SCHEDULE 14A INFORMATION

(RULE 14a-101)

_____________________

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

_____________________

(Amendment No. )

Filed by the Registrant | | ☒ | | |

Filed by a Party other than the Registrant | | ☐ | | |

Check the appropriate box:

☒ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

☐ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material Under Rule 14a-12 |

Guardian Variable Products Trust

___________________________________________________________________________

(Name of Registrant as Specified in Its Charter)

___________________________________________________________________________

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | | No fee required. |

☐ | | Fee paid previously with preliminary materials |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The Guardian Insurance & Annuity Company, Inc.

10 Hudson Yards

New York, New York 10001

October [*], 2023

To Contract Owners:

Enclosed is a Proxy Statement that contains important proposals with respect to each series (each, a “Fund”) of Guardian Variable Products Trust (the “Trust”). Each Fund serves as an investment option under certain variable annuity contracts and variable life insurance policies issued by The Guardian Insurance & Annuity Company, Inc. (each, a “Contract”). The proposals do not seek to change the benefits or provisions of your Contract.

As the owner of a Contract, you have the right to instruct The Guardian Insurance & Annuity Company, Inc. how to vote the shares of each Fund attributable to your Contract with respect to the applicable proposal(s) and in connection with the special meeting of shareholders of the Funds to be held on October 31, 2023 at 4:00 p.m., Eastern time.

After careful consideration, the Board of Trustees of the Trust unanimously recommends that you vote FOR each proposal that applies to your Fund(s).

Formal notice of the special meeting of shareholders appears on the next page, followed by the Proxy Statement. The proposals are described in the enclosed Proxy Statement, which you should read carefully.

We appreciate your prompt response to the enclosed Proxy Statement and thank you for your continued investment in the Fund(s).

Sincerely,

| /s/ Dominique Baede | |

Dominique Baede | |

Director and President

The Guardian Insurance & Annuity Company, Inc.

Guardian Variable Products Trust

10 Hudson Yards

New York, New York 10001

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 31, 2023

The Proxy Statement is also available at https://www.proxy-direct.com/gua-33485.

NOTICE IS HEREBY GIVEN THAT A SPECIAL MEETING OF SHAREHOLDERS (with any postponements or adjournments, the “Special Meeting”) of each series (each, a “Fund”) of Guardian Variable Products Trust (the “Trust”), a Delaware statutory trust, will be held via teleconference on October 31, 2023 beginning at 4:00 p.m., Eastern time.

As the owner of a variable annuity contract or variable life insurance policy issued by The Guardian Insurance & Annuity Company, Inc. (each, a “Contract”), a stock life insurance company incorporated in the State of Delaware (“GIAC”), you have the right to instruct GIAC, the record owner of the shares of each Fund, how to vote the shares of each Fund attributable to your Contract at the Special Meeting. However, to make the enclosed Proxy Statement easier to read, Contract owners are described as if they are voting directly on the Proposals (defined below) at the Special Meeting as opposed to instructing GIAC how to vote on a Proposal. Additionally, Contract owners with some or all of their Contract value invested in one or more Funds are sometimes referred to in the Proxy Statement as “shareholders” for ease of reading purposes.

As more fully described in the accompanying Proxy Statement, at the Special Meeting, shareholders of each Fund will be asked to consider and approve the following proposals (each, a “Proposal” and collectively, the “Proposals”), as applicable:

