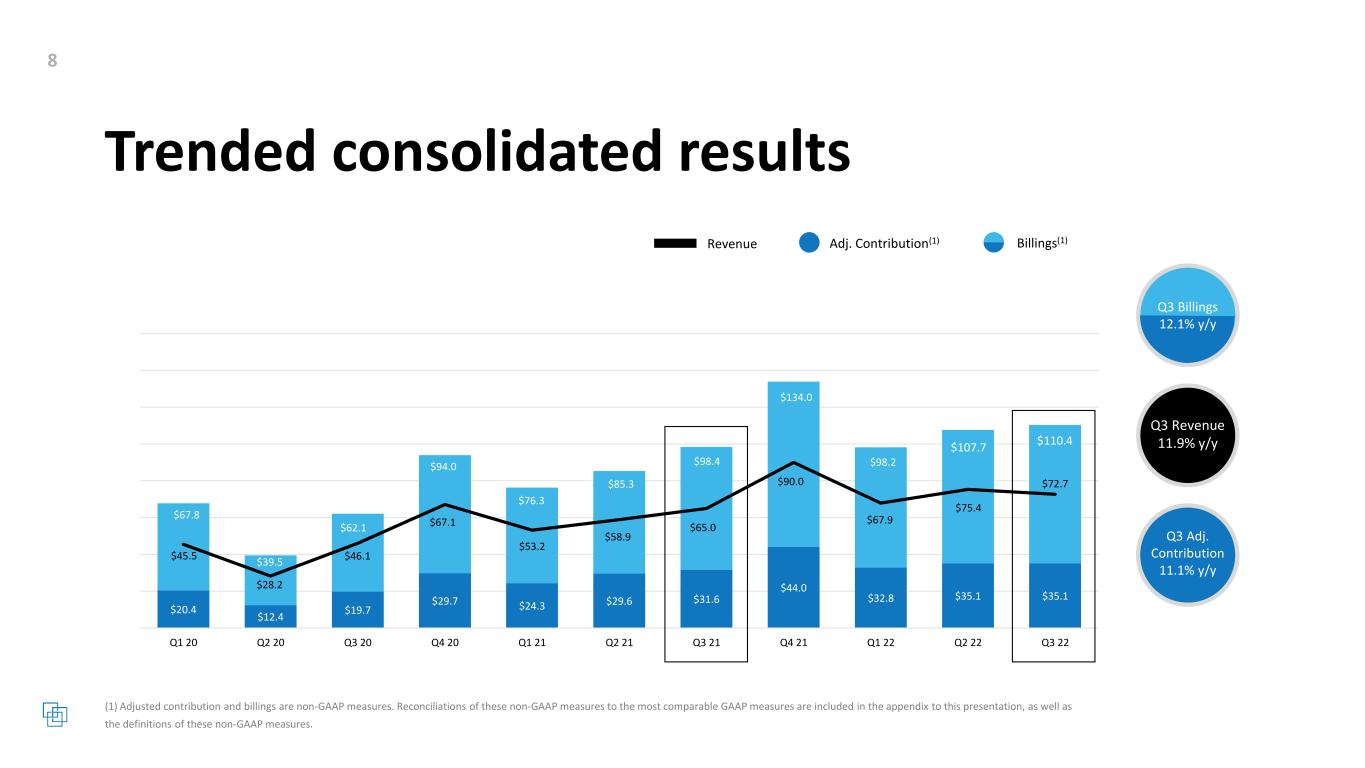

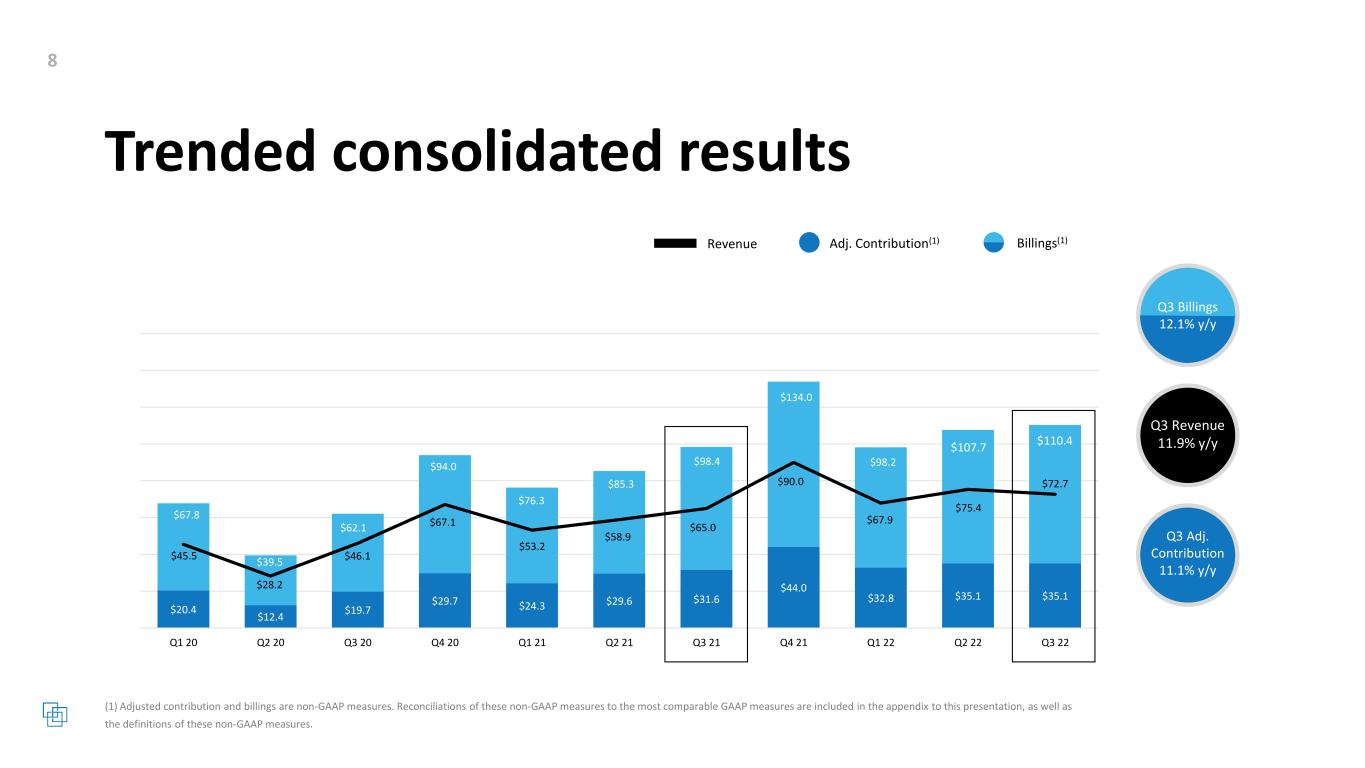

Trended consolidated results Q3 Adj. Contribution 11.1% y/y Q3 Revenue 11.9% y/y Q3 Billings 12.1% y/y Revenue Adj. Contribution(1) Billings(1) $107.7 $20.4 $12.4 $19.7 $29.7 $24.3 $29.6 $31.6 $44.0 $32.8 $35.1 $35.1 $45.5 $28.2 $46.1 $67.1 $53.2 $58.9 $65.0 $90.0 $67.9 $75.4 $72.7 $67.8 $39.5 $62.1 $94.0 $76.3 $85.3 $98.4 $134.0 $98.2 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 $107.7 $110.4

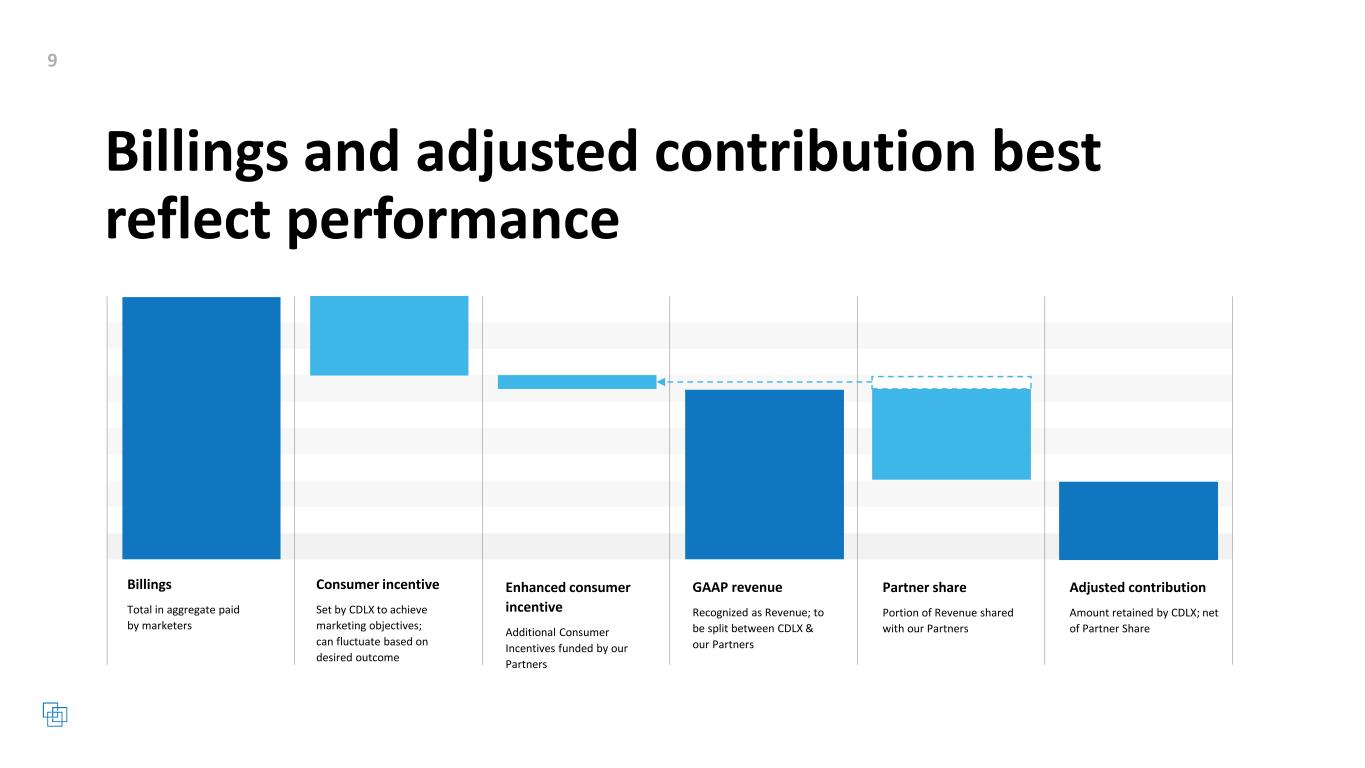

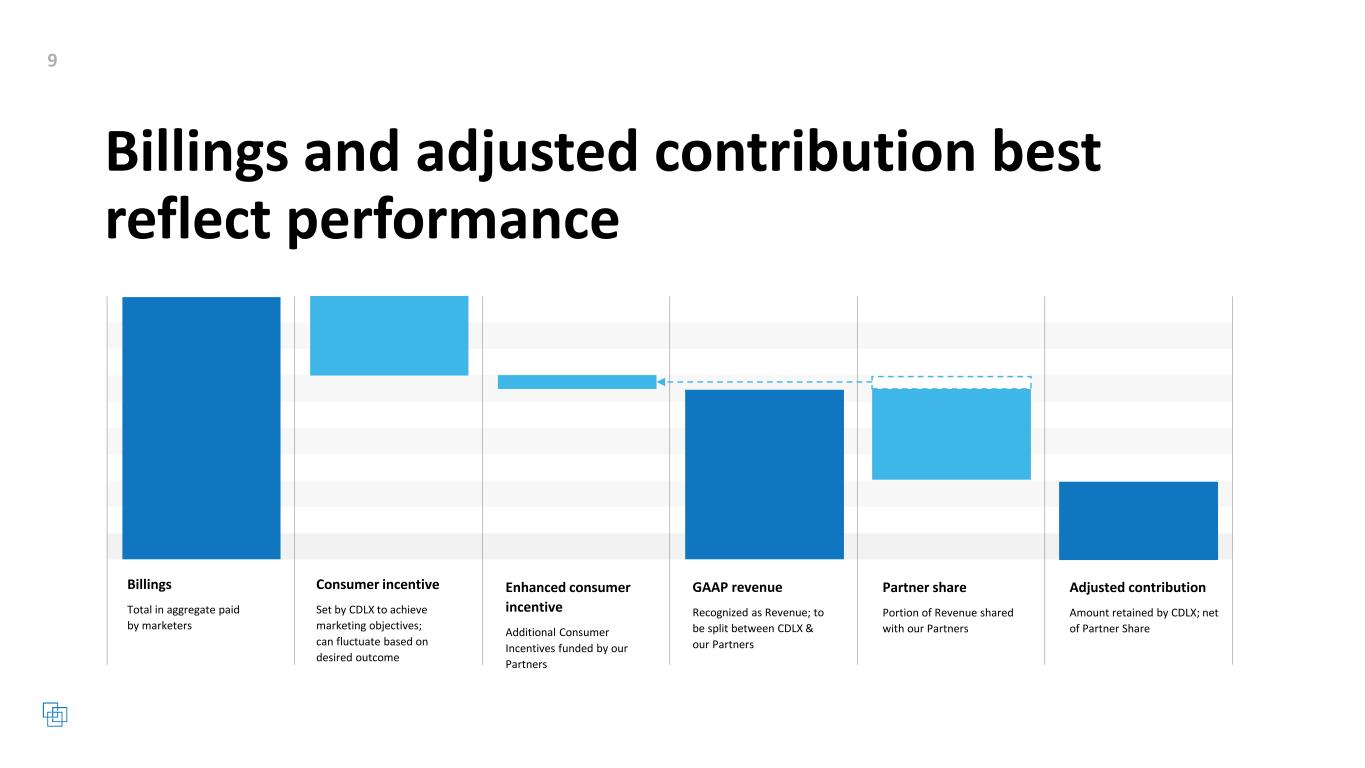

Billings and adjusted contribution best reflect performance Billings Total in aggregate paid by marketers Consumer incentive Set by CDLX to achieve marketing objectives; can fluctuate based on desired outcome Enhanced consumer incentive Additional Consumer Incentives funded by our Partners GAAP revenue Recognized as Revenue; to be split between CDLX & our Partners Partner share Portion of Revenue shared with our Partners Adjusted contribution Amount retained by CDLX; net of Partner Share

