thanks

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to_____

Commission file number: 001-37908

CAMPING WORLD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | 81‑1737145

(I.R.S. Employer

Identification No.) |

250 Parkway Drive, Suite 270

Lincolnshire, IL 60069

Telephone: (847) 808‑3000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Title of each class | Name of each exchange on which registered |

Common Stock, Par Value $0.01 Per Share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the new registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ | Accelerated filer ☐ | Non‑accelerated filer ☒

(Do not check if a

smaller reporting company) | Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of March 13, 2017, the registrant had 18,946,000 shares of Class A common stock outstanding, 62,002,729 shares of Class B common stock outstanding, and one share of Class C common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to its 2017 Annual Meeting of Stockholders to be filed with the SEC within 120 days after the end of the fiscal year ended December 31, 2016 are incorporated herein by reference in Part III.

Camping World Holdings, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2016

INDEX

BASIS OF PRESENTATION

As used in this Annual Report on Form 10-K (this “Form 10-K”), unless the context otherwise requires, references to:

| · | | “we,” “us,” “our,” the “Company,” “Camping World,” “Good Sam” and similar references refer to Camping World Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including CWGS Enterprises, LLC, which we refer to as “CWGS, LLC” and, unless otherwise stated, all of its subsidiaries. |

| · | | “Continuing Equity Owners” refers collectively to ML Acquisition, funds controlled by Crestview Partners II GP, L.P. and the Former Profit Unit Holders and each of their permitted transferees that own common units in CWGS, LLC and who may redeem at each of their options their common units for, at our election (determined solely by our independent directors within the meaning of the rules of the New York Stock Exchange who are disinterested), cash or shares of our Class A common stock. |

| · | | “Crestview” refers to Crestview Advisors, L.L.C., a registered investment adviser to private equity funds, including funds affiliated with Crestview Partners II GP, L.P. |

| · | | “CWGS LLC Agreement” refers to CWGS, LLC’s amended and restated limited liability company agreement, as amended. |

| · | | “Former Equity Owners” refers to those Original Equity Owners controlled by Crestview Partners II GP, L.P. that have exchanged their direct or indirect ownership interests in CWGS, LLC for shares of our Class A common stock in connection with the consummation of our initial public offering (“IPO”). |

| · | | “Former Profit Unit Holders” refers collectively to our named executive officers (excluding Marcus Lemonis), Andris A. Baltins and K. Dillon Schickli, who are members of our board of directors, and certain other current and former non executive employees and former directors, in each case, who held common units of CWGS, LLC pursuant to CWGS, LLC’s equity incentive plan that was in existence prior to our IPO and received common units of CWGS, LLC in exchange for their profit units in CWGS, LLC. |

| · | | “ML Acquisition” refers to ML Acquisition Company, LLC, a Delaware limited liability company, indirectly owned by each of Stephen Adams and our Chairman and Chief Executive Officer, Marcus Lemonis. |

| · | | “ML Related Parties” refers to ML Acquisition and its permitted transferees of common units. |

| · | | “ML RV Group” refers to ML RV Group, LLC, a Delaware limited liability company, wholly owned by our Chairman and Chief Executive Officer, Marcus Lemonis. |

| · | | “Original Equity Owners” refers to the direct and certain indirect owners of interests in CWGS, LLC, collectively, prior to the Reorganization Transactions and Recapitalization (as defined in Note 1 – Summary of Significant Accounting Policies and Note 18 – Stockholders’ Equity to our consolidated financial statements included in Part II, Item 8 of this Form 10-K, respectively) conducted in conjunction with our IPO, including ML Acquisition, funds controlled by Crestview Partners II GP, L.P. and the Former Profit Unit Holders. |

| · | | “Tax Receivable Agreement” refers to the tax receivable agreement that the Company entered into with CWGS, LLC, each of the Continuing Equity Owners and Crestview Partners II GP, L.P. in connection with the Company’s IPO. |

CAUTIONARY NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts contained in this Annual Report on Form 10-K may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected new retail location openings, including greenfield locations and acquired locations; profitability of new retail locations; future capital expenditures and debt service obligations; refinancing, retirement or exchange of outstanding debt; expectations regarding consumer behavior and growth; our comparative advantages and our plans and ability to expand our consumer base; our ability to respond to changing business and economic conditions; volatility in sales; our ability to drive growth; and expectations regarding increase of certain expenses are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘anticipates,’’ ‘‘could,’’ ‘‘intends,’’ ‘‘targets,’’ ‘‘projects,’’ ‘‘contemplates,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘potential’’ or ‘‘continue’’ or the negative of these terms or other similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We believe that these important factors include, but are not limited to, the following:

| · | | the availability of financing to us and our customers; |

| · | | fuel shortages, or high prices for fuel; |

| · | | the well-being, as well as the continued popularity and reputation for quality, of our manufacturers; |

| · | | general economic conditions in our markets, and ongoing economic and financial uncertainties; |

| · | | our ability to attract and retain customers; |

| · | | competition in the market for services, protection plans, products and resources targeting the RV lifestyle or RV enthusiast; |

| · | | our expansion into new, unfamiliar markets as well as delays in opening or acquiring new retail locations; |

| · | | unforeseen expenses, difficulties, and delays frequently encountered in connection with expansion through acquisitions; |

| · | | our failure to maintain the strength and value of our brands; |

| · | | our ability to successfully order and manage our inventory to reflect consumer demand in a volatile market and anticipate changing consumer preferences and buying trends; |

| · | | fluctuations in our same store sales and whether they will be a meaningful indicator of future performance; |

| · | | the cyclical and seasonal nature of our business; |

| · | | our ability to operate and expand our business and to respond to changing business and economic conditions, which depends on the availability of adequate capital; |

| · | | the restrictive covenants in our Senior Secured Credit Facilities and Floor Plan Facility; |

| · | | our reliance on three fulfillment and distribution centers for our retail, e-commerce and catalog businesses; |

| · | | natural disasters, whether or not caused by climate change, unusual weather condition, epidemic outbreaks, terrorist acts and political events; |

| · | | our dependence on our relationships with third party providers of services, protection plans, products and resources and a disruption of these relationships or of these providers’ operations; |

| · | | whether third party lending institutions and insurance companies will continue to provide financing for RV purchases; |

| · | | our inability to retain senior executives and attract and retain other qualified employees; |

| · | | our ability to meet our labor needs; |

| · | | our inability to maintain the leases for our retail locations or locate alternative sites for our stores in our target markets and on terms that are acceptable to us; |

| · | | our business being subject to numerous federal, state and local regulations; |

| · | | regulations applicable to the sale of extended service contracts; |

| · | | our dealerships’ susceptibility to termination, non-renewal or renegotiation of dealer agreements if state dealer laws are repealed or weakened; |

| · | | our failure to comply with certain environmental regulations; |

| · | | climate change legislation or regulations restricting emission of ‘‘greenhouse gases;’’ |

| · | | a failure in our e-commerce operations, security breaches and cybersecurity risks; |

| · | | our inability to enforce our intellectual property rights and accusations of our infringement on the intellectual property rights of third parties; |

| · | | our inability to maintain or upgrade our information technology systems or our inability to convert to alternate systems in an efficient and timely manner; |

| · | | disruptions to our information technology systems or breaches of our network security; |

| · | | Marcus Lemonis, through his beneficial ownership of our shares directly or indirectly held by ML Acquisition Company, LLC and ML RV Group, LLC, has substantial control over us and may approve or disapprove substantially all transactions and other matters requiring approval by our stockholders, including, but not limited to, the election of directors; |

| · | | the exemptions from certain corporate governance requirements that we will qualify for, and intend to rely on, due to the fact that we are a ‘‘controlled company’’ within the meaning of the New York Stock Exchange, or NYSE, listing requirements; |

| · | | whether we are able to realize any tax benefits that may arise from our organizational structure and any redemptions or exchanges of CWGS Enterprises, LLC common units for cash or stock; and |

| · | | the other factors set forth under ‘‘Risk Factors’’ In Item 1A of Part I of this Annual Report on Form 10-K. |

We qualify all of our forward-looking statements by these cautionary statements. The forward-looking statements in this Annual Report on Form 10-K are only predictions. We have based these forward-looking

statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. For a further discussion of the risks relating to our business, see “Item 1A—Risk Factors” in Part I of this Annual Report on Form 10-K.

