Exhibit 99.3

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | |

| Contents |

| About Fortis | 1 | | Liquidity and Capital Resources | 11 |

| Key Developments | 1 | | Cash Flow Requirements | 11 |

| Performance at a Glance | 2 | | Cash Flow Summary | 12 |

| Business Unit Performance | 4 | | Contractual Obligations | 14 |

| ITC | 5 | | Capital Structure and Credit Ratings | 14 |

| UNS Energy | 5 | | Capital Plan | 15 |

| Central Hudson | 6 | | Business Risks | 16 |

| FortisBC Energy | 6 | | Accounting Matters | 16 |

| FortisAlberta | 7 | | Financial Instruments | 16 |

| FortisBC Electric | 7 | | Long-Term Debt and Other | 16 |

| Other Electric | 8 | | Derivatives | 17 |

| Energy Infrastructure | 8 | | Summary of Quarterly Results | 17 |

| Corporate and Other | 8 | | Related-Party and Inter-Company Transactions | 18 |

| Non-U.S. GAAP Financial Measures | 9 | | Outlook | 18 |

| Focus on Sustainability | 9 | | Forward-Looking Information | 19 |

| Regulatory Highlights | 10 | | Glossary | 20 |

| Financial Position | 10 | | Condensed Consolidated Interim Financial Statements (Unaudited) | F-1 |

| | | | |

Dated July 27, 2022

This Interim MD&A has been prepared in accordance with National Instrument 51-102 - Continuous Disclosure Obligations. It should be read in conjunction with the Interim Financial Statements, the 2021 Annual Financial Statements and the 2021 Annual MD&A and is subject to the cautionary statement and disclaimer provided under "Forward-Looking Information" on page 19. Further information about Fortis, including its Annual Information Form filed on SEDAR, can be accessed at www.fortisinc.com, www.sedar.com, or www.sec.gov.

Financial information herein has been prepared in accordance with U.S. GAAP (except for indicated Non-U.S. GAAP Financial Measures) and, unless otherwise specified, is presented in Canadian dollars based, as applicable, on the following U.S. dollar-to-Canadian dollar exchange rates: (i) average of 1.28 and 1.23 for the quarters ended June 30, 2022 and 2021, respectively; (ii) average of 1.27 and 1.25 year-to-date June 30, 2022 and 2021, respectively; (iii) 1.29 and 1.24 as at June 30, 2022 and 2021, respectively; (iv) 1.26 as at December 31, 2021; and (v) 1.25 for all forecast periods. Certain terms used in this Interim MD&A are defined in the "Glossary" on page 20.

ABOUT FORTIS

Fortis (TSX/NYSE: FTS) is a well-diversified leader in the North American regulated electric and gas utility industry, with 2021 revenue of $9.4 billion and total assets of $60 billion as at June 30, 2022. The Corporation's 9,100 employees serve 3.4 million utility customers in five Canadian provinces, nine U.S. states and three Caribbean countries.

For additional information on the Corporation's operations, reportable segments and strategy, refer to the "About Fortis" section of the 2021 Annual MD&A and Note 1 to the Interim Financial Statements.

KEY DEVELOPMENTS

ITC Midwest Capital Structure Complaint

In May 2022, the Iowa Coalition for Affordable Transmission, including Interstate Power and Light Company, a subsidiary of Alliant Energy Corporation, filed a complaint with FERC requesting that ITC Midwest's common equity component of capital structure be reduced from 60% to 53%. The complaint alleges that ITC Midwest does not meet FERC's three-part test for authorizing the use of the utility's actual capital structure for rate-making purposes. We believe the complaint is without merit as it does not demonstrate that ITC Midwest fails to meet FERC's three-part test. ITC Midwest filed a response to the complaint in June 2022. The timing and outcome of this proceeding is unknown.

| | | | | | | | | | | |

| 1 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

TEP General Rate Application

In June 2022, TEP filed a general rate application with the ACC requesting new rates effective September 1, 2023 using a December 31, 2021 test year. The application includes: (i) an allowed ROE of 10.25% and an equity component of capital structure of 54%; (ii) Rate Base of US$3.6 billion; and (iii) a net increase in non-fuel and fuel-related revenue of US$136 million. The timing and outcome of this proceeding is unknown.

See "Regulatory Highlights" on page 10 for further information on these regulatory developments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PERFORMANCE AT A GLANCE | | | | | | |

| Key Financial Metrics | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

| Revenue | 2,487 | | | 2,130 | | | 357 | | | 5,322 | | | 4,669 | | | 653 | |

| Common Equity Earnings | | | | | | | | | | | |

| Actual | 284 | | | 253 | | | 31 | | | 634 | | | 608 | | | 26 | |

Adjusted (1) | 272 | | | 259 | | | 13 | | | 641 | | | 619 | | | 22 | |

Basic EPS ($) | | | | | | | | | | | |

| Actual | 0.59 | | | 0.54 | | | 0.05 | | | 1.33 | | | 1.30 | | | 0.03 | |

Adjusted (1) | 0.57 | | | 0.55 | | | 0.02 | | | 1.34 | | | 1.32 | | | 0.02 | |

Dividends paid per common share ($) | 0.535 | | | 0.505 | | | 0.03 | | | 1.07 | | | 1.01 | | | 0.06 | |

Weighted average number of common shares outstanding (# millions) | 477.8 | | | 470.2 | | | 7.6 | | | 476.8 | | | 469.0 | | | 7.8 | |

| Operating Cash Flow | 759 | | | 740 | | | 19 | | | 1,572 | | | 1,479 | | | 93 | |

Capital Expenditures (1) | 930 | | | 840 | | | 90 | | | 1,894 | | | 1,720 | | | 174 | |

(1)See "Non-U.S. GAAP Financial Measures" on page 9

Revenue

The increase in revenue for the quarter and year-to-date periods was due primarily to: (i) higher flow-through costs in customer rates, driven by higher commodity prices; (ii) Rate Base growth; (iii) higher wholesale electricity sales at UNS Energy; and (iv) favourable foreign exchange of $51 million and $46 million, respectively.

Earnings and EPS

Common Equity Earnings increased by $31 million in comparison to the second quarter of 2021. Results for the quarter were driven by: (i) Rate Base growth; (ii) higher earnings from the energy infrastructure segment, largely reflecting favourable changes in the mark-to-market accounting of natural gas derivatives at Aitken Creek; and (iii) a higher U.S.-to-Canadian dollar foreign exchange rate. Growth in earnings was partially offset by losses on investments that support retirement benefits at UNS Energy and ITC, reflecting market conditions, and the timing of quarterly earnings from Arizona and Alberta. In comparison to the same period in 2021, results from UNS Energy were tempered, as expected, by the timing of earnings related to the Oso Grande generating facility, and earnings from FortisAlberta were lower due to the timing of operating expenses.

Common Equity Earnings for the year-to-date period increased by $26 million compared to the same period in 2021. The increase in earnings was due to the same factors discussed for the quarter but also reflected lower hydroelectric production in Belize, and higher operating costs at Central Hudson associated with the implementation of a new customer information system.

In addition to the above-noted items impacting earnings, the change in EPS for the quarter and year-to-date periods reflected an increase in the weighted average number of common shares outstanding, largely associated with the Corporation's DRIP.