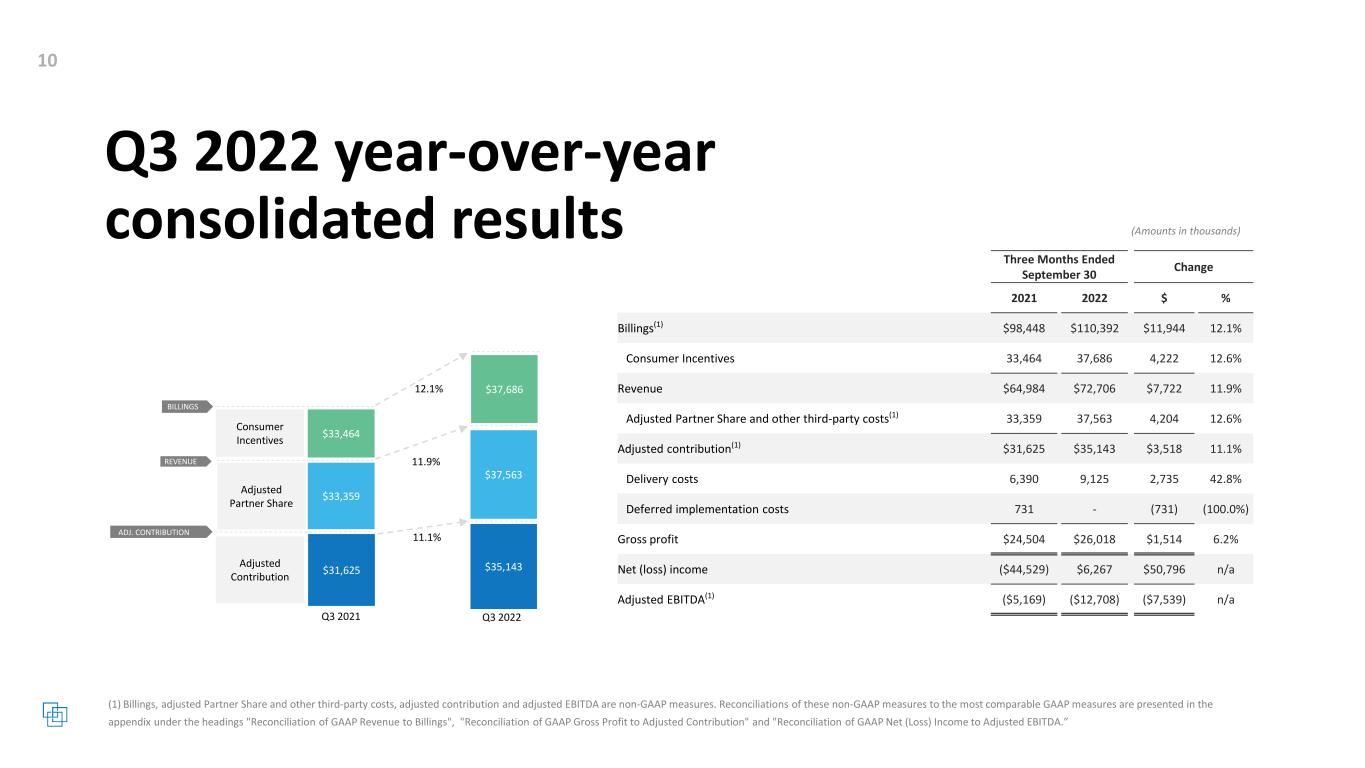

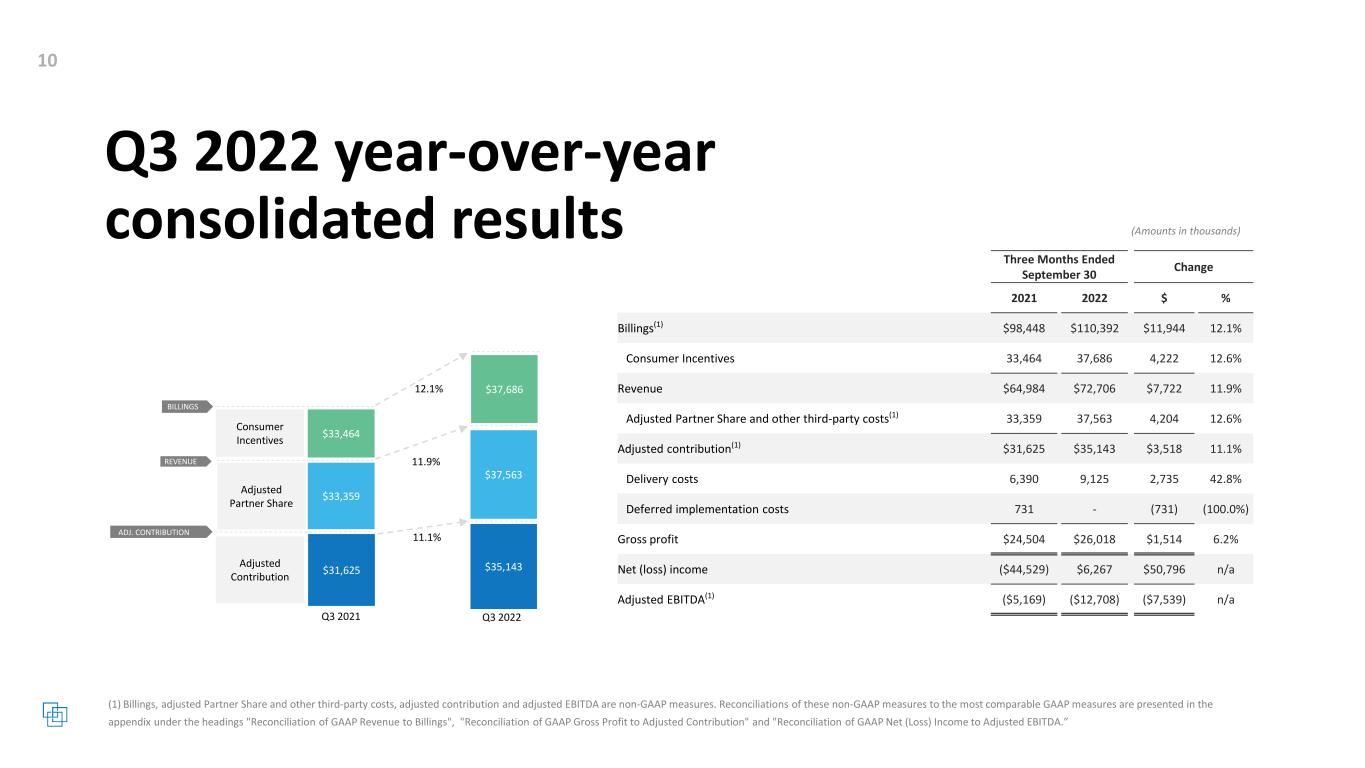

Q3 2022 year-over-year consolidated results Consumer Incentives $33,464 $37,686 Adjusted Partner Share $37,563 $31,625 $35,143 BILLINGS REVENUE ADJ. CONTRIBUTION Adjusted Contribution 12.1% 11.9% 11.1% Q3 2021 Q3 2022 $33,359 Three Months Ended September 30 Change 2021 2022 $ % Billings(1) $98,448 $110,392 $11,944 12.1% Consumer Incentives 33,464 37,686 4,222 12.6% Revenue $64,984 $72,706 $7,722 11.9% Adjusted Partner Share and other third-party costs(1) 33,359 37,563 4,204 12.6% Adjusted contribution(1) $31,625 $35,143 $3,518 11.1% Delivery costs 6,390 9,125 2,735 42.8% Deferred implementation costs 731 - (731) (100.0%) Gross profit $24,504 $26,018 $1,514 6.2% Net (loss) income ($44,529) $6,267 $50,796 n/a Adjusted EBITDA(1) ($5,169) ($12,708) ($7,539) n/a

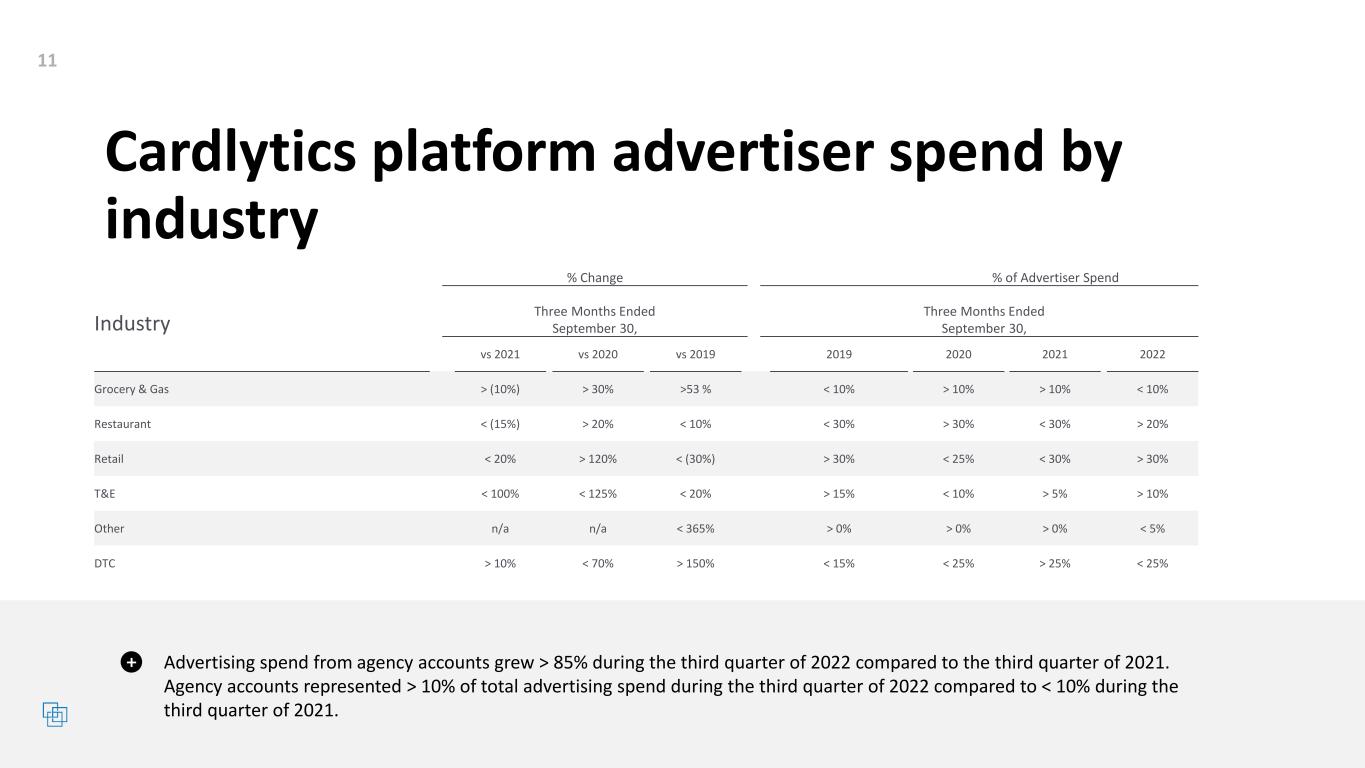

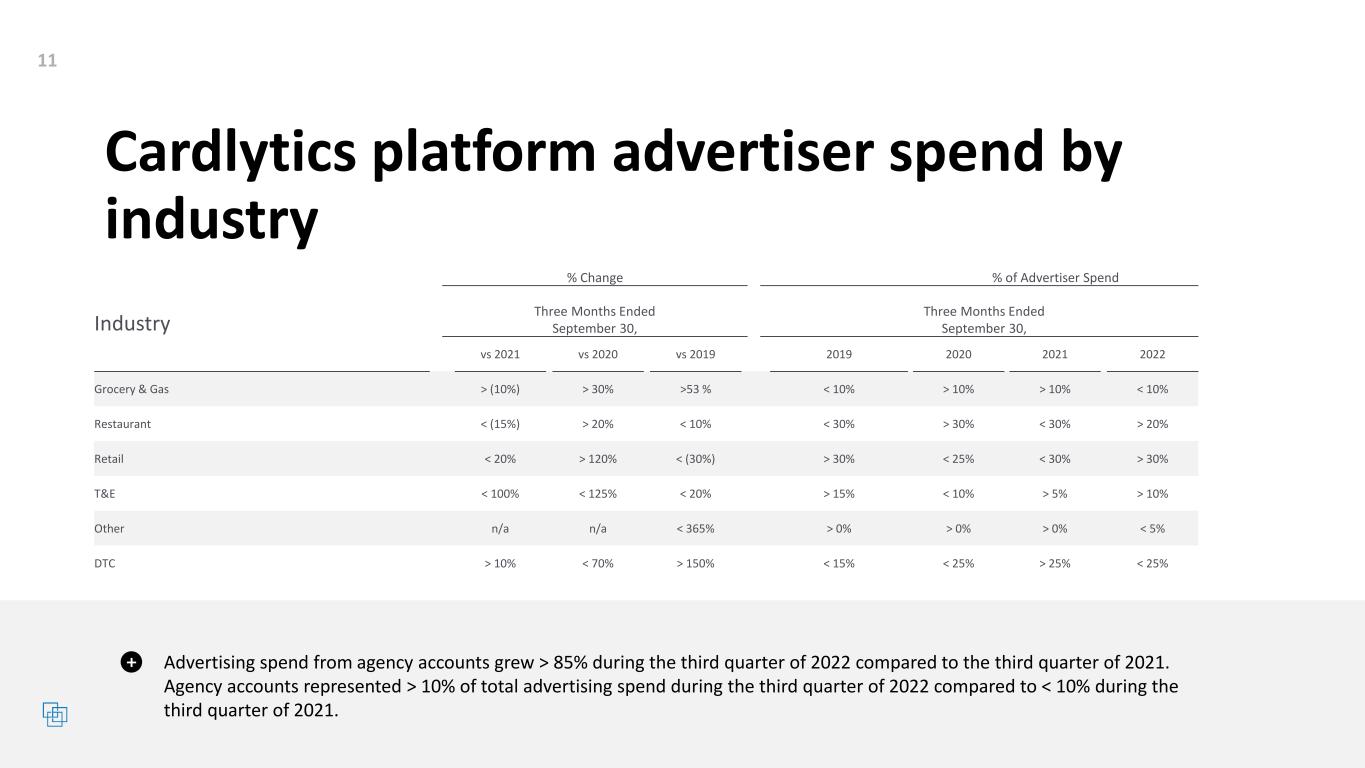

Cardlytics platform advertiser spend by industry Advertising spend from agency accounts grew > 85% during the third quarter of 2022 compared to the third quarter of 2021. Agency accounts represented > 10% of total advertising spend during the third quarter of 2022 compared to < 10% during the third quarter of 2021. Industry % Change % of Advertiser Spend Three Months Ended September 30, Three Months Ended September 30, vs 2021 vs 2020 vs 2019 2019 2020 2021 2022 Grocery & Gas > (10%) > 30% >53 % < 10% > 10% > 10% < 10% Restaurant < (15%) > 20% < 10% < 30% > 30% < 30% > 20% Retail < 20% > 120% < (30%) > 30% < 25% < 30% > 30% T&E < 100% < 125% < 20% > 15% < 10% > 5% > 10% Other n/a n/a < 365% > 0% > 0% > 0% < 5% DTC > 10% < 70% > 150% < 15% < 25% > 25% < 25%

Cardlytics platform engagement metrics(1) There may be variation in future quarters due to factors such as global economic events, bank launches, new advertisers with significant spend, and growth in nascent or new verticals. Monthly log-in days(2) show that MAUs logged in 10 days per month in Q3 2022 and Q3 2021. Offer activation rates(2) show higher rates for small-ticket, volume-heavy offers versus large-ticket and subscription offers. Campaign spend ratios(2) show Cardlytics currently targets a small proportion of total MAU spend. + As budgets increase and more advertisers come onto the platform, more spend from MAUs can be targeted with offers. + There remains considerable room to target larger audiences in light of existing MAU engagement levels. Campaign Spend Ratios by Industry Offer Activation Rates by Industry Q3 2021 Q3 2022 Q3 2021 Q3 2022 0.43% 0.50% 0.90% 0.03% 3.47% 1.19% 1.83% 2.24% 0.63% 1.53% 1.10% 0.47% 2.36% 1.35% 0.31% 2.56% 1.97% 2.10% 3.66% 2.73% 7.30% 2.76% 2.83% 5.25% 2.17% 2.91% 2.92% 2.34% 6.99% 2.54% 2.66% 4.32%

