Exhibit 99.1

Quick Facts. TSX/NYSE: FTS -7% EPS year-over-year growth $4.0 billion capital expenditures 49 consecutive years dividend increases $64 billion total assets 9,200 dedicated employees 3.4 million electricity and gas customers 73% Fortis utilities have female CEO or Board Chair ~$10 million community investment 28% since 2019 GHG emissions reductions 10 regulated utilities in Canada, the U.S. and Caribbean

What’s inside 2 Message to shareholders 5 Our purpose and values 6 Notice of our 2023 annual meeting 7 2023 management information circular 9 About the shareholder meeting 10 Voting 14 What the meeting will cover 16 About the nominated directors 29 Additional information about the directors 34 Governance 35 Our governance policies and practices 36 About the Fortis board 58 Executive compensation 59 Message from the chair of the human resources committee 63 Compensation discussion and analysis 63 Compensation strategy 63 Compensation governance 70 Compensation design and decision-making 74 2022 Executive compensation 95 Share performance and cost of management 99 Compensation details 110 Other information 113 Appendices 113 Statement of corporate governance practices 120 Board of directors mandate

Message from the Chair of the Board and the President and Chief Executive Officer

| |  |

Jo Mark Zurel

Chair, Board of Directors | | David G. Hutchens

President and Chief Executive Officer |

Dear fellow shareholders,

On behalf of the board of directors and management of Fortis Inc., it is our pleasure to invite you to our 2023 annual meeting of shareholders on Thursday, May 4, 2023 beginning at 10:30 a.m. (Newfoundland Daylight Time). As this will be a hybrid meeting, you have the choice to attend the meeting virtually or in person.

During the meeting, shareholders will receive the presentation on our financial results for 2022, vote on specific items of business and ask questions. The enclosed management information circular contains important information about the meeting and how to vote your shares, either in advance or during the meeting. Voting information begins on page 10.

Living our purpose and values

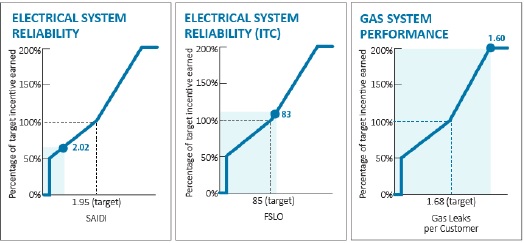

In 2022 Fortis utilities delivered electricity and gas service to 3.4 million customers while outperforming industry averages in Canada and the U.S. for reliability and safety. At the same time, Fortis significantly reduced its Scope 1 greenhouse gas (GHG) emissions and is on track to transition to a cleaner energy future for the benefit of all our stakeholders, including our customers, shareholders and employees.

Strong fiscal performance

Over the past 20-year period, Fortis has yielded a total annualized shareholder return of 11.3% and in 2022 Fortis continued to deliver strong fiscal results through the execution of its organic growth strategy.

In 2022 Fortis invested over $4 billion in capital1 with over $600 million focused on delivering cleaner energy to customers. We delivered earnings per share (EPS) growth of approximately 7%, announced the largest five-year capital plan in our history at $22.3 billion and approved a 5.6% increase in our quarterly dividend. This marks 49 consecutive years of annual dividend increases – one of the longest records held by a Canadian public corporation.

These strong financial results were achieved amidst challenging macroeconomic conditions that included rising inflation, global energy market disruptions and geopolitical unrest, and are a reflection of the tremendous work and leadership across the Fortis group of companies.

2022 financial highlights

Net earnings attributable to common equity shareholders in 2022 were $1.3 billion, or $2.78 per common share compared to $1.2 billion, or $2.61 per common share, for 2021. We achieved adjusted net earnings attributable to common equity shareholders1 of $1.3 billion, or $2.78 per common share in 2022, compared to $1.2 billion, or $2.59 per common share in 2021. Financial performance for the year was primarily driven by rate base growth across our utilities as well as higher electricity sales and transmission revenue in Arizona. The translation of U.S. dollar-denominated subsidiary earnings at the higher U.S.-to-Canadian dollar foreign exchange rate and lower stock-based compensation costs also contributed to results.

Leading North American utility

Fortis is a leading North American regulated gas and electric utility with six core strengths:

| 3. | Diversified regulated portfolio |

| 4. | Substantially autonomous business model |

| 5. | Growth opportunities within and proximate to our service territories |

| 1 | Non-US GAAP measure. For a detailed description of this and each of the other non-US GAAP measures used in this circular (adjusted net earnings attributable to common equity shareholders, adjusted EPS and adjusted EPS for annual incentive purposes) and a detailed reconciliation to the most directly comparable measures under US GAAP, please see About non-US GAAP measures starting on page 111 of this circular. |

The non-US GAAP measures set out in this circular are intended to provide additional information to investors and do not have standardized meanings under US GAAP, and therefore may not be comparable to other issuers, and should not be considered in isolation as a substitute for measures prepared in accordance with US GAAP.

Advances in sustainability

Fortis is committed to remaining a strong, sustainable company for the benefit of all our stakeholders. We demonstrated this commitment by amending our $1.3 billion revolving credit facility in 2022 to establish a sustainability-linked loan structure, which includes pricing adjustments connected to our achievement of carbon emissions and board diversity targets.

We continue to enhance our sustainability disclosure and align with leading reporting frameworks. Our 2022 sustainability report includes more than 35 new sustainability performance indicators and fully aligns with applicable Sustainability Accounting Standards Board (SASB) standards. We also released our first TCFD and climate assessment report in 2022. Both documents are available on our website (www.fortisinc.com).

In 2022 we delivered strong performance on environmental, social and governance (ESG) matters:

Environmental

Our assets consist primarily of those needed to deliver electricity and natural gas to our customers which limits our carbon footprint and impact on the environment. For the small portion of our business consisting of generation, we have a detailed plan to significantly reduce our carbon footprint.

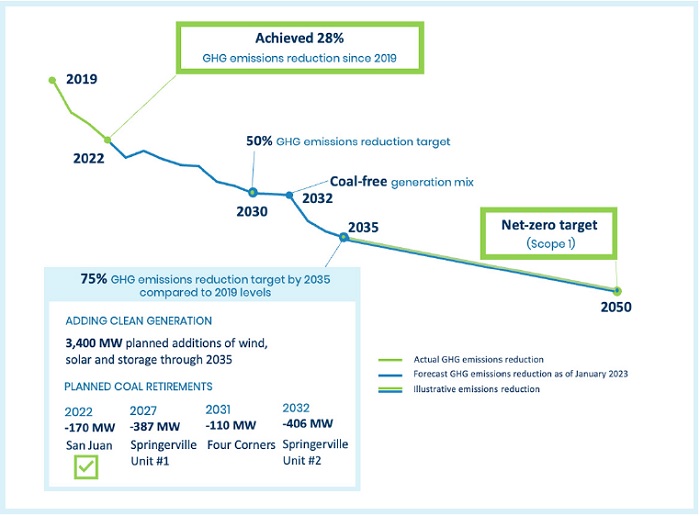

We have a goal to achieve net-zero Scope 1 GHG emissions by 2050, including our corporate-wide interim targets to reduce our GHG emissions 50% by 2030 and 75% by 2035, compared to 2019 levels. We have made solid progress, reducing Scope 1 emissions by 28% compared to 2019 levels, which is the equivalent of taking approximately 760,000 vehicles off the road. The closure of UNS Energy Corporation’s 170 MW coal-fired San Juan Generating Facility in mid-2022 contributed to the reduction. With this progress, we are on track to achieve our targets while remaining committed to preserving customer reliability and affordability (see page 42).

Social

Fortis values its 9,200 employees and recognizes that success is dependent on a workforce which is safe, supported and engaged. In 2022 we achieved our collective lowest recordable injury rate in history. In early 2022, however, an accident resulted in an employee fatality at Fortis Belize – a tragic reminder of the dangers present in the work that we do and the critical importance of safety in all our operations.

We continue to advance our work on diversity, equity and inclusion (DEI), building on the framework we established in 2019. In 2022 we linked executive compensation to a corporate DEI performance measure, collected baseline representation data across all Fortis utilities, set expectations for leader education and significantly expanded our diversity disclosure (see page 38).

Governance

Fortis has for many years been recognized as a governance leader, with practices that enhance strategic planning, support effective oversight and are aligned with shareholder interests. In December 2022 the Fortis board of directors ranked first out of 226 companies in the S&P/TSX Composite Index in the annual Globe and Mail’s Board Games ranking of corporate governance practices.

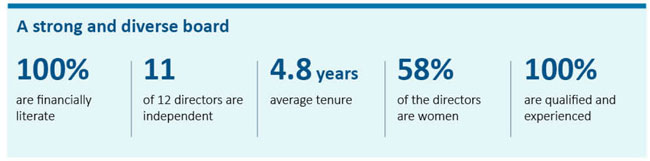

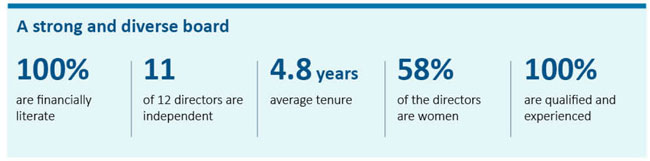

Critical to good governance is a strong board composed of qualified directors with a variety of expertise, experience and diversity. Fortis is committed to maintaining a board where at least 40% of independent directors are women. Currently, 54% of the board are women. Fortis also had previously targeted to have at least two directors who identify as a visible minority or Indigenous person by 2023 and met this target in 2022 (see page 50).

In 2022 we continued to reinforce the importance of ESG in executive compensation by adding new measures focused on carbon reduction and DEI in both our annual and long-term incentive plans (see page 67).

We maintain strong board and management oversight of cybersecurity and technology including a robust enterprise-wide cybersecurity risk management program. We have not had any reportable cybersecurity breaches since we began reporting on cybersecurity in 2018.

