DAVIS FUNDAMENTAL ETF TRUST | Trustee Approval of Advisory Agreement (Unaudited) |

Board Considerations Regarding Approval of Advisory Agreement

The Board of Trustees (the “Trustees”) of the Davis Fundamental ETF Trust (the “Trust”) oversees the management of each series of the Trust, which includes Davis Select U.S. Equity ETF, Davis Select Financial ETF, Davis Select Worldwide ETF, and Davis Select International ETF (each a “Fund” and collectively the “Funds”). The Trustees, as required by law, determine annually whether to approve the continuance of each Fund’s advisory agreement.

With the assistance of counsel, the Independent Trustees undertook a comprehensive review process in anticipation of their annual contract review meeting, held in May 2024 (the “Meeting”). During the Meeting, the Trustees, including the Independent Trustees separately, considered whether to renew the investment advisory agreement with Davis Selected Advisers, L.P. (the “Adviser”) and Davis Selected Advisers–NY, Inc. (the “Sub-Adviser”) (jointly “Davis Advisors” and, such agreement, the “Advisory Agreement”). As part of this process, Davis Advisors provided the Independent Trustees with material (including investment performance data) that was responsive to questions and requests for information submitted to Davis Advisors on behalf of the Independent Trustees. At this meeting, the Independent Trustees reviewed and evaluated all information which they deemed reasonably necessary under the circumstances, and were provided guidance by their independent counsel. In reaching their decision, the Independent Trustees also took into account information furnished to them throughout the year and otherwise provided to them during their quarterly meetings or through other prior communications. The Independent Trustees concluded that they had been supplied with sufficient information and data to analyze the Advisory Agreement and that their questions and information requests had been sufficiently answered by Davis Advisors. Upon completion of this review, the Independent Trustees found that the terms of the Advisory Agreement were fair and reasonable and that continuation of the Advisory Agreement is in the best interests of the Funds and their shareholders.

Reasons the Independent Trustees Approved Continuation of the Advisory Agreement

The Independent Trustees’ determinations were based upon a comprehensive consideration of all information provided to them, and they did not identify any single item or piece of information as the controlling factor. Each Independent Trustee did not necessarily attribute the same weight to each factor. The following considerations and conclusions were important, but not exclusive, to the Independent Trustees’ recommendation to renew the Advisory Agreement.