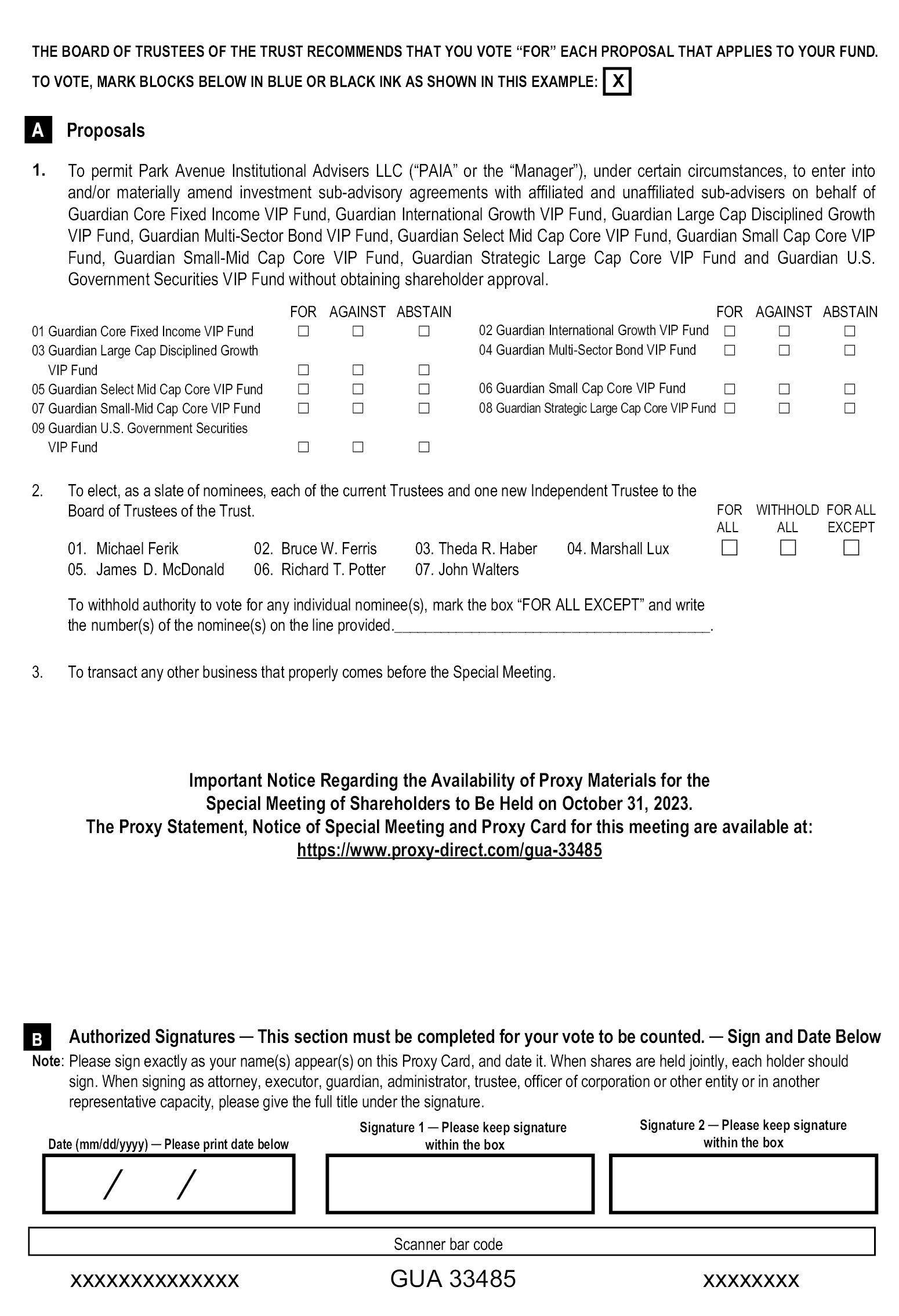

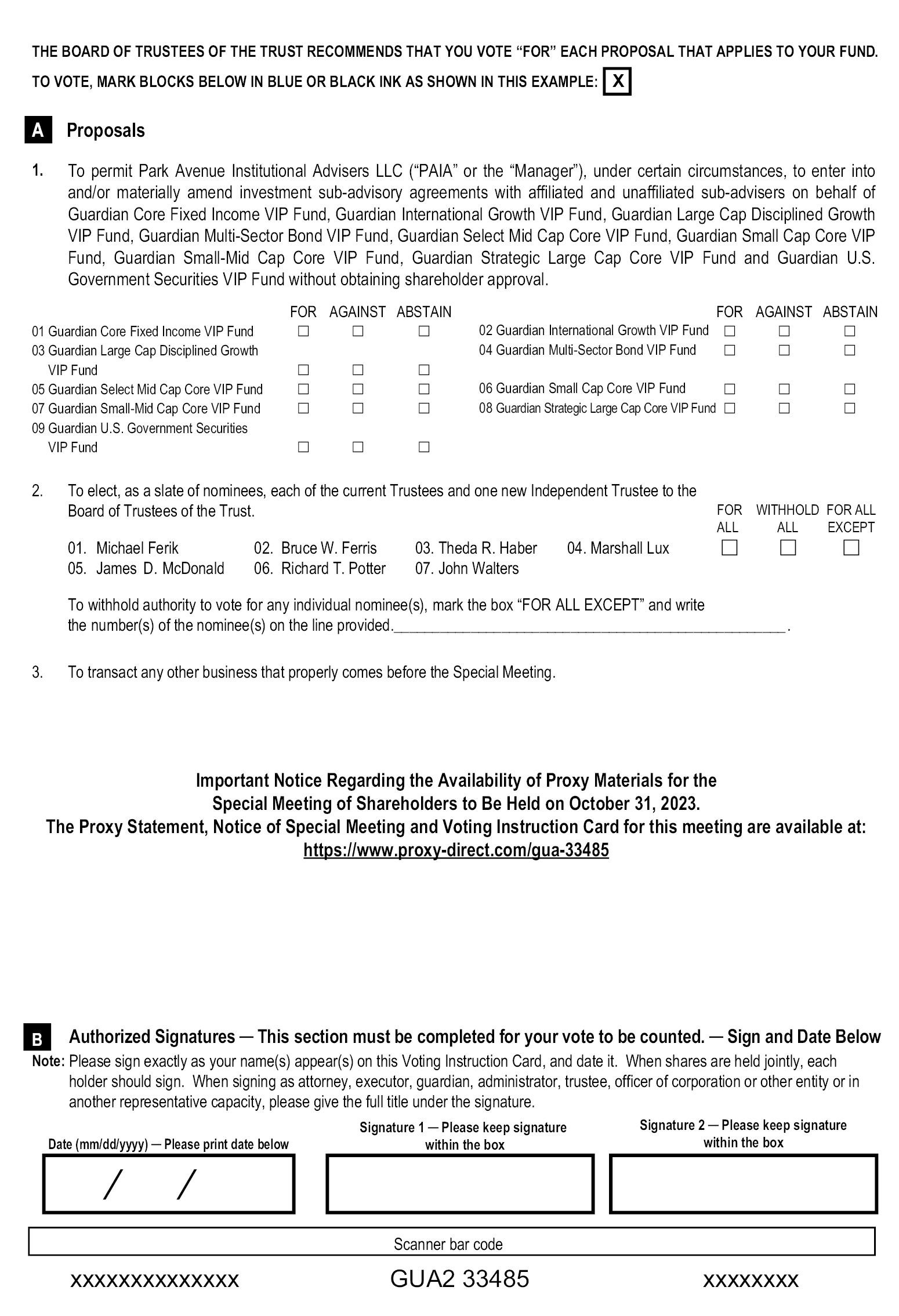

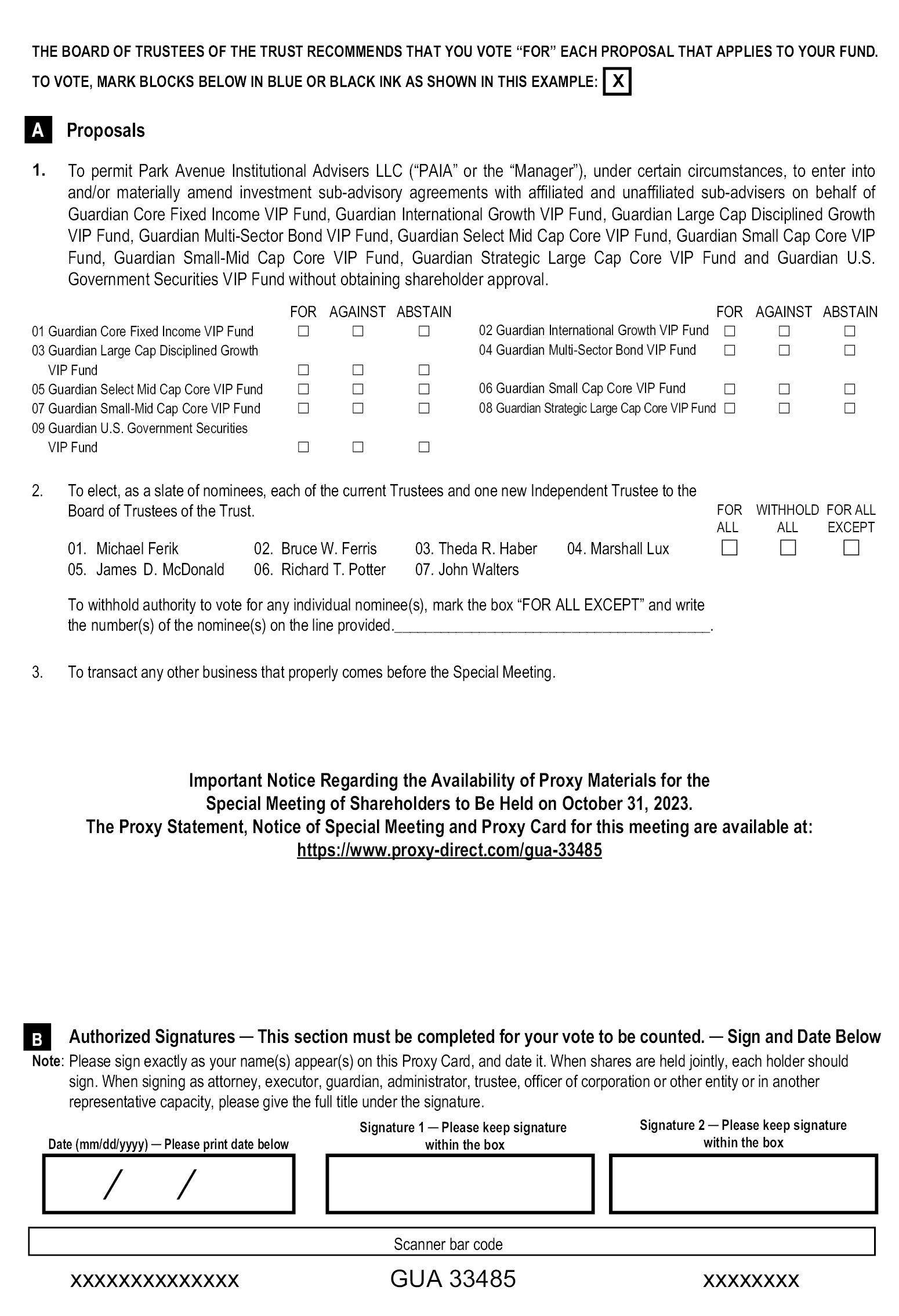

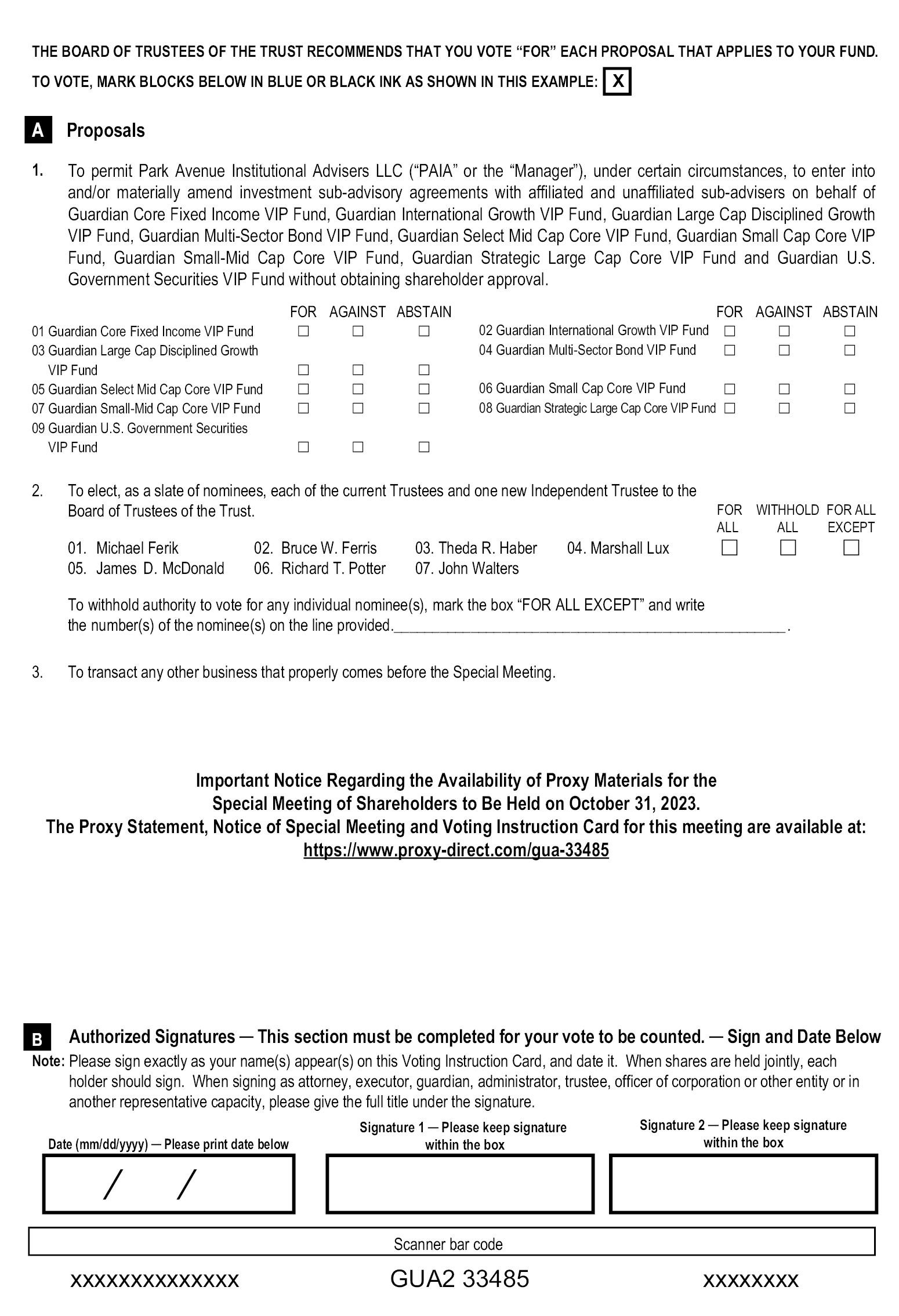

1. To permit Park Avenue Institutional Advisers LLC (“PAIA” or the “Manager”), under certain circumstances, to enter into and/or materially amend investment sub-advisory agreements with affiliated and unaffiliated sub-advisers on behalf of Guardian Core Fixed Income VIP Fund, Guardian International Growth VIP Fund, Guardian Large Cap Disciplined Growth VIP Fund, Guardian Multi-Sector Bond VIP Fund, Guardian Select Mid Cap Core VIP Fund, Guardian Small Cap Core VIP Fund, Guardian Small-Mid Cap Core VIP Fund, Guardian Strategic Large Cap Core VIP Fund and Guardian U.S. Government Securities VIP Fund without obtaining shareholder approval;

2. To elect, as a slate of nominees, each of the current Trustees and one new Independent Trustee to the Board of Trustees of the Trust; and

3. To transact any other business that properly comes before the Special Meeting.

Proposal One corresponds to the ability of each Fund to operate in a “manager-of-managers” structure pursuant to an exemptive order issued by the U.S. Securities and Exchange Commission, which permits PAIA, under certain circumstances and with approval of the Board of Trustees of the Trust (the “Board” or “Trustees”), to enter into and/or materially amend investment sub-advisory agreements with certain affiliated and unaffiliated sub-advisers on behalf of a Fund without obtaining shareholder approval. As explained further below, the Funds may not rely on the order without first obtaining shareholder approval.

