UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | | |

Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| | |

| Kinsale Capital Group, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

2221 Edward Holland Drive

Suite 600

Richmond, VA 23230

April 9, 2018

Dear Stockholder:

We cordially invite you to attend Kinsale Capital Group, Inc.’s Annual Meeting of Stockholders. The meeting will be held at The Commonwealth Club, 401 W. Franklin Street, Richmond, VA 23220 at 10:30 A.M., Eastern Time, on May 24, 2018.

Details regarding admission to the Annual Meeting and the business to be conducted at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached Proxy Statement.

Thank you for your support of Kinsale Capital Group, Inc.

Sincerely,

Michael P. Kehoe

President and Chief Executive Officer

2221 Edward Holland Drive, Suite 600

Richmond, VA 23230

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

| | |

| Time and Date | 10:30 A.M., Eastern Time, on May 24, 2018 |

| | |

| Place | The Commonwealth Club, 401 W. Franklin Street, Richmond, VA 23220 |

| | |

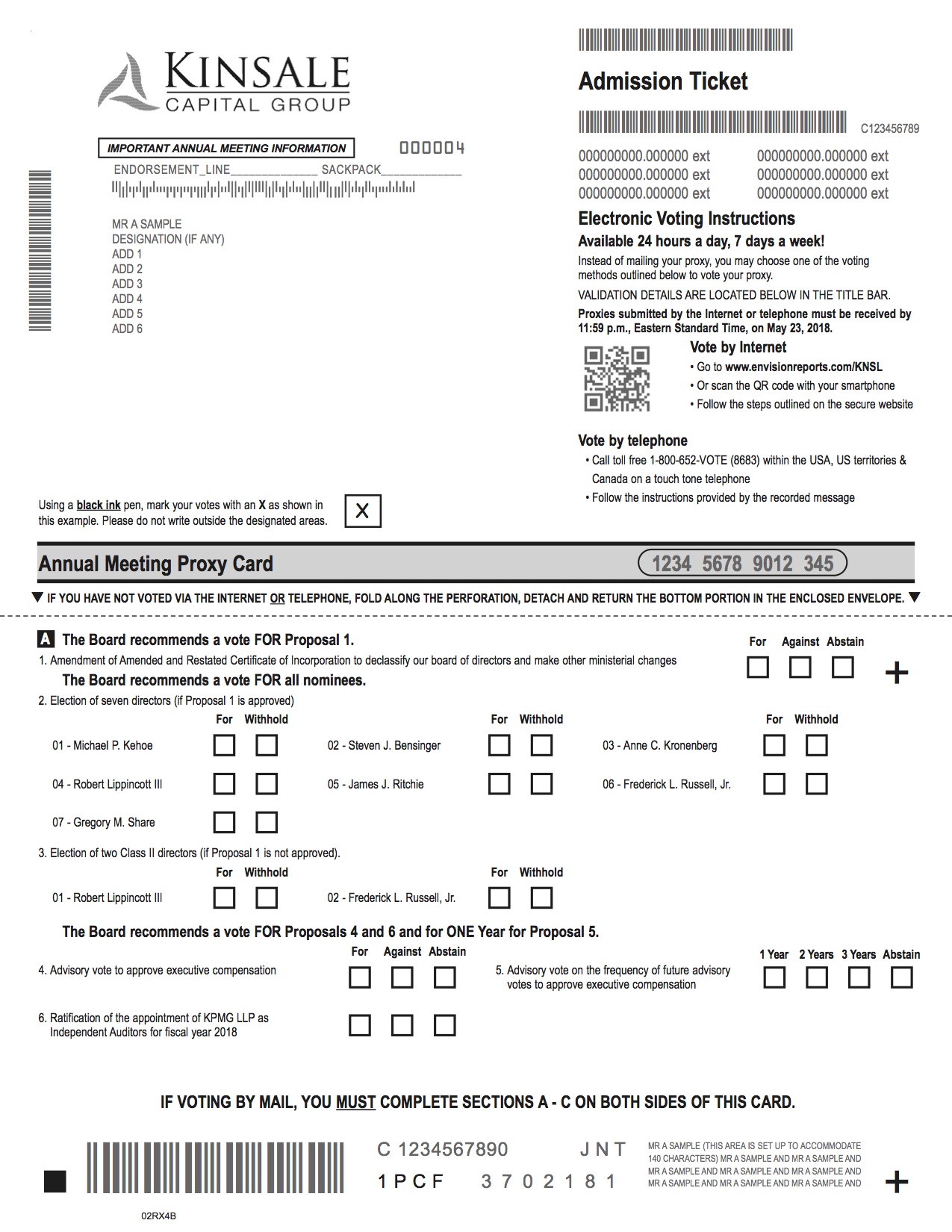

| Items of Business | 1. To amend our Amended and Restated Certificate of Incorporation to declassify our board of directors and make other ministerial changes;

2. To elect the seven directors identified in the accompanying proxy statement to serve a one-year term until the 2019 Annual Meeting of Stockholders if Proposal 1 to declassify our board is approved;

3. To elect the two directors identified in the accompanying proxy statement as Class II directors to serve for a three-year term if Proposal 1 to declassify our board is not approved;

4. To hold an advisory vote on executive compensation;

5. To hold an advisory vote on the frequency of holding an advisory vote on executive compensation;

6. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year 2018; and

7. To transact any other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

|

| | |

| Record Date | You are entitled to vote at the Annual Meeting and at any adjournment or postponement thereof if you were a holder of shares of our common stock of record at the close of business on March 26, 2018. |

| | |

| Voting | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. If you are a stockholder of record, you may vote via the internet at http://www.envisionreports.com/KNSL, or, if you have received a printed copy of these proxy materials by mail, you may vote by phone or by signing, dating, and returning your proxy card in the prepaid envelope provided. If you are a beneficial owner, you should follow the voting instructions provided by your broker, bank or other intermediary. |

| | |

| Internet Availability of Proxy Materials | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 24, 2018. Kinsale Capital Group, Inc.’s Proxy Statement and 2018 Annual Report to Stockholders are available at: http://www.edocumentview.com/KNSL. |

| | |

| | | By Order of the Board of Directors, |

| April 9, 2018 | /s/ Amanda Viol |

| Richmond, Virginia | Amanda Viol |

| | Secretary |

2221 Edward Holland Drive

Suite 600

Richmond, VA 23230

PROXY STATEMENT

The Board of Directors of Kinsale Capital Group, Inc. (the “Company,” “we,” “us” or “our”) is soliciting your proxy to vote at the 2018 Annual Meeting of Stockholders to be held at 10:30 A.M., Eastern Time, on May 24, 2018, and any adjournment or postponement of that meeting (the “Annual Meeting”). The Annual Meeting will be held at The Commonwealth Club, 401 W. Franklin Street, Richmond, VA 23220. A Notice of Internet Availability of Proxy Materials (the “Proxy Notice”), containing instructions on how to access this Proxy Statement and our Annual Report to Shareholders (the "Annual Report") online, was mailed to stockholders on or about April 9, 2018. On that date, we also began mailing a full set of proxy materials to those stockholders who had previously requested paper copies of our proxy materials.

If you received the Proxy Notice by mail, you will not automatically receive a printed copy of the proxy materials or the Annual Report to Shareholders. Instead, the Proxy Notice instructs you how you may access this information online and instructs you how you may submit your proxy. If you would like to receive a printed copy of our proxy materials, including our Annual Report, you should follow the instructions for requesting such materials included in the Proxy Notice.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

Why am I receiving these materials?

We are providing these proxy materials to you in connection with the solicitation, by our board of directors, of proxies to be voted at our Annual Meeting and at any adjournment or postponement thereof. You are receiving this Proxy Statement because you were a Company stockholder as of the close of business on the Record Date. This Proxy Statement provides notice of the Annual Meeting, describes the proposals presented for stockholder action and includes information required to be disclosed to stockholders.

