As filed electronically with the Securities and Exchange Commission on or about May 21, 2021

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________________________________

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

[ ] Pre-Effective Amendment No. ___ [ ] Post-Effective Amendment No. ___

| | FIRST TRUST EXCHANGE-TRADED FUND VIII | |

(Exact Name of Registrant as Specified in Charter)

| 120 East Liberty Drive

Suite 400

Wheaton, Illinois 60187 | |

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Area Code and Telephone Number)

| | W. Scott Jardine

First Trust Advisors L.P.

Suite 400

120 East Liberty Drive

Wheaton, Illinois 60187 | |

(Name and Address of Agent for Service)

With copies to:

Eric F. Fess

Chapman and Cutler LLP

111 West Monroe Street

Chicago, Illinois 60603

TITLE OF SECURITIES BEING REGISTERED:

Shares of beneficial interest ($0.01 par value per share) of

EquityCompass Risk Manager ETF, a Series of the Registrant.

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EquityCompass Tactical Risk Manager ETF

and

EquityCompass Risk Manager ETF

A Message from the Chairman of the Board of Trustees

[ ], 2021

Dear Shareholder:

I am writing to you to ask for your vote on a very important matter that will significantly affect your investment in EquityCompass Tactical Risk Manager ETF (“TERM”) or EquityCompass Risk Manager ETF (“ERM”), as applicable. Enclosed is a joint proxy statement and prospectus (“Proxy Statement/Prospectus”) seeking your approval of a proposal at a joint special meeting of shareholders of TERM and ERM (the “Meeting”).

At the Meeting, which will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2021, at [ ] a.m., shareholders will be asked to consider and vote upon proposals involving a reorganization transaction (the “Reorganization”) whereby TERM will be combined with ERM, an exchange-traded fund (“ETF”) organized as a separate series of First Trust Exchange-Traded Fund VIII, an open-end management investment company, pursuant to which shareholders of TERM would become shareholders of ERM.

Through the Reorganization, shares of TERM would be exchanged, on a tax-free basis for federal income tax purposes as further described herein, for shares of ERM with an equal aggregate net asset value, and TERM shareholders will become shareholders of ERM.

In determining to recommend approval of the proposals, the Board of Trustees of each of TERM and ERM considered the following factors, among others:

| · | TERM and ERM utilize substantially similar investment strategies and are managed by the same sub-adviser; |

| · | given that TERM may no longer be offered on the platform through which it is primarily sold, the Reorganization would allow shareholders of TERM who become shareholders of ERM to remain in the sub-adviser’s tactical risk manager (“Risk Manager”) investment strategy without being forced to liquidate their position, and additional assets in ERM and having a single fund dedicated to the Risk Manager strategy could garner more investor interest over time, which could help shareholders in the form of improved bid/ask spreads; and |

| · | the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. |

The Board of Trustees of each of TERM and ERM has approved the Agreement and Plan of Reorganization (the “Plan”) and the transactions it contemplates and recommends that TERM shareholders vote “FOR” approval of the Plan and the Reorganization it contemplates, and that ERM shareholders vote “FOR” approval of the issuance of additional ERM shares in the Reorganization. A copy of the Plan is attached as Exhibit A to the enclosed Proxy Statement/Prospectus.

Also included in this booklet are the following materials concerning the upcoming Meeting:

| · | a Joint Notice of Special Meeting of Shareholders, which summarizes the respective proposal for which you are being asked to provide voting instructions; and |

| · | a joint proxy statement and prospectus, which provides detailed information on ERM, the specific proposals being considered at the Meeting and why the proposals are being made, including the differences between TERM and ERM. |

While you are, of course, welcome to join us at the Meeting, most shareholders cast their vote by filling out and signing the enclosed proxy card or by voting by touch-tone telephone or via the Internet. We urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed proxy card or vote by touch-tone telephone or via the Internet. A postage-paid envelope is enclosed for mailing, and touch-tone telephone and Internet voting instructions are listed at the top of your proxy card.

Your vote is very important. As a shareholder, you are entitled to cast one vote for each share of TERM or ERM that you own. Please take a few moments to read the enclosed materials and then cast your vote.

Our proxy solicitor, AST Fund Solutions LLC, may contact you to encourage you to exercise your right to vote.

We appreciate your participation in this important Meeting. Thank you.

Sincerely yours,

James A. Bowen

Chairman of the Board of Trustees,

First Trust Exchange Traded Fund VIII, on behalf of

EquityCompass Tactical Risk Manager ETF and

EquityCompass Risk Manager ETF

If You Need Any Assistance, Or Have Any Questions Regarding The Proposed Reorganization Or How To Vote Your Shares, Call AST Fund Solutions LLC at 866-342-2676 Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

Important Notice to Shareholders of

EquityCompass Tactical Risk Manager ETF

and

EquityCompass Risk Manager ETF

Questions & Answers

[ ], 2021

Although we recommend that you read the entire joint proxy statement and prospectus, for your convenience, we have provided a brief overview of the issues to be voted on.

| A. | You are being asked to to approve one of the following proposals to be considered at a joint special meeting of shareholders (the “Meeting”) of EquityCompass Tactical Risk Manager ETF (“TERM”) and EquityCompass Risk Manager ETF (“ERM,” and TERM and ERM are each a “Fund” and, together, the “Funds”), both of which are series of First Trust Exchange-Traded Fund VIII (the “Trust”): |

| · | For shareholders of TERM: you are being asked to consider and approve an Agreement and Plan of Reorganization (the “Plan”) between the Trust, on behalf of TERM, and the Trust, on behalf of ERM, pursuant to which the assets and liabilities of TERM will be transferred to ERM, and shareholders of TERM will become shareholders of ERM (collectively, the “Reorganization”). |

| · | For shareholders of ERM: you are being asked to consider and approve the issuance of shares by ERM in the Reorganization. |

The Board of Trustees of each of TERM and ERM has determined that the proposal applicable to each Fund is in the best interests of the respective Fund. The Board of Trustees of each Fund recommends that you vote FOR the proposal applicable to your Fund.

| Q. | How will the Reorganization be effected? |

| A. | Assuming TERM shareholders approve the Reorganization and ERM shareholders approve the issuance of additional shares of ERM, TERM will be reorganized into ERM. |

Upon the closing of the reorganization of TERM into ERM, TERM shareholders will receive newly issued shares of ERM. Shareholders of TERM will receive a number of ERM shares equal in aggregate net asset value to the aggregate net asset value of the TERM shares held by such shareholders, each computed as of the close of regular trading on the New York Stock Exchange on the business day immediately prior to the date of the closing of the Reorganization (the “Valuation Time”).