Proposal Two asks that you elect, as a slate of nominees, each of the current Trustees and one new Independent Trustee to the Board.

Although the Trustees have determined that each Proposal is in the best interests of each applicable Fund, the final decision to approve each Proposal is up to shareholders. The Board recommends that you vote FOR each Proposal that relates to a Fund of which you hold shares.

In addition, shareholders will be asked to consider and approve such other matters as may properly come before the Special Meeting.

All shareholders are requested to vote by proxy over the Internet, by telephone or by completing, dating and signing the enclosed proxy card and returning it promptly. The Special Meeting will be conducted via teleconference. If you plan to participate in the Special Meeting, please email shareholdermeetings@computershare.com in advance of the Special Meeting and provide us with your full name, the “control number” on your proxy or voting instruction card, and mailing address to receive the teleconference dial-in information. Requests to attend the Special Meeting must be received no later than 5:00 p.m., Eastern Time, on October 26, 2023. Instructions with regard to how to vote at the Special Meeting will be provided during the teleconference.

Your attention is directed to the accompanying Proxy Statement for further information regarding the Special Meeting and the Proposals. You may vote if you were a shareholder of one or more of the Funds as of the close of business on July 31, 2023. If you attend the Special Meeting, you may vote the shares of each Fund attributable to your Contract by following the instructions provided during the teleconference. Even if you do not attend the Special Meeting, you may authorize your proxy or provide your voting instruction by: (i) completing, signing, and returning the enclosed proxy or voting instruction card by mail in the postage-paid envelope provided;

or (ii) following the instructions on the card for authorizing your proxy or providing your voting instruction by submitting your vote via telephone or the Internet. Please refer to the enclosed card for more information on how you may vote. You may revoke your proxy or voting instruction at any time prior to the date the proxy or voting instruction is to be exercised in the manner described in the Proxy Statement.

Your vote is very important to us. Whether or not you plan to attend the Special Meeting, please cast your vote using one of the voting options listed on your enclosed card. You can vote your shares toll-free at 1-866-298-8476 to reach an automated touchtone voting line, or, if you have questions about the Special Meeting agenda, or about how to vote your shares, please call toll-free 1-888-GUARDIAN (1-888-482-7342) to reach a GIAC customer service representative.

By Order of the Board of Trustees,

| /s/ Dominique Baede | |

Dominique Baede | |

President

Guardian Variable Products Trust

October [*], 2023

_________________________

IMPORTANT NOTICE

PLEASE VOTE USING THE ENCLOSED PROXY OR VOTING INSTRUCTION CARD AS SOON AS POSSIBLE. YOUR VOTE IS VERY IMPORTANT TO US NO MATTER HOW MANY SHARES ARE ATTRIBUTABLE TO YOUR CONTRACT. YOU CAN HELP AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATIONS BY PROMPTLY VOTING ON THE ENCLOSED PROXY OR VOTING INSTRUCTION CARD.

_________________________

Guardian Variable Products Trust

10 Hudson Yards

New York, New York 10001

PROXY STATEMENT

OCTOBER [*], 2023

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 31, 2023

This Proxy Statement is also available at https://www.proxy-direct.com/gua-33485.

INTRODUCTION

This is a combined Proxy Statement for series of Guardian Variable Products Trust (the “Trust”), a Delaware statutory trust. This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees of the Trust (the “Board” or “Trustees”), on behalf of each Fund listed below, for a special meeting of shareholders of the Funds (with any postponements or adjournments, the “Special Meeting”). The Special Meeting will be held via teleconference on October 31, 2023 beginning at 4:00 p.m., Eastern Time. This Proxy Statement, the attached Notice of Special Meeting of Shareholders and the enclosed proxy or voting instruction card will be first distributed on or about October [*], 2023 to all shareholders of record of the Funds as of the close of business on July 31, 2023 (“Record Date”).

Proposal One applies ONLY to the following Funds:

Guardian Core Fixed Income VIP Fund | | Guardian Small Cap Core VIP Fund |

Guardian International Growth VIP Fund | | Guardian Small-Mid Cap Core VIP Fund |

Guardian Large Cap Disciplined Growth VIP Fund | | Guardian Strategic Large Cap Core VIP Fund |

Guardian Multi-Sector Bond VIP Fund | | Guardian U.S. Government Securities VIP Fund |

Guardian Select Mid Cap Core VIP Fund | | |

Proposal Two applies with respect to the following Funds, which comprise ALL series of the Trust:

Guardian All Cap Core VIP Fund | | Guardian Large Cap Disciplined Value VIP Fund |

Guardian Balanced Allocation VIP Fund | | Guardian Large Cap Fundamental Growth VIP Fund |

Guardian Core Fixed Income VIP Fund | | Guardian Mid Cap Relative Value VIP Fund |

Guardian Core Plus Fixed Income VIP Fund | | Guardian Mid Cap Traditional Growth VIP Fund |

Guardian Diversified Research VIP Fund | | Guardian Multi-Sector Bond VIP Fund |

Guardian Equity Income VIP Fund | | Guardian Select Mid Cap Core VIP Fund |

Guardian Global Utilities VIP Fund | | Guardian Short Duration Bond VIP Fund |

Guardian Growth & Income VIP Fund | | Guardian Small Cap Core VIP Fund |

Guardian Integrated Research VIP Fund | | Guardian Small-Mid Cap Core VIP Fund |

Guardian International Equity VIP Fund | | Guardian Strategic Large Cap Core VIP Fund |

Guardian International Growth VIP Fund | | Guardian Total Return Bond VIP Fund |

Guardian Large Cap Disciplined Growth VIP Fund | | Guardian U.S. Government Securities VIP Fund |

You are receiving this Proxy Statement because you are the owner of a variable annuity contract or variable life insurance policy issued by The Guardian Insurance & Annuity Company, Inc. (each, a “Contract”), a stock life insurance company incorporated in the State of Delaware (“GIAC”), and some or all of your Contract value was invested in one or more Funds as of the Record Date. Although GIAC is the record owner of the Funds’ shares, as the Contract owner, you have the right to instruct GIAC how to vote the shares of each Fund attributable to your Contract at the Special Meeting. However, to make the enclosed Proxy Statement easier to read, Contract owners are described as if they are voting directly on the Proposals (defined below) at the Special Meeting as opposed to instructing GIAC how to vote on the Proposals. Additionally, Contract owners with some or all of their Contract value invested in one or more Funds are sometimes referred to in the Proxy Statement as “shareholders” for ease of reading purposes.

2

As more fully described below, at the Special Meeting, shareholders of each Fund will be asked to consider and approve the following proposals (each a “Proposal” and, collectively, the “Proposals”), as applicable:

1. To permit Park Avenue Institutional Advisers LLC (“PAIA” or the “Manager”), under certain circumstances, to enter into and/or materially amend investment sub-advisory agreements with affiliated and unaffiliated sub-advisers on behalf of Guardian Core Fixed Income VIP Fund, Guardian International Growth VIP Fund, Guardian Large Cap Disciplined Growth VIP Fund, Guardian Multi-Sector Bond VIP Fund, Guardian Select Mid Cap Core VIP Fund, Guardian Small Cap Core VIP Fund, Guardian Small-Mid Cap Core VIP Fund, Guardian Strategic Large Cap Core VIP Fund and Guardian U.S. Government Securities VIP Fund without obtaining shareholder approval;

2. To elect, as a slate of nominees, each of the current Trustees and one new Independent Trustee to the Board of Trustees of the Trust; and

3. To transact any other business that properly comes before the Special Meeting.

Proposal One corresponds to the ability of each Fund to operate in a “manager-of-managers” structure pursuant to an exemptive order issued by the U.S. Securities and Exchange Commission (the “SEC”), which permits PAIA, under certain circumstances and with approval of the Board, to enter into and/or materially amend investment sub-advisory agreements with certain affiliated and unaffiliated sub-advisers on behalf of a Fund without obtaining shareholder approval. As explained further below, the Funds may not rely on the order without obtaining shareholder approval. The approval sought in Proposal One also would permit each Fund and PAIA to rely on any rule, regulation or SEC guidance or subsequent exemptive order that relates to operating such Fund in a manager-of-managers structure with regard to affiliated or unaffiliated sub-advisers.

Proposal Two relates to the election, as a slate of nominees, each of the current Trustees and one new Trustee to the Board of Trustees of the Trust.

Shareholders may vote on the Proposals at the Special Meeting by following the instructions provided during the teleconference. It is anticipated that, with shareholder approval, the Proposals would take effect as soon as practicable with respect to Proposal One and with respect to Proposal Two. Shareholders of each Fund will vote separately with respect to Proposal One as it relates to the applicable Fund and approval of Proposal One for a Fund is not contingent on approval of the Proposal by any other Fund(s) or any other Proposal. For Proposal Two, when a quorum is present, the election of trustees requires the affirmative vote of a plurality of votes cast at the Special Meeting by or on behalf of shareholders of the Trust as a whole.

3

Although the Trustees have determined that each Proposal is in the best interests of each applicable Fund, the final decision to approve a Proposal is up to shareholders. A summary of the factors considered by the Board in connection with reaching this determination for each Proposal is set forth below. The Board recommends that you vote FOR each Proposal that relates to a Fund of which you hold shares.

The Proposals do not seek to change any benefits or provisions under your Contract.

In addition, shareholders will be asked to consider and approve such other matters as may properly come before the Special Meeting. The Trust is not aware of any matters to be presented at the Special Meeting other than the Proposals described in this Proxy Statement.

