EXPLANATORY NOTES

This Amendment No. 1 to Form

10-K

(this “Amendment”) amends the Annual Report on Form

10-K

for the fiscal year ended December 31, 2019 of LSC Communications, Inc. (“LSC,” “LSC Communications,” “we,” “our,” “us” and the “Company”), as originally filed with the Securities and Exchange Commission (the “SEC”) on March 2, 2020 (the “Original Form

10-K”).

We are filing this Amendment to present the information required by Part III of Form

10-K

that was previously omitted from the Original Form

10-K

in reliance on General instruction G(3) to Form

10-K

because a definitive proxy statement containing such information will not be filed within 120 days after the end of the Company’s fiscal year ended December 31, 2019.

In addition, Item 15 of Part IV has been amended solely to include the currently dated certification of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of our principal executive officer and principal financial officer are filed with this Amendment as Exhibits 31.3 and 31.4 hereto. Because financial statements have not been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to

Items 307 and 308 of Regulation

S-K,

paragraphs 3, 4 and 5 of the certifications have been omitted. We are not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment.

Except as expressly set forth herein, this Amendment does not otherwise update information in the Original Form

10-K

to reflect facts or events occurring subsequent to the file date of the Original Form

10-K.

This Amendment should be read in conjunction with the Original Form

10-K.

2019 marked the third complete fiscal year since R. R. Donnelley & Sons Company (“RR Donnelley” or “RRD”) effected its separation into three independent public companies: Donnelley Financial Solutions, Inc., LSC and RR Donnelley. The separation (the “Separation”) was effected when RRD distributed on a pro rata basis to holders of its common stock at least 80% of the outstanding shares of LSC common stock.

On October 30, 2018, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among Quad/Graphics, Inc. (“Quad”), QLC Merger Sub, Inc. and LSC to combine in an

all-stock

transaction with Quad (the “Merger”). The U.S. Department of Justice filed a lawsuit to enjoin the transaction in June 2019. In light of the significant time and resources that would have been required to defend the lawsuit coupled with the uncertainty of the outcome, it was determined that continuing to litigate against the Department of Justice was not in the best interests of the Company or our stockholders. On July 22, 2019, Quad and LSC entered into a letter agreement, pursuant to which the parties agreed to terminate the Merger Agreement.

| | | | | |

| | |

| | + First Half Target: For LSC (excluding the Office Products segment), non-GAAP reported EBITDA of $223 million for 2019 + Second Half Target: For corporate employees (which includes all NEOs), non-GAAP reported EBITDA of $132.2 million for the second half of 2019 + See Financial Review – Non-GAAP Measures in the Form 10-K for a reconciliation of net (loss) income to non-GAAP EBITDA + Non-GAAP reported EBITDA defined as net income adjusted for income taxes, interest expense, investment and other income, depreciation and amortization, restructurings and impairments, acquisition-related expenses and certain other charges or credits |

| | + Varies year to year, depending upon the individual’s key business objectives and areas of emphasis |

The first half 2019 performance payout curve applicable to the NEOs was structured as follows:

| | + Payout starts at 90% of the target, with an AIP payout of 10%; |

| | + | Payout scales upward from 10% to 100%, with the target needing to be attained for the AIP to fund at 100%; and |

| | + Performance at 105.4% and above would result in an AIP payout at 125%. |

The second half 2019 performance payout curve applicable to the NEOs was structured as follows:

| | + Payout starts at 82% of the target, with an AIP payout of 10%; | |

| | + | Payout scales upward from 10% to 100%, with the target needing to be attained for the AIP to fund at 100%; and |

| | + No additional payout for performance above the target. | |

Payouts are modified (downward only) by achievement levels on individual performance goals.

Given marketplace dynamics and the possibility of unforeseen developments, the HR Committee retains discretion to increase or decrease the amount of participants’ AIP awards if it determines prior to the end of the plan year that an adjustment was appropriate to better reflect the actual performance of the Company and/or the participant; provided, that the HR Committee has discretionary authority to decrease the amount of an executive officers’ award at any time, including after the end of the plan year. The HR Committee also has discretionary authority to reduce the amount of an AIP award payable to any participant at any time, including after the end of the plan year if it determines the participant engaged in misconduct.

Long-Term Incentive Program

Our Amended and Restated 2016 Performance Incentive Plan, an amendment to which was approved by stockholders at our 2019 Annual Meeting of Stockholders, allows the HR Committee to grant long-term incentive awards (including performance share units (“PSUs”), restricted share units (“RSUs”), restricted stock awards (“RSAs”), stock options, stock appreciation rights (“SARs”) and long-term incentive cash awards) to any eligible employee. Long-term incentive awards are generally granted to directly align the interests of our NEOs with those of our stockholders.

In 2019, under the Merger Agreement, the HR Committee was restricted from granting PSUs or any other type of performance-based equity awards to any employee and from granting equity awards to our NEOs (other than to Ms. Hoxie and Mr. Hansen). As a result, no 2019 equity grants were made to Mr. Quinlan, Ms. Bettman, Mr. Coxhead or Mr. Lane, however, the HR Committee granted RSUs to Mr. Hansen and other employees. Prior to her promotion to Controller in November 2019, Ms. Hoxie was not eligible to receive long-term incentive awards. No PSUs, RSAs, stock options or SARs were granted to any employees.

In August 2019, following the Merger Termination, the HR Committee determined to grant cash-settled long-term performance awards (the “2019 LTIP Awards”) to the NEOs. The HR Committee recognized that Mr. Quinlan, Ms. Bettman, Mr. Coxhead and Mr. Lane had not received grants of long-term incentive equity awards (which generally comprise approximately 40% of each NEOs’ target total direct compensation) in 2019 due to restrictions in the Merger Agreement and that incentivizing and retaining LSC’s top executive talent was critical. One-third of each 2019 LTIP Award was time-vested subject to the grantee’s continued employment with LSC through August 5, 2020. The remaining two-thirds of each 2019 LTIP Award will vest ratably following each of our 2021 and 2022 fiscal years, in each case subject to LSC’s achievement of the applicable performance metric and the grantee’s continued employment with LSC through the date the HR Committee certifies the achievement of such performance. The amounts of the 2019 LTIP Awards were as follows: (i) Thomas J. Quinlan III, $2,400,000; (ii) Suzanne S. Bettman, $810,000; (iii) Andrew B. Coxhead, $810,000; (iv) Kent A. Hansen, $325,000; and (v) Richard T. Lane, $675,000. Ms. Hoxie was not an NEO at the time of such grants and, as a result, did not receive a 2019 LTIP Award. Mr. Hansen’s and Mr. Lane’s 2019 LTIP Awards were forfeited by their terms upon their terminations of employment with LSC.

EXECUTIVE COMPENSATION DECISION-MAKING PROCESS

The HR Committee establishes and monitors LSC’s overall compensation strategy to ensure that our executive compensation supports the Company’s business objectives, and oversees and establishes the compensation of the CEO, other senior officers and key management employees. While the HR Committee does not administer or have direct purview over our employee benefit plans, it reviews such plans so as to have a better understanding of the Company’s overall compensation structure.

