© Atkore Inc. Second Quarter 2022 Earnings Presentation May 3, 2022

© Atkore Cautionary Statements This presentation is provided for general informational purposes only and it does not include every item which may be of interest, nor does it purport to present full and fair disclosure with respect to Atkore Inc. (the “Company” or “Atkore”) or its operational and financial information. Atkore expressly disclaims any current intention to update any forward-looking statements contained in this presentation as a result of new information or future events or developments or otherwise, except as required by federal securities laws. This presentation is not a prospectus and is not an offer to sell securities. This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K and the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third-party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, but you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. This presentation should be read along with the historical financial statements of Atkore, including the most recent audited financial statements. Historical results may not be indicative of future results. We use non-GAAP financial measures to help us describe our operating and financial performance. These measures may include Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month (“TTM”) basis), Free Cash Flow (net cash provided by operating activities less capital expenditures) and Return on Capital to help us describe our operating and financial performance. These non-GAAP financial measures are commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, total debt, net cash provided by operating activities, return on assets, and other income data measures as determined in accordance with generally accepted accounting principles in the United States, or GAAP, or as better indicators of operating performance. These non-GAAP financial measures as defined by us may not be comparable to similarly-titled non-GAAP measures presented by other companies. Our presentation of such non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of the non-GAAP financial measures presented herein to the most comparable financial measures as determined in accordance with GAAP. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters typically end on the last Friday in December, March and June. 2

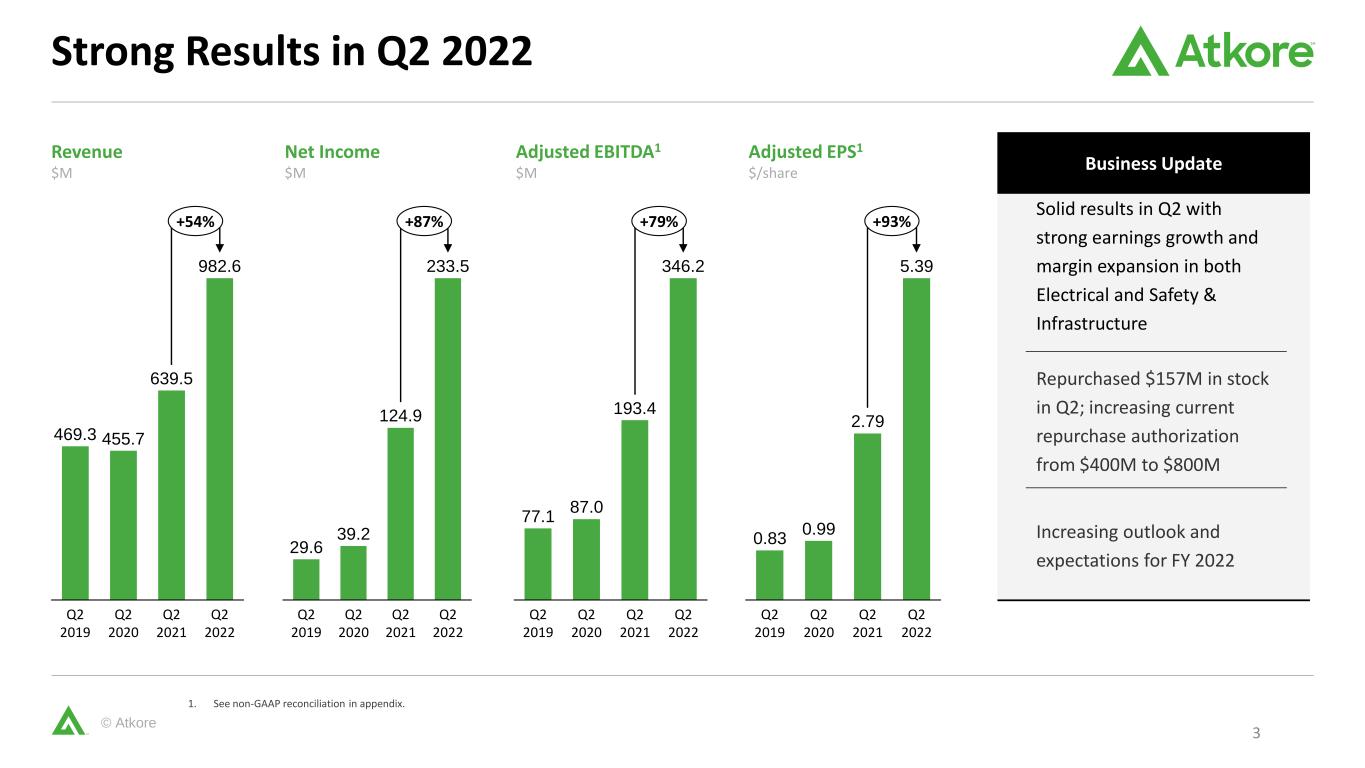

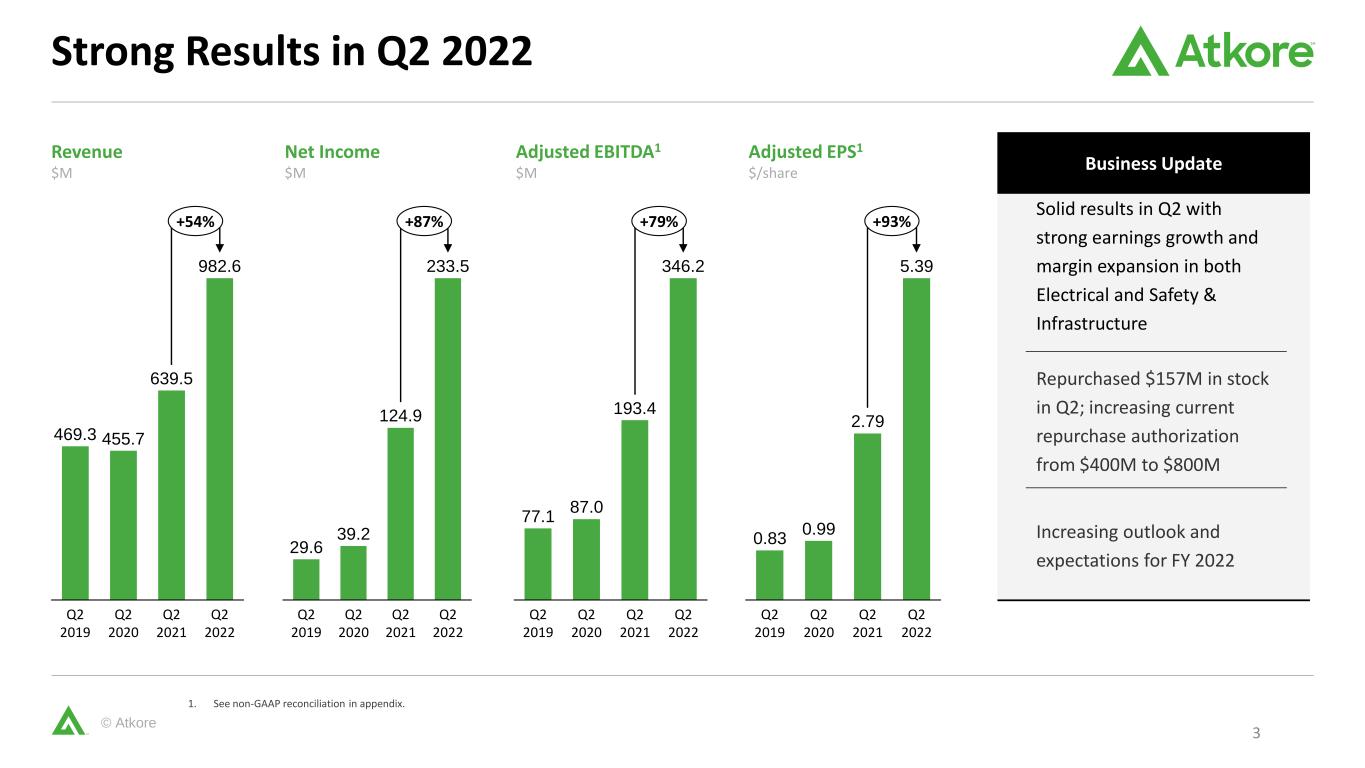

© Atkore Strong Results in Q2 2022 1. See non-GAAP reconciliation in appendix. 469.3 455.7 639.5 982.6 Q2 2021 Q2 2019 Q2 2020 Q2 2022 +54% 29.6 39.2 124.9 233.5 Q2 2021 Q2 2019 Q2 2020 Q2 2022 +87% 77.1 87.0 193.4 346.2 Q2 2022 Q2 2021 Q2 2019 Q2 2020 +79% 0.83 0.99 2.79 5.39 Q2 2022 Q2 2020 Q2 2019 Q2 2021 +93% Revenue $M Net Income $M Adjusted EBITDA1 $M Adjusted EPS1 $/share Solid results in Q2 with strong earnings growth and margin expansion in both Electrical and Safety & Infrastructure Repurchased $157M in stock in Q2; increasing current repurchase authorization from $400M to $800M Increasing outlook and expectations for FY 2022 Business Update 3