Only shareholders who owned shares of a Fund on the Record Date are entitled to vote. Each share of a Fund that you owned as of the Record Date entitles you to one (1) vote with respect to the Proposals and such other matters as may properly come before the Special Meeting. A fractional share has a fractional vote. The number of shares outstanding as of the Record Date is included as Appendix A to this Proxy Statement.

It is important for you to vote on the Proposals described in this Proxy Statement. We recommend that you read this Proxy Statement in its entirety as the explanations will help you to decide how to vote on the Proposals.

Important Notice Regarding Availability of Proxy Materials for the

Special Meeting of Shareholders to be Held on October 31, 2023.

This Proxy Statement is available on the Internet at

https://www.proxy-direct.com/gua-33485.

4

PROPOSAL ONE

APPROVAL TO PERMIT PARK AVENUE INSTITUTIONAL ADVISERS LLC, UNDER CERTAIN CIRCUMSTANCES, TO ENTER INTO AND/OR MATERIALLY AMEND SUB-ADVISORY AGREEMENTS WITH AFFILIATED AND UNAFFILIATED SUB-ADVISERS WITHOUT OBTAINING SHAREHOLDER APPROVAL

You are being asked to approve a proposal to permit Park Avenue Institutional Advisers LLC (“PAIA” or the “Manager”), in its capacity as the investment manager to Guardian Core Fixed Income VIP Fund, Guardian International Growth VIP Fund, Guardian Large Cap Disciplined Growth VIP Fund, Guardian Multi-Sector Bond VIP Fund, Guardian Select Mid Cap Core VIP Fund, Guardian Small Cap Core VIP Fund, Guardian Small-Mid Cap Core VIP Fund, Guardian Strategic Large Cap Core VIP Fund and Guardian U.S. Government Securities VIP Fund (each, a “Fund” and, collectively, the “Funds”), each a series of Guardian Variable Products Trust (the “Trust”), subject to the oversight of the Board of Trustees of the Trust (the “Board” or “Trustees”), to enter into, and/or materially amend, sub-advisory agreements with affiliated and unaffiliated sub-advisers retained by PAIA, to manage a Fund, with prior Board approval but without obtaining shareholder approval. Such an advisory structure is referred to as a “manager-of-managers” arrangement (“Proposal One”).

Section 15(a) of the Investment Company Act of 1940, as amended (the “1940 Act”), requires that all contracts pursuant to which persons serve as investment advisers to investment companies be approved by shareholders. As interpreted, this requirement also applies to the appointment of sub-advisers to investment companies, such as the Funds. The Manager and the Trust have received an exemptive order1 (the “Order”) from the U.S. Securities and Exchange Commission (“SEC”) to permit the Manager, on behalf of a Fund and subject to the approval of the Board, including a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”), to hire, and to modify any existing or future sub-advisory agreement with, unaffiliated sub-advisers and sub-advisers that are indirect or direct “wholly-owned subsidiaries” (as defined in the 1940 Act) of the Manager, or a sister company of the Manager that is an indirect or direct wholly-owned subsidiary of a company that, indirectly or directly, wholly owns the Manager, and to provide relief from certain disclosure obligations with regard to sub-advisory fees. The Order is subject to certain conditions, including that each Fund notify shareholders and provide them with certain information required by the Order within 90 days of hiring a new sub-adviser.

5

Pursuant to orders issued to GIAC by the SEC permitting the substitution of shares of certain funds available as investment options under the Contracts with corresponding shares of each Fund, among other series of the Trust2 (the “Substitution Orders”), the Manager and the Trust may not change a sub-adviser, add a new sub-adviser, or otherwise rely on the Order or any replacement order from the SEC with respect to any of the Funds covered under the Substitution Orders without first obtaining shareholder approval of the change in sub-adviser, the new sub-adviser, or the Fund’s ability to rely on the Order, or any replacement order from the SEC, at a shareholder meeting, to the extent required by law.

By approving Proposal One, shareholders are approving the operation by each Fund in a manager-of-managers structure under any such terms or conditions necessary to satisfy the conditions of the Order. Shareholders also are approving any manager-of-managers structure that may be permitted in the future pursuant to future exemptive relief, guidance from the SEC or its staff, or law or rule.

How Would the “Manager-of-Managers” Arrangement Benefit the Funds and their Shareholders?

As noted below, the Board believes that it is in the best interests of each Fund and its shareholders to provide PAIA and the Board with flexibility to make changes in sub-advisers and to change sub-advisers without incurring the significant delay and expense associated with obtaining shareholder approval. PAIA believes that the manager-of-managers arrangement under the Order would permit each Fund to operate more efficiently and cost-effectively than operating without the ability to rely on the Order. For example, PAIA would have greater flexibility to make decisions with respect to sub-advisers in a more time sensitive manner. Currently, the Trust must call and hold a shareholder meeting of a Fund before it may appoint a new sub-adviser or materially amend a sub-advisory agreement, as required by applicable law. Each time a shareholder meeting is called, the Trust must create and distribute proxy materials and solicit proxy votes from the Fund’s shareholders. This process is time-consuming and costly, and such costs may be borne by the Fund, thereby reducing shareholders’ investment returns.

As the investment manager to the Funds, PAIA is responsible for supervising the sub-advisers in the performance of their duties to the Funds. Under the Trust’s “manager-of-managers” arrangement, PAIA is responsible for providing various ongoing oversight and monitoring functions with

6

respect to each sub-adviser and reporting to the Board in connection with these functions. Also, PAIA is currently responsible for recommending to the Board whether a sub-advisory agreement should be entered into, continued or terminated with respect to each Fund. In determining whether to recommend to the Board the continuation or termination of a sub-advisory agreement, PAIA considers several factors, including the sub-adviser’s performance record while managing the relevant Fund.

Pursuant to the investment management agreement between the Trust, on behalf of the Funds, and PAIA (“Management Agreement”), PAIA is responsible for managing the assets of each Fund, either directly or via one or more sub-advisers under PAIA’s supervision. Consistent with the terms of the Management Agreement, PAIA believes that shareholders already expect that PAIA and the Board will take responsibility for overseeing any sub-advisers engaged for a Fund and recommending whether a particular sub-adviser should be hired, terminated, or replaced without shareholder approval. This approach would avoid the considerable costs and significant delays associated with seeking specific shareholder approval for entering into sub-advisory agreements, on behalf of a Fund, or materially amending such agreements. Further, such an approach would be consistent with shareholders’ expectations that PAIA will use its experience and expertise to recommend qualified candidates to serve as sub-advisers and would permit PAIA to more efficiently and effectively take steps intended to meet such expectations for monitoring such sub-advisers.

If shareholders approve Proposal One, the Board would continue to oversee the selection and engagement of sub-advisers. Further, the Board would continue to evaluate and consider for approval all new sub-advisory agreements and all amendments to existing agreements. Also, under the 1940 Act and the terms of the individual sub-advisory agreements, the Board would continue to be required to review and consider each of the sub-advisory agreements for renewal annually, after the expiration of an initial term of up to two years. Prior to entering into, renewing, or amending a sub-advisory agreement, PAIA and the relevant sub-adviser have a legal duty to furnish the Board with such information as may reasonably be necessary to evaluate the terms of the agreement.

Would this Proposal Have Any Effect on the Advisory Fees Paid by the Funds to PAIA or the Quality of Advisory Service the Funds Receive?

Proposal One would not directly affect the amount of management fees paid by any Fund to PAIA. When entering into and amending sub-advisory agreements, PAIA has negotiated and will continue to negotiate fees paid to the sub-advisers for their services. Also, if Proposal One is approved, PAIA will continue to pay sub-advisory fees for the Funds from its own assets. The fees paid to PAIA by the Funds are considered by the Board in approving and renewing the management and sub-advisory agreements. Further, whether or

7

not shareholders approve Proposal One, PAIA will continue to be required to provide the same level of management and administrative services to the Funds as it currently provides, in accordance with the Management Agreement.

What were the Primary Factors Considered by the Board in Connection with Proposal One?

The Board considered the desirability of retaining flexibility for PAIA recommend, and for the Board to approve, changes in certain sub-advisers that may become necessary due to, among other things, concerns regarding performance, compliance, and other matters. Although the Board took into account that shareholders would no longer have the opportunity to vote to approve such changes, the Board considered that shareholders’ interests would be served by avoiding the delay and expense of convening a shareholder meeting to enter into new sub-advisory agreements or materially amend such agreements. The Board considered that the Order imposed conditions that were designed to protect the interests of shareholders. In addition, the Board considered that the manager-of-managers structure would continue to serve the best interests of the Funds’ shareholders without creating any adverse impact on the provision of sub-advisory services to the Funds.

board recommendation

After careful consideration, the Board, including the Independent Trustees, unanimously recommends that the shareholders of each Fund vote FOR Proposal One.

8

PROPOSAL TWO

TO ELECT EACH CURRENT TRUSTEE AND

ONE NEW INDEPENDENT TRUSTEE OF THE TRUST

Shareholders of all of the series of the Trust (each, a “Fund” and collectively, the “Funds”) are being asked to elect as a slate of nominees, each of the current Trustees and one new Independent Trustee (individually, a “Nominee” and collectively, the “Nominees”) to the Board (“Proposal Two”).

The Board, including the Independent Trustees, unanimously recommends that shareholders of the Funds vote in favor of Proposal Two. Detailed information about each of the Nominees is provided below.

For Proposal Two, you are being asked to elect, as a slate of nominees, each of the six current Trustees of the Trust, as well as one new Independent Trustee. The Proposal arises from legal requirements that apply to mutual funds, such as the Funds. Specifically, the 1940 Act permits vacancies on a mutual fund’s board to be filled by appointment of a trustee (without a shareholder vote) only if, immediately after such appointment, at least two-thirds of the mutual fund’s board of trustees have been elected by shareholders. The Board currently consists of six Trustees, four of whom (Messrs. Ferris, Lux and Walters and Ms. Haber) were elected by GIAC, the initial shareholder of the Trust, at the Trust’s inception. Each of Messrs. Ferris, Lux and Walters and Ms. Haber is an Independent Trustee.