In carrying out its responsibilities, the HR Committee is guided by the LSC Compensation Philosophy and also relies on the following:

+ Stakeholder and Say on Pay vote feedback;

+ Review of tally sheet information;

+ Peer group data/market for talent;

+ The business judgment and experience of the members of the HR Committee;

+ Guidance and counsel from its independent compensation consultant, Willis Towers Watson; and

+ Recommendations from management.

Note that during the pendency of the proposed Merger, our HR Committee was restricted from making certain compensation changes, including with respect to our NEOs, without first obtaining the approval of Quad.

Stakeholders and Say on Pay Vote Feedback

In connection with its determinations regarding 2017 NEO compensation and its 2018 and 2019 compensation planning and decisions, our HR Committee directed a proactive and robust process to garner stockholder feedback in response to the results of our 2017 Say on Pay vote and on other governance topics annually. Because of the pendency and subsequent termination of the proposed Merger, we were not able to hold discussions with stakeholders in 2018 and 2019 so as to remain compliant with the relevant securities law restrictions on solicitations of proxies.

At meetings held with our stakeholders in the past, we have discussed various governance issues and received feedback on our executive compensation program. This process previously culminated in important changes to the compensation entitlements of certain of our NEOs, most notably, the removal of the legacy Section 280G excise tax gross-ups in Mr. Quinlan’s and Ms. Bettman’s legacy employment agreements with RRD that were assigned to the Company in the Separation and certain other enhanced disclosures in this CD&A.

Review of Tally Sheet Information

Along with performance and the other relevant factors discussed in this CD&A, the HR Committee generally considers the following information, which is presented on a “tally sheet” for each NEO when setting compensation:

| | + | The targeted values of base salary, annual cash incentive (at various levels of goal attainment) and long-term incentive awards (at grant date value and market value on the date of review) as compared to survey data and, where available, peer group proxy data; |

+ Total and realized compensation for the current and prior years;

+ Annual incentive targets and amounts achieved for the current and prior years; and

+ The grant date and current market value of unvested equity awards.

In general, target total direct compensation levels for the NEOs are targeted at the 50th percentile of peer group data, when available for a position, and by market survey data. This 50th percentile target level provides a total competitive anchor point for LSC’s executive compensation program. Actual compensation levels vary up or down from targeted levels based on the Company’s performance and the individual’s role, responsibilities, experience and performance.

Reviewing the information presented on the tally sheets assists the HR Committee in understanding the total compensation being delivered to and the long-term retentive elements in place for NEOs.

The HR Committee considers internal pay equity, among other factors, when making compensation decisions, but does not use a fixed ratio or formula when comparing compensation among executive officers.

Mr. Quinlan, our CEO, is compensated at a higher level than other executive officers due to his higher level of responsibility, authority, accountability and experience. The HR Committee believes that Mr. Quinlan’s 2019 target total direct compensation was reasonable and appropriate in relation to the compensation targeted for the other NEOs and to one another.

With assistance from Willis Towers Watson, in April 2019, the HR Committee reviewed and evaluated LSC’s executive and employee compensation practices and concluded, based on this review, that any risks associated with such practices are not likely to have a material adverse effect on LSC. The determination primarily took into account the balance of cash and equity payouts, the balance of annual and long-term incentives, the type of performance metrics used, incentive plan payout leverage, possibility that the plan designs could be structured in ways that might encourage gamesmanship, avoidance of uncapped rewards, multi-year vesting for equity awards, use of stock ownership requirements for senior management and the HR Committee’s oversight of our executive compensation program.

Peer Group Data/Market for Talent

The HR Committee reviews the competitive market for talent as part of its review of our compensation program’s effectiveness in attracting and retaining talent, and to help determine our NEOs’ compensation.

Willis Towers Watson assisted the HR Committee in the initial creation of a peer group for LSC in 2016. The primary focus of this process was on a broad group of industrial companies of generally similar or larger size, complexity and scope rather than companies only in LSC’s industry, since the Company is significantly larger than many of its direct competitors and its markets for talent are necessarily broader. Willis Towers Watson’s analysis looked at companies in comparable industries and with revenue between one-half to two times the size of our revenue. The HR Committee, with input from management, suggested changes to the broad group before finalization. The peer group is reviewed annually by the HR Committee with assistance from Willis Towers Watson. In 2019, one company, Bemis Company, Inc., was removed from the peer group as it was acquired. The resulting 2019 peer group is comprised of the following 19 companies:

| | | | | |

| | | | | |

| | | | Ashland Global Holdings Inc. |

| | | | | |

Avery Dennison Corporation | | | | |

| | | | | |

| | Graphics Packaging Holding Company | | |

| | | | | |

Packaging Corporation of America | | | | |

| | | | | |

| | R. R. Donnelley & Sons Company | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

Role of the Compensation Consultant

The HR Committee again engaged Willis Towers Watson in 2019 as its outside executive compensation consultant to provide objective analysis, advice and recommendations on executive officer pay in connection with the HR Committee’s decision-making process. Willis Towers Watson was also hired to assist in the calculation of the CEO pay ratio and to assist the HR Committee in reviewing this CD&A. Willis Towers Watson regularly attends HR Committee meetings and reports directly to the HR Committee, not to management, on matters relating to compensation for the executive officers and for directors.

While Willis Towers Watson provides additional services to the Company other than those under the direction of the HR Committee, all such non-HR Committee services have been approved by the HR Committee. The HR Committee has assessed the non-HR Committee work and services provided by Willis Towers Watson and determined that (A) those services were provided on an independent basis and (B) no conflicts of interest exist. Factors considered by the HR Committee in its assessment included: (i) other services provided to LSC by Willis Towers Watson; (ii) fees paid by LSC as a percentage of Willis Towers Watson’s total revenue; (iii) Willis Towers Watson’s policies and procedures that are designed to prevent a conflict of interest and maintain independence between the personnel who provide HR Committee services and those who provide non-HR Committee services; (iv) any business or personal relationships between individual consultants involved in the engagement and HR Committee members; (v) whether any LSC stock is owned by individual consultants involved in the engagement; and (vi) any business or personal relationships between LSC’s executive officers and Willis Towers Watson or the individual consultants involved in the engagement.

The Company’s management, including the CEO, develops preliminary recommendations regarding compensation matters with respect to the executive officers other than the CEO, and provides these recommendations to the HR Committee for its review. Management’s recommendations focus on, among other things, experience, performance, job responsibilities, future potential and accomplishments. With respect to the AIP, the CEO has a discussion with the HR Committee on the payouts for the other NEOs, including a discussion of performance against individual performance goals.

The HR Committee reviews management’s recommendations but makes all final compensation decisions for LSC’s executive officers. Management is responsible for the administration of the compensation programs once the HR Committee’s decisions are finalized.

2019 COMPENSATION DECISIONS

The LSC Compensation Philosophy and structure of the executive compensation program were applied consistently to all NEOs (other than Ms. Hoxie). Total compensation was targeted at the 50th percentile of peer group data, when available for a position, and by market survey data. Any differences in compensation levels and mix that exist among the NEOs are primarily due to differences in market practices for similar positions and the responsibility, scope, future potential and complexity of the NEO’s role at LSC.