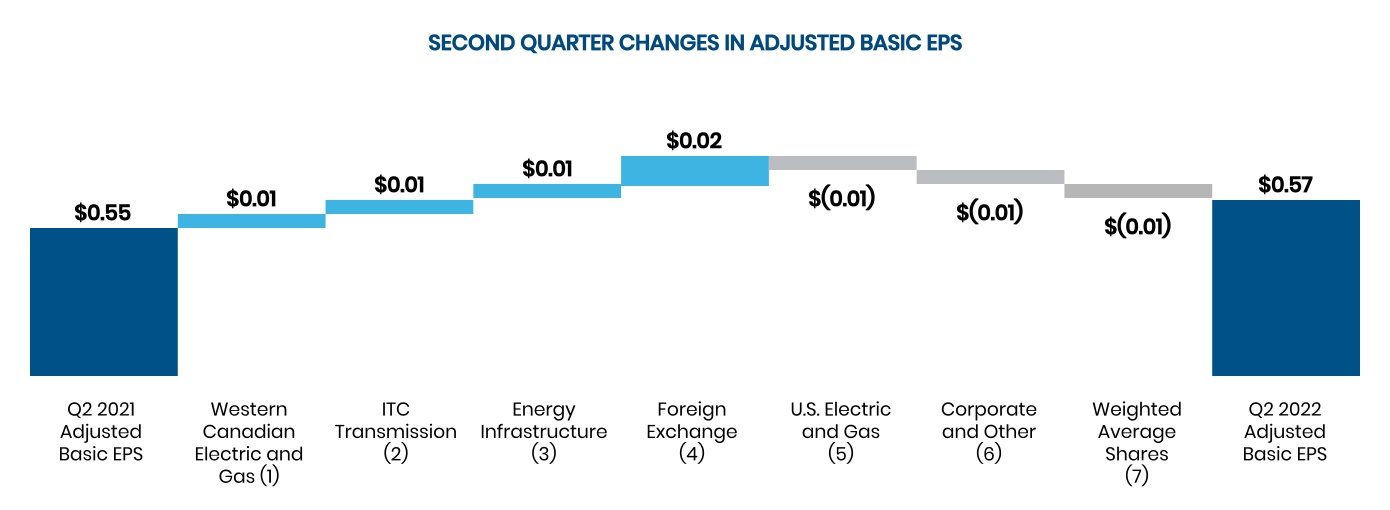

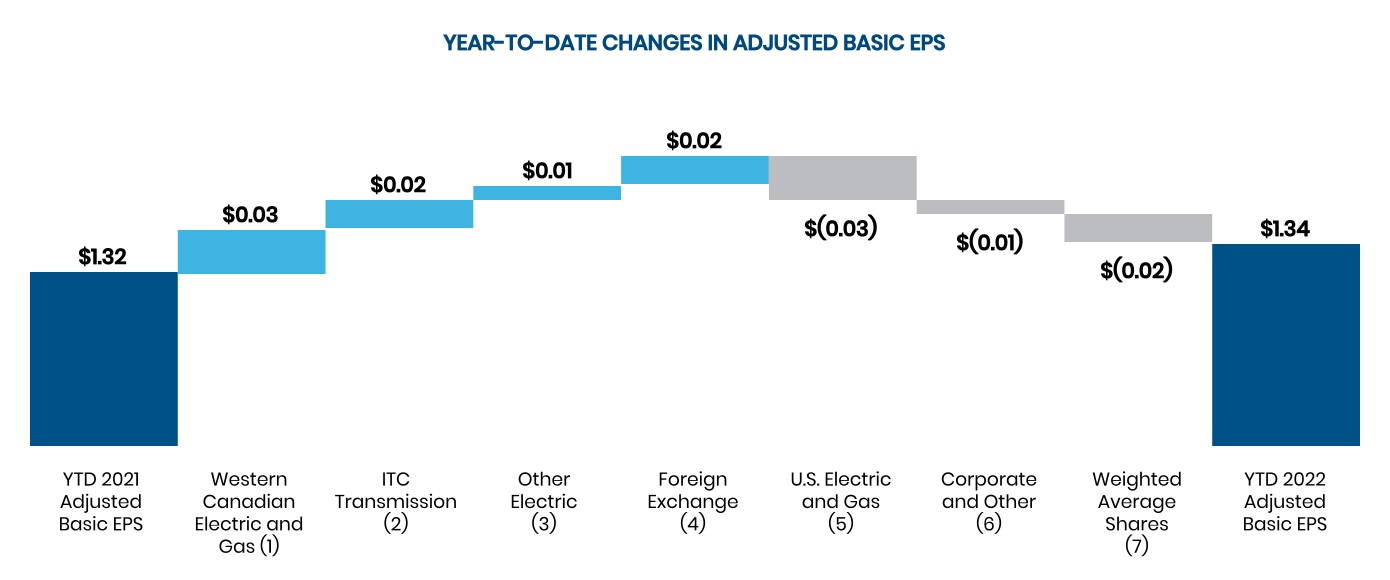

For the quarter and year-to-date periods: (i) Adjusted Common Equity Earnings increased by $13 million and $22 million, respectively; and (ii) Adjusted Basic EPS increased by $0.02. Refer to "Non-U.S. GAAP Financial Measures" on page 9 for a reconciliation of these measures. The changes in Adjusted Basic EPS for the quarter and year-to-date periods are illustrated in the following charts.

| | | | | | | | | | | |

| 2 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

(1) Includes FortisBC Energy, FortisAlberta and FortisBC Electric. Reflects Rate Base growth, partially offset by the timing of operating costs at FortisAlberta

(2) Reflects Rate Base growth, partially offset by losses on investments that support retirement benefits

(3) Reflects higher hydroelectric production in Belize associated with rainfall levels

(4) Average foreign exchange rate of 1.28 in 2022 compared to 1.23 in 2021

(5) Includes UNS Energy and Central Hudson. Reflects lower earnings from UNS Energy, due to losses on investments that support retirement benefits, as well as the timing of earnings associated with the Oso Grande generating facility. This impact was partially offset by higher earnings at Central Hudson, reflecting new customer rates due to the conclusion of the general rate application in 2021

(6) Primarily reflects mark-to-market losses on foreign exchange contracts and total return swaps

(7) Weighted average shares of 477.8 million in 2022 compared to 470.2 million in 2021

(1) Includes FortisBC Energy, FortisAlberta and FortisBC Electric. Reflects Rate Base growth, partially offset by the timing of operating costs at FortisAlberta

(2) Reflects Rate Base growth, partially offset by losses on investments that support retirement benefits

(3) Primarily reflects Rate Base growth and higher electricity sales

(4) Average foreign exchange rate of 1.27 in 2022 compared to 1.25 in 2021

(5) Includes UNS Energy and Central Hudson. Reflects lower earnings from UNS Energy, due to the timing of earnings associated with the Oso Grande generating facility and losses on investments that support retirement benefits. Also reflects lower earnings at Central Hudson, due to higher operating expenses associated with the implementation of a new customer information system, partially offset by new customer rates

(6) Primarily reflects mark-to-market losses on foreign exchange contracts and total return swaps

(7) Weighted average shares of 476.8 million in 2022 compared to 469.0 million in 2021

| | | | | | | | | | | |

| 3 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Dividends and TSR

Fortis paid a dividend of $0.535 in the second quarter of 2022, up 5.9% from the second quarter of 2021.

Fortis has increased its common share dividend for 48 consecutive years. In 2021, Fortis reaffirmed its targeted average annual dividend growth of approximately 6% through 2025.

Growth of dividends and the market price of the Corporation's common shares have together yielded the following TSR.

| | | | | | | | | | | | | | | | | | | | | | | |

TSR (1) (%) | 1-Year | | 5-Year | | 10-Year | | 20-Year |

| Fortis | 15.0 | | | 9.9 | | | 10.6 | | | 12.3 | |

(1)Annualized TSR per Bloomberg as at June 30, 2022

Operating Cash Flow

The $19 million and $93 million increase in Operating Cash Flow for the quarter and year-to-date periods, respectively, was due to higher cash earnings, reflecting Rate Base growth. The timing of flow-through costs in customer rates, including transmission payments at FortisAlberta, as well as collateral deposits received at UNS Energy related to derivative energy contracts, also contributed to the increase. The higher U.S.-to-Canadian dollar exchange rate also positively impacted results in 2022. The increase was partially offset by higher inventory levels, largely reflecting natural gas storage at Aitken Creek, and lower Operating Cash Flow at Central Hudson, due to higher accounts receivable, and on a year-to-date basis, storm restoration costs incurred in the first quarter of 2022.

Capital Expenditures

Capital Expenditures were approximately $1.9 billion year-to-date June 2022, representing 48% of the Corporation's annual $4.0 billion Capital Plan, and up $0.2 billion compared to year-to-date June 2021.

While global supply chain constraints and rising inflation are issues of potential concern that continue to evolve, the Corporation does not expect a material impact on its 2022 or five-year Capital Plan, although certain planned expenditures may shift within the five years. See "Capital Plan" on page 15. The Corporation is proactively working to mitigate supply chain constraints by identifying high priority materials and consolidating buying power to improve outcomes, increasing inventory levels, and closely working with suppliers to ensure material availability.

Capital Expenditures and Capital Plan reflect Non-U.S. GAAP Financial Measures. Refer to "Non-U.S. GAAP Financial Measures" on page 9 and the "Glossary" on page 20.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BUSINESS UNIT PERFORMANCE | | | | | | | | | | | | |

| Common Equity Earnings | Quarter | | Year-to-Date |

| Periods ended June 30 | | | | | Variance | | | | | | Variance |

| ($ millions) | 2022 | | | 2021 | | | FX (1) | | Other | | 2022 | | | 2021 | | | FX (1) | | Other |

| Regulated Utilities | | | | | | | | | | | | | | | |

| ITC | 114 | | | 103 | | | 5 | | | 6 | | | 223 | | | 206 | | | 4 | | | 13 | |

| UNS Energy | 77 | | | 83 | | | 4 | | | (10) | | | 120 | | | 128 | | | 4 | | | (12) | |

| Central Hudson | 10 | | | 6 | | | — | | | 4 | | | 42 | | | 45 | | | — | | | (3) | |

| FortisBC Energy | 17 | | | 15 | | | — | | | 2 | | | 136 | | | 126 | | | — | | | 10 | |

| FortisAlberta | 35 | | | 36 | | | — | | | (1) | | | 71 | | | 71 | | | — | | | — | |

| FortisBC Electric | 19 | | | 17 | | | — | | | 2 | | | 37 | | | 33 | | | — | | | 4 | |

Other Electric (2) | 33 | | | 34 | | | — | | | (1) | | | 59 | | | 54 | | | — | | | 5 | |

| 305 | | | 294 | | | 9 | | | 2 | | | 688 | | | 663 | | | 8 | | | 17 | |

| Non-Regulated | | | | | | | | | | | | | | | |

Energy Infrastructure (3) | 19 | | | (5) | | | — | | | 24 | | | 13 | | | 9 | | | — | | | 4 | |

Corporate and Other (4) | (40) | | | (36) | | | — | | | (4) | | | (67) | | | (64) | | | — | | | (3) | |

| Common Equity Earnings | 284 | | | 253 | | | 9 | | | 22 | | | 634 | | | 608 | | | 8 | | | 18 | |

(1) The reporting currency of ITC, UNS Energy, Central Hudson, Caribbean Utilities, FortisTCI and Fortis Belize (formerly known as BECOL) is the U.S. dollar. The reporting currency of Belize Electricity is the Belizean dollar, which is pegged to the U.S. dollar at BZ$2.00=US$1.00. The Corporate and Other segment includes certain transactions denominated in U.S. dollars.