The current Independent Trustees voted to recommend that shareholders of the Trust elect James D. McDonald as a new Independent Trustee of the Trust to fill a vacancy due to the resignation of Lisa K. Polsky effective December 31, 2022, and also to elect (or re-elect, as applicable) the current six Trustees of the Trust.

At this time the Board is unable to appoint Mr. McDonald to fill the current vacancy on the Board for an Independent Trustee because immediately after such appointment, less than two-thirds of the Trustees would have been elected by shareholders. Therefore, shareholder approval is required before Mr. McDonald can be added to fill the current vacancy on the Board.

Although not required by applicable law or the Trust’s governing documents, the Board, for reasons of efficiency and to attempt to reduce future costs and expenses of the Funds, has determined that it is in the best interests of the Funds to seek the election by shareholders of all six current Trustees, in addition to Mr. McDonald. If Mr. McDonald and all of the six current Trustees are elected, following the Special Meeting, all seven Trustees of the Trust will have been elected by shareholders. This will permit the Board to fill several future vacancies on the Board without having to incur the costly expense of a proxy solicitation.

9

Board Considerations

At its quarterly in-person meeting held on September 13-14, 2023 (the “Board Meeting”), the Board was provided with information regarding the Proposal and considered whether to recommend that shareholders vote in favor of the Proposal. Based on information provided to the Board during and in advance of the Board Meeting and subsequent review and consideration, the Board unanimously voted, within the context of its full deliberations, to recommend that shareholders of the Funds vote in favor of the proposal to elect Mr. McDonald as a new Independent Trustee and elect all six current Trustees of the Trust.

Prior to the Board Meeting, the Board considered and discussed, among other things, information about the current Trustees’ capacity, their expected length of service, the experience and knowledge of the Board, both individually and in the aggregate, the number, size and complexity of the Funds, and the number of sub-advisers to the Funds. The Board also took into account that the Board recently had been composed of six Trustees and how the Board had operated with a size of six Trustees.

In considering candidates to serve as a new Independent Trustee, the Independent Trustees considered each potential candidate’s business or professional experience and expected contributions to the Board. In addition, the Independent Trustees evaluated each candidate’s qualifications for Board membership and the independence of such candidates from the investment advisers and other principal service providers for the Funds as well as any relationships beyond those delineated in the 1940 Act that might impair independence. The Independent Trustees also considered each candidate’s expertise with respect to investment matters, financial and accounting matters, and other matters relevant for Board service, as well as the age and expertise of the current Trustees. Mr. McDonald’s experience and qualifications are discussed below.

In determining to recommend that shareholders vote in favor of electing Mr. McDonald to the Board, in addition to Mr. McDonald’s qualifications and experience, the Board determined (1) that Mr. McDonald is sufficiently independent from relationships with the Trust, both within the terms and the spirit of the statutory independence requirements specified under the 1940 Act and the rules thereunder; and (2) that Mr. McDonald demonstrated an ability and willingness to make the considerable time commitment, including attendance at Board meetings, believed necessary to function as an effective Board member.

In considering whether to recommend that shareholders elect the six current Trustees, the Board considered and discussed information about the 1940 Act voting requirements, including the potential to mitigate future costs and the flexibility that may be created with respect to the future appointment of Trustees to the Board if shareholders elect the current Trustees. The Board

10

also considered its current composition, including its individual and collective business and professional experience. The Board also considered the fact that because the Funds would have to undertake the costs of a proxy in order to elect Mr. McDonald as a new Independent Trustee to the Board and that therefore it would be efficient to seek shareholder election of the current Trustees alongside Mr. McDonald as a slate of Nominees for the Board.

If shareholders elect Mr. McDonald, it is anticipated that he will begin to serve the Trust as an Independent Trustee immediately after the shareholder meeting. Irrespective of whether shareholders elect the six current Trustees, all six current Trustees will continue to serve as Trustees without interruption.

Individual Nominee Qualifications

The Board has determined to recommend to shareholders that each of the Nominees should be elected to the Board because of his or her ability to review and understand information about the Funds, identify and request other information relevant to the performance of his or her duties, question management and other service providers regarding material factors bearing on the management and administration of the Funds, and exercise his or her business judgment in a manner that serves the best interests of the Trust’s shareholders. The Board has concluded that each of the Nominees should serve as a Trustee based on his or her own experience, qualifications, attributes and skills as described below. Information about each of the Nominees is set forth below.

Current Independent Trustees and Nominees

Bruce W. Ferris. Mr. Ferris has extensive experience in the financial services industry, including as President and Chief Executive Officer of a broker-dealer responsible for distribution of annuity products, and has served as Chairman of an industry trade organization.

Theda R. Haber. Ms. Haber has extensive experience in the asset management industry, including various senior positions at large asset managers, including General Counsel of a trust company affiliated with a major, global financial institution.

Marshall Lux. Mr. Lux has extensive experience in the financial services industry, including various senior positions in risk management and investment banking. Mr. Lux is a Senior Advisor at the Boston Consulting Group and was formerly a Senior Partner at the Boston Consulting Group and at McKinsey & Company. He is a Senior Fellow at Harvard University’s John F. Kennedy School of Government, the Wharton School of the University of Pennsylvania, Georgetown University and the Kellogg School of Management at Northwestern University. He currently serves as an advisor to various financial technology companies.

11

John Walters. Mr. Walters has extensive experience in the financial services industry, including prior executive positions at a large insurance company. Mr. Walters has served and continues to serve on other boards.

New Independent Trustee Nominee

James D. McDonald. Mr. McDonald has extensive experience in the financial services industry, including as Chief Investment Strategist for institutional and wealth management clients globally; he also served as Executive Vice President and Chief Investment Strategist and Director of Research for a large U.S.-based bank and served in various capacities as a controller and as an auditor at a major public accounting firm. Mr. McDonald has served and continues to serve on other boards.

Current Interested Trustees and Nominees

Michael Ferik. Mr. Ferik is Head of Individual Markets of The Guardian Life Insurance Company of America. The Individual Markets organization provides products and services to individual customers including life insurance, disability, annuities, and wealth management products and services. His experience also includes serving as Guardian Life’s Chief Financial Officer, where he led the financial, risk, actuarial, and internal audit functions.

Richard T. Potter. Mr. Potter served for over 25 years as Vice President and Equity Counsel of The Guardian Insurance Company of America, where he was responsible for providing legal advice with respect to Guardian Life’s securities-related businesses, including mutual funds, investment advisers and variable insurance products.

In its periodic assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees primarily in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Trust. Moreover, references to the qualifications, attributes and skills of Nominees are pursuant to requirements of the SEC, do not constitute holding out of the Board or any Nominee as having any special expertise or experience, and shall not be deemed to impose any greater responsibility or liability on any such person or on the Board by reason thereof.

12

The tables below show information about the Nominees, including each of the current Trustees.

Name and Year

of Birth | | Term of

Office,

Position(s)

Held and

Length of

Service(1) | | Principal Occupation(s) During Past Five Years | | Number of

Funds in Fund

Complex

Overseen by

Trustees(2) | | Other

Directorships

Held by

Trustee |

| | | | | Independent Trustees | | | | |

Bruce W. Ferris (born 1955)(3) | | Trustee | | Retired (since 2015); President and CEO, Prudential Annuities Distributors, Inc. (2013 – 2015); Director/Trustee, Advanced Series Trust, The Prudential Series Fund and Prudential’s Gibraltar Fund, Inc. (2013 – 2015); Senior Vice President, Prudential Annuities (2008 – 2015). | | 24 | | None. |

Theda R. Haber (born 1954)(3) | | Trustee | | Adjunct Assistant Professor of Law, UC College of Law, SF (since 2013); Member of the Board of Directors, Fairholme Trust Company, LLC (2015 – 2019); Visiting Professor of Law, UC Davis School of Law (2014 – 2021); Managing Director and General Counsel, BlackRock Institutional Trust Company, N.A. and predecessor companies (1998 – 2011). | | 24 | | None. |

13

Name and Year

of Birth | | Term of

Office,

Position(s)

Held and

Length of

Service(1) | | Principal Occupation(s) During Past Five Years | | Number of

Funds in Fund

Complex

Overseen by

Trustees(2) | | Other

Directorships

Held by

Trustee |

Marshall Lux

(born 1960)(3) | | Trustee | | Senior Advisor, The Boston Consulting Group (since 2014); Board Member, New York Community Bancorp, Inc. and New York Community Bank (banking) (since 2022); Board Member, DHB Capital (special purpose acquisition company) (2021 – 2023); Board Member, Mphasis (public global IT company) (since 2018); Board Member, Kapitus (financing) (since 2018); Senior Partner and Managing Director, The Boston Consulting Group (2009 – 2014). | | 24 | | None. |

James D. McDonald

(born 1959) | | Trustee Nominee | | Executive Vice President and Chief Investment Strategist (2009 – 2023) and Director of Equity Research (2001 – 2008) of Northern Trust Investments, Inc. (asset management). | | 24 | | Trustee of 50 South Capital Alpha Core Strategies Fund (since 2011) |

14

Name and Year

of Birth | | Term of

Office,

Position(s)

Held and

Length of

Service(1) | | Principal Occupation(s) During Past Five Years | | Number of

Funds in Fund

Complex

Overseen by

Trustees(2) | | Other

Directorships

Held by

Trustee |

John Walters

(born 1962)(3) | | Lead Independent Trustee | | Independent Director, Kindley Re LTD (life insurance) (since January 2023); Board Member, Amerilife Holdings LLC (insurance distribution) (2015 – 2020); Member, Board of Governors, University of North Carolina, Chapel Hill (2013 – 2019); Board Member, Stadion Money Management LLC (investment adviser) (2011 – 2019); President and Chief Operating Officer, Hartford Life Insurance Company (2000 – 2010). | | 24 | | Trustee, Victory Portfolios III, formerly USAA Mutual Funds Trust, (registered investment company offering 45 individual funds) (since 2019). |

| | | | | Interested Trustees | | | | |

Michael Ferik

(born 1972)(4) | | Chairman and Trustee (Since December 2019) | | Head of Individual Markets (since 2020) and Executive Vice President and Chief Financial Officer (2017 – 2019) of The Guardian Life Insurance Company of America. | | 24 | | None. |

Richard T. Potter

(born (1954)(4) | | Trustee (since July 2021) | | Retired (since 2021); Vice President and Equity Counsel, The Guardian Life Insurance Company of America prior thereto. | | 24 | | None. |

15

Securities Beneficially Owned by Each Trustee

Shares of the Funds are available only through certain variable annuity contracts and variable life insurance policies issued by GIAC. As of June 30, 2023, Mr. Potter beneficially owned shares of the Funds through variable annuities issued by GIAC within the dollar ranges presented in the table below.

