Exhibit 99.14

Unofficial translation from the French and Dutch originals

Anheuser-Busch InBev

Société anonyme / Naamloze vennootschap

Grand’ Place / Grote Markt 1, 1000 Brussels, Belgium

Register of legal entities: 0417.497.106 (Brussels)

Convening notice to attend the extraordinary shareholders’ meeting to be

held on 28 September 2016

The Board of Directors of Anheuser-Busch InBev SA/NV (“AB InBev” or the “Company”) invites shareholders to attend an extraordinary shareholders’ meeting (the “Meeting”) to be held on Wednesday 28 September 2016 at 9.00 am (CET) at Diamant Center Brussels, Boulevard A. Reyers 80, 1030 Brussels in connection with the proposed business combination between SABMiller plc. and the Company (the “Transaction”).

It is contemplated that the Transaction will be implemented by way of a three stage inter-conditional process involving (i) a UK law court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006 (the “UK Scheme”), (ii) a Belgian law voluntary cash takeover offer pursuant to the Belgian Law of 1 April 2007 and the Belgian Royal Decree of 27 April 2007 on public takeover bids (the “Belgian Offer”), and (iii) the merger of AB InBev into Newbelco SA/NV (“Newbelco”) through a merger by absorption under the Belgian Companies Code pursuant to which Newbelco will be the surviving entity (the “Belgian Merger”).

The Meeting will discuss and vote on the following agenda:

| A. | Transaction and Belgian Offer |

| 1. | Approval of the Transaction and the acquisition by the Company of Newbelco shares in the context of the Belgian Offer |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, the Transaction, including the acquisition by AB InBev of the shares of Newbelco at a price of £0.45 each under the Belgian Offer, for a value exceeding one third of the consolidated assets of AB InBev.

| 2. | Acknowledgement by the shareholders of the following documents, of which they can obtain a copy free of charge: |

| | • | | the common draft terms of merger drawn up by the boards of directors of the merging companies in accordance with article 693 of the Belgian Companies Code (the “Merger Terms”); |

| | • | | the report prepared by the board of directors of the Company in accordance with article 694 of the Belgian Companies Code; |

| | • | | the report prepared by the statutory auditor of the Company in accordance with article 695 of the Belgian Companies Code. |

| 3. | Communication regarding significant changes in the assets and liabilities of the merging companies between the date of the Merger Terms and the date of the shareholders’ meeting, in accordance with article 696 of the Belgian Companies Code |

| 4. | Merger by absorption by Newbelco of all assets, without any exception or reserve, of AB InBev (the “Belgian Merger”), in accordance with the Merger Terms, effective upon passing of the notarial deed acknowledging completion of the Belgian Merger (the “Final Notarial Deed”) |

Proposed resolution: approve (i) the Merger Terms, (ii) the Belgian Merger, subject to the conditions set out in the Merger Terms and effective upon passing of the Final Notarial Deed, and (iii) the dissolution without liquidation of AB InBev upon completion of the Belgian Merger.

| 5. | Delistings as a result of the Belgian Merger |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, (i) the delisting of the securities of the Company from Euronext Brussels, (ii) the delisting of the securities of the Company from the Johannesburg Stock Exchange, and (iii) the cancellation of the registration of the securities of the Company with the National Securities Registry (RNV) maintained by the Mexican Securities and Banking Commission (Comisión Nacional Bancaria y de Valores or CNBV) and the delisting of such securities from the Bolsa Mexicana de Valores, S.A.B. de C.V. (BMV), all such delistings and cancellation of registration subject to and with effect as of completion of the Belgian Merger.

Proposed resolution: approve the delegation of powers to:

| | (i) | any director of the Company from time to time, Sabine Chalmers, Lucas Lira, Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris and Romanie Dendooven (each an “Authorised Person”), each acting together with another Authorised Person, to acknowledge by notarial deed the completion of the Belgian Merger after completion of the conditions precedent set out in the Merger Terms; |

| | (ii) | the board of directors for the implementation of the resolutions passed; and |

| | (iii) | Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris, Romanie Dendooven, Philip Van Nevel and Els De Troyer, each acting alone and with power to sub-delegate, the power to proceed to all formalities at a business desk in order to perform the inscription and/or the modification of the Company’s data in the Crossroad Bank of Legal Entities and, if necessary, at the Administration for the Value Added Tax. |

The proposed resolutions set out in items 1 and 5 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least 75% of the shares attending or represented.

2

The proposed resolution set out in item 4 can be validly adopted if the shareholders attending the meeting, in person or by proxy, represent at least half of the capital, subject to the approval by at least 75% of the votes cast.

The proposed resolution set out in item 6 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least the majority of the votes cast.

The directors of the Company consider the Belgian Offer and the Belgian Merger to be in the best interests of the Company and its shareholders as a whole and unanimously and unconditionally recommend that the shareholders of the Company vote in favour of the resolutions set out above.

*

Persons attending the Meeting are invited to arrive 45 minutes before the time set for the Meeting in order to complete the registration formalities.

QUESTIONSCONCERNINGITEMSONTHEAGENDA

A time for questions is provided during the Meeting. Additionally, shareholders may submit written questions to the Company prior to the Meeting in relation to items on the agenda. Such questions should be addressed to the Company by letter or e-mail by 22 September 2016, 5.00 pm (CET) at the latest. A communication by email will only be valid if signed by means of an electronic signature in accordance with the applicable Belgian legislation.

Questions validly addressed to the Company will be raised during the question time. Questions of a shareholder will only be considered if the latter has complied with all admission formalities to attend the Meeting.

AMENDMENTTOTHEAGENDA

One or more shareholders holding together at least 3% of the share capital of the Company may add new items to the agenda of the Meeting or new proposed resolutions concerning items put or to be put on the agenda.

Such request will only be valid if, at the date the Company receives it, it is accompanied by a document establishing the above-mentioned shareholding. For registered shares, this document must be a certificate establishing that the corresponding shares are registered in the register of registered shares of the Company. For dematerialized shares, this document must be a certificate established by an authorised account holder or a clearing organisation, certifying the registration of the shares in one or more accounts held by such account holder or clearing organisation.

The Company must receive the text of the new items or new proposed resolutions to be put on the agenda on a signed original paper document by 6 September 2016, 5.00 pm (CET) at the latest. The text can also be communicated to the Company within the same period by electronic means, provided that the communication is signed by means of an electronic signature in accordance with the applicable Belgian legislation. The Company will acknowledge receipt of the communication made by letter or electronic means to the address as indicated by the shareholder, within 48 hours following such receipt.

The Company will publish a revised agenda by 13 September 2016 at the latest if it has validly received within the above-mentioned period one or more requests to add new items or new proposed resolutions to the agenda. In this case the Company will also provide to the shareholders new proxy forms and forms to vote by correspondence including the new items or proposed resolutions. Proxies received before the completed agenda has been issued will remain valid for the items covered.

3

The Meeting will only examine new items or proposed resolutions to be put on the agenda upon the request of one or more shareholders if the latter have complied with all admission formalities to attend the Meeting.

FORMALITIESFORADMISSION

In accordance with Article 25 of the articles of association of the Company, the right of a shareholder to vote at the Meeting in person, by proxy or prior to the Meeting by correspondence is subject to the compliance with the two formalities described hereunder:

| (a) | the registration of the ownership of the shares in the name of the shareholder by 14 September 2016, 12.00 midnight (CET) (the “Registration Date”), in the following way: |

| | - | forregistered shares, by the registration of these shares in the name of the shareholder in the register of registered shares of the Company; or |

| | - | fordematerialized shares, by the registration of these shares in the name of the shareholder in the accounts of an authorised account holder or clearing organisation. Owners of dematerialized shares should request their financial institution - authorised account holder or clearing organisation - to issue a certificate stating the number of dematerialized shares registered in the name of the shareholder in its books on the Registration Date and to send it directly to Euroclear Belgium, attn. Issuer Services, 1 Boulevard du Roi Albert II, 1210 Brussels (Belgium) (e-mail : ebe.issuer@euroclear.com / fax: +32 2 337 54 46) by 22 September 2016, 5.00 pm (CET) at the latest; |

| (b) | the notification in writing by the shareholder, by 22 September 2016, 5.00 pm (CET) at the latest of his/her intention to participate in the Meeting and the number of shares for which he/she wants to participate: |

1. owners ofdematerialized sharesshould send such notification directly to Euroclear Belgium, attn. Issuer Services, 1 Boulevard du Roi Albert II, 1210 Brussels (Belgium) (e-mail: ebe.issuer@euroclear.com / fax: +32 2 337 54 46);

2. owners ofregistered shares should send such notification to Mr. Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (e-mail: benoit.loore@ab-inbev.com).

