- CWH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Camping World (CWH) DEF 14ADefinitive proxy

Filed: 3 Apr 20, 8:05am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | Filed by a Party other than the Registranto | |||||||

Check the appropriate box: | ||||||||

o | Preliminary Proxy Statement | |||||||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

ý | Definitive Proxy Statement | |||||||

o | Definitive Additional Materials | |||||||

o | Soliciting Material Pursuant to §240.14a-12 | |||||||

| CAMPING WORLD HOLDINGS, INC. | ||||

(Name of Registrant as Specified in its Charter) | ||||

Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials: | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount previously paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Camping World Holdings, Inc. | ||

| NOTICE & PROXY STATEMENT | ||

Annual Meeting of Stockholders | ||

May 15, 2020 1:30 p.m. (Central Time) | ||

| | | |

CAMPING WORLD HOLDINGS, INC. |

April 3, 2020

To Our Stockholders:

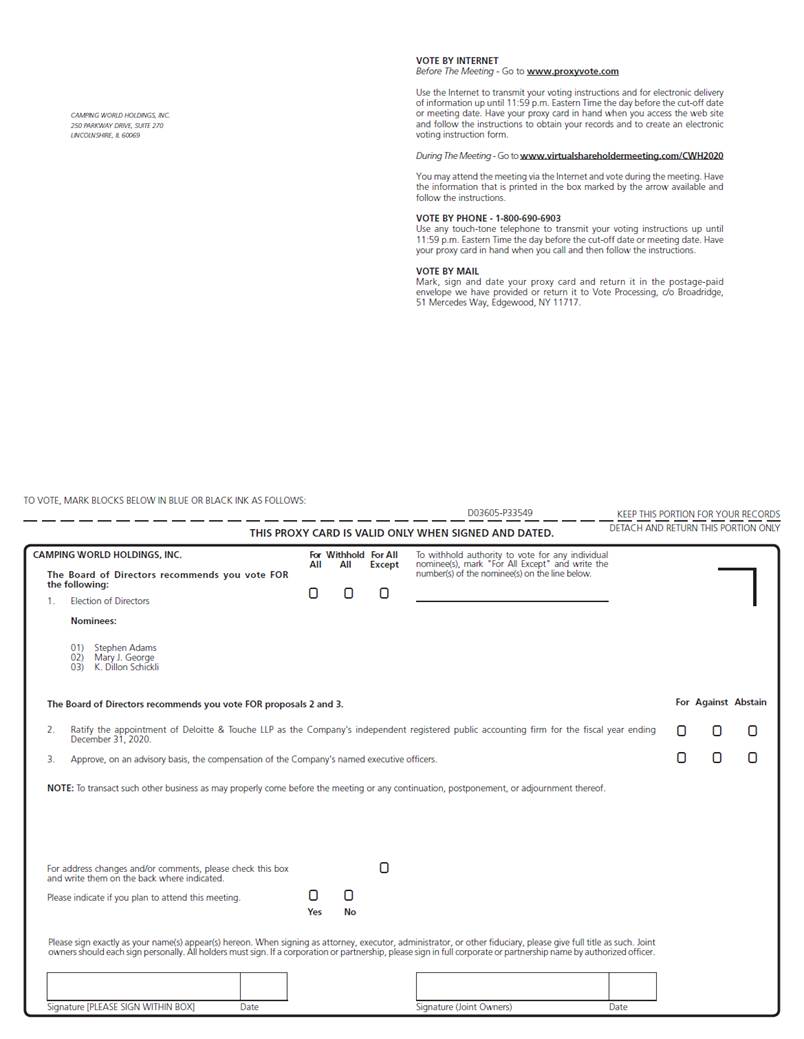

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Camping World Holdings, Inc. (the "Company") to be held on Friday, May 15, 2020 at 1:30 p.m., Central Time. Our Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CWH2020. Utilizing the latest technology and a virtual meeting format will allow stockholders to participate from any location and we expect will lead to increased attendance, improved communications and cost savings for our stockholders and the Company.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Details regarding how to attend the meeting and the business to be conducted at the Annual Meeting are more fully described in the Notice of Annual Meeting and Proxy Statement.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote your shares electronically, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

/s/ Marcus A. Lemonis

Marcus A. Lemonis

Chief Executive Officer and Chairman of the Board of Directors

Notice of Annual Meeting of Stockholders |

CAMPING WORLD HOLDINGS, INC.

250 PARKWAY DRIVE, SUITE 270, LINCOLNSHIRE, ILLINOIS 60069

The Annual Meeting of Stockholders (the "Annual Meeting") of Camping World Holdings, Inc., a Delaware corporation (the "Company"), will be held at 1:30 p.m., Central Time, on Friday, May 15, 2020. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting electronically and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CWH2020. The Annual Meeting is called for the following purposes:

| To elect Stephen Adams, Mary J. George and K. Dillon Schickli as Class I Directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; | |||

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; | |||

To approve, on an advisory basis, the compensation of our named executive officers; and | |||

To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

Holders of record of our outstanding shares of capital stock, composed of Class A common stock, Class B common stock and Class C common stock, at the close of business on March 20, 2020, are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these stockholders will be available for examination by any stockholder during the ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to InvestorRelations@CampingWorld.com, stating the purpose of the request and providing proof of ownership of Company stock. This list of stockholders will also be available on the bottom panel of your screen during the meeting after entering the 16 digit control number included on the Notice of Internet Availability of Proxy Materials or any proxy card that you received, or on the materials provided by your bank or broker. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

/s/ Melvin Flanigan

Melvin Flanigan

Chief Financial Officer and Secretary

Lincolnshire, Illinois

April 3, 2020

CONTENTS |

| | Page | |

|---|---|---|

PROXY STATEMENT | 1 | |

PROPOSALS | 2 | |

RECOMMENDATIONS OF THE BOARD | 2 | |

INFORMATION ABOUT THIS PROXY STATEMENT | 3 | |

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS | 4 | |

PROPOSALS TO BE VOTED ON | 9 | |

PROPOSAL 1: Election of Directors | 9 | |

PROPOSAL 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 15 | |

Report of the Audit Committee of the Board of Directors | 17 | |

Independent Registered Public Accounting Firm Fees and Other Matters | 18 | |

PROPOSAL 3: Advisory Vote on the Compensation of our Named Executive Officers | 19 | |