Name of Trustee | | Name of Fund | | Dollar Range of Equity Securities in the Fund | | Aggregate

Dollar Range

of Equity

Securities in

All Registered

Investment

Companies

Overseen

by Trustee

in Family of

Investment

Companies |

Richard T. Potter | | Guardian Core Plus Fixed Income VIP Fund | | $1 – $10,000 | | Over $100,000 |

| | | Guardian Global Utilities VIP Fund | | $1 – $10,000 | | |

| | | Guardian International Growth VIP Fund | | $1 – $10,000 | | |

| | | Guardian International Equity VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Large Cap Disciplined Growth VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Large Cap Disciplined Value VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Large Cap Fundamental Growth VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Mid Cap Relative Value VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Mid Cap Traditional Growth VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Multi-Sector Bond VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Small Cap Core VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Total Return Bond VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian U.S. Government Securities VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Integrated Research VIP Fund | | $10,001 – $50,000 | | |

16

Name of Trustee | | Name of Fund | | Dollar Range of Equity Securities in the Fund | | Aggregate

Dollar Range

of Equity

Securities in

All Registered

Investment

Companies

Overseen

by Trustee

in Family of

Investment

Companies |

| | | Guardian Select Mid Cap Core VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Small-Mid Cap Core VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Strategic Large Cap Core VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Core Fixed Income VIP Fund | | $10,001 – $50,000 | | |

| | | Guardian Short Duration Bond VIP Fund | | $10,001 – $50,000 | | |

Board Composition and Leadership Structure

The Board has appointed officers of the Trust, with responsibility to monitor and report to the Board on the Trust’s operations. Information about the officers of the Trust is included in Appendix B to this Proxy Statement. The Board receives regular reports from these officers and service providers regarding the Trust’s operations. The Board has appointed a Chief Compliance Officer who administers the Trust’s compliance program, oversees the compliance programs of certain service providers to the Trust, and regularly reports to the Board as to compliance matters. Like most mutual funds, the Board delegates the day-to-day management of the Trust to the various service providers that have been contractually retained to provide such day-to-day services to the Trust. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the day-to-day affairs of the Trust and its oversight role does not make the Board a guarantor of the Trust’s investments, operations or activities.

The Board is currently composed of six Trustees, a majority of which are Independent Trustees. The Chairman of the Board is an Interested Trustee. The Independent Trustees have appointed John Walters as Lead Independent Trustee of the Trust. The Lead Independent Trustee serves as the principal liaison between the Independent Trustees and management between Board meetings. In addition, the Lead Independent Trustee’s responsibilities include presiding at executive sessions of the Independent Trustees, consulting and coordinating with the Chairman of the Board and Chairs of the Audit Committee and Investment Committee with respect to Board and committee meeting agendas and performing such other functions with respect to the Trust from time to time as may be agreed with the Chairman of the Board.

17

The Board meets as often as necessary to discharge its responsibilities. The Board meets in person or by video or telephone at regularly scheduled meetings four times a year and also may meet in-person or by video or telephone at special meetings to discuss specific matters that may require action prior to the next regularly scheduled meeting. As described below, the Board has established an Audit Committee and Investment Committee to assist the Board in fulfilling its oversight function. The Board met four times during the fiscal year ended December 31, 2022.

The Trustees have determined that the Trust’s leadership structure is appropriate because it allows the Trustees to effectively perform their oversight responsibilities. The Independent Trustees have engaged independent legal counsel to assist them in fulfilling their responsibilities.

Board Attendance

During each Fund’s most recent fiscal year, each Trustee attended 75% or more of each Fund’s Board meetings and the committee meetings (if a member thereof) held during the period for which such Trustee was a Trustee.

Board Oversight of Risk Management

The day-to-day management of various risks related to the administration and operation of the Trust is the responsibility of management and other service providers retained by the Trust or by management, most of whom employ professional personnel who have risk management responsibilities. Risk management is a broad concept comprised of many elements. Accordingly, Board oversight of different types of risks is handled in different ways. As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel. The Board, Audit Committee and Investment Committee also receive periodic reports as to how the Manager conducts service provider oversight and how it monitors for other risks, such as derivatives risks, operational risks, cyber risks, business continuity risks and risks that might be present with individual portfolio managers or specific investment strategies. The Independent Trustees meet regularly with the Chief Compliance Officer to discuss compliance and operational risks.

The Board oversees the Funds’ liquidity risk through, among other things, receiving periodic reporting and presentations by investment and other personnel of the Manager. Additionally, as required by Rule 22e-4 under the 1940 Act, the Trust implemented the Liquidity Program, which is reasonably designed to assess and manage the Funds’ liquidity risk. The Board, including a majority of the Independent Trustees, approved the designation of a liquidity risk management program administrator (the “Liquidity Program Administrator”) who is responsible for administering the Liquidity Program. The Board reviews, no less frequently than annually, a written report prepared

18

by the Liquidity Program Administrator that addresses the operation of the Liquidity Program and assesses its adequacy and effectiveness of implementation.

In its oversight role, the Board has adopted, and periodically reviews, policies and procedures designed to address risks associated with the Trust’s activities. In addition, the Manager and the Trust’s other service providers have adopted policies, processes and procedures to identify, assess and manage risks associated with the Trust’s activities.

The Board recognizes that it is not possible to identify all of the risks that may affect the Funds or to develop processes and controls to mitigate or eliminate all risks and their possible effects, and that it may be necessary to bear certain risks (such as investment risks) to achieve the Funds’ investment objectives. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Board Committees

The Board has established an Audit Committee, which is composed of all of the Independent Trustees of the Trust (Bruce W. Ferris, Theda R. Haber, Marshall Lux (Chair), and John Walters). The Board has determined that each of Mr. Ferris, Mr. Lux and Mr. Walters is an “audit committee financial expert,” as such term is defined in the applicable SEC rules. The Audit Committee’s functions include, among other things, overseeing the Trust’s processes for accounting, auditing, financial reporting and internal controls. The Audit Committee met four times during the fiscal year ended December 31, 2022. It is expected that, if elected by shareholders, Mr. Ferris, Mr. Lux (Chair), Mr. McDonald, Mr. Walters and Ms. Haber will serve as members of the Audit Committee. A copy of the Charter of the Audit Committee is included as Appendix C to this Proxy Statement.

The Board has established an Investment Committee, which is composed of all of the Independent Trustees of the Trust (Bruce W. Ferris (Chair), Theda R. Haber, Marshall Lux, and John Walters). The primary purposes of the Investment Committee are to assist the Board in overseeing the Funds’ investment performance, consistency of the Funds with their stated objectives and styles, and management’s selection of benchmarks and other performance measures for the Funds. The Investment Committee met three times during the fiscal year ended December 31, 2022. It is expected that, if elected by shareholders, Mr. Ferris (Chair), Mr. Lux, Mr. McDonald, Mr. Walters and Ms. Haber will serve as members of the Investment Committee. A copy of the Charter of the Investment Committee is included as Appendix D to this Proxy Statement.

19

Compensation of Trustees

The Trust pays each Independent Trustee an annual retainer fee for participation in Board meetings and associated committee meetings. In addition, the Lead Independent Trustee, the Chairperson of the Audit Committee and the Chairperson of the Investment Committee each receive additional annual compensation for their services. The Trust may also pay the Independent Trustees for participation in special Board or committee meetings. Independent Trustees are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at Board and committee meetings. Each Fund in the Trust pays a pro rata share of these fees. The pro rata share paid by each Fund is based on each Fund’s average net assets as a percentage of the average net assets of all of the Funds in the Trust as of the end of each fiscal year. The Trust does not pay any compensation to the Interested Trustees. The Trust has no pension or retirement plan or benefits.

During the fiscal year ended December 31, 2022, each Independent Trustee received compensation from the Trust as follows:

Name of Fund | | Bruce W.

Ferris | | Theda R.

Haber | | Marshall

Lux | | John

Walters |

Guardian Small Cap Core VIP Fund | | $ | 10,434 | | $ | 9,205 | | $ | 9,205 | | $ | 11,665 |

Guardian Global Utilities VIP Fund | | $ | 2,799 | | $ | 2,479 | | $ | 2,479 | | $ | 3,144 |

Guardian Multi-Sector Bond VIP Fund | | $ | 10,192 | | $ | 9,043 | | $ | 9,043 | | $ | 11,470 |

Guardian U.S. Government Securities VIP Fund | | $ | 8,948 | | $ | 7,935 | | $ | 7,935 | | $ | 10,064 |

Guardian Total Return Bond VIP Fund | | $ | 11,541 | | $ | 10,239 | | $ | 10,239 | | $ | 12,985 |

Guardian All Cap Core VIP Fund | | $ | 4,671 | | $ | 4,053 | | $ | 4,053 | | $ | 5,107 |

Guardian Select Mid Cap Core VIP Fund | | $ | 9,011 | | $ | 7,961 | | $ | 7,961 | | $ | 10,093 |

Guardian Small-Mid Cap Core VIP Fund | | $ | 12,141 | | $ | 10,759 | | $ | 10,759 | | $ | 13,648 |

Guardian Strategic Large Cap Core VIP Fund | | $ | 11,709 | | $ | 10,383 | | $ | 10,383 | | $ | 13,171 |

Guardian Balanced Allocation VIP Fund | | $ | 5,938 | | $ | 5,114 | | $ | 5,114 | | $ | 6,434 |

Guardian Equity Income VIP Fund | | $ | 3,854 | | $ | 3,319 | | $ | 3,319 | | $ | 4,176 |

20

Name of Fund | | Bruce W.