PART I

ITEM 1. BUSINESS

For purposes of this Annual Report on Form 10-K, we define an "Active Customer" as a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. Unless otherwise indicated, the date of measurement is December 31, 2016, our most recently completed fiscal quarter. Additionally, references herein to the approximately 9 million U.S. households that own a recreational vehicle are based on The RV Consumer in 2011, an industry report published by the University of Michigan in 2011 (the "RV Survey"), which we believe to be the most recent such survey.

Our Company

We believe we are the only provider of a comprehensive portfolio of services, protection plans, products and resources for recreational vehicle (“RV”) enthusiasts. Approximately 9 million households in the U.S. own an RV, and of that installed base, we have approximately 3.3 million Active Customers. We generate recurring revenue by providing RV owners and enthusiasts the full spectrum of services, protection plans, products and resources that we believe are essential to operate, maintain and protect their RV and to enjoy the RV lifestyle. We provide these offerings through our two iconic brands: Good Sam and Camping World.

Good Sam Consumer Services and | | | | | | |

Plans | | Camping World Retail |

Consumer Services | | New and Used | | Parts, Service | | Dealership Finance |

and Plans | | Vehicles | | and Other | | and Insurance |

| | | | | | |

•Extended vehicle service contracts •Emergency roadside assistance •Property and casualty insurance programs •Membership clubs •Vehicle financing and refinancing •Travel protection •Co‑branded credit cards •Consumer activities and resources: –Membership events and chapters –Consumer shows –Trip planning, travel directories and campground / fuel discounts –Consumer magazines –E‑commerce and social media –Contact centers and technical hotlines –Hosted online forums | | •New and used travel trailers •New and used fifth wheel trailers •New and used motorhomes | | •RV and auto repair and maintenance •Installation of parts and accessories •Collision repair •OEM and aftermarket parts •RV accessories, maintenance products and supplies –Outdoor lifestyle products –Generators and electrical –Satellite receivers and GPS –Towing and hitching –RV appliances –Essential supplies | | •Vehicle financing •Protection plans –Extended vehicle service contracts –Tire, wheel, paint and fabric protection –Gap protection –Travel protection –Emergency roadside assistance and alert notifications |

We believe our Good Sam branded offerings provide the industry’s broadest and deepest range of services, protection plans, products and resources, including: extended vehicle service contracts and insurance protection plans, roadside assistance, membership clubs and financing products. A majority of these programs are on a multi‑year or annually renewable basis. Across our extended vehicle service

contracts, emergency roadside assistance, property and casualty insurance programs and membership clubs, for each of the years ended December 31, 2016, 2015 and 2014, we experienced high annual retention rates that ranged between 65% and 74%, 66% and 74%, and 63% and 76%, respectively. We also operate the Good Sam Club, which we believe is the largest RV organization in the world, with approximately 1.7 million members as of December 31, 2016. Membership benefits include a variety of discounts, exclusive benefits, specialty publications and other membership benefits, all of which we believe enhance the RV experience, drive customer engagement and provide cross‑selling opportunities for our other services, protection plans and products.