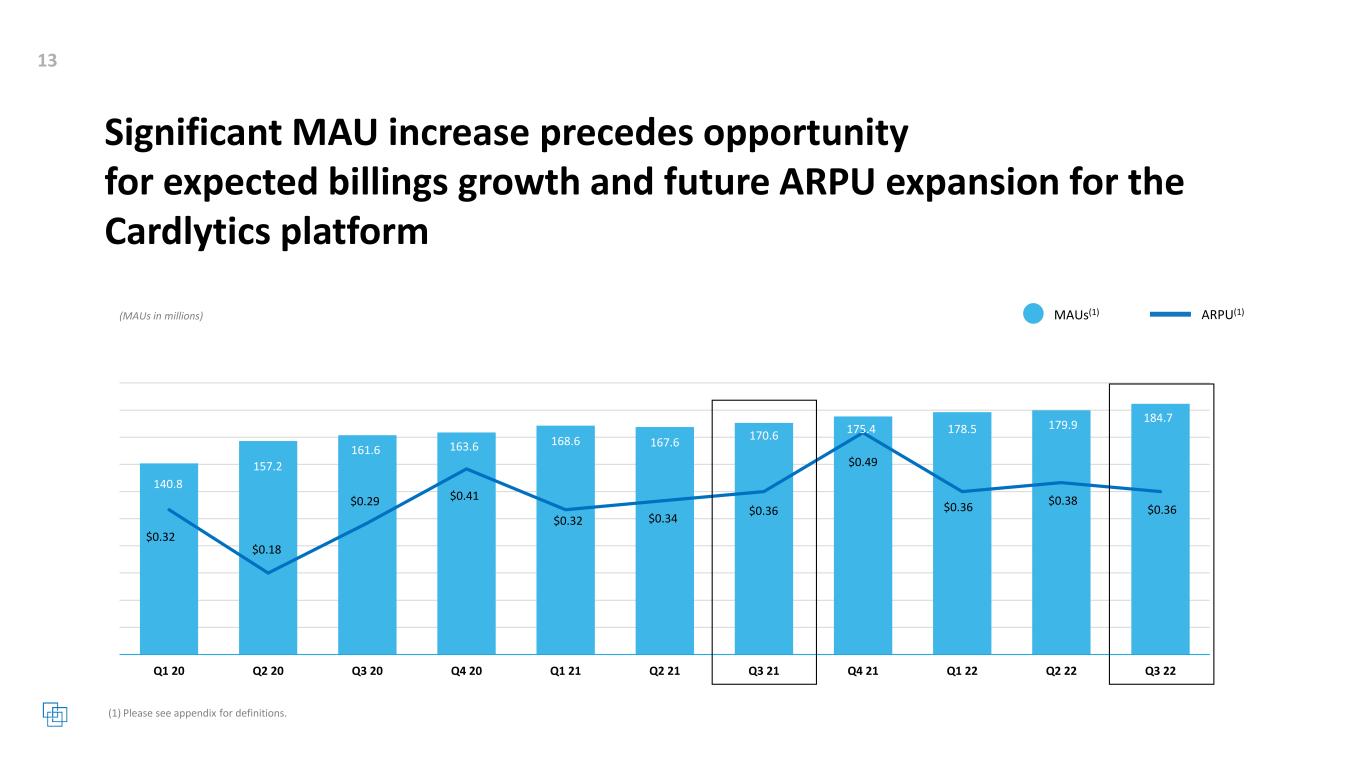

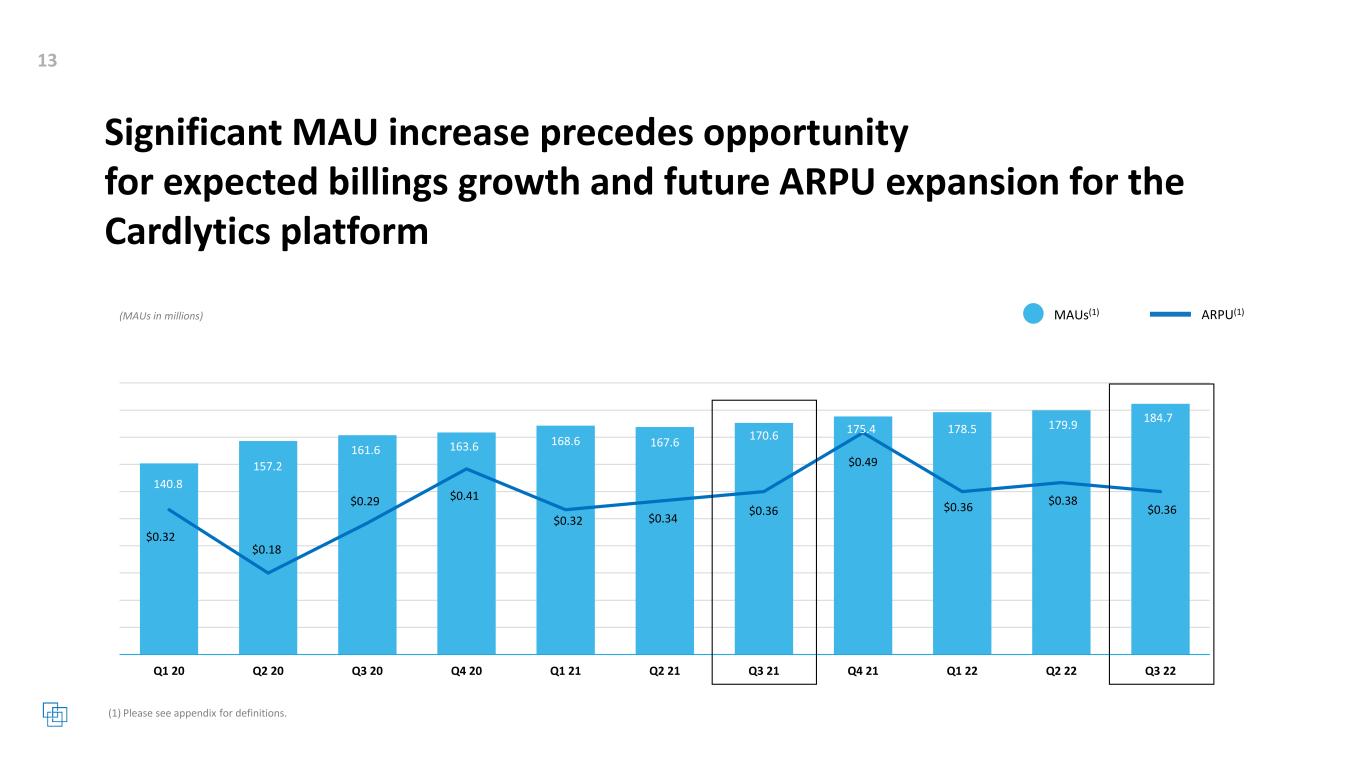

Significant MAU increase precedes opportunity for expected billings growth and future ARPU expansion for the Cardlytics platform ARPU(1)MAUs(1) 140.8 157.2 161.6 163.6 168.6 167.6 170.6 175.4 178.5 179.9 184.7 $0.32 $0.18 $0.29 $0.41 $0.32 $0.34 $0.36 $0.49 $0.36 $0.38 $0.36 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22

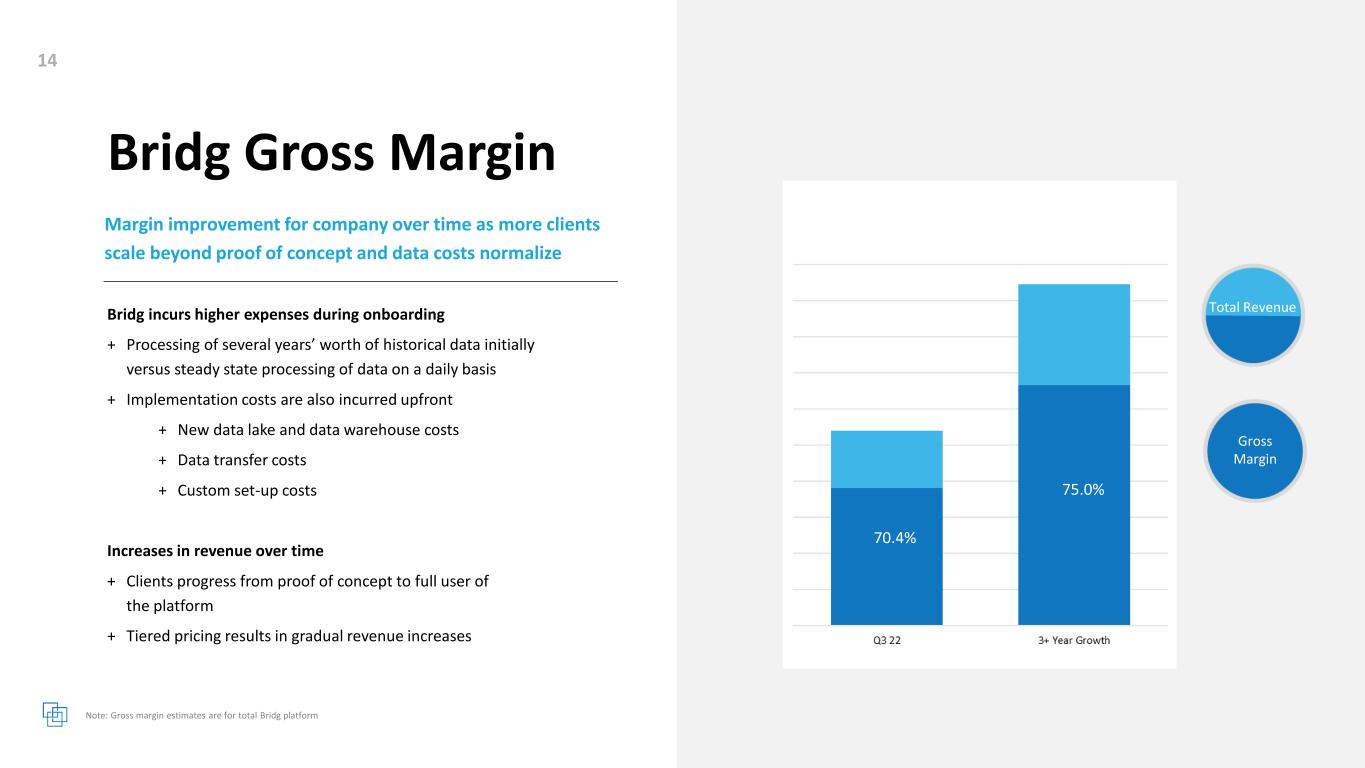

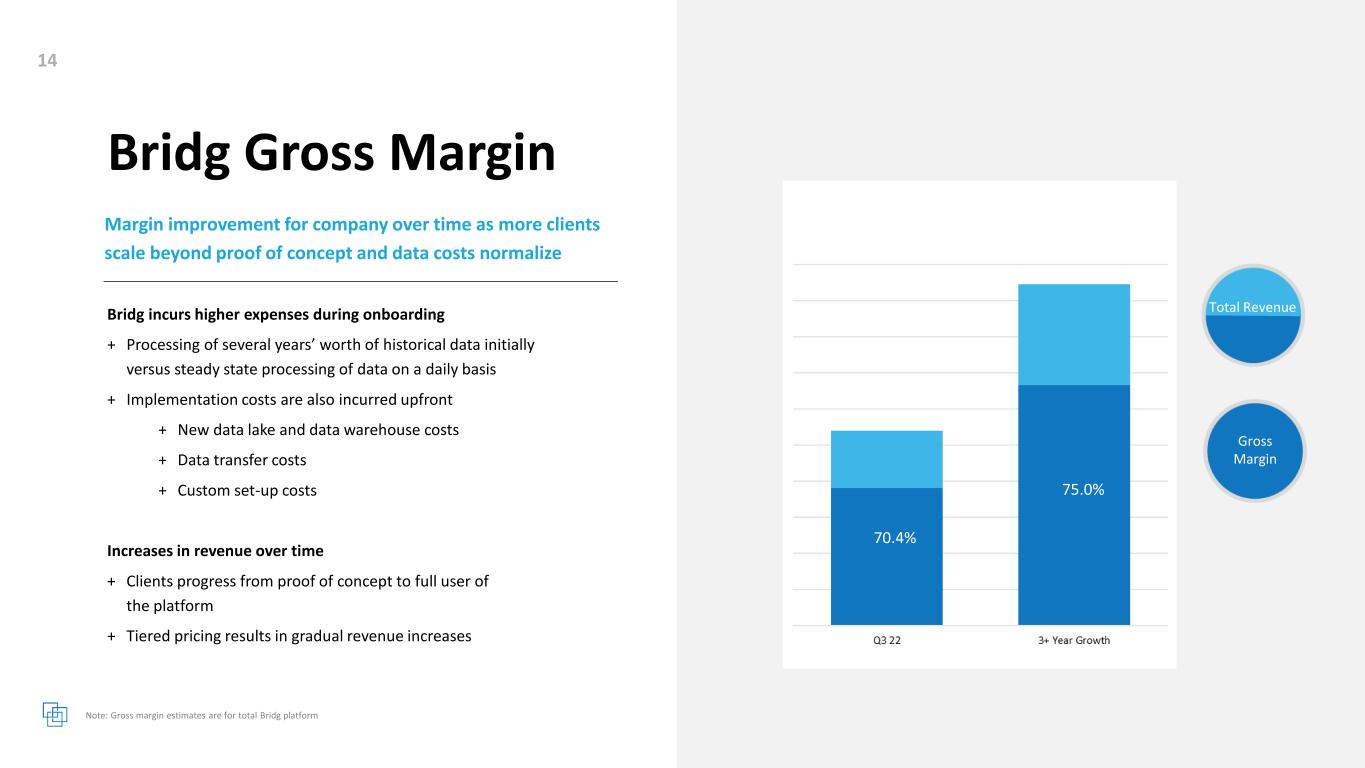

Bridg Gross Margin Bridg incurs higher expenses during onboarding + Processing of several years’ worth of historical data initially versus steady state processing of data on a daily basis + Implementation costs are also incurred upfront + New data lake and data warehouse costs + Data transfer costs + Custom set-up costs Increases in revenue over time + Clients progress from proof of concept to full user of the platform + Tiered pricing results in gradual revenue increases Margin improvement for company over time as more clients scale beyond proof of concept and data costs normalize Note: Gross margin estimates are for total Bridg platform Total Revenue Gross Margin 75.0% 70.4%

Appendix

Q3 2022 results Three Months Ended September 30, Change Nine Months Ended September 30, Change 2022 2021 AMT % 2022 2021 AMT % Revenue $72,706 $64,984 $7,722 11.9% $216,039 $177,067 $38,972 22.0% Billings(1) 110,392 98,448 11,944 12.1% 316,361 260,102 56,259 21.6% Gross Profit 26,018 24,504 1,514 6.2% 79,223 67,177 12,046 17.9% Adjusted contribution(1) 35,143 31,625 3,518 11.1% 103,043 85,596 17,447 20.4% Net income (loss) attributable to common stockholders 6,267 (44,529) 50,796 n/a (86,985) (116,730) 29,745 (25.5%) Net income (loss) per share (EPS), diluted $0.19 ($1.35) $1.54 n/a ($2.60) ($3.67) $1.07 (29.2%) Adjusted EBITDA(1) ($12,708) ($5,169) ($7,539) n/a ($39,030) ($14,779) ($24,251) n/a Adjusted EBITDA margin(1)(2) (17.5%) (8.0%) (9.8%) n/a (18.1%) (8.3%) (9.7%) n/a Non-GAAP net loss(1) ($16,549) ($10,971) ($5,578) n/a ($50,571) ($33,702) ($16,869) n/a Non-GAAP net loss per share(1) ($0.50) ($0.33) ($0.17) n/a ($1.51) ($1.06) ($0.45) n/a Cardlytics MAUs (in millions) 184.7 170.6 14.1 8.3% 181.2 167.5 13.7 8.2% Cardlytics ARPU $0.36 $0.36 $0.00 n/a $1.11 $1.03 $0.08 7.77% Bridg ARR $22,115 $12,734 $9,381 73.7% $22,115 $12,734 $9,381 73.7%