Only persons who are shareholders of the Company on the Registration Date are entitled to participate in and vote at the Meeting.

Specific note for the owners of bearer shares who have not converted their bearer shares into registered or dematerialised shares by 31 December 2013

The owners ofbearer shares were required to convert their bearer shares into registered or dematerialised shares by 31 December 2013, in accordance with the Belgian Law of 14 December 2005 on the abolition of bearer securities. On 1 January 2014, the bearer shares that had not been converted by their owner into registered or dematerialised shares have been automatically converted into dematerialised shares and registered by the Company in a securities account in the Company’s name (the “Converted Shares”). In accordance with the Law of 14 December 2005, the Converted Shares have been sold on Euronext Brussels on 02 November 2015 and proceeds of the sale have been transferred to the Caisse des Dépôts et Consignations/Deposito en Consignatiekas. The exercise of voting rights attached to the Converted Shares is no longer possible.

Specific note for shareholders whose shares are held in South Africa through Central Securities Depository Participants (CSDP) and brokers and are traded on the securities exchange operated by JSE Limited

4

Record Date

The record date for the purpose of determining which shareholders are entitled to receive the convening notice of the Meeting is Friday, 26 August 2016. The record date for the purpose of determining which shareholders are entitled to participate in and vote at the Meeting is Wednesday, 14 September 2016 (“the voting record date”). Therefore, the last day to trade in the Company’s shares on the JSE in order to be recorded as a shareholder by the voting record date is Friday, 9 September 2016.

Voting at the Meeting

Your broker or CSDP should contact you to ascertain how you wish to cast your vote at the Meeting and should thereafter cast your vote in accordance with your instructions. If you have not been contacted by your broker or CSDP, it is advisable for you to contact your broker or CSDP and furnish it with your voting instructions.

If your broker or CSDP does not obtain voting instructions from you, it will be obliged to vote in accordance with the instructions contained in the custody agreement concluded between you and your broker or CSDP. You must not complete the form of proxy communicated by the Company.

Attendance and representation at the Meeting

In accordance with the mandate between you and your broker or CSDP, you must advise your broker or CSDP if you wish to attend the Meeting and if so, your broker or CSDP will issue the necessary letter of representation to you to attend and vote at the Meeting.

VOTEBY CORRESPONDENCE

Any shareholder may vote by correspondence prior to the Meeting, in accordance with Article 26bis of the articles of association of the Company.

Such vote must be submitted on the paper form prepared by the Company. The paper form to vote by correspondence can be obtained from Mr. Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (e-mail: benoit.loore@ab-inbev.com) and is also available at the Company’s website (www.ab-inbev.com).

At the latest on 22 September 2016, 5.00 pm (CET), the signed form must either reach Euroclear Belgium, attn. Issuer Services, 1 Boulevard du Roi Albert II, 1210 Brussels, Belgium (e-mail: ebe.issuer@euroclear.com / fax: +32 2 337 54 46) or Mr. Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (e-mail: benoit.loore@ab-inbev.com).

DESIGNATIONOFPROXYHOLDERS

Any shareholder may be represented at the Meeting by a proxyholder. A shareholder may designate only one person as proxyholder, except in circumstances where Belgian law allows the designation of multiple proxyholders.

The proxyholder must be designated using the paper form prepared by the Company. The proxy form can be obtained from Mr. Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (e-mail: benoit.loore@ab-inbev.com) and is also available at the Company’s website (www.ab-inbev.com).

At the latest on 22 September 2016, 5.00 pm (CET), the signed proxy form must either reach Euroclear Belgium, attn. Issuer Services, 1 Boulevard du Roi Albert II, 1210 Brussels (Belgium) (e-mail: ebe.issuer@euroclear.com / fax: +32 2 337 54 46) or Mr. Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (e-mail: benoit.loore@ab-inbev.com).

5

Any appointment of a proxyholder must comply with the applicable Belgian legislation, notably in terms of conflicting interests and record keeping.

IDENTIFICATIONANDREPRESENTATIONPOWERS

The natural persons who intend to attend the Meeting in their capacity of owners of securities, proxyholders or representatives of a legal entity must be able to provide evidence of their identity in order to be granted access to the Meeting. The representatives of legal entities must hand over the documents establishing their capacity as corporate representative or attorney-in-fact. These documents will be verified immediately before the start of the Meeting.

RIGHTSOFHOLDERSOFBONDS,SUBSCRIPTIONRIGHTSORCERTIFICATES

In accordance with Article 537 of the Belgian Companies Code, the holders of bonds, subscription rights or certificates issued with the cooperation of the Company, may attend the Meeting in an advisory capacity. In order to do so, they must comply with the same formalities for admission mentioned above as apply to the owners of shares.

AVAILABILITYOFDOCUMENTS

The Merger Terms, the report prepared by the board of directors of the Company in accordance with article 694 of the Belgian Companies Code, the report prepared by the statutory auditor of the Company in accordance with article 695 of the Belgian Companies Code and the other documents which the law requires to be made available to the shareholders together with the present convening notice, including the form to vote by correspondence and the proxy form are available at the Company’s website (www.ab-inbev.com).

The shareholders, bondholders, holders of subscription rights or certificates issued with the cooperation of the Company may also inspect all documents which the law requires to make available to them on business days and during normal office hours, at the administrative seat of Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium.

COMMUNICATIONSTOTHE COMPANYAND HELPLINE

Prior written questions concerning items on the agenda and requests to amend the agenda of the Meeting must be exclusively addressed to Mr Benoît Loore, Anheuser-Busch InBev SA/NV, Brouwerijplein 1, 3000 Leuven, Belgium (tel: + 32 (0)16 27 68 70 / e-mail: benoit.loore@ab-inbev.com) in accordance with the modalities specified in the present convening notice.

Holders of securities issued by the Company can also address any questions concerning the Meeting or the present convening notice to Mr Benoît Loore.

In addition, the Company has set up a helpline for retail investors for any queries on the Meeting. To reach the helpline, please dial the European Toll Free number 00800 3814 3814 or the Toll number +44 (0)117 3785 209. The helpline is open between 9 am and 5 pm CET Monday to Friday (excluding bank holidays).

The Board of Directors

6

Annex 2

|

CONFIRMATION OF PARTICIPATION Extraordinary shareholders’ meeting of Anheuser-Busch InBev SA/NV (the “Company”) of September 28, 2016 (9.00 am CET) |

This signed form must be returned by Thursday September 22, 2016 5.00 pm CET at the latest by ordinary mail or electronic mail, to: For registered shares: Anheuser-Busch InBev SA/NV Mr. Benoit Loore Brouwerijplein 1 3000 Leuven (Belgium) (benoit.loore@ab-inbev.com) For dematerialized shares: Euroclear Belgium, attn. Issuer Services 1 Boulevard du Roi Albert II 1210 Brussels (Belgium) (ebe.issuer@euroclear.com / fax : +32 2 337 54 46) |

| | | | |

| | The undersigned (name and first name / name of the company) | | |

| | |

| | | | |

| | |

| | Domicile / Registered office | | |

| | |

| | | | |

| | |

| | | | |

| | | | | | |

| | | | | | |

| Owner of | | | | registered shares (*) dematerialized shares (*) | | of Anheuser-Busch InBev SA/NV |

| | | | | | |

| | quantity | | | | |

| (*) | Cross out what is not applicable |

Confirms his intention to participate in the extraordinary shareholders’ meeting of the Company that will be held in Brussels on Wednesday September 28, 2016 (9.00 am) with all above-mentioned shares.

Done at …………………………....…………, on ............................

Signature(s): .................................................. (**)

| (**) Legal | entities must specify the name, first name and title of the natural person(s) who sign on their behalf. |

Annex 3

|

VOTE BY MAIL Extraordinary shareholders’ meeting of Anheuser-Busch InBev SA/NV (the “Company”) of September 28, 2016 (9.00 am CET) |

This signed form must be returned by Thursday September, 22, 2016 at 5.00 pm (CET) at the latest by ordinary mail or electronic mail, to: For registered shares: Anheuser-Busch InBev SA/NV Mr. Benoit Loore Brouwerijplein 1 3000 Leuven (Belgium) (benoit.loore@ab-inbev.com) For dematerialized shares: Euroclear Belgium, attn. Issuer Services 1 Boulevard du Roi Albert II 1210 Brussels (Belgium) (ebe.issuer@euroclear.com / fax : +32 2 337 54 46) |

|

The undersigned (name and first name / name of the company) Domicile / Registered office |

| | | | | | |

| | | | | | |

| Owner of | | | | dematerialized shares (*) registered shares (*) | | of Anheuser-Busch InBev SA/NV |

| | | | | | |

| | quantity | | | | |

(*) Cross out what is not applicable

votes by mail in the following way with respect to the extraordinary shareholders’ meeting of the Company that will be held on Wednesday September 28, 2016 in Brussels (9.00 am) (the “Meeting”) with all above-mentioned shares.

