UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

LSC Communications, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form of Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

|

2018 ANNUAL MEETING OF STOCKHOLDERS MEETING NOTICE AND PROXY STATEMENT LSC COMMUNICATIONS, INC. |

|

Thursday, May 17, 2018 • 10 a.m. Central Time 10th Floor Conference Center, 191 N. Wacker Drive, Chicago, Illinois 60606 |

LETTER FROM OUR LEAD DIRECTOR

DEAR FELLOW STOCKHOLDERS,

Thank you for your investment in LSC Communications and for trusting the Board of Directors to oversee your interests in our business. Our Board understands that it is elected by you, the stockholders, to oversee the long-term health and overall success of our Company.

It has been my privilege to serve as LSC’s Lead Director this year, working with a group of highly-engaged and knowledgeable directors who are strongly attuned to their roles as your fiduciaries. I would like to reflect on 2017, our first full year as a public company, and the many ways in which our Board worked together to provide independent oversight of management and represent your interests throughout the year.

Independent Board Oversight

Our Board is composed of fully independent directors, with the exception of Tom Quinlan, our Chairman and Chief Executive Officer. The skills each of our directors bring to the Board reflect the deep expertise essential to effective oversight of our business, including operational leadership, governance, strategy and extensive experience in finance, sales, marketing and information technology.

In 2017, our directors utilized their deep knowledge and diverse backgrounds to work with management in its oversight of the Company’s corporate strategy. Additionally, we reviewed specific business and organizational initiatives, capital allocation priorities and business development opportunities. We continued our efforts to take the pulse of our Company by inviting our business leaders to participate in Board meetings throughout the year. With visits to our facilities and employees in Las Vegas, Nevada, Spartanburg, South Carolina and Bolingbrook, Illinois we were committed to asking the tough questions. In addition, our Board and its committees were involved in overseeing enterprise risk management, including risk priorities and developments that could impact our business and we also looked to the future by our ongoing review of director and management succession planning.

On top of our focus on the financial and operational performance of the Company, our Board also oversees other important Company initiatives and functions, including our safety, sustainability and ethics programs, in order to ensure that our Company’s culture aligns with our strategy and operates in the best interest of our stockholders.

Independent Board Leadership

As Lead Director, I work closely with our Chairman and Chief Executive Officer and other members of management to ensure that an active dialogue exists between our independent directors and management. In addition, in my role as Lead Director, I contribute to the development of, and approval of, Board meeting schedules, agendas, and materials. I attend each Board and Board committee meeting and also preside over the executive sessions of the Board held with our independent directors. Further, I am responsible, along with the Chairman of our Human Resources Committee, for leading the independent directors’ evaluation of the effectiveness of our Chief Executive Officer.

Good Governance Practices

As directors, we remain accountable to you through a variety of governance practices that are informed by our ongoing engagement with our stockholders. The Corporate Responsibility & Governance Committee of the Board, consisting of independent directors, oversees our annual multi-step self-evaluation process, which provides directors an opportunity to assess the Board, the Board committees and each individual director. Whereas our independent directors serving on the Human Resources Committee establish and monitor the Company’s overall executive compensation strategy to ensure that executive officer compensation supports the Company’s business objectives. Please see theCompany Information — Corporate Governance andCompensation Discussion & Analysis sections of this proxy statement for more details on these and other governance highlights.

Our Board remains committed to serving your interests in 2018 and thanks you for your continued engagement and support of our Company.

Sincerely,

Judith H. Hamilton

Lead Director

April 10, 2018

LSC COMMUNICATIONS, INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

| | |

| Date: | | Thursday, May 17, 2018 |

| Time: | | 10 a.m. Central time |

Place: | | 10thFloor Conference Center 191 N. Wacker Drive Chicago, Illinois 60606 |

| Items of Business: | | + To elect six nominees identified in this proxy statement for aone-year term as directors + To approve, on an advisory basis, the Company’s executive compensation + To ratify the appointment by the Audit Committee of Deloitte & Touche LLP as the Company’s independent registered public accounting firm + To conduct any other business if properly raised |

| Record Date: | | The close of business on March 29, 2018 |

You will find more information on the matters for voting in the proxy statement on the following pages. If you are a stockholder of record, you may vote by mail, by toll-free telephone number, by using the Internet or in person at the annual meeting.

Your vote is important! We strongly encourage you to exercise your right to vote as a stockholder. You will find instructions on how to vote beginning on page 7. Please vote, by signing, dating and returning the enclosed proxy card or voting instruction card in the envelope provided, calling the toll-free number or logging on to the internet — even if you plan to attend the annual meeting. You may revoke your proxy at any time before it is exercised.

Most stockholders vote by proxy and do not attend the annual meeting in person. However, as long as you were a stockholder at the close of business on March 29, 2018, you are invited to attend the annual meeting, or to send a representative. Please note that only persons with an admission ticket or evidence of stock ownership or who are guests of the Company will be admitted to the annual meeting.

By Order of the Board of Directors

Suzanne S. Bettman

Secretary

April 10, 2018

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting of Stockholders To Be Held on May 17, 2018

This proxy statement and our annual report to stockholders are available on the Investors portion of our website at www.lsccom.com. On this site, you will also be able to access our 2017 annual report on Form10-K for the fiscal year ended December 31, 2017, and all amendments or supplements that are required to be furnished to stockholders.

TABLE OF CONTENTS

TABLE OF CONTENTS

2018 Proxy Statement | LSC COMMUNICATIONS, INC

TABLE OF CONTENTS

LSC COMMUNICATIONS, INC | 2018 Proxy Statement

PROXY SUMMARY

PROXY SUMMARY

This summary highlights certain information from our proxy statement for the 2018 Annual Meeting of Stockholders. You should read the entire proxy statement carefully before voting.

2018 ANNUAL MEETING INFORMATION

| | |

| Date: | | Thursday, May 17, 2018 |

| Time: | | 10 a.m. Central time |

| Place: | | 10thFloor Conference Center 191 N. Wacker Drive Chicago, Illinois 60606 |

| Record Date: | | The close of business on March 29, 2018 |

For additional information about voting, seeQuestions and Answers About How to Vote Your Proxy.

MATTERS TO BE VOTED ON AT OUR 2018 ANNUAL MEETING

| | | | | | | | |

| | | | | Board

Recommendation | | Page | |

Proposal 1: Election of Directors | | | | FOR each of our nominees | | | 2 | |

Proposal 2: Advisory Vote to Approve Executive Compensation | | | | FOR | | | 4 | |

Proposal 3: Ratification of Independent Registered Public Accounting Firm | | | | FOR | | | 6 | |

Company Background

On October 1, 2016, R. R. Donnelley & Sons Company (“RR Donnelley” or “RRD”) effected its previously-announced intention to separate into three independent public companies: Donnelley Financial Solutions, Inc. (“Donnelley Financial” or “DFS”), LSC Communications, Inc. (“LSC,” “LSC Communications,” “we,” “our,” “us” and the “Company”) and RR Donnelley. The separation (the “Separation”) was effected when RRD distributed on a pro rata basis to holders of its common stock at least 80% of the outstanding shares of LSC common stock (the “Distribution”). SeeCertain Relationships and Related Party Transactions for more information regarding Separation-related agreements. Our common stock is traded on the New York Stock Exchange (the “NYSE”) under the trading symbol “LKSD.”

