DowDuPont 1Q18 Earnings Conference Call May 3, 2018

Safe Harbor Statement Regulation G This presentation includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures include the Company's pro forma consolidated results and pro forma earnings per share on an adjusted basis, which excludes the after-tax impact of pro forma significant items and the after-tax impact of pro forma amortization expense associated with DuPont's intangible assets. Management uses these measures internally for planning, forecasting and evaluating the performance of the Company's segments, including allocating resources. DowDuPont's management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year-over-year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations of non-GAAP measures to GAAP are provided in the financial schedules attached to the earnings news release and the Investor Relations section of the Company’s website. DowDuPont does not provide forward-looking GAAP financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most comparable GAAP financial measures on a forward- looking basis because the Company is unable to predict with reasonable certainty the ultimate outcome of pending litigation, unusual gains and losses, foreign currency exchange gains or losses, potential future asset impairments and purchase accounting fair value adjustments, as well as discrete taxable events, without unreasonable effort. These items are uncertain, depend on various factors, and could have a material impact on GAAP results for the guidance period. Operating EBITDA is defined as earnings (i.e.,” Income from continuing operations before income taxes”) before interest, depreciation, amortization and foreign exchange gains (losses), excluding significant items. Pro forma Operating EBITDA is defined as pro forma earnings (i.e., pro forma “Income from continuing operations before income taxes”) before interest, depreciation, amortization and foreign exchange gains (losses), excluding the impact of adjusted significant items. Adjusted EPS is defined as “Earnings per common share from continuing operations – diluted” excluding the after-tax impact of significant items and the after-tax impact of amortization expense associated with DuPont’s intangible assets. Pro forma Adjusted EPS is defined as “Pro forma earnings per common share from continuing operations – diluted” excluding the after-tax impact of pro forma significant items and the after-tax impact of pro forma amortization expense associated with DuPont’s intangible assets. Full year and prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. Cautionary Statement about Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” and similar expressions and variations or negatives of these words. On December 11, 2015, The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) entered into an Agreement and Plan of Merger, as amended on March 31, 2017, (the “Merger Agreement”) under which the companies would combine in an all-stock merger of equals transaction (the “Merger”). Effective August 31, 2017, the Merger was completed and each of Dow and DuPont became subsidiaries of DowDuPont (Dow and DuPont, and their respective subsidiaries, collectively referred to as the "Subsidiaries"). Forward-looking statements by their nature address matters that are, to varying degrees, uncertain, including the intended separation, subject to approval of the Company’s Board of Directors, and customary closing conditions, of DowDuPont’s agriculture, materials science and specialty products businesses in one or more tax-efficient transactions on anticipated terms (the “Intended Business Separations”). Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the Company’s control. Some of the important factors that could cause DowDuPont’s, Dow’s or DuPont’s actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) costs to achieve and achieving the successful integration of the respective agriculture, materials science and specialty products businesses of Dow and DuPont, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined operations; (ii) costs to achieve and achievement of the anticipated synergies by the combined agriculture, materials science and specialty products businesses; (iii) risks associated with the Intended Business Separations, including conditions which could delay, prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances related to the Intended 2 ©2018 DowDuPont. All rights reserved.

Safe Harbor Statement, continued Forward-Looking Statements, continued Business Separations, associated costs, disruptions in the financial markets or other potential barriers; (iv) disruptions or business uncertainty, including from the Intended Business Separations, could adversely impact DowDuPont’s business (either directly or as conducted by and through Dow or DuPont), or financial performance and its ability to retain and hire key personnel; (v) uncertainty as to the long-term value of DowDuPont common stock; and (vi) risks to DowDuPont’s, Dow’s and DuPont’s business, operations and results of operations from: the availability of and fluctuations in the cost of feedstocks and energy; balance of supply and demand and the impact of balance on prices; failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including trade disputes and retaliatory actions; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for the Company, adversely impact demand or production; ability to discover, develop and protect new technologies and to protect and enforce the Company’s intellectual property rights; failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks are and will be more fully discussed in the current, quarterly and annual reports filed with the U. S. Securities and Exchange Commission by DowDuPont. While the list of factors presented here is, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s, Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. None of DowDuPont, Dow or DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A) of DowDuPont’s 2017 annual report on Form 10-K. The Dow Diamond, DuPont Oval logo, DuPont™, the DowDuPont logo and all products, unless otherwise noted, denoted with ™, ℠ or ® are trademarks, service marks or registered trademarks of The Dow Chemical Company, E. I. du Pont de Nemours and Company, DowDuPont Inc. or their affiliates. In order to provide the most meaningful comparison of results of operations and results by segment, supplemental unaudited pro forma financial information has been included in the following financial schedules. The unaudited pro forma financial information is based on the historical consolidated financial statements and accompanying notes of both Dow and DuPont and has been prepared to illustrate the effects of the Merger, assuming the Merger had been consummated on January 1, 2016. The results for the three months ended March 31, 2018, are presented on a U.S. GAAP basis. For all other periods presented, adjustments have been made for (1) the preliminary purchase accounting impact, (2) accounting policy alignment, (3) eliminate the effect of events that are directly attributable to the Merger Agreement (e.g., one-time transaction costs), (4) eliminate the impact of transactions between Dow and DuPont, and (5) eliminate the effect of consummated divestitures agreed to with certain regulatory agencies as a condition of approval for the Merger. The unaudited pro forma financial information was based on and should be read in conjunction with the separate historical financial statements and accompanying notes contained in each of the Dow and DuPont Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K for the applicable periods. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma financial information has been presented for informational purposes only and is not necessarily indicative of what DowDuPont's results of operations actually would have been had the Merger been completed as of January 1, 2016, nor is it indicative of the future operating results of DowDuPont. The unaudited pro forma financial information does not reflect any cost or growth synergies that DowDuPont may achieve as a result of the Merger, future costs to combine the operations of Dow and DuPont or the costs necessary to achieve any cost or growth synergies. Discussion of revenue, operating EBITDA and price/volume metrics on a divisional basis for Agriculture is based on the results of the Agriculture segment; for Materials Science is based on the combined results of the Performance Materials & Coatings, Industrial Intermediates & Infrastructure, and Packaging & Specialty Plastics segments; and for Specialty Products is based on the combined results of the Electronics & Imaging, Nutrition & Biosciences, Transportation & Advanced Polymers, and Safety & Construction segments. The divisional discussions are for informational purposes only and do not purport to be indicative of results, including on a pro forma basis, for each of Agriculture, Materials Science and Specialty Products on a standalone basis as if the Intended Business Separations had already occurred. Furthermore, the divisional discussions should not be construed as representative of future results of operations or financial condition for each of Agriculture, Materials Science and Specialty Products on a standalone basis in connection with the Intended Business Separations. 3 ©2018 DowDuPont. All rights reserved.