The vote of the undersigned on the proposed resolutions is as follows: (**)

(**) Please tick the boxes of your choice.

| A. | Transaction and Belgian Offer |

| 1. | Approval of the Transaction and the acquisition by the Company of Newbelco shares in the context of the Belgian Offer |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, the Transaction, including the acquisition by AB InBev of the shares of Newbelco at a price of £0.45 each under the Belgian Offer, for a value exceeding one third of the consolidated assets of AB InBev.

| 2. | Acknowledgement by the shareholders of the following documents, of which they can obtain a copy free of charge: |

| | • | | the common draft terms of merger drawn up by the boards of directors of the merging companies in accordance with article 693 of the Belgian Companies Code (the “Merger Terms”); |

| | • | | the report prepared by the board of directors of the Company in accordance with article 694 of the Belgian Companies Code; |

| | • | | the report prepared by the statutory auditor of the Company in accordance with article 695 of the Belgian Companies Code. |

| 3. | Communication regarding significant changes in the assets and liabilities of the merging companies between the date of the Merger Terms and the date of the shareholders’ meeting, in accordance with article 696 of the Belgian Companies Code |

| 4. | Merger by absorption by Newbelco of all assets, without any exception or reserve, of AB InBev (the “Belgian Merger”), in accordance with the Merger Terms, effective upon passing of the notarial deed acknowledging completion of the Belgian Merger (the “Final Notarial Deed”) |

Proposed resolution: approve (i) the Merger Terms, (ii) the Belgian Merger, subject to the conditions set out in the Merger Terms and effective upon passing of the Final Notarial Deed, and (iii) the dissolution without liquidation of AB InBev upon completion of the Belgian Merger.

2

| 5. | Delistings as a result of the Belgian Merger. |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, (i) the delisting of the securities of the Company from Euronext Brussels, (ii) the delisting of the securities of the Company from the Johannesburg Stock Exchange, and (iii) the cancellation of the registration of the securities of the Company with the National Securities Registry (RNV) maintained by the Mexican Securities and Banking Commission (Comisión Nacional Bancaria y de Valores or CNBV) and the delisting of such securities from the Bolsa Mexicana de Valores, S.A.B. de C.V. (BMV), all such delistings and cancellation of registration subject to and with effect as of completion of the Belgian Merger.

Proposed resolution: approve the delegation of powers to:

| | (i) | any director of the Company from time to time, Sabine Chalmers, Lucas Lira, Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris and Romanie Dendooven (each an “Authorised Person”), each acting together with another Authorised Person, to acknowledge by notarial deed the completion of the Belgian Merger after completion of the conditions precedent set out in the Merger Terms; |

| | (ii) | the board of directors for the implementation of the resolutions passed; and |

| | (iii) | Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris, Romanie Dendooven, Philip Van Nevel and Els De Troyer, each acting alone and with power to sub-delegate, the power to proceed to all formalities at a business desk in order to perform the inscription and/or the modification of the Company’s data in the Crossroad Bank of Legal Entities and, if necessary, at the Administration for the Value Added Tax. |

The proposed resolutions set out in items 1 and 5 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least 75% of the shares attending or represented.

The proposed resolution set out in item 4 can be validly adopted if the shareholders attending the meeting, in person or by proxy, represent at least half of the capital, subject to the approval by at least 75% of the votes cast.

The proposed resolution set out in item 6 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least the majority of the votes cast.

* * *

3

This present form will be considered to be null and void in its entirety if the shareholder has not indicated above his choice concerning one or more of the items on the agenda of the Meeting.

The shareholder who has cast his vote by validly returning the present form to the Company, p/o Euroclear Belgium, cannot vote in person or by proxy at the Meeting for the number of votes already cast.

If the Company publishes at the latest on 13 September 2016 a revised agenda for the Meeting to include new items or proposed resolutions upon the request of one or more shareholders in execution of Article 533ter of the Companies Code, the present form will remain valid for the items on the agenda it covers, provided it has validly reached the Company, p/o Euroclear Belgium, prior to the publication of such revised agenda. Notwithstanding the above, the vote cast in the present form on an item on the agenda will be null and void if the agenda has been amended concerning this item to include a new proposed resolution in application of Article 533ter of the Companies Code.

(***) Legal entities must specify the name, first name and title of the natural person(s) who sign on their behalf.

4

Annex 4

|

PROXY Extraordinary shareholders’ meeting of Anheuser-Busch InBev SA/NV (the “Company”) of September 28, 2016 (9.00 am CET) |

This proxy must be returned by Thursday September 22, 2016 5.00 pm (CET) at the latest by ordinary

mail or electronic mail, to: For registered shares: Anheuser-Busch InBev SA/NV Mr. Benoit Loore Brouwerijplein 1 3000 Leuven (Belgium) (benoit.loore@ab-inbev.com) For dematerialized shares: Euroclear Belgium, attn. Issuer Services 1 Boulevard du Roi Albert II 1210 Brussels (Belgium) (ebe.issuer@euroclear.com / fax : +32 2 337 54 46) |

|

| The undersigned (name and first name / name of the company) (the “Principal”) |

|

Domicile / Registered office |

|

|

| | | | | | |

Owner of | | | | dematerialized shares (*) registered shares (*) | | of Anheuser-Busch InBev

SA/NV |

| | quantity | | | | |

| | |

| hereby appoints as proxyholder the following person (the “Proxyholder”): |

in order to represent him/her at the extraordinary shareholders’ meeting of the Company that will be held on Wednesday September 28, 2016 (9.00 am) in Brussels (theMeeting) and to vote as follows on each of the proposed resolutions on behalf of the Principal: (**)

(*) Cross out what is not applicable.

(**) Please tick the boxes of your choice.

| A. | Transaction and Belgian Offer |

| 1. | Approval of the Transaction and the acquisition by the Company of Newbelco shares in the context of the Belgian Offer. |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, the Transaction, including the acquisition by AB InBev of the shares of Newbelco at a price of £0.45 each under the Belgian Offer, for a value exceeding one third of the consolidated assets of AB InBev.

| 2. | Acknowledgement by the shareholders of the following documents, of which they can obtain a copy free of charge: |

| | |

| • | | the common draft terms of merger drawn up by the boards of directors of the merging companies in accordance with article 693 of the Belgian Companies Code (the “Merger Terms”); |

| • | | the report prepared by the board of directors of the Company in accordance with article 694 of the Belgian Companies Code; |

| • | | the report prepared by the statutory auditor of the Company in accordance with article 695 of the Belgian Companies Code. |

| 3. | Communication regarding significant changes in the assets and liabilities of the merging companies between the date of the Merger Terms and the date of the shareholders’ meeting, in accordance with article 696 of the Belgian Companies Code |

| 4. | Merger by absorption by Newbelco of all assets, without any exception or reserve, of AB InBev (the “Belgian Merger”), in accordance with the Merger Terms, effective upon passing of the notarial deed acknowledging completion of the Belgian Merger (the “Final Notarial Deed”) |

Proposed resolution: approve (i) the Merger Terms, (ii) the Belgian Merger, subject to the conditions set out in the Merger Terms and effective upon passing of the Final Notarial Deed, and (iii) the dissolution without liquidation of AB InBev upon completion of the Belgian Merger.

| 5. | Delistings as a result of the Belgian Merger. |

Proposed resolution: approve, in accordance with article 23 of the articles of association of the Company, (i) the delisting of the securities of the Company from Euronext Brussels, (ii) the delisting of the securities of the Company from the Johannesburg Stock Exchange, and (iii) the cancellation of the registration of the securities of the Company with the National Securities Registry (RNV) maintained by the Mexican Securities and Banking Commission (Comisión Nacional Bancaria y de Valores or CNBV) and the delisting of such securities from the Bolsa Mexicana de Valores, S.A.B. de C.V. (BMV), all such delistings and cancellation of registration subject to and with effect as of completion of the Belgian Merger.