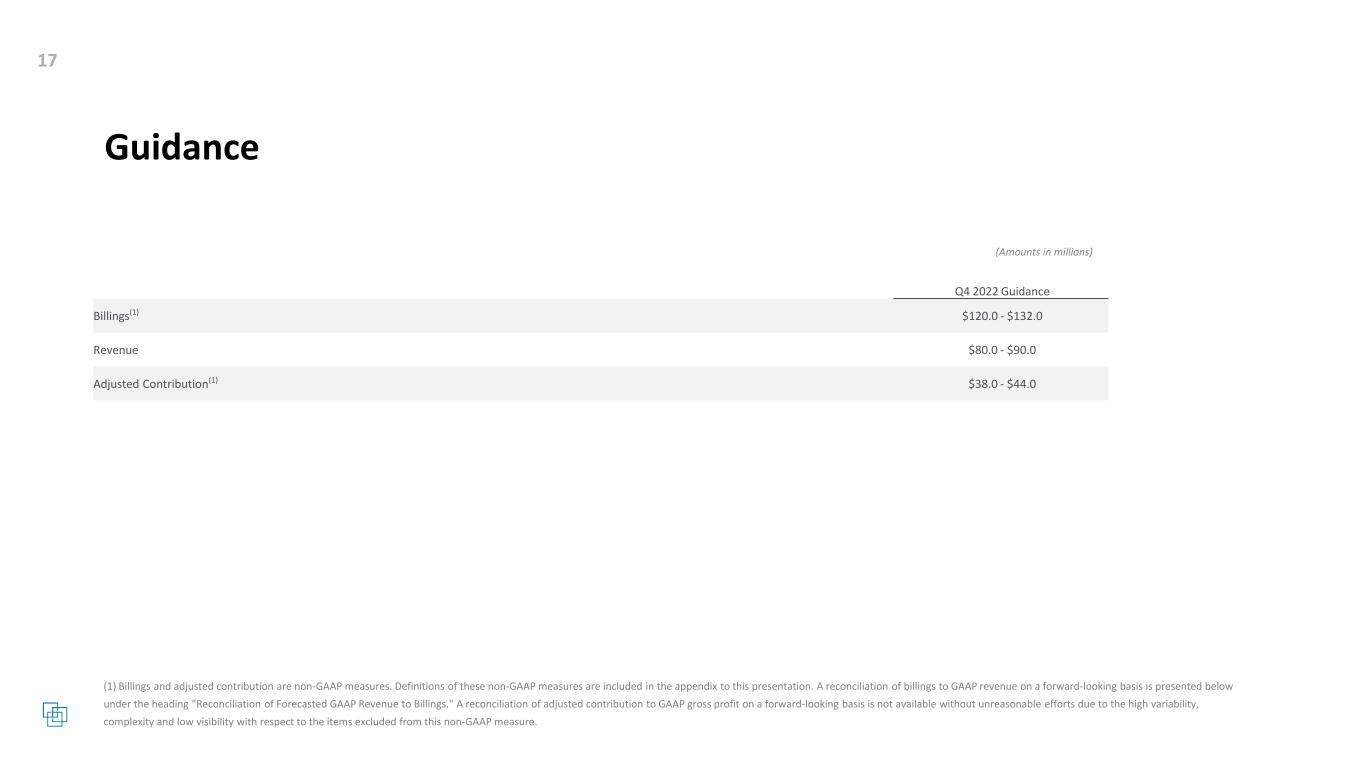

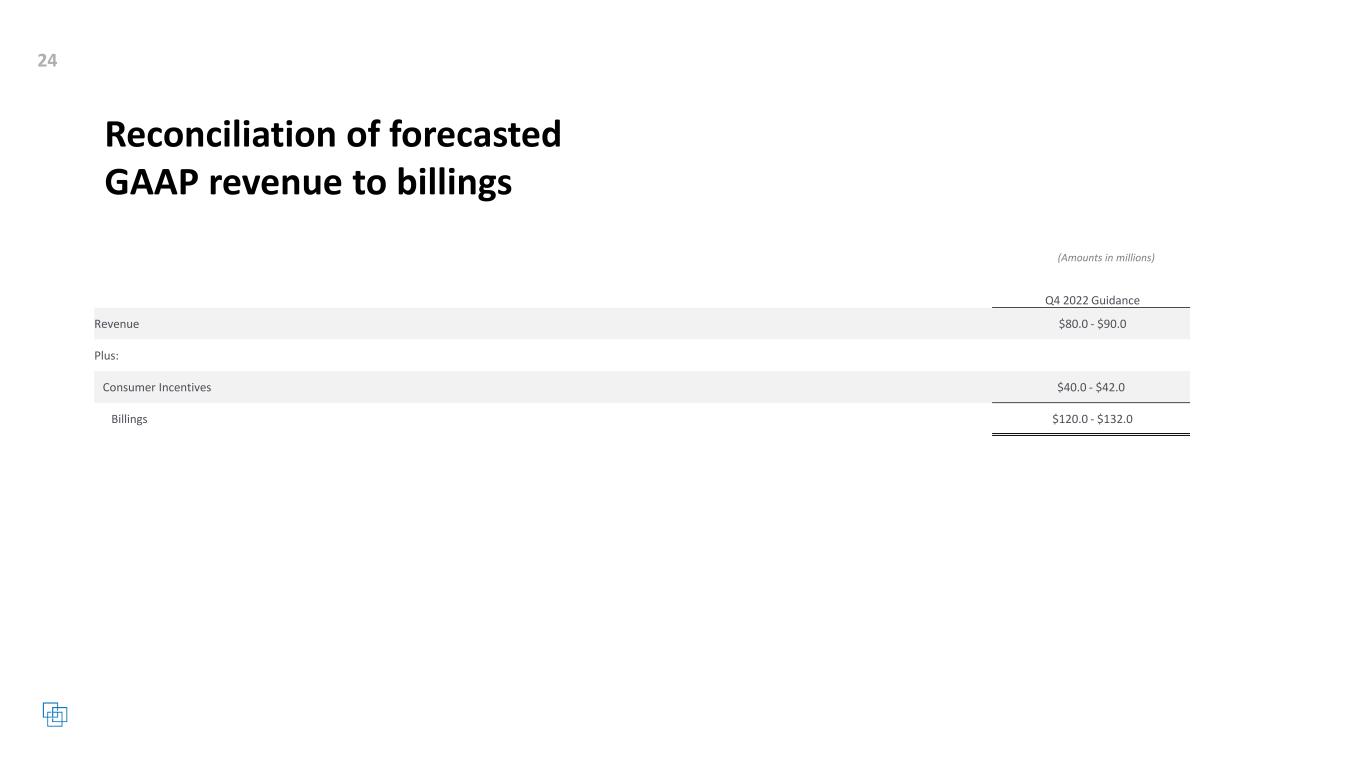

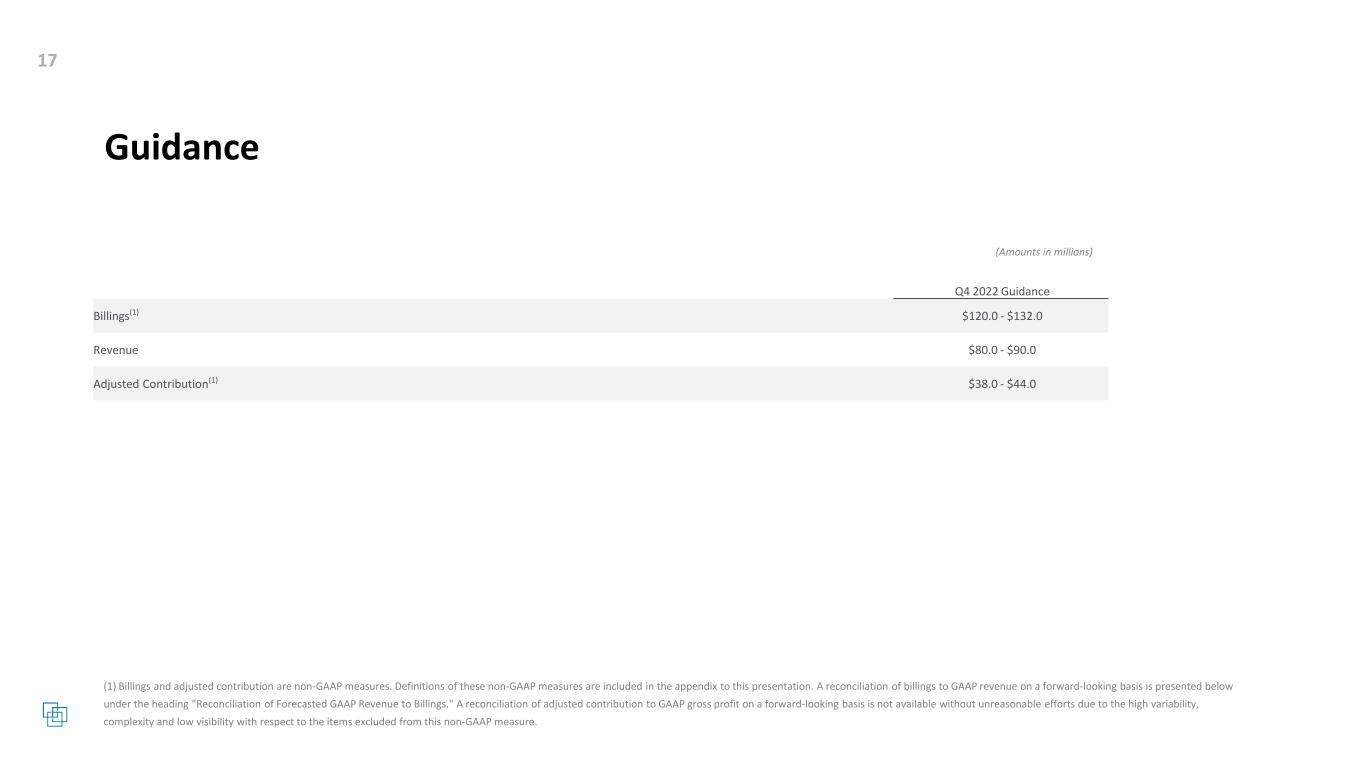

Guidance Q4 2022 Guidance Billings(1) $120.0 - $132.0 Revenue $80.0 - $90.0 Adjusted Contribution(1) $38.0 - $44.0