EXECUTIVE OFFICERS | 20 | |

CORPORATE GOVERNANCE | 21 | |

GENERAL | 21 | |

BOARD COMPOSITION | 21 | |

VOTING AGREEMENT | 21 | |

DIRECTOR INDEPENDENCE | 23 | |

CONTROLLED COMPANY EXEMPTION | 23 | |

DIRECTOR CANDIDATES | 24 | |

COMMUNICATIONS FROM INTERESTED PARTIES | 25 | |

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT | 25 | |

ANTI-HEDGING POLICY | 26 | |

CODE OF ETHICS | 26 | |

ATTENDANCE BY MEMBERS OF THE BOARD OF DIRECTORS AT MEETINGS | 26 | |

EXECUTIVE SESSIONS | 26 | |

COMMITTEES OF THE BOARD | 27 | |

AUDIT COMMITTEE | 27 | |

COMPENSATION COMMITTEE | 28 | |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | 29 | |

EXECUTIVE COMPENSATION | 30 | |

COMPENSATION DISCUSSION AND ANALYSIS | 30 | |

EXECUTIVE SUMMARY | 30 | |

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 40 | |

NARRATIVE TO SUMMARY COMPENSATION TABLE AND GRANTS OF PLAN-BASED AWARDS TABLE | 42 | |

DIRECTOR COMPENSATION | 54 | |

2019 DIRECTOR COMPENSATION TABLE | 54 | |

NARRATIVE DISCLOSURE TO DIRECTOR COMPENSATION TABLE | 55 | |

COMPENSATION COMMITTEE REPORT | 57 | |

CEO PAY RATIO | 58 |

i

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 59 | |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 64 | |

POLICIES AND PROCEDURES FOR RELATED PERSON TRANSACTIONS | 64 | |

TRANSACTIONS RELATED TO DIRECTORS, EQUITY HOLDERS AND EXECUTIVE OFFICERS | 64 | |

OTHER MATTERS | 69 | |

DELINQUENT SECTION 16(A) REPORTS | 69 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 69 | |

STOCKHOLDERS' PROPOSALS | 69 | |

OTHER MATTERS AT THE ANNUAL MEETING | 70 | |

SOLICITATION OF PROXIES | 70 | |

CAMPING WORLD'S ANNUAL REPORT ON FORM 10-K | 70 |

ii

|

PROXY STATEMENT |

CAMPING WORLD HOLDINGS, INC. |

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Camping World Holdings, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday, May 15, 2020 (the "Annual Meeting"), at 1:30 p.m., Central Time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CWH2020 and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of outstanding shares of capital stock, composed of Class A common stock, Class B common stock and Class C common stock (collectively, "Common Stock"), at the close of business on March 20, 2020 (the "Record Date"), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting, and will vote together as a single class on all matters presented at the Annual Meeting. Each share of our Class A common stock and Class B common stock entitles its holders to one vote per share on all matters presented to our stockholders generally, except that the shares of Class B common stock held by ML Acquisition Company, which is indirectly owned by each of Stephen Adams and the Company's Chairman and Chief Executive Officer, Marcus A. Lemonis ("ML Acquisition," and together with its permitted transferees, "ML Related Parties"), are entitled to the number of votes necessary such that the shares, in the aggregate, cast 47% of the total votes eligible to be cast by all holders of our Common Stock voting together as a single class on all matters presented to a vote of our stockholders at the Annual Meeting. Additionally, the one share of outstanding Class C common stock entitles its holder, ML RV Group, LLC, which is wholly-owned by Mr. Lemonis ("ML RV Group"), to the number of votes necessary such that the holder casts 5% of the total votes eligible to be cast by all holders of our Common Stock, voting together as a single class on all matters presented to a vote of our stockholders at the Annual Meeting. At the close of business on the Record Date, there were 37,539,786 shares of Class A common stock, 50,706,629 shares of Class B common stock and one share of Class C common stock issued and outstanding and entitled to vote at the Annual Meeting, representing 33.1%, 61.1%, and 5.0% combined voting power of our Common Stock, respectively.

This proxy statement and the Company's Annual Report to Stockholders for the fiscal year ended December 31, 2019 (the "2019 Annual Report") will be released on or about April 3, 2020 to our stockholders on the Record Date.

In this proxy statement, "we," "us," "our," the "Company" and "Camping World" refer to Camping World Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including CWGS Enterprises, LLC, which we refer to as "CWGS, LLC" and, unless otherwise stated, all of its subsidiaries.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON FRIDAY, MAY 15, 2020

This Proxy Statement and our 2019 Annual Report to Stockholders are available at http://www.proxyvote.com/

1

PROPOSALS |

At the Annual Meeting, our stockholders will be asked:

| To elect Stephen Adams, Mary J. George and K. Dillon Schickli as Class I Directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; | ||

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; | ||

To approve, on an advisory basis, the compensation of our named executive officers; and | ||

To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company's proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD |

The Board of Directors (the "Board") recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted, and the Board recommends that you vote:

| FOR the election of Stephen Adams, Mary J. George and K. Dillon Schickli as Class I Directors; | ||

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and | ||

FOR the approval, on an advisory basis, of the compensation of our named executive officers. |

2

INFORMATION ABOUT THIS PROXY STATEMENT |

Why you received this proxy statement. You are viewing or have received these proxy materials because Camping World's Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (the "SEC") and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, Camping World is making this proxy statement and its 2019 Annual Report available to its stockholders electronically via the Internet. On or about April 3, 2020, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the "Internet Notice") containing instructions on how to access this proxy statement and our 2019 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in this proxy statement and 2019 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC's rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate set of proxy materials, as requested, to any stockholder at the shared address to which a single set of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at 1 866 540 7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one set of future proxy materials for your household, please contact Broadridge at the above phone number or address.

3

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS |

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING? |

The Record Date for the Annual Meeting is March 20, 2020. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. You will need to obtain your own Internet access if you choose to attend the Annual Meeting and/or vote over the Internet. Each share of our Class A common stock and Class B common stock entitles its holders to one vote per share on all matters presented to our stockholders generally, except that the shares of Class B common stock held by ML Acquisition are entitled to the number of votes necessary such that the shares, in the aggregate, cast 47% of the total votes eligible to be cast by all holders of our Common Stock voting together as a single class on all matters presented to a vote of our stockholders at the Annual Meeting. Additionally, the one share of outstanding Class C common stock entitles its holder, ML RV Group, LLC, to the number of votes necessary such that the holder casts 5% of the total votes eligible to be cast by all holders of our Common Stock, voting together as a single class on all matters presented to a vote of our stockholders at the Annual Meeting. At the close of business on the Record Date, there were 37,539,786 shares of Class A common stock, 50,706,629 shares of Class B common stock and one share of Class C common stock issued and outstanding and entitled to vote at the Annual Meeting, representing 33.9%, 61.1%, and 5.0% combined voting power of our Common Stock, respectively.