How do I obtain electronic access to the Annual Report and proxy materials?

This Proxy Statement and Annual Report are available at http://www.edocumentview.com/KNSL. If you are a stockholder of record, you may elect to receive future annual reports or proxy statements electronically by so indicating on our proxy voting website at http://www.envisionreports.com/KNSL or

on your proxy card. If you hold your shares in “street name,” you should contact your broker, bank or other intermediary for information regarding electronic delivery of proxy materials.

An election to receive proxy materials electronically will remain in effect for all future annual meetings unless revoked. Stockholders requesting electronic delivery may incur costs, such as telephone and internet access charges, that must be borne by the stockholder.

What proposals will be voted on at the Annual Meeting?

There are six proposals scheduled to be voted on at the Annual Meeting:

| |

| • | Proposal 1: To amend our Amended and Restated Certificate of Incorporation to declassify our board of directors and make other ministerial changes; |

| |

| • | Proposal 2: To elect the seven directors identified in this Proxy Statement to serve until the 2019 Annual Meeting of Stockholders if Proposal 1 to declassify our board is approved; |

| |

| • | Proposal 3: To elect the two directors identified in this Proxy Statement as Class II directors to serve for a three-year term if Proposal 1 to declassify the board is not approved; |

| |

| • | Proposal 4: To hold an advisory vote on executive compensation; |

| |

| • | Proposal 5: To hold an advisory vote on the frequency of holding an advisory vote on executive compensation |

| |

| • | Proposal 6: To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2018; and |

| |

| • | Such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

What is the board of directors’ voting recommendation?

Our board of directors recommends that you vote your shares:

| |

| • | “FOR” the amendment to our Amended and Restated Certificate of Incorporation to declassify our board of directors and make other ministerial changes; |

| |

| • | “FOR” the election of the seven directors identified in this Proxy Statement to serve a one-year term until the 2019 Annual Meeting of Stockholders if Proposal 1 to declassify our board is approved; |

| |

| • | “FOR” the election of the two directors identified in this Proxy Statement as Class II directors to serve for a three-year term if Proposal 1 to declassify the board is not approved; |

| |

| • | “FOR” the approval, on an advisory basis, of the compensation of our executive officers; |

| |

| • | For “1 YEAR” frequency of the advisory vote on executive compensation; and |

| |

| • | “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2018. |

What shares owned by me can be voted?

All shares owned by you as of the Record Date, which is the close of business on March 26, 2018, may be voted by you. These shares include shares that are:

| |

| • | held directly in your name as the stockholder of record; and |

| |

| • | held for you as the beneficial owner through a broker, bank or other nominee. |

Who is entitled to vote at the Annual Meeting?

All stockholders who owned common shares as of the Record Date, which is the close of business on March 26, 2018, may vote at the Annual Meeting, either in person or by proxy. Each common stock holder is entitled to one vote on each matter properly brought before the Annual Meeting. On the Record Date, we had approximately 21,072,152 shares of our common stock outstanding and entitled to vote.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with the transfer agent of our common stock, Computershare Inc. (“Computershare”), you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to certain officers or to vote in person at the Annual Meeting. You may vote by phone, via the internet, or, if you have received a printed copy of these proxy materials by mail, by signing, dating, and returning your proxy card in the prepaid envelope provided.

Beneficial Owner. If your shares are held in an account at a broker, bank or other intermediary, like many of our stockholders, you are considered the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other intermediary how to vote your shares, and you are also invited to attend the Annual Meeting.

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, or other intermediary that is the stockholder of record of your shares giving you the right to vote the shares at the Annual Meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. If available, you may also vote by proxy on the internet or by telephone. Your broker, bank or other intermediary mailed you a proxy notice or proxy card with voting instructions.

How can I vote my shares in person at the Annual Meeting?

Stockholders of record and beneficial owners as of Record Date may vote in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring proof of ownership of our common stock on the Record Date, such as a proxy card or the legal proxy, voting instruction card provided by your broker, bank or other intermediary, as well as proof of identification.

Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

Whether you hold your shares directly as the stockholder of record or beneficially in “street name,” you may direct your vote without attending the Annual Meeting by proxy. If you are a stockholder of record, you may vote via the internet at http://www.envisionreports.com/KNSL, or, if you have received a printed copy of these proxy materials by mail, you may vote by phone or by signing, dating, and returning your proxy card in the prepaid envelope provided. If you are a beneficial owner, you should follow the voting instructions provided by your broker, bank or other intermediary. Mailed proxy cards must be received no later than May 23, 2018 in order to be counted for the annual meeting.

What is the quorum requirement for the Annual Meeting?

A quorum is necessary to hold a valid Annual Meeting. A quorum exists if the holders of a majority of our capital stock issued and outstanding and entitled to vote thereat are present in person or represented by proxy. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the particular matter on which the broker has expressly not voted. Thus, a broker non-vote will not impact our ability to obtain a quorum and will not otherwise affect the outcome of the vote on a proposal that requires a plurality of votes cast (Proposals 2 and 3) or the approval of a majority of the votes present in person or represented by proxy and entitled to vote (Proposals 4, 5 and 6). With respect to Proposal 1, broker non-votes have the same effect as an “AGAINST” vote.

Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares.

What happens if I do not give specific voting instructions?

If your shares are held in “street name” and you do not instruct your broker on how to vote your shares, your broker, in its discretion, may either leave your shares unvoted or vote your shares on routine matters. Only Proposal 6 (Ratification of Independent Registered Public Accounting Firm) is considered a routine matter. If your broker returns a proxy card but does not vote your shares, this results in a “broker non-vote.” Broker non-votes will be counted as present for the purpose of determining a quorum. For routine matters, any shares represented by proxies that are marked to “ABSTAIN” from voting on a proposal will be counted as present in determining whether we have a quorum. They will also be counted in determining the total number of shares entitled to vote on a routine matter.

Proposal 1 (Amendment of Amended and Restated Certificate of Incorporation to Declassify Our Board of Directors and Make Other Ministerial Changes), Proposal 2 (Election of Directors if Proposal 1 is approved), Proposal 3 (Election of Class II Directors if Proposal 1 is not approved), Proposal 4 (Advisory Vote on Executive Compensation) and Proposal 5 (Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation) are not considered routine matters, and without your instruction, your broker cannot vote your shares. Because brokers do not have discretionary authority to vote on these proposals, broker non-votes will not be considered in determining the number of votes necessary for approval and, therefore, will have no effect on the outcome of the votes for Proposal 2, 3, 4 and 5. With respect to Proposal 1, broker non-votes have the same effect as an “AGAINST” vote. However, broker non-votes

with respect to any proposal will be treated as shares present for purposes of determining a quorum at the Annual Meeting.

What is the vote required for each proposal?

|

| | |

| Proposal | Vote Required | Broker Discretionary Voting Allowed |

| Proposal 1-Amendment of Amended and Restated Certificate of Incorporation to declassify our board of directors and make other ministerial changes | Majority of Shares Outstanding | No |

| Proposal 2-Election of seven directors (if Proposal 1 is approved) | Plurality of Votes Cast | No |

| Proposal 3-Election of two Class II directors (if Proposal 1 is not approved) | Plurality of Votes Cast | No |

| Proposal 4-Advisory vote on executive compensation | Majority of the Shares Entitled to Vote and Present in Person or Represented by Proxy | No |

| Proposal 5-Advisory vote on frequency of advisory vote on executive compensation | Majority of the Shares Entitled to Vote and Present in Person or Represented by Proxy | No |

| Proposal 6-Ratification of auditors for fiscal year 2018 | Majority of the Shares Entitled to Vote and Present in Person or Represented by Proxy | Yes |

With respect to Proposals 1, 4 and 6, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN” from voting on any of these proposals, the abstention will have the same effect as an “AGAINST” vote.