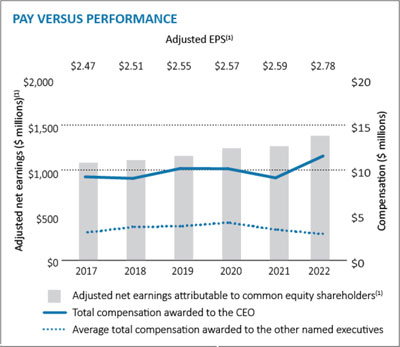

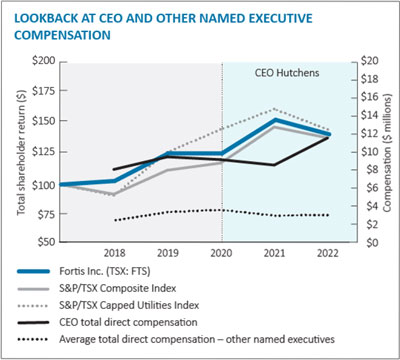

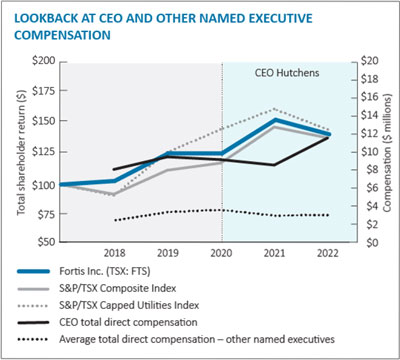

Pay aligned with performance

The board and the human resources committee work diligently to ensure executive compensation supports the business strategy, links to performance and aligns with shareholder interests, including sustainability. The corporate performance component, which accounts for 90% of the annual incentive, was assessed at a factor of 116.9% for 2022. You can read more about the 2022 compensation decisions and changes to the compensation program in the letter from the chair of the human resources committee beginning on page 59 and in the compensation discussion and analysis beginning on page 63.

Board transition

Douglas J. Haughey will retire from the board in May at the end of our 2023 annual meeting after serving 14 years as a Fortis director, including six years as Chair of the board. In July 2022 the board announced Jo Mark Zurel would become Chair of the board effective January 1, 2023.

The board’s announcement follows the recommendation by the board chair selection committee, which was established in 2021 as an ad hoc committee of the board to assist in overseeing the process for selecting and recommending an eligible candidate to serve as Chair of the board (see page 54).

| | |

| 2023 MESSAGE TO SHAREHOLDERS | 3 |

As Chair, Doug has focused on key strategic issues and brought out the best in every director. He is a gifted communicator and facilitator who leaves a legacy of excellence in board governance and a company that has successfully expanded into the United States. During Doug’s term as Chair, Fortis has pivoted to an organic growth strategy and advanced its sustainability efforts in tangible and meaningful ways. We sincerely thank Doug for his strong leadership and service.

Paul J. Bonavia is also not standing for re-election, having reached age 72 before the 2023 annual meeting and therefore reaching the maximum age set out in our term limits for directors. Paul previously served on the board of Fortis from May 2015 to February 2016 and is the former CEO and Executive Chairman of UNS Energy, which Fortis acquired in 2014. We thank Paul for his tremendous insights and contributions.

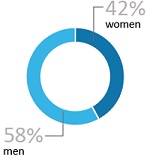

Election of directors

This year we are asking you to elect 12 directors to the Fortis board: 11 current directors and one new nominee, Donald R. Marchand. All the nominees are highly qualified, and together they bring a strong and diverse mix of skills, experience and perspectives to the board. Assuming all nominees are elected, the board will have seven (58%) female and five (42%) male directors. You can read about each nominee beginning on page 17 and the diversity of our board on page 50.

Leadership transition

In May 2022 the board announced the retirement of Nora M. Duke, Executive Vice President, Sustainability and Chief Human Resource Officer after a 36-year career at Fortis. We thank Nora for her thoughtful leadership on sustainability, diversity and inclusion and talent management and her strategic guidance throughout her longstanding career.

James R. Reid, Executive Vice President, Sustainability and Chief Legal Officer assumed oversight responsibilities for sustainability, human resources, communications and government relations, in addition to his legal and governance portfolio, effective July 1, 2022.

Gary J. Smith, formerly Executive Vice President, Eastern Canadian and Caribbean Operations, assumed the new position of Executive Vice President, Operations and Innovation effective January 1, 2022. Gary is responsible for advancing our innovation priorities and provides leadership in safety, reliability and capital investment across the entire organization. He oversees our cybersecurity and technology functions and provides oversight for our Eastern Canadian and Caribbean operations.

Engaging with stakeholders and communities

We believe in the importance of regular and effective communication with our employees, customers, shareholders and other stakeholders. In 2022 Fortis held over 125 in-person and virtual meetings with existing and potential investors. In addition, the Chair, incoming Chair and the three committee chairs hosted a hybrid meeting with some of our largest shareholders. You can read more about our board-shareholder engagement on page 57.

Across our organization, the Fortis group contributed $9.7 million over the past year to support social development, education, biodiversity, environment and safety, health and wellness, small business, arts and culture in the various communities that we serve.

Positioned for future success

Fortis’ low-risk organic growth strategy and diversified portfolio of utility businesses continue to enhance shareholder value. We will continue to invest in cleaner energy for the benefit of our stakeholders as we work to achieve our GHG reduction targets and deliver safe, reliable and cost-effective service to our customers. We remain committed to ensuring a successful and sustainable Fortis for years to come.

Your vote is important so please remember to vote your shares. We thank you for your confidence in Fortis and look forward to hosting you at our annual meeting of shareholders on May 4, 2023.

Sincerely,

|  |

Jo Mark Zurel

Chair, Board of Directors | David G. Hutchens

President and Chief Executive Officer |

PURPOSE Delivering a cleaner energy future We value We keep our people it local VALUES ® @ (§) @ We never We act with Weare We aim for compromise courage and community excellence on safety integrity champions every day

Notice of our 2023 annual meeting

When

Thursday, May 4, 2023

10:30 a.m. (Newfoundland Daylight Time)

Where

St. John’s Convention Centre

50 New Gower Street

St. John’s, NL

Or attend virtually by live webcast

https://web.lumiagm.com/460861679

What the meeting will cover

| 1. | Receive the Fortis Inc. (Fortis) consolidated financial statements for the financial year ended December 31, 2022 and the auditors’ report |

| 3. | Appoint the auditors and authorize the directors to set the auditors’ fees |

| 4. | Vote, on an advisory basis, on executive pay |

| 5. | Transact any other business that may properly come before the meeting |

Your right to vote

You are entitled to receive notice of and vote at the shareholder meeting if you held Fortis common shares at the close of business on March 17, 2023. If you acquired your shares after this date, you can ask for your name to be included in the list of eligible shareholders up to 10 days before the meeting if you provide evidence of your ownership of Fortis shares.

The board of directors recommends that shareholders vote FOR all the resolutions. You can read more about these items in the attached management information circular.

The board of directors has approved the contents of this notice and authorized us to send this information to our shareholders, directors and auditors.

By order of the board of directors,

James R. Reid

Executive Vice President, Sustainability and Chief Legal Officer

St. John’s, Newfoundland and Labrador

March 17, 2023

| How to vote |

|  |  |  |

| Online | Phone | Mail | In person |

Vote your shares in advance using the proxy form or voting instruction form in your package of materials OR Vote in real time in person at the meeting or virtually Please read the voting information beginning on page 10 of the management information circular. |

Management information circular

You have received this management information circular because you owned common shares of Fortis Inc. as of the close of business on March 17, 2023 (the record date) and are entitled to receive notice of and vote at our annual meeting of shareholders on Thursday, May 4, 2023 (or a reconvened meeting if the meeting is postponed or adjourned). This will be a hybrid meeting so you can attend the meeting virtually, or in person.

Management is soliciting your proxy for the meeting. Solicitation is mainly by mail, but you may also be contacted by phone, e-mail, internet or fax by a Fortis director, officer or employee or our proxy solicitation agent, Kingsdale Advisors (Kingsdale).

We pay for the costs of preparing and distributing the meeting materials, including reimbursing brokers and other entities for mailing the materials to our beneficial shareholders. We have retained Kingsdale as our proxy solicitation agent at a cost of $42,000 for their services and will reimburse them for any related expenses.

Your vote is important. Please read this circular carefully and then vote your shares. You can vote your shares in advance by proxy or in real time at the meeting, or you can appoint someone else to be your proxyholder to attend the meeting on your behalf and vote your shares. Voting information begins on page 10.

In this document:

| • | we, us, our and Fortis mean Fortis Inc. |

| • | you, your and shareholder refer to holders of Fortis common shares |

| • | shares and Fortis shares mean common shares of Fortis, unless otherwise indicated |

| • | all dollar amounts are in Canadian dollars, unless indicated otherwise |

| • | information is as of March 17, 2023, unless indicated otherwise. |

The board of directors of Fortis has approved the contents of this circular and authorized us to send it to all shareholders of record.