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 1

PROPOSALS

PROPOSALS

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | |

| | PROPOSAL SUMMARY | | |

| | | | | |

| | | Proposal 1: The election of six nominees identified in this proxy statement for aone-year term as directors Board Recommendation: The Board recommends that stockholders voteFOR each of our nominees; only directors that receive a majority of the votes castFOR their election will be elected |

Our Certificate of Incorporation provides for a classified board consisting of three classes of directors. Class I directors served until the first annual meeting of stockholders following the Separation (which was held on May 18, 2017), and our stockholders elected their successor directors to one-year terms until the 2018 Annual Meeting of Stockholders. Class II directors serve until the second annual meeting of stockholders following the Separation (which will be held on May 17, 2018), and our stockholders will elect their successor directors to one-year terms at the 2018 Annual Meeting of Stockholders. Class III directors, which together with Class I directors and Class II directors are referred to as the “Initial Directors,” serve until the third annual meeting of stockholders following the Separation, which will be held in May 2019. Following the expiration of the Class III directors’ initial three-year term, our stockholders will elect their successor directors to one-year terms. Our Certificate of Incorporation provides that our Board of Directors (the “Board”) fully declassifies upon the expiration of the terms of our Class III directors.

OurBy-laws provide that directors are elected to the Board by a majority of the votes cast, except in contested elections, wherein directors are elected to the Board by a plurality of the votes cast.

In the event that an incumbent director is not reelected, the Company’sPrinciples of Corporate Governance require that director to promptly tender his or her resignation. The Board will accept this resignation unless it determines that the best interests of the Company and its stockholders would not be best served by doing so.

If any nominee does not stand for election, proxies voting for that nominee may be voted for a substitute nominee selected by the Board. The Board may also choose to reduce the number of directors to be elected at the annual meeting.

In 2017 the Board met ten times. Each director of the Company during 2017 attended at least 75% of the total number of meetings of the Board and those committees of which the director was a member during the period he or she served as a director.

The names of the nominees, along with their present positions, their career highlights, current directorships held with other public companies, as well as public directorships during the past five years, other affiliations, their ages and the year first elected as a director, are set forth below. Certain individual qualifications, experiences and skills of our directors that contribute to the Board’s effectiveness as a whole are also described below.

| | |

| | |

Thomas J. Quinlan III, 55 Chairman, Chief Executive Officer and President Director since:2016 Current Public Directorships:None Former Public Directorships: RR Donnelley | | Key Experience and Qualifications |

| | Mr. Quinlan’s extensive experience at RR Donnelley and now LSC provides the Board with expertise in the printing and office products industries, especially with respect to business integration strategies needed to achieve our Company’s business plan. He also brings to the Board his familiarity with a broad range of operational issues, including sales, manufacturing and corporate staff functions, as a result of his many experiences in management roles across several industries. |

| | Career Highlights + Chairman of the Board, Chief Executive Officer and President of the Company since October 2016 + Chief Executive Officer and President of RR Donnelley from April 2007 to October 2016 + Other positions at RR Donnelley from 2004 to April 2007 including Group President, Global Services, Chief Financial Officer and Executive Vice President, Operations |

| |

| | |

2 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

PROPOSALS

| | |

| | |

M. Shân Atkins, 61 Director since:2016 Current Public Directorships: Darden Restaurants, Inc. SpartanNash Company SunOpta Inc. Former Public Directorships: The Pep Boys—Manny, Moe & Jack Tim Hortons Inc. Shoppers DrugMart Corporation Other Affiliations: True Value Company | | Key Experience and Qualifications |

| | Ms. Atkins has extensive experience in finance and accounting and in developing and executing strategic and operating plans for major consumer and retail organizations. She also has considerable corporate governance experience through years of service on the boards of other companies. |

| | Career Highlights + Full time independent director + Co-founder and Managing Director of Chetrum Capital LLC, a private investment firm from 2001 to 2017 + Various executive positions with Sears, Roebuck & Company, a North American retailer, from 1996 to 2001 + A leader in the consumer and retail practice at Bain & Company, an international management consultancy, from 1982 to 1996 + Began career as a public accountant at what is now PricewaterhouseCoopers LLP, an accounting firm |

| |

| | |

| | |

Margaret A. Breya, 56 Director since:2016 Current Public Directorships:None Former Public Directorships: Jive Software, Inc. Other Affiliations: InCorta, Inc. NSONE, Inc. | | Key Experience and Qualifications |

| | Ms. Breya’s extensive experience brings marketing, operations and enterprise software expertise to the Board. |

| | Career Highlights + Chief Operating Officer of Ionic Security Inc. since January 2016 + Chief Marketing Officer and Executive Vice President of Market Development at Informatica Corporation, a leading independent provider of enterprise data integration and data quality software and services, from December 2012 to August 2015 + Various positions of increasing responsibility in operations and marketing at Hewlett-Packard Company, a global provider of products, technologies, software, solutions and services, from 2010 to 2012 + Various positions of increasing responsibility at SAP AG, an enterprise software company, from 2006 to 2010 |

| |

| | |

| | |

Thomas F. O’Toole, 60 Director since:2016 Current Pubic Directorships: Alliant Energy Corporation (and its wholly owned subsidiaries Wisconsin Power and Light Company and Interstate Power and Light Company) Extended Stay America, Inc. Former Public Directorships: None Other Affiliations: Corporation for Travel Promotion | | Key Experience and Qualifications |

| | Mr. O’Toole has extensive experience in leadership, customer perspectives and information systems, and provides the Board with a combination of abilities and unique insights into its strategy and operations. |

| | Career Highlights + Senior Fellow and Clinical Professor of Marketing at the Kellogg School of Management at Northwestern University since November 2016 and a Senior Advisor at McKinsey and Company since January 2017 + Senior Vice President, Chief Marketing Officer of United Airlines and President of MileagePlus for United Continental Holdings, Inc., a global air carrier, from 2015 to December 2016; Senior Vice President, Marketing and Loyalty and President, MileagePlus from 2012 to 2015; Chief Operating Officer, Mileage Plus Holdings, LLC from 2010 to 2012; and Senior Vice President and Chief Marketing Officer in 2010 + Advisor with Diamond Management & Technology Consultants, a management and technology consulting firm, from 2009 to 2010 + Various positions of increasing responsibility at Hyatt Hotels Corporation from 1995 to 2008, including Chief Marketing Officer and Chief Information Officer |

| |

| | |

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 3

PROPOSALS

| | |

| | |

Douglas W. Stotlar, 57 Director since:2016 Current Public Directorships: AECOM Reliance Steel & Aluminum Co. Former Public Directorships: URS Corporation Con-way Inc. Other Affiliations: Stone Canyon Packaging, LLC | | Key Experience and Qualifications |

| | Mr. Stotlar has substantial knowledge of the transportation and logistics sector, which is relevant to our business activities. In addition, due to his prior experience as the former chief executive officer and as a director of a public company, Mr. Stotlar contributes valuable leadership experience as well as knowledge of legal and regulatory requirements and trends. |

| | Career Highlights + Former President and Chief Executive Officer ofCon-way, Inc., a transportation and logistics company, from April 2005 to October 2015 + Various positions of increasing responsibility atCon-way, Inc. since 1985 |

| |

| | |

| | |

Shivan S. Subramaniam, 69 Director since:2016 Current Pubic Directorships: Citizens Financial Group, Inc. Former Public Directorships: None Other Affiliations: FM Global Inc. Lifespan Corporation | | Key Experience and Qualifications |

| | Mr. Subramaniam has significant experience as a chairman and chief executive officer and provides the Board with financial, strategic and operational leadership. He also has considerable corporate governance experience as the chair of a governance committee. |

| | Career Highlights + Chairman of FM Global Inc., a property and casualty insurance company, since 2002 + Chief Executive Officer of FM Global Inc. from 1999 to 2014 and President and Chief Executive Officer from 1999 to 2002 + Various finance positions of increasing responsibility at Allendale Insurance Company from 1974 to 1999, including as Chairman and Chief Executive Officer from 1992 to 1999 |

| |

| | |

PROPOSAL 2: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

| | | | |

| | PROPOSAL SUMMARY | | |

| | | | | |

| | | Proposal 2: An advisory vote to approve the Company’s executive compensation as described in this proxy statement Board Recommendation: The Board recommends that the stockholders voteFOR Proposal 2 |

As required by Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), the Company is presenting a proposal that gives stockholders the opportunity to cast an advisory(non-binding) vote on our executive compensation for named executive officers described in this proxy statement by voting for or against it. The advisory vote on executive compensation described in this proposal is commonly referred to as a Say on Pay vote.