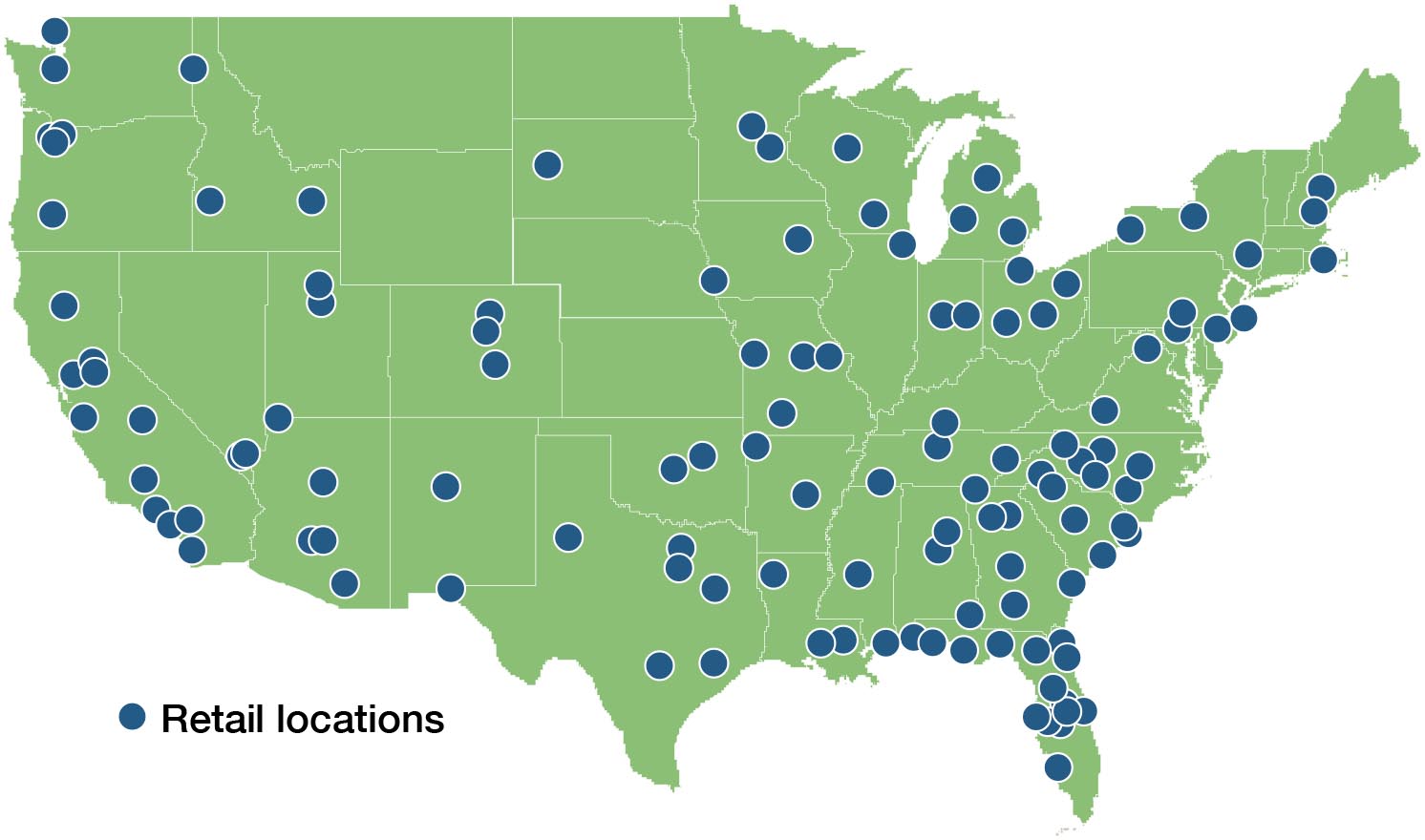

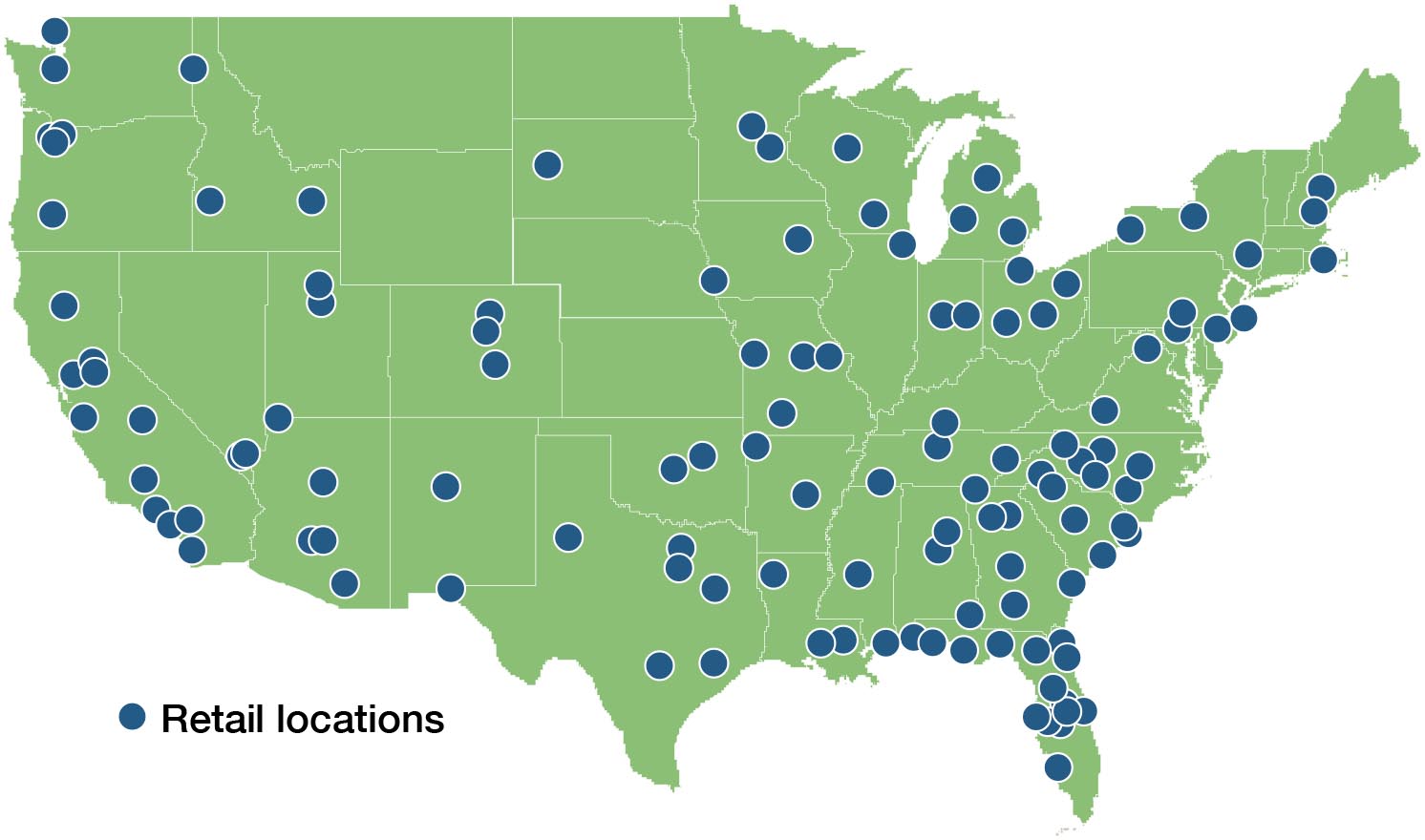

Our Camping World brand operates the largest national network of RV‑centric retail locations in the United States through our 122 retail locations in 36 states, as of December 31, 2016, and through our e‑commerce platforms. We believe we are significantly larger in scale than our next largest competitor. We provide new and used RVs, repair parts, RV accessories and supplies, RV repair and maintenance services, protection plans, travel assistance plans, RV financing, and lifestyle products and services for new and existing RV owners. Our retail locations are staffed with knowledgeable local team members, providing customers access to extensive RV expertise. Our retail locations are strategically located in key national RV markets. In 2016, our network generated approximately 3.7 million transactions, continuing to build our Active Customer database.

We attract new customers primarily through our retail locations, e‑commerce platforms and direct marketing. Once we acquire our customers through a transaction, they become part of our customer database where we leverage customized customer relationship management (“CRM”) tools and analytics to actively engage, market and sell multiple products and services. Our goal is to consistently grow our customer database through our various channels to increasingly cross‑sell our products and services.

Our Strengths

Our Iconic Brands. With over fifty years of history dating back to 1966, we believe Camping World and Good Sam are iconic, industry defining brands that are synonymous with the RV lifestyle. Our consistent quality, breadth and depth of offerings, as well as our comprehensive range of RV lifestyle resources, have resulted in our customers having passionate loyalty to and enduring trust in our brands.

Comprehensive Portfolio of Services, Protection Plans and Products. We believe we are the only provider of a comprehensive portfolio of services, protection plans, products and resources for RV enthusiasts. We offer more than 10,000 products and services through our retail locations and membership clubs. Our offerings are based on 50 years of experience and customer feedback from RV enthusiasts. Further, we evaluate new products and, through acquisitions or our supplier collaborations, offer certain unique products that are developed based on customer feedback, including private label products.

Customer Database. We have over 12 million unique contacts in our database and we have approximately 3.3 million Active Customers. We use a customized CRM system and database analytics to track customers and selectively market and cross‑sell our offerings. We believe our customer database is a competitive advantage and significant barrier to entry.

Leading Market Position and Scale. Camping World is the largest national RV retail network in the United States, and we believe Good Sam is the largest RV organization in the world, with each of our businesses having a distinct web presence through our e‑commerce platforms. Our scale and our long‑term stability make us attractive to our suppliers, financiers and real estate investors. The strong relationship with our suppliers enables us to negotiate attractive product pricing and availability. We also align with our suppliers on product development in which we leverage our customer base to provide feedback in exchange for exclusive early launch periods for new products. In recent years, we have also leveraged our supplier relationships to introduce private label products, which has improved our product availability.

Core of High Margin, Recurring Revenue. At the core of our offerings are certain high margin products and services targeting the installed base of RV households that generate recurring revenue streams. These offerings include certain Consumer Services and Plan offerings, which we believe are characterized by increased customer engagement, such as our extended vehicle service contracts, emergency roadside

assistance, property and casualty insurance programs and membership clubs. As of December 31, 2016, 2015, and 2014, we had 2.6 million, 2.5 million, and 2.4 million participants, respectively, across these Consumer Services and Plan offerings, including those who participated in more than one of our offerings. The increased engagement of our customers in these areas has led to high annual retention rates. Across our extended vehicle service contracts, emergency roadside assistance, property and casualty insurance programs and membership clubs, for each of the years ended December 31, 2016, 2015, and 2014, we experienced high annual retention rates that ranged between 65% and 74%, 66% and 74%, and 63% and 76%, respectively. These offerings also include our Retail parts, services and other offerings, which we believe to be stable and more consistent than the sale of new and used vehicles. Concentrating on our Consumer Services and Plans and Retail parts, services and other offerings has allowed us to grow a core of recurring revenue with gross margins of 57.1% and 46.4%, respectively, for the year ended December 31, 2016, which is significantly higher than our consolidated gross margins of 28.3% for the year ended December 31, 2016.

Variable Cost Structure and Capital Efficient Model. Our decentralized and flat management structure coupled with incentive programs focused on profitability have allowed us to achieve a highly variable cost structure. Our database analytics provide us significant flexibility and meaningfully improve our marketing efficiency via nimble, targeted marketing programs. We believe our model leads to strong and stable margins through economic cycles, resulting in what we believe to be high cash flow generation, low capital expenditure requirements and impressive returns on invested capital. As a result, we have been successful in generating access to highly attractive real estate and floor plan financing terms, thereby reducing costs and significantly reducing our need for capital. This capital efficient model provides a large share of capital funding at attractive terms for new locations and acquisitions.

Experienced Team. Our management team has an average of 21 years of industry experience. We offer highly competitive compensation tightly tied to performance, which has allowed us to attract and retain our highly experienced management team. Since 2012, our team has increased total revenue from $1.9 billion to $3.5 billion for the year ended December 31, 2016, increased net income from $42.3 million to $203.2 million for the year ended December 31, 2016 and increased Adjusted EBITDA from $129.5 million to $291.3 million for the year ended December 31, 2016. Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to net income, the most closely comparable GAAP measure, see “Non-GAAP Financial Measures” in Item 7 of Part II of this Annual Report on Form 10-K.