With respect to Proposal 2, you may vote “FOR” all nominees, “WITHHOLD” your vote as to all nominees, or “FOR” all nominees except those specific nominees from whom you “WITHHOLD” your vote. The seven nominees receiving the most “FOR” votes will be elected. “WITHHOLD” and broker non-votes will have no effect on the outcome. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than seven directors and stockholders may not cumulate votes in the election of directors.

With respect to Proposal 3, which will only be presented for stockholder consideration at the Annual Meeting if Proposal 1 fails, you may vote “FOR” all nominees, “WITHHOLD” your vote as to all nominees, or “FOR” all nominees except those specific nominees from whom you “WITHHOLD” your vote. The two nominees receiving the most “FOR” votes will be elected. “WITHHOLD” and broker non-votes will have no effect on the outcome. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than two directors and stockholders may not cumulate votes in the election of directors.

With respect to Proposal 5, you may vote “FOR Every Year,” “FOR Every Two Years,” “FOR Every Three Years,” or “ABSTAIN.”

If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted as described above in “What happens if I do not give specific voting instructions?”

What does it mean if I receive more than one proxy or voting instruction card?

It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Who will count the vote?

A representative of Computershare will tabulate the votes and act as the inspector of election.

Can I revoke my proxy or change my vote?

Yes. You may revoke your proxy or change your voting instructions prior to the vote at the annual meeting. You may enter a new vote by mailing a new proxy card or new voting instruction card bearing a later date (which will automatically revoke your earlier voting instructions). Your new vote must be received by 11:59 p.m. Eastern Time on May 23, 2018. You may also enter a new vote by attending the annual meeting and voting in person. Your attendance at the annual meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic transmission by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. In addition, we may reimburse the transfer agent, brokerage firms and other persons representing beneficial owners of shares of our common stock for their expenses in forwarding solicitation material to such beneficial owners.

Where may I request a separate copy of this proxy statement or Annual Report if I share an address with other stockholders?

To reduce expenses, in some cases, we are delivering one set of proxy materials to certain stockholders who share an address, unless otherwise requested by one or more of the stockholders. A separate proxy card will be included with the proxy materials for each stockholder. Any stockholder of record who wishes to receive a separate copy of this Proxy Statement or Annual Report on Form 10-K as filed with the SEC without charge may (i) call us at 804-289-1272 or (ii) mail a request to: Kinsale Capital Group, Inc., 2221 Edward Holland Drive, Suite 600, Richmond, VA 23230, Attention: Secretary, and we will promptly deliver the requested materials to you at no additional cost to you. You may also obtain the Annual Report on Form 10-K, as well as this Proxy Statement, on the SEC’s website (www.sec.gov), or on our website at http://ir.kinsalecapitalgroup.com.

Is my vote confidential?

Yes. We encourage stockholder participation in corporate governance by ensuring the confidentiality of stockholder votes. We have designated Computershare to receive and tabulate stockholder votes. Your vote on any particular proposal will be kept confidential and will not be disclosed to us or any of our officers or employees except (i) where disclosure is required by applicable law, (ii) where disclosure of your vote is expressly requested by you or (iii) where we conclude in good faith that a bona fide dispute exists as to the authenticity of one or more proxies, ballots or votes, or as to the accuracy of any tabulation of such proxies, ballots or votes. However, aggregate vote totals will be disclosed to us from time to time and publicly announced at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 13, 2018 regarding the beneficial ownership of our common shares by (1) each person, or group of affiliated persons, known by us to be the beneficial owner of 5% or more of our outstanding common shares, (2) each of our directors, (3) each of our executive officers named in the Summary Compensation Table appearing in the “Executive Compensation” section of this proxy statement and (4) all of our directors and executive officers as a group. In addition, except as otherwise indicated, the address for each person named below is c/o Kinsale Capital Group, Inc. 2221 Edward Holland Drive, Suite 600, Richmond, Virginia, 23230.

The amounts and percentages owned are reported on the basis of the SEC’s rules governing the determination of beneficial ownership of securities. The SEC’s rules generally attribute beneficial ownership of securities to each person who possesses, either solely or shared with others, the voting power or investment power, which includes the power to dispose of those securities. The rules also treat as issued and outstanding all shares that a person would receive upon exercise of options held by that person that are immediately exercisable or exercisable within 60 days of March 13, 2018. These shares are deemed to be outstanding and to be beneficially owned by the person holding those options for the purpose of computing the number of shares beneficially owned and the percentage ownership of that person, but they are not treated as issued and outstanding for the purpose of computing the percentage ownership of any other person. Under these rules, one or more persons may be a deemed beneficial owner of the same securities.

|

| | | | |

| | | Shares of Common Stock Beneficially Owned |

| |

| | Name of Beneficial Owner | Number of Shares | % of Class |

| | Greater than 5% Stockholders: | | |

| | Baron Capital Group, Inc. and affiliated entities(1) | 1,364,484 |

| 6.5 |

| | JPMorgan Chase & Co.(2) | 1,335,665 |

| 6.3 |

| | RE Advisers Corp(3) | 1,298,571 |

| 6.2 |

| | T. Rowe Price Associates, Inc.(4) | 1,132,028 |

| 5.4 |

| | Named Executive Officers and Directors: | | |

| | Michael P. Kehoe(5) | 1,049,383 |

| 5.0 |

| | Brian D. Haney(6) | 182,268 |

| * |

| | Bryan P. Petrucelli(7) | 65,956 |

| * |

| | William J. Kenney, Jr.(8) | 131,587 |

| * |

| | Ann Marie Marson(9) | 119,084 |

| * |

| | Steven J. Bensinger(10) | 25,898 |

| * |

| | Anne C. Kronenberg(11) | 1,111 |

| * |

| | Robert Lippincott III(12) | 20,017 |

| * |

| | James J. Ritchie(13) | 23,356 |

| * |

| | Frederick L. Russell, Jr.(14) | 80,677 |

| * |

| | Gregory M. Share(15) | 31,111 |

| * |

| | All executive officers and directors as a group (11 persons) | 1,730,448 |

| 8.2 |

* Less than 1%.

(1) Information is based on a Schedule 13G filed with the SEC on February 14, 2018 by BAMCO Inc /NY/ (the “BAMCO 13G”). Baron Capital Group, Inc. and its subsidiaries BAMCO, Inc. and Baron Capital Management, Inc., reported beneficial ownership in the aggregate of 1,364,484 shares of common stock. According to the BAMCO 13G, (i) Baron Capital Group, Inc. and Ronald Baron, who owns a controlling interest in Baron Capital Group, Inc., have shared voting power over 1,241,243 shares of common stock and shared dispositive power over 1,364,484 shares of common stock, (ii) BAMCO Inc. has shared voting power over 1,151,723 shares of common stock and shared dispositive power over 1,274,964 shares of common stock and (iii) Baron Capital Management, Inc. has shared voting and dispositive power over 89,520 shares of common stock. The address of BAMCO, Inc., Baron Capital Group, Inc., Baron Capital Management, Inc. and Ronald Baron is 767 Fifth Avenue, 49th Fl, New York, NY 10153.

(2) Information is based on a Schedule 13G filed with the SEC on January 10, 2018 by JPMorgan Chase & Co. JPMorgan Chase & Co. reported sole voting power over 1,225,431 shares of common stock and sole dispositive power over 1,335,665 shares of common stock. The address of JPMorgan Chase & Co. is 270 Park Avenue, New York, NY 10017.

(3) Information is based on a Schedule 13G filed with the SEC on February 13, 2018 by RE Advisers Corporation. RE Advisers Corporation reported sole voting and dispositive power over 1,298,571 shares of common stock. The address of RE Advisers Corporation is 4301 Wilson Boulevard, Arlington, VA 22203.