As disclosed in theCompensation Discussion & Analysis section of this proxy statement (the “CD&A”), we believe our 2017 executive compensation program was designed to strike an appropriate balance between aligning stockholder interests, rewarding executives for strong performance, ensuring the Company’s long-term success and retaining key executive talent. The information presented in the compensation tables in theExecutive Compensation section of this proxy statement relates to the Company’s 2017 fiscal year, which ended on December 31, 2017.

LSC Compensation Philosophy

The Human Resources Committee (the “HR Committee”) has adopted the following compensation philosophy (the “LSC Compensation Philosophy”) to guide its compensation decisions:

| | + | | compensation programs should be simple, equitable and transparent; |

| | + | | the compensation program framework should support and reinforce the business strategy and encourage collaboration, as appropriate; |

4 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

PROPOSALS

| | + | | rewards policies and plans should effectively attract and retain critical industry talent by targeting total compensation and underlying pay elements at the 50th percentile of the external market and provide the opportunity to earn compensation above the 50th percentile of the market if superior performance results are achieved, taking into account tenure and affordability; |

| | + | | external market should acknowledge that talent is likely to come from a wide spectrum of industries; |

| | + | | incentive plans should have performance linkages to financial and operational results; |

| | + | | there should be clearline-of-sight in the annual incentive plan to financial and operational objectives incorporating a limited number of metrics; |

| | + | | equity should be recognized as a valuable resource that will be allocated based on employee level, contribution/performance and potential; |

| | + | | incentive design should consider the industry nature (cyclical dynamics, etc.) of the Company’s operations and the impact of external market conditions; and |

| | + | | perquisites and othernon-performance reward elements should be limited. |

2017 Executive Compensation Program Highlights

| | + | | Removal of Legacy 280G Excise TaxGross-Ups. In response to stockholder feedback and the results of our Say on Pay vote at the Company’s 2017 Annual Meeting of Stockholders, the legacy 280G excise taxgross-ups contained in Mr. Quinlan and Ms. Bettman’s employment agreements were removed. |

| | + | | Vigorous and Informed Decision-Making Process. The HR Committee, which met nine times in 2017, has a vigorous and informed decision-making process which is guided by the LSC Compensation Philosophy and also considers input from its independent compensation consultant. |

| | + | | Stockholder Engagement. LSC undertook a proactive and robust process to solicit stockholder feedback and otherwise increase stockholder engagement regarding compensation and other governance matters. |

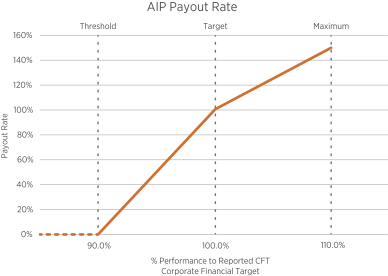

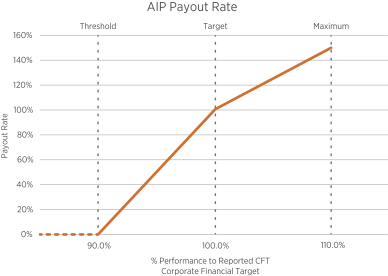

| | - | | Consistent with our pay for performance philosophy, and following management’s recommendation, the HR Committee made the determination that while the net sales threshold target was met, year to date performance against the EBITDA corporate financial target did not merit annual cash bonus payouts under the Annual Incentive Plan (“AIP”) and thus, no annual bonus payments were paid under the AIP for 2017 to any employee, including the Chief Executive Officer and the other named executive officers. |

| | - | | No increases were made to the named executive officers’ base salaries in 2017. |

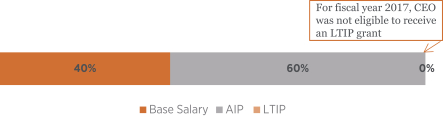

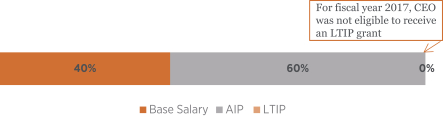

| | + | | No 2017 Long-Term Incentive Plan Grant for the CEO. In consideration of Mr. Quinlan’s Founders’ Award granted to him in October 2016, the HR Committee chose not to award to Mr. Quinlan a 2017 long-term incentive plan equity grant. |

Proposal 2 gives our stockholders the opportunity to express their views on the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. For the reasons discussed above, we are asking our stockholders to indicate their support for our named executive officer compensation by votingFOR the following resolution at the 2018 Annual Meeting of Stockholders:

“RESOLVED: that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s proxy statement for its 2018 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including theCompensation Discussion & Analysis, the 2017Summary Compensation Table and the other related tables and disclosures in this proxy statement.”

The Say on Pay vote is an advisory vote only, and therefore it will not bind the Company or our Board (including the HR Committee). However, the Board and the HR Committee will consider the voting results when making future decisions regarding executive compensation, as appropriate.

The affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or by proxy at the 2018 Annual Meeting of Stockholders and entitled to vote on the advisory vote on executive compensation is required to approve the proposal.

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 5

PROPOSALS

PROPOSAL 3: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| | | | |

| | PROPOSAL SUMMARY | | |

| | | | | |

| | | Proposal 3: A vote to ratify the appointment by the Audit Committee of Deloitte & Touche LLP as the Company’s independent registered public accounting firm Board Recommendation: The Board and the Audit Committee recommend that the stockholders voteFOR Proposal 3 |

Proposal 3 is the ratification of the Audit Committee’s appointment of Deloitte & Touche LLP as the independent registered public accounting firm to audit the financial statements of the Company for fiscal year 2018. In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment. The Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’ best interests. Representatives of Deloitte & Touche LLP will be present at the annual meeting. They will be available to respond to your questions and may make a statement if they desire.

The affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or by proxy at the 2018 Annual Meeting of Stockholders and entitled to vote on the proposal is required to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2018. Deloitte & Touche LLP has served as our independent auditor since the Separation in October 2016.

6 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

QUESTIONS AND ANSWERS ABOUT HOW TO VOTE YOUR PROXY

QUESTIONS AND ANSWERS ABOUT HOW TO VOTE YOUR PROXY

Below are instructions on how to vote, as well as information on your rights as a stockholder as they relate to voting. Some of the instructions vary depending on how your stock is held. It’s important to follow the instructions that apply to your situation.