Our Growth Strategy

Grow Our Active Base of Customers. We believe our strong brands, leading market position, ongoing investment in our service platform, broad product portfolio and full suite of resources will continue to provide us with competitive advantages in targeting and capturing a larger share of consumers with whom we do not currently transact in addition to the growing number of new RV enthusiasts that will enter the market. We expect to continue to grow the Active Customer base primarily through three strategies:

| · | | Targeted Marketing. We continuously work to attract new customers to our existing retail and online locations through targeted marketing, attractive introductory offerings and access to our wide array of resources for RV enthusiasts. We have focused specifically on marketing to the fast‑growing demographic of younger market entrants, and through our NASCAR Truck Series and participation at college athletic events and music festivals, we believe we attract an outsized share of younger RV owners to our platform. |

| · | | Greenfield Retail Locations. We establish retail locations in new and existing markets to expand our customer base. Target markets and locations are identified by employing proprietary data and analytical tools. We believe there is ample white space for additional development opportunities which, consistent with most of our locations, have the benefit of what we believe to be low‑cost land acquisition prices. We typically take eight to 14 months from site identification until we open the doors to the new store. Since 2012, we have successfully opened 13 new greenfield locations. We intend to continue to open sites that will grow our Active Customer base and present attractive risk‑adjusted returns and significant value‑creation opportunities. Our greenfield locations typically reach profitability within three months. |

| · | | Retail Location Acquisitions. The RV dealership industry is highly fragmented with a large number of independent RV dealers. We use acquisitions of independent dealers as a fast and capital efficient alternative to new retail location openings to expand our business and grow our customer base. While acquired sites typically remain open following an acquisition, in certain instances we may close a location following an acquisition for remodeling for a period of time generally not in excess of eight weeks. We believe our experience and scale allow us to operate these acquired locations more efficiently. Since 2012, we have successfully acquired and integrated 33 new retail locations, and in 2015, we sold two retail locations. Our acquisitions are typically profitable within two full calendar months after an acquisition, with the exception of acquisitions we consider turn‑around opportunities, which are typically profitable within two to four months. We intend to continue to pursue acquisitions that will grow our Active Customer base and present attractive risk‑adjusted returns and significant value‑creation opportunities. |

Cross‑Sell Growing Portfolio of Services, Protection Plans and Products. We believe our customer database of over 12 million unique contacts provides us with the opportunity to continue our growth through the cross‑selling of our products and services. We use our customized CRM system and database analytics to proactively market and cross‑sell to Active Customers. We also seek to increase the penetration of our customers who exhibit higher multi‑product attachment rates.

New Products and Vertical Acquisitions. Introduction of new products enhances our cross‑selling effort, both by catering to evolving customer demands and by bringing in new customers. Through relationships with existing suppliers and through acquisitions, we will look to increase the new products we can offer to our customers. Similarly, an opportunistic vertical acquisition strategy allows us to earn an increased margin on our services, protection plans and products, and we evaluate such acquisitions that can allow us to capture additional sales from our customers at attractive risk‑adjusted returns.

Our Services, Protection Plans, Products and Resources

We operate through two reportable segments: Consumer Services and Plans and Retail. See Note 22 — Segment Information to our consolidated financial statements for further information regarding our reportable segments. Through our retail locations, e commerce platforms and clubs, we offer RV owners and RV enthusiasts the full spectrum of services, protection plans, products and resources that we believe are essential to operate, maintain, protect and to enjoy the RV lifestyle, including, among others:

Good Sam Offerings

Consumer Services and Plans

Extended vehicle service contracts: We offer a mechanical breakdown insurance program developed and offered exclusively for the members of the Good Sam Club and underwritten and insured by QBE Europe Insurance Ltd (“QBE”). The contracts cover the cost of parts, labor and repairs to motorized and towable RVs as well as autos, pick-up trucks and SUVs. The contracts ensure the members will have continuous protection during the life of the contracts. QBE assumes full underwriting risk associated with the contracts and we are compensated on a commission basis. As of December 31, 2016, we had approximately 64,000 contracts in force underwritten by QBE.

Emergency roadside assistance: We offer on-demand roadside assistance for RVs, autos and motorcycles. Our roadside assistance services include towing, jump start, tire change, mobile mechanic and other services. Membership prices range from $80 to $140 per year depending on coverage, with our Good Sam Club members receiving a discount. We contract with Signature’s Nationwide Motor Club, Inc. to handle dispatch calls through its network of tow providers and we pay a fee per incident or call. As of December 31, 2016, we had approximately 603,000 members in our emergency roadside assistance plan.

Property and casualty insurance programs: We provide third party auto, RV, motorcycle and boat specialty insurance and home insurance through arrangements with underwriters, including National General, Progressive, Nationwide and Safeco. For the year ended December 31, 2016, we sold, through third party insurance providers, insurance policies with an aggregate net written premium of $209 million. We do not

share the underwriting risk of the insurance programs and we receive a marketing fee based on the amount of premium paid to the insurance providers.

Membership clubs: We operate two membership clubs: The Good Sam Club and the Coast to Coast Club. The Good Sam Club members enjoy savings on purchases at Camping World retail locations, discounts on nightly rates at affiliated Good Sam RV parks and other benefits related to the RV lifestyle. We believe the Good Sam Club is the largest RV enthusiast organization in the world. The Coast to Coast Club provides access to, and savings at, private membership campgrounds and other travel related benefits. As of December 31, 2016, we had approximately 1.8 million members across our two clubs.

Vehicle financing and refinancing: We market third party financing and refinancing solutions for new and used RVs and boats through an arrangement with Essex Credit, a Division of Bank of the West. Essex Credit provides the financing and assumes full underwriting and credit risk, and we receive a marketing fee based on the referred business.

Travel protection: We contract with On Call International to offer travel protection plans through Good Sam TravelAssist, where On Call International primarily assumes the underwriting risk. The plans provide 24/7 coverage for medical assistance and care, medical evacuation, emergency travel services, emergency dental care and return-home services. Prices range from $70 to $130 per policy per year depending on coverage. As of December 31, 2016, we had approximately 171,000 contracts in force primarily underwritten by On Call International.

Co-branded credit cards: We contract with Visa and Comenity Capital Bank to offer a Good Sam | Camping World Visa® branded credit card. Cardholders receive enhanced rewards points, which are referred to as REC rewards, for money spent at our retail locations, on our e-commerce platforms and at private campgrounds across the U.S. and Canada. As of December 31, 2016, we had approximately 128,000 issued and open co-branded credit card accounts.

Consumer activities and resources:

| · | | Membership events and chapters: Our Good Sam Club collaborates with parks and campgrounds across the country to organize numerous events for its members. In addition, we have approximately 1,200 Good Sam Chapters across North America, which comprise smaller groups of members within the Good Sam Club that share common interests. Chapters hold campouts, plan social events and organize community volunteer opportunities. In 2016, our Good Sam Club and Chapters hosted over 70 events, which provide the social interaction associated with the RV lifestyle. |

| · | | Consumer shows: During 2016, we promoted and operated 18 separate consumer shows in 15 different cities across 12 different states. The primary focus of these consumer shows is to promote the RV lifestyle with the sales of new RVs, accessories and destination options. During 2016, the shows attracted in excess of 209,000 participants in total. Our consumer show division acquired five new shows in five cities in three states in the third quarter of 2016. These shows provide a strategic opportunity to expose first time buyers and existing RV enthusiasts to our products and services. To encourage participation by our Good Sam Club members, we offer members a 50% discount on admission fees. |

| · | | Trip planning, travel directories and campground / fuel discount programs: We help RV enthusiasts with trip planning in a variety of ways. On our Good Sam website, www.goodsamclub.com, and through our printed travel and campground directory, Good Sam RV Travel and Savings Guide, RV enthusiasts can plan trips by, among other things, searching campgrounds based on destination or particular needs and reading reviews. Good Sam Club members can search for parks that offer the Good Sam Club discount. Our fuel discount program, Good Sam Club Swipe & Save, enables our members to purchase gas, diesel and propane at discounted prices. Currently, members enjoy a 3 cent discount per gallon of gas and diesel at select service stations. |

| · | | Consumer magazines: We produce Trailer Life and MotorHome, two monthly consumer publications with an average monthly circulation in 2016 of 284,400 and 177,900, respectively. Both publications are produced in print and digitally and cater to the RV enthusiasts. Each publication is well recognized in the industry, with Trailer Life having celebrated its 75th anniversary in June 2016. In addition, we produce an annual RV Buyers Guide, which is sold on newsstands and distributed at most consumer shows free with the purchase of admission. |

| · | | E-commerce and social media: We use digital media extensively to market, sell and communicate with our customers and members. Each of our businesses has a distinct Web presence where consumers can learn about the services we provide, get rate quotes (as applicable), make purchases and interact with us on an ongoing basis. We make use of cross-selling and on-site marketing to present additional products to consumers as they visit our websites and transact business with us. We are active on social media, including Facebook, to support and promote the RV lifestyle, to engage with our customers and to reach potential new customers on an ongoing basis. |

| · | | Contact centers and technical hotline: We operate two multi-channel, full-service contact centers with over 260 seats. RV enthusiasts call, email, internet chat and use social media to contact us regarding products, consumer services and protection plans, concerns and anything else related to the RV lifestyle. For the year ended December 31, 2016, our contact centers handled over 2.2 million calls and responded to over 220,000 emails and social media contacts. |

| · | | Hosted online forums: RV.net, an internet based hosted forum, experienced approximately 7.0 million visitor sessions in 2016. With volunteer moderators ensuring a positive user experience, RV owners use RV.net to share information about the RV lifestyle, for assistance with “do it yourself” projects and to otherwise discuss all matters associated with RVing. |