During the pendency of the proposed Merger, the Merger Agreement constrained the HR Committee’s ability to take certain actions regarding executive compensation without Quad’s consent. In addition, due to certain restrictions in the Merger Agreement, the HR Committee determined to make no long-term equity awards to Ms. Bettman and Messrs. Quinlan, Coxhead and Lane, and was not permitted to grant PSUs or other performance-based equity awards to any executive or other service providers. Following the Merger Termination, the HR Committee determined to grant the 2019 LTIP Awards described above in

Compensation Overview—Long-Term Incentive Program

, to each of the NEOs.

As Ms. Hoxie became an NEO in late November 2019, the HR Committee did not review or make any changes to her compensation in 2019. Her 2019 compensation was set and determined by management at levels and using a pay mix consistently applied to similarly situated LSC employees. She was not eligible to receive long-term incentive awards in her prior position and in 2019 she was not granted a 2019 LTIP Award. Her compensation will be reviewed and determined by the HR Committee in 2020.

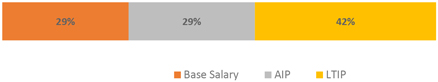

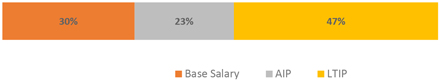

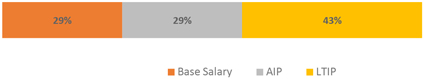

The charts below describe, for each of our NEOs, their key responsibilities and 2019 target annual compensation mix (totals may not add to 100% due to rounding).

| | | |

Chairman, Chief Executive Officer and | | |

Our Chairman, Chief Executive Officer and President is responsible for managing our business operations and overseeing our senior leaders. He leads the implementation of corporate policy and strategy and is the primary liaison between our Board and the management of the Company. In addition to his role as the leader of our organization and people, he also serves as the primary public face of the Company. |

| | 2019 Target Annual Compensation Mix |

| |  |

| 6 | On November 22, 2019, Ms. Hoxie became Controller of the Company. |

| 7 | Mr. Hansen’s employment with the Company ended on November 22, 2019. |

| 8 | Mr. Lane’s employment with the Company ended on November 15, 2019. |

GRANTS OF PLAN-BASED AWARDS

The table below shows additional information regarding awards granted during the year ended December 31, 2019 under LSC’s performance incentive plans, including (i) the threshold, target and maximum level of annual cash incentive awards for the NEOs for performance during 2019, as established by the HR Committee in February 2019, (ii) the 2019 LTIP awards granted on August 5, 2019 under the LSC PIP and (iii) the RSUs granted in February 2019 under the LSC PIP. See

Compensation Discussion & Analysis — Long Term Incentive Program

for a more detailed discussion of certain of the awards discussed in the following table.

Grants of Plan-Based Awards Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | Payouts Under Non-Equity

Incentive Plan Awards | | | Estimated Future

Payouts Under Equity

Incentive Plan Awards | | | All Other Stock Awards: Number of Shares of Stock or Units (#)(i) (1) | | | Grant Date Fair Value of Stock and Option Awards ($)(l) (2) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (4) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Consists of RSUs awarded under the LSC PIP. Each RSU is equivalent to one share of Company common stock and the awards vest in full on March 2, 2021. The RSUs have no dividend or voting rights and are payable on a 1:1 ratio in shares of common stock of the Company upon vesting. SeePotential Payments Upon Termination or Change in Control |

| 2 | Grant date fair value with respect to the RSUs is determined in accordance with ASC Topic 718. SeeNote 18 to the Consolidated Financial Statements Outstanding Equity Awards at Fiscal Year-End |

| 3 | The AIP begins to fund above the threshold, which is set at 90% of target. SeeCompensation Discussion & Analysis |

| 4 | In each case, the amount actually earned by each NEO is reported as Non-Equity Incentive Plan Compensation in the2019 Summary Compensation Table Compensation Discussion & Analysis |

| 5 | One-third of each 2019 LTIP Award was time-vested subject to the grantee’s continued employment with LSC through August 5, 2020. The remaining two-thirds of each 2019 LTIP Award will vest ratably following each of our 2021 and 2022 fiscal years, in each case subject to LSC’s achievement of the applicable performance metric and the grantee’s continued employment with LSC through the date the HR Committee certifies the achievement of such performance. Messrs. Hansen’s and Lane’s 2019 LTIP Awards were forfeited by their terms upon their terminations of employment with LSC. |

OUTSTANDING EQUITY AWARDS AT FISCAL

YEAR-END

The table below shows (i) each grant of stock options that are unexercised and outstanding and (ii) the aggregate number of unvested RSUs, PSUs, and restricted stock awards (“RSAs”) outstanding for the NEOs as of December 31, 2019. Per the terms of Messrs. Hansen’s and Lane’s Equity Award agreements, all unvested equity was cancelled and forfeited upon their terminations of employment with the Company.

Outstanding Equity Awards at Fiscal

Year-End

Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#)(b) | | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#)(c) | | | Option

Exercise

Price

($)(e) | | | | | | Number of

Shares or

Units of

Stock That Have Not Vested (#)(g) (1) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(h) (2) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(i) (3) | | | Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units or Other Rights That Have Not Vested ($)(j) (4) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note: | Multiple awards have been aggregated where the expiration date and the exercise price of the instruments are identical. |

| 1 | The following table provides information with respect to the vesting schedule of each NEO’s outstanding unvested RSUs over shares of common stock that are set forth in the above table. |

| 2 | Assumes a closing price per share of LSC of $0.206 on December 31, 2019 (the last trading day of the year). |

| 3 | For Mr. Quinlan, represents (i) 114,930 PSUs from a grant on February 26, 2018, which are earned for achieving a specified non-GAAP Free Cash Flow target over a three-year period ending December 31, 2020 (the “2018 PSUs”), subject to continued employment. |

For Ms. Bettman, represents (i) 15,230 RSAs from a grant on February 27, 2017 (for which performance through December 31, 2017 was certified by the HR Committee, with performance achievement certified at 120% of target), which will cliff vest on March 2, 2020 (the “2017 RSAs”), subject to continued employment and (ii) 22,240 PSUs remaining from her grant of 2018 PSUs, which will vest on March 2, 2021, subject to continued employment.

For Mr. Coxhead, represents (i) 18,140 RSAs remaining from his grant of 2017 RSAs, which will vest on March 2, 2020 subject to continued employment and (ii) 26,875 PSUs remaining from his grant of 2018 PSUs, which will vest on March 2, 2021 subject to continued employment.

| 4 | Assumes performance achievement of 100% payout of the PSUs and a closing price per share of $0.206 on December 31, 2019 (the last trading day of the year). |

OPTION EXERCISES AND STOCK VESTED

The following table shows information regarding the value of options exercised and RSAs and, RSUs vested during the year ended December 31, 2019.