| A. | You are entitled to one vote on each proposal for each share of the Company’s common stock that you own as of the close of business on the record date, March 29, 2018. |

| Q. | What is the difference between holding shares as a “shareholder of record” and a “street name” holder? |

| A. | If your shares are registered directly in your name through Computershare, the Company’s transfer agent, you are considered a “shareholder of record.” If your shares are held in a brokerage account or bank, you are considered a “street name” holder. |

| Q. | How do I vote if shares are registered in my name (as shareholder of record)? |

| A. | By Mail:Sign, date and return the enclosed proxy card in the postage paid envelope provided. Your voting instructions must be received by May 16, 2018. |

| | By Telephone or Internet:You may either call the toll-free number listed on your proxy card, log on to the website listed on your proxy card, or scan the QR code on your proxy card and follow the simple instructions provided. |

| | The telephone and Internet voting procedures are designed to allow you to vote your shares and to confirm that your instructions have been properly recorded consistent with applicable law. Please see your proxy card for specific instructions. Stockholders who wish to vote over the Internet should be aware that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, and that there may be some risk a stockholder’s vote might not be properly recorded or counted because of an unanticipated electronic malfunction. |

| | Voting by telephone and the Internet will be closed at 1:00 a.m. Central time on the date of the 2018 Annual Meeting of Stockholders. |

| Q. | How do I vote if my shares are held in “street name?” |

| A. | You should give instructions to your broker on how to vote your shares. If you do not provide voting instructions to your broker, your broker has discretion to vote those shares on matters that are routine. However, a broker cannot vote shares onnon-routine matters without your instructions. This is referred to as a “brokernon-vote.” |

| | All of the proposals other than the ratification of appointment of the independent registered public accounting firm (Proposal 3) are considerednon-routine matters. Accordingly, your broker will not have the discretion to vote shares as to which you have not provided voting instructions with respect to any of these matters. Ratification of the appointment of the independent registered public accounting firm is considered a routine matter, so there will not be any brokernon-votes with respect to Proposal 3. |

| Q. | Can I vote my shares in person at the Annual Meeting? |

| A. | If you plan to attend the annual meeting and vote in person, your instructions depend on how your shares are held: |

| | + | | Shares registered in your name — check the appropriate box on your proxy card and bring either the admission ticket attached to the proxy card or evidence of your stock ownership with you to the annual meeting. |

| | + | | Shares registered in the name of your broker or other nominee — ask your broker to provide you with a broker’s proxy card (also known as a “Legal Proxy”) in your name (which will allow you to vote your shares in person at the meeting)and bring evidence of your stock ownership from your broker with you to the annual meeting. |

| | Remember that attendance at the annual meeting will be limited to stockholders as of the record date (March 29, 2018) with an admission ticket or evidence of their share ownership and guests of the Company. |

| Q. | Can I revoke my proxy or change my vote after I have voted? |

| A. | If your shares are registered in your name, you may revoke your proxy at any time before it is exercised. There are several ways you can do this: |

| | + | | By delivering a written notice of revocation to the Secretary of the Company; |

| | + | | By executing and delivering another proxy that bears a later date; |

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 7

QUESTIONS AND ANSWERS ABOUT HOW TO VOTE YOUR PROXY

| | + | | By voting by telephone at a later time; |

| | + | | By voting over the Internet at a later time; or |

| | + | | By voting in person at the annual meeting. |

| | If your shares are held in street name, you must contact your broker to revoke your proxy. |

| A. | In tallying the results of the voting, the Company will count all properly executed and unrevoked proxies that have been received in time for the 2018 Annual Meeting of Stockholders. To hold a meeting of stockholders, a quorum of the shares (which is a majority of the shares outstanding and entitled to vote) is required to be represented either in person or by proxy at the meeting. Abstentions and brokernon-votes are counted in determining whether a quorum is present for the meeting. |

| Q. | What are my options when voting for directors (Proposal 1)? |

| A. | When voting on Proposal 1, you have three options: |

| | + | | Vote AGAINST a nominee; or |

| | + | | ABSTAIN from voting on a nominee. |

| | In the election of directors, each nominee will be elected by the vote of the majority of votes cast. A majority of votes cast means that the number of votes cast “FOR” a nominee’s election must exceed the number of shares voted “AGAINST” such nominee’s election. Each nominee receiving a majority of votes cast “FOR” his or her election will be elected. If you choose to “ABSTAIN” with respect to a nominee for director, the abstention will not impact the election of such nominee. |

| | Election of directors is considered anon-routine matter. Accordingly, brokernon-votes will not count as a vote “FOR” or “AGAINST” a nominee’s election and will not impact the election of such nominee. In tabulating the voting results for the election of directors, only “FOR” and “AGAINST” votes are counted. |

| Q. | What are my options when voting on any other proposals (Proposals 2 and 3)? |

| A. | When voting on any other proposal, you have three options: |

| | + | | Vote FOR a given proposal; |

| | + | | Vote AGAINST a given proposal; or |

| | + | | ABSTAIN from voting on a given proposal. |

| | Proposals 2 and 3 require the affirmative vote of a majority of the shares present at the meeting and entitled to vote on the proposal. If you indicate on your proxy card that you wish to “ABSTAIN” from voting on any of Proposals 2 or 3, your shares will not be voted on that proposal. Abstentions are not counted in determining the number of shares voted “FOR” or “AGAINST” any proposal, but will be counted as present and entitled to vote on the proposal. Accordingly, an abstention will have the effect of a vote against the proposal. |

| | Brokernon-votes are not counted in determining the number of shares voted for or against any proposal and will not be counted as present and entitled to vote on any of Proposals 2 and 3. |

| Q. | How will my shares be voted if I sign and return my proxy card with no votes marked? |

| A. | If you sign and return your proxy card with no votes marked, your shares will be voted as follows: |

| | + | | Proposal 1:FORthe election of all nominees for director identified in this proxy statement; |

| | + | | Proposal 2:FORthe advisory vote on the Company’s executive compensation; and |

| | + | | Proposal 3:FORthe ratification of the appointment of the Company’s independent registered public accounting firm. |

| Q. | How are proxies solicited and what is the cost? |

| A. | The Company actively solicits proxy participation. In addition to this notice by mail, the Company encourages banks, brokers and other custodian nominees and fiduciaries to supply proxy materials to our stockholders, and reimburses them for their expenses. However, the Company does not reimburse its own employees for soliciting proxies. The Company has hired Morrow Sodali LLC, 470 West Ave., Suite 3000, Stamford, CT 06902, to help solicit proxies, and has agreed to pay it $8,000 plusout-of-pocket expenses for this service. All costs of this solicitation will be borne by the Company. |

| Q. | How many shares of stock were outstanding on the record date? |

| A. | As of the record date, there were 34,962,612 shares of common stock outstanding. Each outstanding share is entitled to one vote on each proposal. |

8 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

COMPANY INFORMATION

COMPANY INFORMATION

ABOUT THE CONTINUING DIRECTORS

The information below describes the directors who are not standing for election whose terms continue to run after the annual meeting. Information on directors who are standing for election this year is provided earlier under Proposal 1.

Directors Of Class III — Terms Expire In 2019

| | |

Judith H. Hamilton, 73 Director since:2016 Current Public Directorships: None Former Public Directorships: RR Donnelley Other Affiliations: Novell, Inc. Software.com Lante Corporation Giga Information Group, Inc. | | Key Experience and Qualifications |

| | Ms. Hamilton’s experience as a chief executive officer of various software and technology companies helps the Board address the challenges faced due to rapid changes in communications strategies. Her involvement in early stage companies also brings to the Board entrepreneurial experience. She also has considerable corporate governance experience through years of service on the boards of other companies. |

| | Career Highlights + Lead Director of the Company’s Board since October 2016 + Former President and Chief Executive Officer of Classroom Connect Inc., a provider of materials integrating the Internet into the education process + Former President and Chief Executive Officer of FirstFloor Software, an Internet software publisher + Former Chief Executive Officer of Dataquest, a market research firm for technology |

| |

| | |

Francis J. Jules, 61 Director since:2016 Current Public Directorships:None Former Public Directorships: ModusLink Global Solutions, Inc. | | Key Experience and Qualifications |

| | Mr. Jules has a proven track record in leading large, complex teams around the globe in sales, marketing, product and technical solutions to serve enterprise, medium, and small customers around the world. He has both operational and strategic leadership skills. |

| | Career Highlights + President of Global Business for AT&T Corporation since 2012 + AT&T Corporation’s Executive Vice President, Global Enterprise Solutions sales team from 2010 to 2012, President and Chief Executive Officer, Advertising Solutions from 2007 to 2010 and Senior Vice President, Network Integration from 2005 to 2007 + President, Global Markets (East) for SBC Communications from 2003 to 2005 |

