Fourth Quarter 2022 Earnings Supplement Claros Mortgage Trust, Inc. (CMTG) February 16, 2023 The properties above are not representative of all transactions.

The information herein generally speaks as of the date hereof or such earlier date referred to on specific pages herein. In furnishing this document, Claros Mortgage Trust, Inc. and its consolidated subsidiaries (the “Company” or “CMTG”) do not undertake to update the information herein. No legal commitment or obligation shall arise by the provision of this presentation. All financial information is provided for general reference purposes only and is superseded by, and is qualified in its entirety by reference to, CMTG’s financial statements. No Offer or Solicitation This document does not constitute (i) an offer to sell or a solicitation of an offer to purchase any securities in CMTG, (ii) a means by which any other investment may be offered or sold or (iii) advice or an expression of our view as to whether an investment in CMTG is suitable for any person. Portfolio Metrics; Basis of Accounting The performance information set forth in this document has generally been prepared on the basis of generally accepted accounting principles in the United States (U.S. GAAP). The basis on which CMTG’s operating metrics are presented in this document may vary from other reports or documents that CMTG prepares from time to time for internal or external use. Net Debt / Equity Ratio, Total Leverage Ratio, and Distributable Earnings Net Debt / Equity Ratio, Total Leverage Ratio, and Distributable Earnings are non-GAAP measures used to evaluate the Company’s performance excluding the effects of certain transactions, non-cash items and GAAP adjustments, as determined by our Manager, which the Company believes are not necessarily indicative of the Company’s current performance and operations. Net Debt / Equity Ratio is a non-GAAP measure, which the Company defines as the ratio of asset-specific debt and Secured Term Loan, less cash and cash equivalents, to total equity. Total Leverage Ratio is a non-GAAP measure, which the Company defines as the ratio of asset-specific debt and Secured Term Loan, plus non-consolidated senior interests held by third parties, less cash and cash equivalents, to total equity. Distributable Earnings is a non-GAAP measure, which the Company defines as net income as determined in accordance with GAAP, excluding (i) non-cash equity compensation expense (income), (ii) incentive fees, (iii) real estate depreciation and amortization, (iv) any unrealized gains or losses from mark-to-market valuation changes (other than permanent impairments) that are included in net income for the applicable period, (v) one-time events pursuant to changes in GAAP and (vi) certain non-cash items, which in the judgment of the Company’s Manager, should not be included in Distributable Earnings. Distributable Earnings is substantially the same as Core Earnings, excluding incentive fees, as defined in the Management Agreement, for the periods presented. The Company believes that Net Debt / Equity Ratio and Total Leverage Ratio provide meaningful information to consider in addition to the Company’s total liabilities and balance sheets. Net Debt / Equity Ratio and Total Leverage Ratio are used to evaluate the Company’s financial leverage. The Company believes that Distributable Earnings provides meaningful information to consider in addition to the Company’s net income and cash flows from operating activities determined in accordance with GAAP. The Company believes the Distributable Earnings measure helps it to evaluate the Company’s performance excluding the effects of certain transactions, non-cash items and GAAP adjustments, as determined by the Company’s Manager, that it believes are not necessarily indicative of the Company’s current performance and operations. Distributable Earnings does not represent net income or cash flows from operating activities and should not be considered as an alternative to GAAP net income, an indication of the Company’s cash flows from operating activities, a measure of the Company’s liquidity or an indication of funds available for the Company’s cash needs. In addition, the Company’s methodology for calculating Net Debt / Equity Ratio, Total Leverage Ratio, and Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures and, accordingly, the Company’s reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. In order to maintain the Company’s status as a REIT, the Company is required to distribute at least 90% of its REIT taxable income, determined without regard to the deduction for dividends paid and excluding net capital gain, as dividends. Distributable Earnings, and other similar measures, have historically been a useful indicator of mortgage REITs’ ability to cover their dividends, and to mortgage REITs themselves in determining the amount of any dividends. Distributable Earnings is a key factor considered by the board of directors in setting the dividend and as such the Company believes Distributable Earnings is useful to investors. Accordingly, the Company believes providing Distributable Earnings on a supplemental basis to the Company’s net income as determined in accordance with GAAP is helpful to its stockholders in assessing the overall performance of its business. While Distributable Earnings excludes the impact of the Company’s unrealized current provision for credit losses, loan losses are charged off and recognized through Distributable Earnings when deemed non-recoverable. Non-recoverability is determined (i) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of foreclosure, when the underlying asset is sold), or (ii) with respect to any amount due under any loan, when such amount is determined to be non-collectible. The information provided herein is as of December 31, 2022 unless otherwise noted. Important Notices

Important Notices (cont’d) Determinations of Loan-to-Value / Loan-to-Cost LTV represents “loan-to-value” or “loan-to-cost”, which is calculated as our total loan commitment from time to time, as if fully funded, plus any financings that are pari passu with or senior to our loan, divided by our estimate of either (1) the value of the underlying real estate, determined in accordance with our underwriting process (typically consistent with, if not less than, the value set forth in a third-party appraisal) or (2) the borrower’s projected, fully funded cost basis in the asset, in each case, as we deem appropriate for the relevant loan and other loans with similar characteristics. Loans with specific current expected credit loss (“CECL”) reserves are reflected as having an LTV of 100%. Underwritten values and projected costs should not be assumed to reflect our judgment of current market values or project costs, which may have changed materially since the date of origination. LTV is updated only in connection with a partial loan paydown and/or release of collateral, material changes to expected project costs, the receipt of a new appraisal (typically in connection with financing or refinancing activity) or a change in our loan commitment. Totals represent weighted average based on loan commitment, including non-consolidated senior interests and pari passu interests. Forward-Looking Statements This document and oral statements made in connection therewith contain forward-looking statements within the meaning of U.S. federal securities laws. Forward-looking statements express CMTG’s views regarding future plans, expectations and the potential impact of the COVID-19 pandemic. They include statements that include words such as “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “plan,” “intend” and similar words or expressions. Forward-looking statements in this presentation include, but are not limited to, statements regarding future operations, business strategy, cash flows, income, costs, expenses, liabilities and profits of CMTG. These statements are based on numerous assumptions and are subject to risks, uncertainties or change in circumstances that are difficult to predict or quantify, in particular due to the uncertainties created by the COVID-19 pandemic, including the projected impact of COVID-19 on our business, financial performance and operating results. Actual future results may vary materially from those expressed or implied in these forward-looking statements, and CMTG’s business, financial condition and results of operations could be materially and adversely affected by numerous factors, including such known and unknown risks and uncertainties. As a result, forward-looking statements should be understood to be only predictions and statements of our current beliefs, and are not guarantees of performance. Statements regarding the following subjects, among others, may be forward-looking: expected investments by CMTG or any other parties; CMTG’s business and investment strategy; CMTG’s projected operating results; the timing of cash flows from CMTG’s investments; the state of the U.S. economy generally or in specific geographic regions; actions and initiatives of the U.S. government and changes to U.S. government policies; CMTG’s ability to obtain financing arrangements; CMTG’s expected leverage; general volatility of the markets in which CMTG may invest; the return or impact of current and future investments; changes in interest rates; rates of default or decreased recovery rates on CMTG’s target assets; changes in governmental regulations, tax law and rates, and similar matters (including interpretation thereof); CMTG’s ability to maintain its qualification as a REIT; availability of investment opportunities in mortgage-related and real estate-related investments and securities; the ability to locate suitable investments for CMTG, monitor, service, and administer CMTG’s investments and execute its investment strategy; availability of qualified personnel; estimates relating to CMTG’s ability to make distributions to its stockholders in the future; projections of net equity investment, yield, internal rate of return, and loan-to-value or loan-to-cost ratios; continuing impact of COVID-19; CMTG’s understanding of its competition; and market trends in CMTG’s industry, interest rates, real estate values, the debt securities markets or the general economy. The forward-looking statements are based on beliefs, assumptions, and expectations about future performance, taking into account all information currently available. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions, and expectations can change as a result of many possible events or factors, not all of which are known. If a change occurs, CMTG’s business, financial condition, liquidity, and results of operations may vary materially from those expressed in any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect CMTG. Except as required by law, CMTG is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Fourth Quarter 2022 Highlights See Endnotes in the Appendix. $7.4 billion Loan Portfolio3 $2.5 billion Equity Book Value 8.5% Dividend Yield1 8.6% Weighted Average All-In Yield2 97% Senior Loans3,15 98% Floating Rate Loans3 68.2% Weighted Average Portfolio LTV4 2.2x Net Debt / Equity Ratio5

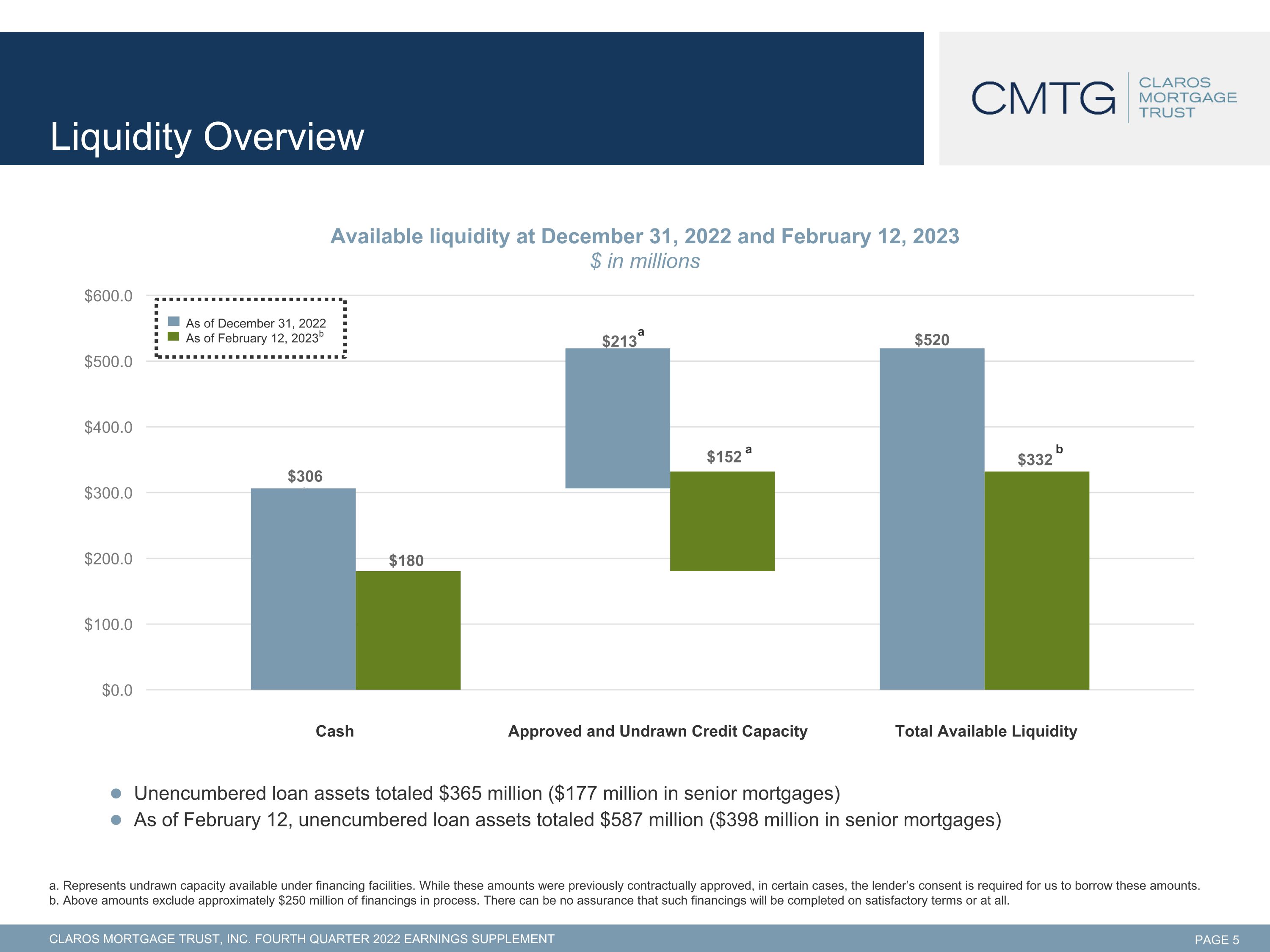

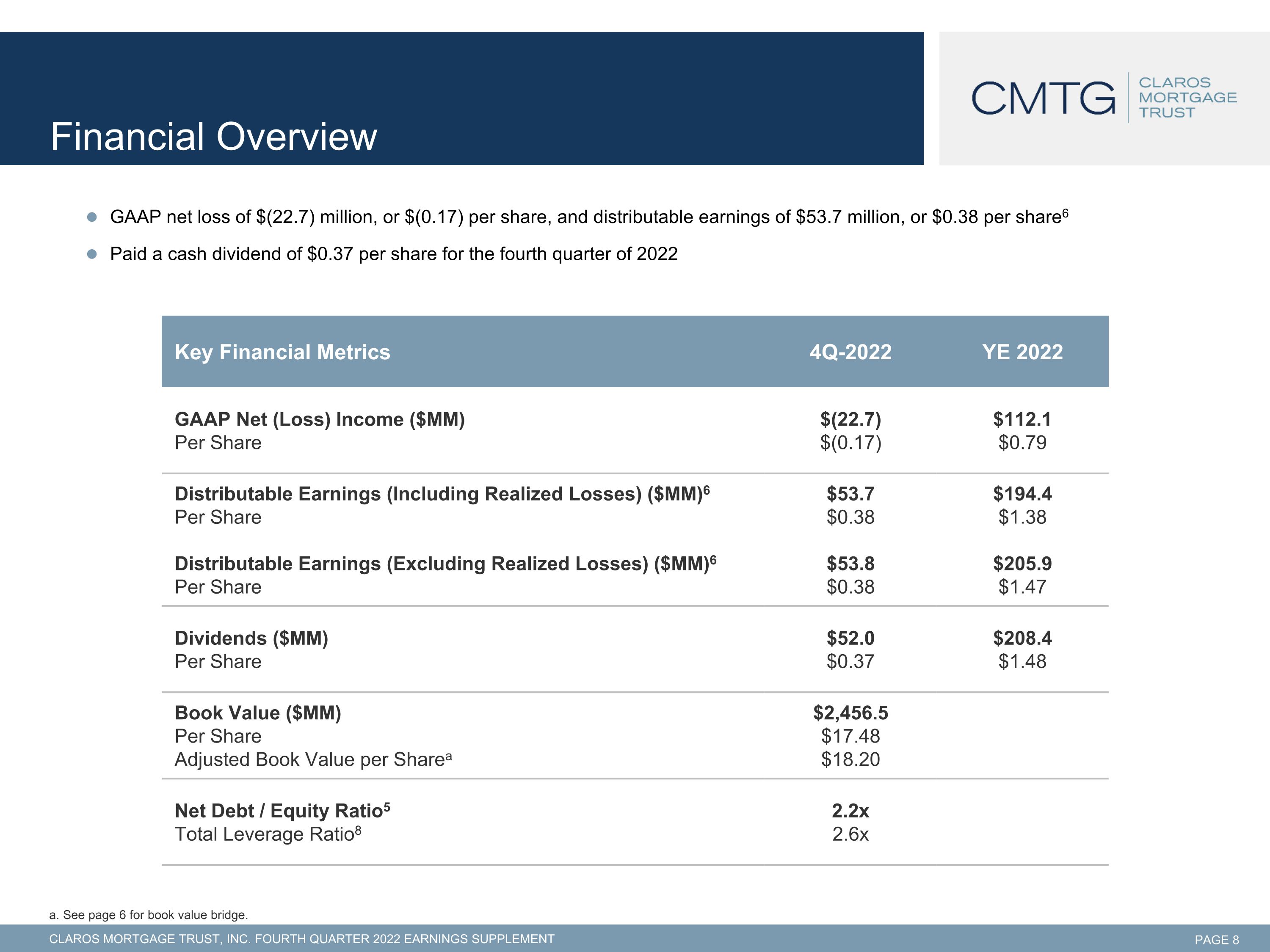

Financial GAAP net loss of $(22.7) million, or $(0.17) per share; distributable earnings of $53.7 million, or $0.38 per share6 Paid a cash dividend of $0.37 per share for the fourth quarter of 2022 NYC REO investment contributed $0.03 per share to distributable earnings for the quarter Assuming a static portfolio as of 4Q, a 100-basis point increase in rates would generate incremental annual net interest income of $0.11 per share14 Originations In 2022, originated $3.5 billion in loan commitments across 32 investments (average loan size of $108 million), of which $2.0 billion was funded at closing In Q4, originated $359 million in loan commitments across three investments (average loan size of $120 million), of which $34 million was funded at closing 39% backed by life sciences, 31% by multi-family, and 30% by industrial properties Investment Portfolio3,7 $7.4 billion loan portfolio of which 98% are floating-rate and 97% are senior loans15 Multi-family exposure of 41% New York exposure of 23% Weighted average portfolio LTV of 68.2% increased slightly from 67.8% at September 30, 20224 In Q4, fundings made on pre-existing loan portfolio totaled $198 million Loans with a risk rating of 4 or higher increased to 17% as of December 31, 2022, from 11% at September 30, 2022 $75 million in loan repayments during the quarter (includes $33 million for three full repayments) Liquidity and Capitalization At year end, strong liquidity position of $520 million consisting of $306 million of cash and $213 million of approved and undrawn credit capacity During Q4, closed a $1 billion financing facility; $258 million outstanding at December 31, 2022 Warehouse financing capacity totaled $5.0 billion across six counterparties; $4.0 billion outstanding at December 31, 2022 Entered into two asset-specific financings totaling $112 million of commitments; $18 million outstanding at December 31, 2022 Net debt / equity ratio of 2.2x and total leverage ratio of 2.6x as of December 31, 2022, compared to 2.0x / 2.4x at September 30, 20225,8 During Q4, repurchased $7.5 million of common shares at a weighted average price of $12.68 per share during the quarter Fourth Quarter 2022 Highlights (cont’d) See Endnotes in the Appendix.