James R. Reid

Executive Vice President, Sustainability and Chief Legal Officer

St. John’s, Newfoundland and Labrador

March 17, 2023

About notice and access Fortis is using Notice and Access rules adopted by Canadian securities regulators to reduce the volume of paper in the materials distributed for the 2023 annual meeting of shareholders. Instead of receiving this circular with the proxy form or voting information form, shareholders received a notice of the meeting with instructions for accessing the remaining materials online. We have sent the notice of the meeting and proxy form directly to registered shareholders, and the notice of the meeting and voting instruction form directly to non-objecting beneficial owners. If you are a non-registered shareholder, and Fortis or its agent has sent the notice of meeting and voting instruction form directly to you, your name and address and information about your holdings of Fortis shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding them on your behalf. We plan to pay the cost for intermediaries to deliver the notice of meeting, voting instruction form and other materials to objecting beneficial owners. This circular and the proxy form can be viewed online on EnVision (www.envisionreports.com/fortis2023), on our website (www.fortisinc.com) and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov). See page 13 for details about how to receive free paper copies of the meeting materials. |

| | |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 7 |

About forward-looking information

Fortis includes forward-looking information in this circular within the meaning of applicable Canadian securities laws and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (collectively referred to as forward-looking information). Forward-looking information reflects expectations of Fortis management regarding future growth, results of operations, performance, business prospects and opportunities. Wherever possible, words such as anticipates, believes, budgets, could, estimates, expects, forecasts, intends, may, might, plans, projects, schedule, should, target, will, would, and the negative of these terms, and other similar terminology or expressions have been used to identify the forward-looking information, which includes, without limitation: forecast capital expenditures for 2023 to 2027, including cleaner energy investments; the 2030 GHG emissions reduction target; the 2035 GHG emissions reduction target and projected asset mix; the expectation to achieve the 2030 and 2035 GHG emissions reduction targets without the use of carbon offsets; the 2050 net-zero GHG emissions target and how that target is expected to be achieved; targeted GHG emission reductions and renewable energy projects associated with TEP’s Integrated Resource Plan; planned coal retirements and the expectation to exit coal by 2032; Maritime Electric’s 2030 GHG emissions reduction target; and the timing and projected benefits of the Wataynikaneyap Transmission Power Project.

Certain material factors or assumptions have been applied in drawing the conclusions contained in the forward-looking information, including, without limitation: no material impact from volatility in energy prices, global supply chain constraints and rising inflation; reasonable regulatory decisions by utility regulators and the expectation of regulatory stability; the successful execution of the capital plan; no material capital project or financing cost overrun; sufficient human resources to deliver service and execute the capital plan; continued technological advancement; and the board exercising its discretion to declare dividends, taking into account the business performance and financial condition of Fortis. Fortis cautions readers that a number of factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking information. These factors should be considered carefully, and undue reliance should not be placed on the forward-looking information. For additional information with respect to certain of these risks or factors, refer to the continuous disclosure materials filed from time to time by Fortis with Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission (SEC). All forward-looking information included in this circular is given as of the date of this circular. Fortis disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Additional information

The information contained on, or accessible through, any website referenced in this circular is not incorporated by reference in this circular and is not, and should not be considered to be, a part of this circular unless it is explicitly incorporated herein.

1 About the shareholder meeting This section gives important information about our 2023 annual meeting and the voting process. Please remember to vote your shares by 10:30 a.m. Newfoundland Daylight Time on May 2, 2023. Where to find it 10 Voting 14 What the meeting will cover 16 About the nominated directors 29 Additional information about the directors

1 About the shareholder meeting This section gives important information about our 2023 annual meeting and the voting process. Please remember to vote your shares by 10:30 a.m. Newfoundland Daylight Time on May 2, 2023. Where to find it 10 Voting 14 What the meeting will cover 16 About the nominated directors 29 Additional information about the directors

| 2023 MANAGEMENT INFORMATION CIRCULAR | 9 |

Voting

Who can vote

You are entitled to receive notice of and vote at the meeting if you held common shares of Fortis at the close of business on the record date of March 17, 2023. As of the record date, we had 484,357,731 common shares issued and outstanding. Each share entitles the holder to one vote on each of the three voting items and any other matters that may properly come before the meeting (see page 14).

The voting process differs by type of shareholder, which are as follows:

| • | registered shareholders – your shares are registered in your name |

| • | non-registered (beneficial) shareholders – your shares are held in the name of your nominee (usually a bank, trust company, securities dealer or other financial institution) and you are the beneficial owner of the shares. |

If you acquired your Fortis shares after the record date, you can ask for your name to be included in the list of eligible shareholders up to 10 days before the meeting if you provide evidence that you own the shares. To vote your shares acquired after the record date, contact our transfer agent, Computershare Trust Company of Canada (Computershare), as soon as possible (see below).

Voting in advance

Registered shareholders

Voting by proxy. This means you have the right to appoint a person or entity (your proxyholder) to attend the meeting and vote your shares for you other than the persons named on the proxy form. Your proxyholder does not need to be a shareholder, but this person or company must attend the meeting and vote on your behalf.

Print the name of the person or company you are appointing in the space provided on the proxy form in your package of materials. Then complete your voting instructions, date and sign the form and return it to Computershare.

Vote by proxy

| | Go to www.investorvote.com. Enter the 15-digit control number printed on the proxy form and follow the instructions on screen. |

| | Call 1.866.732.8683 (toll-free in North America) and enter the 15-digit control number printed on the proxy form. Follow the interactive voice recording instructions to submit your vote. |

| | Enter your voting instructions on the proxy form, sign and date it, and send the completed form to Computershare Trust Company of Canada, Attention: Proxy Department,

100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 |

If you do not appoint your own proxyholder, the Fortis representatives named on the proxy form will act as your proxyholder and will vote your shares according to your instructions. Your proxyholder will have discretion to vote on amendments or variations to the business of the meeting or any other matters to be voted on at the meeting.

If you sign and return the form but do not give your voting instructions or specify that you want your shares withheld, the Fortis representatives will vote FOR the items of business:

| • | FOR the nominated directors |

| • | FOR the appointment of Deloitte LLP as our auditors |

| • | FOR our approach to executive compensation. |

Non-registered (beneficial) shareholders

By choosing to send these materials to you directly, Fortis (and not the intermediary holding the shares on your behalf) has assumed responsibility for delivering these materials to you and executing your proper voting instructions. Please return your voting instructions as specified in the voting instruction form.

Submit your voting instructions in advance

Use one of the methods provided on your voting instruction form (phone or over the internet), or simply complete the form and mail it to the address provided on the form. Your voting instruction form provides you with the right to appoint a person or company (your proxyholder) to attend the meeting and vote your shares for you.

We may use the Broadridge QuickVote™ service to assist non-registered shareholders with voting their shares over the phone, and Kingsdale may contact non-registered shareholders to help with this service. If you have questions or need help voting, please call or email Kingsdale (see page 11).

Sending in your advanced voting instructions right away

Take some time to read this circular and then vote your shares. We must receive your voting instructions by 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023 to ensure your shares are voted at the meeting.

If you are a non-registered shareholder, you will need to allow enough time for your nominee (or their representative) to receive your voting instructions and then submit them to Computershare.

If the meeting is postponed or adjourned, you must send your voting instructions at least 48 hours (not including Saturdays, Sundays and holidays) before the time the meeting is reconvened. The Chair of the meeting can waive or extend the proxy cut-off time without any advance notice.

Questions?

Call Kingsdale at:

| • | 1.888.518.6828 (toll-free within North America) or |

| • | 416.867.2272 (collect call outside North America) |

Or send an email to: contactus@kingsdaleadvisors.com

Voting in real time

Voting in person at the meeting

Registered shareholders – Check in with a Computershare representative when you arrive at the meeting. As you will cast your vote at the meeting, you do not need to fill out the proxy form.

Non-registered (beneficial) shareholders – Print your name in the space provided on the voting instruction form to appoint yourself as proxyholder, and follow the instructions from your nominee. Check in with a Computershare representative when you arrive at the meeting. Do not submit your vote using your voting instruction form because your vote will be taken at the meeting.

Voting virtually at the meeting

Registered shareholders

If you want to vote your shares virtually in real time, print your name in the space provided on the proxy form in your package of materials to appoint yourself as proxyholder. Then date and sign the form and return it to Computershare.

If you want to appoint someone else to attend the meeting virtually and vote your shares for you (third-party proxyholder), print the name of the person or company you are appointing in the space provided on the proxy form in your package of materials. Then date and sign the form, and submit your form to Computershare by internet, phone or mail (see page 10) by 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023.

After you submit the form to Computershare, you MUST register your third-party proxyholder with Computershare. Go to http://www.computershare.com/Fortis by 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023 to register your third-party proxyholder and provide the contact information required.

Computershare needs this information so it can confirm the registration and send an email notification with a control number. Your proxyholder needs the control number in order to vote your shares in real time. Your third-party proxyholder should receive the email notification after 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023.

Your proxyholder must vote your shares according to your instructions, but will have discretion to vote on amendments or variations to the business of the meeting or any other matters to be voted on at the meeting.

Non-registered (beneficial) shareholders

If you want to vote your shares virtually in real time, print your name in the space provided on your voting instruction form to instruct your nominee to appoint you as proxyholder (third-party proxyholder). Follow the instructions from your nominee for submitting the form, or use one of the methods provided on your voting instruction form (usually phone or over the internet). If you are a U.S. beneficial shareholder and you have received a legal proxy form from your nominee, you must mail your form to Computershare in Toronto (see page 10) or email it to USLegalProxy@computershare.com.

After you submit the form to your nominee, you MUST register yourself as a third-party proxyholder with Computershare. This step also applies if you are a U.S. beneficial shareholder and submitted your proxy form directly to Computershare.

Go to http://www.computershare.com/Fortis by 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023 to register yourself and provide your contact information. Computershare requires this information so it can confirm the registration and send you an email notification with a control number. You need the control number in order to vote your shares in real time.

You should receive your email notification after 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023.

| 2023 MANAGEMENT INFORMATION CIRCULAR | 11 |

Appointing a proxyholder

You have the right to appoint a person or entity (your proxyholder) to attend the meeting and vote your shares for you. Your proxyholder does not need to be a shareholder, but this person or company must attend the meeting (in person or virtually) and vote on your behalf.

If you are a registered shareholder and you are appointing someone other than the Fortis representatives named in the proxy form to be your proxyholder (third-party proxyholder), or you are a non-registered (beneficial) shareholder and you are instructing your nominee to appoint you as proxyholder (third-party proxyholder), you must register them with Computershare AFTER you have submitted your proxy form to Computershare or your voting instruction form to your nominee.

If you do not register the third-party proxyholder, they will not receive a control number and they will NOT be able to participate in the meeting and vote your shares.