WHAT IS THE DIFFERENCE BETWEEN BEING A "RECORD HOLDER" AND HOLDING SHARES IN "STREET NAME"? |

A record holder holds shares in his or her name. Shares held in "street name" means shares that are held in the name of a bank or broker on a person's behalf.

AM I ENTITLED TO VOTE IF MY SHARES ARE HELD IN "STREET NAME"? |

Yes. If your shares are held by a bank or a brokerage firm, you are considered the "beneficial owner" of those shares held in "street name." If your shares are held in street name, our proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If you haven't received a 16-digit control number, you should contact your bank or broker to obtain your control number or otherwise vote through the bank or broker.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING? |

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, electronically or by proxy, of the holders of a majority in voting power of Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

WHO CAN ATTEND THE 2020 ANNUAL MEETING OF STOCKHOLDERS? |

You may attend the Annual Meeting only if you are a Camping World stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. The Annual Meeting will be held entirely online to allow greater participation. You will be able to attend the Annual

4

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS

Meeting and submit your questions by visiting the following website: www.virtualshareholdermeeting.com/CWH2020. You will also be able to vote your shares electronically at the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 1:30 p.m., Central Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 1:15 p.m., Central Time, and you should allow ample time for check-in procedures. If you hold your shares through a bank or broker, instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you lose your 16-digit control number, you may join the Annual Meeting as a "Guest," but you will not be able to vote, ask questions, or access the list of stockholders as of the Record Date.

WHY A VIRTUAL MEETING? |

We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for us and our stockholders. We believe the virtual meeting will enable increased stockholder attendance and participation since stockholders can participate from any location around the world. Furthermore, as part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the COVID-19 pandemic, we believe that hosting a virtual meeting is in the best interests of the Company and such attendees of the Annual Meeting.

WHAT IF DURING THE CHECK-IN TIME OR DURING THE ANNUAL MEETING I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL MEETING WEBSITE? |

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call technical support at 1-800-586-1548 (U.S.) or 1-303-562-9288 (International).

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING? |

If a quorum is not present at the scheduled time of the Annual Meeting, (i) the chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present electronically or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE OR MORE THAN ONE SET OF PROXY MATERIALS? |

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

5

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS

HOW DO I VOTE? |

We recommend that stockholders vote by proxy even if they plan to participate in the Annual Meeting and vote electronically during the meeting. If you are a stockholder of record, there are three ways to vote by proxy:

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on May 14, 2020. Stockholders may vote at the Annual Meeting by visiting www.virtualshareholdermeeting.com/CWH2020 and entering the 16-digit control number included on your Internet Notice, proxy card or the instructions that accompanied your proxy materials. The Annual Meeting webcast will begin promptly at 1:30 p.m., Central Time, on May 15, 2020.

If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares at the Annual Meeting, you may visit www.virtualshareholdermeeting.com/CWH2020 and enter the 16-digit control number included in the voting instruction card provided to you by your bank or brokerage firm. If you hold your shares in street name and you do not receive a 16-digit control number, you may need to log in to your bank or brokerage firm's website and select the shareholder communications mailbox to access the meeting and vote. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm.

CAN I CHANGE MY VOTE AFTER I SUBMIT MY PROXY? |

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your virtual attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote electronically during the Annual Meeting.

6

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote electronically during the Annual Meeting.

WHO WILL COUNT THE VOTES? |

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED? |

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board's recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE ANNUAL MEETING? |

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company's proxy card will vote your shares in accordance with their best judgment.

HOW MANY VOTES ARE REQUIRED FOR THE APPROVAL OF THE PROPOSALS TO BE VOTED UPON AND HOW WILL ABSTENTIONS AND BROKER NON-VOTES BE TREATED? |

| Proposal | Votes required | Effect of Votes Withheld / Abstentions and Broker Non-Votes | ||

| | | | | |

| Proposal 1: Election of Directors | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative "FOR" votes will be elected as Class I Directors. | Votes withheld and broker non-votes will have no effect. | ||

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company that are present electronically or by proxy and entitled to vote on the proposal. | Abstentions will have the same effect as votes against the proposal. We do not expect any broker non-votes on this proposal. | ||

| Proposal 3: Advisory Vote on the Compensation of Camping World's Named Executive Officers | The affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company that are present electronically or by proxy and entitled to vote on the proposal. | Abstentions will have the same effect as votes against the proposal. Broker non-votes will have no effect. |

WHAT IS AN ABSTENTION AND HOW WILL VOTES WITHHELD AND ABSTENTIONS BE TREATED? |

A "vote withheld," in the case of the proposal regarding the election of directors, or an "abstention," in the case of the two other proposals to be voted on at the Annual Meeting, represents a stockholder's affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have the same effect as a vote against the ratification of the

7

QUESTIONS AND ANSWERS ABOUT THE 2020 ANNUAL MEETING OF STOCKHOLDERS

appointment of Deloitte & Touche LLP and the advisory vote on the compensation of our named executive officers.

WHAT ARE BROKER NON-VOTES AND DO THEY COUNT FOR DETERMINING A QUORUM? |

Generally, broker non-votes occur when shares held by a broker in "street name" for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors and the advisory vote on the compensation of our named executive officers. Broker non-votes count for purposes of determining whether a quorum is present.

WHERE CAN I FIND THE VOTING RESULTS OF THE 2020 ANNUAL MEETING OF STOCKHOLDERS? |

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC shortly after the Annual Meeting.

8

PROPOSALS TO BE VOTED ON |

PROPOSAL 1: Election of Directors |

At the Annual Meeting, three (3) Class I Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2023 and until such director's successor is elected and qualified or until such director's earlier death, resignation or removal.

We currently have nine (9) directors on our Board. The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative "FOR" votes will be elected as Class I Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

Our Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the third annual meeting of stockholders following election or such director's death, resignation or removal, whichever is earliest to occur. The current class structure is as follows: Class I, whose term currently expires at the 2020 Annual Meeting of Stockholders and whose subsequent term will expire at the 2023 Annual Meeting of Stockholders; Class II, whose term will expire at the 2021 Annual Meeting of Stockholders; and Class III, whose term will expire at the 2022 Annual Meeting of Stockholders. The current Class I Directors are Stephen Adams, Mary J. George and K. Dillon Schickli; the current Class II Directors are Andris A. Baltins, Daniel G. Kilpatrick and Brent L. Moody; and the current Class III Directors are Brian P. Cassidy, Marcus A. Lemonis and Michael W. Malone. Jeffrey A. Marcus, a former Class II Director, resigned from the Board, effective February 1, 2020, and Mr. Kilpatrick was elected as a Class II Director on the same date.