© Atkore Increasing FY2022 expectations given results and performance in the first half of the year. Providing a preliminary perspective on FY2023. FY2022 Outlook 4 1. Reconciliation of the forward-looking quarterly and full-year 2022 outlook for Adjusted EBITDA and Adjusted EPS is not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. 2. Represents weighted-average shares outstanding in millions used in calculation of Adjusted EPS outlook. Outlook Summary Outlook Items for Consolidated Atkore Q3 2022 Outlook FY2022 Outlook Changes to Prior FY2022 Outlook Net Sales +15% – 20% +25% – 30% +~20% / +~25% Adjusted EBITDA1 $320 – $340M $1,250 – $1,300M +$375M Adjusted EPS1 $5.00 – $5.35 $19.65 – $20.45 +$6.85 Interest Expense $30 – $32M - Tax Rate 25% – 27% - Capital Expenditures $80 – $90M - Stock Buybacks ≥ $400M + ≥ $200M Diluted Shares Outstanding2 ~45M (1)M Preliminary expectations for FY2023 Adjusted EBITDA are in the range of $800 to $900 million dollars Preliminary FY2023 perspective may vary due to changes in assumptions or market conditions Preliminary FY2023 Perspective

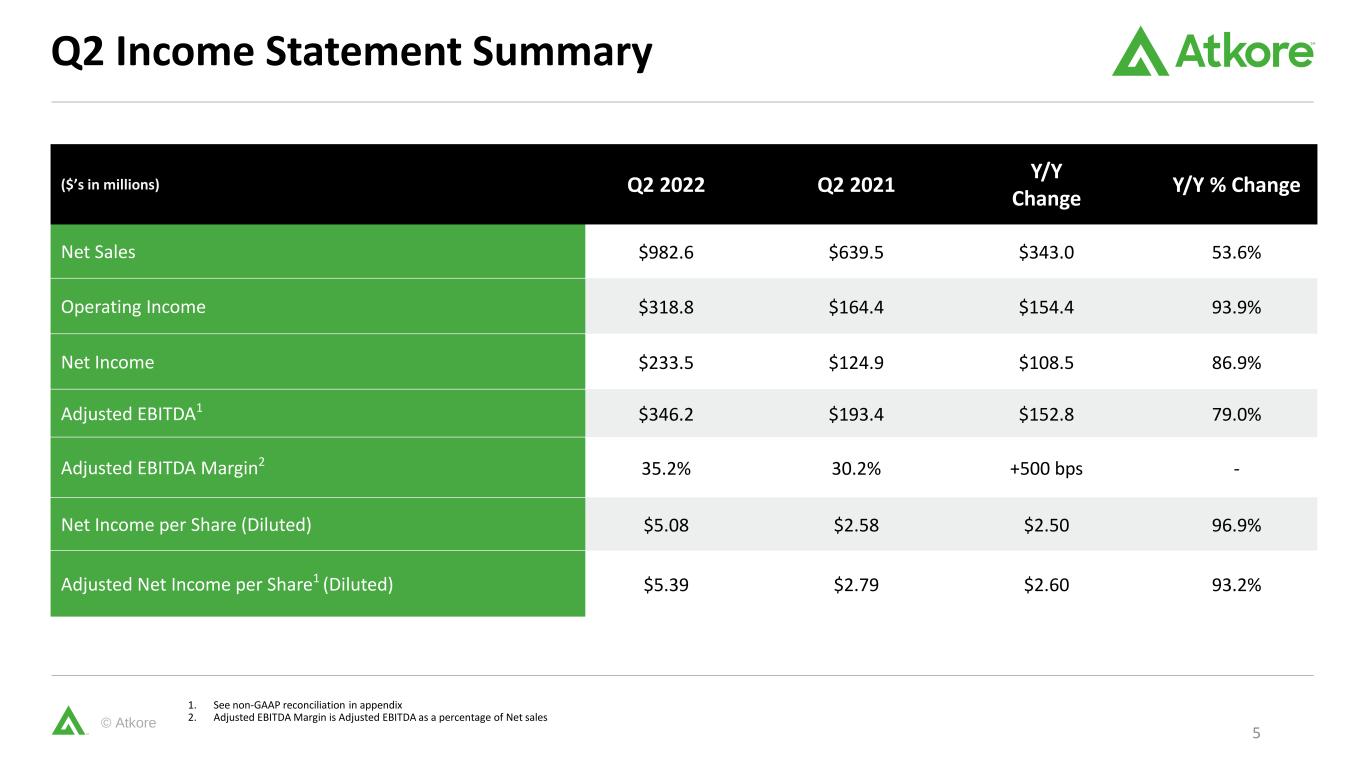

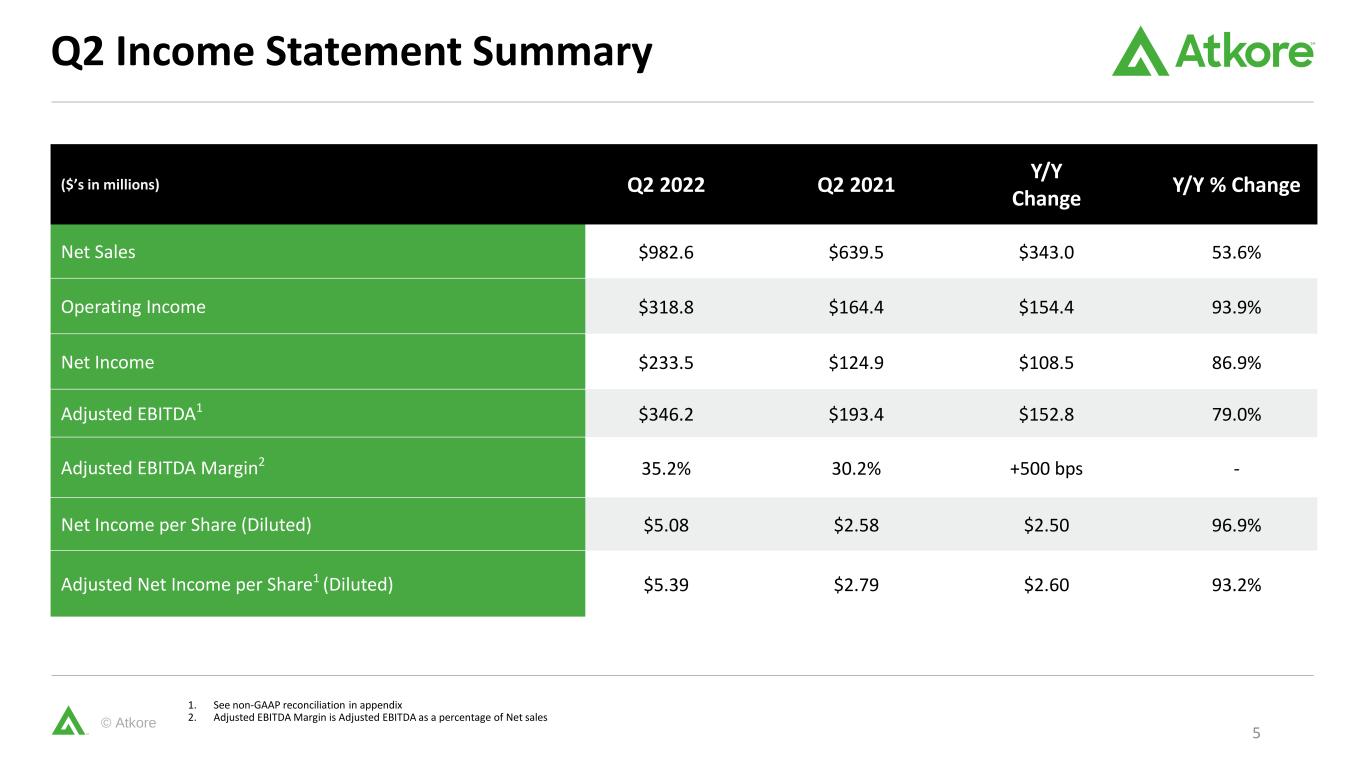

© Atkore Q2 Income Statement Summary 5 1. See non-GAAP reconciliation in appendix 2. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net sales ($’s in millions) Q2 2022 Q2 2021 Y/Y Change Y/Y % Change Net Sales $982.6 $639.5 $343.0 53.6% Operating Income $318.8 $164.4 $154.4 93.9% Net Income $233.5 $124.9 $108.5 86.9% Adjusted EBITDA1 $346.2 $193.4 $152.8 79.0% Adjusted EBITDA Margin2 35.2% 30.2% +500 bps - Net Income per Share (Diluted) $5.08 $2.58 $2.50 96.9% Adjusted Net Income per Share1 (Diluted) $5.39 $2.79 $2.60 93.2%