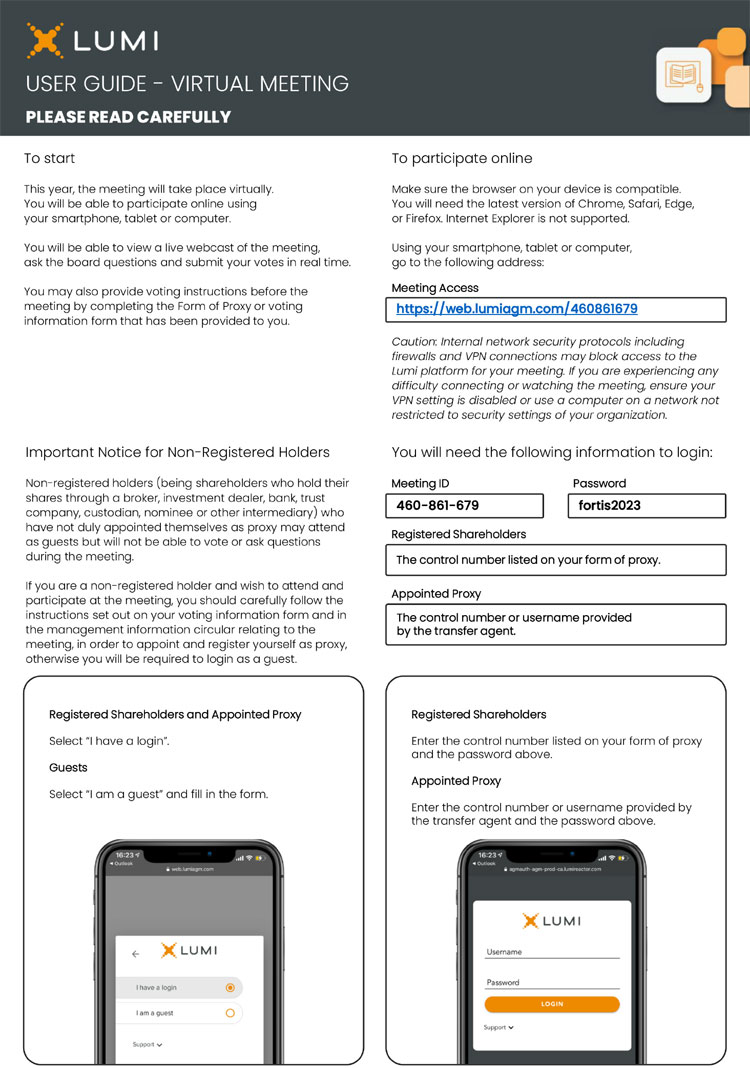

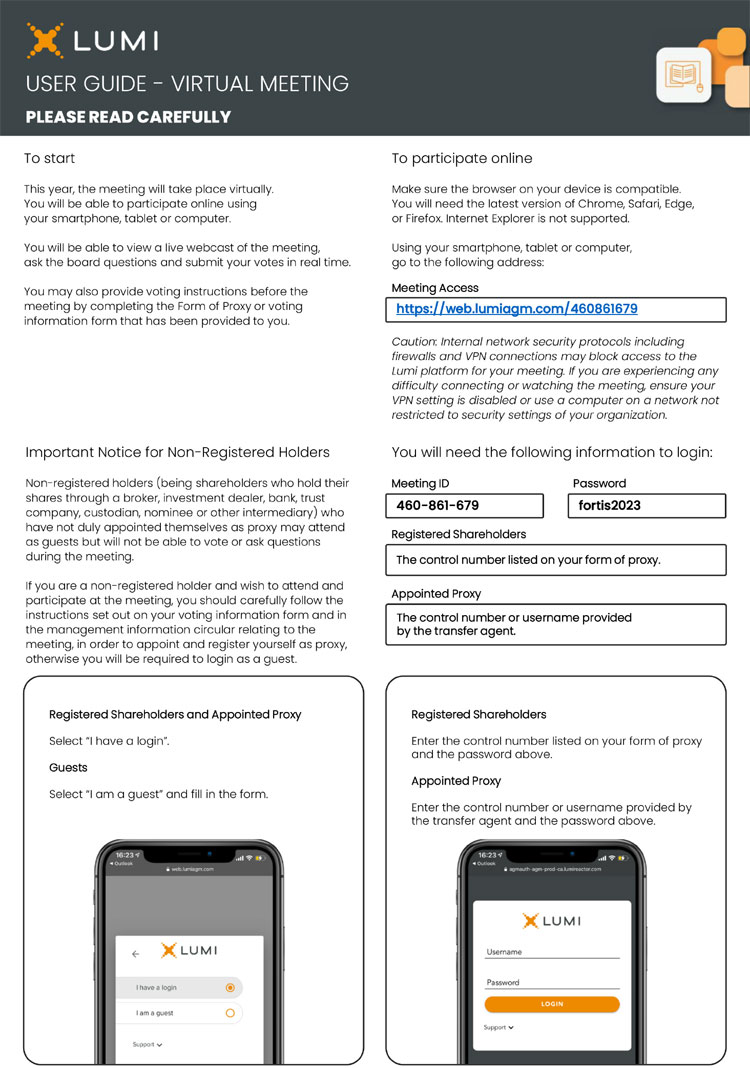

Participating in the meeting virtually

Use your smartphone, tablet or computer to participate in the meeting. Participating in the meeting means you can vote your shares in real time, ask questions and engage with management, members of the board and other shareholders.

Only registered shareholders and duly appointed proxyholders can vote at the meeting.

How to log in

You or your proxyholder should log in at least 30 minutes before the start of the meeting.

Go to https://web.lumiagm.com/460861679 on your smartphone, tablet or computer.

Click I have a login and enter the password fortis2023.

If you are a registered shareholder and you appointed yourself as proxyholder, enter the 15-digit control number on your proxy form as your user name.

If you are a registered shareholder and you appointed someone else to be your proxyholder (third-party proxyholder), or if you are a non-registered (beneficial) shareholder and you appointed yourself as proxyholder (third-party proxyholder) or someone else as your proxyholder (also a third-party proxyholder), that person or company will receive an email notification from Computershare with a control number that will also serve as their user name (see above).

Checklist for voting virtually

You will need the following to access the meeting:

| 1. | The latest version of Chrome, Safari, Edge or Firefox as your internet browser |

| 2. | Fortis meeting ID: 460-861-679 |

| 3. | Meeting password: fortis2023 |

| 4. | Your user name or control number (see below). |

Stay connected after you log in

After you log in to the meeting, remember to stay connected to the internet so you can vote when the balloting begins. See the user guide at the back of the circular for details about how to follow the proceedings, vote and ask questions.

Attending the meeting as a guest

You are not allowed to vote if you attend the virtual meeting as a guest. You can only watch or listen to the meeting.

How to log in

You should log in at least 30 minutes before the start of the meeting.

Go to https://web.lumiagm.com/460861679 on your smartphone, table or computer.

Click I have a login and enter the password fortis2023.

If you are a registered shareholder, enter the 15-digit control number on your proxy form as your user name.

If you are a non-registered (beneficial) shareholder, click I am a guest and complete the online form.

Changing your vote

If you change your mind about how you want to vote your shares, you can revoke your proxy at any time before it is acted on in one of the following ways, or by any other means permitted by law.

If you are a registered shareholder:

| • | vote again on the internet or by phone before 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023 |

| • | complete a proxy form with a later date than the form you originally submitted, and mail it as soon as possible so that it is received before 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023 |

| • | send a written notice to our Executive Vice President, Sustainability and Chief Legal Officer so that it is received before 10:30 a.m. (Newfoundland Daylight Time) on May 2, 2023. |

You can also attend the meeting and change your vote. Using your control number to log in to the meeting virtually means you will be revoking all previously submitted proxies and will have the opportunity to vote by online ballot on any voting items. If you do not revoke any previously submitted proxies, you will not be able to participate in the meeting.

If you are a non-registered shareholder and have submitted your voting instructions, follow the instructions provided by your nominee.

Confidentiality and voting results

Proxy votes are tabulated by our transfer agent so individual shareholder votes are kept confidential.

The voting results will be available after the meeting on our website (www.fortisinc.com), and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov).

Receiving paper copies of the meeting materials

You can ask for free paper copies of this circular and the proxy form or voting instruction form to be sent to you by mail.

To receive paper copies before the meeting

If you want to receive copies before the meeting and voting deadline, make your request right away to allow enough time for the items to be delivered to you. You will need the control number on your proxy form or voting instruction form to make the request. Requests must be made by April 20, 2023.

If you have a 15-digit control number

| • | Call 1.866.962.0498 (toll-free within North America) or +1.514.982.8716 (outside North America) |

| • | Enter the control number as it appears on your proxy form or voting instruction form |

If you have a 16-digit control number

| • | Call 1.877.907.7643 (toll-free) |

| • | Enter the control number as it appears on your proxy form or voting instruction form |

To receive paper copies after the meeting

Requests can be made up to one year from the date the meeting materials are posted on our website (www.fortisinc.com). If you have questions about notice and access or want to order paper copies of the meeting materials after the meeting, please contact Kingsdale (see page 11) or write to our Executive Vice President, Sustainability and Chief Legal Officer:

Fortis Inc.

Fortis Place, Suite 1100

5 Springdale Street, PO Box 8837

St. John’s, NL A1B 3T2

Canada

| 2023 MANAGEMENT INFORMATION CIRCULAR | 13 |

What the meeting will cover

You will receive an update on our 2022 financial performance and vote on at least three items of business. An item is approved if a simple majority (50% plus one) of shares represented in person or by proxy at the meeting are voted FOR a resolution, except for the election of directors (see the note below about our majority voting policy for electing directors).

Except as described below, none of our officers or current directors have any material interest, direct or indirect, in any matter to be acted on at the meeting.

Quorum

We must have a quorum at the beginning of the shareholder meeting for it to proceed and to transact business. This means we must have at least two people present who together hold, or represent by proxy, at least 25% of our shares issued and outstanding as of the record date.

1. Receive the financial statements

We will present our consolidated financial statements for the year ended December 31, 2022 together with the auditors’ reports. We mailed our consolidated financial statements to beneficial shareholders who requested a copy and a notice to all registered shareholders with information about how they can access the document online. You can find a copy of the consolidated financial statements on our website (www.fortisinc.com) and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov).