Ferris | | Theda R.

Haber | | Marshall

Lux | | John

Walters |

Guardian Core Fixed Income VIP Fund | | $ | 12,727 | | $ | 10,957 | | $ | 10,957 | | $ | 13,786 |

Guardian Short Duration Bond VIP Fund | | $ | 5,492 | | $ | 4,730 | | $ | 4,730 | | $ | 5,950 |

Guardian Large Cap Disciplined Growth VIP Fund | | $ | 19,343 | | $ | 17,172 | | $ | 17,172 | | $ | 21,785 |

Guardian Large Cap Fundamental Growth VIP Fund | | $ | 10,798 | | $ | 9,587 | | $ | 9,587 | | $ | 12,162 |

Guardian Integrated Research VIP Fund | | $ | 13,531 | | $ | 11,920 | | $ | 11,920 | | $ | 15,088 |

Guardian Diversified Research VIP Fund | | $ | 6,068 | | $ | 5,380 | | $ | 5,380 | | $ | 6,825 |

Guardian Large Cap Disciplined Value VIP Fund | | $ | 6,892 | | $ | 6,110 | | $ | 6,110 | | $ | 7,750 |

Guardian Growth & Income VIP Fund | | $ | 6,126 | | $ | 5,427 | | $ | 5,427 | | $ | 6,884 |

Guardian Mid Cap Relative Value VIP Fund | | $ | 7,491 | | $ | 6,637 | | $ | 6,637 | | $ | 8,418 |

Guardian Mid Cap Traditional Growth VIP Fund | | $ | 3,874 | | $ | 3,434 | | $ | 3,434 | | $ | 4,356 |

Guardian International Equity VIP Fund | | $ | 13,160 | | $ | 11,669 | | $ | 11,669 | | $ | 14,800 |

Guardian International Growth VIP Fund | | $ | 4,662 | | $ | 4,137 | | $ | 4,137 | | $ | 5,248 |

Guardian Core Plus Fixed Income VIP Fund | | $ | 11,098 | | $ | 9,849 | | $ | 9,849 | | $ | 12,492 |

board recommendation

After careful consideration, the Board, including the Independent Trustees, unanimously recommends that the shareholders of each Fund vote FOR Proposal Two.

21

VOTING AND OTHER INFORMATION

This Proxy Statement is being provided in connection with the solicitation of proxies and voting instructions for the Proposals to be voted upon at the Special Meeting, which will be held via teleconference on October 31, 2023 at 4:00 p.m., Eastern time.

You may provide GIAC with your voting instructions in one of four ways:

• By Mail: Complete and sign the enclosed voting instruction card and mail it to us in the enclosed prepaid return envelope (if mailed in the United States);

• Online: Visit the website address printed on your voting instruction card;

• By Touch-Tone Telephone Prior to the Special Meeting: Call the toll-free number printed on your voting instruction card; or

• By Teleconference During the Special Meeting: Follow the procedures set forth in the Notice of Special Meeting of Shareholders to obtain the dial-in number for the Special Meeting and provide voting instructions as directed during the Special Meeting.

Please note, to vote via the Internet or telephone, you will need the “control number” that appears on your voting instruction card.

Voting instruction cards must be received by the day before the Special Meeting. Voting instructions submitted by touch-tone telephone or on the Internet must be submitted by 3:59 p.m. Eastern time on the day of the Special Meeting. You may submit your voting instructions at the Special Meeting, even though you may have already returned a voting instruction card or submitted your voting instructions by telephone or on the Internet.

You may revoke a voting instruction once it is given, so long as it is submitted within the voting period, by submitting a later-dated voting instruction or a written notice of revocation to the Trust. You may also revoke your voting instructions by attending the Special Meeting and providing your voting instructions at the Special Meeting. All properly executed proxies or voting instructions received in time for the Special Meeting will be voted as specified in the proxy or voting instruction, or, if no specification is made, FOR each proposal.

Only shareholders of the applicable Fund as of the close of business on the Record Date are entitled to receive notice of and to vote. Each share held as of the close of business on the Record Date is entitled to one vote. Participation in the Special Meeting by phone or by proxy (i.e., GIAC as the record owner of the Funds’ shares) entitled to cast one-third of votes eligible to be cast at the Special Meeting will constitute a quorum for the conduct

22

of all business. When a quorum is present, approval of Proposal One will require the affirmative vote of the holders of a “majority of the outstanding voting securities” of the applicable Fund, which is defined in the 1940 Act as the lesser of: (1) 67% or more of the voting securities of the Fund present at the Special Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present at the Special Meeting or by proxy, or (2) more than 50% of the outstanding voting securities of the Fund. When a quorum is present, Proposal Two will require a plurality vote to elect a Trustee to the Board.

GIAC, as the holder of record of shares of each Fund, is required to “pass through” to its Contract owners the right to vote shares of each Fund. The Trust expects that GIAC will vote 100% of the shares of each Fund held by its separate account(s) in accordance with instructions from its Contract owners. Under an “echo voting policy,” GIAC will vote shares for which no instructions have been received from its Contract owners and any other shares that it or its affiliates own in their own right in the same proportion as it votes shares for which it has received instructions. No minimum number of voting instructions from Contract owners is required before GIAC may vote the shares for which no voting instructions have been received. Because GIAC will vote its shares of each Fund in the same proportion as votes submitted by Contract owners, it is possible that a small number of Contract owners could determine the outcome of a proposal. Furthermore, as the sole record owner of each Fund’s shares, GIAC’s presence at the Special Meeting will constitute a quorum for the transaction of business.

Any meeting of shareholders, whether or not a quorum is present, may be adjourned for any lawful purpose by a majority of the votes properly cast upon the question of adjourning a meeting to another date and time provided that no meeting shall be adjourned for more than six months beyond the originally scheduled meeting date. In addition, any meeting of shareholders, whether or not a quorum is present, may be adjourned or postponed by, or upon the authority of, the Chairman or the Trustees to another date and time provided that no meeting shall be adjourned or postponed for more than six months beyond the originally scheduled meeting date. Any adjourned or postponed session or sessions may be held, within a reasonable time after the date set for the original meeting as determined by, or upon the authority of, the Trustees in their sole discretion without the necessity of further notice.

Although it is not expected that the Funds will receive abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter), abstentions and broker non-votes will be treated as present for purposes of determining a quorum, but will not be included in the denominator for purposes of

23

calculating the number of votes required to approve any proposal to adjourn the Special Meeting. In addition, under the rules of the New York Stock Exchange, if a broker has not received instructions from beneficial owners or persons entitled to vote and the Proposals to be voted upon may “affect substantially” a shareholder’s rights or privileges, the broker may not vote the shares as to that proposal even if it has discretionary voting power. As a result, these shares also will be treated as broker non-votes for purposes of proposals that may “affect substantially” a shareholder’s rights or privileges (but will not be treated as broker non-votes for other proposals, including adjournment of the Special Meeting). Abstentions and broker non-votes, if any, will have the same effect as votes against the Proposal.

The individuals named as proxies on the enclosed proxy card will vote in accordance with the shareholder’s direction, as indicated thereon, if the proxy card is received and is properly executed. If a shareholder properly executes a proxy or voting instruction card and gives no voting instructions with respect to Proposal One or Two, the shares will be voted in favor of the relevant Proposals. The individuals named as proxies on the enclosed proxy card will vote in accordance with their discretion with regard to any business that properly comes before the Special Meeting.

Shareholders of each Fund will vote separately with respect to each Proposal as it relates to the applicable Fund and approval of a Proposal for a Fund is not contingent on approval of the Proposal by any other Fund(s) or any other Proposal.

If shareholders of a Fund do not approve a Proposal applicable to the Fund, the Board would then consider what, if any, further steps to take.

Future Shareholder Proposals

The Trust is not required to hold regular meetings of shareholders, and to minimize its costs, does not intend to hold meetings of shareholders unless so required by applicable law, regulation, regulatory policy, or unless otherwise deemed advisable by the Board or the Trust’s management. Therefore, it is not practicable to specify a date by which proposals must be received in order to be incorporated in an upcoming proxy statement for a meeting of shareholders.

Communications with the Board of Trustees

Shareholders who wish to communicate with Trustees with respect to matters relating to the Trust may address their written correspondence to the Board as a whole or to individual Trustees at 10 Hudson Yards, New York, New York 10001.

24

Solicitation Expenses and Other Expenses Related to the Special Meeting

Proxies or voting instructions will be solicited via regular mail and also may be solicited via telephone, e-mail or other personal contact by personnel of GIAC or its affiliates or, in GIAC’s discretion, a commercial firm retained for this purpose. The Trust has retained Computershare to provide proxy solicitation services in connection with the Special Meeting. Those proxy solicitation services include printing, mailing and vote tabulation. The expenses relating to the Proposal One, including the preparation, printing, mailing, solicitation, and tabulation of the votes, including the costs of any proxy solicitor, any additional solicitation and mailings, and costs related to any necessary prospectus supplements, will be borne by GIAC. These costs are estimated to be approximately $[*]. The expenses relating to the Proposal Two, including the preparation, printing, mailing, solicitation, and tabulation of the votes, including the costs of any proxy solicitor, any additional solicitation and mailings, and costs related to any necessary prospectus supplements, will be borne by the Trust. These costs are estimated to be approximately $[*].