(4) Information is based on a Schedule 13G filed with the SEC on February 14, 2018 by T. Rowe Price Associates, Inc. T. Rowe Price Associates, Inc. reported sole voting power over 274,671 shares of common stock and sole dispositive power over 1,132,028 shares of common stock. The address of T. Rowe Price Associates, Inc. is 100 East Pratt Street, Baltimore, MD 21202

(5) Consists of (i) 319,379 shares of common stock held by Michael P. Kehoe directly, (ii) 42,394 shares of common stock Mr. Kehoe has the right to acquire pursuant to options that are currently exercisable, (iii) 651,738 shares of common stock held by M.P. Kehoe, LLC, of which Michael P. Kehoe is the sole manager, and (iv) 35,872 shares of common stock held by the Marilyn F. Kehoe Revocable Trust, of which Michael P. Kehoe is a trustee.

(6) Consists of (i) 168,518 shares of common stock held by Brian D. Haney directly and (ii) 13,750 shares of common stock Mr. Haney has the right to acquire pursuant to options that are currently exercisable.

(7) Consists of (i) 52,216 shares of common stock held by Bryan P. Petrucelli directly and (ii) 13,750 shares of common stock Mr. Petrucelli has the right to acquire pursuant to options that are currently exercisable.

(8) Consists of (i) 68,701 shares of common stock held by the William J. Kenney, Jr. Trust, of which Mr. Kenney is a trustee and (ii) 62,886 shares of common stock held by the Pamela A. Kenney Trust, of which Mr. Kenney is spouse to Pamela A. Kenney, the trustee of the Pamela A. Kenney Trust..

(9) Consists of (i) 105,334 shares of common stock held by Ann Marie Marson directly and (ii) 13,750 shares of common stock Ms. Marson has the right to acquire pursuant to options that are currently exercisable.

(10) Consists of (i) 20,787 shares of common stock held by Steven J. Bensinger directly (ii) 4,000 shares of common stock Mr. Bensinger has the right to acquire pursuant to options that are currently exercisable and (iii) 1,111 restricted shares granted January 1, 2018.

(11) Consists of 1,111 restricted shares granted January 1, 2018.

(12) Consists of (i) 14,906 shares of common held by Robert Lippincott, III directly (ii) 4,000 shares of common stock Mr. Lippincott has the right to acquire pursuant to options that are currently exercisable and (iii) 1,111 restricted shares granted January 1, 2018.

(13) Consists of (i) 18,245 shares of common stock held by James J. Ritchie directly (ii) 4,000 shares of common stock Mr. Ritchie has the right to acquire pursuant to options that are currently exercisable and (iii) 1,111 restricted shares granted January 1, 2018.

(14) Consists of (i) 16,000 shares of common stock Frederick L. Russell, Jr. has the right to acquire pursuant to options that are currently exercisable (ii) 63,566 shares of common stock held by The Frederick L. Russell, Jr. Revocable Trust, of which Mr. Russell is the trustee and (iii) 1,111 restricted shares granted January 1, 2018.

(15) Consists of (i) 30,000 shares of common stock held by Ambina Partners LLC, of which Gregory M. Share is the sole member and (ii) 1,111 restricted shares granted January 1, 2018.

PROPOSAL 1: AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY OUR BOARD OF DIRECTORS AND MAKE OTHER MINISTERIAL CHANGES

After careful consideration, in August 2017, our board of directors voted unanimously to approve, and to recommend to our stockholders that they approve, an amendment to our Amended and Restated Certificate of Incorporation to declassify the board of directors effective at the Annual Meeting. This will allow our stockholders to vote on the election of our entire board of directors each year rather than on a staggered basis as with our current classified board structure.

If approved by our stockholders, our Amended and Restated Certificate of Incorporation will be amended to provide for the annual election of all directors commencing immediately at the Annual Meeting (see Proposal 2 to elect seven nominees). As of the date of the Annual Meeting, each of our directors whose term does not expire at the Annual Meeting will have tendered his or her resignation, contingent and effective upon stockholder approval of this Proposal 1. If our stockholders do not approve this Proposal 1, our board will remain classified, the contingent resignations will be ineffective, and our stockholders will instead be asked to elect only two Class II directors at the Annual Meeting (see Proposal 3 to elect two nominees).

Current Classified Board Structure

Article FIFTH, paragraph (c) of our Amended and Restated Certificate of Incorporation currently requires that our board of directors be divided into three classes of approximately equal size (Class I, Class II and Class III), each with a three-year term. Generally, absent the earlier resignation or removal of a director, the terms of the classes are staggered, meaning that only one of the three classes stands for reelection at each annual meeting of stockholders.

Rationale for Declassification

In determining whether to propose declassifying the board to our stockholders, the board of directors considered the arguments in favor of and against continuation of the classified board structure and determined that it would be in the best interests of the Company and our stockholders to amend our Amended and Restated Certificate of Incorporation to declassify our board of directors.

Our board of directors recognizes that a classified structure may offer several advantages, such as promoting board continuity and stability, encouraging directors to take a long-term perspective, and ensuring that a majority of the board will always have prior experience with the Company. Additionally, classified boards provide effective protection against unwanted takeovers and proxy contests as they make it difficult for a substantial stockholder to gain control of the board without the cooperation or approval of incumbent directors.

Our board of directors, however, also recognizes that a classified structure does not enable stockholders to express a view on each director’s performance by means of an annual vote, which may affect directors’ accountability to stockholders. Moreover, many institutional investors believe that the election of

directors is the primary means for stockholders to influence corporate governance policies and to hold management accountable for implementing those policies.

Proposed Declassification of the Board of Directors

Declassification of the board of directors requires several changes to our Amended and Restated Certificate of Incorporation. Specifically, Article FIFTH, paragraphs (c) and (d) of our Amended and Restated Certification of Incorporation must be amended to delete the references to the classified board structure. The full text of the proposed Second Amended and Restated Certificate of Incorporation is attached as Appendix A hereto and has been marked to show changes from the current Amended and Restated Certificate of Incorporation. If approved by our stockholders, we will file the Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware promptly after approval of this Proposal 1, upon which filing the amendment will become effective. Our board of directors will then be declassified immediately, so that every director will stand for election at the Annual Meeting (and thereafter) for a one-year term.

Stockholders are requested in this Proposal 1 to approve the proposed amendment to the Amended and Restated Certificate of Incorporation to declassify the board of directors effective at the Annual Meeting.

Ministerial Changes

The Company’s Amended and Restated Certificate of Incorporation contains a number of references to the Company’s former private equity sponsors. The Second Amended and Restated Certificate of Incorporation will delete these obsolete references and include the re-numbering and lettering of remaining provisions. We do not believe that any of these ministerial changes would materially affect the rights or preferences of our stockholders. We believe that these changes are advisable in order to simplify the Amended and Restated Certificate of Incorporation for our stockholders, directors, officers, employees, agents and advisors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT OF THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY OUR BOARD OF DIRECTORS AND MAKE OTHER MINISTERIAL CHANGES.

PROPOSAL 2: ELECTION OF DIRECTORS

If our stockholders approve Proposal 1 at the Annual Meeting, our stockholders will be asked to consider seven nominees for election to our board of directors to serve a one-year term until the 2019 annual meeting of stockholders. If our stockholders do not approve Proposal 1, this Proposal 2 will not be submitted to a vote of our stockholders at the Annual Meeting, and instead Proposal 3 (Election of Class II Directors) will be submitted in its place.