2

Proposed resolution: approve the delegation of powers to:

| | (i) | any director of the Company from time to time, Sabine Chalmers, Lucas Lira, Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris and Romanie Dendooven (each an “Authorised Person”), each acting together with another Authorised Person, to acknowledge by notarial deed the completion of the Belgian Merger after completion of the conditions precedent set out in the Merger Terms; |

| | (ii) | the board of directors for the implementation of the resolutions passed; and |

| | (iii) | Benoît Loore, Ann Randon, Patricia Frizo, Gert Boulangé, Jan Vandermeersch, Philip Goris, Romanie Dendooven, Philip Van Nevel and Els De Troyer, each acting alone and with power to sub-delegate, the power to proceed to all formalities at a business desk in order to perform the inscription and/or the modification of the Company’s data in the Crossroad Bank of Legal Entities and, if necessary, at the Administration for the Value Added Tax. |

If the Principal has not given any voting instructions concerning one or more proposed resolutions, the Proxyholder will vote in favour of such proposed resolutions.

The proposed resolutions set out in items 1 and 5 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least 75% of the shares attending or represented.

The proposed resolution set out in item 4 can be validly adopted if the shareholders attending the meeting, in person or by proxy, represent at least half of the capital, subject to the approval by at least 75% of the votes cast.

The proposed resolution set out in item 6 can be validly adopted irrespective of the capital represented by the shareholders attending the meeting in person or by proxy, subject to the approval by at least the majority of the votes cast.

* * *

The Principal acknowledges to have been informed of the fact that, after the publication of the convening notice to attend the Meeting, one or more shareholders holding together at least 3% of the share capital of the Company may addnew items to the agenda of the Meeting ornew proposed resolutions concerning items put or to be put on the agenda. At the latest on 13 September 2016 the Company will publish a revised agenda if it has validly received new items or new proposed resolutions to be added to the agenda of the Meeting. In this case the Company will also provide to the shareholders an updated proxy form that includes the new items or new proposed resolutions, and the rules set out hereunder will apply:

| (a) | if the present proxy has been validly communicated to the Company before the publication of the revised agenda of the Meeting, it will remain valid for the items of the agenda of the Meeting which have been initially mentioned in the convening notice to attend the Meeting; |

3

| (b) | if the Company has published a revised agenda including one or morenew proposed resolutions for items which were initially mentioned on the agenda, the law authorises the Proxyholder to deviate at the Meeting from the voting instructions possibly and initially given by the Principal if, in the Proxyholder’s opinion, the execution of such instructions would risk to compromise the Principal’s interests. The Proxyholder must inform the Principal if he deviates from his voting instructions; and |

| (c) | if the Company has published a revised agenda to includenew items, the law imposes that the present proxy form indicates whether the Proxyholder is authorised or not to vote on these new items or whether he should abstain. |

In view of the indications given in (c) above, the Principal: (**)

| | |

| | | authorises the Proxyholder to vote on the new items to be put on the agenda of the Meeting |

or

| | |

| | | gives instruction to the Proxyholder to abstain from voting on the new items to be put on the agenda of the Meeting |

If the Principal has not ticked one of the above boxes or has ticked both boxes, the Proxyholder will abstain from voting on the new items to be put on the agenda of the Meeting.

The present proxy is irrevocable. The shareholders who have validly given a proxy can no longer vote at the Meeting in person or by mail.

(**) Please tick the appropriate boxes.

(***) Legal entities must specify the name, first name and title of the natural person(s) who sign this proxy on their behalf.

4

Grand’ Place/Grote Markt 1

1000 Brussels

0417.497.106 RPM/RPR (Brussels)

MERGER

BETWEEN ANHEUSER-BUSCH INBEV SA/NV AND NEWBELCO SA/NV

REPORTOFTHEBOARDOFDIRECTORS

PREPAREDINACCORDANCEWITH ARTICLE 694OFTHE BELGIAN COMPANIES CODE

The board of directors of AB InBev has prepared this Report in connection with the contemplated reverse merger of AB InBev and Newbelco pursuant to which AB InBev will merge into Newbelco, implemented in accordance with the Belgian Companies Code (theBelgian Merger). The terms and conditions of the Belgian Merger have been presented in the Merger Terms prepared by the respective boards of directors of AB InBev and Newbelco and attached to this Report asSchedule 1.

Capitalised terms used in this Report shall have the meaning set out in the glossary attached to this Report asSchedule 6.

| 1. | OVERVIEW OF THE TRANSACTION AND RECOMMENDATION |

| 1.1 | DESCRIPTIONOFTHE TRANSACTIONINTHE MERGER TERMS |

The Belgian Merger is part of the proposed business combination of SABMiller and AB InBev announced on 11 November 2015 by AB InBev and SABMiller.

The Board refers to the following sections of the Merger Terms for a description of:

| - | the overview of the Transaction (section 1); |

| - | the structure of the Transaction (section 2); and |

| - | the rationale of the Transaction (section 4), |

which are deemed to be incorporated in this Report as if they were reproduced herein.

After having taken all relevant considerations into account, the Board has concluded that the Transaction is in the best interests of AB InBev and the AB InBev Shareholders.

The Board considered many factors in reaching the decisions described above. In arriving at its decisions, the Board consulted with AB InBev’s management, legal advisors, financial advisors, accounting advisors and other advisors, reviewed a significant amount of information, considered a number of factors in its deliberations and concluded that a number of factors supported its decision, including that the Transaction is likely to result in significant benefits to AB InBev and its shareholders, as described in section 4 of the Merger Terms.

As further detailed in section 3.5 of this Report, the Board also believes that the Transaction will generate attractive synergies and create additional shareholder value.

The Board weighed these factors against a number of uncertainties, risks and potentially negative factors relevant to the Transaction and concluded that the uncertainties, risks and potentially negative factors relevant to the Transaction were outweighed by the potential benefits that it expected AB InBev and AB InBev shareholders would achieve as a result of the Transaction.

The Board therefore unanimously and unconditionally recommends that the AB InBev Shareholders vote in favour of the AB InBev Resolutions to be proposed at the AB InBev General Meeting.

| 1.3 | TIMETABLEANDPOSSIBLEEXTENSIONS |

All dates given in this Report as dates on which the relevant steps of the Transaction are intended to take place are indicative. These dates may be changed and, if so, the boards of directors of AB InBev and Newbelco will inform the shareholders of AB InBev and Newbelco accordingly at, or prior to, respectively, the AB InBev General Meeting and the Newbelco General Meeting, without making an amended version of this Report available.

| 2.1 | TERMSOFTHE BELGIAN MERGER |

| 2.1.1 | Legal nature of the Belgian Merger |

The Belgian Merger constitutes a merger by absorption under articles 693 and following of the Belgian Companies Code, whereby:

| • | | Newbelco will automatically substitute AB InBev in all its rights and obligations and all assets and liabilities of AB InBev will be transferred to Newbelco under universal succession of title; such transfer will relate to all assets and rights held by AB InBev, including any real estate and intellectual rights the transfer of which will be enforceable towards third parties upon completion of the formalities required for the transmission of such rights; |

| • | | the AB InBev Shareholders will become shareholders of Newbelco; |

| • | | AB InBev ADSs, each representing one AB InBev Share, will instead represent one New Ordinary Share, thereby becoming Newbelco ADSs; and |

| • | | AB InBev will cease to exist following its dissolution without liquidation. |

In the context of the Belgian Merger, it is proposed that one New Ordinary Share will be issued to the AB InBev Shareholders in exchange for one AB InBev Share, without any cash compensation.

| 2.1.3 | Financial situation of the merging companies |

A description of the assets and liabilities of AB InBev can be found in the consolidated balance sheet of AB InBev as at 31 December 2015, which is attached asSchedule 2 to this Report.