Under the Voting Agreement (as defined under "Corporate Governance—Voting Agreement"), ML Acquisition has been deemed to have designated Messrs. Adams, Baltins and Schickli and ML RV Group has been deemed to have designated Mr. Lemonis, for the applicable elections to our Board. Also under the Voting Agreement, Crestview Advisors L.L.C. ("Crestview") has been deemed to have designated Messrs. Cassidy and Kilpatrick for the applicable elections to our Board. As a result of the Voting Agreement and the aggregate voting power of the parties to the agreement, we expect that the parties to the agreement acting in conjunction will control the election of directors at Camping World. For more information, see "Corporate Governance—Voting Agreement".

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented by the proxy for the election as Class I Directors the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve or for good cause will not serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

9

PROPOSAL 1 – ELECTION OF DIRECTORS

VOTE REQUIRED |

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative "FOR" votes will be elected as Class I Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS |

| The Board of Directors unanimously recommends a vote FOR the election of the below Class I Director nominees. |

NOMINEES FOR CLASS I DIRECTORS (CURRENT TERMS TO EXPIRE AT THE 2020 ANNUAL MEETING) |

The nominees for election to the Board as Class I Directors are as follows:

Name | Age | Served as a Director Since | Positions with Camping World | |||

| | | | | | | |

Stephen Adams | 82 | 2016 | Director | |||

Mary J. George | 69 | 2017 | Director | |||

K. Dillon Schickli | 66 | 2016 | Director | |||

| | | | | | | |

The principal occupations and business experience, for at least the past five years, of each Class I Director nominee are as follows:

| | | |

STEPHEN ADAMS | Age 82 | |

| | | |

Stephen Adams has served on the board of directors of Camping World Holdings, Inc. since March 2016, as the chairman of the board of directors of CWGS, LLC since February 2011, as the chairman of the board of directors of Good Sam Enterprises, LLC since December 1988, as the chairman of the board of directors of Camping World, Inc. since April 1997 and as the chairman of the board of directors of FreedomRoads Holding Company, LLC since February 3, 2005. In addition, Mr. Adams is the chairman of the board of directors and the controlling shareholder of Adams Outdoor Advertising, Inc., which operates an outdoor media advertising business. From November 2011 until April 2012, Mr. Adams inadvertently failed to timely file ownership reports on Forms 4 and 5 and as of the end of calendar year 2011, as of May 15, 2012 and as of the end of calendar year 2012, Mr. Adams mistakenly failed to timely file Schedule 13G amendments with respect to an entity in which he unknowingly accumulated an interest in excess of 5%. As a result, the Securities and Exchange Commission entered an order on September 10, 2014, pursuant to which Mr. Adams agreed to cease and desist from committing or causing any violations of the requirements of Section 13(d) and 16(a) of the Exchange Act and certain of the rules promulgated thereunder and paid a civil money penalty to the SEC without admitting or denying the findings therein. In August 2009, Affinity Bank, a California depositary institution in which Mr. Adams indirectly owned a controlling interest, was closed by the California Department of Financial Institutions and the Federal Deposit Insurance Corporation was appointed as the receiver. Mr. Adams received an M.B.A. from the Stanford Graduate School of Business and a B.S. from Yale University. Mr. Adams' long association with the Company as a chairman of the board of directors of several of its subsidiaries since he acquired Good Sam Enterprises, LLC in 1988 and his current or former ownership of a variety of businesses with significant

10

PROPOSAL 1 – ELECTION OF DIRECTORS

assets and operations during his over 40 year business career, during which time he has had substantial experience in providing management oversight and strategic direction, make him well qualified to serve on our board of directors.

| | | |

MARY J. GEORGE | Age 69 | |

| | | |

Mary J. George has served on the board of directors of Camping World Holdings, Inc. since January 2017. Ms. George has also served as executive chairman of Ju Be, a retailer of premium diaper bags and other baby products since January 2018. Ms. George has been a founding partner of Morningstar Capital Investments, LLC, an investment firm, since 2001. Ms. George served as chief executive officer and a director at Easton Hockey Holdings Inc., a private manufacturer of ice hockey equipment, from August 2014 to December 2016. From 2002 to 2015, Ms. George held various positions, including co chairman (2002 to 2009) and vice chairman (2009 to 2015), at Bell Automotive Products, Inc., a private manufacturer of automotive accessories. From 1994 to 2004, Ms. George held various positions, including chief operating officer (1995 to 1998), chief executive officer (1998 to 2000), and chairman (2000 to 2004), at Bell Sports Inc., a formerly public helmet manufacturer. Ms. George also currently serves or previously served as a director of various public and private companies, including Image Entertainment, Inc., a formerly public independent distributor of home entertainment programming, from 2010 to 2012, Oakley, Inc., a public sports equipment and lifestyle accessories manufacturer, from 2004 to 2007, BRG Sports Inc. since 2013, 3 Day Blinds Inc. from 2007 to 2015, and Oreck Corporation from 2008 to 2012. Ms. George's experience in sales, marketing and general management in the consumer products industry, as well as success in the development of internationally renowned branded products, provides our board of directors with greater insight in the areas of product branding and strategic growth in the consumer products industry, and make her well qualified to serve on our board of directors.

| | | |

K. DILLON SCHICKLI | Age 66 | |

| | | |

K. Dillon Schickli has served on the board of directors of Camping World Holdings, Inc. since March 2016 and on the board of directors of CWGS, LLC since August 2011. Mr. Schickli previously served on the board of directors of CWGS, LLC from 1990 until 1995 and was chief operating officer of Affinity Group, Inc., the predecessor of Good Sam Enterprises, LLC, from 1993 until 1995. Previously, Mr. Schickli was a co investor with Crestview in DS Waters Group, Inc. ("DS Waters") and served as vice chairman of its board of directors until it was sold to Cott Corporation in December 2014. Prior to that time, Mr. Schickli was the chief executive officer of DS Waters from June 2010 until February 2013 and subsequently led the buyout of the business by Crestview. Mr. Schickli also previously led the buyout of DS Waters from Danone Group & Suntory Ltd. in November 2005 and was also a co investor in DS Waters with Kelso & Company. Mr. Schickli served as co-chief executive officer and chief financial officer of DS Waters from November 2005 until June 2010, when he became the sole chief executive officer. Mr. Schickli started his business career in the capital planning and acquisitions group of the Pepsi Cola Company after he received his M.B.A. from the University of Chicago. Mr. Schickli received a B.A. from Carleton College in 1975. Mr. Schickli's long association with, and knowledge of, the Company, extensive experience serving as a director of other businesses, operating experience as a chief executive officer and his experience as a private equity investor with respect to acquisitions, debt financings, equity and financings make him well qualified to serve on our board of directors.