(2) Consists of the utility operations in eastern Canada and the Caribbean: Newfoundland Power; Maritime Electric; FortisOntario; Wataynikaneyap Power; Caribbean Utilities; FortisTCI; and Belize Electricity

(3) Primarily consists of long-term contracted generation assets in Belize and Aitken Creek in British Columbia

(4) Includes Fortis net corporate expenses and non-regulated holding company expenses

| | | | | | | | | | | |

| 4 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ITC | Quarter | | Year-to-Date |

| Periods ended June 30 | | | | | Variance | | | | | | Variance |

| ($ millions) | 2022 | | | 2021 | | | FX | | Other | | 2022 | | | 2021 | | | FX | | Other |

Revenue (1) | 468 | | | 418 | | | 17 | | | 33 | | | 928 | | | 844 | | | 15 | | | 69 | |

Earnings (1) | 114 | | | 103 | | | 5 | | | 6 | | | 223 | | | 206 | | | 4 | | | 13 | |

(1)Revenue represents 100% of ITC. Earnings represent the Corporation's 80.1% controlling ownership interest in ITC and reflect consolidated purchase price accounting adjustments

Revenue

The increase in revenue, net of foreign exchange, for the quarter and year-to-date periods was due primarily to higher flow-through costs in customer rates and Rate Base growth.

Earnings

The increase in earnings, net of foreign exchange, for the quarter and year-to-date periods was due to Rate Base growth, partially offset by losses on certain investments that support retirement benefits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNS Energy | Quarter | | Year-to-Date |

| Periods ended June 30 | | | | | Variance | | | | | | Variance |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | FX | | Other | | 2022 | | | 2021 | | | FX | | Other |

Retail electricity sales (GWh) | 2,793 | | | 2,820 | | | — | | | (27) | | | 4,968 | | | 4,970 | | | — | | | (2) | |

Wholesale electricity sales (GWh) (1) | 1,411 | | | 1,317 | | | — | | | 94 | | | 2,804 | | | 3,044 | | | — | | | (240) | |

Gas sales (PJ) | 2 | | | 2 | | | — | | | — | | | 9 | | | 9 | | | — | | | — | |

| Revenue | 648 | | | 556 | | | 24 | | | 68 | | | 1,186 | | | 1,078 | | | 22 | | | 86 | |

| Earnings | 77 | | | 83 | | | 4 | | | (10) | | | 120 | | | 128 | | | 4 | | | (12) | |

(1) Primarily short-term wholesale sales

Sales

The decrease in retail electricity sales for the quarter was due primarily to lower cooling load due to cooler temperatures as compared to the same period in 2021. Retail electricity sales year to date were relatively consistent with the comparable period in 2021.

Changes in wholesale electricity sales for the quarter and year-to-date periods was driven by short-term wholesale sales. Revenue from short-term wholesale electricity sales is primarily credited to customers through regulatory deferral mechanisms and, therefore, does not materially impact earnings. The year-to-date decrease in short-term wholesale electricity sales was partially offset by higher long-term wholesale electricity sales.

Gas sales were consistent with the comparable periods in 2021.

Revenue

The increase in revenue, net of foreign exchange, for the quarter and year-to-date periods was due primarily to: (i) higher long-term wholesale electricity sales; (ii) higher revenue from short-term wholesale electricity sales due to favourable pricing; (iii) the recovery of overall higher fuel and non-fuel costs through the normal operation of regulatory mechanisms; and (iv) higher transmission revenue related to the finalization of the FERC rate case (see "Regulatory Highlights" on page 10). The increase in year-to-date revenue was partially offset by lower short-term wholesale electricity sales.

Earnings

The decrease in earnings, net of foreign exchange, for the quarter and year-to-date periods was due primarily to: (i) the timing of earnings, as expected, associated with AFUDC recognized during the construction of the Oso Grande generating facility in the first half of 2021; (ii) losses on certain investments that support retirement benefits as compared to gains for the comparable periods in 2021; and (iii) higher costs associated with Rate Base growth not yet reflected in customer rates. The decrease in earnings was partially offset by higher long-term wholesale electricity sales, as well as higher transmission revenue, discussed above. Earnings for the quarter were also unfavourably impacted by lower retail electricity sales and higher operating expenses.

The Oso Grande generating facility was completed in May 2021, and as 2022 is the first full year of operations for the facility, there is an impact on the timing of quarterly earnings. While costs associated with operating the facility are recorded throughout the year, the benefit related to production tax credits is recognized through the effective tax rate provision and is primarily recognized in the third quarter, reflecting the seasonality of sales and earnings. In comparison to the first half of 2021, the timing of earnings also reflects the recognition of AFUDC during the construction of the facility in that period.

| | | | | | | | | | | |

| 5 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Central Hudson | Quarter | | Year-to-Date |

| Periods ended June 30 | | | | | Variance | | | | | | Variance |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | FX | | Other | | 2022 | | | 2021 | | | FX | | Other |

Electricity sales (GWh) | 1,261 | | | 1,151 | | | — | | | 110 | | | 2,517 | | | 2,441 | | | — | | | 76 | |

Gas sales (PJ) | 4 | | | 5 | | | — | | | (1) | | | 14 | | | 14 | | | — | | | — | |

| Revenue | 281 | | | 207 | | | 7 | | | 67 | | | 656 | | | 492 | | | 6 | | | 158 | |

| Earnings | 10 | | | 6 | | | — | | | 4 | | | 42 | | | 45 | | | — | | | (3) | |

Sales

The increase in electricity sales for the quarter and year-to-date periods was due primarily to higher average consumption by residential and commercial customers. The increase year to date was partially offset by lower average consumption in the first quarter of 2022.

Gas sales were relatively consistent with the comparable periods in 2021.

Changes in electricity and gas sales at Central Hudson are subject to regulatory revenue decoupling mechanisms and, therefore, do not materially impact revenue and earnings.

Revenue

The increase in revenue, net of foreign exchange, for the quarter and year-to-date periods was due primarily to: (i) the flow through of higher energy supply costs driven by commodity prices, and (ii) an increase in gas and electricity delivery rates, reflecting a return on increased Rate Base assets and the recovery of higher operating and finance expenses, associated with the conclusion of Central Hudson's general rate application in the fourth quarter of 2021.

Earnings

The increase in earnings, net of foreign exchange, for the quarter was due primarily to new customer rates approved in Central Hudson's general rate application, discussed above.

The decrease in earnings, net of foreign exchange, year to date reflects higher operating expenses associated with the implementation of a new customer information system, as well as the timing of other operating expenses, partially offset by the impact of new customer rates.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FortisBC Energy | | | | | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

Gas sales (PJ) | 47 | | | 42 | | | 5 | | | 128 | | | 122 | | | 6 | |

| Revenue | 396 | | | 317 | | | 79 | | | 1,090 | | | 903 | | | 187 | |

| Earnings | 17 | | | 15 | | | 2 | | | 136 | | | 126 | | | 10 | |

Sales

The increase in gas sales for the quarter and year-to-date periods was due primarily to higher average consumption by residential and commercial customers.

Revenue

The increase in revenue for the quarter and year-to-date periods was due primarily to a higher cost of natural gas recovered from customers and Rate Base growth, partially offset by the normal operation of regulatory deferrals.

Earnings

The increase in earnings for the quarter and year-to-date periods was due primarily to Rate Base growth. Earnings year to date were also favourably impacted by lower operating costs.

FortisBC Energy earns approximately the same margin regardless of whether a customer contracts for the purchase and delivery of natural gas or only for delivery. Due to regulatory deferral mechanisms, changes in consumption levels and commodity costs do not materially impact earnings.

| | | | | | | | | | | |

| 6 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FortisAlberta | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

Electricity deliveries (GWh) | 3,794 | | | 3,777 | | | 17 | | | 8,378 | | | 8,189 | | | 189 | |

| Revenue | 169 | | | 162 | | | 7 | | | 336 | | | 320 | | | 16 | |

| Earnings | 35 | | | 36 | | | (1) | | | 71 | | | 71 | | | — | |

Deliveries

The increase in electricity deliveries for the quarter and year-to-date periods was due to higher load from industrial customers, higher average consumption by commercial customers, and customer additions. The increase was partially offset by lower average consumption by residential customers due mainly to milder weather in the second quarter of 2022.