2 | 41

Given the fact that, upon completion of the Capital Increase, Newbelco’s sole asset will be its holding in SABMiller, a description of the assets and liabilities of Newbelco at the time of the Belgian Merger can be derived from the consolidated balance sheet of SABMiller as at 31 March 2016, which is attached asSchedule 3 to this Report.

| 2.1.4 | Report by the auditor |

AB InBev has appointed Deloitte Bedrijfsrevisoren BV CVBA – Réviseurs d’Entreprises SC SCRL, represented by Mr Joël Brehmen in its capacity of auditor of AB InBev for the purpose of drafting the report required by article 695 of the Belgian Companies Code.

| 2.1.5 | Capital increase and number of shares resulting from the Belgian Merger |

The Belgian Merger will result in (i) a capital increase of Newbelco by an amount of EUR 1,238,608,344.12 and (ii) the recordation by Newbelco of an amount of EUR 13,186,369,502.01 as issuance premium. Such capital increase shall be made through the issue of 1,608,242,156 New Ordinary Shares to the AB InBev Shareholders, in accordance with the exchange ratio retained for the Belgian Merger.1

Taking into account the treasury shares that will be retained by Newbelco, upon Completion, the outstanding share capital of Newbelco will consist of:

| | - | | 1,693,242,156 New Ordinary Shares2; and |

| | - | | between 316,999,695 (assuming only Altria and BEVCO elect for the Partial Share Alternative) and 326,000,000 Restricted Newbelco Shares. |

Further details relating to the level of the share capital and issue premium account of Newbelco after completion of the Belgian Merger (taking into account the reduction of the share capital and issue premium account which will take place upon Completion with a view to creating reserves in Newbelco) are provided in section 2.3.1.2.

| 2.2 | BELGIAN MERGERPROCEDURE |

| 2.2.1 | Conditions precedent |

The Transaction is subject to several pre-conditions and conditions that are described in detail in the Rule 2.7 Announcement. Such pre-conditions and conditions include amongst others:

| | - | | the obtaining of regulatory approvals from applicable antitrust or competition law authorities in the European Union, the United States, China, South Africa and other relevant jurisdictions; and |

| | - | | the approval of the relevant aspects of the Transaction by the AB InBev Shareholders, the Newbelco Shareholders and the SABMiller Shareholders. |

As at the date of this Report, the Transaction has already been approved by a number of antitrust or competition law authorities, including the European Commission, the US Federal Trade Commission, the Ministry of Commerce of the People’s Republic of China and the Competition Tribunal of South Africa and the Financial Surveillance Department of the South African Reserve Bank. Accordingly, AB InBev confirmed on 29 July 2016 that all pre-conditions of the Transaction have been satisfied.

| 1 | The amount of the capital increase and issue premium and the number of shares to be issued by Newbelco as a result of the Belgian Merger are based on the amount of capital and issue premium and the number of shares existing at the level of AB InBev prior to the Belgian Merger. |

| 2 | This number of shares results from the sum of (i) the 1,608,242,156 New Ordinary Shares that will be issued to the AB InBev Shareholders and (ii) the 85,000,000 New Ordinary Shares which will be retained by Newbelco upon Completion. |

3 | 41

The AB InBev General Meeting, the Newbelco General Meeting and the SABMiller General Meeting are expected to be held on or around 28 September 2016 to vote on the aspects of the Transaction requiring shareholders’ approval.

As described in the Merger Terms, the Transaction will be implemented by way of a three stage process involving (i) the UK Scheme, a UK scheme of arrangement under Part 26 of the UK Companies Act 2006 between SABMiller and its shareholders through which Newbelco will acquire the entire share capital of SABMiller, (ii) the Belgian Offer, a Belgian law voluntary cash takeover offer by AB InBev for all of the shares of Newbelco and (iii) the Belgian Merger, a merger of AB InBev into Newbelco pursuant to which the AB InBev Shareholders will become Newbelco Shareholders and Newbelco will be the surviving entity. Each of the Belgian Offer and the Belgian Merger is conditional on completion of the preceding step of the Transaction.

The Board refers to section 3 of the Merger Terms for a description of the outstanding conditions of the UK Scheme and the Belgian Offer.

The Belgian Merger is conditional on:

| | - | | the AB InBev Resolutions being passed by the requisite majority of AB InBev Shareholders at the AB InBev General Meeting; |

| | - | | the Newbelco Resolutions being passed by the requisite majority of Newbelco Shareholders at the Newbelco General Meeting; |

| | - | | the Belgian Offer completing in accordance with its terms; |

| | - | | the Initial Newbelco Shares tendered in the Belgian Offer being transferred to AB InBev no later than the day before the date of passing of the Final Notarial Deed; and |

| | - | | the passing of the Final Notarial Deed. |

Sections 2.2.2 to 2.2.5 of this Report describe the conditions precedent to the Belgian Merger in more detail.

| 2.2.2 | AB InBev Resolutions |

The Belgian Merger is conditional upon the AB InBev Resolutions being passed at the AB InBev General Meeting. The AB InBev Resolutions include the approval of the acquisition of the Initial Newbelco Shares pursuant to the Belgian Offer and the approval of the Belgian Merger.

Pursuant to article 23 of the articles of association of AB InBev, the acquisition of the Initial Newbelco Shares pursuant to the Belgian Offer requires the approval of the AB InBev Shareholders with a positive vote of 75% of the AB InBev Shares attending or represented at the AB InBev General Meeting, regardless of the number of AB InBev Shares attending.

Pursuant to article 699 of the Belgian Companies Code, the Belgian Merger requires the approval of the AB InBev Shareholders by a majority of 75% of the votes cast and the AB InBev Shareholders present at the meeting must represent at least 50% of AB InBev’s share capital.

AB InBev and SABMiller have received irrevocable undertakings from the AB InBev Reference Shareholder, EPS and BRC, who collectively held approximately 51.68% of the voting rights attached to AB InBev’s shares outstanding as at 31 July 2016, to vote in favour of such resolutions of AB InBev as are necessary to approve the Belgian Offer and the Belgian Merger at the AB InBev General Meeting.

4 | 41

AB InBev has agreed to pay or procure the payment to SABMiller of a break payment amounting to USD 3 billion if, amongst others, the AB InBev Resolutions are not passed at the AB InBev General Meeting, unless the Co-operation Agreement has already been terminated in accordance with its terms.

The AB InBev General Meeting is scheduled to take place on or around 28 September 2016.

| 2.2.3 | Newbelco Resolutions |

The Belgian Merger is also conditional upon the Newbelco Resolutions being passed at the Newbelco General Meeting. The Newbelco Resolutions include the approval of the Capital Increase, the Belgian Merger, the adoption of new articles of association of Newbelco and the cancellation of the Incorporation Shares.

Pursuant to articles 699 (with respect to the Belgian Merger), 581 (with respect to the Capital Increase), 558 (with respect to the adoption of new articles of association of Newbelco) and 612 (with respect to the cancellation of the Incorporation Shares) of the Belgian Companies Code, such resolutions require the approval of Newbelco Shareholders by a majority of 75% of the votes cast and the Newbelco Shareholders present at the meeting must represent at least 50% of Newbelco’s share capital.

The Newbelco General Meeting is scheduled to take place on or around 28 September 2016.

| 2.2.4 | Closing of the Belgian Offer and transfer of the Initial Newbelco Shares |

The Belgian Merger is furthermore conditional on (i) the Belgian Offer being closed in accordance with its terms and (ii) the Initial Newbelco Shares tendered in the Belgian Offer being transferred to AB InBev no later than the day before the date of passing of the Final Notarial Deed.

It is intended that the Belgian Offer will open and close on the day following the date on which the Capital Increase occurs, i.e. on or around 7 October 2016. The transfer of the Initial Newbelco Shares tendered to AB InBev will take place by recordation in the share register of Newbelco promptly after the Belgian Offer has closed.

The Belgian Merger will take effect on the date on which the designated notary in Belgium competent to scrutinise the legality of the Belgian Merger (i) shall have received confirmation that all conditions to which the Belgian Merger is subject (except the passing of the Final Notarial Deed) have been satisfied or waived (as applicable) and (ii) further to the receipt of such confirmation, shall have certified that the Belgian Merger is completed by passing the Final Notarial Deed.

Based on the timetable contemplated at the date of this Report, the date intended for the passing of the Final Notarial Deed is on or around 10 October 2016.

5 | 41

| 2.3.1 | Share capital of the merging companies |

As at the date of this Report, the share capital of AB InBev amounts to EUR 1,238,608,344.12 and the issue premium of AB InBev amounts to EUR 13,186,369,502.01.

The share capital is divided into 1,608,242,156 shares without nominal value held in registered or dematerialised form. All the shares are freely transferable and fully paid up. AB InBev has only one class of shares.