The names of the seven nominees for director, their current positions and offices, tenure as a Company director, and their board committee memberships are set forth in the table below. All of the nominees are current Company directors and have been determined by our board to be independent, with the exception of Mr. Kehoe. The Compensation, Nominating and Corporate Governance Committee of our board of directors (the “CNCG Committee”) has reviewed the qualifications of each of the nominees and has recommended to our board of directors that each nominee be submitted to a vote of our stockholders at the Annual Meeting. The board unanimously approved the CNCG Committee’s recommendation at its meeting on March 1, 2018.

Our board of directors expects each nominee to be able to serve if elected. If a nominee is unable to serve, your proxy may be voted for any substitute candidate nominated by our board of directors. In accordance with our current Amended and Restated Certificate of Incorporation, as amended by Proposal 1, and By-Laws, the seven nominees receiving the most “FOR” votes will be elected for a one-year term.

|

| | | | |

| Name | Position with Company | Age | Director Since | Committee Membership |

| Michael P. Kehoe | Chief Executive Officer, President and Director | 51 | 2009 | None |

| Steven J. Bensinger | Director | 63 | 2015 | Audit Committee, CNCG Committee |

| Anne C. Kronenberg | Director | 58 | 2017 | Audit Committee, Investment Committee |

| Robert Lippincott III | Chairman of the Board | 71 | 2010 | Chairman of CNCG Committee |

| James J. Ritchie | Director | 63 | 2013 | Chairman of Audit Committee |

| Frederick L. Russell, Jr. | Director | 58 | 2010 | CNCG Committee, Chairman of Investment Committee |

| Gregory M. Share | Director | 44 | 2017 | CNCG Committee, Investment Committee |

The following is additional information about each of the nominees as of the date of this Proxy Statement.

Michael P. Kehoe has served as our Chief Executive Officer and President, and as one of our directors, since June 2009 when he founded Kinsale. From 2002 to 2008, Mr. Kehoe was the President and Chief Executive Officer at James River Insurance Company, and before that, served in various senior positions at Colony Insurance Company from 1994 to 2002, finishing as Vice President of Brokerage Underwriting.

Mr. Kehoe received a B.A. in Economics from Hampden Sydney College and a J.D. from the University of Richmond School of Law.

We believe Mr. Kehoe’s qualifications to serve on our board include his 26 years of underwriting and claims experience in the property & casualty industry.

Steven J. Bensinger has served as one of our directors since July 2015. Mr. Bensinger currently serves as Partner and Senior Advisor of TigerRisk Partners LLC, a privately held firm providing sophisticated advisory services to the insurance industry. Prior to joining TigerRisk in October 2015, Mr. Bensinger was a Senior Managing Director at FTI Consulting in its Global Insurance Services Practice. From January 2010 to June 2011, he worked at The Hanover Insurance Group as Executive Vice President and Chief Financial Officer. From September 2002 to October 2008, Mr. Bensinger worked at American International Group, Inc. (AIG), where he held a number of senior executive positions, including Chief Financial Officer. He was appointed Vice Chairman, Financial Services, in May 2008 in addition to retaining Chief Financial Officer responsibilities. Mr. Bensinger has also held senior positions with Combined Specialty Group, Inc. (Aon), Chartwell Re Corporation, Skandia America Corporation and Coopers & Lybrand. Mr. Bensinger is a director of Baldwin & Lyons, Inc., a director of The Doctors Company, a director and Chair of the Finance Committee of the International Insurance Society, and a director and Chair of the Strategic Planning Committee of Ronald McDonald House of New York. Mr. Bensinger is a Certified Public Accountant and a Certified Global Management Accountant. He received a B.S. from New York University’s Leonard N. Stern School of Business.

We believe Mr. Bensinger’s qualifications to serve on our board of directors include his more than 30 years of experience in the insurance industry and his financial and business acumen, which have provided him with significant expertise in our area of business.

Anne C. Kronenberg has served as one of our directors since June 2017. Since May 2010, Ms. Kronenberg has been a member of the Board of Trustees of the Woods Hole Oceanographic Institution, a non-profit organization dedicated to ocean research, exploration and education where she serves as Treasurer and Head of the Finance Committee and also serves on the Audit and Risk Committee, Endowment Committee and Retirement Plan Committee. From August 2003 to January 2010, Ms. Kronenberg was a Managing Director and the Co-head of North American Insurance Investment Banking at J.P. Morgan. Prior to J.P. Morgan, Ms. Kronenberg was a Managing Director in Insurance Investment Banking with Citigroup Solomon Smith Barney from August 1997 to August 2003. Earlier in her career, Ms. Kronenberg was a Principal in Investment Banking at Morgan Stanley both in New York and in London. She received a Sc.B. in Physics and Philosophy from Brown University and an M.S. in Finance from MIT Sloan School of Management.

We believe Ms. Kronenberg’s qualifications to serve on our board of directors include her more than 20 years of experience in the insurance and financial services industries.

Robert Lippincott, III has served as Chairman of our board of directors since March 2015, and has served as one of our directors from July 2010. Mr. Lippincott is the President of Lippincott Consulting, LLC. From November 2005 to September 2006, Mr. Lippincott was the Interim Chief Executive Officer of Quanta Capital Holdings Inc., and before that worked at Towers Perrin Re as Executive Vice President. Prior to Towers Perrin, Mr. Lippincott was the Chairman and Chief Executive Officer of the AXA Property and Casualty Reinsurance companies, which he founded in October 1983. Mr. Lippincott was also a director at Quanta Capital Holdings Inc. and AXA Art Insurance Company. He received a B.S. in Marketing and Management Science from St. Joseph’s College.

We believe Mr. Lippincott’s qualifications to serve on our board of directors include his 45 years of insurance and reinsurance industry experience.

James J. Ritchie has served as one of our directors since January 2013. From 2001 until his retirement in 2003, Mr. Ritchie served as Managing Director and Chief Financial Officer of White Mountains Insurance Group, Ltd.’s OneBeacon Insurance Company, a specialty insurance company, and as the group Chief Financial Officer for White Mountains Insurance Group, Ltd., a financial services holding company. From July 1986 to December 2000, he worked at CIGNA Corporation, where he held a number of senior executive positions. Mr. Ritchie is currently the Chairman of the Board of OM Asset Management plc. Mr. Ritchie is also a Director, Chairman of the Audit and Risk Committee of Old Mutual (Bermuda) Ltd. Mr. Ritchie’s former board experience includes: Ceres Group, Inc.; Fidelity & Guaranty Life Insurance Company (formerly Old Mutual Financial Life Insurance Company, Inc.); KMG America Corporation; Lloyd’s Syndicate 4000; and Quanta Capital Holdings Ltd. He is a member of the National Association of Corporate Directors and the American Institute of Certified Public Accountants. Mr. Ritchie received a B.A. in Economics with honors from Rutgers College and an M.B.A. from Rutgers Graduate School of Business Administration.

We believe Mr. Ritchie’s qualifications to serve on our board of directors include his extensive background in finance, substantial board experience, strategic and operational leadership and wide-ranging knowledge of operational, risk and control initiatives. His background in financial risk and regulation provides valuable guidance to our board of directors and our Company in addressing risk management.

Frederick L. Russell, Jr. has served as one of our directors since April 2010. Mr. Russell has been a Managing Partner at Virginia Capital Partners since its inception in 1997. Mr. Russell received a B.S. from the McIntire School of Commerce at the University of Virginia and an M.B.A. from the University of Pennsylvania, The Wharton School.

We believe Mr. Russell’s qualifications to serve on our board of directors include his more than 25 years of venture capital and private equity experience.