| |

| | |

Richard K. Palmer, 51 Director since:2016 Current Public Directorships: None Former Public Directorships: RR Donnelley Other Affiliations: FCA US LLC | | Key Experience and Qualifications |

| | Mr. Palmer’s experience as chief financial officer of both public and global companies, as well as his position as a member of the highest executive decision-making body of a large multinational company, brings financial, international and operational expertise. He is an audit committee financial expert based on his experience as chief financial officer of a public company as well as his experience as an auditor with a public accounting firm. |

| | Career Highlights + Chief Financial Officer, Senior Vice President and member of Group Executive Council of Fiat Chrysler Automobiles N.V. (FCA), an international group that designs, produces and sells passenger cars and commercial vehicles, since 2011 + Chief Financial Officer of FCA US LLC, a vehicle manufacturer that is part of a global alliance with FCA, since 2009 + Chief Financial Officer of Fiat Group Automobiles S.p.A., industrial vehicle and bus manufacturing company owned by Fiat, from 2006 to 2009 + Chief Financial Officer of Iveco S.p.A and Chief Financial Officer, Comau S.p.A., a developer of automation systems and other robotic devices owned by Fiat, 2003 to 2005. + Prior thereto, various positions at - General Electric Company - United Technologies Corporation - Price Waterhouse (now PricewaterhouseCoopers LLP) |

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 9

COMPANY INFORMATION

THE BOARD’S COMMITTEES AND THEIR FUNCTIONS

The Board has three standing committees. The members of those committees and the committees’ responsibilities are described below. Each committee operates under a written charter that is reviewed annually and is posted on the Investors section of the Company’s website at the following address: www.lsccom.com. A print copy of each charter is available upon request.

| | | | |

| Audit Committee | | | | 2017 Meetings: 9 |

Richard K. Palmer(Chairman) Margaret A. Breya Douglas W. Stotlar Shivan S. Subramaniam | | Responsibilities Assists the Board in its oversight of: + The integrity of the Company’s financial statements and the Company’s accounting and financial reporting processes and financial statement audits + The qualifications and independence of the Company’s independent registered public accounting firm + The performance of the Company’s internal auditing department and its independent registered public accounting firm | | The Audit Committee selects, sets compensation, evaluates and, when appropriate, replaces the Company’s independent registered public accounting firm. Pursuant to its charter, the Audit Committee is authorized to obtain advice and assistance from internal or external legal, accounting or other advisors and to retain third-party consultants, and has the authority to engage independent auditors for special audits, reviews and other procedures. As required by its charter, each member of the Audit Committee is independent and financially literate, as such terms are defined for purposes of the NYSE listing rules and the federal securities laws. The Board has determined that each of Richard K. Palmer, Douglas W. Stotlar and Shivan S. Subramaniam is an “audit committee financial expert” as such term is defined under the federal securities laws. |

| | | | |

| Corporate Responsibility & Governance Committee | | 2017 Meetings: 4 |

Judith H. Hamilton(Chairman) M. Shân Atkins Margaret A. Breya Thomas F. O’Toole Shivan S. Subramaniam | | Responsibilities + Makes recommendations to the Board regarding nominees for election to the Board and recommends policies governing matters affecting the Board + Develops and implements governance principles for the Company and the Board + Conducts the regular review of the performance of the Board, its committees and its members + Oversees the Company’s responsibilities to its employees and to the environment + Recommends director compensation to the Board | | As required by its charter, each member of the Corporate Responsibility & Governance Committee is independent as such term is defined for purposes of the NYSE listing rules and the federal securities laws. Pursuant to its charter, the Corporate Responsibility & Governance Committee is authorized to obtain advice and assistance from outside advisors and to retain third-party consultants and has the sole authority to approve the terms and conditions under which it engages director search firms. |

10 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

COMPANY INFORMATION

| | | | |

| Human Resources Committee | | 2017 Meetings: 9 |

Francis J. Jules(Chairman) M. Shân Atkins Thomas F. O’Toole Douglas W. Stotlar | | Responsibilities + Establishes the Company’s overall compensation strategy + Establishes the compensation of the Company’s Chief Executive Officer, other senior officers and key management employees + Adopts amendments to, and approves terminations of, the Company’s employee benefit plans | | As required by its charter, each member of the HR Committee is independent, as such term is defined for purposes of the NYSE listing rules and the federal securities laws. In addition, in accordance with the NYSE listing rules requiring the Board to affirmatively determine that each member of the HR Committee is independent, the Board considered all factors specifically relevant to determining whether a director has a relationship to the Company which is material to that director’s ability to be independent and affirmatively determined that each member of the HR Committee is independent. Pursuant to its charter, the HR Committee is authorized to obtain advice and assistance from internal or external legal or other advisors and has the sole authority to engage counsel, experts or consultants in matters related to the compensation of the Chief Executive Officer and other executive officers of the Company (with sole authority to approve any related fees and other retention terms). Pursuant to its charter, prior to selecting or receiving any advice from any committee advisor (other thanin-house legal counsel) and on an annual basis thereafter, the HR Committee must assess the independence of such committee advisor in compliance with any applicable NYSE listing rules and the federal securities laws. The HR Committee must also review and approve, in advance, any engagement of any compensation consultant by the Company for any services other than providing advice to the Committee regarding executive officer compensation. |

The HR Committee has engaged Willis Towers Watson as its executive compensation consultant to provide objective analysis, advice and recommendations on executive pay in connection with the HR Committee’s decision-making process. In 2017, Willis Towers Watson’s fees for executive compensation consulting services were approximately $215,000. SeeCompensation Discussion & Analysis for more information regarding the HR Committee’s relationship with Willis Towers Watson.

POLICY ON ATTENDANCE AT STOCKHOLDER MEETINGS

Directors are expected to attend meetings of stockholders in person, except when circumstances prevent such attendance. When such circumstances exist, or in the case of special stockholder meetings, directors may participate by telephone or other electronic means and will be deemed present at such meetings if they can both hear and be heard. Eight of the nine current members of the Board who were members at the time attended the Company’s 2017 Annual Meeting of Stockholders in person.

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 11

COMPANY INFORMATION

CORPORATE GOVERNANCE

Governance Highlights

The Company’s corporate governance practices and policies have been developed in accordance with the highest standards of integrity and include the adoption of a number of governance best practices including:

| | + | | No shareholders rights plan (poison pill) |

| | + | | A classified board that fully declassifies upon the expiration of the initial term of our Class III directors at the 2019 Annual Meeting of Stockholders |

| | + | | An independent, experienced Lead Director |

| | + | | Majority voting for the election of directors |

| | + | | A robust self-evaluation process which provides directors an opportunity to assess the Board, each Board committee and each individual director |

| | + | | No super-majority voting |

| | + | | The right of stockholders representing at least 25% of outstanding shares to call a special meeting |

| | + | | The engagement of independent compensation consultants |

| | + | | Term limits for committee chairs |

| | + | | Political Activities Disclosure Policy |

| | + | | Independent board members with the exception of the Chief Executive Officer |

| | + | | A restriction on the directors standing forre-election after reaching age 75 |

| | + | | Director compensation heavily weighted toward equity |

| | + | | Stock ownership guidelines for senior officers and directors |

As described inCompensation Discussion & Analysis, the Company engages with stockholders about various corporate governance topics, including executive compensation.

Principles of Corporate Governance

The Board has adopted a set ofPrinciples of Corporate Governance to provide guidelines for the Company and the Board to ensure effective corporate governance. ThePrinciples of Corporate Governance cover topics including, but not limited to, director qualification standards, Board and committee composition, director access to management and independent advisors, director orientation and continuing education, director retirement age, succession planning and the annual evaluations of the Board and its committees. Such evaluations determine whether the Board and each committee are functioning effectively, and the Corporate Responsibility & Governance Committee considers the mix of skills and experience that directors bring to the Board to assess whether the Board has the necessary tools to form its oversight function effectively.