As at the date of this Report, the share capital of Newbelco amounts to EUR 61,500 and is divided into 6,150,000 shares without nominal value held in registered form. All the shares are freely transferable and fully paid up.

| (b) | Share capital following the UK Scheme and the Capital Increase |

Upon completion of the Capital Increase, the following steps will take place simultaneously:

| (i) | the share capital of Newbelco will be increased by an amount in euro equal to GBP 7,540,000,000, and an issue premium will be recorded by Newbelco for an amount in euro equal to GBP 67,860,000,000, each such amount to be multiplied by the GBP-EUR Reference Rate;3 |

| (ii) | 165,640,400,700 Initial Newbelco Shares4 will be issued to the UK Scheme Shareholders, each UK Scheme Shareholder receiving 100 Initial Newbelco Shares in respect of each UK Scheme Share; and |

| (iii) | the Incorporation Shares will be cancelled and the share capital of Newbelco decreased by EUR 61,500. |

Following the Capital Increase and the cancellation of the Incorporation Shares, the UK Scheme Shareholders will be the only shareholders in Newbelco and own all outstanding shares of Newbelco.

| 3 | The amounts mentioned in this paragraph for the capital increase and the issue premium assume that, prior to or at the UK Scheme Record Time, there are 1,656,404,007 UK Scheme Shares in issue. This number of UK Scheme Shares is calculated on the basis of (i) SABMiller’s issued share capital as at the close of business on 31 July 2016 of 1,623,481,308 (excluding 57,769,932 treasury shares); and (ii) 43,987,236 SABMiller Shares which may be issued on or after 1 August 2016 on the exercise of options or vesting of awards under the SABMiller share plans (excluding 50,645 cash settled options and stock appreciation rights), netted off against 11,064,537 SABMiller Shares held in SABMiller’s Employee Benefit Trust as at the close of business on 31 July 2016. If the shares held by SABMiller’s Employee Benefit Trust are not used to settle the outstanding options, an additional 11,064,537 SABMiller shares will need to be issued (or transferred out of treasury). |

The amounts of the capital increase and issue premium will remain at the same level even if the number of SABMiller Shares outstanding as at the UK Scheme Record Time exceeds 1,656,404,007, provided however that such amounts will be increased if the number of SABMiller Shares outstanding as at the UK Scheme Record Time was higher than 1,666,000,000.

| 4 | This assumes that, prior to or at the UK Scheme Record Time, there are 1,656,404,007 UK Scheme Shares in issue which will be contributed to Newbelco in exchange for 100 Initial Newbelco Shares for each UK Scheme Share. See footnote 3 for the calculation of the number of 1,656,404,007 UK Scheme Shares. |

6 | 41

| (c) | Share capital following the completion of the Belgian Offer |

After completion of the Capital Increase, AB InBev will launch the Belgian Offer whereby it will offer to purchase all Initial Newbelco Shares held by the UK Scheme Shareholders. Upon completion of the Belgian Offer, AB InBev will own between 105,254,387,968 and 106,921,542,922 Initial Newbelco Shares, depending on the number of UK Scheme Shareholders having validly elected for the Partial Share Alternative.5

Upon the passing of the notarial deed acknowledging the completion of the Belgian Offer, pursuant to the Reclassification and Consolidation, the Initial Newbelco Shares will be reclassified and consolidated as follows:

| (i) | all Initial Newbelco Shares retained by the UK Scheme Shareholders who validly elected (or are deemed to have elected) for the Partial Share Alternative will be reclassified and consolidated into Restricted Newbelco Shares on the basis of a ratio of one Restricted Newbelco Share for every 185.233168056448 Initial Newbelco Shares retained (and the number of Restricted Newbelco Shares resulting from such reclassification and consolidation will be rounded down to the nearest whole number); |

| (ii) | as a result, the UK Scheme Shareholders who validly elected (or are deemed to have elected) for the Partial Share Alternative will hold between 316,999,695 and 326,000,000 outstanding Restricted Newbelco Shares, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative; |

| (iii) | all Initial Newbelco Shares acquired by AB InBev pursuant to the Belgian Offer will be consolidated into New Ordinary Shares on the same ratio, a basis of one New Ordinary Share for every 185.233168056448 Initial Newbelco Shares held by AB InBev (and the number of New Ordinary Shares resulting from such consolidation will be rounded down to the nearest whole number); and |

| (iv) | as a result, AB InBev will hold between 568,226,463 and 577,226,767 New Ordinary Shares, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative.6 |

| (d) | Share capital, issue premium and reserves following completion of the Belgian Merger |

The Belgian Merger will result in (i) a capital increase of Newbelco by an amount of EUR 1,238,608,344.12 and (ii) the recordation by Newbelco of an amount of EUR 13,186,369,502.01 as issuance premium. Such capital increase shall be made through the issue of 1,608,242,156 New Ordinary Shares to the AB InBev Shareholders.

At the same time, Newbelco’s share capital and issue premium account will be reduced through the following steps decided on by the Newbelco General Meeting in the notarial deed approving the Belgian Merger, each such step to become effective simultaneously with the Belgian Merger upon Completion:

| (i) | as a consequence of the Belgian Merger, Newbelco will have acquired all New Ordinary Shares held by AB InBev further to the Belgian Offer; a non-distributable reserve will be |

| 5 | The range of 105,254,387,968 to 106,921,542,922 Initial Newbelco Shares assumes that, prior to or at the UK Scheme Record Time, there are 1,656,404,007 UK Scheme Shares in issue. See footnote 3 for the calculation of the number of 1,656,404,007 UK Scheme Shares. |

| 6 | The shareholding figures included in this paragraph assume that, prior to or at the UK Scheme Record Time, there are 1,656,404,007 UK Scheme Shares in issue. See footnote 3 for the calculation of the number of 1,656,404,007 UK Scheme Shares. |

7 | 41

| | created to account for the value of all such New Ordinary Shares, in accordance with article 623, 1st indent of the Belgian Companies Code, through the reduction of Newbelco’s issue premium account; the amount of the reduction of the issue premium account and the corresponding amount of the non-distributable reserve to be created will be equal to an amount in euro ranging between GBP 47,364,474,585.60 and GBP 48,114,694,314.907, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative; |

| (ii) | all such New Ordinary Shares will then be cancelled, except for 85,000,000 of such New Ordinary Shares which will be held as treasury shares by Newbelco after Completion; the cancellation of all such New Ordinary Shares except the 85,000,000 shares to be held in treasury will be imputed on the non-distributable reserve that will have been created for that purpose as set out in subparagraph (i) above, for an amount in euro ranging between GBP 40,279,305,903.87 and GBP 41,029,525,624.578, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative; and |

| (iii) | with a view to creating a distributable reserve, |

| | - | | Newbelco’s share capital will be reduced by an amount in euro equal to GBP 7,540,000,000; and |

| | - | | Newbelco’s issue premium will be further reduced by an amount in euro ranging between GBP 19,745,305,685.10 and GBP 20,495,525,414.409, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative. |

In each of the cases referred to in subparagraphs (i) to (iii) above, the amounts in GBP shall be converted in euro by multiplying such amounts by the GBP-EUR Reference Rate.

The decisions to reduce Newbelco’s share capital and issue premium account referred to in subparagraphs (i) and (iii) above will be taken by the Newbelco General Meeting in accordance with article 612 of the Belgian Companies Code and the decision to reduce Newbelco’s share capital and issue premium account referred to in subparagraph (iii) above will be taken by the Newbelco General Meeting in accordance with article 613 of the Belgian Companies Code.

As a result of the above steps, upon Completion, Newbelco’s share capital and issue premium will be equal to the AB InBev’s current share capital and issue premium, i.e. respectively EUR 1,238,608,344.12 and EUR 13,186,369,502.01. The share capital will be represented by 1,693,242,156 outstanding New Ordinary Shares and between 316,999,695 and 326,000,000 outstanding Restricted Newbelco Shares, depending on the number of UK Scheme Shareholders who elect for the Partial Share Alternative.

| (e) | Rights and form of the Newbelco Shares |

Restricted Newbelco Shares will have the same rights as New Ordinary Shares except as set out in the articles of association of Newbelco. Restricted Newbelco Shares will be held in registered form only

| 7 | The range of GBP 47,364,474,585.60 to GBP 48,114,694,314.90 assumes AB InBev will own between 105,254,387,968 and 106,921,542,922 Initial Newbelco Shares and as a result between 568,226,463 and 577,226,767 New Ordinary Shares upon completion of the Belgian Offer. See also footnote 5. |

| 8 | The range of GBP 40,279,305,903.87 and GBP 41,029,525,624.57, assumes AB InBev will own between 105,254,387,968 and 106,921,542,922 Initial Newbelco Shares and, as a result, between 568,226,463 and 577,226,767 New Ordinary Shares upon completion of the Belgian Offer. See also footnote 5. |

| 9 | The range of GBP 19,745,305,685.10 to GBP 20,495,525,414.40 assumes the issue premium of GBP 67,860,000,000 upon Capital Increase is reduced by GBP 47,364,474,585.60 to GBP 48,114,694,314.90 upon merger per (i) above per the assumptions of footnote 7. |

8 | 41

and will be unlisted, not admitted to trading on any stock exchange, not capable of being deposited in an ADR programme and will be subject to, among other things, restrictions on transfer until converted into New Ordinary Shares.