As approximately 85% of FortisAlberta's revenue is derived from fixed or largely fixed billing determinants, changes in quantities of energy delivered are not entirely correlated with changes in revenue. Revenue is a function of numerous variables, many of which are independent of actual energy deliveries. Significant variations in weather conditions, however, can impact revenue and earnings.

Revenue

The increase in revenue for the quarter and year-to-date periods was due to Rate Base growth and higher electricity deliveries resulting from customer additions.

Earnings

Earnings for the quarter were lower than the comparable period in 2021, and were consistent with 2021 on a year-to-date basis. This was primarily due to the timing of operating costs, as well as a higher effective income tax rate, partially offset by Rate Base growth.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FortisBC Electric | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

Electricity sales (GWh) | 762 | | | 771 | | | (9) | | | 1,730 | | | 1,704 | | | 26 | |

| Revenue | 108 | | | 108 | | | — | | | 237 | | | 228 | | | 9 | |

| Earnings | 19 | | | 17 | | | 2 | | | 37 | | | 33 | | | 4 | |

Sales

The decrease in electricity sales for the quarter was due primarily to lower average consumption by residential customers driven by cooler temperatures as compared to the second quarter of 2021, partially offset by higher average consumption by industrial customers.

The increase in electricity sales year to date was due primarily to higher average consumption by industrial customers, partially offset by lower average consumption by residential customers, discussed above.

Revenue

Revenue for the quarter was consistent with the comparable period in 2021. The increase in revenue due to Rate Base growth was offset by the normal operation of regulatory deferrals.

The increase in revenue year to date was due to higher electricity sales, an increase in third-party contract work and Rate Base growth, partially offset by the normal operation of regulatory deferrals.

Earnings

The increase in earnings for the quarter and year-to-date periods was due to Rate Base growth and the timing of operating costs.

Due to regulatory deferral mechanisms, changes in consumption levels do not materially impact earnings.

| | | | | | | | | | | |

| 7 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Electric | | | | | | | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| | | | | Variance | | | | | | Variance |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | FX | | Other | | 2022 | | | 2021 | | | FX | | Other |

Electricity sales (GWh) | 2,195 | | | 2,164 | | | — | | | 31 | | | 5,201 | | | 5,006 | | | — | | | 195 | |

| Revenue | 384 | | | 353 | | | 3 | | | 28 | | | 843 | | | 766 | | | 3 | | | 74 | |

| Earnings | 33 | | | 34 | | | — | | | (1) | | | 59 | | | 54 | | | — | | | 5 | |

Sales

The increase in electricity sales for the quarter and year-to-date periods was due to higher average consumption by residential and commercial customers in Eastern Canada. Higher sales in the Caribbean, due to increased tourism-related activities, also contributed to the increase on a year-to-date basis.

Revenue

The increase in revenue, net of foreign exchange, for the quarter and year-to-date periods was due primarily to the flow through of higher energy supply costs, higher electricity sales, discussed above, and the normal operation of regulatory mechanisms at Newfoundland Power.

Earnings

The decrease in earnings for the quarter was due primarily to lower equity income from Belize Electricity, partially offset by Rate Base growth and higher electricity sales.

The increase in earnings year to date was due primarily to Rate Base growth and higher electricity sales, partially offset by lower equity income from Belize Electricity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Energy Infrastructure | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

Electricity sales (GWh) | 37 | | | 26 | | | 11 | | | 54 | | | 79 | | | (25) | |

| Revenue | 33 | | | 9 | | | 24 | | | 46 | | | 38 | | | 8 | |

| Earnings | 19 | | | (5) | | | 24 | | | 13 | | | 9 | | | 4 | |

Sales

The change in electricity sales reflected variations in hydroelectric production in Belize associated with rainfall levels.

Revenue and Earnings

Revenue and earnings for the quarter increased due primarily to the favourable impact of mark-to-market accounting of natural gas derivatives at Aitken Creek, which resulted in unrealized gains of $12 million in the second quarter of 2022 compared to unrealized losses of $6 million for the same period in 2021. Higher hydroelectric production in Belize also contributed to results.

Revenue and earnings year to date increased due primarily to the favourable impact of mark-to-market accounting of natural gas derivatives, which resulted in unrealized losses of $7 million year to date compared to $11 million for the same period in 2021. Higher margins and volumes of gas sold at Aitken Creek also contributed to the increase in revenue and earnings, partially offset by lower hydroelectric production in Belize.

Aitken Creek is subject to commodity price risk, as it purchases and holds natural gas in storage to earn a profit margin from its ultimate sale. Aitken Creek mitigates this risk by using derivatives to materially lock in the profit margin that will be realized upon the sale of natural gas. The fair value accounting of these derivatives creates timing differences and the resultant earnings volatility can be significant.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate and Other | | | | | | | | | | | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | | | Variance |

| Net expenses | (40) | | | (36) | | | (4) | | | (67) | | | (64) | | | | | (3) | |

The increase in net expenses for the quarter and year-to-date periods was due primarily to mark-to-market losses on foreign exchange contracts and total return swaps, reflecting market conditions, as well as higher finance charges. The increase was partially offset by lower operating expenses, and for the year-to-date period, the timing of recognition of income tax.

| | | | | | | | | | | |

| 8 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

NON-U.S. GAAP FINANCIAL MEASURES

Adjusted Common Equity Earnings, Adjusted Basic EPS and Capital Expenditures are Non-U.S. GAAP Financial Measures and may not be comparable with similar measures used by other entities. They are presented because management and external stakeholders use them in evaluating the Corporation's financial performance and prospects.

Net earnings attributable to common equity shareholders (i.e., Common Equity Earnings) and basic EPS are the most directly comparable U.S. GAAP measures to Adjusted Common Equity Earnings and Adjusted Basic EPS, respectively. These adjusted measures reflect the removal of items that management excludes in its key decision-making processes and evaluation of operating results.

Capital Expenditures include additions to property, plant and equipment and additions to intangible assets, as shown on the condensed consolidated statements of cash flows. It also includes Fortis' 39% share of capital spending for the Wataynikaneyap Transmission Power Project, consistent with Fortis' evaluation of operating results and its role as project manager during the construction of this Major Capital Project.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-U.S. GAAP Reconciliation | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

| Adjusted Common Equity Earnings and Adjusted Basic EPS | | | | | | | | | | | |

| Common Equity Earnings | 284 | | | 253 | | | 31 | | | 634 | | | 608 | | | 26 | |

| Adjusting item: | | | | | | | | | | | |

Unrealized (gain) loss on mark-to-market of derivatives (1) | (12) | | | 6 | | | (18) | | | 7 | | | 11 | | | (4) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Common Equity Earnings | 272 | | | 259 | | | 13 | | | 641 | | | 619 | | | 22 | |

Adjusted Basic EPS ($) | 0.57 | | | 0.55 | | | 0.02 | | | 1.34 | | | 1.32 | | | 0.02 | |

| | | | | | | | | | | |

| Capital Expenditures | | | | | | | | | | | |

| Additions to property, plant and equipment | 827 | | | 751 | | | 76 | | | 1,693 | | | 1,515 | | | 178 | |

| Additions to intangible assets | 58 | | | 39 | | | 19 | | | 107 | | | 79 | | | 28 | |

| Adjusting item: | | | | | | | | | | | |

Wataynikaneyap Transmission Power Project (2) | 45 | | | 50 | | | (5) | | | 94 | | | 126 | | | (32) | |

| Capital Expenditures | 930 | | | 840 | | | 90 | | | 1,894 | | | 1,720 | | | 174 | |

(1) Represents timing differences related to the accounting of natural gas derivatives at Aitken Creek, net of income tax expense of $5 million and income tax recovery of $3 million for the three and six months ended June 30, 2022, respectively (income tax recovery of $2 million and $4 million for the three and six months ended June 30, 2021, respectively), included in the Energy Infrastructure segment

(2)Represents Fortis' 39% share of capital spending for the Wataynikaneyap Transmission Power Project, included in the Other Electric segment

FOCUS ON SUSTAINABILITY

Fortis' focus on sustainability is outlined in its 2021 Annual MD&A. During 2022, the Corporation has continued to advance work on a range of important sustainability initiatives. In March 2022, the Corporation made progress on its commitment as a TCFD supporter, with the release of its first TCFD and Climate Assessment Report. As well, in May 2022, Fortis set a 2050 net-zero direct GHG emissions target. The establishment of this additional target reinforces the Corporation's commitment to decarbonize over the long-term, while preserving customer reliability and affordability. Consistent with our pathway to net-zero, in June 2022, TEP retired 170-MW of coal-fired generation through the planned closure of the San Juan Generating Station.

In May 2022, the Corporation amended its unsecured $1.3 billion revolving term committed credit facility agreement to include, amongst other things, the establishment of a sustainability-linked loan structure based on the Corporation's achievement of targets for diversity on the Board of Directors and Scope 1 GHG emissions for 2022 through 2025.

In July 2022, Fortis released its 2022 Sustainability Report, highlighting progress on a number of sustainability priorities, including adding more renewable energy, reducing GHG emissions and improving diversity. The report also provides enhanced information on the Corporation's sustainability strategy, significantly expands the scope of performance indicators, and is fully aligned with applicable Sustainability Accounting Standards Board standards.

| | | | | | | | | | | |

| 9 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

REGULATORY HIGHLIGHTS

ITC

ITC Midwest Capital Structure Complaint: In May 2022, the Iowa Coalition for Affordable Transmission, including Interstate Power and Light Company, a subsidiary of Alliant Energy Corporation, filed a complaint with FERC under Section 206 of the Federal Power Act requesting that ITC Midwest's common equity component of capital structure be reduced from 60% to 53%. The complaint alleges that ITC Midwest does not meet FERC's three-part test for authorizing the use of the utility's actual capital structure for rate-making purposes which requires that ITC Midwest: (i) issue its own debt without guarantees; (ii) have its own credit rating; and (iii) have a capital structure within the range of approved structures. We believe the complaint is without merit as it does not demonstrate that ITC Midwest fails to meet FERC's three-part test. ITC Midwest filed a response to the complaint in June 2022. As at June 30, 2022, ITC Midwest has not recorded a regulatory liability related to the complaint. Although the timing and outcome of this proceeding is unknown, a decrease in ITC Midwest's equity component to 53% would impact Fortis' annual EPS by approximately $0.05.

Transmission Incentives: In 2021, FERC issued a supplemental NOPR on transmission incentives modifying the proposal in the initial NOPR released by FERC in 2020. The supplemental NOPR proposes to eliminate the 50-basis point RTO ROE incentive adder for RTO members that have been members for longer than 3 years. The timeline for FERC to issue a final rule in this proceeding as well as the likely outcome remain unknown. Although any potential impact to Fortis remains uncertain, every 10-basis point change in ROE at ITC impacts Fortis' annual EPS by approximately $0.01.

UNS Energy

TEP General Rate Application: In June 2022, TEP filed a general rate application with the ACC requesting new rates effective September 1, 2023 using a December 31, 2021 test year. The application reflects an allowed ROE of 10.25%, an equity component of capital structure of 54%, and Rate Base of US$3.6 billion. The application also includes a US$136 million net increase in non-fuel and fuel-related revenue, as well as proposals to eliminate certain adjustor mechanisms, and modify an existing adjustor to provide more timely recovery of clean energy investments. The timing and outcome of this proceeding is unknown.

FERC Rate Case: In March 2022, FERC approved the settlement agreement for formula transmission rates at TEP, including an ROE of 9.79%.

PPFAC Mechanism: TEP's PPFAC mechanism allows for the timely recovery or return of purchased power and fuel costs as compared to that collected in customer rates. TEP's purchased power and fuel costs increased in 2021, reflecting higher commodity prices. On April 13, 2022, the ACC approved a rate adjustment to recover a PPFAC balance of US$108 million over an 18-month period.

FortisBC Energy and FortisBC Electric

GCOC Proceeding: The BCUC has initiated a proceeding including a review of the common equity component of capital structure and the allowed ROE. FortisBC filed evidence with the BCUC in the first quarter of 2022 and the proceeding remains ongoing. The timing and outcome of this proceeding, including the effective date of any change in the cost of capital in 2023, remain unknown.

FortisAlberta

2023 GCOC Proceeding: In March 2022, the AUC issued a decision extending the existing allowed ROE of 8.5% using a 37% equity component of capital structure through 2023.

2023 COS Application: FortisAlberta filed its 2023 COS application in 2021 and the proceeding remains ongoing. A decision from the AUC is expected in the third quarter of 2022.

FINANCIAL POSITION | | | | | | | | | | | |

| Significant Changes between June 30, 2022 and December 31, 2021 |

| | | |

| Balance Sheet Account | Increase (Decrease) | |

| ($ millions) | FX | Other | Explanation |

| Cash and cash equivalents | 2 | | 205 | | Reflects the timing of debt issuances and the related reinvestment in capital and operating requirements, primarily at UNS Energy. |

| Accounts receivable and other current assets | 14 | | 132 | | Due to the flow through of higher energy supply costs, slower customer collections at Central Hudson, and an increase in the fair value of energy contracts at UNS Energy, partially offset by seasonality of sales in Canada. |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| 10 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | |

| Significant Changes between June 30, 2022 and December 31, 2021 |

| | | |

| Balance Sheet Account | Increase (Decrease) | |

| ($ millions) | FX | Other | Explanation |

| Regulatory assets (current and long-term) | 22 | | 225 | | Due primarily to: (i) the normal operation of rate stabilization accounts, primarily at FortisBC Energy; (ii) retirement costs associated with the closure of the San Juan Generating Station at UNS Energy; (iii) deferred taxes; and (iv) the deferral of incremental storm costs at Central Hudson. |

| Other assets | 15 | | 106 | | Reflects an increase in the fair value of energy contracts at UNS Energy. |

| Property, plant and equipment, net | 443 | | 854 | | Due to capital expenditures, partially offset by depreciation. |

| | | |

| Goodwill | 191 | | — | | |

| Short-term borrowings | 4 | | 162 | | Reflects the issuance of commercial paper at ITC to finance working capital and capital investment requirements. |

| Accounts payable and other current liabilities | 23 | | (246) | | Due to the timing of the declaration of common share dividends, partially offset by collateral deposits received at UNS Energy related to energy contracts. |

| | | |

| Regulatory liabilities (current and long-term) | 40 | | 270 | | Reflects unrealized gains on energy contracts at UNS Energy, which are utilized to reduce exposure to changes in energy prices, the normal operation of rate stabilization accounts at FortisBC Energy, and the timing of flow-through transmission payments at FortisAlberta. |

| Deferred income tax liabilities | 40 | | 138 | | Due to higher temporary differences associated with ongoing capital investment. |

| Long-term debt (including current portion) | 306 | | 659 | | Reflects debt issuances, partially offset by debt repayments, as well as lower borrowings under committed credit facilities. |

| | | |

| Shareholders' equity | 257 | | 623 | | Due primarily to: (i) Common Equity Earnings for the six months ended June 30, 2022, less dividends declared on common shares; and (ii) the issuance of common shares, largely under the DRIP. |

| | | |

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Requirements

At the subsidiary level, it is expected that operating expenses and interest costs will be paid from Operating Cash Flow, with varying levels of residual cash flow available for capital expenditures and/or dividend payments to Fortis. Remaining capital expenditures are expected to be financed primarily from borrowings under credit facilities, long-term debt offerings and equity injections from Fortis. Borrowings under credit facilities may be required periodically to support seasonal working capital requirements.

Cash required of Fortis to support subsidiary growth is generally derived from borrowings under the Corporation's committed credit facility, the operation of the DRIP and issuances of common shares, preference equity and long-term debt. The subsidiaries pay dividends to Fortis and receive equity injections from Fortis when required. Both Fortis and its subsidiaries initially borrow through their committed credit facilities and periodically replace these borrowings with long-term financing. Financing needs also arise to refinance maturing debt.

| | | | | | | | | | | |

| 11 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Credit facilities are syndicated primarily with large banks in Canada and the U.S., with no one bank holding more than approximately 20% of the Corporation's total revolving credit facilities. Approximately $5.4 billion of the total credit facilities are committed with maturities ranging from 2023 through 2027. Available credit facilities are summarized in the following table.

| | | | | | | | | | | | | | | | | | | | | | | |

| Credit Facilities | | | | | |

| As at | Regulated

Utilities | | Corporate

and Other | | June 30,

2022 | | December 31,

2021 |

| ($ millions) | | | |

Total credit facilities (1) | 3,568 | | | 2,021 | | | 5,589 | | | 4,846 | |

| Credit facilities utilized: | | | | | | | |

| Short-term borrowings | (413) | | | — | | | (413) | | | (247) | |

| Long-term debt (including current portion) | (624) | | | (531) | | | (1,155) | | | (1,305) | |

| Letters of credit outstanding | (67) | | | (72) | | | (139) | | | (115) | |

| Credit facilities unutilized | 2,464 | | | 1,418 | | | 3,882 | | | 3,179 | |

(1) See Note 14 in the 2021 Annual Financial Statements for a description of the credit facilities as at December 31, 2021.

In April 2022, Central Hudson increased its total credit facilities available from US$200 million to US$250 million.

In May 2022, the Corporation amended its unsecured $1.3 billion revolving term committed credit facility agreement to extend the maturity to July 2027, and to establish a sustainability-linked loan structure based on the Corporation's achievement of targets for diversity on the Board of Directors and Scope 1 GHG emissions for 2022 through 2025. Maximum potential annual margin pricing adjustments are +/- 5 basis points and +/- 1 basis point for drawn and undrawn funds, respectively.

Also in May 2022, the Corporation entered into an unsecured US$500 million non-revolving term credit facility. The facility has an initial one-year term, is repayable at any time without penalty, provides the Corporation with additional, cost effective short-term financing and liquidity and enhances financial flexibility.

The Corporation's ability to service debt and pay dividends is dependent on the financial results of, and the related cash payments from, its subsidiaries. Certain regulated subsidiaries are subject to restrictions that limit their ability to distribute cash to Fortis, including restrictions by certain regulators limiting annual dividends and restrictions by certain lenders limiting debt to total capitalization. There are also practical limitations on using the net assets of the regulated subsidiaries to pay dividends, based on management's intent to maintain the subsidiaries' regulator-approved capital structures. Fortis does not expect that maintaining such capital structures will impact its ability to pay dividends in the foreseeable future.

As at June 30, 2022, consolidated fixed-term debt maturities/repayments are expected to average $1,125 million annually over the next five years and approximately 78% of the Corporation's consolidated long-term debt, excluding credit facility borrowings, had maturities beyond five years.

In December 2020, Fortis filed a short-form base shelf prospectus with a 25-month life under which it may issue common or preference shares, subscription receipts or debt securities in an aggregate principal amount of up to $2.0 billion. As at June 30, 2022, $1.0 billion remained available under the short-form base shelf prospectus.

Fortis is well positioned with strong liquidity. This combination of available credit facilities and manageable annual debt maturities/repayments provides flexibility in the timing of access to capital markets. Given current credit ratings and capital structures, the Corporation and its subsidiaries currently expect to continue to have reasonable access to long-term capital in 2022.

Fortis and its subsidiaries were in compliance with debt covenants as at June 30, 2022 and are expected to remain compliant in 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flow Summary | | | | | | | | | | | |

| Summary of Cash Flows | | | |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

| Cash and cash equivalents, beginning of period | 365 | | | 317 | | | 48 | | | 131 | | | 249 | | | (118) | |

| Cash from (used in): | | | | | | | | | | | |

| Operating activities | 759 | | | 740 | | | 19 | | | 1,572 | | | 1,479 | | | 93 | |

| Investing activities | (918) | | | (820) | | | (98) | | | (1,834) | | | (1,658) | | | (176) | |

| Financing activities | 124 | | | 357 | | | (233) | | | 461 | | | 526 | | | (65) | |

| Effect of exchange rate changes on cash and cash equivalents | 8 | | | 5 | | | 3 | | | 8 | | | 3 | | | 5 | |

| | | | | | | | | | | |

| Cash and cash equivalents, end of period | 338 | | | 599 | | | (261) | | | 338 | | | 599 | | | (261) | |

| | | | | | | | | | | |

| 12 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Operating Activities

See "Performance at a Glance - Operating Cash Flow" on page 4.

Investing Activities

The Corporation's Capital Plan for 2022 is estimated to be $4.0 billion, an increase of 11% from $3.6 billion in 2021. The increase in cash used in investing activities for the quarter and year-to-date periods reflects higher capital investments planned for 2022, as well as a higher U.S.-to-Canadian dollar exchange rate. See "Performance at a Glance - Capital Expenditures" on page 4 and "Capital Plan" on page 15.

Financing Activities

Cash flows related to financing activities will fluctuate largely as a result of changes in the subsidiaries' capital expenditures and the amount of Operating Cash Flow available to fund those capital expenditures, which together impact the amount of funding required from debt and common equity issuances. See "Cash Flow Requirements" on page 11.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt Financing | | | | | | | | | |

| Long-Term Debt Issuances | | | Interest | | | | | | |

| Year-to-date June 30, 2022 | Month | | Rate | | | | | | Use of Proceeds |

($ millions, except as noted) | Issued | | (%) | | Maturity | | Amount | |

| ITC | | | | | | | | | |

| Secured first mortgage bonds | January | | 2.93 | | | 2052 | | US | 150 | | | (1) (2) (3) (4) |

| Secured senior notes | May | | 3.05 | | | 2052 | | US | 75 | | | (1) (3) (4) |

| UNS Energy | | | | | | | | | |

| Unsecured senior notes | February | | 3.25 | | | 2032 | | US | 325 | | | (4) (5) |

| Central Hudson | | | | | | | | | |

| Unsecured senior notes | January | | 2.37 | | | 2027 | | US | 50 | | | (4) (5) |

| Unsecured senior notes | January | | 2.59 | | | 2029 | | US | 60 | | | (4) (5) |

| FortisBC Electric | | | | | | | | | |

| Unsecured debentures | March | | 4.16 | | | 2052 | | 100 | | | (1) |

| Newfoundland Power | | | | | | | | | |

| First mortgage sinking fund bonds | April | | 4.20 | | | 2052 | | 75 | | | (1) (4) (5) |

| FortisAlberta | | | | | | | | | |

| Senior unsecured debentures | May | | 4.62 | | | 2052 | | 125 | | | (1) |

| Fortis | | | | | | | | | |

| Unsecured senior notes | May | | 4.43 (6) | | 2029 | | 500 | | | (4) (7) |

(1) Repay credit facility borrowings

(2) US$20 million to fund or refinance a portfolio of eligible green projects

(3) Fund capital expenditures

(4) General corporate purposes

(5) Repay maturing long-term debt

(6) The Corporation entered into cross-currency interest rate swaps to effectively convert the debt into US$391 million with an interest rate of 4.34%. See Note 12 to the Interim Financial Statements

(7) Fund the June 2022 redemption of the Corporation's $500 million, 2.85% senior unsecured notes due December 2023

| | | | | | | | | | | |

| 13 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Equity Financing | | | | | | | | | | | |

| Common Equity Issuances and Dividends Paid |

| Periods ended June 30 | Quarter | | Year-to-Date |

| ($ millions, except as indicated) | 2022 | | | 2021 | | | Variance | | 2022 | | | 2021 | | | Variance |

| Common shares issued: | | | | | | | | | | | |

Cash (1) | 18 | | | 9 | | | 9 | | | 40 | | | 44 | | | (4) | |

Non-cash (2) | 93 | | | 87 | | | 6 | | | 188 | | | 177 | | | 11 | |

| Total common shares issued | 111 | | | 96 | | | 15 | | | 228 | | | 221 | | | 7 | |

Number of common shares issued (# millions) | 1.8 | | | 1.8 | | | — | | | 3.9 | | | 4.4 | | | (0.5) | |

| Common share dividends paid: | | | | | | | | | | | |

| Cash | (164) | | | (150) | | | (14) | | | (324) | | | (297) | | | (27) | |

Non-cash (3) | (92) | | | (87) | | | (5) | | | (186) | | | (176) | | | (10) | |

| Total common share dividends paid | (256) | | | (237) | | | (19) | | | (510) | | | (473) | | | (37) | |

Dividends paid per common share ($) | 0.535 | | | 0.505 | | | 0.030 | | | 1.07 | | 1.01 | | | 0.06 | |

(1) Includes common shares issued under stock option and employee share purchase plans

(2) Common shares issued under the DRIP and stock option plan

(3) Common share dividends reinvested under the DRIP

On February 10, 2022 and July 27, 2022, Fortis declared a dividend of $0.535 per common share payable on June 1, 2022 and September 1, 2022, respectively. The payment of dividends is at the discretion of the board of directors and depends on the Corporation's financial condition and other factors.

Contractual Obligations

There were no material changes to the contractual obligations disclosed in the 2021 Annual MD&A, except issuances of long-term debt and credit facility utilization (see "Cash Flow Summary" on page 12) and new gas purchase obligations at FortisBC Energy.

In 2022, FortisBC Energy signed new long-term biomethane purchase agreements to acquire renewable natural gas. The 20-year agreements allow FortisBC Energy to purchase a maximum annual volume of 9.3 PJs of renewable natural gas, and has increased gas purchase obligations from those disclosed as at December 31, 2021 as follows.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As at June 30, 2022 ($ millions) | Total | | Year 1 | | Year 2 | | Year 3 | | Year 4 | | Year 5 | | Thereafter |

| Gas purchase obligations | 2,725 | | | 6 | | | 34 | | | 74 | | | 126 | | | 151 | | | 2,334 | |

Off-Balance Sheet Arrangements

There were no material changes to off-balance sheet arrangements from those disclosed in the 2021 Annual MD&A.