11

PROPOSAL 1 – ELECTION OF DIRECTORS

CONTINUING MEMBERS OF THE BOARD OF DIRECTORS: |

The current members of the Board who are Class II Directors are as follows:

Name | Age | Served as a Director Since | Positions with Camping World | |||

| | | | | | | |

Andris A. Baltins | 74 | 2016 | Director | |||

Daniel G. Kilpatrick | 39 | 2020 | Director | |||

Brent L. Moody | 58 | 2018 | President | |||

| | | | | | | |

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

| | | |

ANDRIS A. BALTINS | Age 74 | |

| | | |

Andris A. Baltins has served on the board of directors of Camping World Holdings, Inc. since March 2016, on the board of directors of CWGS, LLC since February 2011 and on the board of directors of Good Sam Enterprises, LLC since February 2006. He has been a member of the law firm of Kaplan, Strangis and Kaplan, P.A. since 1979. Mr. Baltins serves as a director of various private and nonprofit corporations, including Adams Outdoor Advertising, Inc., which is controlled by Mr. Adams. Mr. Baltins previously served as a director of Polaris Industries, Inc. from 1995 until 2011. Mr. Baltins received a J.D. from the University of Minnesota Law School and a B.A. from Yale University. Mr. Baltins' over 40 years of legal career as an advisor to numerous public and private companies and his experience in the areas of complex business transactions, mergers and acquisitions and corporate law make him well qualified to serve on our board of directors.

| | | |

DANIEL G. KILPATRICK | Age 39 | |

| | | |

Daniel G. Kilpatrick has served on the board of directors of Camping World Holdings, Inc. since January 2020. Mr. Kilpatrick previously served on the Camping World Holdings, Inc. board of directors from January 2017 to May 2018. Mr. Kilpatrick currently serves as a Partner at Crestview, where he joined in 2009 and oversees investments in companies across a variety of industries, including media and financial services. Mr. Kilpatrick is currently on the board of directors of various Crestview portfolio companies, including WideOpenWest, Inc., Congruex, LLC, Industrial Media Ltd, Venerable Holdings, Inc. and ICM Partners and is a board observer of Fidelis Insurance Holdings Limited. Mr. Kilpatrick received an M.B.A. from the Stanford Graduate School of Business and a B.A. from Yale University. Mr. Kilpatrick's public company director experience and background with respect to acquisitions, debt financings and equity financings make him well-qualified to serve on our board of directors.

| | | |

BRENT L. MOODY | Age 58 | |

| | | |

Brent L. Moody has served as Camping World Holdings, Inc.'s President and the President of CWGS, LLC since September 2018. Mr. Moody previously served as Camping World Holdings, Inc.'s Chief Operating and Legal Officer from March 2016 to September 2018, as the Chief Operating and Legal Officer of CWGS, LLC and its subsidiaries from January 2016 to September 2018, as the Executive Vice President and Chief Administrative and Legal Officer of CWGS, LLC from February 2011 to December 31, 2015, as the Executive Vice President and Chief Administrative and Legal

12

PROPOSAL 1 – ELECTION OF DIRECTORS

Officer of Good Sam Enterprises, LLC from January 2011 to December 31, 2015, as the Executive Vice President and Chief Administrative and Legal Officer of FreedomRoads, LLC and Camping World, Inc. from 2010 until December 31, 2015, as Executive Vice President/General Counsel and Business Development of Camping World, Inc. and FreedomRoads, LLC from 2006 to 2010, as Senior Vice President/General Counsel and Business Development of Camping World, Inc. and Good Sam Enterprises, LLC from 2004 to 2006 and as Vice President and General Counsel of Camping World, Inc. from 2002 to 2004. From 1998 to 2002, Mr. Moody was a shareholder of the law firm of Greenberg Traurig, P.A. From 1996 to 1998, Mr. Moody served as vice president and assistant general counsel for Blockbuster, Inc. Mr. Moody received a J.D. from Nova Southeastern University, Shepard Broad Law Center and a B.S. from Western Kentucky University. Mr. Moody's extensive legal experience, his experience in various areas of complex business transactions and mergers and acquisitions, and his extensive knowledge of the Company's operations make him well qualified to serve on our board of directors.

CONTINUING MEMBERS OF THE BOARD OF DIRECTORS: |

The current members of the Board who are Class III Directors are as follows:

Name | Age | Served as a Director Since | Positions with Camping World | |||

| | | | | | | |

Brian P. Cassidy | 46 | 2016 | Director | |||

Marcus A. Lemonis | 46 | 2016 | Chief Executive Officer and Chairman of the Board | |||

Michael W. Malone | 61 | 2019 | Director | |||

| | | | | | | |

The principal occupations and business experience, for at least the past five years, of each Class III Director are as follows:

| | | |

BRIAN P. CASSIDY | Age 46 | |

| | | |

Brian P. Cassidy has served on the board of directors of Camping World Holdings, Inc. since March 2016 and on the board of directors of CWGS, LLC since March 2011. Mr. Cassidy is a Partner at Crestview, which he joined in 2004, and currently serves as head of Crestview's media and communications strategy. Mr. Cassidy has served as a director of WideOpenWest, Inc., a public company, since December 2015, and has served as a director of various private companies, including Hornblower Holdings since April 2018, Congruex LLC since November 2017, and Industrial Media since October 2016. Mr. Cassidy previously served as a director of Cumulus Media, Inc., a public company, from May 2014 until March 2017, and served as a director of various private companies, including NEP Group, Inc. from December 2012 to October 2018 and Interoute Communications Holdings from April 2015 to May 2018. He was also involved with Crestview's investments in Charter Communications, Inc. and Insight Communications, Inc. Prior to joining Crestview, Mr. Cassidy worked in private equity at Boston Ventures, where he invested in companies in the media and communications, entertainment and business services industries. Previously, he worked as the acting chief financial officer of one of Boston Ventures' portfolio companies. Prior to that time, Mr. Cassidy was an investment banking analyst at Alex, Brown & Sons, where he completed a range of financing and mergers and acquisitions assignments for companies in the consumer and business services sectors. Mr. Cassidy received an M.B.A. from the Stanford Graduate School of Business and an A.B. in Physics from Harvard College. Mr. Cassidy's private equity investment and company oversight experience and

13

PROPOSAL 1 – ELECTION OF DIRECTORS

background with respect to acquisitions, debt financings and equity financings make him well qualified to serve on our board of directors.