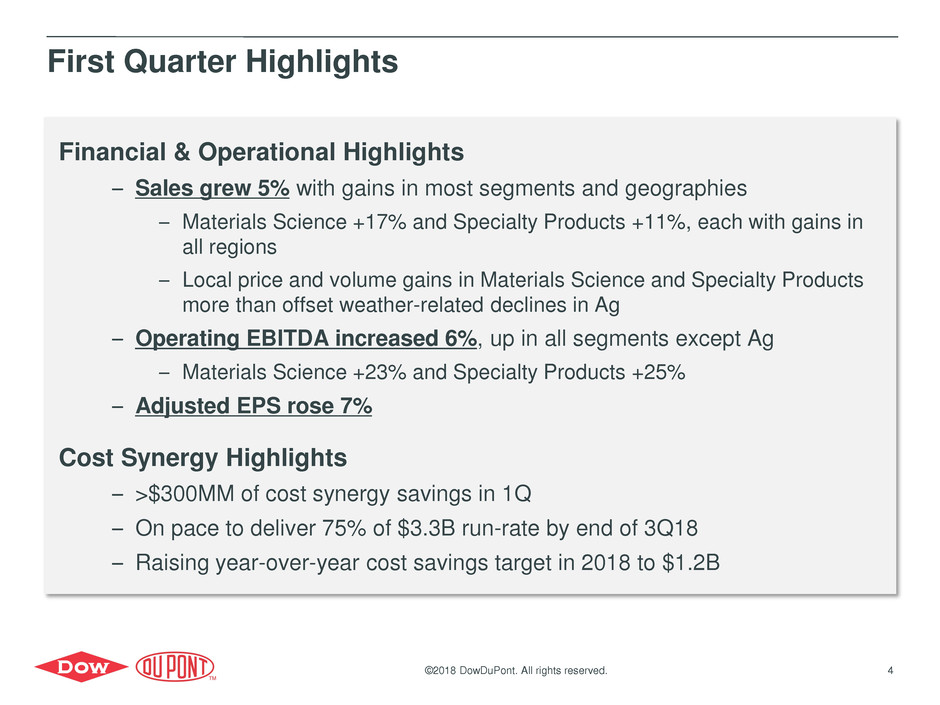

First Quarter Highlights 4 ©2018 DowDuPont. All rights reserved. Financial & Operational Highlights – Sales grew 5% with gains in most segments and geographies – Materials Science +17% and Specialty Products +11%, each with gains in all regions – Local price and volume gains in Materials Science and Specialty Products more than offset weather-related declines in Ag – Operating EBITDA increased 6%, up in all segments except Ag – Materials Science +23% and Specialty Products +25% – Adjusted EPS rose 7% Cost Synergy Highlights – >$300MM of cost synergy savings in 1Q – On pace to deliver 75% of $3.3B run-rate by end of 3Q18 – Raising year-over-year cost savings target in 2018 to $1.2B

Market Access: Deliver a full farm solution via the combination of seeds, crop protection & services New Business Model: Recover divested businesses Innovation & Technology: Incremental pipeline value from launching in additional regions & brands Portfolio: Portfolio combinations & crop protection mixtures; seed treatment enhancements from larger proprietary portfolio Target: ~$500MM ©2018 DowDuPont. All rights reserved. Holistic solution offerings provide customers with a “one stop shop” for a given structure & differentiated offerings by upgrading PE with ECP Packaging: Differentiated offerings in tie layers to improve durability, recyclability & product shelf life Health & Hygiene: Expanded non- wovens portfolio to satisfy unmet demands for improved softness & noise reduction Infrastructure: Drive growth in polymer modifiers, which enable weight reduction & improved wear, through value chain integration Consumer: Broad offering in footwear & cosmetics to improve bonding, processing & blending for improved comfort, performance & durability Target: ~$100MM Electronics & Imaging: Partner with leading OEMs to create integrated offerings & new products that leverage enhanced capability across circuit, semiconductor & display Safety & Construction: Improved market access & integrated application development in construction & filtration markets Transportation & Advanced Polymers: Expanded market access, application development & leverage compounding capabilities for auto, electronics and medical markets Nutrition & Biosciences: Grow food, pharma & microbial portfolio; leverage key account management, channel access & commercial capabilities Target: ~$400MM Growth Synergies Update 5