Capital Structure and Credit Ratings

Fortis requires ongoing access to capital and, therefore, targets a consolidated long-term capital structure that will enable it to maintain investment-grade credit ratings. The regulated utilities maintain their own capital structures in line with those reflected in customer rates.

| | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Capital Structure | June 30, 2022 | | December 31, 2021 |

| As at | ($ millions) | | (%) | | ($ millions) | | (%) |

Debt (1) | 26,708 | | | 55.0 | | | 25,784 | | | 55.2 | |

| Preference shares | 1,623 | | | 3.3 | | | 1,623 | | | 3.5 | |

Common shareholders' equity and non-controlling interests (2) | 20,237 | | | 41.7 | | | 19,293 | | | 41.3 | |

| 48,568 | | | 100.0 | | | 46,700 | | | 100.0 | |

(1) Includes long-term debt and finance leases, including current portion, and short-term borrowings, net of cash

(2) Includes shareholders' equity, net of preference shares, and non-controlling interests. Non-controlling interests represented 3.5% as at June 30, 2022 (December 31, 2021 - 3.5%)

| | | | | | | | | | | |

| 14 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Outstanding Share Data

As at July 27, 2022, the Corporation had issued and outstanding 478.7 million common shares and the following First Preference Shares: 5.0 million Series F; 9.2 million Series G; 7.7 million Series H; 2.3 million Series I; 8.0 million Series J; 10.0 million Series K; and 24.0 million Series M.

Only the common shares of the Corporation have voting rights. The Corporation's first preference shares do not have voting rights unless and until Fortis fails to pay eight quarterly dividends, whether or not consecutive or declared.

If all outstanding stock options were converted as at July 27, 2022, an additional 2.3 million common shares would be issued and outstanding.

Credit Ratings

The Corporation's credit ratings shown below reflect its low risk profile, diversity of operations, the stand-alone nature and financial separation of each regulated subsidiary, and the level of holding company debt.

| | | | | | | | | | | | | | | | | |

| As at June 30, 2022 | Rating | | Type | | Outlook |

| S&P | A- | | Corporate | | Stable |

| BBB+ | | Unsecured debt | | |

| DBRS Morningstar | A (low) | | Corporate | | Stable |

| A (low) | | Unsecured debt | | |

| Moody's | Baa3 | | Issuer | | Stable |

| Baa3 | | Unsecured debt | | |

In January 2022, S&P revised Central Hudson's outlook to negative from stable in consideration of the PSC's order in November 2021 on the company's general rate application, projected elevated capital expenditures, and the resulting impact on the company's financial measures.

In March 2022, S&P confirmed the Corporation's 'A-' issuer and 'BBB+' senior unsecured debt credit ratings and stable outlook.

In May 2022, DBRS Morningstar confirmed the Corporation's A (low) issuer and senior unsecured debt credit ratings and stable outlook.

Capital Plan

Year-to-date Capital Expenditures of $1.9 billion are consistent with expectations and on track with the Corporation's annual $4.0 billion Capital Plan.

While global supply chain constraints and rising inflation are issues of potential concern that continue to evolve, the Corporation does not expect a material impact on its 2022 or five-year Capital Plan, although certain planned expenditures may shift within the five years. The Corporation is proactively working to mitigate supply chain constraints by identifying high priority materials and consolidating buying power to improve outcomes, increasing inventory levels, and closely working with suppliers to ensure material availability.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Expenditures (1) | | | | | | | | | | |

| Year-to-date June 30, 2022 | Regulated Utilities | | | | | | |

| | | UNS Energy | | Central Hudson | | FortisBC Energy | | Fortis Alberta | | FortisBC Electric | | Other Electric | | Total Regulated Utilities | | Non-

Regulated | | |

| ($ millions, except as indicated) | ITC | | | | | | | | | (2) | Total |

| Total | 607 | | | 321 | | | 129 | | | 264 | | | 230 | | | 60 | | | 272 | | | 1,883 | | | 11 | | | 1,894 | |

(1) See "Non-U.S. GAAP Financial Measures" on page 9

(2) Energy Infrastructure segment

Five-Year Capital Plan

The Corporation's five-year 2022-2026 Capital Plan is targeted at $20.0 billion, reflecting an average of $4.0 billion of Capital Expenditures annually. The Capital Plan is low risk and highly executable, with 99% of planned expenditures to occur at the regulated utilities and only 15% relating to Major Capital Projects.

Planned Capital Expenditures are based on detailed forecasts of energy demand, labour and material costs, including inflation, supply chain availability, general economic conditions, foreign exchange rates and other factors. These could change and cause actual expenditures to differ from forecast.

| | | | | | | | | | | |

| 15 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Major Capital Project Update

FortisBC Energy

In May 2022, the CPCN application for the coastal transmission system section of the Transmission Integrity Management Capabilities project was approved by the BCUC. This project will improve gas line safety and transmission integrity, including gas line modifications and looping.

With respect to the proposed Eagle Mountain Woodfibre Gas Pipeline project, in April 2022, Woodfibre LNG Limited issued a Notice to Proceed to its prime contractor for the proposed LNG site in Squamish, British Columbia. This project, however, remains contingent on certain conditions of Woodfibre LNG Limited and on FortisBC Energy receiving the remaining regulatory and permitting approvals.

With respect to further Tilbury expansion, in July 2022, FortisBC Energy's parent company, FortisBC Holdings Inc., entered into an agreement with an Indigenous community to provide an option to purchase equity in certain future regulated LNG investments, if the parties are able to satisfy certain obligations. Any proposed transaction is subject to regulatory approvals and certain conditions precedent.

Additional Investment Opportunities

In July 2022, the MISO board approved the first tranche of projects associated with the LRTP, representing 18 transmission projects across the MISO Midwest subregion with total associated costs estimated at US$10 billion. Six of these projects run through ITC's MISO operating companies' service territories, including Michigan and Iowa, where right of first refusal provisions exist for incumbent transmission owners. Other projects within this portfolio may be subject to competitive bidding, depending on the state in which they are located. Based on recent cost refinements and visibility on scope, ITC estimates transmission investments of US$1.4 billion to US$1.8 billion through 2030 associated with six of the 18 projects, up from US$1.0 billion to US$1.5 billion previously estimated. Given the preliminary analysis around the transmission investment, its timing and uncertainties regarding the awarding of projects, Fortis cannot state with certainty the impact of the estimated LRTP capital expenditures on the Corporation's five-year Capital Plan.

In late July 2022, ITC suspended development activities and commercial negotiations relating to the $1.7 billion Lake Erie Connector project. ITC has determined that there is no viable path to conclude certain key commercial negotiations and other requirements within the required timelines, in part due to recent macroeconomic conditions, including rising inflation, interest rates, and fluctuations in the U.S.-to-Canadian foreign exchange rate. This project has never been included in the Corporation’s five-year Capital Plan.

BUSINESS RISKS

The Corporation's business risks remain substantially unchanged from those disclosed in its 2021 Annual MD&A. See "Regulatory Highlights" on page 10 and "Outlook" on page 18 for applicable updates.

ACCOUNTING MATTERS

Accounting Policies

The Interim Financial Statements have been prepared following the same accounting policies and methods as those used to prepare the 2021 Annual Financial Statements.

Critical Accounting Estimates

The preparation of the Interim Financial Statements required management to make estimates and judgments, including those related to regulatory decisions, that affect the reported amounts of, and disclosures related to, assets, liabilities, revenues, expenses, gains, losses and contingencies. Actual results could differ materially from estimates.

There were no material changes to the nature of the Corporation's critical accounting estimates or contingencies from that disclosed in the 2021 Annual MD&A.

FINANCIAL INSTRUMENTS

Long-Term Debt and Other

As at June 30, 2022, the carrying value of long-term debt, including the current portion, was $26.5 billion (December 31, 2021 - $25.5 billion) compared to an estimated fair value of $24.9 billion (December 31, 2021 - $28.8 billion). Since Fortis does not intend to settle long-term debt prior to maturity, any excess of fair value over carrying value does not represent an actual liability.

The consolidated carrying value of the remaining financial instruments, other than derivatives, approximates fair value, reflecting their short-term maturity, normal trade credit terms and/or nature.

| | | | | | | | | | | |

| 16 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Derivatives

Derivatives are recorded at fair value with certain exceptions including those derivatives that qualify for the normal purchase and normal sale exception.

There were no material changes with respect to the nature and purpose, methodologies for fair value determination, and carrying values of the Corporation's derivatives from that disclosed in the 2021 Annual MD&A, except that, in May 2022, the Corporation entered into cross-currency interest rate swaps with a 7-year term to effectively convert its $500 million, 4.43% unsecured senior notes to US$391 million, 4.34% debt. Additional details are provided in Note 12 to the Interim Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY OF QUARTERLY RESULTS | | | | |

| | | Common Equity | | | | |

| Revenue | | Earnings | | Basic EPS | | Diluted EPS |

| Quarter ended | ($ millions) | | ($ millions) | | ($) | | ($) |

| June 30, 2022 | 2,487 | | | 284 | | | 0.59 | | | 0.59 | |

| March 31, 2022 | 2,835 | | | 350 | | | 0.74 | | | 0.74 | |

| December 31, 2021 | 2,583 | | | 328 | | | 0.69 | | | 0.69 | |

| September 30, 2021 | 2,196 | | | 295 | | | 0.63 | | | 0.62 | |

| June 30, 2021 | 2,130 | | | 253 | | | 0.54 | | | 0.54 | |

| March 31, 2021 | 2,539 | | | 355 | | | 0.76 | | | 0.76 | |

| December 31, 2020 | 2,346 | | | 331 | | | 0.71 | | | 0.71 | |

| September 30, 2020 | 2,121 | | | 292 | | | 0.63 | | | 0.63 | |

Generally, within each calendar year, quarterly results fluctuate primarily in accordance with seasonality. Given the diversified nature of the Corporation's subsidiaries, seasonality varies. Most of the annual earnings of the gas utilities are realized in the first and fourth quarters due to space-heating requirements. Earnings for the electric distribution utilities in the U.S. are generally highest in the second and third quarters due to the use of air conditioning and other cooling equipment.