| | | |

MARCUS A. LEMONIS | Age 46 | |

| | | |

Marcus A. Lemonis has served as Camping World Holdings, Inc.'s Chairman and Chief Executive Officer and on the board of directors of Camping World Holdings, Inc. since March 2016, as the President and Chief Executive Officer and on the board of directors of CWGS, LLC since February 2011, as the Chief Executive Officer and on the board of directors of Good Sam Enterprises, LLC since January 2011, as President and Chief Executive Officer and on the board of directors of Camping World, Inc. since September 2006 and as the President and Chief Executive Officer and on the board of directors of FreedomRoads, LLC since May 1, 2003. Mr. Lemonis received a B.A. from Marquette University. Mr. Lemonis' extensive experience in retail, RV and automotive, business operations and entrepreneurial ventures makes him well qualified to serve on our board of directors.

| | | |

MICHAEL W. MALONE | Age 61 | |

| | | |

Michael W. Malone has served on the board of directors of Camping World Holdings, Inc. since May 2019. Mr. Malone was Vice President, Finance and Chief Financial Officer of Polaris Industries Inc. ("Polaris"), a manufacturer of power sports vehicles, from January 1997 to July 2015 and retired from Polaris in March 2016. From January 1997 to January 2010, Mr. Malone also served as Corporate Secretary. Mr. Malone was Vice President and Treasurer of Polaris from December 1994 to January 1997 and was Chief Financial Officer and Treasurer of a predecessor company of Polaris from January 1993 to December 1994. Mr. Malone joined Polaris in 1984 after four years with Arthur Andersen LLP. Mr. Malone has served on the board of Armstrong Flooring, Inc., a public company, since October 2016, including on the Audit, Finance and Nominating and Corporate Governance Committees, and the board of Stevens Equipment Supply LLC, a private company, since May 2011 as well as the boards of various non-profit organizations. Mr. Malone received a B.A. in accounting and business administration from St. John's University (Collegeville, Minnesota). We believe Mr. Malone's experiences as the former Chief Financial Officer of a public company, his public company board experience, and his in-depth knowledge of the outdoor lifestyle industry make him well qualified to serve on our board of directors.

We believe that all of our current Board members and nominees for Class I directors possess the professional and personal qualifications necessary for Board service, and have highlighted particularly noteworthy attributes for each Board member and nominee in the individual biographies above.

14

PROPOSAL 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

Our Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Our Board has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of Deloitte & Touche LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

On May 18, 2018, our Audit Committee approved the engagement of Deloitte & Touche LLP as the Company's independent registered public accounting firm and Deloitte & Touche LLP served as our independent registered public accounting firm for the fiscal years ended December 31, 2019 and 2018. Neither Deloitte & Touche LLP nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of Deloitte & Touche LLP is expected to attend the Annual Meeting, have an opportunity to make a statement if he or she desires to do so, and be available to respond to appropriate questions from stockholders.

On May 18, 2018, our Audit Committee dismissed Ernst & Young LLP as the Company's independent registered public accounting firm. The reports of Ernst & Young LLP on the Company's financial statements for each of the two fiscal years ended December 31, 2016 and 2017 did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. In the fiscal years ended December 31, 2016 and 2017 and in the subsequent interim period through May 18, 2018, there were no "disagreements" (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K) between the Company and Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which, if not resolved to the satisfaction of Ernst & Young LLP, would have caused Ernst & Young LLP to make reference to the matter in its report on the financial statements for such years.

In the fiscal years ended December 31, 2016 and 2017 and in the subsequent interim period through May 18, 2018, there were no "reportable events" (as described in Item 304(a)(1)(v) of Regulation S-K), except that, as reported in Part II, Item 9A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the "2017 10-K"), the Company reported material weaknesses in its internal control over financial reporting during such period. As disclosed in the 2017 10-K, the Company concluded that its internal control over financial reporting was not effective as of December 31, 2017 due to the existence of material weaknesses in the Company's internal control over financial reporting related to (i) insufficient analysis to correctly determine the portion of the deferred tax asset resulting from the Company's direct investment in CWGS Enterprises, LLC not expected to be realized, (ii) the insufficient documentation and/or execution of certain accounting policies and procedures within FreedomRoads Holding Company, LLC, which operates the Company's RV dealerships, and (iii) ineffective transaction level and management review controls over the valuation of trade-in unit inventory. Ernst & Young LLP's report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2017, which was included in the 2017 10-K, contained an adverse opinion thereon. The Audit Committee discussed the material weaknesses in the Company's internal control over financial reporting with Ernst & Young LLP, and authorized Ernst & Young LLP to respond fully to the inquiries of Deloitte & Touche LLP concerning such material weaknesses.

15

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company provided Ernst & Young LLP with a copy of the disclosures contained in its Current Report on Form 8 K (the "Current Report") filed with the SEC on May 22, 2018 and requested that Ernst & Young LLP furnish the Company with a letter addressed to the SEC stating whether it agreed with the statements contained in the Current Report. A copy of Ernst & Young LLP's letter, dated May 22, 2018, was filed as Exhibit 16.1 to the Current Report.

During the fiscal years ended December 31, 2016 and 2017 and the subsequent interim period through May 18, 2018, neither the Company nor anyone on its behalf consulted with Deloitte & Touche LLP with respect to (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was either the subject of a "disagreement" (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a "reportable event" (as described in Item 304(a)(1)(v) of Regulation S-K).

In the event that the appointment of Deloitte & Touche LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2021. Even if the appointment of Deloitte & Touche LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interests of Camping World.

VOTE REQUIRED |

This proposal requires the approval of the affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company that are present electronically or by proxy and entitled to vote thereon. Abstentions will have the same effect as votes against the proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Deloitte & Touche LLP, we do not expect any broker non-votes in connection with this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS |

| The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm. |

16

Report of the Audit Committee of the Board of Directors |

The Audit Committee has reviewed Camping World's audited financial statements for the fiscal year ended December 31, 2019 and has discussed these financial statements with management and Camping World's independent registered public accounting firm. The Audit Committee has also received from, and discussed with, Camping World's independent registered public accounting firm the matters that they are required to provide to the Audit Committee, including the matters required to be discussed by the Public Company Accounting Oversight Board ("PCAOB") and the SEC.

Camping World's independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and Camping World, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm's communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from Camping World.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board that the audited financial statements be included in Camping World's Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

K. Dillon Schickli (Chair)

Mary J. George

Michael W. Malone

17

Independent Registered Public Accounting Firm Fees and Other Matters |

Set forth below are the fees paid to our independent registered public accounting firm, Deloitte & Touche LLP, for the fiscal years ended December 31, 2019 and 2018 (in thousands):

| | | | ||

|---|---|---|---|---|

Fee Category | Fiscal 2019 | Fiscal 2018 | ||

| | | | | |

Audit Fees | $5,875 | $4,921 | ||

Audit-Related Fees | $167 | $— | ||

Tax Fees | $311 | $478 | ||

All Other Fees | $— | $— | ||

Total Fees | $6,353 | $5,399 | ||

| | | | | |

AUDIT FEES |

Audit fees consist of fees for the audit of our consolidated financial statements, the review of the unaudited interim financial statements included in our quarterly reports on Form 10-Q and other professional services provided in connection with statutory and regulatory filings or engagements.