2. Elect directors (see page 16)

You will vote to elect 12 directors to the board this year. The 12 nominees are:

Tracey C. Ball

Pierre J. Blouin

Lawrence T. Borgard

Maura J. Clark

Lisa Crutchfield

Margarita K. Dilley

Julie A. Dobson

Lisa L. Durocher

David G. Hutchens

Gianna M. Manes

Donald R. Marchand

Jo Mark Zurel

Eleven nominees currently serve on the board. Donald R. Marchand is being nominated for the first time and currently does not serve as a Fortis director.

Douglas J. Haughey who currently serves as a director and served as Chair of the board until December 31, 2022 is not standing for re-election. As disclosed in our 2021 management information circular, in 2020 the board, on the recommendation of the governance and sustainability committee, approved a two-year extension of Mr. Haughey’s maximum term limit to manage the transitions of the Chair and CEO roles. Mr. Haughey will retire as a Fortis director at the end of the 2023 annual meeting. Paul J. Bonavia is also not standing for re-election, having reached the age of 72 and therefore reaching the age limit set out in our term limits for directors in our director governance guidelines.

You can read about each nominated director beginning on page 17, our policy on director tenure on page 54 and the board chair selection process also on page 54.

If for any reason a nominated director is unable to serve as a director of Fortis, the persons named in the enclosed proxy form reserve the right to nominate and vote for another nominee at their discretion, unless the shareholder has specified in their proxy form that their shares are to be withheld from voting for the election of directors.

The board and management recommend that you vote FOR the nominated directors.

Majority voting policy

A nominee must receive more FOR than WITHHOLD votes to serve as a director on our board (see page 16 for details).

3. Appoint the auditors

The board, on the recommendation of the audit committee, proposes that shareholders appoint Deloitte LLP as our independent auditors to hold office for a one-year term until the close of our next annual meeting of shareholders.

In 2017 the audit committee conducted a comprehensive tender process for the external audit engagement and put forward Deloitte LLP as the auditors based on the qualifications of its audit team, its use of technology and an independence assessment. The audit committee annually reviews and evaluates the qualifications, independence and performance of the external auditors.

Formal review process

As a good governance practice, the audit committee uses a formal tender process to select our external auditors and reviews the performance of the external auditors annually.

The board negotiates the fees to be paid to the auditors. Fees are based on the complexity of the engagement and the auditors’ time. Management believes the fees negotiated in 2022 are reasonable and comparable to fees charged by other auditors providing similar services.

The table below shows the fees paid to Deloitte LLP in the last two years:

| | | 2022 | | | 2021 | |

| Audit fees | | | | | | |

| Core audit services | | $ | 9,837,000 | | | $ | 9,497,000 | |

| Audit-related fees | | | | | | | | |

| Assurance and related services that are reasonably related to the audit or review of our financial statements and are not included under audit fees | | $ | 1,398,000 | | | $ | 1,361,000 | |

| Tax fees | | | | | | | | |

| Services related to tax compliance, planning and advice | | $ | 92,000 | | | $ | 269,000 | |

| Other | | | | | | | | |

| Services which are not audit, audit-related or tax fees | | $ | 11,000 | | | $ | 12,000 | |

| Total | | $ | 11,338,000 | | | $ | 11,139,000 | |

The board and management recommend that you vote FOR the appointment of Deloitte LLP as our auditors and FOR the authorization of the board to set the auditors’ fees for 2023.

4. Vote, on an advisory basis, on executive compensation (say on pay) (see page 58)

As part of our commitment to strong corporate governance, the board holds an annual advisory vote on our approach to executive compensation. While the results of the vote are not binding on the board, the board will take the results into account when considering compensation policies, practices and decisions, as well as topics to be discussed as part of its engagement with shareholders on compensation and related matters.

The board believes our executive compensation policies and practices closely align the interests of executives and shareholders and are consistent with corporate governance best practices in Canada. Last year, 92.81% of the votes cast were in favour of our approach to executive compensation.

You can vote FOR or AGAINST the resolution:

RESOLVED THAT:

On an advisory basis and not to diminish the role and responsibilities of the board of directors of Fortis, the shareholders accept the approach to executive compensation as described in the compensation discussion and analysis section of this circular.

The board and management recommend that you vote FOR the non-binding advisory vote on our approach to executive compensation as described in this circular.

5. Other business

Management is not aware of any other matters that may come before the meeting. If an item is properly brought before the meeting, you or your proxyholder can vote on the item as you or they see fit.

Shareholders who are entitled to vote at the 2024 annual meeting and wish to submit a proposal must make sure that we receive the proposal by February 4, 2024 in accordance with the provisions of the Corporations Act (Newfoundland and Labrador).

If you intend to nominate a person for election as a director of Fortis at an annual meeting of shareholders, other than in a shareholder proposal, the nomination must comply with the procedures set out in our advance notice by-law, available on our website (www.fortisinc.com), including providing timely and proper written notice. Shareholders approved our advance notice by-law at our 2020 annual and special meeting of shareholders. You can read more about the by-law in our 2020 management information circular, available on our website (www.fortisinc.com) and on SEDAR (www.SEDAR.com) and EDGAR (www.sec.gov).

| 2023 MANAGEMENT INFORMATION CIRCULAR | 15 |

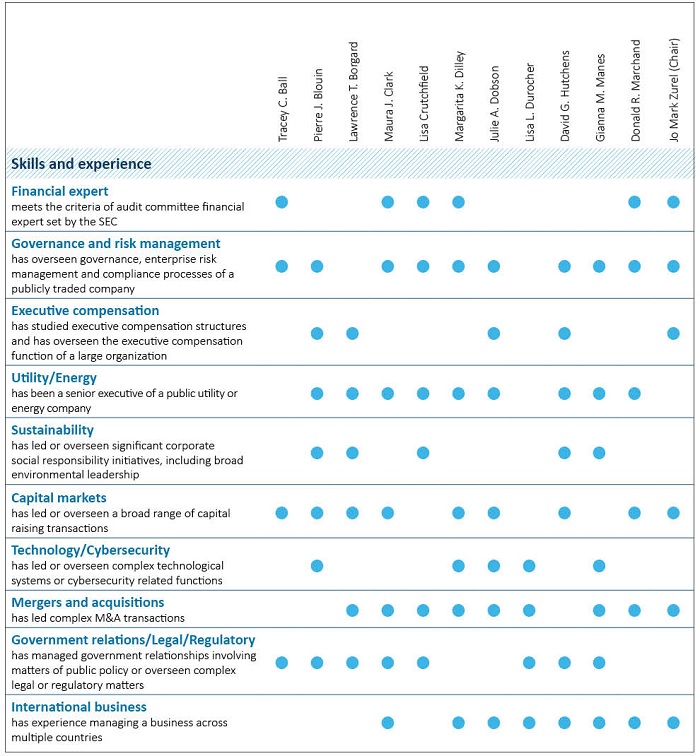

About the nominated directors

This year 12 individuals have been nominated to serve on the board. 11 of the 12 nominees currently serve as Fortis directors and were elected by shareholders at our 2022 annual and special meeting.

The board is led by an independent Chair and all but one of the nominated directors are independent. David Hutchens is not considered independent because he is our President and Chief Executive Officer.

We will not have any board interlocks with the election of this year’s nominees.

None of the nominations involve a contract, arrangement or understanding between a Fortis director and any other person. There is no family relationship between any of the nominated directors or executive officers.

None of the nominated directors, or their associates or affiliates, have a direct or indirect material interest (as a beneficial shareholder or in any other way) in any item of business other than the election of directors.

You can read about the nominated directors in the profiles that follow.

About our majority voting policy

Our majority voting policy requires a nominated director who receives more WITHHOLD votes than FOR votes to immediately tender their resignation to the board for consideration after the meeting. The board will refer the matter to the governance and sustainability committee, who will review the matter and consider all relevant factors before making a recommendation to the board. The board will consider the recommendation of the committee and accept the resignation if there are no exceptional circumstances that would warrant the director continuing to serve on the board as part of its fiduciary duties to Fortis and its shareholders, in which case the board may reject or delay the offer of resignation. A resignation does not take effect until it is accepted by the board. The director will not participate in the committee’s or the board’s deliberations. The board will make its decision within 90 days of the shareholder meeting and announce the details, including the reasons for its decision, in a news release.

This policy does not apply to a contested election of directors, where the number of nominees exceeds the number of directors to be elected, or where proxy materials have been circulated in support of the election of one or more nominees who are not included among the nominees supported by the board.

The board updated the policy in 2021. You can find a copy of the policy on our website (www.fortisinc.com).

Director profiles

The nominated directors have provided the information below about the Fortis shares or deferred share units (DSUs) they own, or exercise control or direction over, directly or indirectly. You can read more about their equity ownership beginning on page 48. We calculated the market value of their holdings using the closing price of our common shares on the TSX: $60.07 on March 18, 2022 and $57.91 on March 17, 2023.

TRACEY C. BALL

Victoria, British Columbia, Canada

Corporate director

Director since May 2014

Age 65

Independent

Skills and experience

| • | Governance and risk management |

| • | Government relations/Legal/Regulatory |

Ms. Ball retired in September 2014 as Executive Vice President and Chief Financial Officer of Canadian Western Bank Group. Prior to joining a predecessor to Canadian Western Bank Group in 1987, she worked in public accounting and consulting. Ms. Ball has served on several private and public sector boards, including the Province of Alberta Audit Committee and the Financial Executives Institute of Canada.

Ms. Ball graduated from Simon Fraser University with a Bachelor of Arts (Commerce). She is a member of the Chartered Professional Accountants of Alberta and the Chartered Professional Accountants of British Columbia. Ms. Ball was elected as a Fellow of the Chartered Professional Accountants of Alberta in 2007. She holds an ICD.D designation from the Institute of Corporate Directors.