The Corporate Responsibility & Governance Committee is responsible for overseeing and reviewing the Company’sPrinciples of Corporate Governance and recommending to the Board any changes to those principles. The full text of thePrinciples of Corporate Governance is available on the Investors section of our website at lsccom.com, and a print copy is available upon request. References to the Company’s website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this proxy statement.

Principles of Ethical Business Conduct and Code of Ethics

In accordance with the NYSE listing requirements and Securities and Exchange Commission (“SEC”) rules, the Company has adopted and maintains a set ofPrinciples of Ethical Business Conduct. The policies referred to therein apply to all directors, officers and employees of the Company. In addition, the Company has adopted and maintains aCode of Ethicsfor the Chief Executive Officer and Senior Financial Officers that applies to its chief executive officer and senior financial officers. ThePrinciples of Ethical Business Conduct and theCode of Ethicsfor the Chief Executive Officer and Senior Financial Officers cover areas of professional conduct, including, but not limited to, conflicts of interest, disclosure

12 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

COMPANY INFORMATION

obligations, insider trading and confidential information, as well as compliance with all laws, rules and regulations applicable to our business. The Company encourages all employees, officers and directors to promptly report any violations of any of the Company’s policies. In the event that an amendment to, or a waiver from, a provision of theCode of Ethicsforthe Chief Executive Officer and Senior Financial Officers is necessary, the Company will post such information on its website. The full text of each of thePrinciples of Ethical Business Conduct and ourCode of Ethics is available on the Corporate Governance section of the Investors portion of our website at lsccom.com, and print copies are available upon request. References to the Company’s website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this proxy statement.

Director Independence

The Company’sPrinciples of Corporate Governance provide that the Board must be composed of a majority of independent directors. No director qualifies as independent unless the Board affirmatively determines that the director has no relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has determined that all eightnon-employee directors of our Board are also independent in accordance with the NYSE requirements. Mr. Quinlan, who as an employee of the Company, is not independent.

Executive Sessions

The Company’s independent directors are expected to meet regularly in executive sessions without management. Executive sessions are led by the Lead Director of the Board. An executive session is expected to be held in conjunction with each regularly scheduled Board meeting. Each committee of the Board also is expected to meet in executive session without management in conjunction with each regularly scheduled committee meeting and such sessions will be led by the chairman of such committee.

Board Leadership

Our Board has the discretion to combine or separate the roles of chairman and chief executive officer as the Board deems appropriate based on the needs of the Company at any given time. To facilitate this decision-making, the Corporate Responsibility & Governance Committee discusses our Board leadership structure, providing its recommendation on the appropriate structure to our independent directors. The Board has determined that having a combined chairman and chief executive officer with an independent Lead Director is the most appropriate Board leadership structure for LSC. This structure puts one person in the best position to be aware of major issues facing the Company on aday-to-day and long-term basis, and to identify and bring key risks and developments facing the Company to the Board’s attention (in coordination with the Lead Director as part of the agenda-setting process). As set forth in ourPrinciples of Corporate Governance, our Lead Director:

| | + | | reviews and approves, in coordination with the chairman/chief executive officer, Board meeting schedules and agendas for Board meetings together with all materials and information sent or presented to the Board; |

| | + | | has the authority to add items to the agenda for any Board meeting; |

| | + | | presides at executive sessions of independent directors, which are held at each regular Board meeting; |

| | + | | serves as anon-exclusive liaison between the other independent directors and the chairman/chief executive officer; |

| | + | | may call meetings of the independent directors in his or her discretion and chair any meeting of the Board or stockholders at which the chairman is absent; |

| | + | | is available to meet with major stockholders and regulators under appropriate circumstances; and |

| | + | | in conjunction with the chairman of the HR Committee, discusses with the chairman/chief executive officer the Board’s annual evaluation of his or her performance as chief executive officer. |

In addition, the powers of the chairman under ourBy-laws are limited to chairing meetings of the Board and meetings of stockholders as well as certain other powers conferred on the chairman such as the ability to call special meetings of stockholders or the Board. These powers can also be exercised by the Board, by a specified number of directors or, in some cases, the Lead Director. Some of the chairman’s powers are administrative in nature (such as the authority to execute documents on behalf of the Company).

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 13

COMPANY INFORMATION

Board’s Role in Risk Oversight

The Board and each of its committees is actively involved in oversight of risks inherent in the operation of the Company’s business and the implementation of its strategic plan. In performing this function, each committee has full access to management, as well as the ability to engage advisors, and each committee reports back to the Board.

Nomination of Directors

It is the policy of the Corporate Responsibility & Governance Committee to consider those candidates for director recommended by stockholders. In order to recommend a candidate, stockholders must submit the individual’s name and qualifications in writing to the Corporate Responsibility & Governance Committee (in care of the Secretary at the Company’s principal executive offices at 191 N. Wacker Drive, Suite 1400, Chicago, Illinois 60606) and otherwise in accordance with the procedures outlined underSubmitting Stockholder Proposals and Nominations for 2019 Annual Meeting. The Corporate Responsibility & Governance Committee evaluates candidates recommended for director by stockholders in the same way that it evaluates any other candidate.

The Corporate Responsibility & Governance Committee also considers candidates recommended by management and members of the Board as well as nominees recommended by stockholders.

In identifying and evaluating nominees for director, the Corporate Responsibility & Governance Committee takes into account the applicable requirements for directors under the listing rules of the NYSE. In addition, the Corporate Responsibility & Governance Committee considers other criteria as it deems appropriate and which may vary over time depending on the Board’s needs, including certain core competencies and other criteria such as the personal and

14 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

Board Risk Oversight Includes: + Strategic plan and direction + Annual budget + Operations of the Company’s business units and corporate functions + Review of the output of the Company’s enterprise risk management process Audit Committee Risk Oversight Includes: + Enterprise risk management process + Disclosure controls + Internal controls over financial reporting + Compliance with legal and regulatory requirements Management + Financial, legal and compliance Risk Corporate Responsibility & HR Committee Risk Oversight Includes: Governance Committee Risk Oversight + Attraction and retention of key Includes: management and employees Reputational + Governance structure and processes + Design of compensation programs and + Related person transactions arrangements + Certain compliance issues + Succession planning for key senior + Board and committee structure management positions + Legislative and regulatory developments

COMPANY INFORMATION

professional qualities, experience and education of the nominees, as well as the mix of skills and experience on the Board prior to and after the addition of the nominees. Although not part of any formal policy, the goal of the Corporate Responsibility & Governance Committee is a balanced and diverse Board, with members whose skills, viewpoints, backgrounds and experiences complement each other and, together, contribute to the Board’s effectiveness as a whole. The Corporate Responsibility & Governance Committee may engage third-party search firms to identify candidates for director and to do preliminary interviews and background and reference reviews of prospective candidates.

Communications with the Board of Directors

The Board has established procedures for stockholders and other interested parties to communicate with the Board. A stockholder or other interested party may contact the Board by writing to the chairman of the Corporate Responsibility & Governance Committee or the othernon-management members of the Board to their attention at 191 N. Wacker Drive, Suite 1400, Chicago, IL 60606; Attention: Secretary. Any stockholder must include the number of shares of the Company’s common stock he or she holds, and any interested party must detail his or her relationship with the Company in any communication to the Board. Communications received in writing will be distributed to the chairman of the Corporate Responsibility & Governance Committee ornon-management directors of the Board as a group, as appropriate, unless such communications are considered, in the reasonable judgment of the Company’s Secretary, improper for submission to the intended recipient(s). Examples of communications that would be considered inappropriate for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to the Company or the Company’s business or communications that relate to improper or irrelevant topics.