Immediately following the reorganization, TERM will be terminated as a series of the Trust.

| Q. | Why is the Reorganization being recommended? |

| A. | Both ERM and TERM were launched in April of 2017 and follow EquityCompass Investment Management LLC’s (“EquityCompass” or the “Sub-Adviser”) tactical risk manager process that rotates the Fund’s allocations from long equity to holding cash, and in some cases for TERM, being short the broad equity market. Asset gathering for both Funds has been slow since launch. Tactical strategies typically perform well in markets that trend up and down over longer periods of time, but tend to underperform in markets that move quickly down, then quickly rebound (or vice versa), which was the case for both TERM and ERM in the last two market downturns. Each of TERM and ERM has lagged its benchmark and peer average since inception and over a 1 and 3 year time period. However, TERM’s performance has been worse than ERM’s since inception and over a 3 year time period, with the Funds’ performance being substantially identical over a 1 year time period. Additionally, First Trust Advisors, L.P., the investment adviser of the Funds (“First Trust” or the “Adviser”), has recently been informed by EquityCompass that TERM may no longer be offered on the platform through which it is primarily sold, in which case TERM may cease its operation. |

Rather than see investors being forced to liquidate positions due to TERM ceasing its operations or have a Fund with limited growth potential, First Trust believes reorganizing TERM into ERM would be in the best interests of TERM investors. The Board of Trustees and management of TERM believe the Reorganization would allow TERM shareholders who become shareholders of ERM to remain in the Sub-Adviser’s tactical risk manager (“Risk Manager”) investment strategy without being forced to liquidate their position. Additionally, ERM shareholders could benefit as the Fund increases in size due to the new assets. Larger funds tend to trade at marginally better spreads and could garner more investor interest over time. If the Reorganization is consummated, TERM’s shareholders will receive ERM shares equal in aggregate net asset value to the aggregate net asset value of their TERM shares as of the Valuation Time. Immediately after the Reorganization, ERM will have a greater asset base than TERM prior to the Reorganization. In addition, ERM has and is expected to maintain a similar total operating expense ratio as TERM following the Reorganization. No assurances can be given that ERM’s total operating expense ratio will remain at its current rate.

| Q. | Will shareholders of the Funds have to pay any fees or expenses in connection with the Reorganization? |

| A. | Yes. The direct costs associated with the proposed Reorganization, including the costs associated with the Meeting, will be borne by First Trust and EquityCompass, regardless of whether the Reorganization is completed. However, the indirect expenses of the Reorganization, primarily relating to the repositioning of the assets of TERM, if any, will be borne by TERM and will impact the net asset value of TERM prior to the Reorganization. Please see the question “Will the value of my investment change as a result of the approval of the proposed Reorganization?” below for additional information regarding the repositioning of the assets of TERM. |

| Q. | Will the shares held by TERM shareholders continue to be listed on the NYSE Arca following the Reorganization? |

| A. | Yes. TERM shares and ERM shares are both currently listed and trade on the NYSE Arca Exchange (the “NYSE Arca”), and ERM shares will continue to be listed and trade on the NYSE Arca following the Reorganization. Shareholders will bear no costs in connection with the delisting of TERM or the listing of additional shares of ERM in connection with the Reorganization. |

| Q. | Do the Funds have similar investment strategies and risks? |

| A. | Yes. The investment strategies of TERM and ERM are similar in certain respects, but have some important differences. As a result of such similarities, the Funds are subject to many of the same investment risks. |

TERM and ERM are both actively managed exchange-traded funds (“ETF”) whose investment objectives are to seek to provide long term capital appreciation with capital preservation as a secondary objective.

TERM seeks to achieve its investment objectives by investing, under normal market conditions, in equity securities of companies domiciled in the United States or listed on a U.S. securities exchange. During periods when the U.S. equity market is determined to be unfavorable by the Sub-Adviser, TERM may invest all or a portion of its assets in cash, cash equivalents and short-term fixed income ETFs. During such periods, TERM may invest all or a significant portion of its assets in securities designed to provide short exposure to broad U.S. market indices including by investing in inverse ETFs.

TERM’s strategy seeks to provide exposure to U.S.-listed equity securities and to avoid large, prolonged market losses and reduce volatility. Although TERM may invest in equity securities of any market capitalization, the equity securities held by TERM are generally stocks in the S&P 100® Index and certain smaller capitalized stocks diversified across major economic sectors, typically within the S&P 500® Index. The portfolio of equity securities and allocation decisions are determined by analyzing technical and fundamental market indicators to determine the current overall favorability of the market. When these indicators determine that the market is entering an unfavorable period, TERM may invest all or a portion of its assets in cash, cash equivalents, money market funds and/or short-term fixed income ETFs, or TERM may invest all or a portion of its assets in a single short-term fixed income ETF, the First Trust Enhanced Short Maturity ETF (“FTSM”). During an unfavorable market period, TERM may also invest in inverse ETFs which seek to provide investment results that match a negative return of the performance of an underlying index like the S&P 500® Index. Certain of the ETFs in which TERM invests may be advised by First Trust.

ERM seeks to achieve its investment objectives by investing, under normal market conditions, in equity securities of companies domiciled in the United States or listed on a U.S. securities exchange. During periods when the U.S. equity market is determined to be unfavorable by the Sub-Adviser, ERM may invest all or a portion of its assets in cash, cash equivalents and short-term fixed income ETFs.

ERM’s strategy seeks to provide exposure to U.S.-listed equity securities and to avoid large, prolonged market losses and reduce volatility. Although ERM may invest in equity securities of any market capitalization, the equity securities held by ERM are generally stocks in the S&P 100® Index and certain smaller capitalized stocks diversified across major economic sectors, typically within the S&P 500® Index. The portfolio of equity securities and allocation decisions are determined by analyzing technical and fundamental market indicators to determine the current overall favorability of the market. When these indicators determine that the market is entering an unfavorable period, ERM may invest all or a portion of its assets in cash, cash equivalents, money market funds and/or short-term fixed income ETFs, or ERM may invest all or a portion of its assets in FTSM. Certain of the ETFs in which ERM invests may be advised by First Trust.

The principal difference between the investment strategies of TERM and ERM is that TERM may invest all or a significant portion of its assets in securities designed to provide short exposure to broad U.S. market indices, including by investing in inverse ETFs, when the U.S. equity market is determined to be unfavorable by the Sub-Adviser. As a result of this difference, TERM and ERM are subject to different risks associated with such different investments and strategies.

| Q. | Are the Funds managed by the same portfolio management team? |

| A. | Yes. First Trust serves as the investment adviser to both TERM and ERM and EquityCompass serves as the sub-adviser to both TERM and ERM. For both Funds, the Investment Committee of First Trust is responsible for the day-to-day management of the Fund with daily decisions being made jointly by Investment Committee members while EquityCompass provides non-discretionary investment advice to the Investment Committee. |

| Q. | Will the Reorganization constitute a taxable event for TERM shareholders? |

| A. | No. The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes and will not occur unless TERM’s counsel provides a tax opinion to that effect. If a shareholder chooses to sell TERM shares prior to the Reorganization, the sale will generate taxable gain or loss; therefore, such shareholder may wish to consult a tax advisor before doing so. Of course, the shareholder also may be subject to periodic capital gains as a result of the normal operations of TERM whether or not the proposed Reorganization occurs. |