Gregory M. Share has served as one of our directors since August 2017, and was previously a member of our board of directors from its inception in June 2009 to March 2015. Mr. Share is Managing Partner of Ambina Partners, LLC, an investment firm focused on software and financial services companies. Previously, Mr. Share served as Partner at Moelis Capital Partners LLC from August 2008 to March 2015, and as Managing Director of Fortress Investment Group LLC from August 2003 to July 2008. Prior to joining Fortress, Mr. Share served as Vice President at Madison Dearborn Partners, LLC from August 1998 to July 2003. Mr. Share received a B.S. in Economics from the University of Pennsylvania, The Wharton School.

We believe Mr. Share’s qualifications to serve on our board of directors include his more than 20 years of private equity investment experience.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL NOMINEES TO SERVE AS DIRECTORS.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board of Directors

Our board currently consists of seven directors. If our stockholders approve Proposal 1 at the Annual Meeting, at each annual meeting of stockholders, all directors will be elected to a one-year term until the next annual meeting of stockholders. If our stockholders do not approve Proposal 1, at each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The division of the three classes and their respective election dates are as follows:

| |

| • | The Class I directors’ terms will expire at the annual meeting of stockholders to be held in 2020 |

| |

| • | The Class II directors’ (following their election at the Annual Meeting) terms will expire at the annual meeting of stockholders to be held in 2021 |

| |

| • | The Class III directors’ terms will expire at the annual meeting of stockholders to be held in 2019 |

If our stockholders do not approve Proposal 1, any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Board Leadership Structure

Our By-Laws provide flexibility to the Board in choosing a Chairman of the Board and a Chief Executive Officer. The By-Laws provide that such offices may be held by different people or the same person, as determined by the Board. This flexibility allows the board to determine whether it is in the best interests of the Company and our stockholders to combine the roles of Chief Executive Officer and Chairman of the Board in the same person. Currently, Robert Lippincott III serves as our Chairman of the Board and Michael P. Kehoe serves as our Chief Executive Officer.

Director Independence

The rules of The Nasdaq Stock Market (“Nasdaq”) require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”).

Under the rules of Nasdaq, a director will only qualify as an “independent director” if such person is not an executive officer or employee of the company and, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. To be considered to be independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Except for Mr. Kehoe, who is Chief Executive Officer and President of the Company, all director nominees are independent within the meaning of the independent director guidelines of Nasdaq. In addition, our Audit Committee and CNCG Committee meet the independent director guidelines of Nasdaq.

Director Attendance

Each director attended at least 75% of the aggregate meetings of our board of directors and committees that he/she served on during 2017 while he/she was in office.

The board of directors held five meetings and acted four times by unanimous written consent during 2017.

The Company does not have a policy about directors' attendance at the Annual Meeting of Stockholders. All director nominees and directors at the time, attended the 2017 Annual Meeting of Stockholders.

Committees of the Board of Directors

We have three standing committees of the board of directors: the Audit Committee; the CNCG Committee; and the Investment Committee.

Audit Committee

Our Audit Committee consists of Mr. Ritchie, who serves as the Chair, and Mr. Bensinger and Ms. Kronenberg. Nasdaq listing rules require each company to have an audit committee of at least three members. Each member of the Audit Committee must meet independence standards under Nasdaq listing rules and Rule 10A-3 of the Exchange Act. Our board of directors has determined that each of Mr. Ritchie, Mr. Bensinger and Ms. Kronenberg meets these independence standards. Our board of directors has determined that Mr. Ritchie qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K, and possesses financial sophistication as defined under Nasdaq listing rules.

The Audit Committee assists our board of directors in fulfilling its oversight responsibilities relating to:

| |

| • | the quality and integrity of our financial statements and our financial reporting process; |

| |

| • | external auditing and the independent registered public accounting firm’s qualifications and independence; |

| |

| • | the performance of our independent registered public accounting firm; |

| |

| • | the integrity and effectiveness of our systems of internal accounting and financial controls; and |

| |

| • | our compliance with legal and regulatory requirements. |

In so doing, the Audit Committee is responsible for maintaining free and open communication between the committee, our independent registered public accounting firm and our management. In this role, the Audit Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of our Company and has the power to retain outside counsel or other experts for this purpose.

The Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The Audit Committee meets in executive session with the independent registered public accounting firm at least quarterly. For further information, the Audit Committee charter may be accessed at http://ir.kinsalecapitalgroup.com.

The Audit Committee held eight meetings during 2017.

Compensation, Nominating and Corporate Governance Committee

The CNCG Committee consists of Mr. Lippincott, who serves as the Chair, and Messrs. Bensinger, Russell and Share. Except under exceptional and limited circumstances, Nasdaq listing rules require each company to have a compensation committee of at least two members. Each committee member must be an independent director as defined under Rule 10A-3. Our board of directors has determined that each of the committee members meets these independence standards.

The CNCG Committee assists our board of directors with reviewing the performance of our management in achieving corporate goals and objectives and assuring that our executives are compensated effectively in a manner consistent with our strategy, competitive practice and the requirements of appropriate regulatory bodies. Toward that end, the CNCG Committee, among other responsibilities, reviews and approves director and executive officer compensation, incentive compensation and equity-based compensation plans, and employee benefit plans. From time to time, the CNCG Committee may form subcommittees, consisting of no fewer than two members, and delegate such power and authority as deemed appropriate. The CNCG Committee also assists our board of directors by:

| |

| • | identifying individuals qualified to become board members; |

| |

| • | recommending to our board of directors the director nominees for the next annual meeting of stockholders; |

| |

| • | leading our board of directors in its annual review of performance and the Company’s executive compensation plans in light of such annual review; |

| |

| • | evaluating annually the performance of the Chief Executive Officer and other executive officers in light of the goals and objectives of the Company’s executive compensation plans and make recommendations to our board of directors with respect to these executives’ compensation level based on this evaluation; |

| |

| • | evaluating annually the level of compensation for directors; and |

| |

| • | recommending a code of conduct to our board of directors. |

Mr. Kehoe, our Chief Executive Officer and President, provides the CNCG Committee with his perspective on the performance of other executive officers and certain other senior officers of the Company, and presents compensation recommendations. The CNCG Committee considers recommendations from Mr. Kehoe in its review of executive officer compensation. In addition, Mr. Kehoe is involved in setting the business goals that are used as the performance goals for the bonus incentive plan, subject to board of directors approval.

The CNCG Committee is directly responsible for the appointment, compensation, and oversight of the work of any compensation consultant, legal counsel, or other adviser that it retains. The Company bears all expenses of such service providers. The CNCG Committee engaged an executive compensation

consulting firm in 2016 to advise it on compensation matters prior to the Company's IPO. The CNCG Committee did not retain a compensation consultant during fiscal 2017, but may do so in the future.

Our CNCG Committee identifies individuals qualified to become board members, assists our board of directors in reviewing the background and qualifications of individuals being considered as director candidates, and recommends to our board of directors the director nominees for election by the stockholders, or appointment by our board of directors.

While the CNCG Committee has not adopted minimum criteria, it considers several qualifications when considering candidates for our board of directors. Among attributes the CNCG Committee takes into account are: experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability, dedication, conflicts of interest and such other relevant factors that the CNCG Committee considers appropriate in the context of the needs of our board of directors. The CNCG Committee may also take into account legal and regulatory independence requirements. The CNCG Committee selects candidates who have a mix of experiences and backgrounds that will enhance the quality of our board of directors’ interactions and decisions. The CNCG Committee has the sole authority to retain or terminate any search firm to be used to identify director candidates and the sole authority to approve the search firm’s fees and other retention terms, such as fees to be borne by the Company.

The CNCG Committee will consider candidates recommended by stockholders for consideration as directors on the same basis it evaluates other candidates. For details on how stockholders may submit nominations for directors, see “Additional Information -Requirements for Stockholder Proposals to be Brought Before Next Year’s Annual Meeting.”

For further information, the CNCG Committee charter may be accessed at

http://ir.kinsalecapitalgroup.com.

The CNCG Committee held five meetings and acted three times by unanimous written consent during 2017.