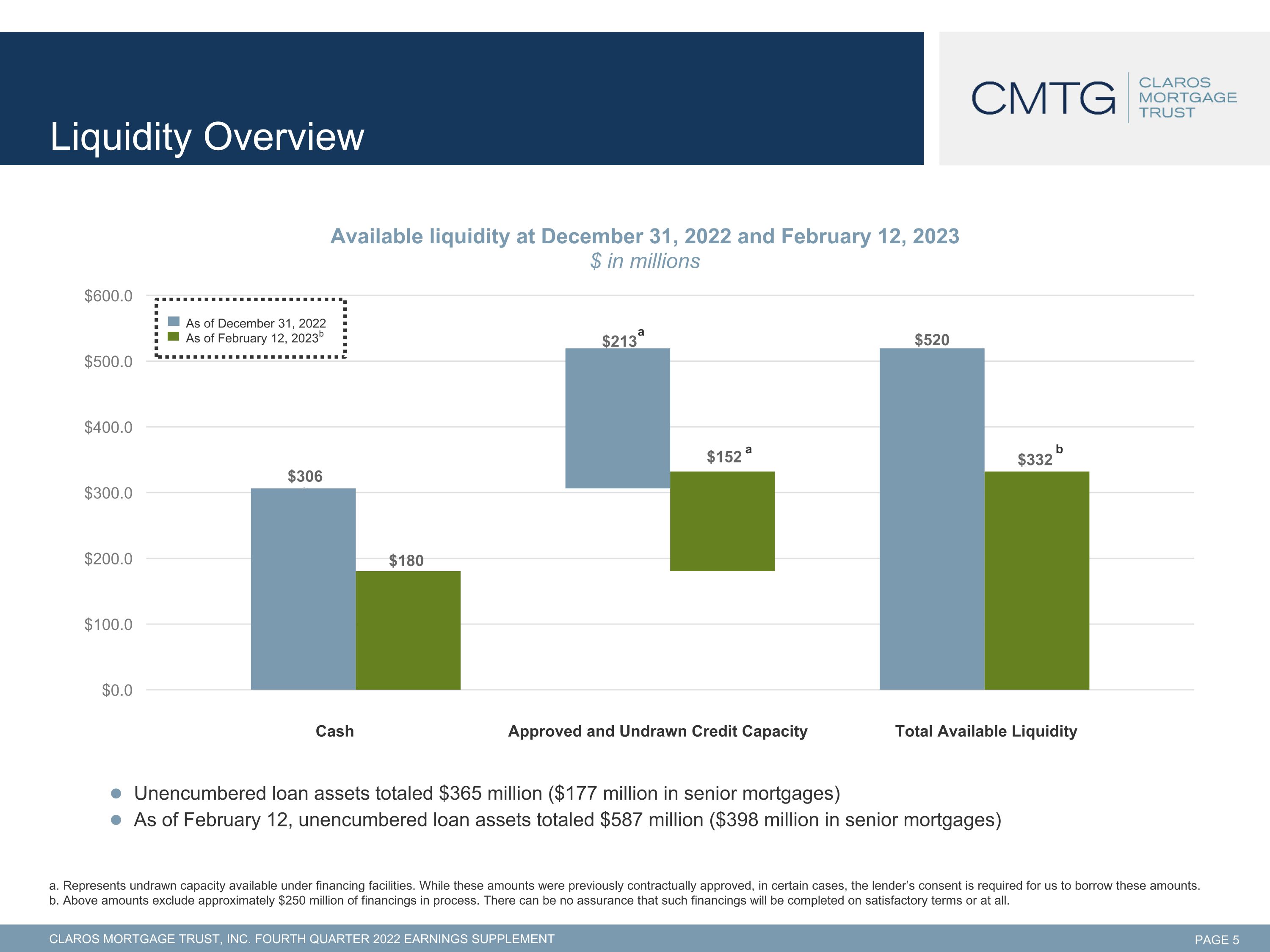

As of December 31, 2022 As of February 12, 2023 a Liquidity Overview a. Represents undrawn capacity available under financing facilities. While these amounts were previously contractually approved, in certain cases, the lender’s consent is required for us to borrow these amounts. b. Above amounts exclude approximately $250 million of financings in process. There can be no assurance that such financings will be completed on satisfactory terms or at all. Cash Approved and Undrawn Credit Capacity Total Available Liquidity Unencumbered loan assets totaled $365 million ($177 million in senior mortgages) As of February 12, unencumbered loan assets totaled $587 million ($398 million in senior mortgages) a b b

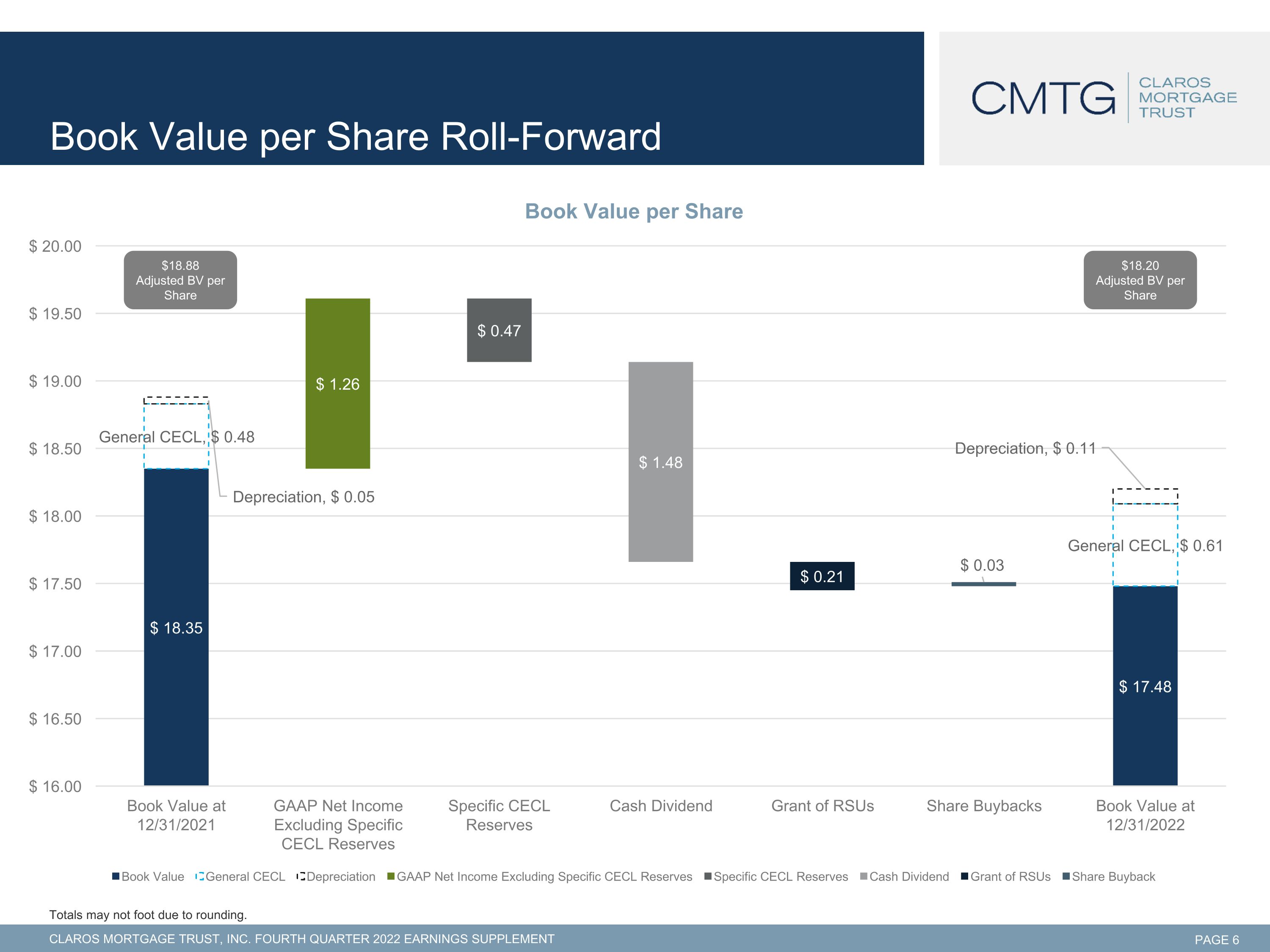

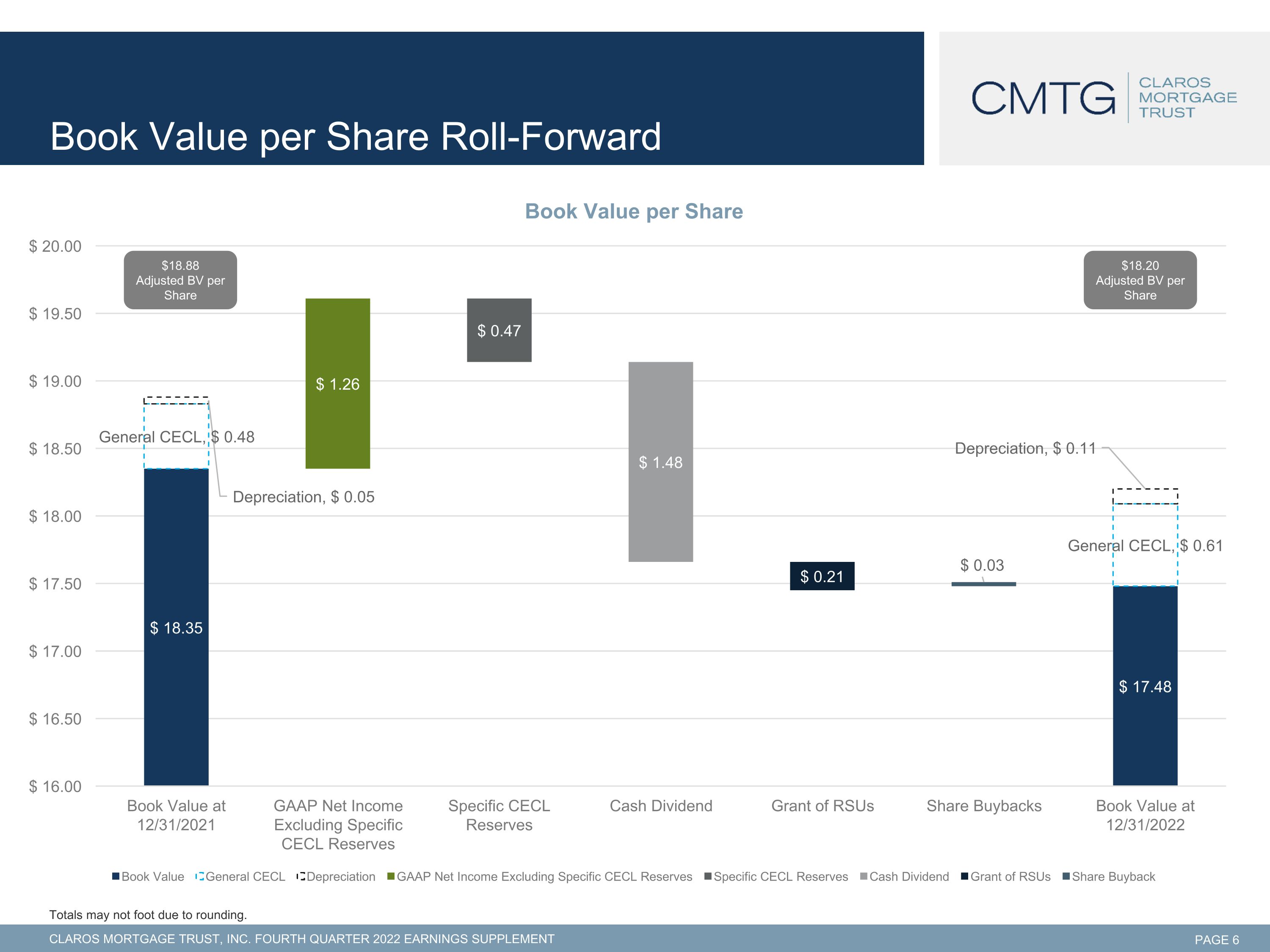

Book Value per Share Roll-Forward Totals may not foot due to rounding. $18.88 Adjusted BV per Share $18.20 Adjusted BV per Share

Highlights9 Originated approximately $359 million of loan commitments across three investments (average loan size of $120 million), of which $34 million was funded at closing 39% backed by life sciences, 31% by multi-family, and 30% by industrial properties 100% of new loan originations were senior, floating-rate Weighted average coupon of SOFR + 6.0% Weighted average LTV of 57.5% Investment Details $140.0 million loan for the pre-development of a life sciences site located in Boston, MA $112.1 million loan for the development of a 398-unit, multi-family property in Seattle, WA $106.5 million loan for the development of an 893K square foot leasehold industrial park located in Reno, NV Fourth Quarter 2022 Originations Overview

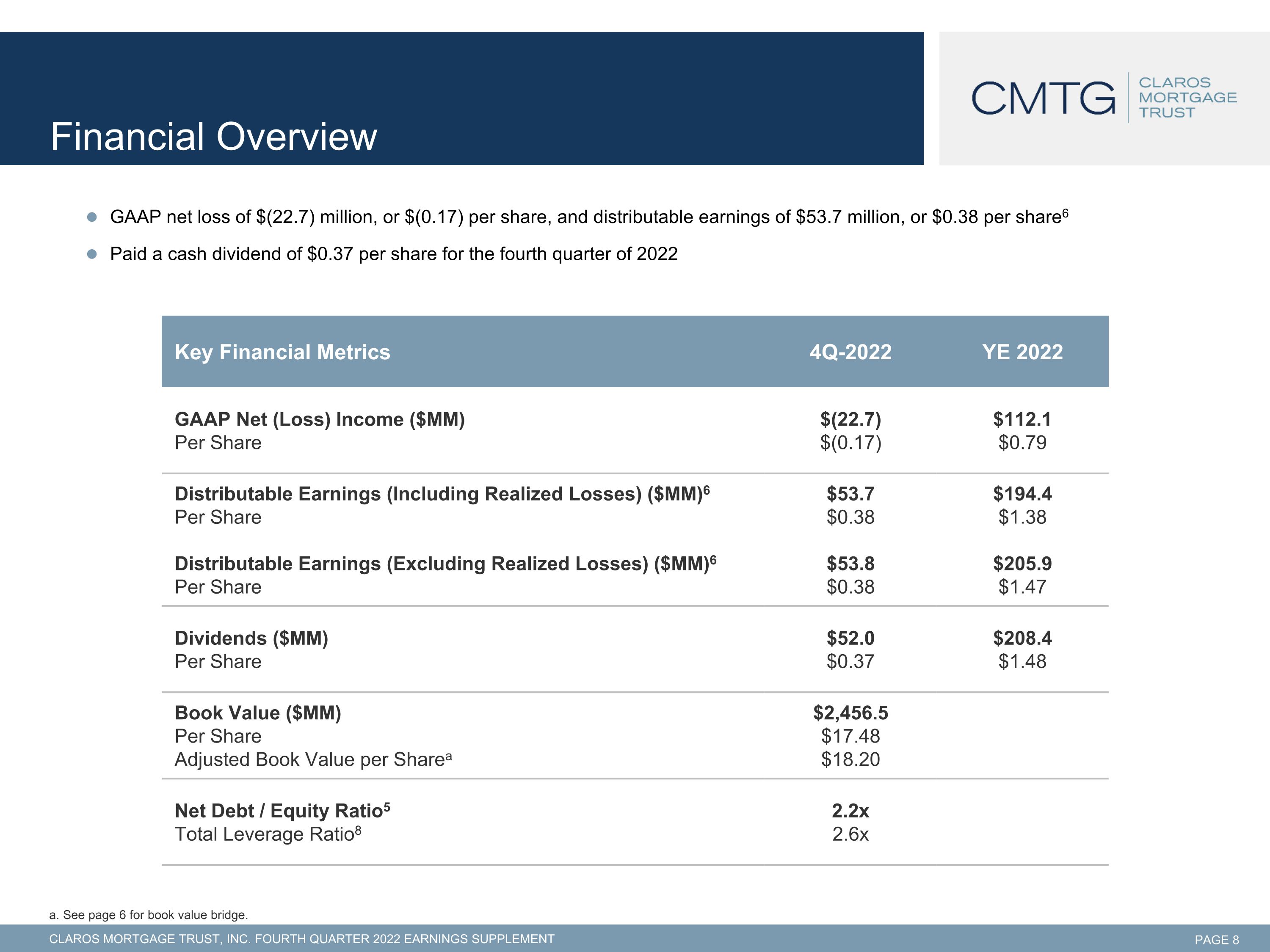

Financial Overview a. See page 6 for book value bridge. Key Financial Metrics 4Q-2022 YE 2022 GAAP Net (Loss) Income ($MM) Per Share $(22.7) $(0.17) $112.1 $0.79 Distributable Earnings (Including Realized Losses) ($MM)6 Per Share Distributable Earnings (Excluding Realized Losses) ($MM)6 Per Share $53.7 $0.38 $53.8 $0.38 $194.4 $1.38 $205.9 $1.47 Dividends ($MM) Per Share $52.0 $0.37 $208.4 $1.48 Book Value ($MM) Per Share Adjusted Book Value per Sharea $2,456.5 $17.48 $18.20 Net Debt / Equity Ratio5 Total Leverage Ratio8 2.2x 2.6x GAAP net loss of $(22.7) million, or $(0.17) per share, and distributable earnings of $53.7 million, or $0.38 per share6 Paid a cash dividend of $0.37 per share for the fourth quarter of 2022