TERM, if requested by ERM, will attempt to dispose of assets that do not conform to ERM’s investment objectives, policies and restrictions in advance of the Reorganization. It is anticipated that none of TERM’s assets will be disposed of prior to the Reorganization at the request of ERM. TERM intends to pay a dividend of any undistributed realized net investment income, if any, immediately prior to the closing of the Reorganization of TERM into ERM. The amount of dividends actually paid, if any, will depend on a number of factors, such as changes in the value of TERM’s holdings and the extent of the liquidation of securities between the date of the Meeting and the closing of such Reorganization. Any net investment income realized prior to the Reorganization will be distributed to TERM’s shareholders as ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to TERM’s shareholders. As of the date hereof, no long-term capital gains distributions are expected to be paid by TERM prior to the Reorganization.

| Q. | Will the value of my investment change as a result of the approval of the proposed Reorganization? |

| A. | Shareholders of TERM will receive a number of ERM shares equal in aggregate net asset value to the aggregate net asset value of the TERM shares held as of the Valuation Time. It is likely that the number of shares a TERM shareholder owns will change as a result of the Reorganization because shares of TERM will be exchanged for shares of ERM at an exchange ratio based on the Funds’ relative net asset values, which will likely differ from one another at the Valuation Time. |

| Q. | What vote is required to approve the proposed Reorganization? |

| A. | In the case of TERM, the approval of the proposed Reorganization requires the affirmative vote of (i) 67% or more of the TERM shares present at the Meeting, if the holders of more than 50% of the outstanding shares of TERM are present or represented by proxy, or (ii) more than 50% of the outstanding shares of TERM, whichever is less. |

In the case of ERM, the approval of the proposed issuance of additional shares of ERM to be issued in the Reorganization requires the vote of a majority of the total votes cast by ERM shareholders on the proposal, assuming a quorum is present at the Meeting.

Both Funds’ shareholders must approve the applicable Reorganization proposal if the Reorganization is to occur. Accordingly, the Reorganization may not be completed even if shareholders of your Fund vote to approve the applicable proposal.

| Q. | How do the Boards of Trustees recommend that shareholders vote on the proposals? |

| A. | After careful consideration, the Board of Trustees of each Fund has determined that the Reorganization is in the best interests of TERM and ERM and that the interests of TERM’s and ERM’s existing shareholders will not be diluted as a result of the Reorganization, and recommends that shareholders vote FOR the applicable proposal. |

| Q. | What will happen if the required shareholder approval is not obtained? |

| A. | In the event that shareholders of TERM do not approve the Reorganization or shareholders of ERM do not approve the issuance of additional shares of ERM to be issued in the Reorganization, each Fund will continue to exist and operate on a stand-alone basis. |

| Q. | When would the proposed Reorganization be effective? |

| A. | If approved, the Reorganization is expected to occur as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of the Reorganization, shareholders of both Funds will receive notice indicating that the Reorganization was completed. |

A. You can vote in any one of four ways:

| • | by mail, by sending the enclosed proxy card, signed and dated; |

| • | by phone, by calling one of the toll-free numbers listed on your proxy card for an automated touchtone voting line or to speak with a live operator; |

| • | via the Internet by following the instructions set forth on your proxy card; or |

| • | in person, by attending the Meeting. |

Whichever method you choose, please take the time to read the full text of the enclosed joint proxy statement and prospectus before you vote.

| Q. | Whom should I call for additional information about the joint proxy statement and prospectus? |

A. Please call AST Fund Solutions LLC, the Funds’ proxy solicitor, at 866-342-2676.

EquityCompass Tactical Risk Manager ETF

and

EquityCompass Risk Manager ETF

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

Notice of Joint Special Meeting of Shareholders

To be held on [ ], 2021

[ ], 2021

To the Shareholders of EquityCompass Tactical Risk Manager ETF and EquityCompass Risk Manager ETF:

Notice is hereby given that a Joint Special Meeting of Shareholders (the “Meeting”) of EquityCompass Tactical Risk Manager ETF (“TERM”), a series of First Trust Exchange-Traded Fund VIII, a Massachusetts business trust (the “Trust”), and EquityCompass Risk Manager ETF (“ERM”), also a series of the Trust, will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2021, at [ ] a.m. Central time, to consider the following (collectively, the “Proposals” and individually, a “Proposal”):

(1) For TERM shareholders, to approve an Agreement and Plan of Reorganization by and between the Trust, on behalf of TERM, and the Trust, on behalf of ERM, pursuant to which TERM would (i) transfer all of its assets to ERM in exchange solely for newly issued shares of ERM and ERM’s assumption of all of the liabilities of TERM and (ii) immediately distribute such newly issued shares of ERM to TERM shareholders (collectively, the “Reorganization”); and

(2) For ERM shareholders, to approve the issuance of additional shares of ERM in the Reorganization in accordance with the applicable rules of the NYSE Arca Exchange.

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting and any adjournments or postponements thereof.

Holders of record of shares of TERM or ERM at the close of business on [ ], 2021 are entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof.

By order of the Board of Trustees of First Trust

Exchange-Traded Fund VIII on behalf of

TERM and ERM,

W. Scott Jardine

Shareholders Who Do Not Expect To Attend The Meeting Are Requested To Promptly Complete, Sign, Date And Return The Proxy Card In The Enclosed Envelope Which Does Not Require Postage If Mailed In The Continental United States. Instructions For The Proper Execution Of Proxies Are Set Forth On The Next Page. If You Need Any Assistance, Or Have Any Questions Regarding Your Fund’s Proposal Or How To Vote Your Shares, Call AST Fund Solutions LLC at 866-342-2676 Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and will avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts: The capacity of the individual signing the proxy should be indicated unless it is reflected in the form of registration. For example:

| Registration | Valid Signature |

| | |

| Corporate Accounts | |

| (1) | ABC Corp. | ABC Corp. |

| (2) | ABC Corp. | John Doe, Treasurer |

| (3) | ABC Corp.

c/o John Doe, Treasurer |

John Doe |

| (4) | ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| | |

| Trust Accounts | |

| (1) | ABC Trust | Jane B. Doe, Trustee |

| (2) | Jane B. Doe, Trustee

u/t/d 12/28/78 |

Jane B. Doe |

| | |

| Custodial or Estate Accounts | |

| (1) | John B. Smith, Cust.

f/b/o John B. Smith, Jr., UGMA |

John B. Smith |

| (2) | John B. Smith | John B. Smith, Jr., Executor |

IMPORTANT INFORMATION FOR SHAREHOLDERS OF

EquityCompass Tactical Risk Manager ETF and EquityCompass risk manager ETF

This document contains a joint proxy statement and prospectus and is accompanied by a proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how to vote on your behalf on an important issue relating to your fund. If you complete and sign the proxy card and return it to us in a timely manner (or tell us how you want to vote by phone or via the Internet), we’ll vote exactly as you tell us. If you simply sign and return the proxy card without indicating how you wish to vote, we’ll vote it in accordance with the recommendation of the Board of Trustees as indicated on the cover of the joint proxy statement and prospectus.

We urge you to review the joint proxy statement and prospectus carefully and either fill out your proxy card and return it to us by mail, vote by phone or vote via the Internet. Your prompt return of the enclosed proxy card (or vote by phone or via the Internet) may save the necessity and expense of further solicitations.

If you have any questions, please call AST Fund Solutions LLC, the proxy solicitor, at the special toll-free number we have set up for you: 866-342-2676.