Option Exercises and Stock Vested Table

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | Number of Shares

Acquired on Exercise

(#)(b) | | | Value Realized

on Exercise

($)(c) | | | Number of Shares Acquired on Vesting (#)(d) (1) | | | Value Realized on Vesting ($)(e) (2) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| 1 | Represents the vesting of RSAs and RSUs under the LSC PIP. |

| 2 | Value realized on vesting of RSUs is the fair market value on the date of vesting, based on the closing price of LSC common stock as reported by the NYSE, which on March 2, 2019 was $8.42. Value realized on vesting of RSAs is the fair market value on the date of vesting, based on the closing price of LSC common stock as reported by the NYSE, which on October 1, 2019 was $1.35. |

Generally, effective December 31, 2011, RRD froze benefit accruals under all of its then existing federal income tax qualified U.S. defined benefit pension plans (collectively referred to as the “RRD Qualified Retirement Plans”) that were still open to accruals. Therefore, beginning January 1, 2012, participants generally ceased earning additional benefits under the RRD Qualified Retirement Plans. Thereafter, the RRD Qualified Retirement Plans were merged into one RRD Qualified Retirement Plan and generally no new participants entered this plan. Before the RRD Qualified Retirement Plans were frozen, accrual rates varied based on age and service. Accruals for the plans were calculated using compensation that generally included salary and annual cash bonus awards. The amount of annual earnings that may be considered in calculating benefits under a qualified pension plan is limited by law.

Defined benefit pension plans for LSC employees (collectively referred to as the “LSC Qualified Retirement Plans”), which were created to be substantially similar to those provided

pre-Separation

by RRD (including with respect to being frozen for future benefit accruals), were adopted in connection with the Separation. The assets and liabilities of

LSC-allocated

employees and certain former employees and retirees were transferred to, and assumed by, such LSC Qualified Retirement Plans. The LSC Qualified Retirement Plans are funded entirely by LSC with contributions made to a trust fund from which the benefits of participants are paid.

The Internal Revenue Code places limitations on pensions that can be accrued under tax qualified plans. Prior to being frozen, to the extent an employee’s pension would have accrued under a qualified retirement plan if it were not for such limitations, the additional benefits were accrued under an unfunded supplemental pension plan by RRD prior to the Separation (the “RRD SERP”) and following the Separation by LSC in an unfunded supplemental pension plan (the “LSC SERP”). The assets and liabilities of the RRD SERP related to

LSC-allocated

employees and certain former employees and retirees were transferred at the time of the Separation to the LSC SERP. Prior to a change of control, the LSC SERP is unfunded and provides for payments to be made out of LSC’s general assets. Generally, no additional benefits will accrue under the LSC Qualified Retirement Plans or the related LSC SERP.

Some participants, including those that have a cash balance or pension equity benefit, can elect to receive either a life annuity or a lump sum amount upon termination. Other participants will receive their plan benefit in the form of a life annuity. Under a life annuity benefit, benefits are paid monthly after retirement for the life of the participant or, if the participant is married or chooses an optional benefit form, generally in a reduced amount for the lives of the participant and surviving spouse or other named survivor.

See

Note 15 to the Consolidated Financial Statements

included in the Original Form

10-K

for a discussion of the relevant assumptions used in calculating the present value of the current accrued benefit under the LSC Qualified Retirement Plan and the LSC SERP set forth in the table below.

| | | | | | | | | | | | | | | | | |

| | | | | Number of Years Credited Service �� (#) (c) (1) | | | | | | During Last

Fiscal Year

($) (e) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | Number of Years Credited Service (#) (c) (1) | | | | | | During Last

Fiscal Year

($) (e) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| 1 | The number of years of credited service was frozen effective December 31, 2011 (the date benefit accruals were frozen by RRD). |

| 2 | LSC did not have a pension plan open to new participants when Ms. Hoxie was hired by LSC, so she is not a participant in our pension plan or supplemental pension plan and has no benefits under either plan. |

| 3 | RRD did not have a pension plan open to new participants when Mr. Hansen was hired by RRD, so he is not a participant in our pension plan or supplemental pension plan and has no benefits under either plan. |

NONQUALIFIED DEFERRED COMPENSATION

Pursuant to RRD’s Deferred Compensation Plan, participants were able to defer up to 50% of base salary and 90% of annual incentive bonus payments. Deferred amounts were credited with earnings or losses based on the rate of return of mutual funds selected by the participant, which the participant could change at any time. RRD did not make contributions to participants’ accounts under the RRD Deferred Compensation Plan in 2016.

In connection with the Separation, LSC created the LSC Deferred Compensation Plan which is substantially similar to the RRD Deferred Compensation Plan, and the assets and liabilities of

LSC-allocated

employees and certain former employees and retirees were transferred to, and assumed by, the LSC Deferred Compensation Plan. Participants’ deferral elections continued through the end of the 2016 calendar year. LSC determined not to offer eligible employees the opportunity to make deferrals for 2017, 2018 or 2019 and will determine, in its discretion, whether to offer eligible employees the opportunity to make deferrals in the future. LSC has not made any contributions to participants’ accounts under the LSC Deferred Compensation Plan.

Distributions generally are paid in a lump sum on the latter of the first day of the year following the year in which the participant’s employment with LSC terminates or the

six-month

anniversary of such termination unless the participant elects that a distribution be made three years after a deferral under certain circumstances.

RRD’s Supplemental Retirement

Plan-B

(the

“SERP-B”)

was transferred to LSC in connection with the Separation. Under the

SERP-B,

participants could defer a portion of their regular earnings substantially equal to the difference between the amount that, in the absence of legislation limiting additions to the Company’s savings plan, would have been allocated to a participant’s account as

before-tax

and matching contributions, minus the deferral amount actually allocated under the Company’s savings plan. Deferred amounts earn interest at the prime rate and such interest and distributions are paid in a lump sum upon the

six-month

anniversary of the termination of the participant’s employment. The

SERP-B

was frozen in 2004 and no additional amounts may be contributed by the NEOs.

The table below shows (i) the contributions made by each of the NEOs during the year ended December 31, 2019, (ii) aggregate earnings on each of the NEO’s account balance during the year ended December 31, 2019 and (iii) the account balance of each NEO as of December 31, 2019. The table also presents amounts deferred under the

SERP-B.