Camping World Offerings

New and Used Vehicles

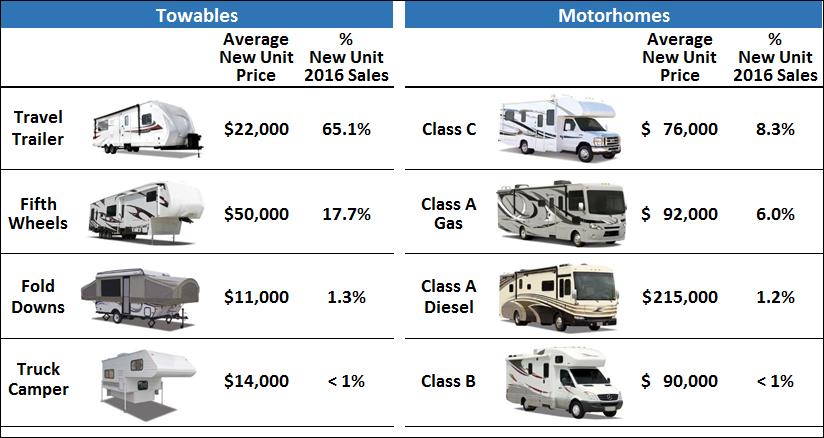

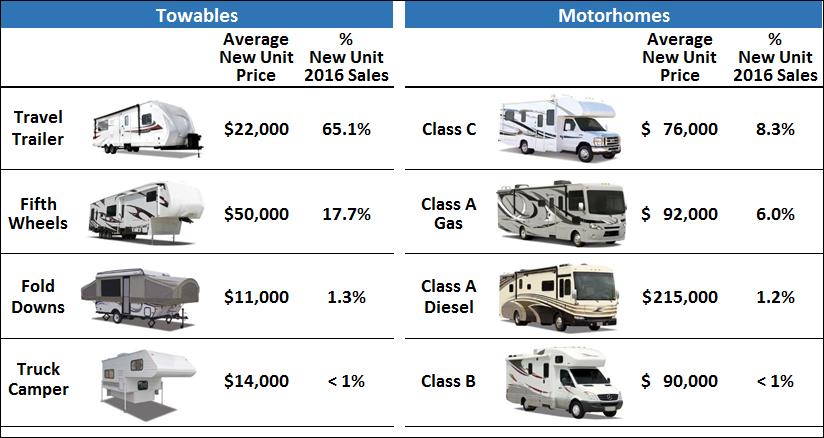

New Vehicles: We offer a comprehensive selection of new RVs across a range of price points, classes and floor plans, from entry level travel trailers to Class A diesel pushers, at our retail locations and on our e-commerce platform. We have formed strategic alliances with leading RV manufacturers, including Thor Industries, Inc. (including Jayco, Inc. which was acquired by Thor Industries, Inc. on June 30, 2016 and operates as a wholly-owned subsidiary of Thor Industries, Inc.), Forest River, Inc., and Winnebago Industries, Inc. The table below sets forth certain information on our primary offerings for the year ended December 31, 2016.

Used Vehicles: We sell a comprehensive selection of used RVs at our retail locations, including the vehicle types listed in the table above. The primary source of used RVs is through trade-ins at the time of the sale of new and used RVs. Used RVs are generally reconditioned in our service departments prior to sale. Used RVs that do not meet our standards for retail sale are typically sold at wholesale auctions.

For the year ended December 31, 2016, we sold approximately 48,700 new and 31,200 used vehicles at our retail locations and through our e-commerce platforms.

Parts, Services and Other

Repair and Maintenance: We offer repair and maintenance services at our 122 retail locations nationwide as of December 31, 2016 and perform warranty repairs for RVs. With over 1,300 RV technicians, we are equipped to offer comprehensive repair and maintenance services for most RV components.

Installation of parts and accessories: Our full-service repair facilities enable us to install all parts and accessories that we sell in our retail locations, including, among other items, towing and hitching products, satellite systems, braking systems, leveling systems and appliances. While other RV dealerships may be able to install RV parts and accessories and other retailers may be able to sell certain parts and accessories, our ability to both sell and install necessary parts and accessories affords us a competitive advantage over online retailers and big box retailers that do not have service centers designed to accommodate RVs and over RV dealerships that do not offer a comprehensive inventory of parts and accessories.

Collision repair: We offer collision repair services at most of our service centers, and over 34% of our service facilities are equipped with full body paint booths. Our facilities are equipped to offer a wide selection of collision repair services, including fiberglass front and rear cap replacement, windshield replacement, interior remodel solutions and paint work. We perform collision repair services for a wide array of insurance carriers, including Progressive, National General and Nationwide.

OEM and aftermarket parts and accessories: Through our retail stores and e-commerce platform, we offer a comprehensive range of original and aftermarket RV parts, accessories and supplies, including towing and hitching, satellite and GPS systems, appliances and furniture, leveling systems, breaking systems, generators and electrical products, supplies and other products necessary or desirable for the RV enthusiast and RV lifestyle.

Dealership Finance and Insurance

Vehicle financing: Through arrangements with third party lenders, such as Bank of America, Bank of the West, US Bank, Ally Bank and M&T Bank, and other regional and local banks and credit unions, we are able to provide financing for most new and used RVs we sell through our retail locations. Generally, our financing transactions are structured through long-term retail installment sales contracts (with terms of up to 20 years), which we enter into with our customers on behalf of our third-party lenders, which have provided initial, non-binding approval to assume our position as creditor. The retail installment sales contracts are assigned on a non-recourse basis, with the third-party lender assuming underwriting and credit risk. In 2016, we arranged financing transactions for approximately 65% of our total annual number of new and used units sold.

Protection Plans: We offer and sell a variety of protection plans and services to the purchasers of our RVs as part of the delivery process, including, among others, our Good Sam branded extended vehicle service contracts, emergency roadside assistance and travel assist plans, and gap, wheel, tire and fabric protection plans. These products are primarily underwritten and administered by independent third parties, and we are primarily compensated on a commission basis.

Customers and Markets

The estimated number of U.S. households that own an RV is approximately 9 million, which we believe has grown consistently over the past 20 years, including during the last economic downturn. We have

approximately 3.3 million Active Customers and aim to market and sell our services, protection plans, products and resources to the growing number of new market entrants.

The recreational vehicle industry is characterized by RV enthusiasts’ investment in, and steadfast commitment to, the RV lifestyle. Owners spend on insurance, extended service contracts, roadside assistance and regular maintenance in order to protect and maintain their RV. They typically invest in new accessories and the necessary installation costs as they upgrade their RV. They also spend on services and resources as they plan, engage in, and return from their road trips. Furthermore, based on industry research and management’s estimates, we believe that RV owners typically trade-in to buy another RV every four to five years.

In 2016, approximately 431,000 new RVs were shipped by manufacturers. Overall, from 2009 to 2016, the number of RV shipments grew by 15% annually. There are two main categories of RVs: motorhomes (motorized units) and towables (units that are towed behind a car, van or pickup). Motorized units include Class C Motorhomes, with prices for new units typically ranging from $50,000 to $100,000, Class A Gas Motorhomes, with prices for new units typically ranging from $65,000 to $160,000, Class A Diesel Motorhomes, with prices for new units typically ranging from $120,000 to $500,000, and Class B Motorhomes, with prices for new units typically ranging from $71,000 to $104,000. Towable units include travel trailers with prices for new units typically ranging from $8,000 to $60,000 and fifth wheel trailers, with prices for new units typically ranging from $24,000 to $90,000. According to data gathered by Statistical Surveys, Inc., which tracks the number of RV registrations in every state except Hawaii and Alaska, from 2010 to 2016, the annual new unit sales growth of diesel motorhomes, gas motorhomes and towables was 4.0%, 18.1% and 12.0%, respectively. RV manufacturers are now producing more innovative models, such as lightweight towables and smaller, fuel efficient motorhomes. In addition, green technologies, such as solar panels and energy efficient components are appearing on an increasing number of RVs.