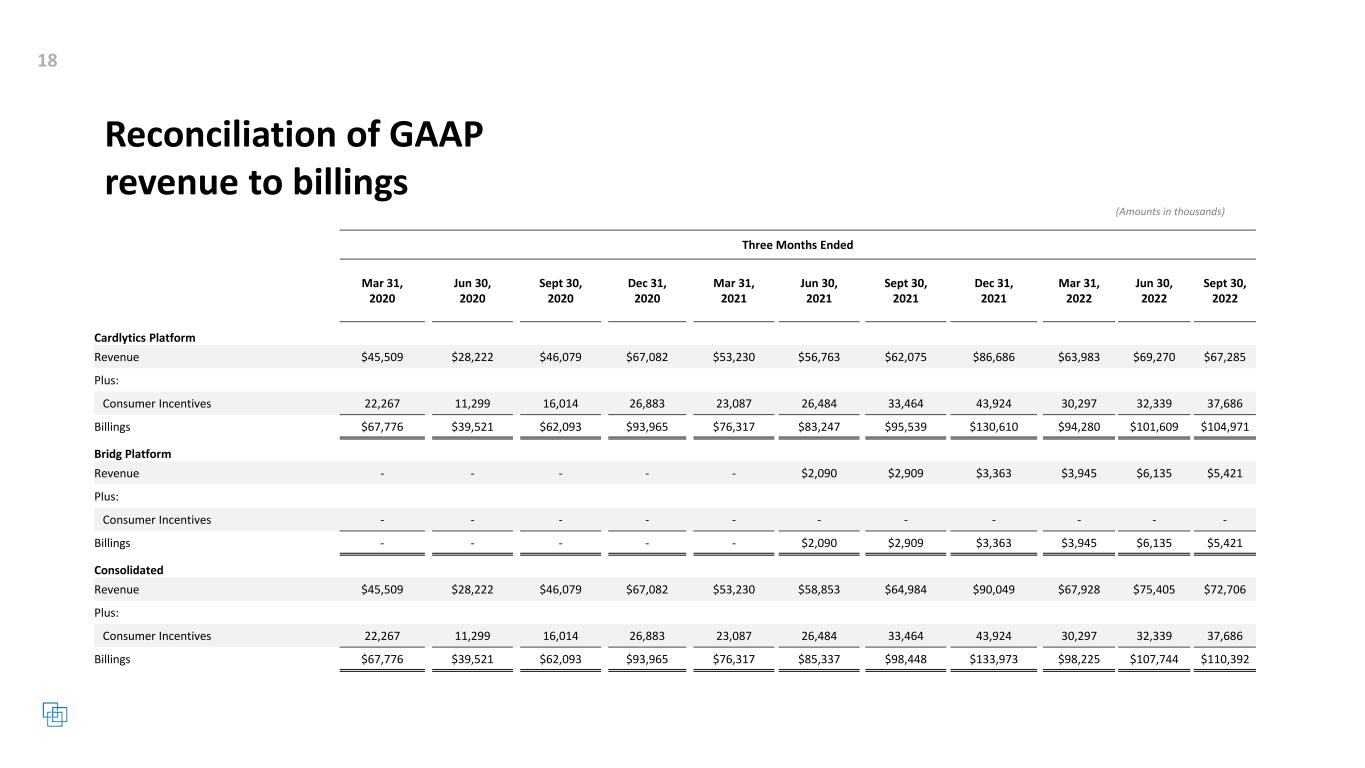

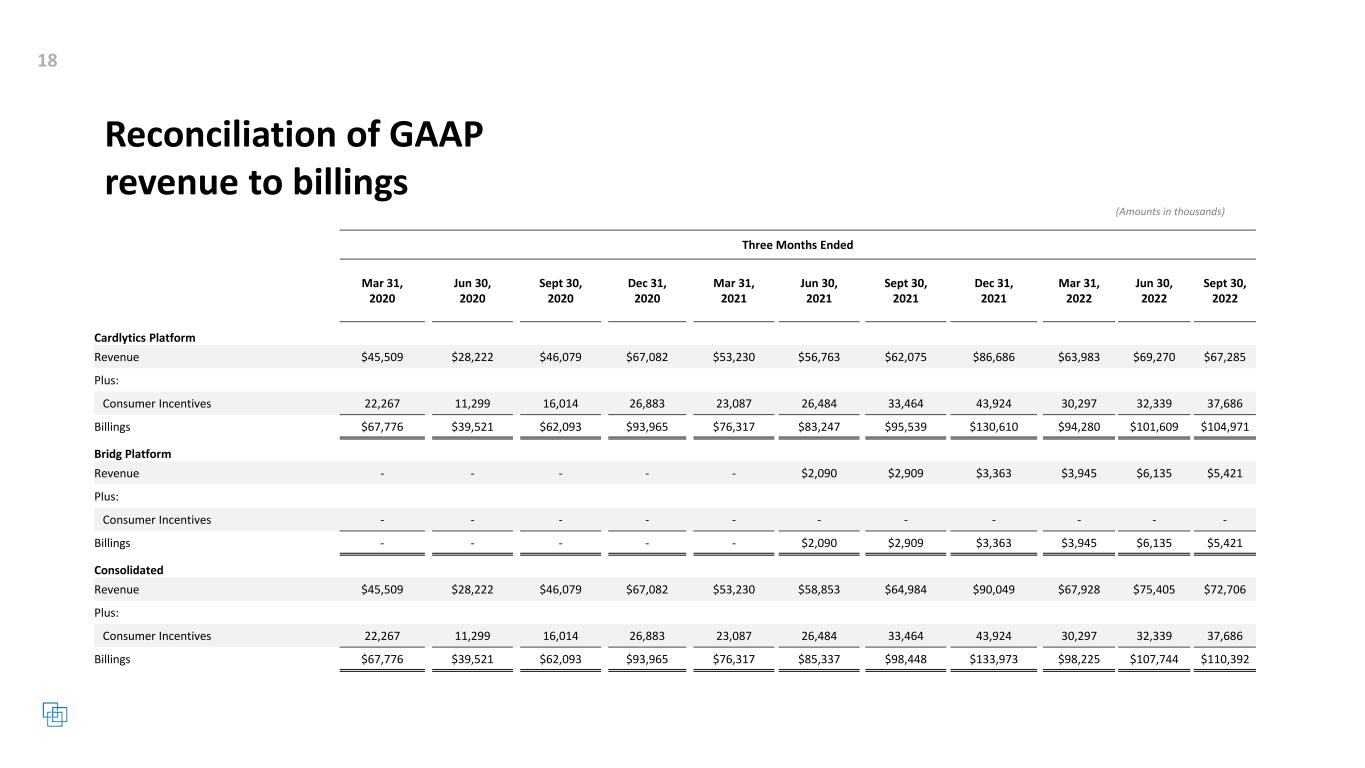

Reconciliation of GAAP revenue to billings Three Months Ended Mar 31, 2020 Jun 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sept 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sept 30, 2022 Cardlytics Platform Revenue $45,509 $28,222 $46,079 $67,082 $53,230 $56,763 $62,075 $86,686 $63,983 $69,270 $67,285 Plus: Consumer Incentives 22,267 11,299 16,014 26,883 23,087 26,484 33,464 43,924 30,297 32,339 37,686 Billings $67,776 $39,521 $62,093 $93,965 $76,317 $83,247 $95,539 $130,610 $94,280 $101,609 $104,971 Bridg Platform Revenue - - - - - $2,090 $2,909 $3,363 $3,945 $6,135 $5,421 Plus: Consumer Incentives - - - - - - - - - - - Billings - - - - - $2,090 $2,909 $3,363 $3,945 $6,135 $5,421 Consolidated Revenue $45,509 $28,222 $46,079 $67,082 $53,230 $58,853 $64,984 $90,049 $67,928 $75,405 $72,706 Plus: Consumer Incentives 22,267 11,299 16,014 26,883 23,087 26,484 33,464 43,924 30,297 32,339 37,686 Billings $67,776 $39,521 $62,093 $93,965 $76,317 $85,337 $98,448 $133,973 $98,225 $107,744 $110,392

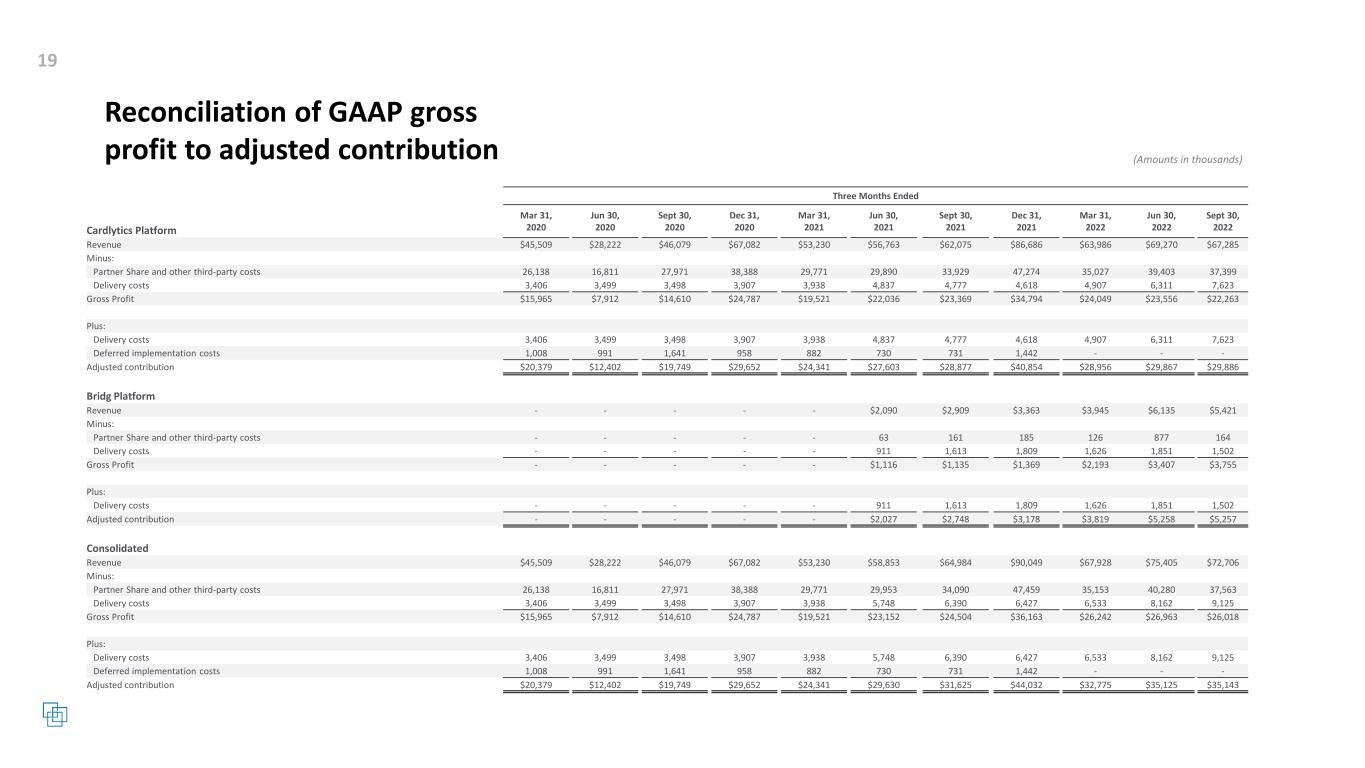

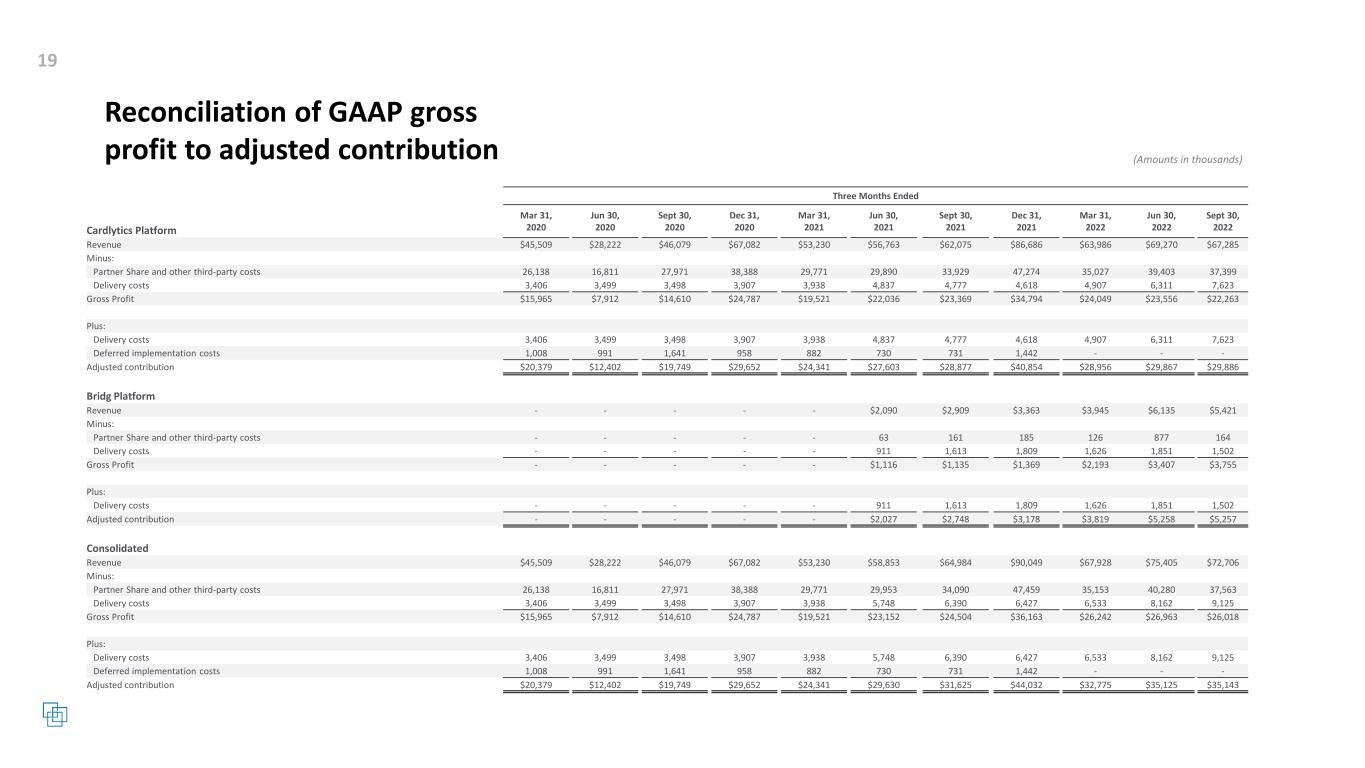

Reconciliation of GAAP gross profit to adjusted contribution Three Months Ended Mar 31, 2020 Jun 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sept 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sept 30, 2022Cardlytics Platform Revenue $45,509 $28,222 $46,079 $67,082 $53,230 $56,763 $62,075 $86,686 $63,986 $69,270 $67,285 Minus: Partner Share and other third-party costs 26,138 16,811 27,971 38,388 29,771 29,890 33,929 47,274 35,027 39,403 37,399 Delivery costs 3,406 3,499 3,498 3,907 3,938 4,837 4,777 4,618 4,907 6,311 7,623 Gross Profit $15,965 $7,912 $14,610 $24,787 $19,521 $22,036 $23,369 $34,794 $24,049 $23,556 $22,263 Plus: Delivery costs 3,406 3,499 3,498 3,907 3,938 4,837 4,777 4,618 4,907 6,311 7,623 Deferred implementation costs 1,008 991 1,641 958 882 730 731 1,442 - - - Adjusted contribution $20,379 $12,402 $19,749 $29,652 $24,341 $27,603 $28,877 $40,854 $28,956 $29,867 $29,886 Bridg Platform Revenue - - - - - $2,090 $2,909 $3,363 $3,945 $6,135 $5,421 Minus: Partner Share and other third-party costs - - - - - 63 161 185 126 877 164 Delivery costs - - - - - 911 1,613 1,809 1,626 1,851 1,502 Gross Profit - - - - - $1,116 $1,135 $1,369 $2,193 $3,407 $3,755 Plus: Delivery costs - - - - - 911 1,613 1,809 1,626 1,851 1,502 Adjusted contribution - - - - - $2,027 $2,748 $3,178 $3,819 $5,258 $5,257 Consolidated Revenue $45,509 $28,222 $46,079 $67,082 $53,230 $58,853 $64,984 $90,049 $67,928 $75,405 $72,706 Minus: Partner Share and other third-party costs 26,138 16,811 27,971 38,388 29,771 29,953 34,090 47,459 35,153 40,280 37,563 Delivery costs 3,406 3,499 3,498 3,907 3,938 5,748 6,390 6,427 6,533 8,162 9,125 Gross Profit $15,965 $7,912 $14,610 $24,787 $19,521 $23,152 $24,504 $36,163 $26,242 $26,963 $26,018 Plus: Delivery costs 3,406 3,499 3,498 3,907 3,938 5,748 6,390 6,427 6,533 8,162 9,125 Deferred implementation costs 1,008 991 1,641 958 882 730 731 1,442 - - - Adjusted contribution $20,379 $12,402 $19,749 $29,652 $24,341 $29,630 $31,625 $44,032 $32,775 $35,125 $35,143