The Restricted Newbelco Shares will be convertible at the election of the holder into New Ordinary Shares on a one-for-one basis with effect from the fifth anniversary of Completion. Restricted Newbelco Shares will be convertible earlier in certain specific limited circumstances. From Completion, such Restricted Newbelco Shares will rank equally with the New Ordinary Shares as regards dividends and voting rights.

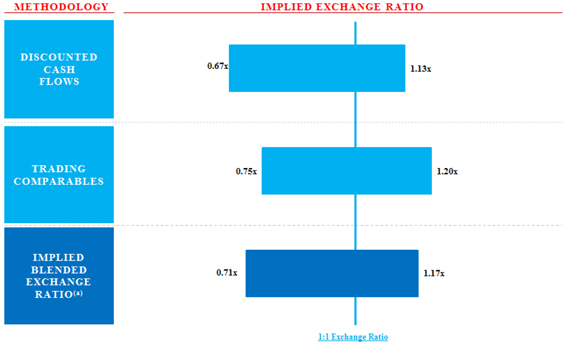

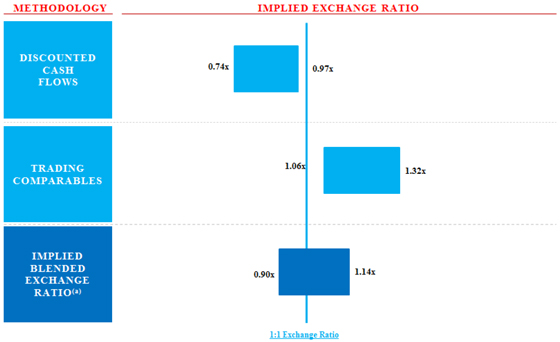

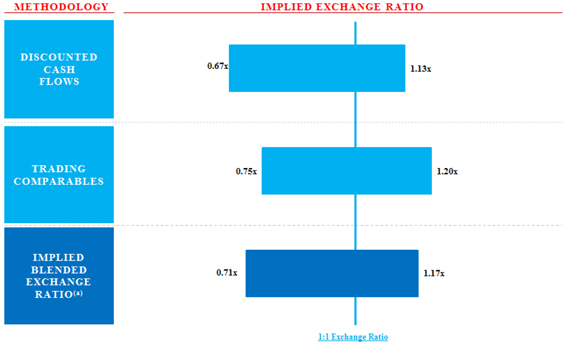

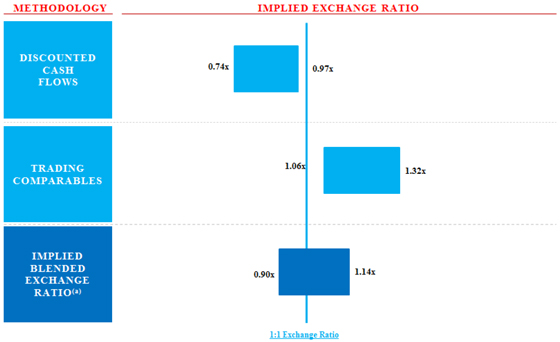

| 2.3.2 | Valuation of AB InBev and Newbelco and exchange ratio |

On the basis of the valuation methods described inSchedule 4 applied to the respective value of AB InBev Pre-Merger, Newbelco Pre-Merger and Newbelco Post-Merger, the boards of directors of AB InBev and Newbelco propose that one New Ordinary Share will be issued to the AB InBev Shareholders in exchange for one AB InBev Pre-Merger Share, without any cash compensation.

In order to support the proposed exchange ratio of one New Ordinary Share against one AB InBev Pre-Merger Share, the boards of directors of AB InBev and Newbelco have considered the consequences of the Belgian Merger for both the AB InBev Shareholders and the Newbelco Shareholders.

Based on the range of exchange ratios obtained using the methods set out inSchedule 4, the boards of directors of AB InBev and Newbelco consider that an exchange ratio of one Newbelco Share for one AB InBev Pre-Merger Share is reasonable.

| 2.3.3 | Difficulties in determining the value of the merging companies and the exchange ratio |

No particular difficulties were encountered in the valuation of the merging companies or in determining the exchange ratio.

| 3. | CONSEQUENCES OF THE BELGIAN MERGER |

| 3.1 | LEGALCONSEQUENCESFOR AB INBEVAND NEWBELCO |

From the date the Belgian Merger is completed, the legal consequences as set out in article 682 of the Belgian Companies Code will apply. AB InBev will automatically be substituted for by Newbelco in all its rights and obligations. Upon being dissolved and without going into liquidation, all of AB InBev’s assets and liabilities and all of its rights and obligations will transfer to Newbelco, including any real estate and intellectual rights the transfer of which will be enforceable towards third parties upon completion of the formalities required for the transmission of such rights.

As a consequence of the Belgian Merger, AB InBev will cease to exist.

In accordance with the Merger Terms, the Belgian Merger shall not have any retroactive effect for accounting purposes and shall be effective only as from the date of the Final Notarial Deed.

| 3.2 | LEGALCONSEQUENCESFORTHE AB INBEV SHAREHOLDERS |

AB InBev Shareholders will become Newbelco Shareholders as a result of the Belgian Merger. As a result of the Belgian Merger, all AB InBev Shareholders will receive one New Ordinary Share for each AB InBev Share they hold. Consequently, upon completion of the Belgian Merger, the share capital of Newbelco will be held by the UK Scheme Shareholders who elected for the Partial Share Alternative (between 16.47% and 16.86% of the share capital) and the AB InBev Shareholders (between 83.14% and 83.53% of the share capital), depending on the number of UK Scheme Shareholders having validly elected for the Partial Share Alternative.10

10 These percentages exclude the treasury shares that will be retained by Newbelco upon Completion.

9 | 41

It is expected that the New Ordinary Shares to be issued to the former AB InBev Shareholders in the context of the Belgian Merger will be delivered (i) in registered form to the former AB InBev Shareholders that held their shares in AB InBev in registered form or (ii) in dematerialised form to the former AB InBev Shareholders that held their shares in AB InBev in dematerialised form. It is further expected that AB InBev Shareholders will no longer be entitled to request the conversion of their AB InBev Shares from registered to dematerialised form, and vice versa, as from a date which will be specified in the listing prospectus relating to the admission to trading and listing of all New Ordinary Shares on Euronext Brussels, prepared in accordance with the Belgian law of 16 June 2006, which will be published on or about the same date as the date on which the convening notices to the AB InBev General Meeting will be published. Please refer to the section entitled “Listing and delivery of the shares” in Part IX of such prospectus for further details.

The New Ordinary Shares will be issued promptly upon Completion by recordation in the share register of Newbelco and will be delivered as follows:

| • | | the New Ordinary Shares to be delivered in registered form will be recorded in the name of the relevant shareholders in the share register of Newbelco; and |

| • | | the New Ordinary Shares to be delivered in dematerialised form will be recorded in the share register of Newbelco in the name of Euroclear, the Belgian central securities depository in its capacity as settlement institution; such shares will be delivered in book-entry form free of payment to the securities accounts of the relevant shareholders via Euroclear as soon as practicable following Completion. |

The above description on the issuance and delivery of the New Ordinary Shares to the former AB InBev Shareholders may be amended or refined based on the finalisation of the practical implementation of the Transaction. If the above description would need to be amended or refined, AB InBev and Newbelco will make available any relevant additional information in due course, without having to update this Report.

Shareholders and investors who, after delivery, wish to have their dematerialised shares registered, should request that Newbelco record their shares in Newbelco’s share register. Holders of registered shares may request that their registered shares be converted into dematerialised shares and vice versa, at their own cost.

The former AB InBev Shareholders will be entitled to participate in the profits of Newbelco for each financial year, including the year ending on 31 December 2016.

| 3.3 | CONSEQUENCESFORTHEEMPLOYEESOF AB INBEV |

As a result of the Belgian Merger, the employees of AB InBev will be transferred to Newbelco.

| 3.4 | CONSEQUENCESFORTHECREDITORSOFTHEMERGINGCOMPANIES |

Upon the Belgian Merger taking effect, the creditors of AB InBev will, as a result of the universal transfer of title, become direct creditors of Newbelco.

Pursuant to article 684 of the Belgian Companies Code, creditors of AB InBev and creditors of Newbelco can request additional security in relation to outstanding claims that existed prior to the publication in the Annexes to the Belgian State Gazette of the deed establishing completion of the Belgian Merger but have not yet matured or are subject to litigation or arbitration. Such additional securities may be requested within two months from such publication in the Belgian State Gazette.