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 15

STOCK OWNERSHIP

STOCK OWNERSHIP

The table below lists the beneficial ownership of common stock as of March 29, 2018 by all directors and nominees, each of the persons named in the tables underExecutive Compensation below, and the directors and executive officers as a group. The table includes all stock awards subject to vesting conditions that vest within 60 days of March 29, 2018. The table also lists all institutions and individuals known to hold more than 5% of the Company’s common stock, which has been obtained from filings made pursuant to Sections 13(d) and (g) of the Exchange Act. Except as otherwise indicated below, each of the entities or persons named in the table has sole voting and investment power with respect to all common stock beneficially owned set forth opposite their name. The percentages shown are based on outstanding shares of common stock as of March 29, 2018. Unless otherwise indicated, the business address of each stockholder listed below is LSC Communications, 191 N. Wacker Drive, Suite 1400, Chicago, IL 60606.

BENEFICIAL STOCK OWNERSHIP OF DIRECTORS, EXECUTIVES AND LARGE STOCKHOLDERS

| | | | | | | | |

| Name | | Number | | | % of Total Outstanding | |

Thomas J. Quinlan III(1) | | | 604,444 | | | | 1.73 | |

Suzanne S. Bettman(2) | | | 80,796 | | | | * | |

Andrew B. Coxhead(3) | | | 55,332 | | | | * | |

Kent A. Hansen(4) | | | 12,783 | | | | * | |

Richard T. Lane(5) | | | 30,489 | | | | * | |

Judith H. Hamilton(6) | | | 43,626 | | | | * | |

M. Shân Atkins(7) | | | 9,428 | | | | * | |

Margaret A. Breya(7) | | | 9,428 | | | | * | |

Francis J. Jules(7) | | | 9,428 | | | | * | |

Thomas F. O’Toole(7) | | | 9,428 | | | | * | |

Richard K. Palmer(8) | | | 33,166 | | | | * | |

Douglas W. Stotlar(7) | | | 9,428 | | | | * | |

Shivan S. Subramaniam(9) | | | 22,928 | | | | * | |

All directors and executive officers as a group | | | 930,704 | | | | 2.58 | |

BlackRock, Inc.(10) | | | 4,819,897 | | | | 13.79 | |

The Vanguard Group(11) | | | 3,553,916 | | | | 10.16 | |

Hotchkis and Wiley Capital Management, LLC(12) | | | 1,994,774 | | | | 5.71 | |

| 1 | Reflects ownership of 258,273 shares of common stock held directly, 988 shares held in Mr. Quinlan’s 401(k) plan account, 119,433 restricted stock awards that are subject to vesting and 225,750 options over common stock. Does not include 366,806 restricted stock units that are subject to vesting. |

| 2 | Reflects ownership of 41,405 shares of common stock held directly, 47 shares held in Ms. Bettman’s 401(k) plan account and 39,344 restricted stock awards that are subject to vesting. Does not include 70,116 restricted stock units that are subject to vesting. |

| 3 | Reflects ownership of 20,743 shares of common stock held directly and 34,589 restricted stock awards that are subject to vesting. Does not include 55,873 restricted stock units that are subject to vesting. |

| 4 | Reflects ownership of 2,448 shares of common stock held directly and 10,335 restricted stock awards subject to vesting. Does not include 8,150 restricted stock units that are subject to vesting. |

| 5 | Reflects ownership of 12,045 shares of common stock held directly and 18,444 restricted stock awards that are subject to vesting. Does not include 32,849 restricted stock units that are subject to vesting. |

| 6 | Reflects ownership of 16,559 shares of common stock held directly, 9,080 restricted stock units that will vest on the earlier of May 18, 2018 or when such director ceases to be a director and 17,987 restricted stock units that will vest when such director ceases to be a director. |

| 7 | Reflects ownership of 3,222 shares of common stock held directly, and 6,206 restricted stock units that will vest on the earlier of May 18, 2018 or when such director ceases to be a director. |

16 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

STOCK OWNERSHIP

| 8 | Reflects ownership of 2,986 shares of common stock held directly, 6,206 restricted stock units that will vest on the earlier of May 18, 2018 or when such director ceases to be a director and 23,974 restricted stock units that will vest when such director ceases to be a director. |

| 9 | Reflects ownership of 16,722 shares of common stock held directly and 6,206 restricted stock units that will vest on the earlier of May 18, 2018 or when such director ceases to be a director. |

| 10 | BlackRock, Inc. (“BlackRock”) is an investment advisor with a principal business office at 55 East 52nd Street, New York, New York 10055. This amount reflects the total shares held by BlackRock clients. BlackRock has sole investment authority over all shares, sole voting authority over 4,637,540 shares and no voting authority over 172,357 shares. |

| 11 | The Vanguard Group, Inc. (“Vanguard”) is an investment advisor with a principal business office at 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. This amount reflects the total shares held by Vanguard clients. Vanguard has sole investment authority over 3,516,227 shares and shared investment authority over 37,689 shares, sole voting authority over 37,834 shares, shared voting authority over 2,620 shares and no voting authority over 3,513,462 shares. |

| 12 | Hotchkis and Wiley Capital Management, LLC (“Hotchkis”) is an investment advisor with a principal business office 725 S. Figueroa Street, 29thFloor, Los Angeles, California 90017. This amount reflects the total shares held by Hotchkis clients. Hotchkis has sole investment authority over all shares, sole voting authority over 1,632,774 shares, and no voting authority over 362,000 shares. |

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 17

COMPENSATION DISCUSSION & ANALYSIS

COMPENSATION DISCUSSION & ANALYSIS

EXECUTIVE SUMMARY

In this Compensation Discussion & Analysis (“CD&A”), we will describe the material components of our executive compensation program applicable to our named executive officers (our “NEOs”). While the discussion in this CD&A is focused on our NEOs, many components of our executive compensation program apply broadly across our executive ranks.

Our NEOs include:

| | + | | Thomas J. Quinlan III, our Chairman, Chief Executive Officer (“CEO”) and President; |

| | + | | Suzanne S. Bettman, our Chief Administrative Officer and General Counsel; |

| | + | | Andrew B. Coxhead, our Chief Financial Officer; |

| | + | | Kent A. Hansen, our Chief Accounting Officer and Controller; and |

| | + | | Richard T. Lane, our Chief Strategy and Supply Chain Officer. |

LSC’s executive compensation program is designed to strike an appropriate balance among rewarding our executives for strong performance, ensuring long-term LSC success, considering stockholder interest and encouraging our executive talent to remain with the Company.

This CD&A describes LSC’s Compensation Philosophy, the components of our executive compensation program, our decision-making process, our 2017 compensation decisions and other relevant policies and practices. Some highlights of the Company’s performance as well as our 2017 executive compensation program are below.