Ms. Ball served on the board of directors of FortisAlberta from April 2011 to April 2018 and served as its Chair from February 2016 to February 2018. Ms. Ball has served as a director of FortisBC Energy and FortisBC since April 2018. She also served on the Fortis board chair selection committee which was established in July 2021 as ad hoc committee of the board.

| | | Joined |

| Board of directors | | May 2014 |

| Audit committee | | May 2014 (chair, May 2017 to May 2021) |

| Governance and sustainability committee | | May 2017 |

| Board chair selection committee (ad hoc committee) (1) | | July 2021 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.28% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.72% votes withheld | | | Audit | | 5 of 5 | | | 100 | % |

| | | Governance and sustainability | | 6 of 6 | | | 100 | % |

| | | Board chair selection (1) | | 3 of 3 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 4,950 | | | | 29,791 | | | | 34,741 | | | $ | 2,011,851 | | | yes (7.8x) |

| 2022 | | | 4,950 | | | | 26,293 | | | | 31,243 | | | $ | 1,876,767 | | | |

| Change | | | – | | | | 3,498 | | | | 3,498 | | | $ | 135,084 | | | |

Other public company directorships (last five years)

–

| (1) | The ad hoc board chair selection committee was disbanded in 2022 after fulfilling its sole objective of selecting, and recommending to the board, an eligible candidate to succeed Douglas J. Haughey as board Chair (see page 54). |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 17 |

PIERRE J. BLOUIN

Montreal, Quebec, Canada

Corporate director

Director since May 2015

Age 65

Independent

Skills and experience

| • | Governance and risk management |

| • | Technology/Cybersecurity |

| • | Government relations/Legal/Regulatory |

Mr. Blouin served as the Chief Executive Officer of Manitoba Telecom Services, Inc. until his retirement in December 2014. Prior to joining Manitoba Telecom Services, Inc. as its Chief Executive Officer in 2005, Mr. Blouin held various executive positions in the Bell Canada Enterprises group of companies, including Group President, Consumer Markets for Bell Canada, Chief Executive Officer of BCE Emergis, Inc. and Chief Executive Officer of Bell Mobility.

Mr. Blouin graduated from Hautes Etudes Commerciales with a Bachelor of Commerce in Business Administration. He is a Fellow of the Purchasing Management Association of Canada.

| | | Joined |

| Board of directors | | May 2015 |

| Human resources committee | | May 2015 |

| Governance and sustainability committee | | May 2016 (chair since January 2020) |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.21% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.79% votes withheld | | Human resources | | 5 of 5 | | | 100 | % |

| | | | Governance and sustainability | | 6 of 6 | | | 100 | % |

| Fortis securities held (as at March 18, 2022 and March 17, 2023) | |

| | |

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 2,380 | | | | 25,998 | | | | 28,378 | | | $ | 1,643,370 | | | yes (6.4x) |

| 2022 | | | 2,380 | | | | 22,642 | | | | 25,022 | | | $ | 1,503,072 | | | |

| Change | | | – | | | | 3,356 | | | | 3,356 | | | $ | 140,298 | | | |

| Other public company directorships (last five years) |

| |

| National Bank of Canada (since September 2016) (Audit Committee, Human Resources Committee, Technology Committee (Chair)) |

LAWRENCE T. BORGARD

Naples, Florida, United States

Corporate director

Director since May 2017

Age 61

Independent

Skills and experience

| • | Mergers and acquisitions |

| • | Government relations/Legal/Regulatory |

Mr. Borgard is the former President and Chief Operating Officer of Integrys Energy Group and the Chief Executive Officer of each of Integrys’ six regulated electric and natural gas utilities. Mr. Borgard retired in 2015, following the successful sale of Integrys. Prior to serving as President at Integrys, Mr. Borgard served in a variety of executive roles.

Mr. Borgard graduated from Michigan State University with a Bachelor of Science (Electrical Engineering) and the University of Wisconsin-Oshkosh with an MBA. He also attended the Advanced Management Program at Harvard University Business School.

| | | Joined |

| Board of directors | | May 2017 |

| Audit committee | | May 2017 |

| Human resources committee | | May 2018 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.77% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.23% votes withheld | | Audit | | 5 of 5 | | | 100 | % |

| | | Human resources | | 5 of 5 | | | 100 | % |

| | | | | | | | | | |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 5,258 | | | | 16,216 | | | | 21,474 | | | $ | 1,243,559 | | | yes (4.3x) |

| 2022 | | | 5,258 | | | | 13,229 | | | | 18,487 | | | $ | 1,110,514 | | | |

| Change | | | – | | | | 2,987 | | | | 2,987 | | | $ | 133,045 | | | |

| Other public company directorships (last five years) |

| |

| – |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 19 |

MAURA J. CLARK

New York, New York, United States

Corporate director

Director since May 2015

Age 64

Independent

Skills and experience

| • | Governance and risk management |

| • | Mergers and acquisitions |

| • | Government relations/Legal/Regulatory |

Ms. Clark retired from Direct Energy, a subsidiary of Centrica plc, in March 2014 where she was President of Direct Energy Business, a leading energy retailer in Canada and the United States. Previously, Ms. Clark was Executive Vice President of North American Strategy and Mergers and Acquisitions for Direct Energy. Ms. Clark’s prior experience includes investment banking and serving as Chief Financial Officer of an independent oil refining and marketing company.

Ms. Clark graduated from Queen’s University with a Bachelor of Arts in Economics and qualified as a Chartered Professional Accountant in Ontario, Canada.

| | | Joined |

| Board of directors | | May 2015 |

| Audit committee | | May 2015 (chair since May 2021) |

| Governance and sustainability committee | | May 2016 to May 2022 |

| Human resources committee | | May 2022 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.16% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.84% votes withheld | | Audit | | 5 of 5 | | | 100 | % |

| | | Governance and sustainability | | 3 of 3 | | | 100 | % |

| | | | Human resources | | 3 of 3 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 2,000 | | | | 23,144 | | | | 25,144 | | | $ | 1,456,089 | | | yes (4.7x) |

| 2022 | | | 2,000 | | | | 19,898 | | | | 21,898 | | | $ | 1,315,413 | | | |

| Change | | | – | | | | 3,246 | | | | 3,246 | | | $ | 140,676 | | | |

| Other public company directorships (last five years) |

| |

| Newmont Corporation (since April 2020) (Audit Committee, Leadership Development and Compensation Committee) |

| |

| Nutrien Ltd. (formerly Agrium Inc.) (since May 2016) (Audit Committee (Chair), Human Resources and Compensation Committee) |

| |

| Garrett Motion Inc. (October 2018 to April 2021) (Nominating and Governance Committee (Chair) and Compensation Committee) |

LISA CRUTCHFIELD

Garnet Valley, Pennsylvania, United States

Corporate director

Director since May 2022

Age 59

Independent

Skills and experience

| • | Governance and risk management |

| • | Mergers and acquisitions |

| • | Government relations/Legal/Regulatory |

Ms. Crutchfield is Managing Principal of Hudson Strategic Advisers, LLC, an economic analysis and strategic advisory firm to the energy, financial services and government sectors. Ms. Crutchfield has over 30 years of leadership experience in the energy and utility industries. Prior to founding Hudson in 2012, she was Executive Vice President and Chief Regulatory, Risk and Compliance Officer for National Grid, plc, and she held various executive roles at PECO, an Exelon Company, and Duke Energy Corporation. From 1993 to 1997, Ms. Crutchfield served as Vice Chairman on the Pennsylvania Public Utility Commission ruling on regulatory matters affecting the electric, gas, telecommunications, water and waste water industries.

Ms. Crutchfield earned a Bachelor of Arts degree in Economics and Political Science from Yale University and an MBA from Harvard Business School with distinction in Finance.

Ms. Crutchfield earned the Governance Leadership Fellow designation from the National Association of Corporate Directors (NACD).

| | | Joined |

| Board of directors | | May 2022 |

| Governance and sustainability committee | | May 2022 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.46% votes for | | Board of directors | | 6 of 6 | | | 100 | % |

| 0.54% votes withheld | | | Governance and sustainability | | 3 of 3 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares

and DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | – | | | | 1,900 | | | | 1,900 | | | $ | 110,029 | | | Has until

May 2027 to meet

the guideline |

| 2022 | | | – | | | | – | | | | – | | | | – | | | |

| Change | | | – | | | | 1,900 | | | | 1,900 | | | $ | 110,029 | | | |

| Other public company directorships (last five years) |

| |

| Vistra Corp. (since February 2020) (Nominating and Corporate Governance Committee and Sustainability and Risk Committee) |

|

| Fulton Financial Corporation (since June 2014) (Nominating and Corporate Governance Committee (Chair), Compensation Committee and Executive Committee) |

|

| Unitil Corp. (January 2012 to April 2022) (Compensation Committee (Chair), Nominating and Corporate Governance Committee and Executive Committee) |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 21 |

MARGARITA K. DILLEY

Washington, D.C., United States

Corporate director

Director since May 2016

Age 65

Independent

Skills and experience

| • | Governance and risk management |

| • | Technology/Cybersecurity |

| • | Mergers and acquisitions |

Ms. Dilley retired from ASTROLINK International LLC in 2004, an international wireless broadband telecommunications company, where she was Vice President and Chief Financial Officer. Ms. Dilley’s prior experience includes serving as Director, Strategy & Corporate Development and Treasurer for Intelsat.

Ms. Dilley graduated from Cornell University with a Bachelor of Arts, from Columbia University with a Master of Arts and from Wharton Graduate School, University of Pennsylvania with an MBA.