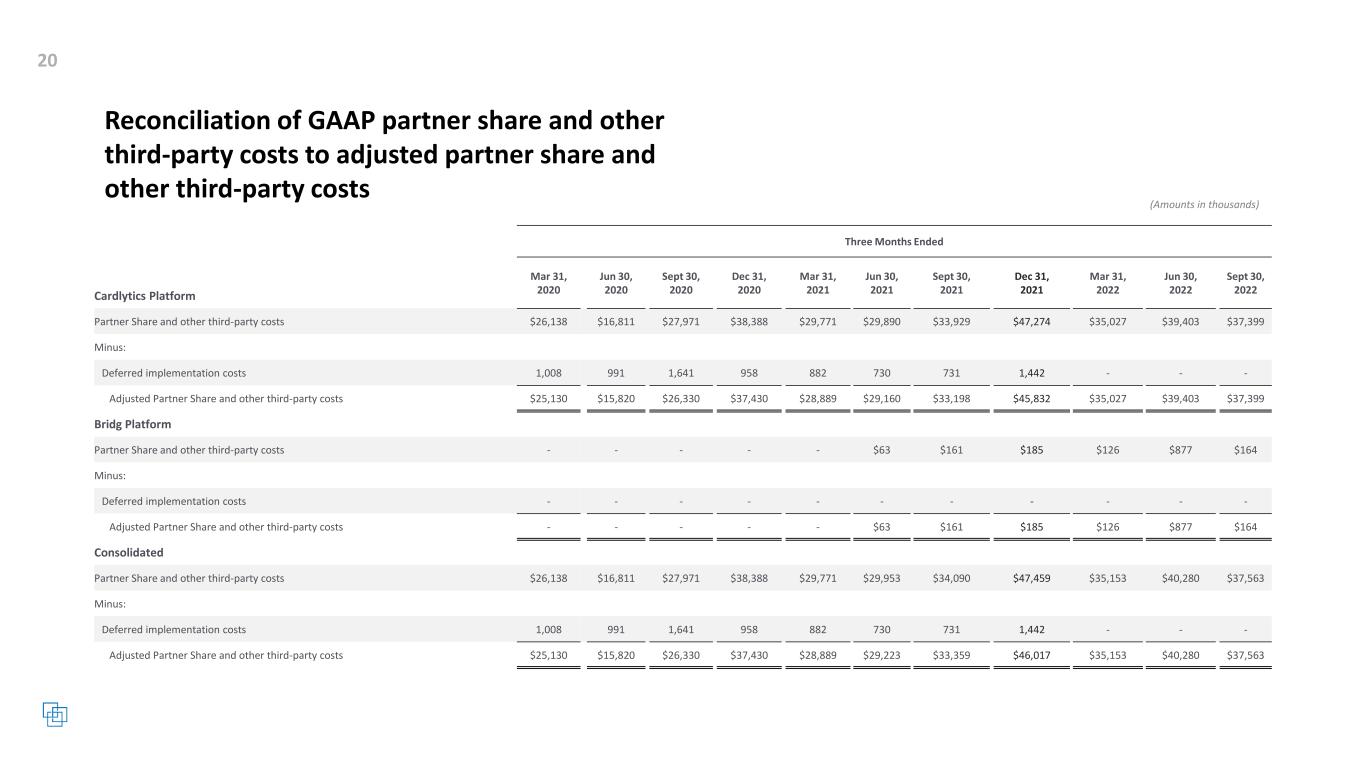

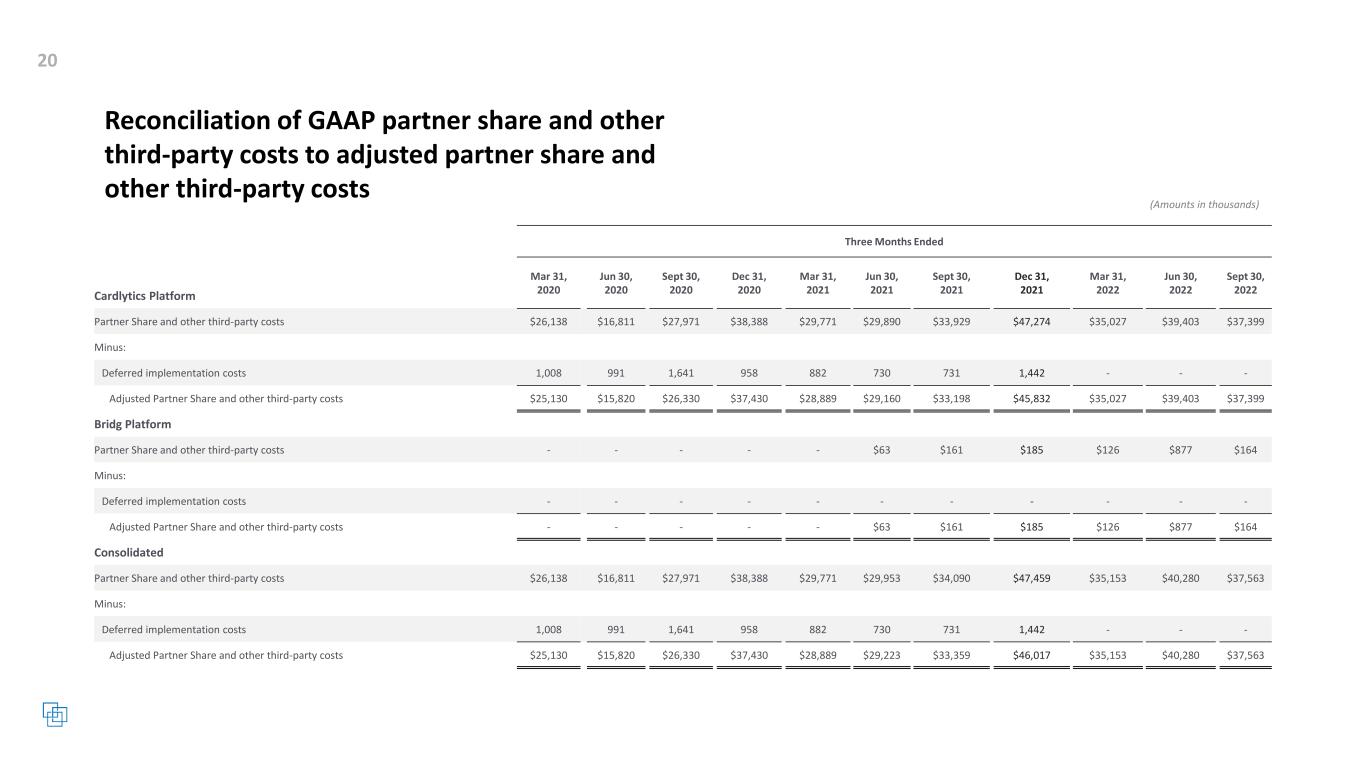

Reconciliation of GAAP partner share and other third-party costs to adjusted partner share and other third-party costs Three Months Ended Mar 31, 2020 Jun 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sept 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sept 30, 2022Cardlytics Platform Partner Share and other third-party costs $26,138 $16,811 $27,971 $38,388 $29,771 $29,890 $33,929 $47,274 $35,027 $39,403 $37,399 Minus: Deferred implementation costs 1,008 991 1,641 958 882 730 731 1,442 - - - Adjusted Partner Share and other third-party costs $25,130 $15,820 $26,330 $37,430 $28,889 $29,160 $33,198 $45,832 $35,027 $39,403 $37,399 Bridg Platform Partner Share and other third-party costs - - - - - $63 $161 $185 $126 $877 $164 Minus: Deferred implementation costs - - - - - - - - - - - Adjusted Partner Share and other third-party costs - - - - - $63 $161 $185 $126 $877 $164 Consolidated Partner Share and other third-party costs $26,138 $16,811 $27,971 $38,388 $29,771 $29,953 $34,090 $47,459 $35,153 $40,280 $37,563 Minus: Deferred implementation costs 1,008 991 1,641 958 882 730 731 1,442 - - - Adjusted Partner Share and other third-party costs $25,130 $15,820 $26,330 $37,430 $28,889 $29,223 $33,359 $46,017 $35,153 $40,280 $37,563

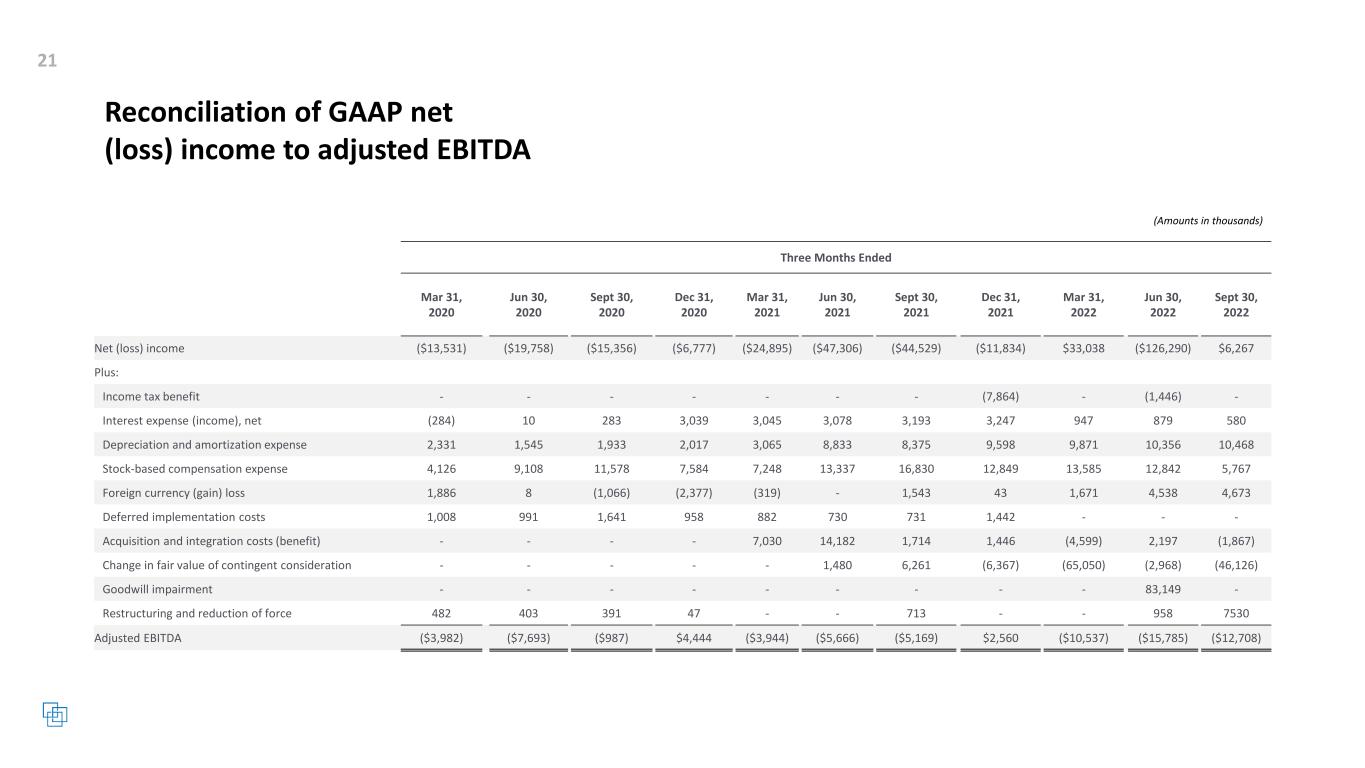

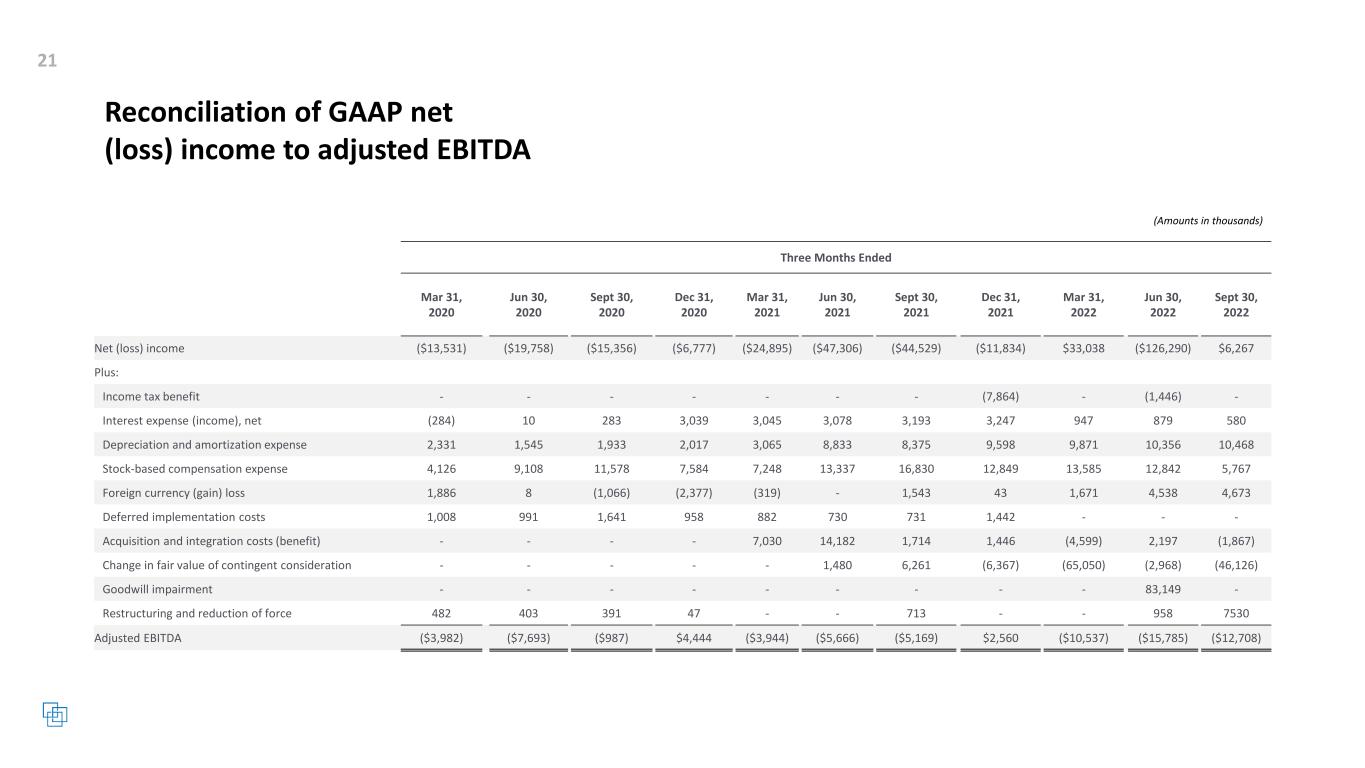

(Amounts in thousands) Reconciliation of GAAP net (loss) income to adjusted EBITDA Three Months Ended Mar 31, 2020 Jun 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sept 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sept 30, 2022 Net (loss) income ($13,531) ($19,758) ($15,356) ($6,777) ($24,895) ($47,306) ($44,529) ($11,834) $33,038 ($126,290) $6,267 Plus: Income tax benefit - - - - - - - (7,864) - (1,446) - Interest expense (income), net (284) 10 283 3,039 3,045 3,078 3,193 3,247 947 879 580 Depreciation and amortization expense 2,331 1,545 1,933 2,017 3,065 8,833 8,375 9,598 9,871 10,356 10,468 Stock-based compensation expense 4,126 9,108 11,578 7,584 7,248 13,337 16,830 12,849 13,585 12,842 5,767 Foreign currency (gain) loss 1,886 8 (1,066) (2,377) (319) - 1,543 43 1,671 4,538 4,673 Deferred implementation costs 1,008 991 1,641 958 882 730 731 1,442 - - - Acquisition and integration costs (benefit) - - - - 7,030 14,182 1,714 1,446 (4,599) 2,197 (1,867) Change in fair value of contingent consideration - - - - - 1,480 6,261 (6,367) (65,050) (2,968) (46,126) Goodwill impairment - - - - - - - - - 83,149 - Restructuring and reduction of force 482 403 391 47 - - 713 - - 958 7530 Adjusted EBITDA ($3,982) ($7,693) ($987) $4,444 ($3,944) ($5,666) ($5,169) $2,560 ($10,537) ($15,785) ($12,708)