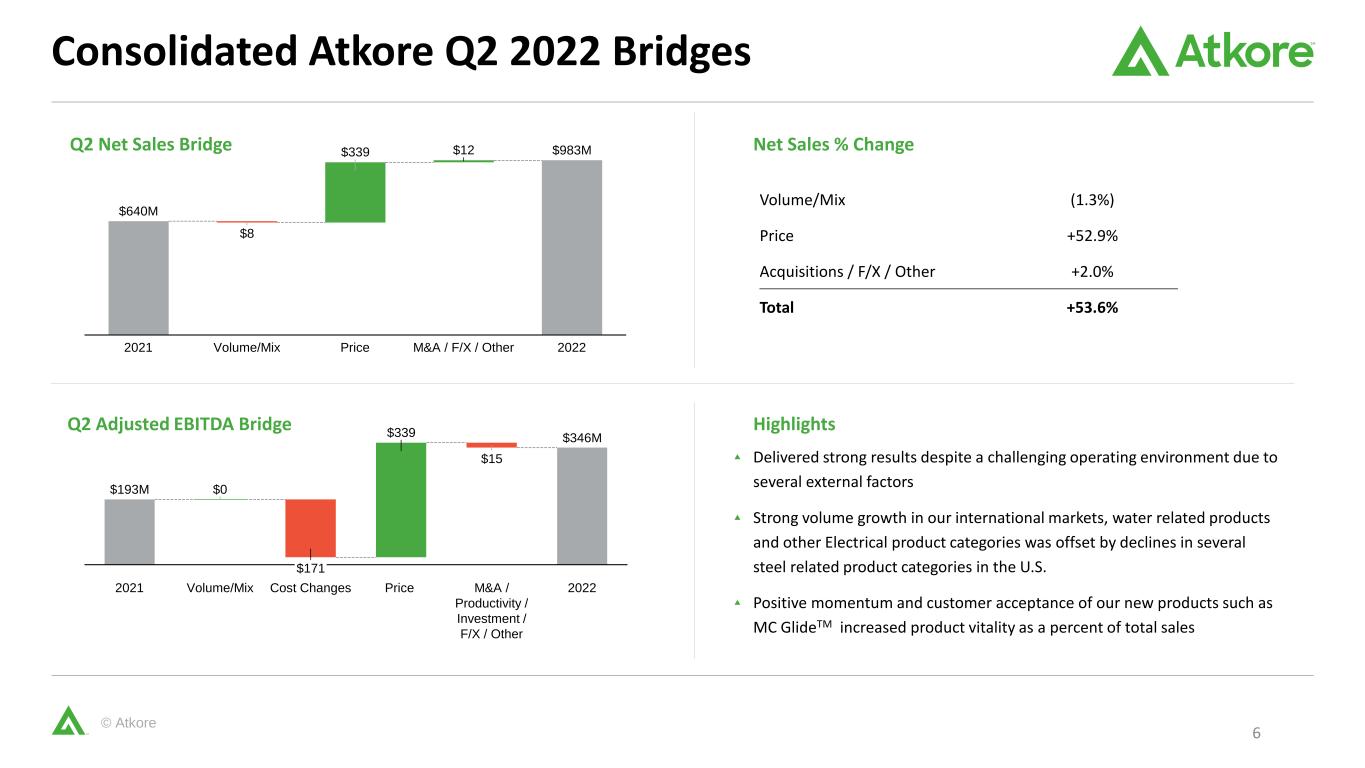

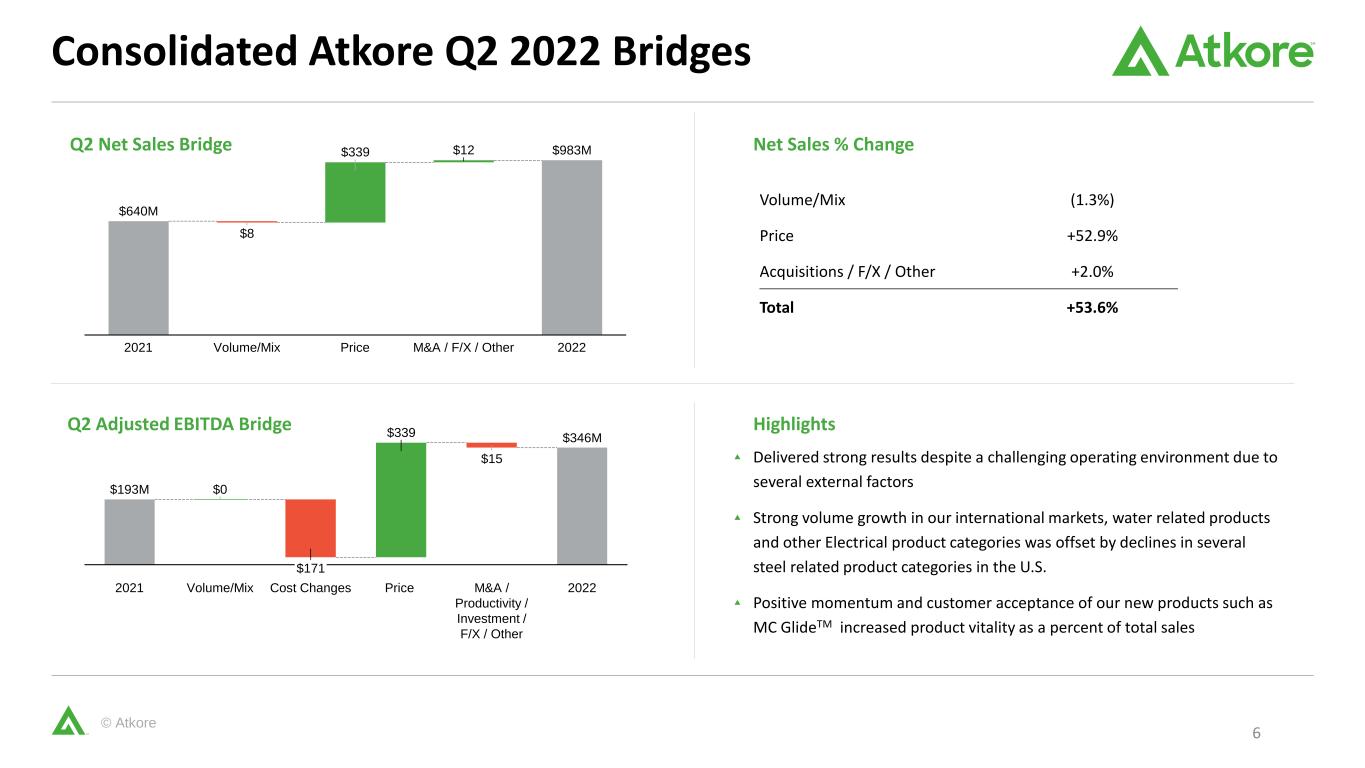

© Atkore Consolidated Atkore Q2 2022 Bridges 6 Volume/Mix (1.3%) Price +52.9% Acquisitions / F/X / Other +2.0% Total +53.6% $8 $339 $12 PriceVolume/Mix2021 M&A / F/X / Other 2022 $640M $983M Delivered strong results despite a challenging operating environment due to several external factors Strong volume growth in our international markets, water related products and other Electrical product categories was offset by declines in several steel related product categories in the U.S. Positive momentum and customer acceptance of our new products such as MC GlideTM increased product vitality as a percent of total sales $339 $15 2021 Volume/Mix $0 $171 Cost Changes Price 2022M&A / Productivity / Investment / F/X / Other $193M $346M Net Sales % Change Highlights Q2 Adjusted EBITDA Bridge Q2 Net Sales Bridge

© Atkore Q2 2022 Segment Results 7 Electrical Safety & Infrastructure ($’s in millions) Q2 2022 Q2 2021 Y/Y Change Net Sales $759.9 $487.5 55.9% Adjusted EBITDA $331.0 $188.8 75.3% Adjusted EBITDA Margin 43.6% 38.7% +490 bps ($’s in millions) Q2 2022 Q2 2021 Y/Y Change Net Sales $224.3 $152.7 46.9% Adjusted EBITDA $28.9 $16.2 78.6% Adjusted EBITDA Margin 12.9% 10.6% +230 bps $1 $263 $8 2021 Volume/Mix M&A / F/X / OtherPrice 2022 $488M $760M $9 $75 $5 20222021 Volume/Mix Price M&A / F/X / Other $153M $224M Q2 Net Sales Bridge Q2 Net Sales Bridge

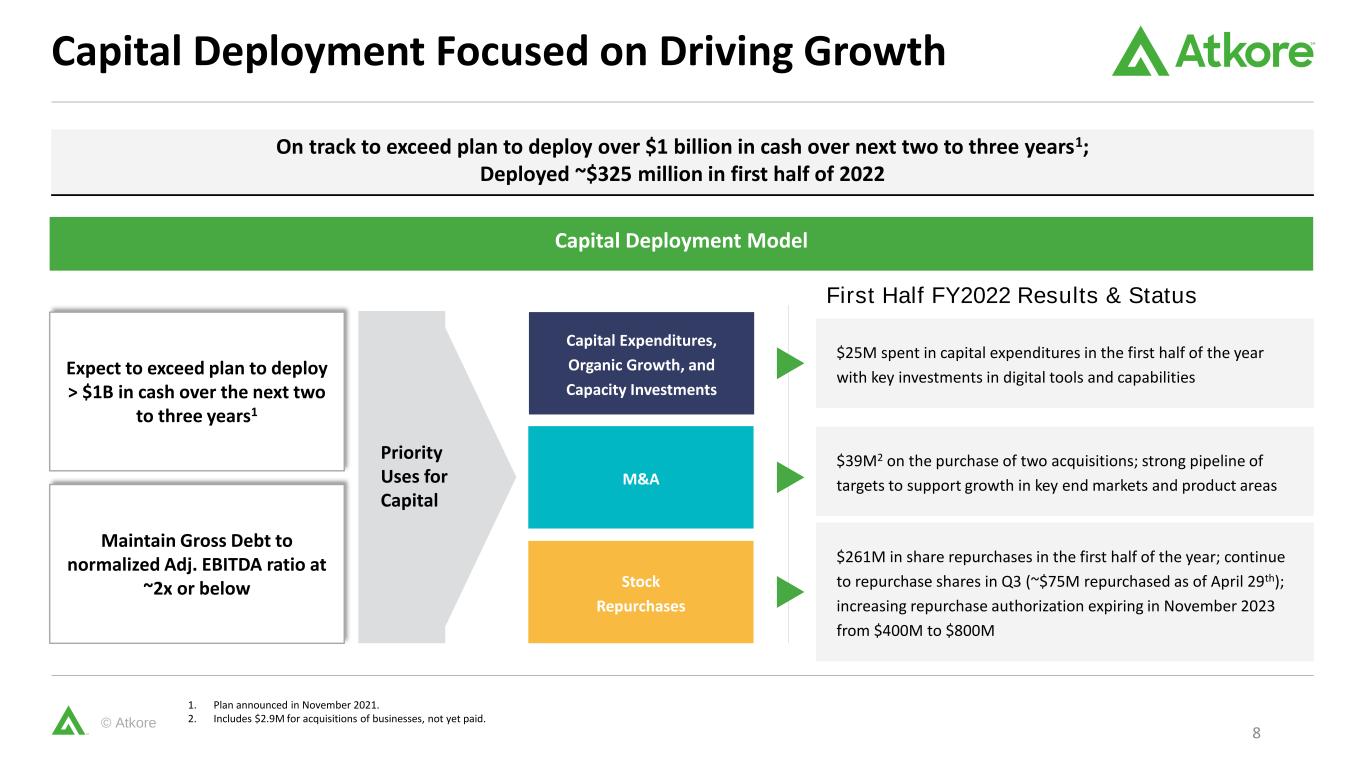

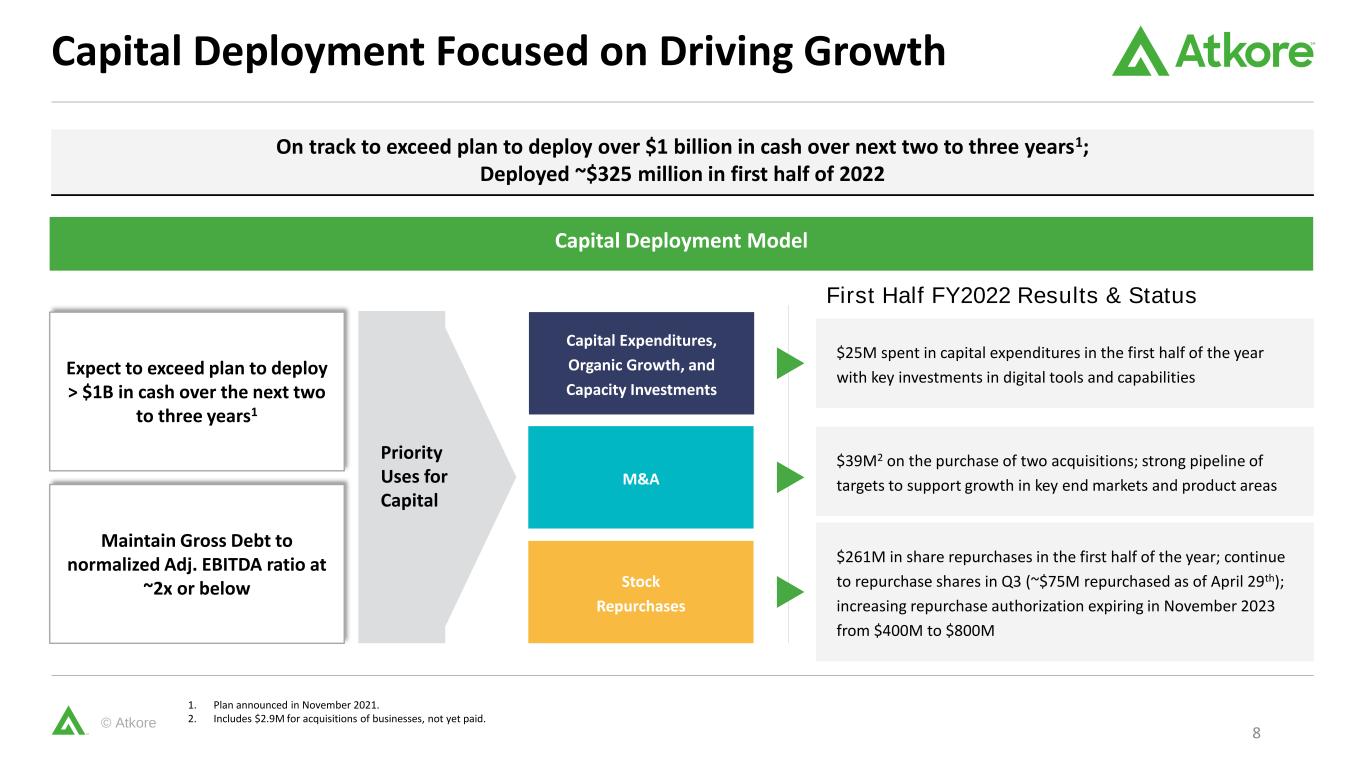

© Atkore On track to exceed plan to deploy over $1 billion in cash over next two to three years1; Deployed ~$325 million in first half of 2022 Capital Deployment Focused on Driving Growth Capital Deployment Model Capital Expenditures, Organic Growth, and Capacity Investments M&A Stock Repurchases Priority Uses for Capital Maintain Gross Debt to normalized Adj. EBITDA ratio at ~2x or below $25M spent in capital expenditures in the first half of the year with key investments in digital tools and capabilities $39M2 on the purchase of two acquisitions; strong pipeline of targets to support growth in key end markets and product areas $261M in share repurchases in the first half of the year; continue to repurchase shares in Q3 (~$75M repurchased as of April 29th); increasing repurchase authorization expiring in November 2023 from $400M to $800M Expect to exceed plan to deploy > $1B in cash over the next two to three years1 8 First Half FY2022 Results & Status 1. Plan announced in November 2021. 2. Includes $2.9M for acquisitions of businesses, not yet paid.

© Atkore Appendix

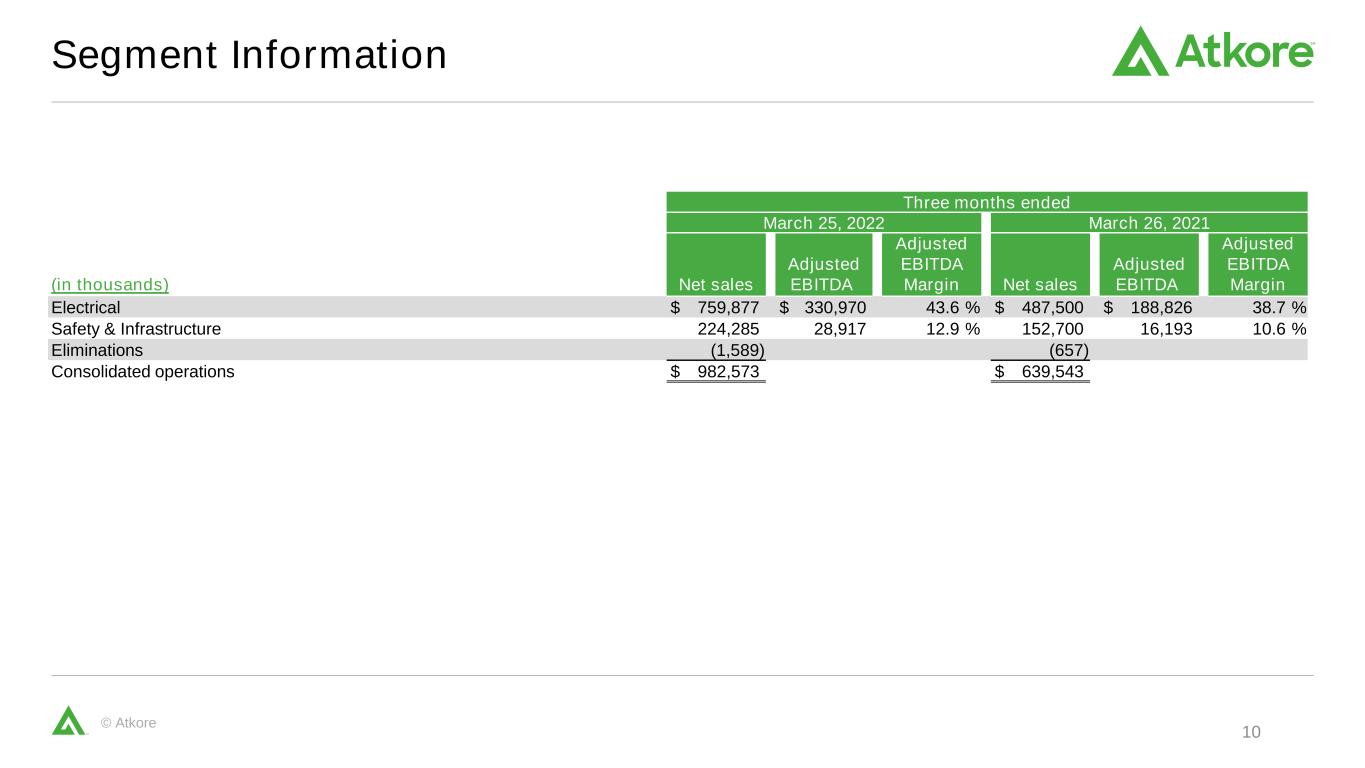

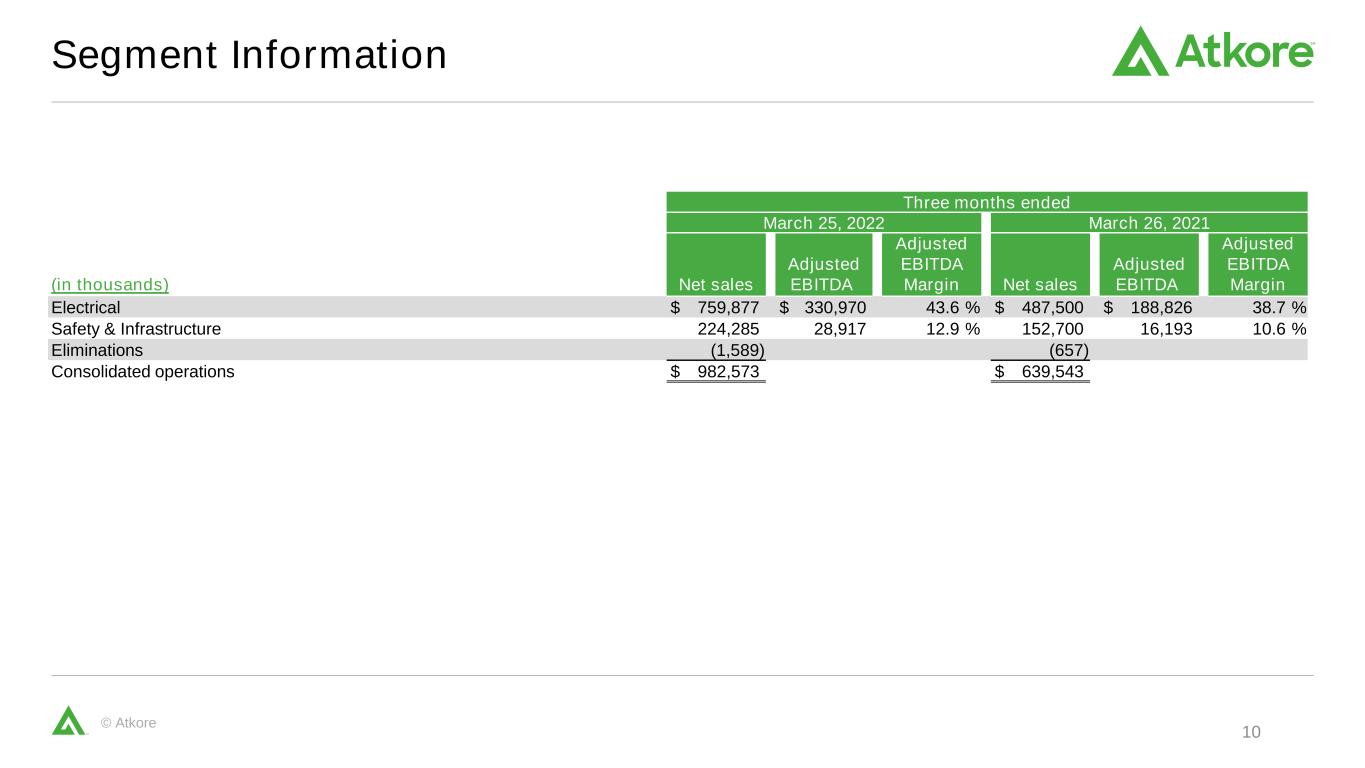

© Atkore Segment Information 10 Three months ended March 25, 2022 March 26, 2021 (in thousands) Net sales Adjusted EBITDA Adjusted EBITDA Margin Net sales Adjusted EBITDA Adjusted EBITDA Margin Electrical $ 759,877 $ 330,970 43.6 % $ 487,500 $ 188,826 38.7 % Safety & Infrastructure 224,285 28,917 12.9 % 152,700 16,193 10.6 % Eliminations (1,589) (657) Consolidated operations $ 982,573 $ 639,543

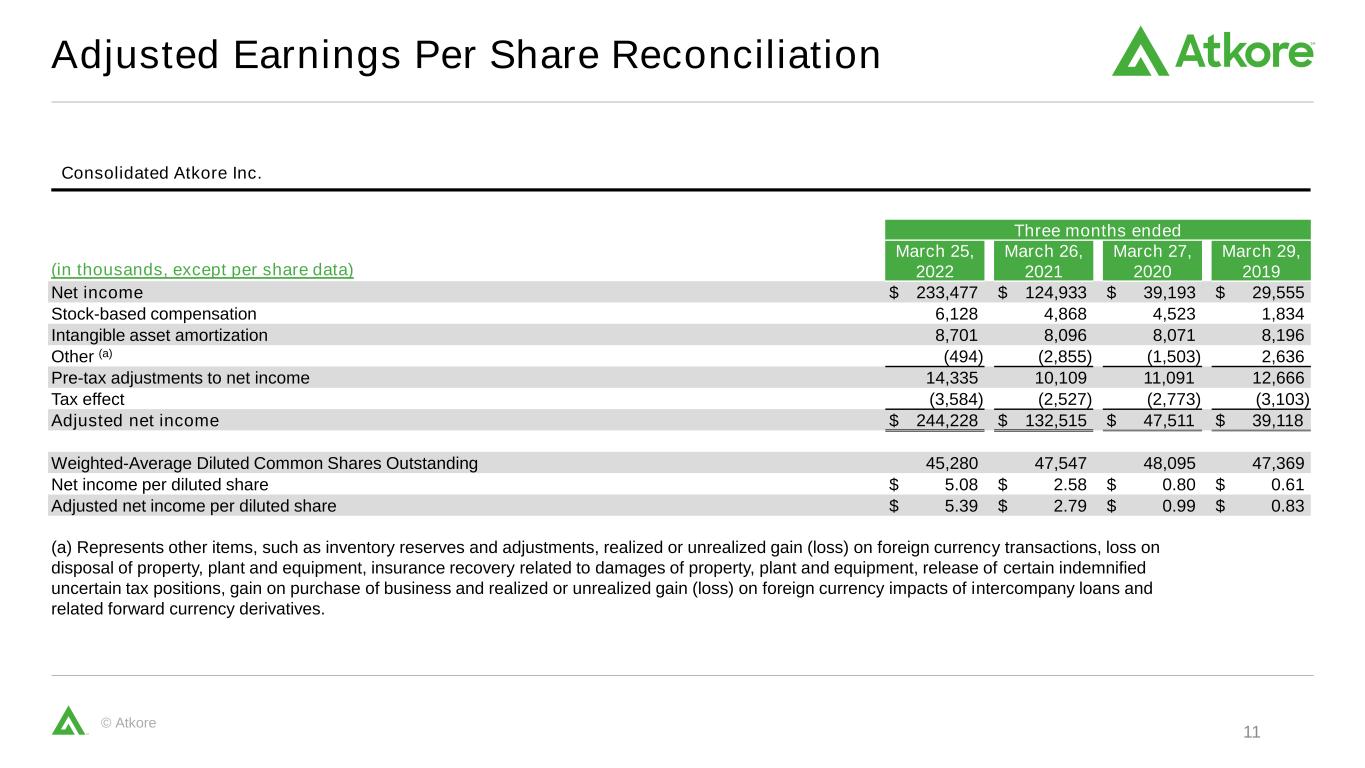

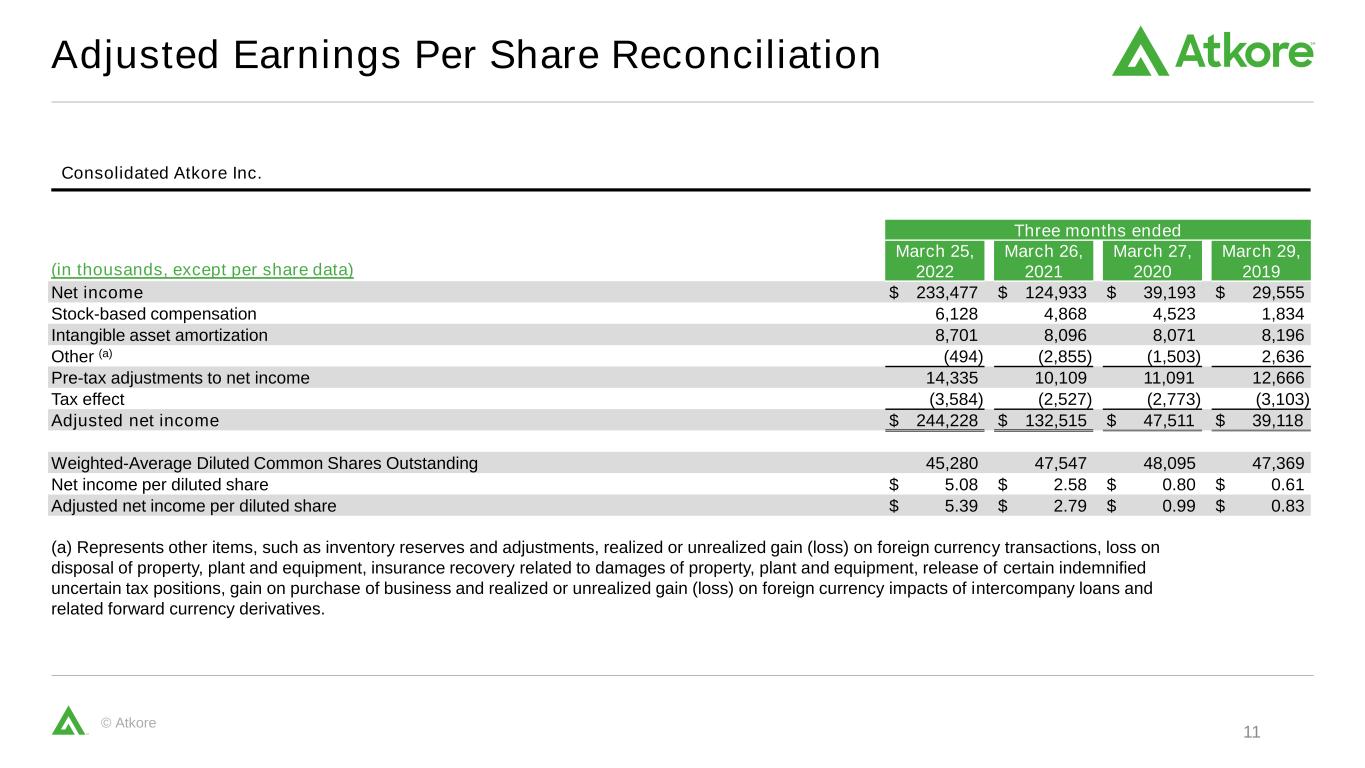

© Atkore Adjusted Earnings Per Share Reconciliation Consolidated Atkore Inc. 11 Three months ended (in thousands, except per share data) March 25, 2022 March 26, 2021 March 27, 2020 March 29, 2019 Net income $ 233,477 $ 124,933 $ 39,193 $ 29,555 Stock-based compensation 6,128 4,868 4,523 1,834 Intangible asset amortization 8,701 8,096 8,071 8,196 Other (a) (494) (2,855) (1,503) 2,636 Pre-tax adjustments to net income 14,335 10,109 11,091 12,666 Tax effect (3,584) (2,527) (2,773) (3,103) Adjusted net income $ 244,228 $ 132,515 $ 47,511 $ 39,118 Weighted-Average Diluted Common Shares Outstanding 45,280 47,547 48,095 47,369 Net income per diluted share $ 5.08 $ 2.58 $ 0.80 $ 0.61 Adjusted net income per diluted share $ 5.39 $ 2.79 $ 0.99 $ 0.83 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of certain indemnified uncertain tax positions, gain on purchase of business and realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives.

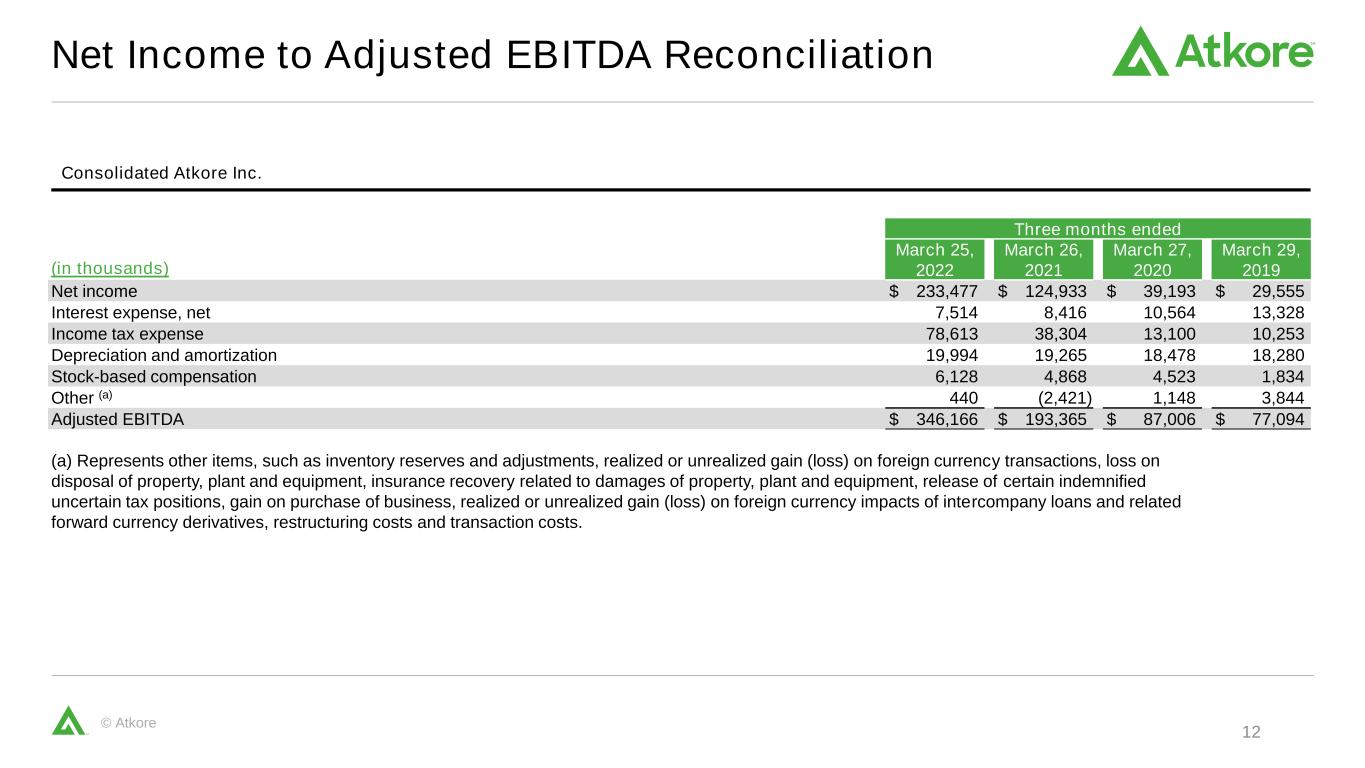

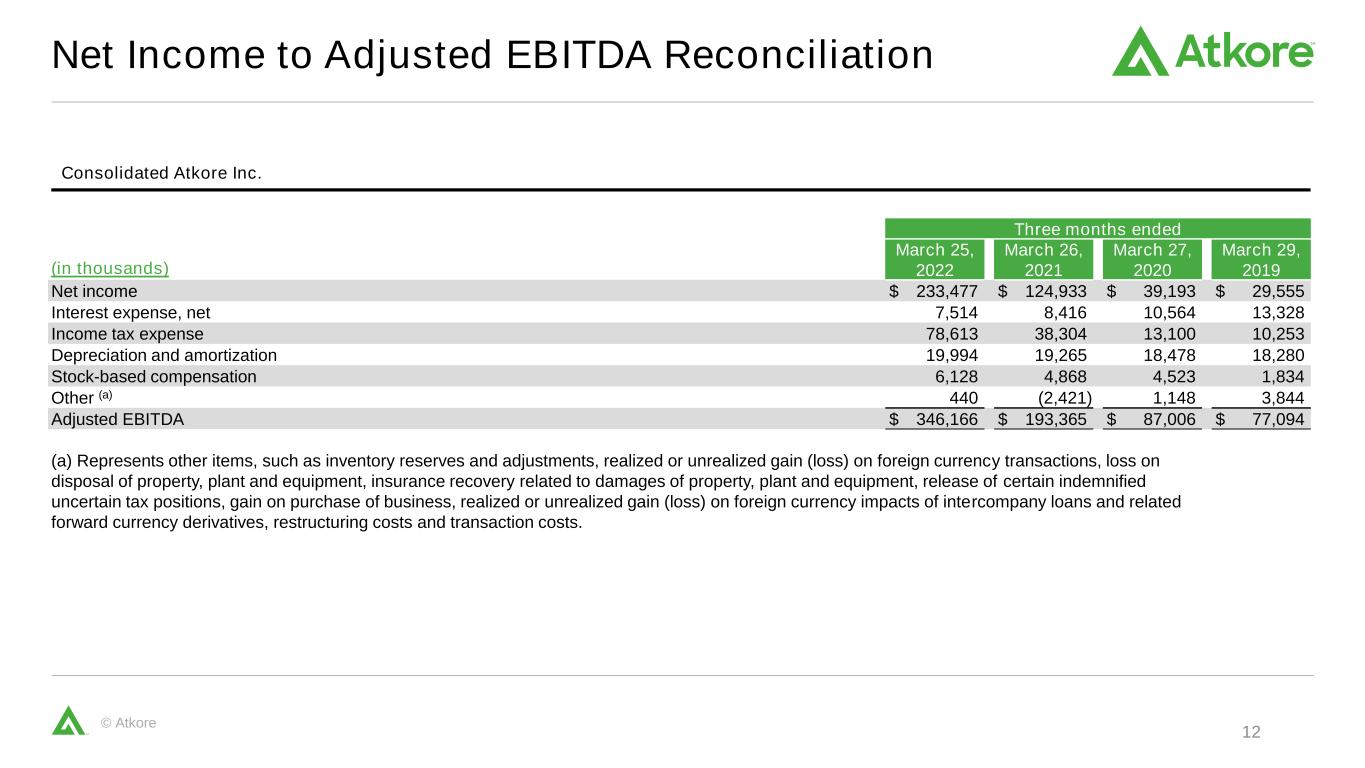

© Atkore Net Income to Adjusted EBITDA Reconciliation Consolidated Atkore Inc. 12 Three months ended (in thousands) March 25, 2022 March 26, 2021 March 27, 2020 March 29, 2019 Net income $ 233,477 $ 124,933 $ 39,193 $ 29,555 Interest expense, net 7,514 8,416 10,564 13,328 Income tax expense 78,613 38,304 13,100 10,253 Depreciation and amortization 19,994 19,265 18,478 18,280 Stock-based compensation 6,128 4,868 4,523 1,834 Other (a) 440 (2,421) 1,148 3,844 Adjusted EBITDA $ 346,166 $ 193,365 $ 87,006 $ 77,094 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of certain indemnified uncertain tax positions, gain on purchase of business, realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives, restructuring costs and transaction costs.

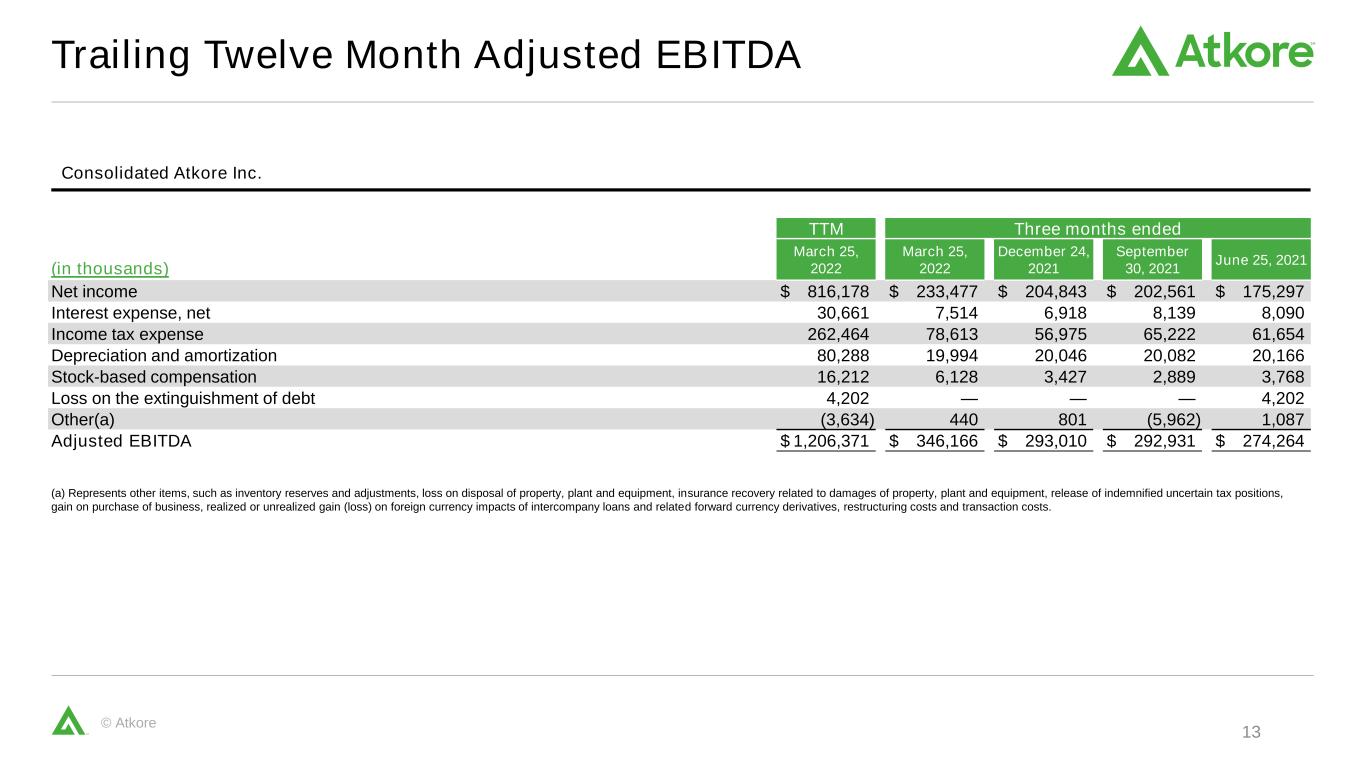

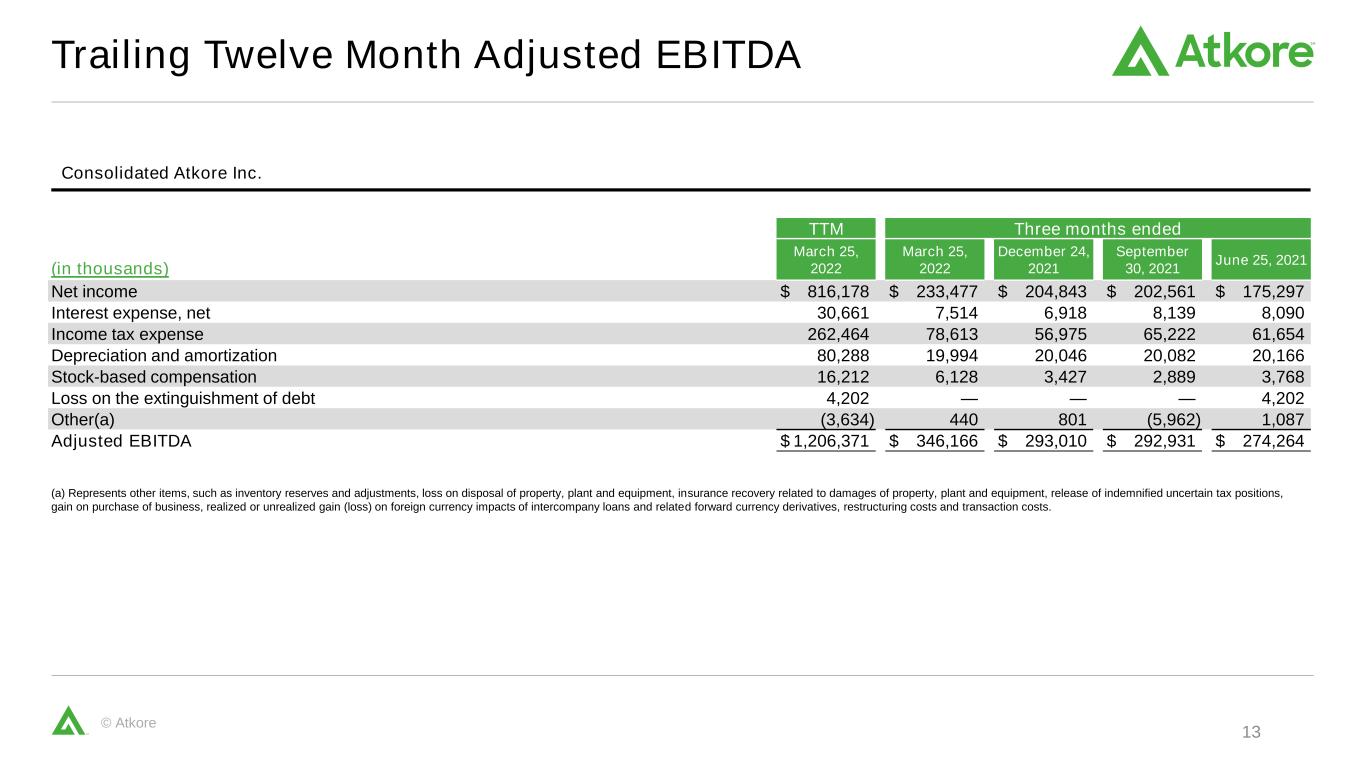

© Atkore Trailing Twelve Month Adjusted EBITDA Consolidated Atkore Inc. 13 TTM Three months ended (in thousands) March 25, 2022 March 25, 2022 December 24, 2021 September 30, 2021 June 25, 2021 Net income $ 816,178 $ 233,477 $ 204,843 $ 202,561 $ 175,297 Interest expense, net 30,661 7,514 6,918 8,139 8,090 Income tax expense 262,464 78,613 56,975 65,222 61,654 Depreciation and amortization 80,288 19,994 20,046 20,082 20,166 Stock-based compensation 16,212 6,128 3,427 2,889 3,768 Loss on the extinguishment of debt 4,202 — — — 4,202 Other(a) (3,634) 440 801 (5,962) 1,087 Adjusted EBITDA $ 1,206,371 $ 346,166 $ 293,010 $ 292,931 $ 274,264 (a) Represents other items, such as inventory reserves and adjustments, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of indemnified uncertain tax positions, gain on purchase of business, realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives, restructuring costs and transaction costs.