Generally, used RVs are sold at a lower price level than comparable new RVs and the sale of used vehicles has historically been more stable through business cycles than the sale of new vehicles.

We believe RV trips remain the least expensive type of vacation and allow RV owners to travel more while spending less. RV trips offer savings on a variety of vacation costs, including, among others, airfare, lodging and dining. While fuel costs are a component of the overall vacation cost, we believe fluctuations in fuel prices are not a significant factor affecting a family’s decision to take RV trips. We believe the average annual mileage use of an RV is between 3,000 miles and 5,000 miles.

The RV owner installed base has benefited positively from the aging and the increased industry penetration of the baby boomer consumer demographic, those aged 52 to 70 years old. In addition to growth from baby boomers, the RVIA estimates the fastest growing RV owner age group includes Generation X consumers, those currently 35 to 54 years old. The U.S. Census Bureau estimates that approximately 84 million Americans were of the age 35 to 54 years old in 2014. Furthermore, according to the RV Survey, RV ownership is most concentrated among those 35 to 64 years old and the median age of an RV owner is 48 years old.

In addition to positive age trends, according to the RV Survey, the typical RV customer has, on average, a household income of approximately $75,000. This is approximately 50% higher than the median household income of the broader United States population at the time of the RV survey, according to the U.S. Census Bureau. The higher average income has resulted in a more resilient RV consumer with greater buying power across economic cycles.

Taken together, we believe the savings RVs offer on a variety of vacation costs, an increase in the pool of potential RV customers due to an aging baby boomer demographic, and the increased RV ownership among younger consumers should continue to grow the installed base of RV owners, and will have a positive impact on RV usage.

Our Camping World Stores

As of December 31, 2016, we operated 122 Camping World retail locations across 36 states. Our retail locations are strategically located in key RV markets. Generally, our retail locations provide repair and installation services, collision repair, parts, services and accessories for RVs and RV enthusiasts, and 105 of our locations sell new and used RVs. We believe our retail store strategy of offering a comprehensive range of parts, services, accessories, products, and in most instances, new and used RVs, generates powerful cross-selling opportunities. The following map shows our retail location footprint as of December 31, 2016:

Store Design and Layout

We present our broad and deep array of services, protection plans, products and resources in a convenient and engaging atmosphere to meet the everyday needs of RV enthusiasts. Our retail locations generally range in size from approximately 30,000 to 45,000 square feet and are typically situated on approximately eight to 18 acres. Approximately 15% of typical retail location floor space is devoted to a new and used RV sales area; approximately 25% is devoted to the sale of RV parts, services, accessories and products, a customer service area and a technical information counter; approximately 55% is comprised of a service, repair and installation facility, which generally contains 8 to 30 repair, installation and collision bays; and approximately 5% is allocated to office and warehouse space. Large parking areas provide sufficient space to facilitate maneuvering of RVs, and the area devoted to new and used RV inventory typically ranges from five to 12 acres.

Our retail locations feature service centers staffed with expert, in-house trained product specialists and are equipped with merchandise demonstrations to assist in educating customers about RV performance products. Our retail locations also provide opportunities to promote a more interactive and consultative selling environment. Our staff is trained to cross-sell and explain the benefits of our breadth of services, protection plans and products to which our customers have become accustomed, such as extended service contracts, emergency roadside assistance products, club memberships, discount camping and travel assistance.

We regularly refresh our retail locations to enhance the customers’ shopping experience and maximize product and service offerings. New products and services are introduced in order to capitalize on the advances of the RV industry and to satisfy our customers’ needs. Store dress, promotional signage and directional signage are also periodically refreshed to further enhance our customers’ shopping experience at our retail locations.

Expansion Opportunities and Site Selection

Our disciplined expansion and acquisition strategy focuses on growing our Active Customer base. We have developed a rigorous and flexible process that employs proprietary data and analytical tools to identify target markets for new store openings and acquisitions. We select sites for new locations or evaluate acquisition opportunities based on criteria such as local demographics, traffic patterns, proximity to RV parks and campgrounds, proximity to major interstates, analytics from our Active Customer database, RV sales and registrations, product availability and availability of attractive acquisition and/or lease terms. Members of our development team spend considerable time evaluating markets and prospective sites. Our prospective sites are typically located on major highways with convenient access and high visibility. Depending on market demographics, our prospective sites generally include eight to 18 acres and accommodate a 30,000 to 45,000 square foot retail footprint and five to 12 acres for RV inventory. Our greenfield locations typically reach profitability within three months. Acquisitions are typically profitable within two full calendar months after an acquisition, with the exception of acquisitions we consider turn-around opportunities, which are typically profitable within two to four months.

As the market leader, with a scalable cost structure, we have an established track record of successful acquisitions. Over the last three years ended December 31, 2016, we have spent over $100 million, net of financing under the floor plan facility (“Floor Plan Facility”), on 15 acquisitions that included 15 retail locations, at multiples of acquired EBITDA in the low to mid-single digit range. We expect most acquisitions to result in cash-on-cash payback periods of under a year, and have designed an identification, assessment, negotiation, acquisition, and closing set of processes and procedures that allow us to move quickly on opportunities.

Store Level Management and Training

Our President of Camping World oversees all retail operations. Our retail locations are each managed by a vice president of operations, each of whom is typically responsible for eight to 21 retail locations. Depending on the number of retail locations managed by any vice president of operations, the vice president of operations may have one or more market managers responsible for a smaller number of retail locations. Our vice presidents of operations have, on average, 23 years of experience in the RV industry and have been employed by us for 12 years.

Each retail location employs a general manager or a general sales manager (in either case, the “GM”) that has responsibility for the daily operations of the retail location. Areas of responsibility include inventory management, hiring, associate training and development, maintenance of the facilities, customer service and customer satisfaction. A GM’s management team includes a sales manager, a parts and accessories manager, a service manager, and a finance and insurance manager to help oversee the operations of each retail location department. A typical retail location employs approximately 40 to 100 full-time equivalent employees.

We employ a national director of inventory and a centralized inventory management team to oversee our RV inventory and provide consistency and controls in the ordering, purchasing and distribution of RV inventory. We also employ a national director of service, a national director of parts and accessories, and a national director of finance and insurance to assist in the management and training for the respective areas.

We actively seek to improve our ability to assess talent during the interview process and hire talented people and provide extensive training programs and opportunities for our employees, including, among others, new-hire training and orientations, e-learning and training modules, national training directors and certification programs for our RV technicians.

Product Sourcing and Distribution

Sourcing

New and Used RVs

We generally acquire new RVs for retail sale directly from the applicable manufacturer. We have strategic contractual arrangements with leading RV manufacturers, including Thor Industries, Inc., Forest River, Inc., and Winnebago Industries, Inc., with such manufacturers supplying approximately 70%, 14%, and 12%, respectively, of our new RV inventory as of December 31, 2016. According to each such company’s latest Annual Report on Form 10-K, we are the largest customer of Thor Industries, Inc. and Winnebago Industries, Inc., representing 20% and 17% of these suppliers’ latest fiscal year revenue, respectively. We maintain a central inventory management and purchasing group to manage and maintain adequate inventory levels and mix. RVs are transported directly from a manufacturer’s facility to our retail locations via a third-party transportation company.

Our strategy is to partner with financially sound manufacturers that make quality products, have adequate manufacturing capacity and distribution, and maintain an appropriate product mix. In certain instances, our manufacturing partners produce private label products exclusively available at our retail locations and through our e-commerce platforms.