The information contained in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

SUBJECT TO COMPLETION, DATED MAY 21, 2021

equitycompass tactical risk manager etf and equitycompass risk manager etf

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(630) 765-8000

JOINT PROXY STATEMENT AND PROSPECTUS

[ ], 2021

This joint proxy statement and prospectus (“Proxy Statement/Prospectus”) is being furnished to shareholders of EquityCompass Tactical Risk Manager ETF (“TERM”), an exchange-traded fund organized as a separate series of First Trust Exchange-Traded Fund VIII, an open-end management investment company (the “Trust”), and shareholders of EquityCompass Risk Manager ETF (“ERM”), an an exchange-traded fund organized as a separate series of the Trust, in connection with a Joint Special Meeting of Shareholders (the “Meeting”) called by the Board of Trustees of the Trust (the “Board of Trustees) on behalf of ERM and the Board of Trustees of on behalf of TERM (will be be held at the offices of TERM and ERM, 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2021, at [ ] a.m. Central time, as may be adjourned or postponed, to consider the proposals listed below, and discussed in greater detail elsewhere in this Proxy Statement/Prospectus. TERM and ERM are referred to herein collectively as the “Funds” and each is referred to herein individually as a “Fund.”

This Proxy Statement/Prospectus explains concisely what you should know before voting on the proposals described in this Proxy Statement/Prospectus or investing in ERM. Please read it carefully and keep it for future reference.

At the Meeting, the shareholders of TERM and ERM will be asked to approve the proposal applicable to their Fund, as described below (collectively, the “Proposals” and individually, a “Proposal”):

Proposal No. 1: For TERM shareholders, to approve an Agreement and Plan of Reorganization by and between the Trust, on behalf of TERM, and the Trust, on behalf of ERM, a copy of which is attached to this Proxy Statement/Prospectus as Exhibit A (the “Plan”), pursuant to which TERM would (i) transfer all of its assets to ERM in exchange solely for newly issued shares of ERM and ERM’s assumption of all of the liabilities of TERM and (ii) immediately distribute such newly issued shares of ERM to TERM shareholders (collectively, the “Reorganization”); and

Proposal No. 2: For ERM shareholders, to approve the issuance of additional shares of ERM in the Reorganization in accordance with the applicable rules of the NYSE Arca Exchange (the “NYSE Arca” of the “Exchange”).

The Board of Trustees of each Fund has approved the Proposals as being in the best interests of TERM and ERM, respectively, and recommend that you vote FOR the Proposal applicable to your Fund. The Board of Trustees believes that, given that TERM may no longer be offered on the platform through which it is primarily sold, the Reorganization would allow TERM shareholders who become shareholders of ERM to remain in the Sub-Adviser’s tactical risk manager (“Risk Manager”) investment strategy without being forced to liquidate their position, and that additional assets in ERM and having a single fund dedicated to the Risk Manager strategy could garner more investor interest over time, which could help shareholders in the form of improved bid/ask spreads.

The proposed Reorganization seeks to combine the Funds, which have similar investment strategies and risks, but also have important distinctions. The Plan provides for the reorganization of TERM into ERM, pursuant to which TERM would (i) transfer all of its assets to ERM in exchange solely for newly issued shares of ERM and ERM’s assumption of all of the liabilities of TERM and (ii) immediately distribute such newly issued shares of ERM to TERM shareholders. Shareholders of TERM will receive a number of ERM shares equal in aggregate net asset value to the aggregate net asset value of the TERM shares held as of the close of regular trading on the New York Stock Exchange on the business day immediately prior to the closing of the reorganization of TERM into ERM (the “Valuation Time”). Through the Reorganization, shares of TERM would be exchanged on a tax-free basis for federal income tax purposes for shares of ERM. In the event that shareholders of TERM do not approve the Reorganization or shareholders of ERM do not approve the issuance of additional shares of ERM to be issued in the Reorganization, each Fund will continue to exist and operate on a stand-alone basis.

The securities offered by this Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

ERM lists and trades its shares on the NYSE Arca. Shares of ERM are not redeemable individually and therefore liquidity for individual shareholders of ERM will be realized only through a sale on any national securities exchange on which the shares are traded at market prices that may differ to some degree from the net asset value of the ERM shares. Reports, proxy materials and other information concerning ERM can be inspected at the offices of the NYSE Arca.

The following documents contain additional information about TERM and ERM, have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

(i) the prospectus and Statement of Additional Information of ERM, dated January 4, 2021, relating to shares of ERM (SEC File No. 333-210186);

(ii) the prospectus and Statement of Additional Information of TERM, dated January 4, 2021, relating to shares of TERM (SEC File No. 333-210186);

(iii) the audited financial statements and related independent registered public accounting firm’s report for ERM and the financial highlights for ERM contained in ERM’s Annual Report to Shareholders for the fiscal year ended August 31, 2020 (SEC File No. 811-23147); and

(iv) the audited financial statements and related independent registered public accounting firm’s report for TERM and the financial highlights for TERM contained in TERM’s Annual Report to Shareholders for the fiscal year ended August 31, 2020 (SEC File No. 811-23147).

A copy of the ERM prospectus accompanies this Proxy Statement/Prospectus. The Statement of Additional Information to this Proxy Statement/Prospectus is also incorporated by reference and legally deemed to be part of this document, and is available upon oral or written request at no charge by calling First Trust Advisors L.P. (“First Trust” or the “Advisor”) at (800) 621-1675 or by writing to First Trust at 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187. In addition, ERM will furnish, without charge, a copy of its prospectus, most recent Annual Report or Semi-Annual Report to a TERM shareholder upon request. TERM’s prospectus dated January 4, 2021, and Annual Report to Shareholders for the fiscal year ended August 31, 2020, containing audited financial statements, have been previously made available or mailed to shareholders. Copies of these documents are available upon request and without charge by writing to First Trust at the address listed above or by calling (800) 621-1675.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith are required to file reports and other information with the SEC. These reports, proxy statement/prospectus materials and other information can be inspected and copied, after paying a duplicating fee, by electronic request at publicinfo@sec.gov. In addition, copies of these documents may be viewed online or downloaded without charge from the SEC’s website at www.sec.gov. Reports, proxy materials and other information concerning TERM and ERM may be inspected at the offices of the NYSE Arca.

This Proxy Statement/Prospectus serves as a prospectus of ERM in connection with the issuance of the additional ERM shares in the Reorganization. In this connection, no person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| A. Synopsis | 1 |

| B. Risk Factors | 9 |

| C. Information About the Reorganization | 15 |

| D. Additional Information About the Investment Policies | 25 |

| Proposal — Reorganization of TERM Into ERM | 30 |

| Proposal — Approval of Issuance of Additional Shares of ERM | 31 |

| ADDITIONAL INFORMATION ABOUT TERM AND ERM | 32 |

| GENERAL INFORMATION | 36 |

| OTHER MATTERS TO COME BEFORE THE MEETING | 43 |

| EXHIBIT A AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B Proxy Card for EquityCompass Tactical Risk Manager ETF | B-1 |

| EXHIBIT C Proxy Card for EquityCompass Risk Manager ETF | C-1 |

INTRODUCTION

You are being asked to vote at the Meeting to approve the Proposal applicable to your Fund. Specifically, shareholders of TERM are being asked to consider and approve the Plan, pursuant to which the assets and liabilities of TERM will be transferred to ERM, and shareholders of TERM will become shareholders of ERM, and shareholders of ERM are being asked to approve the issuance of additional shares of ERM in connection with the Reorganization.