10 | 41

Newbelco can set aside any request by settling the claim at its fair value after deduction of a discount. In the absence of an agreement or if the creditors remain unpaid, the request is referred to the president of the commercial court in the judicial district of the debtor’s registered office who will determine if a security is to be provided and the time limit within which such security must be set as the case may be. If the security is not provided within the set timeframe, the claim shall immediately become due and payable.

| 3.5 | SYNERGIESANDCREATIONOFSHAREHOLDER’SVALUEASARESULTOFTHE TRANSACTION |

The Combined Group will generate attractive synergies and create additional shareholder value. The constituent elements of synergies, which are expected to originate from the cost bases of both the AB InBev Group and the SABMiller Group and are in addition to savings initiatives already underway at the SABMiller Group, will comprise:

| | • | | procurement and engineering savings expected to be generated from third party cost efficiencies as a result of economies of scale through combined sourcing of raw materials and packaging and re-engineering of associated processes across the Combined Group’s cost base; |

| | • | | brewery and distribution efficiency gains expected to be generated from the alignment of brewery, bottling and shipping productivity including: reduced water, energy usage, and extract losses, as well as optimisation of other brewery and distribution processes across geographies; |

| | • | | sharing best practices relating to cost management, efficiency improvements and productivity enhancements across the Combined Group’s administrative operations; and |

| | • | | administrative costs savings expected to be generated from the realignment of corporate headquarters and overlapping regional headquarters across the Combined Group. |

AB InBev also believes that significant further value could be created through the utilisation of the combined global distribution network in order to expand brand portfolio sales worldwide and by leveraging the innovation successes of both the AB InBev Group and the SABMiller Group.

| 4. | GOVERNANCE OF NEWBELCO UPON COMPLETION OF THE TRANSACTION |

Pursuant to the Newbelco Resolutions and with effect from completion of the Belgian Offer, new articles of association of Newbelco will be adopted and a new governance structure will be put in place. Amongst others, the principles set out below will apply. For more detail, please refer to the draft articles of association of Newbelco that will be available on the website of AB InBev in due course.

The corporate purpose of Newbelco reads as follows:

“The company’s corporate purpose is:

| | a) | to produce and deal in all kinds of beers, drinks, foodstuffs and ancillary products, process and deal in all by-products and accessories, of whatsoever origin or form, of its industry and trade, and to design, construct or produce part or all of the facilities for the manufacture of the aforementioned products; |

11 | 41

| | b) | to purchase, construct, convert, sell, let and sublet, lease, license and operate in any form whatsoever all real property and real property rights and all businesses, movable property and movable property rights connected with its activities; |

| | c) | to acquire and manage participating interests and shares in companies or undertakings having a corporate purpose similar or related to, or likely to promote the attainment of, any of the foregoing corporate purposes, and in financial companies; to finance such companies or undertakings by means of loans, guarantees or in any other manner whatsoever; and to take part in the management of the aforesaid companies through membership of its board of directors or the like governing body; and |

| | d) | to carry out all administrative, technical, commercial and financial work and studies for the account of undertakings in which it holds an interest or on behalf of third parties. |

It may, within the scope of its corporate purpose, engage in all civil, commercial, industrial and financial transactions either within or outside Belgium.

It may take interests by way of asset contribution, merger, subscription, equity investment, financial support or otherwise in all undertakings, companies or associations having a corporate purpose similar or related to or likely to promote the furtherance of its corporate purpose.”

Such corporate purpose will remain unchanged after the Belgian Merger.

| 4.2 | CATEGORIESOF NEWBELCO SHARES |

The capital of Newbelco will be divided in two categories of Newbelco Shares: New Ordinary Shares and Restricted Newbelco Shares.

| 4.3 | TRANSFERANDCONVERSIONOF NEWBELCO SHARES |

New Ordinary Shares will be freely transferable.

| 4.3.2 | Restricted Newbelco Shares – Transfer |

No Restricted Newbelco Shareholder will be able, in each case directly or indirectly, to transfer, sell, contribute, offer, grant any option on, otherwise dispose of, pledge, charge, assign, mortgage, grant any lien or any security interest on, enter into any certification or depository arrangement or enter into any form of hedging arrangement with respect to, any of its Restricted Newbelco Shares or any interests therein or any rights relating thereto, or enter into any contract or other agreement to do any of the foregoing, for a period of five years from Completion, save as provided in this section 4.3.2.

As an exception to this rule, any Restricted Newbelco Shareholder may, in each case directly or indirectly, transfer, sell, contribute, offer, grant any option on, otherwise dispose of, pledge, charge, assign, mortgage, grant a lien or any security interest on, or enter into any form of hedging arrangement with respect to, its Restricted Newbelco Shares or any interests therein or any rights relating thereto, or enter into any contract or other agreement to do any of the foregoing, to or for the benefit of any person that is an Affiliate, a Successor and/or a Successor’s Affiliate, provided that if any such transferee ceases to be a member of the Restricted Shareholder Group (as defined in the Newbelco Articles) of the Restricted Newbelco Shareholder that initially made the transfer (or of its Successor), all such Restricted Newbelco Shares which such transferee owns or in which it holds an interest shall be automatically transferred to such Restricted Newbelco Shareholder (or to a person which, at the time of such transfer, is its Affiliate or its Successor) and shall therefore remain Restricted Newbelco Shares.

12 | 41

| 4.3.3 | Restricted Newbelco Shares – Conversion |

Each Restricted Newbelco Shareholder will have the right to convert all or part of its holding of Restricted Newbelco Shares into New Ordinary Shares at its election (i) at any time after the fifth anniversary of Completion, and (ii) in some limited other instances, including immediately prior to or at any time after entering into an agreement or arrangement to effect any permitted transfer, as set out in section 4.3.4 below.

The Restricted Newbelco Shares shall automatically convert into New Ordinary Shares (i) upon any transfer, sale, contribution or other disposal, except in the case of permitted transfers as set out in section 4.3.4 below, provided that, in such cases, the Restricted Newbelco Shares shall automatically be converted into New Ordinary Shares upon any subsequent transfer, sale, contribution or disposal to any party which is not an Affiliate, a Successor or a Successor’s Affiliate of the Restricted Newbelco Shareholder (ii) immediately prior to the closing of a successful public takeover bid for all Newbelco Shares or the completion of a merger of Newbelco as acquiring or disappearing company, in circumstances where the shareholders directly or indirectly, controlling or exercising directly or indirectly joint control over Newbelco immediately prior to such takeover bid or merger will not directly or indirectly control, or exercise joint control over, Newbelco or the surviving entity following such takeover bid or merger, or (iii) upon the announcement of a squeeze-out bid for the outstanding Newbelco Shares, in accordance with article 513 of the Companies Code.

In the event that all the shares in Newbelco are acquired by a company which the shareholders of Newbelco, immediately prior to such acquisition, control or exercise joint control over, Restricted Newbelco Shareholders shall be treated in an equivalent manner to holders of New Ordinary Shares, save that there shall be equivalent differences between the rights and restrictions attaching to the shares to be issued to holders of the New Ordinary Shares and the shares to be issued to holders of Restricted Newbelco Shares to reflect the differences in rights and restrictions between the New Ordinary Shares and the Restricted Newbelco Shares.

Upon conversion, each Restricted Newbelco Share will be re-classified as one New Ordinary Share.

If at any time the New Ordinary Shares shall be changed into a different number of Newbelco Shares or a different class of Newbelco Shares by reason of any share dividend, subdivision, reorganisation, reclassification, recapitalisation, stock split, reverse stock split, combination or exchange of shares, or any similar event shall have occurred, there will be an equivalent share dividend, subdivision, reorganisation, reclassification, recapitalisation, stock split, reverse stock split, combination or exchange of shares or similar event with respect to the Restricted Newbelco Shares (such shares beingRevised Restricted Newbelco Shares), provided that (i) nothing shall be deemed to permit Newbelco (including the Newbelco Board) to take any action with respect to its share capital that is otherwise prohibited by the Newbelco Articles, and (ii) if any such event would otherwise cause any Restricted Newbelco Shareholder to cease to hold at least one Revised Restricted Newbelco Share (by virtue of its entitlement, following such event, being to a fraction of less than one Revised Restricted Newbelco Share) its entitlement shall be rounded up to one Revised Restricted Newbelco Share.

| 4.3.4 | Restricted Newbelco Shares – Pledge |

Notwithstanding any restrictions on transfer in the Newbelco Articles or any provision herein to the contrary, any Restricted Newbelco Shareholder will be able: