Filed Pursuant to Rule 253(g)(2)

File No. 024-10551

KeyStone Solutions, Inc.

3,000,000 Units

Consisting of:

3,000,000 Shares of Series A Cumulative Convertible Redeemable Preferred Stock, par value $0.0001 per share

and

Warrants to Purchase 750,000 Shares of Common Stock, par value $0.0001 per share

(2,892,857 Shares of Common Stock, par value $0.0001 per share, issuable upon Conversion of Series A Cumulative Convertible Redeemable Preferred Stock and Exercise of Warrants)

Minimum purchase: 500 Units ($5,000)

| | |

| |  |

KeyStone Solutions, Inc., a Delaware corporation, qualifies as an “emerging growth company” as defined in the Jumpstart Our Business (JOBS) Startups Act. We are offering units (“Units”), consisting of (a) a minimum of 300,000 shares of Series A Cumulative Convertible Redeemable Preferred Stock, par value $0.0001 (the “Series A Preferred Stock”), and a maximum of 3,000,000 shares of Series A Preferred Stock and (b) warrants to purchase up to 750,000 shares of our common stock, on a “best efforts” basis. Each Unit consists of one share of Series A Preferred Stock and a warrant to purchase 0.25 shares of our common stock at any time on or before seven years from the date of qualification of the Units as exempt from registration by the SEC (the “Qualification Date”) at an exercise price of $2.00 per share of common stock. While the Series A Preferred Stock and the warrants will be sold together as a Unit, the Series A Preferred Stock and warrants will be issued separately. The Units will be sold by the Company in minimum amounts of $5,000 (500 Units).

If $3,000,000 in subscriptions for the Units (the “Minimum Offering”) is not deposited with Folio Investments, Inc., as set forth in more detail in the “Plan of Distribution,” on or before six (6) months after the Qualification Date (the “Minimum Offering Period”), which will be May 8, 2017, all subscriptions will be refunded to subscribers without deduction or interest. The offering will commence within two calendar days from the Qualification Date. The offering will expire twelve (12) months after the Qualification Date (the “Offering Expiration Date”). See “Plan of Distribution” and “Securities Being Offered” for a description of the Units being sold and our capital stock.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to “Accredited Investors” as defined in Rule 501(a) of Regulation D (17 CFR §230.501(a) and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

There is currently no trading market for our Units, preferred stock, common stock, or warrants. The preferred stock and warrants will be issued separately, but can only be purchased together as a Unit. We intend to have the Units trading on either the OTCQX or OTCQB market under the ticker symbol “KEES.U” following our initial closing, although there can be no assurance the Units will trade under that ticker symbol or at all, as the Units have not yet been accepted for trading on either the OTCQX or OTCQB. The separate purchase and sale of the warrants, solely as warrants detached from a Unit, will be restricted for 180 days from the initial closing date. Following this 180-day period, we intend for the underlying preferred stock, common stock, and warrants, to start separately trading on the OTCQX or OTCQB under the ticker symbols “KEES.P”, “KEES”, and “KEES.W”, respectively, concurrently with the Units which will remain trading under “KEES.U”. However, there is no guarantee that any or all of these securities will be quoted under these symbols or at all, as these securities have not yet been accepted for trading on either the OTCQX or OTCQB, or that a market will develop for all of these securities.

These are speculative securities. Investing in the Units involves significant risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 3.

| | | | | | | | | | | | | | | | |

| | | Number of Units | | | Price to Public | | | Underwriting

Discounts and

Commissions (1) | | | Proceeds to Issuer (2) | |

Per Unit | | | 1 | | | $ | 10.00 | | | $ | 0.60 | | | $ | 9.40 | |

Total Minimum: | | | 300,000 | | | $ | 3,000,000 | | | $ | 180,000 | | | $ | 2,820,000 | |

Total Maximum: | | | 3,000,000 | | | $ | 30,000,000 | | | $ | 1,800,000 | | | $ | 28,200,000 | |

| (1) | The underwriting commission represents 6.0% of the gross proceeds for Units sold in the offering. |

| (2) | Does not include (i) underwriters’ allowable accountable expense allocation of 1.0% of the gross proceeds of Units sold in the offering, which is $30,000 and $300,000 for the minimum and maximum offering amounts, respectively, and which amount includes the fee paid to Folio Investments, Inc. (“Folio”) which is calculated based on fifty basis points (50 bps) of the dollar value of the Units issued in the offering, which is $15,000 and $150,000 for the minimum and maximum offering amounts, respectively, and which does not include any amount separately payable to Folio as a reallowance on commissions if Folio participates in the offering as a Dealer in the sale of the Units, (ii) non-accountable expense allowance of 1.0% of the gross proceeds of Units sold in the offering, which is $30,000 and $300,000 for the minimum and maximum offering amounts, respectively, and (iii) other expenses of the offering estimated to be $430,000 and $457,000 for the minimum and maximum offering amounts. See “Plan of Distribution.” |

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

We are providing the disclosure in the format prescribed by Part II of Form 1-A.

14420 Albemarle Point Place, Suite 200, Chantilly, VA, 20151

(703) 953-3838;www.keystonewins.com

The date of this offering circular is November 8, 2016

TABLE OF CONTENTS

OFFERING SUMMARY

The following summary highlights selected information contained in this offering circular. This summary does not contain all the information that may be important to you. You should read the more detailed information contained in this offering circular, including, but not limited to, the “Risk Factors” beginning on page 3. References to “we,” “us,” “our,” “KeyStone Solutions,” “KeyStone” or the “Company” mean KeyStone Solutions, Inc. and its subsidiaries.

Our Company

We are a Delaware holding company that owns all of the outstanding interests of our principal subsidiary, AOC Key Solutions, Inc., a Delaware corporation (“AOC Key Solutions”) (www.aockeysolutions.com), which is a consulting firm formed in 1983 specializing in proposal development, capture, and market strategy services for government contractors. The Company was formed in March 2016 to facilitate its planned expansion in the government contracting outsourced services business through continued organic growth and strategic acquisitions of other government contracts service providers. For the year ended December 31, 2015, AOC Key Solutions generated over $9.6 million of revenue and net income of approximately $422,000. AOC Key Solutions’ revenue for the six-month period ended June 30, 2016 increased by $2,866,175, or 66.5%, to $7,177,345 compared to $4,311,170 in the comparable period in 2015. AOC Key Solutions’ net income for the six-month period ended June 30, 2016 increased by $836,767 to $813,128 compared to a net loss of $23,639 for the comparable period in 2015. As a result, AOC Key Solutions’ comparable period net income margin increased from a loss of 0.5% in 2015 to a gain of 11.3% in 2016.

This Offering

| | |

| Securities offered | | Minimum of 300,000 Units with each Unit consisting of one share of our Series A Preferred Stock and one warrant to purchase 0.25 share of our common stock (and the shares of common stock issuable from time to time upon the conversion of the Series A Preferred Stock or the exercise of the warrants). Maximum of 3,000,000 Units with each Unit consisting of one share of our Series A Preferred Stock and one warrant to purchase 0.25 share of our common stock (and the shares of common stock issuable from time to time upon the conversion of the Series A Preferred Stock or the exercise of the warrants). |

| |

| Preferred and common stock outstanding before the offering | | 5,000,000 shares of common stock No shares of Series A Preferred Stock |

| |

| Preferred and common stock outstanding after the offering (1) | | 5,000,000 shares of common stock 300,000 shares of Series A Preferred Stock |

| |

| Series A Preferred Stock Dividends | | Generally, the Series A Preferred Stock is entitled to quarterly cash dividends of $0.175 (7% per annum) per share. For a minimum offering of 300,000 Units, we anticipate paying the quarterly cash dividends through existing assets and cash flow. For a maximum offering of 3,000,000 Units, we anticipate paying the quarterly cash dividends through cash flow and potential business growth from acquired entities. We do not expect to pay dividends on our common stock in the foreseeable future. We anticipate that future earnings generated from operations, if any, will be retained to develop and expand our business. Our ability to pay dividends on our common stock is restricted by the terms of our Series A Preferred Stock, which require us to pay full cumulative dividends on the Series A Preferred Stock before making any dividend payment on our common stock. |

1

| | |

| Series A Preferred Stock Liquidation Preference | | The Liquidation Preference on shares of the Series A Preferred Stock is $10 per share (the “Issue Price”). |

| |

| Conversion of Series A Preferred Stock | | The Series A Preferred Stock is convertible by holders at any time after the third anniversary of the Qualification Date into shares of our common stock. Upon conversion, each share of Series A Preferred Stock can be converted into such number of shares of common stock as is determined by dividing (i) the sum of (x) Issue Price ($10.00 per share) (as adjusted for stock splits, stock dividends, reclassifications and the like)plus (y) the amount of any accrued but unpaid dividends on such shares being converted, if any, whether or not declared, to and including the date immediately prior to such date of conversion, by (ii) the conversion price equal to (x) $14.00 per share from November 8, 2019 to November 7, 2020 or (y) $15.00 per share from and after November 8, 2020. The Series A Preferred Stock will automatically be converted at the then effective conversion price (i) immediately prior to the closing of the sale of our common stock in a firm commitment underwritten public offering pursuant to an effective registration statement (A) which results in aggregate cash proceeds to the Company of not less than $30,000,000 (net of underwriting discounts and commissions), (B) is made at an offering price per share of at least the then applicable Series A Preferred Stock conversion price (as adjusted) and (C) following such offering, the common stock is listed for trading on a national securities exchange (a “Qualified IPO”), or (ii) on the date specified by written consent or agreement of the holders of at least 662/3% of the then outstanding shares of Series A Preferred Stock. If the closing of a Qualified IPO or an automatic conversion due to the written consent or agreement of the holders of at least 66 2/3% of the then outstanding Shares occurs prior to November 8, 2019, the conversion price per share shall be (i) $11 per share from November 8, 2016 to November 7, 2017; (ii) $12 per share from November 8, 2017 to November 7, 2018; and (iii) $13 per share from November 8, 2018 to November 7, 2019. |

| |

| Redemption of Series A Preferred Stock | | At any time following the third anniversary of the Qualification Date, the Company may redeem all or any portion of the then outstanding Series A Preferred Stock for a redemption price equal to either (a) (i) $14.00 per share from November 8, 2019 to November 7, 2020 or (ii) $15.00 per share from and after November 8, 2020plus (b) the amount of any accrued but unpaid dividends thereon, if any, whether or not declared, to and including the date immediately prior to such date of redemption. At any time after five years (sixtieth month) after the Qualification Date, each holder of the Series A Preferred Stock will have the right to require the Company to redeem all, but not less than all, of such holder’s Series A Preferred Stock for a redemption price of $15.00 per share plus the amount of any accrued but unpaid dividends thereon, if any, whether or not declared, to and including the date immediately prior to such date of redemption. |

| |

| Warrant Exercise Period | | The warrants are immediately exercisable upon issuance, and have an expiration date seven years (eighty-four months) after the Qualification Date. |

| |

| Warrant Exercise Price | | The warrants have an exercise price equal to $2.00 per share. |

| |

| Use of proceeds | | The net proceeds of this offering will be used primarily to fund the Company’s organic growth and strategic acquisition of, and investments in, government contract service providers and government contractors with the balance being used for general corporate purposes. |

| |

| Risk factors | | Investing in Units involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this offering circular. |

| |

| Market Listing or Quotation | | There is currently no trading market for our Units, preferred stock, common stock, or warrants. The preferred stock and warrants will be issued separately, but can only be purchased together as a Unit. We intend to have the Units trading on either the OTCQX or OTCQB market under the ticker symbol “KEES.U” following our initial closing, although there can be no assurance the Units will trade under that ticker symbol or at all, as the Units have not yet been accepted for trading on either the OTCQX or OTCQB. The separate purchase and sale of the warrants, solely as warrants detached from a Unit, will be restricted for 180 days from the initial closing date. Following this 180-day period, we intend for the underlying preferred stock, common stock, and warrants, to start separately trading on the OTCQX or OTCQB under the ticker symbols “KEES.P”, “KEES”, and “KEES.W”, respectively, concurrently with the Units which will remain trading under “KEES.U”. However, there is no guarantee that any or all of these securities will be quoted under these symbols or at all, as these securities have not yet been accepted for trading on either the OTCQX or OTCQB, or that a market will develop for all of these securities. |

| (1) | Assumes the sale of the Minimum Offering Amount of 300,000 Units and no exercise of any Unit warrants. |

2

RISK FACTORS

An investment in Units involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below, together with the cautionary statement that follows this section and the other information included in this offering circular, before purchasing Units in this offering. If one or more of the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the trading price, if any, of our preferred stock and/or common stock could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Risks Related to our Business and Industry

We are a holding company; have no direct operations and depend in large part on funding from our subsidiaries.

KeyStone Solutions, Inc. was formed in March 2016 as a holding company. It has no current business operations of its own. Until we have either formed or acquired other companies, our only significant assets are our cash and equity interest in our principal operating subsidiary, AOC Key Solutions. As a result, we rely on funding from AOC Key Solutions to meet our obligations. If AOC Key Solutions needs to retain its funds to meet its financial obligations or experiences other restrictions on its ability to fund us, that may limit our access to funds and restrict our ability to meet our dividend, redemption and liquidation obligations in respect of our Series A Preferred Stock and to pursue our acquisition strategy or other strategic objectives.

We face aggressive competition that can impact our ability to obtain contracts and therefore affect our future revenues and growth prospects.

Our business is highly competitive, and we compete with larger companies that have greater name recognition and financial resources, as well as many independent sole-proprietors who sell themselves as business development experts.

The markets in which we operate are characterized by rapidly changing technology, and the needs of our clients change and evolve regularly. Accordingly, our success depends on our ability to develop services and solutions that address these changing needs of our government contractor clients, and to provide people and technology needed to deliver these services and solutions. To remain competitive, we must consistently provide superior service, technology and performance on a cost-effective basis to our clients. Our competitors may be able to provide our clients with different or greater capabilities or technologies or better contract terms than we can provide, including technical qualifications, past contract experience, geographic presence, price and the availability of qualified professional personnel. Additionally, we anticipate that larger or new competitors or alliances among competitors may emerge which may adversely affect our ability to compete for new contracts.

The U.S. government may adopt new contract rules and regulations or revise its procurement practices in a manner adverse to us at any time.

Our industry has experienced, and we expect it will continue to experience, significant changes to business practices as a result of an increased focus on affordability, efficiencies and recovery of costs, among other items. U.S. government agencies may face restrictions or pressure regarding the type and amount of services that they may obtain from private contractors. Legislation, regulations and initiatives dealing with procurement reform, mitigation of potential conflicts of interest, deterrence of fraud, and environmental responsibility or sustainability, as well as any resulting shifts in the buying practices of U.S. government agencies, such as increased usage of fixed-price contracts, multiple award contracts and small business set-aside contracts, could have adverse effects on government contractors and the business development services we provide. Any of these changes could impair our ability to obtain new support contracts or renew our existing contracts when those contracts are recompeted. Any new contracting requirements or procurement methods could be costly or administratively difficult for us to implement and could adversely affect our future revenues, profitability and prospects, or alternatively may reduce the need for government contractors to acquire our services.

3

Technology improvements and disruptions could diminish the need for our traditional services.

Based on recent technological developments, the market for consultants has diminished and may continue to diminish. Some companies are beginning to use the World Wide Web to advertise for different services, including experts for sale, anonymous authors to complete certain proposal sections for an “introductory fee,” and even buying entire proposals on-line, sometimes from overseas vendors. The market trend seems to be that these competitors are offering similar types of services at extremely low prices. This trend towards utilization of unknown and unproven companies advertising traditional consulting services may diminish the demand for our services, which may adversely affect our revenues, results of operations and financial condition.

The spending cuts imposed by the Budget Control Act of 2011 (“BCA”) could impact our operating results and profit.

The U.S. government continues to focus on developing and implementing spending, tax, and other initiatives to stimulate the economy, create jobs, and reduce the deficit. One of these initiatives, the BCA, imposed constraints around U.S. government spending. In an attempt to balance decisions regarding defense, homeland security, and other federal spending priorities, the BCA imposed spending caps that contain approximately $487 billion in reductions to the Department of Defense base budgets over a seven year period (to 2021). Additionally, the BCA triggered an automatic sequestration process, effective March 1, 2013, that would have reduced planned defense spending by an additional $500 billion over a nine-year period that began in the U.S. government’s 2013 fiscal year.

On November 2, 2015, the President signed into law the Bipartisan Budget Act of 2015 (“BBA 2015”). BBA 2015 raises the limit on the U.S. government’s debt until March 2017 and raises the sequester caps imposed by the BCA by $80 billion, split equally between defense and non-defense spending over the next two years ($50 billion in the U.S. government’s 2016 fiscal year and $30 billion in the U.S. government’s 2017 fiscal year). On December 18, 2015, the President signed into law the Consolidated Appropriations Act of 2016, funding the government through September 30, 2016 and on February 9, 2016, the President submitted a budget proposal for the U.S. government’s 2017 fiscal year, consistent with BBA 2015 funding levels. BBA 2015 includes discretionary funding for Department of Defense of approximately $580 billion in the U.S. government’s 2016 fiscal year and $583 billion in the U.S. government’s 2017 fiscal year. This funding includes a base budget for the Department of Defense of approximately $521 billion in the U.S. government’s 2016 fiscal year and $524 billion in the U.S. government’s 2017 fiscal year. BBA 2015 also provides approximately $59 billion for Department of Defense Overseas Contingency Operations (OCO) spending in each of the U.S. government’s 2016 and 2017 fiscal years.

The Bipartisan Budget Act of 2013 (“BBA 2013”) passed by Congress in December 2013 alleviated some budget cuts that would have otherwise been instituted through sequestration in the U.S. government’s 2014 and 2015 fiscal years. While BBA 2013 and BBA 2015 (collectively, the “Bipartisan Budget Acts”), taken together, increased discretionary spending limits through the U.S. government’s 2017 fiscal year, the Bipartisan Budget Acts retained sequestration cuts for the U.S. government’s 2018 through 2021 fiscal years, including the across-the-board spending reduction methodology provided for in the BCA. As a result, there remains uncertainty regarding how, or if, sequestration cuts will be applied in the U.S. government’s 2018 fiscal year and beyond. Department of Defense and other agencies may have significantly less flexibility in how to apply budget cuts in future years. While the defense budget sustained the largest single reductions under the BCA, other civil agencies and programs have also been impacted by significant spending reductions. In light of the BCA and deficit reduction pressures, and the upcoming change in administrations, it is likely that discretionary spending by the U.S. government will remain constrained for a number of years. Additionally, if an annual appropriations bill is not enacted for the U.S. government’s 2017 fiscal year or beyond, the U.S. government may operate under a continuing resolution, abating RFP processes, restricting new contract or program starts and government slowdowns, or even shutdowns, could arise. We anticipate there will continue to be significant debate within the U.S. government over defense spending throughout the budget appropriations process for the U.S. government’s 2017 fiscal year and beyond. The outcome of these debates could have long-term consequences for our industry and Company.

4

Since we generate most of our revenues from clients that bid on contracts with U.S. government agencies, our operating results could be adversely affected by spending caps or changes in the budgetary priorities of the U.S. government, as well as by delays in RFP processes, program starts or the award of contracts or task orders under contracts.

Continued or increased market consolidations by large and small contractors.

Last year witnessed a variety of transactions impacting our client base: CACI acquired L-3’s National Security Solutions business unit for $550 million; Harris Corporation acquired Exelis, Inc. for $4.7 billion; Science Applications International Corporation (“SAIC”) acquired Scitor Corporation from Leonard Green Partners for $790 million; The Carlyle Group acquired Novetta Solutions from Arlington Capital; and Computer Sciences Corporation (“CSC”) split its public sector business from its commercial and international business (the public sector business then merged with SRA International to form CSRA, Inc. the largest professional services firm to the U.S. government). This consolidation of our client base could lead to less demand for our services.

Due to the competitive process to obtain contracts and an increase in bid protests, we may be unable to achieve or sustain revenue growth and profitability.

We expect that a majority of the business that we seek in the foreseeable future will be under service agreements awarded to our clients through a competitive bidding process, including Indefinite Delivery/Indefinite Quantity (“ID/IQ”) contracts. The U.S. government has increasingly relied on contracts that are subject to a competitive bidding process, which has resulted in greater competition and increased pricing pressure. As a result, there is a tendency for it to place undue emphasis on low price over technical merit when selecting contractors. This in turn can result in the U.S. government contracts market attracting extremely low-priced competitors who see certain consulting products and services as mere “commodities” and price accordingly. Government contractors may decide that they can prepare their bid responses with internal resources and not engage outside organizations to assist this process.

The competitive bidding process involves substantial costs and a number of risks, including significant cost and managerial time to prepare bids and proposals for contracts that may not be awarded to our clients, and therefore puts our reputation at risk and may affect our future contracts with these clients, or that may be awarded but for which our customers do not receive meaningful task orders which might make them less likely to bid for additional task orders. For support contracts awarded to us, we also face the risk of inaccurately estimating the resources and costs that will be required to fulfill these engagements, which also could impact our reputation and the likelihood of getting additional engagements for capture and proposal support.

Our business is directly tied to the success of our government contracting clients, which are increasingly reliant on ID/IQ contracts. ID/IQ contracts are not firm orders for services, and we may generate limited or no revenue from these contracts which could adversely affect our operating performance.

ID/IQ contracts are typically awarded to multiple contractors, and the award of an ID/IQ contract does not represent a firm order for services. Generally, under an ID/IQ contract, the government is not obligated to order a minimum of services or supplies from its contractor, irrespective of the total estimated contract value. In effect, an ID/IQ award acts as a “hunting license,” permitting a contractor to bid on task orders issued under the ID/IQ contract, but not guaranteeing the award of individual task orders. Following an award under a multi-award ID/IQ program, the customer develops requirements for task orders that are competitively bid against all of the contract awardees. However, many contracts also permit the U.S. government to direct work to a specific contractor. Our clients may not win new task orders under these contracts for various reasons, including price, past performance and responsiveness, among others. We support our government contractor clients both when they compete to get the umbrella ID/IQ contract and subsequently when we help the winners of those contracts compete for individual tasks. The proposals for both of these stages can be relatively brief and require quick turn-arounds, thus potentially reducing some opportunities to be awarded significant turn-key engagements. While it is possible that the increased importance of winning the umbrella ID/IQ contract will prompt clients to hire outside firms to prepare their proposals, it is also likely that government contractors will decide to prepare ID/IQ proposals without the assistance from outside experts.

5

Increased reliance on task order responses as the preferred method of proposal submission may significantly and adversely affect our future revenues, cash flow and financial results.

The U.S. government sometimes makes use of abbreviated (miniature) submissions to a solicitation by requiring a task order response rather than a full proposal, especially for ID/IQ contracts. Task Order Responses (TORs) as a rule tend to be relatively brief and have a short response period (often 10 days). These reduced page counts and shorter response times reduce the need for our traditional services, and if TORs become more of a standard for the U.S. government, this could adversely impact our operations, cash flow and financial results.

Our business could be negatively impacted by cyber and other security threats or disruptions.

We face various cyber and other security threats, including attempts to gain unauthorized access to sensitive information and networks; insider threats; threats to the safety of our directors, officers and employees; threats to the security of our facilities and infrastructure; and threats from terrorist acts or other acts of aggression. Our clients and partners (including subcontractors and joint ventures) face similar threats. Although we utilize various procedures and controls to monitor and mitigate the risk of these threats, there can be no assurance that these procedures and controls will be sufficient. These threats could lead to losses of sensitive information or capabilities, harm to personnel, infrastructure or products, and/or damage to our reputation as well as our partners’ ability to perform.

Cyber threats are evolving and include, but are not limited to, malicious software, destructive malware, attempts to gain unauthorized access to data, disruption or denial of service attacks, and other electronic security breaches that could lead to disruptions in mission critical systems, unauthorized release of confidential, personal or otherwise protected information (ours or that of our employees, customers or partners), and corruption of data, networks or systems. In addition, we could be impacted by cyber threats or other disruptions or vulnerabilities found in products we use or in our partners’ or customers’ systems that are used in connection with our business. These threats, if not prevented or effectively mitigated, could damage our reputation, require remedial actions and lead to loss of business, regulatory actions, potential liability and financial losses.

We provide services to various customers (commercial and occasionally government) who also face cyber threats. Our services may themselves be subject to cyber threats and/or they may not be able to detect or deter threats, or effectively to mitigate resulting losses. These losses could adversely affect our customers and our Company.

The impact of these factors is difficult to predict, but one or more of them could result in the loss of information or capabilities, harm to individuals or property, damage to our reputation, loss of business, regulatory actions and potential liability, any one of which could have a material adverse effect on our financial position, results of operations and/or cash flows.

Although we have identified general criteria and guidelines that we believe are important in evaluating prospective target businesses for merger or acquisition, we may enter into a potential business combination with a target that does not meet such criteria and guidelines, and as a result, the target business with which we enter into a potential business combination may not have attributes entirely consistent with our general criteria and guidelines.

Although we have identified general criteria and guidelines for evaluating prospective target businesses for merger or acquisition, it is possible that a target business with which we enter into a potential business combination will not have all of these positive attributes. If we complete a potential business combination with a target that does not meet some or all of these guidelines, such combination may not be as successful as a combination with a business that does meet all of our general criteria and guidelines.

6

Resources could be wasted in researching acquisitions that are not completed, which could materially adversely affect subsequent attempts to locate and acquire or merge with another business.

We anticipate that the investigation of each specific target business and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial costs for accountants, attorneys and others. If we decide not to complete a potential business combination, the costs incurred up to that point for the proposed transaction likely would not be recoverable. Furthermore, if we reach an agreement relating to a specific target business, we may fail to complete a potential business combination for any number of reasons including those beyond our control. Any such event will result in a loss to us of the related costs incurred which could materially adversely affect subsequent attempts to locate and acquire or merge with another business.

We may seek investment opportunities in industries outside of our management’s area of expertise.

We intend to focus on target businesses in industries that complement our management team’s backgrounds including consulting for the procurement of government contracts. However, we may also pursue acquisition opportunities in other markets. Although our management will endeavor to evaluate the risks inherent in any particular business combination candidate, we cannot assure you that we will adequately ascertain or assess all of the significant risk factors. We also cannot assure you that an investment in our Units will not ultimately prove to be less favorable to investors in this offering than a direct investment, if an opportunity were available, in a business combination candidate.

Our strategy of growth through acquisitions could harm our business.

It is our intent to continue to grow through strategic acquisitions. Successful integration of newly acquired target companies may place a significant burden on our management and internal resources. The diversion of management’s attention and any difficulties encountered in the transition and integration processes could harm our business, financial condition and operating results. In addition, we may be unable to execute our acquisition strategy, resulting in under-utilized resources and a failure to achieve anticipated growth. Our operating results and financial condition will be adversely affected if we are unable to achieve, or achieve on a timely basis, cost savings or revenue opportunities from any future acquisitions, or incur unforeseen costs and expenses or experience unexpected operating difficulties from the integration of acquired businesses.

Our ability to successfully effect a potential business combination and to be successful thereafter will be totally dependent upon the efforts of our key personnel, some of whom may join us following a potential business combination. The loss of key personnel could negatively impact the operations and profitability of our post-combination business.

Our ability to successfully effect business combinations is dependent upon the efforts of our key personnel. The role of our key personnel in the target business, however, cannot presently be ascertained. Although some of our key personnel may remain with the target business in senior management or advisory positions following our business combination, it is likely that some or all of the management of the target business will remain in place. While we intend to closely scrutinize any individuals we engage after our business combination, we cannot assure you that our assessment of these individuals will prove to be correct. These individuals may be unfamiliar with the requirements of operating a company regulated by the SEC, which could cause us to have to expend time and resources helping them become familiar with such requirements and take time away from oversight of our operations.

We may have a limited ability to assess the management of a prospective target business and, as a result, may effect a potential business combination with a target business whose management may not have the skills, qualifications or abilities to manage a growing company.

When evaluating the desirability of effecting a potential business combination with a prospective target business, our ability to assess the target business’s management may be limited due to a lack of time, resources or information. Our assessment of the capabilities of the target’s management, therefore, may prove to be incorrect and such management may lack the skills, qualifications or abilities we suspected. Should the target’s management not possess the skills, qualifications or abilities necessary to manage a growing company, the operations and profitability of the post-combination business may be negatively impacted. Accordingly, any stockholders who choose to remain stockholders following the business combination could suffer a reduction in the value of their shares. The officers and directors of an acquisition candidate may resign upon completion of a potential business combination. The departure of a potential business combination target’s key personnel could negatively impact the operations and profitability of our post-combination business. The role of an acquisition candidate’s key personnel upon the completion of a potential business combination cannot be ascertained at this time.

7

We may issue additional common or preferred shares to complete business combinations or under an employee award plan after completion of business combinations, any one of which would dilute the interest of our stockholders and likely present other risks.

Our Certificate of Incorporation authorizes the issuance of up to 32,500,000 shares – 25,000,000 shares of common stock, par value $0.0001 per share, and 7,500,000 shares of preferred stock, par value $0.0001 per share. Immediately after this offering (assuming the Maximum Offering Amount is raised), there will be 16,091,270 authorized but unissued shares of common stock available for issuance, which amount takes into account shares reserved for issuance (a) upon conversion of outstanding Series A Preferred Stock, (b) upon the exercise of outstanding Unit Warrants and the warrant held by Avon Road, and (c) under the Company’s equity award plan. Immediately after this offering, there will be (x) if the Company receives subscriptions for the minimum number of shares available in the offering, 300,000 and (y) if the Company receives subscriptions for the maximum number of shares available in the offering 3,000,000 shares of preferred stock issued and outstanding. We may issue a substantial number of additional shares of common or preferred stock to complete a proposed business combination. The issuance of additional shares of common or preferred stock:

| | • | | may significantly dilute the equity interest of investors in this offering; |

| | • | | may further subordinate the rights of holders of common stock if preferred stock is issued with rights senior to those afforded our common stock; |

| | • | | could cause a change in control if a substantial number of common stock is issued, which could result in the resignation or removal of our present officers and directors; and |

| | • | | may adversely affect prevailing market prices, if we are listed on an exchange, for our Units, preferred stock, common stock and/or warrants. |

We may issue additional notes or other debt securities, or otherwise incur substantial additional debt, to complete a business combination, which may adversely affect our leverage and financial condition and thus negatively impact the value of our stockholders’ investment in us.

The anticipated cash needs of our business could change significantly as we pursue and complete business acquisitions, if our business plans change, if economic conditions change from those currently prevailing or from those now anticipated, or if other unexpected circumstances arise that may have a material effect on the cash flow or profitability of our business. If we require additional capital resources to grow our business, either internally or through acquisition, we may seek to secure debt financing. We may not be able to obtain financing arrangements in amounts or on terms acceptable to us in the future.

Although we have no commitments as of the date of this offering circular to issue any additional notes or other debt securities, or to otherwise incur additional outstanding debt, we may choose to incur substantial debt to complete a business combination. The incurrence of debt could have a variety of negative effects, including:

| | • | | default and foreclosure on our assets if our operating revenues are insufficient to repay our debt obligations; |

| | • | | acceleration of our obligations to repay the indebtedness even if we make all principal and interest payments when due if we breach certain covenants that require the maintenance of certain financial ratios or reserves without a waiver or renegotiation of that covenant; |

| | • | | our immediate payment of all principal and accrued interest, if any, if the debt security is payable on demand; |

| | • | | our inability to obtain necessary additional financing if the debt security contains covenants restricting our ability to obtain such financing while the debt security is outstanding; |

| | • | | our inability to pay dividends on our preferred stock and common stock; |

| | • | | using a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for dividends on our common stock if declared, expenses, capital expenditures, acquisitions and other general corporate purposes; |

8

| | • | | limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate; |

| | • | | increased vulnerability to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; and |

| | • | | limitations on our ability to borrow additional amounts for expenses, capital expenditures, acquisitions, debt service requirements, execution of our strategy and other purposes and other disadvantages compared to our competitors who have less debt. |

We may attempt to simultaneously complete business combinations with multiple prospective targets, which may hinder our ability to complete a business combination and give rise to increased costs and risks that could negatively impact our operations and profitability.

If we attempt to simultaneously acquire several businesses that are owned by different sellers, we may need for each of such sellers to agree that our purchase of its business is contingent on the simultaneous closings of the other business combinations. With multiple business combinations, we could also face additional risks, including additional burdens and costs with respect to possible multiple negotiations and due diligence investigations (if there are multiple sellers) and the additional risks associated with the subsequent assimilation of the operations and services or products of the acquired companies in a single operating business. If we are unable to adequately address these risks, it could negatively impact the Company’s profitability and results of operations.

Risks Related to the Investment in our Securities

The ownership of our common stock is concentrated among existing executive officers and directors.

Upon the sale of all of the shares offered in this offering, our executive officers and directors will continue to own beneficially, in the aggregate, a vast majority of the outstanding shares of our common stock. As a result, they will be able to exercise a significant level of control over all matters requiring shareholder approval, including the election of directors, amendments to our Certificate of Incorporation, and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of the Company or changes in management and will make the approval of certain transactions difficult or impossible without the support of these stockholders.

Holders of our Series A Preferred Stock will have limited voting rights.

Except with respect to certain material changes in the terms of the Series A Preferred Stock and certain other matters and except as may be required by Delaware law, holders of Series A Preferred Stock will have no voting rights unless and until such Series A Preferred Stock is converted into our common stock. You will have no right to vote for any members of our Board of Directors unless and until such Series A Preferred Stock you hold is converted into our common stock.

Although we have five directors on our Board of Directors, only one is independent and four are our executive officers, and we may not be able to appoint additional qualified independent directors.

Currently, although we have five directors, we have only one independent director, Glen Goord, who joined our Board of Directors in March 2016 in connection with the formation of the Company. Although we do not currently intend to apply to have our Units or shares of preferred stock or common stock approved for trading on any trading market or securities exchange upon the completion of this offering, to have our stock listed on a securities exchange we will be required to have a majority of independent directors, but we may not be able to identify independent directors qualified to be on our board who are willing to serve. In the absence of a majority of independent directors, we would be prevented from listing our stock on any such exchange. In addition, the Board of Directors, which includes four of our executive officers, could establish policies and enter into transactions over the objections of the sole independent director. This could present the potential for a conflict of interest between us and our stockholders generally and the executive officers, stockholders or directors. The absence of more independent directors who could provide a more neutral point of view could jeopardize your interests. For example, in the absence of a compensation committee, or a nominating and governance committee, comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our officers, or recommendations for director nominees, respectively, may be made by existing members of the Board of Directors, who may have a direct or indirect interest in the outcome of those decisions.

Additionally, we do not currently have, nor are we currently required to have under the rules and regulations applicable to us, an audit committee or an audit committee financial expert, and therefore have not established independent oversight over our management and internal controls. Audit committees must be comprised of entirely independent members of the Board of Directors with a minimum of three members under the independence standards of the major securities exchanges. Therefore, we are exposed to the risk that material misstatements or omissions caused by errors or fraud with respect to our financial statements or other disclosures may occur and not be detected in a timely manner or at all. In the event there are deficiencies or weaknesses in our internal controls, we may misreport our financial results or lose significant amounts due to misstatements caused by errors or fraud. These misstatements or acts of fraud could also cause our company to lose value and investors to lose confidence in us.

Terms of subsequent financings may adversely impact your investment.

We may have to engage in common equity, preferred stock or debt financing in the future, as a result of which our stockholders could suffer significant dilution. Your rights and the value of your investment in Units could be reduced. Interest on debt securities could increase costs and negatively impact operating results. Preferred stock could be issued in series from time to time with such designation, rights, preferences, and limitations as are needed to raise capital. The terms of preferred stock could be more advantageous to those investors than to the holders of common stock. In addition, if we need to raise more equity capital from the sale of common stock, institutional or other investors may negotiate terms at least as, and possibly more, favorable than the terms of your investment. Shares of common stock which we sell could be sold into any market which develops, which could adversely affect the market price.

9

If our Series A Preferred Stock is converted into common stock, these converting stockholders will have significant voting power, and they will have the ability to exert substantial influence over matters requiring stockholder approval.

The Series A Preferred stockholders may convert their shares of Series A Preferred Stock at any time after the third anniversary of the Qualification Date into shares of our common stock. If all of our Series A Preferred Stock is converted into common stock (assuming the Maximum Offering Amount is raised), the shares issued upon this conversion will total approximately 24.1% of our outstanding common stock. Therefore, although these stockholders may not acquire majority control upon conversion of their Series A Preferred Stock, if these distinct stockholders were to act together, they will have the ability to exert substantial influence over all matters requiring approval of our stockholders, including the election and removal of directors, the approval of mergers or other business combinations, and other significant corporate actions. This ability to influence the Company’s affairs might be disadvantageous to our other stockholders.

Provisions in our Certificate of Incorporation and Bylaws and Delaware law could delay or discourage a takeover and could adversely affect the price of our common stock.

Our Board of Directors has the authority to issue 7,500,000 shares of preferred stock, and to determine the price, rights, preferences, privileges and restrictions, including voting rights, of those shares without any further vote or action by holders of our common stock. If additional preferred stock is issued, the voting and other rights of the holders of our common stock may be subject to, and may be adversely affected by, the rights of the holders of our preferred stock. The issuance of preferred stock may have the effect of delaying or preventing a change of control of the Company that could have been at a premium price to our stockholders.

Certain provisions of our Certificate of Incorporation and Bylaws could discourage potential takeover attempts and make stockholders’ attempts to change management difficult. Our Board of Directors has the authority to impose various procedural and other requirements that could make it more difficult for our stockholders to effect certain corporate actions.

In addition, certain provisions of Delaware law could have the effect of delaying or preventing a change of control of the Company. Section 203 of the Delaware General Corporation Law, for example, prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years from the date the person became an interested stockholder unless certain conditions are met.

The cumulative feature of the Series A Preferred Stock will create obligations for the Company.

If any dividends payable with respect to the Series A Preferred Stock are not paid when due, the dividends will accrue, even in cases when the Company is financially unable to pay such dividends. As dividends in arrears accrue they can become a significant obligation to the Company which will accumulate and compound at the rate of seven percent (7%) per annum. Any accumulation of dividends can become a financial burden that the Company is obligated to pay in full. Such accumulations if not paid down on a regular basis can become an obligation that may delay or prevent the Company from using its cash to meet its obligations for operations, acquisitions by the Company and dividends on the Company’s common stock.

We do not expect to pay cash dividends on common stock in the foreseeable future.

We have not declared or paid cash or other dividends on our common stock and do not expect to pay cash dividends for the foreseeable future. Our ability to pay dividends on our common stock is also restricted by the terms of our Series A Preferred Stock which require us to pay full cumulative dividends on the Series A Preferred Stock before making any dividend payment on our common stock. Generally, the Series A Preferred Stock is entitled to quarterly dividends of $0.175 (7% per annum) per share. We currently intend to retain all future earnings for use in the operation of our business and to fund future growth. Any future cash dividends will depend upon our results of operations, financial conditions, cash requirements, the availability of a surplus and other factors.

10

There currently is no public trading market for our securities and an active market may not develop or, if developed, be sustained. If a public trading market does not develop, you may not be able to sell any of your securities.

There is currently no public trading market for our common stock, our preferred stock or our warrants, and an active market may not develop or be sustained. If an active public trading market for our securities does not develop or is not sustained, it may be difficult or impossible for you to resell your securities at any price. Even if a public market does develop, the market price could decline below the amount you paid for your securities.

11

USE OF PROCEEDS

We estimate the net proceeds from the sale of Units by us in this offering, excluding the proceeds, if any, from the exercise of the warrants, after deducting the placement agent fees and estimated offering expenses payable by us, will be approximately $2,330,000 for the minimum offering or $27,143,000 for the maximum offering. We cannot predict when or if the warrants will be exercised, and it is possible that the warrants may expire and never be exercised. We intend to use the net proceeds from the sale of the Units offered by us in this offering to fund the Company’s organic growth and strategic acquisition of, and investments in, government contract service providers and government contractors, and for general corporate purposes. We intend for any such acquisitions to become 100% wholly owned subsidiaries of KeyStone Solutions. We do not anticipate our ownership in any particular acquisition to be less than 80%. The Company does not believe that its acquisition strategy will cause it to become an “investment company” under the Investment Company Act of 1940, as amended (the “1940 Act”) nor does it intend to become one.

Accordingly, although our expected use of proceeds is based on reasonable estimates, it is subject to change as the Company’s opportunities for acquisitions and operational expenses change from time-to-time. Set forth below is a table showing the estimated sources and uses of the proceeds from this offering.

| | | | | | | | | | | | | | | | |

| | | Minimum Offering | | | Maximum Offering | |

| | | Amount | | | Percentage | | | Amount | | | Percentage | |

Gross Proceeds | | $ | 3,000,000 | | | | 100.0 | % | | $ | 30,000,000 | | | | 100.0 | % |

Underwriting Discounts & Commissions (1) | | | 180,000 | | | | 6.0 | % | | | 1,800,000 | | | | 6.0 | % |

Estimated Offering Expenses (2) | | | 490,000 | | | | 16.3 | % | | | 1,057,000 | | | | 3.5 | % |

| | | | | | | | | | | | | | | | |

Net Proceeds | | $ | 2,330,000 | | | | 77.7 | % | | $ | 27,143,000 | | | | 90.5 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Strategic acquisition of government contract service providers and government contractors | | $ | 1,758,000 | | | | 58.6 | % | | $ | 24,443,000 | | | | 81.5 | % |

| | | | |

General corporate purposes | | | 572,000 | | | | 19.1 | % | | | 2,700,000 | | | | 9.0 | % |

| | | | |

Total Use of Net Proceeds | | $ | 3,000,000 | | | | 100.0 | % | | $ | 30,000,000 | | | | 100.0 | % |

| (1) | The underwriting commission represents 6.0% of the gross proceeds for Units sold in the offering. |

| (2) | Includes (i) underwriters’ allowable accountable expense allocation of 1.0% of the gross proceeds of Units sold in the offering, which is $30,000 and $300,000 for the minimum and maximum offering amounts, respectively, and which amount includes the fee paid to Folio Investments, Inc. (“Folio”) which is calculated based on fifty basis points (50 bps) of the dollar value of the Units issued in the offering, which is $15,000 and $150,000 for the minimum and maximum offering amounts, respectively, and which does not include any amount separately payable to Folio as a reallowance on commissions if Folio participates in the offering as a Dealer in the sale of the Units, (ii) non-accountable expense allowance of 1.0% of the gross proceeds of Units sold in the offering, which is $30,000 and $300,000 for the minimum and maximum offering amounts, respectively, and (iii) other expenses of the offering estimated to be $430,000 and $457,000 for the minimum and maximum offering amounts. See “Plan of Distribution.” |

Since this is a best efforts offering, if we are only able to sell $3,000,000, the minimum offering amount required to be raised in order to continue with the offering, we expect to use the net proceeds from the sale to fund the Company’s strategic acquisition of, and investments in, government contract service providers and government contractors, and for general corporate purposes. To the extent that we sell more than 300,000 Units, the additional net proceeds will be used primarily to fund the Company’s strategic acquisition of, and investments in, government contract service providers and government contractors, with the remainder being used for general corporate purposes. These general corporate purposes may include capital expenditures and additions to working capital.

The foregoing information is an estimate based on our current business plan. We may find it necessary or advisable to re-allocate portions of the net proceeds reserved for one category to another, and we will have broad discretion in doing so. Pending these uses, we intend to invest the net proceeds of this offering in short-term, interest-bearing securities.

12

BUSINESS

General

The Company was formed in March 2016 as a holding company for the purpose of creating or acquiring professional services companies that provide support to the government contracting (GovCon) industry. We formed the Company through a corporate reorganization of AOC Key Solutions, which, as a result, became a wholly owned subsidiary of the Company. We believe this structure will allow the Company to make acquisitions and raise capital in a more efficient manner.

The operations of the Company are currently conducted by and through its wholly owned subsidiary, AOC Key Solutions. AOC Key Solutions is an established business development and consulting firm that assists government contractors in winning government contracts. It also helps commercially focused firms gain entry into the government contracting market for the first time. Since commencing operations in 1983, AOC Key Solutions has assisted clients in winning over approximately $150 billion of government contract awards.

AOC Key Solutions was a division of American Operations Corporation before being spun off in 2008 and has been profitable since becoming an independent company in 2008.

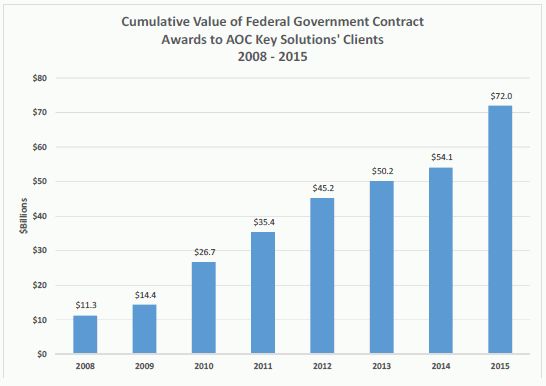

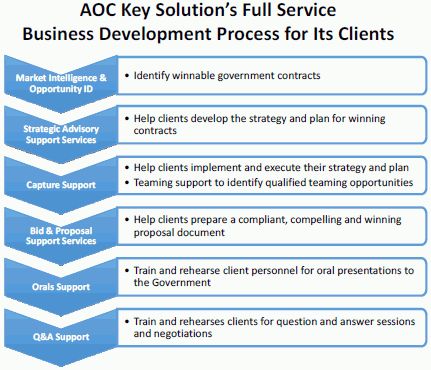

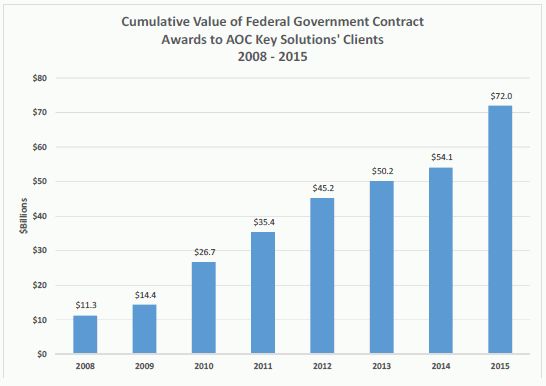

The Company identifies winnable government contracts for clients and provides teaming support to help its clients identify qualified teaming opportunities from the Company’s large database of government contractors. Next, AOC Key Solutions helps its clients develop the strategy and plan to win contracts, implement and execute their strategy and plan, and prepare a compliant, compelling and winning proposal document. For more than 30 years AOC Key Solutions has provided market intelligence, proposal, capture, advisory and teaming support and other important services toFortune 50 companies and small businesses alike. Since the 2008 spin-off, AOC Key Solutions’ cumulative client awards have exceeded $72 billion. For the year ended December 31, 2015, AOC Key Solutions generated over $9.6 million of revenue and net income of approximately $422,000. For the six-month period ended June 30, 2016, AOC Key Solutions’ revenues were $7,177,345 as compared to $4,311,170 for the same period in 2015.

We seek to improve how the federal government and government contractors operate. For the former, KeyStone works to increase the efficiency and effectiveness of government on behalf of the taxpayer. For the latter, KeyStone assists companies who are in, or seek to enter, the lucrative government contracting market. KeyStone helps contractors seeking to achieve two types of results: positive societal contributions; and success measured by our clients’ profits and return on investment.

Members of KeyStone’s management team have extensive experience in the government contracting sector and collective breadth of experience managing organic growth as well as growth through acquisitions and integration. In connection with the formation of the Company as a platform for expansion in the GovCon sector, Robert A. Berman joined the Company as Chief Executive Officer and became an investor in the Company. See“Interest of Management and Others in Certain Transactions.” Prior to investing in the Company, Mr. Berman executed a successful growth acquisition strategy by building a $6 million in annual revenue, 50-employee hospitality company into the hospitality sector’s premiere service provider. In just three years, the hospitality company grew by more than 3,000 employees and $280 million in revenues with offices around the globe by acquiring well-run synergistic companies. In addition to successfully operating and growing businesses through acquisitions, Mr. Berman has extensive capital market experience in both the public and private sectors. Mr. James McCarthy is the Company’s Chairman and his career spans over 30 years of marketing strategy creation, proposal development, and oral presentation coaching to contractors seeking to expand their market shares or to enter the government contracts market sector. Dr. Richard Nathan, our Chief Operating Officer, President and Member of the Board, brings over 45 years of corporate management, program management, and business and proposal development experience. He has led large management and operation contracts valued at more than a billion dollars and managed service and technical contracts for DOE, DoD, DHS, NASA, EPA, and state government. We believe that the combined expertise of Mr. Berman, Mr. McCarthy and Dr. Nathan will help to identify and evaluate key strategic acquisitions as we pursue our growth strategy.

13

KeyStone’s strategy includes diversifying its services offering within the market it knows well gaining a critical mass of sustainable revenues. We intend to use the net proceeds of this offering to fund organic growth and to add both vertical and horizontal capabilities by acquiring GovCon service providers through a disciplined acquisition strategy. We intend to foster communication and knowledge transfer by constructing a “bridge” across which efficiencies and best practices will be shared between the private sector and government, benefiting government, industry and the taxpayer.

Our Mission Statement

Through acquisitions and integration, KeyStone intends to provide a “one-stop,” full suite of services and products to the Government Contracting Market, making us a cohesive force in an extremely fragmented industry. KeyStone will diversify its services within the market it knows well in an effort to gain a critical mass of sustainable revenues.

Background

On March 15, 2016, the Company entered into a merger agreement (the “Merger Agreement”) with KCS Merger Sub, Inc. (“Merger Sub”), a wholly owned subsidiary of the Company, and AOC Key Solutions. Pursuant to the Merger Agreement, on March 15, 2016, Merger Sub was merged with and into AOC Key Solutions, with AOC Key Solutions becoming a wholly owned subsidiary of the Company.

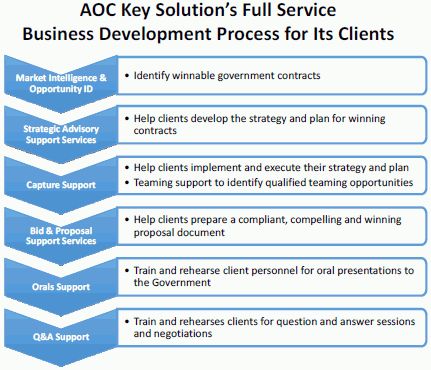

Our Process

AOC Key Solutions works with clients across nearly all federal agencies and market sectors, and specializes in information technology, defense and homeland security, healthcare, energy and environment, infrastructure support services, design/build, and new and emerging markets. Our full service business development process is shown below.

14

Distinctive Characteristics

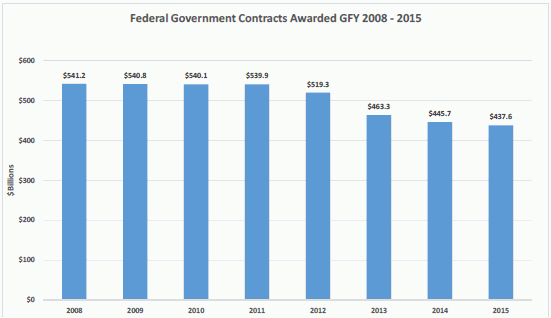

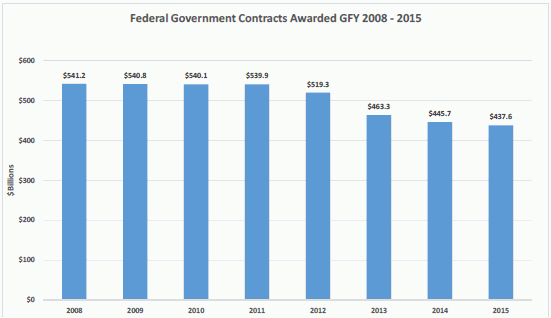

The United States Government purchases between $450 billion and $500 billion in products and services each year from the private sector, making it the single largest customer on the planet. As policy evolves, KeyStone evolves with government keeping itself and its clients ahead of the curve.

The following characteristics have contributed to our success and, we believe will have a material and positive impact on the growth anticipated from KeyStone’s strategy:

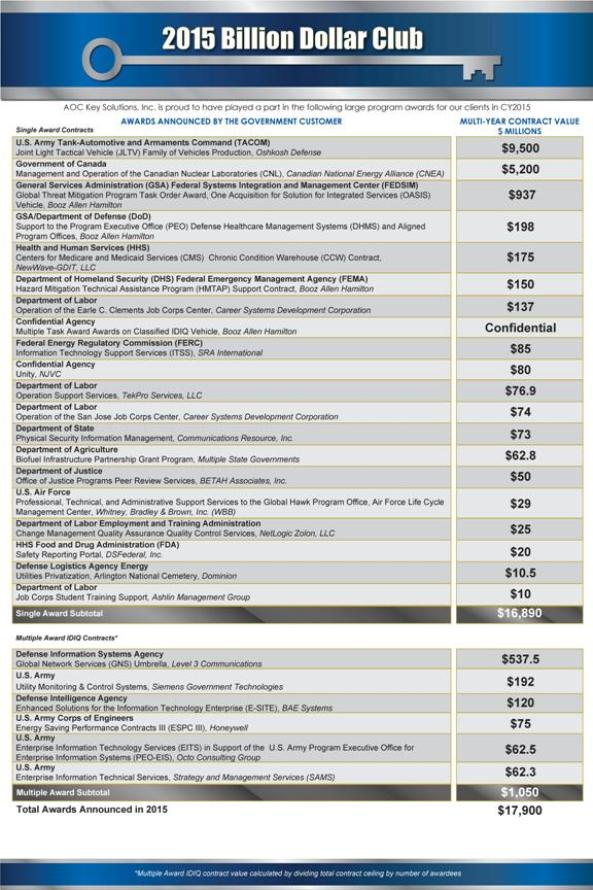

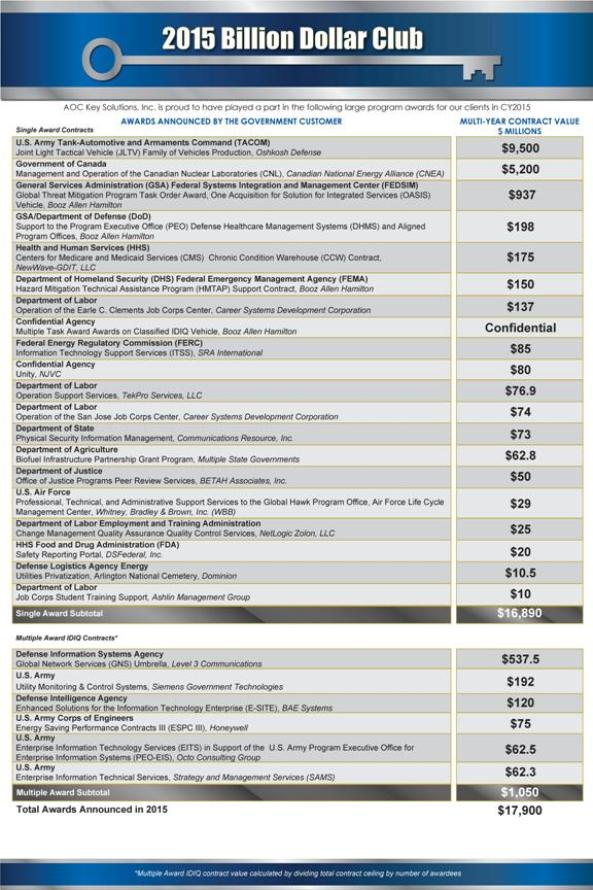

Win Record. Each year we list, in our Billion Dollar Club, the major contract awards that we have helped our clients to win. Our 2015 members are shown below. From 2011 through 2015 we provided support to our clients for over 175 winning bids. During this period, we averaged $9 billion annually in government contract award wins for our clients. Our clients compensated us on a time and materials basis for our services. We do not provide additional services after a contract has been awarded.

15

16

Ability to Provide Value to the Influx of Small Businesses. Recent data suggest that the Small Business Administration helps to start approximately 14,200 small businesses per year. We believe that a number of these new entities intend to enter the GovCon sector and may be potential KeyStone clients. We have a toolbox of services and products tailored to help new businesses gain entry into this lucrative market.

Access to Government and Industry Decision-Makers. We support our clients in seeking work from a majority of federal agencies. We know well the executive and working-level staff at all of our government contractor clients, and they are aware of the value of our services. As a result, we have key market intelligence that allows us to recommend teaming arrangements that have strategic value and are designed to increase the likelihood of our client winning a contract.

Government Contracting Weekly. This is a TV show we produced and are transitioning to the Internet to broaden its exposure. This show was previously broadcast for several years on CBS in Washington, DC and continues to open doors to us.Government Contracting Weeklyalso provides an open and transparent forum to discuss the many issues relevant to both the government and contractors.

Expertise and Depth of Resources. We employ over 25 in-house proposal development specialists backed by approximately 300 contract technical and management subject matter experts. Many of our employees maintain federal security clearances up to and including Top Secret.

Client Base of World Class Companies. Our client base has grown to over 450 companies, ranging fromFortune 50 firms to small and minority-owned businesses and start-ups. Over the Company’s 33-year history, we have supported a majority of the top-100 federal contractors, based on revenue.

Client Base Continues to Expand. Even with the size of our client base, the total number of contractors registered in the government’s System for Acquisition Management (SAM) exceeds 413,000, the majority of whom we do not currently serve.

Successful Long-Term Performance is Due to Our Sound and Proven Business Model. We have been in business for over 33 years with continuity of management from the beginning. Our proprietary processes and tools have afforded us the opportunity to train the next generation of talent.

Dedication to Principle-Centered Winning (PCW). We create value for our clients by focusing on winning— but winning theright way, not justany way. PCW is a code of conduct, a set of ethical principles and rules; based on service, sacrifice where necessary, and always seeking to act in the interests of our clients. We also seek to act in the best interests of the Federal Government. In part, this is because we are selective about who we take on as clients – only those companies which we believe will be able to successfully perform to government requirements. Thus, we play the important role of providing the right capabilities and the right price to the government entity with which our client is contracting.

State-of-the-Art Proposal Facility. For those clients who prefer an off-site proposal venue, we have a modern, secure and well-equipped proposal facility capable of simultaneously hosting multiple client engagements.

Our Network of Strategic Relationships. To increase our access to senior executives in government and industry, we have created a wide network of strategic relationships with organizations that include the George Washington University, Virginia Science and Technology Campus, Technology Accelerator, George Mason University Procurement and Technical Assistance Center, Arbinger Institute, Coalition for Government Procurement and the Veterans Institute for Procurement. It is through these relationships that we are able to:

| | • | | Keep our finger on the pulse of the GovCon market |

| | • | | Secure meetings for our clients that may be denied to outsiders |

| | • | | Continuously refresh our pool of prospective clients and subject matter experts |

17

Our Services

We believe clients value our services for four primary reasons. First, we offer a full suite of services for GovCon industry best practices allowing our clients to outsource their non-core competencies and focus on performing their contracts more efficiently. Second, many companies cannot maintain a large support infrastructure in-house and find it more cost effective to outsource. Third, our proprietary tools help clients maintain a healthy pipeline. And fourth, our win record supports their top-line revenue growth.

Clients engage us for a variety of important reasons when they:

| | • | | Identify a strategically important contract |

| | • | | Face an upcoming recompete of one or more of their foundational “bread and butter” contracts |

| | • | | Want to form and lead a team of companies to pursue a large, complex contract |

| | • | | Have special expertise and want to secure a spot on a team led by a prime contractor |

| | • | | Want to break into the GovCon market for the first time, or expand into a new line of business |

| | • | | Seek a footprint in a government agency for which they never before have worked |

| | • | | Need introductions to government decision-makers and senior executives from industry |

| | • | | Realize that their opportunity pipeline is empty, or filled with too many of the wrong kinds of targets |

| | • | | Know that their business development, capture and proposal processes are not working |

| | • | | Have a new technology or process they wish to bring to the market |

| | • | | Realize they are experiencing declines in market share, top-line revenues, or bottom-line profits |

| | • | | Face formidable competition and are unaware of how best to proceed |

| | • | | Have selected a contract target, but have no compelling strategy to win |

| | • | | Lack differentiators that separate them from the pack of bidders |

| | • | | Have never produced a complex or large proposal |

| | • | | Are in the midst of a prolonged losing streak and must quickly turn the tide |

| | • | | Lack the capacity or bandwidth to provide the necessary resources to win |

| | • | | Produce proposals that are boring, dense, wordy, unattractive, and non-compliant with the government’s requirements |

| | • | | Have an internal champion who must deliver results, but lacks necessary support infrastructure |

| | • | | Lack a program manager or other key personnel to feature in their proposal |

| | • | | Win a contract but are unable to staff it with technically-skilled personnel or those with the required security clearances |

| | • | | Rely too heavily in their proposal on boilerplate and outdated or recycled material |

| | • | | Are about to grow out of their small business size standard or graduate from the SBA’s 8(a) program |

| | • | | Recognize a need for our industry leading best practices and our expertise in winning |

| | • | | Wish to make their company attractive to potential buyers or outside investors |

The services we provide include:

| | • | | Market Research. We monitor funds that the government spends on government contractors, the consumption of government spending by government contractors, and latest developments in the sector. We identify trends and emerging issues and track where congressionally appropriated funds eventually result in a program or procurement. We also keep tabs on contractors competing for government contracts, diagnose the health of the various segments within the overall GovCon market and advise clients on whether and how to best operate in those segments. |

| | • | | Identifying Funded and Winnable Contract Opportunities. We highlight opportunities that we consider to be most advantageous for our clients. Using various market research tools, we identify and screen the contract opportunity, estimate its potential dollar value, forecast its lifecycle schedule and timeline, research the type and extent of work to be performed, provide the names and contact information for government decision-makers and identify which companies might be best to participate with by forming and leading a team, or joining another team. |

| | • | | Managing Client Opportunity Pipelines. We install an infrastructure for our clients to track and manage the universe of opportunities available to them. We refresh a client’s opportunity pipeline and help them identify contracts that match their core competencies and which we believe have the highest probability of winning (“P-Win”) for them. |

18

| | • | | Assistance Making a Bid Decision. After assembling the requisite data, we help clients make informed decisions on which opportunities—among hundreds or even thousands of targets—to bid and spend scarce bid and proposal dollars on. |

| | • | | Assistance in the Early Phases of Business Development and Capture. In some cases, we take the lead in laying the groundwork for an ultimate win. In other cases, we may be advisors to the client’s pursuit team to bid a given contract opportunity. In either case, we set up meetings with government decision-makers, prepare the necessary capability statements and other documents and prep our clients to meet with the government to create a strong first impression. |

| | • | | Help Developing a Strategy to Win. To provide an overall strategy to win, we host a strategy session to develop certain tools and artifacts (e.g., SWOT analyses, Value Proposition, Opportunity Profile) that are necessary to win. At these sessions, we guide clients on how to address government’s needs, wants, and biases. We help craft win themes and discriminators for the eventual proposal, assemble an “Offer Design” that represents the value proposition to be carried forth to the proposal, conduct an analysis of our client’s strengths and vulnerabilities, offering suggestions on how to leverage the former, and mitigate the latter. We also evaluate the likely competition and provide our recommendations and input to the strategy. In short, we develop the concepts and action plans necessary to win. |