A. Synopsis

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus with respect to the proposed Reorganization and shareholders should reference the more complete information contained in this Proxy Statement/Prospectus and in the accompanying statement of additional information (the “Reorganization SAI”) and the appendices thereto. Shareholders should read the entire Proxy Statement/Prospectus carefully. Certain capitalized terms used but not defined in this summary are defined elsewhere in this Proxy Statement/Prospectus.

The Proposed Reorganization

The Board of Trustees of each of TERM and ERM, including the trustees who are not “interested persons” of the Funds (as defined in the 1940 Act), has approved the proposed Reorganization, including the Plan. If the shareholders of TERM approve the Plan (as set forth under Proposal No. 1) and shareholders of ERM approve the issuance of additional shares of ERM in connection with the Reorganization (as set forth under Proposal No. 2), TERM will reorganize into ERM, pursuant to which TERM would (i) transfer all of its assets to ERM in exchange solely for newly issued shares of ERM and ERM’s assumption of all of the liabilities of TERM and (ii) immediately distribute such newly issued shares of ERM to TERM shareholders. In connection with the Reorganization, ERM will issue to TERM shareholders book entry interests for the shares of ERM registered in a “street name” brokerage account held for the benefit of such shareholders. Shareholders of TERM will receive a number of ERM shares equal in aggregate net asset value to the aggregate net asset value of the TERM shares held as of the Valuation Time. Through the Reorganization, shares of TERM would be exchanged on a tax-free basis for federal income tax purposes for shares of ERM. Like shares of TERM, shares of ERM are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

Background and Reasons for the Proposed Reorganization

Both ERM and TERM were launched in April of 2017 and follow EquityCompass Investment Management LLC’s (“EquityCompass” or the “Sub-Adviser”) tactical risk manager process that rotates the Fund’s allocations from long equity to holding cash, and in some cases for TERM, being short the broad equity market. Asset gathering for both Funds has been slow since launch. Tactical strategies typically perform well in markets that trend up and down over longer periods of time, but tend to underperform in markets that move quickly down, then quickly rebound (or vice versa), which was the case for both TERM and ERM in the last two market downturns. Each of TERM and ERM has lagged its benchmark and peer average since inception and over a 1 and 3 year time period. However, TERM’s performance has been worse than ERM’s since inception and over a 3 year time period, with the Funds’ performance over a 1 year time period being substantially identical. Additionally, First Trust Advisors, L.P., the investment adviser of the Funds (“First Trust” or the “Adviser”), has recently been informed by EquityCompass that TERM may no longer be offered on the platform through which it is primarily sold.

Rather than see investors being forced to liquidate positions and have a Fund with limited growth potential, First Trust believes reorganizing TERM into ERM would be in the best interests of TERM investors. The Board of Trustees and management of TERM believe the Reorganization would allow TERM shareholders who become shareholders of ERM to remain in the Sub-Adviser’s tactical risk manager (“Risk Manager”) investment strategy without being forced to liquidate their position. Additionally, ERM shareholders could benefit as the Fund increases in size due to the new assets. Larger funds tend to trade at marginally better spreads and could garner more investor interest over time. If the Reorganization is consummated, TERM’s shareholders will receive ERM shares equal in aggregate net asset value to the aggregate net asset value of their TERM shares as of the Valuation Time. Immediately after the Reorganization, ERM will have a greater asset base than TERM prior to the Reorganization. In addition, ERM has and is expected to maintain a similar total operating expense ratio as TERM following the Reorganization. No assurances can be given that ERM’s total operating expense ratio will remain at its current rate.

Board Considerations Relating to the Proposed Reorganization

Based on information provided by First Trust, the Board of Trustees of each Fund considered the following factors, among others, in determining to recommend that shareholders of TERM and ERM approve the Plan and the Reorganization it contemplates:

| · | Compatibility of Investment Objectives and Policies. The Board noted that TERM and ERM are both actively managed exchange-traded funds that follow the Sub-Advisor’s Risk Manager investment strategy that rotates the Funds’ allocations tactically from long equity to holding cash, although, under certain circumstances, TERM may also go short the broad equity market. The Board noted that the investment strategies for TERM and ERM are substantially similar except for TERM’s ability to go short the market. The Board also considered the 100% overlap of the Funds’ portfolio holdings and nearly identical cash positions as of December 7, 2020. |

| · | Comparison of Fees and Expense Ratios; Expense Savings. The Board considered comparative expense information for TERM and ERM, including comparisons between the current unitary management fee rates and expense ratios for TERM and ERM and the estimated pro forma unitary management fee rate and expense ratio of the combined fund. The Board noted that each Fund’s unitary management fee rate is 0.65% of its average daily net assets and would not change as a result of the Reorganization. |

| · | Expenses of the Reorganization. The Board noted that the Advisor and the Sub-Advisor proposed to bear the direct costs of the Reorganization, including costs associated with proxy solicitation. The Board also noted that portfolio turnover and, therefore, brokerage costs, in connection with the Reorganization were expected to be limited given the 100% overlap of the Funds’ portfolio holdings as of December 7, 2020. |

| · | Potential Improved Trading and Liquidity. The Board considered the Advisor’s statement that additional assets in ERM and having a single fund dedicated to the Sub-Advisor’s Risk Manager strategy could garner more investor interest over time, which could help shareholders in the form of improved bid/ask spreads. |

| · | Fund Performance. The Board reviewed the historical performance of TERM and ERM, noting that each Fund had underperformed its respective benchmark and peer group average over the one- and three-year periods ended September 30, 2020, and over the period from inception on April 10, 2017 through September 30, 2020, with ERM outperforming TERM for the three-year and since-inception periods. The Board also noted that the Funds’ performance over the one-year period ended September 30, 2020 was substantially identical. |

| · | Portfolio Management. The Board noted that each Fund is managed by the Advisor’s Investment Committee, with the Sub-Advisor providing non-discretionary investment advice to the Investment Committee. The Board noted that the Advisor’s Investment Committee would continue to manage ERM, with the Sub-Advisor continuing to provide non-discretionary investment advice to the Investment Committee, following the closing of the Reorganization. |

| · | Anticipated Tax-Free Reorganization; Capital Loss Carryforwards. The Board noted the Advisor’s statement that the Reorganization will be structured with the intention that it qualify as a tax-free reorganization for federal income tax purposes and that TERM and ERM will obtain an opinion of counsel substantially to this effect (based on certain factual representations and certain customary assumptions). In addition, the Board noted information provided by the Advisor indicating that TERM’s capital loss carryforwards could be transferred in the Reorganization, which, subject to certain limitations, could then be used by ERM. |

| · | Terms and Conditions of the Reorganization. The Board considered the terms and conditions of the Reorganization and whether the Reorganization would result in the dilution of the interests of existing shareholders of TERM and ERM in light of the basis on which shares of ERM would be issued to shareholders of TERM. |

Please see “Information About the Reorganization—Background and Trustees’ Considerations Relating to the Proposed Reorganization” below for a further discussion of the deliberations and considerations undertaken by the Board of Trustees in connection with the proposed Reorganization.