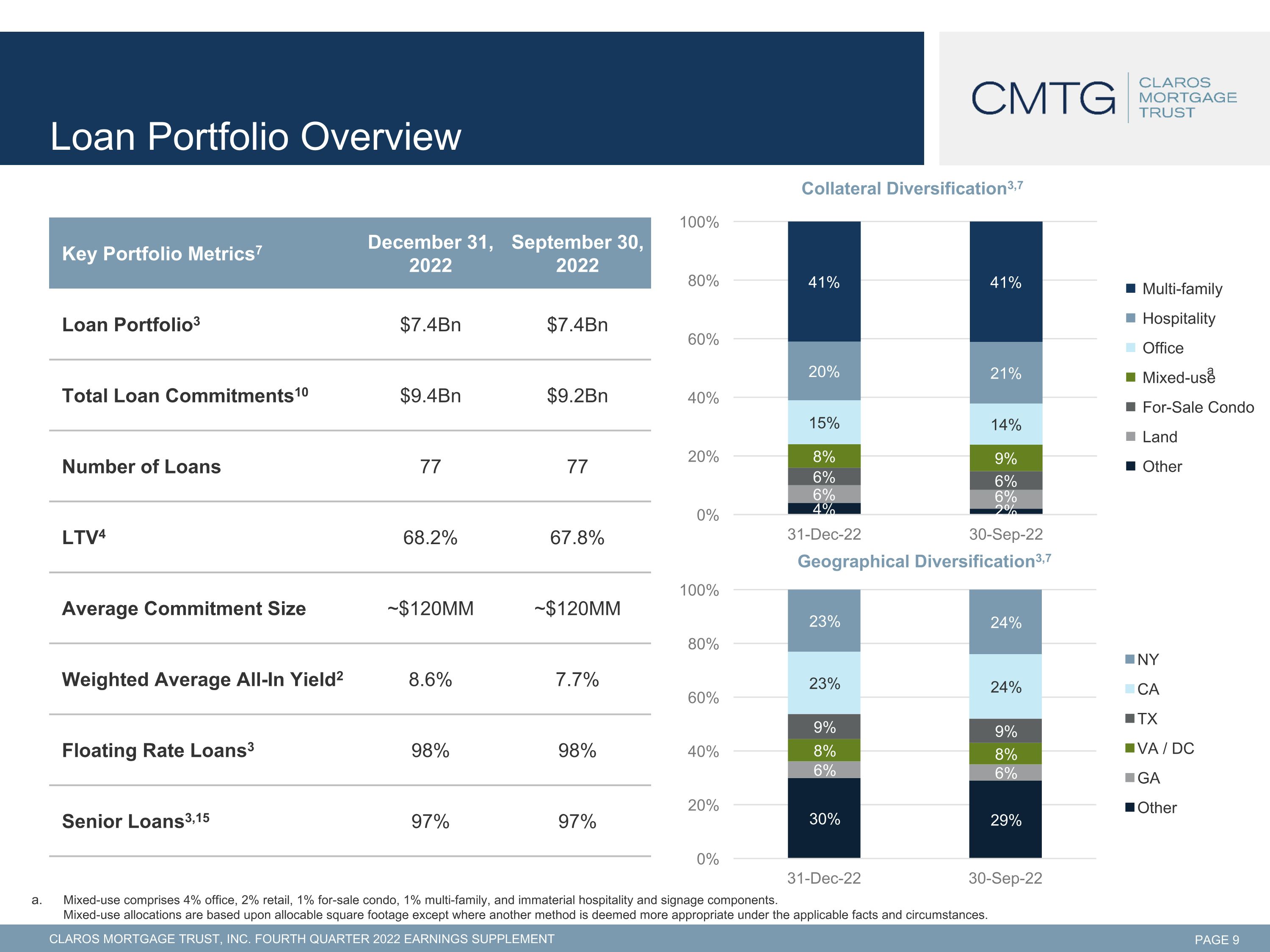

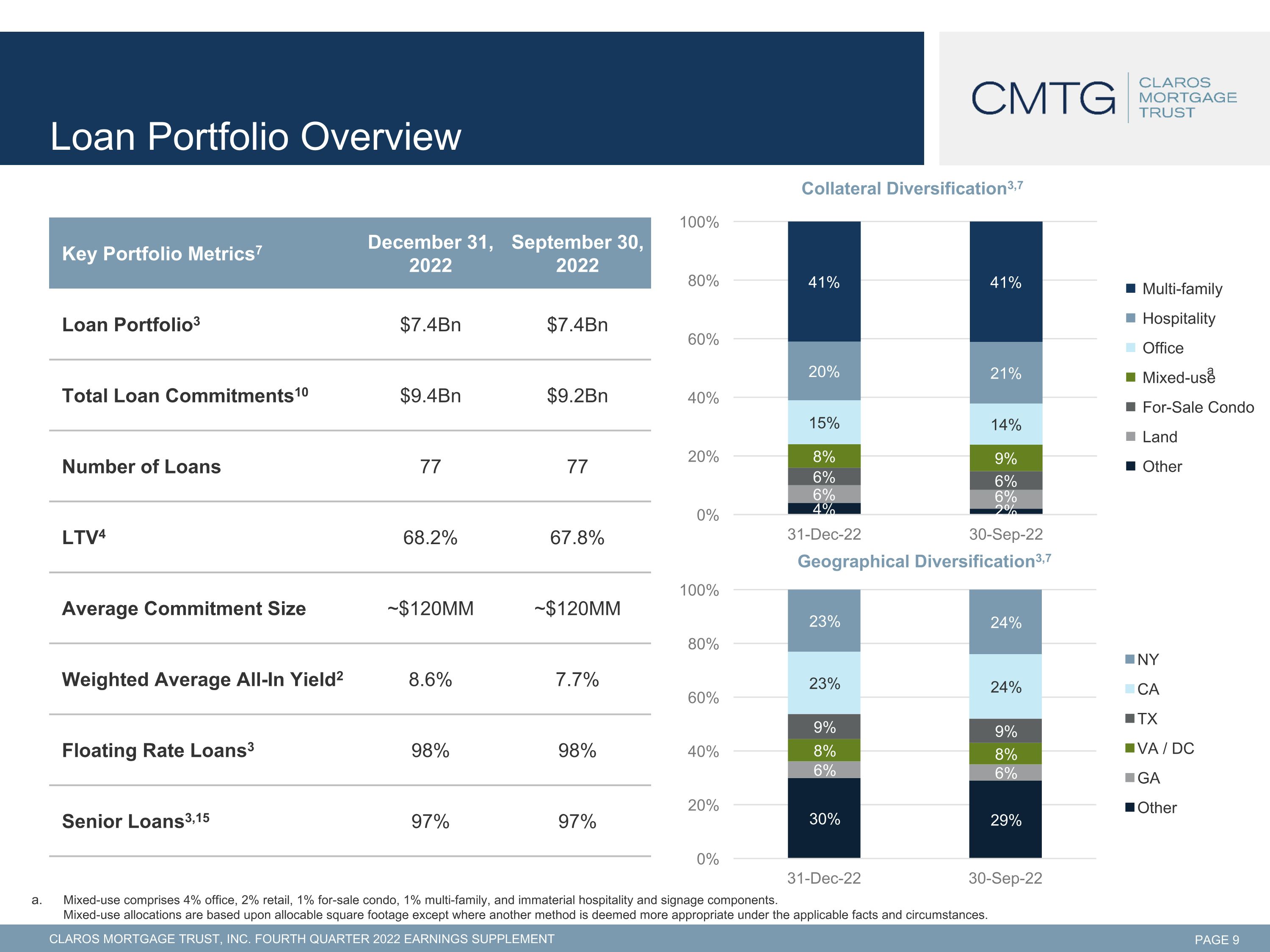

Loan Portfolio Overview Key Portfolio Metrics7 December 31, 2022 September 30, 2022 Loan Portfolio3 $7.4Bn $7.4Bn Total Loan Commitments10 $9.4Bn $9.2Bn Number of Loans 77 77 LTV4 68.2% 67.8% Average Commitment Size ~$120MM ~$120MM Weighted Average All-In Yield2 8.6% 7.7% Floating Rate Loans3 98% 98% Senior Loans3,15 97% 97% a Mixed-use comprises 4% office, 2% retail, 1% for-sale condo, 1% multi-family, and immaterial hospitality and signage components. Mixed-use allocations are based upon allocable square footage except where another method is deemed more appropriate under the applicable facts and circumstances.

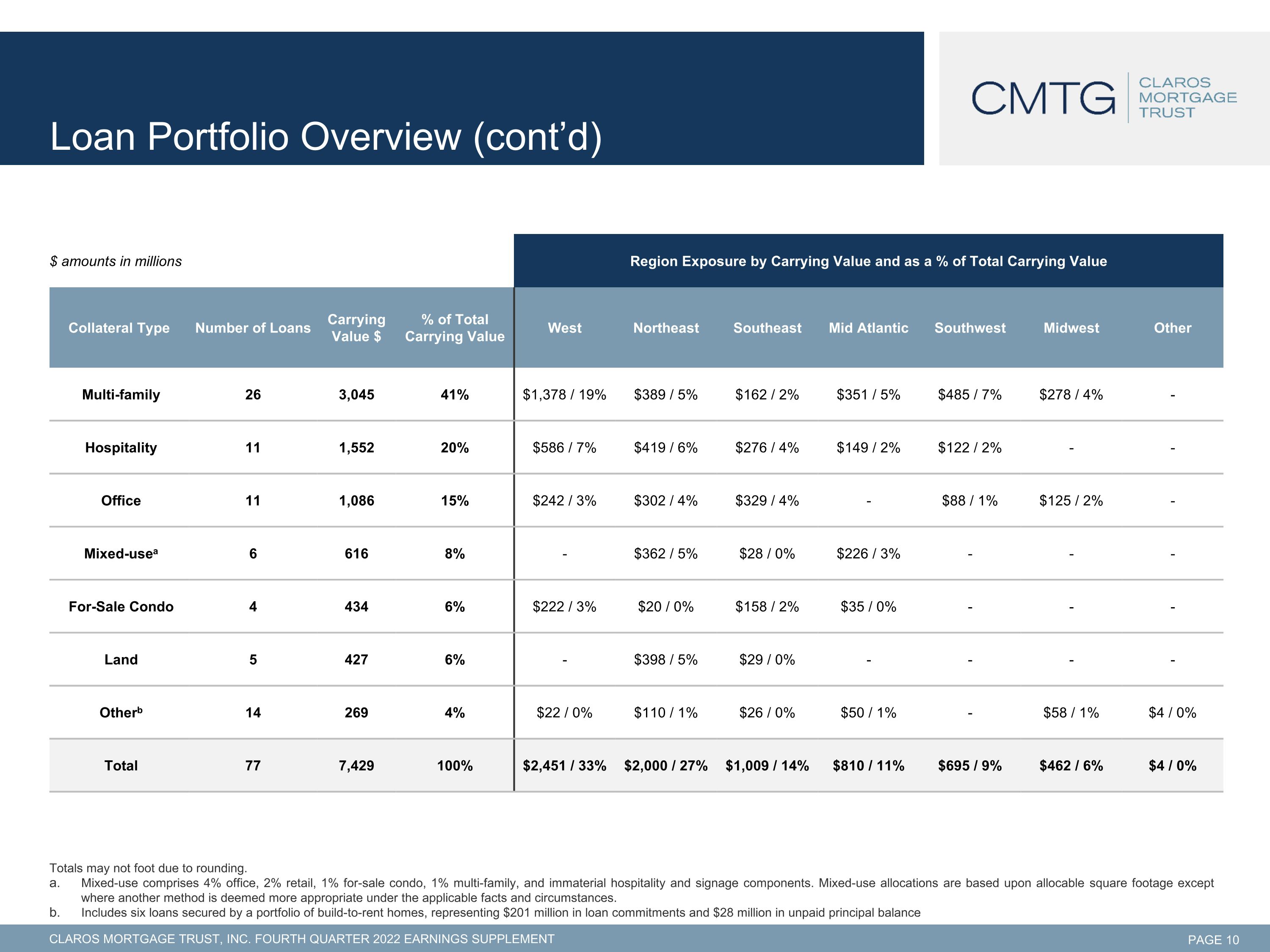

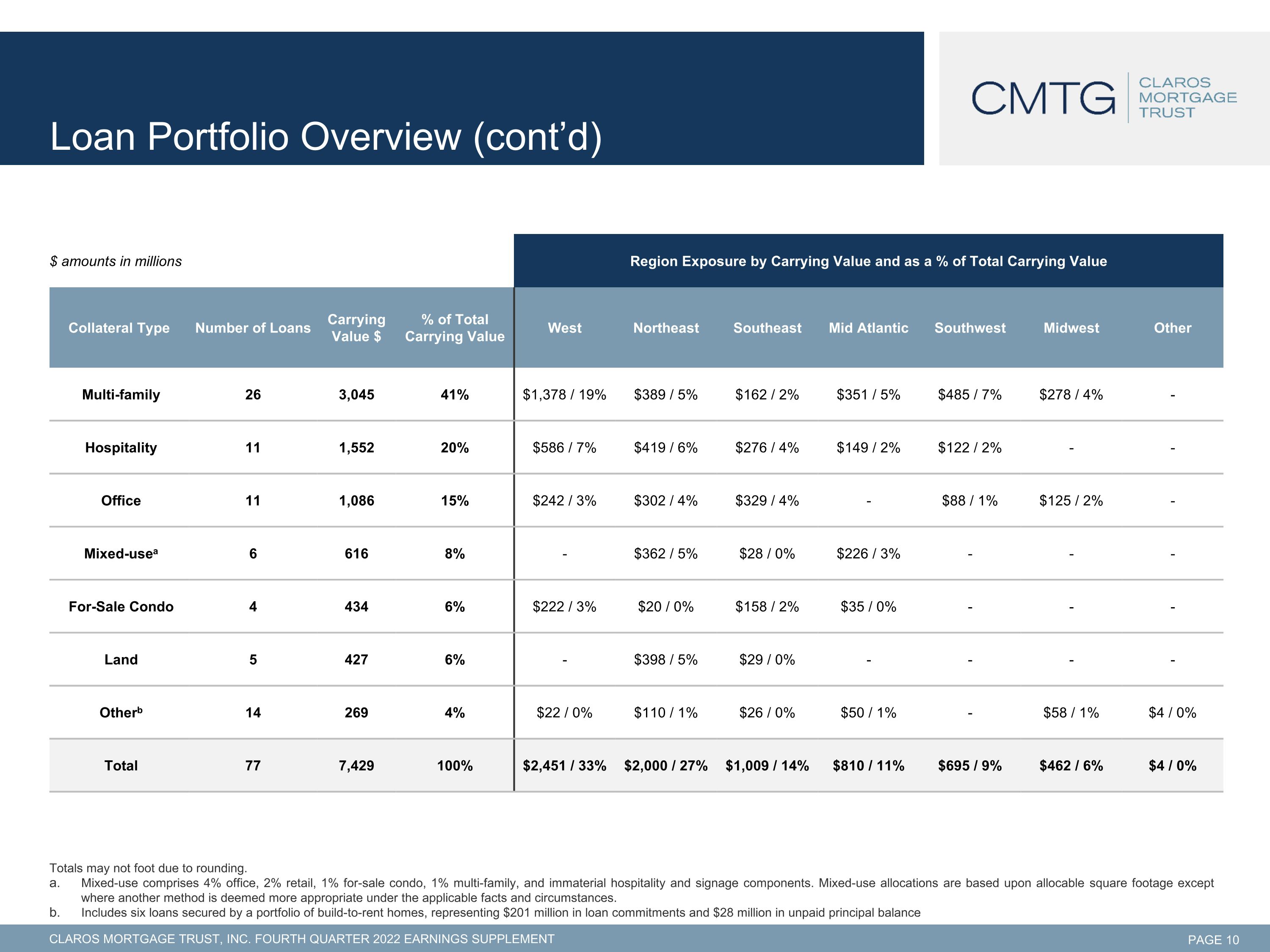

$ amounts in millions Region Exposure by Carrying Value and as a % of Total Carrying Value Collateral Type Number of Loans Carrying Value $ % of Total Carrying Value West Northeast Southeast Mid Atlantic Southwest Midwest Other Multi-family 26 3,045 41% $1,378 / 19% $389 / 5% $162 / 2% $351 / 5% $485 / 7% $278 / 4% - Hospitality 11 1,552 20% $586 / 7% $419 / 6% $276 / 4% $149 / 2% $122 / 2% - - Office 11 1,086 15% $242 / 3% $302 / 4% $329 / 4% - $88 / 1% $125 / 2% - Mixed-usea 6 616 8% - $362 / 5% $28 / 0% $226 / 3% - - - For-Sale Condo 4 434 6% $222 / 3% $20 / 0% $158 / 2% $35 / 0% - - - Land 5 427 6% - $398 / 5% $29 / 0% - - - - Otherb 14 269 4% $22 / 0% $110 / 1% $26 / 0% $50 / 1% - $58 / 1% $4 / 0% Total 77 7,429 100% $2,451 / 33% $2,000 / 27% $1,009 / 14% $810 / 11% $695 / 9% $462 / 6% $4 / 0% Loan Portfolio Overview (cont’d) Totals may not foot due to rounding. Mixed-use comprises 4% office, 2% retail, 1% for-sale condo, 1% multi-family, and immaterial hospitality and signage components. Mixed-use allocations are based upon allocable square footage except where another method is deemed more appropriate under the applicable facts and circumstances. Includes six loans secured by a portfolio of build-to-rent homes, representing $201 million in loan commitments and $28 million in unpaid principal balance