Householding

Unless you have instructed the Trust otherwise, only one copy of this proxy statement may be mailed to multiple Contract owners who share a mailing address (a “Household”). If you need additional copies of this proxy statement, please contact the Customer Service Office Contact Center at 1-888-GUARDIAN (1-888-482-7342). If you do not want the mailing of your proxy solicitation materials to be combined with those of other members of your Household in the future, or if you are receiving multiple copies and would rather receive just one copy for your Household, please write to The Guardian Insurance & Annuity Company, Inc., Customer Service Office, P.O. Box 981592, El Paso, TX 79998-1592, or call GIAC toll free at 1-888-GUARDIAN (1-888-482-7342).

Shareholder Reports

Each Fund will furnish without charge, upon request, a printed version of the most recent Annual/Semiannual Reports to Contract owners. To obtain information, or for shareholder inquiries, contact the Customer Service Office Contact Center at 1-888-GUARDIAN (1-888-482-7342).

Investment Manager

Park Avenue Institutional Advisers LLC, a Delaware limited liability company located at 10 Hudson Yards, New York, NY 10001, serves as the investment manager of each Fund pursuant to an Investment Management Agreement dated August 8, 2016, as amended from time to time.

25

Distributor

Park Avenue Securities LLC, a Delaware limited liability company located at 10 Hudson Yards, New York, NY 10001, serves as the distributor for the shares of each Fund pursuant to a Distribution and Service Agreement dated August 8, 2016, as amended from time to time.

Administrator

State Street Bank and Trust Company, a Massachusetts trust company located at One Lincoln Street, Boston, Massachusetts 02111, provides certain administrative services, including fund accounting and tax-related services, to the Funds pursuant to an Administration Agreement dated August 25, 2016, as amended from time to time.

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP (“PwC”), 300 Madison Avenue, New York, NY 10017, serves as the independent registered public accounting firm for the Trust. PwC will audit and report on the Funds’ annual financial statements, review certain regulatory reports, and perform other attestation, auditing, tax and advisory services when engaged to do so by the Trust. Representatives of PwC will attend the Special Meeting and be available at the Special Meeting to respond to questions, but it is not expected that they will make any statement at the Special Meeting.

Audit Fees

The aggregate fees billed for professional services rendered by PwC in connection with the annual audit of the Trust’s financial statements and for services normally provided by PwC in connection with statutory and regulatory filings or engagements for the fiscal years ended December 31, 2022 and December 31, 2021 were $730,992 and $576,000, respectively.

Audit-Related Fees

There were no fees billed to the Funds in the Trust’s last two fiscal years for other products and services by PwC, other than the services reported above (together, “Other Fees”). With respect to engagements that related directly to the operations or financial reporting of the Trust, PwC did not bill PAIA or any of its affiliates for Other Fees in the Trust’s last two fiscal years.

Tax Fees

There were no fees billed to the Funds in the Trust’s last two fiscal years for professional services related to tax compliance, tax advice and tax planning.

26

All Other Fees

There were no other fees billed to the Funds in the Trust’s last two fiscal years other than as described above.

Board Consideration of Non-Audit Services

The Audit Committee considers whether PwC’s provision of any non-audit services that were rendered to PAIA or any of its affiliates that did not receive pre-approval pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining PwC’s independence. There were no non-audit fees billed by PwC for services rendered to the Trust, PAIA, or any entity controlling, controlled by or under common control with PAIA that provides ongoing services to the Trust for each of the last two fiscal years of the Trust.

Other Matters

The Board is not aware of any matters that will be presented for action at the Meeting other than the matters set forth herein. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters in accordance with their best judgment in the interest of the Trust and each Fund, as applicable.

27

APPENDIX A

Shares Outstanding as of the Record Date

As of July 31, 2023, the Funds had the following number of shares outstanding:

Fund Name | | Number of

Shares Outstanding |

Guardian Small Cap Core VIP Fund | | 22,550,887.984 |

Guardian Global Utilities VIP Fund | | 4,706,732.879 |

Guardian Multi-Sector Bond VIP Fund | | 24,134,178.997 |

Guardian U.S. Government Securities VIP Fund | | 19,966,380.380 |

Guardian Total Return Bond VIP Fund | | 27,776,560.710 |

Guardian All Cap Core VIP Fund | | 17,623,870.497 |

Guardian Select Mid Cap Core VIP Fund | | 23,813,063.118 |

Guardian Small-Mid Cap Core VIP Fund | | 32,043,667.592 |

Guardian Strategic Large Cap Core VIP Fund | | 26,120,321.607 |

Guardian Balanced Allocation VIP Fund | | 21,048,307.480 |

Guardian Equity Income VIP Fund | | 13,325,303.483 |

Guardian Core Fixed Income VIP Fund | | 43,613,480.193 |

Guardian Short Duration Bond VIP Fund | | 18,301,656.545 |

Guardian Large Cap Disciplined Growth VIP Fund | | 19,067,133.443 |

Guardian Large Cap Fundamental Growth VIP Fund | | 11,670,046.213 |

Guardian Integrated Research VIP Fund | | 18,495,202.642 |

Guardian Diversified Research VIP Fund | | 6,452,486.735 |

Guardian Large Cap Disciplined Value VIP Fund | | 8,380,178.566 |

Guardian Growth & Income VIP Fund | | 7,549,757.742 |

Guardian Mid Cap Relative Value VIP Fund | | 9,044,457.136 |

Guardian Mid Cap Traditional Growth VIP Fund | | 3,989,046.091 |

Guardian International Equity VIP Fund | | 23,282,831.487 |

Guardian International Growth VIP Fund | | 6,650,701.041 |

Guardian Core Plus Fixed Income VIP Fund | | 23,129,431.698 |

A-1

Beneficial Ownership of Shares

As of July 31, 2023, the officers and Trustees of the Trust, as a group, owned less than 1% of the outstanding shares of each Fund.

As of July 31, 2023, to the Funds’ knowledge, the shareholders who owned of record 5% or more of the outstanding shares of any Fund were as set forth in the following table:

Fund Name | | Name and Address of Beneficial Owner | | Percentage

of Shares |

Guardian Small Cap Core VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BJ

10 HUDSON YARDS

NEW YORK, NY 10001 | | 42.53 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 4AB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 31.62 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 4AL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 16.27 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE ‘12 - 0LJ

10 HUDSON YARDS

NEW YORK, NY 10001 | | 6.84 | % |

Guardian Global Utilities VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 2AB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 45.92 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 2AL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 24.52 | % |

A-2

Fund Name | | Name and Address of Beneficial Owner | | Percentage

of Shares |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BF

10 HUDSON YARDS

NEW YORK, NY 10001 | | 23.82 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE ‘12 - 0LF

10 HUDSON YARDS

NEW YORK, NY 10001 | | 5.74 | % |

Guardian Multi-Sector Bond VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 0DB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 42.64 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BH

10 HUDSON YARDS

NEW YORK, NY 10001 | | 29.04 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 0DL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 24.08 | % |

Guardian U.S. Government Securities VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 0AB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 39.29 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BA

10 HUDSON YARDS

NEW YORK, NY 10001 | | 32.44 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 0AL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 21.14 | % |

A-3

Fund Name | | Name and Address of Beneficial Owner | | Percentage

of Shares |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE ‘12 - 0LA

10 HUDSON YARDS

NEW YORK, NY 10001 | | 5.43 | % |

Guardian Total Return Bond VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 0SB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 57.48 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 0SL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 29.05 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BD

10 HUDSON YARDS

NEW YORK, NY 10001 | | 12.39 | % |

Guardian All Cap Core VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A D - 4DJ

10 HUDSON YARDS

NEW YORK, NY 10001 | | 24.29 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A B - B14

10 HUDSON YARDS

NEW YORK, NY 10001 | | 23.20 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A A - 4AH

10 HUDSON YARDS

NEW YORK, NY 10001 | | 20.45 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A E - 0EJ

10 HUDSON YARDS

NEW YORK, NY 10001 | | 8.73 | % |

A-4

Fund Name | | Name and Address of Beneficial Owner | | Percentage

of Shares |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A Q - 0QA

10 HUDSON YARDS

NEW YORK, NY 10001 | | 7.91 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A K - 080

10 HUDSON YARDS

NEW YORK, NY 10001 | | 7.64 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: SS/A R GIAB - 0RD

10 HUDSON YARDS

NEW YORK, NY 10001 | | 5.48 | % |

Guardian Select Mid Cap Core VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 0FB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 35.31 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A Q - 0QC

10 HUDSON YARDS

NEW YORK, NY 10001 | | 20.42 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 2EL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 18.66 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R GIAB - 0RE

10 HUDSON YARDS

NEW YORK, NY 10001 | | 13.55 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R SVA BSHARE - 4Z5

10 HUDSON YARDS

NEW YORK, NY 10001 | | 7.84 | % |

A-5

Fund Name | | Name and Address of Beneficial Owner | | Percentage

of Shares |

Guardian Small-Mid Cap Core VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 0QB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 49.48 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 2FL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 26.56 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BK

10 HUDSON YARDS

NEW YORK, NY 10001 | | 9.01 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A Q - 0QE

10 HUDSON YARDS

NEW YORK, NY 10001 | | 8.71 | % |

Guardian Strategic Large Cap Core VIP Fund | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE - 2EB

10 HUDSON YARDS

NEW YORK, NY 10001 | | 37.45 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R B SHARE ‘12 - 0BP

10 HUDSON YARDS

NEW YORK, NY 10001 | | 26.30 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R L SHARE - 2QL

10 HUDSON YARDS

NEW YORK, NY 10001 | | 20.79 | % |

| | | GUARDIAN INSURANCE &

ANNUITY COMPANY, INC.

FBO: S/A R SVA B SHARE - 4Z4

10 HUDSON YARDS