The Board of Trustees of each Fund has concluded that the Reorganization is in the best interests of its respective Fund and that the interests of the existing shareholders of each Fund will not be diluted as a result of the Reorganization. In the event that shareholders of TERM and ERM do not approve the applicable Reorganization Proposal, each Fund will continue to exist and operate on a stand-alone basis.

Material Federal Income Tax Consequences of the Reorganization

For federal income tax purposes, no gain or loss is expected to be recognized by TERM or its shareholders as a direct result of the Reorganization. Any undistributed net investment income realized prior to the Reorganization will be distributed to TERM’s shareholders as ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to TERM’s shareholders. As of the date hereof, no long-term capital gains dividends are expected to be paid by TERM prior to the Reorganization. Through the Reorganization, TERM shares will be exchanged, on a tax-free basis for federal income tax purposes, for shares of ERM with an equal aggregate net asset value, and TERM shareholders will become shareholders of ERM.

Comparison of the Funds

General. Both TERM and ERM are diversified, actively managed ETFs that were created as series of the Trust, an open-end management investment company organized as a Massachusetts business trust on February 22, 2016.

Investment Objectives, Policies and Strategies. The investment strategies of TERM and ERM are similar, but have some important distinctions, each as discussed and summarized below. The primary difference between the investment strategies of TERM and ERM is that TERM may invest all or a significant portion of its assets in securities designed to provide short exposure to broad U.S. market indices, including by investing in inverse ETFs, when the U.S. equity market is determined to be unfavorable by the Sub-Adviser. As a result of such differences, TERM and ERM are subject to the different risks associated with such different investments and strategies. The similarities and differences between the Funds’ investment objectives, principal strategies and policies and non-principal and other investment strategies and policies are highlighted below.

Each Fund’s investment objectives are fundamental policies of the Fund and may not be changed without the approval of a ��majority of the outstanding voting securities” of the respective Fund. A “majority of the outstanding voting securities” means the lesser of (i) 67% or more of the shares represented at a meeting at which more than 50% of the outstanding shares are represented, or (ii) more than 50% of the outstanding shares.

Purchase, Redemption and Distribution. TERM and ERM issue and redeem shares on a continuous basis, at net asset value, only in large specified blocks of shares (each a “Creation Unit”). TERM and ERM shares are not individually redeemable securities of TERM and ERM, respectively, except when aggregated as Creation Units. Shares of TERM and ERM are listed and traded on NYSE Arca under the ticker symbol “TERM” and “ERM,” respectively, to provide liquidity for individual shareholders of TERM and ERM in amounts less than the size of a Creation Unit. Shareholders of TERM and ERM are entitled to dividends as declared by their respective Trustees. Each of TERM and ERM distribute their net investment income quarterly and their net realized capital gains at least annually, if any.

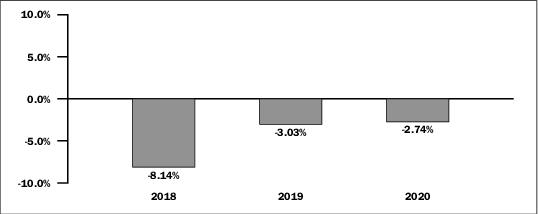

Past Performance. The bar charts and tables below provide some indication of the risks of investing in the Funds by showing you how the performance of each Fund has varied from year to year, and how the average total returns of the Funds for different periods compare. A Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Performance information for ERM is provided below.

EquityCompass Risk Manager ETF

Calendar Year Total Returns as of 12/31(1)

(1) The Fund’s calendar year-to-date total return based on net asset value for the period January 1, 2021 to February 28, 2021 was 6.69%.

During the Periods shown in the chart above:

| Best Quarter | Worst Quarter |

| 19.17% December 31, 2020 | -26.06% March 31, 2020 |

ERM’s past performance (before and after taxes) is not necessarily an indication of how ERM will perform in the future.

Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume a shareholder sold their shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from ERM returns, or taxes.

A shareholder’s own actual after-tax returns will depend on their specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold, or will hold, ERM shares in tax-deferred accounts such as individual retirement accounts (“IRAs”) or employee-sponsored retirement plans.

ERM will be the accounting survivor in the Reorganization.

| Average Annual Total Returns for the Periods Ended December 31, 2020 |

| ERM | 1 Year | Since Inception(1) |

| Return Before Taxes | -2.76% | 2.94% |

| Return After Taxes on Distributions | -3.37% | 2.20% |

| Return After Taxes on Distributions and Sale of Fund Shares | -1.68% | 1.93% |

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 18.40% | 15.53% |

| Hedge Fund Research HFRI Equity Index(2) (reflects no deduction for fees, expenses or taxes) | 17.67% | 8.40% |

| (1) | Inception Date 4/10/2017. |

| (2) | Cumulative total return for the period April 30, 2017 through December 31, 2020. Performance data is not available for the entire period shown in the table for the index because performance data for the index is only available on a month-end basis. Performance data for the index may be updated on an ongoing basis and is subject to change. |

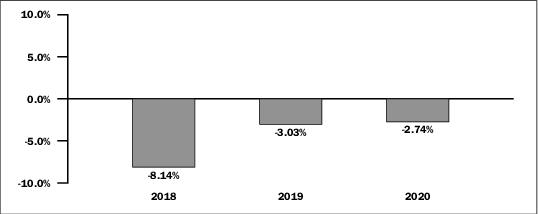

Performance information for TERM is provided below.

EquityCompass Tactical Risk Manager ETF

Calendar Year Total Returns as of 12/31(1)

(1) The Fund’s calendar year-to-date total return based on net asset value for the period January 1, 2021 to February 28, 2021 was 6.67%.

During the Periods shown in the chart above:

| Best Quarter | Worst Quarter |

| 19.13% December 31, 2020 | -26.05% March 31, 2020 |

TERM’s past performance (before and after taxes) is not necessarily an indication of how TERM will perform in the future.

Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume a shareholder sold their shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from TERM returns, or taxes.

A shareholder’s own actual after-tax returns will depend on their specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold TERM shares in tax-deferred accounts such as IRAs or employee-sponsored retirement plans.

| Average Annual Total Returns for the Periods Ended December 31, 2020 |

| TERM | 1 Year | Since Inception(1) |

| Return Before Taxes | -2.74% | -0.86% |

| Return After Taxes on Distributions | -3.35% | -1.51% |

| Return After Taxes on Distributions and Sale of Fund Shares | -1.67% | -0.92% |

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 18.40% | 15.53% |

| Hedge Fund Research HFRI Equity Index(2) (reflects no deduction for fees, expenses or taxes) | 17.67% | 8.40% |

| (1) | Inception Date 4/10/2017. |

| (2) | Cumulative total return for the period April 30, 2017 through December 31, 2020. Performance data is not available for the entire period shown in the table for the index because performance data for the index is only available on a month-end basis. Performance data for the index may be updated on an ongoing basis and is subject to change. |

B. Risk Factors

The investment strategies of TERM and ERM are similar, but have some important distinctions, as discussed in this Proxy Statement/Prospectus. The principal difference between the investment strategies of TERM and ERM is that TERM may invest all or a significant portion of its assets in securities designed to provide short exposure to broad U.S. market indices, including by investing in inverse ETFs, when the U.S. equity market is determined to be unfavorable by the Sub-Adviser. As a result of this difference, TERM and ERM are subject to different risks associated with such different investments and strategies.