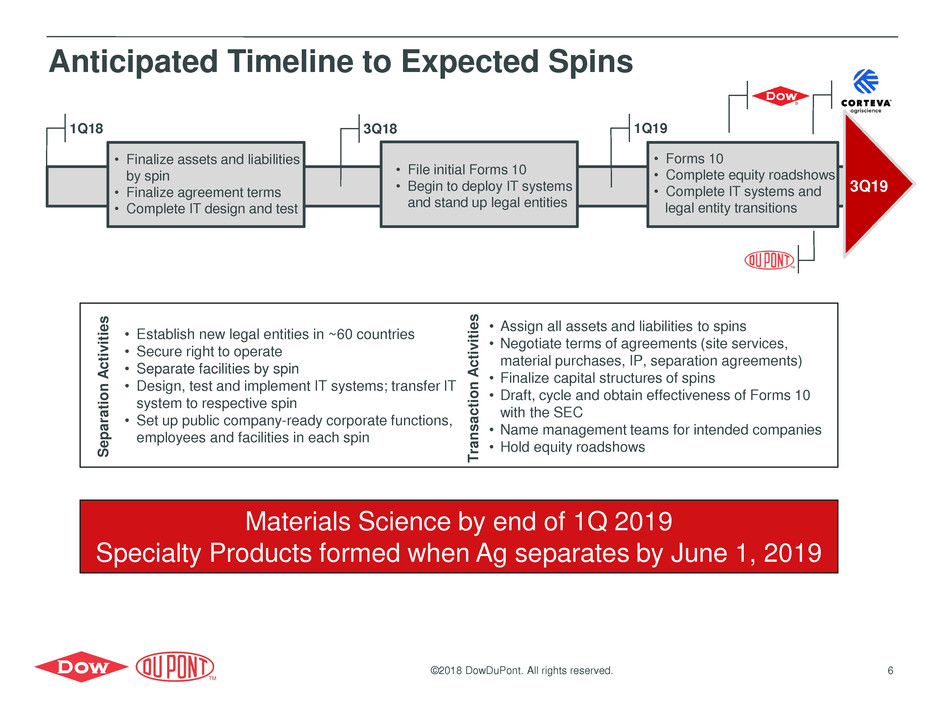

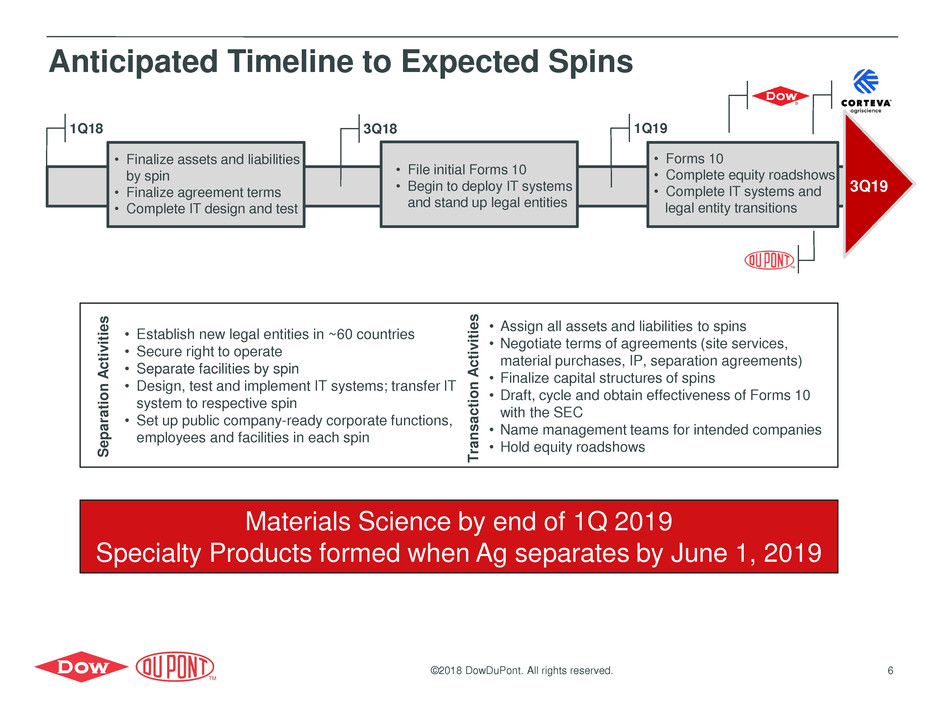

• Forms 10 • Complete equity roadshows • Complete IT systems and legal entity transitions • File initial Forms 10 • Begin to deploy IT systems and stand up legal entities • Finalize assets and liabilities by spin • Finalize agreement terms • Complete IT design and test • Establish new legal entities in ~60 countries • Secure right to operate • Separate facilities by spin • Design, test and implement IT systems; transfer IT system to respective spin • Set up public company-ready corporate functions, employees and facilities in each spin • Assign all assets and liabilities to spins • Negotiate terms of agreements (site services, material purchases, IP, separation agreements) • Finalize capital structures of spins • Draft, cycle and obtain effectiveness of Forms 10 with the SEC • Name management teams for intended companies • Hold equity roadshows Materials Science by end of 1Q 2019 Specialty Products formed when Ag separates by June 1, 2019 ©2018 DowDuPont. All rights reserved. 6 Anticipated Timeline to Expected Spins S e p arat io n A ct iv it ie s T ran s a c ti o n A ct iv it ie s 3Q19 3Q18 1Q19 1Q18