Nonqualified Deferred Compensation Table

| | | | | | | | | | | | | | | | | | | | | |

| | | | | Registrant

Contributions

in Last FY ($)

(c) | | | Aggregate Earnings in Last FY ($) (d) | | | Aggregate

Withdrawals/

Distributions

($) (e) | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

Supplemental Executive Retirement Plan-B | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Compensation Plan | | | | | | | | | | | | | | | | | | | | |

| 1 | Amounts in this column with respect to the Deferred Compensation Plan are not included in the 2019Summary Compensation Table Summary Compensation Table |

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

In 2018, each of the NEOs, other than Mr. Quinlan and Ms. Hoxie, agreed to enter into a participation agreement (each, a “Participation Agreement”) to commence participation in the Company’s Key Employee Severance Plan (the “Severance Plan”) and, in exchange therefore, waived their existing employment agreements with the Company. Ms. Hoxie does not have an employment agreement with the Company and did not enter into a Participation Agreement until January 2020. This section describes the payments that would have been received by the NEOs upon termination of employment at December 31, 2019. References in this section to “agreement(s)” shall be deemed to include Mr. Quinlan’s employment agreement, to the extent applicable and to the Participation Agreement and Severance Plan for each of Ms. Bettman and Mr. Coxhead. The amount of these payments would have depended upon the circumstances of termination, which include termination by LSC without Cause, termination by the employee for Good Reason, other voluntary termination by the employee, death, disability, or termination following a Change in Control of LSC (each as defined in the applicable agreement). The information in this section is based upon the agreements as in effect as of December 31, 2019. This information is presented to illustrate the payments the NEOs would have received from LSC under the various termination scenarios. A description of the terms with respect to each of these types of terminations follows. As Mr. Hansen and Mr. Lane were not employed by the Company on December 31, 2019, they are not included in the below discussion or in the tables that follow. Messrs. Lane and Hansen were not eligible for severance benefits from LSC under the Key Employee Severance Plan or otherwise in connection with their departures from the Company in November 2019. Upon termination of their employment, both also forfeited their 2019 LTIP Awards and all outstanding equity awards pursuant to their terms.

TERMINATION OTHER THAN AFTER A CHANGE IN CONTROL

The agreements in effect on December 31, 2019 with Messrs. Quinlan and Coxhead and Ms. Bettman provided for payments of certain benefits, as described below, upon termination of employment. The NEOs’ rights upon a termination of employment depend upon the circumstances of termination. Central to an understanding of the rights of each NEO under the agreements is an understanding of the definitions of ‘Cause’ and ‘Good Reason’ that are used in those agreements. For purposes of the agreements:

| | + | LSC hasto terminate Mr. Quinlan if he has engaged in any of a list of specified activities, including refusing to substantially perform duties consistent with the scope and nature of his position or refusal or failure to attempt in good faith to follow the written direction of the Board, committing an act materially injurious (monetarily or otherwise) to LSC or LSC’s subsidiaries, or commission of a felony or other actions specified in the definition. LSC hasto terminate an NEO (other than Mr. Quinlan) if the NEO has engaged in any of a list of specified activities, including engaging in conduct that materially violates the policies of the Company, failing to perform the essential functions of the job or failing to carry out the Company’s reasonable directions issued by the NEO’s supervisor with respect to the NEO’s material duties, misappropriation of corporate funds or other acts of fraud, dishonesty or self-dealing or commission of a felony or other actions specified in the definition. |

| | + | The NEOs are said to haveto terminate employment (and thereby gain access to the benefits described below) if LSC assigns the NEO duties that represent a material diminution of his or her duties or responsibilities, reduces the NEO’s compensation, generally requires that the NEO’s principal office be located other than in or around Chicago, Illinois (for Ms. Bettman and Mr. Coxhead) or New York, New York (for Mr. Quinlan), or materially breaches the agreement. |

TERMINATION AFTER A CHANGE IN CONTROL

In response to stockholder feedback, the legacy Section 280G excise tax gross-ups contained in Mr. Quinlan and Ms. Bettman’s agreements were removed, and therefore, none of the NEOs are entitled to tax gross-ups upon a termination after a Change in Control.

As with the severance provisions described above, the rights to which the NEOs are entitled under the Change in Control provisions upon a termination of employment are dependent on the circumstances of the termination. The definitions of Cause and Good Reason are the same in this termination scenario as in a termination other than after a Change in Control.

POTENTIAL PAYMENT OBLIGATIONS UNDER AGREEMENTS UPON TERMINATION OR CHANGE IN CONTROL

The following tables set forth LSC’s payment obligations under the circumstances specified upon a termination of the employment of the NEOs or upon a Change in Control, assuming such termination occurred on December 31, 2019. The tables do not include payments or benefits that do not discriminate in scope, terms or operation in favor of the NEOs and are generally available to all salaried employees, or pension or deferred compensation payments that are discussed in

and

Nonqualified Deferred Compensation

above.

Mr. Quinlan’s employment agreement provides that if he is terminated without Cause or for Good Reason not in connection with a Change in Control, he will be entitled to receive:

| | + | an amount equal to two times of the sum of Mr. Quinlan’s base salary and target annual bonus, paid in equal installments over the 24-month period following his termination, subject to the execution of a customary release; and |

| | + | continuation of all benefits (including Mr. Quinlan’s car allowance) to which Mr. Quinlan was eligible to receive prior to his termination until and including the last day of the second calendar year following the calendar year in which the qualifying termination occurs. |

In general, Ms. Bettman’s and Mr. Coxhead’s agreements provide that, in the event they experience a termination without Cause or resign for Good Reason (each of which we refer to as a “qualifying termination”), and in each case not in connection with a Change in Control, they will be entitled to receive the following benefits, subject to the execution of a release and agreement to certain restrictive covenants, including non-competition, non-solicitation and confidentiality covenants:

| | + | salary continuation for 18 months paid in accordance with the Company’s regular payroll dates; |

| | + | equal payments made in accordance with the Company’s regular payroll dates that, in the aggregate, equal 150% of the NEO’s target annual bonus over a period of 24 months; |

| | + | a lump-sum payment representing the difference between the NEO’s monthly medical insurance cost immediately prior to his or her qualifying termination and the monthly cost for COBRA for 18 months; and |

| | + | six months of outplacement assistance from a provider selected by the Company. |

Mr. Quinlan’s employment agreement provides that if he is terminated without Cause or for Good Reason within two years of a Change in Control, he will be entitled to receive:

| | + | cash in an amount equal to three times of the sum of Mr. Quinlan’s base salary and target annual bonus, payable in a lump sum, subject to the execution of a customary release; |

| | + | a pro rata bonus for the year of the qualifying termination, payable at the same time as all other annual bonuses are paid to LSC’s senior executives; |

| | + | continuation of all benefits (including Mr. Quinlan’s car allowance) to which Mr. Quinlan was eligible to receive prior to his termination until and including the last day of the second calendar year following the calendar year in which the qualifying termination occurs; and |

| | + | a lump sum payment of $75,000, payable six months and one day after Mr. Quinlan’s qualifying termination. |

In general, Ms. Bettman’s and Mr. Coxhead’s agreements provide that, in the event they experience a qualifying termination within two years following a Change in Control, they will be entitled to receive the following benefits, subject to the execution of a release and agreement to certain restrictive covenants, including non-competition, non-solicitation and confidentiality covenants:

| | + | salary continuation for 24 months paid in accordance with the Company’s regular payroll dates; |

| | + | equal payments made in accordance with the Company’s regular payroll dates that, in the aggregate, equal 200% of the NEO’s target annual bonus over a period of 24 months; |

| | + | a lump-sum payment representing the difference between the NEO’s monthly medical insurance cost immediately prior to his or her qualifying termination and the monthly cost for COBRA for 24 months; and |

| | + | six months of outplacement assistance from a provider selected by the Company. |

Messrs. Quinlan and Coxhead and Ms. Bettman are entitled to pension benefits upon death or disability according to the terms of the LSC Qualified Retirement Plans. Each is entitled to benefits paid under a supplemental disability insurance policy and a supplemental life insurance policy maintained by LSC for the NEO’s benefit. Pursuant to the terms of the AIP, such NEO may be entitled to his or her annual bonus for the year in which the disability or death occurs, payable at the same time as and to the extent that all other annual bonuses are paid and as available to all employees who participate in the AIP, determined in the HR Committee’s discretion. Additionally, all unvested equity awards held by such NEO, except the performance unit awards granted in 2018, will immediately vest upon disability or death pursuant to the terms of their applicable award agreements. With respect to the performance unit awards granted in 2018, 50% of all such unvested awards (based on the greater of the target and actual performance level) held by such NEO will immediately vest upon disability or death, pursuant to the terms of the applicable award agreement.