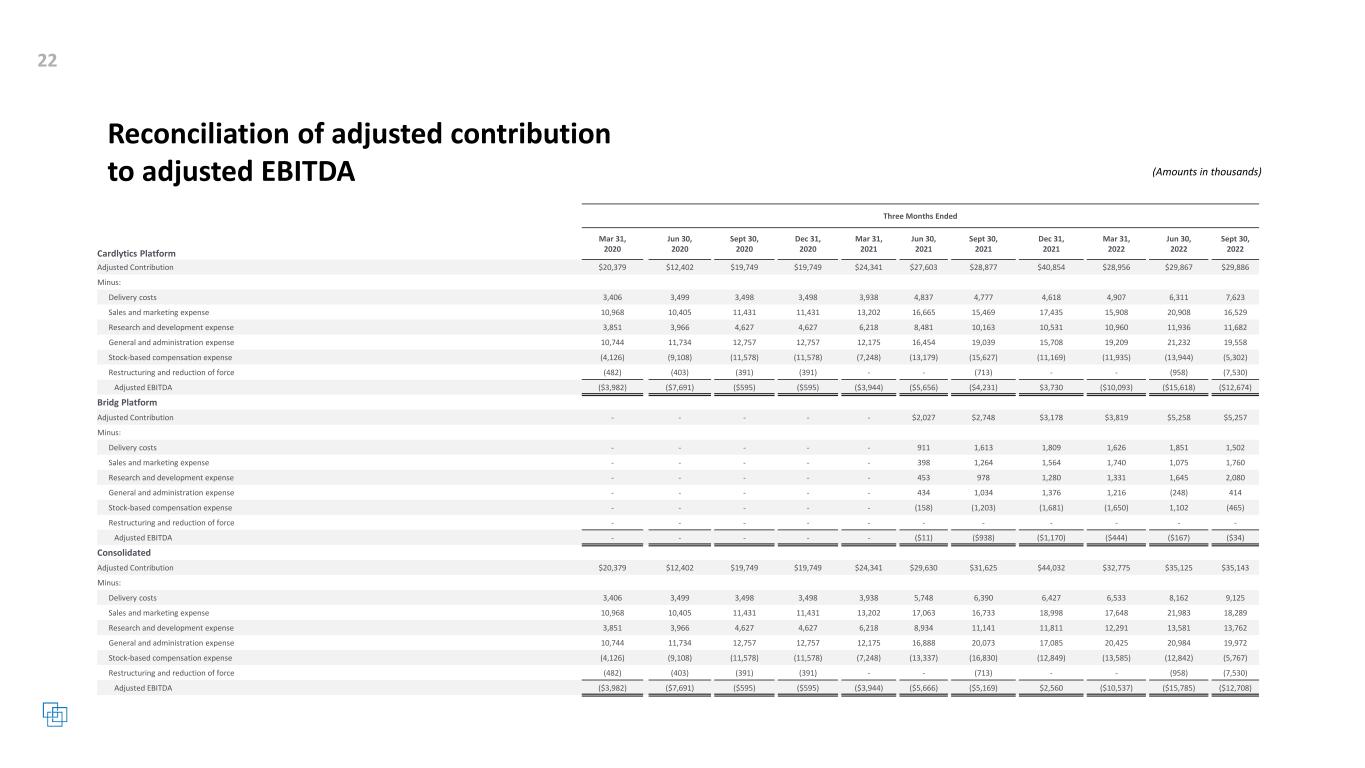

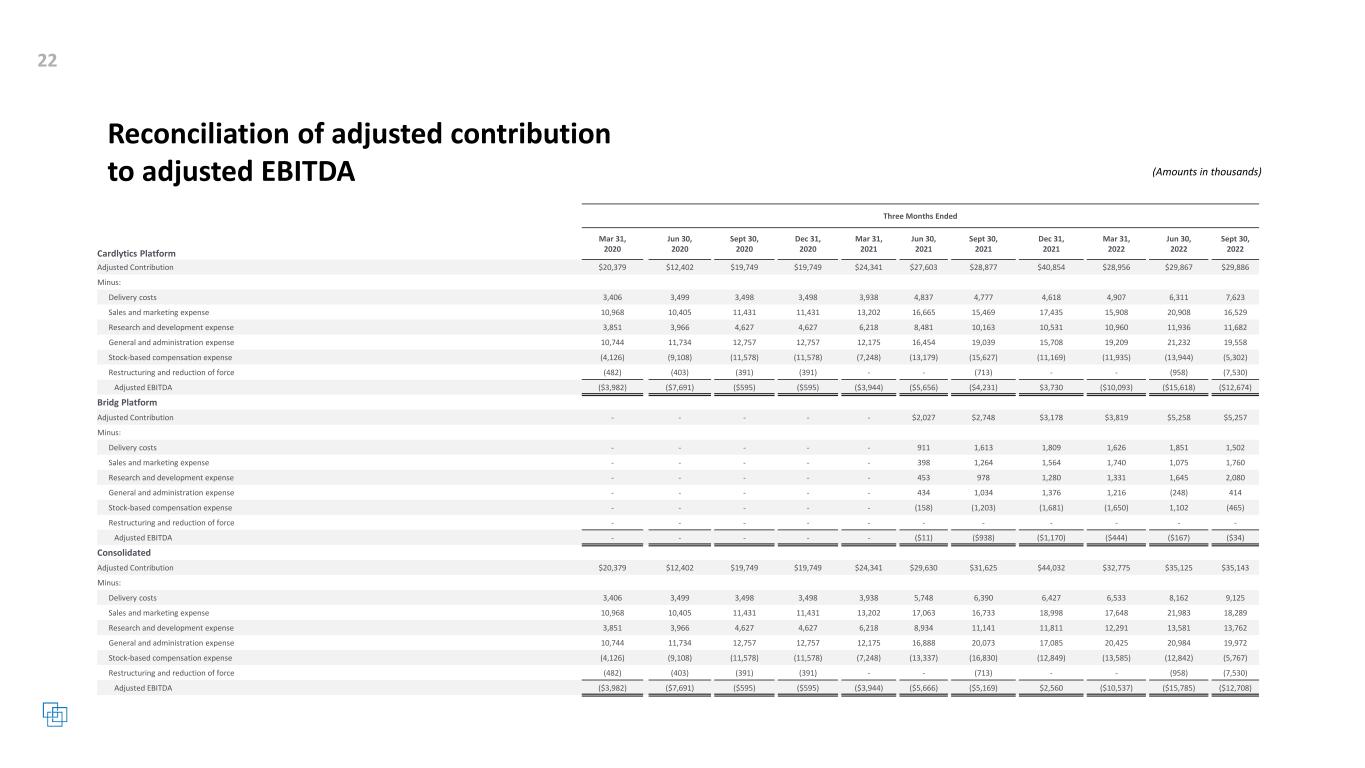

Reconciliation of adjusted contribution to adjusted EBITDA (Amounts in thousands) Three Months Ended Mar 31, 2020 Jun 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sept 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sept 30, 2022Cardlytics Platform Adjusted Contribution $20,379 $12,402 $19,749 $19,749 $24,341 $27,603 $28,877 $40,854 $28,956 $29,867 $29,886 Minus: Delivery costs 3,406 3,499 3,498 3,498 3,938 4,837 4,777 4,618 4,907 6,311 7,623 Sales and marketing expense 10,968 10,405 11,431 11,431 13,202 16,665 15,469 17,435 15,908 20,908 16,529 Research and development expense 3,851 3,966 4,627 4,627 6,218 8,481 10,163 10,531 10,960 11,936 11,682 General and administration expense 10,744 11,734 12,757 12,757 12,175 16,454 19,039 15,708 19,209 21,232 19,558 Stock-based compensation expense (4,126) (9,108) (11,578) (11,578) (7,248) (13,179) (15,627) (11,169) (11,935) (13,944) (5,302) Restructuring and reduction of force (482) (403) (391) (391) - - (713) - - (958) (7,530) Adjusted EBITDA ($3,982) ($7,691) ($595) ($595) ($3,944) ($5,656) ($4,231) $3,730 ($10,093) ($15,618) ($12,674) Bridg Platform Adjusted Contribution - - - - - $2,027 $2,748 $3,178 $3,819 $5,258 $5,257 Minus: Delivery costs - - - - - 911 1,613 1,809 1,626 1,851 1,502 Sales and marketing expense - - - - - 398 1,264 1,564 1,740 1,075 1,760 Research and development expense - - - - - 453 978 1,280 1,331 1,645 2,080 General and administration expense - - - - - 434 1,034 1,376 1,216 (248) 414 Stock-based compensation expense - - - - - (158) (1,203) (1,681) (1,650) 1,102 (465) Restructuring and reduction of force - - - - - - - - - - - Adjusted EBITDA - - - - - ($11) ($938) ($1,170) ($444) ($167) ($34) Consolidated Adjusted Contribution $20,379 $12,402 $19,749 $19,749 $24,341 $29,630 $31,625 $44,032 $32,775 $35,125 $35,143 Minus: Delivery costs 3,406 3,499 3,498 3,498 3,938 5,748 6,390 6,427 6,533 8,162 9,125 Sales and marketing expense 10,968 10,405 11,431 11,431 13,202 17,063 16,733 18,998 17,648 21,983 18,289 Research and development expense 3,851 3,966 4,627 4,627 6,218 8,934 11,141 11,811 12,291 13,581 13,762 General and administration expense 10,744 11,734 12,757 12,757 12,175 16,888 20,073 17,085 20,425 20,984 19,972 Stock-based compensation expense (4,126) (9,108) (11,578) (11,578) (7,248) (13,337) (16,830) (12,849) (13,585) (12,842) (5,767) Restructuring and reduction of force (482) (403) (391) (391) - - (713) - - (958) (7,530) Adjusted EBITDA ($3,982) ($7,691) ($595) ($595) ($3,944) ($5,666) ($5,169) $2,560 ($10,537) ($15,785) ($12,708)

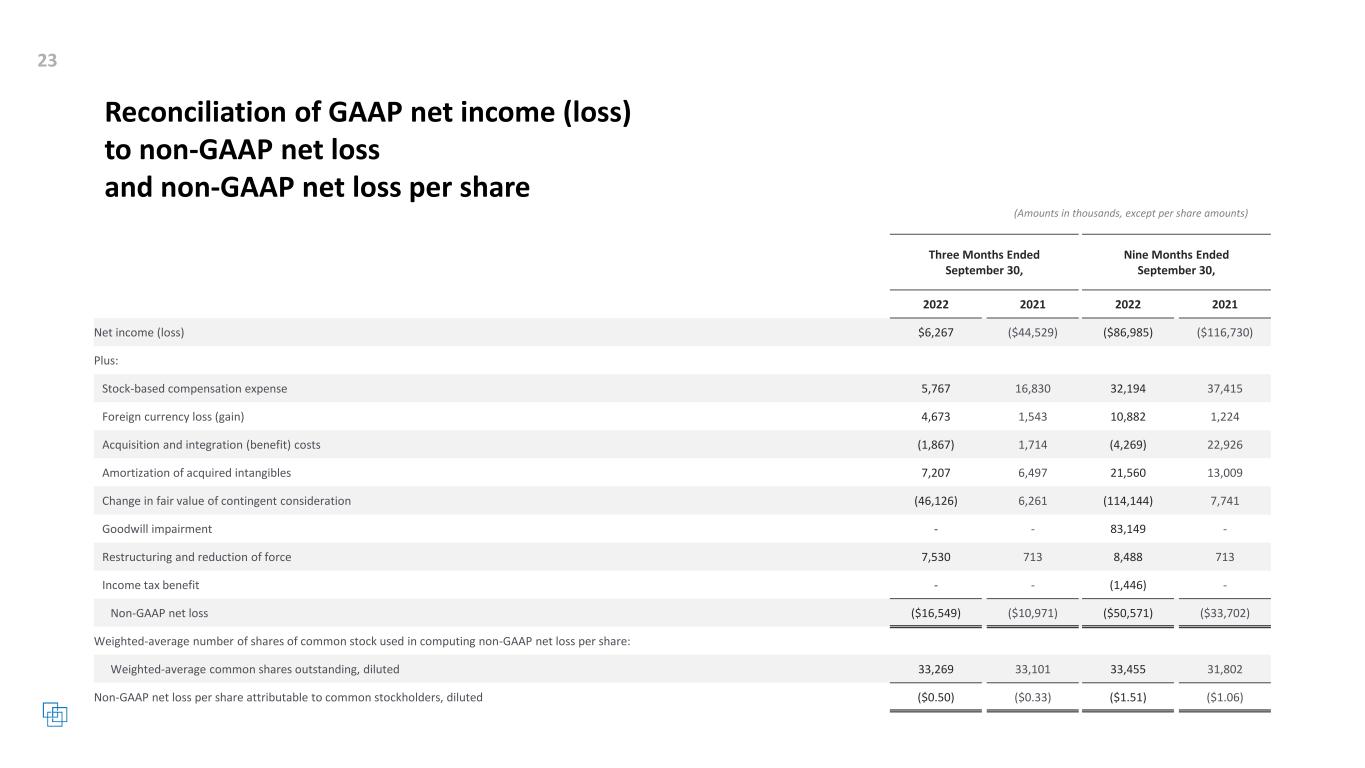

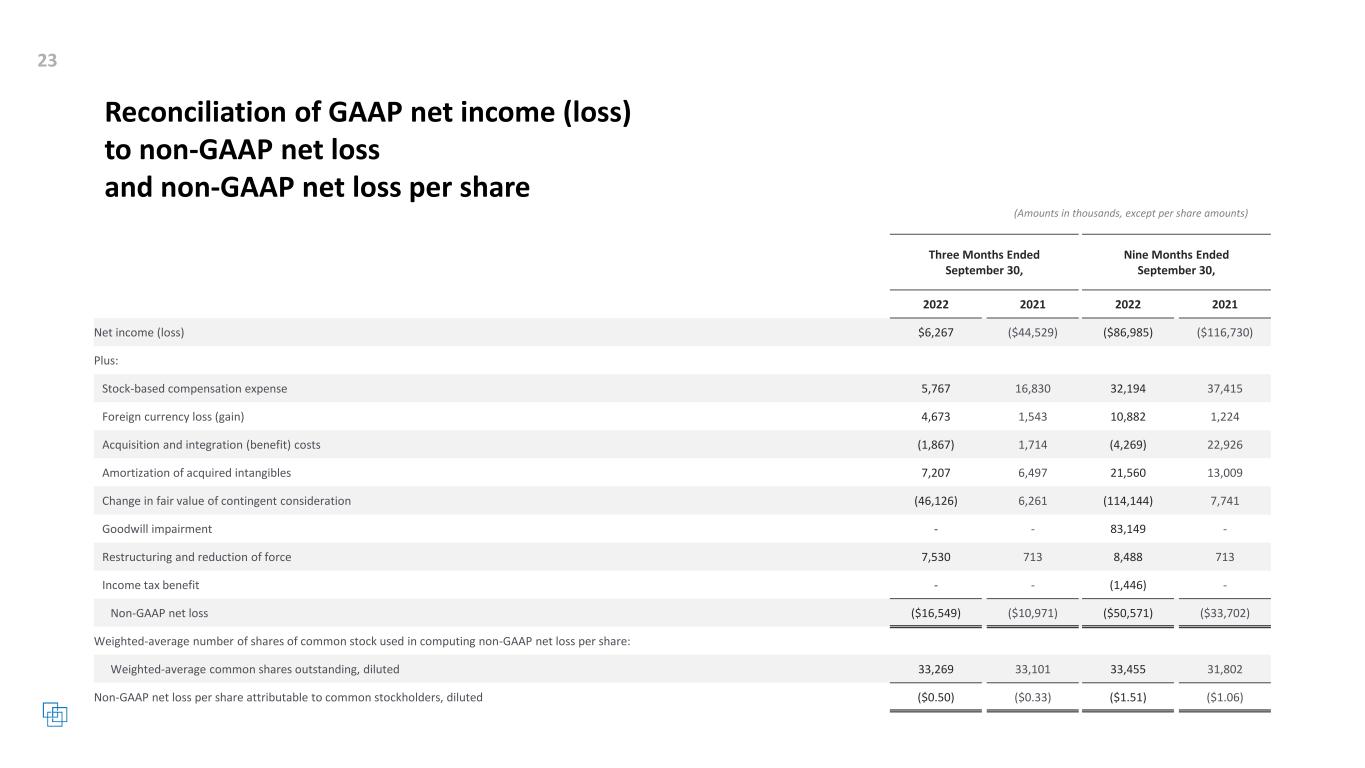

Reconciliation of GAAP net income (loss) to non-GAAP net loss and non-GAAP net loss per share Three Months Ended Nine Months Ended September 30, September 30, 2022 2021 2022 2021 Net income (loss) $6,267 ($44,529) ($86,985) ($116,730) Plus: Stock-based compensation expense 5,767 16,830 32,194 37,415 Foreign currency loss (gain) 4,673 1,543 10,882 1,224 Acquisition and integration (benefit) costs (1,867) 1,714 (4,269) 22,926 Amortization of acquired intangibles 7,207 6,497 21,560 13,009 Change in fair value of contingent consideration (46,126) 6,261 (114,144) 7,741 Goodwill impairment - - 83,149 - Restructuring and reduction of force 7,530 713 8,488 713 Income tax benefit - - (1,446) - Non-GAAP net loss ($16,549) ($10,971) ($50,571) ($33,702) Weighted-average number of shares of common stock used in computing non-GAAP net loss per share: Weighted-average common shares outstanding, diluted 33,269 33,101 33,455 31,802 Non-GAAP net loss per share attributable to common stockholders, diluted ($0.50) ($0.33) ($1.51) ($1.06)