Generally, from one calendar year to the next, quarterly results reflect: (i) continued organic growth driven by the Corporation's Capital Plan; (ii) any significant temperature fluctuations from seasonal norms; (iii) the timing and significance of any regulatory decisions; (iv) changes in the U.S.-to-Canadian dollar exchange rate; (v) for revenue, the flow through in customer rates of commodity costs; and (vi) for EPS, increases in the weighted average number of common shares outstanding.

June 2022/June 2021

See "Performance at a Glance" on page 2.

March 2022/March 2021

Common Equity Earnings decreased by $5 million and basic EPS decreased by $0.02 in comparison to the first quarter of 2021 due to higher unrealized losses of $14 million on the mark-to-market accounting of natural gas derivatives at Aitken Creek. Excluding this impact, the Corporation delivered earnings growth driven by Rate Base growth at ITC and the western Canadian utilities, and higher sales in the Caribbean. Growth was partially offset by lower hydroelectric production in Belize, and lower earnings at Central Hudson mainly due to the costs of implementing a new customer information system.

Earnings in Arizona were broadly consistent with the first quarter of 2021. The impact of higher electricity sales and lower planned generation maintenance costs was offset by the timing of earnings related to the Oso Grande generating facility, as expected. Losses on retirement investments also unfavourably impacted earnings at UNS Energy in the quarter.

The change in EPS also reflected an increase in the weighted average number of common shares outstanding, largely associated with the Corporation's DRIP.

| | | | | | | | | | | |

| 17 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

December 2021/December 2020

Common Equity Earnings decreased by $3 million and basic EPS decreased by $0.02 due primarily to: (i) lower earnings in Arizona, due to lower retail electricity sales resulting from milder weather and lower wholesale electricity sales, as well as lower gains on certain investments that support retirement benefits, partially offset by higher transmission revenue; (ii) the timing of earnings at FortisAlberta, due the reversal of income tax expense in the fourth quarter of 2020; (iii) the operation of regulatory mechanisms at Central Hudson; and, (iv) higher non-recoverable costs at ITC. Lower earnings in Belize and the impact of foreign exchange also unfavourably impacted earnings. The decrease in earnings was partially offset by growth in Rate Base, the finalization of Central Hudson's rate application with retroactive application to July 1, 2021, and the favourable impact of mark-to-market accounting of derivatives at Aitken Creek.

The decrease in basic EPS reflects lower Common Equity Earnings and an increase in the weighted average number of common shares outstanding, largely associated with the Corporation's DRIP.

September 2021/September 2020

Common Equity Earnings and basic EPS were relatively consistent with the same period in 2020. Growth in Common Equity Earnings was tempered by a lower U.S. dollar-to-Canadian dollar exchange rate, unfavourably impacting earnings by $13 million.

Excluding the impact of foreign exchange, Common Equity Earnings increased by $16 million due to: (i) Rate Base growth; (ii) higher sales, largely associated with favourable weather, and the timing of expenditures at FortisAlberta; (iii) continued recovery in the Caribbean from economic conditions experienced in 2020 associated with the COVID-19 Pandemic; and (iv) an adjustment related to the amortization of interest rate swaps at ITC. New customer rates effective January 1, 2021 at TEP also contributed to results. The increase in earnings was partially offset by: (i) lower sales in Arizona due to cooler weather; (ii) realized losses on natural gas contracts at Aitken Creek; and (iii) the delay in Central Hudson's general rate application. The change in basic EPS also reflected an increase in the weighted average number of common shares outstanding, largely associated with the DRIP.

RELATED-PARTY AND INTER-COMPANY TRANSACTIONS

Related-party transactions are in the normal course of operations and are measured at the amount of consideration agreed to by the related parties. There were no material related-party transactions for the three and six months ended June 30, 2022 and 2021.

Inter-company transactions between non-regulated and regulated entities not eliminated on consolidation include the lease of gas storage capacity and gas sales by Aitken Creek to FortisBC Energy. These transactions did not have a material impact on consolidated earnings, financial position or cash flows.

As at June 30, 2022, accounts receivable included approximately $11 million due from Belize Electricity (December 31, 2021 - $22 million).

Fortis periodically provides short-term financing, the impacts of which are eliminated on consolidation, to subsidiaries to support capital expenditures and seasonal working capital requirements. As at June 30, 2022, inter-segment loans of $129 million were outstanding (December 31, 2021 - $126 million). Interest charged on inter-segment loans was not material for the three and six months ended June 30, 2022 and 2021.

OUTLOOK

The Corporation's long-term outlook remains unchanged. Fortis continues to enhance shareholder value through the execution of its Capital Plan, the balance and strength of its diversified portfolio of utility businesses, and growth opportunities within and proximate to its service territories. While energy price volatility, global supply chain constraints and rising inflation are issues of potential concern that continue to evolve, including from the effects of the COVID-19 Pandemic, war in Eastern Europe, economic sanctions and geopolitical tensions, the Corporation does not currently expect there to be a material impact on its operations or financial results in 2022.

Fortis is executing on the transition to a clean energy future and is on track to achieve its corporate-wide target to reduce GHG emissions by 75% by 2035. Upon achieving this target, 99% of the Corporation's assets will be focused on energy delivery and renewable, carbon-free generation. The Corporation's additional 2050 net-zero direct GHG emissions target reinforces Fortis' commitment to decarbonize over the long-term, while preserving customer reliability and affordability.

The Corporation's $20 billion five-year Capital Plan is expected to increase midyear Rate Base from $31.1 billion in 2021 to $41.6 billion by 2026, translating into a five-year CAGR of approximately 6%. Above and beyond the five-year Capital Plan, Fortis continues to pursue additional energy infrastructure opportunities.

| | | | | | | | | | | |

| 18 | FORTIS INC. | JUNE 30, 2022 QUARTER REPORT | |

| | | | | | | | |

| Interim Management Discussion and Analysis |

Additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the U.S. to facilitate the interconnection of cleaner energy including infrastructure investments associated with MISO's LRTP; natural gas resiliency investments in pipelines and LNG infrastructure in British Columbia; and the acceleration of cleaner energy infrastructure investments across our jurisdictions.

Fortis expects long-term growth in Rate Base will support earnings and dividend growth. Fortis is targeting average annual dividend growth of approximately 6% through 2025. This dividend growth guidance is premised on the assumptions listed under "Forward-Looking Information".

FORWARD-LOOKING INFORMATION

Fortis includes forward-looking information in the MD&A within the meaning of applicable Canadian securities laws and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, (collectively referred to as "forward-looking information"). Forward-looking information reflects expectations of Fortis management regarding future growth, results of operations, performance, business prospects and opportunities. Wherever possible, words such as anticipates, believes, budgets, could, estimates, expects, forecasts, intends, may, might, plans, projects, schedule, should, target, will, would, and the negative of these terms, and other similar terminology or expressions have been used to identify the forward-looking information, which includes, without limitation: targeted average annual dividend growth through 2025; forecast capital expenditures for 2022 and 2022-2026; the expectation that volatility in energy prices, global supply chain constraints and rising inflation will not have a material impact on operations or financial results in 2022 or the five-year capital plan; forecast Rate Base and Rate Base growth for 2022 through 2026; the expectation that long-term growth in Rate Base will support earnings and dividend growth; the nature, timing, benefits and expected costs of certain capital projects, including FortisBC's Eagle Mountain Woodfibre Gas Line project, FortisBC Energy's Transmission Integrity Management Capabilities project, further Tilbury expansion at FortisBC, and additional opportunities beyond the capital plan, including the MISO LRTP; the impact of macroeconomic conditions on additional investment opportunities, including the ability to secure a viable transmission service agreement within the required timeline for the Lake Erie Connector project; the 2035 GHG emissions reduction target and project asset mix; the 2050 net-zero direct GHG emissions target; the expectation that Fortis is well positioned to capitalize on evolving industry opportunities, including additional investment opportunities beyond the Capital Plan; the expected timing, outcome and impact of regulatory decisions; the expected or potential funding sources for operating expenses, interest costs and capital plans; the expectation that maintaining the targeted capital structure of the regulated operating subsidiaries will not have an impact on the Corporation's ability to pay dividends in the foreseeable future; the expected consolidated fixed-term debt maturities and repayments over the next five years; the expectation that the Corporation and its subsidiaries will continue to have access to long-term capital and will remain compliant with debt covenants in 2022; the expected uses of proceeds from debt financings; and the targeted capital structure.