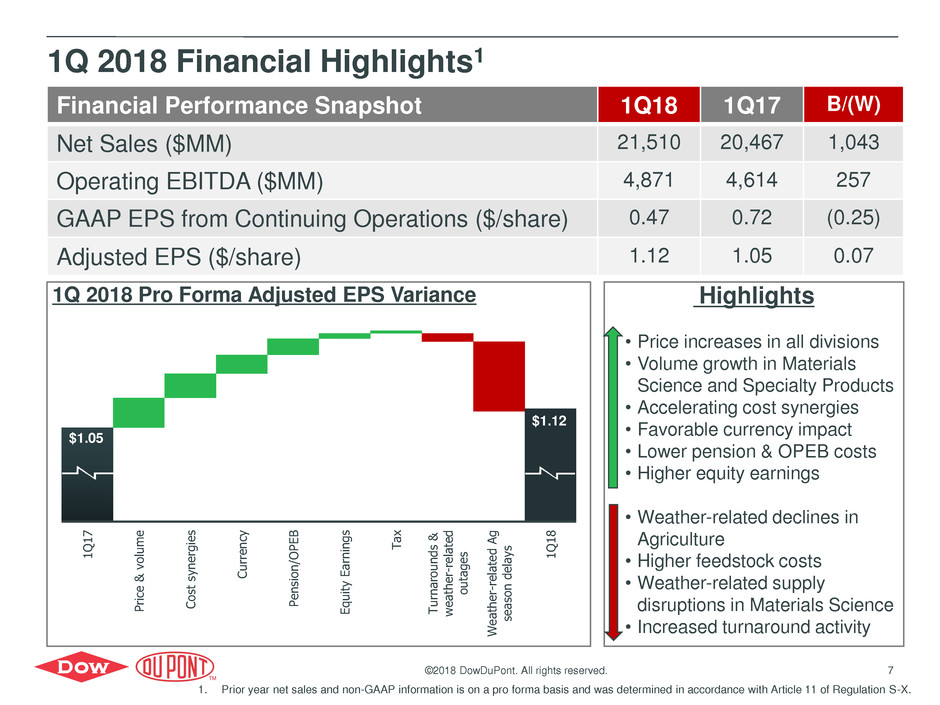

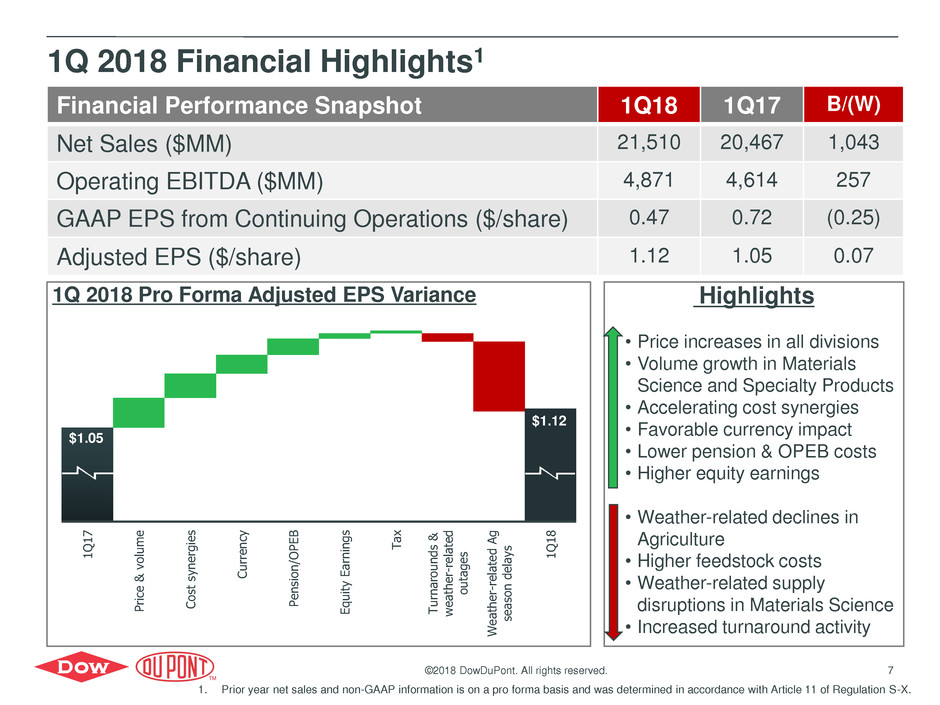

1Q 2018 Financial Highlights1 7 ©2018 DowDuPont. All rights reserved. Highlights • Price increases in all divisions • Volume growth in Materials Science and Specialty Products • Accelerating cost synergies • Favorable currency impact • Lower pension & OPEB costs • Higher equity earnings • Weather-related declines in Agriculture • Higher feedstock costs • Weather-related supply disruptions in Materials Science • Increased turnaround activity $0.67 $1.08 1Q1 7 P ri ce & v olu m e C os t sy n e rg ie s C u rr e n cy P e n sion /O P E B E q ui ty E a rni n g s T a x Tu rn a roun d s & w e a th e r- re la te d ou ta g e s W e a th e r- re la te d A g se a son d e la ys 1Q1 8 $1.05 $1.12 Financial Performance Snapshot 1Q18 1Q17 B/(W) Net Sales ($MM) 21,510 20,467 1,043 Operating EBITDA ($MM) 4,871 4,614 257 GAAP EPS from Continuing Operations ($/share) 0.47 0.72 (0.25) Adjusted EPS ($/share) 1.12 1.05 0.07 1Q 2018 Pro Forma Adjusted EPS Variance 1. Prior year net sales and non-GAAP information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