Our supply arrangements with manufacturers are typically governed by dealer agreements, which are customary in the RV industry. Our dealer agreements with manufacturers are generally made on a location-by-location basis. The terms of these dealer agreements are typically subject to, among other things, us meeting all the requirements and conditions of the manufacturer’s applicable programs, us maintaining certain minimum inventory requirements and meeting certain retail sales objectives, us performing services and repairs for all owners of the manufacturer’s RVs (regardless from whom the RV was purchased) that are still under warranty and us carrying the manufacturer’s parts and accessories needed to service and repair the manufacturer’s RVs in stock at all times, us actively advertising and promoting the manufacturer’s RVs and us indemnifying the manufacturer under certain circumstances. Our dealer agreements generally designate a specific geographical territory for us, which is often exclusive to us, provided that we are able to meet the material obligations of the applicable dealer agreement. In addition, many of our dealer agreements contain stocking level requirements and certain of our dealer agreements contain contractual provisions concerning minimum advertised product pricing for current model year units. Wholesale pricing is generally established on a model year basis and is subject to change in the manufacturer’s sole discretion. In certain cases, the manufacturer may also establish a suggested retail price, below which we cannot advertise that manufacturer’s RVs.

We generally acquire used RVs from customers, primarily through trade-ins, as well as through auctions and other sources, and we generally recondition used RVs acquired for retail sale in our parts and service departments. Used RVs that we do not sell at our retail locations generally are sold at wholesale prices through auctions.

We finance the purchase of substantially all of our new RV inventory from manufacturers through our Floor Plan Facility. Used vehicles may also be financed from time to time through our Floor Plan Facility. For more information on our Floor Plan Facility, see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Senior Secured Credit Facilities and Floor Plan Facility” included in Part II, Item 7 of this Form 10-K and Note 3 — Inventories, net and Notes Payable — Floor Plan, net to our audited consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Parts and Accessories

The purchasing activities for our parts and accessories departments are focused on RV maintenance products, outdoor lifestyle products, RV parts and accessories, such as, among others, generators and electrical, satellite receivers and GPS, towing and hitching products and RV appliances, essential supplies and other products and services necessary or desirable for the RV lifestyle. We maintain central purchasing, replenishment and distribution functions to manage inventory planning, allocate merchandise to our retail locations and oversee the replenishment of basic merchandise to our distribution centers. We have no long-term purchase commitments. During the year ended December 31, 2016, we purchased merchandise from approximately 1,300 vendors with no vendor accounting for more than approximately 7% of total merchandise purchased. During the year ended December 31, 2016, approximately 8% of our merchandise was imported directly from vendors located in foreign countries, with a substantial portion of the imported merchandise

being obtained directly from vendors in China. We have established long-standing, continuous relationships with our largest vendors. We believe that the volume of merchandise we purchase from domestic and international suppliers and our ability to buy direct from manufacturers enables us to obtain merchandise at costs which compare favorably to local RV dealers and retailers.

Our merchant team located in Bowling Green, Kentucky currently manages our parts and accessories sourcing. To ensure our product offerings are tailored to local market conditions and demand, our merchant team routinely meets one-on-one with vendors, attends trade shows, reviews trade periodicals and evaluates merchandise offered by other retail and online merchants. We also consistently gather feedback and new product reviews from our store management and employees, as well as from reviews submitted by our customers. We believe this feedback is valuable to our vendor-partners and improves our access to new models and technologies.

Distribution and Fulfillment

We distribute our merchandise from three leased distribution and fulfillment centers located in Franklin, Kentucky, Bakersfield, California, and Fort Worth, Texas, which are 250,000, 169,123, and 197,400 square feet, respectively. The distribution centers support replenishment of parts and accessories for our 122 retail locations as of December 31, 2016 and manage the fulfillment of direct-to-consumer e-commerce and catalog orders. We use common carriers for replenishment of our retail locations and ship merchandise to our e-commerce customers via courier service. An experienced distribution management team leads a staff of approximately 110 full-time distribution center employees.

Our distribution centers have scalable systems and processes that we believe can accommodate continued new store growth. We use an Oracle enterprise system to procure inventory, manage online customer and retail demand and fulfill orders through the warehouse management module. Additionally, we have customized an order packing and shipping software package to handle the specific requirements of the e-commerce and retail business. We have the capability to both case pick and item pick, which is designed to ensure our retail locations have sufficient quantities of product while also allowing us to maintain in inventory slow moving but necessary items. This balance allows us to stock the right products at the necessary locations, all at the right time and in the correct quantity.

Marketing and Advertising

We market our Good Sam branded offerings through retail point of sale, websites, e-mail, direct mail, inserts, paid search, space advertisements, promotional events, member-get-a-member campaigns, and telemarketing. In 2016, retail point of sale marketing efforts accounted for approximately 68% of new paid enrollments in our Good Sam Club. We generally use our internal proprietary database for marketing and advertising. We have over 12 million unique contacts in our database and we have approximately 3.3 million Active Customers.

We market our Camping World brand through the strategic location of our retail stores in high traffic RV areas, in-store promotions, our websites, mail order catalogs, direct mail retail flyers, local TV and radio, RV and outdoor shows, billboards, newspaper, email, paid search, advertisements in national and regional industry publications, vendor co-op advertising programs, promotional events, and personal solicitations and referrals. Camping World’s principal marketing strategy is to capitalize on its broad name recognition among RV owners.

We currently operate an extensive network of RV lifestyle related websites, including www.goodsamclub.com, www.campingworld.com and www.goodsamcamping.com, that experienced more than 70 million visitor sessions in 2016. Our websites feature RV and RV lifestyle associated content, as well as the ability to purchase parts, services and accessories that enhance the RV lifestyle. We believe our network of websites provide RV owners and enthusiasts with the most expansive access to RV related content and e-commerce in the RV industry. Our websites also allow RV owners and enthusiasts to read about the RV lifestyle, make purchases and gather more information about RV parks and other RV-related entities.

In addition to websites, our digital presence includes apps and services that enable current and potential RV owners and enthusiasts to research RVs, read product reviews written by RV experts and other RV owners and enthusiasts, plan RV trips (including mapping routes and planning which RV parks to visit) and purchase thousands of products to support their RV lifestyle. We use various digital tools and services to foster the RV lifestyle and to introduce new and/or future RV owners and enthusiasts to our network of websites and the products and services we offer. Our wide reaching digital presence provides extensive marketing for the products and services we sell, while providing the RV community with access to valuable content and tools to enhance the RV lifestyle.

We also use promotional events as marketing tools. During 2016, we promoted and operated 18 consumer shows in 15 cities across 12 states, which are primarily RV, boat and sport shows. The total audience of RV, boating, powersports and outdoor recreation enthusiasts who attended our shows during 2016 exceeded 209,000. Our consumer show division acquired shows in five cities in three states in the third quarter of 2016. In addition, we have sponsored sporting events such as the NASCAR Camping World Truck Series, NASCAR Sprint Cup Series races and the College Football Camping World Independence Bowl. Periodically, we promote the opening of each new retail location through grand opening celebrations at which we may have special events and discounted prices.

E-Commerce Platform and Digital Strategy

General

We believe our websites and other digital marketing channels enable us to provide instant, on-demand access to the wide array of content, products and services we offer. Our content, such as RV park descriptions, ratings and user reviews, encourage RV owners and enthusiasts, whether or not current customers or members, to visit our websites.

We use a combination of targeted email, social media and e-newsletters to promote ongoing communication with our customers and members. We believe that by communicating with our customers and members on an ongoing basis, we build affinity and the likelihood of a continued consumer to business relationship.

We believe our websites help attract new customers who may not live near one of our retail locations, who desire to transact business online or who are discovering us for the first time. Additionally, we believe many people who transact at our retail locations visit our websites prior to visiting our retail locations. To attract new customers to our websites we use a combination of online marketing methods, including social media, paid search, search engine optimization and other web-based marketing methods. We test new online marketing methods on an ongoing basis. Once a customer interacts with us online and elects to receive our e-newsletters and/or promotional emails, we offer ongoing email-based content delivery and promotions. We also use customer data to enable cross-selling of complementary products and services.

Our Camping World website works in concert with our retail locations and logistics operations, with orders for stocked inventory shipped from the same distribution centers that support our network of retail locations. We currently offer more than 20,000 products on www.campingworld.com and associated websites, which include products that are not available in our retail locations. To further support sales, we make use of various affiliate relationships, which helps us reach the RV community across a wide array of websites.