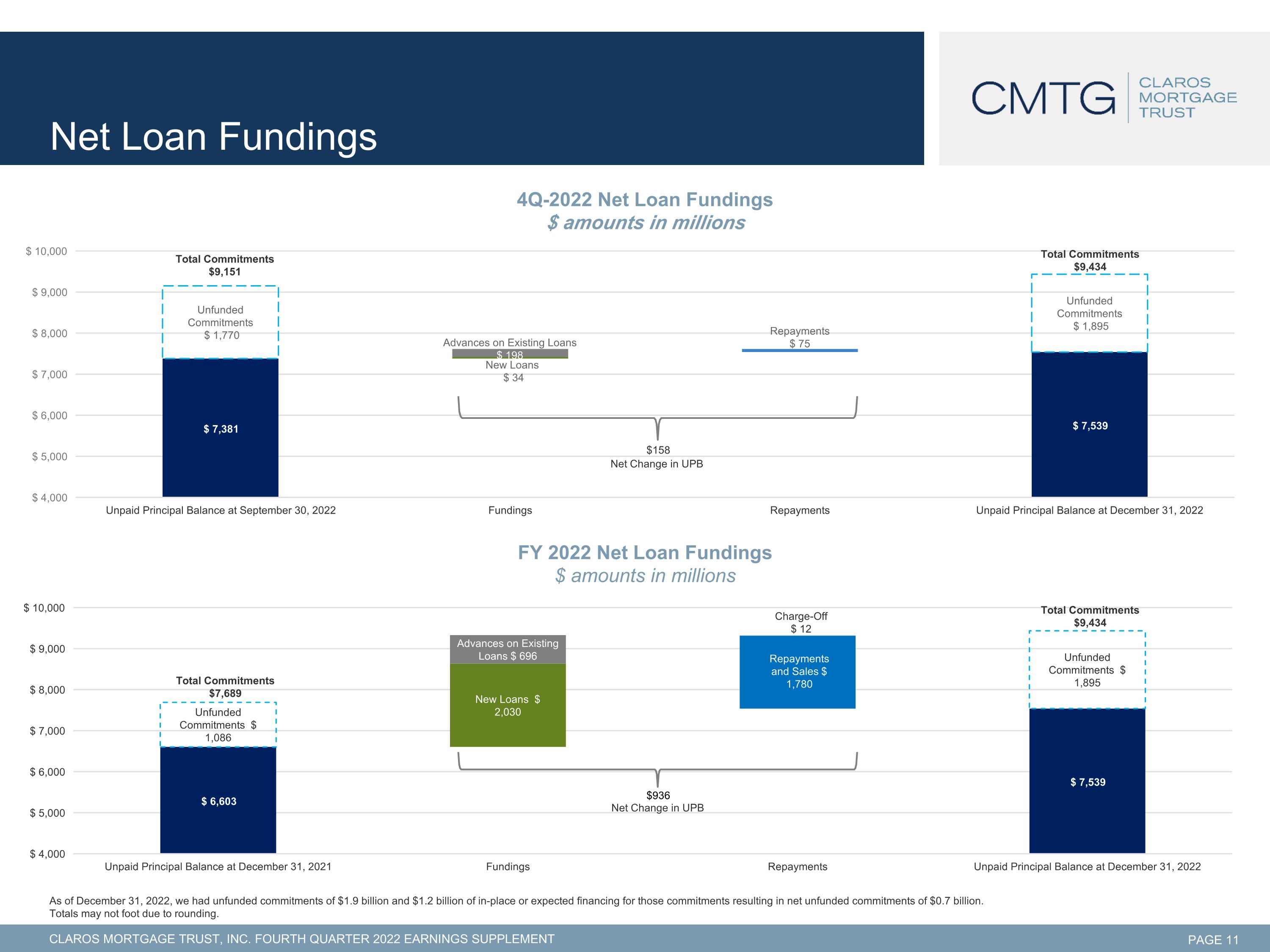

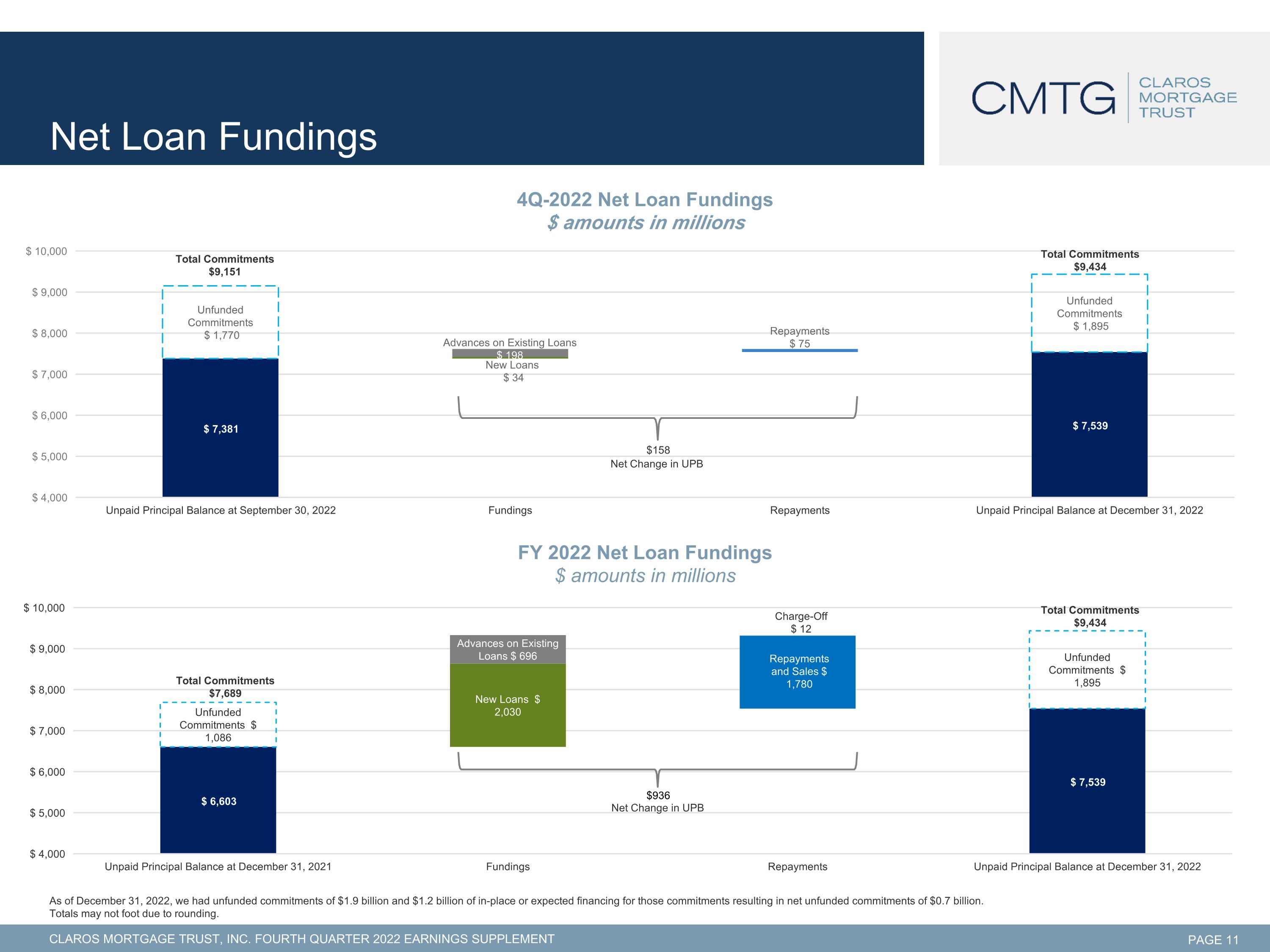

Net Loan Fundings As of December 31, 2022, we had unfunded commitments of $1.9 billion and $1.2 billion of in-place or expected financing for those commitments resulting in net unfunded commitments of $0.7 billion. Totals may not foot due to rounding. Total Commitments $9,151 Total Commitments $9,434 $158 Net Change in UPB Total Commitments $7,689 $936 Net Change in UPB Total Commitments $9,434

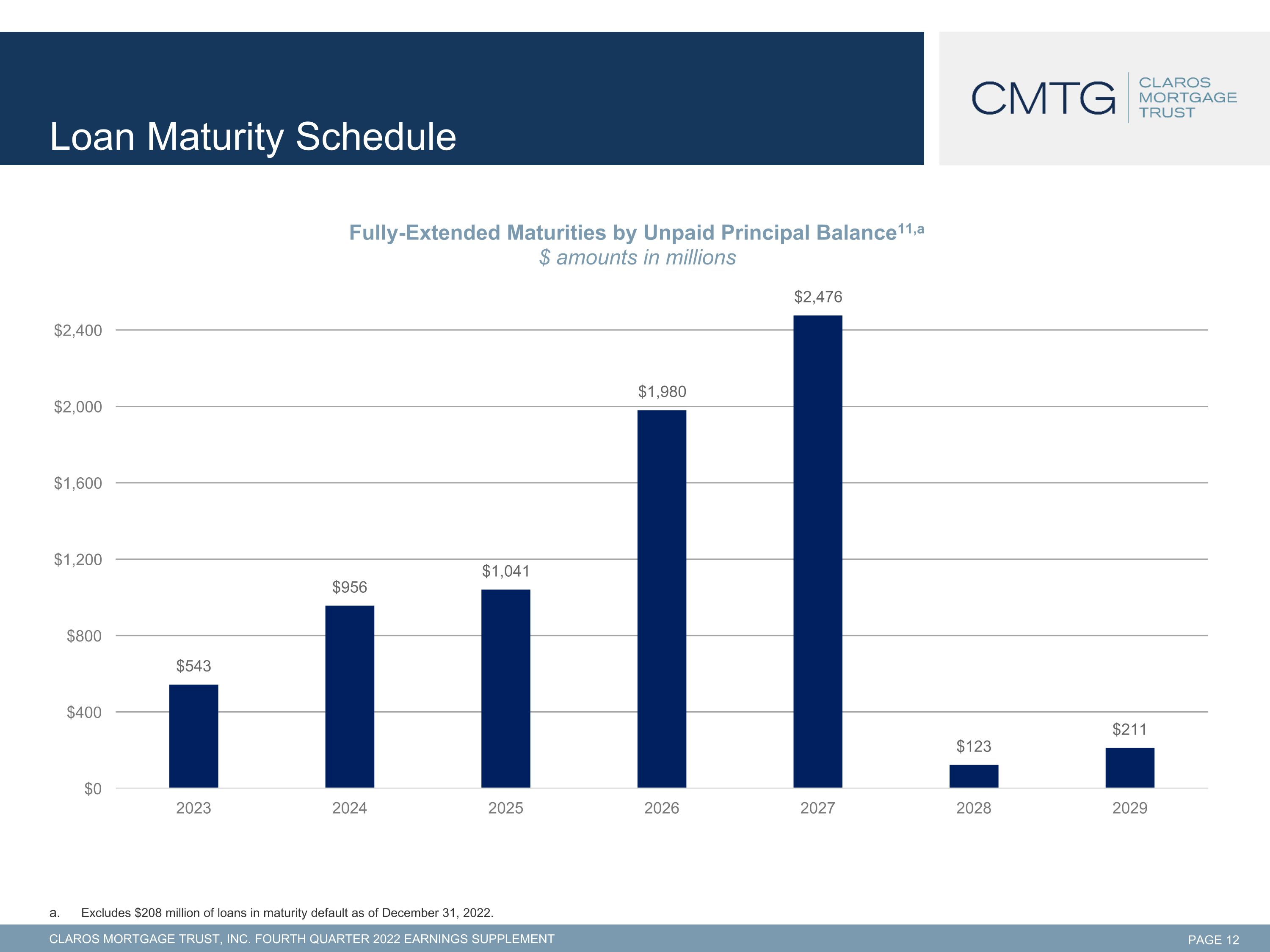

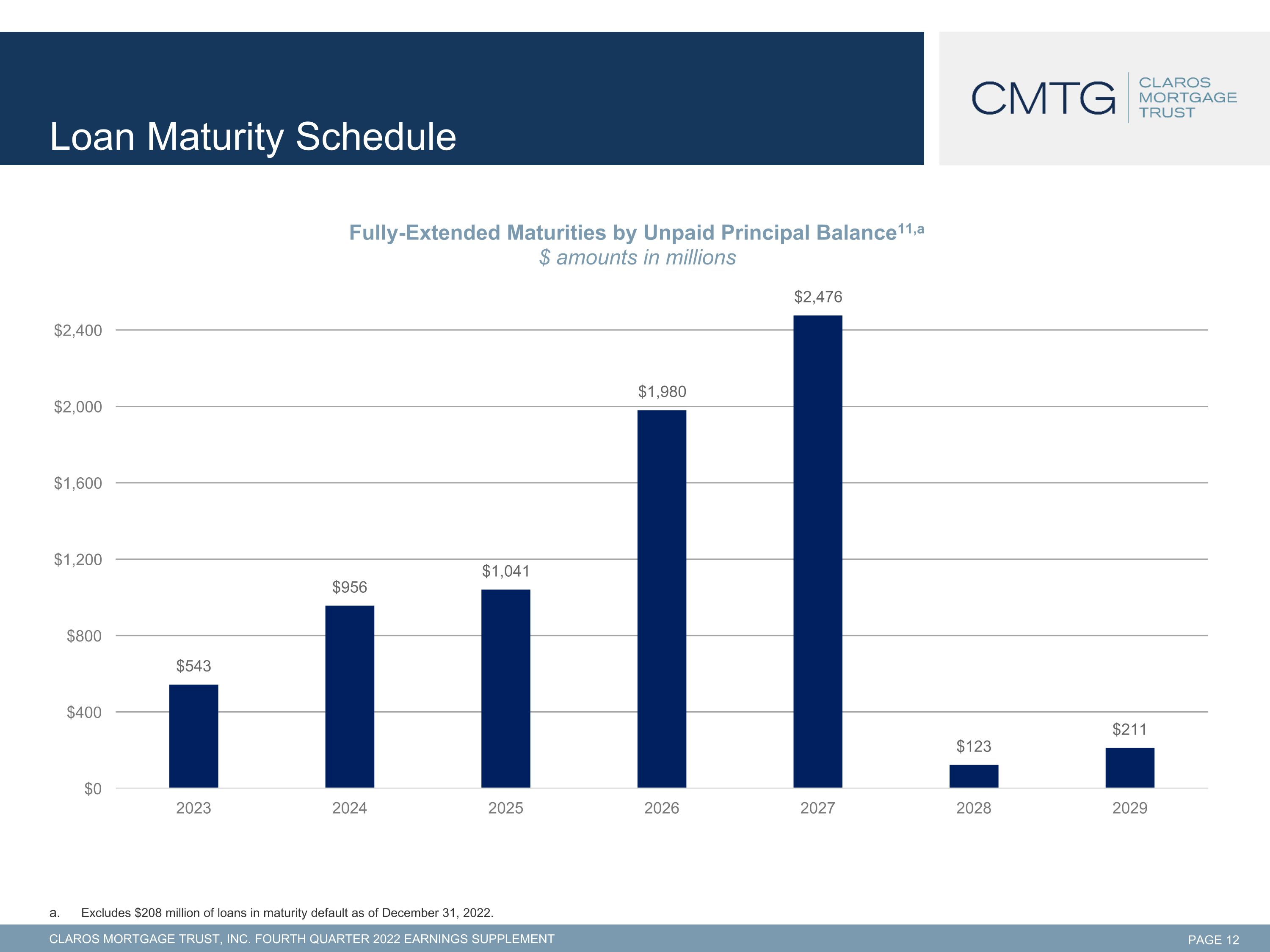

Loan Maturity Schedule Excludes $208 million of loans in maturity default as of December 31, 2022.

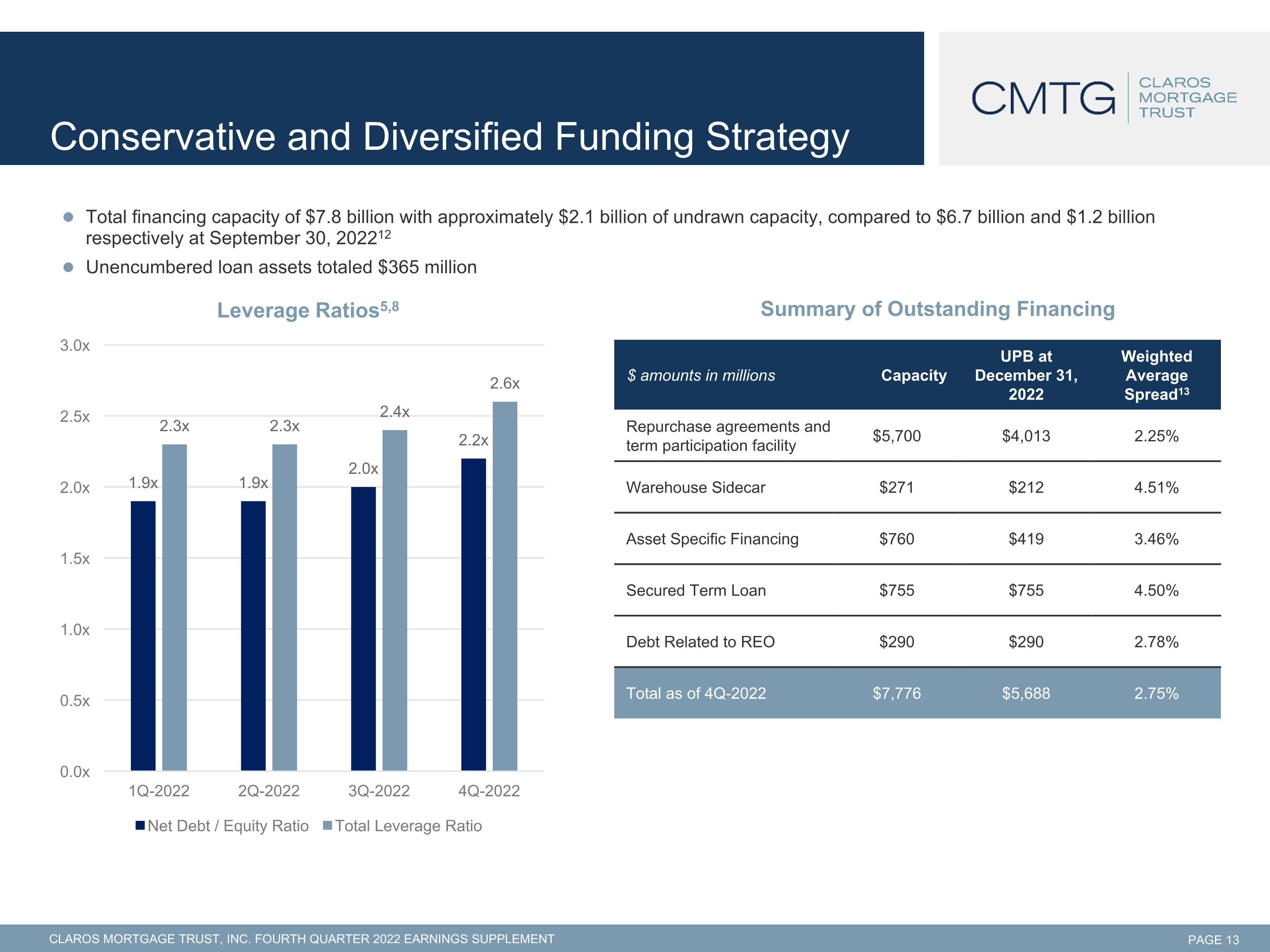

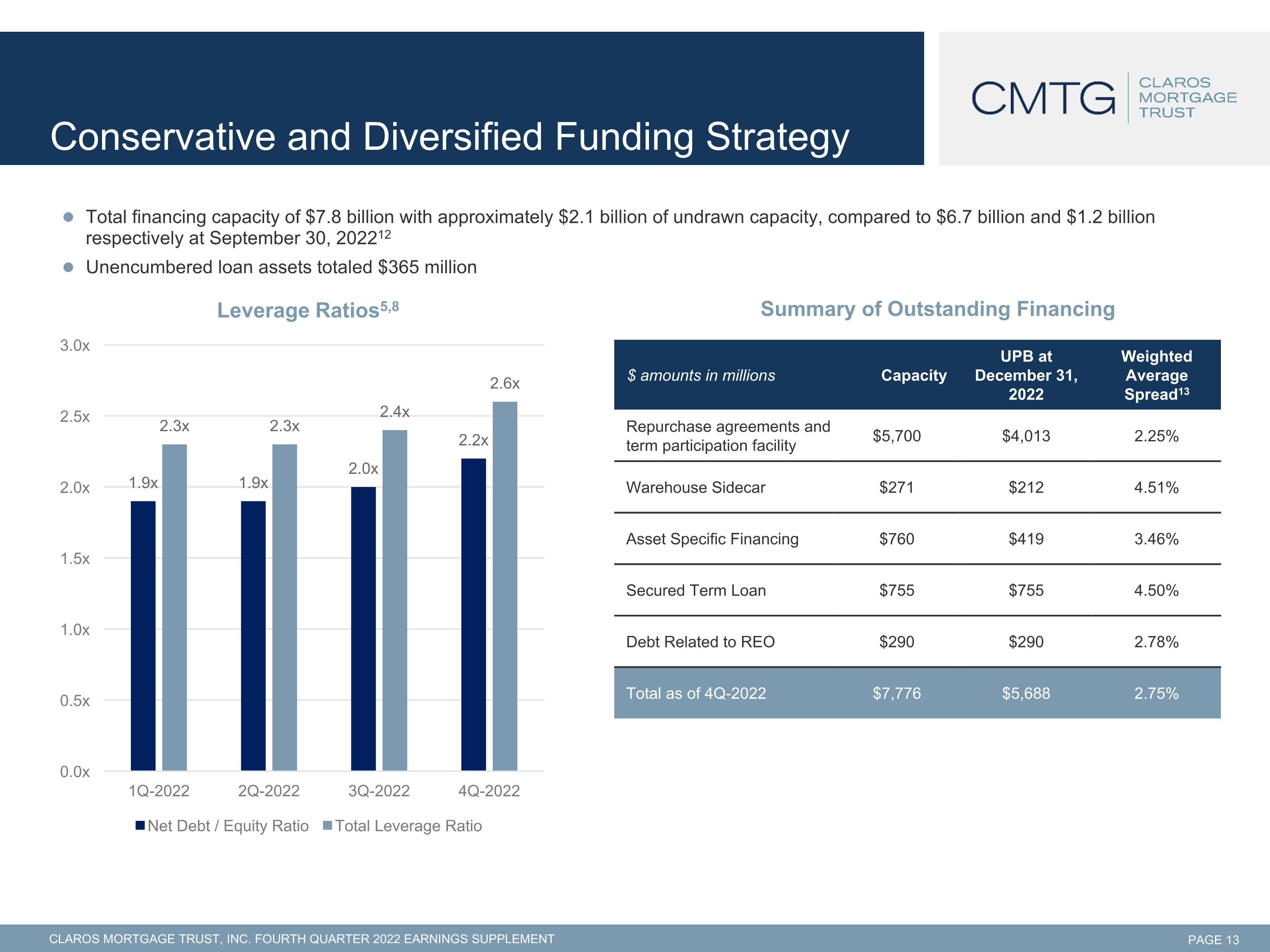

Conservative and Diversified Funding Strategy Total financing capacity of $7.8 billion with approximately $2.1 billion of undrawn capacity, compared to $6.7 billion and $1.2 billion respectively at September 30, 202212 Unencumbered loan assets totaled $365 million Summary of Outstanding Financing $ amounts in millions Capacity UPB at December 31, 2022 Weighted Average Spread13 Repurchase agreements and term participation facility $5,700 $4,013 2.25% Warehouse Sidecar $271 $212 4.51% Asset Specific Financing $760 $419 3.46% Secured Term Loan $755 $755 4.50% Debt Related to REO $290 $290 2.78% Total as of 4Q-2022 $7,776 $5,688 2.75%