Pursuant to the terms of their applicable agreements, Mr. Quinlan and Ms. Bettman are entitled to immediate vesting of all outstanding time-based equity awards in the event of any termination initiated by the NEO for Good Reason or termination initiated by LSC without Cause (whether or not in connection with a Change in Control). All of Mr. Quinlan’s and Ms. Bettman’s performance-based equity awards will be treated in accordance with the applicable award agreement. Our NEOs are generally entitled to immediate vesting of all outstanding equity awards granted to them in 2016 and 2017 upon a Change in Control (as defined in the applicable performance incentive plan) under the terms of the applicable performance incentive plan, prior to the amendments to the performance incentive plan that were approved at our 2017 Annual Meeting of Stockholders. The terms of the outstanding equity awards granted to our NEOs in 2018 require both a Change in Control and qualifying termination within two years following such Change in Control for such awards to vest. For all NEOs, all unvested equity awards are forfeited in the event of a resignation other than for Good Reason or termination with Cause.

Mr. Quinlan’s employment agreement generally provides that, after resignation for Good Reason or termination without Cause, LSC will continue providing the same medical, dental, and vision coverage to him that he was eligible to receive immediately prior to such termination for a 24-month period following the date of termination. Ms. Bettman and Mr. Coxhead’s agreements provide that, after resignation for Good Reason or termination without Cause, they are each entitled to receive a lump-sum payment representing the difference between his or her monthly medical insurance cost immediately prior to his or her resignation or termination and the monthly cost for COBRA for 18 months, if prior to a Change in Control, or for 24 months if within two years following a Change in Control. Note, however, that Ms. Bettman does not receive medical benefits through LSC and thus would not receive the aforementioned lump-sum payment. Benefits payable upon disability or death are described in

above.

The following tables assume that termination or any Change in Control took place on December 31, 2019. The following does not include a termination table for Ms. Hoxie because as of December 31, 2019 Ms. Hoxie was a participant in the Company’s Separation Pay Plan that is generally available to all salaried employees upon a qualifying termination.

Mr. Quinlan, the Company’s Chairman, Chief Executive Officer and President, would be entitled to the following:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Good Reason or

Termination

Without | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Benefits and Perquisites: (12) | | | | | | | | | | | | | | | | | | | | | | | | |

Post-Termination Health Care | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental Life Insurance | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental Disability Insurance | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Mr. Quinlan is entitled to 2.0x base salary and 2.0x target annual bonus as if all targets and objectives had been met, paid over the applicable severance period. Mr. Quinlan would have been entitled to his annual bonus on December 31 pursuant to the terms of the AIP (which provides for payment of the bonus to any participant who is on the payroll as of December 31, the same terms generally available to all salaried employees who participate in the AIP), which is not reflected in this table. |

| 2 | Mr. Quinlan is entitled to 3.0x base salary and 3.0x annual bonus as if all targets and objectives had been met, paid over the applicable severance period, which are reflected in this table. Pursuant to the terms of his employment agreement, Mr. Quinlan is also entitled to his pro-rated annual bonus for the year in which the termination after a Change in Control occurs, payable at the same time as and to the extent that all other annual bonuses are paid. This bonus is not reflected in this table as, assuming a termination date of December 31, 2018, Mr. Quinlan would have been entitled to this bonus pursuant to the terms of the plan under which the annual bonus is paid (which provides for payment of the bonus to any participant who is on the payroll as of December 31) which are the same terms generally available to all salaried employees who participate in the plan. Also included as bonus is a $75,000 lump sum payment to which Mr. Quinlan is entitled pursuant to the terms of his employment agreement. |

| 3 | Mr. Quinlan is entitled to the same 60% of base salary until age 65 with a maximum $10,000 per month that is generally available to all salaried employees upon disability. |

| 4 | Mr. Quinlan may be entitled to his annual bonus for the year in which the disability or death occurs, payable at the same time as and to the extent that all other annual bonuses are paid, which are the same terms generally available to all salaried employees who participate in the AIP, and determined in the HR Committee’s discretion. |

| 5 | Assumes the closing price per share of LSC of $0.206 on December 31, 2019 (the last trading day of the year). |

| 6 | All unvested time-based equity awards held by Mr. Quinlan will vest immediately upon his resignation for Good Reason or termination without Cause pursuant to the terms of his employment agreement. |

| 4 | Mr. Coxhead may be entitled to his annual bonus for the year in which the disability or death occurs, payable at the same time as and to the extent that all other annual bonuses are paid, which are the same terms generally available to all salaried employees who participate in the AIP, and determined in the HR Committee’s discretion. |

| 5 | Assumes the closing price per share of LSC of $0.206 on December 31, 2019 (the last trading day of the year). |

| 6 | All unvested time-based equity awards granted to Mr. Coxhead prior to 2018 will vest immediately upon a Change in Control (as defined in the LSC PIP) under the terms of the LSC PIP. All unvested time-based equity awards granted to Mr. Coxhead in 2018 will remain outstanding upon a Change in Control (as defined in the LSC PIP). |

| 7 | All unvested time-based equity awards held by Mr. Coxhead will immediately vest upon disability or death pursuant to the terms of the applicable award agreements. |

| 8 | Per the terms of the 2018 PSU award agreement, upon the date of a Change in Control, the PSUs shall be deemed met at the greater of target and actual performance at such date in connection with such event, but will remain subject to time-based vesting for the remainder of the performance period. All PSUs granted to Mr. Coxhead will vest upon his resignation for Good Reason or termination without Cause after a Change in Control, based on the performance level as determined in the prior sentence. |

| 9 | With respect to the performance unit awards granted in 2018, 50% of all such unvested awards (based on the greater of the target and actual performance level) will immediately vest upon disability or death. The table assumes such event occurred on December 31, 2019 and vesting and payment of the PSUs at the target performance level. |

| 10 | With respect to the 2019 LTIP award granted in August 2019, a pro-rated portion of the LTIP will immediately vest upon death. The table assumes such event occurred on December 31, 2019 and vesting and payment of the LTIP at the target performance level. |

| 11 | Except as disclosed, Mr. Coxhead receives the same benefits that are generally available to all salaried employees upon death or disability. |

| 12 | Represents lump sum payment for 18 months of medical premiums equal to the difference in the COBRA rate and the regular employee rate. |

| 13 | Represents lump sum payment for 24 months of medical premiums equal to the difference in the COBRA rate and the regular employee rate. |

| 14 | Represents benefits payable under a supplemental life insurance policy maintained by LSC for the benefit of Mr. Coxhead in excess of the amount generally available to all salaried employees. |

| 15 | Represents benefits payable under a supplemental disability insurance policy maintained by LSC for the benefit of Mr. Coxhead in excess of the amount generally available to all salaried employees. |

| 16 | Represents the approximate cost of six months of outplacement assistance from a provider to be selected by LSC. |