We continually invest in our network of websites and point of sale technology. Knowing our customers’ purchasing history provides us with the opportunity to have a greater understanding of the wants and needs of our customers. Our websites enable simplified access to all Good Sam content and services in an integrated fashion through www.goodsam.com. The Camping World website, www.campingworld.com, features access to product search and optimized product presentation, as well as shopping and checkout processes. We invest in our websites on an ongoing basis to continually improve our customers’ experience, and to increase visits and purchases by new and returning customers.

Customer Service

We believe customer service and access to a live person is a critical component of our digital marketing and sales operation. Our sales and customer service centers in Englewood, Colorado and Bowling Green, Kentucky are multi-channel, full-service contact centers. RV enthusiasts call, email, internet chat and use social media to contact us regarding products, consumer services and protection plans, concerns and anything else related to the RV lifestyle. RV enthusiasts can also speak with our customer service specialists for help with orders, to receive answers to questions and to make purchases for any product offered through our websites.

Our contact center in Englewood, Colorado is an approximately 230-seat contact center that is over 20,000 square feet. For the year ended December 31, 2016, the Englewood, Colorado contact center handled approximately 2.1 million calls and responded to over 220,000 emails and social media contacts. Our contact center in Bowling Green, Kentucky provides service and support to the Camping World internet and catalog product sales. This contact center also houses a retail support team that handles our retail location overflow calls. For the year ended December 31, 2016, this team handled over 165,000 calls. Our dual contact centers give us the opportunity to establish redundant systems that provide back up in the event of a natural disaster, electrical problems or weather issues that may affect either location.

Our contact center specialists are extensively trained to assist customers with complex orders and provide a level of service that leads to long-term customer relationships. In addition, our quality assurance team monitors contacts daily and provides the leadership team with tools to maintain sales and service standards. With low turnover, we retain our employees longer than the industry average, which we believe allows our callers to be assisted by experienced contact center agents who are familiar with the RV lifestyle and our services, protection plans and products.

Management Information Systems

We utilize sophisticated computer systems to support our operations, including a third-party dealer management system, point-of-sale registers (“POS”), enterprise resource planning system, supply chain management system, CRM, event business management system and marketing database. In addition, we utilize proprietary membership systems and data warehouses to provide analytical views of our data.

To support the applications, we have multiple data centers with advanced servers, storage and networking capabilities. We have a secure wide area network that facilitates communication within and between our offices and provides both voice and data services. Business critical systems are replicated in real time and all systems are protected with on and off site backups.

A database containing all customer activity across our various businesses and programs has been integrated into our websites and contact centers. Comprehensive information on each customer, including a profile of the purchasing activities, is made available to our CRM, POS and marketing database. We utilize information technology and analytics to actively market and sell multiple products and services to our Active Customers, including list segmentation and merge and purge programs, to select prospects for direct mail solicitations and other direct marketing efforts. We employ publishing software for publication makeup, content and advertising to support our publications operations.

Our management information systems and electronic data processing systems consist of an extensive range of retail, mail order, financial and merchandising systems, including purchasing, inventory distribution and logistics, sales reporting, accounts payable and merchandise management. Our POS and dealer management systems report comprehensive data in near real time to our data warehouses, including detailed sales volume, inventory information by product, merchandise transfers and receipts, special orders, supply orders and returns of product purchases to vendors. The registers capture Good Sam Club member numbers and associated sales and references to specific promotional campaigns. In conjunction with its nightly polling, our central computer sends price changes to registers at the point of sale. Management monitors the performance of each retail location and mail order operations to evaluate inventory levels, determine markdowns and analyze gross profit margins by product.

Competition

We face competition in all of our business segments. We believe that the principal competitive factors in our industry are breadth and depth of product selection, value pricing, convenient retail locations, technical services and customer service. Our competitors vary in size and breadth of their product offerings. We compete directly or indirectly with the following types of companies:

| · | | major national insurance and warranty companies, providers of roadside assistance and providers of extended vehicle service contracts; |

| · | | other dealers of new and used RVs for sale; |

| · | | other specialty retailers that compete with us across a significant portion of our merchandising categories through catalog or e-commerce businesses; and |

Additional competitors may enter the businesses in which we currently operate. Moreover, some of our mass merchandising competitors do not currently compete in many of the product categories we offer, but may choose to offer a broader array of competing products in the future.

Trademarks and Other Intellectual Property

We own a variety of registered trademarks and service marks related to our brands and our services, protection plans, products and resources, including Good Sam and Camping World. We also own the copyrights to certain articles in our publications and numerous domain names, including www.goodsamclub.com and www.campingworld.com, among others. We believe that our trademarks and other intellectual property have significant value and are important to our marketing efforts. We do not know of any material pending claims of infringement or other challenges to our right to use our intellectual property in the United States or elsewhere.

Government Regulation

Our operations are subject to varying degrees of federal, state and local regulation, including our RV sales, vehicle financing, outbound telemarketing, direct mail, roadside assistance programs, extended vehicle service contracts and insurance activities. These laws and regulations include consumer protection laws, so-called “lemon laws,” privacy laws, escheatment laws, anti-money laundering laws and other extensive laws and regulations applicable to new and used vehicle dealers, as well as a variety of other laws and regulations. These laws also include federal and state wage and hour, anti-discrimination and other employment practices laws. Furthermore, new laws and regulations, particularly at the federal level, may be enacted that could also affect our business. See “Risk Factors — Risks Related to Our Business — Our business is subject to numerous federal, state and local regulations.” in Item 1A of Part I of this Annual Report on Form 10-K.

Motor Vehicle Laws and Regulations

Our operations are subject to the National Traffic and Motor Vehicle Safety Act, Federal Motor Vehicle Safety Standards promulgated by the United States Department of Transportation and the rules and regulations of various state motor vehicle regulatory agencies. We are also subject to federal and numerous state consumer protection and unfair trade practice laws and regulations relating to the sale, transportation and marketing of motor vehicles, including so-called “lemon laws.” Federal, state and local laws and regulations also impose upon vehicle operators various restrictions on the weight, length and width of motor vehicles that may be operated in certain jurisdictions or on certain roadways. Certain jurisdictions also prohibit the sale of vehicles exceeding length restrictions. Federal and state authorities also have various environmental control standards relating to air, water, noise pollution and hazardous waste generation and disposal.

Our financing activities with customers are subject to federal truth-in-lending, consumer leasing and equal credit opportunity laws and regulations as well as state and local motor vehicle finance laws, leasing laws, installment finance laws, usury laws and other installment sales and leasing laws and regulations, some of which regulate finance and other fees and charges that may be imposed or received in connection with motor vehicle retail installment sales. Claims arising out of actual or alleged violations of law may be asserted against us or our retail locations by individuals, a class of individuals, or governmental entities and may expose us to significant damages or other penalties, including revocation or suspension of our licenses to conduct retail operations and fines.

The Dodd-Frank Act, which was signed into law on July 21, 2010, established the CFPB, an independent federal agency funded by the United States Federal Reserve with broad regulatory powers and limited oversight from the United States Congress. Although automotive dealers are generally excluded, the Dodd-Frank Act could lead to additional, indirect regulation of automotive dealers, in particular, their sale and marketing of finance and insurance products, through its regulation of automotive finance companies and other financial institutions. In March 2013, the CFPB issued supervisory guidance highlighting its concern that the practice of automotive dealers being compensated for arranging customer financing through discretionary markup of wholesale rates offered by financial institutions (“dealer markup”) results in a significant risk of pricing disparity in violation of the ECOA. The CFPB recommended that financial institutions under its jurisdiction take steps to address compliance with the ECOA, which may include imposing controls on dealer markup, monitoring and addressing the effects of dealer markup policies, and eliminating dealer discretion to markup buy rates and fairly compensating dealers using a different mechanism that does not result in disparate impact to certain groups of consumers.

Insurance Laws and Regulations

As a marketer of insurance programs, we are subject to state rules and regulations governing the business of insurance including, without limitation, laws governing the administration, underwriting, marketing, solicitation and/or sale of insurance programs. The insurance carriers that underwrite the programs that we sell are required to file their rates for approval by state regulators. Additionally, certain state laws and regulations govern the form and content of certain disclosures that must be made in connection with the sale, advertising or offer of any insurance program to a consumer. We review all marketing materials we disseminate to the public for compliance with applicable insurance regulations. We are required to maintain certain licenses and approvals in order to market insurance programs.

Marketing Laws and Regulations