Aside from these differences, as investment companies following similar strategies, many of the principal risks applicable to an investment in TERM are also applicable to an investment in ERM. Shares of each Fund may change in value, and an investor could lose money by investing in either Fund. The Funds may not achieve their investment objectives. An investment in a Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in a Fund involves risks similar to those of investing in equity securities of any fund traded on an exchange. Risk is inherent in all investing.

As noted above, although many of the principal risks applicable to an investment in TERM are also applicable to an investment in ERM, there are some differences in the risks applicable to each Fund. Because the Funds have substantially similar investment strategies, the Funds’ principal risks are substantially similar. The principal risks below should be considered by shareholders of each Fund in their evaluation of the Reorganization.

Principal Risks of ERM also applicable to TERM

The following are the principal risks ERM which are also applicable TERM.

Asset-Backed Securities Risk

Under certain market conditions, the Funds may invest in ETFs that hold asset-backed securities. Asset-backed securities are debt securities typically created by buying and pooling loans or other receivables other than mortgage loans and creating securities backed by those similar type assets. They are typically issued by trusts and special purpose co-purchasers that pass income from the underlying pool to investors. As with other debt securities, asset-backed securities are subject to credit risk, extension risk, interest rate risk, liquidity risk and valuation risk. Certain asset-backed securities do not have the benefit of the same security interest in the related collateral as do mortgage-backed securities, nor are they provided government guarantees of repayment. Credit card receivables are generally unsecured, and the debtors are entitled to the protection of a number of state and federal consumer credit laws, many of which give such debtors the right to set off certain amounts owed on the credit cards, thereby reducing the balance due. In addition, some issuers of automobile receivables permit the servicers to retain possession of the underlying obligations. If the servicer were to sell these obligations to another party, there is a risk that the purchaser would acquire an interest superior to that of the holders of the related automobile receivables. The impairment of the value of collateral or other assets underlying an asset-backed security, such as a result of non-payment of loans or non-performance of underlying assets, may result in a reduction in the value of such asset-backed securities and losses to an underlying ETF.

Authorized Participant Concentration Risk

Only an authorized participant may engage in creation or redemption transactions directly with a Fund. A limited number of institutions act as authorized participants for a Fund. Although participants are not obligated to make a market in a Fund’s shares or submit purchase and redemption orders for creation units. To the extent that these institutions exit the business, reduce their role or are unable to proceed with creation and/or redemption orders and no other authorized participant steps forward to create or redeem, a Fund’s shares may trade at a premium or discount to the Fund’s net asset value and possibly face delisting.

Call Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. Some debt securities may be redeemed at the option of the issuer, or “called,” before their stated maturity date. In general, an issuer will call its debt securities if they can be refinanced by issuing new debt securities which bear a lower interest rate. An underlying ETF is subject to the possibility that during periods of falling interest rates an issuer will call its high yielding debt securities. An underlying ETF would then be forced to invest the unanticipated proceeds at lower interest rates, likely resulting in a decline in the fund’s income. Such redemptions and subsequent reinvestments would also increase an underlying ETF’s portfolio turnover. If a called debt security was purchased by an underlying ETF at a premium, the value of the premium may be lost in the event of a redemption.

Counterparty Risk

Under certain market conditions, the Funds may invest in ETFs that are subject to counterparty risk. If an underlying ETF enters into an investment or transaction that depends on the performance of another party, the ETF becomes subject to the credit risk of that counterparty. An underlying ETF's ability to profit from these types of investments and transactions depends on the willingness and ability of the ETF’s counterparty to perform its obligations. If a counterparty fails to meet its contractual obligations, an underlying ETF may be unable to terminate or realize any gain on the investment or transaction, resulting in a loss to the ETF. An underlying ETF may experience significant delays in obtaining any recovery in an insolvency, bankruptcy, or other reorganization proceeding involving a counterparty (including recovery of any collateral posted by it) and may obtain only a limited recovery or may obtain no recovery in such circumstances. If an underlying ETF holds collateral posted by its counterparty, it may be delayed or prevented from realizing on the collateral in the event of a bankruptcy or insolvency proceeding relating to the counterparty. Under applicable law or contractual provisions, including if an underlying ETF enters into an investment or transaction with a financial institution and such financial institution (or an affiliate of the financial institution) experiences financial difficulties, then the ETF may in certain situations be prevented or delayed from exercising its rights to terminate the investment or transaction, or to realize on any collateral and may result in the suspension of payment and delivery obligations of the parties under such investment or transactions or in another institution being substituted for that financial institution without the consent of the underlying ETF. Further, an underlying ETF may be subject to “bail-in” risk under applicable law whereby, if required by the financial institution's authority, the financial institution's liabilities could be written down, eliminated or converted into equity or an alternative instrument of ownership. A bail-in of a financial institution may result in a reduction in value of some or all of securities and, if an underlying ETF holds such securities or has entered into a transaction with such a financial security when a bail-in occurs, such ETF may also be similarly impacted.

Credit Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. An issuer or other obligated party of a debt security held by an underlying ETF may be unable or unwilling to make dividend, interest and/or principal payments when due. In addition, the value of a debt security may decline because of concerns about the issuer’s ability or unwillingness to make such payments. Debt securities are subject to varying degrees of credit risk which are often reflected in credit ratings. The credit rating of a debt security may be lowered if the issuer or other obligated party suffers adverse changes to its financial condition. These adverse changes may lead to greater volatility in the price of the debt security and affect the security’s liquidity. High yield and comparable unrated debt securities, while generally offering higher yields than investment grade debt with similar maturities, involve greater risks, including the possibility of dividend or interest deferral, default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay dividends or interest and repay principal. To the extent that an underlying ETF holds debt securities that are secured or guaranteed by financial institutions, changes in credit quality of such financial institutions could cause values of the debt security to deviate.

Cyber Security Risk

The Funds are susceptible to operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause a Fund to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause a Fund to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. These risks typically are not covered by insurance. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber incidents include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data or causing operational disruption. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users). Cyber security failures by or breaches of the systems of the Advisor, distributor and other service providers (including, but not limited to, sub-advisers, index providers, fund accountants, custodians, transfer agents and administrators), market makers, authorized participants or the issuers of securities in which a Fund invests, have the ability to cause disruptions and impact business operations, potentially resulting in: financial losses; interference with a Fund’s ability to calculate its net asset value; disclosure of confidential trading information; impediments to trading; submission of erroneous trades or erroneous creation or redemption orders; the inability of a Fund or its service providers to transact business; violations of applicable privacy and other laws; regulatory fines penalties, reputational damage, reimbursement or other compensation costs; or additional compliance costs. Substantial costs may be incurred by a Fund in order to resolve or prevent cyber incidents in the future. While the Funds have established business continuity plans in the event of, and risk management systems to prevent, such cyber attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified and that prevention and remediation efforts will not be successful. Furthermore, the Funds cannot control the cyber security plans and systems put in place by service providers to the Funds, issuers in which the Funds invest, market makers or authorized participants. However, there is no guarantee that such efforts will succeed, and the Funds and their shareholders could be negatively impacted as a result.