Investment Committee

Our Investment Committee consists of Mr. Russell, who serves as the Chair, Ms. Kronenberg, and Mr. Share. The Investment Committee is appointed by the board or directors to assist in discharging the board’s responsibilities in establishing and overseeing the Company’s investment policies and strategies and the implementation of such policies and strategies.

The Investment Committee develops our investment policy and oversees our investment managers.

The Investment Committee held four meetings during 2017.

Risk Oversight Management

The board of directors oversees the risk management activities designed and implemented by our management. Our senior management is responsible for assessing and managing our risks on a day-to-day basis. The board of directors executes its oversight responsibility for risk management both directly and through its committees. The full board of directors considers specific risk topics, including risks associated with our strategic plan, business operations and capital structure. In addition, the board of directors receives detailed regular reports from members of our senior management and other personnel that include assessments and potential mitigation of the risks and exposures involved with their respective areas of responsibility.

Our board of directors has delegated to the Audit Committee oversight of our risk management process. Our Audit Committee oversees and reviews with management our policies with respect to risk assessment and risk management and our significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures. Our board of directors has delegated to the CNCG Committee the oversight of risk related to compensation policies. Our CNCG Committee also considers and addresses risk as it performs its responsibilities. Both standing committees report to the full board as appropriate, including when a matter rises to the level of a material or enterprise-level risk.

Stockholder Communications with Our Board of Directors

Stockholders and interested parties may communicate with our board of directors by sending correspondence to the board of directors, a specific committee of our board of directors or a director at: Kinsale Capital Group, Inc., Attn: Secretary, 2221 Edward Holland Drive, Suite 600, Richmond, VA 23230. The communication must prominently display the legend “BOARD COMMUNICATION” in order to indicate to the Secretary that it is a communication for the board.

Our Secretary reviews all communications to determine whether the contents include a message to a director and will provide a summary and copies of all correspondence (other than solicitations for services, products or publications) to the applicable director or directors at each regularly scheduled meeting. The Secretary will alert individual directors to items that warrant a prompt response from the individual director prior to the next regularly scheduled meeting. Items warranting prompt response, but not addressed to a specific director, will be routed to the applicable committee chairperson.

Compensation Committee Interlocks and Insider Participation

None of the members of our CNCG Committee and none of our executive officers has had a relationship that would constitute an interlocking relationship with executive officers or directors of another entity or insider participating in compensation decisions.

Code of Conduct

We have a Code of Conduct applicable to our directors, officers and employees that complies with the requirements of applicable rules and regulations of the SEC and the Nasdaq. This code is designed to deter wrongdoing and to promote:

| |

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| |

| • | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in other public communications made by us; |

| |

| • | compliance with applicable governmental laws, rules and regulations; and |

| |

| • | prompt internal reporting to an appropriate person or persons identified in the Code of Conduct of violations of the Code of Conduct; and accountability for adherence to the Code of Conduct. |

Our Code of Conduct is available at http://ir.kinsalecapitalgroup.com. Any amendments to the Code of Conduct will be disclosed on our website.

Director Compensation

The following table sets forth information concerning compensation earned by our non-employee directors for the year ended December 31, 2017:

|

| | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Option Awards ($) | | All Other Compensation ($) | | Total ($) |

| Steven J. Bensinger | | 70,000 |

| | — |

| | — |

| | 70,000 |

|

| Robert Lippincott III | | 90,000 |

| | — |

| | — |

| | 90,000 |

|

| James J. Ritchie | | 85,000 |

| | — |

| | — |

| | 85,000 |

|

| Frederick L. Russell, Jr. | | 70,000 |

| | — |

| | — |

| | 70,000 |

|

| Anne C. Kronenberg (1) | | 35,000 |

| | — |

| | — |

| | 35,000 |

|

| Gregory M. Share (2) | | 17,500 |

| | — |

| | — |

| | 17,500 |

|

(1) Ms. Kronenberg was appointed to the board of directors on June 19, 2017.

(2) Mr. Share was appointed to the board of directors on August 28, 2017.

Directors who are also our employees receive no compensation for serving as directors. Non-employee directors, or their designees, received an annual retainer in the amount of $70,000 for their service on the Board of Directors. The chairman of our board of directors received an additional annual retainer of $20,000 and the chair of the Audit Committee received an additional annual retainer of $15,000 for their service in that capacity. Directors do not receive any fees for attending board or committee meetings. We also reimburse all directors (including employee directors) for reasonable out-of-pocket expenses they incur in connection with their service as directors.

Our directors, or their designees, are eligible to receive grants of Common Stock under the 2016 Omnibus Incentive Plan (the "2016 Incentive Plan") when and if determined by the board of directors, in consultation with the CNCG Committee, as well as non-qualified stock options and other equity-based awards.

Family Relationships

There are no family relationships among any of our directors or executive officers.

PROPOSAL 3: ELECTION OF CLASS II DIRECTORS

PROPOSAL 3 WILL NOT BE ADOPTED IF OUR STOCKHOLDERS APPROVE PROPOSAL 1

Our Amended and Restated Certificate of Incorporation currently provides for a classified board of directors. Each person elected as a Class II director at the Annual Meeting will serve for a three-year term expiring on the date of the 2021 Annual Meeting of stockholders. Our board of directors has nominated Robert Lippincott, III and Frederick L. Russell, Jr. for election as Class II directors at the Annual Meeting - ONLY in the event Proposal 1 is NOT APPROVED and the board of directors remains classified. Information about each of the nominees as of the date of this Proxy Statement, including their current positions and offices, business experience, tenure as a Company director, and the experiences, qualifications, attributes or skills that caused the CNCG Committee and our board of directors to determine that the nominees should serve as one of our directors is set forth in ���Proposal 2 - Election of Directors” above. In the event Proposal 1 is NOT APPROVED and the Class II nominees standing for election at the Annual Meeting are elected, the directors will serve in the classes specified below:

|

| | | |

| Name | Class I (term expires at 2020 annual meeting) | Class II (standing for election for a term expiring at 2021 annual meeting) | Class III (term expires at 2019 annual meeting) |

| Michael P. Kehoe | X | | |

| Steven J. Bensinger | | | X |

| Anne C. Kronenberg | X | | |

| Robert Lippincott, III | | X | |

| James J. Ritchie | | | X |

| Frederick L. Russell, Jr. | | X | |

| Gregory M. Share | X | | |

The board of directors expects each nominee to be able to serve if elected. If a nominee is unable to serve, your proxy may be voted for any substitute candidate nominated by the board of directors. In accordance with our current Amended and Restated Certificate of Incorporation and By-Laws, the two nominees receiving the most “FOR” votes will be elected for a three-year term.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE NOMINEES FOR DIRECTORS:

ROBERT LIPPINCOTT, III AND FREDERICK L. RUSSELL, JR.