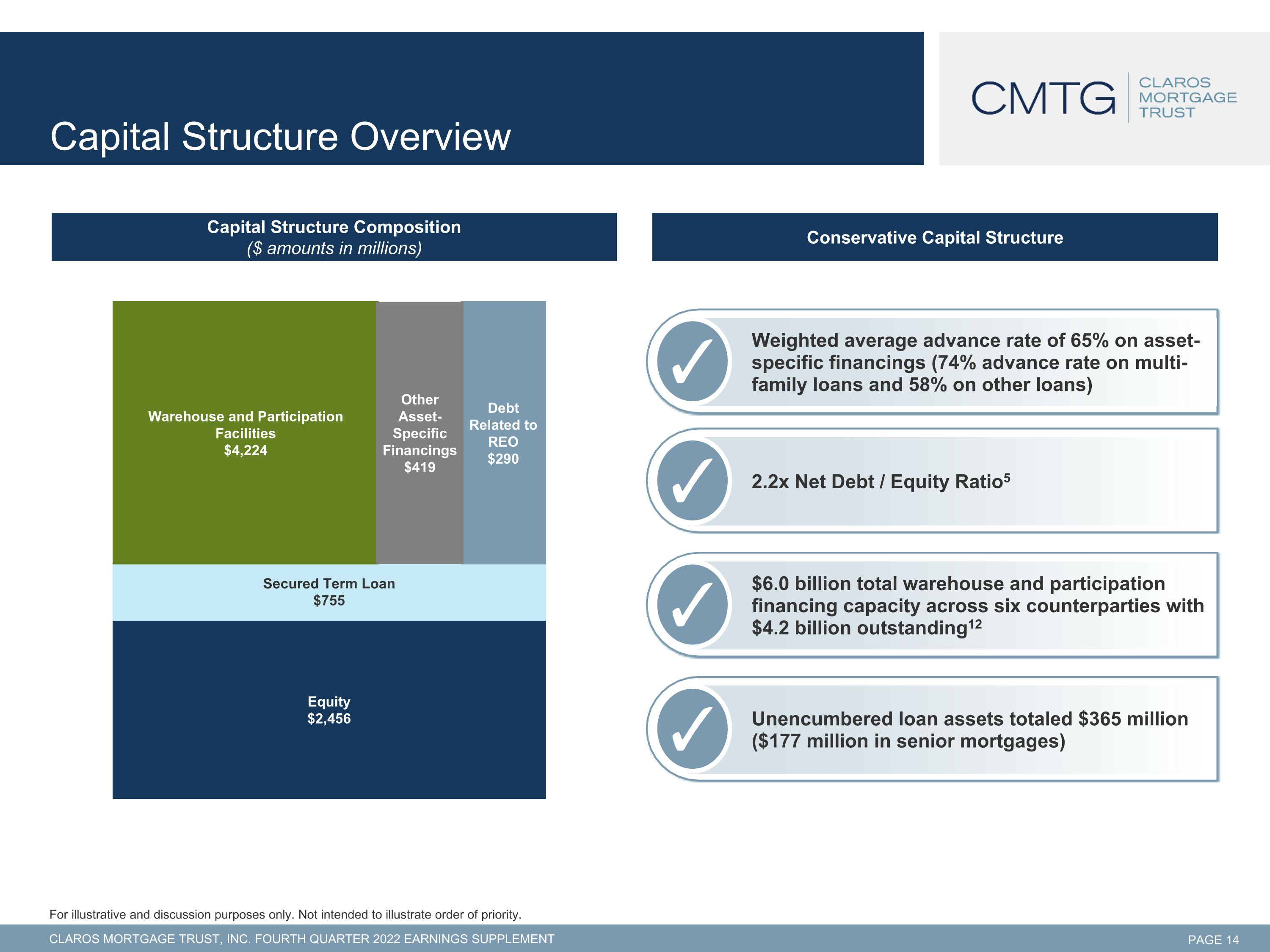

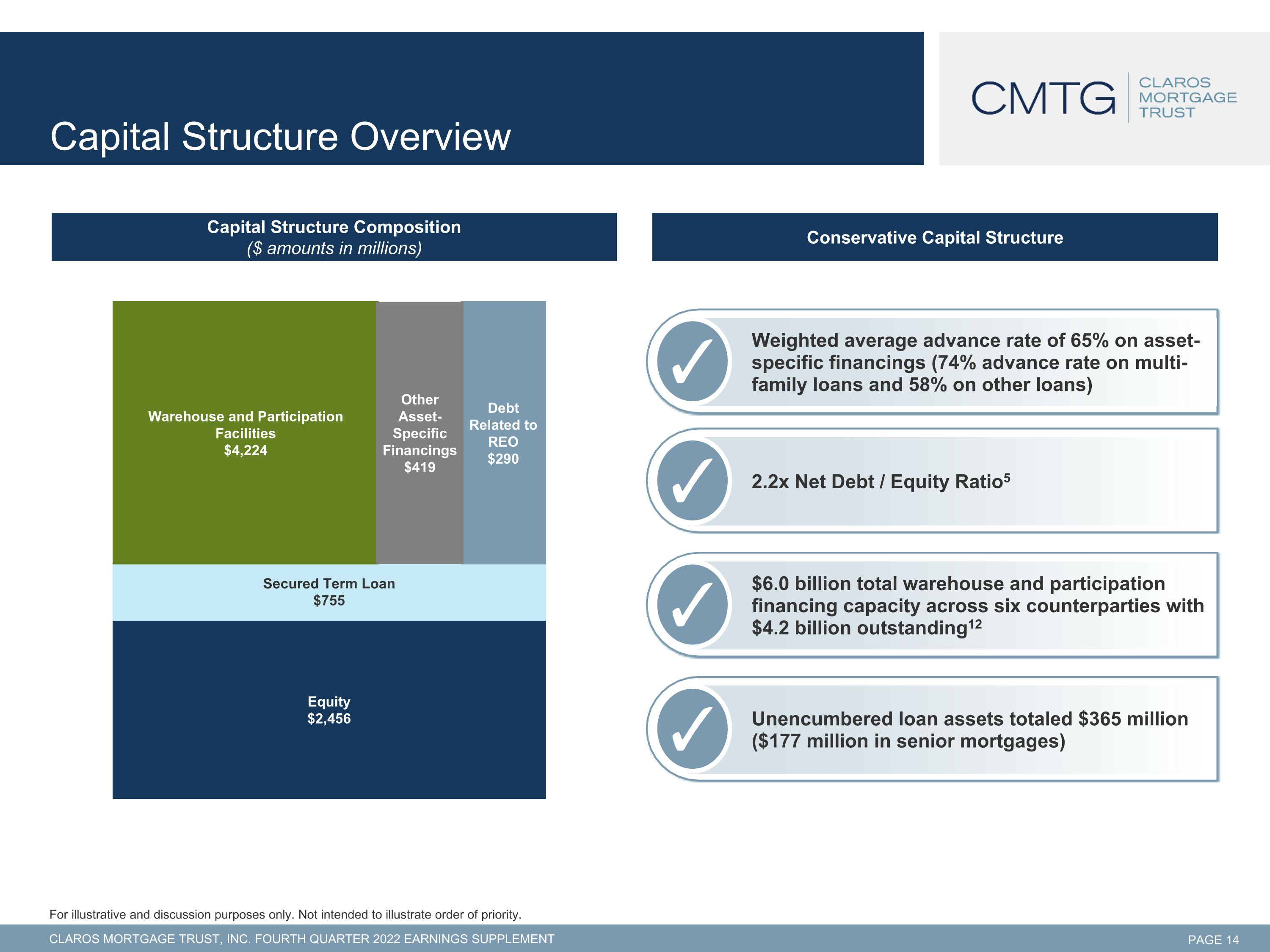

Capital Structure Overview Conservative Capital Structure Capital Structure Composition ($ amounts in millions) 2.2x Net Debt / Equity Ratio5 $6.0 billion total warehouse and participation financing capacity across six counterparties with $4.2 billion outstanding12 Weighted average advance rate of 65% on asset-specific financings (74% advance rate on multi-family loans and 58% on other loans) For illustrative and discussion purposes only. Not intended to illustrate order of priority. Warehouse Facilities $3,919 Other Asset- Specific Financings $375 Debt Related to REO $290 Unencumbered loan assets totaled $365 million ($177 million in senior mortgages) Equity $2,456 Secured Term Loan $755 Warehouse and Participation Facilities $4,224 Debt Related to REO $290 Other Asset-Specific Financings $419

Appendix A The properties above are not representative of all transactions.

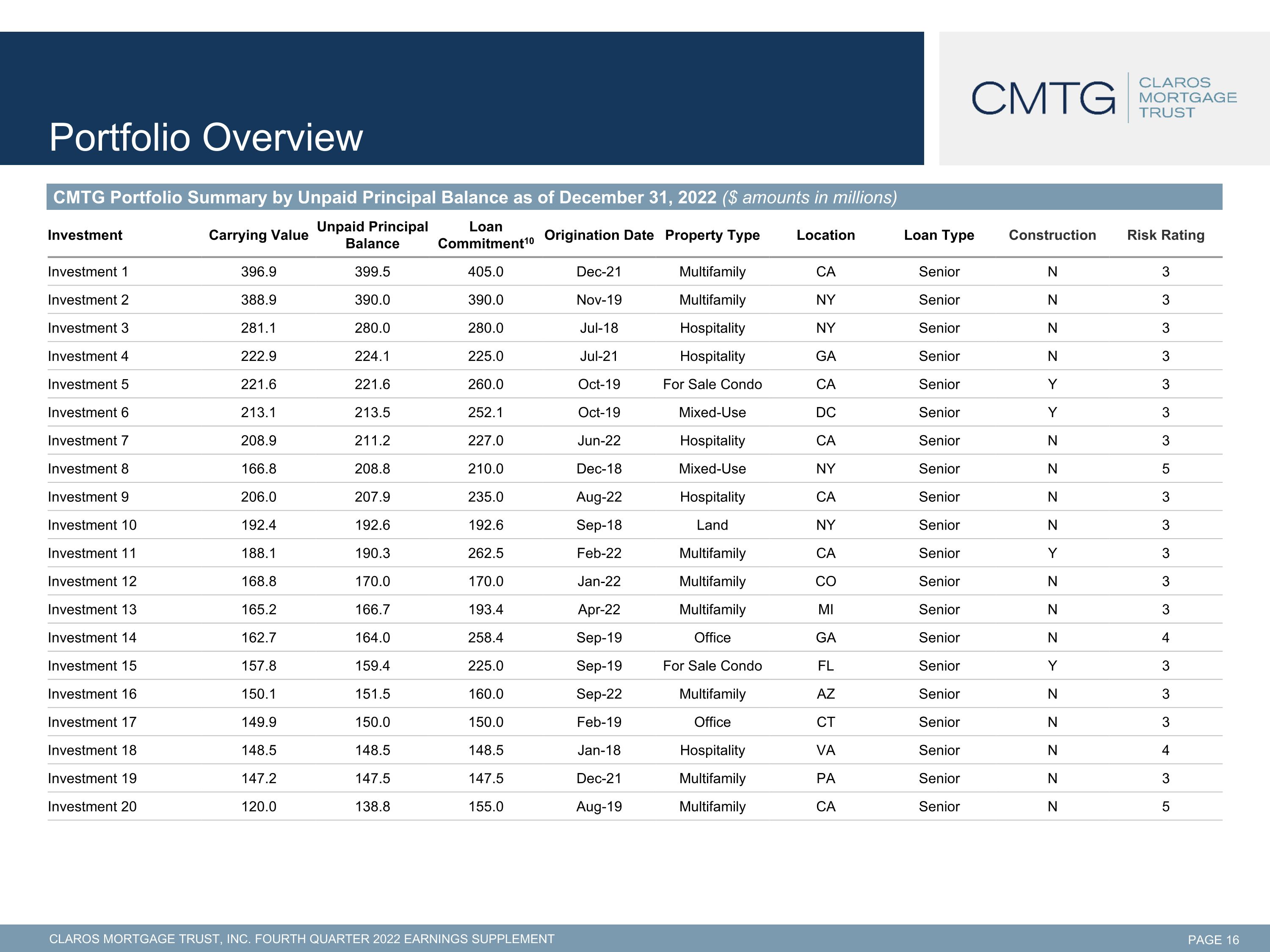

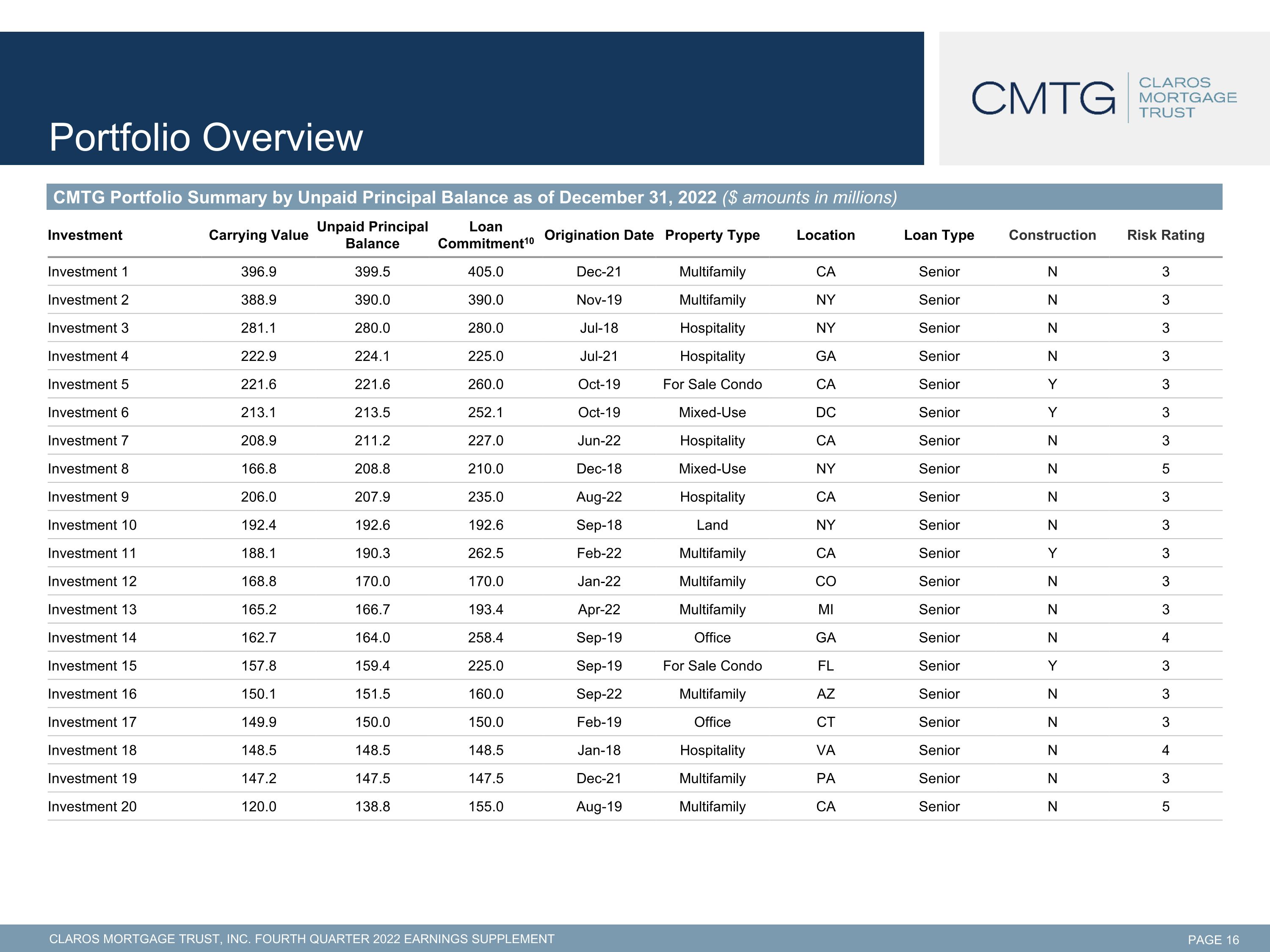

Portfolio Overview Investment Carrying Value Unpaid Principal Balance Loan Commitment10 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 1 396.9 399.5 405.0 Dec-21 Multifamily CA Senior N 3 Investment 2 388.9 390.0 390.0 Nov-19 Multifamily NY Senior N 3 Investment 3 281.1 280.0 280.0 Jul-18 Hospitality NY Senior N 3 Investment 4 222.9 224.1 225.0 Jul-21 Hospitality GA Senior N 3 Investment 5 221.6 221.6 260.0 Oct-19 For Sale Condo CA Senior Y 3 Investment 6 213.1 213.5 252.1 Oct-19 Mixed-Use DC Senior Y 3 Investment 7 208.9 211.2 227.0 Jun-22 Hospitality CA Senior N 3 Investment 8 166.8 208.8 210.0 Dec-18 Mixed-Use NY Senior N 5 Investment 9 206.0 207.9 235.0 Aug-22 Hospitality CA Senior N 3 Investment 10 192.4 192.6 192.6 Sep-18 Land NY Senior N 3 Investment 11 188.1 190.3 262.5 Feb-22 Multifamily CA Senior Y 3 Investment 12 168.8 170.0 170.0 Jan-22 Multifamily CO Senior N 3 Investment 13 165.2 166.7 193.4 Apr-22 Multifamily MI Senior N 3 Investment 14 162.7 164.0 258.4 Sep-19 Office GA Senior N 4 Investment 15 157.8 159.4 225.0 Sep-19 For Sale Condo FL Senior Y 3 Investment 16 150.1 151.5 160.0 Sep-22 Multifamily AZ Senior N 3 Investment 17 149.9 150.0 150.0 Feb-19 Office CT Senior N 3 Investment 18 148.5 148.5 148.5 Jan-18 Hospitality VA Senior N 4 Investment 19 147.2 147.5 147.5 Dec-21 Multifamily PA Senior N 3 Investment 20 120.0 138.8 155.0 Aug-19 Multifamily CA Senior N 5 CMTG Portfolio Summary by Unpaid Principal Balance as of December 31, 2022 ($ amounts in millions)