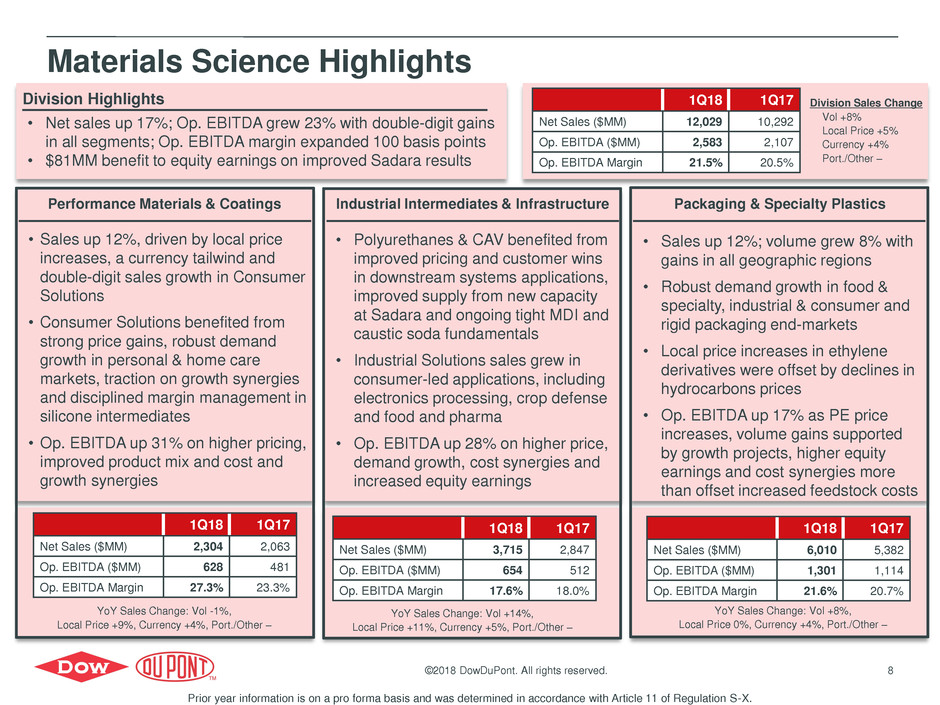

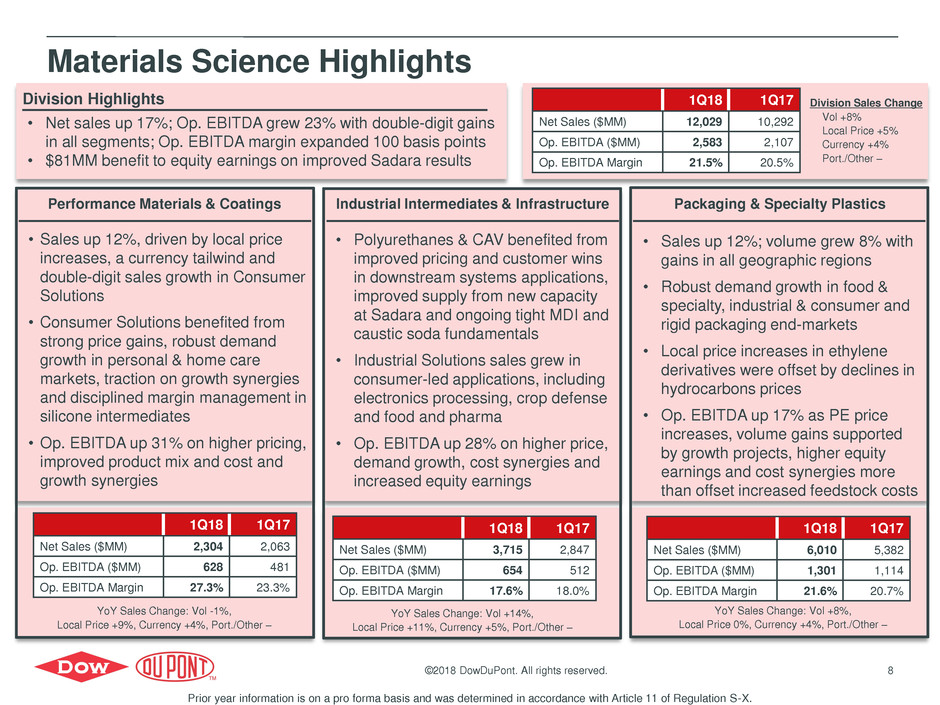

Materials Science Highlights Performance Materials & Coatings • Sales up 12%, driven by local price increases, a currency tailwind and double-digit sales growth in Consumer Solutions • Consumer Solutions benefited from strong price gains, robust demand growth in personal & home care markets, traction on growth synergies and disciplined margin management in silicone intermediates • Op. EBITDA up 31% on higher pricing, improved product mix and cost and growth synergies ©2018 DowDuPont. All rights reserved. Jen/Ann YoY Sales Change: Vol -1%, Local Price +9%, Currency +4%, Port./Other – Division Highlights 1Q18 1Q17 Net Sales ($MM) 12,029 10,292 Op. EBITDA ($MM) 2,583 2,107 Op. EBITDA Margin 21.5% 20.5% • Net sales up 17%; Op. EBITDA grew 23% with double-digit gains in all segments; Op. EBITDA margin expanded 100 basis points • $81MM benefit to equity earnings on improved Sadara results YoY Sales Change: Vol +8%, Local Price 0%, Currency +4%, Port./Other – • Polyurethanes & CAV benefited from improved pricing and customer wins in downstream systems applications, improved supply from new capacity at Sadara and ongoing tight MDI and caustic soda fundamentals • Industrial Solutions sales grew in consumer-led applications, including electronics processing, crop defense and food and pharma • Op. EBITDA up 28% on higher price, demand growth, cost synergies and increased equity earnings • Sales up 12%; volume grew 8% with gains in all geographic regions • Robust demand growth in food & specialty, industrial & consumer and rigid packaging end-markets • Local price increases in ethylene derivatives were offset by declines in hydrocarbons prices • Op. EBITDA up 17% as PE price increases, volume gains supported by growth projects, higher equity earnings and cost synergies more than offset increased feedstock costs Industrial Intermediates & Infrastructure Packaging & Specialty Plastics Division Sales Change Vol +8% Local Price +5% Currency +4% Port./Other – 8 1Q18 1Q17 Net Sales ($MM) 2,304 2,063 Op. EBITDA ($MM) 628 481 Op. EBITDA Margin 27.3% 23.3% 1Q18 1Q17 Net Sales ($MM) 3,715 2,847 Op. EBITDA ($MM) 654 512 Op. EBITDA Margin 17.6% 18.0% 1Q18 1Q17 Net Sales ($MM) 6,010 5,382 Op. EBITDA ($MM) 1,301 1,114 Op. EBITDA Margin 21.6% 20.7% YoY Sales Change: Vol +14%, Local Price +11%, Currency +5%, Port./Other – Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

Specialty Products Highlights Electronics & Imaging 1Q18 1Q17 Net Sales ($MM) 1,153 1,164 Op. EBITDA ($MM) 357 327 Op. EBITDA Margin 31.0% 28.1% • Continued strong demand in key end markets, led by double-digit growth in semis and interconnect solutions; partially offset by declines in PV & Adv. Materials • Op. EBITDA up 9% as lower pension/OPEB costs, cost synergies, volume growth and a currency benefit more than offset a negative impact from portfolio and higher unit costs 9 ©2018 DowDuPont. All rights reserved. Jen/Ann YoY Sales change: Vol +1%, Local Price +1% Currency +2%, Port./Other (5)% Division Highlights 1Q18 1Q17 Net Sales ($MM) 5,597 5,052 Op. EBITDA ($MM) 1,566 1,257 Op. EBITDA Margin 28.0% 24.9% • Volume gains delivered by all four segments in most regions • Op. EBITDA margin expanded by 310 bps; growth in all segments 1Q18 1Q17 Net Sales ($MM) 1,720 1,424 Op. EBITDA ($MM) 418 317 Op. EBITDA Margin 24.3% 22.3% YoY Sales change: Vol +4%, Local Price +1% Currency +4%, Port./Other +12% 1Q18 1Q17 Net Sales ($MM) 1,425 1,251 Op. EBITDA ($MM) 437 321 Op. EBITDA Margin 30.7% 25.7% YoY Sales change: Vol +3%, Local Price +5% Currency +6% , Port./Other – 1Q18 1Q17 Net Sales ($MM) 1,299 1,213 Op. EBITDA ($MM) 354 292 Op. EBITDA Margin 27.3% 24.1% YoY Sales change: Vol +3%, Local Price – Currency +4%, Port./Other – • Volume growth led by N&H with double-digit growth in probiotics and pharma, coupled with gains in systems & texturants • Volume growth in IB led by double-digits gains in CleanTech, coupled with growth in microbial control solutions and bioactives • Op. EBITDA up 32% on a portfolio benefit, volume growth, cost synergies and lower pension/OPEB costs • Gains in local price were driven by nylon and polyesters amid tight supply and higher feedstock costs • Volume gains led by performance solutions for electronics and aerospace markets; performance resins also up • Op. EBITDA rose 36% on lower pension/OPEB costs, currency, sales gains and cost synergies • Volume gains were led by Tyvek® and Nomex® • Demand from industrial markets remained strong; construction sales reflected weather-related delays • Op. EBITDA increased 21% primarily due to lower pension/OPEB costs, cost synergies, reliability improvements and currency; partially offset by higher costs Nutrition & Biosciences Transportation & Advanced Polymers Safety & Construction Division Sales Change Vol +3% Local Price +2% Currency +4% Port./Other +2% Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

©2018 DowDuPont. All rights reserved. U.S. Weather Impact on Agriculture Segment 10 Key Business Data Points Many seed reps provide deliveries to our farmer customers within a few days or less of planting A majority of Pioneer-branded seed in the U.S. is delivered over a 4-week period just ahead of planting Currently corn plantings are expected to be ~3-4 weeks delayed Corn shipments through April 1 were ~1/3 of previous year Soil temps of 50 degrees are optimal for corn planting Majority of corn belt was still below 50 degrees on April 1 Soil Temperatures April 1-7, 2018 U.S. Corn Planting Progress Source: USDA

Agriculture Highlights 1Q18 1Q17 Net Sales ($MM) 3,808 5,049 Op. EBITDA ($MM) 891 1,461 Op. EBITDA Margin 23.4% 28.9% YoY Sales change: Vol (28)%, Local Price +1% Currency +2%, Port./Other – First Quarter Results First Half Outlook Innovation • Seed sales of $2.3 billion declined 34% driven by a delayed start to the Northern Hemisphere and Brazil seasons and an expected reduction in planted area in the North American and Brazil seasons. Volume was also negatively impacted by lower sales in Brazil as farmers moved towards lower technology corn offerings due to the shortened safrinha season. • Crop Protection sales of $1.5 billion declined 3% as favorable price and currency were more than offset by lower volumes due to the delayed seasons. Volume reductions were partially offset by strong insecticide sales growth and local selling price increases in crop protection driven by continuing efforts to capture value in established brands across the portfolio globally. • Operating EBITDA of $891 million declined 39% due to the delay in Northern Hemisphere and Brazil seasons and lower expected planted area in North America and Brazil, which was partially offset by cost synergies, favorable currency, higher local pricing and lower pension/OPEB costs. 11 • First half sales expected to decline low-single digits percent and operating EBITDA is expected to decline mid-single digits percent versus prior year. Expected growth in new product sales, local pricing gains, and cost synergy realization are anticipated to be more than offset by lower planted area in North America and Brazil, a lower-technology seed mix in Brazil, and higher product costs driven by higher soybean royalty costs. ©2018 DowDuPont. All rights reserved. • Select new products contributing to growth in 2018 (weighted towards 2H) • RinskorTM and ArylexTM herbicides • VessaryaTM and ZorvecTM fungicides • PyraxaltTM and IsoclastTM insecticides Q1 2018 Net Sales Seed Crop Protection Prior year information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.

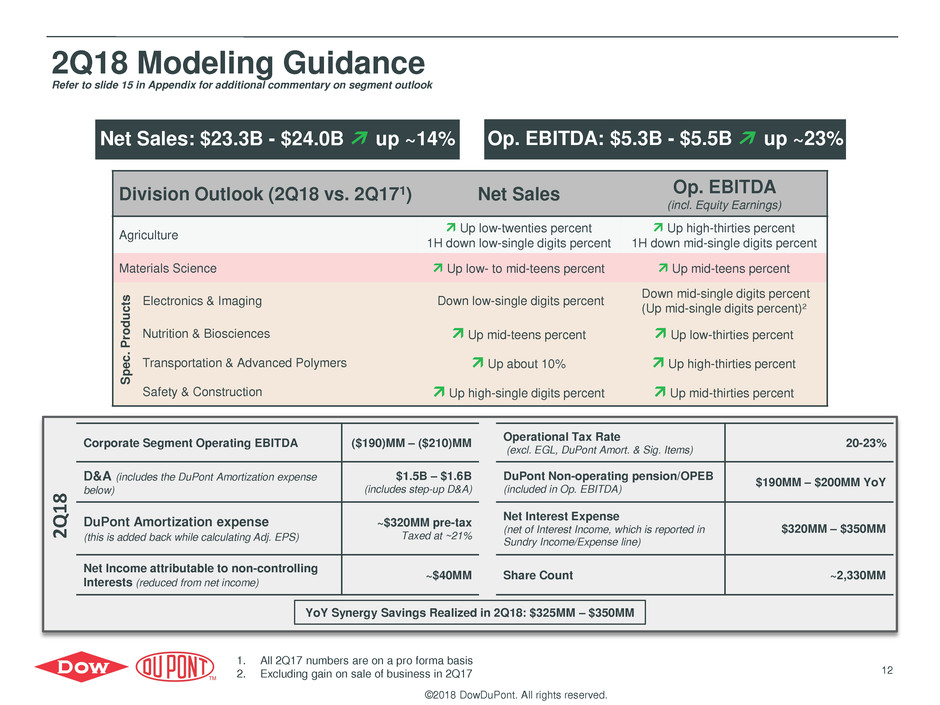

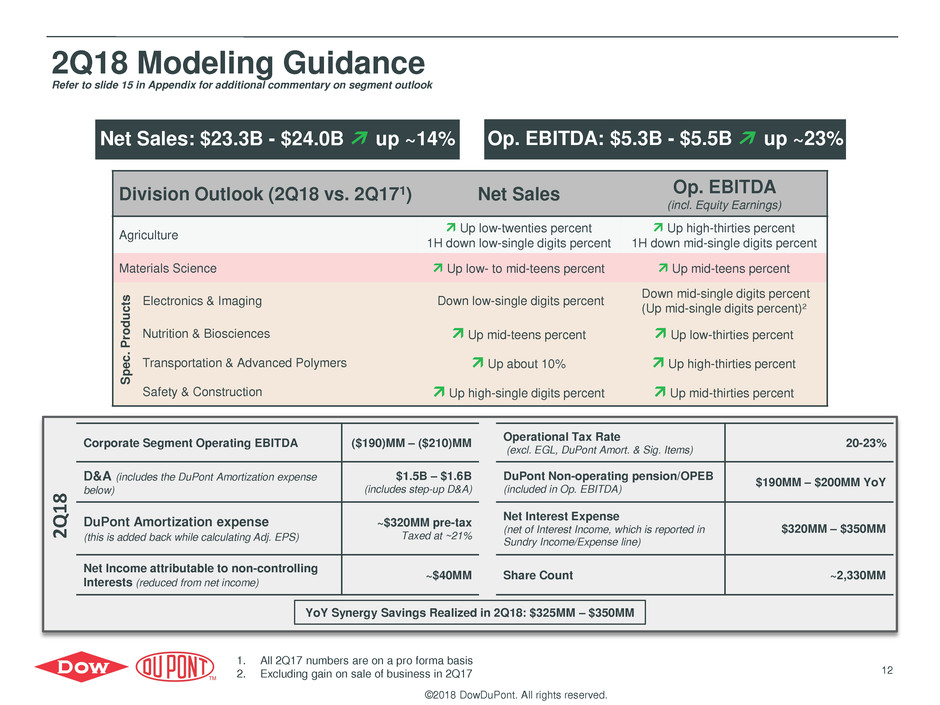

12 ©2018 DowDuPont. All rights reserved. 2Q18 Modeling Guidance 2 Q 1 8 Corporate Segment Operating EBITDA ($190)MM – ($210)MM Operational Tax Rate (excl. EGL, DuPont Amort. & Sig. Items) 20-23% D&A (includes the DuPont Amortization expense below) $1.5B – $1.6B (includes step-up D&A) DuPont Non-operating pension/OPEB (included in Op. EBITDA) $190MM – $200MM YoY DuPont Amortization expense (this is added back while calculating Adj. EPS) ~$320MM pre-tax Taxed at ~21% Net Interest Expense (net of Interest Income, which is reported in Sundry Income/Expense line) $320MM – $350MM Net Income attributable to non-controlling Interests (reduced from net income) ~$40MM Share Count ~2,330MM Division Outlook (2Q18 vs. 2Q171) Net Sales Op. EBITDA (incl. Equity Earnings) Agriculture Up low-twenties percent 1H down low-single digits percent Up high-thirties percent 1H down mid-single digits percent Materials Science Up low- to mid-teens percent Up mid-teens percent Electronics & Imaging Down low-single digits percent Down mid-single digits percent (Up mid-single digits percent)2 Nutrition & Biosciences Up mid-teens percent Up low-thirties percent Transportation & Advanced Polymers Up about 10% Up high-thirties percent Safety & Construction Up high-single digits percent Up mid-thirties percent Net Sales: $23.3B - $24.0B up ~14% Op. EBITDA: $5.3B - $5.5B up ~23% 1. All 2Q17 numbers are on a pro forma basis 2. Excluding gain on sale of business in 2Q17 Refer to slide 15 in Appendix for additional commentary on segment outlook YoY Synergy Savings Realized in 2Q18: $325MM – $350MM S p ec. P ro d u ct s

Appendix

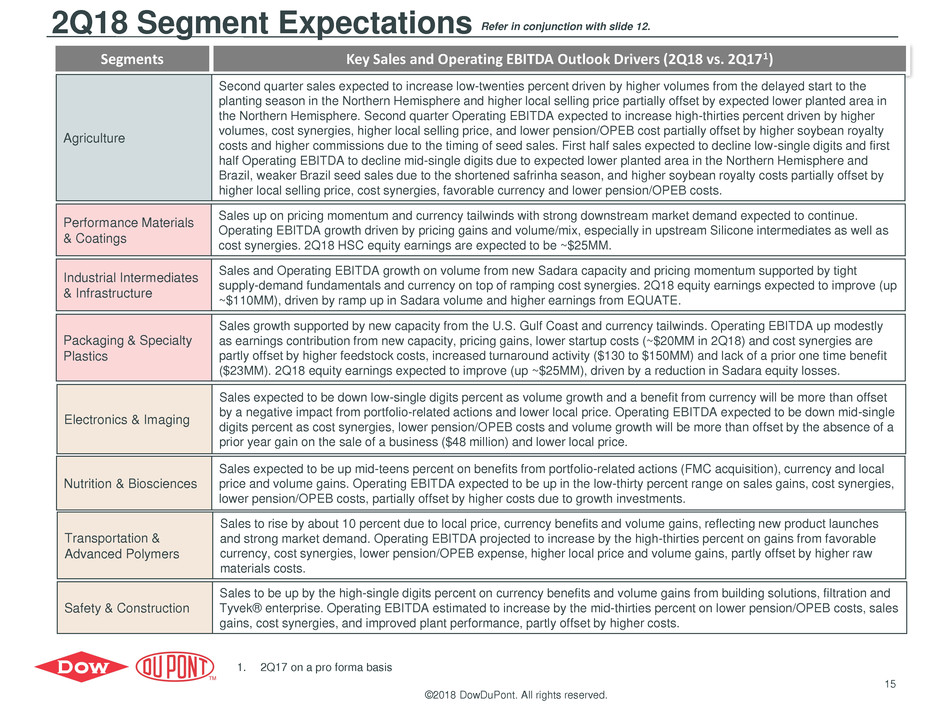

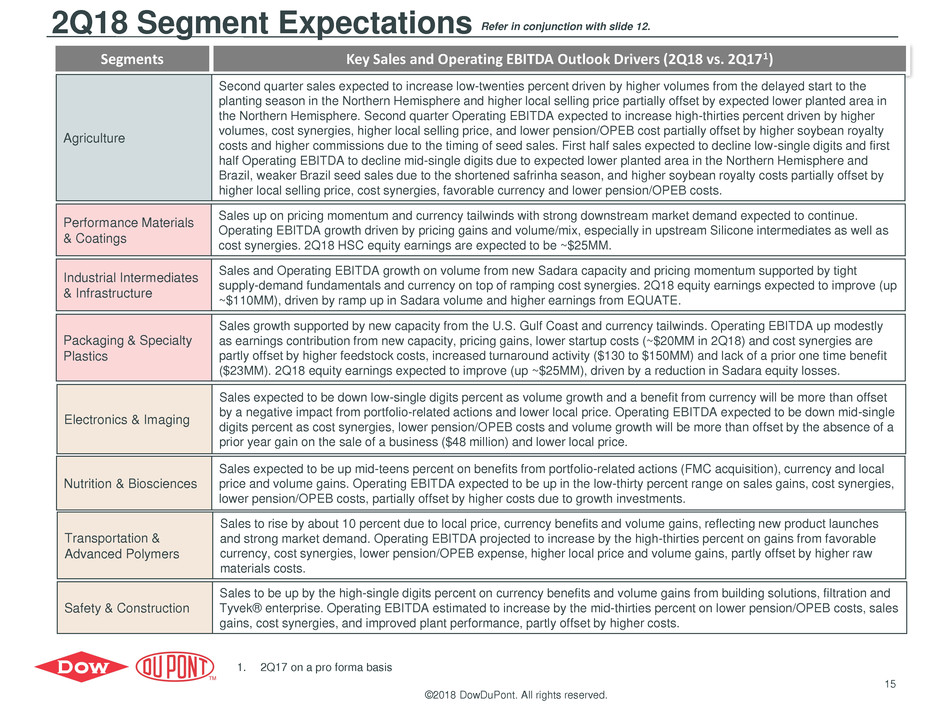

15 2Q18 Segment Expectations 1. 2Q17 on a pro forma basis Segments Key Sales and Operating EBITDA Outlook Drivers (2Q18 vs. 2Q171) Safety & Construction Sales to be up by the high-single digits percent on currency benefits and volume gains from building solutions, filtration and Tyvek® enterprise. Operating EBITDA estimated to increase by the mid-thirties percent on lower pension/OPEB costs, sales gains, cost synergies, and improved plant performance, partly offset by higher costs. Transportation & Advanced Polymers Sales to rise by about 10 percent due to local price, currency benefits and volume gains, reflecting new product launches and strong market demand. Operating EBITDA projected to increase by the high-thirties percent on gains from favorable currency, cost synergies, lower pension/OPEB expense, higher local price and volume gains, partly offset by higher raw materials costs. Nutrition & Biosciences Sales expected to be up mid-teens percent on benefits from portfolio-related actions (FMC acquisition), currency and local price and volume gains. Operating EBITDA expected to be up in the low-thirty percent range on sales gains, cost synergies, lower pension/OPEB costs, partially offset by higher costs due to growth investments. Electronics & Imaging Sales expected to be down low-single digits percent as volume growth and a benefit from currency will be more than offset by a negative impact from portfolio-related actions and lower local price. Operating EBITDA expected to be down mid-single digits percent as cost synergies, lower pension/OPEB costs and volume growth will be more than offset by the absence of a prior year gain on the sale of a business ($48 million) and lower local price. Refer in conjunction with slide 12. ©2018 DowDuPont. All rights reserved. Agriculture Second quarter sales expected to increase low-twenties percent driven by higher volumes from the delayed start to the planting season in the Northern Hemisphere and higher local selling price partially offset by expected lower planted area in the Northern Hemisphere. Second quarter Operating EBITDA expected to increase high-thirties percent driven by higher volumes, cost synergies, higher local selling price, and lower pension/OPEB cost partially offset by higher soybean royalty costs and higher commissions due to the timing of seed sales. First half sales expected to decline low-single digits and first half Operating EBITDA to decline mid-single digits due to expected lower planted area in the Northern Hemisphere and Brazil, weaker Brazil seed sales due to the shortened safrinha season, and higher soybean royalty costs partially offset by higher local selling price, cost synergies, favorable currency and lower pension/OPEB costs. Packaging & Specialty Plastics Sales growth supported by new capacity from the U.S. Gulf Coast and currency tailwinds. Operating EBITDA up modestly as earnings contribution from new capacity, pricing gains, lower startup costs (~$20MM in 2Q18) and cost synergies are partly offset by higher feedstock costs, increased turnaround activity ($130 to $150MM) and lack of a prior one time benefit ($23MM). 2Q18 equity earnings expected to improve (up ~$25MM), driven by a reduction in Sadara equity losses. Industrial Intermediates & Infrastructure Sales and Operating EBITDA growth on volume from new Sadara capacity and pricing momentum supported by tight supply-demand fundamentals and currency on top of ramping cost synergies. 2Q18 equity earnings expected to improve (up ~$110MM), driven by ramp up in Sadara volume and higher earnings from EQUATE. Performance Materials & Coatings Sales up on pricing momentum and currency tailwinds with strong downstream market demand expected to continue. Operating EBITDA growth driven by pricing gains and volume/mix, especially in upstream Silicone intermediates as well as cost synergies. 2Q18 HSC equity earnings are expected to be ~$25MM.