Debt Securities Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. Investments in debt securities subject the holder to the credit risk of the issuer or other obligor. Credit risk refers to the possibility that the issuer of a security will not be able or willing to make payments of interest and principal when due. Generally, the value of debt securities will change inversely with changes in interest rates. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply. During periods of falling interest rates, the income received by an underlying ETF may decline. If the principal on a debt security is prepaid before expected, the prepayments of principal may have to be reinvested in obligations paying interest at lower rates. Debt securities generally do not trade on a centralized securities exchange making them generally less liquid and more difficult to value than common stock. The values of debt securities may also increase or decrease as a result of market fluctuations, actual or perceived inability or unwillingness of issuers, guarantors or liquidity providers to make scheduled principal or interest payments or illiquidity in debt securities markets generally.

Equity Securities Risk

Equity securities prices fluctuate for several reasons, including changes in investors' perceptions of the financial condition of an issuer or the general condition of the relevant equity market, such as market volatility, or when political or economic events affecting the issuers occur. Common stock prices may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or they may occur in only a particular country, company, industry or sector of the market. Additionally, holders of an issuer's common stock may be subject to greater risks than holders of its preferred stock and debt securities because common stockholders' claims are subordinated to those of holders of preferred stocks and debt securities upon the bankruptcy of an issuer.

ETF Risk

Under certain market conditions, the Funds may invest in ETFs. Most ETFs use a “passive” investment strategy and seek to replicate the performance of a market index. Such ETFs do not take defensive positions in volatile or declining markets their shares may trade below net asset value. While some ETFs seek to achieve the same return as a particular market index, the performance of the ETF may diverge from the performance of the index. Some ETFs are actively managed ETFs and do not track a particular index which indirectly subjects an investor to active management risk. An active secondary market in ETF shares may not develop or be maintained and may be halted or interrupted due to actions by its listing exchange, unusual market conditions or other reasons. There can be no assurance that an ETF’s shares will continue to be listed on an active exchange. In addition, shareholders bear both their proportionate share of a Fund’s expenses and, indirectly, the ETF’s expenses, incurred through a Fund’s ownership of the ETF. Because the expenses and costs of an ETF are shared by its investors, redemptions by other investors in the ETF could result in decreased economies of scale and increased operating expenses for such ETF. These transactions might also result in higher brokerage, tax or other costs for the ETF. This risk may be particularly important when one investor owns a substantial portion of the ETF. There is a risk that ETFs in which a Fund invests may terminate due to extraordinary events. For example, any of the service providers to ETFs, such as the trustee or sponsor, may close or otherwise fail to perform their obligations to the ETF, and the ETF may not be able to find a substitute service provider. Also, certain ETFs may be dependent upon licenses to use various indexes as a basis for determining their compositions and/or otherwise to use certain trade names. If these licenses are terminated, the ETFs may also terminate. In addition, an ETF may terminate if its net assets fall below a certain amount.

Extension Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. Extension risk is the risk that, when interest rates rise, certain obligations will be paid off by the issuer (or other obligated party) more slowly than anticipated, causing the value of these debt securities to fall. Rising interest rates tend to extend the duration of debt securities, making them more sensitive to changes in interest rates. The value of longer-term debt securities generally changes more in response to changes in interest rates than shorter-term debt securities. As a result, in a period of rising interest rates, securities may exhibit additional volatility and may lose value. Extension risk is particularly prevalent for a callable debt security where an increase in interest rates could result in the issuer of that security choosing not to redeem the debt security as anticipated on the security’s call date. Such a decision by the issuer could have the effect of lengthening the debt security’s expected maturity, making it more vulnerable to interest rate risk and reducing its market value.

Floating Rate Securities Risk

Under certain market conditions, the Funds may invest in ETFs that hold floating rate securities. Floating rate securities are structured so that the security’s coupon rate fluctuates based upon the level of a reference rate. Most commonly, the coupon rate of a floating rate security is set in the loan agreement at the level of a widely followed interest rate, plus a fixed spread. As a result, it is expected that when interest rates change, the value of floating rate securities will fluctuate less than the value fixed rate debt securities. The coupon on floating rate securities will generally decline in a falling interest rate environment, causing an underlying ETF to experience a reduction in the income it receives from the security. A floating rate security’s coupon rate resets periodically according to the terms of the security. Consequently, in a rising interest rate environment, floating rate securities with coupon rates that reset infrequently may lag behind the changes in market interest rates and may affect the value of the security. Floating rate securities may also contain terms that impose a maximum coupon rate the issuer will pay, regardless of the level of the reference rate which would decrease the value of the security. The secondary market value of a floating rate security is based on the volatility of the reference rate, the time remaining to maturity, the outstanding amount of such securities, market interest rates and the credit quality or perceived financial status of the issuer. Floating rate securities may be less liquid than other types of securities.

High Yield Securities Risk

Under certain market conditions, the Funds may invest in ETFs that hold high yield securities. An underlying ETF’s investment in high yield securities, or “junk” bonds, may entail increased credit risks and the risk that the value of the fund’s assets will decline, and may decline precipitously, with increases in interest rates. In recent years there have been wide fluctuations in interest rates and therefore in the value of debt securities generally. High yield securities are, under most circumstances, subject to greater market fluctuations and risk of loss of income and principal than are investments in lower-yielding, higher-rated debt securities. As interest rates rise, the value of high yield securities may decline precipitously. Increased rates may also indicate a slowdown in the economy which may adversely affect the credit of issuers of high yield securities resulting in a higher incidence of defaults among such issuers. A slowdown in the economy, or a development adversely affecting an issuer’s creditworthiness, may result in the issuer being unable to maintain earnings or sell assets at the rate and at the prices, respectively, that are required to produce sufficient cash flow to meet its interest and principal requirements. An underlying ETF’s portfolio managers cannot predict future economic policies or their consequences or, therefore, the course or extent of any similar market fluctuations in the future. In addition, high yield securities are generally less liquid than investment grade securities.

Income Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. An underlying ETF’s income may decline when interest rates fall. This decline can occur because an underlying fund may subsequently invest in lower-yielding securities as debt securities in its portfolio mature, are near maturity or are called, or the fund otherwise needs to purchase additional debt securities. In addition, an underlying fund’s income could decline when a fund experiences defaults on the debt securities it holds.

Inflation Risk

Under certain market conditions, the Funds may invest in ETFs that hold debt securities. Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of a Fund’s assets and distributions may decline. Inflation creates uncertainty over the future real value (after inflation) of an investment. Inflation rates may change frequently and drastically as a result of various factors, including unexpected shifts in the domestic or global economy, and a Fund’s investments may not keep pace with inflation, which may result in losses to Fund investors.

Interest Rate Risk