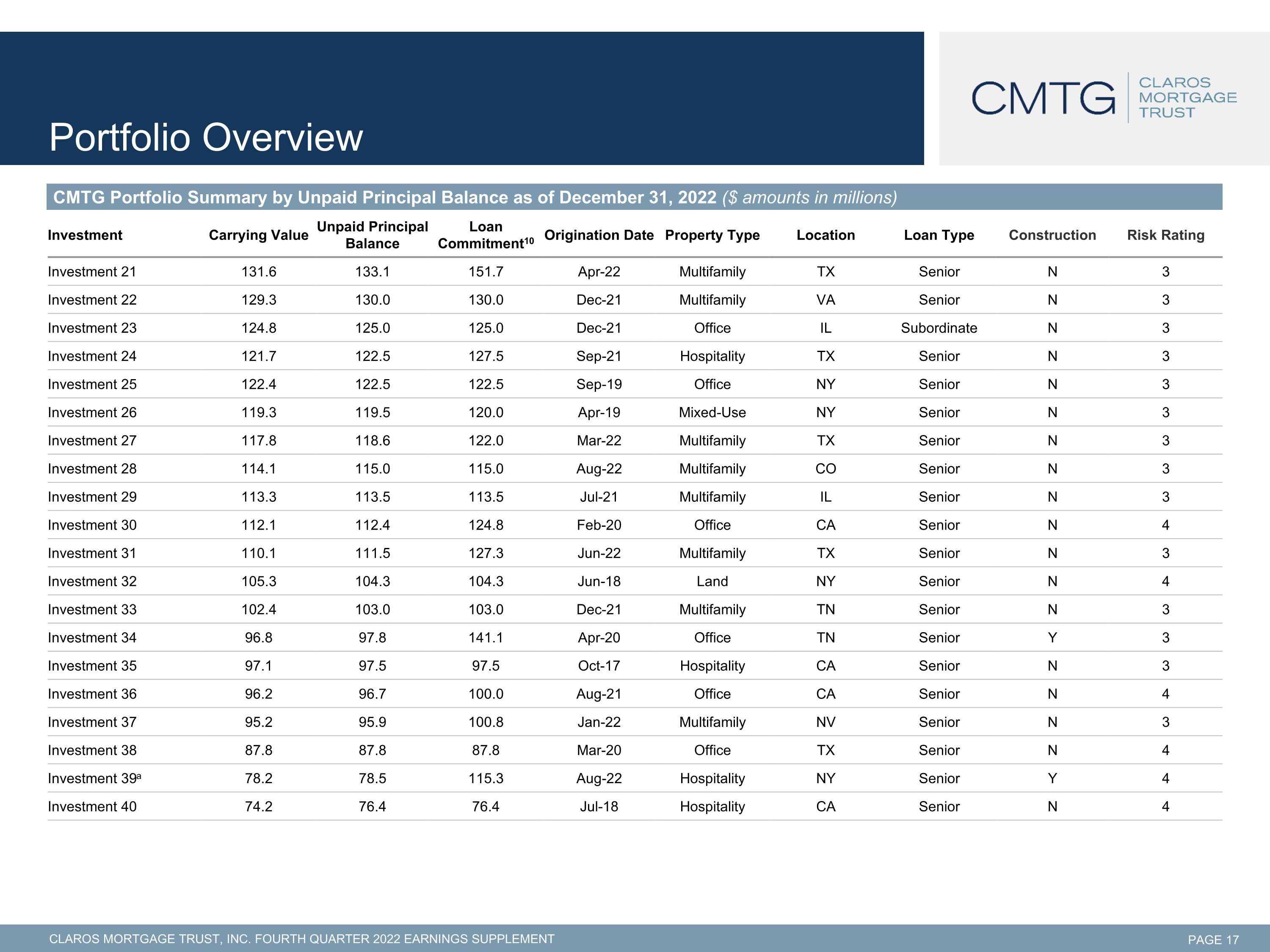

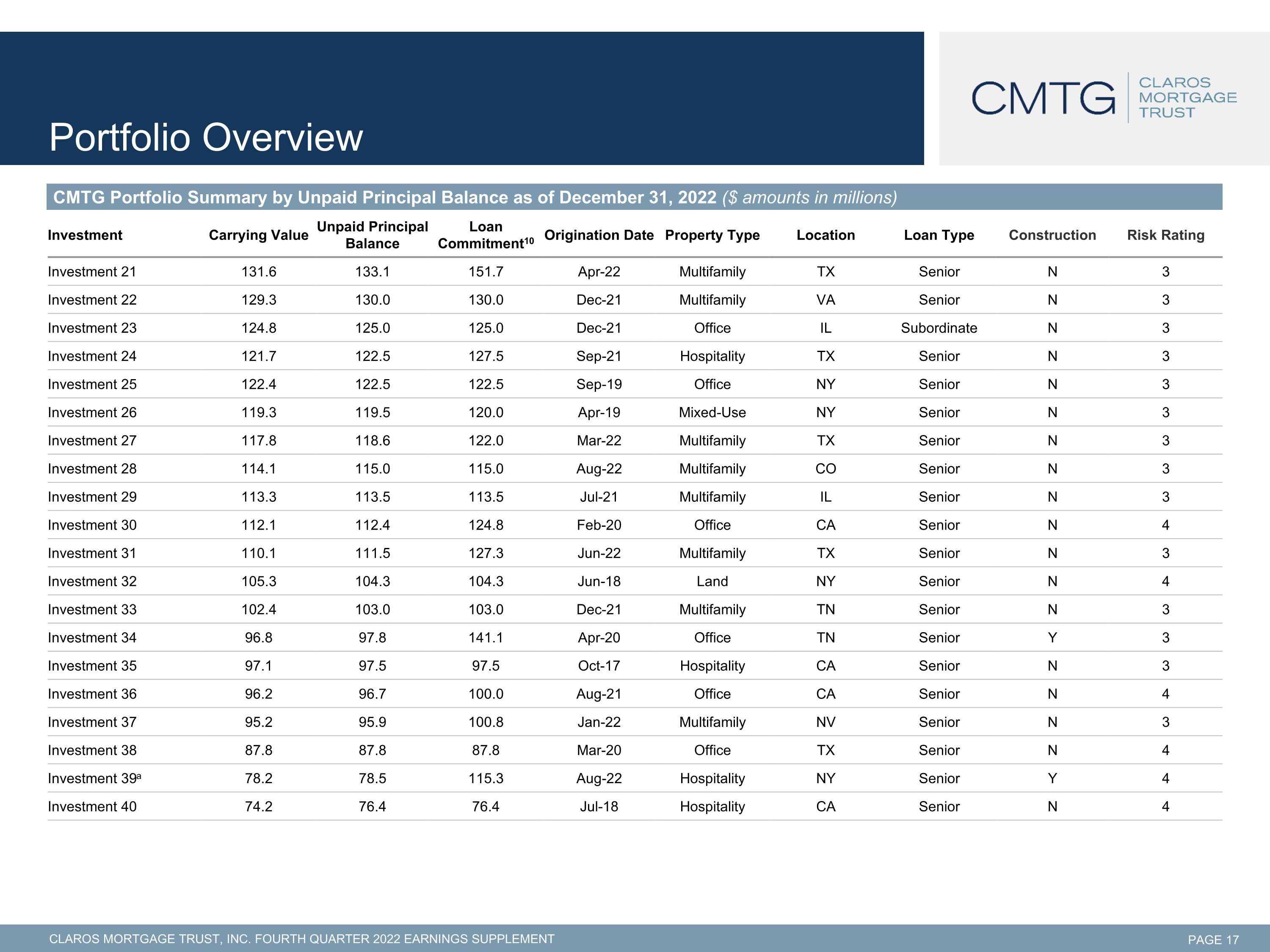

Portfolio Overview Investment Carrying Value Unpaid Principal Balance Loan Commitment10 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 21 131.6 133.1 151.7 Apr-22 Multifamily TX Senior N 3 Investment 22 129.3 130.0 130.0 Dec-21 Multifamily VA Senior N 3 Investment 23 124.8 125.0 125.0 Dec-21 Office IL Subordinate N 3 Investment 24 121.7 122.5 127.5 Sep-21 Hospitality TX Senior N 3 Investment 25 122.4 122.5 122.5 Sep-19 Office NY Senior N 3 Investment 26 119.3 119.5 120.0 Apr-19 Mixed-Use NY Senior N 3 Investment 27 117.8 118.6 122.0 Mar-22 Multifamily TX Senior N 3 Investment 28 114.1 115.0 115.0 Aug-22 Multifamily CO Senior N 3 Investment 29 113.3 113.5 113.5 Jul-21 Multifamily IL Senior N 3 Investment 30 112.1 112.4 124.8 Feb-20 Office CA Senior N 4 Investment 31 110.1 111.5 127.3 Jun-22 Multifamily TX Senior N 3 Investment 32 105.3 104.3 104.3 Jun-18 Land NY Senior N 4 Investment 33 102.4 103.0 103.0 Dec-21 Multifamily TN Senior N 3 Investment 34 96.8 97.8 141.1 Apr-20 Office TN Senior Y 3 Investment 35 97.1 97.5 97.5 Oct-17 Hospitality CA Senior N 3 Investment 36 96.2 96.7 100.0 Aug-21 Office CA Senior N 4 Investment 37 95.2 95.9 100.8 Jan-22 Multifamily NV Senior N 3 Investment 38 87.8 87.8 87.8 Mar-20 Office TX Senior N 4 Investment 39a 78.2 78.5 115.3 Aug-22 Hospitality NY Senior Y 4 Investment 40 74.2 76.4 76.4 Jul-18 Hospitality CA Senior N 4 CMTG Portfolio Summary by Unpaid Principal Balance as of December 31, 2022 ($ amounts in millions)

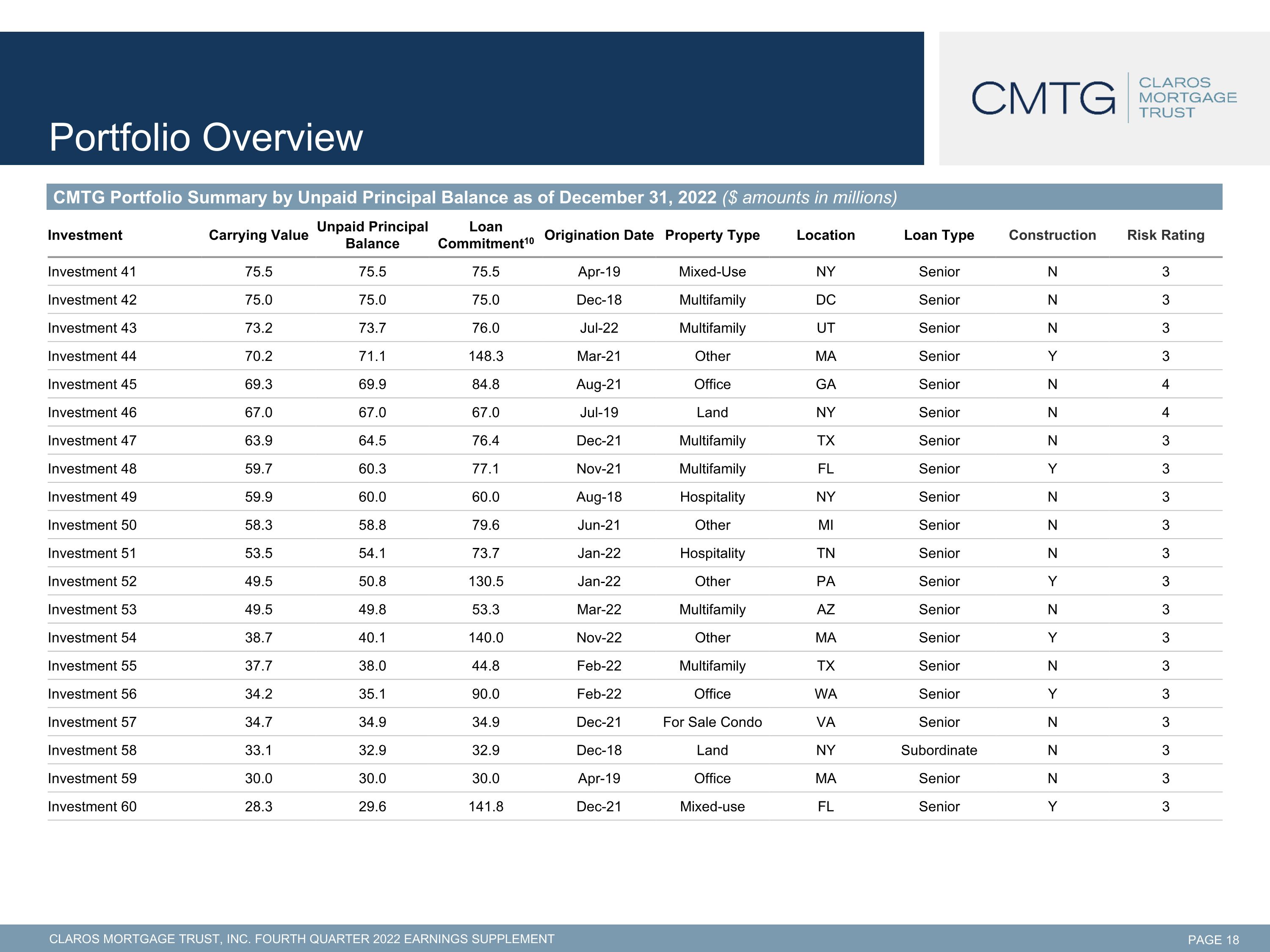

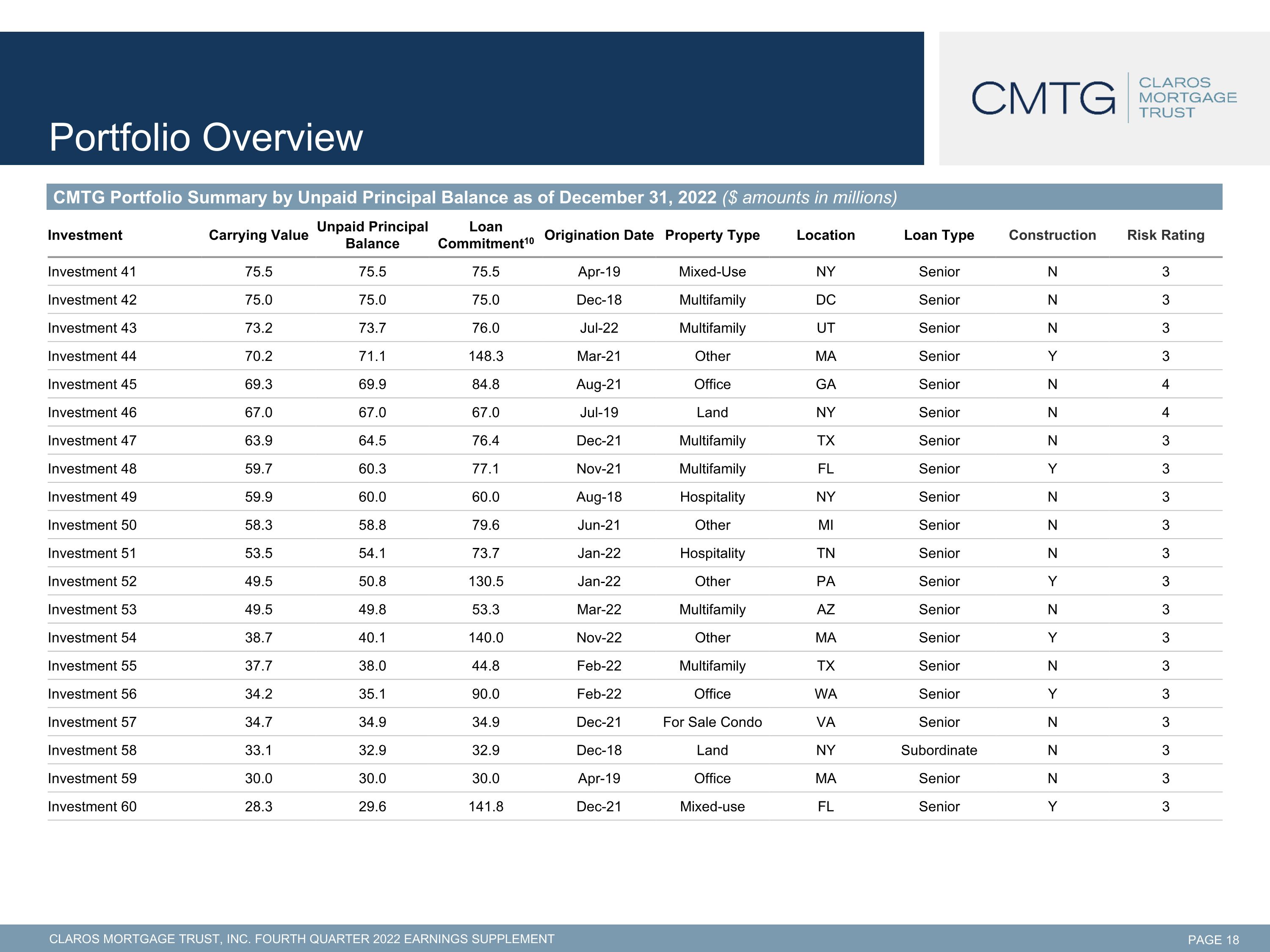

Portfolio Overview Investment Carrying Value Unpaid Principal Balance Loan Commitment10 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 41 75.5 75.5 75.5 Apr-19 Mixed-Use NY Senior N 3 Investment 42 75.0 75.0 75.0 Dec-18 Multifamily DC Senior N 3 Investment 43 73.2 73.7 76.0 Jul-22 Multifamily UT Senior N 3 Investment 44 70.2 71.1 148.3 Mar-21 Other MA Senior Y 3 Investment 45 69.3 69.9 84.8 Aug-21 Office GA Senior N 4 Investment 46 67.0 67.0 67.0 Jul-19 Land NY Senior N 4 Investment 47 63.9 64.5 76.4 Dec-21 Multifamily TX Senior N 3 Investment 48 59.7 60.3 77.1 Nov-21 Multifamily FL Senior Y 3 Investment 49 59.9 60.0 60.0 Aug-18 Hospitality NY Senior N 3 Investment 50 58.3 58.8 79.6 Jun-21 Other MI Senior N 3 Investment 51 53.5 54.1 73.7 Jan-22 Hospitality TN Senior N 3 Investment 52 49.5 50.8 130.5 Jan-22 Other PA Senior Y 3 Investment 53 49.5 49.8 53.3 Mar-22 Multifamily AZ Senior N 3 Investment 54 38.7 40.1 140.0 Nov-22 Other MA Senior Y 3 Investment 55 37.7 38.0 44.8 Feb-22 Multifamily TX Senior N 3 Investment 56 34.2 35.1 90.0 Feb-22 Office WA Senior Y 3 Investment 57 34.7 34.9 34.9 Dec-21 For Sale Condo VA Senior N 3 Investment 58 33.1 32.9 32.9 Dec-18 Land NY Subordinate N 3 Investment 59 30.0 30.0 30.0 Apr-19 Office MA Senior N 3 Investment 60 28.3 29.6 141.8 Dec-21 Mixed-use FL Senior Y 3 CMTG Portfolio Summary by Unpaid Principal Balance as of December 31, 2022 ($ amounts in millions)

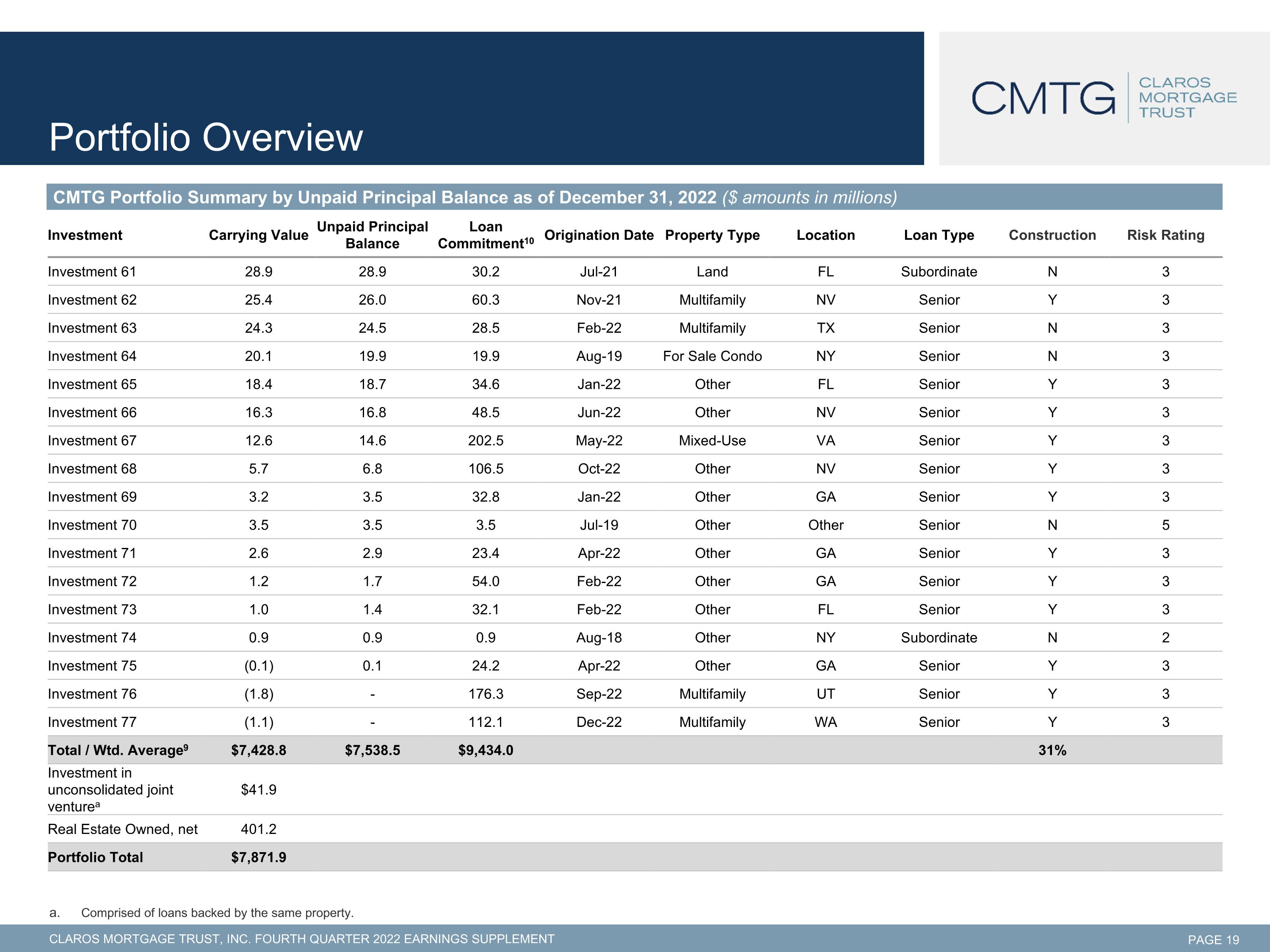

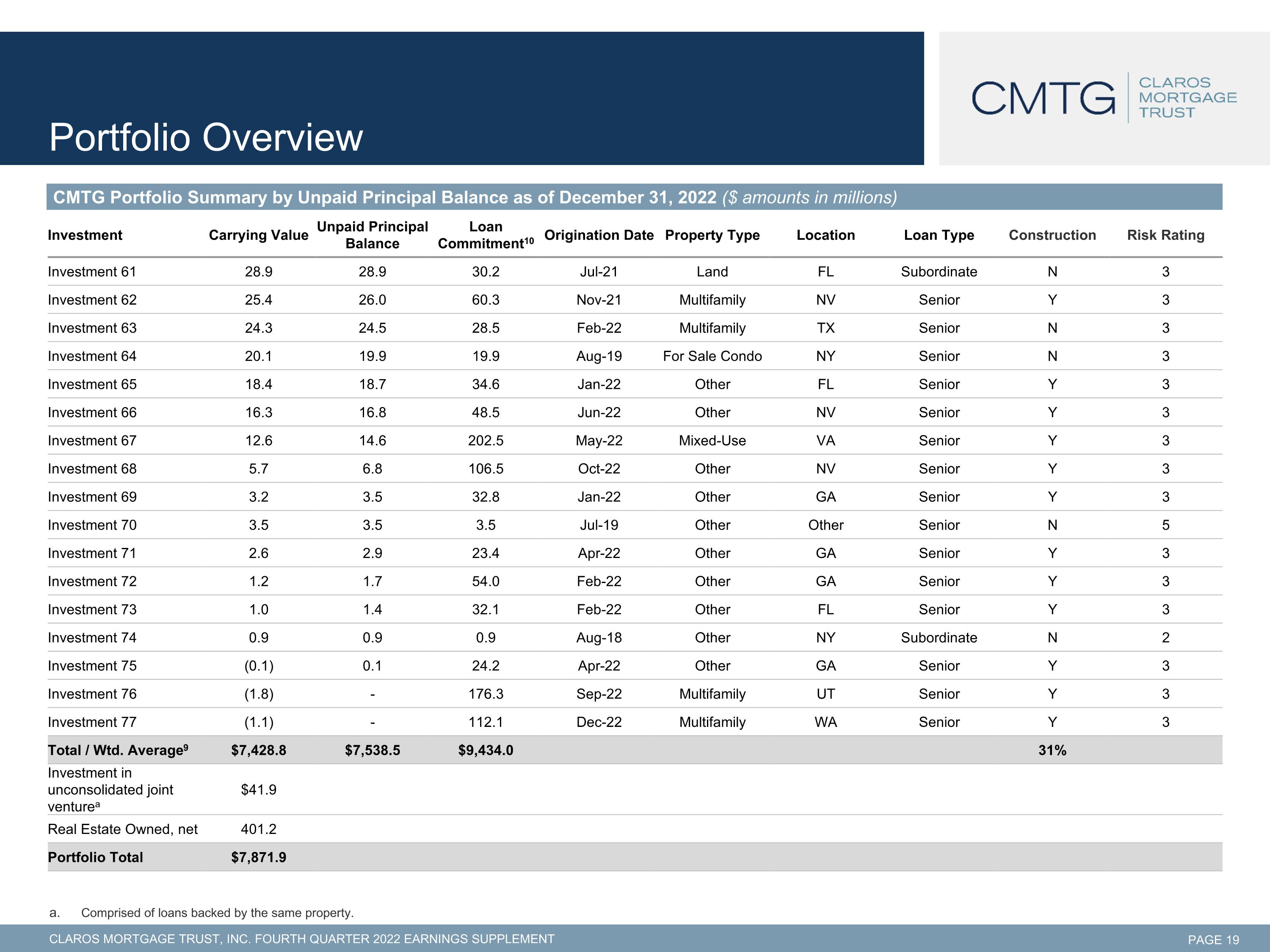

Portfolio Overview Investment Carrying Value Unpaid Principal Balance Loan Commitment10 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 61 28.9 28.9 30.2 Jul-21 Land FL Subordinate N 3 Investment 62 25.4 26.0 60.3 Nov-21 Multifamily NV Senior Y 3 Investment 63 24.3 24.5 28.5 Feb-22 Multifamily TX Senior N 3 Investment 64 20.1 19.9 19.9 Aug-19 For Sale Condo NY Senior N 3 Investment 65 18.4 18.7 34.6 Jan-22 Other FL Senior Y 3 Investment 66 16.3 16.8 48.5 Jun-22 Other NV Senior Y 3 Investment 67 12.6 14.6 202.5 May-22 Mixed-Use VA Senior Y 3 Investment 68 5.7 6.8 106.5 Oct-22 Other NV Senior Y 3 Investment 69 3.2 3.5 32.8 Jan-22 Other GA Senior Y 3 Investment 70 3.5 3.5 3.5 Jul-19 Other Other Senior N 5 Investment 71 2.6 2.9 23.4 Apr-22 Other GA Senior Y 3 Investment 72 1.2 1.7 54.0 Feb-22 Other GA Senior Y 3 Investment 73 1.0 1.4 32.1 Feb-22 Other FL Senior Y 3 Investment 74 0.9 0.9 0.9 Aug-18 Other NY Subordinate N 2 Investment 75 (0.1) 0.1 24.2 Apr-22 Other GA Senior Y 3 Investment 76 (1.8) - 176.3 Sep-22 Multifamily UT Senior Y 3 Investment 77 (1.1) - 112.1 Dec-22 Multifamily WA Senior Y 3 Total / Wtd. Average9 $7,428.8 $7,538.5 $9,434.0 31% Investment in unconsolidated joint venturea $41.9 Real Estate Owned, net 401.2 Portfolio Total $7,871.9 CMTG Portfolio Summary by Unpaid Principal Balance as of December 31, 2022 ($ amounts in millions) Comprised of loans backed by the same property.

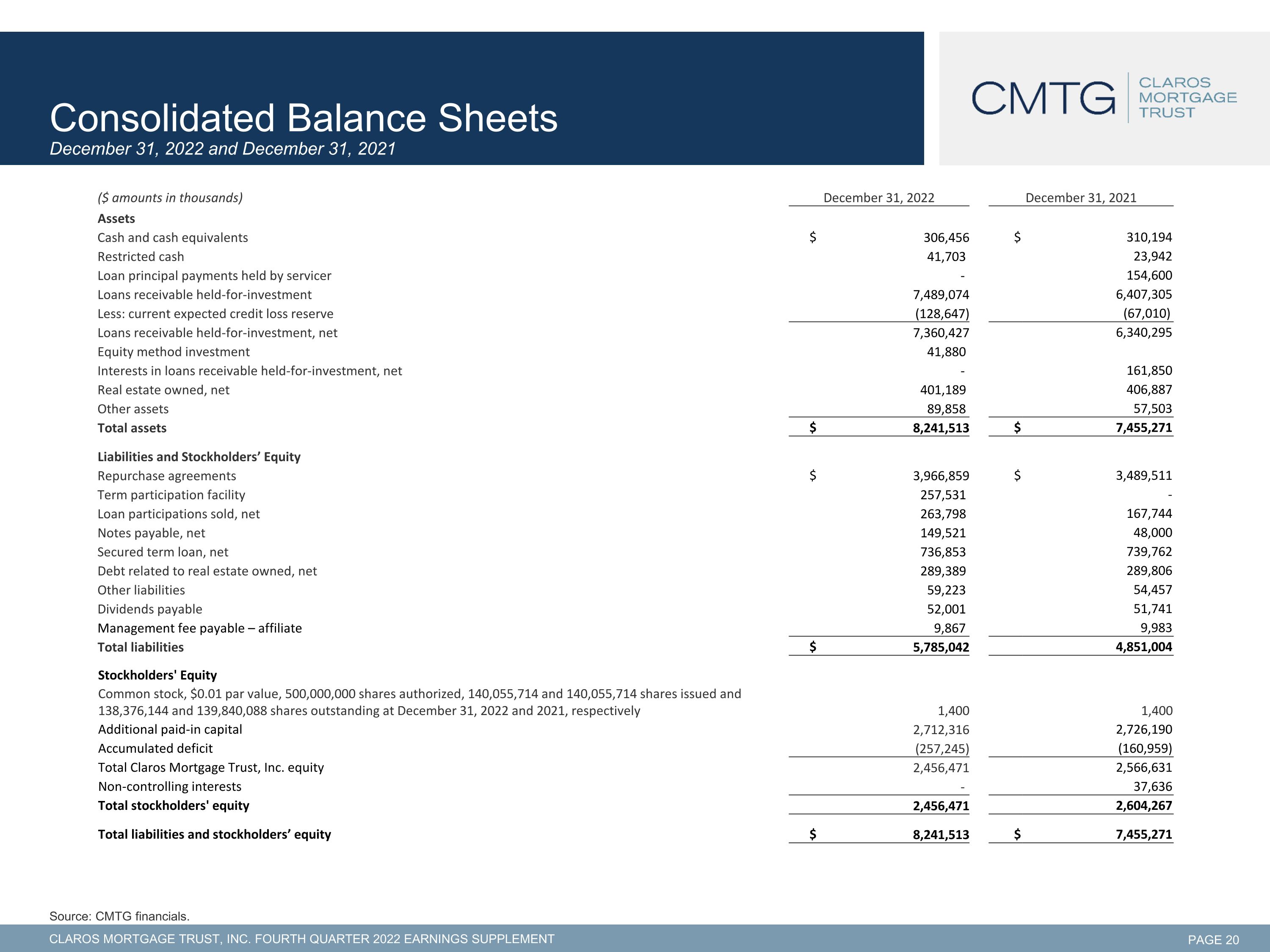

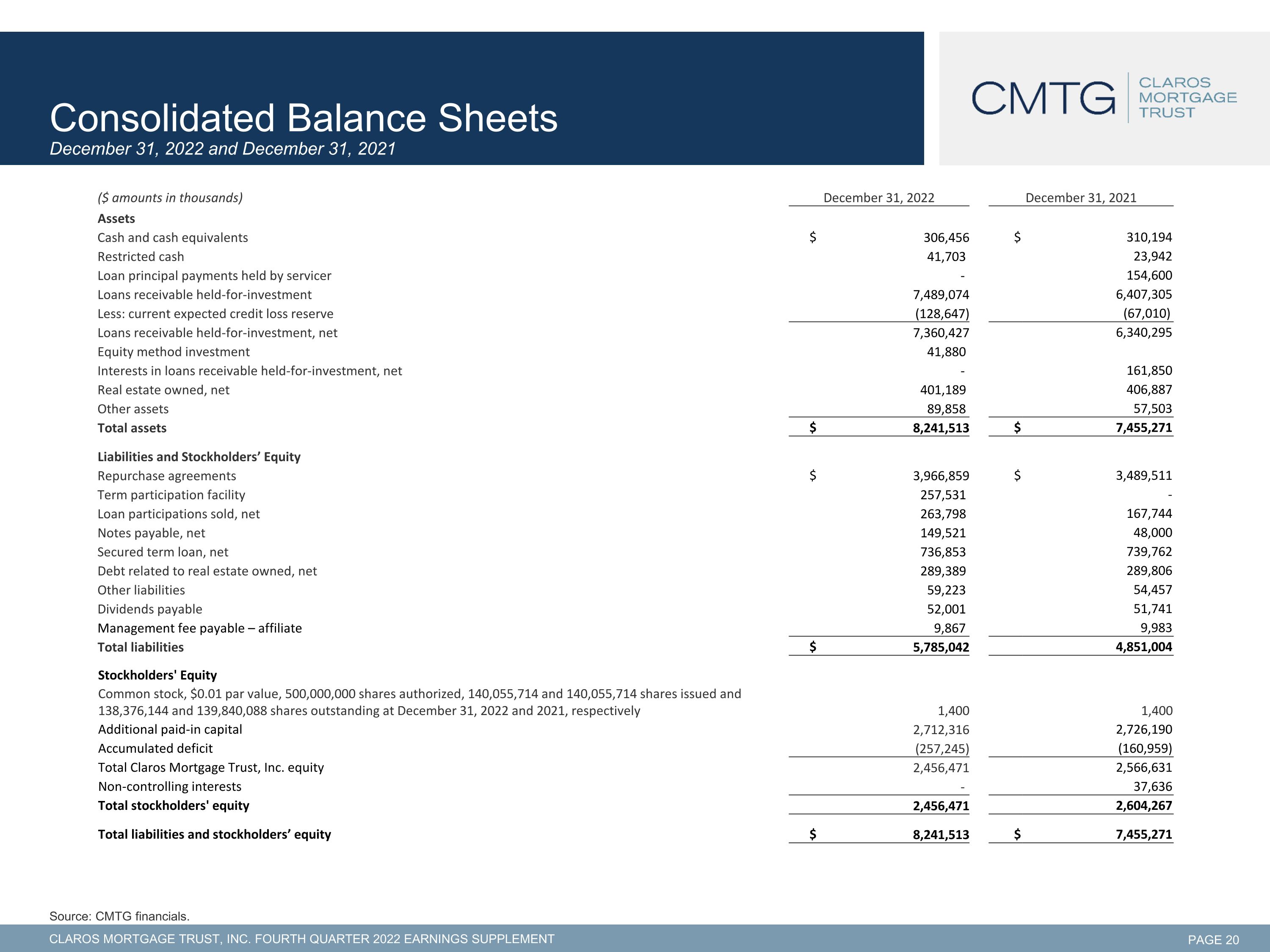

($ amounts in thousands) December 31, 2022 March 31, 2022 December 31, 2021 December 31, 2021 Assets Cash and cash equivalents $ 306,456 $ 310,194 Restricted cash 41,703 23,942 Loan principal payments held by servicer - 154,600 Loans receivable held-for-investment 7,489,074 6,407,305 Less: current expected credit loss reserve (128,647) (67,010) Loans receivable held-for-investment, net 7,360,427 6,340,295 Equity method investment 41,880 Interests in loans receivable held-for-investment, net - 161,850 Real estate owned, net 401,189 406,887 Other assets 89,858 57,503 Total assets $ 8,241,513 $ 7,455,271 Liabilities and Stockholders’ Equity Repurchase agreements $ 3,966,859 $ 3,489,511 Term participation facility 257,531 - Loan participations sold, net 263,798 167,744 Notes payable, net 149,521 48,000 Secured term loan, net 736,853 739,762 Debt related to real estate owned, net 289,389 289,806 Other liabilities 59,223 54,457 Dividends payable 52,001 51,741 Management fee payable – affiliate 9,867 9,983 Total liabilities $ 5,785,042 4,851,004 Stockholders' Equity Common stock, $0.01 par value, 500,000,000 shares authorized, 140,055,714 and 140,055,714 shares issued and 138,376,144 and 139,840,088 shares outstanding at December 31, 2022 and 2021, respectively 1,400 1,400 Additional paid-in capital 2,712,316 2,726,190 Accumulated deficit (257,245) (160,959) Total Claros Mortgage Trust, Inc. equity 2,456,471 2,566,631 Non-controlling interests - 37,636 Total stockholders' equity 2,456,471 2,604,267 Total liabilities and stockholders’ equity $ 8,241,513 $ 7,455,271 Consolidated Balance Sheets�December 31, 2022 and December 31, 2021 Source: CMTG financials.