EACH TO SERVE AS A CLASS II DIRECTOR OF THE COMPANY FOR THREE YEARS, SUBJECT TO THE APPROVAL OF PROPOSAL 1, AND UNTIL A RESPECTIVE SUCCESSOR FOR EACH IS DULY ELECTED AND QUALIFIED OR UNTIL DEATH, RESIGNATION OR REMOVAL, WHICHEVER IS EARLIEST TO OCCUR.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis (CD&A) describes the Company’s executive compensation philosophies, objectives and programs, as well as the compensation-related actions taken in fiscal year 2017 for the following named executive officers (NEOs):

|

| |

| Name | |

Michael P. Kehoe President and Chief Executive Officer Age 51 | Mr. Kehoe has served as our Chief Executive Officer and President, and as one of our directors, since June 2009 when he founded Kinsale. From 2002 to 2008, Mr. Kehoe was the President and Chief Executive Officer at James River Insurance Company, and before that, served in various senior positions at Colony Insurance Company from 1994 to 2002, finishing as Vice President of Brokerage Underwriting. Mr. Kehoe received a B.A. in Economics from Hampden Sydney College and a J.D. from the University of Richmond School of Law. |

Bryan P. Petrucelli Chief Financial Officer Age 52 | Mr. Petrucelli has served as our Senior Vice President and Chief Financial Officer since March 2015, and as our Treasurer since December 2015, and before that, was our Vice President of Finance from 2009. Prior to his role at the Company, Mr. Petrucelli was a Senior Manager in Ernst & Young’s audit practice with over 13 years of experience serving clients in the insurance industry. Prior to Ernst & Young, Mr. Petrucelli spent seven years with Travelers Insurance Company, leaving as a senior auditor. Mr. Petrucelli received a B.B.A. in Finance from James Madison University and a Post Baccalaureate Certificate in Accounting from Virginia Commonwealth University. Mr. Petrucelli is a Certified Public Accountant. |

Brian D. Haney Senior Vice President and Chief Operating Officer Age 48 | Mr. Haney has served as our Senior Vice President and Chief Operating Officer since March 2015, and was previously our Chief Actuary from 2009. From 2002 to 2009, Mr. Haney was the Chief Actuary of James River Insurance Company, where he was responsible for the actuarial functions, as well as catastrophe modeling and the purchasing of ceded reinsurance. From 1997 to 2002, Mr. Haney was the Chief Actuary of Colony Insurance Company, and was previously a business manager at Capital One Financial Corporation. Mr. Haney began his career at GEICO as an actuarial associate. He is a Fellow of the Casualty Actuarial Society and a member of the American Academy of Actuaries. Mr. Haney received a B.A. in Mathematics and Economics from the University of Virginia in 1992. |

Ann Marie Marson Senior Vice President and Chief Claims Officer Age 60 | Ms. Marson has served as our Senior Vice President and Chief Claims Officer since August 2009. From February 2003 to June 2009, Ms. Marson was the Senior Vice President and Chief Claims Officer at James River Insurance Company. Prior to James River Insurance Company, she served as Claims Vice President with ACE USA managing its National Claims Facility where she was accountable for a nationwide program focused on the resolution of aged, complex casualty claims. Ms. Marson received a B.A. in History and Political Science from Farleigh Dickinson University and a J.D. from Temple University Beasley School of Law. |

William J. Kenney, Jr. Senior Vice President and Chief Information Officer Age 66 | Mr. Kenney has served as our Senior Vice President and Chief Information Officer since June 2009. From 2001 to 2009, Mr. Kenney was the Senior Vice President and Chief Information Office at James River Insurance Company. Prior to James River Insurance Company, he served as Vice President and Chief Information Officer at Colony Insurance Company since 1997. Mr. Kenney received a B.A. in Political Science from Merrimack College and a Masters in Information Technology from Virginia Polytechnic and State University. |

In this CD&A section and the "Executive Compensation" section, the terms “we,” “our,” and “us” refer to management, the Company and sometimes as applicable, the Compensation, Nominating, and Corporate Governance Committee (“Committee”) of the Company's Board of Directors (the “Board”). When referring to the Chief Executive Officer (“CEO”) in any narrative disclosure, such reference is to the Company's CEO at the end of fiscal year 2017, Michael P. Kehoe.

Compensation Philosophy and Objectives

We seek to closely align the interests of our NEOs with the interests of our shareholders. Our compensation programs are designed to reward our NEOs for the achievement of short-term and long-term strategic and operational goals, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. We design the mix of our pay elements to most effectively support our strategic priorities of profitability, growth, operational excellence and the retention of high performing talent. Our NEOs’ total compensation is comprised of a mix of base salary, annual cash incentive awards, equity awards and other benefits.

Compensation Determination Process

The CNCG Committee is responsible for establishing, maintaining and overseeing our compensation and benefit policies. The CNCG Committee relies significantly on the input and recommendations of our CEO when evaluating factors relative to the compensation of the NEOs (other than the CEO). In addition, our CEO is involved in helping the CNCG Committee to set the business goals that are used as the performance goals for the bonus incentive plan, subject to Board approval. Our CEO provides the CNCG Committee with his assessment of the performance of each NEO and his perspective on the factors described below in developing his recommendations for each NEO’s compensation, including salary adjustments, equity grants and incentive bonuses. The CNCG Committee discusses our CEO’s recommendations and then approves or modifies the recommendations in collaboration with the CEO.

Our CEO’s compensation is determined by the CNCG Committee, which approves any adjustments to his base salary, performance incentive compensation and equity awards from year to year. The CNCG Committee makes determinations regarding our CEO’s compensation independently and without him present. Our CEO attends portions of the CNCG Committee meetings, but does not attend portions of those meetings related to making specific decisions on his compensation.

In addition to recommendations put forth by our CEO, other members of our executive team are involved in the compensation process by assembling data to present to the CNCG Committee. Other members of our executive management team also occasionally attend portions of the CNCG Committee meetings.

The CNCG Committee engaged an executive compensation consulting firm in 2016 to advise it on compensation matters prior to the Company's IPO. The CNCG Committee did not retain a compensation consultant during fiscal 2017, but may do so in the future. The CNCG Committee is directly responsible for the appointment, compensation, and oversight of the work of any compensation consultant, legal counsel, or other adviser that it retains. The Company bears all expenses of such service providers.

Risk Assessments

With respect to risk related to compensation matters, the CNCG Committee considers, in establishing and reviewing the Company’s compensation program, whether the program encourages unnecessary or excessive risk taking. Executives’ base salaries are fixed in amount and thus do not encourage risk-taking. Bonuses are tied to overall corporate performance. A portion of compensation provided to the executive officers may be in the form of options, restricted stock units and restricted stock that are important to help further align executives’ interests with those of the Company’s stockholders. The CNCG Committee believes that our compensation program does not encourage unnecessary or excessive risk-taking.

Executive Compensation Program Elements

We design the mix of our pay elements to most effectively support our strategic priorities of quality, growth, operational excellence and the retention of high performing talent. In 2017, our compensation consisted of the following components:

Base Salary

The CNCG Committee determine our NEOs’ base salary based on a number of factors, including:

| |

| ◦ | The nature, responsibilities and duties of the officer's position; |

| |

| ◦ | The officer's expertise, demonstrated leadership ability and prior performance; |

| |

| ◦ | The officer's salary history and total compensation, including annual cash bonuses and long-term incentive compensation; and |

| |

| ◦ | The competitiveness of the market for the officer's services. |

We intend for the base salaries of our NEOs to provide a minimum level of compensation for highly qualified executives. The base salaries of our NEOs are subject to occasional modification based on an evaluation of each executive’s contribution, experience, responsibilities, external market data as well as the relative pay among senior executives at the Company. Each factor is considered on a discretionary basis without formulas or weights. We consider relative pay between executives because our perspective is that some consistency in pay emphasizes teamwork across the senior leadership level. In fiscal year 2017, as part of its annual review of executive compensation, the CNCG Committee reviewed the base salaries of our NEOs, focusing on the competitiveness of salaries. The salaries of our NEOs in 2017 increased from 0% to 5% compared to their 2016 salaries. See "Executive Compensation- Summary Compensation Table" for amounts.

Annual Cash Incentive

We intend that bonuses paid to our NEOs will reward them for the achievement of successful financial, strategic, and operational performance over a short period of time. Each NEO was eligible to earn an annual cash incentive in 2017 under the 2017 bonus program which covers all employees. In March, the CNCG Committee approved the bonus pool calculation parameters for 2017. A portion of the pool is determined by measuring underwriting income against performance goals, which could result in a bonus pool of 0% to 150% of the target bonus allocation according to the following matrix:

|

| | | | |