© Atkore Net Debt to Total Debt and Leverage Ratio Consolidated Atkore Inc. (a) Leverage ratio and TTM Adjusted EBITDA reconciliations for all periods above can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on January 31, 2022, November 18, 2021, August 3, 2021, April 29, 2021, and February 2, 2021. 14 ($ in thousands) March 25, 2022 December 24, 2021 September 30, 2021 June 25, 2021 March 26, 2021 December 25, 2020 Short-term debt and current maturities of long-term debt $ — $ — $ — $ 4,000 $ — $ — Long-term debt 759,461 758,924 758,386 780,489 765,049 764,379 Total debt 759,461 758,924 758,386 784,489 765,049 764,379 Less cash and cash equivalents 390,399 498,959 $ 576,289 397,142 304,469 280,420 Net debt $ 369,062 $ 259,965 $ 182,097 $ 387,347 $ 460,580 $ 483,959 TTM Adjusted EBITDA (a) $ 1,206,371 $ 1,053,570 $ 897,547 $ 702,815 $ 492,274 $ 385,915 Total debt/TTM Adjusted EBITDA 0.6 x 0.7 x 0.8 x 1.1 x 1.6 x 2.0 x Net debt/TTM Adjusted EBITDA 0.3 x 0.2 x 0.2 x 0.6 x 0.9 x 1.3 x

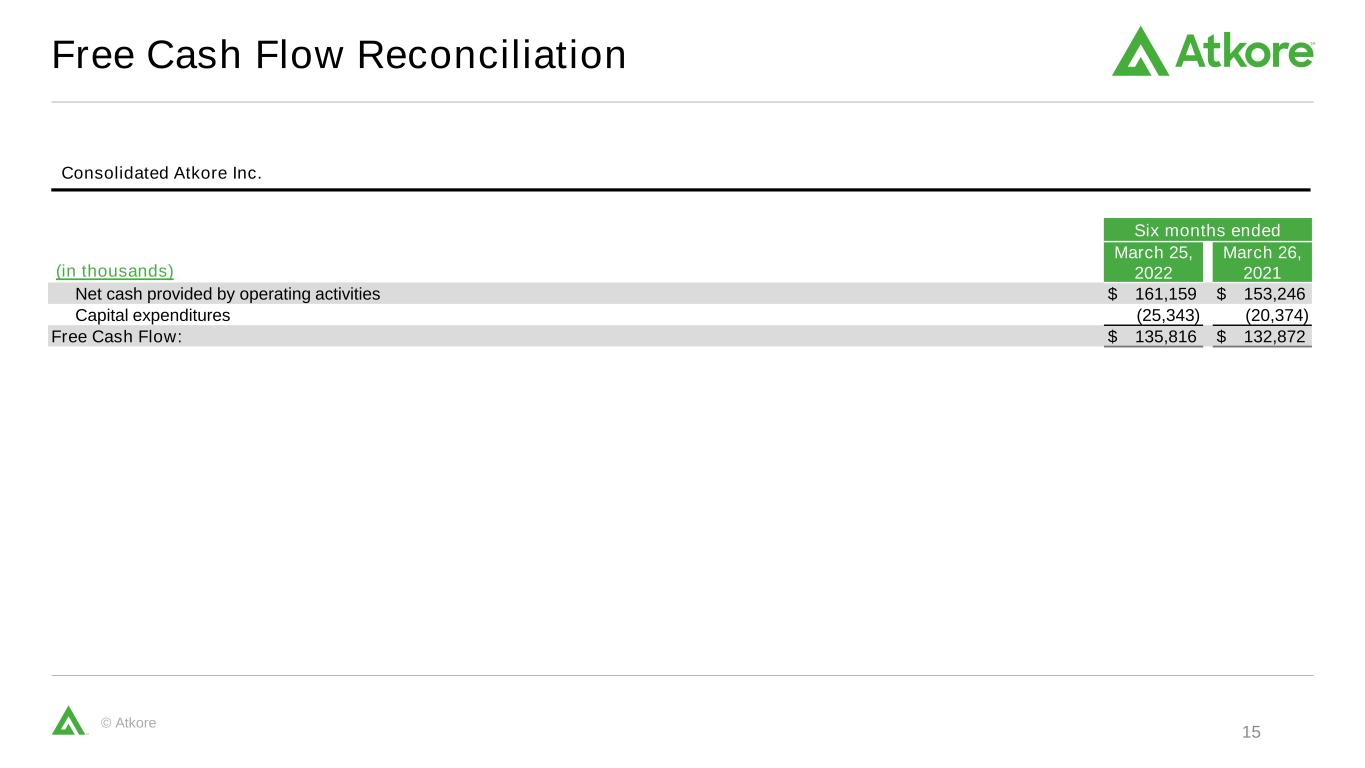

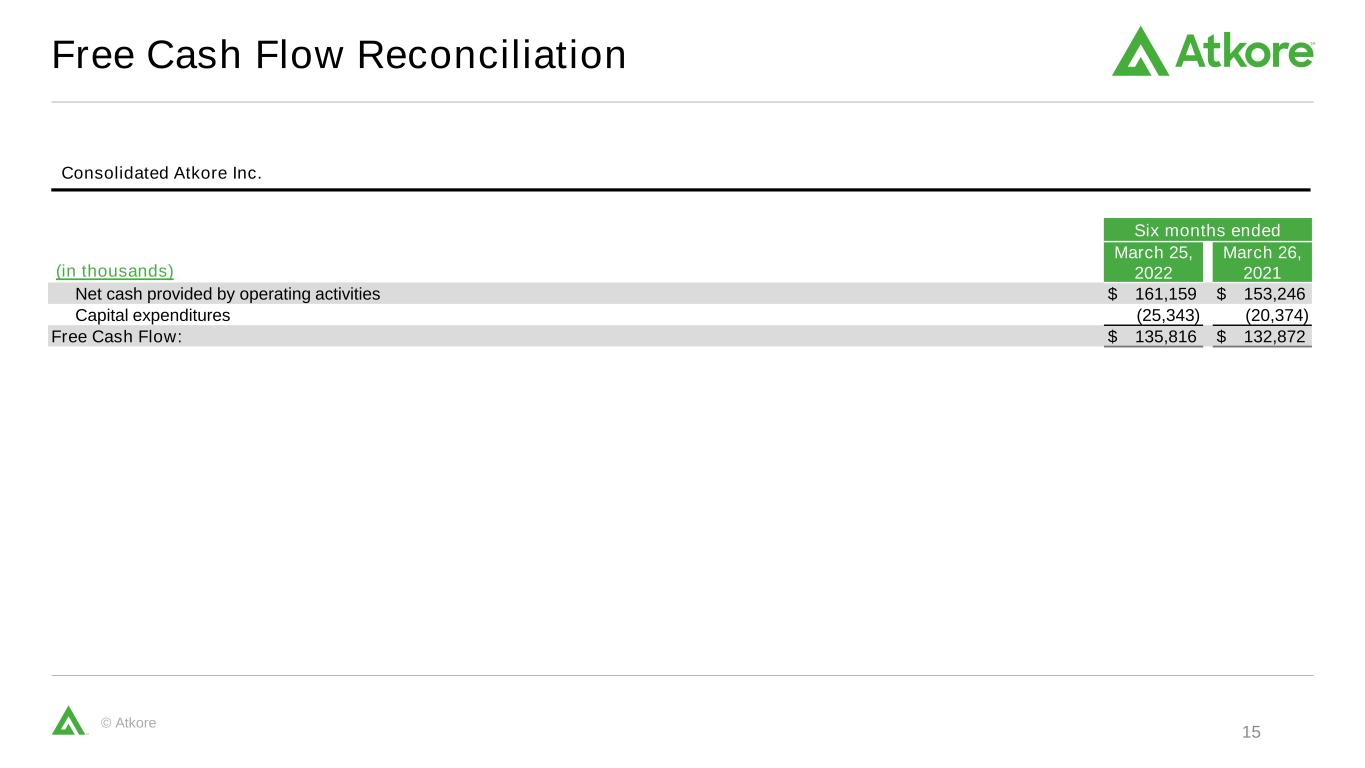

© Atkore Free Cash Flow Reconciliation Consolidated Atkore Inc. 15 Six months ended (in thousands) March 25, 2022 March 26, 2021 Net cash provided by operating activities $ 161,159 $ 153,246 Capital expenditures (25,343) (20,374) Free Cash Flow: $ 135,816 $ 132,872

© Atkore atkore.com © Atkore