Ms. Dilley has served as a director of CH Energy Group since December 2004 and Central Hudson since June 2013 and has served as the Chair of those boards since January 2015.

| | | Joined |

| Board of directors | | May 2016 |

| Audit committee | | May 2016 |

| Human resources committee | | May 2017 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.76% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.24% votes withheld | | Audit | | 5 of 5 | | | 100 | % |

| | | | Human resources | | 5 of 5 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 2,040 | | | | 20,456 | | | | 22,496 | | | $ | 1,302,743 | | | yes (4.5x) |

| 2022 | | | 2,040 | | | | 17,310 | | | | 19,350 | | | $ | 1,162,355 | | | |

| Change | | | – | | | | 3,146 | | | | 3,146 | | | $ | 140,388 | | | |

| Other public company directorships (last five years) |

| |

| – |

JULIE A. DOBSON

Potomac, Maryland, United States

Corporate director

Director since May 2018

Age 66

Independent

Skills and experience

| • | Governance and risk management |

| • | Technology/Cybersecurity |

| • | Mergers and acquisitions |

Ms. Dobson is Non-Executive Chairman of Telebright, Inc. a private firm established in 1989, where she oversees the development of telecom management software applications and mobile applications for the business to business and business to consumer markets. She was Chief Operating Officer at Telecorp PCS, Inc. and held various senior management positions with Bell Atlantic Corporation during her 18-year career with the company.

Ms. Dobson graduated from the College of William and Mary with a Bachelor of Science and from the University of Pittsburgh with an MBA.

| | | Joined |

| Board of directors | | May 2018 |

| Human resources committee | | May 2020 (chair since May 2022) |

| Governance and sustainability committee | | May 2018 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.27% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.73% votes withheld | | Human resources | | 5 of 5 | | | 100 | % |

| | | | Governance and sustainability | | 6 of 6 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares

and DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 2,200 | | | | 12,959 | | | | 15,159 | | | $ | 877,858 | | | yes (3.0x) |

| 2022 | | | 2,200 | | | | 10,093 | | | | 12,293 | | | $ | 738,441 | | | |

| Change | | | – | | | | 2,866 | | | | 2,866 | | | $ | 139,417 | | | |

| Other public company directorships (last five years) |

| |

| Safeguard Scientifics, Inc. (March 2003 to June 2018) (former director and member of Compensation Committee (Chair), Nominating and Governance Committee and Audit Committee) |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 23 |

LISA L. DUROCHER

Whitby, Ontario, Canada

Executive Vice President, Financial Services Rogers Communications Inc.

Director since May 2021

Age 56

Independent

Skills and experience

| • | Technology/Cybersecurity |

| • | Mergers and acquisitions |

| • | Government relations/Legal/Regulatory |

Ms. Durocher leads Financial Services at Rogers Communications. As part of the executive leadership team, she is the Chief Executive Officer of Rogers Bank and develops financial services for the company. Prior to this role, Lisa was the Chief Digital Officer at Rogers where she led the digital strategy, design and delivery for digital platforms across the consumer and enterprise businesses. Lisa has been with Rogers since 2016. Prior to joining Rogers, Lisa worked at American Express in New York City where she held several senior leadership positions over 15 years including leading global product and marketing organizations in digital payments, charge cards and travel which provided her with experience in mergers and acquisitions, product design and development and general management.

Ms. Durocher is a graduate of Wilfrid Laurier University’s Business Administration program and also sits on the board of Rogers Bank.

| | | Joined |

| Board of directors | | May 2021 |

| Audit committee | | May 2022 |

| Governance and sustainability committee | | May 2021 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.23% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.77% votes withheld | | Audit | | 3 of 3 | | | 100 | % |

| | | | Governance and sustainability | | 6 of 6 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | – | | | | 8,227 | | | | 8,227 | | | $ | 476,426 | | | Has until May 2026 to meet

the guideline |

| 2022 | | | – | | | | 3,524 | | | | 3,524 | | | $ | 211,687 | | | |

| Change | | | – | | | | 4,703 | | | | 4,703 | | | $ | 264,739 | | | |

| Other public company directorships (last five years) |

| |

| – |

DAVID G. HUTCHENS

Tucson, Arizona, United States

President and Chief Executive Officer, Fortis Inc.

Director since January 2021

Age 56

Not independent

Skills and experience

| • | Governance and risk management |

| • | Government relations/Legal/Regulatory |

Mr. Hutchens was appointed President and Chief Executive Officer of Fortis Inc. effective January 1, 2021.

His career in the energy sector spans more than 25 years. In January 2020 Mr. Hutchens assumed the newly created role of Chief Operating Officer of Fortis, with responsibility for overseeing our 10 utilities while remaining Chief Executive Officer of UNS Energy. In 2018 Mr. Hutchens was appointed an officer of Fortis as Executive Vice President, Western Utility Operations, overseeing our FortisBC and FortisAlberta operations while continuing to serve as President and Chief Executive Officer of UNS Energy. Prior to joining the Fortis group, he held a variety of positions at our electric and gas utilities in Arizona culminating in being named President and CEO of UNS Energy in 2014.

Mr. Hutchens earned a Bachelor of Aerospace Engineering degree and an MBA from the University of Arizona, and is a former nuclear submarine officer in the U.S. Navy.

Mr. Hutchens serves on the boards of Fortis utility subsidiaries ITC Holdings and FortisBC.

| | | Joined |

| Board of directors | | January 2021 |

| 2022 Voting results | | 2022 Board and committee attendance (1) | |

| 99.80% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.20% votes withheld | | | | | | | | | |

Fortis securities held (as at March 18, 2022 and March 17, 2023) (2)

| Year | | Common

shares (#) | | | Restricted share

units (RSUs) (#) | | | Total shares

and RSUs (#) | | | Total market

value ($) | | | Meets executive share

ownership target |

| 2023 | | | 102,928 | | | | 93,266 | | | | 196,194 | | | $ | 11,361,595 | | | yes (7.3x)

|

| 2022 | | | 83,911 | | | | 69,101 | | | | 153,012 | | | $ | 9,191,431 | | | |

| Change | | | 19,017 | | | | 24,165 | | | | 43,182 | | | $ | 2,170,164 | | | |

| Other public company directorships (last five years) |

| |

| – |

| (1) | The President and Chief Executive Officer does not serve on any of the board committees. Mr. Hutchens is invited to committee meetings in his capacity as President and Chief Executive Officer and he attended all committee meetings in 2022, including the board chair selection committee which was formed in 2021 as an ad hoc committee of the board (see page 54 to read about the board Chair selection process). |

| (2) | Mr. Hutchens does not receive director compensation (cash or DSUs) as a member of the Fortis board. He receives performance share units (PSUs) and RSUs as part of his executive compensation (see page 70). You can read more about Mr. Hutchens’ holdings of Fortis equity on page 68. |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 25 |

GIANNA M. MANES

Fort Mill, South Carolina, United States

Corporate director

Director since May 2021

Age 58

Independent

Skills and experience

| • | Governance and risk management |

| • | Technology/Cybersecurity |

| • | Mergers and acquisitions |

| • | Government relations/Legal/Regulatory |

Ms. Manes was President and Chief Executive Officer of ENMAX Corporation, an electricity company with operations in Alberta and Maine, from 2012 until her retirement in July 2020. She has over 30 years of experience in the energy sector in Canada, the United States and Europe. Prior to joining ENMAX, she worked for Duke Energy Corporation, one of the largest integrated utilities in North America, and held a number of executive positions including Senior Vice President and Chief Customer Officer from 2008 to 2012.

Ms. Manes graduated from Louisiana State University with a Bachelor of Science in industrial engineering and from the University of Houston with an MBA. She completed the Advanced Management Program at Harvard University and holds an ICD.D designation from the Institute of Corporate Directors.

Ms. Manes served on the Fortis board chair selection committee which was established in July 2021 as an ad hoc committee of the board.

| | | Joined |

| Board of directors | | May 2021 |

| Audit committee | | May 2021 |

| Human resources committee | | May 2021 |

| Board chair selection committee (ad hoc committee) (1) | | July 2021 |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.46% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.54% votes withheld | | Audit | | 5 of 5 | | | 100 | % |

| | | Human resources | | 5 of 5 | | | 100 | % |

| | | | Board chair selection (1) | | 3 of 3 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares and

DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | – | | | | 9,743 | | | | 9,743 | | | $ | 564,217 | | | Has until

May 2026 to meet

the guideline |

| 2022 | | | – | | | | 4,241 | | | | 4,241 | | | $ | 254,757 | | | |

| Change | | | – | | | | 5,502 | | | | 5,502 | | | $ | 309,460 | | | |

| Other public company directorships (last five years) |

| |

| Keyera Corporation (since May 2017) (Human Resources Committee (Chair)) |

| (1) | The ad hoc board chair selection committee was disbanded in 2022 after fulfilling its sole objective of selecting, and recommending to the board, an eligible candidate to succeed Douglas J. Haughey as board Chair (see page 54). |

DONALD R. MARCHAND

Calgary, Alberta Canada

Corporate director

New nominee

Age 60

Independent

Skills and experience

| • | Governance and risk management |

| • | Mergers and acquisitions |

Mr. Marchand retired in November 2021 from TC Energy Corporation, a leading North American energy infrastructure company, where he was Executive Vice-President. He served as Chief Financial Officer of TC Energy and its predecessor TransCanada Corporation from 2010 until July 2021, with additional responsibility for Strategy and Corporate Development from 2015 to 2017 and 2020 to 2021. During his 27-year tenure with the company, Mr. Marchand led many of its financial functions including treasury, finance, accounting, taxation, risk management and investor relations.

Mr. Marchand graduated from the University of Manitoba with a Bachelor of Commerce degree and subsequently qualified as a Chartered Accountant and Chartered Financial Analyst. He is a member of the Institute of Chartered Professional Accountants of Alberta, the CFA Institute and the Calgary Society of Financial Analysts.

| | | Joined |

| Board of directors | | New nominee |

Fortis securities held (as at March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

units (DSUs) (#) | | | Total shares

and DSUs (#) | | | Total market

value ($) | | | Meets share

ownership target |

| 2023 | | | 2,000 | | | | – | | | | 2,000 | | | $ | 115,820 | | | If elected, has until

May 2028 to meet

the guideline |

| Other public company directorships (last five years) |

| |

| – |

| 2023 MANAGEMENT INFORMATION CIRCULAR | 27 |

JO MARK ZUREL

St. John’s, Newfoundland and Labrador, Canada

Corporate director

Chair of the board since January 2023

Director since May 2016

Age 59

Independent

Skills and experience

| • | Governance and risk management |

| • | Mergers and acquisitions |

From 1998 to 2006, Mr. Zurel was Senior Vice-President and Chief Financial Officer of CHC Helicopter Corporation. Mr. Zurel serves on several private and public sector boards, including Highland Copper Company Inc., Major Drilling Group International Inc. and served on the Canada Pension Plan Investment Board until August 2021. He also serves on the board of Sustainable Development Technology Canada.