Under SEC rules, we are required to calculate and disclose the annual total compensation of our median employee and the ratio of the annual total compensation of our Chief Executive Officer to the annual total compensation of our median employee. Set forth below is the annual total compensation of our median employee, the annual total compensation of Mr. Quinlan and the ratio of those two values:

| | + | The 2019 annual total compensation of the employee identified as the median employee of LSC (other than our Chief Executive Officer) was $41,502 ($36,341 wages and $5,161 change in pension value); |

| | + | The 2019 annual total compensation of our Chief Executive Officer, Mr. Quinlan, was $1,863,514 ; and |

| | + | For 2019, the estimated ratio of the annual total compensation of Mr. Quinlan to the annual total compensation of our median employee was approximately 45:1. |

As is permitted under SEC rules, for our 2019 CEO pay ratio determination, the Company used the same median employee that was determined to be our median employee as of October 31, 2018. The SEC rules allow us to identify our median employee once every three years unless there has been a change in our employee population or employee compensation arrangements that we reasonably believe would result in a significant change in our pay ratio disclosure. Analysis was conducted and, for 2019, there was no significant change in our employee population, our employee compensation arrangements or our median employee’s circumstances that we believe would significantly impact our pay ratio disclosure. Therefore, as permitted by SEC rules, we calculated the 2019 pay ratio set forth above using the same median employee that we used to calculate our 2018 pay ratio.

As SEC rules allow for companies to adopt a wide range of methodologies, to apply country exclusions and to make reasonable estimates and assumptions that reflect their compensation practices to identify the median employee. To determine our median employee in 2018, we used our employee population as of October 31, 2018. On that determination date, we had approximately 21,992 employees globally, 175 of whom were employed in Canada and who were excluded pursuant to the 5% de minimis exemption permitted under SEC rules. For the remaining population of 21,817 full-time and part-time employees worldwide, we measured compensation using W-2 compensation components (determined for the period from January 1, 2018 through October 31, 2018), or the international equivalent, and converted the amounts reported for international employees to U.S. dollars using the exchange rate reported on October 31, 2018.

LSC’s Non-Employee Director Compensation Plan provides that annual compensation for non-employee directors consists of a cash retainer and an equity retainer. The Corporate Responsibility & Governance Committee periodically reviews director compensation and recommends changes as appropriate. Annual director compensation is paid as of the date of the annual meeting of stockholders, however, if any director joins the LSC Board

on a date other than the date of the annual meeting, a pro-rata portion of each of the applicable cash retainer and equity retainer from the date joined to the next annual meeting date will be granted. RSU awards granted to directors who were on the board of directors of RR Donnelley and who became directors of LSC were adjusted and converted to RSUs of LSC. Such RSUs are subject to the same terms and conditions (including with respect to vesting and deferral elections) as applicable to the corresponding RR Donnelley award immediately prior to the Separation.

Note however, that under the terms of the Merger Agreement, in 2019 our directors did not receive equity retainers and instead received an additional cash retainer equal to the value of the equity retainer such directors otherwise would have been entitled to and such amounts were paid on May 23, 2019. The terms of this Plan otherwise remained unchanged.

LSC’s directors are subject to stock ownership guidelines.

The annual base cash retainer is $90,000, and a director may also receive, as applicable, the following additional cash retainer amounts:

| | | | | |

| | | | |

Chair of the Audit Committee | | | | |

Chair of the Human Resources Committee | | | | |

Chair of the Corporate Responsibility & Governance Committee | | | | |

The annual equity retainer is paid in the form of a grant of RSUs with a fair market value of $135,000. Our Lead Director receives an additional equity retainer with a fair market value of $62,500. Fair market value is defined as the closing price of LSC’s common stock on the date of grant. Under the terms of the grant agreements, each RSU will vest and be payable in full in the form of common stock on the first anniversary of the grant date with the opportunity to defer vesting of any award until termination of service on the Board. The RSUs will also vest and be payable in full on the earlier of the date a director ceases to be a director and a Change in Control (as defined in the LSC PIP). Dividend equivalents on the RSUs will be deferred and credited with interest quarterly (at the same rate as five-year U.S. government bonds) and paid out in cash at the same time the corresponding portion of the RSU award vests.

2019 NON-EMPLOYEE DIRECTOR COMPENSATION TABLE

As an employee of the Company, Mr. Quinlan receives no additional fees for service as a director. The table below shows 2019 compensation received by non-employee directors.

| | | | �� | | | | | | | | | | | | | |

| | Fees Earned

or Paid in

Cash | | | | | | All Other Compensation ($) (2) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| 1 | The amounts shown in this column constitute a cash retainer equal to the value of the equity retainer such directors otherwise would have been entitled to. |

| 2 | Includes interest accrued on dividend equivalents on RSUs credited to each director’s account. |

| 3 | Includes $3,859 of dividends on phantom shares under the Policy on Retirement Benefits, Phantom Stock Grants and Stock Options for Directors, credited as additional phantom shares. As of December 31, 2019, Ms. Hamilton had outstanding 7,914 phantom shares, with an additional 610 phantom shares credited from accrued dividends, all of which are fully vested. |

| 4 | Mr. Palmer did not stand for reelection at the Company’s 2019 Annual Meeting of Stockholders. |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

EQUITY COMPENSATION PLAN INFORMATION

Information as of December 31, 2019 concerning compensation plans under which LSC Communications’ equity securities are authorized for issuance is as follows:

| | | | | | | | | | | | | |

| | Number of Securities

to Be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights | | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) | | | | |

| | | | | | | | | |

Equity compensation plan approved by security holders | | | | | | $ | | | | | | |

| | (a) | Includes 1,632,630 shares issuable upon the vesting of RSUs. |

| | (b) | RSUs were excluded when determining the weighted-average exercise price of outstanding options, warrants and rights. |

| | (c) | The LSC PIP allows grants in the form of cash or bonus awards, stock options, stock appreciation rights, restricted stock, stock units or combinations thereof. The maximum number of shares of common stock that may be granted with respect to bonus awards, including performance awards or fixed awards in the form of restricted stock or other form, is 6,600,000 in the aggregate, of which 3,581,951 remain available for issuance. |

BENEFICIAL STOCK OWNERSHIP OF DIRECTORS, EXECUTIVES AND LARGE STOCKHOLDERS

The table below lists the beneficial ownership of common stock as of April 3, 2020 by all current directors, each of the persons named in the tables under

, and the directors and executive officers as a group. The table includes all stock awards subject to vesting conditions that vest within 60 days of April 3, 2020. The table also lists all institutions and individuals known to hold more than 5% of the Company’s common stock, which has been obtained from filings made pursuant to Sections 13(d) and (g) of the Exchange Act. Except as otherwise indicated below, each of the entities or persons named in the table has sole voting and investment power with respect to all common stock beneficially owned set forth opposite their name. The percentages shown are based on outstanding shares of common stock as of April 3, 2020. Unless otherwise indicated, the business address of each stockholder listed below is LSC Communications, 191 N. Wacker Drive, Suite 1400, Chicago, IL 60606.