AUDIT-RELATED FEES |

In 2019, audit-related fees related to sell-side due diligence services in connection with a potential divestiture. There were no audit-related fees incurred in 2018.

TAX FEES |

Tax fees consist of fees for a variety of permissible services relating to domestic and partnership tax compliance, tax planning, and tax advice.

ALL OTHER FEES |

There were no other fees incurred in 2019 or 2018.

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PROCEDURES |

Our Audit Committee's charter provides that the Audit Committee, or the chair of the Audit Committee, must pre-approve any audit or non-audit service provided to us by our independent registered public accounting firm, unless the engagement is entered into pursuant to appropriate pre-approval policies established by the Audit Committee or if the service falls within available exceptions under SEC rules. Without limiting the foregoing, the Audit Committee may delegate authority to one or more independent members of the Audit Committee to grant pre-approvals of audit and permitted non-audit services, and any such pre-approvals must be presented to the full Audit Committee at its next scheduled meeting. All services provided by our independent registered public accounting firm in 2018 and 2019 were approved in accordance with such pre-approval policies and consistent with SEC rules.

18

PROPOSAL 3: Advisory Vote on the Compensation of our Named Executive Officers |

This Proposal 3 gives our stockholders the opportunity to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers.

As described in detail under the heading "Compensation Discussion and Analysis," our executive compensation programs are designed to attract, motivate, and retain our named executive officers, who are critical to our success. Please read "Compensation Discussion and Analysis" beginning on page 30 of this proxy statement for additional details about our executive compensation programs. We are asking our stockholders to indicate their support for our named executive officer compensation as described in this proxy statement. This proposal, commonly known as a "say-on-pay" proposal, gives our stockholders the opportunity to express their views on the compensation of our named executive officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and our compensation philosophy, policies and practices for named executive officers described in this proxy statement. Accordingly, we will ask our stockholders to vote "FOR" the following resolution at the Annual Meeting:

"RESOLVED, that the Company's stockholders approve, by a non-binding advisory vote, the compensation of the named executive officers, as disclosed in the Company's Proxy Statement for the 2020 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and narrative discussion."

The say-on-pay vote is advisory, and therefore not binding on the Company, the Board or the Compensation Committee. However, the Board and the Compensation Committee value the opinions of our stockholders and intend to consider our stockholders' views regarding our executive compensation programs.

FREQUENCY OF SAY-ON-PAY VOTE & 2019 SAY-ON-PAY VOTE |

At our 2017 Annual Meeting of Stockholders held on May 16, 2017, the Company's stockholders recommended, on an advisory basis, that the stockholder vote on the compensation of our named executive officers occur every year. In light of the foregoing recommendation, the Company has determined to hold a "say-on-pay" advisory vote every year. Accordingly, our next advisory say-on-pay vote (following the non-binding advisory vote at this Annual Meeting) is expected to occur at our 2021 Annual Meeting of Stockholders. At our 2019 Annual Meeting of Stockholders, approximately 99.3% of the votes cast on the say-on-pay proposal were voted "for" the proposal.

VOTE REQUIRED |

This proposal requires the approval of the affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present electronically or by proxy and entitled to vote thereon. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS |

| The Board of Directors unanimously recommends a vote FOR the approval of the compensation of our named executive officers. |

19

EXECUTIVE OFFICERS |

The following table identifies our current executive officers:

Name | Age | Position | |||

| | | | | | |

Marcus A. Lemonis1 | 46 | Chief Executive Officer and Chairman of the Board | |||

Brent L. Moody2 | 58 | President | |||

Melvin Flanigan3 | 60 | Chief Financial Officer and Secretary | |||

Tamara Ward4 | 52 | Chief Operating Officer |

20

CORPORATE GOVERNANCE |

GENERAL |

Our Board has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of Camping World. You can access our current committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics in the "Governance" section of the "Investor Relations" page of our website located at www.campingworld.com, or by writing to our Secretary at our offices at 250 Parkway Drive, Suite 270, Lincolnshire, Illinois 60069.

BOARD COMPOSITION |

Our Board currently consists of nine (9) members: Stephen Adams, Andris A. Baltins, Brian P. Cassidy, Mary J. George, Daniel G. Kilpatrick, Marcus A. Lemonis, Michael W. Malone, Brent L. Moody, and K. Dillon Schickli. Our Board is currently divided into three classes with staggered, three-year terms. Jeffrey A. Marcus, a former Class II Director, resigned from the Board, effective February 1, 2020, and Mr. Kilpatrick was elected as a Class II Director on the same date. At each annual meeting of stockholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the third annual meeting following election or such director's death, resignation or removal, whichever is earliest to occur. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of the Company. Our directors may be removed only for cause, at a meeting called for that purpose.

VOTING AGREEMENT |

In connection with the initial public offering of our Class A common stock in October 2016 (our "IPO"), ML Acquisition, ML RV Group, CVRV Acquisition II LLC, CVRV Acquisition LLC and Crestview Advisors L.L.C. entered into a Voting Agreement with us (the "Voting Agreement").

Pursuant to the Voting Agreement, Crestview Advisors, L.L.C. ("Crestview"), a registered investment adviser to private equity funds, including funds affiliated with Crestview Partners II GP, L.P., has the right to designate certain of our directors (the "Crestview Directors"), which will be four Crestview Directors (unless Marcus A. Lemonis is no longer our Chief Executive Officer, in which case, Crestview has the right to designate three Crestview Directors) for as long as Crestview Partners II GP, L.P. directly or indirectly, beneficially owns, in the aggregate, 32.5% or more of our Class A common stock, three Crestview Directors for so long as Crestview Partners II GP, L.P., directly or indirectly, beneficially owns, in the aggregate, less than 32.5% but 25% or more of our Class A common stock, two Crestview Directors for as long as Crestview Partners II GP, L.P., directly or indirectly, beneficially owns, in the aggregate, less than 25% but 15% or more of our Class A common stock and one Crestview Director for as long as Crestview Partners II GP, L.P., directly or indirectly, beneficially owns, in the aggregate, less than 15% but 7.5% or more of our Class A common stock (assuming in each such case that all outstanding common units in CWGS, LLC are redeemed for newly-issued shares of our Class A common stock on a one-for-one basis). As of the Record Date, Crestview Partners II GP, L.P. was entitled to designate two Crestview Directors. Each of ML Acquisition and ML RV Group