Mr. Zurel graduated from Dalhousie University with a Bachelor of Commerce. He is a Fellow of the Association of Chartered Professional Accountants of Newfoundland and Labrador. He holds an ICD.D designation from the Institute of Corporate Directors.

Mr. Zurel served as a director of Newfoundland Power from January 2008 and as Chair of that board from April 2012 until July 2016.

| | | Joined |

| Board of directors | | May 2016 (Chair of the board since January 2023) |

| Audit committee | | May 2017 |

| Human resources committee | | May 2016 (chair, May 2018 to May 2022) |

| 2022 Voting results | | 2022 Board and committee attendance | |

| 99.73% votes for | | Board of directors | | 8 of 8 | | | 100 | % |

| 0.27% votes withheld | | Audit | | 5 of 5 | | | 100 | % |

| | | | Human resources | | 5 of 5 | | | 100 | % |

Fortis securities held (as at March 18, 2022 and March 17, 2023)

| Year | | Common

shares (#) | | | Deferred share

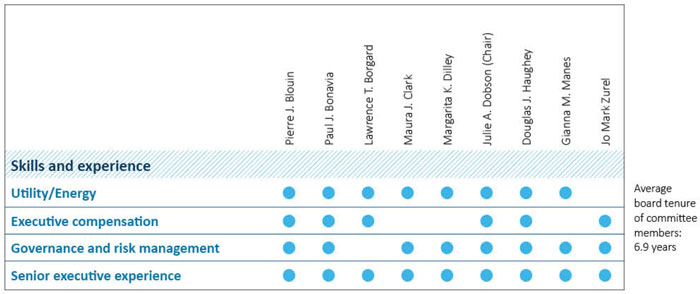

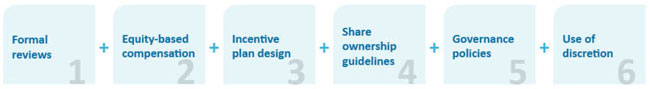

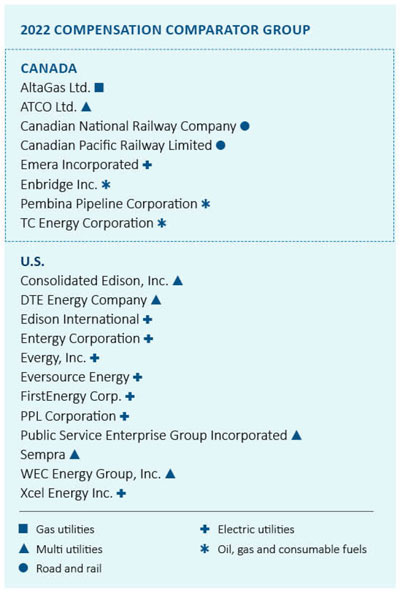

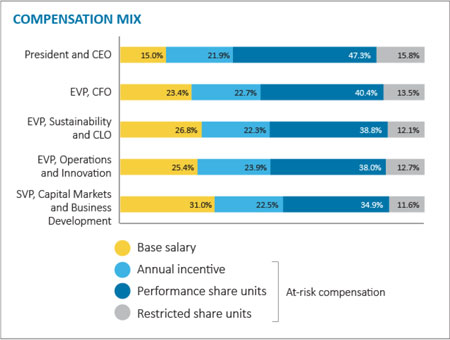

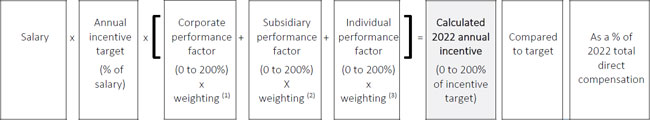

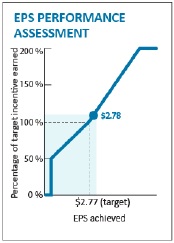

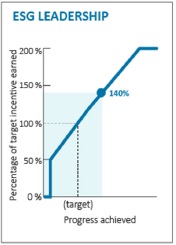

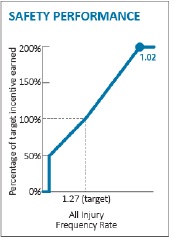

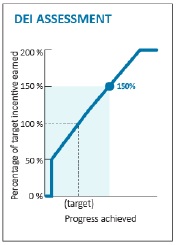

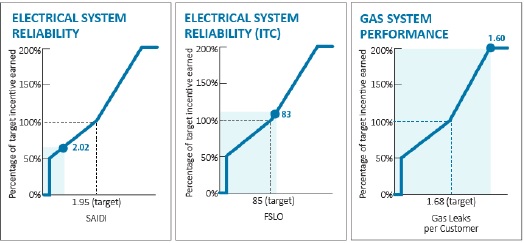

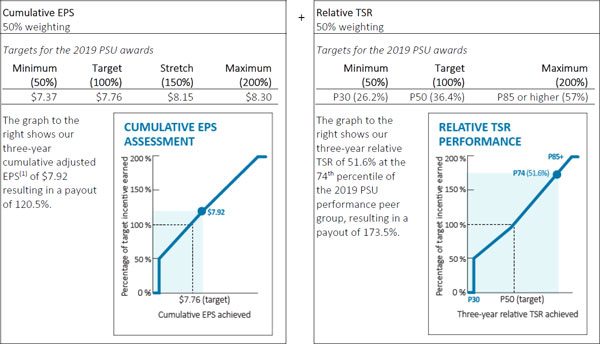

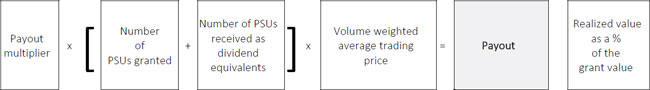

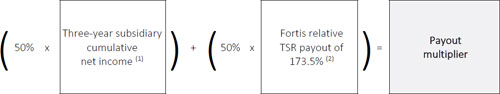

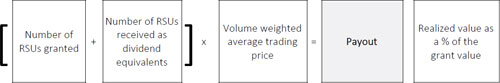

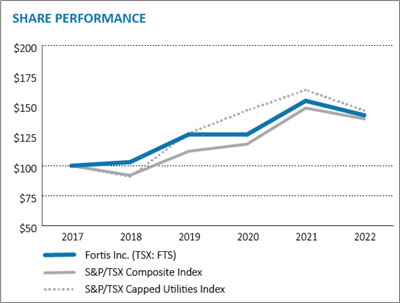

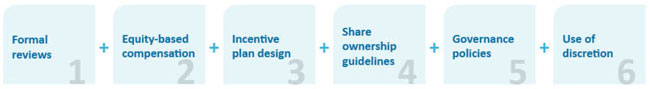

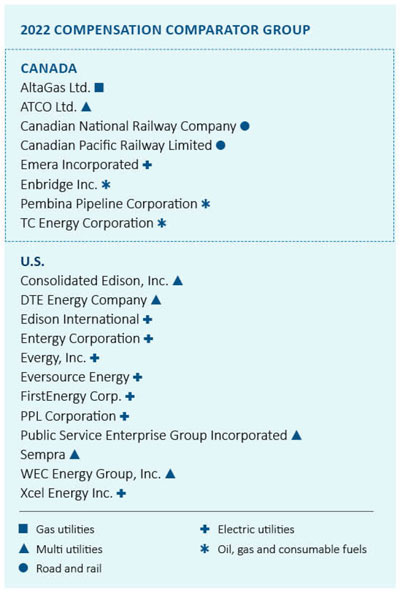

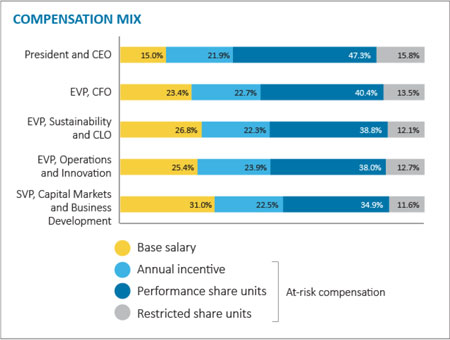

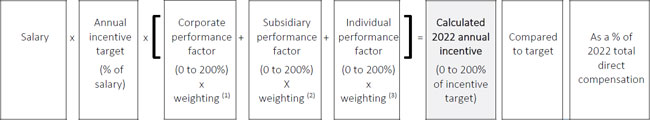

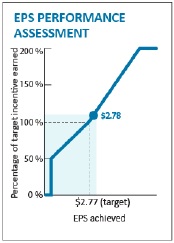

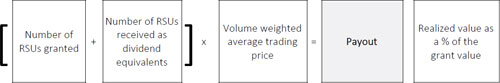

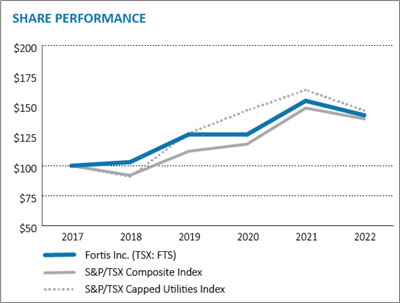

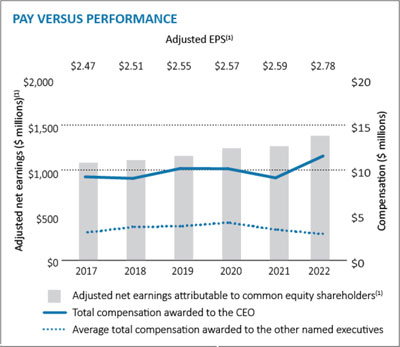

units (DSUs) (#) | | | Total shares and