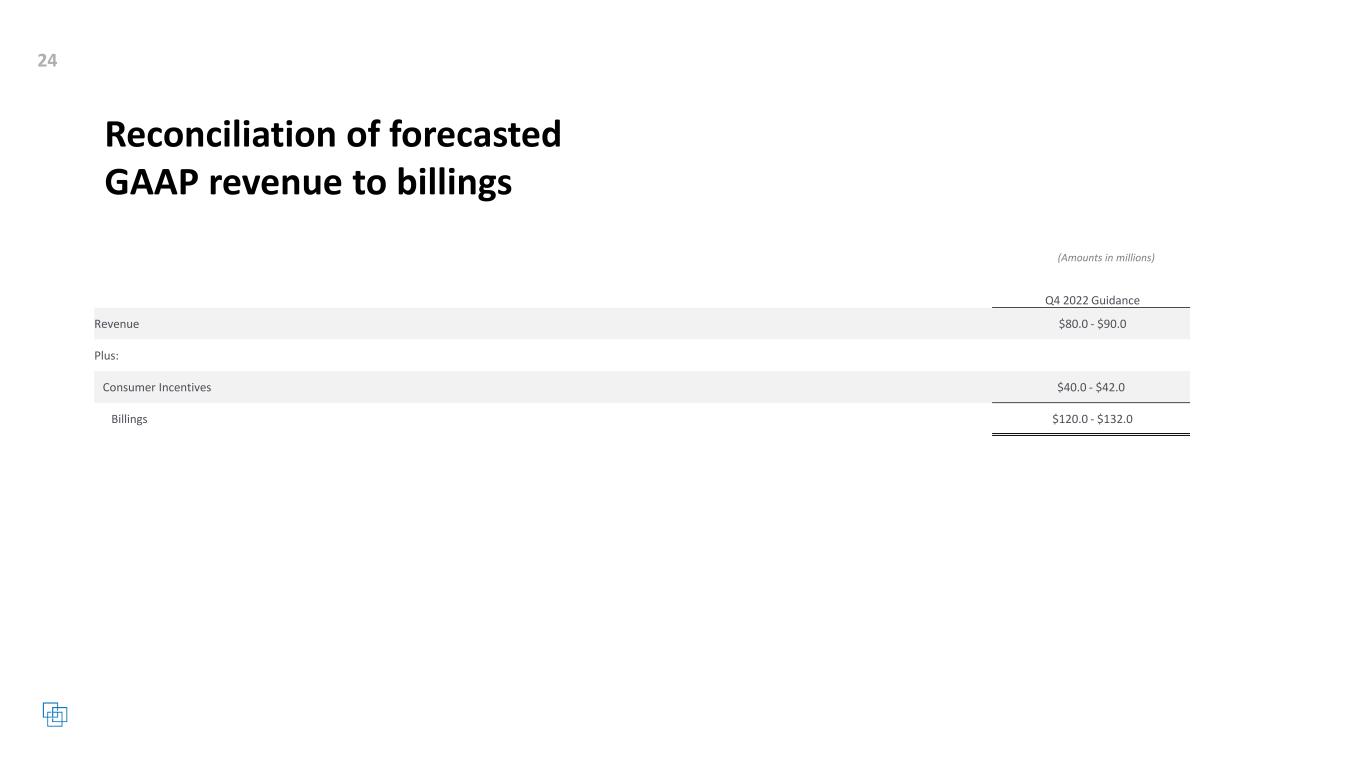

Reconciliation of forecasted GAAP revenue to billings Q4 2022 Guidance Revenue $80.0 - $90.0 Plus: Consumer Incentives $40.0 - $42.0 Billings $120.0 - $132.0

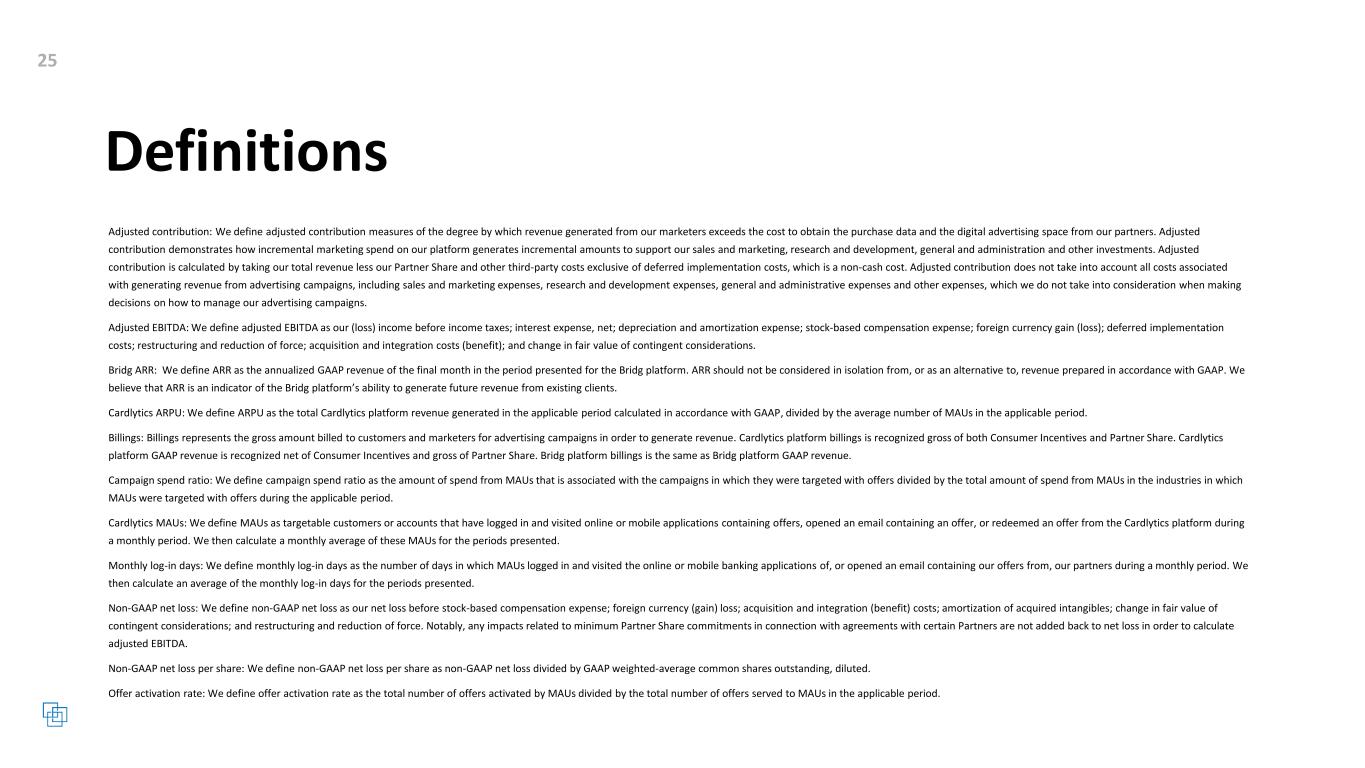

Definitions Adjusted contribution: We define adjusted contribution measures of the degree by which revenue generated from our marketers exceeds the cost to obtain the purchase data and the digital advertising space from our partners. Adjusted contribution demonstrates how incremental marketing spend on our platform generates incremental amounts to support our sales and marketing, research and development, general and administration and other investments. Adjusted contribution is calculated by taking our total revenue less our Partner Share and other third-party costs exclusive of deferred implementation costs, which is a non-cash cost. Adjusted contribution does not take into account all costs associated with generating revenue from advertising campaigns, including sales and marketing expenses, research and development expenses, general and administrative expenses and other expenses, which we do not take into consideration when making decisions on how to manage our advertising campaigns. Adjusted EBITDA: We define adjusted EBITDA as our (loss) income before income taxes; interest expense, net; depreciation and amortization expense; stock-based compensation expense; foreign currency gain (loss); deferred implementation costs; restructuring and reduction of force; acquisition and integration costs (benefit); and change in fair value of contingent considerations. Bridg ARR: We define ARR as the annualized GAAP revenue of the final month in the period presented for the Bridg platform. ARR should not be considered in isolation from, or as an alternative to, revenue prepared in accordance with GAAP. We believe that ARR is an indicator of the Bridg platform’s ability to generate future revenue from existing clients. Cardlytics ARPU: We define ARPU as the total Cardlytics platform revenue generated in the applicable period calculated in accordance with GAAP, divided by the average number of MAUs in the applicable period. Billings: Billings represents the gross amount billed to customers and marketers for advertising campaigns in order to generate revenue. Cardlytics platform billings is recognized gross of both Consumer Incentives and Partner Share. Cardlytics platform GAAP revenue is recognized net of Consumer Incentives and gross of Partner Share. Bridg platform billings is the same as Bridg platform GAAP revenue. Campaign spend ratio: We define campaign spend ratio as the amount of spend from MAUs that is associated with the campaigns in which they were targeted with offers divided by the total amount of spend from MAUs in the industries in which MAUs were targeted with offers during the applicable period. Cardlytics MAUs: We define MAUs as targetable customers or accounts that have logged in and visited online or mobile applications containing offers, opened an email containing an offer, or redeemed an offer from the Cardlytics platform during a monthly period. We then calculate a monthly average of these MAUs for the periods presented. Monthly log-in days: We define monthly log-in days as the number of days in which MAUs logged in and visited the online or mobile banking applications of, or opened an email containing our offers from, our partners during a monthly period. We then calculate an average of the monthly log-in days for the periods presented. Non-GAAP net loss: We define non-GAAP net loss as our net loss before stock-based compensation expense; foreign currency (gain) loss; acquisition and integration (benefit) costs; amortization of acquired intangibles; change in fair value of contingent considerations; and restructuring and reduction of force. Notably, any impacts related to minimum Partner Share commitments in connection with agreements with certain Partners are not added back to net loss in order to calculate adjusted EBITDA. Non-GAAP net loss per share: We define non-GAAP net loss per share as non-GAAP net loss divided by GAAP weighted-average common shares outstanding, diluted. Offer activation rate: We define offer activation rate as the total number of offers activated by MAUs divided by the total number of offers served to MAUs in the applicable period.

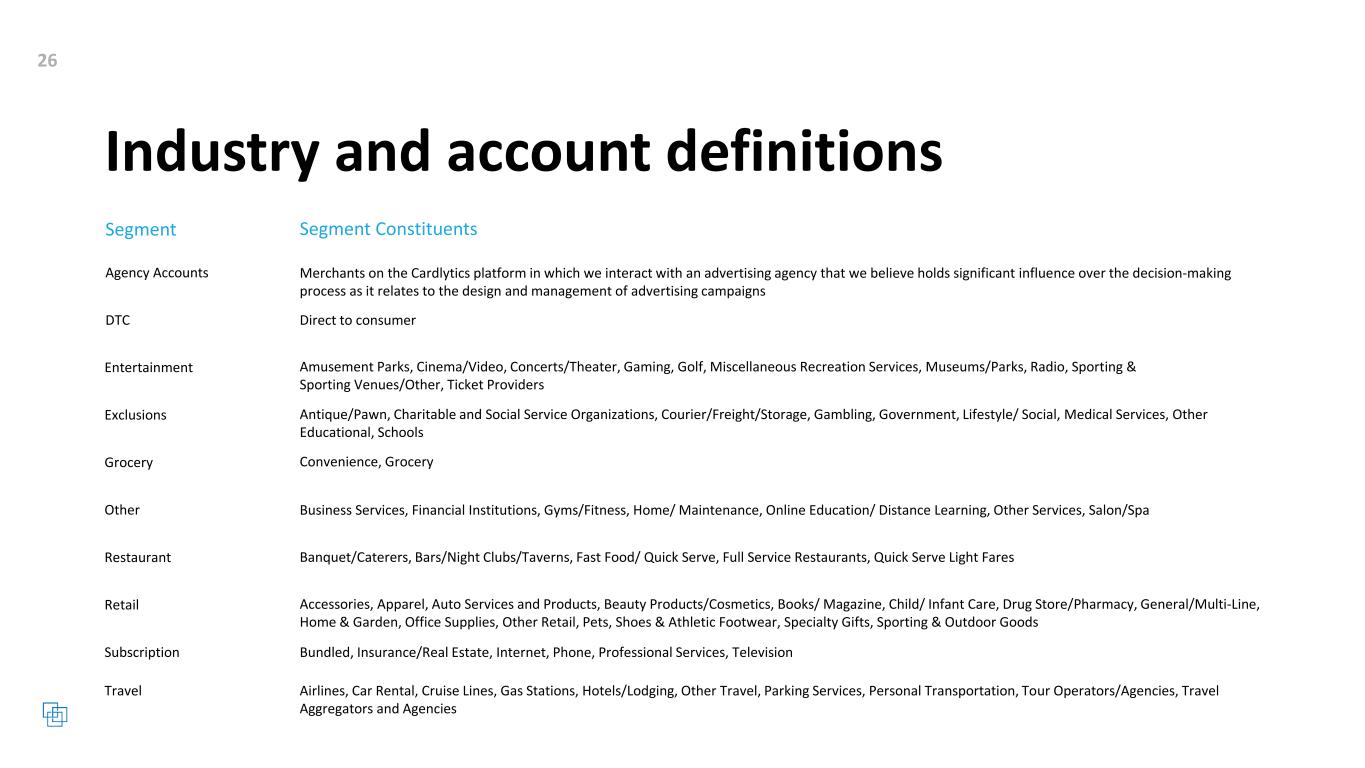

Industry and account definitions Segment Segment Constituents DTC Direct to consumer Entertainment Amusement Parks, Cinema/Video, Concerts/Theater, Gaming, Golf, Miscellaneous Recreation Services, Museums/Parks, Radio, Sporting & Sporting Venues/Other, Ticket Providers Grocery Convenience, Grocery Other Business Services, Financial Institutions, Gyms/Fitness, Home/ Maintenance, Online Education/ Distance Learning, Other Services, Salon/Spa Restaurant Banquet/Caterers, Bars/Night Clubs/Taverns, Fast Food/ Quick Serve, Full Service Restaurants, Quick Serve Light Fares Retail Accessories, Apparel, Auto Services and Products, Beauty Products/Cosmetics, Books/ Magazine, Child/ Infant Care, Drug Store/Pharmacy, General/Multi-Line, Home & Garden, Office Supplies, Other Retail, Pets, Shoes & Athletic Footwear, Specialty Gifts, Sporting & Outdoor Goods Subscription Bundled, Insurance/Real Estate, Internet, Phone, Professional Services, Television Travel Airlines, Car Rental, Cruise Lines, Gas Stations, Hotels/Lodging, Other Travel, Parking Services, Personal Transportation, Tour Operators/Agencies, Travel Aggregators and Agencies Exclusions Antique/Pawn, Charitable and Social Service Organizations, Courier/Freight/Storage, Gambling, Government, Lifestyle/ Social, Medical Services, Other Educational, Schools Merchants on the Cardlytics platform in which we interact with an advertising agency that we believe holds significant influence over the decision-making process as it relates to the design and management of advertising campaigns Agency Accounts