BENEFICIAL STOCK OWNERSHIP OF DIRECTORS, EXECUTIVES AND LARGE STOCKHOLDERS

| | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Shivan S. Subramaniam (11) | | | | |

All directors and executive officers as a group | | | | |

AQR Capital Management, LLC (12) | | | | |

| | | | |

| 1 | Reflects ownership of 499,797 shares of common stock held directly, 988 shares held in Mr. Quinlan’s 401(k) plan account, and 107,000 options over common stock. Does not include 114,930 RSUs that are subject to vesting or 114,930 PSUs that are subject to performance based vesting conditions. |

| 2 | Reflects ownership of 102,837 shares of common stock held directly, and 47 shares held in Ms. Bettman’s 401(k) plan account. Does not include 22,240 RSUs that are subject to vesting or 22,240 PSUs subject to performance based vesting conditions. |

| 3 | Reflects ownership of 65,437 shares of common stock held directly. Does not include 26,875 RSUs that are subject to vesting or 26,875 PSUs subject to performance based vesting conditions. |

| 4 | Reflects ownership of 7,562 shares of common stock held directly. |

| 5 | Reflects ownership of 99,203 shares of common stock held directly and 10,363 RSUs that will vest when such director ceases to be a director. Does not include 7,914 shares of phantom stock that may be settled only in cash. |

| 6 | Reflects ownership of 9,428 shares of common stock held directly, and 10,895 RSUs that will vest when such director ceases to be a director. |

| 7 | Reflects ownership of 59,428 shares of common stock held directly, and 10,895 RSUs that will vest when such director ceases to be a director. |

| 8 | Reflects ownership of 45,323 shares of common stock held directly. |

| 9 | Reflects ownership of 44,061 shares of common stock held directly as of his departure from being a director. Mr. Palmer ceased being a director of the Company on October 27, 2019. |

| 10 | Reflects ownership of 92,828 shares of common stock held directly, and 10,895 RSUs that will vest when such director ceases to be a director. |

| 11 | Reflects ownership of 22,928 shares of common stock held directly, and 10,895 RSUs that will vest when such director ceases to be a director. |

| 12 | AQR Capital Management Holdings, LLC (“AQR Holdings”) and its wholly owned subsidiary, AQR Capital Management, LLC (“AQR Management”), are investment advisors with a principal business office at Two Greenwich Plaza, Greenwich, CT 06830. AQR Holdings and AQR Management have shared investment and voting authority over all shares. |

| 13 | The Vanguard Group, Inc. (“Vanguard”) is an investment advisor with a principal business office at 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. This amount reflects the total shares held by Vanguard clients. Vanguard has sole investment authority over 2,136,911 shares and shared investment authority over 31,182 shares, sole voting authority over 30,941 shares, shared voting authority over 2,620 shares and no voting authority over 2,134,532 shares. |

Item 13. CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS and director independence

CERTAIN RELATIONSHIPS AND POTENTIAL CONFLICS OF INTEREST; RELATED PARTY TRANSACTION APPROVAL POLICY

The Company has a written policy relating to approval or ratification of all transactions involving an amount in excess of $120,000 in which the Company is a participant and in which a related person has or will have a direct or indirect material interest, including without limitation any financial transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships, subject to certain enumerated exclusions. Under the policy, such related person transactions must be approved or ratified by (i) the Corporate Responsibility & Governance Committee or (ii) if the Corporate Responsibility & Governance Committee determines

that the approval or ratification of such transaction should be considered by all of the disinterested members of the Board, such disinterested members of the Board by a majority vote. Related persons include any of our directors, certain executive officers, certain of our stockholders and their immediate family members.

In considering whether to approve or ratify any related person transaction, the Corporate Responsibility & Governance Committee or such disinterested members of the Board, as applicable, may consider all factors that they deem relevant to the transaction, including, but not limited to: the size of the transaction and the amount payable to or receivable from a related person; the nature of the interest of the related person in the transaction; whether the transaction may involve a conflict of interest; and whether the transaction involves the provision of goods or services to the Company that are available from unaffiliated third parties and, if so, whether the transaction is on terms and made under circumstances that are at least as favorable to the Company as would be available in comparable transactions with or involving unaffiliated third parties.

To identify related person transactions, at least once a year all directors and executive officers of the Company are required to complete questionnaires seeking, among other things, disclosure with respect to such transactions of which such director or executive officer may be aware. In addition, on an ongoing basis, each executive officer of the Company is required to advise the Chair of the Corporate Responsibility & Governance Committee of any related person transaction of which he or she becomes aware.

The Company’s

Principles of Corporate Governance

provide that the Board must be composed of a majority of independent directors. No director qualifies as independent unless the Board affirmatively determines that the director has no relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has determined that all eight non-employee directors of our Board are also independent in accordance with the NYSE guidelines. Mr. Quinlan, who is an employee of the Company, is not independent.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

— Deloitte & Touche LLP (Deloitte) was the Company’s independent registered public accounting firm for the year ended December 31, 2019. Total fees paid to Deloitte for audit services rendered during 2019 and 2018 were $2.3 million and $2.6 million respectively.

— Total fees paid to Deloitte for audit-related services rendered during 2019 were $0.4 million primarily related to attestation reports for services that the Company provides to customers and during 2018 were $0.3 million, primarily related to attestation reports for services that the Company provides to customers.

— No fees were paid to Deloitte for tax services during 2019 or 2018.

— No other fees were paid to Deloitte for any other services rendered during 2019 or 2018.

Audit Committee Pre-Approval Policy

— The Audit Committee has policies and procedures that require the approval by the Audit Committee of all services performed by, and as necessary, fees paid to the Company’s independent registered public accounting firm. The Audit Committee approves the proposed services, including the scope of services contemplated and the related fees, associated with the current year audit. In addition, Audit Committee pre-approval is also required for those engagements that may arise during the course of the year that are outside the scope of the initial services and fees pre-approved by the Audit Committee. The Audit Committee pre-approves, up to an aggregate dollar amount and individual dollar amount per engagement, certain permitted non-audit services anticipated to be provided by the Company’s independent registered public accounting firm. In the event permitted non-audit service amounts exceed the thresholds established by the pre-approval policy, the Audit Committee must specifically approve such excess amounts. The Audit Committee chair has the authority to approve any services outside the specific pre-approved non-audit services and must report any such approval at the next meeting of the Audit Committee.

Pursuant to the Sarbanes-Oxley Act of 2002, the fees and services provided as noted above were authorized and approved by the Audit Committee in compliance with the pre-approval policies and procedures described above.

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

The exhibits listed on the accompanying index are filed as part of this annual report on Form 10-K.