2017 Company Highlights

LSC took significant actions in 2017 to implement our strategic vision for our first full year as a stand-alone company following the Separation and we successfully:

| | + | | Generated free cash flow of $145 million; |

| | + | | Returned $34 million to stockholders in the form of quarterly dividends of $0.25 per quarter; |

| | + | | Transitioned to LSC all of the significant transitions services that had been provided by RRD following the Separation; |

| | + | | Pursued strategic opportunities to build out our service offerings, both organically and through acquisitions, as described below: |

| | - | | Successfully acquired and integrated Hudson Yards Studios, Fairrington Transportation, Creel Printing, NECI, Publishers Press, Quality Park and The Clark Group; |

| | - | | Rolled out enhanced service offerings in logistics, warehousing and distribution driven by technology and innovation; and |

| | + | | Amended our credit agreement to, among other things, reduce the interest rate for the term B loans thereunder. |

2017 Executive Compensation Program Highlights

| | + | | Removal of Legacy 280G Excise TaxGross-Ups.In response to stockholder feedback, the legacy 280G excise taxgross-ups contained in Mr. Quinlan and Ms. Bettman’s employment agreements were removed. |

| | + | | Vigorous and Informed Decision-Making Process.The HR Committee, which met nine times in 2017, has a vigorous and informed decision-making process which is guided by the LSC Compensation Philosophy and also considers input from its independent compensation consultant. |

| | + | | Stockholder Engagement.LSC undertook a proactive and robust process to solicit stockholder feedback and otherwise increase stockholder engagement regarding compensation and other governance matters. |

| | - | | Consistent with our pay for performance philosophy, and following management’s recommendation, the HR Committee made the determination that while the net sales threshold target was met, year to date performance against the EBITDA corporate financial target did not merit annual cash bonus payouts under the Annual Incentive Plan (“AIP”) and thus, no annual bonus payments were paid under the AIP for 2017 to any employee, including the CEO and the other NEOs. |

| | - | | No increases were made to the NEOs’ base salaries in 2017. |

18 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

COMPENSATION DISCUSSION & ANALYSIS

| | + | | No 2017 Long-Term Incentive Plan (“LTIP”) Grant for the CEO.In consideration of Mr. Quinlan’s 2016 Founders’ Award (as more fully described under2017 Compensation Decisions – Long-Term Incentive Program), the HR Committee chose not to award to Mr. Quinlan a 2017 LTIP grant. |

LSC COMPENSATION PHILOSOPHY

The HR Committee adopted the following LSC Compensation Philosophy at the time of the Separation to guide its compensation decisions:

| | + | | compensation programs should be simple, equitable and transparent; |

| | + | | the compensation program framework should support and reinforce the business strategy and encourage collaboration, as appropriate; |

| | + | | rewards policies and plans should effectively attract and retain critical industry talent by targeting total compensation and underlying pay elements at the 50th percentile of the external market and provide the opportunity to earn compensation above the 50th percentile of the market if superior performance results are achieved, taking into account tenure and affordability; |

| | + | | external market should acknowledge that talent is likely to come from a wide spectrum of industries; |

| | + | | incentive plans should have performance linkages to financial and operational results; |

| | + | | there should be clearline-of-sight in the annual incentive plan to financial and operational objectives incorporating a limited number of metrics; |

| | + | | equity should be recognized as a valuable resource that will be allocated based on employee level, contribution/performance and potential; |

| | + | | incentive design should consider the industry nature (cyclical dynamics, etc.) of the Company’s operations and the impact of external market conditions; and |

| | + | | perquisites and othernon-performance reward elements should be limited. |

2018 Proxy Statement | LSC COMMUNICATIONS, INC. 19

COMPENSATION DISCUSSION & ANALYSIS

| | | | |

| COMPENSATION GOVERNANCE | | |

| What We Do | | What We Don’t Do | | |

| | | |

+ Pay for Performance Philosophy.NEO compensation is heavily weighted towards variable pay, and vesting of equity awards is predominantly performance-based + Reasonable Compensation Levels Aligned with Our Pay for Performance Philosophy. Overall compensation levels are targeted at market median and, where available, peer group target medians, with a range of opportunity to reward strong performance and withhold rewards when Company performance objectives are not achieved + Double Trigger Equity Acceleration Upon aChange-in-Control. All long-term incentive award grants made under our equity plan provide for accelerated vesting upon a change in control only if the NEO is involuntarily terminated without cause or resigns for good reason + Executive Stock Ownership Guidelines.The NEOs and certain other executives are expected to hold LSC stock worth one to five times their base salary (depending on their position) within three years of the date of hire or promotion; in the event an executive does not achieve or make progress toward the required stock ownership level, the HR Committee has the discretion to take appropriate action + Independent Executive Compensation Consultant.The HR Committee regularly consults with an independent executive compensation consultant on matters surrounding executive officer pay and governance + Clawback Policy.The NEOs and all other current or former executive officers are subject to a Clawback Policy that allows the HR Committee to recoup incentive compensation under certain circumstances + Risk Review.The HR Committee regularly reviews and evaluates LSC’s executive and employee compensation practices to ensure that any risks associated with such practices are not likely to have a material adverse effect on LSC + Investor Outreach and Engagement.We engage proactively with institutional investors on a number of topics, including our executive compensation program + Prudent Equity Award Practices. Management and the HR Committee evaluate share utilization levels by reviewing the dilutive impact of stock compensation + Use of Tally Sheets.Comprehensive historical and comparative compensation information is presented to the HR Committee on tally sheets + Review of Internal Pay Equity. The HR Committee considers internal pay and gender equity, among other factors, when making compensation decisions, but does not use a fixed ratio or formula when comparing compensation among executive officers | | + No Excise TaxGross-Ups Upon aChange-in-Control. The NEOs’ employment arrangements do not include anygross-ups for excise taxes, and the HR Committee has determined that any future executive officer arrangements will not include anygross-ups for excise taxes + No Payment of Current Dividends on PSUs or RSUs. Our equity award agreements do not permit the payment or accrual of dividends on unvested performance share units or restricted share units held by employees + No Excessive Perquisites.We provide limited benefits and perquisites to our executive officers + No TaxGross-Ups on Perquisites or Benefits.We do not provide excise taxgross-ups on supplemental benefits or perquisites + No Pledging/No Hedging/No Short Sales.We have a policy that prohibits (and does not provide for exceptions or waivers) employees, directors and certain of their family members from pledging, short sales, trading in publicly traded options, puts or calls, hedging or similar transactions with respect to LSC stock + No Repricings or Cash Buyouts.Our equity plan prohibits repricing (including cash buyouts) ofout-of the money options or stock appreciation rights without stockholder approval + No Below Market Grants.Our equity plan does not permit option grants below fair market value + No Liberal Share Counting.Our equity plan explicitly prohibits the regranting of shares withheld or tendered to pay option exercise prices to satisfy tax obligations, repurchased by LSC with option exercise proceeds, and shares of stock subject to SARs not issued upon settlement + No Guaranteed Bonus Arrangements.In keeping with our pay for performance philosophy, bonuses are only paid upon the achievement of pre-defined metrics and goals; they are never guaranteed | | |

20 LSC COMMUNICATIONS, INC. | 2018 Proxy Statement

COMPENSATION DISCUSSION & ANALYSIS

COMPENSATION OVERVIEW

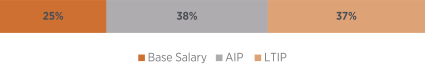

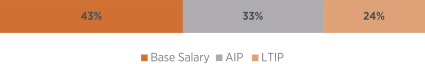

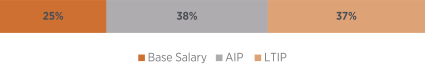

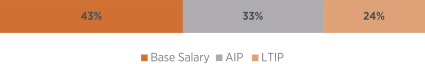

The HR Committee determined the 2017 compensation for the NEOs, which was comprised of three major components: base salary, annual incentive compensation and long-term incentive compensation. In addition, the NEOs were eligible to receive certain benefits and to participate in benefit programs generally available to other employees of LSC.

In general, total compensation levels for the NEOs were targeted at the 50th percentile of peer group data, when available for a position, and by market survey data from the Willis Towers Watson 2016 CDB Executive Compensation Survey Report — U.S. and Mercer’s 2016 US MDB: Executive Compensation Survey. This 50th percentile target level provided a total competitive anchor point for LSC’s executive compensation program. Actual compensation levels varied up or down from targeted levels based on the Company’s performance and the individual’s role, responsibilities, experience and performance.

The table below describes the elements of the executive compensation program for our NEOs.

| | | | |

| Component | | Description/Rationale | | Determining Factors |

| | | |