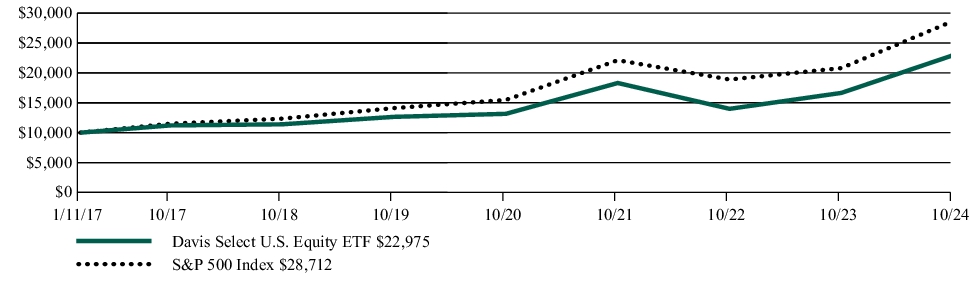

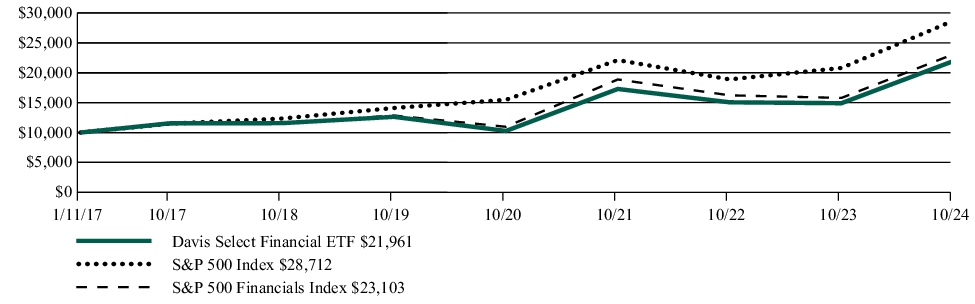

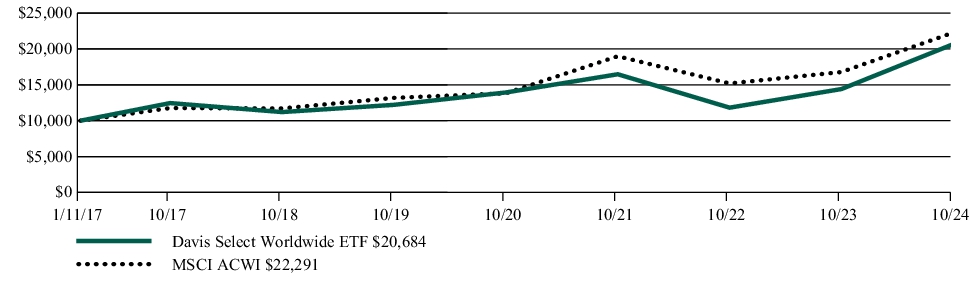

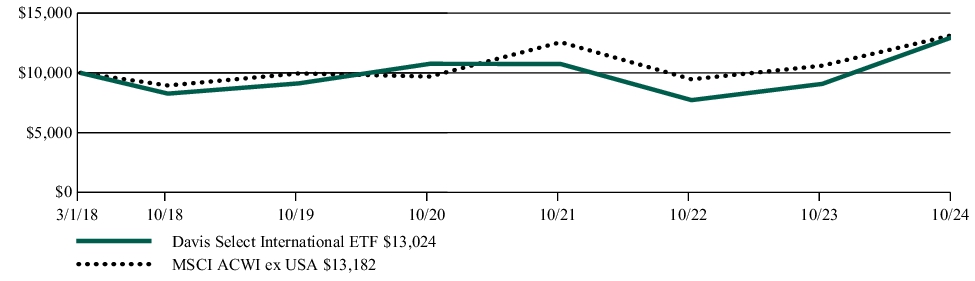

The Independent Trustees considered the investment performance of each Fund on an absolute basis as well as relative to its benchmark and other comparable funds. The Independent Trustees not only considered the investment performance of each Fund, but also the full range and quality of services provided by Davis Advisors to each Fund and its shareholders, including whether:

1.A Fund achieves satisfactory investment results after all costs;

2.Davis Advisors efficiently and effectively handles shareholder and authorized participant requests;

3.Davis Advisors provides quality accounting, legal, and compliance services, and oversees third-party service providers; and

4.Davis Advisors fosters healthy investor behavior.

The Independent Trustees considered that a shareholder’s ultimate return is the product of a fund’s results, as well as the shareholder’s behavior, specifically in selecting when to buy, sell, or hold. The Independent Trustees concluded that, through its actions and communications, Davis Advisors has attempted to have a meaningful, positive impact on investor behavior. The Independent Trustees also considered the investment management team and Davis Advisors’ investment process. The Independent Trustees noted that Davis Advisors employs a disciplined, company-specific, research-driven, businesslike, long- term investment philosophy. The Independent Trustees considered the quality of Davis Advisors’ investment process as well as the experience, capability, and integrity of its senior management and other personnel.

Davis Advisors takes its role as stewards of capital seriously and maintains a strong alignment of interests with its clients. The Independent Trustees noted that Davis Advisors has made significant investments in the Funds. The Independent Trustees considered that these investments tend to align Davis Advisors’ interests with other shareholders, as they face the same risks, pay the same fees, and are motivated to achieve satisfactory long-term returns.

The Independent Trustees noted the importance of reviewing quantitative measures, but recognized that qualitative factors are also important in assessing whether shareholders are likely to be well served by the continuation of the Advisory Agreement. They noted both the value and shortcomings of purely quantitative measures, including the data provided by independent service providers, and concluded that, while such measures and data may be informative, the judgment of the Independent Trustees must