21

CORPORATE GOVERNANCE

has agreed to vote, or cause to vote, all of their outstanding shares of our Class A common stock, Class B common stock and Class C common stock at any annual or special meeting of stockholders in which directors are elected, so as to cause the election of the Crestview Directors. In addition, the ML Related Parties also have the right to designate certain of our directors (the "ML Acquisition Directors"), which will be four ML Acquisition Directors for as long as the ML Related Parties, directly or indirectly, beneficially own in the aggregate 27.5% or more of our Class A common stock, three ML Acquisition Directors for as long as the ML Related Parties, directly or indirectly, beneficially own, in the aggregate, less than 27.5% but 25% or more of our Class A common stock, two ML Acquisition Directors for as long as the ML Related Parties, directly or indirectly, beneficially own, in the aggregate, less than 25% but 15% or more of our Class A common stock and one ML Acquisition Director for as long as the ML Related Parties, directly or indirectly, beneficially own, in the aggregate, less than 15% but 7.5% or more of our Class A common stock (assuming in each such case that all outstanding common units in CWGS, LLC are redeemed for newly-issued shares of our Class A common stock on a one-for-one basis). Moreover, ML RV Group has the right to designate one director for as long as it holds our one share of Class C common stock (the "ML RV Director"). Funds controlled by Crestview Partners II GP, L.P. have agreed to vote, or cause to vote, all of their outstanding shares of our Class A common stock and Class B common stock at any annual or special meeting of stockholders in which directors are elected, so as to cause the election of the ML Acquisition Directors and the ML RV Director. Additionally, pursuant to the Voting Agreement, we must take commercially reasonable action to cause (i) the Board to be comprised at least of nine directors; (ii) the individuals designated in accordance with the terms of the Voting Agreement to be included in the slate of nominees to be elected to the Board at the next annual or special meeting of stockholders of the Company at which directors are to be elected and at each annual meeting of stockholders of the Company thereafter at which a director's term expires; (iii) the individuals designated in accordance with the terms of the Voting Agreement to fill the applicable vacancies on the Board; and (iv) an ML Acquisition Director or the ML RV Director to be the Chairperson of the Board (as defined in our Amended and Restated Bylaws). The Voting Agreement allows for the Board to reject the nomination, appointment or election of a particular director if such nomination, appointment or election would constitute a breach of the Board's fiduciary duties to the Company's stockholders or does not otherwise comply with any requirements of our Amended and Restated Certificate of Incorporation or Amended and Restated Bylaws or the charter for, or related guidelines of, the Board's nominating and corporate governance committee.

The Voting Agreement further provides that, for so long as Crestview Partners II GP, L.P., directly or indirectly, beneficially owns, in the aggregate, 22.5% or more of our Class A common stock, or the ML Related Parties, directly or indirectly, beneficially own, in the aggregate, 22.5% or more of our Class A common stock (assuming in each such case that all outstanding common units in CWGS, LLC are redeemed for newly-issued shares of our Class A common stock on a one-for-one basis), the approval of Crestview Partners II GP, L.P. and the ML Related Parties, as applicable, will be required for certain corporate actions. These actions include: (1) a change of control; (2) acquisitions or dispositions of assets above $100 million; (3) the issuance of securities of Camping World Holdings, Inc. or any of its subsidiaries (other than under equity incentive plans that have received the prior approval of our Board or in connection with any redemption of common units as set forth in the LLC Agreement); (4) amendments to our or our subsidiaries' Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws or other applicable formation or governing documents; and (5) any change in the size of the Board. The Voting Agreement also provides that, for so long as either Crestview Partners II GP, L.P., directly or indirectly, beneficially owns, in the aggregate, 28% or more

22

CORPORATE GOVERNANCE

of our Class A common stock, or the ML Related Parties, directly or indirectly, beneficially own, in the aggregate, 28% or more of our Class A common stock (assuming in each such case that all outstanding common units of CWGS, LLC are redeemed for newly-issued shares of our Class A common stock, on a one-for-one basis), the approval of Crestview Partners II GP, L.P. and the ML Related Parties, as applicable, will be required for the hiring and termination of our Chief Executive Officer; provided, however, that the approval of Crestview Partners II GP, L.P., and the ML Related Parties, as applicable, will only be required at such time as Marcus A. Lemonis no longer serves as our Chief Executive Officer.

As a result of the Voting Agreement, we expect that the parties to the agreement acting in conjunction will control the election of directors at Camping World.

DIRECTOR INDEPENDENCE |

Our Board has affirmatively determined that each of Andris A. Baltins, Brian P. Cassidy, Mary J. George, Daniel G. Kilpatrick, Michael W. Malone, Jeffrey A. Marcus and K. Dillon Schickli is independent, as defined under rules of the New York Stock Exchange (the "NYSE"). The Board previously determined that Jeffrey A. Marcus and Howard A. Kosick were independent as defined under the rules of the NYSE. In evaluating and determining the independence of the directors, the Board considered that Camping World may have certain relationships with its directors. Specifically, the Board considered that Brian P. Cassidy, Daniel G. Kilpatrick and Jeffrey A. Marcus are affiliated with Crestview Partners II GP, L.P., which is the beneficial owner of outstanding shares of Common Stock representing approximately 18.1% of combined voting power as of March 20, 2020. The Board also considered that Andris A. Baltins is a member of Kaplan, Strangis and Kaplan, P.A., a law firm that provides legal services to the Company from time to time. The Board determined that these relationships do not impair the foregoing directors' independence from us and our management.

CONTROLLED COMPANY EXEMPTION |

Pursuant to the terms of the Voting Agreement, Marcus A. Lemonis, through his beneficial ownership of our shares directly or indirectly held by ML Acquisition and ML RV Group, and certain funds controlled by Crestview Partners II GP, L.P., in the aggregate, have more than 50% of the voting power for the election of directors, and, as a result, we are considered a "controlled company" for the purposes of the NYSE listing requirements. As such, we qualify for, and rely on, exemptions from certain corporate governance requirements. As a result, we are not subject to certain corporate governance requirements, including that a majority of our Board consists of "independent directors," as defined under the rules of the NYSE. In addition, we are not required to have a nominating and corporate governance committee or compensation committee that is composed entirely of independent directors with a written charter addressing the committee's purpose and responsibilities or to conduct annual performance evaluations of the nominating and corporate governance and compensation committees. In the future, we may elect to rely on such exemptions. Accordingly, our stockholders may not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the NYSE.

If at any time we cease to be a "controlled company" under the rules of NYSE, our Board intends to take all action necessary to comply with the NYSE corporate governance rules.

23

CORPORATE GOVERNANCE

DIRECTOR CANDIDATES |