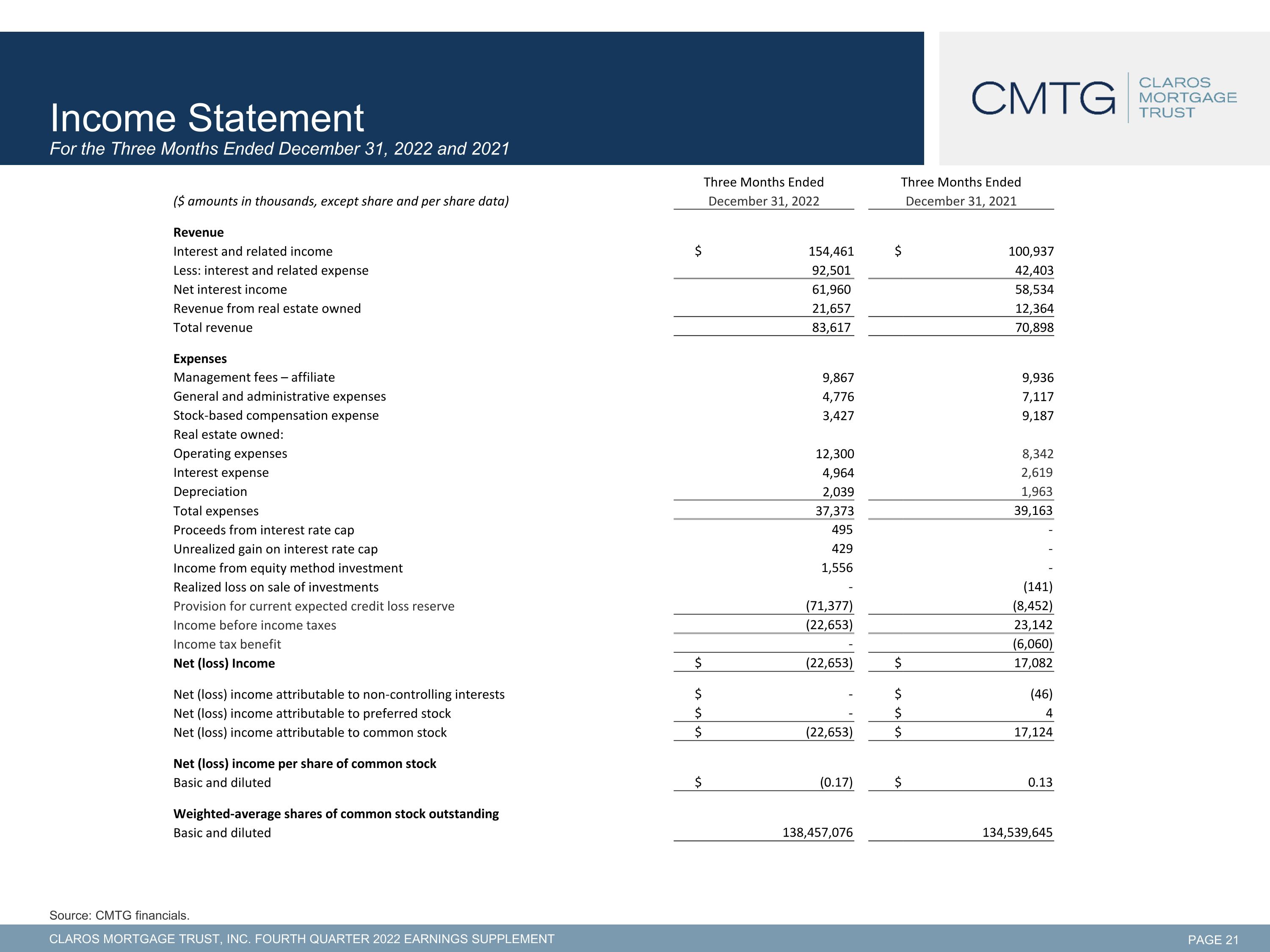

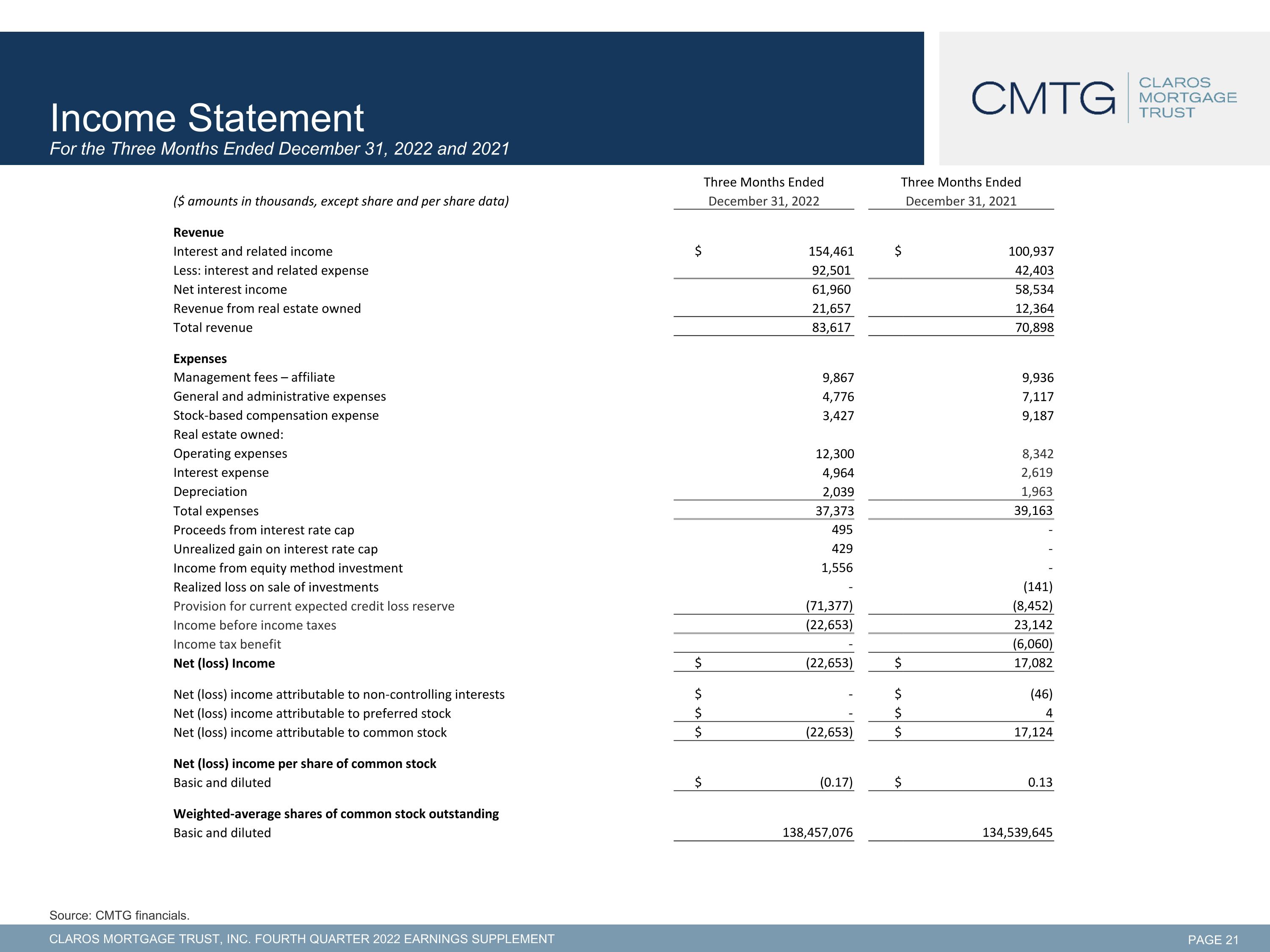

Income Statement�For the Three Months Ended December 31, 2022 and 2021 Source: CMTG financials. Three Months Ended Three Months Ended Three Months Ended Three Months Ended ($ amounts in thousands, except share and per share data) December 31, 2022 March 31, 2022 December 31, 2021 March 31, 2021 Revenue Interest and related income $ 154,461 $ 100,937 Less: interest and related expense 92,501 42,403 Net interest income 61,960 58,534 Revenue from real estate owned 21,657 12,364 Total revenue 83,617 70,898 Expenses Management fees – affiliate 9,867 9,936 General and administrative expenses 4,776 7,117 Stock-based compensation expense 3,427 9,187 Real estate owned: Operating expenses 12,300 8,342 Interest expense 4,964 2,619 Depreciation 2,039 1,963 Total expenses 37,373 39,163 Proceeds from interest rate cap 495 - Unrealized gain on interest rate cap 429 - Income from equity method investment 1,556 - Realized loss on sale of investments - (141) Provision for current expected credit loss reserve (71,377) (8,452) Income before income taxes (22,653) 23,142 Income tax benefit - (6,060) Net (loss) Income $ (22,653) $ 17,082 Net (loss) income attributable to non-controlling interests $ - $ (46) Net (loss) income attributable to preferred stock $ - $ 4 Net (loss) income attributable to common stock $ (22,653) $ 17,124 Net (loss) income per share of common stock Basic and diluted $ (0.17) $ 0.13 Weighted-average shares of common stock outstanding Basic and diluted 138,457,076 134,539,645

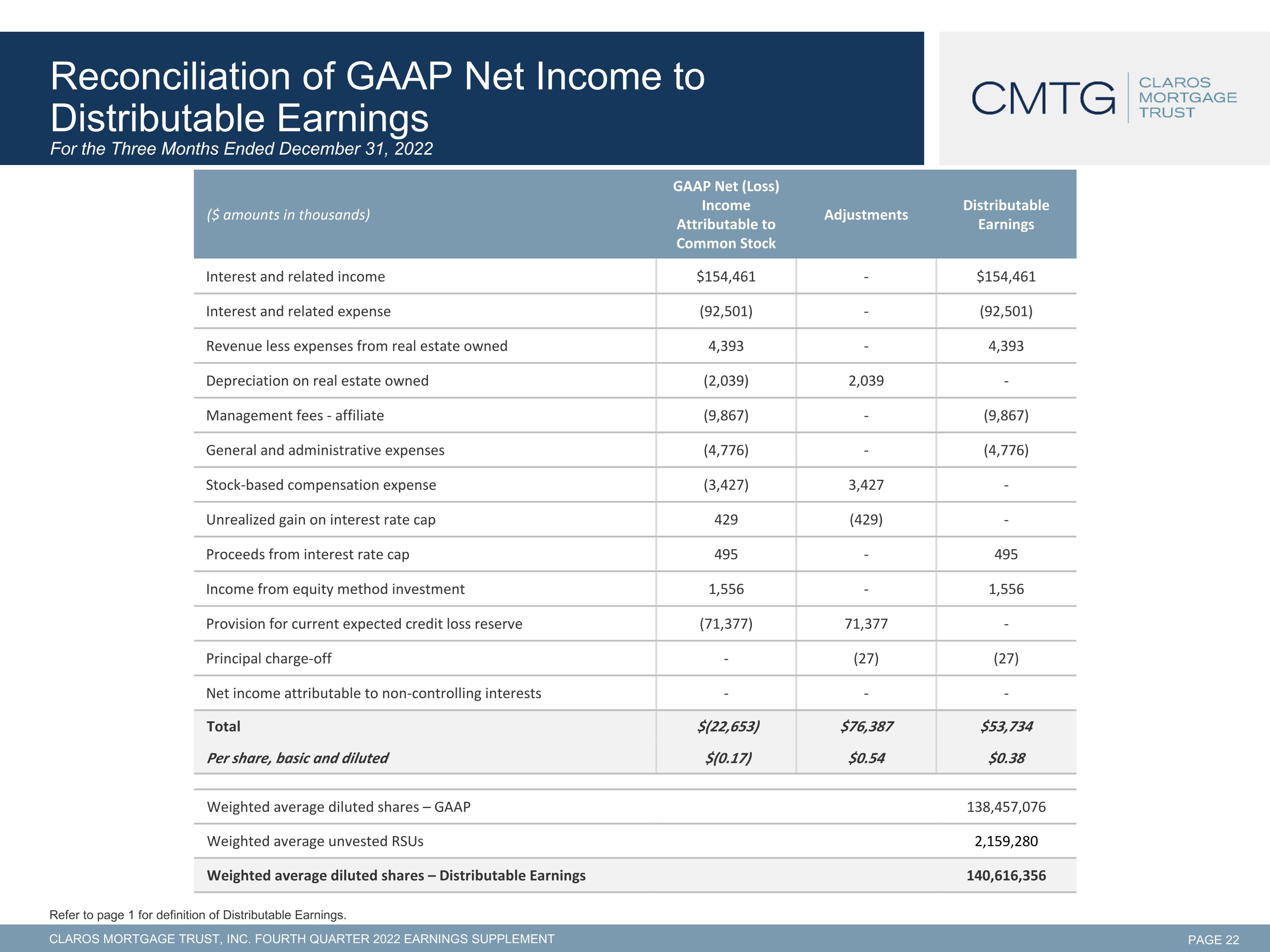

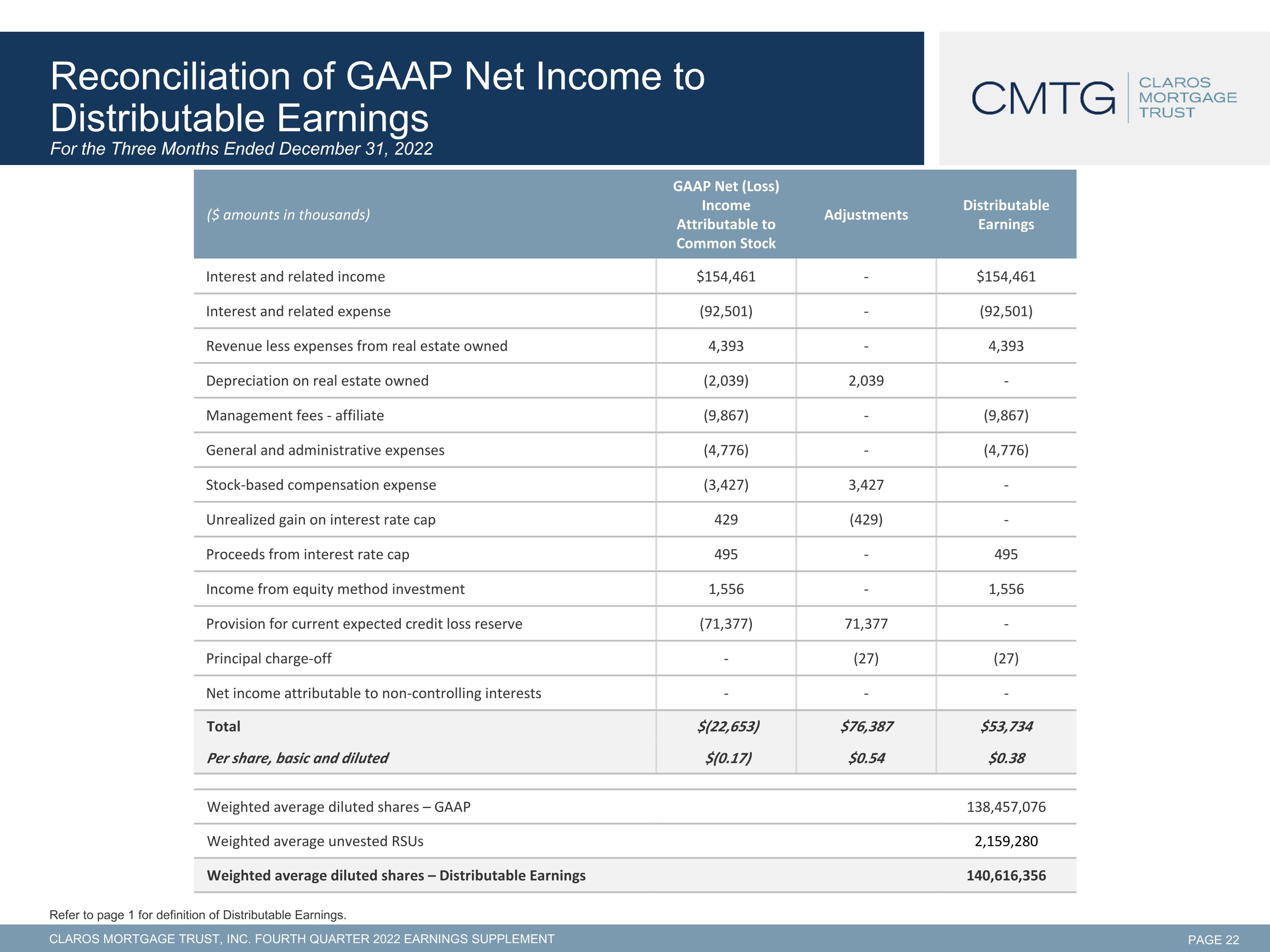

($ amounts in thousands) GAAP Net (Loss) Income Attributable to Common Stock Adjustments Distributable Earnings Interest and related income $154,461 - $154,461 Interest and related expense (92,501) - (92,501) Revenue less expenses from real estate owned 4,393 - 4,393 Depreciation on real estate owned (2,039) 2,039 - Management fees - affiliate (9,867) - (9,867) General and administrative expenses (4,776) - (4,776) Stock-based compensation expense (3,427) 3,427 - Unrealized gain on interest rate cap 429 (429) - Proceeds from interest rate cap 495 - 495 Income from equity method investment 1,556 - 1,556 Provision for current expected credit loss reserve (71,377) 71,377 - Principal charge-off - (27) (27) Net income attributable to non-controlling interests - - - Total $(22,653) $76,387 $53,734 Per share, basic and diluted $(0.17) $0.54 $0.38 Reconciliation of GAAP Net Income to�Distributable Earnings�For the Three Months Ended December 31, 2022 Refer to page 1 for definition of Distributable Earnings. Weighted average diluted shares – GAAP 138,457,076 Weighted average unvested RSUs 2,159,280 Weighted average diluted shares – Distributable Earnings 140,616,356

Endnotes Calculated as the annualized quarterly dividend per share divided by book value per share. All-in yield represents the weighted average annualized yield to initial maturity of each loan, inclusive of coupon and contractual fees, based on the applicable floating benchmark rate/floors (if applicable), in place as of December 31, 2022. For loans placed on non-accrual, the annualized yield to initial maturity used in calculating the weighted average annualized yield to initial maturity is 0%. Based on carrying value. LTV represents underwritten “loan-to-value” or “loan-to-cost.” Underwriting is generally not updated after origination and generally does not take into consideration the potential impact of market conditions and other factors on asset values or project costs. See Important Notices beginning on page 1 for additional information. Net Debt / Equity Ratio is calculated as the ratio of asset-specific debt and Secured Term Loan, less cash and cash equivalents, to total equity. For further information, please refer to Item 7 (MD&A) of our 10-K. Refer to page 22 for a reconciliation of distributable earnings to GAAP Net Income attributable to common stock. Excludes our one real estate owned (REO) investment, unless otherwise noted. Total Leverage Ratio is calculated as the ratio of asset-specific debt and Secured Term Loan, plus non-consolidated senior interests held by third parties, less cash and cash equivalents, to total equity. Based on total loan commitments. Loan commitment represents principal outstanding plus remaining unfunded loan commitments. Fully extended maturity assumes all extension options are exercised by the borrower upon satisfaction of the applicable conditions. Subject to approval of financing counterparty as well as pledging of additional unencumbered assets. Weighted average spreads exclude LIBOR / SOFR floors. Fixed-rate financings are presented as a spread over the relevant floating benchmark rate. The calculation of incremental net interest income is provided for illustration purposes only and is not a guarantee or prediction that such income will materialize. It assumes that interest rates rise by the specified amount while other performance factors remain constant including, among others, the composition of our portfolio, in-place financings and borrower performance. These assumptions may be materially different from actual events and accordingly no reliance should be placed on this information. Senior loans include senior mortgages and similar loans, including related contiguous subordinate loans (if any), and pari passu participations in senior mortgage loans.